Abstract

We examine lessons from the telecommunications access regulation experience in the EU and US and apply those lessons to the package delivery industry. In hindsight, telecommunications assets thought to be bottlenecks necessary for competition were circumvented in unexpected ways. While access obligations facilitated entry based on incumbent networks, the evidence is that they have tended to impede investment in the purported bottleneck facilities as well as alternative technologies. These effects are likely to be particularly costly for social welfare in industries like telecommunications where there was the potential for substantial future investment and innovation. Recent calls to impose access obligations on e-commerce companies in relation to package delivery activities, where similar investment and innovation potential exists, are therefore particularly fraught.

Access provided by Autonomous University of Puebla. Download chapter PDF

Similar content being viewed by others

Keyword

1 Introduction

The package delivery industry in the European Union is typically regarded as highly competitive. For example, the European Commission (EC) has recently referred to “fierce competitive pressure” and “intense and dynamic competition” in parcel delivery (European Commission, 2021a). In recent years parcel senders and recipients have benefited from substantially enhanced delivery options and service quality. Moreover, in the modern package delivery marketplace, the number of competitive providers has grown tremendously. In many cases the providers have developed interconnected and interdependent operations through commercial agreements.

These industry characteristics and developments typically satisfy policy makers that there is no need to introduce regulation to promote entry and competition. Indeed, that has recently been the conclusion reached by the European Commission (European Commission, 2021b). Nonetheless, the package delivery industry’s growth and increasing societal significance, together with the entry and growth of players that are vertically integrated into e-commerce, have fueled calls from some EU regulators for “greenfields” regulation of package delivery services. In particular, the European Regulators Group for Postal services (ERGP) expressed concern that online marketplace platforms were reshaping the postal sector by “integrating activities along the value chain (e.g., matchmaking, ordering, (traditional) fulfillment, payment)…” and urged the European Commission to expand the reach of postal regulation outside of the traditional bounds of postal services, calling for a reconsideration of “the scope of the postal sector in a forward-looking perspective to deal with these new players and business models” and a shift in focus of postal sector regulation from universal service obligations for letter delivery to parcel delivery (ERGP, 2020).

The ERGP concluded that sector-specific regulation remains necessary and that “a new framework should focus on a proper functioning of markets and competition as the primary means to meet user demand” with national regulatory authorities having “sufficient power to intervene ex-ante in case of actual or potential competition problems,” including “the competence to impose regulatory obligations such as: access to the network and its components at cost orientated prices, the publication of a reference offer, non-discrimination and development of margin squeeze tests following an analysis of the relevant market.” Hence, the commentary of the ERGP appears to contemplate the possibility of access regulation, imposed ex ante, to address competitive concerns that have not yet materialized. The ERGP was not specific about the nature of the access regulations it might advocate nor on whom it would advocate the access be imposed.

The Italian regulator, AGCOM, has adopted specific new regulatory measures in relation to package delivery services in Italy (AGCOM, 2022). This new regulation is notable in that it is targeted not at the incumbent operator, as has been traditional in regulatory policy in the postal, telecommunications, and other sectors, but instead on a relatively recent entrant, Amazon, that does not even operate its own last-mile delivery services in Italy.Footnote 1 Following a lengthy investigation of package delivery services in Italy, AGCOM concluded that Amazon is able to (among other things) leverage market power from its position as an e-commerce platform for third-party sellers into package delivery services; and may in the future make use of its vertical integration to generate barriers to entry into package delivery services.

The forms of regulation adopted by AGCOM are focused on transparency and include a set of information requirements applying to all large operators,Footnote 2 and additional information requirements applying only to Amazon, particularly pertaining to Amazon’s “Fulfilment by Amazon” (“FBA”) program for delivery services, as well as to average prices paid to package delivery service providers.

Regulation can be imposed not only by sector regulators, but also by competition authorities. In late 2021, the Italian competition authority (AGCM) issued a decision related to its investigation of Amazon regarding alleged self-preferencing of Amazon’s delivery logistics services (AGCM, 2021). AGCM concluded that Amazon leveraged a bottleneck in intermediation services on e-commerce “marketplaces” to impede competition in e-commerce logistics services, in which AGCM includes package delivery. In addition to a fine, the AGCM decision imposes access obligations on Amazon by which third-party sellers can obtain certain visibility benefits on the Amazon marketplace without having to fulfill orders using FBA. The efforts of the competition authority to impose access obligations at the e-commerce platform level of activity to purportedly protect competition in package delivery (broadly defined to include fulfillment) is noteworthy.

