Abstract

Investment portfolio optimization problem is an important issue and challenge in the investment field. The goal of portfolio optimization problem is to create an efficient portfolio that incurs the minimum risk to the investor across different return levels. It should be noted that in many real cases, financial data are tainted by uncertainty and ambiguity. Accordingly, in this study, the fuzzy portfolio optimization model using possibilistic programming is presented that is capable to be used in the presence of fuzzy data and linguistic variables. Three objectives including the return, the systematic risk, and the non-systematic risk are considered to propose the fuzzy portfolio optimization model. Finally, the possibilistic portfolio optimization model is implemented in a real case study from the Tehran stock exchange to show the efficacy and applicability of the proposed approach.

Access provided by Autonomous University of Puebla. Download chapter PDF

Similar content being viewed by others

Keywords

- Portfolio optimization problem

- Fuzzy optimization

- Stock return

- Systematic risk

- Non-Systematic risk

- Possibilistic programming

1 Introduction

Portfolio optimization (PO) problem has been a practically important challenge and issue in financial markets ((Markowitz 1952); (Lobo et al. 2007); (Kalayci et al. 2019); (Ahmadi-Javid and Fallah-Tafti 2019)). PO problem is concerned with choosing an optimal and efficient portfolio strategy that can strike a trade-off between maximizing investment return and minimizing investment risk ((Konno and Suzuki 1995); (Cesarone et al. 2013); (Björk et al. 2014); (Guo et al. 2019); (Salah et al. 2020)). The important point that should be considered for modeling investment PO problem is the uncertainty of financial data ((Ghahtarani and Najafi 2013, 2018); (Huang 2017); (Peykani and Mohammadi 2018); (Li et al. 2019); (Peykani et al. 2020)). It should be noted that for proposing uncertain portfolio optimization (UPO) models, according to the nature and type of uncertainty, the popular uncertain programming approaches such as stochastic optimization (SO) ((Land et al. 1993); (Sueyoshi 2000); (Cooper et al. 2002); (Wu et al. 2013); (Zha et al. 2016)), fuzzy optimization (FO) ((Zadeh 1978); (Azadeh and Kokabi 2016); (Peykani et al. 2018a, 2019a, 2019b, 2021); (Peykani and Mohammadi 2018); (Seyed Esmaeili et al. 2019); (Peykani and Gheidar-Kheljani 2020)), and robust optimization (RO) ((Soyster 1973); (Ben-Tal and Nemirovski 2000); (Bertsimas and Sim 2004); (Ghassemi et al. 2017); (Namakshenas et al. 2017); (Ghassemi 2019); (Namakshenas and Pishvaee 2019); (Peykani and Roghanian 2015); (Peykani and Mohammadi 2018); (Peykani et al. 2018, 2019, 2019d; Peykani et al. 2020)) can be utilized.

The goal of this paper is to present the possibilistic portfolio optimization (PPO) model that is capable to be implemented under fuzzy data. It should be explained that a possibilistic programming approach is employed for dealing with the uncertainty and ambiguity of financial data. The possibilistic programming is an applicable and powerful approach for dealing with the epistemic uncertainty that is caused by the absence or lack of knowledge about the exact value of model parameters in fuzzy mathematical programming (FPP) (Naderi et al., 2016). Notably, to demonstrate the applicability of the proposed fuzzy portfolio optimization model, the PPO approach is implemented in a Tehran stock exchange (TSE).

The rest of this paper is organized as follows. The modeling of the deterministic portfolio optimization model will be explained in Sect. 2. Then, the possibilistic portfolio optimization model using possibilistic programming will be proposed in Sect. 3. The proposed PPO model is employed for the sample test from the Tehran stock exchange in Sect. 4. Finally, conclusions, as well as some future research directions, will be introduced in Sect. 5.

2 Deterministic Portfolio Optimization Model

In this section, the deterministic portfolio optimization (DPO) model will be introduced. It should be noted that three aspects of stock including the rate of return, the systematic risk, and the non-systematic risk are considered in the DPO model. The nomenclatures of the paper are introduced as follows:

\(j\) | the indices of stocks \(j = 1,...,n\) |

|---|---|

\(t\) | the indices of periods \(t = 1,...,T\) |

\(R_{E}\) | the expected return of portfolio |

\(R_{j}\) | the average return of jth stock |

\(R_{tj}\) | the return of jth stock in tth period |

\(R_{M}\) | the return of the market |

\(\sigma_{M}^{2}\) | the variance of the market |

\(\beta_{E}\) | the expected beta of the portfolio |

\(\beta_{j}\) | the beta of jth stock |

\(A_{j}\) | the minimum level of total fund which can be invested in the jth stock |

