Abstract

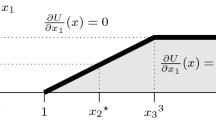

An article is dedicated to the discussion about the ways to find solutions for the questions and closely related questions of IPO’s strategy as the pattern of hierarchy with a variety of alternatives upon criteria. The type of public offering in which shares of a company are sold to institutional investors and usually also retail (individual) investors. An IPO is underwritten by one or more investment banks, who also arrange for the shares to be listed on one or more stock exchanges. Fundamentally, this article consists of a systematic introducing to the theory of relative value of criteria, and this theory had been developing the author during the period of a couple of decades. In the article, there is the axiomatic methodology of presenting is utilized. This methodology is the type of method where previously the set of requirements, named axiom, is formed which then are associated with the group of tasks being under consideration. The most important resources for this are the information about the relative values of the criteria.

Access this chapter

Tax calculation will be finalised at checkout

Purchases are for personal use only

Similar content being viewed by others

References

Penzin, K.: On the way to Russian IPOs, Money and Credit, 6, (2015)

Marttunen, M., Belton, V., Lienert, J.: Are objectives hierarchy related biases observed in practice: a meta-analysis of environmental and energy applications of multi-criteria decision analysis. Eur. J. Oper. Res. 265(1), 178–194 (2018)

Nihat, A., Kathleen, A., Ettore, C., Ozdakak, A.: Stock market development and the financing role of IPOs in acquisitions. J. Bank. Finance 98, 25–38 (2019)

Bomas, V.V.: Support for making multi-criteria decisions according to user preferences, DSS DSB, UTES, p. 172. Ed.: Publishing House of the Moscow Aviation Institute (2006)

Corner, T.: Prerequisites and factors for the development of business activity in IPO markets. T.V. Corner, Actual problems of international relations: political, economic, legal aspects: AI materials Int. (Correspondence.) Nauch. practical. conf. (Lviv, 19 September 2012), Council of Young Scientists of the Faculty of International Affairs. rel. Lviv. nat Un to them I. Franko. Lviv. nat Un to them I. Franko, 175 (2012)

Federal Law of December 26, 1995 No. 2008-ФЗ On Joint-Stock Companies (harm of Federal Laws of June 13, 1996 No. 65-ФЗ, as of May 24, 1999, No. 101-FL), Rossiyskaya gazeta. M., 29 December 1995, no. 248, p. 3; Meeting of the legislation of the Russian Federation. - M., №1 Article 1. (with subsequent changes), (1996)

Hafiz, H., Shaolong, M.: Partial private sector oversight in China’s A-share IPO market: an empirical study of the sponsorship system. J. Corp. Financ. 56, 15–37 (2019)

Shevchenko, I., Puchkina, E., Tolstov, N.: Shareholders’ and managers’ interests: collisions in russian corporations. High. School Econ. 23(1), 118–142 (2019)

Database on IPOs and mergers and acquisitions. http://dealogic.com. Accessed 21 Dec 2019

Instruction of the Central Bank of the Russian Federation of 10.03.2006 No. 128-I: On the rules for issuing and registering securities by credit organizations in the territory of the Russian Federation (2019)

Lotov, A.V., Pospelova, I.I: Multicriteria decision-making problems. Achievable goals method, p. 203. UNPress, Moscow (2018)

Rife, G.: Analysis of solutions (introduction to the problem of choice in the condition of uncertainty). Per. Sangl., p. 408. Nauka, Moscow (1977)

Bebchuk, L.A., Brav, A., Jiang, W.: The long-term effects of hedge fund activism. Columbia Law Rev. 83–115 (2015)

Kim, M.: Valuing IPOs. J. Financ. Econ. 53, 409–437 (1999)

Kini, R., Rife, X: Decision making under many criteria: preferences and substitutions: Per. Sangl. I.R. Shakhova, p. 560. Radio communication, Moscow (1981)

Kostogryzov, A.I., Nistratov, G.A.: Standardization, mathematical modeling, rational management and certification in the field of systems and applied engineering, p. 396. Publishing House of the military-industrial complex and 3 Central Research Institute of the Ministry of Defense of the Russian Federation, Moscow (2004)

Napolov, A.V.: Structuring of initial public offerings of shares of Russian companies, Dis. Cand. econ Sciences: 08.00.10, p. 247 (2019)

Global IPO Trends 2010 Ernst & Young Homepage. https://drivkraft.ey.se/wp-content/uploads/2011/06/EY-Global-IPO-trends-2010. Accessed 21 Dec 2019

Global IPO Trends 2011 Ernst & Young Homepage. https://drivkraft.ey.se/wp-content/uploads/2012/08/EY-Global-IPO-trends-2011. Accessed 21 Dec 2019

