Abstract

The issue of gender inequalities and the contribution of women in companies is extensively debated in the literature. Instead, there are few contributions on the topic of the information relevance on gender issues, with particular regard to women’s perspective. This study is situated in the conceptual framework of the legitimacy theory to verify the extent of the information provided by Italian public companies about women and gender issues before and after European Directive 2014/95 is transposed into the national legislation. To comply with the chapter’s aim a qualitative research methodology based on multiple case studies was used. The authors carried out a content analysis on the nonfinancial statement—or on similar documents—produced by Italian nonfinancial companies listed on the FTSE-MIB before and after the first application in Italy of the national legislation implementing the European Directive. The findings reveal that there is a growing interest in the topic but, even today, it is not possible to assert that it is considered of primary importance, since only a relatively small number of companies, required to analyze gender issues, give relevance to the topic. Nonetheless, the results obtained explain that the directive impact on the quality and quantity of information produced by businesses is largely positive. No empirical evidence was found regarding specific information on the effect that COVID-19 has had on female work in the company.

This study fills a gap in the existing literature and can have an impact not only on the behavior followed by companies but also by European and international policymakers. The study’s conclusions propose insights to policymakers in order to measure the effectiveness of the rules on nonfinancial disclosure, given the absence of a precise framework that requires companies to adopt uniform and universally accepted accounting standards or principles. This chapter can also contribute to the current consideration about the updating of the mentioned directive by the EU and European and international accounting bodies.

Access provided by Autonomous University of Puebla. Download chapter PDF

Similar content being viewed by others

Keywords

1 Introduction

Over the last decade, there has been a growing interest by international organizations, national authorities, and businesses in nonfinancial information reports. Moreover, in several circumstances, there has been a shift from voluntary to mandatory disclosure. For instance, this obligation was introduced by the European Directive 2014/95, which yields that from 2017 large companies (exceeding 500 employees) belonging to the Member States are required to give some social, environmental, and governance disclosures.

In conformity with the past, the doctrine has continued to examine the general and specific issues of nonfinancial information reports (Gulenko, 2018; Helfaya et al., 2019; Khlif & Achek, 2017; Leopizzi et al., 2020; Liao et al., 2015; Mazzotta et al., 2020; Michelon et al., 2015; Paoloni et al., 2016).

At the directive level, a specific issue which the doctrine has not focused particular attention on is the amount of information provided by businesses.

The issue of gender inequalities and the contribution of women in companies is extensively debated in the literature. Instead, there are few contributions on the topic of the information relevance on gender issues, with particular regard to women’s issues. The gender concerns have been examined by the literature with regard to the correlation between the presence of women, especially in boards, and companies performance, the ESG or GHG information produced, but not on the quality and quantity of information, provided by companies regarding the subject of gender (Cucari et al., 2018; Furlotti et al., 2019; Harjoto et al., 2015; Purwa et al., 2020; Setó-Pamies, 2015). The present investigation is situated in the conceptual framework of the legitimacy theory to verify the extent of the information provided by large companies about women working in these before and after the national legislation application on nonfinancial disclosure. More precisely, this is a study that fills a gap in the existing literature and can have an impact not only on the behavior followed by companies but also by European and international policymakers.

This chapter aims to analyze the changes that the entry into force of the European Directive 2014/95 produced on the disclosure of large Italian publicly listed companies, with regard to the gender inequality issue and to the contribution of female presence in businesses. In particular, this study examines the quality, the quantity, and the modalities of information presentation related to women in these, in order to verify to what extent the issue linked to the condition of women is considered relevant by companies in the context of information relating to personnel, and what impact the transposition of the Directive in terms of adopted standards has produced on the disclosure. In addition, this chapter strives to verify whether the COVID-19 information reporting focused on the effects that COVID-19 could have on women working in companies and, therefore, whether there was a specific report about the impact that COVID-19 had on women’s performance in businesses.

In this vein, we can formulate our research questions:

-

RQ1: Within the context of information related to personnel, how relevant is the issue linked to the condition of women?

-

RQ2: What impact on disclosure has the transposition of the Directive produced?

-

RQ3: Was there a specific disclosure on the impact that COVID-19 had on women’s performance?

