Abstract

Merchant transmission investment planning has recently emerged as a promising alternative or complement to the traditional centralized planning paradigm and it is considered as a further step toward the deregulation and liberalization of the electricity industry. However, its widespread application requires addressing two fundamental research questions: which entities are likely to undertake merchant transmission investments and whether this planning paradigm can maximize social welfare as the traditional centralized paradigm. Unfortunately, previously proposed approaches to quantitatively model this new planning paradigm do not comprehensively capture the strategic behavior and decision-making interactions between multiple merchant investors. This Chapter proposes a novel non-cooperative game-theoretic modeling framework to capture these realistic aspects of merchant transmission investments and provide insightful answers to the above research questions. More specifically, two different models, both based on non-cooperative game theory, have been developed. The first model addresses the first research question by adopting an equilibrium programming approach. The decision-making problem of each merchant investing player is formulated as a bi-level optimization problem, accounting for the impacts of its own actions on locational marginal prices (LMP) as well as the actions of all competing players. This problem is solved after converting it to a mathematical program with equilibrium constraints (MPEC). An iterative diagonalization method is employed to search for the likely outcome of the strategic interactions between multiple players, i.e., Nash equilibria (NE) of the game. Case studies on a simple 2-node system demonstrate that merchant networks investments will be mostly undertaken by generation companies in areas with low LMP and demand companies in areas with high LMP, as apart from collecting congestion revenue they also increase their energy surpluses. These case studies also demonstrate that the merchant planning solution approaches the centralized one as the number of competing players increases. However, because of its iterative nature, this first model cannot guarantee convergence to existing NE, especially as the number of players and the size of the network increase. Therefore, it cannot establish whether the merchant planning solution yields the same solution as centralized planning under the participation of a “sufficiently large” number of competing investors, as it cannot deal with a large number of players, especially in large networks. In order to address this challenge and provide insightful answers to this second research question, a second model is developed, where the set of merchant investors is approximated as a continuum. The proposed approximation makes the impact of each infinitesimal player’s decisions on system quantities negligible, allowing us to derive mathematical conditions for the existence of a NE solution in an analytical fashion. Based on this model, we perform an analytical comparison of the merchant planning solution under the participation of a “sufficiently large” number of competing investors against the one obtained through the traditional centralized paradigm, as well as a numerical comparison through case studies on a 2-node, a 3-node, and a 24-node system. These comparisons demonstrate that merchant planning can achieve the same (maximum) social welfare as the centralized planning approach only when the following conditions are satisfied: (a) fixed investment costs are neglected, and (b) the network is radial and does not include any loops. As these conditions do not generally hold in reality, our findings suggest that even a fully competitive merchant transmission planning framework, involving the participation of a very large number of competing merchant investors, is not generally capable of maximizing social welfare, as implied by previous work.

Access provided by Autonomous University of Puebla. Download chapter PDF

Similar content being viewed by others

1 Introduction

1.1 Motivation

During the last decades, deregulation of the electricity industry has been observed worldwide, involving the unbundling of vertically integrated monopoly utilities, the introduction of competition in the generation and supply sectors, and the open access to the electricity networks. In this deregulated environment, two general approaches are adopted for transmission network planning (Kirschen and Strbac 2004; Joskow and Tirole 2005; Shrestha and Fonseka 2007; Strbac et al. 2014).

Under the first approach, known as regulated transmission investment planning and investigated in Part 2 of this book, planning is centrally carried out by a regulatory authority, the system/network operator or the regulated transmission company, which realizes under regulatory supervision the optimal transmission expansion plan that maximizes the social welfare while satisfying security of supply requirements. The required capital cost plus a suitable rate of return for the transmission company is recovered from the network users. In this context, quantitative research efforts have focused on the solution of the centralized optimal transmission planning problem (Latorre et al. 2003), as well as the allocation of transmission costs among the network users (Lima et al. 2009).

Under the second approach, known as merchant transmission investment planning (Joskow and Tirole 2005) and investigated in Part 3 of this book, transmission planning relies on competitive market forces and decentralized, profit-driven decisions of self-interested players. These players may generally include merchant transmission companies (companies aiming at making profits through investing in transmission) as well as generation and demand users of the network, who are rewarded on the basis of the collected congestion revenues created by their network investments. This paradigm is gaining continuously ground as it accounts for the interests of the different market agents and the resulting competition in transmission planning is advocated as a further step toward the deregulation and liberalization of the electricity industry (Joskow and Tirole 2005; Shrestha and Fonseka 2007; Strbac et al. 2014; Gil et al. 2002). The first instances of merchant transmission planning can be found in the USA, Australia, Argentina, Brazil, and Chile, although the adopted frameworks constitute a mix of centralized and merchant planning where the regulator still determines the final expansion plan, reconciling the conflicting interests of the different entities (Joskow and Tirole 2005; Shrestha and Fonseka 2007; Littlechild 2003; Federal Energy Regulatory Commission 2002; Electric Light & Power 2016; DUKE American Transmission Co 2017; StarWood Energy Group et al. 2007).

However, critical open questions need to be answered before the widespread application of this merchant transmission planning paradigm:

-

(i)

Which entities are likely to undertake network investments under this planning paradigm?

-

(ii)

Is this planning paradigm able to achieve the same (maximum) social welfare as the traditional centralized planning approach?

