Abstract

The core product of all airlines is rather homogenous as in selling a seat on a flight between two airports. Therefore, the only protectable strategic resources of an airline are its brand, the customer basis and its position at a hub airport. The core of its operations is shaped by its network meaning that network management is crucial. This chapter shows the different strategies as well as their typologies including point-to-point or hub-and-and-spoke. The different strategies mainly rely on network effects and are shaped by many variables. These can also be complemented by cooperation such as alliances or codeshares. Furthermore, the application of network effects creates additional value for customers which helps differentiate business models and in turn shapes the different airlines’ concepts.

Access provided by Autonomous University of Puebla. Download chapter PDF

Similar content being viewed by others

Keywords

- Network

- Strategy

- Hub

- Customers

- Brand

- Network management

- Hubbing

- Milk can runs

- Point-to-point

- Niche

- Alliances

- Joint-venture

- Codeshares

- Network effects

- Economies of scale

- Connectivity

- Waves

- Airline business models

- Full-service

- Network carriers

- Regional carriers

- Leisure airlines

- No-frills

- Unbundlers

- Boutique

- Connectors

-

The only protectable strategic resources of an airline are the brand, the customer basis and the position at a hub.

-

The core of airline operations is networks and therefore network management.

-

Different strategies rely on a different extent of network effects.

-

The use of network effects also differentiates business models.

-

Different types of planes lead to different concepts of airlines.

The core product of all airlines is rather homogenous as in selling a seat on a flight between two airports. Therefore, the only protectable strategic resources of an airline are its brand, the customer basis and its position at a hub airport. The core of its operations is shaped by its network meaning that network management is crucial. This chapter shows the different strategies as well as their typologies including point-to-point or hub-and-and-spoke. The different strategies mainly rely on network effects and are shaped by many variables. These can also be complemented by cooperation such as alliances or codeshares. Furthermore, the application of network effects creates additional value for customers which helps differentiate business models and in turn shapes the different airlines’ concepts.

5.1 Introduction

The airline sector has a reputation of not being very profitable and vulnerable towards external impacts. Over time, some years with profits followed years of losses due to a strong dependency of airlines on economic development and impacts of technological progress. Since the airline sector is a commodity market, where margins are small, this is still the case. Therefore, airline managers need to look for strategies, which allow them to become more efficient, mostly by applying economies of scale either through the size of their own company or by cooperating with other airlines in networks or alliances. Networks allow to operate more efficiently and to realise net effects in bigger entities. They have an impact on the choice of airline business models which influence the profit margin and the airplane concept of an airline.

Firstly, this chapter briefly highlights the developments in aviation strategy and shows some airline strategy approaches. Secondly, it introduces the reader to network management of airline operations by defining airline net economies, the main variables of airline network design and network management processes. Thirdly, airline business models and the different concepts behind them are described.

5. Introductory Case: Austrian Airlines

By Andreas Wittmer and Christopher Siegrist

Austrian Airlines was founded in 1957 (“Österreichische Luftverkehrs AG”). After many years of cooperation with SAS and Swissair, which even led to a first strategic alliance – the so-called Qualiflyer group in the 1990s – Austrian Airlines joined the Star Alliance in 2000. At first it did well as an independent Airline and member of the Star Alliance. But after 2004 it turned bad. After years of losses, including a record loss of EUR 430 million in 2008, Austrian Airlines were taken over by the Lufthansa Group in 2009. The takeover posed the beginning of a successful restructuring process with a restructuring assistance of EUR 500 million granted by the European Commission. This led to product improvements and lowering the cost base, e.g. by reducing the variety of aircraft in their fleet.

Austrian Airlines operates a limited number of intercontinental connections with a comparably high share of tourist traffic which it inherited with the acquisition of the former charter carrier Lauda Air in 2004. The network focuses on links to Central and Eastern European countries. Today, the airline offers services to an impressive variety of destinations in Eastern Europe and Central Europe (◘ Fig. 5.1). At its Vienna hub, Austrian Airlines operates with a fleet of 83 aircraft to over 130 destinations, with over 35 destinations in Central and Eastern Europe providing a dense network.

Austrian Airlines has made substantial investments in its product. The Business Class is known for its top cuisine. Austrian outlines in its mission statement that their focus lies in connecting East and West through their centrally located hub in Vienna. This implies a short-haul hub between Eastern and Western Europe, which from a network strategy perspective is questionable. From a customer perspective, the airline states following credo:

-

Technical reliability, punctuality and an orientation to service

-

“We carry Austria in our hearts, and ever more customers into the world”

-

Huge personal commitment every day by its employees

The network faced several difficulties in the past decade. With the restructuring programme taking place, Austrian Airlines’ network was cut down to a handful of destinations in Asia and North America. Furthermore, with Austrian Airlines being part of the Lufthansa Group, Zurich was developed as the third intercontinental hub within the group, thus weakening Vienna’s position. The long-time challenge facing Austrian Airlines’ East-West network strategy in combination with the rapid expansion of low-cost carriers at Vienna airport and nearby Bratislava airport. Especially the market entry of Wizzair is challenging Austrian Airlines. Being an Eastern European low-cost carrier, Wizzair offers cheap flights between Western, Central and Eastern Europe, a strategy that Austrian Airlines has been pursuing. But also, the entry of RyanAir by taking over FlyNicki and especially the European base of Easy Jet in Vienna, made Vienna to become an airport dominated by low-cost carriers, although the airport provides a high level of service in a modern environment enabling fast connection times for the hub carrier.

The new competition is going to create a three-fold increase in seats offered from Vienna of seven million by 2020. Furthermore, Austrian Airlines is going to face low-cost competition on 60% of its routes. This has prompted Austrian to through a further phase of streamlining its operations, with staff numbers being reduced and the fleet further streamlined to remain competitive against the new threat.

Austrian Airlines business model focusing on being a connector between West and East has not worked, as Austrian early on focused on connection West and East Europe, instead of focusing on becoming a leading connector of Europe to Far East. The above-mentioned aggressive low-cost carriers took their core business, which could not have a very profitable one in any case, as stop-overs on the short-haul market are expensive and under high price pressure.

(Austrian Airlines, n.d.; Benz, 2019)

Route map of Austrian Airlines (routes covered by Austrian Airlines: grey connection; code share routes: white connections) (Source: ► www.austrian.com)

Questions:

Why did Austrian run into troubles in the mid-2000s, while Swiss recovered from the grounding?

How do you evaluate the network of Austrian Airlines?

What is the challenge with the East-West connecting model?

5.2 Foundation of Aviation Strategies

Due to the strong regulation of the air transport industry, carriers, for a long time, rarely had the need to be concerned with competitive strategy. As barriers to entry and exit were high and competitors relatively weak, until the late 1970s, the level of airline competition was relatively low or non-existent. It was not until the US airline deregulation act in 1978, that new entrants entered the market, challenged the status quo and gave rise to “competitive structures” in aviation. Immediately after deregulation, new airlines with significantly lower costs – largely driven by low-cost non-union labour and the wide availability of inexpensive second-hand aircraft – entered the formerly regulated high volume point-to-point markets of the established carriers. However, the established airlines were largely able to capitalise on their size and responded with a full range of innovative strategies. They set up frequent flyer programmes (FFP) and exploited computer reservation systems (CRS). The most important strategic development was the adoption of the hub-and-spoke network which allowed the airlines to dramatically reduce the number of flights required whilst still being able to provide universal coverage throughout their networks. This in turn reduced airline costs, which were passed on to the consumers in the form of lower fares.

