Abstract

IAS 38 “Intangible Assets” forces companies in which business model innovation (BMI) occurs to recognize expenditures in the research stage aimed at formulating and designing alternatives for new or improved processes, systems, or additional services, as well as expenditures during the development stage at the moment of incurring such costs, before meeting the criteria for capitalizing expenses in profit or loss. This requirement is important as BMI is driven by internally generated intangible assets that often cannot be recognized in the statement of financial position, resulting in the need for nonfinancial information in regard to these expenses.

Access provided by Autonomous University of Puebla. Download conference paper PDF

Similar content being viewed by others

Key words

17.1 Introduction

Business model innovation (BMI) has emerged as a potential path to growth and value creation (Wirtz & Daiser, 2017; Sinfield et al., 2012). CEO-level surveys also identify it as a key source of sustained value creation (Foss & Saebi, 2017). Schneider and Spieth (2013) believe there is a need for a deeper and more reliable understanding of the impact of BMI on financial performance because, interestingly, little is known about this issue.

An important input in the process of evaluating the success of BMI is information about internally generated intangibles (e.g., research and development (R&D)), the recognition of such assets in the statement of financial position demonstrating the indirect impact of BMI on financial performance. The objective of the research underlying this article is to determine the role of IAS 38 “Intangible Assets” in explaining this impact.

A review of pertinent literature was conducted, as well as empirical analysis, based on the financial statements of companies from the following sectors: biotechnology, gaming, information technology (IT), and pharmaceuticals.

In the field of accounting research, this article may be treated as an attempt to examine BMI from the perspective of financial statements.

17.2 Data and Methodology

The literature review was based on six databases containing publications related to accounting: EBSCO, Emerald, JSTOR, ProQuest, Scopus, and Wiley Online Library. The search was limited to abstracts in scholarly journals with the primary filter aimed at identifying articles related to the topic of this text. Table 17.1 presents the preliminary results of the literature review.

The identified articles were then analyzed to pinpoint those that focus strictly on the topic of this article. The literature review was supplemented by a critical analysis of the International Financial Reporting Standards (IFRS).

The empirical study was based on a content analysis of the 2017 financial statements of 52 Polish companies in terms of research and development. Table 17.2 presents the research sample divided according to sector.

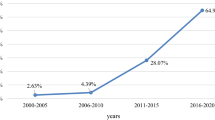

The financial statements were produced by companies in four industrial sectors in which BMI is a frequent occurrence: biotechnology (five companies), gaming (seven), IT (31), and pharmaceuticals (nine). The building blocks for such companies are their research and development activities (IAS 38) creating enormous potential for creating value (Govindarajan et al., 2018a; Maniora, 2017) and contributing to explaining the indirect impact of BMI on financial performance. According to SEG (2016), the significant change in current business models is confirmed by the varying proportions of asset types in the S&P 500 over four decades (Fig. 17.1).

The change in proportion of the components of the S&P 500. (Source: SEG, 2016)

In 1975, tangible assets amounted to 83% of the S&P 500 index, while these assets represented only 16% of the index in 2015. The resulting challenge for accounting is the reporting of intangible assets, which today requires a qualitatively different approach (SEG, 2016).

17.3 Results and Discussion

17.3.1 The Literature Study

BMI can be defined as a process of finding a novel way of doing business, which results in the reconfiguration of value creation and value capturing mechanisms (Bashir & Verma, 2017; Björkdahl & Holmén, 2013). It is consistent with Foss and Saebi (2017), who describe BMI as designed, novel, and nontrivial changes to the key elements of a firm’s business model and/or the architecture linking these elements (Bashir & Verma, 2017; Demil & Lecocq, 2010).

According to Amit and Zott (2012), BMI is of greatest importance to managers because it represents an often underutilized source of value. Researchers, scholars, and top executives also concur that BMI is a new form of innovation that is distinct from product innovation (Bashir & Verma, 2017; Björkdahl & Holmén, 2013). One of the major advantages associated with BMI is that it is much more difficult for companies to replicate a novel system than to imitate a product. The returns of product innovation are often relatively easier to undermine and can be eroded over time. On the other hand, BMI aims at consciously renewing a firm’s core business logic rather than restricting its scope of innovation to single products (Schneider & Spieth, 2013), and it can be translated into a competitive advantage (Bashir & Verma, 2017; Amit & Zott, 2012). So the benefits linked with BMI undoubtedly outstrip any other form of innovation (Bashir & Verma, 2017; Lindgardt et al., 2009; Snihur & Zott, 2013). Product innovation emphasizes the status quo of a firm’s current business model and focuses on adjustments and incremental innovations within the established business model framework, whereas BMI removes itself from the status quo and focuses on opportunities within the external environment of a firm.