1.2 Relevant Work

A few recent papers have developed quantitative models of this new transmission planning paradigm in order to answer these questions. Employing Lagrangian relaxation (LR) principles, authors in Gil et al. (2002) demonstrate that this decentralized paradigm leads to the same planning solution as the one obtained by the centralized paradigm, concluding that introduction of competition in network planning is plausible. However, this outcome is subject to two simplifying assumptions. First of all, the fixed costs of network assets are neglected because LR is generally unable to produce the centralized solution in the presence of non-convexities (Bazaraa et al. 2006); as a result, the undeniable economies of scale associated with transmission investment are not properly considered (Kirschen and Strbac 2004; Joskow and Tirole 2005). More importantly, players participating in merchant transmission planning are assumed to be competitive, price-taking entities, considering the locational marginal prices (LMP) as exogenous signals that cannot be influenced by their individual actions. In reality, however, in a similar fashion as strategic behavior observed in energy markets, participants will attempt to exercise market power and manipulate the LMP to increase their profits beyond the competitive equilibrium levels, through strategic network investments (Joskow and Tirole 2005; Shrestha and Fonseka 2007; Sauma and Oren 2007; Bushnell and Stoft 1996; Bushnell and Stoft 1997; Molina and Rudnick 2010).

In Bushnell and Stoft (1996), Bushnell and Stoft (1997) and Joskow and Tirole (2005), this competitive behavior assumption is removed. Authors in Bushnell and Stoft (1996), Bushnell and Stoft (1997) show that under certain conditions (neglect of fixed costs of network assets, congestion rights satisfying certain feasibility constraints, no imperfections in the energy market), merchant investments are socially efficient. In the seminal work (Joskow and Tirole 2005), the authors demonstrate through theoretical discussion and illustrative examples that this conclusion does not hold when the above simplifying conditions are relaxed. However, these papers investigate the social efficiency of investments by a single merchant company, neglecting that the very essence of the merchant planning paradigm lies in the introduction of competition in transmission planning, through the participation of multiple players. In fact, authors in Joskow and Tirole (2005) recognize through a simple 3-node example that gaming interactions between multiple merchant investors are likely in reality (pages 54–55), but they do not provide a comprehensive modeling framework capturing these interactions.

Authors in Shrestha and Fonseka (2007) make the first attempt to consider a setting with multiple strategic merchant companies and analytically derive the relation between the procured transmission capacities under the centralized and the merchant planning paradigm. The results indicate that decentralized planning by merchant companies leads to under-investment with respect to the centralized approach but the extent of this under-investment is reduced as the number of merchant companies is increased. Extending the analysis to the theoretical case where the number of merchant companies approaches infinity, the authors in Shrestha and Fonseka (2007) demonstrate that the differences between the planning solutions of the two paradigms in this case tend to zero. Although this theoretical scenario with an infinite number of merchant companies does not correspond to a realistic setting, this result is of great significance as it implies that under a “sufficiently large” number of competing merchant companies, the socially optimal transmission planning solution can be approached. However, this paper carries out simplifying assumptions that sacrifice the generality of the obtained results; transmission branches are presumed congested at the optimal solution and fixed costs of network assets are neglected. More importantly, the multiple merchant companies are assumed to make investment decisions sequentially, without accounting for the reactions of the competing players. In other words, the adopted approach does not comprehensively model the decision-making interactions between multiple investors.

1.3 Chapter Contributions

As mentioned in Molina and Rudnick (2010), a non-cooperative game-theoretic modeling framework is required to accurately capture the strategic behavior and interactions of multiple merchant investors, discussed in Sect. 1.2. This Chapter aims at developing such a novel framework and exploiting it to answer the research questions outlined in Sect. 1.1. More specifically, two different models, both based on non-cooperative game theory, are developed.

The first model adopts an equilibrium programming approach. The decision-making problem of each player is formulated as a bi-level optimization problem, accounting for the impacts of its own actions on LMP as well as the actions of all competing players. The upper-level problem represents the surplus maximization of the player, and the lower-level problem represents the energy market clearing process subject to the network constraints. This bi-level problem is formulated for different types of players (merchant transmission companies, generation companies, and demand companies) and solved after converting it to a mathematical program with equilibrium constraints (MPEC). An iterative diagonalization method is employed to search for the likely outcome of the strategic interactions between multiple players, i.e., Nash equilibria (NE) of the game.

Case studies on a simple 2-node system provide the following answers to the identified research questions:

-

(i)

Which entities are likely to undertake network investments under the merchant planning paradigm?

Networks investments will be mostly undertaken by generation companies in areas with low LMP and demand companies in areas with high LMP (higher-motivated players), as apart from collecting congestion revenue they also increase their energy surpluses. Merchant transmission companies, generation companies in areas with high LMP, and demand companies in areas with low LMP (lower-motivated players) could also be motivated to invest by the collection of congestion revenue under certain circumstances. Case studies illustrate the interdependencies between the different players’ decisions; in certain cases, the large network capacity desired by higher-motivated players reduces the obtainable congestion revenue by lower-motivated players and thus prevents the latter from investing in capacity.

-

(ii)

Is the merchant planning paradigm able to achieve the same (maximum) social welfare as the traditional centralized planning approach?

The merchant planning solution approaches the centralized one as the number of competing players increases. The largest deviations from the centralized solution are observed in the case where the set of participating players includes only merchant transmission companies, as they procure significantly lower capacity in order to increase their profits through higher LMP differentials.

