Abstract

Considering the new paradigm expressed in EBA LOM guidelines, in this paper, we intend to answer the following research questions: (i) Are ESG factors capable of mitigating and reducing the probability of default of companies?; (ii) To what extent does ESG performance is correlated with a reduction in the likelihood of default?; (iii) Is the risk reduction effect differentiated for companies operating in different geographic areas?. To provide an answer to these research questions, a difference in difference analysis model was applied to a sample of 840 European and American listed companies with annual observations from 2000 to 2021: the data were collected on Bloomberg and Refinitiv DataStream.

Access provided by Autonomous University of Puebla. Download chapter PDF

Similar content being viewed by others

4.1 Introduction

The new EBA guidelines aim to strengthen banks’ ability to assess customers’ creditworthiness, proposing an innovative approach to credit risk management (De Laurentis, 2021; EBA, 2020a). The ability of banks to efficiently allocate capital to cover credit risk and constitute the conditio sine qua non to achieve long-term equilibrium plays a relevant macroeconomic role for the regulator. A reduced ability of institutions to correctly assess creditworthiness compromises loans granted to the real economy, reinforcing the impact of the opposing phases of the economic cycleFootnote 1 (EBA, 2020b). From a microeconomic point of view, the EBA guidelines lay the foundations for a paradigm shift, orienting the credit analysis and management processes toward an anticipatory and proactive model (Tirloni & Antonietti, 2020): a critical novelty is represented by the evaluation of Environment Social and Governance (ESG) factors in determining firms’ creditworthiness. Environmental sustainability is of significant interest to governments, legislators, and supervisory bodies. As part of the Agenda for Sustainable Development, the United Nations has identified 17 goals (social and environmental) that the 190 member states have committed to pursuing by 2030. These include the fight against climate change, the spread of responsible consumption and production ideals, improving working conditions, seeking gender equality, and guaranteeing access to clean and renewable energy.Footnote 2

Similarly, in 2018 the European Commission published a document called “Action Plan: Financing Sustainable Growth” to facilitate the spread of sustainable finance in the European context. It is divided into three main objectives: (i) convey savings flows toward sustainable forms of investment; (ii) limit the risks deriving from climate change, uncontrolled exploitation of resources, and degradation of ecosystems; and (iii) spreading a financial culture of investments more oriented toward the long term and facilitating the transition process employing regulatory interventions. In the banking sector, the EBA has welcomed the idea of sustainable development and contributed to the debate by publishing a working paper to introduce a taxonomy and a unique approach to the issue for the entire banking system and financial institutions (EBA, 2021; Ernst & Young, 2019a; McKinsey, 2020b).Footnote 3

Considering the new paradigm expressed in EBA guidelines, in this chapter, we intend to address the following research questions: (i) Are ESG factors capable of mitigating and reducing companies’ default probability?; (ii) To what extent is ESG performance correlated with a reduction in the likelihood of default?; (iii) Is the risk reduction effect differentiated for companies operating in different geographic areas?.

To provide an answer to these research questions, a difference-in-difference analysis model was applied to a sample of 840 European and American listed companies with annual observations from 2000 to 2021: the data were collected from the Bloomberg and Refinitiv DataStream platforms. After a preliminary overview of the new regulatory provisions defined by the EBA (Sect. 3.2), the work structure analyzes the main contributions offered by the literature concerning the relationship between ESG factors and the probability of default (Sect. 3.3). Then, the methodology and dataset indicated are developed in the context of Sect. 3.4, followed by a presentation of the results obtained (Sect. 3.5). Finally, the contribution ends in Sect. 3.6 with brief reflections and ideas for further refining the research topic.

4.2 The Regulatory Framework: What Has Changed?

The “Final Report – Guidelines on Loan Origination and Monitoring” aims to guide institutions toward the definition of credit granting and monitoring procedures based on prudential standards, providing an integrated approach to credit risk management while ensuring the protection of borrowers. The entry into force of the guidelines for new credit concessions took effect on 30 June 2021, while for credits subject to change in the terms and conditions, the application was deferred for one year. As a result, the monitoring system will be fully operational on 30 June 2024.Footnote 4

The guidelines are structured in five main sections: (i) internal governance; (ii) loan granting procedures; (iii) pricing; (iv) evaluation of collaterals; and (v) monitoring framework. Finally, a brief, non-exhaustive examination of the news and main points covered in the document is presented, leaving out the aspects beyond this work’s scope.Footnote 5

4.2.1 Internal Governance

As regards the area of internal governance, it is envisaged that the management body has the task of approving the strategy for credit risk in line with the profiles defined in the context of the internal capital adequacy assessment process (ICAAP), of the internal liquidity adequacy assessment process (ILAAP) and the objectives expressed in the risk appetite framework (RAF): the risk appetite; risk tolerance; risk limits, risk capacity, and early warnings (Ernst & AIFIRM, 2021; Young, 2019b). In addition, management must also validate the credit application approval process and the monitoring system and promote a credit culture by encouraging the development and acquisition of skills and competencies of the entire bank staff.

