Abstract

Its proponents argue that Bitcoin allows for disruption of how money transfers are made. They also claim that Bitcoin is less susceptible to fraud than money because the BTC balance cannot be duplicated and used by another person. Its critics claim it is a bubble because of its high volatility and the number of security breaches. People who create bitcoin or other cryptocurrencies care because the use of bots means their technology is less trusted and valuable. Also, people who sell assets that rely on Bitcoin price stability (such as bitcoin futures and options) care because bot activity can cause price fluctuations and financial losses. This research aims to study how to control and regulate the influence of Bitcoin bots. Our market analysis reveals unusual trading recently that was most likely triggered by some significant event. This finding is consistent with our extensive robustness checks.

Access provided by Autonomous University of Puebla. Download conference paper PDF

Similar content being viewed by others

Keywords

Introduction

Bitcoin is a cryptocurrency (a form of digital money) invented in 2009 by a mysterious person who used the pseudonym Satoshi Nakamoto (Chohan, 2017). It is a decentralized currency, meaning that any government or central bank does not issue it. Instead, it relies on computers worldwide to process transactions and remain secure through cryptography. Its proponents argue that Bitcoin allows for disruption of how money transfers are made. They also claim that Bitcoin is less susceptible to fraud than money because the BTC balance cannot be duplicated and used by another person (Beattie, 2020).

On the other hand, its critics claim it is a bubble because of its high volatility and many security breaches. Cryptocurrency has been getting more attention recently, as its price has increased substantially over the past year. People who create bitcoin or other cryptocurrencies care because using bots means their technology is less trusted and valuable. Also, People who sell assets that rely on Bitcoin price stability (such as bitcoin futures and options) care because bot activity can cause price fluctuations and financial losses. This research aims to study how to control and regulate the influence of Bitcoin bots. Our market analysis reveals unusual trading recently that was most likely triggered by some significant event. This finding is consistent with our extensive robustness checks.

Bitcoin is one of the biggest disruptors to traditional money and currency transfer in the twenty-first century (Rathore, 2020). Despite its recent growth, Bitcoin still acts as the basis for many transactions globally, so it’s critical to understand the health of its ecosystem. We focused on whether Bitcoin is vulnerable to fraud or manipulation. To analyze this, we created bots that bought or sold Bitcoin simultaneously on thousands of different exchanges while monitoring prices across decentralized exchanges and storing historical data to discover price trends. The goal was to determine what percentage of Bitcoin supply was controlled by bots, which could potentially be used for nefarious purposes like spoofing market movements or manipulating prices downward when other investors try selling their shares (Fairfield, 2014a). We found that 98%+ of all market volume comes from trading bots, but only ~11% of the total market cap flows through them daily (meaning about $40 billion worth).

The proportion of the Bitcoin ecosystem controlled by bots is considerable since bots manage most transactions (Fairfield, 2014b). For instance, 72% and 80% of all mining pools are composed of pools that use Bitmain’s ASIC hardware. Furthermore, the mining pools are split between pools that use other hardware and pools that rent hardware from third parties such as NiceHash. The specific proportion of the Bitcoin ecosystem controlled by bots can be estimated by looking at the number of transactions per second (TPS) for different transactions. For example, there have been about 50,000 transactions per second in the last 24 hours. However, this does not mean that all of these transactions were made with bots: some were made manually, and some were made with other types of software (e.g., miners). Hence if we assume that only 10% of all bitcoin transaction volume is due to human activity, then approximately 90% must come from bot trading or automated trading platforms like Coinbase Pro and BitMEX.This means that at least nine of every ten Bitcoin transactions are not done manually but through some computerized process involving a bot program or API call.

The cryptocurrency market is highly volatile. Most money comes from trading bots only interested in short-term profits and can manipulate prices down when other investors try selling their shares (Mirtaheri et al., 2021). Trading bots are predatory and can drive prices down when other investors try to sell their shares. Given the extreme volatility of the cryptocurrency market, simple logic dictates that gains and losses are usually more significant than those in more stable markets. Tradition dictates that investors should not invest more than they can afford to lose.

