Abstract

If the overall amount of the company’s assets is smaller than its total debts, then a fair solution is to give, to each creditor, the amount proportional to the corresponding debt, e.g., 10 center for each dollar or 50 cents for each dollar. But what if the debt amounts are not known exactly, and for some creditors, we only know the lower and upper bounds on the actual debt amount? What division will be fair in such a situation? In this paper, we show that the only fair solution is to make payments proportional to an appropriate convex combination of the bounds – which corresponds to Hurwicz optimism-pessimism criterion for decision making under interval uncertainty.

Access provided by Autonomous University of Puebla. Download chapter PDF

Similar content being viewed by others

1 Formulation of the Problem

What is a Bankruptcy Problem. A company goes bankrupt if the total amount of its assets is smaller than the total amount of debts. Some of the debts have priority – e.g., according to the US labor law, salary needs to be paid in full, irrespective of debts to others. Once these priority debts are paid, we face a problem of how to divide the remaining assets A between the creditors to whom the company owes amounts \(d_1,\ldots ,d_n\).

How this Problem is Usually Solved. In this case, a usual solution is to make payments proportional to debts, i.e., depending on the ratio between the assets and the debts, 10 cents per dollar, 50 cents per dollar, etc. In general, the amount \(g_i\) given to the i-th creditor is equal to

Need to Take Interval Uncertainty into Account. In some cases, the debt is purely monetary, and its amount \(d_i\) is known exactly. In many practical situations, however, the situation is more complicated, so for many creditors, we only know the bounds \(\underline{d}_i\le d_i\le \overline{d}_i\) of the actual debt amount. How should we divide the assets in this situation?

Case of Interval Uncertainty: How is this Problem Solved Now. Several papers describe how to solve the bankruptcy problem under interval uncertainty. For example, the paper [2] suggests selecting a single value \(d_i\) within each interval, and then using these values \(d_i\) to divide the assets. For example, to select \(d_i\), we can use Hurwicz optimism-pessimism criterion [3, 6, 8]: namely, we agree on some value \(\alpha \in [0,1]\) and take \(d_i=\alpha \cdot \overline{d}_i+(1-\alpha )\cdot \underline{d}_i\).

A more complex scheme was proposed in [7] – following a solution to a similar problem in [15].

What We do in this Paper. In this paper, we show that a natural formalization of fairness uniquely determines Hurwicz-based solutions – which are thus recommended as the fair ones.

2 How to Describe Fairness

Fairness: First Requirement. Fairness means, first, that if the debt \(d_i\) to creditor i is smaller than or equal to the debt \(d_j\) to creditor j, then the payment \(g_i\) to creditor i should be smaller than or equal to the payment to creditor j.

Fairness: Second Requirement. Second, fairness means that two creditors should not gain or lose by joining together. In other words:

-

if for debts \(d_1,d_2,d_2,\ldots ,d_n\), we had payments \(g_1,g_2,g_3,\ldots ,g_n\),

-

them for debts \(d_1+d_2,d_2,\ldots ,d_n\), we should have payments \(g_1+g_2,g_3,\ldots ,g_n\).

Continuity. It also makes sense to require that if in two situations, debts are close, then payments should be close – i.e., that payments should be a continuous function of debts.

3 What if We Impose Fairness Requirements in Situations When We Know the Exact Amount of Debts

Before we consider the case of interval uncertainty, let us analyze what will happen if we impose fairness requirements in the situations when we know the exact amount of debt.

Definition 1

Let \(A<D\) be two positive numbers.

-

We will call A the amount of assets, and we will call D the amount of debt.

-

By a solution to the bankruptcy problem (or simply solution, for short), we mean a function S that maps every tuple \(\langle d_1,\ldots ,d_n\rangle \) of positive real numbers for which \(d_1+\ldots +d_n=D\) into a tuple of non-negative real numbers \(\langle g_1,\ldots ,g_n\rangle \) for which

$$g_1+\ldots +g_n=A.$$

Definition 2

We say that the solution S is fair if it satisfies the following two requirements for each tuple \(\langle d_1,d_2,d_3,\ldots ,d_n\rangle \) and for \(S(\langle d_1,\ldots ,d_n\rangle )=\langle g_1,\ldots ,g_n\rangle \):

-

if \(d_i\le d_j\), then \(g_i\le g_j\);

-

\(S(\langle d_1+d_2,d_3,\ldots ,d_n\rangle )=\langle g_1+g_2,g_3,\ldots ,g_n\rangle \).

