Abstract

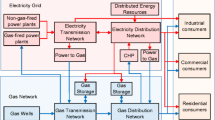

With growing penetration of gas-fired generation in many systems, the economics and planning of natural gas and electric transmission networks are increasingly intertwined. However, in the United States these two sectors have investment mechanisms which differ greatly. This may impede coordination of expansion and investment, especially when intermediate power contract markets are weak. The New England region offers a case study of a gas transmission-constrained region where the decentralized, private, contract-based decision-making of the U.S. natural gas pipeline sector has not supported new gas capacity needed to fuel gas-fired generation, even with rapidly growing renewable energy production. New policy mechanisms may be needed to enable the interstate pipeline sector to better match the needs of highly variable electric generation.

The opinions expressed in this chapter are solely those of the authors and do not reflect the opinion of Charles River Associates or its clients.

Access provided by Autonomous University of Puebla. Download chapter PDF

Similar content being viewed by others

Keywords

1 Introduction

The increasing penetration of gas-fired generation in some liberalized power markets has created new challenges in coordinating planning and investment in gas and electric transmission infrastructure. When gas-fired generation is critical to meeting electric demand, the regional availability of natural gas supplies can be a key driver of reliability and may have a large impact on consumer power prices. This is especially true in regions (such as New England) where there are coincident high winter gas and electric demand. While there is a substantial literature on investment in the electric grid, there is a more limited literature on policy issues associated with gas–electric interactions. In this chapter, we explore some of the economic and policy issues arising from differing investment models for electric and natural gas transmission, with a focus on New England, a region of the United States that has been substantially impacted by lack of new investment in regional pipeline infrastructure.

2 Investment Models in U.S. Electric and Gas Transmission

Electric and natural gas transmission are largely federally regulated in the United States, but the mechanisms for investment in new transmission assets are substantially different.Footnote 1 Planning in the electric sector is generally centralized, with most regional and inter-regional expansion planning conducted by regional transmission organizations (RTOs) and independent system operators (ISOs), which operate the transmission grid in large regions. While not all transmission-operating utilities are in an ISO, FERC’s Order 1000 (issued in 2011) required other federally regulated transmission utilities to join some form of regional transmission planning group.

The interstate natural gas industry is quite different, as transmission expansion is not planned by any central authority. Natural gas pipelines do not demonstrate the network external costs issues affecting integrated electric grids, making decentralized operations economically possible (Makholm 2012). FERC approval is needed to build an interstate gas pipeline, under the terms of the Natural Gas Act of 1938. A pipeline company is required to obtain a certificate of public convenience and necessity to build a new pipe, but no regional or federal agency oversees pipeline system planning or coordinates investment decisions between pipeline companies. Instead, pipeline companies are often in vigorous competition to build new pipelines to serve customers willing to sign the requisite long-term gas transportation contracts.

2.1 Regional Electric Transmission Planning

An ISO typically performs three primary roles:

-

1.

Short-term operation of the regional power grid,

-

2.

Managing wholesale electric markets and,

-

3.

Future transmission system planning.

Power system planning requires the ISO to make certain that the region has adequate resources and transmission capacity to meet the demand for electricity over a planning horizon—this includes the interchange of power between adjacent ISOs. To initiate this process, the ISO performs detailed network studies to determine where system improvements and/or upgrades are required. The results of this analysis are made public to provide market signals as to where investments are required.

An ISO will typically develop and maintain a regional transmission system plan, which looks at system adequacy and reliability over a longer horizon. Under FERC’s Order 1000 requirements, ISOs and other regional transmission planning groups must consult with stakeholders, consider state and federal public policy requirements (such, for example, state renewal portfolio standards), and coordinate with other regions, if necessary. Order 1000 also changed long-standing U.S. policy and removed any “right of first refusal” for existing transmission owners to build new lines or facilities in their service territories. Historically, a transmission-owning utility could build any new required transmission projects within its service territory. The elimination of the right of first refusal created the scope in some cases for competition to build new projects within a region needed under the ISO’s regional plan. While transmission developers may compete to build these projects, the costs are recovered in transmission rates. ISOs (or other FERC-regulated regional transmission planning groups) are responsible for evaluating proposals for the required system improvements. Allocating the costs of these projects among different users of the regional transmission system has proved controversial in some cases, despite broad FERC policy guidance on the topic (Adamson 2018).

