Abstract

Understanding the relationship between family management and firm performance has emerged as one of the most prominent issues for both scholars and professionals in the family firm research field. This chapter aims to shed light on this theme by analyzing how family members in top management teams (TMT) impact on firm performance. Moreover, this chapter adds the effect of an interaction factor that has become essential for the improvement of firms’ competitiveness: technological innovation efficiency. By conducting a panel data analysis on 1154 observations of private manufacturing firms over the period 2010–2015, the findings reveal a negative impact of family members in TMT on firm performance. The empirical analysis also reveals that technological innovation efficiency weakens the negative effect of family presence in TMT on firm performance.

Access provided by Autonomous University of Puebla. Download chapter PDF

Similar content being viewed by others

Keywords

- Family management

- Firm performance

- Technological innovation efficiency

- Upper echelon

- Socioemotional wealth

1 Introduction

Firm performance is essential to guarantee firm success and survival (Diéguez-Soto et al. 2015; Martínez-Romero 2018). However, and notwithstanding the importance of family firms worldwide (Family Firm Institute 2018; La Porta et al. 1999; Zellweger 2017), the existing research regarding the influence of family firms’ characteristics on firm performance is far from offering conclusive results (Basco 2013; De Massis et al. 2015; López-Delgado and Diéguez-Soto 2015).

Recent studies have focused on how family involvement in management impacts on firm performance (Diéguez-Soto et al. 2019; Sciascia et al. 2014). Family managers, and individual family members in top management teams (hereafter TMT), as the dominant coalition in family firms (Chrisman et al. 2012; Chua et al. 1999), are in charge of strategic decision-making, having a determining influence on performance outcomes.

The impact of family TMT members on performance outcomes could be justified in the light of both the upper echelon (Hambrick and Mason 1984) and the socioemotional wealth (Gómez-Mejia et al. 2007) theories. On the one hand, the upper echelon theory states that TMT members’ behavior and characteristics are important, influential factors of performance outcomes (Certo et al. 2006; Kor 2006). On the other hand, it is widely accepted that family TMT members take strategic decisions considering not only financial objectives but also noneconomic goals (Astrachan and Jaskiewicz 2008; Martínez-Romero and Rojo-Ramírez 2017; Zellweger and Astrachan 2008), influencing their firms’ performance.

Despite the existing studies analyzing the direct impact of family management on performance outcomes (Sciascia and Mazzola 2008; Sciascia et al. 2014), there is scarce previous literature using the number of family TMT members to measure family management. Moreover, there is also a lack of prior research analyzing specific factors that moderate the relationship between family TMT members and firm performance in private firms. Therefore, in an attempt to deepen in such relationships, this chapter introduces a continuous variable to measure family management and a moderating factor which may well be helpful to explain the current findings. Specifically, the effect of technological innovation efficiency (hereafter TI efficiency) was included as an additional element that may influence the impact of family TMT members on firm performance. We contend that family firm research should essentially consider another factor, namely, TI efficiency, which may encourage family managers to start changes in the way the strategic inovation process is developed, with the final goal of enhancing performance outcomes.

Thereby, this chapter addresses a twofold research question. First, how do family TMT members influence performance in the context of private firms? Second, does TI efficiency moderate the expected relationship between family TMT members and firm performance? To answer these questions, an empirical analysis is developed utilizing a longitudinal dataset comprising 1154 observations of Spanish manufacturing firms over the period 2010–2015. Spain is a fascinating context for analyzing the effect of family TMT members on firm performance, because the family presence in the TMT of Spanish firms is around 70%, meanwhile in 51.6% of Spanish family firms, all TMT members belong to the family (IEF & Red de Cátedras de Empresa Familiar 2015, 2018).

This chapter offers relevant contributions to the literature. First, we answer the call for further research on the family management-performance relationship in the context of private firms (Sciascia et al. 2014; Zattoni et al. 2015). Specifically, we investigate the influence of family TMT members on performance outcomes (Ling and Kellermanns 2010). At this respect, we go beyond previous research which has mainly used a binary measure of family involvement in management (e.g., Diéguez-Soto et al. 2018; Rojo-Ramírez and Martínez-Romero 2018) and employ a continuous variable to report the family presence in TMT, counting the number of family members in top management positions. This is of utmost interest because it allows disclosing heterogeneity among family firms. Second, we surpass the conceptual frame that analyzes the direct effect of family involvement in management on firm performance, and we introduce TI efficiency as a moderator of the abovementioned relationship. In such a way, we investigate how family presence in TMT interacts with TI efficiency in influencing firm performance. Notwithstanding prior research has examined different factors (Diéguez-Soto et al. 2019; Kellermanns et al. 2012) that may influence the family presence in TMT on firm performance, to the best of the authors’ knowledge, no research has analyzed when and under what conditions TI efficiency influences such relationship.

The chapter is structured as follows. Section 2 introduces the theoretical foundations and hypotheses development. Data and methodology are depicted in Sect. 3, meanwhile, Sect. 4 exhibits empirical results. Finally, the discussion of our findings, the limitations, and future research and the conclusions are exposed.

2 Theoretical Foundations

2.1 Family Presence in Top Management Team and Firm Performance

There is no doubt that family firms present peculiar features conditioning their performance outcomes (Arosa et al. 2010; Arrondo-García et al. 2016), due to the intermeshing of the family and the business (Berrone et al. 2010, 2012; Zellweger 2017). As family involvement in the firm increases, so does the overlap between the family and the business (Le Breton-Miller et al. 2011).

Specifically, family presence in management is an important conditioning of firm performance (Diéguez-Soto et al. 2019), since it is an expression of the family’s ability to influence the firm’s outcomes (De Massis et al. 2014).

