Abstract

The baking industry is an important branch of the European and also, as a particular case, the Romanian food industry in terms of commodities supply and production volumes, revenues, labor force involvement, and other reasons.

This paper aims to describe a synopsis of the sustainability aspects concerning the baking industry in the particular case of Romania. In this context, a summary-up of the Romanian milling & bakery industry within the food supply chain is made. Qualitative research was performed for a refreshing up-dating on the sustainability in the Romanian baking industry. It was based on a survey considering a few standard requirements applying quality, food safety and environmental aspects, assuming the leadership, resources allocation, management review, people, and environmental issues.

Results indicated that the Romanian bakery market is fragmented but intensively competitive. Within the Romanian milling and bakery industry, decisions for performance improvement at the firm level for gaining a competitive advancement against the competitors consisted of implementing management systems complying with international standards. Still, the interest of almost all interviewed enterprises focused more on food safety than quality assurance or environmental performance. Especially for smaller businesses, the socio-political factors seem to be the main drivers for any management system implementation, besides the economic goals.

Access provided by Autonomous University of Puebla. Download chapter PDF

Similar content being viewed by others

Keywords

1 Introduction

Bread and other farinaceous foodstuffs are seen as staple food worldwide, this specific supply chain from farm to consumers being an essential part of the entire food supply chain globally. As for Europe, the bakery industry is in the top five of the food industry. According to Fortune Business Insights (2022), only the world bakery market sized 397.90 billion USD in 2020, of which USD 137.05 billion counted for Europe. They reported a bakery market segmentation for 2020, where bread represented the significant segment (almost half), followed by a second segment of cake and pastries, 14.61% biscuits and cookies, and the last narrowed part of other bakery products.

As Briceño-León et al. (2021) reviewed, the distribution of the industry according to the bakeries‘size (as production scale) and segmentation by distribution channels between industrial bakery commodities, traditional bakeries, and food services differ from region to region and from a country to another. As for Europe, between 2010 and 2020, the industrial sector of 45% was covered by approximately 1000 plant bakeries, while 190,000 small and medium bakeries ensured the European market segment of 55% bakery products (Briceño-León et al., 2021; Federation of Bakers, 2019). The industrial baking sector in Europe is better represented in countries such as the United Kingdom, Netherlands, and Bulgaria. In contrast, Greece and Spain are areas for traditional and smaller craft bakeries (Federation of Bakers, 2019).

Also, the European consumption patterns vary widely in both quantity and range of bakery products. With a slightly decreasing trend during the last decade, it is estimated to have an average yearly consumption of 45–50 kg of bread per inhabitant, having fresh bread as the star of best-sold bakery food commodities. However, it registered growth for pastries and biscuits.

Because of regional and global trends and policies in force, the baking sector along its food supply chain experienced different paradigms for lasting development, circular economy, or sustainable growth. Thus, the shape of the baking industry changed at national and local levels in many respects. The cereal-to-bread supply chain is essential among other food supply chains. A sustainable approach is necessary for all dimensions, i.e., social, economic, and environmental. Noteworthy, along the cereal-to-bread chain in Europe, there are solid links between agriculture, milling, food processing, and distribution. Some of the larger or multinational companies in the baking industry also own farms and other agricultural or milling assets (inclusive grain storages).

On the other hand, as a movement against the fast-food lifestyle and in order to promote local food traditions and cultures, since the 1980s, an organization has grown internationally, i.e., Slow Food, that envisages global sustainability along the food supply chain from farm to fork (Slow Food, 2004). They addressed the variety of the food supply equally, including the cereal-to-bread chain (Slow Food, 2017). Its members, with people from over 160 countries, have been actively involved in combating the disappearance of biodiversity, local food, and sustainable archaic practices in agriculture and food production. They attract attention to the food we eat and our food choices, their philosophy pledging for good, clean, and fair agro-food products worldwide (Slow Food, 2021).

From a social standpoint, the baking sector employs approximately a third of the labor force involved in the European Food and Drink industries sector, but with lower labor productivity than other food industries. Automated machinery, new equipment, and legislation contributed to better working conditions for operators in the baking industry. And human resources were differentially capitalized (in terms of workers’ protection, occupational safety and health, labor practices, professional training, added value through innovation and knowledge transfer, etc.) within this supply chain.

In comparison with other food chains, the bakery sector is more focused on consumers. Although the main offer consists of bread as a staple food, nowadays, there is a considerable diversification of baked and other farinaceous foodstuffs to meet the consumers’ demand in relation to customers’ choices and preferences. For instance, affordable, nutrition, convenience, and healthier alternative are the main attributes considered by consumers when they refer to bakeries and other mealy foodstuffs. Noteworthy, no matter the range of mealy products, food safety along the whole cereal-to-bread/mealy products chain must be an implicit pre-requisite (in many world regions and countries, food safety is foreseen in food laws).

As mentioned, the baking market is very fragmented between small and medium enterprises (SMEs) and large companies. Also, the main baked foodstuffs offered on this market are fresh, which means the period for their commercialization is smaller, and an intense focalization on clients is foreseen. These are the reasons why the bakery market is intensely competitive, and the economic criterion is compulsory for survival. Consequently, to meet the requirements of consumers, many companies invest in innovation and technology for financial performance increasing and not at last environmental protection or at least compliance with national or regional environmental laws and policies. For economic sustainability, organizations that act along the cereal-to-bakery and farinaceous products supply chain work to implement sustainable business models, management systems, and even corporate practices to increase their profitability, continual improvement, and sustainability in the long term. Firms try to valorize better business opportunities for a competitive advantage in the market and sustainable growth at each level. Obviously, the tools used for economic gain differ from SMEs and more prominent companies, but the main purpose is the same, namely to capture, keep and even increase a particular market share.

The concerns towards environmental aspects are considered different depending on the country, plant or bakery scales, regional policies, and national environmental laws and policies. Many focus on environmental processes, eco-technologies and eco-practices, some for environmental performance and ecological impact assessment, and others for eco-design and environmental claims.