To comply with the chapter aims a qualitative research methodology based on multiple case studies is used. The authors carry out a content analysis on the nonfinancial statement (NFS)—or on similar documents—produced by Italian nonfinancial companies listed on the FTSE-MIB before and after the first application in Italy of the national legislation implementing the European Directive. More precisely, in this first analysis of the topic, the NFS concerning the years 2016 and 2019 are examined in order to observe the changes in the information reporting on gender over time (e.g., gender inequalities, and contribution of the female presence in companies). In conducting the research, a scoring model based on key disclosure parameters is used.

This study can fill a gap in the existing literature and can have an impact not only on the behavior followed by companies but also by European and international policymakers. At the same time, the study’s conclusions propose insights to policymakers in order to measure the effectiveness of the rules on nonfinancial disclosure, given the absence of a precise framework that requires companies to adopt uniform and universally accepted accounting standards or principles. This chapter can also contribute to the current consideration about the updating of the mentioned directive by the EU and European and international accounting bodies.

The chapter is structured as follows. In the Sect. 2, a theoretical framework is set out. Next, research methodology, results and discussion are shown in Sect. 3. Implications for future research and conclusions are presented in Sect. 4.

2 Theoretical Framework

In this chapter, the matter of gender disclosure provided by large listed companies is addressed from the perspective of the legitimacy theory. This theory is described by Tyler (2006) as “the characteristic of being legitimized by being placed within a framework through which something (…) is viewed as right and proper” (Tyler, 2006, p. 376).

According to this theory, the legitimacy of an organization depends on whether its actions are considered acceptable or not in light of the system of values, norms, beliefs, and definitions of the social context to which they relate (Suchman, 1995).

Thus, the societal organization is so highly related to the expectations of its stakeholders (shareholders, creditors, customers, suppliers, workers, NPOs, authorities) that, according to Deegan (2007), this theory represents one of the most valuable insights into the organization to undertake actions that are more acceptable to the different categories of stakeholders. Due to the importance of this feature, many scholars, such as Guthrie and Parker (1989), Gray et al. (1995), have used the theory of legitimacy in their studies as the most suitable basis for legitimizing corporate existence and their practices.

At the heart of this theory, there is the idea that an implicit contract was formed between individual organizations and the social context in which they operate (Chen & Roberts, 2010). Expectations are based on numerous social shared norms hence the survival and success of an organization depend on its ability to meet these expectations in the fulfilment of this tacit contract (Cho et al., 2015) as well as on how the organization will legitimize its operations to the public (Deegan, 2004).

In accordance with DiMaggio and Powell (1983), organizations always try to operate within the limits of their social spheres by striving to be perceived as legitimate. Consequently, the greater the likelihood of an adverse change in society’s expectations of how an organization operates, the greater the organization’s desire to change these adverse views to ensure their legitimacy (Branco & Rodrigues, 2006). Furthermore, Dowling and Pfeffer (1975) argue that organizations recognize that a change of opinion may require some corrective actions. Corporate sustainability practices must be accompanied by appropriate disclosure, since they are the most effective corrective actions (Cormier & Gordon, 2001).

According to the theory of legitimacy, corporate disclosure strategies are then applied by organizations to achieve social acceptance (Deegan 2002; Deegan et al., 2002). In a context of mandatory reporting, where the coercive force of the law prevails, companies disclose nonfinancial information, as obliged, and therefore the State plays a role in supporting the ideology of legitimation (Archel et al., 2009). Within this approach, the EU Directive could be seen as a political action to provide corporate nonfinancial disclosure with material legitimacy, which is a form of legitimacy that allows organizations to merge what matters to the company with the primary concerns of its key stakeholders (Dumay et al., 2015).

As a matter of fact, the NFS and the sustainability reports are tools for communicating sustainability performance to stakeholders and also a mean for legitimization before them (Safari & Areeb, 2020).

In the search for legitimacy, the organization can adopt various approaches. The legitimacy literature distinguishes between symbolic and substantive methods.