We cannot predict the outcomes of future regulatory efforts in package delivery, but given the commentary of the ERGP, AGCOM, and AGCM, it is clear that regulatory authorities are increasingly interested in access obligations and have begun, at least in Italy, to impose them.

The EU has extensive experience with access regulation in the context of telecommunications. Indeed, the telecommunications industry bears a number of high-level similarities to the package delivery industry. Like package delivery, the telecommunications industry is characterized by interconnected networks exhibiting economies of scale, scope, and density. It has experienced industry-altering technological developments and it exhibits vertical as well as horizontal relationships among competitors.

The purpose of this paper is to identify lessons learned from successes and failings of telecommunications regulation in the EU and examine how they inform concerns being raised in the package delivery arena. We draw on the experiences of telecommunications regulation in the EU and the US, which adopted somewhat different philosophical approaches and experienced substantially different evolutions of telecommunications regulation and deregulation.Footnote 3 We focus our attention on access regulation, both because it has been a primary tool of market-opening regulation in telecommunications since the 1990s, and because, as noted above, recent calls for regulation in package delivery have embraced the concept of access obligations. As a matter of economics, requiring a company to allow its competitors to access its facilities or assets is among the most intrusive of regulatory interventions, with potential to affect innovation and investment, and merits special scrutiny.Footnote 4

The paper is organized as follows. In Sect. 2.1 we summarize the ways in which telecommunications regulation and deregulation over the last 25 years have succeeded or fallen short. Section 2.2 articulates key lessons from that experience, and Sect. 2.3 applies those lessons to the package delivery industry. We offer brief concluding comments in Sect. 3.

2 Lessons from the Experience of Telecommunications Regulation and their Application to Package Delivery

2.1 Where did Telecom Regulation Succeed and Where Might It Have Fallen Short?

To derive lessons from the regulatory experience in the telecommunications sector it is useful to first consider which aspects of telecommunications regulation were successful and which were unsuccessful. In Europe, liberalization of telecommunications occurred gradually beginning in earnest in the late 1980s and continues to evolve. The regulatory scheme included the requirement that incumbents provide broad access to the incumbents’ networks, with the breadth of access obligations decreasing over time according to a framework known as the “ladder of investment” (LOI). According to the LOI theory, access obligations would be successively removed as access-only entrants made investments in facilities that provided alternatives to the incumbents’ network elements. Liberalization and access regulation in telecommunications are regarded as having been largely successful in facilitating competition in the sector, albeit with substantial variation in outcomes across Member States (Parcu and Silvestri, 2014; Liikanen, 2001; Cave et al., 2019).

There certainly was significant entry following liberalization of European telecommunications markets that was facilitated by access regulation. EC data show that in 2014 incumbent shares of retail broadband services were below 50% in most Member States and competitive provision of broadband using access to incumbent DSL networks was significant in many (European Commission, 2014). Indeed, by 2015 entrants in Europe served nearly half of all broadband subscribers that were served using incumbent DSL networks (European Commission, 2016). For the vast majority of these subscriptions, entrants were taking advantage of access obligations imposed on incumbent operators by using unbundled incumbent local loops and combining these with their own core and aggregation networks, with only small proportions served via wholesale broadband access or pure resale. Cable, fiber, and other technologies (mainly fixed wireless access) were also significant in many Member States; however, in many Member States and in the EU overall, competitors accessing DSL networks from incumbent operators served more broadband subscribers than competitors using alternative technologies.

Hence, access regulation undoubtedly resulted in declines in incumbent retail market shares. Some evidence also indicates that local loop unbundling was associated with broadband speed improvementsFootnote 5 and price reductions.Footnote 6 Entrant investments in alternative core and aggregation networks have also, consistent with the LOI theory, allowed the access requirement to be narrowed substantially.

