Abstract

This study examines the role of artificial intelligence (AI) in the digital transformation of the Jordanian listed banks. It explores the current state of AI adoption in the Jordanian financial sector, as well as investigating the drivers and challenges of AI adoption in this industry. Additionally, through using the deductive research approach, the study examined the impact of AI on various financial functions such as risk management, fraud detection, and customer service. Consequently, the findings suggest that the Jordanian financial industry is at an early stage of AI adoption, with limited awareness of its potential benefits. The study highlights the need for financial institutions to invest in AI and develop a strategic plan for its implementation to fully realize its benefits. The study had revealed that Rob advisor, block chain, and artificial intelligence approaches are all contributing to the digital transformation of Jordan's banking system, with the second null hypothesis rejected due to its lower level of significance.

Access provided by Autonomous University of Puebla. Download chapter PDF

Similar content being viewed by others

Keywords

1 Introduction

The implementation of Artificial Intelligence “AI” (from here onwards) in different industries has proven the superiority of Artificial Intelligence over human intelligence, which has given rise to the age of digitalization ([7]. Thus, due to its heavy reliance on human labor in order to provide its services; the implementation of AI systems in the financial industry took a place progressively when it is compared with other industries [5, 8]. However, the rapid rate of technological innovation is bringing ways across various industries as competitive dynamics shift, and new business models emerge, which has made it necessary for companies to scramble on the digital transformation bandwagon. However, there are several organizations struggling to develop an effective approach to transform themselves electronically, whereas, the success rates of such transformation efforts are consistently low with less than 30% succeed [3, 5]. Although advances in finance are not a new notion, however, the emphasis on technical advances, and its pace have increased substantially [1, 6]. There are several reasons behind the necessity for employing artificial intelligence techniques in financial institutions. One of the most important factors that led to the applications of AI in the banking industry is the regulatory encouragement. For instance, in December 2018, US government agencies including Federal Reserve, Federal Deposit Insurance Corporation, Financial Crimes Enforcement Network, and National Credit Union joined in an effort to combat money laundering, and terrorist financing [21, 29].

The banking industry has undertaken substantial changes in recent years, due to the demand for more efficient and secure financial transactions and services [1, 9]. To meet such demands, the banking industry found itself face-to-face with the need for digitalization, which requires technologies that will impact virtually all banking operations [33], [36]. According to [31], the role of (IT) traditionally was to cut business operating costs as well as elevating organizational efficiency through automating most of business processes. IT has brought about a whole new way of doing business today thanks to a set of new prevalent digital tools and technologies [14]. Based on this new prevalent role of IT, organizations on the whole are forced to transform the way they do business by constructing and adopting new business models that are based on the adoption and implementation of IT’s tools [14, 16].

The study holds significant importance due to the following reasons:

-

1.

Enhancing Banking System Efficiency: The study highlights the role of Artificial Intelligence (AI) techniques in improving the banking system's efficiency. It emphasizes how AI can automate various banking operations and reduce manual errors, thereby saving time and resources.

-

2.

Providing Competitive Advantage: With the increasing use of digital technology in the banking industry, AI can provide a competitive advantage to the Jordanian banking system. This study helps in identifying the benefits of using AI techniques in the banking system, which can help banks stay ahead of their competitors.

-

3.

Addressing Security Concerns: The banking industry is prone to security breaches, and AI can play a vital role in detecting and preventing fraudulent activities. The study sheds light on the significance of AI in enhancing the security of the banking system and how it can protect the customers' personal and financial information.

-

4.

Identifying Areas of Improvement: The study can help identify areas of improvement in the banking system by highlighting the potential areas where AI techniques can be applied. This can help the banking industry in Jordan to enhance its services and customer experience.

-

5.

Promoting Economic Growth: The study also holds importance from an economic standpoint. The digital transformation of the banking system through AI techniques can lead to increased efficiency and productivity, which can help in promoting economic growth in Jordan.

The implementation of AI brings about new compound challenges to businesses that go beyond the traditional management of the classical IT applications [5]. In this regard, [16] indicated that the intense competition between financial services companies, has forced these companies to adopt and implement a set of new predominant and ubiquitous technologies, such as big data analytics, social media, and cloud computing, which are the foundation of FinTech.

