Abstract

Currently, legislative and social pressures led companies to widen their main goals and have been now considering not only economical but also environmental goals into their supply chain activities. In addition, the uncertainty associated with supply chains activities and the need to obtain more realistic values led to the need of addressing the associated financial risk. This paper explores this tendency and presents a mixed integer linear programming model for the design and planning of green supply chains that account for the economic and environmental concerns in the same objective function by monetizing environmental impacts. Also, the goal of minimizing the associated financial risk is considered. To deal with these two goals an augmented \(\varepsilon \)-constraint method is used to generate a pareto-optimal curve to determine the trade-off between the two objective functions. In this way, the present work contributes to the literature by providing a new model that considers the environmental impacts’ monetization as well as models risk considering both economic and environmental performances of the supply chain. A case study is explored.

Access provided by Autonomous University of Puebla. Download conference paper PDF

Similar content being viewed by others

Keywords

1 Introduction

Supply chain (SC) management has been well-known for years in both academic and business communities. Taking into account that supply chain is a logistic system that covers a set of all activities from suppliers to customers, there is always high complexity associated. For that reason, it involves careful and efficient management in order to be possible to obtain satisfactory results for the company.

Considering the complex decisions, number of products, variables and entities involved, managing supply chain is a challenge, particularly if this management covers the design and planning of the supply chain. This management should be capable of optimizing customer value and achieving a competitive advantage in the market.

In the past, when supply chains were optimized, decision-makers were only concerned with the economic performance of the supply chain. Taking into account the increasing companies’ competitiveness and governmental pressures, SC has extended its goals to consider environmental and social concerns as well [4]. The management of those economic, environmental and social concerns led to the appearance of the sustainable supply chain (SSC) concept, which is a long well-recognized area in the World Commission on Environment and Development [1].

In addition to the sustainability and responsiveness that supply chain management must obey, risk management is also a reality that needs to be accounted for. Risk management has always been a debated subject in the academic community, because of the different points of view that management can encompass, as well as because of the adequacy of the use of risk measures. However, when it comes to design and planning of supply chain, it is consensual among the scientific community that risk management should be addressed, since there are many uncertainties associated that can only be taken into account when considering the risk [4]. Thus, the design and planning models for minimization of supply chain costs need to become more holistic. Actually, most of the real supply chain problems have several uncertain aspects associated, such as demand, and raw material prices [6]. In this way, it is necessary to develop risk management tools that efficiently address the supply chain uncertainty. In fact, there are several examples of the application of risk measures in supply chain design and/or planning in the literature [3, 10]. Nevertheless, this is not applied neither in the environmental nor in the social performance of the SC. But is important to highlight that risk can impact multiple sustainability dimensions, namely economic, environmental and social performances. Therefore, there is the need to account for those performances when analysing risk in supply chains, particularly in green and in sustainable supply chains.

This work addresses this need and presents a mixed integer linear programming model (MILP) that accounts for the economic and environmental concerns in the same objective function by monetizing environmental impacts and considering a risk measure. The goal is to maximize the difference between economic and environmental performances while minimizing the associated risk.

2 Methodologies for Monetization of Environmental Impacts

Taking into account the assessment of environmental impacts, there are several methods to assess them. According to the literature, the most used methodology is life cycle assessment (LCA), which is composed by four main phases, namely the goal and scope definition, inventory analysis, life cycle impact assessment (LCIA), and life cycle interpretation.

LCIA encompasses four steps: the classification of flows into impact categories, the quantification of the impacts through a characterization process, the normalization and the application of weighting factors. This may include some difficulties in choosing the best method to use. The LCIA methods allow us to quantify environmental impacts, however, the majority of them evaluate the environmental impacts in points. Few of the methods apply monetization to environmental impacts. Monetization is the process of translating environmental impacts into monetary units. According to the European Commission [7], EPS 2000 is a quite complete method of monetization that has the uncertainties fully specified when compared to other LCIA methods.