Nevertheless, despite the great deal of attention that the relationship between family involvement (in management) and firm performance has received, results are far from being conclusive (Basco 2013; De Massis et al. 2015; Sciascia et al. 2014). Most of the existing research has focused on large (e.g., Dyer 2006; Kammerlander et al. 2015) and public (e.g., Diéguez-Soto et al. 2019) companies. However, prior studies do not assure that results found for public firms could hold for private businesses (Martínez-Romero et al. 2020; Miller et al. 2007). Among those studies analyzing the family management-firm performance relationship in private firms, the existing results reveal both a positive influence (e.g., Gallucci et al. 2015) and a negative influence (e.g., Sciascia and Mazzola 2008) of family managers on firms’ outcomes.

In any case, what is clear is that family members present in the firm management, and, namely, in the TMT, belong to the dominant coalition of the firm and thus exert significant influence on organizational outcomes (Hambrick and Mason 1984). Family managers have been demonstrated to be the most important decision-makers within the context of family firms (Vandekerkhof et al. 2015). In this vein, the upper echelon theory states that TMT members’ experiences, attitudes, and beliefs drive strategic decision-making (Cyert and March 1963; Hambrick and Mason 1984). Namely, the beliefs, values, and goals of TMT members will influence the implementation of strategies and, consequently, the firms’ outcomes.

Moreover, in a family firm context, family’s presence in the TMT leads to peculiar performance outcomes due to the overlapping of economic and noneconomic goals, which rises as a primary driver in guiding family firms’ strategic choices (Gómez-Mejia et al. 2007). Specifically, family managers normally overweigh emotional considerations over purely financial objectives (Vandekerkhof et al. 2015; Zellweger et al. 2011). Thus, decision-making within family-managed firms is highly influenced by noneconomic objectives, captured by SEW, which may conduct family managers toward the fulfillment of affective needs, rather than acting under effectiveness principles (Martínez-Romero and Rojo-Ramírez 2017).

Accordingly, gains or losses in SEW become the pivotal frame of reference that family firms use to make strategic decisions (Berrone et al. 2012; Gómez-Mejia et al. 2007; Martínez-Romero and Rojo-Ramírez 2016), and family managers would avoid strategic choices that are perceived as threats to their SEW. For example, family managers are reluctant to allow new members from outside the family to take control over strategic decisions as this involves losing control of their firms (Gómez-Mejia et al. 2007, 2010). Therefore, even though collaboration networks and relationships with external stakeholders might well be associated with improved performance (De Massis et al. 2013b; Sorenson 1999), family managers perceive these strategies as a loss of control over their firms and as a cession of discretionary power over outsiders. These concerns may hinder collaborative relationships with external partners (De Massis et al. 2013a; Manzaneque et al. 2020), limiting the possibilities of obtaining performance outcomes.

Moreover, family managers’ desire to maintain their SEW might lead to a lack of professionalism in the firm, since firm managers may be selected based on nepotism or altruism rather than on meritocracy principles (Llach and Nordqvist 2010; Poutziouris 2001). Problems related to self-control and altruism result in higher agency costs (Schulze et al. 2001) while also increasing the difficulty of monitoring the firm performance (Dyer 2006). That is, whether nepotism is the accepted norm, incompetent family members might be placed in key management positions, thus jeopardizing firm performance (Manzaneque et al. 2018).

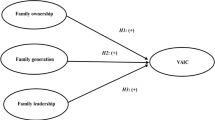

Therefore, family managers in order to maintain the control of their firms and, namely, to preserve their SEW may act under nonpurely financial ideals (Martínez-Romero et al. 2020; Martínez-Romero and Rojo-Ramírez 2017), prioritizing family over economic goals (Chrisman et al. 2012; Martínez-Romero et al. 2020; Rojo-Ramírez and Martínez-Romero 2018). Furthermore, as the number of family members in management increases, noneconomic goals acquire greater relevance over economic objectives. Thus, our first hypothesis is:

Hypothesis 1

A higher presence of family members in the firm TMT exerts a negative influence on firm performance.

2.2 The Moderating Influence of Technological Innovation Efficiency

We have previously hypothesized that firms with a higher family presence in TMT are likely to diminish their performance outcomes. Herein, we argue that this relationship might be moderated by TI efficiency.

Prior research reveals that TI efficiency is a fundamental factor in the obtaining of superior incomes (Wang 2007) and the improvement of firms’ competitiveness (Gao and Chou 2015). TI efficiency is defined as the relative capability of a firm to achieve TI outputs given a certain quantity of TI inputs (Cruz-Cázares et al. 2013; Manzaneque et al. 2020). Furthermore, Cruz-Cázares et al. (2013) showed that in a complex and long-term innovation process, the efficiency with which innovation inputs are converted into innovation outputs is the key to increase firm performance.

Family management is often related to a long-term perspective due to the overlap between the family and the business. In this vein, authors agree that innovation is a necessary condition for family firms’ continuity (Kellermanns et al. 2012; Martínez-Alonso et al. 2018). Accordingly, by refining the management of innovation resources and capabilities, family-managed firms may be able to increase the probability of sustainability and survival in the long term (Revilla et al. 2016; Yu et al. 2011). Moreover, although family involvement in TMT is seen as a specific governance structure (Diéguez-Soto et al. 2018) that enables the possession of unique characteristics such as long-standing relationships (Patel and Fiet 2011), social capital (Arregle et al. 2007), or tacit knowledge (Llach and Nordqvist 2010), it does not appear to be a sufficient condition for the achievement of competitive advantages and the enhancement of firm performance (Dyer 2006; Wagner et al. 2015). At this respect, a higher efficiency in the conversion of innovation inputs into innovation outputs (Duran et al. 2016) may help family-managed firms to reinforce their unique systemic conditions, contributing to the development of idiosyncratic resources and dynamic capabilities (Sirmon et al. 2007; Teece et al. 1997). Specifically, these characteristics may be fully developed by being the best at orchestrating resources (Chirico et al. 2011), because the simple possession of innovation resources is not enough to achieve superior firm performance (Sirmon and Hitt 2003).