Points 56–57 introduce the possibility for institutions to include environmental, social, and governance (ESG) factors: (i) in the assessment of risk appetite; (ii) in defining credit risk management policies; and (iii) as well as in all the other procedures directly or directly involved in the provision of credit, maintaining an integrated perspective with the risk profile. In addition, ESG factors are considered to examine the potential deterioration of the financial performance of clients following environmental, social, and governance events that may affect them, such as, for example:

-

Climate change;

-

Civil liability for damage caused by failure to comply with mandatory environmental parameters;

-

The risks associated with the transition process from traditional energy sources to others with a lower environmental impact; and

-

The change in customer preferences concerning new types of products.

Points n. 58–59 deal with “sustainable” credit lines, i.e., a concession subject to compliance with specific environmental parameters (Ernst & Young, 2020). Institutions are thus required to build procedures detailing the set of activities or projects deemed worthy of credit from the point of view of environmental sustainability and the procedures for verifying the correct use of these credit lines. In addition, a phase of monitoring the results must follow this type of credit disbursement. It is the responsibility of the institutes to ensure that the applicant has developed an adequate reporting and assessment system of the environmental objectives achievement state. These assessments will be carried out using qualitative metrics and, if possible, quantitative objectives for measuring the level of integration with the assumptions of the strategic plan and the purposes expressed in the context of the risk appetite framework. Unfortunately, at the first entry date into force of the Loan Originationand Monitoring (LOM) guidelines, a reference set of qualitative and quantitative indicators helpful in assessing the sustainability of concessions meeting the ESG criteria is not available (EBA, 2020c).

Further new aspects around internal governance are represented by the need to define clear and sufficiently documented credit approval and resolution procedures, identifying a hierarchy of responsibilities and powers that reflect the limits and risk appetite of the institution. The latter must be represented by objectively measurable indicators representative of the characteristics of the loan portfolio: (i) concentration; (ii) diversification objectives; (iii) lines of business; (iv) geographical areas; (v) economic sectors; (vi) products; (vii) credit limits; and (viii) maximum exposures. Credit decisions must also be impartial and free from conflicts of interest.Footnote 6

The LOM guidelines initiate a process of accountability of the business lines by entrusting them with developing adequate internal monitoring systems. The operating units that generated the risk will be required to manage the credit for the entire duration of the loan. The strategic decisions taken upstream bind downstream operations. If any misalignments are generated, the latter will take all the necessary corrective actions to readjust the risk objectives defined in risk planning.

Finally, it should be emphasized that the credit management policies in use must be integrated with a series of “capacity limits” defined regarding a series of budget indicators, such as the debt service coverage ratio, the debt-to-equity ratio, and the cash flow to debt service ratio. In other words, banks are required to establish thresholds for the acceptability of credit applications concerning specific key indicators of an economic-financial nature.Footnote 7

4.2.2 The Procedures for Granting Loans

The procedures for granting loans introduce and define a minimum set of information and processes for calculating customers’ creditworthiness, which helps make the credit disbursement process more efficient. In the first place, the institutions in the phase of evaluation of the disbursements to individuals are required to have the following information: (i) purpose of the loan; (ii) customer profession; (iii) ability to repay; (iv) composition of the family unit; (v) financial commitments previously undertaken and related obligations; (vi) regular expenses; and (vii) real and personal guarantees. In the case of loans to businesses, the data to be collected are: (i) purpose of the loan; (ii) income and cash flow; (iii) financial position and commitments; (iv) business model; (v) business plans supplemented by economic and financial projections; (vi) real and personal guarantees; and (vii) specific legal documentation (permits, contracts) (Ernst & Young, 2021).

The guidelines specify how the exclusive creditworthiness of the customer should be assessed as a stand-alone component or regardless of the presence of guarantees. This indicator’s rationale is linked to the ultimate purpose of granting contracts, namely an exit strategy that can be followed in the event of worst-case scenarios. The cash flow generated by the applicant’s ordinary transactions constitutes the primary source of reimbursement, which must be assessed according to the characteristics and conditions of the transaction. A second evolutionary aspect is implementing a forward-looking approach in determining the ability to fulfill the customer’s obligations, considering the entire time horizon and the set of factors that could alter or compromise the regular repayment of the debt.Footnote 8 For example, in paragraphs 107–108, banks are asked to evaluate, employing a sensitivity analysis, the change in the creditworthiness of applicants following adverse shocks such as the increase in interest rates for variable rate loans; the reduction of income received; and potential unfavorable changes in the exchange rate between the nominal currency of the loan and the customer’s income. More in detail, a list of idiosyncratic and market events is provided that could manifest the ability to affect the customer’s creditworthiness significantly and, consequently, compromise the relative ability to fulfill contractual obligations. Respectively, these are the following events:

-

Severe contractions in turnover or profit margins;

-

Serious operational losses;

-

Severe management problems;

-

The default of an important trading partner, customer, or supplier;

-

Serious damage to reputation;

-

Severe reductions in liquidity, changes in funding, or an increase in financial leverage;

-

Unfavorable changes in the prices of the goods to which the customer is mainly exposed and exchange rates.

-

Severe macroeconomic slowdowns;

-

Crisis of the economic sector of reference for the applicant and his customers;

-

Increased political, regulatory, and geographic risk; and

-

Increase in the cost of financing generated by interest rate increases.

The elements based on which the creditworthiness of companies must be assessed are at least the following: (i) the financial position and credit risk; (ii) the organizational structure, business model, and corporate strategy (possibly formalized in specific plans); (iii) credit scoring or rating; (iv) the financial commitments undertaken toward other institutions; and (v) contractual structure of the loan. As can be seen, the rating, from a final and summary element expressing the relative reliability of the customer, becomes one of a set of factors that the bank must consider in the overall evaluation of the counterparty.