\(B_{j}\) | the maximum level of total fund which can be invested in the jth stock |

\(\varpi_{j}\) | the weight of jth stock in the portfolio |

\(\Omega_{t}\) | the value of the non-systematic risk of the portfolio in tth period |

\(\tau_{j}\) | a binary variable which will be one if jth stock is selected and zero otherwise |

Investment risk can be decomposed into two components including systematic risk and non-systematic risk. Systematic risk includes that part of the risk which depends on market variability and is unavoidable.

Beta \((\beta )\) sensitivity coefficient is one of the most popular systematic risk measures. The beta coefficient describes the sensitivity of the share return to the market portfolio return. In other words, beta is a measure of the volatility of share with the overall market and is obtained from Eq. (1) as follows:

Non-systematic risk indicates that a part of the investment risk can be eliminated by diversification. The absolute deviation (AD) is a non-systematic risk measure introduced by Konno & Yamazaki ((Konno and Yamazaki 1991)) for the first time. The definition of absolute deviation is as given in Eq. (2):

Now, the mean-absolute deviation-beta (MADB) model for portfolio optimization problem is presented as Model (3):

It should be noted that in Model (3), \(A_{j}\) and \(B_{j}\) are the lower and the upper bounds, respectively, for each stock and \(\varpi_{j}\) is the portion of the investment portfolio that is assigned to each stock. Accordingly, the limit of investment for each stock as a common financial market constraint is considered in the proposed portfolio optimization model.

3 Possibilistic Portfolio Optimization Model

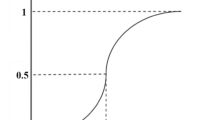

In this section, the possibilistic portfolio optimization (PPO) model under fuzzy data will be presented. It should be explained that the return and the beta have a trapezoidal fuzzy distribution \(\tilde{R}{ }(R^{1} ,R^{2} ,R^{3} ,R^{4} )\) and \(\tilde{\beta }{ }(\beta^{1} ,\beta^{2} ,\beta^{3} ,\beta^{4} )\) with the condition of \(R^{1} < R^{2} < R^{3} < R^{4}\) and \(\beta^{1} < \beta^{2} < \beta^{3} < \beta^{4}\). Now, a possibilistic programming approach and chance-constrained programming (CCP) will be applied to deal with fuzzy data in the MADB model as follows:

Then, by applying the possibility measure and chance-constrained programming, converting fuzzy chance-constraints into their equivalent crisp ones in one special confidence level \((\delta )\) is done as follows:

\({\text{Min}}{ }\frac{{1}}{{\text{T}}} \, \sum\limits_{t = 1}^{T} { \, \Omega_{t} }\) | (5) |

|---|---|

\({\text{S.t.}}\sum\limits_{j = 1}^{n} {\left( {\left( \delta \right)R_{j}^{3} + \left( {1 - \delta } \right)R_{j}^{4} } \right)\varpi_{j} } \ge R_{E}\) | |

\(R_{E} - \sum\limits_{j = 1}^{n} {\left( {\left( \delta \right)R_{tj}^{3} + \left( {1 - \delta } \right)R_{tj}^{4} } \right)\varpi_{j} } \le \Omega_{t} { },{ }\forall t\) | |

\(\sum\limits_{j = 1}^{n} {\left( {\left( {1 - \delta } \right)R_{tj}^{1} + \left( \delta \right)R_{jt}^{2} } \right)\varpi_{j} } - R_{E} \le { }\Omega_{t} { },{ }\forall t\) | |

\(\sum\limits_{j = 1}^{n} {\left( {\left( {1 - \delta } \right)\beta_{j}^{1} + \left( \delta \right)\beta_{j}^{2} } \right)\varpi_{j} } \le \beta_{E}\) | |

\(\sum\limits_{j = 1}^{n} {\varpi_{j} } = 1\) | |

\(A_{j} \tau_{j} \le \varpi_{j} \le B_{j} \tau_{j} { },{ }\forall j\) | |

\(\tau_{j} \in \{ 0,1\} { },{ }\forall j\) | |

\(\Omega_{t} \ge 0{ },{ }\forall t\) | |

\(\varpi_{j} \ge 0{ },{ }\forall j\) |

Finally, the possibilistic mean-absolute deviation-beta (PMADB) model is proposed as Model (5) that can be employed by investors for portfolio optimization under fuzzy data and linguistic variables.