Hence, more efficient management of innovation resources would enable family managers to attract external stakeholders, including other family-managed firms (Miller and Le Breton-Miller 2005). Greater TI efficiency derived from the consolidation of these relationships (Diéguez-Soto et al. 2018) allows family managers to further develop their social capital (Schulze and Gedajlovic 2010). These external groups are usually aware of the innovative potential of family-managed firms, and therefore, they are eager to establish long-standing and prosperous relationships with them (Miller and Le Breton-Miller 2005). Accordingly, the establishment of these relationships could lead to the development of open innovation projects (Feranita et al. 2017) and more precisely R&D collaborations (Grimpe and Kaiser 2010), which might increase TI efficiency and, thus, can help family-managed firms to improve their firm performance (Carney 2005).

Moreover, these external partners are aware of the family firms’ desire to preserve their SEW in the long term (Martínez-Romero et al. 2020), as well as their concern to protect and maintain the family firm reputation and identity (Deephouse and Jaskiewicz 2013), given the closeness these firms show to the environment in which they operate (Berrone et al. 2010). As a consequence, whether family managers do not perceive a threat over their SEW and their firm control and, more importantly, whether their noneconomic goals are not surpassed by economic ones, they would be willing to accept the establishment of such collaborative innovation ties (Feranita et al. 2017). These innovation networks will increase the R&D critical mass augmenting the possibilities of obtaining innovation outcomes and, thus, TI efficiency (Galende Del Canto and Suárez González 1999; Kancs and Siliverstovs 2016). Therefore, increased TI efficiency will enable family managers to take full advantage of this privileged knowledge derived from the relationships with selected stakeholders and, then, enhance firm performance (Matzler et al. 2015).

It is known that better communication and tacit knowledge may increase TI efficiency in family-managed firms. Some family-managed firms could create a virtuous circle in such a way that TI efficiency may enhance the business-oriented, friendly, sincere, and close relationships inside the firm (Gómez-Mejia et al. 2007). In this vein, TI efficiency may permit a more fluid communication among family-managed firms’ members (Diéguez-Soto et al. 2018), an improved decision-making quality (Vandekerkhof et al. 2018), and also the transmission of valuable ideas across different departments (Bammens et al. 2015). This strong feeling of mutual trust between family managers, due to the increased TI efficiency, positively contributes to wider dissemination of tacit knowledge throughout the firm (Nieto et al. 2015). The possession of this unique and non-transferable knowledge (Duran et al. 2016) will enable family managers to reinforce the commitment and identification with their firms (Chrisman et al. 2012; Pazzaglia et al. 2013) and, consequently, improve their performance outcomes. That is, TI efficiency will reinforce the abovementioned family-managed firms’ distinctive characteristics, unlocking their performance potential.

Based on the previous discussion, we state that TI efficiency may weaken the negative influence of family TMT members on firm performance since it contributes to align economic and noneconomic goals improving firms’ outcomes. Therefore, our second hypothesis is:

Hypothesis 2

Technological innovation efficiency weakens the negative influence of family presence in TMT on firm performance.

The theoretical model and the proposed hypotheses are presented in Fig. 1.

3 Research Method

3.1 Sample and Data Sources

In order to check our hypotheses, we employed the Survey on Business Strategies (ESEE). Specifically, we analyzed the 2010–2015 period. The ESEE is administrated by the State Partnership of Manufacturing Equity (SEPI) foundation on behalf of the Spanish Ministry of Industry and consists of manufacturing firms. The survey is designed following both exhaustive and random sampling criteria, guaranteeing the representativeness of the population and the validity of the contents. Notably, the data include the whole population of Spanish manufacturing businesses with 200 or more employees and a stratified random sample of 5% of the population of firms with at least 10 but fewer than 200 employees. The survey, which has been conducted year by year since 1990, encompasses unbalanced data covering 1800 firms on average per year. After removing businesses with incomplete data for the analyzed variables, we adopted a matched-pair research design (see among others Allouche et al. 2008) through which each firm that achieves TI efficiency was matched with another one without TI efficiency. This approach is based on two potential factors, firm size (ln of total assets) and industry (three-digit SIC code). The matching was conducted for each year (see Table 1 for the distribution of pairs by year). The final sample comprises 1154 observations of private manufacturing firms (577 with TI efficiency and 577 without TI efficiency). Table 1 provides a more detailed view of the sample.

3.2 Variables

Dependent Variable

In this chapter, firm performance is measured by the return on assets ratio (earnings before interest and tax to total assets), which is commonly used in the family business field (e.g., Anderson and Reeb 2003) and particularly when studying innovation in family businesses (e.g., Diéguez-Soto et al. 2019).

Independent Variable

Family presence in management is the independent variable. In line with the study of Kotlar et al. (2014), we contemplate both family ownership and family involvement in TMT as factors that affect decision-making in family businesses. Accordingly, we define family presence in management as a continuous variable counting the number of family members in the firm’s TMT (Kotlar et al. 2013; Manzaneque et al. 2020).

Moderating Variable

We employ TI efficiency as a moderating variable. Following Cruz-Cázares et al. (2013), who consider that an optimal measure of TI efficiency should include both innovation input and innovation output, we use R&D expenses as innovation input (Qiao and Fung 2016) and the number of product innovations as innovation output (Cruz-Cázares et al. 2013). Therefore, TI efficiency is measured by the ratio of the number of product innovations over R&D expenses.