The Federation of European Manufacturers and Suppliers of Ingredients to the Bakery, Confectionery and Patisserie Industries (Fedima) acknowledge the initiatives and supporting actions of its members to contribute to a more sustainable European bakery industry with the purpose of achieving at least six (Fedima, 2021) of the UN Sustainable Development Goals, i.e., SDGs 3, 8, 12, 13, 15 and 17 (UN, 2015). In this aim, some of Fedima’s members found new ways to reduce food waste and packaging through responsible consumption and production (SDG 12). They acted to sustainable packaging, responsible sourcing, and reduced energy emissions, aimed at achieving SDG 13 (climate action) and SDG 15 (life on land). Others promoted good health, nutrition, and well-being through an adequate, improved diet (SDG 3). By building partnerships for achieving the goals (SDG 17), some offered decent work and ensured economic growth (SDG 8) (Fedima, 2021).

2 Research Methodology

This paper aims to describe a synopsis of the sustainability features of the Romanian baking industry. In this context, a summary-up of the Romanian milling & bakery industry has been made within the food supply chain. And a qualitative research was performed for sustainability assessment of the Romanian baking industry complying with some standards requirements.

Firstly, extensive documentary research was performed. The data was collected from trade and media press (newsletters, leaflets, online information), professional associations, industrial business operators’ websites, legislation, scientific studies, and other technical papers (inclusive standards). The information covers aspects of:

-

the Romanian bakery market, with outcomes and challenges facing the milling & bakery industry along the food supply chain;

-

sustainable bread supply, as a general approach, with the specific case of Romania;

-

the importance of standards for sustainability implementation along the food supply chain and impact on Romanian bakery businesses.

The study introduced further is not extensive enough to have a very in-depth blueprint of the baking sector nor outline a SWOT (Strengths, Weaknesses, Opportunities, and Threats) analysis. Still, a SWOT analysis is not the purpose but to identify the adequate context of the research. So, an overview of the bread industry in Romania is introduced to have the big picture of its features along the cereal-to-bakery products supply chain and identify the context of organizations. Generally speaking, the baking industry ensures adequate, safe, nutritionally, and affordable baking goods for the Romanians. And an up-dating on the sustainability in the Romanian baking industry is proposed.

Secondly, in the period July 2020 to August 2021, a research was conducted based on a survey with representatives of several business operators. As information sources for defining the premises and scope of the research, it took into account the literature review on business models, organizational culture, management systems, standard requirements, Life cycle assessment (LCA), environmental issues, and the multi-criteria approach sustainability concepts.

Standardization is a factor in promoting technical progress, achieving and improving the quality of food commodities (incl. Food safety), economic rationalization, as well as facilitating trade in domestic and international markets. Based on an empirical approach, at this stage is proposed a brief assessment of how the Romanian baking manufacturers comply with standards requirements towards sustainability. For the social dimension of sustainability was considered food safety with an impact on the health and well-being of the consumers. At the same time, quality management was foreseen as a tool for economic performance. Concerning environmental aspects should be noted that neither official food waste, carbon footprint, nor energy consumption statistics are available at the national level, the reason for which the study does not focus on environmental performance assessment but on how the environmental processes are kept under control within the Romanian baking industry. Assumed research criteria were leadership, resources allocation, management review, personnel, and environmental issues. As depicted in Table 6.1, following the standard requirements, these five sections address many sustainability dimensions than one.

So, the experimental data have been collected from 40 companies by proposing a model about environmental issues, food safety, and quality using management systems for a more sustainable supply chain following specific standard requirements (of ISO 14001:2015, ISO 9001:2015, and ISO 22000:2018).

The methodology used in this case study has been based on qualitative research. A survey was conducted based on a questionnaire, having closed or open questions, and completed with the additional direct interviews to clarify or understand specific issues related.

3 An Overview on Romanian Bakery Industry

The Romanian food market is placed on second top of the largest markets in Central Eastern Europe after Poland, being very dynamic, even in specific and challenging conditions of the COVID-19 pandemic period of 2021 (FRD, 2021).

The latest data shows that Romanians are ranked the first in the EU-27 in terms of baked goods consumption. Romanian bread consumption is placed second after Turkey as part of the Balkan region (comprising areas of South-Eastern Europe). Although the total consumption of bread in Romania has continued to decrease in the last three decades, it remains up to 60% more than the European average.

Traditional commerce ensures approximately 50% of the total sales, and the preferences for fresh white bread are still on top of the Romanians’ consumption habits. The preferred places for bread purchase are traditional neighborhood markets and grocery stores, followed by bakeries shops and super- and hypermarkets (Scurtu Cristu et al., 2016). Approximately a decade ago, a growing sector became In-store bakeries. Also, bread and other bakery products are sold within the food service sector for consumption outside the home, mainly as part of the menu. Bakery-cafes developed mostly in cities. Especially since the end of March 2020, during the Covid-19 pandemic, online shopping for food flourished on e-commerce platforms (with 42–48% compared to 2019), and home delivery systems developed for various baked foodstuffs and mealy products.

Among the factors that influence consumption patterns and determine trends in the bakery market, it mentions fast food, consumption outside the home, globalization of markets, and health concerns. The consumption patterns for bakery products are influenced by age, gender, education, geographical area, environment (rural-urban), and individual preferences (Sîrbu, 2009b). Scurtu Cristu et al. (2016) analyzed the average bread consumption by regions in Romania; they observed the highest consumption of bread was recorded in the South-Western Region of Oltenia (with more than 10 kg/inhabitant/month), while the lowest was found in the North-East Region (with 6.5 kg/inhabitant/month). Also, consumers’ types of bread and desired quality slightly varied from one region to another (Sîrbu, 2009). Regarding bread, there are also differences between regions of Romania in terms of preferences for packed vs. unpacked bread and the loaf size, respectively, in the sold portions (Scurtu Cristu et al., 2016).

Regarding the reasons driving the consumers’ preferences, the results seem to be different between packed and unpacked bread. For instance, Scurtu Cristu et al. (2016) highlighted that among the first criteria for packed bread assessment, the taste, price, and brand seem to be the most important. On the contrary, other sources showed that the main attributes of fresh unpacked bread are quality (in general), freshness, and ingredients (recipes) (Arta alba, 2019). Still, sliced bread is considered more convenient to buy and consume, becoming of interest to consumers as well as the bakers.