In these respects, it might be said that the European telecommunications regulatory framework was a success. However, while access-based entry and competition in itself might deliver some quality improvements and price reductions, these are relatively static gains. Access regulation does not come without a cost, and a full assessment of its success or otherwise necessitates accounting for the effects of a regulatory framework on investment incentives and longer-term dynamic efficiency. An incumbent that is required to allow its competitors to compete with it using its own facilities has depressed incentives and ability to engage in future investments in those facilities or new facilities (e.g., Grajek and Röller, 2012; Laffont and Tirole, 2001; Newbery, 2002; Yoo, 2012). Moreover, there are countervailing investment incentive effects of LOI regulation (or any regulation that provides access to the last-mile bottleneck) on entrants, potentially encouraging some investment by entrants in core and aggregation networks, but depressing investment by entrants in alternative last-mile infrastructures.Footnote 7

It is well-accepted that facilities-based competition (inter-platform competition, in which competitors provide their own last-mile connections) tends to deliver greater benefits to consumers than access-based (intra-platform) competition and should be preferred where it is feasible. Empirical studies have found that broadband adoption is higher, quality is higher, and prices are lower where competition is inter-platform relative to intra-platform (see, e.g., Smith et al., 2013; Nardotto et al., 2014; Aron and Burnstein, 2003). Inter-platform competition also provides consumers greater choice of product attributes. Cave et al. (2019) summarized the literature by referring to full (facilities-based) competition between infrastructures as “the gold standard” and concluding that it “yields better results than access-based competition” (see also Cave 2014).Footnote 8

There has been considerable empirical research on the effects of unbundling obligations on incumbent and entrant investment. While the literature does not provide unambiguous conclusions, there is evidence that access regulation in Europe negatively impacted last-mile investment by both incumbents and entrants. A much-cited empirical study by Grajek and Röller (2012) found that access regulation increased investment by entrants but reduced investment by incumbents and reduced investment overall by €16.4 billion (representing 23% of the infrastructure stock). The same study also found evidence of a regulatory commitment problem further discouraging investment: the more investment incumbents undertake, the more likely they will find their networks subject to access regulation. See also, Crandall (2005). Briglauer et al. (2017) found that more stringent access regulations harm incumbent investment in fiber networks.

In relation to entrant investment, using US data Crandall et al. (2004) found that growth of facilities-based entrants tended to be slower when prices for access to unbundled network elements were lower (i.e., when access regulation was more generous to entrants). Similarly, Cave et al. (2019) observed, anecdotally, that European countries that declined to regulate access to incumbent fiber networks experienced investments in alternative fiber networks by entrants, whereas countries that regulated access to incumbent fiber tended to find that only the incumbents made fiber network investments.

The premise that where access to particular facilities is required it will be used, at the expense of investment in alternative infrastructure and innovation, was vividly exhibited in the US, where competition has developed quite differently and in stark contrast to Europe. In the US, the access rules established by the FCC after the passage of the Telecommunications Act of 1996 provided for essentially complete access to incumbents’ end-to-end voice networks at low, “cost-based” rates, without sunset provisions and without a showing that competitors would be impaired without such access (at least, not without a showing that satisfied the US courts). Initially after the establishment of these rules there was an influx of new entrants into local voice telephony using the incumbents’ end-to-end services, including a reported $30 billion in investment and hundreds of new companies (Huber, 2003; see also Woroch, 2002, reporting that between Q1 1996 and Q4 1999, the number of competitive local exchange carriers (CLECs) in the US holding telephone numbering codes had increased from 16 to 275). To a large extent, the investment was not in network facilities but rather in software, systems for interfacing with the incumbent, and other costs associated with standing up a business based on, effectively, resale of the incumbent’s service. At the same time, very low regulated prices made it difficult for companies to compete by investing in network facilities.

The chaos of the near-decade between the passage of the Telecommunications Act and the ultimate rescission of mandatory access to end-to-end service at low, “cost-based” rates in the US included the dot-com bust (Kellogg, 2015–2016), three court rulings remanding the FCC’s access regulations (AT&T Corp. v. Iowa Utilities Bd., (525 U.S. 366 [1999]; United States Telecom Ass’n v. FCC, 290 F.3d 415 [D.C. Cir. 2002], and United States Telecom Ass’n v. FCC, 359 F.3d 554 [D.C. Cir. 2004]), multiple rounds of revised rules (FCC, 1999, 2003, and 2005), and the ultimate withdrawal by the FCC of mandatory access to certain components of the network that, in turn, ended the availability of end-to-end access at very low regulated rates (FCC, 2005). Most of the entrants operating at that time no longer exist today (or no longer exist as stand-alone companies).

Today in the US, although unbundled last-mile facilities (“local loops”) remain available at “cost-based” regulated prices based on forward-looking incremental cost, the number of lines served by competitors using incumbents’ local loops is miniscule (FCC, 2021). Competition for both voice and broadband service in the US today, particularly for residential customers, is largely provided by cable companies and wireless carriers. Moreover, the incumbent telecom providers, who provide broadband service over aDSL and fiber-to-the-home (FTTH), provide a minority of fixed broadband lines, and cable companies provide the vast majority (FCC, 2022).