For this reason, in this work, monetization is performed by using EPS. The environmental impacts are quantified in a monetary unit (in euros) through EPS, which is mainly derived from future costs (raw material depletion), direct losses (production) and willingness-to-pay (health, biodiversity, and aesthetic values). Considering the willingness-to-pay, EPS method evaluates the environmental impacts based on academic knowledge from the Organization for Economic Cooperation and Development (OECD), which correspond to the value that the inhabitants would be willing to pay to avoid those environmental impacts.

3 Problem Description and Model Characterization

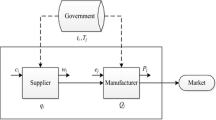

For this work, it is considered a generic supply chain, where it is intended to study its design. This SC considers raw materials flow from suppliers to factories, where final products are produced. Then, these final products move to warehouses or straight to markets. Also, at the markets, end-of-life products may be recovered and sent to warehouses or right to factories so as to be remanufactured.

Considering the possible set of locations of SC entities, products within the SC, technologies involved, and transportation modes between entities, the main purpose is to obtain the network structure of the SC, supply and purchase levels, transportation network, entities’ capacities production, storage and remanufacturing levels, supply flow amounts, and product recovery levels, with the aim of maximizing profit, minimizing environmental impacts and financial risk.

The model used to solve this problem is a mixed integer linear programming (MILP) model that is based on the model presented in [9]. This base model is extended to consider simultaneously two objective functions through the augmented -constraint method [8]. This extension considers the maximization of the difference between economic and environmental performances, and the minimization of the financial risk, considering demand uncertainty.

Product’s demand uncertainty is modelled through a scenario tree approach, since this is a method that allows the discretization of stochastic data over the time horizon and can be adjusted during the planning horizon. In this scenario tree, a node N characterizes a possible state and the arcs represent the evolutions it may have. Each node has a specific probability and a path from the root to a leaf node represents a scenario.

In the model developed, Eq. (1) represents the first objective function, which is the maximization of the difference between the expected net present value (eNPV) and expected environmental impact (eEnvImpact). The economic performance is assessed through the eNPV (considered in Eq. (2)), which is obtained through the sum of each node’s probability multiplied by the discounted cash flows (CF\(_{Nt}\)) in each period t and for each node N at a given interest rate (ir). These CF\(_{{N}_t}\) are obtained from de net earnings (difference between incomes and costs). The costs include raw material costs, product recovery costs, operating costs, transportation costs, contracted costs with airline or freight, handling costs at the hub terminal, inventory costs, and labour costs. Furthermore, for the last time period, it is considered the salvage values of the SC (FCI\(_\gamma \)). The environmental performance is assessed by the eEnvImpact (considered in Equation (3)), LCA is performed on the transportation modes, in the production technology involved, and on entities installed in the SC boundaries, using EPS 2015 (an updated version of EPS 2000). The Life Cycle Inventory is retrieved from the Ecoinvent database (assessed through SimaPro 8.4.0 software). The LCA results are expressed in Environmental Load Units (ELU) and used as input data (ei) in Eq. (3), particularly in the environmental impact of transportation (first term), in the environmental impact of entity (second term), and in the environmental impact of technology (third term). Considering that environmental impacts are in a monetary unit, it is necessary to use a similar methodology to the discounted cash-flows that result in the present value of expected future environmental impacts at a given interest rate (ir).

The second objective function is represented by Eq. (4), where financial risk is minimized, which is modelled through the adoption of conditional value at risk (CVaR), where VaR is the minimum difference between NPV and EnvImpact for a given confidence level (\(\alpha \)). CVaR evaluates the likelihood of obtaining the difference between eNPV and eEnvImpact lower than value-at-risk (VaR). CVaR apart from being recognised as a coherent risk measure has been used in supply chain studies where it has been proved to be quite useful in supporting decision makers decisions [2, 5].

The model also involves a set of constraints, not described here due to space restrictions, that model the main problem characteristics: entities locations, capacities definition (e.g., supply; stock; production and transportation); demand satisfaction; technology constraints modelling process suitability and associated performance; transportation constraints considering transportation modes suitability and availability.