20 years after the industry deregulation began in the USA, deregulation of airline markets has been replicated in Europe and another 10 years later in many regions around the world. The airline industry has become increasingly global in its orientation and scope and much more competitive. As a consequence, all players in the industry are increasingly searching for answers on how to maintain their position in competition. Apart from the approaches introduced before (frequent flyer programmes, customer reservation system and network management), other fields of strategic orientation that have recently gained importance are the development of strategic alliances and customer relationship management.

Since the air transportation industry still is not fully deregulated, strategic management issues – including the range of strategic choices – are subject to a number of limitations which prevent the industry from developing like other industries. Mergers & Acquisitions (M&A), for example, remain a politically sensitive matter. Contrary to other markets such as telecommunication, car manufacturing or shipping, in which internationally organised enterprises develop, cross-border or global mergers and acquisitions are still limited in the aviation industry. Furthermore, the industry is often not able to act completely independently from its respective governments. While on the one hand this leads to a certain protection of individual actors, on the other hand it may limit the independence of the industry players and the range of strategic choices and ultimately harm other airlines. For instance, agreements on the number and destinations of cross-border flights can still be defined by governments in bilateral air agreements. Very often governments take positions contrary to free market beliefs whenever these are deemed to be against their national interests, thus strongly limiting competition.

5.3 Airline Strategy Approaches

Today, the airline industry is highly competitive and the various industry players constantly strive to build up and maintain a competitive advantage. Strategies can be static or dynamic. Static strategies focus on protecting existing market positions in which the brand and hub dominance play important roles. Dynamic strategies focus on market development and move forward through learning and building up of a knowledge database (e.g. about customers, markets, etc.).

Porter (1996) states that airline “strategy involves a whole system of activities, not a collection of parts. Its [the airlines’] competitive advantage comes from the way its activities fit and reinforce one another”. While this quotation illustrates that airline strategy cannot be reduced to single elements but is rather a combination of three fields with several factors. They can be built on the basis of market advantages, advantages in networks and advantages with regard to resources (◘ Fig. 5.2).

Network

Network structure: A network can be defined as a collection of nodes and edges (Wojahn, 2008). Airline networks generally consist of air traffic connections (edges) from one airport to another (nodes). Major characteristics that specify air traffic networks are parameters such as size, frequency and connectivity. Airline network management has important links to service attributes such as punctuality and geographical coverage. There are two basic strategies concerning the outlay of a network in air transportation: a hub-and-spoke system (single-hub or multi-hub) and a point-to-point network. Airlines that operate the former try to offer a high connectivity and many different O&D (Origin & Destination) connections. Carriers thereby build on economies of scale, scope and density that are inherent to large networks. The hub-and-spoke strategy builds on the concentration of air traffic through the hub. In general, it is possible to pursue both a multi-hub network strategy and a single-hub strategy. In any case, the concentration of airlines on hub operations leads to a situation in which individual airports often are dominated by a single airline. As a consequence, these airlines frequently control a high number of slots at individual airports. With these valuable resources they are able to build up strong hub entrance barriers. At many airports, big international flag carriers control most slots, and by not selling the latter, these flag carriers are able to maintain control over the access to the hub. In contrast, point-to-point traffic relies on strong and stable individual markets which allow for filling up the planes without feeding traffic. These networks can be operated with a much lower degree of complexity. The opening or closure of point-to-point traffic does not affect the overall network structure.

Partnerships and alliances: Given the strong limitations to M&A activities in the international airline industry, Stoll (2004) states that “the formation of alliances fundamentally reflects the airline industry’s efforts to develop its global network-based structure within the limits imposed by government regulations”. In recent years, with the trend moving towards an increasing globalisation of the airline industry, the formation of airline alliances has gathered momentum as a means to remain competitive and to gain access to a global market which is too large to be dominated by any existing airline. Today, most major airlines are involved in alliance. The three big alliances – Star Alliance, oneworld and SkyTeam – contain almost three-quarters of the worldwide scheduled air traffic (73.1 per cent as of December 2008). Besides the revenue-generating functions of alliances such as code-sharing and selling seats on each other’s flights, many alliances include service elements like mutual access to airport lounges, pooling of frequent flyer programmes and joint marketing and thus share costs.

Resources

Brand image: Brands serve for the identification and positioning of usually rather homogenous service products. By serving as an element of trust and orientation they help to reduce the risk perceived by customers. In general, it takes several years or even decades to build up a positive brand image. Once a brand is associated with positive attributes such as quality and reliability it may represent an important asset for airlines which can be capitalised on, for example, in the form of price premiums.

Service level and service innovation: The service product of an airline consists of a wide range of different service attributes. These comprise services on the ground (such as lounge access) and in the air (such as in-flight amenities and meals). Even though, in general, services are highly cost intensive, they allow for skimming a price premium and for a differentiation from competition and by this creating customer perceived barriers. An airlines capability to know service needs of their customers is a unique advantage. It leads to constant service innovation and the development of new services. Service innovation and introduction instead of unbundling services by copying competitors is creating strategic advantage and keeps the airline being a first mover.

Customer loyalty and relationship management: Customer loyalty does not only lead to more frequent purchases, but also has important side effects like word of mouth and reduced-price sensitivity. As the acquisition of new customers is expensive, airlines put a strong focus on the retention of existing customers. An important element of customer relationship management is the operation of reward systems. Frequent flyer programmes [FFPs] in particular represent a mechanism that allows transforming monetary value into a new “currency” which – due to its reduced transparency but increased prestige – has a higher perceived value for the customer than a pure financial reward. There are two kinds of points passengers can collect: (1) Reward points, which can be used to upgrade flights or buy a product in the airlines’ shop offer. (2) Status points which allow passengers to be listed into different status levels (e.g. blue, silver, gold and platinum), which allow status holders to receive different services or service levels. While this non-monetary award leads to an increased customer value, the associated status systems also allow differentiating customers and providing them with personally identifiable services. By this, FFP can be used as effective market entry barriers.

Hub dominance: A hub must have a minimal size (minimal number of frequencies) in order to be attractive and thus be able to increase passenger market shares. With the increasing frequency of flights, especially the attraction of business passengers also increases. The dominant airline (owning the best slots) of an airport offers the best connections at the best times and makes it attractive to other airlines to use the hub if there is a good selection of connecting flights. If it becomes too big and crowded, market shares decrease again. This is the case when hub dominance and crowdedness of the airport lead to increasing waiting times at check-in and security and longer distances between gates. In such cases, passengers mind those airports as connecting airports. Hence, hub airports and hub carriers need to collaborate to make sure the efficiency won’t decrease for the passengers once economies for the airline and airport increase.

Market

The airline industry operates in a highly competitive commodity market. Basic products (planes, seats, safety regulation, etc.) are similar. Some airlines have chosen to create value by offering the basic, unbundled product for a low price, but charge extra for ancillaries. By this the customer perceives the price of the flight as very low and does not take all extra costs into consideration, when making a travel decision. Once the decision has been made and the customer books, the willingness to pay has increased as the mind is already set for the visit of the destination and deals with accommodation etc. Other airlines provide global connectivity in a global network (alliance) and differentiate by providing supplementary services to customers. They need to charge slightly higher prices due to their higher cost structure and less utilisation of their capital (planes) due to network connectivity (higher turnaround times and waiting times for delayed passengers, etc.). Some airlines focus on specific market segments such as leisure carriers and some aim at supporting network airlines on a regional level by offering wet lease opportunities for the big network airlines.