However, because of its iterative nature, this first model cannot guarantee convergence to existing NE, especially as the number of players and the size of the network increase; as a result, the examined case studies are limited to a 2-node system with up to 10 players. In other words, although this model captures the strategic decision-making interactions between competing merchant investors and accounts for fixed costs of transmission assets [aspects not captured by the modeling framework of Shrestha and Fonseka (2007)], it cannot establish whether the important finding of Shrestha and Fonseka (2007) (i.e., that merchant planning yields the same solution as centralized planning under the participation of a “sufficiently large” number of competing investors) is valid or not, as it cannot deal with a large number of players, especially in large networks.

In order to address this challenge and validate this important finding of Shrestha and Fonseka (2007), a second model is developed, where the set of merchant investors is approximated as a continuum. The proposed approximation makes the impact of each infinitesimal player’s decisions on system quantities negligible, allowing us to derive mathematical conditions for the existence of a NE solution in an analytical fashion.

Based on this model, this Chapter investigates the validity of the finding of Shrestha and Fonseka (2007), through analytical and numerical comparison of the merchant planning solution against the one obtained through the traditional centralized paradigm. This comparison demonstrates that merchant planning can achieve the same (maximum) social welfare as the centralized planning approach only when the following conditions are satisfied:

-

(a)

fixed investment costs are neglected, and

-

(b)

the network is radial and does not include any loops.

As these conditions do not generally hold in reality, our findings suggest that even a fully competitive merchant transmission planning framework, involving the participation of a very large number of competing merchant investors, is not generally capable of maximizing social welfare, as implied by the previous work (Shrestha and Fonseka 2007). Numerical simulations supporting these findings are carried out on a 2-node, a 3-node, and a 24-node system, while the largest case study examined in the previous relevant works discussed in Sect. 1.2 corresponds to a 6-node system.

1.4 Chapter Outline

The rest of this Chapter is organized as follows. Section 2 outlines a basic model of traditional centralized transmission planning, against which the merchant planning approach will be later compared. Sections 3 and 4 detail the two developed game-theoretic models and present results of relevant case studies. Finally, Sect. 5 discusses conclusions and future extensions of this work.

2 Centralized Transmission Planning Model

Under the centralized transmission planning paradigm, a regulatory authority, the system/network operator or the regulated transmission company, determines the capacity to be added in the existing network, so as to maximize the long-term social welfare or, equivalently, minimize the long-term system cost (Kirschen and Strbac 2004). The latter is given by the sum of two terms: the difference between generation operating cost and demand benefit, plus the investment cost required for delivering the new capacity. Employing a DC load flow model, the optimization problem determining the centralized planning solution is formulated as follows:

where:

Subject to:

Accounting for the realistic economic properties of network investments, the network investment cost \(T_{m}\) for branch m includes (i) a fixed component, which does not depend on the procured capacity but only on the binary decision \(u_{m}\) of whether new capacity will be added on branch m or not and (ii) a variable component, which is incurred when this binary decision is positive \((u_{m} = 1)\), and is proportional to the procured capacity \(F_{m}\), as expressed by (2). System operation constraints are expressed by (4)–(7); the Lagrangian multipliers \(\lambda_{n,t}\) associated with the nodal demand–supply balance constraints (4) express the LMP at the respective node n and period t. Generation and demand limits are enforced by (8) and (9).

For presentation clarity and without loss of generality, the above model (as well as the rest of the models in this Chapter) involves the following assumptions:

-

(i)

the addition of transmission capacity on branch m does not affect its reactance; in other words, the matrices \(\varvec{\Phi}\) and \(\varvec{\Psi}\) are constant and do not depend on capacity additions, and

-

(ii)

a one-to-one mapping between nodes and generation/demand participants; in other words, each generation/demand participant corresponds to the whole generation/demand at a particular node n.

3 Modeling Merchant Transmission Planning: Equilibrium Programming

3.1 Setting and Assumptions

Under the merchant paradigm investigated in this Chapter, transmission planning relies on competitive market forces and decentralized, profit-driven decisions of self-interested players. Specifically, different market entities participate in network planning by making network expansion proposals, including merchant transmission companies as well as generation and demand companies. These entities are assumed to be rational players and determine their network expansion proposals so as to maximize their own economic surpluses. In the case of merchant companies, the surplus is given by the difference between the congestion revenue and the investment cost associated with the network capacity they procure. In the case of generation and demand companies, apart from the congestion revenue and investment cost of the procured capacity, their proposals are also driven by the impact of network capacity additions on their profits from selling energy and on their utilities from buying energy, respectively.

The expansion proposals made by the different players are interdependent, since the power flows, the LMP and the generation/demand dispatch affecting their surpluses will be driven by the aggregation of the individual network expansion decisions. Therefore, each player needs to account for the decisions of the rest of the players. Furthermore, in a similar fashion as behavior observed in energy markets, each of these players will not act as a price-taker but will rather attempt to manipulate the LMP through its expansion decisions in order to increase its surplus beyond the competitive equilibrium levels. These interactions can be described through a non-cooperative game among the players involved in the planning process.

3.2 Bi-Level Optimization Model of Merchant Investor

In the non-cooperative game-theoretic setting outlined in Sect. 3.1, the decision-making of a single player i can be formulated as a bi-level optimization problem, a modeling approach widely adopted in literature investigating the strategic behavior of generation companies in electricity markets (Hobbs et al. 2000; Weber and Overbye 2002; Ruiz and Conejo 2009). The upper-level (UL) problem determines the optimal individual transmission expansion decisions maximizing the surplus of player i and is subject to the lower level (LL) problem representing the energy market clearing process. These two problems are coupled, since the expansion decisions made by the UL problem affect the power flow constraints of the LL problem, while the power flows, the LMP and the generation/demand dispatch determined by the LL problem affect the objective function of the UL problem.

