Abstract

The article studied the impact of the global value chain integration level on Vietnam’s exports from 1990 – 2018. The study used a Bayesian linear regression analysis approach to assess the impact of foreign-origin added value (FVA), domestic added value (DVA), and domestic value-added export (DVX) of other countries in comparison with the value of Vietnam’s exports (EXPORT). The findings showed positive relationships between foreign − origin added value (FVA), domestic added value (DVA), domestic value-added export of other countries, and export value of Vietnam. The more Vietnam is integrated into the global value chain, the more export value increases.

Access provided by Autonomous University of Puebla. Download chapter PDF

Similar content being viewed by others

Keywords

1 Introduction

In the strategic period of the past ten years, from 2011 to 2020, Vietnam formed some critical industries of the economy. Those such as oil and gas exploitation and processing; electronics, telecommunications, information technology; metallurgy, iron, and steel; cement and construction materials; textiles, footwear; mechanical engineering, automotive, and motorcycles, which have created an essential foundation for long-term growth and promotes the process of modernization and industrialization. In particular, the industry is the sector with the highest growth rate among the national economic sectors, with a contribution of approximately 30% to GDP, which becomes the primary export sector of the country and contributes to bringing Vietnam from the 50th position (2010) to the 22nd place (2019) among the world’s largest exporting countries.

According to the World Development Report of the World Bank (2020), most countries in the world participate in global value chains related to cross − border transactions and transactions with buyers in worldwide and international companies. Globally, up to two − thirds of world trade occurs through a global value chain, where production passes through at least one border before reaching the final assembly stage. In Vietnam, the trade balance in goods in the 2016 − 2020 period continuously had a trade surplus from 1.6 billion USD in 2016 to nearly 20 billion USD in 2020. In 2020, the value of exports reached US $282.63 billion; the value of imports reached US $262.69 billion in 2020; and the trade surplus reached US $19.94 billion (Firmani, n.d.). According to preliminary data from the Government of Vietnam, the manufacturing sector contributed significantly to the expansion of the trade balance, with an industrial trade surplus exceeding 10 billion USD for the first time in 2019. Vietnam is a net importer of services, with imports at $18.2 billion and exports at $14.9 billion in 2018.

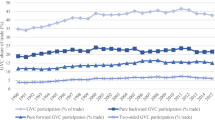

The Minister of Industry and Trade of Vietnam said that a motive in the production and export of industrial products of Vietnam is still mainly driven by the Foreign Direct Invesment (FDI) sector, accounting for approximately 70% of the country’s total export turnover. Production and export dynamics are affected by FDI, mainly because of weak linkages between FDI and domestic enterprises in the supply chain. It also shows the limited competitiveness of domestic enterprises when participating in global value chains (Fig. 1). This article was designed to study the influence of the components constituting the level of global value chain integration (including DVX, FVA, and DVA) on Vietnam’s export value in the period 1990 − 2018 to recognize and evaluate the impact of these components on the export value of Vietnam. Hence, our study recommended improving the Vietnamese economy’s global value chain integration level.

Our study includes the literature review in part 2, the research method in part 3, the research results in part 4, and the conclusion and policy implications in part 5.

2 Literature Review

2.1 Value Chain and Global Value Chain (GVC)

The value chain involves all essential activities to produce a product or service from inputs, which go through different stages of production (i.e., the combination and transformation of input material and various production services), bring that product to the end consumer, and performs the service after use.

Porter, (2001) separated the supply chain stages (such as inbound logistics, operations, outbound logistics, marketing, sales, and after-sales services) based on his research. A business gets its job done by converting inputs like production processes, warehousing, quality, and continuous improvement, as well as the supporting services it needs (e.g., strategic planning, human resources, technology development, procurement).

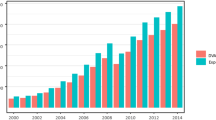

According to the (World Bank, 2020), the Global Value Chain (GVC) refers to the production division between countries. Countries participating in the value chain were positively correlated to exporting inputs to other countries to produce their exports. In contrast, they were negatively related to import inputs to process and continue exporting (Fig. 2).

Global Value Chain. Ource: World Bank, 2020

According to United Nations Conference on Trade and Development (2013), the primary global value chain indicators include:

Foreign Origin Value Added (FVA): The FVA indicates which part of a country’s total exports includes inputs from other countries. The FVA share is the proportion of a country’s exports that do not add to the country’s GDP.

-

Domestic value added (DVA): The DVA is the part of exports generated in the country, which means that exports contribute to GDP.

-

Domestic value added integrates into other countries’ exports (DVX): This index indicates the extent to which a country’s exports are used as inputs for other countries’ exports.