BMI may be undertaken for a number of reasons, such as reducing costs, optimizing processes, introducing new additional services, accessing new markets, and, of course, ultimately improving financial performance (Foss & Saebi, 2017). However, once invoked as part of the motivation, attention to those consequences often fades. In fact, few articles explain how BMI improves competitive advantage, profitability, or other areas of innovation (Foss & Saebi, 2017; Aspara et al., 2010; Giesen et al., 2007).

One reason for this is that BMI research is a relatively recent development. In comparison with the huge volume of research on business models, the number of published papers that address BMI is still comparatively low. The literature on the topic exhibits many of the characteristics of an emerging research stream—notably, a lack of construct clarity (Foss & Saebi, 2017) and a resulting absence of a comprehensive framework (Di Fabio & Avallone, 2018; Beattie & Smith, 2013; Bini et al., 2016).

Relative to accounting, BMI may affect a firm’s financial performance both directly and indirectly (c.f. Karwowski, 2019). Firstly, it enhances the prospect of additional revenues from new products or services and superior business models. This logic assumes a relatively direct link between BMI and financial performance through revenue growth and higher margins (Lichtenthaler, 2018).

Secondly, it also affects financial performance indirectly (Salman & Saives, 2005). In particular, innovation activities may strengthen the image and reputation of both the firm and its solutions (Chiang & Hung, 2010). In turn, this bolstered market position may enable the company to achieve superior financial results—for example, arising from a higher brand value than that of competitors (Lichtenthaler, 2018).

17.3.2 The Empirical Study

According to the Conceptual Framework for Financial Reporting (2018), financial statements represent economic phenomena in words and numbers. In preparing useful information, entities must consider recognition, measurement, presentation, and disclosure issues. In the case of internally generated intangibles, which are crucial for BMI, IAS 38 introduces strict recognition and measurement criteria (c.f. Karwowski, 2017). All research expenditures are to be recognized as expenses when they are incurred. An intangible asset generated internally as a result of development work is recognized if, and only if, the six recognition criteria illustrated in Table 17.3 can be demonstrated.

The cost of an internally generated intangible asset is the sum of expenditures incurred from the date when the intangible asset first meets the abovementioned recognition criteria. Expenditures previously recognized as expenses cannot be capitalized. The cost of an internally generated intangible asset comprises directly attributable costs necessary to create, produce, and prepare that asset to be capable of operating in the manner intended by management. Table 17.4 illustrates expenditures included and not included in the cost of an internally generated intangible asset.

Upon the completion of development work, such internally generated intangibles are amortized over the estimated period in which the entity is expected to generate revenues (c.f. Karwowski, 2017).

The form of presentation of internally generated intangible assets is not specified in IAS 38. Of the 52 studied financial statements, 38 (73%) present development costs in the statement of financial position and/or research expenditures in the statement of profit or loss. One company recognized all expenditures referring to research and development works as expenses in profit or loss. Fourteen companies (27%) do not present development expenditures in the statement of financial position and/or as research expenses in the statement of profit or loss. Of the 14 financial statements, two provide information that research expenses amount to zero, while 12 offer no information about research and development expenses. Based on the analysis of the financial statements in which such information is disclosed, it can be concluded that the most suitable solution for companies in which BMI occurs is to present completed development projects as a separate category in the statement of financial position, such as “internally generated intangibles,” and development projects that are still incomplete as, for instance, “costs of development projects in progress.”

The final issue to consider in preparing useful information is disclosure. Figure 17.2 illustrates if the companies from the research sample divided by sector disclose information on accounting policy concerning R&D expenditures.

The 52 financial statements examined provide the following data:

-

Forty-one (79%) companies disclose information about accounting policies concerning research and development expenditures—among them are all the companies in the biotechnology sector. Thirty-five of these companies present development costs in the statement of financial position and/or as research expenses in the statement of profit or loss, while six of these companies present neither development costs in the statement of financial position nor research expenses in the statement of profit or loss.

-

Eleven companies (21%) do not disclose information about accounting policies concerning research and development expenditures—among them are seven companies from the IT sector. Three of these companies present development costs in the statement of financial position and/or research expenses in the statement of profit or loss—but as the amount is not material, it need not be treated as a deviation from the requirements of financial accounting. Eight of these companies present neither development costs in the statement of financial position nor research expenses in the statement of profit or loss.