2 Literature Review

A study by [2] argued that the digital trading system as a product of technological advancements played a vital role to improve the stability of small and medium enterprises, which are listed on the Amman stock exchange by reducing the trading costs as well as facilitating trading processes for investors. According to [23] innovative financial services and products produce and promote new financial spectrum of know-hows, new organizations, and new market places. Such digital innovation, according to [16] can be manifested in the form of a new service, product, procedure, or business platform which necessitates major modifications by the business, and is facilitated and made possible by Information technology (IT).

AI is not utilized in segregation but frequently applied in aggregation with other technologies [7]. Such technologies include Application Programming Interfaces (APIs), Internet of Things, cloud computing, big data analytics, and open-source algorithms [34]. Since AI improves human intelligence rather than being an alternative for it [5], it is acknowledged that AI requires the interactions with humans to be conducted and enable decision-making process to yield the best outcomes [13]). Like all other sectors, financial institutions implement AI technology in different ways like identification of unusual transactions and frauds, customized services, decision making about creditworthiness, utilization of natural language processing on text documents, risk management and cyber security [3, 10].

2.1 Mobile Banking

The tool of mobile banking facilitates the banks’ services for customers as compared to their physical visits to branches; so it results in increasing banks’ revenues. That’s why banking sector is paying close attention to the adaptation and implementation of emerging technologies in an attempt to improve the quality of services and to be competitive in the market [10].

2.2 The Applications of Block-Chain in the Banking Industry

Blockchain technology is a decentralized, distributed ledger that allows for the secure, transparent and tamper-proof recording of transactions. It has the potential to revolutionize the financial industry by reducing costs, increasing efficiency, and enhancing security [12, 15, 17]. Research has also shown that blockchain technology can reduce the time it takes to settle trades, from several days to just a few minutes [12]. One major challenge is the need for standardization and interoperability between different blockchain systems [33]. Despite these challenges, research suggests that blockchain technology has the potential to significantly transform the financial industry [12].

2.3 Robo Advisor in Financial Industry

This tool has rapidly become a popular alternative to traditional financial advisors, as it uses algorithms to provide automated financial advices and investment solutions to customers [19, 25]. Robo-advisors offer a range of benefits over traditional financial advisors. They are generally more affordable, have lower minimum investment requirements, and can offer 24/7 accessibility to financial advice. However, despite the advantages, robo-advisors also have drawbacks [20, 24]. One major concern is the lack of human interaction and personalized attention, which can be critical for clients with complex financial situations or emotional reactions to market volatility. Other concerns include the potential for algorithmic errors, regulatory uncertainty, and cyber-security risks [7].. They can reduce the need for human financial advisors and impact the way investment firms manage their businesses [21]. One potential effect is the democratization of investing, as robo-advisors can offer lower fees and minimum investments that make investing more accessible to a wider audience [28, 30]. However, the proliferation of robo-advisors can also lead to increased homogeneity in investment strategies, as many use similar algorithms and models [19, 31]. This could lead to increased systemic risk if market shocks affect all robo-advisors simultaneously [26, 32].

2.4 The Significance of Digital Trading for Financial Industry

Digital trading platforms have transformed the financial industry by enabling investors trading electronically [29]. Digital trading offers several benefits over traditional trading methods [6, 15]. It provides increased efficiency and speed of trade execution, lower trading costs, and enhanced transparency [15]. Other concerns include the lack of human oversight, the risk of cyber-attacks, and the potential for market manipulation by high-frequency traders [15, 22]. Additionally, the rise of digital trading has the potential to significantly disrupt the financial industry. It can increase market efficiency, liquidity, and accessibility, but also has the potential to amplify market volatility and exacerbate market shocks [11, 14].

3 Research Methodologies and Sampling

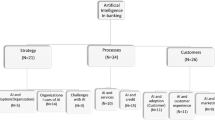

This research endeavors to evaluate the role of artificial intelligence in the digital transformation of the Jordanian banking system [22]. Therefore, the study aims at identifying the extent to which artificial intelligence has been adopted and implemented in the financial industry of Jordan, as well as its impact in business operations, customer service, and the overall performance as well [11, 18]. For this purpose, the study adopted the deductive research approach in order to analyze a primary data those are collected by demonstrated a structured questionnaire that was distributed to a sample of 150 managers, executives, as well as IT professionals who are working in the listed banks of Jordan, which are consisting of fourteen commercial and Islamic listed banks. Thus, by using the STATA software the study employed the descriptive statistics tests to identify key trends, patterns, and insights related to the use of artificial intelligence in the banking system of Jordan. Additionally, it is used the T-test as well as the paired sample T-test to examine the following main hypotheses:

-

H01: Artificial Intelligence’s Techniques have significantly contributed in the digital transformation of Jordanian banking system.

