Abstract

In this paper we present the simulation model of financial flows of an enterprise based on discrete-event approach. The model simulates interactions of an enterprise with customers, suppliers and banks. Financial operations of the enterprise are modeled in the event sections and reflected in accounting statements. The developed model optimizes settlement payment strategy with counterparties and loan repayment scheme, taking into account fluctuations of frequency and volume of orders. Experimental studies are aimed at developing a loan repayment scheme for a medium-sized business, which would ensure the permanent solvency of the enterprise with a minimum cost of working capital attraction. Scenario calculations were compiled for conservative, optimistic and pessimistic prognosis of interest rate and volume of orders during the period.

Access provided by Autonomous University of Puebla. Download conference paper PDF

Similar content being viewed by others

Keywords

Introduction

Computer-based financial modeling systems are today gaining much greater acceptance in business organizations [4]. Despite this, a wide gap seems to exist between the information and logic structures programmed into financial models, and the precepts and algorithms derived from a theory of corporate financial management. For the rational organization of financial flows, it is necessary to ensure their quantitative and temporal correspondence to material flows. In organizations this movement is rarely synchronous—either an advance payment is made, or payment is delayed as a result of a lack of funds. This leads to difficulties in planning financial flows by traditional econometric methods [2] and determines the need to use stochastic modeling to support decision making [8]. Simulation methods are already widely used in project planning [3, 5] and analysis of financial markets [7]. Simulating financial flows of the organization, their reflection in financial accounting and calculation of financial results based on the received data would lead to effective management of operating capital and reduce its costs.

Structure of the Model

The proposed methodology for simulating financial flows of an enterprise includes the following steps:

-

1.

Reproduction of the initial financial condition of the company (its accounts, assets and liabilities) on the basis of accounting data.

-

2.

Simulation of the receipt of orders and the process of their implementation.

-

3.

Simulation of interactions with the bank and the counterparties.

-

4.

Reflection of operations in the financial statements; determination of the lack of financial resources, cost of their attraction and financial results of the enterprise.

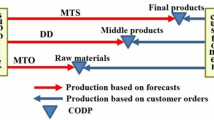

The simulation model of financial flows of an enterprise is based on the discrete-event approach. The sequence of events is reflected in the graph-scheme (Fig. 1.1). Each vertex of the graph corresponds to a certain event [6]. Events are scheduled in the queue, which manages their execution. The sequence of events can be determined by conditions U. When the event is executed, changes are reflected in the accounting entries, which ensures the accuracy of the statistics generated as a result of simulation.

The model is based on two assumptions: (1) “just in time” delivery system; (2) sufficiency of the production to fulfill the order without delay. The sequence of actions of the enterprise within each event sections is defined. For example, within the event section “Receipt of order from a customer” a list of materials for production is formed, they are grouped so that each delivery would include materials ordered from one supplier, and the arrival of each delivery is scheduled after a certain period, which is specified by the available information about the supplier.

On the input interface of the model information about previous periods and current activities of the enterprise is loaded: loans, orders, accounts receivable and payable, available cash and production capacities. In the process of modeling, receipt of orders, scheduling of supplies, information about manufactured products and changes in the value of receivables and payables is reflected in the model database. Accounting balance is compiled for the current date; as well as profit and loss statement for the previous period. Accounting is implemented in a simplified form, nevertheless, it is possible to make reliable estimates of profitability, sustainability and other financial indicators of the enterprise on its basis [1].

Modeling Results

The aim of the experiment was to develop a loan repayment scheme for a medium-sized business, which would ensure the permanent solvency of the enterprise with a minimum cost of working capital attraction. Manageable factors in the model are date, period and amount of the credit. Unmanageable scenario parameters are interest rate for the credit, volume of orders from customers during the period and type of orders distribution function. The scenarios were designed for calculations which combine various combinations of these factors. Simulated period was limited to one year, to the level of operative planning.

There are a huge number of combinations of controlled factors, so it is difficult to make an experiment plan in advance. The starting point is identification of requirement for credit resources. The model is run without planning the loan and it is determined when the enterprise lacks working capital and how much cash it needs. After analysis of modeling results, credit options are introduced and changes are observed. After the permanent level of solvency is reached, the volume of credits is optimized. The target function is to minimize the amount of interest paid for using the credit (Table 1.1).

Optimization is based on iterative calculations on the model, and the conditions under which there is lack of funds are excluded from consideration. Results of the experiment for the Scenario #1 (interest rate 25%, volume of orders 220 mil RUR, even distribution of the orders) are shown in Table 1.1. Combination of controlled factors in the experiment number 7 has the best characteristics. In this case, the enterprise does not lack working capital and the total costs of financial recourses attraction is 22917 RUR. Similar experiments were conducted for other scenarios.

Conclusions

The developed simulation model of financial flows reflects in detail financial operations of an enterprise. Implementing the model for support of financial decisions allows to reduce the cost of working capital by optimizing payment schedule with counteragents and loan repayment scheme. Modeling parameters change in accordance with the market situation within a set of scenarios, which are analyzed through a multivariate analysis of simulation results. The proposed model and algorithms can be implemented both for financial planning support and for reproduction interactions of enterprises in macro-economy simulation models.

References

E.F. Brigham, Financial Management: Theory & Practice, South-Western College Pub (2010)

E. Dhaoui, What we have learnt from financial econometrics modeling? MPRA Paper 63843, University Library of Munich, Germany (2013). https://ideas.repec.org/p/pra/mprapa/63843.html

C. Fang, F. Marle, A simulation-based risk network model for decision support in project risk management. Decis. Support Syst. 52(3), 635–644 (2012)

G.J. Hahn, H. Kuhn, Designing decision support systems for value-based management: a survey and an architecture. Decis. Support Syst. 53(3), 591–598 (2012). https://doi.org/10.1016/j.dss.2012.02.016

Y. H. Kwak, L. Ingall, Exploring Monte-Carlo simulation applications for project management. IEEE Eng. Manage. Rev. 37, 83–83 (2009). https://doi.org/10.1109/EMR.2009.5235458

A.M. Law, W.D. Kelton, Simulation Modeling and Analysis, 3rd edn. (McGraw-Hill, New York, 2000)

R. Low, E. Tan, The role of analysts’ forecasts in the momentum effect. Int. Rev. Financ. Anal. (2016). https://doi.org/10.1016/j.irfa.2016.09.007

D.J. Power, R. Sharda, Model-driven decision support systems: concepts and research directions. Decis. Support Syst. 43(3), 1044–1061 (2007). https://doi.org/10.1016/j.dss.2005.05.030

Acknowledgements

Development of simulation algorithms of an enterprise’s interactions with counterparties was funded by RFBR according to the project № 18-310-00185.

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2021 The Author(s), under exclusive license to Springer Nature Switzerland AG

About this paper

Cite this paper

Mashkova, A.L., Savina, O.A. (2021). Simulation Model of Financial Flows of An Industrial Enterprise. In: Ahrweiler, P., Neumann, M. (eds) Advances in Social Simulation. ESSA 2019. Springer Proceedings in Complexity. Springer, Cham. https://doi.org/10.1007/978-3-030-61503-1_1

Download citation

DOI: https://doi.org/10.1007/978-3-030-61503-1_1

Published:

Publisher Name: Springer, Cham

Print ISBN: 978-3-030-61502-4

Online ISBN: 978-3-030-61503-1

eBook Packages: Physics and AstronomyPhysics and Astronomy (R0)