Abstract

This paper is a presentation on recent trends and a survey of recent research on private security, and its relationship with policing in the United States. Recent research suggests a larger role for private security in crime deterrence efforts than was previously assumed. This research suggests that increases in some forms of private security generate reductions in some types of crime, and that private security can act as complements or substitutes for police in different environments. We also review the industry structures for private security and detectives, and do the same for public police and detectives. In addition, we examine how private security is regulated in the U.S. and the limitations of these regulations.

Access provided by Autonomous University of Puebla. Download chapter PDF

Similar content being viewed by others

1 Introduction

A substantial body of economic literature exists on the role of crime deterrence investments and criminal behavior. Starting with Becker (1968), this literature examines the role of apprehension and punishment in affecting criminal behavior. Becker advanced this rational choice model of crime asserting that individuals weigh the expected benefit of a particular criminal activity vs. the expected cost. As perceptions of these costs change, criminal activity changes. These expected costs include the probability of getting caught while engaging in the activity, and the expected punishment that accompanies the crime if caught, as well as the opportunity cost of outside options (e.g. labor market options) available to individuals. As expected costs of a criminal activity increase, either through an increase in the probability of getting caught, or increased expected punishment, the amount of the activity engaged in should fall. It appears that the probability of apprehension has a larger impact on criminal activity than changing punishment (see Lee & McCrary, 2009; Grogger, 1991). Efforts aimed at increasing the probability of apprehension include both private and public security measures aimed at identifying and catching perpetrators, and stopping the activity before it happens. For example, a public police officer stationed on the side of a busy road both increases the probability of catching a speeding car on that road, and also deters the activity itself as potential speeders notice the police car before engaging in speeding. Private deterrence efforts can achieve similar goals, cameras and burglar alarms allow for quicker response to burglaries and increased chances of identification of the perpetrator. Security guards stationed outside a jewelry store could dissuade a burglary before it is even attempted. Much of the deterrence research has focused on the impact of public police on crime, but recently a surge in studies on privately purchased security has examined the role of private deterrence investments. Private security in the U.S. and around the world has risen in recent decades (Blackstone & Hakim, 2010). Some estimates suggest that private security are more than three times as prevalent as public police within the U.S. (Joh, 2004). Security investments to deter crime come in many forms such as; burglar alarms, monitoring devices, private investigators, and private security guards. This paper will focus on recent U.S. trends and research findings regarding private security and public police services, how they interact, and how they could interact more efficiently moving forward. In Sect. 2 we examine U.S. trends for public and private security professions over time, Sect. 3 takes a deeper dive into investigative services, while Sect. 4 does the same for guard and patrol services, Sects. 5 and 6 deal with the impact of private security and police on crime, Sect. 7 adds some discussion and Sect. 8 concludes.

2 Recent Trends

US national data were collected for the years 1997 through 2021; these data include: GDP, reported crime, public and private security employment and wages, Internet related crime figures, and employment and wage figures on information technology security analysts. We present diagrams to examine relationships among these variables. The objective is to show overarching trends in these industries relative to aggregate economic and crime conditions in the U.S., and to speculate on possible supply and demand determinants for both police and private security employment.

Staring with public police, Fig. 1 shows annual changes in police employment are somewhat unrelated to both GDP and crime, but more closely related to GPD growth. Figure 2 indicates that police employment and expenditures are a relatively constant percentage of state and local employment. Indeed, the ratio of spending on police and total state and local spending (which includes spending on education by the state and local governments) ranges narrowly between 3.67 and 3.81 percent. Further, police employment as a percentage of total state and local employment remains steady around 22 percent over the data period. Figure 2 shows how closely parallel both expenditures and employment move. Control of crime is a major responsibility of police. Specifically, property crimes declined from 1978 through 2021, and violent crimes declined through 2016 but then increased through 2021. However, both the decline and the rise in crimes were not met with respective changes in police manpower or budgets. The implication is that the supply of available funding appears to be a significant determinant of police employment, while the demand variable stemming from changing crime levels for police protection seems not to be driving changes in policing expenditures and employment.

Figure 3 shows complaints to the Federal Trade Commission for identity theft, fraud and other cybercrime and reflects the rapid growth of these “new crimes”. The employment of IT security professionals rises similar to the increase of these crimes but unfortunately, data categorizing pure cybercrime do not exist. Most local communities and even states do not have the professional manpower or the interest in handling cybercrimes like identity theft, and these crimes can emanate from anywhere in the world. Even the FBI has difficulty in handling crimes that originate outside the U.S. Addressing these crimes, which are growing at a faster rate than the eight traditional FBI Uniform crimes (violent and property crimes), has not been an easy job for governments at any level to handle. Perhaps that is why we observe the growth in private sector IT security employment that mirrors these complaints (Fig. 3).

Private security employment appears to be positively related to GDP fluctuations and behaves like a “normal good,”Footnote 1 hence the employment in private security changes in the same direction as GDP (Fig. 4). For example, between 2019 and 2020, during the COVID-19 pandemic, real GDP declined by 3.4 percent while private security employment declined by 1.8 percent. There does not appear to be a robust relationship between private police employment and crime. But, as with any measure of security (both public and private) the relationship between crime and security is endogenous, in particular at such an aggregated level. Increasing crime may increase demand for police or private security services, but an increase in these security services may reduce crime. Thus, there is an ambiguous relationship between aggregate measures of crime and security.

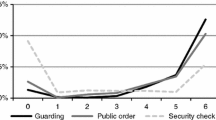

Figure 5 provides trends on average hourly wages for security professions over time. Private detective wages were 71 percent higher in 2021 than private guards, while police detective wages were just 33 percent higher than patrol officers. Further, police investigators and patrol officers’ wages in 2021 were 68 percent and 116.5 percent, respectively, higher than private investigators and guards. Guards include a wide gamut from stationary guards to private sworn officers, where the majority are probably in the lower end category. For example, only about 10 percent of private guards are armed, presumably usually sworn officers, and they earn higher wages than unarmed guards (Perry, 2020). The rapid growth in the “new crimes” is expected to be handled by IT security professionals who have the highest average wages of all security professions listed. Between 2012 and 2021 IT security employment experienced the largest growth in earnings of 29 percent compared with 11 percent for police detectives. It seems unlikely that significant new demand for private detective services will arise over time. There is a greater chance that patrol and guard could experience a significant growth via colleges and healthcare institutions including hospitals. Perhaps the most significant buyer could be government where some security services might well be shifted from police. These issues will be further developed in the following sections.