However, it is interesting that the same consumption trends quoted by Sîrbu (2009) have been kept in the last two decades concerning bakery products, as follows:

-

increasing demand for packed “long-life” products to the detriment of fresh bread;

-

decreasing bread consumption in favor of other mealy products (biscuits, industrial pastries, cookies, pasta, etc.);

-

increasing demand for ethnic (e.g., pita) and traditional bakery products;

-

an increasing trend for convenient ready-to-bake products, such as frozen dough and part-baked products;

-

increased interest in healthy bakery products, dietetic and functional foods, and even organic products.

Obviously, the tendencies changed, as a rate, in different periods, depending on other macroeconomic factors and the political context. For instance, during the COVID-19 pandemic in the period 2021–2022, the sales of packed bread vertiginously increased, while the demand for expensive functional or organic food had a slower rate, also related to the decrement of purchasing power of the consumers.

Most Romanians’ consumption trends can be correlated with social changes in recent decades and, in context, are somewhat similar to those of other European consumers. However, there are certain peculiarities in quantity demanded on the market, the accepted price, products’ quality appreciation by consumers, and preferred assortments.

Even if the bread market is consistent and competition in the market is intense, that does not mean irregularities appear. Besides very active marketing, most issues related to non-compliant with the food laws appeared in bread labeling with non-declared ingredients or incomplete mentions with a potential to mislead the consumers (Scurtu Cristu et al., 2016).

Different reports showed that European average yearly bread consumption decreased in the last three decades from approximately 75–80 kg/inhabitant to cc. 45–50 kg/inhabitant nowadays; compared to this, the changes in the bakery products market in Romania were more significant. Firstly, in Romania, the bread consumption decreased from about 121.87 kg/inhabitant in 1990 to cc. 108–110 kg/inhabitant in 2007–2008 (Sirbu, 2009) and below 100 kg/inhabitant after the 2010s. An estimated yearly consumption of bread among Romanians from 2015–2016 is around 80–85 kg/inhabitant (Deselnicu et al., 2020; Scurtu Cristu et al., 2016). Besides the decrease in individual bread consumption (as average figures), another factor affecting the total production volumes and sales was the population decrement from 23.2 million inhabitants in 1990 to cc. 19.3 million residents in 2020. In that way, a reduction in total production happened with cc. 70% for the period mentioned above. Even so, the baking industry is an important branch of the Romanian food industry in terms of goods offered and production volumes, revenues, labor force involvement, and other economic indicators.

According to the Classification of Activities in the National Economy (NACE codes) 2022 in Romania, the Manufacture of bakery and farinaceous products is included in section C – Manufacturing, Class 107 (Codes from 1071 to 1073), as part of the Manufacture of food products (CAEN, 2022). This class refers to the manufacture of bread, fresh and preserved pastry, cakes, rusks and biscuits, pasta (macaroni, noodles, etc.), couscous, and similar farinaceous products. Bakery and farinaceous products consist of an extensive range of leavened and unleavened bread, pastry, pies, cakes, pizza, and other flour-based products. The assortment of baked foodstuffs continues to be enriched, being difficult sometimes to distinguish between various ranges of farinaceous products.

Firme.Info (2022) reported that, in Romania, there are registered 12,948 companies with a NACE code 107, with different distribution among 1071 NACE (11,804 firms), 1072 NACE (912 firms), and 1073 NACE (232 firms). The best represented area is bakery activity for manufacturing leaven bread (cc. 90% as a number of companies, but not in production volume). Although the number of enterprises in the baking industry considerably increased in the last decade (e.g., from 8449 companies in 2014 – source: Scurtu Cristu et al., 2016), of these registered companies, only cc. 70% are still running bakery and farinaceous production business in 2022. That means a reconfiguration of the baking sector in terms of producers and not only in distribution channels. Like the European baking market, the Romanian one is fragmented between smaller bakeries and large plants.

After the declared turnover, the leading players in the baking industry are Vel Pitar (bread and pastry) followed by CHIPITA ROMANIA Ltd. (biscuits, cookies, preserved pastry), CROCO Ltd. (biscuits, cookies, preserved pastry), FORNETTI ROMANIA Ltd. (bread and fresh pastry), PHOENIXY Ltd. (biscuits and preserved pastry), and LA LORRAINE Ltd. (bread and fresh pastry) (Firme.Info, 2022).

However, do not forget, when bread production discusses, that the food supply chain involves milling and baking. In this respect, the companies, especially the larger ones with activities in NACE code 107, also have registered other NACE codes such as milling (NACE code 106 – Manufacture of grain mill products, starches and starch products). In this context, the shape of the milling & baking industry changes in-depth. Consequently, the main actors in the top five companies with a turnover higher than 50 million euros are Vel Pitar SA. (which is part of the same group with Sapte Spice, having primary the milling activities), Oltina Impex Prod Com Ltd., Boromir Ind Ltd., and Dobrogea Group SA. Except for the financial outcomes, they differ in shareholding type, national dispersion, and production scale. Some companies are joint-stock, and others are limited companies. Some are concentrated in a specific county, and others have manufacturing distributed in many branches in different regions in Romania.

The first eleven companies, which produced with cc. 30 large industrial plants, made a turnover of 6.5 billion RON in 2019, representing approximately 25% of this industry sales (Deselnicu et al., 2020). These data prove that the industrial milling and baking sector is highly concentrated.

As Deselnicu et al. (2020) pointed out, the milling and baking industry is one of the challenging Fast Moving Consumer Goods (FMCG) industries. And this statement is supported by the collection of firms with activities engaged in the bakeries sector as well as how changed the top-ranking of companies from one period to another (for comparison, see Sîrbu (2009) and Deselnicu et al. (2020). That means it is essential to use all resources (human, financial, material) of the organization adequately to produce and sell bakery products and find the best strategies to keep a competitive place in this market. For this purpose, at least the larger companies engaged in the milling and baking industry are applying a differentiation strategy.

Besides the harsh competition between the more prominent players, there is also a certain dynamic of the competition for SMEs, who either wish to grow or survive. Competition in this specific market for distribution channels and increasing sales is between producers no matter the manufacturer scale without any evident partition between smaller and larger firms. For example, larger companies have their own retail chains as neighborhood shops. At the same time, even smaller bakers wish to jump with their products from the local markets and corner bakeries into the hypermarkets.

Deselnicu et al. (2020) commented on the forces driving the Romanian baking industry competition, analyzing four strategic groups existent in this food sector. These strategic groups were distinguished by considering the geographical coverage and range of mealy products marketed by the leading players as strategic dimensions.