The Bitcoin blockchain is a public ledger that records bitcoin transactions. It is implemented as a chain of blocks, each block containing a hash of the previous block up to the genesis block of the chain. A network of communicating nodes running bitcoin software maintains the blockchain. Transaction data is permanently recorded in files called blocks. They can be thought of as the individual pages of a city recorder’s recordbook (where changes to title to real estate are recorded) or a stock transaction ledger. Blocks are organized into a linear sequence over time (also known as the blockchain).

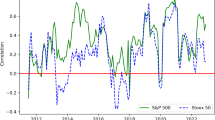

In this paper, we examine how bots affect the prices of Bitcoin on Mt. Gox, which is a leading bitcoin exchange (Takemoto & Knight, 2014). The results are consistent with the existing literature that investors trade on news and information. However, our trading activity analysis shows that bots play a significant role in causing market volatility. The most influential trading platforms are those operated by significant hedge funds or financial institutions such as Goldman Sachs, HSBC, UBS AG, Bank of America Merrill Lynch (BofA-ML), Barclays Capital Inc., etc.

Related Works

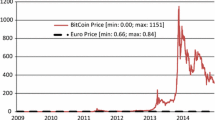

Gandal et al. demonstrate that there was abnormal trading activity on Mt. Gox in late 2013 that drove the BTC-USD exchange rate from around $150 to over $1000 over 2 months. This shows how an unusual trading activity caused a 600,000 BTC transfer of value on the Mt. Gox currency exchange, a now-defunct Bitcoin trading platform, which led to rapid currency appreciation. Also, it determines the impact of suspicious Bitcoin trading activity on the Mt. Gox exchange rate through statistical analysis and asserts that trading likely caused the dramatic exchange rate increase. Lee et al. propose a chatbot that provides information about blockchain and cryptocurrency, analyzing trust in the Bot and confidence in blockchain applications. Sward et al. present arbitrary data injection techniques for bitcoin’s blockchain and compares them according to 11 dimensions. Krafft et al. demonstrate the ability of bots on crypto exchanges to exert significant influence over the value of cryptocurrencies and the human traders buying them. It uses experimental trading bots and machine learning to understand how traders interact and the social influence effects in the cryptocurrency ecosystem (Gandal et al., 2018).

Chen et al. propose a method for identifying large-scale market manipulation schemes in the cryptocurrency market by analyzing the transaction history of the Mt. Gox exchange. They show that many cryptocurrency networks are correlated with Mt. Gox’s price, and accounts in those networks have market manipulation patterns, suggesting that there was market manipulation going on in Mt. Gox during the time it operated. Analyzes the manipulation patterns of large-scale market manipulation using an approach of financial transaction network analysis (Chen et al., 2019).

Hu et al. analyze orders placed on the Gemini exchange from 2016 to 2019 and finds market manipulation. They find that ~99.92% of bitcoin trades are executed as limit orders, contrary to the popular narrative of a decentralized currency. Furthermore, their work shows that during the 2017 bubble, market orders increased dramatically, contradicting the claim that bitcoin is immune to market influence (Hu et al., 2022).

Fratric et al. proposed a model to examine systemic risk in cryptocurrency markets by simulating Bitcoin market activity, analyzing empirical data, and comparing model predictions to actual data. Their work shows how an agent-based simulation of a market with various agents engaged in different trading strategies can be used to identify suspicious trading patterns and document the role of an active manipulative agent. Furthermore, they used an agent-based model to study how market manipulation works and found that manipulating the price reduced volume trading in the asset (Fratric et al., 2022).

Bot System

Program trading, also known as algorithmic trading, is a computer-based method of placing orders to trade securities used in the financial markets. It uses pre-programmed trading instructions, accounting for variables such as time, price, and volume. These instructions are known as algorithms.