3 The US Investigative Services Industry

In this section we analyze how competitive the private detective and investigative industries are, how the concentration of these industries has changed over time, how they are expected to function in the future, and whether private security is expected to grow by providing some existing police services.

The investigative service industry (NAICS 561611) has been and remains unconcentrated. Table 1 shows that the industry is highly competitive where the 4 firm concentration ratio is well below 40 percent, which is the beginning range of oligopoly, according to Industrial Organization teachings (Oxford, n.d.). Moreover, the HHI (Herfindahl-Hirschman Index, see Hirschman, 1964) of 176.3 indicates that this industry is equivalent to one with at most 56 equal size firms. Even if the industry is composed of local or regional markets, the large number of firms competing suggests low concentration. For example, Pennsylvania with 2180 private defectives in 2021 and an average size of firm in the industry of 3 employees, means that Pennsylvania could have 726 companies. Further confirmation is the statement by IBISWorld (2020) that no major national players exist in the industry. The data provided on investigators by the BLS is only for these small independent firms. However, the number of in-house investigators in law firms and insurance companies are not included in these statistics. The BLS (2022, A) reports that only 36 percent of private investigators are employed by such firms. This means that the data for this market is substantially undercounted. Perry (2020) estimated that the overall security market is $15–20 billion larger than the data indicate. Law firms and management companies compete for some of the services offered by private investigative firms, suggesting even more competition than indicated by the concentration figures alone.

The average sales per private investigative firm in 2017 was $1.4 million, compared with $1.18 Million for just one lawyer, which is indicative of the small size of these firms. Further, there is no obvious trend towards larger establishments (C. Barnes, 2021) suggesting the absence of economies of scale or scope. Most investigative firms have just one establishment with an average of three employees, and a market share of less than one percent. For example, All State Investigations Inc. has a market share of 0.7 percent, North American Investigations has a market share of 0.2 percent, and Pinkerton, which is now a division of the Swedish based Securitas has merely 0.1 percent (IBISWorld, 2020). The number of establishments has decreased by 20 percent since 1997 and the number of firms has diminished by 10 percent in the 5 years ending in 2017. These declines reflect limited entry into the industry, which is highly competitive, suggesting low profitability. Also, there seem to be limited economies of scale and scope since the industry remains comprised of small firms. Between 1997 and 2017, the industry grew in current dollars by 220 percent while GDP grew by 228 percent. In real terms the industry grew in this period by 1.24 times while GDP grew 1.9 times. Thus, the investigative industry grew slightly below GDP, which explains why entry to the industry is not especially attractive.

Entry barriers are relatively low, when compared to other U.S. Industries. Investigative firms appear to incur low start-up and overhead costs. Most start-ups can begin at home with initial capital required below $3000 (Caramela, 2022). Regulation varies among states. Most states require detectives seeking licensure to have work experience in a related field, licensees to undergo a background check, and some require a test. Additional requirements are imposed for those who wish to be armed (IBISWorld, 2020). Thus, when demand rises (falls), new small firms enter (exit) with a short delay.

A survey of private investigators revealed that the most common specialties and services offered were background checks (34%), civil investigations (33%), and surveillance (26%). Other less common services included insurance investigations (19%), fraud (17%), corporate investigations (13%), accident reconstruction (17%), domestic investigations (13%), infidelity (13%), and other (19%) (Faber, 2013). The low industry concentration and its high degree of competition along with low entry barriers yields firms offering a multitude of services with limited specialization.

The high competitiveness of the private investigators industry suggests normal competitive profits with limited resources to invest into major technological innovations. As, in theory, within a perfectly competitive market, normal profits leave no or limited resources for research and development and no or limited technological progress. Since there are no public corporations that reveal profits in this industry, we report margins for the firms. The margins reflect the operating profits before interest, taxes, depreciation, and amortization. The margins before interest and taxes were estimated at only 5.2 percent in 2020. Comparing this industry to the S & P-500-listed companies shows that the S&P margins are 11–14 percent, substantially above the private investigative industry and reflecting again its highly competitive nature. Further, 10 percent or higher is generally considered to reflect good profitability (Wiblin, 2021). Recognizing that 2020 may be a low profit year and the industry’s low capital intensity, nevertheless the substantial difference in profitability compared to benchmarks suggest a low or normal profitability industry.

Finally, private detectives do not appear to take profits in the form of high wages. Private detectives average wage in 2021 was $28,860 while an average police investigator’s wage was $107,890 in 2021. The median salary of private detectives was $45,500 whereas the top 10 percent made more than $85,000.

4 The US Guard Services Industry

The guard services are the largest part of the private security industry. In 2017, total sales were five times, and total wages 9.3 times, larger than the investigative segment of the industry. Between 1997 and 2017, the 4 firm concentration ratio grew to 40.7 percent, which, according to a general rule of thumb for Industrial Organization economics (See Oxford Reference, four-firm concentration ratio), approaches the bottom of an oligopoly classification. The second four firms each had an average market share of 1.45 percent, indicating the small size of most of the industry’s firms. The HHI in 2017 indicates that the industry had the equivalent of about 19 equal size firms. The government standard is that an industry of at least seven equal size firms is unconcentrated (U.S. department of Justice, Horizontal Merger Guideline, 2010). Another indication of the concentration is the statement by Perry (2020: 53) that the combined market shares of G4S, Securitas, and Garda in 2019 was 30 percent. Along with Allied Universal, it is reasonable that the concentration in 2019 remains about the same as in 2017 and is considerably higher than the private investigation industry. Like the private investigators industry, the data provided here refer to 61 percent of guards employed in such firms and as casino surveillance officers (BLS, B, 2022). Finally, the industry is more nationally oriented than the detective industry.

Mergers in the guard industry have contributed to the increase in concentration. Most of the acquisitions have been of larger firms acquiring small firms. For example, since its founding in 1972, Securitas has been making a large number of acquisitions worldwide but not in the US. The acquisitions include companies which specialized in guards, cash collection using armored vehicles, electronic security, security consulting, security technology, video security, cloud based and automation services (Securitas AB, 2021). Two advantages for such acquisitions are penetrating additional geographical markets and achieving economies of scope where one service yields reduced costs of other services. All Securitas acquisitions have not directly increased concentration of the guards or any other security services in the US.