Hence, in the US, unlike in Europe, competition initially followed a tumultuous path driven by overly-broad access obligations, the lack of a clear path toward narrowing those obligations, abrupt changes in policy once companies had begun to make investments in access-based business models, and, in no small measure, the failure to appreciate the effect that access to incumbent networks would have on the incentives for and viability of facilities investment. Until the access rules were limited, competition was largely access-based and once access rules were narrowed, and after a turbulent adjustment, competition has become largely facilities-based (inter-platform).

Cave et al. (2019) concede that the EU access regime was more successful at squeezing static efficiencies from the existing system than stimulating the dynamic transition to next generation infrastructures and services. According to Cave (2014), the ladder of investment did have the effect of an increasing prevalence of competitive lines offered over the incumbents’ last-mile infrastructure, but it was not necessarily intended to and did not lead to duplication of last-mile infrastructure by entrants.Footnote 9

2.2 What Lessons Can We Draw from the Experience of Telecommunications Regulation?

The experience of telecommunications regulation teaches us that it is risky to innovate and potentially self-reinforcing to pronounce an asset to be a bottleneck and to regulate access to it. In telecommunications, the premise of access regulation in both the US and Europe was that at a minimum, the “top” rung of the ladder, the last mile, could not be economically replicated at any time in the foreseeable future. In fact, this proved to be false: the last-mile bottleneck was overcome through technological developments in wireless and cable. In wireless, the allocation of additional spectrum and the improvements in wireless technology that allowed vast improvements in capacity of the networks (which, in turn, reduced costs and prices) allowed for a proliferation of services beyond voice, starting with texting and advancing to high-speed broadband, real-time video streaming, and mobile social networks. This did not merely vault wireless technology into the ranks of a competitor to traditional wireline services, but relegated wireline services to second-tier status, at least for voice, and increasingly for broadband. Around the same time, and relatively quickly, the cable network became an economically viable platform for voice telephony with the development of VoIP, and, subsequently, also broadband internet access.

The lesson is that in markets that are characterized by technological change, regulators should be reluctant to assume that a purported bottleneck requires regulatory intervention (such as access regulation) to overcome or that regulated access to that purported bottleneck will advance competition and social welfare. Presuming that technology is static leads to myopic policymaking. Given the risk that regulation may actively impede investments in alternative technologies (e.g., by making life so easy for access-based entrants that investments in alternative technologies become uneconomic), this is an important lesson for regulatory design.

An access regime that is too favorable for entrants and that lacks a sunset provision is likely to depress incentives of entrants to invest in their own alternative facilities. According to Cave (2006):

one cause of lack of replication can be regulation itself: if comprehensive access products are too cheap, competitive investment will not materialise. The lack of investment may then be taken to justify the access policy, completing the circular argument.

The circularity of access obligations—reliance on a company’s assets discourages alternative investment, and the absence of alternative investment justifies the continuation of the access requirement—is partly attributable to the absence of evidence of the investments that would have been made and alternatives that might have been developed had access not been provided. The experience in the US was that depressing incentives to invest in alternative platforms and technologies via unbundling obligations in the early 2000s was costly.

Access regulations are least risky where investment is already sunk; and have the potential for the greatest social welfare costs where future investment is expected to be substantial and where innovation and the value of the service to consumers depend on that investment. In telecommunications, the greatest risks to social welfare from dampened incentives to invest that arose from access obligations related to the risk of delaying or dampening investment in next generation broadband services and alternative technologies, not the risks of dampening investments in pre-existing copper networks.

In the EU, the establishment of criteria for removing regulation that were based on traditional principles of economics and competition policy was valuable to the marketplace. The fact that the EC appears to have largely adhered to the established criteria over many years was perhaps more valuable and praiseworthy than has been appreciated. Whether the criteria were perfect or not, their adherence to well-accepted discipline-based principles provided limits on the scope of regulation, and the EC’s continued application of those guidelines provided relative predictability to the market and a path for sunsetting regulation. In contrast, the eagerness of US regulators to provide easy entry paths to competitors to the point of abandoning principles of sound governance and standard antitrust economics created the setting for ongoing, repeated conflicts between the courts and the regulators that whipsawed participants and disrupted business models of entrants and incumbents until the costliest access obligations were removed.