According to Sect. 3.1, the formulation of this bi-level problem depends on whether the considered player i is a merchant transmission company, a generation company, or a demand company. In case of a merchant transmission company, this problem is formulated as follows:

(Upper level)

where:

Subject to:

(Lower level)

Subject to:

The objective function (10) of the UL problem constitutes the surplus of the merchant transmission company i and is given by the difference between the congestion revenue (first term) and the investment cost (second term) associated with the network capacity it procures on each branch. The share of the total congestion revenue belonging to player i is equal to the share of the total capacity it owns, as expressed by the first ratio in (10). Likewise, the share of the total fixed investment cost paid by player i is equal to the share of the total capacity addition it procures, as expressed by the second ratio in (10). This total capacity addition is given by the sum of the individual players’ capacity additions (11). The UL problem is subject to procured capacity limits (13) and the LL problem. The latter represents the market clearing process, maximizing the short-term social welfare (14), subject to system operation constraints (15)–(18) and generation/demand limits (19)–(20).

In the case that the considered player i is the generation company of node n, the objective function of the UL problem is given by (21). Apart from the congestion revenue (first term) and the investment cost (second term) associated with the network capacity player i procures, this objective function also includes its revenue from selling energy at the LMP of node n (third term) and its operating cost (fourth term).

In the case that the considered player i is the demand company of node n, the objective function of the UL problem is given by (22). Apart from the congestion revenue (first term) and the investment cost (second term) associated with the network capacity player i procures, this objective function also includes its payment for buying energy at the LMP of node n (third term) and its perceived benefit (fourth term).

In order to solve this bi-level optimization problem in a mathematically rigorous fashion, following the approach adopted in literature investigating the strategic behavior of generation companies in electricity markets (Hobbs et al. 2000; Weber and Overbye 2002; Ruiz and Conejo 2009), we convert it to a mathematical program with equilibrium constraints (MPEC). This is achieved through the replacement of the LL problem by its Karush–Kuhn–Tucker (KKT) optimality conditions, which is enabled by the continuity and convexity of the LL problem. The MPEC formulation is omitted but follows the logic detailed in Hobbs et al. (2000), Weber and Overbye (2002), Ruiz and Conejo (2009).

3.3 Determining Nash Equilibrium

The above bi-level optimization/MPEC model expresses the decision-making problem of a single player i. Our interest, however, lies in determining the likely outcome of the strategic interactions between multiple merchant investors, given that the very essence of the merchant planning paradigm is the introduction of competition in transmission planning (Sect. 1.1). According to game theory (Fudenberg and Tirole 1991), this likely outcome corresponds to a Nash equilibrium (NE) of the non-cooperative game, which expresses a condition where none of the players can increase its surplus by unilaterally modifying its decisions.

In order to determine a NE solution of the merchant planning game, the iterative diagonalization method, which was in introduced the mathematical paper (Pang and Chan 1982) and was employed in Hobbs et al. (2000), Weber and Overbye (2002), is adopted. This iterative procedure involves three steps:

-

(1)

The players’ expansion decisions are initialized, the iteration counter is set to 1 and the convergence tolerance \(\varepsilon\) is determined.

-

(2)

At every iteration r, each player determines its expansion decisions by solving its respective MPEC, accounting for the decisions of the rest of the players as fixed parameters, equal to their values at iteration \(r - 1\).

-

(3)

The vector of all players’ decisions at iteration r is compared to the one at iteration \(r - 1\). If their distance is lower than \(\varepsilon\), the iterative procedure terminates. As discussed in Hobbs et al. (2000), Weber and Overbye (2002), the resulting outcome after convergence corresponds by definition to a pure strategy NE of the game, since none of the players can increase its surplus by unilaterally modifying its decisions.

It should be noted at this point that existence and uniqueness of NE are not generally guaranteed and that the iterative diagonalization approach is not generally guaranteed to converge, even if NE exist (Hobbs et al. 2000; Weber and Overbye 2002).

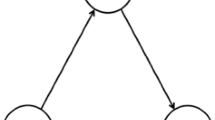

3.4 Case Studies on 2-Node System: Analyzing Which Entities Undertake Network Investments

The relevant generation and demand data (Kirschen and Strbac 2004) of the 2-node system considered in the case studies of this Section is illustrated in Fig. 1. It is assumed that the existing capacity of the single branch is zero and that the operational timescale of the planning problem includes a single time period. Generation costs are assumed to be quadratic functions of the respective power productions. The demands in the two nodes are assumed inelastic and equal to constant values, i.e., their benefit functions are constant and can thus be omitted from the two optimization problems. The investment cost includes only a variable component \(T_{1}^{V} = 4{\pounds}/{\text{MWh}}\) while fixed costs are neglected \((T_{1}^{F} = 0)\).

In order to comprehensively analyze the outputs of the merchant planning model, the following five cases with different sets of participating players have been examined. The NE determined by the diagonalization approach of Sect. 3.3 in each of these cases are presented in Table 1. Due to the existence of a single network branch in the considered system, the subscript \(m = 1\) is omitted from the representation \(F_{m} \left( i \right)\) of the expansion decisions in Table 1.