2.2 The Decentralized Pipeline Expansion Model

In stark contrast to the electric planning process, the process for new gas infrastructure investment begins as a discussion between an interstate natural gas pipeline—which seeks to sell transportation capacity on the pipeline under contract—and potential shippers of gas on the pipeline. A shipper may be a natural gas local distribution company (LDC), a gas marketer, large industrial customer, a gas producer or a power generator. These discussions are generally non-public and do not address regional issues, but focus on the needs of the potential shipper customers. In most cases, especially for larger projects, the discussions may include several shippers. Once the pipeline and shippers conclude their discussions and arrive at a project structure that meets their needs, the pipeline will hold an “open season.” US pipelines are subject to open access regulations, and an open season is required by FERC to assure all parties have an equal opportunity to acquire capacity on the proposed project. Often the open season announcement is the first time there is any public notice of such discussions or that a project is being considered. In some cases the open season is largely a formality. In other cases, the open season process is used to identify additional shippers for the pipeline. Upon the completion of the open season process, the pipeline will typically begin the public process of permitting the project. FERC administers the approval and permitting process. In most cases, the pipeline will present contracts, known as precedent agreements, it has executed with the shippers as proof of need for the project.

Historically, FERC policy has deemed the existence of commercial counterparties willing to sign long-term contracts for natural gas transportation as a strong market signal that such capacity is needed, and FERC will often not undertake a market needs analysis.

Typically there has been limited or no discussion or consideration of coordination or broader regional needs for a natural gas pipeline project. As part of the FERC approval process, there is a requirement to investigate alternatives to the proposed new infrastructure. The primary purpose of this exercise is to minimize potential environmental impacts of the new project. At this point, FERC may consider coordinated grid improvements between existing pipelines, but this path is rarely taken given the established contractual agreements that exist between the pipelines and their shippers. Upon receipt of a FERC certificate and associated permits, the pipeline must secure appropriate financing to construct the facilities. Historically, pipeline companies have been the sole equity holders for new pipeline projects, leaving little room for outside investment. This has changed recently as new shippers have often been able to secure equity positions in the pipeline assets—this is particularly true for larger greenfield pipelines.

3 National and Regional Transmission Investment Experience

The differences between regulatory models for investment in natural gas pipelines and electric transmission have helped produce differing levels of investment over the last few decades.

3.1 National Experience in Transmission Investment

U.S. interstate natural gas pipeline companies had have substantial success building new pipeline infrastructure over the past fifteen years. Demand for new natural gas pipelines grew sharply around 2007 as gas needed to be moved from new shale producing regions. As shown in Fig. 1, pipeline developers were able to respond quickly to shippers’ need for new transportation capacity. Investment more than tripled in a few years, much of it into new “producer-push” pipelines—that is, a pipeline largely contracted by gas producers that takes gas from producing fields to market. The large amount of investment and new capacity in 2017 was largely associated with new pipelines bringing gas from the Marcellus and Utica shale regions to market.

Investment on the electric side has grown much more modestly, even with the need to integrate substantial quantities of new renewable generation in many regional markets. Figure 2 shows the trend in electric transmission investment over the decade to 2015.

Many of the investment dollars represented in Fig. 2 do not reflect new transmission capacity. Rather, the investments have been primarily used for the rehabilitation of existing assets (Edison Electric Institute 2016). Since transmission-owning utilities may have incentives to capitalize large rehabilitation and rebuilding of existing transmission asset, these often are reflected in new electric transmission capital expenditure data.

3.2 The New England Regional Experience

The New England experience over the last 10–15 years differs substantially from the national experience. ISO New England (ISO-NE), the regional transmission and market operator, has seen relatively significant levels of investment, while new gas pipeline additions have been minimal despite a significant need for new gas transportation capacity into the region.

3.2.1 ISO New England and Regional Transmission Additions

ISO-NE operates and plans the transmission grid for most of the six New England states, as shown in Fig. 3. ISO-NE is interconnected with the New York ISO, the Hydro Québec system, and to New Brunswick in Canada. New England imports substantial amounts of electricity, especially from Canada.

Over the period 2003 through October 2018, ISO-NE placed $10.7 billion of new power transmission assets into service, with the majority of this since 2008 and concentrated in a few large projects (ISO New England 2018). ISO-NE calculate the sum of congestion, uplift and reliability agreement costs in the region have fallen from approximately $700 million per year to less than $100 million per year in 2017 and 2018 due to transmission investment.

3.2.2 Regional Pipeline Additions

New England is served by three major interstate pipelines that bring gas into the region, which has no gas production and very limited gas storage. There are also LNG import terminals in the region but utilization of these facilities is currently low. As in other regions of the United States, there is no regional pipeline operator—each pipeline is responsible for its own operations under the terms of its FERC tariff (Fig. 4).

Despite successes in other parts of the country, the interstate pipeline industry has not succeeded in building much new capacity in New England, as shown in Fig. 5.