Control Variables

In order to rule out possible alternative explanations to that formally hypothesized, we include several control variables that might affect firm performance. Because firm capabilities are formed through experience acquired over time (Cruz-Cázares et al. 2013), we control by firm age, measured as the number of years between the firm’s foundation and the observation year (Martínez-Romero and Rojo-Ramírez 2017). Since large firms have advantages in comparison with small firms in terms of financial and economic resources or internal knowledge (Cohen and Klepper 1996), which are expected to increase both TI efficiency and firm performance, we controlled for firm size measured as the log of total assets (Kotlar et al. 2013). Moreover, because firms with more significant financial resources can achieve greater firm performance, leverage is measured as debt to total assets ratio (Block 2012). We also measure the geographical localization by adding a group of dummy variables to control for the territorial specificities or context conditions (Camagni and Capello 2013). These control variables also allow us to capture the effect of geographical opportunities to improve firm performance and to develop innovation (Diéguez-Soto et al. 2019). Specifically, we include dummy variables representative of seven Spanish territorial subdivisions (NUTS1, Nomenclature des Unités Territoriales Statistiques).Footnote 1 Finally, 18 dummy variables referring to specific sub-industries were included in all models.

3.3 Methods

Given that our primary goal is to analyze both the influence of family TMT members on firm performance and the moderating effect of TI efficiency in the abovementioned relationship, we estimate different models based on the following equation:

We use a panel data methodology, which allows us to control for individual heterogeneity or unobservable individual effects. Commonly, it is required to distinguish fixed effect from random effect in panel data, typically using Hausman test. However, in our case fixed effect estimation is not appropriate given the time-invariant nature of the industry affiliation and territorial subdivisions dummies (Diéguez-Soto and López-Delgado 2019; González et al. 2013). Consequently, to test our hypotheses, we use robust and two-stage least squares regression with random effects controlling for heteroscedasticity.

4 Results

Means, other descriptive statistics for continuous variables, and frequencies for categorical variables are reported in Panel A, Table 2.

The correlation matrix is presented in Panel B, Table 2. Multicollinearity should not be a concern in our study as we found only moderate levels of correlation between our variables. Besides, we analyzed the variance inflation factors (VIF) and observed that all values were lower than 1.13, which is below the suggested warning level proposed in prior research (Hair et al. 1999). Thus, there is enough evidence to rule out multicollinearity in the data.

Table 3 shows the regressions results. Model 1 is the baseline model and includes only control variables. Model 2 is a variant of model 1 in which we add the variable family presence in TMT. The coefficient of family presence in management is negative and significant in explaining the firm performance (β = −0.004; p < 0.1), supporting our first hypothesis.

The variable TI efficiency is then introduced in Model 3. The results show that the coefficient of TI efficiency is nonsignificant. However, the direct effect of the moderator is not substantial for testing the moderating hypothesis (Baron and Kenny 1986); on the contrary, whether the moderator is uncorrelated with the dependent variable, the interpretation of the interaction term is more straightforward (Michiels et al. 2014). Further, what we want to examine is when and to what extent TI efficiency through long-standing relationships, tacit knowledge, and social capital leads family-managed firms to the improvement of their performance outcomes. TI efficiency is thus expected to indirectly affect the relationship between family presence in TMT and firm performance.

Hence, to capture this potential moderating impact of TI efficiency on the family presence in TMT-firm performance relationship, Model 4 includes the interaction effect of Family management*TI efficiency, which is positive and statistically significant (β = 84.989; p < 0.1). Therefore, our results provide support for our second hypothesis.

Figure 2 shows a plot of this interaction effect with a positive slope for family presence in TMT and firm performance when TI efficiency is high and a negative slope for family presence in TMT and firm performance when TI efficiency is low. These results further confirm H2.

4.1 Robustness Test

To strengthen the obtained findings, we developed an additional robustness control on the interaction effect of TI efficiency, using an alternative measure of this moderating variable. Thus, in this case, TI efficiency is calculated by the ratio of the number of product innovations over R&D intensity. R&D intensity has been commonly utilized in prior literature (e.g., Manzaneque et al. 2018) as an innovation input in the measurement of TI efficiency.

Table 4 shows that the robustness test results are very similar to those obtained in previous analyses (Table 3), thus reinforcing our empirical findings. Model 6 reveals that the interaction effect of Family management*TI efficiency exerts a positive and significant impact (β = 7.68e−06; p < 0.1) on firm performance.

In short, this check enables us to guarantee the consistency of our results.

5 Discussion

Investigating how family presence in TMT influences firm performance has become an important topic in management research (e.g., Block et al. 2011; Manzaneque et al. 2020). Prior literature has shown that family-managed firms often prioritize noneconomic goals over economic ones (Gómez-Mejia et al. 2007, 2010), creating a unique context that affects decision-making and strategy implementation and, ultimately, the achieved performance (Martínez-Romero et al. 2020; Rojo-Ramírez and Martínez-Romero 2018). However, as previously stated, the existing results regarding the effect of family presence in TMT on firm performance are far from being conclusive (Vandekerkhof et al. 2018). At this respect, it is important to highlight that we found a lack of prior studies investigating firms’ factors that may have an indirect impact on the family involvement-performance relationship. This is why we introduce a moderating factor, i.e., TI efficiency, which might well be helpful to explain the controversial results.

In line with recent studies (Martínez-Romero et al. 2020; Sciascia and Mazzola 2008), our empirical findings show that family involvement in management, and specifically family presence in the TMT, exerts a negative influence on firm performance. These results can be explained in the light of both the upper echelon and the SEW theories, since family managers would avoid taking strategic decisions that imply a loss of control over their firms (Gómez-Mejia et al. 2007, 2010), knowing that these decisions might involve improved performance outcomes. Furthermore, our findings reveal a positive moderating effect of TI efficiency on the family management-performance relationship. That is, firms with higher family presence in TMT and with enhanced TI efficiency, by promoting long-standing and prosperous relationships with selected stakeholders (Patel and Fiet 2011), social capital (Arregle et al. 2007), and tacit knowledge (Llach and Nordqvist 2010), weaken the negative relationship between family presence in TMT and firm performance.