However, the rules of the “game” change all the time within this specific food market because, firstly, bread is a staple food; and secondly, all socio-political and economic pressure is apparent on bread commodities and end-consumers.

4 Assessing the Sustainability in Baking Industry Complying with Standards Requirements

4.1 Sustainability on Baking Sector in Romania - Premises

Sustainability can be conceptually approached along the food supply chain considering all its dimensions, i.e., economic, social, and environmental. Meantime, the baking industry as a part of the cereal-to-bread supply chain should be proceeded in a distinct manner, having particular features when sustainability discusses.

Many authors analyzed sustainability along the whole cereal-to-bakery and farinaceous products supply chain (e.g., Galli et al., 2015; Gava et al., 2014). In order to perform a sustainability assessment of the cereal-to-bakery and farinaceous products supply chain should be addressed three main areas, i.e., agriculture, food processing, and trade (wholesale distribution, retails, and other forms of commerce, including the food services). These areas are strongly interconnected and sometimes dependent. Although various models for sustainability evaluation were proposed considering multi-criteria analysis and multiple indicators, an accurate assessment is still difficult to conduct, and this topic for scientific research is still open.

Next, it refers to the Romanian baking sector considering the bread manufacturing and processing of other farinaceous, as well as trade towards the end-consumers. For sure, the baking industry is not out of the general context of the whole supply chain from farm to fork. But following, the attention focuses on the baking industry, which comprises farinaceous food processing and commercialization activities.

Sustainable development of this sector became evident in the 2000s when the bakery and other farinaceous products’ market became a more competitive market (Sîrbu, 2009). The reasons that drove these changes were due to the significant growth of the leading players and market reshaping, adoption of Community acquis and various European policies and regulations (related to food, environment, etc.), and entering international markets.

A Few Aspects of the Social Dimension of the Romanian Baking Industry

Since the pre-accession to the EU, Romanian legislation was harmonized with the “Community acquis”. In this respect, starting in 2000–2006, food and environmental laws intensively changed and updated toward a sustainable approach. Government strategies aligned with those of the European Union for public health and food safety had an indirect impact on sustainability, even if, at that very moment, sustainability was not a primary goal envisaged.

This market is consumer-oriented, and consumer behavior continues to be an essential variable that challenges the Romanians and business operators in the baking industry. For example, demand for convenient and ready-to-eat products increased the percentage of sliced and packed bread commodities, which can be easier divided into small portions, have prolonged shelf life, and, not at last, appear safer (due to avoiding additional hands on the foodstuffs but no otherwise).

Even if bread remains an essential food in the Romanian daily diet, the assortment of other baked commodities changed visibly in the domestic bakery market. The industry has started to supply healthier and functional bakery foodstuffs using new or many ingredients or trying to revive already forgotten traditional methods or handcrafts.

It is well that health concerns have grown among Romanians in recent decades, but sometimes social media manipulates consumers’ decision-making. For instance, an intensive “information” against white bread has been launched in the last years; regular white bread was considered unhealthy and responsible for obesity and cardiovascular diseases. For sure, it is excellent to increase the number or change some ingredients for variety and additional functional characteristics in the diet. However, bread is still a staple food for Romanians. Besides that, in Romania, this kind of regular white bread is made without adding sugar (as in other international recipes), and they use wheat flour 650 type (with 0.65% ash) but no refined white flours as 450 or 480 types. Regarding salt content, according to the Romanian standards and laboratory determinations, in most bread, sodium chloride content varies in percentage from 1 to 1.3 or 1.5 maximum, a level lower than other European figures (e.g., see Joossens et al., 1994; Pérez Farinós et al., 2018).

Indeed, bread consumption is higher than in other European countries. This food pattern can be explained in Romanian traditions and how Romanians associate bread with other food in their daily meals. No less true that, for Romanians with lower purchasing power, bread often appears in food consumption patterns by replacing more expensive foodstuffs as a substitution effect.

On the other hand, communication and social media influence bread consumption and food patterns (Lădaru et al., 2021).

If considering human capital and labor force as a component of social sustainability, it is necessary to highlight that in 2019 the Romanian milling and bakery industry engaged almost 45,000 employees, having still registered a labor shortage of nearly 10% (Barbu, 2019).

Towards a Sustainable Economic Baking Industry

Businesses run in the bread supply chain cover the Romanian market, being restrictive neither national nor local. As a whole, different companies use inputs or supply goods globally. So, beyond the national competition in the baking market, significantly larger enterprises also face competitive rules abroad. That is more challenging because, compared with other food sectors, most of the leading players in this milling and bakery market are companies with Romanian capital investments (e.g., Oltina Impex Prod Com, Boromir Ind), part of them starting as small family-type businesses in the 1990s.

In the pre-accession period of the EU, the efforts to attract investment funds intensified, aiming at re-tech and automation, increasing production capacities or building new plants or facilities, and innovating new products, processes, and adaptive marketing and management systems.

During the last decades, many outcomes in product innovation were registered for diversification and adapting to consumers’ requirements, considering the global or regional trends in nutrition and well-being (inclusive cereal by-products high valorized through bio-fortification of the baked foodstuffs).

Food manufacturing occurs in artisan bakeries, small-scale, or large industrial plants in the milling and baking industries. Production scale, type of raw materials handled, technological inputs, and how the processes are operated all these influence financial performances that ensure the economic sustainability of the companies. Knowledge transfer, access to an experience economic environment, scientific advancement and theories, and self-learning lessons urged Romanian bakers to apply business models based on managerial principles and the Deming cycle. Thus, it became compulsory to correctly manage overall operations within the baking industry to improve financial outcomes and economic efficiency. No matter the bakery scale, all wish to gain money at the end of the day.

Environmental Issues Addressing the Baking Sector

Using different tools, such as LCA and various environmental indicators (e.g., carbon footprint, energy consumption, greenhouse gas (GHG) emissions, water footprint), in literature, different authors try to estimate at least partially the environmental impact of bread processing. For example, Andersson and Ohlsson (1999) discussed the relation of the production scale with environmental issues, such as energy use, emissions, and waste management. Espinoza-Orias et al. (2011) evaluated the carbon footprint of bread produced and consumed in the United Kingdom. Kannan and Boie (2003) studied energy management aspects for bakeries‘sustainability in Germany, while Briceño-León et al. (2021) discussed ecological issues of energy consumption in bakeries of Ecuador. But, in-depth studies on environmental performance evaluation and the environmental effects generated by bread production and consumption in Romania did not find.