Mergers have played a major role in the growth of leading US guard firms. For example, a small Philadelphia guard service for sporting events named SpectaGuard was bought by two partners in the 1990s and then proceeded, in 2000, to buy Allied Security, followed by acquisition of additional large companies including Barton Protective, at the time with $350 million in revenues, and Initial Security with $225 million in revenues. The newly named AlliedBarton made 10 additional acquisitions. Then, in 2016, AlliedBarton with revenues of $2.5 billion merged with Universal Protection with revenues of $2.3 billion. Finally, in 2021 G4S, with $9 billion in revenue, originally a Danish company that went through a series of similar worldwide mergers, was bought for $5.3 billion by Allied Universal (Perry, 2020). Allied Universal paid a 68 percent premium for G4S shares after a bidding rivalry with Garda and gained the unique technology of G4S and its customer base (Perry, 2021). Neither the US antitrust authorities nor the EU competitive commission challenged the merger. Suggesting that the authorities did not view this merger as anti-competitive.

Observing the profits in the form of EBITDA (earnings before interest, taxes, depreciation, and amortization) reveals that small guard companies earned 8 percent profits in 2009 while showing losses between 2018 and 2021. Regional guard companies showed steady 7 percent profits for the same period while the large national/international firms exhibited a slight rise throughout the period from 6 percent in 2009 to 8.5 percent in 2021 (Perry, 2021: 65). As of 2021, these profit margins reflect modest profitability even for the large companies. It is important to note that the data were gathered from hundreds of companies where the small companies usually provided guard services while the large companies had a major guard component but, also provided mixture of other security services requested by their customers. However, there were some companies that provided services like those that used armored cars for cash transfer that are not part of this industry. Given these qualifications, the data indicate that the profitability of guard companies rises with size, reflecting a likely decline in the future share of the small companies. It also suggests that guard companies’ long-term existence depends on the demand side, on the provision of related services. It may also suggest, on the supply side, economies of scale and scope and buying power on costs of insurance, uniforms, and automobiles. The existing trend of the last twenty plus years suggests that the share of the small companies could continue shrinking, with the larger firms becoming more technologically oriented, providing a wide mix of security services. Thus, it is likely that the improved services of the large companies could mean their market shares might well continue to increase, and their increased mix of security services will enhance contracting out security by government and business. On the other hand, some consumers may prefer dealing with a smaller firm, offering more personal services.

It appears that much of the growth in the industry occurred mostly in the five largest firms that gained market share at the expense of the other smaller companies. Overall, the growth of the guard’s industry between 1997 and 2017 in real dollars was 124 percent while GDP grew 189 percent. Thus, this industry has grown less than the entire economy while at a similar rate as the investigative services industry. Entry barriers could also contribute to increasing concentration and are discussed below, and while entry barriers to this industry would appear modest in some states, competing with the large firms anywhere would require more capital and technological knowhow. Entry by foreign firms is also possible. For example, Prosegur, a Spanish firm is a recent entrant. Finally, a low-level concentrated oligopoly may be an optimal market structure, large enough to be innovative but still competitive enough to have near competitive profits (Table 2).

As mentioned above, another factor that contributes to increased concentration for private security firms is regulation. Private security in the U.S. is primarily regulated at the state level. Some states require occupational licenses to enter into the industry and others do not. But, the requirements for these licenses vary across states and over time. Meehan (2015) documents how more stringent licensing requirements impact the size of firms and average wages of security guards at these firms. Bonding and insurance requirements, law enforcement experience requirements, and training requirements were shown to increase the average wage of security guards in at least one of the paper’s empirical specifications. Most of these requirements also had disproportionately negative impacts on firms with less 100 employees, and disproportionately positive impacts on firms that had more than 100 employees. As they tend to increase, these entry requirements increase the proportion of firms that have more than 100 employees while decreasing the proportion of firms that have less than 100 employees. It appears that these regulations tend to increase the proportion of private security firms that are relatively large.

Examining the regulatory supply side of this issue can help explain some of the occupational licensing patterns across the U.S. In some states, private security licenses are just simple business licenses, but in other states an entire separate regulatory bureaucracy is set up to evaluate and propose new requirements for entry. In states where specific licensing boards are set up that include licensed security guards or security guard firm owners, requirements tend to be much more stringent. In particular, this type of regulatory infrastructures is associated with much higher training and experience requirements after controlling for state and time level fixed effects. The analysis also indicates that examination requirements are around 60% more likely when private security guards control the licensing boards than when no specific authority is given control of the licensure requirements. From a public choice perspective, it is argued that these self-interested security guard board members want to increase these requirements to reduce entry and thus stifle competition for their services. Sometimes these licensing requirements are left to the public police. When public police are involved with overseeing these licensing requirements, the law enforcement experience requirements tend to be higher than when no specific regulatory authority existed. Bonding and insurance requirements also tended to be higher as well as the likelihood of an exam requirement. With the exception of the law enforcement experience requirement, the results suggest that the most stringent requirements occurred when licensed private security guards were in control of these regulatory institutions (Meehan & Benson, 2015). Thus, it may not be desirable to have a possible substitute for private security in control of licensing when licensing requirements act as substantial barriers to entry.

5 Private Security Guards and Crime

Becker argued that private security was probably a specific crime deterrent but did not generate a large impact on general deterrence; instead, potential criminals would simply substitute unprotected targets for targets that were protected by private security (Becker, 1968, 201). In a process now often called displacement, as this thinking goes, areas that increase private security measures displace crime to other areas, actually producing a negative externality on these other areas in terms of increased crime. Much of the recent empirical research on private security and crime does not support this hypothesis, and some actually finds the direct opposite externality exists, that private security generates positive spillovers, as crime in entire cities and states declines as private security increases. Thus, this research suggests that private security plays a role as a general crime deterrent.

As mentioned above, investments in private security come in many forms. This section will draw primarily from the literature on private security guards and patrol officers. But, studies on other forms of privately purchased security are informative in showing how private investments can generate spillovers. An illustration of a private investment that generated general crime deterrence was highlighted by Ayres and Levitt (1998). They laid out the interesting case of Lojack, a hidden radio transmitter that can be installed on automobiles. Because there is no visible indication that a vehicle is equipped with Lojack, a potential car thief cannot identify if Lojack is installed on a targeted vehicle. Lojack greatly reduced the expected loss for car owners who use them, as 95 percent of the cars equipped with these devices are recovered compared to 60 percent for non-Lojack equipped cars. They also found that it acted as a general deterrent, it had a significant crime reducing effect, as a one percentage point increase in installations of the device in a market was associated with a 20 percent decline in auto thefts within large cities, and a five percent reduction in the rest of the state. Since other crime rates are not correlated with the drop in auto theft and installation of Lojack, the obvious implication is that many potential auto thieves are aware of the increased probability that they will be arrested, and are deterred as a consequence. These results are also consistent with a more recent investigation of the introduction of Lojack in Mexican states (Gonzalez-Navarro, 2013).

