Abstract

Scholars have highlighted the importance of decarbonizing manufacturing industries for several years already. Industry accounts for about 20% of the EU’s greenhouse gas emissions. In order to meet the targets set in the Paris Agreement, industry must reduce emissions to almost zero by 2050. A wide range of measures can be taken to achieve climate neutrality consisting of three categories: reducing greenhouse gases by adapting business models, substituting products or offsetting the emitted greenhouse gases. Companies have to determine the optimal set of measures taking into account their individual situation as well as available resources. From this, a complex optimization problem arises and the proposed decision model offers significant sup-port for the selection of decarbonization measures. By using the decision model, companies can achieve the greatest possible emissions reduction with a minimal set of resources according to their target system, thus taking into account net present value, benefits, and risks. This paper introduces a novel modeling of measures that incorporates relevant evaluation criteria. The arising decision model is solved by using Mixed-Integer Programming. The presented approach was validated in a case study with an industrial corporation.

Access provided by Autonomous University of Puebla. Download conference paper PDF

Similar content being viewed by others

Keywords

1 Motivation

Rising energy and CO2 prices increase the financial pressure on companies to reduce their emissions [1]. One of the most relevant groups in the energy transition is the industrial sector. Not only does it account for a large proportion of most countries’ energy consumption, but also for associated energy- and process-related emissions [2]. Bauer et al. [26] present pathways for decarbonising different emission-intensive sectors such as production and end-use optimization. Available measures to reduce CO2-emissions in industrial companies include [3]. Reduction of energy consumption through energy efficiency measures, reduction of process-related or process-induced emissions, for instance by substituting (metallurgical) coke with green hydrogen in steel production as well as the self-generation of renewable energies and their storage. Making decisions to decarbonize goes along with the need to identify an optimal mix of measures for a company. For stakeholders in general, but also for a company in particular, it makes sense to pursue pathways to achieve what is needed in an optimal way.

The ideal mix cannot be taken off the shelf, as each company’s situation varies, even if the difference appears marginal [4].

Despite the importance of decarbonization, companies still face a lack of decision support methods to help identify the optimal mix of measures. By developing a decision support system, barriers can be lowered and the decarbonization of the industry can be advanced.

Therefore, the research question arises, how companies can identify their optimal selection of decarbonization measures. The focus of this paper is to present an approach using mixed-integer optimization to determine a company’s ideal set of decarbonization measures on the basis of strategic priorities, predefined measures and boundaries. The paper is structured as follows: First, the related work is presented. This is followed by a definition of the problem, the measures and the mathematical formulation. Then, a case study is presented followed by a conclusion.

2 Related Work

Buettner et al. [2] focusses on questions that need to be answered to determine one’s ideal decarbonization strategy and present a literature review that is condensed hereafter [2]. A number of studies explore pathways for decarbonization. Many of them focused much on the technological pathways and less on organizational frameworks [5]. Bataille et al. [6] present an “integrated [policy] strategy for a managed transition” in energy intensive industries, also including technology options. Rissman et al. [7] review policy options, sociological, technological, and practical solutions in detail. These studies address decarbonization of industry from either a policy, a supply-side, or technology perspective but are short of giving corporate concrete advice on how to get started from an individual company’s perspective. Similarly, studies such as the one by Johnson et al. [8] analyze and compare national roadmaps for decarbonizing the heavy industry on a global scale, alongside factors such as ambition, financial effort, and mitigation measures. Nevertheless, this approach again leaves a gap when it comes to company-tailored advice. One effective way to develop decarbonization roadmaps involves applying approaches from the backcasting framework literature. This concept, established by Robinson [9], refers to a strategy where stakeholders/policymakers set up a target (energy consumption/emissions) and work backwards from this target to reach it in the future. This framework is widely applied in designing emission-reduction pathways.