2.3 Applying the Lessons of Telecom to the Regulatory Concerns in the Package Delivery Sector

A number of characteristics of the package delivery sector are particularly salient to the lessons from the history of telecommunications regulation.

2.3.1 Access Regulation in Package Delivery is an Ill-suited Intervention in Light of the Dynamic Nature of IT and Adjacent Markets

The lesson from telecommunications that substitutes to bottlenecks can come from unanticipated sources is highly resonant with the package delivery industry and, indeed, with the e-commerce platform marketplace. After decades of relative technological stasis, the package delivery industry is being transformed by innovation driven by information technologies that are developing rapidly, and the ways that companies reach customers are proliferating in inventive ways. Package delivery networks are considered to be highly competitive, have evolved rapidly in recent years, and have a good chance of delivering as much if not more change in the near future (see, e.g., McKinsey & Co., 2019; Keeney, 2020). At the same time, e-commerce platforms are a relatively new business model and purported market power, if it exists, would be subject to the competitive pressures brought by rapid innovation in business models.Footnote 10 In this context, and in light of the telecommunications experience, the premise advanced by some regulatory and competition authorities, discussed earlier, that e-commerce platforms may come to constitute a bottleneck or essential facility that impedes competition in package delivery is a questionable basis for imposing access regulations and, if acted on, susceptible to the risk of depressing investment and innovation.

2.3.2 Investments in E-commerce Platforms and in Package Delivery are Ongoing and Continuing, Making Access Obligations Particularly Risky for Social Welfare

In contrast to the focus in the mid-1990s on access to the largely sunk copper voice telecommunications network, we know today that both e-commerce and package delivery are in the throes of technological development. Investments in package delivery networks have been massive in recent years and are anticipated to continue to be so in years to come, driven by the need to reduce costs and meet increasing customer expectations for same or next-day delivery (requiring more distribution centers closer to delivery addresses and enhanced logistics capabilities), tracking technology, and a variety of delivery options (e.g., parcel lockers). Companies are testing new modes of delivery such as automated cars, robotics, and drones (Barnard, 2022; Keeney, 2020). At the same time there are significant opportunities for brick-and-mortar retailers and international parcel operators to enter or expand their presence in same-day and next-day delivery (see, e.g., Netzer et al., 2017), as well as for urban delivery companies such as Uber, Lyft, and TaskRabbit and entrants offering new modes of delivery (McKinsey & Co., 2019).

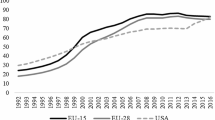

As can be seen in Fig. 1, e-commerce sales worldwide are expected to continue to grow by around 10% or more each year, according to data research firm Statista. Reflecting this growth potential, funding for e-commerce tech firms reached US$21 billion in Q1 2021 (CB Insights, 2021).

Ongoing industry growth not only enriches opportunities for existing providers to invest and diversify but facilitates new entry and new business models, including for retailers selling directly to consumers and organizing their own delivery.

As Fig. 2 shows, there are many existing industry participants who may benefit from and exploit these growth opportunities. Any of these marketplace competitors might be the source of fundamental change in e-commerce technology, although history tells us, and the telecommunications industry experience taught us, that radical change is most likely to come from a new challenger rather than an established player. Moreover, the future of e-commerce is not necessarily in online marketplaces. As can be seen in Fig. 2, according to Statista more than 50% of global e-commerce is transacted through channels other than online marketplaces. Headless commerce players such as Shopify facilitate more opportunities for retailers to sell their products directly to consumers online and are offering delivery logistics capabilities that allow small retailers to access scale economies in delivery when selling directly to consumers online.

We do not know how technology will shape these industries in coming years, but, unlike in telecommunications in the 1990s, we know that we do not know. And we know that the social costs of interfering with incentives to invest and innovate by imposing access regulations are likely to be high.

2.3.3 Rigorous Adherence to Standard Economic Principles for Criteria Necessary to Justify Regulation is Beneficial

The experience in the telecommunications industry taught us that unpredictability of regulatory policy in the US, due in part to the failure to adhere to well-known economic principles, did not promote the facilities-based competition that ultimately developed, but disrupted and damaged it. Current proposals from some quarters to apply access regulation to e-commerce operators in connection with package delivery invite similar risks because, at a minimum, they invite disputes and policy reversals of the sort that created chaos in US telecommunications in the early 2000s. Investment is depressed and business models are distorted when industry participants face material risks that the regulatory structure upon which their business models rely may be rescinded unexpectedly.