For all categories of companies considered and evaluating a series of innovative indicators on each part of the set currently used, the EBA regulations establish the opportunity to analyze ESG factors in defining creditworthiness (McKinsey, 2020a).Footnote 9 In particular, for micro and small businesses, it is indicated that, although an analysis of the specific customer in detail is preferable, it is still possible to carry out the related findings concerning the portfolio of this class of borrowers. A provision follows that regardless of the size of the company: specifies that if customers are in any case characterized, directly or indirectly, by a more significant risk related to environmental factors, banks should use heat maps to carry out more in-depth analysis of the business model and assess the state of compliance with regulations relating to greenhouse gas emissions and the impact of ESG regulations on the customer’s financial position.Footnote 10

4.2.3 Pricing

Pricing must be consistent with risk appetite, business strategy, product type, customer creditworthiness, and market conditions. This procedure will be detailed according to the kind of customer: for SMEs, the operation is contextualized regarding the entire portfolio of products requested by the customer, while for large companies, the main focus is the operation itself. The pricing will follow the logic of the markup and will be stratified into the following components: (i) cost of capital; (ii) cost of financing and coverage of specific risks; (iii) administrative costs; (iv) cost of credit risk; and (v) other markups. Any significant transaction lower than the cost, including the related markups, must be reported and justified. Furthermore, it is the task of the institutes to equip themselves with monitoring systems aimed at controlling and integrating information on the levels of risk assumed, the prices applied, and the expected profitability (KPMG, 2019).

Regarding pricing, it should be recalled that the disclosure analysis promoted by the EBA in 2019 resulted in the surprising outcome of how the European banks did not show an adequate correlation between the riskiness of the counterparties and the pricing of the related loan transactions (EBA, 2019).

4.2.4 Monitoring Framework

The monitoring framework constitutes the infrastructure that allows the continuous management and control of risk levels, detailing the information down to individual exposures (Deloitte, 2021).Footnote 11 To achieve a high degree of efficiency and high timeliness of data, the progressive abandonment of manual procedures in favor of automated algorithms for data collection and processing a credit rating is required.Footnote 12 It will be the task of the banks to feed their time series to facilitate the identification of adequate early warnings, also by using external sources for data collection (Ernst & Young, 2019b).Footnote 13

Institutions are required to regularly review the creditworthiness of “at least” medium-sized companies, update credit scoring with variable frequency, and, if necessary, adjust the customer’s ratingFootnote 14 In addition, the institutions must conduct a sensitivity analysis considering the external risk factors capable of altering the customer’s repayment capacity and the overall amount of the position. Macroeconomic, sectoral, and idiosyncratic factors are added to these factors.Footnote 15

The monitoring framework must consider exceeding the threshold levels of the early warning indicators.Footnote 16 The activation of a trigger involves the insertion of the indicator within a watchlist and the activation of the intervention procedures.Footnote 17 This process must occur without undue delay, and the designated managers, assessing the extent of the severity of the activation of the indicator, will identify the corrective actions to be undertaken.Footnote 18 Furthermore, each decision must be documented and shared with the functions affected by the event (KPMG, 2019). The monitoring framework defined by the EBA is configured in (De Laurentis, 2021):

-

Regular review, aimed at the complete reassessment of the borrower’s creditworthiness, analyzes the risk profile changes. These transactions take place regularly and are followed by a rating correction.

-

Continuous monitoring is carried out daily and verifies early warnings and the trend analysis of credit lines.

4.3 Literature Review

A positive correlation between credit ratings and ESG factors is evident in the literature. The line of empirical studies that analyzed samples of medium and large companies has shown that the management of ESG risks is correlated with an improvement in creditworthiness and a simultaneous decrease in the probability of default. A paper based on a sample of Italian and Spanish companies confirmed this relationship by applying a logistic regression (De Valle et al., 2017). The authors observed that social and governance issues have a more significant impact on increasing creditworthiness, unlike environmental variables, characterized by a low level of statistical significance.Footnote 19 In opposition to this last conclusion, a Chinese study, again based on logistic regression, but having as a dependent variable no longer the credit rating but the probability of default of plain vanilla bond issues of Chinese companies, confirmed the statistical significance of the environmental variables, in reducing the likelihood of default (Li et al., 2020).Footnote 20

This latest study also highlighted that ESG factors have a signaling power toward the market, demonstrating the company’s ability to enhance human resources and create stable and sustainable networks. As regards the scope of risk management, ESG risk is not only correlated with credit risk but also with operational risk. The validity and statistical significance of the environmental, social, and governance components considered individually are also confirmed in work concerning a dataset of 122 listed companies in the Bombay 500‒BSE500 (Bhattacharya & Sharma, 2019). From the evidence of the model, it is possible to observe that ESG factors have a more significant impact on the creditworthiness of small and medium-sized enterprises, unlike those with large capitalization.Footnote 21 The latter already benefit from a low cost of capital, unlike small and medium-sized enterprises, whose limited access to the capital market. A work based on a sample of European and American companies has identified in ESG metrics a more remarkable ability to mitigate credit risk for medium-sized companies (Barth et al., 2021; Kiesel & Lücke, 2019). This evidence, confirmed by a quantile regression, made it possible to identify a U-Shaped relationship between ESG and CDS factors.Footnote 22 Companies that begin to mitigate ESG risk, not yet benefiting from credibility concerning the management of sustainability issues, will derive minor marginal benefits compared to counterparties with an established environmental and sustainability reputation.

