Abstract

This research aims to analyze if innovation, regarded as a distinctive feature of entrepreneurship, is a key element for obtaining satisfactory performance during a recession. The relationships between entrepreneurship and recession are difficult to establish, and there is no consensus in the literature on the effects of recession on entrepreneurial activities. This research has been conducted on four items in the “Individual level data GEM 2009 APS Global” survey. Results show the ineffective trend of innovation strategies in start-ups during times of economic prosperity. However, this negative effect disappears and even becomes positive in situations of economic crisis.

Access provided by Autonomous University of Puebla. Download chapter PDF

Similar content being viewed by others

Keywords

These keywords were added by machine and not by the authors. This process is experimental and the keywords may be updated as the learning algorithm improves.

5.1 Introduction

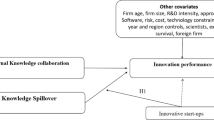

This research, as we show more extensively in the methodology section, has been conducted on four items in the “Individual level data GEM 2009 APS Global” survey. Three items provide information on whether business start-ups carry out an innovative activity in the opinion of their respective entrepreneurs, and an item indicates how these entrepreneurs value payback.

Business start-ups in this research correspond to newly created businesses, characterized by carrying out market exchanges with their products or services, and that are not a mere appendix to another company or a subsidiary company, thus fulfilling the definition proposed by Luger and Koo (2005: 18): a firm “not only newly created and active but also independent.” New companies (in this case from the year 2004 when the research began) are used to establish a close relationship between start-ups and entrepreneurship because the new combinations of factors that characterize entrepreneurship (Shane 2012; Shane and Venkataraman 2000; Schumpeter 1934) largely materialize in the creation of companies. Although in a considerable part of the literature entrepreneurship is linked to SMEs in general (Blackburn and Kovalainen 2009; Zimmerer and Scarborough 2002), in its broadest sense it is linked to new combinations of factors that involve innovation, regardless of the type or size of the enterprise (Shane 2012; Schumpeter 1934).

This present study focuses on innovation as a dimension of entrepreneurship and the way it relates to the economic crisis through business start-ups.

Relationships between entrepreneurship and economic crisis are difficult to establish. There is no consensus in the literature on how an economic crisis affects entrepreneurial activities. For some authors like Filippetti and Archibugi (2010) situations of weak growth, recession or stagnation of GDP, can favor the discovery of opportunities and innovation, while other authors consider that the slowdown of the economy negatively affects entrepreneurial attitude, limiting the discovery of opportunities and investment in innovation (Klapper and Love 2011). The destruction of industry during a slowdown or drop in GPD clearly implies a decrease in the number of entrepreneurs or less activity from them, but this empirical finding refers to entrepreneurs in general and we know little about those who manage to maintain or improve their performance in a time of crisis.

In this context, our research question is:

In situations of economic crisis, is innovation—as a distinctive feature of entrepreneurship—the key element for obtaining satisfactory performance?

5.2 Methodology

5.2.1 Sample and Data

We used a secondary data source to assess the effects of the 2008 economic crisis on the relationship between innovation and performance of business start-ups. The database used for this purpose, that includes entrepreneurs who founded a new business which we ask about, was the “Individual level data GEM 2009 APS Global” from the Global Entrepreneurship Research Association (GEM). The GEM project is an annual assessment of the entrepreneurial activity, aspirations, and attitudes of individuals across a wide range of countries. This GEM initiative was initiated in 1999 as a partnership between London Business School and Babson College.

The years selected from the database for carrying out our study were 2004, 2005, 2006, 2007, and 2008, 4 years before the 2008 crisis and 2008. The analysis was carried out jointly for 11 European countries and the USA (the USA, Netherlands, France, Spain, Hungary, Italy, Rumania, Austria, Denmark, Sweden, Norwegian, and Germany). The GDP was considered as a measure of the economic context of a country, and the variation of the GDP between years, if negative, as the measure of the deepness of the crisis in a specific country. The variation of the GDP of the countries considered in this study is shown in Table 5.1.