Case 1.1

The set of players includes two merchant transmission companies \(M_{1}\) and \(M_{2}\). The two companies procure equal capacities in the NE solution. Table 2 justifies the expansion decision of each of the two players given the decision of its competitor as determined by the NE solution of Table 1. By procuring a capacity of 267 MW, each company collects a congestion revenue which is higher than the incurred investment cost and therefore makes a positive profit of £2131. It is noted that energy surplus is not defined in the case of merchant companies, as they are not involved in the energy market.

Case 1.2

The set of players includes the two generation companies \(G_{1}\) and \(G_{2}\) of nodes 1 and 2, respectively. Only \(G_{1}\) procures capacity in the NE solution. The addition of network capacity increases the power exported from the lower-priced (due to the combination of cheaper generation and lower demand) node 1 to the higher-priced (due to the combination of more expensive generation and higher demand) node 2. Therefore, it also reduces the LMP differential between the two nodes, by increasing the LMP in node 1 and reducing the LMP in node 2. As a result, \(G_{1}\) invests in network capacity not only to collect congestion revenue (like the merchant companies of Case 1.1) but also to increase its energy surplus [given by the difference between its revenue from selling energy and its operating cost in (21)], as demonstrated in Table 3. On the other hand, \(G_{2}\) does not invest despite the potential congestion revenue, due to the adverse effect of the interconnection on its energy surplus; this is justified by Table 3, which presents the impact of a small capacity procurement by \(G_{2}\) (10 MW) on its surplus.

Case 1.3

The set of players includes the two demand companies \(D_{1}\) and \(D_{2}\) of nodes 1 and 2, respectively. Only \(D_{2}\) procures capacity in the NE solution. Since the addition of network capacity reduces the LMP in node 2, \(D_{2}\) invests in high network capacity in order to increase its energy surplus (i.e., reduce its energy payment, since demand is assumed inelastic), despite the fact that the congestion revenue it collects does not cover the incurred investment cost (Table 4). On the other hand, \(D_{1}\) does not invest due to both the adverse effect of the interconnection on its energy surplus and the fact that the potential congestion revenue does not cover the required investment cost, given the high capacity procured by \(D_{2}\) (Table 4).

Case 1.4

The set of players includes the two generation companies \(G_{1}\) and \(G_{2}\) and the two demand companies \(D_{1}\) and \(D_{2}\). Following the analysis of Cases 1.2 and 1.3, \(G_{1}\) and \(D_{2}\) procure capacity in the NE solution in order to increase their energy surpluses (increase their energy profit and reduce their energy payment, respectively), despite the fact that they do not collect any congestion revenue in this case (Table 5). The reason behind this zero congestion revenue is that the total capacity procured in the NE solution of this case is so high that it eliminates congestion and therefore the price differential between the two nodes. It is also worth noting that this value of the total capacity \((F\left( {G_{1} } \right) + F\left( {D_{2} } \right) = 933\,{\text{MW}})\) constitutes the minimum value for which congestion is eliminated (Kirschen and Strbac 2004). In other words, no player has motivation to invest in further capacity, as this action will not affect the dispatch and the LMP, and consequently they will have to incur the additional investment cost without improving their energy surplus and congestion revenue. This also explains why \(G_{2}\) and \(D_{1}\) experience no change in their energy surplus and congestion revenue from potential investments (Table 5) and thus do not invest in network capacity.

Case 1.5

The set of players includes the two generation companies \(G_{1}\) and \(G_{2}\), the two demand companies \(D_{1}\) and \(D_{2}\), and two merchant transmission companies \(M_{1}\) and \(M_{2}\). As in Case 1.4, \(G_{1}\) and \(D_{2}\) procure capacity in the NE solution. Given that the total capacity they procure is so high that it eliminates congestion and the price differential between the two nodes, the two merchant companies do not have motivation to invest in further capacity (Table 6), in contrast with Case 1.1 where they constitute the only participating players. This result demonstrates the interdependencies between the different players’ decisions in the merchant planning framework.

Next, we analyze the outputs of the merchant planning model in each of the above five cases when the linear cost coefficient of generation company \(G_{2}\) is increased to \(30{\pounds}/{\text{MWh}}\) (Table 7).

In every case, the total and individual capacity additions are increased with respect to Table 1, due to the higher generation cost differential (and therefore higher LMP differential) between the two nodes, which motivates further capacity investments.

Furthermore, the particularly interesting difference in the results is that \(G_{2}\) and \(D_{1}\) invest in network capacity in Cases 1.2 and 1.3, respectively. This is because the higher LMP differential makes the collected congestion revenues more significant than the adverse effect of these investments on their energy surpluses and the required investment costs (Tables 8 and 9). However, the capacity procured by \(G_{2}\) and \(D_{1}\) is still lower than the one procured by \(G_{1}\) and \(D_{2}\), respectively, who are motivated to invest in capacity not only by the congestion revenues but also by the improvement of their energy surpluses.

Furthermore, in Cases 1.4 and 1.5, the total capacity procured by the higher-motivated players \(G_{1}\) and \(D_{2}\) reduces the obtainable congestion revenue by \(G_{2}\) and \(D_{1}\), preventing the latter from investing in capacity (Table 10), in contrast with Cases 1.2 and 1.3 where fewer players participate. This result again demonstrates the interdependencies between the different players’ decisions in the merchant planning framework.