These are relatively small additions to the New England system, where peak day sendout LDC is greater than 4.3 billion cubic feet per day (Bcf/d). By 2020 peak demand for natural gas is expected to near 6 Bcf/d.

Figure 6 shows that this trend has continued for some years, with the recent jump in investment in 2016–17 primarily tied to one pipeline expansion project.

3.2.3 Price Signals for New Investment

The lack of new pipeline investment is not due to a lack of strong price signals showing the value of new capacity. Pipeline developers and shippers look to gas basis (the difference between locational gas prices in two different markets) as a signal of the potential value of pipeline capacity. Figure 7 shows basis prices from 2010 through 2018 at the Algonquin Citygate market point (the most liquid market point in New England) versus spot prices at Henry Hub in Louisiana, the most commonly referenced gas pricing point in North America. On many days even cheaper gas is available in the Appalachian region (location of the Marcellus and Utica shale plays) which is closer to New England.

A shipper with transmission capacity into New England on an import pipeline would see large profits on days when the Algonquin Citygate price increases sharply. The 2014 “polar vortex” event and other spikes show that these basis spikes occur primarily in periods of very high regional gas demand, usually tied to low temperatures in the region.

Figure 8 presents the basis differential into New England on the Algonquin Pipeline as a function of available pipeline capacity.Footnote 2 As the graph shows, prices within the New England region rise materially as available pipeline capacity diminishes.

Gas LDCs typically cover most or all of their core gas demand requirements with firm transportation contracts, and, with regulatory approval, pass these costs through to their core customers. LDC peak gas demand, however, has been growing relatively slowly in the region for years. In contrast, ISO-NE, as the regional electric grid operator, has shown significant concern over the region’s dependence on gas-fired generation with potential shortfalls in regional gas deliverability (van Welie 2018). Natural gas is the primary fuel for 45% of the region’s generating capacity and sets the locational marginal price (LMP) more than 75% of the time. ISO-NE has stated that ensuring adequate fuel supply for the region’s generators is New England’s most pressing electric reliability challenge, and that by winter 2024/25 many modeled scenarios showed risk of load shedding due to fuel shortfalls.

3.2.4 Contracting Issues Hindered Proposed Pipeline Projects

Several major pipeline projects have been proposed in recent years to bring additional gas into the region. The $3.3 billion Northeast Energy Direct pipeline failed due to a lack of contractual commitments for transportation capacity. The Access Northeast project would have upgraded 125 miles of the Algonquin pipeline which serves most of the region’s gas-fired generation. The project developers noted merchant generators in the region had little incentive or ability to sign long-term contracts for pipeline capacity, as, unlike LDCs, there is no pass-through mechanism for these costs (Kruse 2016). A proposed mechanism under which certain pipeline transportation costs could be recovered through utility electric rates was rejected by the Massachusetts Supreme Judicial Court (MSJC 2016).

Increases in peak natural gas demand in New England are driven primarily by the electric generation sector, but in the absence of market incentives, or means to pass-through these costs, generators have been unwilling or unable to sign the long-term pipeline capacity agreements that would allow the pipeline expansion capacity to be built. In conjunction with the difficult environmental and land use issues in the densely populated New England region, the lack of gas pipeline contractual counterparties has led to relatively little new pipeline capacity being built in the region, even with a high “basis” price signal.

3.2.5 Electric Transmission as an Alternative to Pipelines

With its high gas prices, New England also has relatively high electricity prices. In theory, lack of new gas transportation into New England could be, at least partially, ameliorated by new electric transmission facilities from neighboring regions, especially Québec, which has substantial hydropower resources. This has proven quite difficult, however, due to issues associated with siting new large electric transmission facilities.

For example, in March 2017 the Massachusetts state regulator approved a process in which state electricity utilities could procure a large amount of new clean energy under long-term contracts; these contracts could include the costs of building new transmission lines within and into New England (Department of Public Utilities 2017). In January 2018, the “Northern Pass” project was selected. This was to be a 1090 MW high voltage direct current (HVDC) and AC transmission line system designed to move Québec hydropower to Massachusetts, with much of the HVDC line routed through the state of New Hampshire. In March 2018, the Site Evaluation Committee of the State of New Hampshire denied a certificate for Northern Pass to be built through that state (Site Evaluation Committee 2018).

Following the permit denial, the local utilities in Massachusetts terminated the selection of the Northern Pass project and selected an alternate new transmission line project through Maine for delivering hydropower from Québec (Department of Energy Resources 2018). This alternate project has recently received certificate approval by the Maine state utility commission but still faces substantial political and legal opposition (Gheorghiu 2019).