A relatively early cross-sectional study by Zedlewski (1992) found that greater levels of employment in private security firms was associated with lower crime rates. This analysis included 124 SMSA’s in the U.S., and results suggested that private security generated positive spillovers. And thus, the presence of private security resulted in general crime deterrence. This study’s findings should be interpreted with caution, as it did not control for the endogenous relationship between crime and security. This endogenous relationship between security measurers is highlighted by Ehrlich (1973). Security investments might have a negative impact on crime, but demand for these security investments also rise as crime increases, as people demand more protection. So more recent empirical studies have focused on how to separate the security-determines-crime relationship from the crime-determines security relationship (Meehan & Benson, 2017).

Improving on the cross-sectional analysis and addressing the endogeneity concerns, Benson and Mast (2001) used a panel of U.S. county level data from 1977–1992. This study used the number of firms and employees in 23 different industries that were expected to have relatively high demand for private security as instrumental variables in estimating private security presence in a county. Benson and Mast also included NRA membership, and lagged percentages of the state level republican vote within their estimation. The results suggested that increases in private security guard employees were associated with lower burglary and rape rates. This study used U.S. Census County Business Patterns data to account for the private security guard employee measures.

One issue with the Benson and Mast paper, as well as many other local level crime studies, is that they employed the FBI’s county level crime counts published in the annual Uniform Crime Reports (UCR). These statistics are fraught with error. The count data are self-reported by local police departments, and departments that actually report data vary wildly from year to year. Much of the variation in these statistics is from these underreporting errors and not from changes in the underlying crime conditions themselves. After a thorough review of this county level data, Maltz and Targonski comment (2002, 298): “we conclude that county-level crime data [UCR-data], as they are currently constituted, should not be used, especially in policy studies.” The annual state-level UCR data are considered to be better. The state level data used are estimated crime rates that attempt to correct for underreporting by police departments. When police agencies fail to report crime statistics for a given year, their data are replaced with equivalent data formed from what the FBI considers “similar” agencies. The county level data do not correct for these underreporting problems and simply report the error filled crime counts. Another advantage of state level studies is that they are less likely to have results impacted by displacement. The larger geographic areas make it less likely that potential criminals are just substituting unprotected targets by engaging in criminal activity in a completely different state.

Both Zimmerman (2014) and Meehan and Benson (2017) use the state level measures in panel studies to examine the impact of private security on crime. Zimmerman uses the Arellano and Bond (1991) estimation technique to account for the endogeneity of crime and private security. This technique uses lagged values of private security employees to instrument for current period numbers. The paper results suggest some deterrence impact for private security for murder and larceny, although these results are sensitive to estimation specification choice.

Meehan and Benson (2017) use occupational licensing requirements as instrumental variables to address endogeneity concerns. Findings suggest that increases in private security generate reductions in robbery and burglary rates (significant at the 5% level) and for larceny and motor vehicle theft (significant at the 10% level). The occupational licensing requirements used were: law enforcement experience, bond and insurance, training, and examination requirements. These licensing requirements tended to be firm level license requirements. The goal was to find the regulations that served as entry conditions for an independent contractor or firm and not as an employee of an existing firm. Overall the results suggested that private security had a large role in deterring property crime, as a 30% increase in the instrumented private security firms was associated in an 11.8% decrease in property crimes. The occupational licensing regulations examined looked at unarmed guards, and were intended to be a lower bound for entry into this industry. Many states have additional requirements for armed guards. Most security guards are not armed in the U.S. and around the world. Estimates of the proportion of security guards that are armed ranges from 20% to 30% (Graduate Institute of International Development Studies, 2011) to less than 10% (Cunningham & Taylor, 1985) in the U.S.

As an alternative to the county and state level panel data approaches, MacDonald et al. (2016) focused their analysis on a small section of the city of Philadelphia. This analysis attempts to measure the impact of sustained geographic variations in police officers, and the sustained impact on crime. The study explores geographic variations in police, examining police levels and subsequent crime levels on either side of a private police patrol boundary around the University of Pennsylvania by pooling city block level around this boundary from 2006 and 2010. The authors argue that this boundary is a historical artifact and blocks on either side of this boundary are believed to be very similar in their sociodemographic characteristics. The number of actively patrolling private police within the University of Pennsylvania’s Police patrol zone was more than double number of publicly funded police in the neighborhood blocks just outside the boundary. The natural variation was the larger (private) police force patrolling one side of this area. The number of private police was more than twice the number of public police on the other side of the boundary. This larger private police force was associated with a 45–60% reduction in all reported crimes in the neighborhoods on the Penn Police patrol side of the boundary. The study estimated elasticities for these private police of −0.7 for violent crimes and −0.2 for property crimes. They also address displacement concerns with the following statement:

We also estimated our models by using yearly block level data and obtained substantively similar findings. Because crime rates dropped overall in the University City district between 2005 and 2010 this provides evidence that the addition of Penn Police did not simply displace crime to other parts of the University City district. (pg. 834)

6 The Relationship Between Police and Private Security

If private security can act as a general crime deterrent, what is the mechanism by which it works? Does it produce these results as a stand-alone service or does it act as a complement to public police efforts? Private security and public police could substitute for one another as crime deterrents in some roles. The presence of security guards tends to increase the costs of attacking a specific target much like the presence of public police officers would. Private security guards often operate in similar ways to police through patrol and increase the probability of potential criminals becoming apprehended. But in some areas, private security guards have provided substitutes for many of the duties typically assigned to public police.