Definition 3

We say that the solution S is continuous, if for every n, if \(d^{(k)}_i \rightarrow d_i\) for all i, \(S(\langle d^{(k)}_1,\ldots ,d^{(k)}_n\rangle )=\langle g^{(k)}_1,\ldots ,g^{(k)}_n\rangle \), and \(g^{(k)}_i\rightarrow g_i\) for all i, then

Proposition 1

For each solution S, the following two conditions are equivalent to each other:

-

the solution is fair and continuous,

-

the solution has the form

$$\begin{aligned} g_i=d_i\cdot (A/D). \end{aligned}$$(2)

Comment. So, the usual solution is the only one which is fair (and continuous).

Proof

It is easy to check that the above solution is fair and continuous. So, to complete the proof, it is sufficient to prove that every fair continuous solution S has this form.

Indeed, let S be a fair and continuous solution. For every natural number N, we can consider the tuple \(\langle d_1,\ldots ,d_N\rangle =\langle D/N,\ldots ,D/N\rangle \) consisting of N equal debt values. By the first fairness requirement, since the debts \(d_i\) are all equal, the payments \(g_i\) are also all equal. Since \(g_1+\ldots +g_N=A\), this means that \(N\cdot g_i=A\) hence \(g_i=A/N\), and the payments tuple has the form \(\langle g_1,\ldots ,g_N\rangle =\langle A/N,\ldots ,A/N\rangle \).

For any sequence of natural numbers \(k_1,\ldots ,k_n\) for which \(k_1+\ldots +k_n=N\), the tuple \(\langle k_1\cdot (D/N),\ldots ,k_n\cdot (D/N) \rangle \) can be obtained from the tuple \(\langle 1/N,\ldots ,1/N\rangle \) by adding up the first \(k_1\) terms, then the next \(k_2\) terms, etc. So, due to the second fairness requirements, the resulting payment tuple \(\langle g_1,\ldots ,g_n\rangle \) can be obtained from the tuple \(\langle A/N,\ldots ,A/N\rangle \) by adding the first \(k_1\) terms, then the next \(k_2\) terms, etc. Thus, the payment tuple has the form \(\langle k_1\cdot (A/N),\ldots ,k_n\cdot (A/N)\rangle \). In other words, for each debt \(d_i=k_i\cdot (D/N)\), the payment is equal to \(g_i=k_i\cdot (A/N)\). From \(d_i=k_i\cdot (D/N)\), we conclude that \(k_i=d_i\cdot (N/D)\), hence \(g_i=k_i\cdot (A/N)=d_i\cdot (N/D)\cdot (A/N)=d_i\cdot (A/D),\) i.e., that indeed \(g_i=d_i\cdot (A/D).\)

We have proved the desired equality (2) for all the cases when for all the debts \(d_i\), we have \(d_i=k_i\cdot (D/N)\) for some integer \(k_i\), i.e., when \(d_i/D=k_i/N\). Any real number \(d_i/D\) can be approximated – with accuracy 1/N – by an appropriate fraction \(k_i/N\). As N increases, the fraction tends to \(d_i/D\). Thus, since the solution S is continuous, in the limit, we will have (2) for all possible real values \(d_i\).

The proposition is proven.

Comment. At first glance, it may sound reasonable to also require that if we combine two bankruptcy problems together, then in the combined problem, each creditors should receive the sum of what he/she would receive in each solutions. In other words:

-

if we have \(S(\langle d_1,\ldots ,d_n\rangle )=\langle g_1,\ldots ,g_n\rangle \) and \(S(\langle d'_1,\ldots ,d'_n\rangle )=\langle g'_1,\ldots ,g'_n\rangle \),

-

then we should have \(S(\langle d_1+d'_1,\ldots ,d_n+d'_n\rangle )=\langle g_1+g'_1,\ldots ,g_n+g'_n\rangle \).