-

H02: The techniques of Artificial intelligence are unequally contributing in the digital transformation of Jordanian banking system.

4 Results Analysis and Discussion

Table 1 describes frequencies in order to explain respondents’ answers regarding the role of AI in digital transformation.

The study ran the descriptive statistics test in order to identify the role of AI in the digital transformation of Jordanian banking system. Consequently, statistics regarding respondents’ answers revealed that the Rob advisor technique was positively impacted banks’ performance through lowering the fees of banks’ services as well as improving the accuracy of investment recommendations. Likewise, the block chain technique was positively influenced banks’ performance through increasing the speed of conducting financial transactions. However, a majority of respondents are daily using the ASE’s trading platform as it conducts a vital role in facilitating the trading process, as well as they asserted that the use of digital trading contributed in improving banks’ market capitalization. Furthermore, it is revealed that most of banks’ clients tend to use mobile banking for the privacy and security’s features, as well as making electronic transfer.

Table 2 describes statistics regarding the examination of the second hypothesis, which assumed that “Artificial Intelligence’s Techniques have significantly contributed in the digital transformation of Jordanian banking system”.

Through running the one sample tests, results from the above table proved that since the sig value for each tool is found to be lower than their levels of significance, the suggested null hypothesis was rejected. Thus, since the null hypothesis was replaced by the alternative one, the results revealed that the techniques of artificial intelligence are significantly contributing in the digital transformation of the Jordanian banking system as represented by the listed commercial as well as Islamic banks. Therefore, the study ran the paired samples test in order to compare the role of AI techniques in the digital transformation of Jordanian banking system, and subsequently, the results are as demonstrated by the following table:

Table 3 describes statistics regarding the examination of the first hypothesis, which assumed that “The techniques of Artificial intelligence are unequally contributing in the digital transformation of Jordanian banking system”.

Through running the paired sample test in order to check whether AI’s techniques contribute equally in the digital transformation of Jordanian banking system, statistics from the above table revealed that since the values of significance are less than the level of significance 5%; the second null hypothesis was rejected. Which in other words, findings from this test confirmed that the techniques of Artificial intelligence are equally contributing in the digital transformation of Jordanian banking system.

5 Future Studies and Research Limitations

5.1 Future Research

While this study has shed light on the significance of artificial intelligence (AI) techniques in the digital transformation of the Jordanian banking system, there are several areas where further research could be conducted. For instance, future research could focus on:

The impact of AI techniques on customer experience: While the study has discussed the potential benefits of AI on the banking system, further research could examine the impact of AI on the customer experience, including satisfaction, loyalty, and retention.

The impact of AI on the workforce: As AI techniques continue to be adopted in the banking industry, future research could examine the impact of these technologies on the workforce, including the potential displacement of human workers and the need for upskilling and reskilling.

The adoption and implementation of AI techniques: Future research could examine the factors that influence the adoption and implementation of AI techniques in the Jordanian banking system, including organizational culture, resources, and regulatory frameworks.

5.2 Research Limitations

Despite the significance of this study on the role of AI techniques in the digital transformation of the Jordanian banking system, there are several limitations that need to be acknowledged. These include:

Limited sample size: The study was conducted on a limited sample size, which may not be representative of the entire banking industry in Jordan. Further research with a larger sample size may be needed to generalize the findings.

Lack of qualitative data: The study mainly relied on quantitative data, which may not provide an in-depth understanding of the impact of AI on the banking system. Future research could incorporate qualitative data to gain a more comprehensive perspective on the topic.

Single country focus: The study focuses on the banking industry in Jordan, which may not be applicable to other countries with different economic, cultural, and regulatory contexts. Future research could compare the adoption and impact of AI techniques in the banking industry across different countries.

6 Conclusion

In conclusion, the financial industry in Jordan is witnessing a significant shift towards the use of technology, with robo-advisors, blockchain, and digital trading gaining popularity among investors and financial institutions. Robo-advisors have revolutionized the way individuals invest their money by providing cost-effective and personalized investment advice, making investing accessible to a broader audience.