5.2.2 Measures

The indicators selected from the GEM database for measuring the innovation variable are shown below. For the “Innovation” variable we considered three items (see Table 5.2) regarding innovation in technology and products. Due to the clearly different components of the innovations considered, this scale is conceptualized as a formative scale (Podsakoff et al. 2006), and we added these three indicators to form the “Innovation” variable. The items are asked inversely (e.g., many (potential) customers consider product new/unfamiliar? 1 = all; 2 = some; 3 = none), so the innovation scale was inversed after adding the items.

The items considered two aspects of innovation. Two related with product innovation and another one related to technological innovation. Firms that offer products that are adapted to the needs and wants of target customers and that market them faster and more efficiently than their competitors are in a better position for performance (Alegre et al. 2006). At the same time, technological innovation is related with a better performance (Augusto et al. 2011), through the way products are made, reducing costs, and improving their quality. Product innovations are primarily driven by the market, whereas process innovation is usually related with operation objectives such as flexibility, costs, quality, and delivery time (Schilling 2008).

An innovative strategy, however, does not always give its fruits, and to prove the positive impact of investments in innovation on organizational performance is no easy task.

The performance has been measured as the payback amount of the new business estimated by the entrepreneur. Managerial perception of organizational outcomes has been already used as method of measurement in multiple previous work on the question (e.g., Tippins and Sohi 2003; Powell and Dent-Micallef 1997) and the use of subjective assessments of performance is widespread after having contrasted its convergence with the objective measures. A seven-point Likert scale is used, which increases depending on their perception of the period of the payback amount.

Payback period is the most widely used measure for evaluating potential investments and it is easy to understand. Nevertheless, the payback period does not afford any clue about how the start-up would perform after the break-even period. For this reason, the payback amount has been chosen as a proxy for performance.

5.2.3 Analysis

For each of the years (2004, 2005, 2006, 2007, and 2008) the correlation among the variables performance and innovation was studied. Each year was characterized in terms of the GDP growth. Table 5.1 shows the global results for the whole sample (all the countries). The global GDP growth was calculated as the average of the growth of the countries in the sample, weighted by the number of cases by which each country contributes to the sample (Table 5.3).

5.3 Results

As can be seen, the correlation between innovation and payback is negative, indicating that the most innovative start-ups have lesser payback amounts. However, this relationship does not remain constant throughout the period considered. For those years where growth has remained around 3.5 % this relationship is significant at levels of 90 or 99 % (years 2004, 2005) or not significant, though close to the p-value 0.01 (years 2006, 2007), away clearly from these values in the year 2008. For this year, when the effect of the economic crisis can already be seen and the average of the estimated growth of the sample is only 0.69 %, the correlation clearly has a p-value of 0.06, greater than the previous values.

If we apply the Fisher’s z test to the payback–innovation correlation of the year 2008 (GDP growth = 0.69 %) and the year 2005 (GDP growth = 2.72 %), the significance is considerable (p < 0.001).

This aggregate behavior is also reflected when countries are analyzed individually. For instance, in the case of Spain (Table 5.4), with some growth between 2004 and 2007 above 3 %, we see a negative relationship between innovation and performance, but not significant (except in the year 2004). This trend clearly changes in 2008, showing a positive sign in the relationship between innovation and performance (measured as the payback). The data are not significant, however, except in one of the years examined, especially due to the small number of cases. Nevertheless, in the Fisher’s z test of the payback–innovation correlation of the year 2008 (GDP growth = 0.90 %) and the year 2005 (GDP growth = 3.60 %), the significance is p = 0.057. In the years 2008 and 2004 (GDP growth = 3.30 %) the significance of the Fisher’s z test is p < 0.001 (Tables 5.5 and 5.6).

For the rest of the countries, the sample is too small to extract any conclusive conclusion. Notwithstanding, some pattern of the same kind can be observed. For instance, in the USA, excepting the contradictory results of 2006, there is a clear drop of the negative effect of innovation over the payback between the years 2007 and 2008, although the sample, 20 and 54 start-ups, respectively, is too small to affirm any conclusion.

Nevertheless, not all countries show this behavior, and erratic behaviors occur in certain samples. Thus, in the UK the correlations vary, although in none of the cases they are significant.