Further research has confirmed through quantitative models the improvement effect of ESG performance on creditworthiness. A study on a large sample of American companies operating internationally (in particular, 27,892 companies analyzed and with a time horizon of 37 years) used the linear and quadratic discriminant methodologies to confirm the positive effect of ESG factors on credit ratings (Michalskia & Low, 2020).Footnote 23 The authors suggest that regulatory authorities implement ESG metrics mandatory within the rating techniques. Under this perspective, a recent paper based on a smaller sample (of 565 companies) demonstrates through applying a discriminant function that the inclusion of ESG performance increases the predictive power of rating models (Klein, 2019). A significant contribution is using the Altman Z-Score within the credit rating evaluation model (Altman, 1968). As Bhattacharya highlighted, considering ESG metrics generates a more significant benefit in SMEs, although assessments are made more difficult by the lack of data. The use of the Z-Score allows banks, in the application of the EBA guidelines, to extend the valuation models to smaller companies, ensuring more efficient credit allocation.Footnote 24

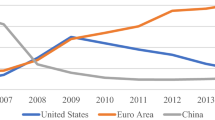

The effect of reducing credit risk through the implementation and consideration of ESG factors has territorial characteristics: the positive results are more evident in countries with a high focus on sustainability issues and where stakeholders reward the reduction of ESG risk (Hübel, 2020); furthermore, the cost of capital for ESG firms is lower in countries where investor protection is more excellent (Breuer et al., 2018); finally, it was observed that the credit risk mitigation effect is present for European companies, but not for American ones (Barth et al., 2021).

As shown in the previous chapter, the mandatory nature of non-financial disclosure will impose a “carbon premium” on carbon-inefficient financial institutions. In fact, the existence of this spread presupposes a higher level of riskiness for brown companies. Continuing the discussion introduced in the previous chapter, we will investigate whether the probability of corporate default discounts an actual reduction in PD due to improvements in ESG performance. More specifically, the question arises as to whether the existence of a “carbon premium” is really priced within the probability of default observed in the market.

In the context of qualitative studies, a widespread orientation can be observed in favor of considering ESG performance in calculating creditworthiness. For example, an Australian case study showed that ESG rating metrics diverge according to the sector and the business model considered (Stubbs & Rogers, 2015). However, it is noted that the ideal characteristics of a rating methodology based on sustainability principles must have the following three factors: (i) objectivity; (ii) transparency of the method; and (iii) uniformity. Unfortunately, these properties are not yet present on the market, and there is no uniformity of vision on the subject (Henisz & Mcglinch, 2019; Rocca, 2021).Footnote 25

A further literature field has highlighted some critical issues regarding adopting ESG metrics. It was possible to observe the existence of non-uniformity in ESG ratings as a manifestation of an additional risk component that a risk-averse investor must bear (De Santis et al., 2020; Gibson et al., 2021). The main implication is that although the inclusion of ESG metrics raises the expected return and tends to improve the credit rating, companies could sustain a partial increase in the cost of capital as a reward for the higher risks perceived by risk-averse investors. The assessments provided by the rating companies are not uniform and convergent: the existence of a rater-specific bias is noted, a phenomenon because of which the evaluator who assigns a particular rating to a company in one of the three dimensions making up the scope ESG, will tend to standardize the remaining two areas to that evaluation (Berg et al., 2019).Footnote 26

4.4 Database and Methodology

The initial dataset (source: Refinitiv Datastream) consists of annual observations of the 505 companies that comprise the Standard & Poor’s 500 and 335 companies listed in the main European listingsFootnote 27 (Table 3.1). To build a model extended to all companies operating in Europe and the United States, it was decided to consider all the companies listed in the markets analyzed. About 15 ESG variables were collected for each of them, and another three related to the issuer’s riskiness over 21 years by applying a filter in terms of data continuity (Tables 3.2 and 3.3). The observations of the companies that in the year under consideration had null values in at least two variables that make up the three leading indicators of the overall ESG score or for which the probability of default was not available were also eliminated.

The econometric model did not consider all the summary variables in the ESG field offered by Refinitiv. The subset of variables used is the following:

-

ESGit, as a summary indicator of the ESG performance of the i-th company at the year of observation t. It is based on the weighting of an overall set of 396 variables divided into groups and subgroups as set out in Table 3.2;

-

ENVit, as a summary indicator of the subset of environmental variables of the i-th company at the observation year t;

-

SOCit, as a summary indicator of the subgroup of social variables of the i-th company at the observation year t;

-

GOVit, as a summary indicator of the subset of governance variables of the i-th company at the year of observation t.

This chapter decided not to use the 381 detailed ESG variables, as the model does not consider the differences related to the scope of operations of the individual companies analyzed. In addition, using a comprehensive and capillary set of environmental, social, and governance variables and generating multicollinearity issues would have been incompatible with the chapter’s objective.

