Abstract

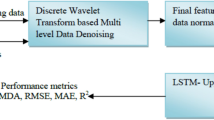

Financial Analysis is a challenging task in the present-day world, where investment value and quality are paramount. This research work introduces the use of a prediction technique that uses a combination of Discrete Wavelet Transform (DWT) and Long Short-Term Memory (LSTM) to predict stock prices in the Saudi stock market for the subsequent seven days.

A time series model is used where comprises the historical closing values of several stocks listed on the Saudi stock exchange. This model is called the Discrete Long Short-Term Memory (DLSTM) which comprises memory elements that preserve data for extended periods. The function determined the historical closing price of the stock market and then employed Autoregressive Integrated Moving Average (ARIMA) for analysis. The DLSTM-based experimental model had a prediction accuracy of 97.54%, while that of ARIMA was 97.29%. The results indicate that DLSTM is an effective tool for predicting the prices in the stock market. The results highlight the importance of deep learning and the concurrent use of several information sources to predict stock price levels

Access this chapter

Tax calculation will be finalised at checkout

Purchases are for personal use only

Similar content being viewed by others

Abbreviations

- LSTM:

-

Long Short Term Memory

- DWT:

-

Discrete Wavelet Transform

- RNN:

-

Recurrent Neural Networks

- DLSTM:

-

Discrete Long Short Term Memory

References

Li, R., DianZheng F., Zeyu, Z.: An analysis of the correlation between internet public opinion and stock market. Paper presented at the 2017 4th International Conference on Information Science and Control Engineering (ICISCE) (2017)

Nabipour, M., Nayyeri, P., Jabani, H., Mosavi, A., Salwana, E.: Deep learning for stock market prediction. Entropy 22(8), 840 (2020)

Jarrah, M., Salim, N.: A recurrent neural network and a discrete wavelet transform to predict the Saudi stock price trends. Int. J. Adv. Comput. Sci. Appl. 10(4), 155–162 (2019)

Batra, R., Daudpota, S.M.: Integrating stocktwits with sentiment analysis for better prediction of stock price movement. Paper presented at the 2018 International Conference on Computing, Mathematics and Engineering Technologies (iCoMET) (2018)

Bruce, L.M., Koger, C.H., Li, J.: Dimensionality reduction of hyperspectral data using discrete wavelet transform feature extraction. IEEE Trans. Geosci. Remote Sens. 40(10), 2331–2338 (2002)

Chou, J.-S., Nguyen, T.-K.: Forward forecast of stock price using sliding-window metaheuristic-optimized machine-learning regression. IEEE Trans. Industr. Inf. 14(7), 3132–3142 (2018)

Fischer, T., Krauss, C.: Deep learning with long short-term memory networks for financial market predictions. Eur. J. Oper. Res. 270(2), 654–669 (2018)

Li, R., Fu, D., Zheng, Z.: An analysis of the correlation between internet public opinion and stock market. Paper presented at the 2017 4th International Conference on Information Science and Control Engineering (ICISCE) (2017)

Minh, D.L., Sadeghi-Niaraki, A., Huy, H.D., Min, K., Moon, H.: Deep learning approach for short-term stock trends prediction based on two-stream gated recurrent unit network. IEEE Access 6, 55392–55404 (2018)

Mithani, F., Machchhar, S., Jasdanwala, F.: A modified BPN approach for stock market prediction. Paper presented at the 2016 IEEE International Conference on Computational Intelligence and Computing Research (ICCIC) (2016)

Zhu, L.-F., Ke, L.-L., Zhu, X.-Q., Xiang, Y., Wang, Y.-S.: Crack identification of functionally graded beams using continuous wavelet transform. Compos. Struct. 210, 473–485 (2019)

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2021 The Author(s), under exclusive license to Springer Nature Switzerland AG

About this paper

Cite this paper

Jarrah, M., Salim, N. (2021). A Long Short Term Memory and a Discrete Wavelet Transform to Predict the Stock Price. In: Saeed, F., Mohammed, F., Al-Nahari, A. (eds) Innovative Systems for Intelligent Health Informatics. IRICT 2020. Lecture Notes on Data Engineering and Communications Technologies, vol 72. Springer, Cham. https://doi.org/10.1007/978-3-030-70713-2_29

Download citation

DOI: https://doi.org/10.1007/978-3-030-70713-2_29

Published:

Publisher Name: Springer, Cham

Print ISBN: 978-3-030-70712-5

Online ISBN: 978-3-030-70713-2

eBook Packages: Intelligent Technologies and RoboticsIntelligent Technologies and Robotics (R0)