Pricing plays, next to network management, a key role in managing an airline in a competitive market.

-

Pricing: Due to the perishability of the product, pricing in aviation has – apart from its revenue generating and positioning function – an important task of steering demand. As a consequence, pricing is considered an important strategic component that represents one of the core functions of an airline. Generally, two main concepts of pricing can be distinguished. On the one hand, prices are constantly adapted (in the sense of short term finetuning) according to the reservation curve reflecting current and projected ticket purchases. On the other hand, prices are set according to service and booking categories. As for the service category, today most airlines operate a three-class system. Airlines commonly fence service classes by service product elements (such as lounge access, ground service, seat quality and catering). Booking classes are fenced by booking conditions (such as minimum time for pre-booking, refunds and minimum stay). The general aim of pricing strategies is to target each single passenger’s maximum readiness to pay. The fencing mechanisms introduced beforehand are used to separate markets in a way that somebody who would be ready to pay more cannot take advantage of a lower price category. Different pricing strategies that may be applied in the aviation industry could be the matching or penetration strategy (match or even offer prices below those offered by competitors) with the goal of gaining or preserving market shares or a skimming strategy (keeping prices higher than competitors) with the goal of skimming the market of well-paying customers.

-

Distribution channels: The choice and mix of distribution channels (both direct and indirect) are important for airlines and can be used as a market entry barrier. Indirect offline sales (such as specialised corporate client programmes and travel agencies) and online sales represent major distribution channels. On the one hand, separate sales channels can be used to target different customer groups. For example, certain tariff categories are still heavily booked merely through travel agencies. On the other hand, it may become necessary to distribute discounts and unbundled products with ancillaries and supplementary services through special channels (for example through the cooperation with retailers, or directly online over one’s webpage or by using IATA’s New Distribution System (NDC)) to avoid a cannibalisation of the main market. It becomes more and more important to be able to generate extra sales in combination with the ticket sale. Some airlines make up to 50% with extra sales revenue.

Competitive advantages can be achieved as a result of a focus on resources by following a combination of a static and dynamic approach. Protecting the brand and the dominant position at hub airport are static approaches, whereas creating customer loyalty by using tools such as loyalty programmes focus on developing a better position in the demand market.

Combining the different factors introduced before, it is suggested that there exist three generic airline strategies which are pursued in the airline industry. While specific factors may feature a stronger or weaker forming at individual airlines, can be proposed that a firm is able to build competitive advantages by pursuing the general outlay of one of the following three common strategies based on Porter’s strategy concept (Porter, 1980). Around these generic strategies different business models have appeared on the market:

The Quality Leadership Strategy

In general, airlines that pursue a quality leadership strategy establish a sizeable worldwide network, building upon a critical mass at a hub or a dominant position in a particular geographical market. The key underlying strategy is to draw on the hub-and-spoke economies, namely economies of scale, scope and density (economies of scale, scope and density are explained in ► Sect. 5.1).

The sophistication in network and hub management is competitive advantage, but over the years has become a core competence of airlines and airports and by this a standard for success. It can still be used as an effective barrier against small and medium-sized airlines trying to challenge a major player’s established and well-integrated network. This holds particularly true where the network’s power is reinforced by infrastructural entry barriers which are caused by congestion, e.g. the non-availability of slots at key airports. Furthermore, an airline that is able to dominate a big hub is generally in the position to demand a “hub premium” with regard to both leisure and business traffic. A disadvantage of large hub-and-spoke networks is their complex and expensive operation, requiring a huge surplus of material, space and labour.

Airlines that pursue a quality leadership strategy usually build on a strong brand, with a special focus on attributes such as quality and service. Since airlines that focus on service-quality are able to build up a strong brand image, a special focus of these carriers is laid on the offering of services, both on the ground and in the air.

Airlines that differentiate themselves on the basis of the service level are able to partially reduce the need to compete on costs and prices. For business passengers, who are willing to pay more for certain amenities than leisure travellers, a superior service level is of particular importance. Services that are offered include in-flight services (e.g. catering, in-flight entertainment) and ground services (e.g. lounges, premium check-in facilities). Another important part of the service level is the successful operation of a full-size network. Through this, it is aimed to offer high frequencies and to minimise the travelling time.

Regarding customer relationship management, airlines that focus on a quality leadership strategy must have a clear understanding of their customers’ needs and of the investments and capabilities necessary to meet those needs, e.g. sophisticated frequent flyer programmes (Stoll 2004). Customers will reward this uniqueness with a higher willingness to pay and an increased loyalty. Moreover, FFPs and substantial volume-based commissions that have to be paid to travel agents may represent an effective barrier for competitors.

Airlines that pursue a quality leadership strategy generally follow a multi-channel distribution strategy to reach various customer segments. In this context, indirect offline sales play an important role. In addition, however, bookings via online travel agencies and company homepages are also offered. Hub-and-spoke networks allow for a more efficient marketing and customer relationship management due to distribution advantages through agents and an increased attractiveness of the airlines’ FFPs.

In general, carriers which operate in this segment are a member in one of the major international airline alliances and/or have close connections and financial stakes in other companies (e.g. Air France/KLM Group and Lufthansa Group).

The Cost Leadership Strategy

Airlines that pursue a cost-leadership strategy strive to outperform rivals by producing their services at a high labour and capital productivity. In this context “standardisation” is often considered the main attribute for the success of this strategy. Airlines that follow a cost-leadership strategy are often called “low-cost” or “no-frills” or point-to-point carriers.

Concerning the network structure, a low-cost basis is achieved by offering non-complex point-to-point transportation services on high-volume routes. The routes are served with quick turnaround times and are operated with few or one type of aircraft. Airports which are served by low-cost carriers are often dominated by one company, resulting in a high bargaining power for this carrier.

Concerning the brand, low-cost airlines pursue an image strategy which underlies their core value proposition of offering a low-cost product. Marketing expenditures are substantially lower than compared to those of full-service carriers and commonly are cut to a basic level.

Low-cost airlines have significantly lower input costs due to reduced service levels. By cutting off most frills, these carriers usually do not offer free meals, in-flight entertainment and lounges. A single-class, high density seating configuration is employed. Service attributes that are directly connected to the core of the actual transport service, i.e. punctuality, reliability and offered frequencies, however, are kept at a high level to attract passengers.

For cost-saving reasons, low-cost airlines do not maintain a sophisticated customer relationship management, which is linked to frequent flyer programmes. Customers of these airlines are considered to be less sensitive to service-based characteristics.

The simplicity of the low-cost business model is reflected in its simple, one-way-based pricing structure of fares, which only makes use of minimal fencing restrictions. Low-cost airlines generally sell their inventory on a first-come, first-served basis. In general, low-cost airlines are not members of an airline alliance, but put a strong focus on market dominance concerning specific routes or specific regions.

The Niche Carrier Strategy (“Focus Strategy”)

Apart from the other two generic strategies, a set of niche opportunities exists from which niche carriers may take advantage. The niche or focus strategy is directed towards serving the needs of a limited customer group or market segment. Niches in air transportation can either be service related, geographically defined or to be confined for cost advantages. In this context, airlines are supposed to be able to gain a competitive advantage by better serving the needs of the chosen segment and by concentrating their efforts and activities. However, since there are a number of different approaches to operate in a niche and airlines may focus one distinctive approach, the individual carrier´s niche strategy may not be suitable for generalisations and thus might hardly be representative.