Global IPO Trends 2012 Ernst & Young Homepage. https://drivkraft.ey.se/wp-content/uploads/2013/10/EY-Global-IPO-trends-2012. Accessed 21 Dec 2019

Global IPO Trends 2013 Ernst & Young Homepage 2013. https://drivkraft.ey.se/wp-content/uploads/2014/12/EY-Global-IPO-trends-2013. Accessed 21 Dec 2019

Global IPO trends 2014 Ernst & Young Homepage. https://drivkraft.ey.se/wp-content/uploads/2015/14/EY-Global-IPO-trends-2014. Accessed 21 Dec 2019

Global IPO trends 2015 1Q Ernst & Young Homepage. https://www.ey.com/Publication/vwLUAssets/EY-global-ipo-trends-2015-q1. Accessed 21 Dec 2019

Global IPO trends 2016 2Q Ernst & Young Homepage. https://www.ey.com/Publication/vwLUAssets/EY-global-ipo-trends-2016-q2. Accessed 21 Dec 2019

Global IPO trends 2017 3Q Ernst & Young Homepage. https://www.ey.com/Publication/vwLUAssets/EY-global-ipo-trends-2017-q3. Accessed 21 Dec 2019

Global IPO trends 2018 4Q Ernst & Young Homepage. https://www.ey.com/Publication/vwLUAssets/EY-global-ipo-trends-2018-q4. Accessed 21 Dec 2019

Hearn, B., Filatotchev, I.: Founder retention as CEO at IPO in emerging economies: the role of private equity owners and national institutions. J. Bus. Ventur. 34(3), 418–438 (2019)

Bellman, R., Zade, L.: Decision-making in vague conditions.Issues of analysis and decision-making procedures. Trans. Eng., pp. 172–175. Mir, Moscow (1976)

IPO Watch Europe Q1 2016 Electronic resource Review compiled by PricewaterhouseCoopers (2016). www.pwc.ru/ru/capital-markets. Accessed 21 Dec 2019

IPO Watch Europe Q1 2017 Electronic resource, Review compiled by PricewaterhouseCoopers (2017). www.pwc.ru/ru/capital-markets. Accessed 21 Dec 2019

IPO Watch Europe Q2 2018 Electronic resource, Review compiled by PricewaterhouseCoopers (2018). www.pwc.ru/ru/capital-markets. Accessed 21 Dec 2019

IPO Watch Europe Q3 2016 Electronic resource, Review compiled by PricewaterhouseCoopers (2016). www.pwc.ru/ru/capital-markets. Accessed 21 Dec 2019

IPO Watch Europe, Report for the third quarter of 2017 Electronic resource, the report is published by the World Federation of Exchanges World Federation of Exchanges, December 2017. https://www.pwc.ru/ru/publications/ipo-watch-europe.html. Accessed 21 Dec 2019

Pinelli, M.: Global IPO trends, Electronic resource, Report prepared by Ernst & Young (E & Y). http://www.ey.com/Publication/vwLUAssets/ey-q4-14-global-ipo-trends-report/$FILE/ey-q4-14-global-ipo-trends-report. Accessed 27 Dec 2019

Russian IPO Pioners-2: a review of Russian and CIS companies, PNB. http://www.pbnco.com. Accessed 25 Dec 2019

Sieradzki, R.: Does he pay to invest in IPO’s: evidence from the Warsaw Stock Exchange. National Bank of Poland Working Paper, p. 139 (2018)

Tailor, M.A: The role of IPO scales in Russia and the socio-economic consequences of these processes. Electronic resource, Russia and America in the XXI century, p. 1 (2019)

Xunjie, G., Zeshui, X., Huchang, L., Francisco, H.: Multiple criteria decision making based on distance and similarity measures under double hierarchy hesitant fuzzy linguistic environment. Comput. Ind. Eng. 126, 516–530 (2018)

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2021 Springer Nature Switzerland AG

About this paper

Cite this paper

Shevchenko, I., Tretyakova, S., Avedisyan, N., Khubutiya, N. (2021). IPO – The Pattern of Hierarchy with a Variety of Alternatives upon Criteria. In: Antipova, T. (eds) Integrated Science in Digital Age 2020. ICIS 2020. Lecture Notes in Networks and Systems, vol 136. Springer, Cham. https://doi.org/10.1007/978-3-030-49264-9_11

Download citation

DOI: https://doi.org/10.1007/978-3-030-49264-9_11

Published:

Publisher Name: Springer, Cham

Print ISBN: 978-3-030-49263-2

Online ISBN: 978-3-030-49264-9

eBook Packages: Intelligent Technologies and RoboticsIntelligent Technologies and Robotics (R0)