Despite the importance of decarbonizing manufacturing industry, the optimal selection of decarbonization measures is an area of research that has received little attention to date. However, approaches from the field of energy efficiency provide valuable information and can be generalized to other decarbonization measures. Bayata et al. [10] develop a model for energy efficiency optimization in the design process of buildings using multi objective optimization. There are three objective functions to be minimized: building energy consumption, investment level, and CO2 emissions. Bre et al. [11] present an optimization model for the optimal determination of building design parameters. For example, window type, roof type, and wall type are considered and variants with three to eight different states are modeled for individual parameters. The solution is based on the evolutionary algorithm for multi-objective optimization NSGA-2. Diakaki et al. [12] utilize multi-criteria optimization for increasing the energy efficiency of buildings including but not only focused on the design phase compared to Bayata et al. [10]. The model consists of different decision variables related to the building envelope and technologies. Energy demand, investment costs and CO2 emissions are the objective functions. Eskander et al. [13] focus on the optimization of energy efficiency measures in Portuguese households. The optimization model identifies optimal retrofit solutions in different regions of Portugal. Six different energy efficiency measures are considered. The optimal energy efficiency measures are selected using a genetic algorithm with the inclusion of a constrained investment budget. The investment budget can only take the forms low, medium and high. Kontogirgos et al. [14] present a model for mixed-integer evaluation of residential energy conservation measures under uncertainty.

In addition to approaches in energy efficiency there are other optimization approaches focusing on decarbonization in industry. Maigret et al. [15] present a multi objective optimization using an evolutionary algorithm to minimize annual costs and CO2-emissions in a refinery. Hu et al. [16] develop a multi-objective decision-making method to evaluate correlated decarbonization measures using a pareto optimal and marginal cost-effectiveness criterion.

In summary, it can be seen that approaches for the optimized selection of decarbonization measures in industry are still an understudied field of research. The formulation of the selection of decarbonization measures in the form of a decision model has not yet been carried out. However, preliminary work in the field of energy efficiency provides valuable information for the development of a solution procedure.

3 Methodology

3.1 Problem Definition

The following chapter describes the optimization problem that companies face when selecting decarbonization measures.

Choosing what measures must be prioritized requires determining the target criteria. Targets are the foundation to allow assessing which states or results are desirable and how their quality is to be measured [17]. For the development of a decision model, it is therefore crucial to determine the relevant dimensions of these preferences and to derive how these are to be measured. Cooreman [18] examines strategic dimensions of energy efficiency measures and concludes that the three strategic competitive advantages are cost, risk, and value of the measure. Adapting this approach, the goal criteria used for the optimization problem are cost, risks, and avoided CO2 emissions.

With regard to the available measures Buettner et al. [3] describe measure categories that can be pursued by companies on site (internal measures).

-

reduction of energy consumption (and of the connected load) through energy efficiency measures, including utilizing waste energy and passive resources such as passive ventilation;

-

reduction of process-related or process-induced emissions, for instance, by substituting coke by green hydrogen in steel production or emissions released by the process itself;

-

self-generation of renewable energies and their storage, for instance, solar-, wind-, hydro- or geothermal energy, including means for flexibilising the energy demand.

In addition to the optimized selection of decarbonization measures, constraints may exist that need to be incorporated into the optimization problem in the form of equations and inequalities. Constraints mentioned in the literature for the selection of measures include the investment budget [19,20,21] and emission targets [19, 22]. Based on these literature, the investment budget and CO2 emission targets are used in the optimization problem in the form of constraints.

3.2 Assessment of Decarbonization Measures

In order to derive relevant evaluation criteria and thereby create an evaluation system, it is first necessary to define what characterizes the relevance of the evaluation system. Based on the research of Cooreman [18] referenced in the previous chapter, three strategic dimensions, cost, risk, and avoided CO2 emissions, are to be used to assess a decarbonization measure.

With regard to the costs, three methods are most frequently used to assess the profitability of an investment [23]: Payback period, net present value (NPV), and internal rate of return (IRR). For the cost evaluation of decarbonization measures, the NPV is selected in the context of this work because it is described as an important lever for energy efficiency, which again can be generalized to decarbonization measures [24].

The second dimension is based on the avoided CO2 emissions represented by \({\text{tones}} {\text{CO}}_{{2 {\text{eq}}{\text{. avoided}}}}\). Due to the importance of other greenhouse gases, the assessment is based on CO2 equivalents.