A typical service-related niche is focusing merely on the market of business travellers. Corporate business travellers tend to have high product expectations in terms of comfort and often are status-conscious. A focused strategy might therefore strive to satisfy these needs on the basis of exclusivity and timely implementation of processes.

Geographically defined niche carriers try to dominate a local market. Examples are island-based airlines such as Air Seychelles or Air Mauritius. The niche of low-yield long-haul services to holiday destinations could prove to be sustainable as no network carrier is able to operate these routes in a profitable way.

Regional carriers or regionally focused feeder carriers represent a further geographically defined niche. These airlines are closely linked to major network carriers as, for example, Air Dolomiti to the Lufthansa Group. These carriers often operate on so called capacity provision agreements or by available seat mile purchase agreements, under which the niche carrier is paid on a per-flight basis to operate for the major carrier. The responsibility of marketing, revenue accounting and yield management functions is typically taken over by the major carrier. Furthermore, on-board product and service-based specifications are established in cooperation with and in line with the standards of the partner.

5. Mini Case: Pan Am

By Andreas Wittmer and Christopher Siegrist

Pan American World Airways (short: Pan Am) was once the USA’s largest international airline, operating international flights across the globe. Initially, it was founded in 1927 and started its first flights between Key West, Florida and Cuba. Throughout the years, it gradually expanded its international services to include South America and first transatlantic services to Europe. Later, transpacific flights to Japan, and beyond South East Asia, complemented its intercontinental route portfolio.

Whilst the airline had built an extensive intercontinental network, it hadn’t built its own domestic network in the USA. As such, it sought to build its own network or acquire domestic US carriers like American Airlines. However, such undertakings were blocked by the authorities which were approached by other airlines expressing their fears over Pan Am using its monopoly to dominate the domestic market.

To cater to their transcontinental network, Pan Am had accumulated a sizeable fleet of Boeing 747s. When the oil crisis in 1973 unrolled, the demand for air travel sank internationally. Resultingly, Pan Am suffered from overcapacity with their fleet of Boeing 747s. Due to the lack of a domestic network, Pan Am were unable to reallocate the overcapacity on domestic routes. The following losses were further exacerbated by the deregulation in the USA, which opened international routes to all American carriers. This led to increased competition for Pan Am, further worsening its economic condition. Despite restructuring and attempts to build a feeder network, Pan Am failed to return to profit and eventually ceased operations in 1991. The assets were then taken over by Delta Airlines.

5. Mini Case: Qantas and Emirates

By Andreas Wittmer and Christopher Siegrist

Qantas was founded as the Queensland and Northern Territory Aerial Service (QANTAS) in 1920, operating regional flights within Queensland. Throughout the 20s, it grew by increasing its domestic flights and starting to operate a flying doctor service. In 1935, the first overseas flights to Singapore followed. This network eventually expanded to the Middle East, where flights connected with the British airline BOAC to London. With the advent of the jet-age, Qantas expanded outside the British Empire and continuously grew its network, eventually to Europe and the USA.

In 2004, Qantas faced increasing pressure in the Australian market from low-cost carriers Virgin Blue and TigerAir. This led to the airline launching its own low-cost subsidiary Jetstar to compete. On the so-called “Kangaroo route” between Australia and the Europe, Qantas also started experiencing strong competition from Asian and Middle Eastern carriers, resulting in increasing losses. To maintain its foothold in this market, Qantas entered a partnership with Emirates in 2013. This saw Emirates and Qantas offering improved connections between Australia and Europe by Qantas redirecting flights through Dubai, which offered passengers more connections to European destinations.

This partnership has proved successful and in 2015 Qantas returned to profit, posting a profit of USD 557 m. The partnership has proven successful so that Qantas and Emirates have extended their initial partnership until 2023 and streamlined their route networks.

5. Mini Case: Singapore Airlines as a First Mover

By Andreas Wittmer and Christopher Siegrist

Singapore Airlines has for many years been at the forefront of airline rankings such as Skytrax (Skytrax, 2019). The airline is best known for its Singapore Girl icon, a symbolic Singapore Airlines stewardess, which epitomises the carrier’s high standards of service and customer care. As a result, new recruits undergo very rigorous cabin crew training and need to adhere to strict standards onboard to provide outstanding service.

However, Singapore Airlines’ reputation stretches far beyond the excellent onboard service provided. The airline is also known for being a first mover by innovating service and the onboard product to distinguish itself from competitors. One example is the Suites which were introduced alongside the Airbus A380’s entry into service and are exclusive to that aircraft type. The designer suite encompasses lie-flat seats which are enclosed by walls and offer maximum comfort. An advantage of the suites is the possibility of combining the two middle suites into one suite, thus allowing for a double bed to be set up. This was novel for a commercial aircraft and allowed couples to have a luxurious and personal journey onboard. Competitors only recently followed, e.g. Qatar Airways introduced their Qsuite which offers similar features.

Another innovation in terms of onboard service is the “book the cook” programme. The programme is available to first, business and premium economy passengers. It allows the passengers to select their main course of choice up to 24 h before departure (Singapore Airlines, n.d.-a). The menu varies by departure airport and features regional dishes too. A passenger travelling from Zurich can even choose to have an OLMA Bratwurst or “Zürich Geschnetzeltes” (sliced veal) (Singapore Airlines, n.d.-b). This presents another innovation, providing an even more individualised service for passengers.

This is only a small selection of small innovations that Singapore Airlines have implemented as part of their first mover strategy. This has allowed them to maintain their high brand reputation and thus distinguish themselves from competitors.

5. Mini Case: Comparison of Major Airline Alliances 2019

By Andreas Wittmer and Christopher Siegrist

Star Alliance

Star Alliance is the world’s largest global airline alliance. It was founded in 1997 by Air Canada, Lufthansa, Scandinavian Airlines, Thai Airways and United Airlines. New members have since joined the alliance, and 28 member carriers currently operate at over 1300 different airports within 193 countries. Star Alliance categorises its frequent flyer customers into silver, gold and (depending on the issuing airline) platinum or honorary status tiers. This is in addition to the status level that is held with an individual airline’s FFP.

Star Alliance Silver Status: After reaching the premium level of one of the different airline members, the frequent flyer receives Star Alliance Silver status. This status includes a priority waitlisting and a guaranteed seat reservation if a place becomes available on a fully booked flight. Passengers also have priority standby on the next scheduled flight in the event of missing their original flight.

Star Alliance Gold Status: Gold status cardholders receive the same benefits as the Silver status members plus five additional benefits. The cardholder receives access to all Star Alliance airport lounges worldwide, regardless of the class of travel. Priority check-in is permitted at all airports and cardholders receive priority boarding and an additional 20 kg baggage. Bags belonging to Gold card members get priority handling and are among the first to be unloaded.

Oneworld

The oneworld alliance was founded in 1999 by American Airlines, British Airways, Cathay Pacific, Canadian Airlines and Qantas. It has 13 airlines and 30 affiliated partners who collectively serve over 1100 destinations in 180 countries. Oneworld offers different tier benefits to its customers. Oneworld member airlines work together to deliver a superior, seamless travel experience consistently, with special privileges and rewards for frequent flyers, including earning and redeeming miles and points across the entire alliance network. Some of the status benefits are intangible, unlike direct discount schemes such as mileage points:

Oneworld Ruby Privileges: The lowest tier status is awarded when a customer reaches the first premium level of a members’ FFP. In addition to the benefits afforded by the member airline, three oneworld privileges exist. These are access to business class priority check-in; preferred or pre-reserved seating; and priority standby on fully booked flights.