This chapter contributes to previous literature in several manners. First, we analyzed the family presence in TMT-firm performance relationship in the context of private firms, which up to now has not received enough attention (Martínez-Romero et al. 2020; Sharma and Carney 2012), despite the mixing findings (Sciascia et al. 2014). In line with recent studies (Diéguez-Soto et al. 2019), our findings reveal that family managers, as the dominant coalition in family firms (Hambrick and Mason 1984; Vandekerkhof et al. 2015), negatively influence performance outcomes. Furthermore, we go a step further than previous research that used a binary measure of family management (e.g., Diéguez-Soto et al. 2018; Rojo-Ramírez and Martínez-Romero 2018), by using a continuous variable of family presence in TMT, disclosing heterogeneity across family firms concerning firm performance.

Second, with the purpose of shedding some light on the family management-performance relationship, this chapter introduces the moderating effect of TI efficiency. Thus, our study provides relevant insights regarding the interactive effect of TI efficiency and family presence in TMT with regard to performance outcomes. In such a way, our findings highlight that when TI efficiency is high, firms with a significant family presence in TMT can obtain higher performance outcomes, whereas when TI efficiency is low, firms with a significant family presence in TMT decrease their performance results. That is, Fig. 2 evinces that the moderating effect of TI efficiency on the family management-performance relationship is contingent upon the number of family managers on the TMT. Thus, our results seem to suggest that when there is a higher presence of family members in the TMT and a greater TI efficiency, family managers do not perceive any threat to their emotional endowment, because they dominate the strategic decision-making. In these situations, family managers enter in a virtuous circle and will be willing to establish collaborative innovation ties that increase TI efficiency (Feranita et al. 2017) and thus, firm performance, since these innovative collaborations are not contemplated as a loss of their firm control.

Our findings also have important practical implications, particularly for those family-managed firms that are disposed to enhance their firm’s outcomes. In this sense, family managers should be aware of the importance of attaining higher TI efficiency in order to reach a proper balance between their economic and noneconomic goals. In this vein, family-managed firms may hire key external managers to learn from them the necessary skills and knowledge to improve efficiency in the resource management and implement an innovative culture that persists in the long term (Diéguez-Soto et al. 2016). Furthermore, external managers can avoid certain common practices in family firms such as overcompensation (Anderson and Reeb 2004) or prevent an unqualified family member from becoming CEO (Shleifer and Vishny 1986), which could be detrimental to the implementation and development of innovative projects and, thus, to TI efficiency and firm performance.

Notwithstanding the relevance of the obtained results, this chapter presents certain limitations that, in turn, open new lines for future research. Although we have focused on the family members’ presence in the TMT, we have not contemplated the heterogeneity between these members. At this respect, future studies should analyze whether the interaction effect of TI efficiency on firm performance is the same when in a family firm, TMT members of various generations with different goals and values coexist (Chrisman et al. 2012). What is more, we measured TI efficiency using number of products as innovation output instead of using process innovation, which has been considered essential to decrease costs and to improve production efficiency by reducing the required level of input (Chang et al. 2015; Ramos et al. 2011). Thus, further research should consider the use of both product and process innovations as outputs to calculate TI efficiency in order to see its possible consequences on firm performance.

6 Conclusion

Overall, this chapter examines fundamental relationships in the family firm field, relating family presence in TMT to firm performance and highlighting the key role of TI efficiency. Thus, this manuscript reveals that TI efficiency weakens the negative relationship between the family presence in TMT and firm performance. Notwithstanding our study extends the theoretical and empirical contributions of prior literature (Diéguez-Soto et al. 2019; Sciascia and Mazzola 2008; Sciascia et al. 2014), more research is required to better understand the management implications in family firms performance and, more importantly, to identify what new factors may indirectly contribute to enhancing the family presence in TMT-firm performance relationship.

Notes

- 1.

Regions in the European Union-NUTS 2013/EU-28. Eurostat: http://ec.europa.eu/eurostat/web/nuts/overview [Accessed 10th of October of 2018]. The subdivisions are (1) Northwest, (2) Northeastern, (3) Madrid, (4) Center, (5) East, (6) South, and (7) Canarias.

References

Allouche, J., Amann, B., Jaussaud, J., & Kurashina, T. (2008). The impact of family control on the performance and financial characteristics of family versus nonfamily businesses in Japan: A matched-pair investigation. Family Business Review, 21(4), 315–329.

Anderson, R. C., & Reeb, D. M. (2003). Founding-family ownership and firm performance: Evidence from the S&P 500. The Journal of Finance, 58(3), 1301–1329.

Anderson, R. C., & Reeb, D. M. (2004). Board composition: Balancing family influence in S&P 500 firms. Administrative Science Quarterly, 49(2), 209–237.

Arosa, B., Iturralde, T., & Maseda, A. (2010). Ownership structure and firm performance in non-listed firms: Evidence from Spain. Journal of Family Business Strategy, 1(2), 88–96.

Arregle, J.-L., Hitt, M. A., Sirmon, D. G., & Very, P. (2007). The development of organizational social capital: Attributes of family firms. The Journal of Management Studies, 44(1), 73–95.

Arrondo-García, R., Fernández-Méndez, C., & Menéndez-Requejo, S. (2016). The growth and performance of family businesses during the global financial crisis: The role of the generation in control. Journal of Family Business Strategy, 7(4), 227–237.

Astrachan, J. H., & Jaskiewicz, P. (2008). Emotional returns and emotional costs in privately held family businesses: Advancing traditional business valuation. Family Business Review, 21(2), 139–149.

Bammens, Y., Notelaers, G., & Van Gils, A. (2015). Implications of family business employment for employees’ innovative work involvement. Family Business Review, 28(2), 123–144.

Baron, R. M., & Kenny, D. A. (1986). The moderator-mediator variable distinction in social psychological research: Conceptual, strategic and statistical considerations. Journal of Personality and Social Psychology, 51, 1173–1182.

Basco, R. (2013). The family’s effect on family firm performance: A model testing the demographic and essence approaches. Journal of Family Business Strategy, 4(1), 42–66.

Berrone, P., Cruz, C., Gómez-Mejia, L. R., & Larraza-Kintana, M. (2010). Socioemotional wealth and corporate responses to institutional pressures: Do family-controlled firms pollute less? Administrative Science Quarterly, 55(1), 82–113.