Using the previously defined target system, a method for assessing risks in implementing decarbonization measures utilizing an approach presented by Schneider et al. [25] is used. Using the method, each measure is assigned a risk value representing the risk assigned connected to the measure’s implementation. Thus, there is a ranking for the risk of all considered decarbonization measures.

3.3 Mathematical Formulation

The following section describes the previously defined problem in a mathematical form. The decision variables of the optimization problem in this case represent the decision for a set of certain decarbonization measures, which can be represented in a form where 1 stands for a selection of the measure and 0 for a non-selection.

where:

The basic decision to select a set of decarbonization measures is reduced to a series of individual decisions on whether or not to implement an available measure. Since a measure can be selected or not selected in binary form, it is a mixed integer problem. Integer constraints are, for example, compliance with the available investment budget.

The set of available action plans (1) of the decision maker is corresponding to the measures previously given as input variables and is formed by the cross product of the individual measures. This means that each combination of measures represents a possible investment plan.

A preference function is used to order given alternatives based on their relative utility for the user. Within the optimization problem the function consists of the weighted sum of the individual factors presented in the chapter above. These consist of the tons of CO2 emissions avoided, the net present value associated with the measure and represented by the NPV and the risks of implementation. The individual preference functions are first transposed to the interval [0, 1]. \(U\) represents the value function, while Φ is used to describe the sum of the individual value functions.

The value Φ(A) present in (2) represents the valuation of an alternative according to the preference of the decision maker. The individual preference dimensions are summarized to the overall weighted preference function.

The weighting can be set directly by the decision-maker in a simple form. However, this method, which is often used in practice, is criticized from a scientific point of view and alternative methods are recommended [26]. Alternatively, the determination of the weights can follow the pairwise comparison of the Analytic Hierarchy Process by Saaty [27].

Constraints of the problem arise from the limitations of the investment budget and possible requirements on the CO2 savings achieved.

Equations can occur when exact savings (possibly with deviations) are to be fulfilled. Next, the individual components are combined to form an optimization problem re-presented in a maximization form. The following optimization problem (3) arises, where \(h_{i} \left( A \right)\) and \(g_{i} \left( A \right)\) and represent constraints in the form of equations and inequalities.

For the solution of the defined problem under the selected conditions, different optimization algorithms can be used fulfilling the requirements of the problem class of the optimization problem.

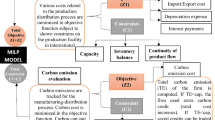

Figure 1 summarizes the process of determining the optimal investment plans. The starting point is a set of decarbonization measures that are already available in evaluated form, i.e. the criteria necessary for decision-making have been evaluated. For the risk assessment for example a separate risk assessment method was presented by Schneider [25]. For the optimization, it is furthermore necessary to determine the relevant constraints and the weighting of the target dimensions. Once this is done, the mixed-integer problem can be solved and the optimal set of measures can be determined.

4 Case Study

In the following, the presented optimization is applied in a case study. The aim is to identify the optimal action plans for selected investment budgets, i.e. to decide which of the available measures should be implemented. By determining relevant economic evaluation criteria for the action plans, this represents a key decision-making tool for management. The implementation of the case study requires a data set of measures. The case presented below is founded on a database of proposed decarbonization measures from a large industrial company in Germany. The dataset includes 32 decarbonization measures, most of which relate to energy efficiency measures. Individual measures also include the self-generation of renewable energy.

The measures included have already been evaluated by the company’s experts in terms of cost, annual energy saved, the measures’ service life, and other parameters. Due to the confidentiality of the data, only excerpts of selected measures are presented as examples in Table 1.

A number of algorithms are available for solving mixed-integer optimization problem with most of those based on the branch-and-bound method [28]. Within the selected programming environment Matlab the branch-and-bound algorithm intlinprog is applied due to the already available implementation.