Blockchain technology has also gained significant traction in Jordan's financial industry, as it provides a secure and transparent way to conduct transactions. The technology's ability to reduce intermediaries, enhance transparency, and automate processes has attracted various financial institutions in Jordan to explore its potential applications.

Digital trading has also made it possible for traders to execute trades from anywhere at any time, using their smartphones or computers. This technology has simplified the trading process, reduced transaction costs, and increased market efficiency.

Overall, the use of robo-advisors, blockchain, and digital trading in the financial industry in Jordan has brought significant benefits, including increased accessibility, efficiency, and security. As the financial industry in Jordan continues to embrace new technologies, we can expect to see more advancements that will enhance customer experiences and improve financial services in the country.

While this study has identified the potential benefits of AI techniques in the digital transformation of the Jordanian banking system, there is a need for further research to explore the impact of these technologies on customer experience, the workforce, and the factors that influence their adoption and implementation. It is also important to acknowledge the limitations of this study, including the limited sample size, lack of qualitative data, and single country focus. Future studies should focus on the adoption of AI in different financial services, such as insurance and investment management.

Overall, the successful adoption of AI in the Jordanian banking system depends on collaboration between stakeholders, including financial institutions, regulators, and policymakers, as well as continuous investment in research and development.

References

Abusalma, A.: The effect of implementing artificial intelligence on job performance in commercial banks of Jordan. Manage. Sci. Lett. 11(7), 2061–2070 (2021)

Ali, M.S.: The Digital Revolution in Financial Services Industry Theory and Practice, 1st ed, Generis Publishing, Europe, Republic of Moldova

Ali, M.S., Ismail, A.R., Swiety, I.A.: Assessing the role of technologically enabled trading system in the stability of small and medium enterprises: the case of Jordan. In: 2021 22nd International Arab Conference on Information Technology (ACIT), IEEE (2021)

Azzam, Z.: Factors affecting the adoption of e-marketing technologies in services industry: empirical study on hotel sector in Jordan. Zarqa J. Res. Stud. Humanit. 13(1), 210–224 (2013)

Berente, N., Gu, B., Recker, J., Santhanam, R.: Managing Ai. MIS Quart. 1–5 (2019)

Bibel, W.: Artificial intelligence in a historical perspective. AI Commun. 27(1), 87–102 (2014)

Brock, J.K.-U., Von Wangenheim, F.: Demystifying AI: what digital transformation leaders can teach you about realistic artificial intelligence. Calif. Manage. Rev. 61(4), 110–134. (2019). https://doi.org/10.1177/1536504219865226

Capgemini. World FinTech Report 2018 (2018). https://www.capgemini.com/wp-content/uploads/2018/03/world_fintech_report_2018.pdf

Casares, A.P.: The brain of the future and the viability of democratic governance: the role of artificial intelligence, cognitive machines, and viable systems. Futures 103, 5–16 (2018)

Cavus, N., Mohammed, Y.B., Yakubu, M.N.: An artificial intelligence based model for prediction of parameters affecting sustainable growth of mobile banking apps. Sustainability, 13(11), 6206 (2021). https://doi.org/10.3390/su13116206

Chui, M., Malhotra, S.: AI Adoption Advances, but Foundational Barriers Remain. McKinsey Global Institute, McKinsey’s San Francisco, USA (2018)

Crosby, M., Pattanayak, P., Verma, S., Kalyanaraman, V.: Blockchain technology: beyond bitcoin. Appl. Innov. 2(6–10), 71–81 (2016)

Dhar, N., Holly, T., Ryan, D., Galeaz, G.: Top financial services issues of 2018, PWC (2017)

El Sawy, O., Pereira, F.: Business Modelling in the Dynamic Digital Space: An Ecosystem Approach, 1st edn. Springer, USA (2013)

Esther, H.R., John, F.: Role of chat bots in customer engagement valence. Psychol. Educ. 57(9), 2181–2186 (2020)

Fichman, G., Santos, B., Zheng, Z.: Digital innovation as a fundamental and powerful concept in the information systems curriculum. MIS Q. 38(2), 329–353 (2014)

Frame, W.S., White, L.J.: Technological change, financial innovation, and diffusion in banking. Leonard, N. (ed.) Stern School of Business, Department of Economics, pp. 1–5. Atlanta, GA, USA (2014)

Gallego-Gomez, C., De-Pablos-Heredero, C.: Artificial intelligence as an enabling tool for the development of dynamic capabilities in the banking industry. Int. J. Enterp. Inf. Syst. (IJEIS), 16(3), 20–33 (2020). https://doi.org/10.4018/ijeis.2020070102