Governments often shed services or contract out depending on the nature of the service. Theoretically, when government provides a service that aids an individual entity and imposes no positive or negative externalities on others, it is providing a private good which could be shed for market provision. For example, some local governments provide animal control services, like capturing a bird caught in a chimney, where the service seems not to have any effects beyond the individual site and thus should be shed by police. If police offer such service, it will usually not be provided by private firms. On the other hand, when the service is a public good, shifting its provision from monopolistic police to competitive market provision could yield more efficient production, which may also reflect lower costs of inputs. For example, police response to a domestic dispute may generate positive externalities for the community, but the use of a professional psychologist or social worker may be more effective than a response of sworn officer or other typical first responders (see Cacciatore et al. 2011 for an example program involving social workers teamed with fire department first responders). In both cases of contracting-out and shedding, police could be allowed to compete with the private firms for the provision of the service. Such police involvement requires that it is conducted “under level playing field rules.” Contracting out public good services requires that the output can be clearly quantified in the contract, and that the demand for such a service is greater than the minimum threshold for normal profits. In the case of shedding, government no longer assumes responsibility for the service. Indeed, shedding is the greatest degree of privatization. In both shedding and contracting out the objective is to increase efficiency, where competition replaces monopolistic police.

Obviously, private security can also provide similar or enhanced versions of the services provided by public police. For example, police patrol provides deterrence and faster response to crimes than police dispatch. However, merchants of a particular shopping area may wish to enhance security beyond the “standard” police level to attract customers and, therefore, they hire a private security company to complement police presence. This is a privately provided public good, which is effectively a Public Private Partnership.

An example of shedding is the case of burglar alarm response in Salt Lake City, Utah. When police respond to burglar alarm activations, 94 to 99 percent of the time they are false alarms. Blackstone et al. (2020) argue that such responses to false activations are a private good where only the alarm owner benefits, and such service must be shed. Police could choose to compete with private response companies if they do so on a leveled playfield. Indeed, Salt Lake City (SLC) changed its alarm ordinance to require verification of an actual or attempted burglary before police will respond. The initial response to the alarm in this scenario is by a contracted security guard service. The results of this Verified Response policy in SLC were a decrease in the number of police responses to false alarms by 87 percent. Also, police responses to high priority calls improved, as it declined from an average of 12:04 minutes to 4:05 after the policy was implemented. While response to lower priority calls also improved, as on average it fell from 11:52 minutes to 8:37 minutes between 2000 and 2003. Burglaries also declined in the relevant period by 26 percent relative to burglaries in a control group of cities. Since response to high priority calls, including valid burglar alarms, significantly declined, burglary deterrence increased. In addition to faster police responses, the community benefited by having alarm owners pay for the costs they initially imposed on police and the subsequent savings in police expenditures generated crime reduction benefits, while specialization occurred in the competitive market for private alarm response that developed.

Contracting out specific police services is illustrated by two following examples. In 2019, Milwaukee announced a plan that instead of hiring additional officers, to add cameras and to employ a private security company to assist the police to fight crime. Also, in 2019 Virginia signed a contract for a private security firm to transport mental health patients instead of using sworn officers. In both these examples, private security companies substituted for police in performing a public good service (Perry, 2020: 51). Competition is here introduced through the open and widely advertised bidding for the service. Contracting out is the intermediate degree of privatization. The ultimate solution where possible, is to allow consumers sovereignty as discussed in the Salt Lake City example. However, where the services are public goods, government is more likely to be responsible for their provision and should do so for a given quality at the lowest costs. Thus, contracting out using open bidding is a potential solution for this public goods provision where feasible.

Hybrid models are the most common and growing form of Public Private Partnership (PPP) where both police and private security participate in the delivery of a public good. In this category, the supply level of police services is insufficient for the consumers who demand more and supplement police with private security. Two major employers for such cooperation and complementarity are hospitals and educational institutions, which according to BLS (2022, B) are the largest employers (at 6 percent each) of private security guards other than security firms.

With the rise of attacks on the medical staff in hospitals,Footnote 2 police response tends to be relatively slow and demand for supplementary private security has became acute. One indication of the security problem in hospitals is the recent Occupational Health and Safety Administration (OHSA) report, which states: “almost 75 percent of workplace violent victims are employed in healthcare settings” (Shah et al., 2022). Healthcare workers suffer more than 5 times the risk of workplace violence than workers in general. Hospitals are especially vulnerable for both patients and medical staff (Shah et al., 2022). Emergency rooms and psychiatric wards are especially vulnerable. A survey of 340 US hospitals revealed that 72 percent employed non-sworn officers, 18 percent employed sworn officers, 21 percent of hospitals had public police officers, 3 percent used contract security guards of whom 28 percent were non-sworn. Almost half of private security officers had the power of arrest (Schoenson & Pompeii, 2016).

Colleges and universities compete for students and therefore need to address the major considerations of parents and the prospective students. In a survey of parents, a safe environment was found to be a top concern with 74.5 percent saying it was the most important consideration (Youngblood, 2015). Universities and colleges are also inviting targets for those who want to commit property or violent crimes. The Clery Act of 1990 requires colleges and universities to collect and publish statistics on crime in and around their campuses. Since its passage, rising numbers of colleges and universities have employed security services of their own. In the academic year 2011/12 75 percent of campuses had their own sworn and armed officers growing from 68 percent 7 years earlier. Overall, 94 percent of sworn officers were armed. The campus private officers usually have full police powers, and often patrol areas surrounding the campus. Seventy percent of the campus police have a cooperative agreement with the outside law enforcement agencies in their communities (Reaves, 2015). Campus police may request the City’s police help investigating crime, and the Campus officers patrol the neighborhood and sometimes respond to 911 calls. When a city officer stops a driver or a suspect, campus police may assist the officer. Another form of private supplementing, used in addition to both city and campus police, is when parents hire a private force to patrol the vicinity of the students’ residences (Armstrong, 2022).

In Washington DC, New Orleans,Footnote 3 San Francisco, Los Angeles, and Portland Oregon neighborhoods and business districts have hired private security companies to enhance public police protection. On occasion, sworn officers work as private security to supplement their police earnings. Residents of some wealthy neighborhoods, retail business districts or chain stores, and critical infrastructure augment standard police protection with private police. On private property, private security has the same powers as the owner, which is substantial, while on public property private security can exercise citizens’ arrest power and then turn the perpetrator over to police. In New York City, for example, off duty police officers guard local retail chains where the payments by the merchants are funneled through the city and paid as overtime to the officers (Akinnibi & Holder, 2022).