On the one hand, the substantive methods are “attempt to obtain legitimacy through changes in actions and policies, as a strategic response to external conditions; in sum, it should be critical for external public to “know much more about whether those changes in strategy also changed in action” (Hopwood, 2009). A substantive approach applied to nonfinancial information implies that the organization publishes reports capable of improving the quality of the information provided regarding the conduct held and the initiatives were undertaken. On the other hand, the symbolic approaches are “stakeholders’ perceptions of the firm, engaging in apparent actions that lead key stakeholders to believe that the company is committed to societal requirements” (Ashforth & Gibbs, 1990) and, thus, to create a positive corporate image (Hopwood, 2009). Nonfinancial information becomes a means of communication that is exploited as an opportunity to disguise corporate activities, obfuscate negative performance (Cho et al., 2010), and project corporate images detached from reality (Boiral, 2013).

Accordingly, from this viewpoint, the disclosure of nonfinancial information (NFI) becomes a way to influence external perceptions and to build or maintain legitimacy to operate (Dawkins & Fraas, 2011; Suchman, 1995). Indeed, organizational legitimacy is often constructed and maintained through the use of symbolic actions (Dowling & Pfeffer, 1975; Elsbach, 1994; Neu et al., 1998) that are part of the public image of the organization.

Although various studies apply the legitimacy theory to nonfinancial information (Mazzotta et al., 2020; Velte & Stawinoga, 2017), few researches apply it specifically with regard to the disclosure provided by companies on the matter of gender disparities.

In part, this is because, in the past, companies have dealt with the problems of women and equal opportunities in their annual reports in a limited way (Adams et al., 1995; Adams & Harte, 1998; Benschop & Meihuizen, 2002). Adams and Harte (1998) explored the issue of gender and female employment in the annual corporate reports of major UK banks and retail companies. Their research shows that numerous companies have made simple political statements about women’s employment while little is said about their performance.

Similarly, Benschop and Meihuizen (2002) investigated gender information in annual financial reports through texts, statistics, and images in the Netherlands. The authors found that stereotyped images are dominant, and the data produced confirms the traditional gender division of labor.

If these studies show a limited interest in the topic of gender, using an essentially symbolic approach in the disclosure provided, other studies arrive at different results, representative of more substantial approaches.

Among the US listed organizations, Gul et al. (2011) find that diversity disclosures (such as those on gender diversity) at the board level enhanced a firm’s stock price informativeness, increased transparency and encouraged private information sharing in small firms. Disclosures about women and minorities in organizational annual reports and other sources therefore should not be considered as mere window dressing (Gamson et al., 1992). Such types of disclosures show an organization’s intent to promote its strategies while highlighting its commitment to diversity to its stakeholders (Singh & Point, 2004). Along with commitment, the presentation of such factors underlines organizational stewardship for its diversity objectives (Bernardi et al., 2002).

With the introduction of the European directive on nonfinancial information, there was a shift from an optional to a mandatory disclosure, which is also of a social nature. Leopizzi et al. (2020) underline that this legislation has brought an improvement with a positive increase in the level of information reporting in all sectors and for all types of risks. Venturelli et al. (2017) examined “the information gap for Italian companies and, consequently, the adjustments required by the new Directive on nonfinancial information.” This author uncovered that an information gap remains, although the implementation of the directive should help to fill it in the coming years. Analyzing the Italian case, the chapter achieves results in line with that part of the literature according to which the role of regulation in improving the quality of disclosure of nonfinancial information (Beets & Souther, 1999; Deegan, 2007). Therefore, the potential contribution of the EU directive to nonfinancial disclosure in Italy appears to be greater than we had expected.

Nevertheless, the issue is debated. According to Brown (2009), the quantitative increase would not be accompanied by a qualitative increase since the use of a standardized framework would penalize the use of company- and sector-specific indicators and information.

Indeed, other empirical studies show that regulation is not always associated with improvement in the quality of nonfinancial information (Lock & Seele, 2016), or at least that regulation alone cannot guarantee a better level of nonfinancial disclosure (Costa & Agostini, 2016; Luque-Vilchez & Larrinaga, 2016). In this sense, the study by Ioannou and Serafeim (2014) of the Chinese and South African contexts produced controversial results.