In the equities world, different kinds of bots have become common nowadays. One type of Bot welcomed in the equities market is the high-frequency trader (HFT). HFT is a bot that provides liquidity to regular buyers and sellers of equities. However, bots are not always identical in cryptocurrency, and some bots are not there to help you.

Bots are ubiquitous; nowadays, you can find them in every corner of the equities market. Some traders welcome bots that function as liquidity providers to their orders, allowing them to execute them faster. However, the cryptocurrency world is more complicated since many trading bots exist. Some of them are just used for manipulating the price of a cryptocurrency by buying and selling a coin with pre-programmed algorithms.

Manipulating Cryptocurrencies by Bots

Bots are used for automated trading in traditional financial markets, for example, the stock market. A bot can be developed independently or purchased online. But the main difference between cryptocurrency and traditional financial markets is that cryptocurrency exchanges are not regulated by any regulatory body, providing scope for large-scale manipulation.

The market was manipulated by a bot that purposefully acted against Virgil’s algorithm. The Bot tracked the rates of a cryptocurrency on different exchanges. It bought it where the rate was lower and sold it where it was higher. At that time, Virgil tracked the rates once a minute, but within a few seconds before checking again, the Bot began to place an order for the sale of Etherium at a price lower than other sellers, forcing Virgil to try to purchase from him. This Bot is similar to spoofing – when traders make false orders to cancel them. This tactic allows you to create the impression that the supply or demand for an asset is more significant than it is. In 2010, the United States declared it illegal in the stock and futures markets.

Manipulation takes the form of “pump and dump.” For example, a trader convinces other market participants to buy a cryptocurrency, increasing its rate. And then the trader sells it. As a result, it makes a profit, and investors who purchased the cryptocurrency at the peak suffer losses. Such a scheme is considered fraudulent and is prohibited in stock trading.

One of the tools allows traders to place buy and sell orders of the same cryptocurrency back and forth among themselves. Such transactions are considered fictitious in stock and futures markets and are prohibited.

Investigating Methods

The application was made on the buying and selling values of crypto coins that we determined with the data we received from the Coinmarketcap website. In this study, Bot was used at two different operating levels. Figure 1 shows the application settings of the bots. Three different cryptos were used for this study. These are Solano, Cardano, and Cronos, respectively. Both long and short bot methods were bought and sold based on the same period for these three cryptos.

Figure 2 shows the volume and value statistics of the Solano coin. In our study, a three-day data field was marked over 1 month’s data of Solano. Over these 3 days, the buying and selling data were examined. In region A, the Solano section has experienced a rise and fall when examined, respectively. However, when the pre-declining volume values are examined, it will be seen in the following B and C regions that a low volume has been realized. In the B region, where the volume figures increased in the last month, the lowest price value of the previous month was obtained. When that day’s buying and selling deals are examined on Binance, an artificial perception has been made that the sales figures are intensely entered, and Solano owners sell their coins via bots. Finally, bullishness has increased in zone C, although the volume has dropped, and buying figures have declined. When the buying and selling data on Binance is analyzed in the C region, the bots have opened purchase-based transactions.

Figure 3 shows the volume and value statistics of the Cardano coin. We used the three regions we marked for Solano in Cardano. Over these 3 days, the buying and selling data were examined. When analyzed, it switched from an uptrend to a downtrend in region A. Volume values formed the second-highest peak in the monthly data in this region. The volume figures formed the highest peak in the B region in a month’s data. However, it reached the lowest-priced value in this region. This period created the largest pit area in the monthly data. When the buying and selling values of that day are examined on Binance, selling pressure was created by the Bots for Cardano owners to sell the coin in their hands. When the buying and selling data on Binance is analyzed in the C region, the bots have opened purchase-based transactions. An artificial increase in the market has been achieved by creating an artificial purchase by bots.