The San Francisco Patrol Special Police was founded in 1847 and includes non-sworn officers that are under the regulatory control of the San Francisco police commission. The patrol provides a variety of private security services and are paid by the clients on an hourly basis. They attend civic and merchant meetings to stay aware of the needs of the community. A 2009 survey conducted by Stringham showed that the Special Police force made the neighborhoods where they operate safer than other neighborhoods (Wikipedia, 2022). This private group relieves the police of dealing with low priority private matters that prevent police in other communities from concentrating on their main mission. The services provided by the Special Police are mostly private goods and usually do not involve externalities. The exceptions include the response to valid 911 calls, apprehending law breakers, or aiding public police in emergencies.

Since most services provided by the Special police are private or client oriented, free entry should be allowed to create a more competitive market. In the case above of Salt Lake City, its Verified Response (VR) policy allowed free entry of burglar alarm response companies so that alarm owners could choose among them. This free entry policy increased social welfare, which is reduced in the San Francisco practice since the Special Police seem to have monopolistic power for low priority responses. However, even with this deficiency the San Francisco practice is still superior to most other communities where response for private services in funded and conducted by public police.

7 Discussion

The private investigation industry is small and is composed of small firms, limited use of technology, 2.1 percent growth, which is roughly similar to or slightly below US GDP average growth. The industry has modest profitability and likely lacks economies of scale and scope. The average wage of private detectives over time has been around 45–47 percent of police detectives. There has been no significant contracting out of detective tasks from government over time. Police detectives have been trained and employed as patrol officers before being promoted to detectives. The state regulations for private detectives have been generally modest compared with the training of public detectives. Thus, there is no apparent reason for police to contract out services to private detectives. There is another group of investigators employed by large law or accounting firms for which no data exist and therefore is not addressed here.

One growth area for private investigators is closely related to counterfeit goods and fraud, where brand named companies hire private detectives and then provide the evidence to the district attorney to pursue criminal charges. Identity thefts, which most often extend beyond local jurisdictions are not addressed by police or the district attorney’s office, and often require professional private help. The rapid growth of such crimes may provide opportunities for highly professional private detectives. It is evident, however, that the existing industry is not yet equipped to address this expected growing demand. In fact, police have in many cases shed enforcement of these laws, forcing victims to seek private help.

In 2022, public detectives are usually hired after successfully serving as a line police officer with considerable professional experience. Also, to be promoted to detective, police officers must pass a test. Private detectives usually must meet more modest requirements. Further, the small size of such firms and their limited capital and technology make less likely contracting out from police, district attorneys, and federal agencies. However, retired police detectives are the prime candidates for entering the private detective industry to improve its performance. Further, to address crimes like identity thefts, fraud, and other cyber related crimes an investigative firm needs in-house accountants, lawyers, IT professionals, and good investigators. Demand by victims and contracting out by public agencies must grow significantly to enable this industry to hire such high-income professionals. The current fragmented and highly competitive industry shows few signs of meeting the challenge.

The growth of both the investigative and the guard industries has been similar and modest over this period and even below GDP growth. The guard segment of the industry has been adopting technology, witnessed mergers that may well result in, and lead to, more technological and managerial innovations but that also may have been the result of regulatory incentives. The ability of the guard industry to adopt new technology and procedures as well as its flexibility to change may have contributed to government at all levels to contract out services to them. On the other hand, investigative services seem to remain structurally as small firms and show limited signs for technological and managerial innovations. Technological gains in security services can be witnessed on many fronts, security companies introducing new cameras, alarms, and equipment. It appears that investigative services haven’t been as active in these endeavors, perhaps that is why there is a reluctance by individuals and government to contract out these services.

Forecasting the near future is risky, but it is reasonable to assume that the guard services, which appear to innovate and have moved to the low end of regulatory or technologically induced oligopoly, and as such exhibit a greater chance of economic profits and further growth. Thus, this trend seems to provide incentives for government and police to contract out services to the large private guard companies and even establish Public Private Partnerships (P3) relationships. On the other hand, government seems not to gain from either contracting out or establishing P3 relationships with the private investigative industry, which suggest that this industry is not expected to experience significant growth. One possible exception may arise from the rapidly growing new types of internet crimes where state and local authorities refrain from addressing, and thus shift victims to the private investigation industry. However, since dealing with such IT crimes requires professional efforts that are missing in the “traditional” small investigation companies, it is reasonable to conclude that addressing such crimes will be in IT companies or large law or accounting companies and will not yield any significant demand to the existing investigative industry.

The guard industry provides direct preventive and deterrence services to clients, where they address the specific client requirements. The number of private guards is estimated to be 20 percent higher than all officers at local, state, and federal law enforcement agencies (BLS, A & B).

The guard industry is modestly concentrated where the share of the largest firms is likely to grow somewhat. The firms have adopted technology to be able to provide integrated security services that clients demand. Their purchasing flexibility unlike the rigid and bureaucratic public police, their large size which allows them to potentially utilize economies of scale, and their lower wages than public police together enables them to provide services at lower costs than public police. Further, the competition among the large firms encourages adoption of new technology and efficiency in the delivery of services. Thus, we expect more contracting out of specific security services by government including even the police. For example, it is possible to reduce or complement patrolling with cameras spread throughout the community, as was planned for in most of London (Satariano, 2020). The system could even be integrated with drones. In case of a serious event, a task force or nearby patrol officer could be dispatched to the site. Such a service would likely deter burglars and other law breakers because of the high visibility and quicker response. It may be conducted by local police or, because of significant technological efficiencies, be contracted out to private security. A national security company that installs and operates such systems in many places may resolve problems that local police may be unable to do. One cautionary note is that the industry concentration now is modest but it would be undesirable for regulation to make entry difficult so that competition is threatened. Allowing police or existing security companies to exercise control over entry of a potential competitors is also problematic (Meehan & Benson, 2015).

Police officers are often extensively trained for some the tasks they perform, but not well trained for others. Specialization in the areas that they are better trained, or areas where they have a comparative advantage (dealing with violent crime deterrence and investigation perhaps) may increase efficiency. Police often perform tasks for which they overqualified and overpaid relative to alternative service providers. For example, sworn officers work as clerks, write parking tickets, guarding municipal facilities, directing traffic, or helping children cross the street. Such tasks can be contracted out under competitive bidding to lower paid guards of private companies. On the hand, officers are often underqualified to manage technology or investigate financial frauds that require highly paid professionals whose salaries are beyond government levels (see Fig. 5 for IT/cyber security service wages). This again creates an opportunity for contracting out, or complete shedding, of such services and increased specialization by existing police forces.