To calculate avoided CO2 emissions from energy efficiency measures, the specific greenhouse gas emissions were estimated at 200 g/kWh in CO2equivalents per kilowatt-hour of electricity. The number used is based on assumptions taking into account numbers published by the German Umweltbundesamt [29] specifying greenhouse gas emissions in CO2equivalents (CO2eq) per kilowatt hour of electricity with 428 g/kWh as well as estimated reductions by around 50% compared to today’s level to meet the ambition level of the Climate Protection Plan by 2030 [30]. For energy efficiency measures, the amount of avoided CO2equivalents is calculated by multiplying the saved energy per year with the lifetime of the measure and the CO2equivalent.

Avoiding CO2 emissions from self-generation of energy with the aid of PV systems is based on the assumptions made above and on figures from Fraunhofer ISE [31] and the Umweltbundesamt, who assume a greenhouse gas potential for PV electricity of 56 g CO2 eq./kWh for system operation in Germany. The limitations of the estimation have to be pointed out.

An exact calculation on a yearly level and the company-specific emission data was not carried out because the data was not made available by the company the case study is based on. Therefore the presented case study is based on data derived from the sources stated above. This represents a weakness of the results. Moreover, no reliable range can be given because the specific CO2 savings vary so much from company to company. For example, a company with a 100% self-supply of renewable energy would represent one extreme value, while a company that is supplied with electricity from coal power would represent another extreme value.

The calculation of the net present value is based on a discount rate of 6%. The discount rate used for the calculation of the NPV is based on numbers given by the company the case study is based on and represents the value and represents the rate at which future cash flows are discounted. The discount rate, represents the return that could be earned per unit of time on an investment with similar risk.

The following illustration in Fig. 1 represents a central result of the optimization algorithm. The best possible selection of decarbonization measures was calculated for available investment budgets in steps of fifty thousand euros each. Accordingly, each data point represents an iteration of the optimization algorithm. In a figurative sense, the performed mixed-integer optimization corresponds to the so-called knapsack problem.

A single data point represents an optimal investment programme for decarbonization measures. I.e. for all available measures it is decided whether to implement the measures or not. The curve flattens out at the end as the investment budget is fully utilized. Accordingly, no further measures can be integrated as there are no more available.

The objective function is based on a weighting in which the avoided CO2 emissions are weighted with 0.4, the present value with 0.4 and the risk with 0.2. The figure supports a decision-maker on which savings are possible depending on the investment budget.

A more in-depth examination of the objective function’s influence is shown in Fig. 2. In this figure, a design of experiment was carried out using differently weighted objective functions and the maximum CO2 emissions that can be avoided. The used objective function was evaluated in each case. The aim of this presentation is to gain a more precise understanding of how the weighting of the target dimensions by the decision-maker influences the achievable CO2 savings.

The achievable CO2 reduction clearly depends on how the risk is evaluated. The more a decision-maker weights the importance of the risk of decarbonization measures, the lower the achievable savings. In the extreme case of weighting it 1, i.e., a decision based exclusively on the risk associated with the implementation of measures, the achievable savings converge towards 0. On the other hand, there is a high correlation between NPV and avoided emissions. This is particularly due to the cost savings associated with energy efficiency measures (Fig. 3).

5 Conclusion

Due to the increasing importance of reducing CO2 emissions in the industrial sector, companies must decide on measures and determine the optimal quantity of measures. Especially for large companies, there is a great variety of possible measures and the decision is correspondingly complex. Using the presented mixed-integer optimization approach, companies can determine the set of optimal decarbonization measures in their individual situation. Decision-makers are faced with the complex challenge of determining the optimal mix of measures for their company. Yet, due to the individual situation of each company, optimal action plans cannot be determined generically and each case must be considered individually.

For the user, the proposed decision model provides the benefit of scientifically sound decision support that determines the best possible actions for the selected preference.

The approach is based on the assumption of individually characterized utility functions, which are represented by an objective function individually weighted by the decision maker. The presented investigation of the objective function with the help of an experiment design illustrates the high dependence of the achievable CO2 savings on the target weighting, in particular the weighting of the risk.