This requirement is explicitly mentioned in [7]. Let us show, however, that the fair solution does not have this property. Indeed:

-

let us take \(d_1=4\), \(d_2=1\), and \(A=2\), then \(D=d_1+d_2=4+1=5\), so \(A/D=2/5=0.4\), \(g_1=d_1\cdot (A/D)=4\cdot 0.4=1.6\), and \(g_2=d_2\cdot (A/D)=1\cdot 0.4=0.4\);

-

let us also take \(d'_1=d'_2=1\) and \(A'=1\), then \(D'=d'_1+d'_2=1+1=2\), so \(A'/D'=1/2=0.5\), and \(g'_i=d'_i\cdot (A'/D')=1\cdot 0.5=0.5.\)

On the other hand, for \(d_1+d'_1=5\), \(d_2+d'_2=2\), and \(A+A'=3\), we have \(D+D'=7\), so \((A+A')/(D+D')=3/7\). Thus, for the first creditor, the payment is

which is different from this creditor’s summary payment \(g_1+g'_1=1.6+0.5=2.1\) in two original situations.

4 Case of Interval Uncertainty

Interval Sum and Interval Order: Reminder. In the case of interval uncertainty, if we only know that the debt \(d_1\) is in the interval \([\underline{d}_1,\overline{d}_1]\) and that the debt \(d_2\) is in the interval \([\underline{d}_2,\overline{d}_2]\), then the only conclusion we can make about the summary debt \(d_1+d_2\) to these two creditors is that this sum belongs to the interval

This interval is known as the sum \([\underline{d}_1,\overline{d}_1]+[\underline{d}_2,\overline{d}_2]\) of the two intervals \([\underline{d}_1,\overline{d}_1]\) and \([\underline{d}_2,\overline{d}_2]\); see, e.g., [4, 9, 11].

A natural order is component-wise: we say that the debt \([\underline{d}_i,\overline{d}_i]\) to creditor i is smaller than or equal to the debt \([\underline{d}_j,\overline{d}_j]\) to creditor j if \(\underline{d}_i\le \underline{d}_j\) and \(\overline{d}_i\le \overline{d}_j\).

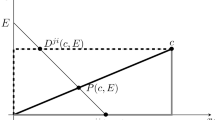

Definition 4

Let A be a positive real numbers and let \([\underline{D},\overline{D}]\) be an interval for which \(0<\underline{D}\) and \(A<\overline{D}\).

-

We will call A the amount of assets, and we will call \([\underline{D},\overline{D}]\) the amount of debt.

-

By a solution to the bankruptcy problem (or simply solution, for short), we mean a function S that maps every tuple \(\langle [\underline{d}_1,\overline{d}_1]\ldots ,[\underline{d}_n,\overline{d}_n]\rangle \) of intervals for which \(0\le \underline{d}_i\), numbers for which \(\underline{d}_1+\ldots +\underline{d}_n=\underline{D}\), and \(\overline{d}_1+\ldots +\overline{d}_n=\overline{D}\) into the same-size tuple of non-negative real numbers \(\langle g_1,\ldots ,g_n\rangle \) for which

$$g_1+\ldots +g_n=A.$$

Definition 5

We say that the solution S is fair if the following two requirements are satisfied when \(S(\langle [\underline{d}_1,\overline{d}_1],\ldots ,[\underline{d}_n,\overline{d}_n]\rangle )=\langle g_1,\ldots ,g_n\rangle :\)

-

if \(\underline{d}_i\le \underline{d}_j\) and \(\overline{d}_i\le \overline{d}_j\), then \(g_i\le g_j\);

-

\(S(\langle [\underline{d}_1+\underline{d}_2,\overline{d}_1+\overline{d}_2],[\underline{d}_3,\overline{d}_3],\ldots ,[\underline{d}_n,\overline{d}_n]\rangle )=\langle g_1+g_2,g_3\ldots ,g_n\rangle \).