It is assumed that since December 2015, following the Paris Climate Agreement, environmental issues have enjoyed such significance as affecting the assessment of the probability of default of a company. Therefore, it follows that the PD observed on Bloomberg before that date is considered net of this dimension, unlike the post-agreement ones, which internally express a probability of default already corrected for performance in the social and environmental fields and governance.Footnote 28

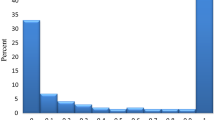

The objective is to verify the impact of ESG metrics in the creditworthiness assessment procedures in a sample of companies listed in the main European and American lists. For this purpose, the difference in difference analysis was used, which helps highlight the changes in the dependent variable following the occurrence of events of an exogenous nature (Wooldridge & Imbens, 2009). In addition, the one-year probability of default was used as a dependent variable as a driver of the credit risk of the companies considered in the sample (Altman, 1968). The logical model used to build the model is represented in Fig. 3.1. It is noted that the use of the Z-Score is aimed at representing the risk expressed by the balance sheet and income statement items that make up the indicator: (i) working capital; (ii) total assets; (iii) retention of profits; (iv) EBIT; (v) market capitalization; (vi) total liabilities; and (vii) turnover.

Hypothesis 1

ESG factors are negatively correlated with the probability of default. An improvement in ESG scoring causes a decrease in the likelihood of default and a consequent increase in creditworthiness.

Hypothesis 2

The improvement in creditworthiness, resulting from ESG metrics in the evaluation processes, is more remarkable in the sample of European companies than that of American counterparts.

The econometric model used to verify the above hypotheses is the following:

with: (i) \({\mathrm{PD}}_{it}\) = probability of default; (ii) \(\alpha\) = constant; (iii) \({\mathrm{ZSC}}_{it}\) = Z-Score; (iv) \({\mathrm{ESG}}_{it}\) = summary ESG Score; (v) \({\mathrm{D}}_{{\mathrm{time}}_{it}}\) = dummy which takes a value of 1 for the years after 2014 and 0 in the other cases; (vi) \({\mathrm{D}}_{{\mathrm{trm}}_{it}}\) = dummy which takes value 1 in the group of companies treated and 0 in the rest; (vii) \({\mathrm{D}}_{{\mathrm{trm}}_{it}}*{\mathrm{D}}_{{\mathrm{tm}}_{it}}\) = interaction variable that assumes a value of 1 in the case of companies belonging to the treatment group for the years after 2014; and (viii) \({u}_{it}\) = error term.

Using this model, it is possible to compare the changes in the probability of default as a function of the risk implicit in the financial statements, the time factor, and the contribution of ESG metrics as an exogenous factor captured by the model. The samples of European and American companies were divided into control groups and treatment groups using a pseudo-random number generation algorithm. All the company observations for each year of observation were included within each group.

Table 3.4 shows the model’s operating framework scheme according to the exogenous event and the division into control and treatment groups. \({\gamma }_{1}\), \({\gamma }_{2}\), and \({\lambda }_{1}\) constitute the coefficients of interest for the analysis carried out. They, respectively, measure the coefficient of the effect of time (\({\gamma }_{1 })\), , of the impact of the introduction of ESG measures (\({\gamma }_{2}),\) and the interaction between the two previous variables (\({\lambda }_{1})\). Hence, the latter constitutes the coefficient of interest.

For the sole purpose of explaining the theoretical framework, the following covariates were excluded: (i) Z-Score; (ii) ESG Score.

)4.5 Results

The econometric model was applied to the European and American companies’ databases, showing a significance of 99.99% in both cases. The F-test of the American model FUSA0.001 (5; 8.960) = 9.565 is greater than the critical value of the F-test with five regressors with the same confidence interval, FCV0.001 (5; ∞) = 4.10.Footnote 30 The same conclusions apply to the European dataset as FEU0.001 (5; 3.775) = 26.68 > FCV 0.001 (5; ∞) = 4.10 (Table 2.5).

Consistently with expectations, all the regression coefficients assume a negative sign for both samples. The probability of default over a time horizon of one-year decreases as the Z-Score increases with a confidence of 90% for American companies and over 99.99% for European counterparties. The coefficient \({\lambda }_{1}\) of the difference-in-difference model assumes a negative value in both datasets with a confidence interval greater than 99.99% for American companies and 90% for European companies (\({\lambda }_{1}\) = treatment_time). It is concluded that following the management of environmental, social, and governance issues, the probability of default of the companies in the treatment group has a PD at one year on average lower than the control group and those before treatment. Thus, the truthfulness of hypothesis 1 is verified.

The estimate of \({\lambda }_{1}\) is subject to the variable trend obtained from the multiplication between time and treatment. Both have negative coefficients, although only time is statistically relevant in both samples considered.

It is important to note that an increase in the ESG score contributes to the decrease of the PD at one year by 1.77% for the sample of American companies. In contrast, for the European counterparts, the decline is equal to 6.235% (this factor is indicated as \({\theta }_{\mathrm{country}}\)).Footnote 31 This percentage improvement is parameterized to the probability of default (PDuncorrected), not corrected for ESG factors. For example, a company with a PDuncorrected equal to 10%, following a marginal increase in the ESG Score if it is located in America, will benefit from an expected reduction of 0.177% in the probability of insolvency in the case of a European company, the reduction will be 0.635 percentage points.Footnote 32 These coefficients were estimated with a confidence interval of 99.9% (Tables 2.6 and 3.5).