Berrone, P., Cruz, C., & Gómez-Mejia, L. R. (2012). Socioemotional wealth in family firms: Theoretical dimensions, assessment approaches, and agenda for future research. Family Business Review, 25(3), 258–279.

Block, J. H. (2012). R&D investments in family and founder firms: An agency perspective. Journal of Business Venturing, 27(2), 248–265.

Block, J. H., Jaskiewicz, P., & Miller, D. (2011). Ownership versus management effects on performance in family and founder companies: A Bayesian reconciliation. Journal of Family Business Strategy, 2(4), 232–245.

Camagni, R., & Capello, R. (2013). Regional innovation patterns and the EU regional policy reform: Toward smart innovation policies. Growth and Change, 44(2), 355–389.

Carney, M. (2005). Corporate governance and competitive advantage in family-controlled firms. Entrepreneurship & Regional Development, 29(3), 249–265.

Certo, S. T., Lester, R. H., Dalton, C. M., & Dalton, D. R. (2006). Top management teams, strategy and financial performance: A meta-analytic examination. Journal of Management Studies, 43(4), 813–839.

Chang, J., Bai, X., & Li, J. J. (2015). The influence of leadership on product and process innovations in China: The contingent role of knowledge acquisition capability. Industrial Marketing Management, 50, 18–29.

Chirico, F., Sirmon, D. G., Sciascia, S., & Mazzola, P. (2011). Resource orchestration in family firms: Investigating how entrepreneurial orientation, generational involvement, and participative strategy affect performance. Strategic Entrepreneurship Journal, 5(4), 307–326.

Chrisman, J. J., Chua, J. H., Pearson, A. W., & Barnett, T. (2012). Family involvement, family influence, and family-centered non-economic goals in small firms. Entrepreneurship Theory and Practice, 36(2), 267–293.

Chua, J. H., Chrisman, J. J., & Sharma, P. (1999). Defining the family business by behavior. Entrepreneurship Theory and Practice, 23(4), 19–39.

Cohen, W. M., & Klepper, S. (1996). A reprise of size and R & D. The Economic Journal, 106(437), 925–951.

Cruz-Cázares, C., Bayona-Sáez, C., & García-Marco, T. (2013). You can’t manage right what you can’t measure well: Technological innovation efficiency. Research Policy, 42(6–7), 1239–1250.

Cyert, R. M., & March, J. G. (1963). A behavioral theory of the firm. New York: Wiley-Blackwell.

De Massis, A., Frattini, F., & Lichtenthaler, U. (2013a). Research on technological innovation in family firms: Present debates and future directions. Family Business Review, 26(1), 10–31.

De Massis, A., Kotlar, J., Campopiano, G., & Cassia, L. (2013b). Dispersion of family ownership and the performance of small-to-medium size private family firms. Journal of Family Business Strategy, 4(3), 166–175.

De Massis, A., Kotlar, J., Chua, J. H., & Chrisman, J. J. (2014). Ability and willingness as sufficiency conditions for family-oriented particularistic behavior: Implications for theory and empirical studies. Journal of Small Business Management, 52(2), 344–364.

De Massis, A., Kotlar, J., Campopiano, G., & Cassia, L. (2015). The impact of family involvement on SMEs’ performance: Theory and evidence. Journal of Small Business Management, 53(4), 924–948.

Deephouse, D. L., & Jaskiewicz, P. (2013). Do family firms have better reputations than non-family firms? An integration of socioemotional wealth and social identity theories. Journal of Management Studies, 50(3), 337–360.

Diéguez-Soto, J., & López-Delgado, P. (2019). Does family and lone founder involvement lead to similar indebtedness? Journal of Small Business Management, 57(4), 1531–1558.

Diéguez-Soto, J., López-Delgado, P., & Rojo-Ramírez, A. A. (2015). Identifying and classifying family businesses. Review of Managerial Science, 9(3), 603–634.

Diéguez-Soto, J., Duréndez, A., García-Pérez-de-Lema, D., & Ruiz-Palomo, D. (2016). Technological, management, and persistent innovation in small and medium family firms: The influence of professionalism. Canadian Journal of Administrative Sciences, 33(4), 332–346.

Diéguez-Soto, J., Garrido-Moreno, A., & Manzaneque, M. (2018). Unraveling the link between process innovation inputs and outputs: The moderating role of family management. Journal of Family Business Strategy, 9(2), 114–127.

Diéguez-Soto, J., Manzaneque, M., González-García, V., & Galache-Laza, T. (2019). A study of the moderating influence of R&D intensity on the family management-firm performance relationship: Evidence from Spanish private manufacturing firms. BRQ Business Research Quarterly, 22(2), 105–118.

Duran, P., Kammerlander, N., van Essen, M., & Zellweger, T. M. (2016). Doing more with less: Innovation input and output in family firms. Academy of Management Journal, 59(4), 1224–1264.

Dyer, W. G., Jr. (2006). Examining the “family effect” on firm performance. Family Business Review, 19(4), 253–273.

Family Firm Institute. (2018). Global data points. Retrieved from https://my.ffi.org/page/globaldatapoints

Feranita, F., Kotlar, J., & De Massis, A. (2017). Collaborative innovation in family firms: Past research, current debates, and agenda for future research. Journal of Family Business Strategy, 8(3), 137–156.

Galende Del Canto, J., & Suárez González, I. (1999). A resource-based analysis of the factors determining a firm’s R&D activities. Research Policy, 28(8), 891–905.

Gallucci, C., Santulli, R., & Calabrò, A. (2015). Does family involvement foster or hinder firm performance? The missing role of family-based branding strategies. Journal of Family Business Strategy, 6(3), 155–165.

Gao, W., & Chou, J. (2015). Innovation efficiency, global diversification, and firm value. Journal of Corporate Finance, 30, 278–298.