Oneworld Sapphire Privileges: A Sapphire member receives Ruby benefits plus additional privileges. Sapphire members can access business class lounges at every airport, even if they are flying in economy class, and they receive priority boarding and an additional baggage allowance.

Oneworld Emerald Privileges: The benefits in the Emerald tier status include those of the Ruby and Sapphire levels and two additional privileges. If first-class lounges are available at an airport, cardholders may use them regardless of the class they are flying in. Emerald status cardholders are permitted to check-in at the first-class priority check-in desks, can access fast-track security lanes and receive an additional baggage allowance.

SkyTeam

SkyTeam was formed in June 2000 by Aeroméxico, Air France, Delta Air Lines and Korean Air and had their headquarters in Amsterdam. As of 2019, SkyTeam has 19 member airlines. SkyTeam offers different status levels and benefits, such as:

SkyTeam Elite: Elite status customers benefit from an extra baggage allowance, priority check-in, priority boarding, preferred seating and priority standby.

Sky Team Elite Plus: Elite Plus offers three additional benefits. Members have access to exclusive member lounges and may invite a guest to accompany them. They are guaranteed an economy class seat on every long-haul flight if they book more than 24 h in advance of departure, and their luggage receives priority handling.

5. Mini Case: Definition of Slots at the Example of Zurich Airport

By Andreas Wittmer and Christopher Siegrist

Slots define how many airplanes can take off or land at an airport during a certain time frame. The airport can define how many movements the airport can handle. In practice also Airspace Control needs to be involved I defining an airports capacity as there may be limitations in air space usage based on regulations, weather conditions, demands of neighbourhoods, etc.

In Switzerland, the Federal Council regulates the coordination of slots at the airports in compliance with international conventions binding for Switzerland. The Federal Office of Civil Aviation appoints the body responsible for slot coordination. Slot coordination may be entrusted to a private company. In Switzerland, it is handled by an independent association called Slot Coordination Switzerland.

The airport capacity is defined by the number of slots it can handle. Theses slots can be published by different time frames, e.g. number of slots per 5 min or 10 min, 30 min or even per hour or also per minute. Slot Coordination Switzerland, for example, offers slots at Zurich airport per 5 min, 10 min, 30 min and 60 min. There may be 60 slots per 60 min using a certain runway configuration. Furthermore, it is defined that there may be 5 slots per 5 min. But as there is no limitation below 5 min, it does not matter which of the five planes owning the five slots really takes off first or second, etc.

There are schedule slots and operational slots:

-

Schedule Slots are take-off and landing rights that are allocated at airports, where the demand for departures or arrivals exceeds the capacity of the airport. A schedule slot entitles an airline to plan a departure (or arrival) at that time in the flight schedule. Schedule slots are normally allocated for time frames of 5 min (e.g. for 7:00; 7:05, 7:10, etc.). Schedule slots are allocated twice per year for the summer flight schedule period (end of March to end of October) and the winter flight schedule period (end of October to end of March). If any airline uses their allocated schedule slots within the flight schedule period less than 80% (due to cancelling scheduled flights – delayed flights are still regarded as operated regardless of their real departure time), it loses the right to receive the schedule slot automatically for the same schedule period in the subsequent year. These schedule slots will then be in a slot pool and will be newly allocated according to specified rulesFootnote 1. Any airline attempts to keep as many schedule slots as possible in its key times (its waves) at its hub to keep all entitlements for the next flight schedule period. For example, the slot system at the Zurich Airport allows up to 39 departures per hour from 07:00 to 07:59 am on all days of the week. The flights can be distributed unevenly to individual time sequences of 5 min each during the window of 1 h. Up to 5 take-offs can be planned for a 5-min interval. During the summer flight schedule, SWISS and Edelweiss occupy almost all slots in its morning wave from 07:00 to 07:39 am and planned a total of 27 take-offs.

-

In day-to-day operation “operational slots” are sometimes set when the European Airspace reaches capacity limits (due to adverse weather, air traffic controller shortages, etc.). These operational slots serve the purpose to steer the traffic and should not be confused with schedule slots described above. Operational slots define a 15-min time window, when the aircraft has to be airborne. Then the airspace is capable of handling the full routing of the plane. Operational slots are coordinated European-wide and set by the European Agency Eurocontrol located in Brussels. When an operational slot is set, it usually delays the departure as the airspace is too crowded to handle the aircraft during its originally planned time.Footnote 2 However, once an operational slot has been set for a departure, it must be met. If the plane fails to reach the slot, it will be reprioritised and receives a new slot which is usually much later.

5.4 Airline Network Management

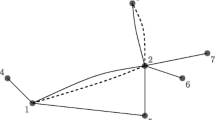

Networks and their operation define the structure of production as well as the product of commercial airlines. Thus, network management can be considered as the core function of each airline. It serves as a market activation, expanding into new and existing markets by offering flights and seats. In most modern airlines, network management is performed by a department which directly reports to the CEO. Airline networks form a part of the transport-networks within the logistics networks. Associated with them is the typology of different airline networks including line networks, raster networks and hub-and-spoke network. These range from simple point-to-point flights, “milk can flights” right through to varying degrees of hubbing, with continuous hubbing signifying the highest degree of hubs (Rossy et al., 2019; ◘ Fig. 5.3).

Network typology (author’s own figure based on Jaeggi, 2000)

Since net economies imply clear and obvious key success factors for the operation of different types of airline networks, airlines need a clear strategy about:

-

The role of net effects in their strategy

-

Their comparative advantage (e.g. market, location, capacity and restrictions of the home airport)

-

The type of network they want to offer

-

The way how they want do develop and transform their networks

By considering these aspects, airlines are also defining their business models. Thus, this chapter provides an introduction into airline net economics, followed by a presentation of the main variables of the development of an airline network. Lastly, different types of airline networks and related business models will be introduced.

5.4.1 Airline Network Economies

A network can be defined as the sum of elements/objects (nodes) and their connections (edge/leg). Thus, net economics are based on net effects. The latter, in turn, can be defined as effects of consequences – economically expressed as benefits or losses – which occur due to an element’s link to or its integration into a network. An airport which has one link to one hub may experience traffic growth if the respective hub strengthens its position and is able to offer more direct connections. In this case, the smaller airport is experiencing a benefit which is not linked to any own activities. The only reason for its growth is its integration into a growing network.

In general, net effects tend to get stronger with increasing network size. The example of hub effects can exemplify this (◘ Fig. 5.4). In the case of only one leg, there is one connection between an origin and a destination (in the sense of a product in form of a transport connection from an origin to a destination) which can be offered. If two legs are linked to the hub, three ODs can be offered. Ten ODs may already be offered if four links exist. Evidently, the number of ODs increases progressively.

The possibility of offering a growing number of ODs with each new leg can be considered as increasing economies of scope. Economies of scope are economies in the form of more variety with decreasing costs. In addition, economies of scale occur if through a bigger operation thus an increased specialisation product can be produced cheaper. This is the case at big hubs, if large maintenance or catering facilities can be operated. Economies of density occur, if services and activities are concentrated and thus, a higher level of productivity and quality exists. Big hubs, for example, can offer improved and optimised services such as lounges and shopping facilities thanks to a concentration of people. Overall, increasing economies in networks constantly lead to lower marginal costs.