The model of correction of the probability of default thus proposed causes a distortion effect on the companies whose PD are more consistent (Fig. 3.2). For example, a company with an incorrect PD of 15%, if it reaches an ESG score of 100 points, would benefit from reducing the probability of insolvency, recording a value for the latter indicator of 11.02% in the case of America and 0.97% in Europe. Therefore, banking institutions should impose a maximum limit to reduce the PD depending on the sector and the territorial area to overcome this problem. The adjustment model is proposed below, indicating with \({\phi }_{\mathrm{sector}}^{\mathrm{country}}\) the maximum applicable reductionFootnote 33:

The table of the previous example is shown considering a maximum ceiling of \({\phi }_{\mathrm{sector}}^{\mathrm{country}}\) equal to 25% (Table 3.6).

A significant difference can be observed in the ESG score’s ability to reduce the probability of default expressed by the estimators \({\theta }_{\mathrm{EU}}\) and \({\theta }_{\mathrm{USA}}\). . The difference between the two indicators is equal to 4.458% and shows a greater tendency toward reducing PDs for European companies compared to their American counterparts. These observations follow the results observed in the sectorial bibliography and verify the truthfulness of hypothesis 2 (Barth et al., 2021; Breuer et al., 2018; Hübel, 2020). The explanation for this phenomenon is due to the propensity of the probability of default to suffer a more substantial reduction following the improvement of ESG performance. In countries where actions to protect the environment are more rewarded and incentivized, the increase in safeguards, social security, and proper governance (Stellner et al., 2015) (Fig. 3.2; Table 3.7).

4.6 Conclusion

This study analyzed the ability of ESG factors to mitigate issuer risk and reduce the probability of default. Thus, because of the new EBA guidelines on loan origination and monitoring, a quantitative approach has been proposed to correct the probability of default concerning the overall ESG score. In addition, the perspective of external stakeholders, such as credit institutions, was taken, and only publicly available information was used.

The results were obtained by analyzing a sample of 840 companies over a time horizon of 20 years, and the contribution of this work is linked to the measurement of the risk mitigation effect, resulting in a lower probability of default for listed companies in both America and Europe. It was also observed that the ESG Score contributes to reducing PD by 1.777% for American companies and 6.235% for European ones, all other factors being equal. It is noted that the countries that most reward and incentivize the improvement of environmental, social, and governance conditions allow companies to benefit from a more comprehensive effect of reducing the risk of insolvency. It would be interesting to study whether the advantage detected for EU companies vs. US ones is possibly related to the better non-financial disclosure by EU companies stressed in the previous chapter as the primary determinant of building a significant European vantage for EU companies.

A further contribution to the reference banking literature is the introduction of the coefficient \({\phi }_{\mathrm{sector}}^{\mathrm{country}}\), which allows the proposed model to limit the reduction of the company’s probability of default below the level of implicit risk expressed by the Z-Score. From an operational point of view, this is an aspect of particular interest for banks, as, depending on the appetite and risk profile, institutions can define the desired value of \({\phi }_{\mathrm{sector}}^{\mathrm{country}}\). Moreover, an increase in this coefficient involves a more significant reduction of the estimated probability of default, thus facilitating access to credit in a specific geographical area or sector.

It is noted that some limits characterize this work. Namely, 2015 was defined as the year from which the probabilities of insolvency, observed on Bloomberg, already include the ESG score but the adoption and introduction within companies of ESG policies and strategies followed a process of gradual and non-uniform adaptation for each geographical area and sector. A further criticality is linked to the use within the model of an overall summary indicator for ESG performance: future studies could evaluate the contribution of each specific area to the reduction of the probability of default. Furthermore, within the overall basket of 396 ESG scores available on Refinitiv, further research could construct a set of detailed indicators, according to the sectors to which they belong, capable of perceiving the contribution to the reduction of PD to the change in the basket of variables sectorial relevant.

Notes

- 1.

Financial resources are thus withdrawn from the real economy in periods of negative economic cycle and banks, in order to recover lost profitability, are induced to invest in markets with a better risk-return profile.

- 2.

- 3.

On 30 June 2021, with the 35th update of Circular 285 of 17 December 2013, the Bank of Italy established that the banks’ corporate strategies and decisions consider the objectives of sustainable finance and, in particular, the integration of environmental and social and governance (ESG) factors.

- 4.

Such adjustment times were granted due to the COVID-19 pandemic. In addition, the increased time available will allow institutions to adapt their internal processes, IT infrastructures, the risk appetite framework, the strategic plan and any planning and monitoring tool involved in the implementation of the aforementioned guidelines.

- 5.

For these reasons, no detail will be provided regarding part (iv) reported in the text.

- 6.

For this purpose, personnel who have: (i) a personal or professional relationship with the customer are excluded from the credit granting decision; (ii) an economic or other interest, direct or indirect, actual, or potential, financial, or non-financial; and (iii) undue political influence on the customer.

- 7.

EBA (2020a), Guidelines on Loan Origination and Monitoring, Annex 1.

- 8.

The characteristics of debt positions with other institutions are considered in this prospective assessment: the amount to be invested; the value of the principal and interest; the residual duration; interest rates; and the amounts not yet reimbursed and the reimbursement behavior.

- 9.

EBA (2020a), Guidelines on Loan Origination and Monitoring, Annex 3.