IAS 38 “Intangible Assets” forces companies in which BMI occurs to recognize expenditures in the research stage aimed at formulating and designing alternatives for new or improved processes, systems, or additional services, as well as expenditures during the development stage at the moment of incurring such costs, before meeting the criteria for capitalizing expenses in profit or loss. This requirement is important as BMI is driven by internally generated intangible assets that cannot be recognized in the statement of financial position. For this reason, nonfinancial information about these expenses must be part of the company’s overall value creation story (Maniora, 2017). Unfortunately, only 13 of the 52 studied financial statements (25%) disclose information regarding research expenses. Nine of these 13 subjects (75%) disclose information that research expenses amount to zero, while four others (25%) disclose information that research expenses exceeded zero. For these four entities, research expenses amounted to 0.5%, 1%, 11%, and 52% of the total assets. Thirty-nine of the 52 studied financial statements (75%) do not disclose any information regarding research expenses, which can be considered a shortcoming of their financial statements.

17.4 Conclusion

Recent research claims that financial statements are practically irrelevant for companies in which BMI often occurs (Govindarajan et al., 2018a, b). The main reason for this is that the value of some potentially significant assets, such as brands, data, domain names, customer relationships, and employees, often are not recognized in the statement of financial position. In particular, according to IAS 38, the expenditures for building idea-based platforms that have enormous potential to create value in such companies are reported as expenses in the initial years when they have little, if any, revenue (ICAEW, 2018).

ICAEW (2018) noted that the International Accounting Standards Board’s (IASB’s) research program before 2015 included intangible assets and the activities of the extractive sector, but little progress was made on the first topic. In view of the growing debate about the financial reporting of climate change and other environmental issues, the IASB has included a project on extractive activities, but any reference to intangible assets was removed based on the belief that any attempt to address the recognition and measurement of intangible assets would require significant resources with very uncertain prospects for any significant improvement in financial reporting. A separate IASB research project will consider just one aspect of accounting in this area: the extent to which intangible assets should be separated from goodwill.

It was acknowledged that previous attempts at progress in the area of standard-setting have not been very successful, and it is undoubtedly a difficult and complex issue where investor views vary. Few intangibles meet the criteria for recognition in a company’s statement of financial position, except in the context of the acquisition of a business. This weakens the extent to which financial reporting can provide a clear picture of a company’s resources to investors and other users of financial reports (ICAEW, 2018).

This concern is only likely to increase as BMI is driven by internally generated intangible assets that cannot be recognized in the statement of financial position. For this reason, nonfinancial information about these assets has to be a part of the company’s overall value creation story (Maniora, 2017). With far-reaching changes to IFRS unlikely, the focus should be firmly on ensuring that companies disclose clear, consistent, and relevant information to investors seeking alternative means of understanding how BMI creates value over time. In terms of disclosing information, it is worth mentioning the guidance in the strategic report published by the Financial Reporting Council, which calls for information on an entity’s intangible resources, including items that are not reflected in the financial statements, and the International Integrated Reporting Framework, which calls for information on the business model, clarifying how a firm’s business activities create or destroy value by processing input—the six forms of capital, including the intellectual capital of knowledge and innovation—into output (ICAEW, 2018; IIRC, 2013).

References

Amit, R., & Zott, C. (2012). Creating value through business model innovation. Sloan Management Review, 53(3), 41–49.

Aspara, J., Hietanen, J., & Tikkanen, H. (2010). Business model innovation vs. replication: Financial performance implications of strategic emphases. Journal of Strategic Marketing, 18(1), 39–56.

Bashir, M., & Verma, R. (2017). Why business model innovation is the new competitive advantage. The IUP Journal of Business Strategy, XIV(1), 7–17.

Beattie, V., & Smith, S. J. (2013). Value creation and business models: Refocusing the intellectual capital debate. The British Accounting Review, 45(4), 243–254.

Bini, L., Dainelli, F., & Giunta, F. (2016). Business model disclosure in the strategic report: Entangling intellectual capital in value creation process. Journal of Intellectual Capital, 17(1), 83–102.

Björkdahl, J., & Holmén, M. (2013). Editorial: Business model innovation: The challenges ahead. International Journal of Product Development, 18(3−4), 213–225.

Chiang, Y. H., & Hung, K. P. (2010). Exploring open search strategies and perceived innovation performance from the perspective of inter-organizational knowledge flows. R&D Management, 40(3), 292–299.