-

The global value chain participation index determines the percentage of participation in exports by a country in a multi − stage commercialization process.

Although the level of exports used by other countries may be less relevant to policymakers since it does not change the DVA contribution of trade, the participation rate is a valuable indicator of how much a country’s exports integrate into the international production network.

2.2 Export and Global Value Chain (GVC)

A country’s exports can be divided into domestically produced added value and imported foreign added value which integrates into that country’s exported goods and services. Moreover, exports to foreign markets can be regarded as the final consumer goods or inputs for producing goods to export to third countries (or back to the original country). Analysis of the Global value chain encompasses foreign value added in exports (upstream view) and export value added with the integration of third-country exports (downstream view). Today’s production processes are structured in several stages and occur in many countries. To produce the final product, companies seek input sourcing from many suppliers; in many cases, these suppliers are located overseas (Nguyễn, N. D, 2022; Nguyễn, N. D., & Nguyễn, Y., 2022). The added value at each stage of the production process and the product can cross the borders several times before being consumed in the last place. The motive of efficiency and cost consideration is considered behind decisions to use foreign inputs or locate production stages, including final assembly abroad. For example, smartphone research and development may occur in an economy with specific competitive advantages. At the same time, the final product is assembled where labor costs are relatively low, and the components are supplied by the countries that specialize in producing them.

Each country involved in the manufacturing process contributes to the total added value of the final product despite different rates. The global value chain has proven to be an important channel for technology transfer between countries.

The opportunity to transfer know-how, technology, and process innovation through participation in the global value chain is enormous. Enterprises can access new technology that integrates into import inputs and benefit from new types of intermediate goods by expanding inputs.

3 Methodology

3.1 Model Research

Bayesian analysis is a powerful analytical tool for statistical modeling, interpretation of results, and data prediction. In Bayesian analysis, the estimation accuracy is not limited by sample size or by limitations such as autocorrelation, endogenous, or heteroscedasticity encountered by frequency methods (Canh & Hoai, 2022; Kreinovich et al, 2019; Nguyen T.N et al., 2019; Thach N.N et al., 2021; Thach N.N et al., 2022). Since the data collected is limited, there is only data from 2010 to 2020 on the Vietnam General Statistics Office website. Therefore, using Bayesian regression is appropriate.

The study data was analyzed using BayES 2.4 software. The study uses the Bayesian linear regression model with specific research model as follows:

In which:

-

N: Number of observations.

-

lnDVX: The natural logarithm of indirect value added, domestic value added integrating into exports of other countries.

-

lnFVA: The natural logarithm of value added originating from abroad.

-

lnDVA: The natural logarithm of value added originating from domestic.

-

lnEXPORT: The natural logarithm of Vietnam’s export value.

-

β: Regression coefficient of the model.

-

ε: Residuals.

-

τ: is the precision of the error term: \(\sigma_\varepsilon^2 = \frac{1}{\tau }\).

The predetermined values of the research model were set as the default of the software (Emvalomatis, 2020), specifically as in Table 1.

The optional arguments for the model are:

Gibbs parameters:

-

Chains:Number of chains to run in parallel (positive integer); the default value is 1.

-

Burnin: Number of burn-in draws per chain (positive integer); the default value is 10000.

-

Draws: Number of retained draws per chain (positive integer); the default value is 20000.

-

Thin: Value of the thinning parameter (positive integer); the default value is 1.

-

Seed: Value of the seed for the random − number generator (positive integer); the default value is 42.

Hyperparameters:

-

m: Mean vector of the prior for β (K × 1 vector); the default value is 0K.

-

Precision matrix of the prior for β (K × K symmetric and positive-definite matrix); the default value is 0.001 · IK.

-

a_tau: Shape parameter of the prior for τ (positive number); the default value is 0.001.

-

b_tau: Rate parameter of the prior for τ (positive number); the default value is 0.001.

-

Dataset and log-marginal likelihood.

-

Dataset: The id value of the dataset that will be used for estimation; the default value is the first dataset in memory (in alphabetical order).

-

logML_CJ: Boolean indicating whether the Chib (1995) and Chib & Jeliazkov (2001) approx-imation to the log-marginal likelihood should be calculated (true|false); the default value is false.

The regression model is satisfactory when the following tests are satisfied Emvalomatis, (2020): the value of regression coefficients is statistically significant when the regression coefficient is different from zero in the 90% confidence interval, the tau values of the variables are positive, and the Inefficiency factor > 1.

To assess the convergence of the MCMC series, the authors used the trace plots with the requirement that the MCMC errors of the post − test means are decimals less than 0.05.