4 Experimental Results

In this section, the possibilistic portfolio optimization model will be implemented for a real-world case study from the Tehran stock exchange. Accordingly, the data set for five stocks are extracted from TSE. Tables 1, 2, 3, 4, and 5 show the data set for beta and return of five stocks under trapezoidal fuzzy number:

Now, after collecting data, the possibilistic mean-absolute deviation-beta model will be run. The results of the PMADB model that is presented in Model (5) for five confidence levels including 0, 25, 50, 75, and 100% are introduced in Table 6:

As can be seen in Table 6, by increasing the confidence level from 0 to 100%, the objective functions including mean, absolute deviation, and beta get worse. Also, illustrative results show that the proposed PMADB model is effective for portfolio optimization in the presence of fuzzy data.

5 Conclusions

In this study, an uncertain portfolio optimization model is presented that is capable to be used under fuzzy environment. It should be explained that in the proposed portfolio optimization model, three objectives including mean, absolute deviation, and beta as well as investment constraint are considered. Also, the possibilistic programming and chance-constrained programming approaches are employed to deal with uncertainty. For future studies, data envelopment analysis approach (Seyed Esmaeili, 2014; Peykani et al., 2018c; Peykani and Mohammadi , 2018, 2019, 2020; Seyed Esmaeili and Rostamy-Malkhalifeh , 2018), machine learning models (Park et al., 2014; Ban et al., 2018; Shahhosseini et al., 2019, 2020, 2019; Paiva et al., 2019), and game theory ( Migdalas, 2002; Sadeghi and Zandieh, 2011; Esmaeili et al., 2015) can be applied for presenting investment portfolio optimization approach.

References

Ahmadi-Javid A, Fallah-Tafti M (2019) Portfolio optimization with entropic value-at-risk. Eur J Oper Res 279(1):225–241

Azadeh A, Kokabi R (2016) Z-number DEA: a new possibilistic DEA in the context of Z-numbers. Adv Eng Inform 30(3):604–617

Ban GY, El Karoui N, Lim AE (2018) Machine learning and portfolio optimization. Manage Sci 64(3):1136–1154

Ben-Tal A, Nemirovski A (2000) Robust solutions of linear programming problems contaminated with uncertain data. Math Program 88(3):411–424

Bertsimas D, Sim M (2004) The price of robustness. Oper Res 52(1):35–53

Björk T, Murgoci A, Zhou XY (2014) Mean–variance portfolio optimization with state-dependent risk aversion. Math Financ: Int J Math Stat Financ Econ 24(1):1–24

Cesarone F, Scozzari A, Tardella F (2013) A new method for mean-variance portfolio optimization with cardinality constraints. Ann Oper Res 205(1):213–234

Cooper WW, Deng H, Huang Z, Li SX (2002) Chance constrained programming approaches to technical efficiencies and inefficiencies in stochastic data envelopment analysis. J Oper Res Soc 53(12):1347–1356

Esmaeili M, Bahrini A, Shayanrad S (2015) Using game theory approach to interpret stable policies for Iran’s oil and gas common resources conflicts with Iraq and Qatar. J Ind Eng Int 11(4):543–554

Ghahtarani A, Najafi AA (2013) Robust goal programming for multi-objective portfolio selection problem. Econ Model 33:588–592

Ghahtarani A, Najafi AA (2018) Robust optimization in portfolio selection by m-MAD model approach. Econom Comput Econom Cybernet Stud Res 52(1):279–291

Ghassemi A, Hu M, Zhou Z (2017) Robust planning decision model for an integrated water system. J Water Resour Plan Manag 143(5):05017002

Ghassemi A (2019) System of systems approach to develop an energy-water nexus model under uncertainty. Doctoral Dissertation, University of Illinois

Guo X, Chan RH, Wong WK, Zhu L (2019) Mean–variance, mean–VaR, and mean–CVaR models for portfolio selection with background risk. Risk Manage 21(2):73–98

Huang X (2017) A review of uncertain portfolio selection. J Intell Fuzzy Syst 32(6):4453–4465

Kalayci CB, Ertenlice O, Akbay MA (2019) A comprehensive review of deterministic models and applications for mean-variance portfolio optimization. Expert Syst Appl 125:345–368

Konno H, Suzuki KI (1995) A mean-variance-skewness portfolio optimization model. J Oper Res Soc Jpn 38(2):173–187