Gentsch, P.: Conversational AI: how chat bots will reshape the digital experience. In: AI in Marketing, Sales and Services. Palgrave Macmillan, Cham (2019)

Indriasari, E., Gaol, F.L., Matsuo, T.: Digital banking transformation: application of artificial intelligence and big data analytics for leveraging customer experience in the Indonesia banking sector. In: 8th International Congress on Advanced Applied Informatics (2019)

Kaur, N., Sahdev, S.L., Sharma, M., Siddiqui, L.: The influence of artificial intelligence on the banking industry and how ai is changing the face of modern day banks. Int. J. Manag. 11(6), 577–585 (2020)

Kitsios, F., Kamariotou, M.: Artificial intelligence and business strategy towards digital transformation: a research agenda. Sustainability 13(4), 2025 (2021). https://doi.org/10.3390/su13042025

Lerner, J., Tufano, P.: The consequences of financial innovation: a counterfactual research agenda. Annu. Rev. Financ. Econ. 3(1), 1–92 (2011)

Malali, A.B., Gopalakrishnan, S.: Application of artificial intelligence and its powered technologies in the Indian banking and financial industry: an overview. IOSR J. Humanit. And Social Science 25(4), 55–60 (2020)

Microsoft News Center. (2019). Digital transformation in the Jordan financial services space streamlined as central bank issues cloud computing guidelines. Microsoft. News Center Middle East and Africa. Retrieved from: https://news.microsoft.com/en-xm/2019/05/10/digital-transformation-in-the-jordan-financial-services-space-streamlined-as-central-bank-issues-cloud-computing-guidelines/

MoDEE. Jordan digital transformation strategy 2020. Ministry of Digital Economy and Entrepreneurship, Jordan (2020). https://www.modee.gov.jo/EBV4.0/Root_Storage/EN/1/Jordan_Digital_Transformation_Strategy_2020_English_Unofficial_Translation.pdf

Al-Shaikh, S.M.: Customers’ perspective towards factors associated with technological products adopting failure. a case of Jordan. Zarqa J. Res. Stud. Humanit. 13(2), 252–261 (2013)

Paul, L.R., Madana, S.A.: Artificial intelligence in predictive analysis of insurance and banking. In: Artificial Intelligence: Fundamentals and Applications (1st ed.). CRC Press, Taylor and Francis Group (2021)

Plastino, E., Purdy, M.: Game changing value from artificial intelligence: eight strategies. Strategy Leadersh. 46(1), 16–22 (2018). https://doi.org/10.1108/sl-11-2017-0106

Puschmann, T.: Fintech. Bus. Inf. Syst. Eng. 59(1), 69–76 (2017)

PwC. Financial Services Technology 2020 and Beyond: Embracing disruption (2018). https://www.pwc.com/gx/en/industries/financial-services/publications/financial-services-technology-2020-and-beyond.html

Verweij, G.: PwC’s global data and analytics survey 2016, PWC (2016). https://www.pwc.com/us/en/services/consulting/analytics/big-decision-survey.html

Yu, T.R., Song, X.: Big data and artificial intelligence in the banking industry. In: Chapter 117 in Handbook of Financial Econometrics, Statistics and Machine Learning, pp. 4025–4041 (2020)

Zavolokina, L., Dolata, M., Schwabe, G.: FinTech transformation: How IT-enabled innovations shape the financial sector. In: FinanceCom, pp. 75–88. Springer, Cham (2016)

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2023 The Author(s), under exclusive license to Springer Nature Switzerland AG

About this chapter

Cite this chapter

Ismail, A., Ali, M.S., Alattar, K., Hasan, M., Durrani, F. (2023). The Role of Artificial Intelligence Techniques in the Digital Transformation of Jordanian Banking System. In: Alareeni, B.A.M., Elgedawy, I. (eds) Artificial Intelligence (AI) and Finance. Studies in Systems, Decision and Control, vol 488. Springer, Cham. https://doi.org/10.1007/978-3-031-39158-3_7

Download citation

DOI: https://doi.org/10.1007/978-3-031-39158-3_7

Published:

Publisher Name: Springer, Cham

Print ISBN: 978-3-031-39157-6

Online ISBN: 978-3-031-39158-3

eBook Packages: EngineeringEngineering (R0)