Definition 6

We say that the solution S is continuous, if for every n, if \(\underline{d}^{(k)}_i \rightarrow \underline{d}_i\) and \(\overline{d}^{(k)}_i \rightarrow \overline{d}_i \) for all i, \(S(\langle [\underline{d}^{(k)}_1,\overline{d}^{(k)}_1],\ldots ,[\underline{d}^{(k)}_n,\overline{d}^{(k)}_n]\rangle )=\langle g^{(k)}_1,\ldots ,g^{(k)}_n\rangle \), and \(g^{(k)}_i\rightarrow g_i\) for all i, then

Proposition 2

For each solution S, the following two conditions are equivalent to each other:

-

the solution is fair and continuous,

-

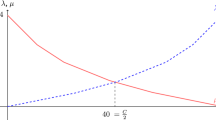

for some \(\alpha \in [0,1]\), the solution has the form \(g_i=d_i\cdot (A/D)\), where

$$d_i{\mathop {=}\limits ^\textrm{def}}\alpha \cdot \overline{d}_i+(1-\alpha )\cdot \underline{d}_i \text{ and } D{\mathop {=}\limits ^\textrm{def}}\alpha \cdot \overline{D}+(1-\alpha )\cdot \underline{D}.$$

Comment. So, the solutions based on Hurwicz combinations \(d_i=\alpha \cdot \overline{d}_i+(1-\alpha )\cdot \underline{d}_i\) are the only one which are fair (and continuous).

Proof

It is east to check that the solution based on Hurwicz combination is fair and continuous. So, to complete the proof, it is sufficient to prove that every fair continuous solution S has this form.

Indeed, let S be a fair and continuous solution. For every natural number N, we can consider the tuple

consisting of:

-

N degenerate debt intervals \([\underline{D}/N,\underline{D}/N]\) and

-

N intervals \([0,(\overline{D}-\underline{D})/N]\).

By the first fairness requirement, since the debts \(d_i\) are the same for all first N creditors, the payments \(g_i\) should also be all equal \(g_1=\ldots =g_N\). Similarly, the payments to the last N creditors should be the same: \(g_{N+1}=\ldots =g_{2N}\).

For any two sequences of natural numbers \(k_1,\ldots ,k_n,\ell _1,\ldots ,\ell _n\) for which

the tuple

can be obtained from the tuple (3) by adding up:

-

the first \(k_1\) intervals from the first half and the first \(\ell _1\) intervals from the second half, then

-

the next \(k_2\) intervals from the first half and the next \(\ell _2\) intervals from the second half, etc.

So, due to the second fairness requirements, the resulting payment tuple \(\langle g_1,\ldots ,g_n\rangle \) can be obtained from the tuple \(\langle g_1,\ldots ,g_1,g_{N+1},\ldots ,g_{N+1}\rangle \) by adding the corresponding payment terms. Thus, the payment tuple has the form

In other words, for each debt interval

the payment is equal to

Here, \(\underline{d}_i=k_i\cdot (\underline{D}/N)\), so \(k_i=\underline{d}_i\cdot (N/\underline{D})\). Similarly, \(\overline{d}_i-\underline{d}_i=\ell _i\cdot ((\overline{D}-\underline{D})/N)\) so \(\ell _i=(\overline{d}_i-\underline{d}_i)\cdot (N/(\overline{D}-\underline{D})).\) Substituting these expressions for \(k_i\) and \(\ell _i\) into the formula (3), we conclude that \(g_i=a\cdot \underline{d}_i+b\cdot (\overline{d}_i-\underline{d}_i)\), where we denoted \(a{\mathop {=}\limits ^\textrm{def}}g_1\cdot (N/\underline{D})\) and \(b{\mathop {=}\limits ^\textrm{def}}g_{N+1}\cdot (N/(\overline{D}-\underline{D}))\). Thus, we have

The first fairness requirement means that if \(\overline{d}_i\) is larger then \(\overline{d}_j\) while \(\underline{d}_i=\underline{d}_j\), then \(g_i\) should be larger (or the same) than \(g_j\). This implies that \(a\ge 0\). Similarly, if \(\underline{d}_i\) is larger then \(\underline{d}_j\) while \(\overline{d}_i=\overline{d}_j\), then \(g_i\) should be larger (or the same) than \(g_j\). This implies that \(a-b\ge 0\).