Plots of the simulated probability series (draw index) with rapid fluctuations do not show anomalous sequences. The correlation plot between the lags of the draws for τ and the variables rapidly decreases to oscillate around zero, which indicates that they are not autocorrelated. The frequency charts and density histogram of the draws are smooth, showing that the sampler has no abnormal phenomenon for any amount drawn in specific regions of the sample space.

3.2 Data

Research data on DVX, FVA, and DVA were collected from The World Trade Organization (WTO), and EXPORT was collected from Vietnam General Statistics Office. Mainly, DVX refers to indirect value-added, domestic value-added, which is integrated into export goods of other countries. FVA refers to value added originating from abroad. DVA means value added originating from domestic. EXPORT refers to the export value of Vietnam.

4 Research Results

Model Evaluation

The results of the stationarity test showed that all variables were stationary at the first difference level. The regression result for the first difference level of the variables is presented in Table 2. The first column of the table contains the names of the variables to which each parameter is linked. The second column (Mean) contains the posterior mean of each parameter, and the third (Median) and fourth columns (Sd.dev) are the median and standard deviation, respectively. The last two columns (5% and 95%) give the value of the first and last points of the 90% confidence intervals.

The regression results showed that the lnDVX variable was not statistically significant except for the regression coefficient of the first difference. The values of the remaining regression coefficients differed from zero in the 90% confidence interval, and the tau value of the variables were positive and Inefficiency factor > 1 (see Table 2).

Thus, there is evidence to conclude that the regression coefficients (except lnDVX) are statistically significant.

Simulation results showed that the MCMC errors of the posterior means were decimals less than 0.05. According to Emvalomatis (2020), the authors used trace plots to evaluate the convergence of MCMC chains.

Figure 1 showed that the plot of the draw index sequence fluctuated rapidly and did not show anomalous sequences.

The correlation chart between the lagging of the draws for t and the variables indicated no autocorrelation. Frequency histograms and density charts of the draws were smooth, showing that the sampler had no abnormalities for any significant draw in specific regions of the sample space (Fig. 3).

Simulation results also show that the MCMC errors (see Table 2) of the posterior means were decimals less than 0.05. The analysis results of the trace plot and the value of MCMC errors showed that the MCMC chain converges, so it was possible to trust the results of Bayes’ inference.

5 Conclusion

The results showed that there is a positive impact between the level of integration into the global value chains and Vietnam’s export value. It shows that the level of integration into global value chain of Vietnam needs to be further increased, which will contribute to improving the value of exports, enhancing commercial position regionally and internationally.Findings showed that Vietnam needs to focus on the domestic value added with its integration into exports of other countries (DVX), which positively impacts on the export value of Vietnam and promotes Vietnam to gradually become an upstream country in the global value chain (i.e., the exporter of goods to other countries for processing).

The results positively impacted the level of integration into the global value chains and Vietnam’s export value. It shows that the level of integration into the global value chain of Vietnam needs to be further increased, which will contribute to improving the value of exports and enhancing its commercial position regionally and internationally. It was determined that Vietnam needs to emphasize its domestic value added by integrating into other countries’ exports (DVX). It positively impacts Vietnamese exports and helps Vietnam gradually become an upstream country in global value chains (i.e., exporting goods to another country for processing).

It is necessary to improve the domestic value added to Vietnamese exports to create high export value. In addition, it should be recognized that the positive impact between the level of integration into the global value chain and the export value of Vietnam is low and needs to be commensurate with the export value of Vietnam. In fact, according to the data of the Vietnam Chamber of Commerce and Industry, the participation of Vietnamese enterprises in the global value chain was meager compared to economies of similar size in Southeast Asia. Specifically, only 36% of Vietnamese enterprises participated in the production network, including direct and indirect exports, while this percentage in Malaysia and Thailand was 60%.

Vietnamese enterprises were fragmented and were less likely to benefit from the spillover effect of foreign investment, technology transfer, knowledge transfer, and improved production capacity. The main reason for this situation is that Vietnam has only about 4% of enterprises with sufficient competitiveness that can participate in the global supply chain.

In Vietnam, domestic enterprises are almost unrelated to global value chains like foreign direct investment enterprises. It is a challenging requirement for Vietnamese enterprises in the current period, making it difficult to break into the global supply chain. Therefore, to improve competitiveness for domestic enterprises, there should be close coordination and joint hands of stakeholders, including the Government, ministries, industry, and localities, in defining strategic priorities, creating policy frameworks, and improving the investment and business environment. Additionally, the role of investors and enterprises must be enhanced in innovation, capacity building, and seeking opportunities from new trends. Vietnam’s ability to participate in the global value chain also emerges from the Government’s firm commitments to improve the business environment through improving key indicators, such as market entry, access to electricity, and intellectual property. Hence, policymakers must be flexible and well − planned so that Vietnam is always an attractive destination for foreign investment, ready to supply highly skilled labor for the economy to catch up with the global market’s growth momentum and profoundly integrate into the global value chain.