Further research on the approach focuses on a more precise determination of avoided CO2 emissions, since at the company level, there is a complex interaction between, for example, energy efficiency measures and the company’s own generation of renewable energies. This leads to a complex determination of the actually achieved CO2 avoidance with an individual measure because the implementation of for example renewable energies leads to lower avoidance of CO2 emissions in energy efficiency measures. Possible further research can be in this consideration of interactions between decarbonization measures.

References

Büttner, S.M., Wang, D., Schneider, C.: Der Weg zur Klimaneutralität. Bausteine einer neuen Methodik zur Bestimmung eines wirtschaftlichen Maßnahmenmix. In: Digitalisierung im Kontext von Nachhaltigkeit und Klimawandel, pp. 89–106 (2021)

Buettner, S.M.: Roadmap to neutrality—what foundational questions need answering to determine one’s ideal decarbonisation strategy. Energies 15, 3126 (2022)

Buettner, S.M., Schneider, C., König, W., Mac Nulty, H., Piccolroaz, C., Sauer, A.: How do German manufacturers react to the increasing societal pressure for decarbonisation? Appl. Sci. 12(2022), 543 (2022)

Eco, U., Schick, W.: Wie man eine wissenschaftliche Abschlußarbeit schreibt: Doktor-, Diplom- und Magisterarbeit in den Geistes- und Sozialwissenschaften, 7, unveränd. Aufl. der dt. Ausg, Facultas Univ.-Verl., Wien (1998)

Nurdiawati, A., Urban, F.: Towards deep decarbonisation of energy-intensive industries: a review of current status, technologies and policies. Energies 14, 2408 (2021)

Bataille, C., Åhman, M., Neuhoff, K., Nilsson, L.J., Fischedick, M., Lechtenböhmer, S., et al.: A review of technology and policy deep decarbonization pathway options for making energy-intensive industry production consistent with the Paris Agreement. J. Clean. Prod. 187, 960–973 (2018)

Rissman, J., Bataille, C., Masanet, E., Aden, N., Morrow, W.R., Zhou, N., et al.: Technologies and policies to decarbonize global industry: review and assessment of mitigation drivers through 2070. Appl. Energy 266, 114848 (2020)

Johnson, O.W., Mete, G., Sanchez, F., Shawoo, Z., Talebian, S.: Toward climate-neutral heavy industry: an analysis of industry transition roadmaps. Appl. Sci. 11, 5375 (2021)

Robinson, J.B.: Energy backcasting a proposed method of policy analysis. Energy Policy 10, 337–344 (1982)

Bayata, Ö., Temiz, İ: Developing a model and software for energy efficiency optimization in the building design process: a case study in Turkey. Turk. J. Electr. Eng. Comput. Sci. 25, 4172–4186 (2017)

Bre, F., Fachinotti, V.D.: A computational multi-objective optimization method to improve energy efficiency and thermal comfort in dwellings. Energy Build. 154, 283–294 (2017)

Diakaki, C., Grigoroudis, E., Kabelis, N., Kolokotsa, D., Kalaitzakis, K., Stavrakakis, G.: A multi-objective decision model for the improvement of energy efficiency in buildings. Energy 35, 5483–5496 (2010)

Eskander, M.M., Sandoval-Reyes, M., Silva, C.A., Vieira, S.M., Sousa, J.M.: Assessment of energy efficiency measures using multi-objective optimization in Portuguese households. Sustain. Cities Soc. 35, 764–773 (2017)

Kontogiorgos, P., Chrysanthopoulos, N., Papavassilopoulos, G.: A mixed-integer programming model for assessing energy-saving investments in domestic buildings under uncertainty. Energies 11, 989 (2018)

de Maigret, J., Viesi, D., Mahbub, M.S., Testi, M., Cuonzo, M., Thellufsen, J.Z., et al.: A multi-objective optimization approach in defining the decarbonization strategy of a refinery. Smart Energy 6, 100076 (2022)

Hu, H., Yuan, J., Nian, V.: Development of a multi-objective decision-making method to evaluate correlated decarbonization measures under uncertainty — the example of international shipping. Transp. Policy 82, 148–157 (2019)