Gómez-Mejia, L. R., Haynes, K. T., Núñez-Nickel, M., Jacobson, K. J. L., & Moyano-Fuentes, J. (2007). Socioemotional wealth and business risks in family-controlled firms: Evidence from Spanish olive oil Mills. Administrative Science Quarterly, 52(1), 106–137.

Gómez-Mejia, L. R., Makri, M., & Kintana, M. L. (2010). Diversification decisions in family-controlled firms. Journal of Management Studies, 47(2), 223–252.

González, M., Guzmán, A., Pombo, C., & Trujillo, M. A. (2013). Family firms and debt: Risk aversion versus risk of losing control. Journal of Business Research, 66(11), 2308–2320.

Grimpe, C., & Kaiser, U. (2010). Balancing internal and external knowledge acquisition: The gains and pains from R & D outsourcing. Journal of Management Studies, 47(8), 1483–1509.

Hair, J. F., Anderson, R. E., Tatham, R. L., & Black, W. C. (1999). Analisis multivariante. Madrid: Prentice Hall.

Hambrick, D. C., & Mason, P. A. (1984). Upper echelons: The organization as a reflection of its top managers. Academy of Management Review, 9(2), 193–206.

IEF & Red de Cátedras de Empresa Familiar. (2015). La Empresa Familiar en España (2015). Barcelona: Instituto de la Empresa Familiar.

IEF & Red de Cátedras de Empresa Familiar. (2018). Factores de Competitividad y Análisis Financiero en la Empresa Familiar. Barcelona: Instituto de la Empresa Familiar.

Kammerlander, N., Sieger, P., Voordeckers, W., & Zellweger, T. M. (2015). Value creation in family firms: A model of fit. Journal of Family Business Strategy, 6(2), 63–72.

Kancs, A., & Siliverstovs, B. (2016). R&D and non-linear productivity growth. Research Policy, 45(3), 634–646.

Kellermanns, F. W., Eddleston, K. A., Sarathy, R., & Murphy, F. (2012). Innovativeness in family firms: A family influence perspective. Small Business Economics, 38(1), 85–101.

Kor, Y. (2006). Direct and interaction effects of top management team and board compositions on R&D investment strategy. Strategic Management Journal, 27(11), 1081–1099.

Kotlar, J., De Massis, A., Frattini, F., Bianchi, M., & Fang, H. (2013). Technology acquisition in family and nonfamily firms: A longitudinal analysis of Spanish manufacturing firms. Journal of Product Innovation Management, 30(6), 1073–1088.

Kotlar, J., Fang, H., De Massis, A., & Frattini, F. (2014). Profitability goals, control goals, and the R&D investment decisions of family and nonfamily firms. Journal of Product Innovation Management, 31(6), 1128–1145.

La Porta, R., Lopez-De-Silanes, F., & Shleifer, A. (1999). Corporate ownership around the world. The Journal of Finance, 54(2), 471–517.

Le Breton-Miller, I., Miller, D., & Lester, R. H. (2011). Stewardship or agency? A social embeddedness reconciliation of conduct and performance in public family businesses. Organization Science, 22, 704–721.

Ling, Y., & Kellermanns, F. W. (2010). The effects of family firm-specific sources of TMT diversity: The moderating role of information exchange frequency. Journal of Management Studies, 47(2), 322–344.

Llach, J., & Nordqvist, M. (2010). Innovation in family and non-family businesses: A resource perspective. International Journal of Entrepreneurial Venturing, 2(3), 381–399.

López-Delgado, P., & Diéguez-Soto, J. (2015). Lone founders, types of private family businesses and firm performance. Journal of Family Business Strategy, 6(2), 73–85.

Manzaneque, M., Diéguez-Soto, J., & Garrido-Moreno, A. (2018). Technological innovation inputs, outputs, and family management: Evidence from Spanish manufacturing firms. Innovation: Management, Policy & Practice, 20(4), 299–325.

Manzaneque, M., Rojo-Ramírez, A. A., Diéguez-Soto, J., & Martínez-Romero, M. J. (2020). How negative aspiration performance gaps affect innovation efficiency. Small Business Economics, 54(1), 209–233.

Martínez-Alonso, R., Martínez-Romero, M. J., & Rojo-Ramírez, A. (2018). Technological innovation and socioemotional wealth in family firm research: Literature review and proposal of a conceptual framework. Management Research: Journal of the Iberoamerican Academy of Management, 16(3), 270–301.

Martínez-Romero, M. J. (2018). Financial performance and value creation in privately held family businesses: The influence of socioemotional wealth. Doctoral thesis, Almería.

Martínez-Romero, M. J., & Rojo-Ramírez, A. A. (2016). SEW: Looking for a definition and controversial issues. European Journal of Family Business, 6(1), 1–9.

Martínez-Romero, M. J., & Rojo-Ramírez, A. A. (2017). Socioemotional wealth’s implications in the calculus of the minimum rate of return required by family businesses’ owners. Review of Managerial Science, 11(1), 95–118.

Martínez-Romero, M. J., Martínez-Alonso, R., & Casado-Belmonte, M. P. (2020). The influence of socioemotional wealth on firm financial performance: Evidence from small and medium privately held family businesses. International Journal of Entrepreneurship and Small Business, 40(1), 7–31.

Matzler, K., Veider, V., Hautz, J., & Stadler, C. (2015). The impact of family ownership, management, and governance on innovation. Journal of Product Innovation Management, 32(3), 319–333.

Michiels, A., Voordeckers, W., Lybaert, N., & Steijvers, T. (2014). Dividends and family governance practices in private family firms. Small Business Economics, 44(2), 299–314.

Miller, D., & Le Breton-Miller, I. (2005). Managing for the long run: Lessons in competitive advantage from great family businesses. Boston, MA: Harvard Business School Press.

Miller, D., Le Breton-Miller, I., Lester, R. H., & Cannella, A. (2007). Are family firms really superior performers? Journal of Corporate Finance, 13(5), 829–858.