Although environmental performance assessment is not available, many bakeries, especially the industrial plants, control their processes with ecological impact for energy savings, reducing electricity consumption, and recovering heat resulting from the baking process in industrial ovens. Generally speaking, through automation, the breadmaking process is better kept under control with optimized quantification of all inputs and cut costs in terms of energy, electricity, and water.

The interest in applying the best manufacturing practices increased simultaneously with the reinforcement of the regulatory field of food safety in Romania and when bakers observed that adequate production management could save their money in many respects. In this case, the potential environmental impact of water, energy, or waste management was appreciated as a second goal after the direct economic benefit. Also, technical equipment advancements and innovations applied in the baking industry proved to be sustainable in both economic and environmental means.

Representatives of Romanian patronages of the milling and baking industry – ROMPAN and ANAMOB raised the issue of food waste within this specific food supply chain, too.

However, it is worth noting that many authors that analyzed the environmental aspects related to the bread manufacturing identified various factors which influence ecological impacts, such as manufacturing scale, recipe used (as regards the ingredients, breadmaking methods, and processing parameters), manufacturing practices, equipment and available infrastructure (warehouses, facilities, etc.), packaging (Andersson & Ohlsson, 1999; Kannan & Boie, 2003; Espinoza-Orias et al., 2011; Galli et al., 2015; Notarnicola et al., 2017).

4.2 Standards, As Tool for Management Systems’ Implementation

As known, the International Organization for Standardization (ISO) offers various standards applicable to different kinds of organizations in many areas of interest. Most of them are voluntary, but they are widely used because they foresee general or specific requirements that support the implementation and operation of various management systems. Sets of standards dealing with several management systems can help organizations to improve their objectives related to many requirements in fields such as quality management, food safety, environmental processes, risk management, conformity, occupational health and safety, information security, accounting aspects and better usage of resources, business continuity, etc. (ISO, 2022). As introduced in Table 6.2, many types of management systems or parts thereof can be implemented in organizations along the food supply chain, singularly or as integrated systems. There are different opinions about successive implementation or many integrated management systems in a whole one, depending on organizations’ needs, resources, and benefits.

This study further considers a few specific requirements of standard families of ISO 9000, ISO 22000, and ISO 14000 for particular management systems implemented in bakeries in Romania. At the organizational level, mostly larger bakeries implemented various management systems with more international standard requirements and later private-labeled certification.

Quality management system implementation (based on ISO 9000 family) envisages quality assurance at an organizational level. It promotes economic performance by reasonably providing all resources, controlling processes, and improving efficiency (cutting costs). Also, it can positively influence the food industry on green performance (Pipatprapa et al., 2017).

Food safety management based on HACCP (Hazard Analysis Critical Control Points) can be systemically applied in accordance with requirements stipulated in ISO 22000 family. In this way, food safety addresses the social dimension of health and well-being by supplying as safe products for consumption as possible on the food market. But FSMS is managed within economic means by food business operators. Additionally, some private certification schemes were developed under the Global Food Safety Initiative (GFSI) umbrella.

The family ISO 14000 comprises a set of standards that express principles, specific requirements, and guidelines either for implementation or certification of the EMS, environmental performance evaluation, eco-efficiency, or eco-design at the organizational level.

By evaluating the activities and inputs/outputs to environmental issues, these consequences are discussed from both economic and ecological standpoints. For instance, ISO 14001 is considered rather a process standard in so far as companies flexibly choose environmental objectives (Mosgaard et al., 2022).

Noteworthy that between management systems, such as QMS, FSMS, and EMS, there are a few similarities concerning managerial principles, resources allocation, communication, and a few other processes. But, they are distinct in scope, eligibility, objectives, and systemic approach. Also, quality and food safety management systems focus on their customers, such as end-consumers.

As shown in Table 6.2, the applicable standards can address one or many dimensions of sustainability along the bakery supply chain. The sustainability approach is not restrictive to ISO 9001, ISO 22000, and ISO 14001, but those standards were more known among all when asked Romanian bakers. Only a few larger bakers have implemented occupational health and safety management system. Of interviewed respondents, a single person acknowledged the business continuity standard, and another said that their company started to implement standards for information security.

There were no concerns about the innovation management system, even though many business operators stated that they are interested in the innovation process as a business opportunity for competitive advantage in the market.

4.3 Assessing the Sustainability in Baking Industry Complying with Standards Requirements – A Case Study

The study aimed to provide an insight into the Romanian baking industry’s response to sustainability, considering some management systems’ peculiarities, which operate in this sector at the organizational level. The first stage introduced external issues relevant to understanding the organizational context for baking manufacturers and outlined premises for the sustainability of this specific sector in Romania. The questionnaire consisted of a set of questions that could analyze a few attributes associated with food safety, food quality, and environmental management systems. For this, five sections were developed.

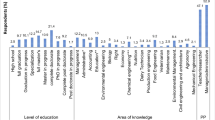

The survey was initially applied to 40 bakeries ‘representatives. The respondents of the baking business operators were from at least one category, i.e., food technologist, baker producer, manager, or team leader for quality/food safety/environment management.

From the initial number of companies participating in the survey, answers of four small bakers from the countryside were considered apart because they did not implement any management system. However, based on additional interviews, those four bakers admitted they comply with food safety requirements based on the HACCP method because they follow the food law. Representatives of Romanian official control at county level, i.e., the Sanitary-Veterinary and Food Safety Directorate (DSVSA), have registered their activities as business food operators. DSVSA guide them and periodically perform control. But above-mentioned bakers did not introduce any particular management system. They learn from experience or knowledge acquisition from various sources (other professionals, fairs, news, etc.). They consider their bakery scale small enough and do not need a whole system to control the breadmaking process and costs associated with inputs (flour, other raw materials, energy, or electricity). They carefully analyze the inputs and outputs to avoid wasting money and making a profit. To the extent that revenues are satisfactory, they do not seem too concerned about increasing profitability on a scientific basis. Regarding the environmental aspects, they consider their production scale too small to have an ecological impact. But food waste and other edibles are valued for animal feed. Instead, they were very proud of the bakery products they provided to customers and the satisfaction of faithful consumers, believing that real sustainability means continuing to run their business in a friendly environment for the next generation.