- 10.

Heatmaps are a methodology of graphical representation of information based on a color coding.

- 11.

Information is required to be reliable, complete, up to date, and timely. Specifically, for credit risk, the database must have the following characteristics: (i) depth and breadth, including the main risk factors; (ii) accuracy, integrity, reliability and timeliness of data; (iii) consistency; and (iv) traceability.

- 12.

The data of interest for credit risk monitoring are: (i) the payment behavior of customers; (ii) the customer's credit risk; (iii) credit risk by geographical position and by sector; and (iv) write-down of exposures.

- 13.

In addition to this objective, the monitoring system will have to allow institutions to create a customer file and be able to build an overall view for each individual customer.

- 14.

The variability is given by the complexity of the operations, the size of the customer, and the risk profile following the principle of proportionality. In the face of clear signs of a deterioration in credit quality, it is necessary to increase the frequency of reviews.

- 15.

The idiosyncratic factors are, for example: the firm's pricing power, prospects for the reference sector; cost structure; relations with shareholders; management quality; and presence and extent of research and development costs.

- 16.

These thresholds are defined in strategic planning and in the risk appetite framework, in conjunction with the intervention procedures aimed at managing temporary overruns of the assumed risk levels.

- 17.

The following events are considered to be signs of deterioration in the customer's credit standing: (i) adverse macroeconomic events; (ii) known adverse changes in the financial position of borrowers; (iii) a decrease in sales revenues; (iv) a significant reduction in operating margins or profit for the year; (v) a significant delay in the execution of a project or investment; (vi) change in credit risk; (vii) an increase in the cost of capital; (viii) a decrease in activities; (ix) an increase in market volatility; (x) a deterioration in the value of the collateral; (xi) legal actions; (xii) unfavorable credit rating migrations; and (xiii) arrears in payments to the institution of 30 days.

- 18.

The activation of an early warning indicator leads to an increase in the review frequency and a greater request for information from the client being reported.

- 19.

The explanation of a lower significance of environmental factors is due to the difficult observability of the impacts of the strategies concerning environmental sustainability. For example, the positive effects of reducing CO2 emissions or the transition of production processes to renewable power sources can be seen in a medium to long-term time frame.

- 20.

The evidence obtained cannot be used to disprove the conclusions of the work of De Valle et al. (2017) as the environmental variable adopted by the Chinese paper is standard energy consumption while the former used a set of three variables: (i) resources used; (ii) CO2 emissions; and (iii) environmental innovation. Therefore, the two studies are not comparable both in terms of regressors and in terms of dependent variable.

- 21.

According to the authors, customers and the market particularly appreciate companies that do not limit themselves to respecting the minimum environmental and social requirements set by law but strive to adopt higher standards and contribute to the improvement of society.

- 22.

In the study, the credit default swap rate is considered as a driver for credit risk.

- 23.

The sample is made up of 17,942 investment grade firms and 9950 speculative grade firms. The years of observation are between 1982 and 2019. As regards the methodological approach, the study suggests the implementation of extremely randomized trees (ERT) and random forest (RF) models.

- 24.

For the purposes of calculating the Z-Score, it is necessary to collect the following indicators: (i) working capital; (ii) total assets; (iii) retention of profits; (iv) EBIT; (v) market capitalization for listed companies only; (vi) total liabilities; and (vii) turnover.

- 25.

According to the authors, the diffusion of multiple evaluation techniques and the lack of convergence is the result of the difficulty of observing ESG drivers.

- 26.

Assume that the evaluator assigns a specific value to the environmental area, the social and governance scoring will be parameterized to that initial value assigned to the environmental area.

- 27.

The Eurostoxx index includes 50 companies from 11 Eurozone countries: Austria; Belgium; Finland; France; Germany; Ireland; Italy; Luxembourg; Netherlands; Portugal; and Spain.

- 28.

The probability of default estimated by Bloomberg is based on the default likelihood calculated using the Merton distance to default (DD) model. Endogeneity problems with the other variables used are excluded.

- 29.

For the sole purpose of explaining the theoretical framework, the following covariates were excluded: (i) Z-Score; (ii) ESG Score.

- 30.

CV = Critical Value.

- 31.

ΔPDUSA = −0.637 * e−5 = −0.01776796624 = −1.777%

ΔPDEU = −9.253 * e−5 = −0.06234622358 = −6.235%

- 32.

All other conditions being equal, ceteris-paribus clause.

- 33.

\(\phi\) Assumes all values between 0 and 100%.

References

AIFIRM. (2021). L’integrazione dei fattori ESG nella valutazione del rischio di credito. Position Paper, 29, 50-56.

Altman, E. I. (1968). Financial ratios, discriminant analysis and the prediction of corporate bankruptcy. The Journal of Finance, 23, 594–596.

Barth, F., Hübel, B., & Scholz, H. (2021). ESG and corporate credit spreads. SSRN Papers, 2–4.

Berg, F., Koelbel, J. F., & Rigobon, R. (2019). Aggregate confusion: The divergence of ESG ratings. MIT Sloan School Working Paper, 5822/19, 28-33.

Bhattacharya, S., & Sharma, D. (2019). Do environment, social and governance performance impact credit ratings: A study from India. International Journal of Ethics and Systems, 35(3), 466–484.