Göbel, E.: Entscheidungstheorie, 2., durchgesehene Auflage; Studienausgabe, UVK Verlagsgesellschaft mbH; UVK Lucius; UTB GmbH, Konstanz, München, Stuttgart (2018)

Cooremans, C., Energy-efficiency investments and energy management: an interpretative perspective. In: EECB’12 Proceedings (2012)

He, Y., Liao, N., Bi, J., Guo, L.: Investment decision-making optimization of energy efficiency retrofit measures in multiple buildings under financing budgetary restraint. J. Clean. Prod. 215, 1078–1094 (2019)

Tan, B., Yavuz, Y., Otay, E.N., Çamlıbel, E.: Optimal selection of energy efficiency measures for energy sustainability of existing buildings. Comput. Oper. Res. 66, 258–271 (2016)

Malatji, E.M., Zhang, J., Xia, X.: A multiple objective optimisation model for building energy efficiency investment decision. Energy Build. 61, 81–87 (2013)

Cano, E.L., Moguerza, J.M., Ermolieva, T., Ermoliev, Y.: Energy efficiency and risk management in public buildings: strategic model for robust planning. CMS 11(1–2), 25–44 (2013). https://doi.org/10.1007/s10287-013-0177-3

Cooremans, C.: Investment in energy efficiency: do the characteristics of investments matter? Energ. Effi. 5, 497–518 (2012)

Müller, E., Engelmann, J., Löffler, T., Strauch, J.: Energieeffiziente Fabriken planen und betreiben. Springer-Verlag, Berlin Heidelberg, Berlin, Heidelberg (2009)

Schneider, C., Burkert, M., Weise, P., Sauer, A.: Risikobewertung von Energieeffizienzmaßnahmen/Risk assessment of energy efficiency measures, wt Werkstattstechnik online 111 (2021), 44–48

Rommelfanger, H.J., Eickemeier, S.H.: Entscheidungstheorie: Klassische Konzepte und Fuzzy-Erweiterungen. Springer, Berlin Heidelberg, Berlin, Heidelberg, s.l. (2002)

Saaty, R.W.: The analytic hierarchy process—what it is and how it is used. Math. Model. 9, 161–176 (1987)

Achterberg, T., Wunderling, R.: Mixed integer programming: analyzing 12 years of progress. In: Jünger, M., Reinelt, G. (eds.) Facets of Combinatorial Optimization: Festschrift for Martin Grötschel, pp. 449–481. Springer, Berlin Heidelberg, Berlin, Heidelberg, s.l. (2013)

Umweltbundesamt, Strom- und Wärmeversorgung in Zahlen. 05 Apr 2022. https://www.umweltbundesamt.de/themen/klima-energie/energieversorgung/strom-waermeversorgung-in-zahlen#Kraftwerke

Umweltbundesamt, Klimaschutz im Stromsektor 2030 — Vergleich von Instrumenten zur Emissionsminderung. 05 Apr 2022. https://www.umweltbundesamt.de/sites/default/files/medien/1/publikationen/2017-01-11_cc_02-2017_strommarkt_endbericht.pdf

Fraunhofer-Institut für Solare Energiesysteme ISE. Aktuelle Fakten zur Photovoltaik in Deutschland. https://www.ise.fraunhofer.de/de/veroeffentlichungen/studien/aktuelle-fakten-zur-photovoltaik-in-deutschland.html

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2023 The Author(s), under exclusive license to Springer Nature Switzerland AG

About this paper

Cite this paper

Schneider, C., Büttner, S., Sauer, A. (2023). Optimal Selection of Decarbonization Measures in Manufacturing Using Mixed-Integer Programming. In: Liewald, M., Verl, A., Bauernhansl, T., Möhring, HC. (eds) Production at the Leading Edge of Technology. WGP 2022. Lecture Notes in Production Engineering. Springer, Cham. https://doi.org/10.1007/978-3-031-18318-8_74

Download citation

DOI: https://doi.org/10.1007/978-3-031-18318-8_74

Published:

Publisher Name: Springer, Cham

Print ISBN: 978-3-031-18317-1

Online ISBN: 978-3-031-18318-8

eBook Packages: EngineeringEngineering (R0)