The 36 complete questionnaires showed that respondents came mainly from SMEs but balanced between small, medium, and large companies. All implemented FSMS until this very moment. Also, some introduced progressively many management systems, successively carried out apart or as an integrate management system. Various management systems applied at the organizational level were chosen as a result of how the external environment of firms changed and internal needs appeared. For instance, representatives of average-scale bakeries pointed out they shifted from one MS to another depending on specific conditions. But only a few large companies integrated more management systems into one.

Management systems’ implementation seems to be conditioned by market reasons. All business operators handled FSMS because food safety requirements are mandatory by food law; standard requirements are easier to follow for any bakery along the food supply chain, no matter the production scale. If a quality management system was more convenient for larger companies, the smaller ones considered they must involve too many resources. If it is not compulsory, for them is more trouble (e.g., additional tasks in the job description, more procedures, and more recordings to keep, allocation of additional funds for a holistic approach). Similarly, many SMEs commented regarding ISO 14001 adoption. So, they supported compliance with standardized management systems in how their efforts to provide resources are justified by gaining visible competitive advantages in a short time. In other words, when asked why they should implement any management system, the main reasons that drove almost producers to act for MS were socio-political factors and economic constraints. In this respect, they enumerated legislation in force, legitimation, customer expectations, and market requirements.

Although the research intended to focus only on management systems’ implementation initially, the certification process seems crucial for Romanian manufacturers because it legitimates their efforts and outcomes toward the market and their direct customers. So, when discussing the management systems implemented within organizations, all respondents referred to the certification of the systems they have actively giving effect at the firm level. Consequently, many systems are also certified by independent third-party audit bodies.

In analyzing the dynamics of MSs within the baking industry, many baker manufacturers first started implementing a quality management system, afterward FSMS with or without an additional EMS. Some bakers stated that they introduced one specific or a couple of management systems at the beginning and later gave up a particular MS; either they adopted different standards, the organizational culture changed, or the whole process of compliance with standard provisions went beyond their interest.

Still, QMS certification for SMEs has dropped recently in favor of food safety, the FSMS certificate being considered a helpful tool in trade relations between partners. Also, food safety certification under private label schemes sometimes becomes compulsory, especially when using larger distribution channels for domestic hypermarkets and international trade.

To and Lee (2014) ranked Romania in seventh place in the top-ten countries in terms of EMS certificated according to ISO 14001 in 2010. They indeed referred to all industrial production but not only the food sector. However, in the last decade, similar to QMS, the interest of Romanian firms in EMS implementation in full or certification has slowed down along the cereal-to-bread supply chain after an increasing trend.

Regarding food safety, from respondents of this survey, cc. 90% of firms had certified FSMS. The other 10 percent represent small bakers who implemented food safety management based on the HACCP method complying with the national food legislation in force.

Of interviewed companies, 61% had International Featured Standards (IFS) certificates. The others had food safety management systems certified according to ISO 22000 and FSSC 22000. Surprisingly, certification granted according to ISO 22000 requirements was available for only 28% of the companies involved in the survey. A few medium and large companies had FSMS ongoing with simultaneous certification labels such as IFS and ISO 22000, IFS and FSSC 22000, IFS and BRC, ISO 22000 and FSSC 22000.

Additionally, related to the social dimension of the sustainable Romanian baking industry, it should emphasize that at least 8% of analyzed firms were concerned with social compliance. They implemented an occupational health and safety management system. Of these, two large companies addressed improving working conditions considering ethical and responsible business practices. In this case, a leading company performed social audits according to Sedex Members Ethical Trade Audit (SMETA) protocol. Another company used Business Social Compliance Initiative (BSCI) to monitor and assess workplace standards.

There is proof that governance models are applied, at least for large companies, to steer the Romanian baking industry towards sustainability and business competitiveness.

Regarding quality management, QMS was certified for 33% of the analyzed companies. Some respondents concluded that, to a certain extent, the top management decided if they continue or not to ask for a third-party audit aiming at certification. But that does not mean that percentage is representative of quality management system implementation. Medium and large companies have combined various management systems with a common structure to control their economic performance, assure conformity to clients, and continually improve (incl. Reducing predictable losses and costs). The last versions of ISO standards promote this kind of managing manifold processes in ways to consider making it easier on simultaneous integration in whole or parts thereof with other management systems and facilitating management system implementation in any organization along the food supply chain, no distinguishing scale-size.

Of respondents, one person highlighted that quality management focused on sustainability is generated internally by the principal owner’s beliefs.

Regarding the environment, there were voluntary initiatives of companies to integrate the ecological dimension of sustainability based on standards. Of interviewed people, only 22% of firms are implemented and certified EMS; and 17% are large companies. Respondents from companies with EMS considered that standards offered them specific guidelines in addressing environmental issues at the company level and helped solve problems in bakeries. The larger companies used ISO 14001 as a tool for improving processes and operational outcomes with economic performance and environmental benefits. Beyond their ecological objectives and QMS, standards help large firms to a strategic approach for efficient management of all resources (inclusive energy-saving, proper water management, waste disposal or recycling, etc.).

But in some cases, respondents admitted that even if EMS is not implemented in full, parts thereof are integrated into another management system. For instance, they introduced waste prevention programs and other specifically ecological measures for operating an EMS into the FSMS or QMS’s documentation.

All interviewed people recognized that ISO 14001 supports regulatory compliance. Some of them assimilated between environmental performance and the regulatory provisions. Many SMEs have considered they lack appropriate resources to improve the environmental outcomes.

Noteworthy, Johnstone and Hallberg (2020) explored the contextual factors supporting EMS with ISO 14001 adoption in SMEs for improved sustainability. Comparable comments with Johnstone and Hallberg’s (2020) results were observed for SMEs under discussion. SMEs with EMS ongoing acknowledged they thought it was better to adopt ISO 14001 for following environmental laws with benefits for legitimizing their environmental actions with control bodies or an improving image in the market, facing potential competitors and end-consumers.

Even if the ISO 14001: 2015 considered EMS to be easier enforced in SMEs, the interest manifested by bakers for EMS implementation fell. Apart from setting environmental goals, the organization must assess its environmental impacts that have implications for the organization and should establish key performance indicators (KPIs) for each environmental objective. When respondents were asked about environmental KPIs, all indicated waste management.