3 Conclusions

We have now had over 25 years of experience with liberalization and access regulation in the telecommunications industry. Even with the benefit of hindsight we do not know how the markets in Europe and the US would have ultimately developed differently, if at all, had the regulatory policy been different in either area. But there are nevertheless useful lessons from those 25 years of experience. At the top, interfering with markets that are in the vortex of rapid and profound reinvention, as are both package delivery and e-commerce, risks delaying or even depriving the economy of innovations in business models and products that we cannot know and whose value is therefore easily underestimated. Interfering by imposing access obligations—thereby depriving a company of the full benefits of its innovation and disincentivizing investments in alternative technologies—always risks harming incentives to the detriment of consumers and general social welfare. Doing so in an industry where the mandated access would be to assets that did not even exist until recently, and for which vast resources are expected to be invested in the future, is especially fraught. The experience from telecommunications teaches us that competition comes from unpredictable avenues and that the calculus of when and where to apply access obligations must take into account the effect of that unknown on social welfare.

Notes

- 1.

In Italy, Amazon is active in the form of an e-commerce marketplace and a logistics operation, which is downstream of last-mile delivery, but is not active in last-mile delivery services.

- 2.

The requirement applies to operators with at least 50 employees and annual turnover relating to postal services for each of the past three years of at least €10 million.

- 3.

We refer the reader to Aron and Edwards (2022) for an extensive description of the regulatory and deregulatory history and outcomes in the US and EU telecommunications industries, as well as details of the history of regulation of package delivery in the EU and the evolution of the package delivery industry.

- 4.

The principle that a company is not obligated by law under general competition principles to share its assets with a competitor was articulated by the US Supreme Court in Verizon Communications, Inc. v. Law Offices of Curtis V. Trinko, LLP, 540 U.S. (2003) (commonly known as the Trinko decision).

- 5.

Consistent increases in broadband speeds have been a global phenomenon over the past two decades, and Europe is no exception. Attributing causality to these increases is difficult; however, Smith et al. (2013) find a positive relationship between the share of unbundled local loops out of all broadband lines and broadband speeds. Similarly, Nardotto et al. (2014) used a detailed data set from the UK to find that access to local loops had a positive effect on broadband speeds.

- 6.

See, e.g., the charts showing the evolution from 1998 to 2014 of average revenue per line (ARPL) for fixed access and voice and for fixed broadband in Lear et al. (2017), pp. 49 and 50.

- 7.

As Hellwig (2008) observed, for entrants, access regulation incentivizes investment in infrastructure needed to make use of the regulated inputs, but at the same time disincentivizes investment in alternative infrastructure that would bypass the regulated inputs.

- 8.

Cave et al. (2019) qualify that, in their view, at the time that the European Union embarked on access regulation there was no facilities-based alternative, as deploying an alternative copper-based infrastructure was unrealistic in the first decade of the twenty-first century, so that a regulated telecoms monopoly was the only real alternative. This somewhat glosses over the developments of cable and mobile networks around that time.

- 9.

For some evidence that investment in cable networks suffered due to mandated access to incumbent telco networks see Waverman (2006).

- 10.

Indeed, there is no consensus that Amazon, or any other e-commerce provider, has market power in the first instance in e-commerce platforms and no consensus that Amazon has market power in package delivery; nor do there appear to be substantial concerns that Amazon has increased price or reduced quality in package delivery markets.

Bibliography

AGCM (2021). Decision, Having Regard to Article 102 of the Treaty on the Functioning of the European Union (TFEU), et al., Autorità Garante della Concorrenza e del Mercato (Competition and Market Authority).

AGCOM (2022). Resolution No 94/22/Cons, Regulatory Obligations in The Parcel Delivery Services Market.

Aron, D. J., & Burnstein, D. E. (2003). Broadband Adoption in the United States: An Empirical Analysis, in A. L. Shampine (Ed.), Down to the Wire: Studies in the Diffusion and Regulation of Telecommunications Technologies. Huappage, NY: Nova Publishers.

Aron, D. J., & Edwards, G. (2022). Access Regulation in Postal Delivery in the EU: Lessons from the History of Telecommunications Regulation. SSRN. https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4168393.

AT&T Corp. v. Iowa Utilities Bd., 525 U.S. 366 (1999).