3.5 Case Studies on 2-Node System: Comparing Centralized and Merchant Planning Solutions

In this Section, we make an attempt to validate the important findings of the previous work (Shrestha and Fonseka 2007), i.e., that the merchant planning solution approaches the centralized one as the number of participating players increases, and the two solutions become identical under the participation of a “sufficiently large” number of players. To this purpose, we apply the developed equilibrium programming model to the same 2-node system presented in Sect. 3.4.

In this context, we have executed the developed model for different scenarios regarding the number of participating players as well as the centralized planning model of Sect. 2, and compared their solutions. Figures 2, 3, and 4 present the total network capacity in the merchant planning solution and the percentage deviation of the long-term system cost of this solution from the respective cost of the centralized solution, when the set of players participating in merchant planning includes:

-

From 1 to 10 merchant transmission companies (Fig. 2).

-

From 1 to 10 generation companies per node (Fig. 3). Each identical company at node 1 and 2 owns an equal share of the total generation capacity at the respective node.

-

From 1 to 10 demand companies per node (Fig. 4). Each identical company at node 1 and 2 supplies an equal share of the total demand at the respective node.

The above results seem to suggest that the findings of Shrestha and Fonseka (2007) are valid, since the total network capacity and system cost of the merchant planning solution approach the respective capacity \((800\,{\text{MW}})\) and system cost of the centralized planning solution, as the number of participating players increases. The largest deviations from the centralized solution are observed in the case where the participating players are merchant transmission companies (Fig. 2), as they procure significantly lower capacity in order to increase their surpluses through higher LMP differentials.

However, these results are not sufficient to comprehensively validate the findings of Shrestha and Fonseka (2007). First of all, the examined studies include up to 10 “active” players (i.e., players procuring positive capacity, unlike the generation companies at node 2 and the demand companies at node 1 in the cases of Figs. 3 and 4, respectively). Therefore, although the merchant planning solution approaches the centralized one, we cannot guarantee that this trend will be still valid for a larger number of players and that the two solutions will eventually become identical under the participation of a “sufficiently large” number of players. Furthermore and more importantly, the examined studies are carried out on a very simple 2-node system; we cannot guarantee that the observed trend will be still valid in larger, more realistic systems.

Unfortunately, the developed equilibrium programming model cannot effectively deal with such larger numbers of players and larger networks. This is because the employed diagonalization approach (Sect. 3.3) cannot guarantee convergence to an existing NE, since it is very sensitive to the initialization of the players’ decisions and its iterative nature often results in an oscillatory behavior, with these problems being aggravated when the number of players and the size of the network increase.

4 Modeling Merchant Transmission Planning: Continuum Approximation

4.1 Setting and Assumptions

In order to overcome the limitations of the equilibrium programming model presented in the previous Section and comprehensively validate the findings of Shrestha and Fonseka (2007), a second model is developed in this Section. This model also adopts a non-cooperative game-theoretic framework. However, in order to deal effectively with a large number of players, the set of players is approximated as a continuum (Khan and Sun 2002). Similar approaches have been previously considered in other economic (Aumann 1964, 1966) and smart grid (Couillet et al. 2012; De Paola et al. 2016) applications. The proposed approximation makes the impact of each infinitesimal player’s decisions on system quantities negligible, allowing us to derive mathematical conditions for the existence of a NE solution in an analytical fashion, and therefore avoid the limitations of the iterative diagonalization approach, discussed in Sect. 3.5.

Before proceeding to a detailed description of this second model, it should be noted that it has its own limitations. First of all, the proposed continuum approximation implies that the number of players approaches infinity, which does not correspond to realistic settings where the number of players is always finite. Nevertheless, this theoretical scenario constitutes a good approximation of a setting with a “sufficiently large” number of players, and, more importantly, it is also examined in Shrestha and Fonseka (2007), the very findings of which we aim at validating. Secondly, this continuum approximation implies that the considered players are identical. Therefore, this model cannot provide an answer to the first research question of Sect. 1.1 (which entities are likely to undertake network investments under merchant planning), for which the equilibrium programming model of Sect. 3 is more suitable. For this reason, the players we consider in this second model are merchant transmission companies which are similar in practice, rather than generation or demand companies which have distinct characteristics (such as generation operating costs, generation capacities, and demand sizes.).

Under the proposed continuum approximation, the set of merchant transmission companies is not described as a finite collection \(I = \left\{ {1,2,..,\left| I \right|} \right\}\) (as in the equilibrium programming model of Sect. 3), but rather as a closed interval \(I \subset {\mathbb{R}}\). With this approximation, system quantities such as investment decisions \(u_{m}\) and \(F_{m}\) are not impacted by each infinitesimal player’s decisions, but only depend on the aggregation of all players’ decisions. In this context, the total capacity addition on branch m is not expressed by the sum (11) but rather as the integration:

The surplus function (10) of player i can be expressed as \(J\left( {i,\varvec{F}\left( \varvec{i} \right),\varvec{u},\varvec{F}} \right)\) where \(\varvec{F}\left( \varvec{i} \right) = \left\{ {F_{m} \left( i \right),\forall m} \right\}\) denotes the vector of the investment decisions of player i, and \(\varvec{u} = \left\{ {u_{m} ,\forall m} \right\}\) and \(\varvec{F} = \left\{ {F_{m} ,\forall m} \right\}\) denote the vectors of the aggregate binary investment decisions and total capacity investment decisions of all players, respectively. Given the above approximation, player i can only modify \(\varvec{F}\left( \varvec{i} \right)\) but cannot impact u and F.