Let us denote the ratio b/a by \(\alpha \). Then, \(b=a\cdot \alpha \) and \(a-b=a\cdot (1-\alpha )\). Thus, the formula (5) takes the form

The sum of all the payments is equal to A, so

hence \(a=A/D\) and the formula (6) takes the desired form

We have proved the desired equality (7) for all the cases when for all the creditors i, we have \(\underline{d}_i=k_i\cdot (\underline{D}/N)\) for some integer \(k_i\) and \(\overline{d}_i-\underline{d}_i=\ell _i\cdot ((\overline{D}-\underline{D})/N)\) for some integer \(\ell _i\). Similarly to the proof of Proposition 1, any two real numbers can be thus approximated, and the larger N, the more accurate the resulting approximation. Thus, due to continuity, in the limit \(N\rightarrow \infty \), we have (7) for all possible values \(\underline{d}_i\) and \(\overline{d}_i\).

The proposition is proven.

First Comment: What if We have Fuzzy Uncertainty? For each creditor, instead of a single interval, we can have different intervals \([\underline{d}_i(\alpha ),\overline{d}_i(\alpha )]\) containing \(d_i\) with different degrees of uncertainty \(\alpha \in [0,1]\). If we pick a narrower sub-interval, then we become less certain that \(d_i\) belongs to this sub-interval than that it belongs to the original interval. Thus, the interval corresponding to a higher degree of uncertainty is a subset of the interval corresponding to a lower degree of uncertainty. Such a sequence of embedded intervals is, in effect, an equivalent representation of a so-called fuzzy number (see, e.g., [1, 5, 10, 12, 13, 16]) for which the corresponding intervals are known as \(\alpha \) -cuts.

In this case, to describe each creditor’s debt, instead of two values \(\underline{d}_i\) and \(\overline{d}_i\), we need to describe infinitely many values \(\underline{d}_i(\alpha )\) and \(\overline{d}_i(\alpha )\) corresponding to different \(\alpha \in [0,1]\). The overall debt corresponding to different \(\alpha \) can be obtained by adding all n debts: \(\underline{D}(\alpha )=\underline{d}_1(\alpha )+\ldots +\underline{d}_n(\alpha )\) and \(\overline{D}(\alpha )=\overline{d}_1(\alpha )+\ldots +\overline{d}_n(\alpha )\).

Arguments similar to the ones we used in the proof of Proposition 2 lead to a conclusion that a fair solution is proportional to the linear combination \(d_i\) of these values, i.e., has the form \(g_i=d_i/D\), where

for some functions (maybe generalized functions) \(f_\pm (\alpha )\), and

What if We have Probabilistic Uncertainty? What if for each \(d_i\), we only know the probability distribution? In this case, it makes sense to use the following additional requirement on the bankruptcy solutions: that if we repeat the same division situation several (N) times, the payments in the resulting overall situation should be N times larger. In the overall situation, the debt amount \(D_i\) is equal to the sum of N independent equally distributed debt amounts: \(D_i=d_i^{(1)}+\ldots +d_i^{(N)}\). According to the Large Numbers Theorem (see, e.g., [14]), for large N, the average

tends to the mean \(E[d_i]\) as N increases. Thus, for large N, the sum is getting (relatively) closer and closer to a single value – N times the mean. So, for large N, we have, in effect, the division problem in which instead of the original random variables, we have N times their means. The payments in the original problem should be N times smaller, i.e., they should be simply equal to the division corresponding to the means.