Barnard, A. (2022, February). What Does the Future of Last Mile Delivery Look Like? CircuitBlog. https://getcircuit.com/route-planner/blog/the-future-of-last-mile-delivery-2021.

Briglauer, W., Cambini, C., & Grajek, M. (2017). Speeding Up the Internet: Regulation and Investment in the European Fiber Optic Infrastructure. ESMT Working Paper 17–02.

Cave, M. (2006). Encouraging Infrastructure Competition Via the Ladder of Investment. Telecommunications Policy, 30(3–4), 223–237.

Cave, M. (2014). The Ladder of Investment in Europe, in Retrospect and Prospect. Telecommunications Policy, 38(8–9), 674–683.

Cave, M., Genakos, C., & Valletti, T. (2019). The European Framework for Regulating Telecommunications: A 25-year Appraisal. Review of Industrial Organization, 55(1), 47–62.

Crandall, R. W., Ingraham, A. T., & Singer, H. J. (2004). Do Unbundling Policies Discourage CLEC Facilities-Based Investment. Topics in Economic Analysis and Policy, 4(1), 1–23.

Crandall, R. W. (2005). Competition and Chaos: U.S. Telecommunications since the 1996 Telecom Act. Washington, D.C.: Brookings Institution Press.

European Commission. (2014). Digital Agenda for Europe—Broadband Indicators.

European Commission. (2016). Connectivity: Broadband Market Developments in the EU, Europe’s Digital Progress Report.

European Commission. (2021a). Commission Staff Working Document, Evaluation of Directive 97/67/EC on Common Rules for the Development of the Internal Market of Community Postal Services and the Improvement of Quality of Service Amended by Directives 2002/39/EC and 2008/6/EC, SWD (2021) 309 final.

European Commission. (2021b). Report from the Commission to the European Parliament and the Council, on the Application of the Postal Services Directive (Directive 97/67/EC as amended by Directive 2002/39/EC and 2008/6/EC), COM (2021) 674 final.

European Regulators Group for Postal Services. (2020). Response to the Public Consultation on the PSD Evaluation.

Federal Communications Commission. (1999). Third Report and Order and Fourth Further Notice of Proposed Rulemaking, In the Matter of Implementation of the Local Competition Provisions in the Telecommunications Act of 1996, Before the Federal Communications Commission, CC Docket Nos. 96–98, FCC 99–238 (Released: November 5, 1999).

Federal Communications Commission. (2003). Report and Order and Order on Remand and Further Notice of Proposed Rulemaking, In the Matter of Review of the Section 251 Unbundling Obligations of Incumbent Local Exchange carriers and Implementation of the Local Competition Provisions of the Telecommunications Act of 1996 and Deployment of Wireline Services Offering Advanced Telecommunications Capability, Before the Federal Communications Commission, CC Docket Nos. 01–338, 96–98, and 98–147, FCC 03–96 (Released: August 21, 2003).

Federal Communications Commission. (2005). Order on Remand, In the Matter of Unbundled Access to Network Elements and Review of the Section 251 Unbundling Obligations of Incumbent Local Exchange Carriers, Before the Federal Communications Commission, WC Docket No. 04–313 and CC Docket No. 01–338, FCC04–290 (Released: February 4, 2005).

Federal Communications Commission. (2021). Voice Telephone Services: Status as of June 30, 2019. Industry Analysis Division Office of Economics and Analytics.

Federal Communications Commission. (2022). Internet Access Services: Status as of June 30, 2019. Industry Analysis Division, Office of Economics & Analytics.

Grajek, M., & Roller, L.-H. (2012). Regulation and Investment in Network Industries: Evidence from European Telecoms. Journal of Law and Economics, 55(1), 189–216.

Hellwig, M. F. (2008). Competition Policy and Sector-specific Regulation for Network Industries. MPI Collective Goods Preprint, (2008/29).

Huber, P. W. (2003). Telecom Undone—A Cautionary Tale. Manhattan Institute for Policy Research. https://www.manhattan-institute.org/html/telecom-undone%C3%A2%E2%82%AC%E2%80%9D-cautionary-tale-1415.html.

Keeney, T. (2020, March 13). Parcel Drone Delivery Should Supercharge E-commerce. Ark Invest. https://ark-invest.com/articles/analyst-research/parcel-drone-delivery/.

Kellogg, M. (2015–2016). Essay in, Reflecting on Twenty Year Under the Telecommunications Act of 1996, A Collection of Essays on Implementation. Federal Communications Law Journal, 68(1).