5.4 Conclusions

The relationship between innovation and performance has always been complex, and the advantages of investment in innovation have always been difficult to prove, especially when the overall economic performance of organizations is considered. Many factors influence the impact of innovative activities on economic performance, such as the time gap between investment and results, always a risk with innovation.

The risk associated with innovation is exacerbated by the risk associated with any new venture. In addition, issues still undeveloped in new organizations, such as organizational and cultural aspects and absorptive capacity, can distort the advantages of innovation.

This study attempts to add a new element, exogenous to organizations, which may be relevant in the strategies of new start-ups: the economic context.

The results of this study, although not conclusive, show the ineffective trend of innovation strategies in start-ups during times of economic prosperity. However, this negative effect disappears, and even becomes positive (but not significant, see Table 5.2), for the year of zero growth in 2008.

These results must be approached with caution, given the limitations of the study (especially because of its simplicity: it only measures the relationship between innovation and payback) and the number of countries surveyed, all differently affected by the 2008 crisis in terms of growth and economic deterioration. The results suggest it is not so much that innovation strategies fail, but rather that conservative strategies are safer in times of economic growth. However, in a deteriorated context of economic crisis, a strategy with little innovation stops being efficient for start-ups.

References

Alegre J, Lapiedra R, Chiva R (2006) A measurement scale for product innovation performance. Eur J Innov Manag 9(4):333–346

Augusto M, Lisboa J, Yasin M (2011) The impact of innovation on the relationship between manufacturing flexibility and performance: a structural modelling approach. Int J Bus Res 11:65–72

Blackburn R, Kovalainen A (2009) Researching small firms and entrepreneurship: past, present and future. Int J Manag Rev 11(2):127–148

Filippetti A, Archibugui D (2010) Innovation in times of crisis: National systems of innovation, structure and demand. Res Policy 40(2):179–192

Luger MI, Koo J (2005) Defining and tracking business start-ups. Small Bus Econ 24:17–28

Klapper L, Love I (2011) The impact of the financial crisis on new firm registration. Econ Lett 113:1–4

Podsakoff NP et al (2006) The role of formative measurement models in strategic management research: review, critique, and implications for future research. Res Meth Strat Manag 3:197–252

Powell TC, Dent-Micallef A (1997) Information technology as competitive advantage: the role of human, business and technology resources. Strateg Manag J 18:375–405

Schilling MA (2008) Strategic management of technological innovation. McGraw-Hill Irwin, New York

Schumpeter JA (1934) The theory of economic development. Harvard University Press, Cambridge, MA

Shane S (2012) Reflections on the 2010 AMR decade Award: delivering on the promise of entrepreneurship as a field of research. Acad Manage Rev 37(1):10–20

Shane S, Venkataraman S (2000) The promise of entrepreneurship as a field of research. Acad Manage Rev 25:217–226

Tippins MJ, Sohi RS (2003) IT competency and firm performance: is organizational learning a missing link? Strateg Manag J 24:745–761

Venkatraman N, Ramanujam V (1987) Measurement of business economic performance: an examination of method convergence. J Manag 13:109–122

Zimmerer TW, Scarborough NM (2002) Essentials of entrepreneurship and small business management, 3rd edn. Prentice Hall, New Jersey

Acknowledgments

Authors gratefully acknowledge support from the Universitat Politècnica de València through project Paid-06-12 (Sp 20120792) and from the Spanish Ministry through project ECO: 2010–17.318.

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2014 Springer International Publishing Switzerland

About this chapter

Cite this chapter

Peris-Ortiz, M., de Borja Trujillo-Ruiz, F., Hervás-Oliver, J.L. (2014). Business Start-ups and Innovation: The Effect of the 2008 Economic Crisis. In: Rüdiger, K., Peris Ortiz, M., Blanco González, A. (eds) Entrepreneurship, Innovation and Economic Crisis. Springer, Cham. https://doi.org/10.1007/978-3-319-02384-7_5

Download citation

DOI: https://doi.org/10.1007/978-3-319-02384-7_5

Published:

Publisher Name: Springer, Cham

Print ISBN: 978-3-319-02383-0

Online ISBN: 978-3-319-02384-7

eBook Packages: Business and EconomicsBusiness and Management (R0)