Thus, in the probabilistic case, we should simply compute the mean values \(E[d_i]\) of the debt amount, and distribute the assets proportionally to these mean values:

References

Belohlavek, R., Dauben, J.W., Klir, G.J.: Fuzzy Logic and Mathematics: A Historical Perspective. Oxford University Press, New York (2017)

Branzei, R., Dimitrov, D., Pickl, S., Tijs, S.: How to cope with division problems under interval uncertainty of claims? Int. J. Uncertain. Fuzziness 12, 191–200 (2004)

Hurwicz, L.: Optimality Criteria for Decision Making Under Ignorance, Cowles Commission Discussion Paper, Statistics, No. 370 (1951)

Jaulin, L., Kiefer, M., Didrit, O., Walter, E.: Applied Interval Analysis, With Examples in Parameter and State Estimation, Robust Control, and Robotics. Springer, London (2001). https://doi.org/10.1007/978-1-4471-0249-6

Klir, G., Yuan, B.: Fuzzy Sets and Fuzzy Logic. Prentice Hall, Upper Saddle River, New Jersey (1995)

Kreinovich, V.: Decision making under interval uncertainty (and beyond). In: Guo, P., Pedrycz, W. (eds.) Human-Centric Decision-Making Models for Social Sciences. SCI, vol. 502, pp. 163–193. Springer, Heidelberg (2014). https://doi.org/10.1007/978-3-642-39307-5_8

Li, X., Li, Y., Zheng, W.: Division schemes under uncertainty of claims. Kybernetika 57(5), 849–855 (2021)

Luce, R.D., Raiffa, R.: Games and Decisions: Introduction and Critical Survey. Dover, New York (1989)

Mayer, G.: Interval Analysis and Automatic Result Verification. de Gruyter, Berlin (2017)

Mendel, J.M.: Uncertain Rule-Based Fuzzy Systems: Introduction and New Directions. Springer, Cham, Switzerland (2017). https://doi.org/10.1007/978-3-319-51370-6

Moore, R.E., Kearfott, R.B., Cloud, M.J.: Introduction to Interval Analysis. SIAM, Philadelphia (2009)

Nguyen, H.T., Walker, C.L., Walker, E.A.: A First Course in Fuzzy Logic. Chapman and Hall/CRC, Boca Raton, Florida (2019)

Novák, V., Perfilieva, I., Močkoř, J.: Mathematical Principles of Fuzzy Logic. Kluwer, Boston, Dordrecht (1999)

Sheskin, D.J.: Handbook of Parametric and Non-Parametric Statistical Procedures. Chapman & Hall/CRC, London, UK (2011)

Yager, R.R., Kreinovich, V.: Fair division under interval uncertainty. Int. J. Uncertain. Fuzziness Knowl.-Based Syst. (IJUFKS) 8(5), 611–618 (2000)

Zadeh, L.A.: Fuzzy sets. Inf. Control 8, 338–353 (1965)

Acknowledgments

This work was supported in part by the National Science Foundation grants 1623190 (A Model of Change for Preparing a New Generation for Professional Practice in Computer Science), and HRD-1834620 and HRD-2034030 (CAHSI Includes), and by the AT &T Fellowship in Information Technology.

It was also supported by the program of the development of the Scientific-Educational Mathematical Center of Volga Federal District No. 075-02-2020-1478, and by a grant from the Hungarian National Research, Development and Innovation Office (NRDI).

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2024 The Author(s), under exclusive license to Springer Nature Switzerland AG

About this chapter

Cite this chapter

Pham, U., Kosheleva, O., Kreinovich, V. (2024). Fair Bankruptcy Solutions Under Interval Uncertainty. In: Ngoc Thach, N., Kreinovich, V., Ha, D.T., Trung, N.D. (eds) Optimal Transport Statistics for Economics and Related Topics. Studies in Systems, Decision and Control, vol 483. Springer, Cham. https://doi.org/10.1007/978-3-031-35763-3_12

Download citation

DOI: https://doi.org/10.1007/978-3-031-35763-3_12

Published:

Publisher Name: Springer, Cham

Print ISBN: 978-3-031-35762-6

Online ISBN: 978-3-031-35763-3

eBook Packages: EngineeringEngineering (R0)