Based on the theory of legitimacy, the chapter investigates the differences that the entry into force of the European Directive 2014/95 has produced on the exposure of large Italian listed companies and therefore whether there has been an effective commitment that has led to greater attention and information on the topic (substantial approach), or if there is only an attempt to build an image of commitment designed to positively influence the perceptions of stakeholders (symbolic approach). According to Hopwood (2009), companies can adopt disclosure strategies to build a new, more legitimate image, reduce the number of questions asked and maintain a level of secrecy. Therefore, it is possible that the fulfillment of a legal obligation does not improve what is known about the objectives, activities, and social and environmental impacts of a company but rather serves to protect the organization from external pressures.

3 Research Methodology, Results, and Discussion

In compliance with the chapter aims, it was used a qualitative research methodology was based on multiple case studies. More precisely, the authors analyzed gender information published in nonfinancial statements (or similar documents) by Italian nonfinancial companies listed on the FTSE-MIB. The FTSE-MIB index was taken into consideration, due to the fact that it represents the most important Italian stock index, including the 40 companies with the greatest capitalization on the Italian capital market.

The data extraction took place in February 2021.

For the research purposes, the companies present in this index were selected both on 31/12/2016 (the year before the first application in Italy of the national legislation implementing the European directive) and on 31/12/2019 (the last date on which the NFS are available of these companies, at the time of the research took place).

In Table 1, the authors show the sample selected, on the basis of the criteria mentioned above.

The method applied in this study is the content analysis, since it is a methodology widely used by researchers to measure the quality, quantity, and presentation of the information produced in corporate reporting (Amran et al., 2006; Gray et al., 1995; Hackston & Milne, 1996; Haniffa & Cooke, 2002; Raar, 2002). Indeed, content analysis is “a research technique for the objective, systematic and quantitative description of the manifest content of communication” (Berelson, 1952).

This research technique allows realizing a replicable and valid inference from the data, according to the context (Krippendorff, 1980). For this scope, the present study relies on a set of query tools, checklists, and decision rules, specific to research questions.

Therefore, specifics were set to minimize the margins of discretion present in the research to make the activity carried out replicable.

To answer the first two questions of the research, a scoring model, based on key disclosure parameters, was prepared. This model makes it possible to use homogeneous parameters to examine the information on gender provided by companies listed in the FTSE-MIB40 both in the sustainability report published in 2016 and in the NFS published in 2019.

As matter of fact, the examination is aimed at comparing the changes that have taken place in this information following the introduction of ad hoc legislation. Table 2 shows the variables investigated to assign the score of the parameters.

In selecting these parameters, it was considered that the companies in the sample used the GRI standards before and after the transposition of the directive on nonfinancial information.

For each parameter, the score assigned varies from zero to one. The value is zero when the parameter is below a value representing an average level of compliance with GRI’s requests or the number of times that terms referring to gender are reported. The value is one when this threshold value is exceeded. The threshold value is equal to the average value of the degree of compliance, obtained taking into consideration the results achieved in the two years. For example, if the GRI provides that 12 KPIs on gender are provided and of these, on average, between 2006 and 2019, the companies provided six, the companies that provided at least six of these indicators scored one, the other zero. Table 2 shows the specific methods of assigning scores concerning each parameter examined, also illustrating in detail the procedure followed in carrying out the research. Table 3 summarizes the variables investigated and the score assigned to them.

To ensure the reliability of the score, the authors underwent a short training period to master the checklist and decision rules. The authors were also exposed to several examples of the various types of risk information. Subsequently, the understanding and skill of the researchers were tested using the inter-rater or inter-observer method, where each author is involved in analyzing the same set of material. In this case, four DFNs were analyzed separately. The results of the content analysis performed by both authors were then correlated to determine the extent of the agreement. The result showed that there were no significant differences between the scores.

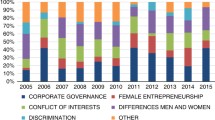

Figure 1 shows the comparison of the results detected in the two years of observation.

The introduction of the legislation on nonfinancial disclosure (NFD) resulted in an improvement in information on gender differences and the contribution of women in the company for 55% of the companies in the analyzed sample (Fig. 2). This result reveals a significant impact of the legislation on corporate disclosure. The entry into force of the directive has prompted 20% of the analyzed companies to introduce the gender issue in their NFS and 35% of them to significantly improve this information.