Konno H, Yamazaki H (1991) Mean-absolute deviation portfolio optimization model and its applications to Tokyo stock market. Manage Sci 37(5):519–531

Land KC, Lovell CK, Thore S (1993) Chance-constrained data envelopment analysis. Manag Decis Econ 14(6):541–554

Li B, Sun Y, Aw G, Teo KL (2019) Uncertain portfolio optimization problem under a minimax risk measure. Appl Math Model 76:274–281

Lobo MS, Fazel M, Boyd S (2007) Portfolio optimization with linear and fixed transaction costs. Ann Oper Res 152(1):341–365

Markowitz H (1952) Portfolio selection. J Financ 7(1):77–91

Migdalas A (2002) Applications of game theory in finance and managerial accounting. Oper Res Int J 2(2):209–241

Naderi MJ, Pishvaee MS, Torabi SA (2016) Applications of fuzzy mathematical programming approaches in supply chain planning problems. In: Fuzzy logic in its 50th year. Springer, Cham, pp 369–402

Namakshenas M, Pishvaee MS, Mahdavi Mazdeh M (2017) Event-driven and attribute-driven robustness. Iran J Oper Res 8(1):78–90

Namakshenas M, Pishvaee MS (2019) Data-driven robust optimization. Robust and constrained optimization: methods and applications. Nova Science Publishers, Inc, pp 1–40

Paiva FD, Cardoso RTN, Hanaoka GP, Duarte WM (2019) Decision-making for financial trading: a fusion approach of machine learning and portfolio selection. Expert Syst Appl 115:635–655

Park J, Lim J, Lee W, Ji S, Sung K, Park K (2014) Modern probabilistic machine learning and control methods for portfolio optimization. Int J Fuzzy Log Intell Syst 14(2):73–83

Peykani P, Gheidar-Kheljani J (2020) Performance appraisal of research and development projects value-chain for complex products and systems: the fuzzy three-stage DEA approach. J New Res Math 6(25):41–58

Peykani P, Mohammadi E (2019) Performance measurement of decision making units with network structure in the presence of undesirable output. J New Res Math 5(17):157–166

Peykani P, Mohammadi E (2020) Window network data envelopment analysis: an application to investment companies. Int J Ind Math 12(1):89–99

Peykani P, Roghanian E (2015) The application of data envelopment analysis and robust optimization in portfolio selection problem. J Oper Res Its Appl 12(44):61–78

Peykani P, Mohammadi E, Pishvaee MS, Rostamy-Malkhalifeh M, Jabbarzadeh A (2018a) A novel fuzzy data envelopment analysis based on robust possibilistic programming: possibility, necessity and credibility-based approaches. RAIRO-Oper Res 52(4–5):1445–1463

Peykani P, Mohammadi E, Seyed Esmaeili FS (2018c) Measuring performance, estimating most productive scale size, and benchmarking of hospitals using DEA approach: a case study in Iran. Int J Hosp Res 7(2):21–41

Peykani P, Mohammadi E, Rostamy-Malkhalifeh M, Hosseinzadeh Lotfi F (2019a) Fuzzy data envelopment analysis approach for ranking of stocks with an application to Tehran stock exchange. Adv Math Financ Appl 4(1):31–43

Peykani P, Mohammadi E, Emrouznejad A, Pishvaee MS, Rostamy-Malkhalifeh M (2019b) Fuzzy data envelopment analysis: an adjustable approach. Expert Syst Appl 136:439–452

Peykani P, Mohammadi E, Seyed Esmaeili FS (2019d) Stock evaluation under mixed uncertainties using robust DEA model. J Qual Eng Prod Optim 4(1):73–84

Peykani P, Mohammadi E (2018) Robust data envelopment analysis with hybrid uncertainty approaches and its applications in stock performance measurement. In: Proceedings of The 14th International Conference on Industrial Engineering. Iran

Peykani P, Mohammadi E (2018) Fuzzy network data envelopment analysis: a possibility approach. In: Proceedings of The 3th International Conference on Intelligent Decision Science. Iran

Peykani P, Mohammadi E (2018) Interval network data envelopment analysis model for classification of investment companies in the presence of uncertain data. J Ind Syst Eng 11(Special issue: 14th International Industrial Engineering Conference):63–72

Peykani P, Mohammadi E (2018) Portfolio selection problem under uncertainty: a robust optimization approach. In: Proceedings of The 3th International Conference on Intelligent Decision Science. Iran