4.2 Determining Nash Equilibrium

Consider feasible vectors \(\varvec{F}^{\varvec{*}} \left( \varvec{i} \right)\), \(\varvec{u}^{\varvec{*}}\), and \(\varvec{F}^{\varvec{*}}\). Based on the definition of NE (Sect. 3.3), and given that player i can only modify \(\varvec{F}\left( \varvec{i} \right)\), these quantities constitute a NE of the merchant planning game if, for any feasible vector \(\varvec{F}\left( \varvec{i} \right)\), the following holds:

It is thus critical to analyze which values of \(\varvec{F}\left( \varvec{i} \right)\) maximize the surplus function (10) of player i for fixed values of u and F. Note that this surplus function is linear with respect to each individual capacity addition \(F_{m} \left( i \right)\) and can alternatively be written as:

where the term \(\varLambda \left( {u_{m} ,F_{m} } \right)\) is expressed as:

Three different conditions need to be examined for each term of the sum in (25):

-

\(\varLambda \left( {u_{m} ,F_{m} } \right) > 0\): the function J is monotonically increasing with respect to \(F_{m} \left( i \right)\). It follows that the surplus of player i can always be increased by selecting a higher value of \(F_{m} \left( i \right)\) and therefore a NE can never be reached.

-

\(\varLambda \left( {u_{m} ,F_{m} } \right) < 0\): the function J is monotonically decreasing with respect to \(F_{m} \left( i \right)\). Therefore, the surplus of player i can always be increased by choosing a lower value of \(F_{m} \left( i \right)\). As a result, a NE could potentially be reached if and only if \(F_{m} \left( i \right) = 0,\forall i\). This is never the case, as the mentioned conditions would lead to \(u_{m} = 0\) and \(\varLambda \left( {u_{m} ,F_{m} } \right) = 0\), contradicting the initial hypothesis.

-

\(\varLambda \left( {u_{m} ,F_{m} } \right) = 0\): the function J does not depend on \(F_{m} \left( i \right)\). If this is true for all \(m \in M\), (24) holds as equality and a NE is reached. It should be noted that, in this case, the marginal value [first term of (26)] and the marginal cost [second term of (26)] of an additional unit of network capacity investment by player i are equal.

Based on the three conditions examined above, the following result can be deduced:

Theorem 1

The vectors \(\varvec{F}^{\varvec{*}} \left( \varvec{i} \right)\), \(\varvec{u}^{\varvec{*}}\), and \(\varvec{F}^{\varvec{*}}\) constitute a NE of the merchant planning game if and only if:

Proof

The three above conditions for \(\varLambda \left( {u_{m} ,F_{m} } \right)\) are considered. When \(\varLambda \left( {u_{m} ,F_{m} } \right) > 0\), we have established that a NE does not exist. This is consistent with the theorem statement, as (27) does not hold in this case. In fact, since \(\varLambda \left( {u_{m} ,F_{m} } \right) > 0\), the term in the left-hand side of (27) is strictly larger than the term in the right-hand side of (27). A similar procedure can be followed for the case \(\varLambda \left( {u_{m} ,F_{m} } \right) < 0\): having established that a NE is never reached, it is sufficient to note that the left-hand side of (27) is strictly smaller than its right-hand side. When \(\varLambda \left( {u_{m} ,F_{m} } \right) = 0\), it has been shown that a NE is reached and (27) always holds, thus concluding the proof.

Theorem 1 provides the necessary and sufficient conditions (27) for existence of a NE of the merchant planning game in an analytical fashion. However, as mentioned in Sect. 3.3, according to game-theory literature (Fudenberg and Tirole 1991), uniqueness of NE is generally not guaranteed. Therefore, it is possible that multiple different investment solutions fulfill (27). Since the focus of this work is not on identifying all possible NE of the merchant planning game but rather on investigating whether merchant planning can yield the same social welfare maximizing solution as centralized planning, we will seek for the NE solution yielding the largest social welfare.

Therefore, the optimization model we will employ for determining the merchant planning solution is formulated as follows:

This problem is similar to the one determining the centralized planning solution (Sect. 2), but it also considers the NE condition (29) of Theorem 1, to be verified on each network branch.

4.3 Theoretical Comparison of Centralized and Merchant Planning Solutions

Given the analytical formulations of the optimization problems determining the centralized solution (CS) (Sect. 2) and the merchant solution (MS) under the participation of a “sufficiently large” number of players (Sect. 4.2), this Section aims at theoretically analyzing under which conditions the two solutions are identical. Based on our analysis, we claim that this equivalence holds if the following conditions are satisfied:

-

(A1)

Fixed investment costs are neglected, i.e., \(T_{m}^{F} = 0,\forall m\).

-

(A2)

The network is radial and does not include any loops, i.e., \(L = \emptyset\).

The sufficiency of the aforementioned conditions A1 and A2 is theoretically proved through Theorem 2 below. This theorem claims that if A1 and A2 hold, then the CS and MS coincide. In order to simplify the theoretical analysis, two auxiliary conditions are introduced:

-

(B1)

The operational timescale of the planning problem includes a single period, i.e., \(\left| T \right| = 1\).

-

(B2)

The existing capacity of every branch is zero, i.e., \(F_{m}^{0} = 0,\forall m\).

Theorem 2

The CS determined by problem (1), (3)–(9) and the MS determined by problem (28), (3)–(9), (29) coincide if conditions A1, A2, B1, and B2 hold.