The introduction of the directive did not produce any effect on disclosure for 25% of the sampled businesses, while for 20% of them a worsening was observed.

Figure 3 highlights the improvement of the parameters, analyzed in this study, following the application of the directive. In 2016, only 20% of the NFSs analyzed achieved the full score of five (Fig. 3b) while in 2019 this percentage rises to 25 (+25%) (Fig. 3a). The percentage of NFSs that achieve the medium/high score (four) from 20 passes to 30% with a 50% increase with a linear trend of the increasing forecast (Fig. 3a, b). Figure 3c highlights the increasing trend of improvement for all five analyzed parameters except the last one.

The comparison of the overall results detected in the sample observed in the two years of reference reveals an improvement in corporate disclosure on the gender inequalities issue, with particular regard to the role of women in businesses.

As a matter of fact, the authors observed both an improvement in the overall score (+34%) and an increase in the number of companies that obtain a score equal to or greater than three (Table 4).

A further parameter for measuring the directive impact on gender issues within the NFD context is summarized in Table 5.

The research results highlight a qualitative and quantitative improvement in the NFD regarding gender issues. Before the implementation of the directive, for example, only 35% of the companies in the sample considered the issue of gender to be relevant in nonfinancial disclosures. In 2019, the percentage rose to 60%. Similarly, for the parameter relating to qualitative information, while that relating to quantitative information remains almost stable.

The only worsening parameter, even though restrained (−7.3%), seems to be the one concerning the comparisons with the previous years about the information on gender issues.

To answer the RQ3, the DFNs and the consolidated financial statements of 2019 of the 20 sampled companies were examined to verify whether these documents included information on any eventual impacts deriving from the COVID-19 crisis, regarding the situation of women within the company.

A complete reading of the documents was carried out to verify the existence of any reference. In this case, the conducted analysis was objective and was independent of any discretionary assessment regarding the type of initiative or impact reported. The value range ranked from zero to one. “Zero” corresponded to the absence of any information on the subject, “one” to its presence, without going into the merits of the type of information provided. From an initial examination of the available documents, it does not appear that specific attention was paid by the nonfinancial companies listed on the FTSE-MIB40 to the impact of COVID-19 on the situation of women.

4 Conclusion

The issue of gender differences and the contribution of women in companies is extensively treated in the literature. Instead, there are few contributions on the issue of the relevance of information on gender issues, with particular regard to women’s issues (Adams et al., 1995; Adams & Harte, 1998; Benschop & Meihuizen, 2002). This study is placed in the conceptual framework of the legitimacy theory (Chen & Roberts, 2010; Suchman, 1995; Tyler, 2006) to verify the extent of the information provided by large companies on women in the company before and after the application of the national regulations on nonfinancial disclosure (Gray et al., 1995; Guthrie & Parker, 1989).

This chapter has analyzed the changes that the entry into force of Directive 2014/95/EU has produced on the disclosure of large Italian listed companies, with particular regard to the issue of gender differences and the contribution of women in companies. Specifically, the quality, quantity, and methods of presentation of information relating to women in these companies were examined, in order i) to verify how much the issue linked to the condition of women is considered relevant by companies in the context of information relating to personnel, and ii) what impact the transposition of the Directive in terms of adopted standards has produced on disclosure.

About the first aspect, the analysis reveals that there is a growing interest in the topic but, even today, it is not possible to assert that it is considered of primary importance, since only a relatively small number of companies, required to analyze gender issues, give relevance to the topic. Still many companies (30% of the sample examined) provide limited information and, in any case, only 25% of them provide a piece of complete satisfactory information, according to the parameters used in this study.

Regarding the second aspect, the results obtained explain that the directive impact on the quality and quantity of information produced by businesses is largely positive.

These results appear consistent with previous studies such as DiMaggio and Powell (1983), according to organizations always try to operate within the limits of their social spheres by striving to be perceived as legitimate. Thus, the greater the likelihood of an adverse change in society’s expectations of how an organization operates, the greater the organization’s desire to change these adverse views to ensure their legitimacy (Branco & Rodrigues, 2006) and achieve social acceptance (Deegan et al., 2002).