Nieto, M. J., Santamaria, L., & Fernandez, Z. (2015). Understanding the innovation behavior of family firms. Journal of Small Business Management, 53(2), 382–399.

Patel, P. C., & Fiet, J. O. (2011). Knowledge combination and the potential advantages of family firms in searching for opportunities. Entrepreneurship Theory and Practice, 35(6), 1179–1197.

Pazzaglia, F., Mengoli, S., & Sapienza, E. (2013). Earnings quality in acquired and nonacquired family firms: A socioemotional wealth perspective. Family Business Review, 26(4), 374–386.

Poutziouris, P. Z. (2001). The views of family companies on venture capital: Empirical evidence from the UK small to medium-size enterprising economy. Family Business Review, 14(3), 277–291.

Qiao, P., & Fung, A. (2016). How does CEO power affect innovation efficiency? The Chinese Economy, 49(4), 231–238.

Ramos, E., Acedo, F. J., & Gonzalez, M. R. (2011). Internationalisation speed and technological patterns: A panel data study on Spanish SMEs. Technovation, 31(10–11), 560–572.

Revilla, A. J., Perez-Luno, A., & Nieto, M. J. (2016). Does family involvement in management reduce the risk of business failure? The moderating role of entrepreneurial orientation. Family Business Review, 29(4), 365–379.

Rojo-Ramírez, A. A., & Martínez-Romero, M. J. (2018). Required and obtained equity returns in privately held businesses: The impact of family nature—Evidence before and after the global economic crisis. Review of Managerial Science, 12(3), 771–801.

Schulze, W. S., & Gedajlovic, E. R. (2010). Whither family business? Journal of Management Studies, 47(2), 191–204.

Schulze, W. S., Lubatkin, M. H., Dino, R. N., & Buchholtz, A. K. (2001). Agency relationships in family firms: Theory and evidence. Organization Science, 12(2), 99–116.

Sciascia, S., & Mazzola, P. (2008). Family involvement in ownership and management: Exploring nonlinear effects on performance. Family Business Review, 21(4), 331–345.

Sciascia, S., Mazzola, P., & Kellermanns, F. W. (2014). Family management and profitability in private family-owned firms: Introducing generational stage and the socioemotional wealth perspective. Journal of Family Business Strategy, 5(2), 131–137.

Sharma, P., & Carney, M. (2012). Value creation and performance in private family firms: Measurement and methodological issues. Family Business Review, 25(3), 233–242.

Shleifer, A., & Vishny, R. W. (1986). Large shareholders and corporate control. Journal of Political Economy, 94(3), 461–488.

Sirmon, D. G., & Hitt, M. A. (2003). Managing resources: Linking unique resources, management, and wealth creation in family firms. Entrepreneurship Theory and Practice, 27(4), 339–358.

Sirmon, D., Hitt, M., & Ireland, R. (2007). Managing firm resources in dynamic environments to create value: Looking inside the black box. Academy of Management Review, 32(1), 273–292.

Sorenson, R. L. (1999). Conflict management strategies used by successful family businesses. Family Business Review, 12(4), 325–339.

Teece, D., Pisano, G., & Shuen, A. (1997). Dynamic capabilities and strategic management. Strategic Management Journal, 18(7), 509–533.

Vandekerkhof, P., Steijvers, T., Hendriks, W., & Voordeckers, W. (2015). The effect of organizational characteristics on the appointment of nonfamily managers in private family firms: The moderating role of socioemotional wealth. Family Business Review, 28(2), 104–122.

Vandekerkhof, P., Steijvers, T., Hendriks, W., & Voordeckers, W. (2018). Socio-emotional wealth separation and decision-making quality in family firm TMTs: The moderating role of psychological safety. Journal of Management Studies, 55(4), 648–676.

Wagner, D., Block, J. H., Miller, D., Schwens, C., & Xi, G. (2015). A meta-analysis of the financial performance of family firms: Another attempt. Journal of Family Business Strategy, 6(1), 3–13.

Wang, E. C. (2007). R&D efficiency and economic performance: A cross-country analysis using the stochastic frontier approach. Journal of Policy Modeling, 29(2), 345–360.

Yu, A., Lumpkin, G. T., Sorenson, R. L., & Brigham, K. H. (2011). The landscape of family business outcomes: A summary and numerical taxonomy of dependent variables. Family Business Review, 25(1), 33–57.

Zattoni, A., Gnan, L., & Huse, M. (2015). Does family involvement influence firm performance? Exploring the mediating effects of board processes and tasks. Journal of Management, 41(4), 1214–1243.

Zellweger, T. M. (2017). Managing the family business: Theory and practice. Cheltenham: Edward Elgar Publishing.

Zellweger, T. M., & Astrachan, J. H. (2008). On the emotional value of owning a firm. Family Business Review, 21(4), 347–363.

Zellweger, T. M., Kellermanns, F. W., Chrisman, J. J., & Chua, J. H. (2011). Family control and family firm valuation by family CEOs: The importance of intentions for transgenerational control. Organization Science, 23(3), 851–868.

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2020 Springer Nature Switzerland AG

About this chapter

Cite this chapter

Martínez-Romero, M.J., Martínez-Alonso, R., Casado-Belmonte, M.P., Diéguez-Soto, J. (2020). Family Management and Firm Performance: The Interaction Effect of Technological Innovation Efficiency. In: Leitão, J., Nunes, A., Pereira, D., Ramadani, V. (eds) Intrapreneurship and Sustainable Human Capital. Studies on Entrepreneurship, Structural Change and Industrial Dynamics. Springer, Cham. https://doi.org/10.1007/978-3-030-49410-0_13

Download citation

DOI: https://doi.org/10.1007/978-3-030-49410-0_13

Published:

Publisher Name: Springer, Cham

Print ISBN: 978-3-030-49409-4

Online ISBN: 978-3-030-49410-0

eBook Packages: Business and ManagementBusiness and Management (R0)