Abstract

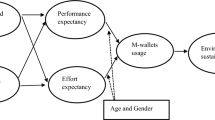

The current research examines the environmental drivers of consumers’ adoption of e-wallet services. It investigates how environmental factors, such as social influence, technology readiness, and government support affect the consumers’ intention to use e-wallet services. In addition, the research assesses the mediating role of perceived usefulness in this relationship. Data was collected through a questionnaire with a sample size of 324 respondents. Structural equation modeling was employed to analyze the collected data. The results showed that all hypotheses were accepted, indicating that the environmental drivers significantly impact users’ intention to use e-wallet services. Also, perceived usefulness positively mediates the relationship between environmental drivers and the intention to use e-wallet services. Further, the results showed that digital wallets are quickly becoming a popular online payment method. Customers are quickly adopting digital wallets due to their convenience and ease of use. Customers are becoming tech-savvy and they are increasingly looking for creative solutions.

Access this chapter

Tax calculation will be finalised at checkout

Purchases are for personal use only

Similar content being viewed by others

References

Sumanjeet, S.: Emergence of payment systems in the age of electronic commerce: the state of art. Global J. Int. Bus. Res. 17–36 (2009)

Akçomak, S., ter Weel, B.: How do social capital and government support affect innovation and growth? Evidence from the EU regional support programmes, UNU-MERIT Working Paper 2007-009 (2007)

Kim, Y., Choi, J., Park, Y.J., Yeon, J.: The adoption of mobile payment services for “Fintech”. Int. J. Appl. Eng. Res. 11(2), 1058–1061 (2016). https://scholarworks.bwise.kr/ssu/han-dle/2018.sw.ssu/34412

Singh, S., Sahni, M.M., Kovid, R.K.: Exploring antecendents of FinTech adoption using adapted technology acceptance model. In: Saran, V.H., Misra, R.K. (eds.) Advances in Systems Engineering. LNME, pp. 337–352. Springer, Singapore (2021). https://doi.org/10.1007/978-981-15-8025-3_34

Ernst & Young. Global Fintech Adoption Index 2019: as Fintech becomes the norm, you need to stand out from the crowd (2019). https://assets.ey.com/content/dam/ey-sites/ey-com/en_gl/topics/financial-services/ey-global-fintech-adoption-index-2019.pdf

Deci, E.L., Ryan, R.M.: Facilitating optimal motivation and psychological well-being across life’s domains. Can. Psychol. 49(1), 14 (2008)

Hu, Z., Ding, S., Li, S., Chen, L., Yang, S.: Adoption intention of fintech services for bank users: an empirical examination with an extended technology acceptance model. Symmetry 11(3), 340 (2019)

Karsen, M., Chandra, Y.U., Juwitasary, H.: Technological factors of mobile payment: a systematic literature review. Procedia Comput. Sci. 157, 489–498 (2019)

Chong, A.Y.L., Chan, F.T., Ooi, K.B.: Predicting consumer decisions to adopt mobile commerce: cross country empirical examination between China and Malaysia. Decis. Support Syst. 53(1), 34–43 (2012)

Sahu, G.P., Singh, N.K.: Identifying Critical Success Factor (CSFs) for the adoption of digital payment systems: a study of indian national banks. In: Dwivedi, Y.K., et al. (eds.) Emerging Markets from a Multidisciplinary Perspective. ATPEM, pp. 61–73. Springer, Cham (2018). https://doi.org/10.1007/978-3-319-75013-2_6

Putri, A.F., Handayani, P.W., Shihab, M.R.: Environment factors affecting individual’s continuance usage of mobile payment technology in Indonesia. Cogent Eng. 7(1), 1846832 (2020)

Venkatesh, V., Thong, J.Y., Xu, X.: Consumer acceptance and use of information technology: extending the unified theory of acceptance and use of technology. MIS Quar. 157–178 (2012)

Amoroso, D.L., Magnier-Watanabe, R.: Building a research model for mobile wallet consumer adoption: the case of mobile Suica in Japan. J. Theor. Appl. Electron. Commer. Res. 7(1), 94–110 (2012). https://doi.org/10.4067/S0718-18762012000100008

Nawayseh, M.K.A.: FinTech in COVID-19 and beyond: what factors are affecting customers’ choice of FinTech applications? J. Open Innov. Technol. Market, Complexity 6(4), 1–15 (2020)

Bashir, I., Madhavaiah, C.: Revisiting Technology Acceptance Model (TAM) at the individual internet banking adoption level. Metamorph. J. Manage. Res. 13(1), 42–56 (2014). https://doi.org/10.1177/0972622520140107

Mun, Y.P., Khalid, H., Nadarajah, D.: millennials’ perception on mobile payment services in Malaysia. In: Procedia Computer Science, vol. 124, pp. 397–404. Elsevier B.V (2017). https://doi.org/10.1016/j.procs.2017.12.170