Laffont, J. J., & Tirole, J. (2001). Competition in Telecommunications. Cambridge, MA: MIT Press.

Lear, Berlin, D. I. W., & Mason, A. (2017). Economic Impact of Competition Policy Enforcement on the Functioning of Telecoms Markets in the EU, Final Report. European Commission.

Liikanen, E. (2001). The European Union Telecommunications Policy. In Speech/01/356 at Telecommunications Seminar Sarajevo, European Commission Press Release Database.

McKinsey and Company. (2019). The Next Normal: The Future of Parcel Delivery: Drones and Disruption. https://www.mckinsey.com/~/media/McKinsey/Featured%20Insights/The%20Next%20Normal/The-Next-Normal-The%20future-of-parcel-delivery-vF.

Nardotto, M., Valletti, T., & Verboven, F. (2014). Unbundling the Incumbent: Evidence from UK Broadband. CEIS Tor Vergata Research Paper Series 13(1), 331.

Netzer, T., Krause, J., Hausmann, L., Bauer, F., & Ecker, T. (2017). The Urban Delivery Bet: USD 5 Billion in Venture Capital at Risk? McKinsey & Company, Travel, Transport and Logistics, Market report. https://www.mckinsey.com/~/media/mckinsey/industries/travel%20logistics%20and%20infrastructure/our%20insights/how%20will%20same%20day%20and%20on%20demand%20delivery%20evolve%20in%20urban%20markets/the-urban-delivery-bet-usd-5-billion-in-venture-capital-at-risk.pdf.

Newbery, D. M. (2002). Privatization, Restructuring, and Regulation of Network Utilities. Cambridge MA: MIT Press.

Parcu, P. L., & Silvestri, V. (2014). Electronic Communications Regulation in Europe: An Overview of Past and Future Problems. Utilities Policy, 31, 246–255.

Smith, R., Northall, P., Ovington, T., & Santamaría, J. (2013). The Impact of Intra-Platform Competition on Broadband Prices and Speeds. Journal of Information Policy, 3, 601–618.

State Of Retail Tech Q1’21 Report: Investment & Sector Trends to Watch. (2021, May 6). CB Insights. https://www.cbinsights.com/research/report/retail-tech-trends-q1-2021/.

United States Telecom Ass’n v. FCC, 290 F.3d 415 D.C. Cir. (2002).

United States Telecom Ass’n v. FCC, 359 F.3d 554 D.C. Cir. (2004).

Verizon Communications v. Law Offices of Curtis V. Trinko, LLP, 540 U.S. 398 (2004).

Waverman, L. (2006). The Challenges of a Digital World and the Need for a New Regulatory Paradigm. Communications: The Next Decade, a Collection of Essays Prepared for the UK Office of Communication, Ofcom.

Woroch, G. A. (2002). Local Network Competition. In M. E. Cave, S. K. Majumdar, & I. Vogelsang (Eds.), Handbook of Telecommunications Economics. Volume 1. Structure, Regulation and Competition (pp. 641–716). Amsterdam; London and New York: Elsevier.

Yoo, C. S. (2012). A Clash of Regulatory Paradigms. Regulation. https://www.cato.org/regulation/fall-2012/clash-regulatory-paradigms.

Acknowledgements

The authors acknowledge Amazon for its partial funding of this research, are grateful for useful suggestions from this book’s editors, and for comments from conference participants at the 30th Conference on Postal and Delivery Economics in Rimini, Italy. All opinions expressed in this paper are those of the authors and not necessarily those of Amazon or of Charles River Associates.

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2023 The Author(s), under exclusive license to Springer Nature Switzerland AG

About this chapter

Cite this chapter

Aron, D., Edwards, G. (2023). Lessons from the Experience of Telecommunications Regulation for Regulation in the EU Package Delivery Industry, with Focus on Access Regulation. In: Parcu, P.L., Brennan, T.J., Glass, V. (eds) Postal Strategies. Topics in Regulatory Economics and Policy. Springer, Cham. https://doi.org/10.1007/978-3-031-25362-1_2

Download citation

DOI: https://doi.org/10.1007/978-3-031-25362-1_2

Published:

Publisher Name: Springer, Cham

Print ISBN: 978-3-031-25361-4

Online ISBN: 978-3-031-25362-1

eBook Packages: Economics and FinanceEconomics and Finance (R0)