Peykani P, Mohammadi E, Sadjadi SJ, Rostamy-Malkhalifeh M (2018) A robust variant of radial measure for performance assessment of stock. In: Proceedings of The 3th International Conference on Intelligent Decision Science. Iran

Peykani P, Seyed Esmaeili FS, Hosseinzadeh Lotfi F, Rostamy-Malkhalifeh M (2019) Estimating most productive scale size in DEA under uncertainty. In: Proceedings of The 11th National Conference on Data Envelopment Analysis. Iran

Peykani, P., Mohammadi, E., Jabbarzadeh, A., Rostamy-Malkhalifeh, M., Pishvaee, M.S.: A novel two-phase robust portfolio selection and optimization approach under uncertainty: A case study of Tehran stock exchange. Plos One 15(10), e0239810 (2020)

Peykani P, Mohammadi E, Farzipoor Saen R, Sadjadi SJ, Rostamy-Malkhalifeh M (2020) Data envelopment analysis and robust optimization: a review. Expert Syst 37(4):e12534

Peykani P, Mohammadi E, Emrouznejad A (2021) An adjustable fuzzy chance-constrained network DEA approach with application to ranking investment firms. Expert Syst Appl 166:113938

Sadeghi A, Zandieh M (2011) A game theory-based model for product portfolio management in a competitive market. Expert Syst Appl 38(7):7919–7923

Salah HB, Gannoun A, Ribatet M (2020) Conditional Mean-Variance and Mean-Semivariance models in portfolio optimization. J Stat Manag Syst 1–24

Seyed Esmaeili FS (2014) The efficiency of MSBM model with imprecise data (interval). Int J Data Envel Anal 2(1):343–350

Seyed Esmaeili FS, Rostamy-Malkhalifeh M (2018) Using interval data envelopment analysis (IDEA) to performance assessment of hotel in the presence of imprecise data. In: Proceedings of The 3th International Conference on Intelligent Decision Science. Iran

Seyed Esmaeili FS, Rostamy-Malkhalifeh M, Hosseinzadeh Lotfi F (2019) The possibilistic Malmquist productivity index with fuzzy data. In: Proceedings of The 11th National Conference on data envelopment analysis. Iran

Shahhosseini M, Hu G, Archontoulis SV (2020) Forecasting corn yield with machine learning ensembles. Front Plant Sci 11:1120

Shahhosseini M, Martinez-Feria RA, Hu G, Archontoulis SV (2019) Maize yield and nitrate loss prediction with machine learning algorithms. Environ Res Lett 14(12):124026

Shahhosseini M, Hu G, Pham H (2019) Optimizing ensemble weights for machine learning models: a case study for housing price prediction. In: Proceedings of INFORMS International Conference on Service Science. Springer, Cham, pp 87–97

Soyster AL (1973) Convex programming with set-inclusive constraints and applications to inexact linear programming. Oper Res 21(5):1154–1157

Sueyoshi T (2000) Stochastic DEA for restructure strategy: an application to a Japanese petroleum company. Omega 28(4):385–398

Wu C, Li Y, Liu Q, Wang K (2013) A stochastic DEA model considering undesirable outputs with weak disposability. Math Comput Model 58(5–6):980–989

Zadeh LA (1978) Fuzzy sets as a basis for a theory of possibility. Fuzzy Sets Syst 1(1):3–28

Zha Y, Zhao L, Bian Y (2016) Measuring regional efficiency of energy and carbon dioxide emissions in China: a chance constrained DEA approach. Comput Oper Res 66:351–361

Author information

Authors and Affiliations

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2022 The Author(s), under exclusive license to Springer Nature Switzerland AG

About this chapter

Cite this chapter

Peykani, P., Namakshenas, M., Nouri, M., Kavand, N., Rostamy-Malkhalifeh, M. (2022). A Possibilistic Programming Approach to Portfolio Optimization Problem Under Fuzzy Data. In: Terzioğlu, M.K. (eds) Advances in Econometrics, Operational Research, Data Science and Actuarial Studies. Contributions to Economics. Springer, Cham. https://doi.org/10.1007/978-3-030-85254-2_23

Download citation

DOI: https://doi.org/10.1007/978-3-030-85254-2_23

Published:

Publisher Name: Springer, Cham

Print ISBN: 978-3-030-85253-5

Online ISBN: 978-3-030-85254-2

eBook Packages: Economics and FinanceEconomics and Finance (R0)