The wages of all police officers vary in a small range depending on rank and seniority. There is only limited room for merit pay for performance. Thus, it is not unusual that officers are over or under paid for their task and their individual productivity. On the other hand, workers in private companies are usually compensated by their task and productivity. Unlike monopolistic police, private security companies are motivated by increasing profits and thus improve productivity and seek to obtain additional clients while competing with other similar companies. Finally, monopolistic police do not have to respond to consumer preferences as much as private companies in a competitive environment.

Introducing the mere possibility of competition will encourage police to improve their performance to preserve their jobs. To conclude, introducing competition to a government monopoly that is normally slow to innovate and respond to consumer preferences is especially likely to improve overall performance.

8 Conclusion

This chapter presented and analyzed the trends in US public and private security, their hypothesized causes from both the demand and supply factors, the private security markets for both guards and detectives, and suggested future trends and policy implications. Spending and employment of public police seem to closely relate to state and local budgets and employment while being unrelated to traditional crime rates and the new internet related crimes. On the other hand, private security employment has a closer relationship to real GDP changes, or the resources available for their clients, while somewhat unrelated to crime fluctuations.

We also analyzed private security and detective market structures including concentration and entry barriers between 1997 and 2017. We find that the guard segment has experienced increased concentration, and borders on oligopoly. The investigative services industry remains relatively unconcentrated, comprised of small firms. Mergers in the guard segment have led to larger firms with more advanced technology which allows them to offer integrated security services. The flexibility of operations, adoption of technology, pecuniary economies of scale and possible economies of scope along with a market structure conducive to modest profitability and strong innovation bodes well for the future of the industry. On the other hand, the unconcentrated private detective industry with an average firm size of three employees, earning at best normal profits and using limited technology is not likely to exhibit significant growth in the coming years. The sources of growth for the security industry overall are likely to come from colleges and universities, healthcare including hospitals and in particular government at all three levels. Contracting out security by these three sectors and businesses in general depends on lower costs and improved quality of service. Government has contracted out guard services but not investigative services and is likely to continue to do so. Large businesses, in general, contract out non-core activities in order that their management can concentrate on the core activities.

The evidence presented above also suggests that private security acts as a general crime deterrent and may possibly act as a complement to public police efforts. If private security generates positive spillovers (as general deterrence would suggest) this would indicate that there is probably an underinvestment in private security relative to what would be the efficient level. Meehan and Benson (2017) demonstrated the negative impacts of occupational licensing regulations on the number of private security firms, which was subsequently correlated with increasing property crime. Thus, the impacts of private security regulation and regulatory formation are of interest to policy makers.

U.S. State law makers should be careful when allocating power to occupational licensing boards dominated by already licensed practitioners or controlled by potential substitute providers. In particular, in areas where underinvestment already exists. These licensed industry members may erect barriers to entry, via licensing requirements, to reduce competition for their services. In the case of private security guards, this comes with another cost to the U.S. criminal justice system, as positive spillovers in the prevention of crime and efficient allocation of public police resources may be sacrificed.

Police training includes coverage of most issues police confront. Sworn officers who are paid significantly more than private guards are often assign to activities that could be fulfilled by lower paid individuals. Examples include officers doing clerical work, officers directing or controlling traffic, guarding municipal facilities, helping children cross the street or escorting funerals. Private guards could be contracted for all such activities. On the other hand, police officers often lack the knowledge to handle Internet related fraud or identity theft that their constituents face, and subsequently a small industry of high paid IT/cyber security experts has emerged to address these issues.

Indeed, government, colleges and universities, among others, already contract private security companies, primarily guard companies that specialize in their specific requirements. These demands are expected to grow, leading to improved managerial and technological innovations of such companies, while the competition among them could provide competitive priciness for their services. The current generally lower professional level of private investigators in comparison to public law enforcement makes difficult significant joint efforts of the two sectors. Unlike the private guard service, the private investigation industry is not expected to grow soon.

Notes

- 1.

Demand increases as income levels increase for a normal good, if income falls, demand also falls.

- 2.

For anecdotal evidence of this problem, see Robert Javlon and Stephan Dafazio, “Police ID Suspect in Attack on Doctoe, Nyrses in LA Hospital”, Associated Press June 4, 2022. https://www.usnews.com/news/us/articles/2022-06-04/man-held-in-attack-on-doctor-nurses-at-california-hospital

- 3.

See Chapter “How to Fight Crime by Improving Police Services: Evidence from the French Quarter Task Force” by Long in this volume.

References

Akinnibi, F., & Holder, S. (2022, Feb 23). NYC businesses hire off-duty police to blunt uptick in violent crime. Bloomberg US Edition. https://www.bloomberg.com/news/features/2022-02-23/new-york-city-businesses-hire-off-duty-police-officers-to-blunt-crime-increase. Last visited 5-27-2022.

Arellano, M., & Bond, S. (1991). Some tests of specification for panel data: Monte Carlo evidence and an application to employment equations. The Review of Economic Studies, 58(2), 277–297.

Armstrong, J. (2022, March 3). Temple mom was right to hire off-Temple security. The Philadelphia Inquirer: A13.

Ayres, I., & Levitt, S. D. (1998). Measuring positive externalities from unobservable victim precaution: An empirical analysis of Lojack. The Quarterly Journal of Economics, 113(1), 43–77.

Becker, G. S. (1968). Crime and punishment: An economic approach. Journal of Political Economy, 76(2), 169–217.

Benson, B. L., & Mast, B. D. (2001). Privately produced general deterrence. Journal of Law and Economics, 44(2), 725–746.

Blackstone, E. A., & Hakim, S. (2010). Private policing: Experiences, evaluation, and future direction. In B. L. Benson & P. R. Zimmerman (Eds.), Handbook on the economics of crime. Edward Elgar.

Blackstone, E. A., Hakim, S., & Meehan, B. (2020). Burglary reduction and improved police performance through private alarm response. International Review of Law and Economics, 63, 1–13.

Bureau of Labor Statistics (BLS, A). (2022, April 18). Occupational outlook handbook. Private Investigators. https://www.bls.gov/ooh/protective-service/private-detectives-and-investigators.htm#tab-3. Last visited 5–25–2022.

Bureau of Labor Statistics (BLS, B). (2022, April 18). Occupational outlook handbook. Private Guards and Gambling Surveillance Officers. https://www.bls.gov/ooh/protective-service/security-guards.htm#tab-3. Last visited 5–25–2022.