According to the literature review, Romania has a lower recycling rate in the UE and risks infringement or penalties. Before the pandemic period, it was quoted that cc. 20% of food waste is lost before consumption.

Based on the survey, most baking firms follow the environmental requirements, mainly pushed by environmental legislation and less induced in the spirit of sustainable principles. Convincing in this respect is the argument that “polluter pays”.

However, some similitudes between FSMS, QMS, and EMS complying with international standards occur concerning managerial principles, resource allocation, management review, a few processes, and even communication. So, a standard backbone structure is available for all these management systems. The methodology applied for the effectiveness of these MSs, follows the recognition of the common requirements (e.g., risk-based thinking, improvement promotion).

Leadership and top management commitment shall demonstrate for the management systems. All respondents acknowledged that policies and objectives are assumed and internally communicated by top management. For those that implemented many systems, they are recognized distinctly between quality, food safety, and environmental goals for the effectiveness of each MS. A more vital link with the company’s strategic approach is also related to its efficiency and is perceived for quality objectives rather than food safety or environmental ones. Except for the top management, for different employees at an intermediate level, the specific objectives for food safety and environmental goals and policies seem to support rather the applicable statutory and regulatory provisions.

Managerial principles based on the Deming cycle, namely PDCA (Plan-Do-Check-Act), are applied in each MS according to the latest versions of ISO 9001, ISO 22000, and ISO 14001 have spawned a basic architecture for joint requirements and processes, such as resource allocation and management review.

A set of questions was asked about resources that support management systems implementation. 80% of respondents were directly or indirectly involved in planning the resources, especially the financial ones. A few were in charge of raw materials. Human resources (HR) are issued mainly by top management and a dedicated HR department. Even though they almost agreed with the statement that the company should provide adequate resources, many bakers pointed to financial funds as threats or constraints for business operating, mainly when they invest in infrastructure, equipment, maintenance, and re-tech discussions. However, contrary to first look and declared statements, the bakery companies focus on suitable allocation and optimization of all resources, and in support of this assertion can observe how flourishing and dynamic the baking market with indubitable economic outcomes is.

Concerning management review, it is foreseen as part of performance evaluation. But top management in larger companies dealt differently with this process than smaller bakers. If leadership in large firms used different tools (e.g., Pareto chart, Gantt diagram) and statistics for reporting tasks, small companies insufficiently developed documentation or did not pay too much attention to keeping minutes. Still, periodically they conducted a fundamental management analysis and monitoring.

Some topics related to the personnel are still sensitive, such as employees’ shortages, gross salaries, or competencies. The opinions are divided between employers and employees, top management and workers at other levels. However, most average-to-large firms agreed with the specific standard requirement, which stipulates that they should provide necessary human resources for an adequate operating of any MS. And acquiring, monitoring, and improving the competence of people are highlighted in terms of training. Cc. 75% acknowledged they performed training by following the PDCA cycle in the company, and topics planned for training are yearly adapted for standard requirements for specific MS. Based on answers given in this respect, the frequency, training level, and allocated resources consistently differ between smaller bakers and larger companies.

5 Conclusion

The Romanian bakery market is economically attractive and dynamic, even if its business operators face many challenges and constraints in terms of decreasing consumption, intensive competition, and others. Depending on firm size and own management, Romanian bakery companies try to increase or consolidate their position on the domestic market, gain revenues and improve their image to consumers, official control, and other stakeholders. Complying with the EU and national regulations regarding quality assurance, food safety, environmental aspects, and others, the bread industry in Romania addresses sustainability, and many firms implement some management systems.

The standardization contributes to economic development by doing business correctly and facilitating commercial activities on the market. This study considered a few standard requirements applying quality, food safety, and environmental aspects for the sustainability assessment in the Romanian baking industry. Still, the interest of almost all interviewed enterprises focused more on food safety than quality management or environmental performance. Especially for smaller businesses, the socio-political factors seem to be the main drivers for any management system implementation, besides the economic objectives and improved satisfaction of their customers.

References

Andersson, K., & Ohlsson, T. (1999). Life cycle assessment of bread produced on different scales. Int J Life Cycle Assess, 4(1), 25–40. https://doi.org/10.1007/BF02979392

Arta albă. (2019). Piaţa pâinii, între tradiţie şi inovaţie (Bread market between tradition and innovation. Arta alba, 27th March 2019 (in Romanian), (Last Accessed on February 27, 2022; Available at: https://artaalba.ro/piata-painii-intre-traditie-si-inovatie/).

Barbu, P. (2019). Romanian milling and bakery industry needs 5,000 employees. Business Review, Agriculture 12th June (Last Accessed on September 27, 2021; Available at: https://business-review.eu/business/agriculture/romania-lacks-nearly-5000-employees-202135).

Briceño-León, M., Pazmiño-Quishpe, D., Clairand, J. M., & Escrivá-Escrivá, G. (2021). Energy efficiency measures in bakeries toward competitiveness and sustainability —case studies in Quito. Ecuadorr Sustainability, 13, 5209. https://doi.org/10.3390/su13095209

CAEN. (2022). Lista completă și actualizată a codurilor CAEN 2022 (complete and updated list of NACE codes 2022) (in Romanian) (last accessed on March 27, 2022; Available at: https://caen.ro/).

Deselnicu, D. C., Bulboacă, M. R., Dumitriu, D., & Alexandrescu, L. (2020). Analysis of the bakery industry strategic groups in Romania. ICAMS 2020 – 8th International Conference on Advanced Materials and Systems III, 4, 271–276. https://doi.org/10.24264/icams-2020.III.4

Espinoza-Orias, N., Stichnothe, H., & Azapagic, A. (2011). The carbon footprint of bread. International Journal of Life Cycle Assessment, 16, 351–365. https://doi.org/10.1007/s11367-011-0271-0

Federation of Bakers. (2019). European Bread Market (last accessed on April 13, 2022; Available at: https://www.fob.uk.com/about-the-bread-industry/industryfacts/european-bread-market/).

Fedima. (2021). Position Paper for a Sustainable European Bakery Industry (Last accessed on February 27, 2022; Available at: https://www.fedima.org/images/210811_Sustainability_Position_Paper_Final_Version.pdf).