The chapter also investigated any information provided by the companies examined in the financial and nonfinancial disclosure 2019 on the effects that COVID-19 can have on women working in the firm and therefore if there was specific information on the effect that COVID-19 on female work in the company. No empirical evidence was found on this aspect.

This study can contribute to the literature about gender studies by investigating the relevance that companies attribute to information on gender issues, with particular regard to women. At the same time, the conclusions of the research offer insights to policymakers to measure the effectiveness of the rules on nonfinancial disclosure in the absence of a precise framework that requires companies to adopt uniform and universally accepted accounting standards or principles. The chapter can also contribute to the ongoing reflection on the updating of the directive on the subject by the EU and European and international accounting bodies.

This research has some limitations. It is, indeed, a preliminary research that offers some indications of the status quo and current trends. To reach conclusions of general validity, it is necessary to extend the sample, including the financial companies listed on the FTSE-MIB40. Furthermore, it is necessary to extend the reference time horizon, including at least the 2020 NFSs.

Another limit of the research is described by the reduced articulation of the scores assigned to the parameters (zero or one), helpful for a first screening but not suitable for grasping the different sensitivities of companies to the issue of gender.

References

Adams, C. A., Coutts, A., & Harte, G. (1995). Corporate equal opportunities (non-) disclosure. The British Accounting Review, 27(2), 87–108.

Adams, C. A., & Harte, G. (1998). The changing portrayal of the employment of women in British banks and retail companies corporate annual reports, accounting. Organizations and Society, 23(8), 781–812.

Amran, A., Manaf Rosli Bin, A., & Che Haat Mohd Hassan, B. (2006). Risk reporting: An exploratory study on risk management disclosure in Malaysian annual reports. Managerial Auditing Journal, 24(1), 39–57.

Archel, P., Husillos, J., Larrinaga, C., & Spence, C. (2009). Social disclosure, legitimacy theory and the role of the state. Accounting, Auditing & Accountability Journal, 22(8), 1284–1307.

Ashforth, B. E., & Gibbs, B. W. (1990). The double-edged of organizational legitimation. Organization Science, 1(2), 177–194.

Beets, S. D., & Souther, C. C. (1999). Corporate environmental reports: The need for standards and an environmental assurance service. Accounting Horizon, 13, 129–145.

Benschop, Y., & Meihuizen, H. E. (2002). Keeping up gendered appearances: Representations of gender in financial annual reports. Accounting, Organizations and Society, 27(7), 611–636.

Bernardi, R. A., Bean, D. F., & Weippert, K. M. (2002). Signaling gender diversity through annual report pictures: A research note on image management. Accounting, Auditing & Accountability Journal, 15(4), 609–616.

Berelson, B. (1952). Content analysis in communication research. Free Press.

Boiral, O. (2013). Sustainability reports as simulacra? A counter-account of a and a+ GRI reports. Auditing & Accountability Journal, 26(7), 1036–1071.

Branco, M. C., & Rodrigues, L. L. (2006). Communication of corporate social responsibility by Portuguese banks. Corporate Communication: An International Journal, 11(3), 232–248.

Brown, J. (2009). Democracy, sustainability and dialogic accounting technologies: Taking pluralism seriously. Critical Perspectives on Accounting, 20(3), 313–342.

Chen, J., & Roberts, R. (2010). Toward a more coherent understanding of the organization–society relationship: A theoretical consideration for social and environmental accounting research. Journal of Business Ethics, 97, 651–665.

Cho, C. H., Roberts, R. W., & Patten, D. M. (2010). The language of US corporate environmental disclosure. Accounting, Organizations and Society, 35(4), 431–443.

Cho, C. H., Laine, M., Roberts, R. W., & Rodrigue, M. (2015). Organized hypocrisy, organizational façades, and sustainability reporting. Accounting, Organizations and Society, 40, 78–94.

Cormier, D., & Gordon, I. M. (2001). An examination of social and environmental reporting strategies. Accounting, Auditing & Accountability Journal, 14(5), 587–616.

Costa, E., & Agostini, M. (2016). Mandatory disclosure about environmental and employee matters in the reports of Italian-listed corporate groups. Social and Environmental Accountability Journal, 36, 10–33.