Cacciatore, J., Carlson, B., Michaelis, E., Klimek, B., & Steffan, S. (2011). Crisis intervention by social workers in fire departments: An innovative role for social workers. Social Work, 56(1), 81–88.

Caramela, S. (2022, April 14). Startup costs: How much cash will you need?. Business News Daily. https://www.businessnewsdaily.com/5-small-business-start-up-costs-options.html

C. Barnes & Co. (2021). U.S. Industry and market report: NAICS 561611: Investigation Services Industry.

Cunningham, W. C., & Taylor, T. H. (1985). Crime and protection in America: A study of private security and law enforcement resources and relationships. U.S. Department of Justice, National Institute of Justice.

Faber, K. (2013, Nov 5). The 10 most common specialties of private investigators. PInow.com. https://www.pinow.com/articles/1737/the-10-most-common-specialties-of-private-investigators. Last visited 5-19-2022.

Ehrlich, I. (1973). Participation in illegitimate activities: A theoretical and empirical investigation. Journal of Political Economy, 81, 521–565.

Gonzalez-Navarro, M. (2013). Deterrence and geographical externalities in auto theft. American Economic Journal: Applied Economics, 5(4), 92–110.

Graduate Institute of International Development Studies. (2011). Small arms survey: States of security. Graduate Institute of International Development Studies.

Grogger, J. (1991). Certainty vs. severity of punishment. Economic Inquiry., Western Economic Association International, 29(2), 297–309.

Hirschman, A. O. (1964). The paternity of an index. The American Economic Review. American Economic Association, 54(5), 761–762.

IBISWorld. (2020, Nov). Private detective services, Industry Report OD4407.

Joh, E. E. (2004). The paradox of private policing. Journal of Criminal Law and Criminology., 95(1), 49–132.

Lee, D., & McCrary, J. (2009). The Deterrence effect of prison: Dynamic theory and evidence. No. 1168. Princeton University, Department of Economics, Center for Economic Policy Studies.

MacDonald, J. M., Klick, J., & Grunwald, B. (2016). The effect of private police on crime: Evidence from a geographic regression discontinuity design. Journal of the Royal Statistical Society A, 179(3), 831–846.

Maltz, M. D., & Targonski, J. (2002). A note on the use of county-level UCR data. Journal of Quantitative Criminology, 18(3), 297–318.

Meehan, B. (2015). The impact of licensing requirements on industrial organization and labor: Evidence from the US private security market. International Review of Law and Economics, 42(C), 113–121.

Meehan, B., & Benson, B. L. (2015). The occupations of regulators influence occupational regulation: Evidence from the US private security industry. Public Choice, 162(1–2), 97–117.

Meehan, B., & Benson, B. L. (2017). Does private security affect crime?: A test using state regulations as instruments. Applied Economics, 49(48), 4911–4924.

Oxford Reference. (n.d.). Four-Firm Concentration Ratio, https://www.oxfordreference.com/view/10.1093/oi/authority.20110803095831707#:~:text=The%20four-firm%20ratio%20is,held%20to%20indicate%20an%20oligopoly

Perry, R. H. (2020, Aug). U.S. Contract Security Industry. Robert H. Perry & Associates, Inc. https://www.nasco.org/wp-content/uploads/2020/09/2020_White_Paper_FINAL.pdf. Last visited 5-23-2022.

Perry, R. H. (2021, April 12). Analysis of Allied Universal Merger of G4S. Security Information.com https://www.securityinfowatch.com/security-executives/protective-operations-guard-services/article/21218234/analyst-allied-universals-acquisition-of-g4s-a-deal-of-historic-proportions. Last visited 5-23-2022.

Reaves, B. A. (2015). Campus Law Enforcement, 2011–12. Special Report, U.S. Department of Justice, Office of Justice Programs, Bureau of Justice Statistics, January.

Satariano, A. (2020, Jan 24). London police are taking surveillance to a whole new level. New York Times, https://www.nytimes.com/2020/01/24/business/london-police-facial-recognition.html. Accessed 5 June 2022.

Schoenson, A. L., & Pompeii, L. A. (2016). Security personnel practices and policies in U.S. hospitals. Workplace Health & Safety, 64(11), 531–542.

Securitas AB. (2021, July 30). Securitas AB: Company Profile. http://www.marketing.comcessed/. May 19, 2022.

Shah, Y., et al. (2022, May 22). Gun violence in a hospital. Philadelphia Inquirer, G2.

U. S. Department of Justice. 2010 Horizontal Merger Guideline. (2010). https://www.justice.gov/atr/horizontal-merger-guidelines-08192010. Last visited June 4, 2022.

Wiblin, B. (2021, Nov 8). What is EBITDA and how to calculate it. Life & Money, https://www.firstrepublic.com/articles-insights/life-money/build-your-business/what-is-ebitda-and-how-to-calculate-it. Last visited 5-20-2022.

Wikipedia. (2022). San Francisco Patrol Special Police. https://en.wikipedia.org/wiki/San_Francisco_Patrol_Special_Police. Last visited 5-28-2022.

Youngblood, J. (2015). Report: What do parents want from colleges?. https://www.noodle.com/articles/report-what-do-parents-want-from-colleges. Last visited 5-26-2022.

Zedlewski, E. W. (1992). Private security and controlling crime. In G. W. Bowman, S. Hakim, & P. Seidenstat (Eds.), Privatizing the United States Justice System: Police adjudication, and corrections services from the private sector. McFarland & Company.

Zimmerman, P. R. (2014). The deterrence of crime through private security efforts: Theory and evidence. International Review of Law and Economics, 37, 66–75.

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2023 The Author(s), under exclusive license to Springer Nature Switzerland AG

About this chapter

Cite this chapter

Blackstone, E.A., Hakim, S., Meehan, B. (2023). An Overview of Private Security and Policing in the United States. In: Blackstone, E., Hakim, S., Meehan, B.J. (eds) Handbook on Public and Private Security. Competitive Government: Public Private Partnerships. Springer, Cham. https://doi.org/10.1007/978-3-031-42406-9_1

Download citation

DOI: https://doi.org/10.1007/978-3-031-42406-9_1

Published:

Publisher Name: Springer, Cham

Print ISBN: 978-3-031-42405-2

Online ISBN: 978-3-031-42406-9

eBook Packages: Economics and FinanceEconomics and Finance (R0)