So far, the supply has been investigated. Significant economies, however, also occur on the demand side. Through the concentration of flight frequencies, more efficient and effective services can be offered to the customers (economies of scale). A bigger network allows for more connections. This in turn allows passengers to choose between a larger number of direct flights (economies of scope). Further advantages of bigger hubs and airlines are, e.g. that fellows and collaborators may use similar airlines and thus mileage programmes can be used more efficiently or meetings can be conducted at the airport or on the flight (economies of density).

Considering all effects on the customer or demand side, increased marginal returns or benefits can be observed. Each additional passenger allows for even more benefits. Mileage programmes with status systems, where customers may collect additional miles and may use privileges, can be regarded as examples of this marginal utility. The respective passenger gains additional benefits with every flight. Continuously decreasing marginal costs on the supply side combined with increasing marginal returns on the demand side lead to natural monopolies. Due to these powerful network effects, whenever two networks compete, the bigger network will be able to operate at lower costs and provide more benefits to its customers. In the long term, a smaller network not being able to draw on other strategic success factors (e.g. a monopoly on serving a specific route or airport, a technical advantage and the geographical location of its hub), will be pushed out of the market, if it is not subsidised. As a result, the big network will dominate all others and will be left alone as a monopolist – in line with the saying “the winner takes it all” (◘ Fig. 5.5).

Natural monopoly (Shapiro & Varian 1999)

However, there are some natural restrictions to the growth of hubs and their respective airlines (◘ Figs. 5.6 and ◘ 5.7). The above-mentioned economies of hubs are opposed by conflicting hub diseconomies. For example, bigger hubs with more connections typically are more sensitive to delays. Delays pile up throughout the day in the entire network, potentially leading to a reduction of perceived quality and compensation costs. Furthermore, the operation of hubs always leads to hub load peaks. If poor meteorological conditions or technical reasons, such as the closing of a runway, lead to operational restrictions, the service quality decreases and delays may occur. Moreover, the development of a hub requires high specific investments within the whole network. As a consequence, tremendous sunk costs might occur, if environmental conditions change and the structure of the hub systems has to be modified.

Since there is a tendency towards natural monopolies in all net industries, companies constantly strive for further growth. As a result, airlines try to attract traffic through their hubs, at whatever costs it may take. Thus, competition with other hubs, dominated by competing airlines, requires a constant strive for cheaper prices than competitors.

Due to this, transfer flights very often are cheaper than direct flights. For example, a flight from Prague via Zurich to New York in tendency is cheaper than a direct flight from Prague to New York. In a competitive situation between hubs, for airlines – at least for a transitional period – it can pay off to lower their prices down to marginal costs. This approach, however, may imply serious financial risks in the long term.

Due to these net effects, special problems and questions occur not only on a company’s level, but also for aviation policy and regulation. Typical questions are: Should a smaller airline be subsidised or given special rights to assure competitiveness and to avoid a natural monopoly? How should the transformation process towards a consolidation of the industry be governed? Marginal cost pricing puts severe economic pressure on airlines, will this also affect their investments in safety and security?

An important economic effect of hubs is the so-called S-Curve or “domination effect”. The higher the share of an airline’s connection at a certain airport, the progressively higher is its market share. This effect is closely related to an increase in consumer benefits, for instance, more connections to choose from and a better ground infrastructure. As a result of this effect, there is hardly any airport in the world which is home to more than one hub carrier (see ◘ Fig. 5.8).

S-Curve Effect (related to Delfmann et al., 2005)

Considering all these effects, the optimal size of a hub is defined by:

-

Its natural home market: the bigger the home market, the higher the number of sustainable flights, the higher the absolute number of transfer passengers that can be serviced; an excessive share of low revenue transfer passengers reduces the airlines yield

-

The cost of operations; lower operating costs allow for a higher share of low paying transfer passengers

-

The runway capacities influenced by the runway infrastructure and organisation as well as approach regulations, which define the slot capacities

-

The organisation of the terminals and thus the minimum connecting time, which defines the timeframe usable for transfers

Network effects function not only in aviation networks, but also in railway or telecommunication networks. However, a difference must be made between competition within or between networks. The aviation industry can be considered as one network. Competition between airlines therefore is competition within the net. In contrast, competition between the railway and the aviation networks is a typical example of competition between networks. In the case of competition between networks, the larger network usually has certain advantages due to its network effects.

5.4.2 Main Variables of Airline Network Design

Due to the powerful hub economies introduced above, most airline networks are, today, constructed around hubs. However, this has not always been the case. Many airlines started their operation with single routes. In the 1920s, for example, Swissair offered transportation from Zurich to Basel continuing to Frankfurt, to Cologne and to Amsterdam. Today, this type of “milk can flight” can still be found in remote areas. For a long time, Aerolineas Argentinas or LATAM Chile offered this type of service along their vast coastlines. After about 1 h of flight time, the next airport was reached, and passengers, mail and cargo were loaded and unloaded. A special form of these “milk can flights” are triangle-flights. They can still be found in charter operations, for instance, flights to the Western Canadian Tourism Centres Vancouver and Calgary are often linked by triangle-flights (◘ Fig. 5.9).

The network operated by low-cost carriers (e.g. easyJet, Ryanair) or traditional carriers, like Lufthansa or SWISS, form their peripheral airports, such as Hamburg or Geneva, is based on single routes from one centre. Carriers assign a number of airplanes to an airport, which are used on a quite independent production basis. In these cases, rather than “hubbing” by offering transfer connections, the airlines aim to internalise economies of scale and to reduce complexity through independent production bases. Geneva airport, for example, is used by SWISS as a production centre. Several Airbus A220 are stationed at this airport to serve routes to London and other places in Europe. At the same time, easyJet has stationed aircraft at Geneva airport to provide an independent low-cost operation including connections to Barcelona and other cities mainly in Western and Southern Europe.

One hub strategy is pursued, for instance, by British Airways and Air France. Both airlines have their main hubs in the capital of the respective home country. For both countries this strategy makes sense because both, France and the UK, are dominated by one important political, cultural and economic centre, the capital. This type of network structure requires large and efficient airports, such as, Charles de Gaulle in Paris or London Heathrow. Through one hub, the respective airlines theoretically are able to internalise a maximum of hub effects.

Hub operation concepts have already been developed into new concepts such as multi-hub networks; for example, the network consisting of four main hubs (Frankfurt, Munich, Vienna and Zurich) operated by the Lufthansa Group, whereas Lufthansa Airline operates two hubs no its own (Frankfurt and Munich). An advantage of that system is a good combination of the internalisation of hub economies and reduced dependency and redundancy through a multitude of hubs. If, for example, one hub must be closed for metrological reasons, passengers can be de-routed to one of the other hubs, where airlines services are fully present. Also, passengers can plan their trips according to the best travel times by combining flights through different hubs. This system is very useful for more decentralised regions with a number of strong business and political centres and the absence of a natural hub. Furthermore, it allows more growth potential, as especially big hubs run at maximum capacity – not only with respect to ground infrastructure, but also with respect to airspace capacity.