4 Case Study

The developed model is applied to an appliance components’ producer based in Verona, Italy. The company’s suppliers are located in Verona. Presently, the company owns a factory and a warehouse with enough capacity to meet the demand of their existing clients. These clients are located in three main European markets, namely in Spain, Italy, and Germany. If there is a significant increase in demand, the supply chain is not able to respond adequately. Currently, there are some new potential clients that are interested in knowing if the company’s decision-makers are going to study different SC forms of expansion.

Taking into account the clients’ locations, Leeds and Hannover are possible locations for opening new factories. The installation of these new entities might lead to important changes in the transportation modes, namely for clients that are located in non-European countries. In addition, it is important to notice that warehouses’ locations close to the markets should be taken into account. Currently, there are two types of products (fp1 and fp2) that are being produced. For this production, it is necessary to use two different types of technology. Moreover, it is important to highlight that end-of-life products can be recovered and remanufactured into final products. Additionally, there are three means of transport that can be used: truck, boat, and plane. There are two types of trucks (Truck1 and Truck2) that are different in capacity, variable costs, depreciation rate, and vehicle consumption. In this way, there is the possibility of transporting only by truck or through a combination of truck, boat and plane. Product’s demand uncertainty is considered.

5 Results

Taking into account the SC reality, two cases are studied to understand the different decisions that can be made, regarding the SC design and planning. Case A considers a stochastic approach since products’ demand is uncertain but it is not considered any risk measure; whereas case B contemplates uncertainty in products’ demand and studies the trade-offs between the expected value of (eNPV-eEnvImpact) and the associated financial risk, assessed through CVaR. Case B is examined for the extreme values (the highest and lowest associated risk). The eNPV and the eEnvImpact obtained in both cases (A and B) are shown in Table 1. For determining the VAR, a confidence level \(\alpha \) of 95% is considered, based on a decision-maker decision. For case B, assuming a confidence level of 95%, it is necessary to compute all the scenarios and assess the cumulative distribution function (Fig. 1). Thus, VaR is equal to \(40741 \times 10^{4}\) €, which means that, at the end of the time horizon, the difference between eNPV and eEnvImpact for the design and planning of this SC is going to be, at least, this value. Accordingly, it is possible to obtain the Pareto curve assessed through the CVaR risk measure (Fig. 2).

When analysing the supply chain structure decisions, it can be seen in Table 2 that there are significant changes comparing cases A and B. In addition, besides the already existent factory in Verona, all cases are going to have the same new factory installed (Hannover). Moreover, the results also show that in all cases there is the need to expand the existing capacity by opening a new warehouse. Concerning suppliers’ allocation, it can be seen that in risk-neutral and high-risk cases the results show that all factories are supplied by the closest suppliers plus Leeds’ supplier, which can be explained by the fact that the closest suppliers reach its capacity and it is necessary to use more distant ones. In contrast, in the low-risk case, where environmental impacts are higher, all factories are supplied by all suppliers, due to the balance between the lower costs of transportation and low costs of raw materials. Regarding intermodal transportation, and for all cases, sea option is preferred to air option, since sea transportation has a lower environmental impact. Considering a careful analysis into the results, it is important to highlight that network structure of the risk-neutral case is similar to the high-risk case, due to the fact that both SC entities and modes of transportation are similar, with some differences in capacities involved and in the product flows between entities.

6 Conclusion

This work presents a mixed integer linear programming model for the design and planning of SC that accounts for the economic and environmental concerns in the same objective function by monetizing environmental impacts and minimizing the associated risk under uncertainty on the products demand.

For the risk assessment, conditional value-at-risk was considered, particularly because it is the most common risk measure used in the literature and there is a consensus on their application in this area. To show the trade-offs between (eNPV - eEnvImpact) and risk, a Pareto optimal curve was developed through the application of the augmented \(\varepsilon \)-constraint method.

It is important to highlight that this analysis was only possible, due to the process of monetization, which allow us to quantify the environmental impacts in a monetary unit, namely in euros. In addition, monetization enables us to include in the same objective function both economic and environmental performances. Moreover, from the analysis done, it is clear that results are influenced by differences in risk strategies and this proves the importance of risk management in solving real-life problems.