In short, building new large-scale electric transmission into the New England region has proven to be costly, slow and difficult, and hence has not provided an easy alternative to the contractual and other issues associated with new gas pipeline construction.

3.2.6 New England Policy Responses

Given a lack of infrastructure coordination and the growing dependence on natural gas generation in the early 2000s, ISO-NE instituted market changes to support reliability. The initial market mechanisms established capacity payment penalties for generators that were unavailable during “critical” periods. These critical periods were often during the winter when gas market demands were at their highest consuming a large share of the available pipeline capacity to the region. Given the magnitude of the price spikes experienced in New England, ISO-NE determined these measures were insufficient to provide the level of reliability required.

To promote greater grid reliability, in 2013, ISO-NE instituted a new Winter Reliability Program in 2013 in an effort to promote greater grid reliability. This program shifted focus from encouraging gas unit availability to promoting the availability of alternate fuels such as LNG, petroleum, and demand response to manage peak generation demand.

Given ongoing reliability concerns, ISO-NE proposed new market rules to replace the Winter Reliability Program in 2018. The new capacity market rules had two primary components: (i) ISO-NE would integrate demand response resources into its daily energy and reserve economic dispatch on a level comparable to generation resources and (ii) ISO-NE introduced Pay-For-Performance capacity market incentives. These rules essentially shifted payments from under-performing generating resources to over-performing resources. The new incentives were added to the Forward Capacity Market after ISO-NE observed a weak linkage between capacity payments and actual performance by resources during times of system stress (FERC 2018).

Despite these policy initiatives, there is little sign electric power generators in the region are willing or able to sign the types of large, long-term capacity contracts necessary to support new pipeline projects into the region. New pipeline development projects remain speculative and no new major construction projects are on the immediate horizon.

3.3 Incomplete Intermediate Contract Markets and Investment

In economic terms, the pipeline investment model has been successful where long-term contract markets are robust and reasonably complete. The largest traditional shippers were regulated gas LDCs who had the ability to pass-through these pipeline transportation costs in their regulated rates, and state regulation often required LDCs to sign such contracts. In this case, pipelines were able to secure the contracts needed to build new transportation capacity to meet growing LDC gas demand.

For pipelines from producing regions (the “producer-push” pipelines), natural gas exploration and production (E&P) companies have strong incentives to secure the pipeline capacity to move their new gas to market, and many E&P companies were capitalized such as to support the credit requirements of long-term pipeline transportation contracts. Forward contracting in the natural gas markets is relatively robust, and E&P’s could hedge much of their delivery basis risks through these contracts.

New England provides a case study of how the pipeline investment model is much less effective when marginal demand growth is largely in the merchant power generation sector, where long-term (e.g., 10 years or more) forward contract markets (for energy and capacity) are much less robust.

The electric distribution companies and retailers, who serve electric loads, tend to contract for only a few years at a time. Regional electricity forward contract markets are not highly liquid, and extend out only a few years. The transactions costs for hedging longer-dated forward power contracts are also high.

In these circumstances, it would be difficult or impossible for merchant power generators to hedge the risks of entering into a 10-year or longer gas supply contract or to directly contract with pipelines for such long-term transportation. The strong correlation between regional natural gas prices and ISO-NE LMPs raises the risks to generators in signing such contracts. Thus, it is unsurprising that the merchant generators have not contracted for extensive new pipeline capacity into New England.

4 Conclusions and Policy Implications

The U.S. interstate pipeline industry has been very successful in developing new projects where demand exists and shippers are willing to sign the long-term contracts necessary to support large-scale pipeline investment. FERC has used the existence of these contracts, or precedent agreements, to signal need for new capacity (a key requirement under the Natural Gas Act in certifying a new project) and pipelines rely on the stable revenues from these long-term contracts to underpin the large sunk cost investments required.

The policy initiatives of ISO-NE discussed in Sect. 3.2.5 have not provided a strong basis for building new regional pipeline capacity to support electric generation. The proposed changes to the regional capacity market, while they may provide some additional incentives to hedge gas exposure among the region’s generators, fundamentally do not support the long-term contracting necessary to stimulate new pipeline construction. Over time both the gas and electric industries have recognized the mismatch in investment models. They have made ongoing adjustments, but with marginal success to date, as the changes made have still been based upon, and reside within, their respective investment models.

Given the fundamental mismatch between the regulatory models for investment natural gas and electric transmission planning, policy design to support any large needed gas transmission investment needed to supply electric generation will be difficult. Requiring merchant generators to contract for firm gas transportation would involve large costs which could not likely be recovered in energy market prices, especially since regional LMPs do not reflect fuel supply scarcity (Adamson and Tabors 2013). Adding capacity market qualification requirements would also involve large fixed cost burdens for merchant generators, which were planned and financed without such obligations.