Another development is the so-called continuous “hubbing”. Several North American hubs are operated in this way, especially with domestic connectivity (and Dubai with Emirates aims at this level of hubbing on an intercontinental level). On airports which have high capacities thanks to an extensive runway system, like Chicago O’Hare which has four parallel runways, continuous “hubbing” can be arranged. By serving all major routes on an hourly – or at least two hourly – basis, long waiting times for transfers and other elements linked to traditional “hubbing” can be avoided. Passengers just arrive at a certain time at the airport, proceed to the gate where their connecting flight is supposed to leave from, and wait for the next available flight. This procedure reduces complexity and improves punctuality, also increasing the convenience for passengers.

The Location of a Hub

The location of hubs must be selected based on market as well as technical criteria. As mentioned above, profitable traffic with high yield results from point-to-point traffic. Hubs located in strong economic areas can, therefore, offer a larger network fuelled solely by their domestic market. Transfer passengers, by contrast, receive lower prices and discounts and may not cover the full costs of their flights. Accordingly, for profitability reasons, the share of transfer passengers that is acceptable for an airline is limited. Therefore, many airlines define strategic goals for the share of transfer passenger (e.g. 40%). This said, hubs can accept higher shares of transfer passengers if

-

They are comparably inexpensive to operate. Reasons for this may be cheap labour costs, no fuel taxes, no emissions charges, 24 h opening time of airports and good geographic location for their selected network operation or low airport fees. Airports and airlines in the Middle East (such as Emirates flying out of Dubai) can consequently accept a considerably higher share of transfer traffic than their North American or European counterparts.

-

The hub is centrally located in a continent or important business area, allowing for relatively short and usually cheaper connecting flights.

Importantly, the efficient operation of a hub requires a runway and gate capacity large enough to allow for the operation of “waves”. The more arrival or departure flights an airport can handle in an hour, the more efficient are the connections that can be offered in a wave.

Defining Connectivity

Connectivity is an important factor for hub-based airline networks. Generally, connectivity can be defined as the number of connections (or hits) per inbound flight. As a rule of thumb, an increased connectivity (and thus larger passenger streams) results in a higher potential to feed outgoing flights. The backbone of connectivity patterns is always long-haul connections. The long-haul planes (usually wide-bodies) have to be fed by enough incoming connecting flights. As a special form, intercontinental “hubbing” can be very profitable, particularly on those routes where long distances do not allow for direct flights, like, for instance, between Europe and Oceania (◘ Fig. 5.10).

Connectivity – key figure of “hubbing” (Jaeggi, 2000)

The “connectivity” is technically defined by the maximum transfer waiting time acceptable for passengers (normally, the shortest connections are shown first in the international booking systems; therefore, flights with short connecting times are easier to sell) – the minimum connecting time (this is the technical time defined by the airport infrastructure and services which allows a proper transfer of passengers and baggage from one plane to the other) – and the runway capacities. Today, the minimum connecting time is often around 30 min. At most big hubs it is around 35 min; at smaller hubs, like Vienna, it can be as low as 20–25 min. The maximum acceptable transfer time is believed to be around 2 h. If the runway capacity is one plane per minute, there are consequently about 1.5 h left to be shared between inbound and outbound flights. Theoretically, 45 incoming flights could feed 45 outbound flights (◘ Figs. 5.9 and 5.11).

Configuration of the hub cycles/waves (Jaeggi, 2000)

Due to these patterns, the traffic of a typical hub is usually organised in so-called “wave structures”. A wave of incoming planes is followed by a wave of outbound planes. The definition of the wave structure is crucial for the operation of an airline. Also, potential intercontinental “hubbing” has to be bundled. The example of the wave structure of SWISS at Zurich airport in ◘ Fig. 5.12 shows this pattern. At 6 a.m. there is an incoming wave of intercontinental planes feeding the outgoing 7 a.m. wave. In this wave, transfer passengers meet business passengers.

Swiss wave structure (Tockenbürger et al., 2017)

Wave structures in a multi-hub-system have to be coordinated. Ideally, a multi-hub-system allows for a

-

Redundancy, in the sense that if one hub is affected by bad weather or technical problems (e.g. the failure of the baggage systems or airline IT systems), at least the well-paying business passengers can be transferred to other, still functioning hubs.

-

Better coverage of different market segments. One hub could be developed into a more mass passenger type of hub where bigger airplanes operate, and lower ticket prices can be offered. Clearly, with this kind of operation all hubs should provide all available class types and product categories to guarantee the net effects.

-

Coordinated wave structure at the different hubs which provides more time flexibility, as different departure times can be offered. On North Atlantic routes where the usable time frame for passenger flights is quite long, one plane could leave from the first hub, for example, New York, at 9 a.m., from the second airport at 11 a.m. and from a third one at 3 p.m. This would allow business travellers to choose the departure time that best suits their needs. However, such a variety of departure times cannot be offered for destinations at which the productive time slot for intercontinental flights is relatively small, for instance, flights from South East Asia to Europe. On these routes, it makes only sense to leave late at night and arrive early in the morning because of the time differences and the flying time.

Internalisation of Net Effects

Airlines can internalise net synergies by cooperating with other airlines. The degree to which airlines internalise the net effects from cooperation depends on the type of integration between airlines. These are as follows (refer also to ► Sect. 5.5 in this chapter about cooperation and alliances):

-

Adjusted timetables

-

Codeshare

-

Integrated network structure

-

Lounge access and combined frequent flyer arrangements

-

Integrated pricing

-

Integrated operations

-

Procurement synergies

-

Fleet management financing

Starting with simple cooperation, airlines can internalise first synergies from adjusting their timetables and code sharing on certain flights. This translates into airlines adjusting their timetables to complement each other, i.e. to feed each other’s flights or to create a more competitive offering such as more frequency on a route. Codeshares give passengers easier access to booking flights operated by partner airlines, as they can be bought using the flight number of the airline issuing/selling their tickets.

A further measure to increase the internalised net gains can be realised by increasing the integration through an alliance structure. By integrating their network structure airlines can seek to adjust their networks with their alliance partners. Furthermore, synergies can be realised by sharing infrastructure such as lounges and combining initiatives such as frequent flyer programmes. With increasing cooperation and integration, measures such as integrated pricing and operations allow airlines to fine tune their pricing and share operational assets to improve the net income of the two partners.

The highest amount of net gains is offered by mergers. This allows airlines to realise procurement synergies such as larger aircraft orders with more discount or having uniform products such as aircraft seats. Financially, a merger improves the financial conditions through financial economies of scale when it comes to capital-intensive acquisitions such as entire aircraft fleets.

Resultingly, net effects and synergies are dependent on the degree of integration between two airlines. The degree of integration as such is a continuum between independence and cooperation. By increasing the level of integration between two airlines, they trade independence for higher net gains and vice versa. Therefore, it is important for both partners to weigh the benefits and the drawbacks of each cooperation.

Synergies

The synergies that arise through cooperation between airlines, can generally be divided into cost and revenue synergies, which then form the total synergies. The proportion of each synergy depends on degree of cooperation.

Revenue synergies tend to form the majority in every type of cooperation. However, the degree does vary considerably. Therefore, codeshares, global alliances and joint ventures tend to, almost exclusively, produce revenue synergies ranging between 90% and 98% of the total possible synergies. Whereas closer cooperation such as equity stakes or a full merger tend to have additional cost synergies of 80% and 70% of total possible synergies, respectively, as cost synergies take up an increasing part of the net effects. A majority of revenue synergies are achievable through less intensive forms of cooperation such as alliances. These include new regional and intercontinental connections, as well as S-Curve effects where the potential revenue is realised. However, measures such as network restructuring only create a feasible income synergy when a complete merger takes place (◘ Fig. 5.13).