For future work, there is the need to develop this topic, particularly to evolve monetization approaches so as to be an effective and reliable alternative to evaluate environmental impacts and better understand how to relate environmental costs with other supply chain costs. Additionally, an extension of this work should consider other risk measures in order to better conclude on its adequacy.

References

Report of the World Commission on Environment and Development: Our Common Future (1987). https://www.are.admin.ch/dam/are/en/dokumente/nachhaltige_entwicklung/dokumente/bericht/our_common_futurebrundtlandreport1987.pdf.download.pdf/our_common_futurebrundtlandreport1987.pdf

Amorim, P., Alem, D., Almada-Lobo, B.: Risk management in production planning of perishable goods. Ind. Eng. Chem. Res. 52(49), 17,538–17,553 (2013). https://doi.org/10.1021/ie402514c

Baptista, S., Barbosa-Póvoa, A.P., Escudero, L.F., Gomes, M.I., Pizarro, C.: On risk management of a two-stage stochastic mixed 0–1 model for the closed-loop supply chain design problem. Eur. J. Oper. Res. 274(1), 91–107 (2019). https://doi.org/10.1016/j.ejor.2018.09.04

Barbosa-Póvoa, A.P., da Silva, C., Carvalho, A.: Opportunities and challenges in sustainable supply chain: An operations research perspective. Eur. J. Oper. Res. 268(2), 399–431 (2018). https://doi.org/10.1016/j.ejor.2017.10.03

Carneiro, M.C., Ribas, G.P., Hamacher, S.: Risk management in the oil supply chain: A cvar approach. Ind. Eng. Chem. Res. 49(7), 3286–3294 (2010). https://doi.org/10.1021/ie901265n

Cristobal, M.P., Escudero, L.F., Monge, J.F.: On stochastic dynamic programming for solving large-scale planning problems under uncertainty. Comput. Oper. Res. 36(8), 2418–2428 (2009). https://doi.org/10.1016/j.cor.2008.09.009

Commission, European: Joint Research Centre- Joint Research Centre - Institute for Environment and Sustainability: International Reference Life Cycle Data System (ILCD) Handbook- Recommendations for Life Cycle Impact Assessment in the European context. Publications Office of the European Union (2011). https://doi.org/10.278/33030

Mavrotas, G.: Effective implementation of the \(\epsilon \)-constraint method in multi-objective mathematical programming problems. Appl. Math. Comput. 213(2), 455–465 (2009). https://doi.org/10.1016/j.amc.2009.03.037

da Silva, C., Barbosa-Póvoa, A.P., Carvalho, A.: Sustainable supply chain: monetization of environmental impacts, pp 773–778 (2018). https://doi.org/10.1016/B978-0-444-64235-6.50136-4

Zeballos, L.J., Gomes, M.I., Barbosa-Povoa, A.P., Novais, A.Q.: Addressing the uncertain quality and quantity of returns in closed-loop supply chains. Comput. Chem. Eng. 47, 237–247 (2012). https://doi.org/10.1016/j.compchemeng.2012.06.034

Acknowledgements

This work was supported by Portugal 2020, POCI-01-0145-FEDER-016418 by UE/FEDER through the program COMPETE2020 and FCT and Portugal 2020 under the project PTDC/EGE-OGE/28071/2017 and Lisboa - 01-0145-FEDER-28071.

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2021 Springer Nature Switzerland AG

About this paper

Cite this paper

da Silva, C., Carvalho, A., Barbosa-Póvoa, A.P. (2021). Design and Planning of Green Supply Chains with Risk Concerns. In: Relvas, S., Almeida, J.P., Oliveira, J.F., Pinto, A.A. (eds) Operational Research . APDIO 2019. Springer Proceedings in Mathematics & Statistics, vol 374. Springer, Cham. https://doi.org/10.1007/978-3-030-85476-8_12

Download citation

DOI: https://doi.org/10.1007/978-3-030-85476-8_12

Published:

Publisher Name: Springer, Cham

Print ISBN: 978-3-030-85475-1

Online ISBN: 978-3-030-85476-8

eBook Packages: Mathematics and StatisticsMathematics and Statistics (R0)