Cucari, N., De Falco, S. E., & Orlando, B. (2018). Diversity of board of directors and environmental social governance: Evidence from Italian listed companies. Corporate, Social, Responsibility and Environmental Management, 25, 250–266.

Dawkins, C., & Fraas, J. (2011). Coming clean: The impact of environmental performance and visibility on corporate climate change disclosure. Journal of Business Ethics, 100(2), 303–322.

Deegan, C. (2002). The legitimizing effect of social and environmental disclosures—A theoretical foundation. Accounting Auditing Accountability Journal, 15, 282–311.

Deegan, C., Rankin, M., & Tobin, J. (2002). An examination of the corporate social and environmental disclosures of BHP from 1983–1997: A test of legitimacy theory. Accounting, Auditing & Accountability Journal, 15(3), 312–343.

Deegan, C. (2004). Environmental disclosures and share prices—A discussion about efforts to study this relationship. Accounting Forum, 28(1), 87–97.

Deegan, C. (2007). Insights from legitimacy theory. In J. Unerman, J. Bebbington, & B. O’Dwyer (Eds.), Sustainability accounting and accountability. Routledge.

DiMaggio, P. J., & Powell, W. W. (1983). The iron cage revisited: Institutional isomorphism and collective rationality in organizational fields. American Sociological Review, 48, 147–160.

Dowling, J., & Pfeffer, J. (1975). Organizational legitimacy: Social values and organizational behavior. The Pacific Sociological Review, 18, 122–136.

Dumay, J., Frost, G., & Beck, C. (2015). Material legitimacy. Journal of Accounting & Organizational Change, 11(1), 2–23.

Elsbach, K. D. (1994). Managing organizational legitimacy in the California cattle industry: The construction and effectiveness of verbal accounts. Administrative Science Quarterly, 39(1), 57–88.

Furlotti, K., Mazza, T., Tibiletti, V., & Triani, S. (2019). Women in top positions on boards of directors: Gender policies disclosed in Italian sustainability reporting. Corporate Social Responsibility and Enviromental Management, 26, 57–70.

Gamson, W. A., Croteau, D., Hoynes, W., & Sasson, T. (1992). Media images and the social construction of reality. Annual Review of Sociology, 18(1), 373–393.

Gray, R., Kouhy, R., & Lavers, S. (1995). Constructing a research database of social and environmental reporting by UK companies. Accounting, Auditing & Accountability Journal, 8(2), 78–101.

Gul, F. A., Srinidhi, B., & Ng, A. C. (2011). Does board gender diversity improve the informativeness of stock prices? Journal of Accounting and Economics, 51(3), 314–338.

Gulenko, M. (2018). Mandatory CSR reporting—Literature review and future developments in Germany. Sustainability Management Forum, 26, 3–17.

Guthrie, J., & Parker, L. D. (1989). Corporate social reporting: A rebuttal of legitimacy theory. Accounting and Business Research, 76(19), 343–352.

Hackston, D., & Milne, M. J. (1996). Some determinants of social and environmental disclosures in New Zealand companies. Accounting, Auditing & Accountability Journal, 9(1), 77–108.

Haniffa, R. M., & Cooke, T. E. (2002). Culture, corporate governance and disclosure in Malaysian corporations. Abacus, 38(3), 317–349.

Harjoto, M., Laksmana, I., & Lee, R. (2015). Board diversity and corporate social responsibility. Journal of Business Ethics, 132(4), 641–660.

Helfaya, A., Whittington, M., & Alawattage, C. (2019). Exploring the quality of corporate environmental reporting: Surveying preparers’ and users’ perceptions. Accounting, Auditing & Accountability Journal, 32(1), 163.

Hopwood, A. G. (2009). Accounting and the environment. Accounting, Organizations and Society, 34, 433–439.

Ioannou, I., & Serafeim, G. (2014). The consequence of mandatory corporate sustainability reporting: Evidence from four countries. In Harvard Business School research working paper (pp. 11–100). Harvard Business School.

Khlif, H., & Achek, I. (2017). Gender in accounting research: A review. Managerial Auditing Journal, 32(6), 627–655.