Pipelines would need a strong incentive mechanism to invest in capacity to serve these electric generation markets, given the risks associated with such investment without the usual 10–15 year transportation contracts with creditworthy shippers. The cost of service regulatory regime for interstate natural gas pipelines caps the upside for pipelines on new investments (through the scope for a rate case and lower subsequent authorized returns on equity in the future if the pipeline is deemed to be over-earning on its original capital investment), while exposing them to substantial downside and stranded asset risks if less firm transportation capacity than projected is contracted in the future. Any pipeline investment-based approach to the gas–electric coordination issues raised in this paper will, therefore, require a fundamental shift in FERC policy toward pipeline investment in such an asymmetric risk environment.

Notes

- 1.

Electric transmission in Alaska, Hawaii and much of Texas are state regulated, as these systems are loosely (or not at all) connected to other grids and hence do not fall under federal interstate regulation. Most long-distance pipelines cross state borders and hence are regulated by the Federal Energy Regulatory Commission (FERC), but intrastate pipelines may be subject to state-level regulation.

- 2.

The Algonquin Pipeline directly serves approximately 50% of the gas-fired generation in New England and the Algonquin City Gate is the most liquid pricing point in New England.

References

S. Adamson, Comparing interstate regulation and investment in U.S. Gas and Electric Transmission. Econ. Energy Environ. Policy 7(1) (2018)

S. Adamson, R. Tabors, Pricing short-term gas availability in power markets, in Growing Concerns, Possible Solutions: The Interdependency of Natural Gas and Electricity Systems (MIT Energy Initiative, 2013)

Department of Energy Resources, Commonwealth of Massachusetts, Letter to D.P.U. regarding petitions for approval of proposed long-term contracts for renewable resources pursuant to Section 83D of Chapter 188 of the Acts of 2016, DPU 18–64, 18–65, 18–66, July 23, 2018 (2018)

Department of Public Utilities, Commonwealth of Massachusetts. Order on Joint Petition, D.P.U. 17–32, March 27, 2017

Edison Electric Institute, Transmission Projects at a Glance (2016)

Energy Information Administration, U.S. Natural Gas Pipeline Project Database (2019). Accessed 26 Feb 2019. Available from https://www.eia.gov/naturalgas/data.cfm#pipelines

Federal Energy Regulatory Commission, Winter 2018–19 Energy Market Assessment. Item No. AD06-3-000, October 18, 2018 (2018). Available from www.ferc.gov/market-oversight/reports-analyses/mkt-views/2018/10-18-18-A-3.pdf

J. Gheorghiu, Controversial $1B Canada—U.S. Transmission Line gets Maine PUC approval, in Utility Dive, April 11, 2019 (2019)

ISO New England, Energy Policy Update: Winter Reliability Program. December 22, 2015 (2015)

ISO New England, Regional System Plan: Transmission Projects and Asset Condition, October 2018 Update (2018). Available from www.iso-ne.com

R. Kruse, Algonquin Gas Transmission, LLC. Presentation at FERC Technical Conference on Capacity Release Tariff Proposal, Docket No. RP16-618-000, May 9, 2016 (2016). Available from https://www.ferc.gov/CalendarFiles/20160509090835-Algonquin%20Presentation.pdf

J. Makholm, The Political Economy of Pipelines (University of Chicago Press, 2012)

Massachusetts Supreme Judicial Court, Decision in Engie Gas & LNG LLC vs. Department of Public Utilities. SJC-12051, August 17, 2016 (2016)

Site Evaluation Committee, State of New Hampshire, Decisions and Order Deny Application for Certification of Site and Facility. Docket 2015–06, March 30, 2018 (2018)

G. van Welie, ISO New England: State of the Grid 2018 (2018). Available from www.iso-ne.com

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2020 Springer Nature Switzerland AG

About this chapter

Cite this chapter

Adamson, S., Hernandez, D., Rakebrand, H. (2020). Coordination of Gas and Electricity Transmission Investment Decisions. In: Hesamzadeh, M.R., Rosellón, J., Vogelsang, I. (eds) Transmission Network Investment in Liberalized Power Markets. Lecture Notes in Energy, vol 79. Springer, Cham. https://doi.org/10.1007/978-3-030-47929-9_16

Download citation

DOI: https://doi.org/10.1007/978-3-030-47929-9_16

Published:

Publisher Name: Springer, Cham

Print ISBN: 978-3-030-47928-2

Online ISBN: 978-3-030-47929-9

eBook Packages: EnergyEnergy (R0)