Figure 4 shows the volume and value statistics of the Cronos coin. We used the three regions we marked for Solano and Cardano in Cronos. Over these 3 days, the buying and selling data were examined. When analyzed, it switched from an uptrend to a downtrend in region A. Volume values formed the second-highest peak in the monthly data in this region. The volume figures started at the highest peak in the B region in a month’s data. However, it reached the lowest-priced value in this region. This period created the largest pit area in the monthly data. When the buying and selling values of that day are examined on Binance, selling pressure was created by the Bots for the Cronos owners to sell the coin in their hands. When the buying and selling data on Binance is analyzed in the C region, the bots have opened purchase-based transactions. In zone C, the price value of Cronos has soared, while volume values have hit their lowest levels. In this region, users have been removed from purchases thanks to bots in an uptrend. For this, an artificial sales situation has been created.

Conclusion

When we examine the three popular crypto coins, bot transactions have serious manipulative effects on users and the market, both buying and selling. In this way, it has been determined that the impact of bots in the market is high with users with a high volume of goods.

Due to the increasing number of crypto coins and the increasing demand for them in recent years, there has been a significant increase in the rate of manipulation in this area. One of the reasons for this situation is the increasing number of trading platforms.

Since the Bitcoin ecosystem is unregulated, there are risks for investors and users. For example, if exchanges do not operate correctly, investor funds may not be secure. As a result, regulators worldwide are working to understand the potential implications of virtual currencies so that they can consider policy options. In the USA and Europe, regulators have used two approaches to consider policy responses to virtual currencies: temporary or ongoing monitoring of virtual currency systems and regulation through licensing or registration of organizations participating in virtual currency markets.

References

Beattie, A. (2020). The history of money: From barter to bitcoin. Investopedia.

Chen, W. et al. (2019). Market manipulation of bitcoin: Evidence from mining the Mt. Gox Transaction Network. In Proceedings – IEEE INFOCOM. https://doi.org/10.1109/INFOCOM.2019.8737364.

Chohan, U. W. (2017). A history of bitcoin. SSRN Electronic Journal. https://doi.org/10.2139/ssrn.3047875

Fairfield, J. (2014a). Smart contracts, bitcoin bots, and consumer protection. Washington and Lee Law Review Online.

Fairfield, J. A. T. (2014b). Washington and Lee Law Review Online smart contracts, bitcoin bots, and consumer protection smart contracts, bitcoin bots, and consumer protection. Washington and Lee Law Review Online.

Gandal, N., et al. (2018). Price manipulation in the Bitcoin ecosystem. Journal of Monetary Economics, 95, 86. https://doi.org/10.1016/j.jmoneco.2017.12.004

Hu, B., et al. (2022). Bitcoin price manipulation: Evidence from intraday orders and trades. Applied Economics Letters, 29, 140. https://doi.org/10.1080/13504851.2020.1861183

Mirtaheri, M., et al. (2021). Identifying and analyzing cryptocurrency manipulations in social media. IEEE Transactions on Computational Social Systems, 8, 607. https://doi.org/10.1109/TCSS.2021.3059286

Rathore, P. S. (2020). Bitcoin: Mystery, history and background innovative technology involved. International Journal for Research in Applied Science and Engineering Technology. https://doi.org/10.22214/ijraset.2020.3186

Takemoto, Y., & Knight, S. (2014). Mt. Gox files for bankruptcy, hit with lawsuit. Reuters.

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2023 The Author(s), under exclusive license to Springer Nature Switzerland AG

About this paper

Cite this paper

Balcıoğlu, Y.S., Özer, G. (2023). What Proportion of the Bitcoin Ecosystem Is Controlled by Bots?. In: Özataç, N., Gökmenoğlu, K.K., Balsalobre Lorente, D., Taşpınar, N., Rustamov, B. (eds) Global Economic Challenges. Springer Proceedings in Business and Economics. Springer, Cham. https://doi.org/10.1007/978-3-031-23416-3_3

Download citation

DOI: https://doi.org/10.1007/978-3-031-23416-3_3

Published:

Publisher Name: Springer, Cham

Print ISBN: 978-3-031-23415-6

Online ISBN: 978-3-031-23416-3

eBook Packages: Economics and FinanceEconomics and Finance (R0)