Calisir, F., Atahan, L., Saracoglu, M.: Factors affecting social network sites usage on smartphones of students in Turkey. In: Lecture Notes in Engineering and Computer Science, vol. 2, pp. 1081–1085. Newswood Limited (2013)

Archibugi, D., Coco, A.: A new indicator of technological capabilities for developed and developing countries (ArCo). World Dev. 32(4), 629–654 (2004)

Gerlach, J.M., Lutz, J.K.: Evidence on usage behavior and future adoption intention of Fintechs and digital finance solutions. Int. J. Bus. Finan. Res. 13(2), 83–105 (2019)

Aji, H.M., Berakon, I., Md Husin, M.: COVID-19 and e-wallet usage intention: a multigroup analysis between Indonesia and Malaysia. Cogent Bus. Manage. 7(1) (2020). https://doi.org/10.1080/23311975.2020.1804181

Mandari, H.E., Chong, Y.L., Wye, C.K.: The influence of government support and awareness on rural farmers’ intention to adopt mobile government services in Tanzania. J. Syst. Inf. Technol. 19(1/2), 42–64 (2017). https://doi.org/10.1108/JSIT-01-2017-0005

Adhi Prakosa, D.J.W.: Analisis Faktor-Faktor Yang Mempengaruhi Minat Penggunaan Ulang E-Wallet Pada Generasi Milenial Di Daerah Istimewa Yogyakarta. Bull. World Health Organ. 15(1), 50–53 (2020)

Tjokrosaputro, I.N., dan M.: Pengaruh Perceived Usefulness, Perceived Ease Of Use Dan Trust Terhadap Intention To Use (Studi. II(3), 715–722 (2020)

Karim, M.W., Ahasanul, H., Mohammad, A.U., Md Alamgir, H., dan Md Zohurul, A.: Factors Influencing the Use of E-wallet as a Payment Method among (2020)

Winarno, W.A., Imam, M., dan Trias, W.P.: Perceived Enjoyment, Application Self-efficacy, and Subjective Norms as Determinants of Behavior Intention in Using OVO Applications. J. Asian Finan. Econ. Bus. 8(2), 1189–1200 (2021). https://doi.org/10.13106/jafeb.2021.vol8.no2.1189

Mohammadi, H.: A study of mobile banking usage in Iran. Int. J. Bank Market. 33(6), 733–759 (2015). https://doi.org/10.1108/IJBM-08-2014-0114

Nayanajith, G., Joy, R.M.: Website usability, perceived usefulness and adoption of internet banking services in the context of sri lankan financial sector. Asian J. Bus. Technol. 2(1), 28–38 (2019)

Aji, H.M., Dharmmesta, B.S.: Subjective norm vs dogmatism: christian consumer attitude towards Islamic TV advertising. J. Islamic Market. 10(3), 961–980 (2019). https://doi.org/10.1108/JIMA-01-2017-0006

Jin, C.C., Seong, L.C., Khin, A.A.: Consumers’ behavioural intention to accept of the mobile wallet in Malaysia. J. Southwest Jiaotong Univ. 55(1) (2020). https://doi.org/10.35741/issn.0258-2724.55.1.3

Hair Jr, F.J, Sarstedt, M., Hopkins, L., Kuppelwieser, V.G.: Partial least squares structural equation modeling (PLS-SEM) an emerging tool in business research. Eur. Bus. Rev. 26(2), 106–121 (2014)

Fornell, C., Larcker, D.F.: Evaluating structural equation models with unobservable variables and measurement error. J. Mark. Res. 18(1), 39–50 (1981)

Bagozzi, R.P., Yi, Y., Nassen, K.D.: Representation of measurement error in marketing variables: review of approaches and extension to three-facet designs. J. Econ. 89(1), 393–421 (1998). https://doi.org/10.1016/S0304-4076(98)00068-2

Chong, A.Y.L., Ooi, K.B., Lin, B., Tan, B.I.: Online banking adoption: an empirical analysis. Int. J. Bank Market. (2010)

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2023 The Author(s), under exclusive license to Springer Nature Switzerland AG

About this paper

Cite this paper

Ahmad, A., Dajani, D., Ali, N. (2023). Consumers’ Adoption of E-Wallet Services in Jordan: Mediating Effect of Perceived Usefulness. In: Yaseen, S.G. (eds) Cutting-Edge Business Technologies in the Big Data Era. SICB 2023. Studies in Big Data, vol 136. Springer, Cham. https://doi.org/10.1007/978-3-031-42455-7_29

Download citation

DOI: https://doi.org/10.1007/978-3-031-42455-7_29

Published:

Publisher Name: Springer, Cham

Print ISBN: 978-3-031-42454-0

Online ISBN: 978-3-031-42455-7

eBook Packages: Intelligent Technologies and RoboticsIntelligent Technologies and Robotics (R0)