Conceptual Framework for Financial Reporting. (2018). IFRS Foundation.

Demil, B., & Lecocq, X. (2010). Business model evolution: In search of dynamic consistency. Long Range Planning, 43(2−3), 227–246.

Di Fabio, C., & Avallone, F. (2018). Business model in accounting: An overview. Journal of Business Models, 6(2), 25–31.

Foss, N. J., & Saebi, T. (2017). Fifteen years of research on business model innovation: How far have we come, and where should we go? Journal of Management, 43(1), 200–227. https://doi.org/10.1177/0149206316675927

Giesen, E., Berman, S. J., Bell, R., & Blitz, A. (2007). Three ways to successfully innovate your business model. Strategy & Leadership, 35(6), 27–33.

Govindarajan, V., Rajgopal, S., Srivastava, A. (2018a, February 26). Why financial statements don’t work for digital companies? Harvard Business Review, hbr.org/2018/02/why-financial-statements-dont-work-for-digital-companies. Access: 12 Nov 2018.

Govindarajan, V., Rajgopal, S., Srivastava, A. (2018b, June 8). Why we need to update financial reporting for the digital era? Harvard Business Review, hbr.org/2018/06/why-we-need-to-update-financial-reporting-for-the-digital-era. Access: 10 May 2019.

ICAEW. (2018). What’s next for corporate reporting: Time to decide? icaew.com/-/media/corporate/archive/files/technical/financial-reporting/information-for-better-markets/whats-next-for-corporate-reporting.ashx. Access: 10 May 2019.

IIRC. (2013). The international integrated reporting framework. International Integrated Reporting Council.

Karwowski, M. (2017). Innowacje w modelach biznesu w rachunkowości. Ekonomika i Organizacja Przedsiębiorstwa, 5, 53–64.

Karwowski, M. (2019). The role of IFRS 15 in the evaluation of the effects of business model innovation. In European financial systems 2019: Proceedings of the 16th international scientific conference (pp. 247−254).

Lichtenthaler, U. (2018). The world’s most innovative companies: A meta-ranking. Journal of Strategy and Management, 11(4), 497–511. https://doi.org/10.1108/JSMA-07-2018-0065

Lindgardt, Z., Reeves, M., Stalk, G., & Deimler, M. S. (2009). Business model innovation. When the game gets tough. In change the game. The Boston Consulting Group.

Maniora, J. (2017). Is integrated reporting really the superior mechanism for the integration of ethics into the core business model? An empirical analysis. Journal of Business Ethics, 140, 755–786. https://doi.org/10.1007/s10551-015-2874-z

Salman, N., & Saives, A. L. (2005). Indirect networks: An intangible resource for biotechnology innovation. R&D Management, 35(2), 203–215.

Schneider, S., & Spieth, P. (2013). Business model innovation: Towards an integrated future research agenda. International Journal of Innovation Management, 17(1), 7–34. https://doi.org/10.1142/S136391961340001X

SEG. (2016). Raportowanie niefinansowe. Wartość dla spółek i inwestorów, publication prepared by Polish Association of Listed Companies, GES Global Ethical Standard and EY, https://seg.org.pl/sites/seg13.message-asp.com/files/seg_esg-2016_www_5.pdf. Access: 13 Feb 2020.

Sinfield, J. V., Calder, E., McConnell, B., & Colson, S. (2012). How to identify new business models? MIT Sloan Management Review, 53(2), 85–90.

Snihur, Y., & Zott, C. (2013). Legitimacy without imitation: How to achieve robust business model innovation. In 35th DRUID celebration conference, June (pp. 1−35).

Wirtz, B. W., & Daiser, P. (2017). Business model innovation: An integrative conceptual framework. Journal of Business Models, 5(1), 14–34.

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2022 The Author(s), under exclusive license to Springer Nature Switzerland AG

About this paper

Cite this paper

Karwowski, M. (2022). The Role of IAS 38 in the Evaluation of the Effects of Business Model Innovation. In: Procházka, D. (eds) Regulation of Finance and Accounting. ACFA ACFA 2021 2020. Springer Proceedings in Business and Economics. Springer, Cham. https://doi.org/10.1007/978-3-030-99873-8_17

Download citation

DOI: https://doi.org/10.1007/978-3-030-99873-8_17

Published:

Publisher Name: Springer, Cham

Print ISBN: 978-3-030-99872-1

Online ISBN: 978-3-030-99873-8

eBook Packages: Economics and FinanceEconomics and Finance (R0)