Firme.Info. (2022). List of firms within NACE categories and 107 codes (Last accessed on February 27, 2022; Available at: http://www.firme.info/industria-alimentara-COD-CAEN-10/fabricarea-produselor-brutarie-produselor-fainoase-COD-CAEN-107.html)

Fortune Business Insights. (2022). Bakery Products – Market Research Report (Last accessed on April 26, 2022; Available at: https://www.fortunebusinessinsights.com/industry-reports/bakery-products-market-101472).

FRD. (2021). Romanian Food Market 2021 (Last accessed on April 26, 2022; Asvailable at: https://www.frdcenter.ro/wp-content/uploads/2021/07/Romanian-Food-Market-2021-by-FRD-Center-2.pdf).

Galli, F., Bartolini, F., Brunori, G., et al. (2015). Sustainability assessment of food supply chains: An application to local and global bread in Italy. Agricultural and Food Economics, 3, 21. https://doi.org/10.1186/s40100-015-0039-0

Gava, O., Bartolini, F., Brunori, G., & Galli, F. (2014). Sustainability of local versus global bread supply chains: a literature review. In 3rd AIEAA (Italian Association of Agricultural and Applied Economics) conference “feeding the planet and greening agriculture: challenges and opportunities for the bio-economy”, June 25–27 (Vol. No. 173096). https://doi.org/10.22004/ag.econ.173096

ISO. (2022). ISO standards (Last accessed on March 27, 2022; Available at: https://www.iso.org/standards.html).

ISO 14001:2015 Environmental management systems — Requirements with guidance for use

ISO 22000:2018 Food safety management systems — Requirements for any organization in the food chain

ISO 9001:2015 Quality management systems — Requirements

Johnstone, L., & Hallberg, P. (2020). ISO 14001 adoption and environmental performance in small to medium sized enterprises. J Environ Manag, 266, 110592. https://doi.org/10.1016/j.jenvman.2020.110592. PMID: 32310124.

Joossens, J. V., Sasaki, S., & Kesteloot, H. (1994). Bread as a source of salt: an international comparison. J Am Coll Nutr, 13(2), 179–183. PMID: 8006300. https://doi.org/10.1080/07315724.1994.10718392

Kannan, R., & Boie, W. (2003). Energy management practices in SME-case study of a bakery in Germany. Energy Convers Manag, 44, 945–959. https://doi.org/10.1016/S0196-8904(02)00079-1

Lădaru, G. R., Siminică, M., Diaconeasa, M. C., Ilie, D. M., Dobrotă, C. E., & Motofeanu, M. (2021). Influencing factors and social media reflections of bakery products consumption in Romania. Sustainability, 13, 3411. https://doi.org/10.3390/su13063411

Mosgaard, M. A., Bundgaard, A. M., & Kristensen, H. S. (2022). ISO 14001 practices – a study of environmental objectives in Danish organizations. Journal of Cleaner Production, 331, 129799. https://doi.org/10.1016/j.jclepro.2021.129799

Notarnicola, B., Tassielli, G., Renzulli, P. A., & Monforti, F. (2017). Energy flows and greenhouses gases of EU (European Union) national breads using an LCA (life cycle assessment) approach. Journal of Cleaner Production, 140, 455–469. https://doi.org/10.1016/j.jclepro.2016.05.150

Pérez Farinós, N., Santos Sanz, S., MªÁ, D. R., et al. (2018). Salt content in bread in Spain, 2014. Nutr Hosp, 35(3), 650–654. https://doi.org/10.20960/nh.1339. PMID: 29974775.

Pipatprapa, A., Huang, H. H., & Huang, C. H. (2017). The role of Quality Management & Innovativeness on green performance. Corporate Social Responsibility and Environmental Management, 24(3), 249–260. https://doi.org/10.1002/csr.1416

Scurtu Cristu, M., Cristu, C., & Stanciu, S. (2016). Analysis of the bakery industry sector in Romania. In The 28th international business information management association conference: vision 2020 innovation management, development sustainability, and competitive economic growth, Seville, Spain, 9-10 November 2016, I – VII:1939-1947.

Sîrbu, A. (2009). Merceologie alimentară – Pâinea şi alte produse de panificaţie (Science of Food commodities – Bread and other bakery products). AGIR Publisher, Bucharest (in Romanian).

Sîrbu, A. (2009b). Preferinţele de consum ale românilor pentru produsele de panificaţie. Studiu de caz efectuat în Râmnicu Vâlcea (Romanians’ consumption preferences for bakery products. A case study conducted in Râmnicu Vâlcea), ROMPAN-Actualităţi în industria de morărit – panificaţie (ROMPAN-Newsletter in the milling & bakery industry, Bucharest) I, 2009, 41–47. (ISSN 1584-7888) (Last accessed on November 26, 2021; available at: http://www.rompan.ro/uploaded_files/file/2009_1_revista.pdf)

Slow Food. (2004). Terra Madre. Slow Food Publisher.

Slow Food. (2017). What’s the price of a loaf of bread? (Last accessed on Feburary 27, 2022; Available at: https://www.slowfood.com/whats-price-loaf-bread/).

Slow Food. (2021). About us (Last accessed on December 27, 2021; available at: https://www.slowfood.com/about-us/).

To WM, Lee PKC. (2014). Diffusion of ISO 14001 environmental management system: global, regional and country-level analyses. Journal of Cleaner Production, 66, 489–498. https://doi.org/10.1016/j.jclepro.2013.11.076

UN. (2015). Transforming our world: the 2030 agenda for sustainable development. A/RES/70/1. New York, USA

Author information

Authors and Affiliations

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2023 The Author(s), under exclusive license to Springer Nature Switzerland AG

About this chapter

Cite this chapter

Sîrbu, A. (2023). Sustainability Assessment of the Baking Industry Complying with Standards Requirements: A Case of Romania. In: Ferreira da Rocha, J.M., Figurek, A., Goncharuk, A.G., Sirbu, A. (eds) Baking Business Sustainability Through Life Cycle Management. Springer, Cham. https://doi.org/10.1007/978-3-031-25027-9_6

Download citation

DOI: https://doi.org/10.1007/978-3-031-25027-9_6

Published:

Publisher Name: Springer, Cham

Print ISBN: 978-3-031-25026-2

Online ISBN: 978-3-031-25027-9

eBook Packages: Biomedical and Life SciencesBiomedical and Life Sciences (R0)