On the cost side of net effects, alliances only produce small synergies across airport services. Over 93% of the cost synergies can only arise when a merger takes place. The main areas are overhead costs for administration, headquarters, etc. and other various cost positions. Other areas of noticeable cost synergies include passenger services, crew, maintenance and/or advertisement (◘ Figs. 5.14 and 5.15).

Cost side of net effects (author’s own figure based on Döring, 2006)

Revenue side of net effects (author’s own figure based on Döring, 2006)

Cost and revenue synergies also differ geographically. Whilst European mergers and alliances create a balance between cost and revenue synergies, the North and South American counterparts realise a considerably higher percentage of revenue synergies as opposed to cost synergies.

5.4.3 Network Management Processes

Network management includes the analysis of markets, route planning, flight management, slot management, capacity management and demand management through sales/distribution and pricing. The goal is to plan, coordinate and manage a network at the highest possible profitability.

Network management is a process which starts 2–3 years before a new flight is introduced. At that time, decisions about routes and markets are being determined. Shortly before the actual flight mission, the plane is subject to capacity management and seat load factor optimisation (for instance through tools like price rebates and standby passengers). Each step of this integrated process consists of important decisions. At the beginning, route planning decides about the destination mix and the routes that will be operated. Next, fleet management has to decide about the optimal aircraft assignment to each route. In the long run, fleet management also has to decide about the type and number of aircraft to be purchased and operated. Scheduling has to deal with issues like slot management. This includes, for example, making necessary slots available by administrative application process or even by buying them. Based on the scheduled timetable, capacity management optimises sales and prices from the publication of the airline’s timetables until shortly before the actual flight. The most important instruments of capacity management are:

-

Revenue management

-

Fleet assignment (for example, short-term change of aircraft size)

-

Distribution and sales, e.g. special campaigns

Each airline assigns its own specific processes within network management, since all the decisions that need to be taken are interdependent. For instance, a decision about the reassignment of a smaller airplane on a specific route will have consequences on the price structure of this route. The way in which these decisions are taken, and how the process of network management is operated, is fundamental for the overall success of an airline.

5.5 Alliances and Cooperation

In the 70s and 80s most airlines were still independent airlines, mostly still state-owned, who were solitary players in mostly regulated markets. As the liberalisation started in the USA and gradually spilled over to Europe, airlines were forced to re-structure their business models and sought to optimise their networks, increase customer value and loyalty by implementing frequent flyer programmes. However, as competition increased, the need of cooperating with other airlines emerged, resulting in the foundation of the three major alliances: Star Alliance, Oneworld and Skyteam. These started to grow gradually after 2000, realising more synergies through intra-alliance mergers such as Air France & KLM within Skyteam. In recent years, the trend is shifting towards joint ventures within alliances, as well as outside of alliances as in the case of QANTAS and Emirates.

Cooperation and mergers prove to be a valuable measure from a financial but also from a network perspective. Efficiency can be increased through adjusting the network to increase loads by combining flights. Furthermore, resources such as administration or technical staff can be shared to reduce the costs. Therefore, it is possible to profit from up to 90% cost synergies through mergers as well as realising revenue synergies of up to 60% in alliances. There are different types of cooperation, all of which vary in the degree of integration (Canelas & Ramos, 2016):

Contractual arrangement: Two airlines can agree to cooperate by a simple contractual agreement covering possible cooperation regarding labour, sales etc. This could be anything from a ground handling contract to sharing lounges etc.

Codeshare: This concept involves two airlines placing their own flight numbers on the partner’s flights. This allows their customers to book the partner’s flights easily using the inventory of the airline they are booking with, making the booking process easier and granting the customers more options in terms of connectivity. This also allows airlines to streamline their networks by offering codeshare flights, which otherwise wouldn’t be profitable to run themselves. In return, the codeshare partner profits from higher loads on their own flights.

Global alliance: As mentioned above, alliances involve a group consisting of member airlines that coordinate strategically on a bigger scale. Often this involves a variety of measures such as strategic network planning with complementing hubs or cooperation between frequent flyer programmes. The three global airline alliances are: Star Alliance, oneworld and Skyteam.

Equity stake: Taking an equity stake allows airlines to lower their capital and financing costs by investing in shares of other airlines. This is widespread in the industry such as Qatar Airways being a minority stakeholder in the International Airlines Group or Delta investing in Virgin Atlantic.

Joint venture: A joint venture involves multiple airlines closely cooperating on one or multiple areas of the business. Often a joint venture is used in route planning, for example, in the transatlantic business where several airlines form joint ventures to fortify their market share.

Merger: Airlines can cooperate by merging two entities, with the result being a group with separate brands or a full merger. This allows the highest level of synergies in all aspects of the business.

The success of a cooperation obviously depends on the process and the synergies realised. There are several factors that can be analysed to determine the success:

-

Economies of scale and scope

-

Cost efficiency and brand quality

-

Good financial ratio

-

Early adoption of new technologies

-

Early adaptation to changes in the regulative environment

-

An operational basis of business, operational reliability and a successful service and marketing

5. Mini Case: British Airways and Iberia Merger

By Andreas Wittmer and Christopher Siegrist

In 2009, the two legacy airlines British Airways and Iberia announced their intention to merge and form a new airline group named International Airlines Group (IAG). The two carriers initially signed a memorandum of understanding, which eventually concluded in the merger in January 2011.

The idea behind the merger is to use synergies and create network effects. By combining their networks out of London and Madrid, the two airlines strengthened their market share on the transatlantic market. The new network offered over 157 new destinations for either airline’s customers. British Airways primarily offers North American destinations in the group, while Iberia mostly operates flights to South and Latin America. As such, both networks offer a complementary fit and allowed to optimise the two hubs by developing Madrid into a hub for Latin and South America and London Heathrow into a North America hub. Furthermore, synergies of up to €400m could be realised over the course of 5 years across several areas of the business, which corresponds to approx. 33% of the revenue. The highest synergies could be made in network and fleet planning as well as the IT and back office.

The merger not only brought synergies but also challenges. Aspects such as cultures or how to set up the management had to be considered without creating friction and/or imbalance between the two airlines. Furthermore, its systems had to be integrated to create a uniform booking platform for customers when it comes to booking flights, collecting miles, etc. The perceived differences in the service quality at the time of merger also had to be given due consideration to create a consistent group that offers a steady quality of service across its brands.

Today, IAG is the third largest airline group in Europe and posts increasing profits every year, thus indicating how synergies in the airline business can be used to create a more profitable business. In the meantime, it has strengthened its stronghold in the Western European and transatlantic market with the merger and acquisition of Aer Lingus, bmi and Vueling, whilst competing in the low-cost market with the creation of its low-cost subsidiary LEVEL.

5.6 Airline Business Models

A business model in the aviation industry can be defined as a simplified plan on how companies design and operate their networks. This plan may include different dimensions (Amit & Zott, 2001; Bieger et al., 2002). In principle, two main types of business models can be identified in the aviation industry: the traditional network model and the point-to-point model (◘ Fig. 5.16).

Development of market shares between the different business models (Auerbach and Delfmann 2005)

Most structuring approaches for business models include dimensions like

-

The type of markets and production applied

-

The type of revenue and pricing systems applied

-

The type of coordination of the value chain or network