References

Canh, T.Q., Hoai, P.T.D.: Factors affecting gdp per capita—Apply Bayesian analysis. VNUHCM J. Econ. Bus. Law 6(2), 2 (2022). https://doi.org/10.32508/stdjelm.v6i2.961

Chib, S.: Marginal likelihood from the Gibbs output. J. Am. Stat. Assoc. 90(432), 1313–1321 (1995)

Chib, S., Jeliazkov, I.: Marginal likelihood from the Metropolis-Hastings output. J. Am. Stat. Assoc. 96(453), 270–281 (2001)

Emvalomatis, G.: Basic linear model. In: User’s Guide BayESTM Bayesian Econometrics Software. http://bayeconsoft.com/html_documentationse25.html#x31-440001 (2020)

Firmani, M.: PX Web. General Statistics Office of Vietnam. https://www.gso.gov.vn/en/px-web/ (n.d.). Retrieved 5 Nov 2022

Kreinovich, V., Thach, N.N., Trung, N.D., Van Thanh, D. (eds.): Beyond Traditional Probabilistic Methods in Economics. Springer International Publishing, Cham (2019)

Nguyễn, N.D.: Export and application of SARIMA model for forecasting the value of Vietnam export during Covid-19. VNUHCM J. Econ. Bus. Law 6(2), 2832–2839 (2022). https://doi.org/10.32508/stdjelm.v6i2.891; http://stdjelm.scienceandtechnology.com.vn/index.php/stdjelm/article/view/891

Nguyễn, N.D., Nguyễn, Y.: Development of supporting industries towards production and export autonomy in Ho Chi Minh City. VNUHCM J. Econ. Bus. Law 6(3), 3386–3395 (2022). https://doi.org/10.32508/stdjelm.v6i3.1031; http://stdjelm.scienceandtechnology.com.vn/index.php/stdjelm/article/view/1031

Nguyen, T.N., Kosheleva, O., Kreinovich, V., Nguyen, H.P.: Blockchains beyond bitcoin: towards optimal level of decentralization in storing financial data. In: Kreinovich, V., Thach, N.N., Trung, N.D., Van Thanh, D. (eds.) ECONVN 2019. SCI, vol. 809, pp. 163–167. Springer, Cham (2019). https://doi.org/10.1007/978-3-030-04200-4_12

Porter, M.E.: The value chain and competitive advantage. Understanding Bus. Proc. 2, 50–66 (2001)

Thach, N.N., Kreinovich, V., Trung, N.D. (eds.): Data Science for Financial Econometrics. SCI, vol. 898. Springer, Cham (2021). https://doi.org/10.1007/978-3-030-48853-6

Thach, N.N., Kreinovich, V., Ha, D.T., Trung, N.D. (eds.): Financial Econometrics: Bayesian Analysis, Quantum Uncertainty, and Related Topics, vol. 427. Springer International Publishing, Cham (2022). https://doi.org/10.1007/978-3-030-98689-6

United Nations Conference on Trade and Development: World Investment Report 2013: Global Value Chains – Investment and Trade for Development. UN (2013). https://doi.org/10.18356/a3836fcc-en

World Bank: World Development Report 2020: Trading for Development in the Age of Global Value Chains. World Bank, Washington, DC (2020). https://doi.org/10.1596/978-1-4648-1457-0

World Integrated Trade Solution (WITS) | Data on Export, Import, Tariff, NTM. https://wits.worldbank.org/ (n.d.). Retrieved 5 Nov 2022

Author information

Authors and Affiliations

Corresponding authors

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2024 The Author(s), under exclusive license to Springer Nature Switzerland AG

About this chapter

Cite this chapter

Diep, N.T.N., Canh, T.Q., Thach, N.N. (2024). The Impact of Global Value Chain Integration on Export: Evidence from Vietnam. In: Ngoc Thach, N., Kreinovich, V., Ha, D.T., Trung, N.D. (eds) Optimal Transport Statistics for Economics and Related Topics. Studies in Systems, Decision and Control, vol 483. Springer, Cham. https://doi.org/10.1007/978-3-031-35763-3_31

Download citation

DOI: https://doi.org/10.1007/978-3-031-35763-3_31

Published:

Publisher Name: Springer, Cham

Print ISBN: 978-3-031-35762-6

Online ISBN: 978-3-031-35763-3

eBook Packages: EngineeringEngineering (R0)