Breuer, W., Müller, T., Rosenbach, D., & Salzmann, A. (2018). Corporate social responsibility, investor protection, and cost of equity: A cross-country comparison. Journal of Banking & Finance, Elsevier, 96(C), 34-55.

De Laurentis, G. (2021). Le guidelines EBA su concessione e monitoraggio dei prestiti: Profili critici e implicazioni per banche e debitori. Bancaria, 70-71.

De Santis, A., Di Marzo, G., Fasano, D., Marlino, M., & Nigro, B. (2020). Pricing risk-adjusted: il ruolo dei parametri ESG. PE Working Paper, 20, 16-28.

De Valle, A., Fiandrino, S., & Cantino, V. (2017). The linkage between ESG performance and credit ratings: A firm-level perspective analysis. International Journal of Business and Management, 12(9), 53–65.

Deloitte. (2021). EBA guidelines on loan origination and monitoring, Deloitte, p. 15. https://www2.deloitte.com/content/dam/Deloitte/rs/Documents/risk/EBA-loan-origination-implementation.pdf

EBA. (2019). Draft guidelines on loan origination and monitoring. Consultation Paper, 7.

EBA. (2020a). Guidelines on loan origination and monitoring.

EBA. (2020b). Explanatory note on the EBA comprehensive approach to loan origination.

EBA. (2020c). EBA Discussion Paper on management and supervision of ESG risks for credit institutions and investment firms.

EBA. (2021). EBA Discussion Paper on Management and supervision of ESG risks for credit institutions and investment firms. Explanatory note on the EBA comprehensive approach to loan origination.

Ernst & Young. (2019a). How ESG creates long-term value: Sustainability’s new frontier, 3–5.

Ernst & Young. (2019b). EBA draft guidelines on loan origination and monitoring—Impact on European banks: Minds made for transforming financial services, 11–15.

Ernst & Young. (2020). Risk, returns and resilience: Integrating ESG in the financial sector, 23–25.

Ernst & Young. (2021). Loan origination & monitoring: Summary insights.

Gibson, R., Krueger, P., & Schmidt, P. S. (2021). ESG rating disagreement and stock returns. Swiss Finance Institute Research Paper Series, 19/67, 25-27.

Henisz, W. J., & Mcglinch, J. (2019). ESG, material credit events, and credit risk. Journal of Applied Corporate Finance, 31(2), 105–117.

Hübel, B. (2020). Do markets value ESG risks in sovereign credit curves? Quarterly Review of Economics and Finance, Elsevier, Vol. 85(C), 134–148.

Klein, C. (2019). Quantitative credit-rating models including ESG factors. The Journal of Environmental Investing, 01, 14–16.

Kiesel, F., & Lücke, F. (2019). ESG in credit ratings and the impact on financial markets. Financial Markets, 28, 263–290.

KPMG. (2019). EBA draft guidelines on loan origination and monitoring: The ECB and EBA’s growing scrutiny on credit standards, 19–35.

Li, P., Zhou, R., & Xiong, Y. (2020). Can ESG performance affect bond default rate? Evidence from China. Sustainability, 12(2954), 1–12.

McKinsey. (2020a). McKinsey on finance: Perspectives on corporate finance and strategy,12–20.

McKinsey. (2020b). A test of resilience: Banking through the crisis, and beyond, 38–39.

Michalskia, L., & Low, R. K. Y. (2020). Corporate credit rating feature importance: Does ESG matter? SSRN Paper, 53–54.

Rocca, E. (2021). Valenza strategica della gestione dei rischi ESG. Bancaria, Vol. 4, 59-65.

Stellner, C., Klein, C., & Zwergel, B. (2015). Corporate social responsibility and Eurozone corporate bonds: The moderating role of country sustainability. Journal of Banking & Finance, 59, 548.

Stubbs, W., & Rogers, P. (2015). Lifting the veil on environment-social-governance rating methods. Social Responsibility Journal, 09, 622–640.

Tirloni, G., & Antonietti, A. (2020). Le nuove Linee Guida EBA sulla concessione e monitoraggio del credito, https://www.dirittobancario.it/wp-content/uploads/sites/default/files/allegati/tirloni_g._antonietti_a._le_nuove_linee_guida_eba_sulla_concessione_e_monitoraggio_del_credito_2020.pdf

Wooldridge, J. M., & Imbens, G. W. (2009). Recent developments in the econometrics of program evaluation. Journal of Economic Literature, 47(1), 5–86.

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2023 The Author(s), under exclusive license to Springer Nature Switzerland AG

About this chapter

Cite this chapter

Palmieri, E., Geretto, E.F., Polato, M. (2023). Loan Origination and Monitoring Guidelines: How Do ESG Indicators Affect Firms’ Probability of Default?. In: Wachtel, P., Ferri, G., Miklaszewska, E. (eds) Creating Value and Improving Financial Performance. Palgrave Macmillan Studies in Banking and Financial Institutions. Palgrave Macmillan, Cham. https://doi.org/10.1007/978-3-031-24876-4_3

Download citation

DOI: https://doi.org/10.1007/978-3-031-24876-4_3

Published:

Publisher Name: Palgrave Macmillan, Cham

Print ISBN: 978-3-031-24875-7

Online ISBN: 978-3-031-24876-4

eBook Packages: Economics and FinanceEconomics and Finance (R0)