Krippendorff, K. (1980). Validity in content analysis. In E. Mochmann (Ed.), Computerstrategien für die kommunikationsanalyse (pp. 69–112). Campus. Retrieved from http://repository.upenn.edu/asc_papers/291

Leopizzi, R., Iazzi, A., Venturelli, A., & Principale, S. (2020). Nonfinancial risk disclosure: The “state of the art” of Italian companies. Corporate, Social, Responsibility and Environmental Management, 27, 358–368.

Liao, L., Luo, L., & Tang, Q. (2015). Gender diversity, board independence, environmental committee and greenhouse gas disclosure. British Accounting Review, 47(4), 409–424.

Lock, I., & Seele, P. (2016). The credibility of CSR (corporate social responsibility) reports in Europe. Evidence from a quantitative content analysis in 11 countries. Journal of Cleaner Production, 122, 186–200.

Luque-Vilchez, M., & Larrinaga, C. (2016). Reporting models do not translate well: Failing to regulate CSR reporting in Spain. Social and Environmental Accountability Journal, 36, 56–75.

Mazzotta, R., Bronzetti, G., & Veltri, S. (2020). Are mandatory non-financial disclosures credible? Evidence from Italian listed companies. Corporate, Social, Responsibility and Enviromental Management, 27, 1900–1913.

Michelon, G., Pilonato, S., & Ricceri, F. (2015). CSR reporting practices and the quality of disclosure: An empirical analysis. Critical Perspectives on Accounting, 33, 59–78.

Neu, D., Warsame, H., & Pedwell, K. (1998). Managing public impressions: Environmental disclosures in annual reports. Accounting, Organizations and Society, 23(3), 265–282.

Paoloni, P., Doni, F., & Fortuna, F. (2016). L’informativa sulla diversità di genere: Cosa cambia con l’Integrated reporting? Il Caso del Sudafrica, (information on gender diversity: What changes with integrated reporting? The case of South Africa). In P. Paoloni (Ed.), I Mondi delle donne Percorsi interdisciplinari, (Women’s worlds interdisciplinary paths). Edicusano.

Purwa, P. A. L., Setiawan, D., & Phua, L. K. (2020). Gender in accounting research: Recent development in Indonesia. Jurnal Akuntansi dan Bisnis, 20(1), 45–56.

Raar, J. (2002). Environmental initiatives: Towards triple-bottom line reporting. Corporate Communications: An International Journal, 7(3), 169–183.

Safari, M., & Areeb, A. (2020). A qualitative analysis of GRI principles for defining sustainability report quality: An Australian case from the preparers’ perspective. Accounting Forum, 44, 344–375.

Setó-Pamies, D. (2015). The relationship between women directors and corporate social responsibility. Corporate Social Responsibility and Environmental Management, 22, 334–345.

Singh, V., & Point, S. (2004). Strategic responses by European companies to the diversity challenge: An online comparison. Long Range Planning, 37(4), 295–318.

Suchman, M. C. (1995). Managing legitimacy: Strategic and institutional approaches. Academy of Management Review, 20(3), 571–610.

Tyler, T. R. (2006). Why people obey the law. Princeton University Press.

Velte, P., & Stawinoga, M. (2017). Integrated reporting: The current state of empirical research, limitations and future research implications. Journal of Management Control, 28, 275–320.

Venturelli, A., Caputo, F., Cosma, S., Leopizzi, R., & Pizzi, S. (2017). Directive 2014/95/EU: Are Italian companies already compliant? Sustainability, 9, 1385.

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2022 The Author(s), under exclusive license to Springer Nature Switzerland AG

About this chapter

Cite this chapter

Cosentino, A., Venuti, M. (2022). In Search of Materiality for Nonfinancial Information Under the Female Lens, After the Directive 2014/95/EU Transposed. A Multiple Italian Case Study. In: Paoloni, P., Lombardi, R. (eds) Organizational Resilience and Female Entrepreneurship During Crises. SIDREA Series in Accounting and Business Administration. Springer, Cham. https://doi.org/10.1007/978-3-030-89412-2_15

Download citation

DOI: https://doi.org/10.1007/978-3-030-89412-2_15

Published:

Publisher Name: Springer, Cham

Print ISBN: 978-3-030-89411-5

Online ISBN: 978-3-030-89412-2

eBook Packages: Business and ManagementBusiness and Management (R0)