Proof

Without loss of generality, it is assumed that the capacity addition of the CS is positive for all branches, i.e., \(F_{m} > 0,\forall m\). If this is not the case for some branches, the following analysis can be performed on the subset of branches \(\tilde{M} \subset M\) for which this assumption holds, i.e., \(\tilde{M} = \{ m \in M:F_{m} > 0,u_{m} = 1\}\). If this is not the case for any branch, i.e., \(F_{m} = 0,u_{m} = 0,\forall m\), it can be shown that the CS and MS coincide as both sides of the NE conditions (29) are zero.

Given condition B1, the subscript t is omitted in the remainder of this proof. Under the current assumptions, a simplified expression can be derived for the problem (1), (3)–(9) determining the CS. Given condition A1, the investment cost term (2) in the objective function (1) can be rewritten as:

Regarding the constraints, (7) is omitted as a result of condition A2. Assuming without loss of generality a “positive” power flow on each branch (i.e., power flows from the reference sending node to the reference receiving node), we implicitly account for constraints (5) by imposing:

These equations hold since (i) \(f_{m} > F_{m}\) violates (5) given that \(F_{m}^{0} = 0\) from condition B2 and ii) \(f_{m} < F_{m}\) is suboptimal as the unused capacity \(F_{m} - f_{m}\) increases the objective function (1). As a result of the above, by combining (4) and (6) and by rewriting each of the (8) and (9) as two separate constraints, the problem determining the CS can be reformulated as:

Subject to:

The Lagrangian function associated with this optimization problem is expressed as:

Derivation of the Lagrangian with respect to \(F_{m}\) yields the following set of necessary conditions for optimality:

The term \(\varphi_{n,m}\) in (39) denotes the element in the nth row and mth column of the sensitivity matrix \(\varvec{\Phi}\), describing the network topology. For each column m of \(\varvec{\Phi}\), we have \(\varphi_{{n_{m}^{s} ,m}} = 1\) and \(\varphi_{{n_{m}^{r} ,m}} = - 1\), while \(\varphi_{n,m} = 0\) for all nodes n not connected to branch m. Therefore, (39) can be rewritten as:

Regarding the MS, as a result of conditions A1, B1, B2, and (31), the necessary and sufficient conditions (29) for achieving NE can be rewritten as:

The optimality conditions (40) of the CS are equivalent to the NE conditions (41) of the MS. This implies that the CS and the MS coincide, concluding the proof.

It should be noted that although the above theoretical analysis considers the auxiliary simplifying hypotheses B1 and B2, the case studies presented in the following Sections will numerically demonstrate that B1 and B2 are not necessary. In other words, it will be shown that the CS and the MS coincide even when B1 and B2 do not hold. On the other hand, these case studies indicate that A1 and A2 are not only sufficient but also necessary: the CS and MS are in principle different when one of the conditions A1 or A2 does not hold.

The physical significance behind the sufficiency and necessity of conditions A1 and A2 is particularly interesting and is discussed below:

Condition A1: As demonstrated in Kirschen and Strbac (2004), under the CS, the total congestion revenue in the whole network covers exactly the variable component of the total investment cost but does not cover fixed costs. On the other hand, the NE condition (29) of the MS requires that the total congestion revenue covers exactly the total investment cost (i.e., both variable and fixed components), as the rational merchant transmission companies do not accept economic losses. Therefore, as demonstrated by the case studies in the following Sections, when fixed costs are accounted for, the total network capacity procured under the MS is lower than the respective capacity procured under the CS, in order to increase the collected congestion revenue and thus cover the fixed costs.

Condition A2: Under the CS, although the total congestion revenue in the whole network is equal to the variable component of the total investment cost, this equality does not necessarily hold for each individual network branch when the network is meshed; in such cases, some branches may generate higher congestion revenue than their variable investment cost, while other branches may generate lower congestion revenue, as demonstrated in Kirschen and Strbac (2004). On the other hand, the NE condition (29) of the MS requires that this equality holds on an individual branch basis, as demonstrated by the case studies in the following Sections. This requirement makes sense since the impact of each infinitesimal player’s decisions on system conditions is negligible. As a result, each of these players assesses its decision for each branch individually, ignoring the impact of this decision on the congestion revenue associated with other branches; it will strive to increase its procured capacity on a branch m if the obtainable congestion revenue from m is higher than the required investment cost and decrease it if the obtainable congestion revenue from m is lower than the required investment cost. Therefore, as demonstrated by the following case studies, the CS and MS do not coincide when the network is meshed.

4.4 Case Studies on 2-Node System

The 2-node system (Fig. 1) and the relevant assumptions considered in the case studies of this Section are the same with the ones considered in Sects. 3.4 and 3.5. The only difference is that two different cases regarding the transmission investment cost have been examined in this Section, with the respective CS and MS presented in Table 11.

Case 1.1: The investment cost includes only a variable component \(T_{1}^{V} = 4\pounds/{\text{MWh}}\) while fixed costs are neglected \((T_{1}^{F} = 0)\). In this case, the CS and MS are identical and involve investment on a line of \(800\,{\text{MW}}\) (Table 11). This result follows from Theorem 2, as conditions A1, A2, B1, and B2 hold and therefore the CS and MS must coincide.

Case 1.2: The investment cost includes both a variable component \(T_{1}^{V} = 4\,\pounds{\text{/MWh}}\) and a fixed component \(T_{1}^{F} = 2283\,\pounds{\text{/h}}\). The capacity procured under the CS does not change with respect to Case 1.1 and, as discussed in Sect. 4.3, the congestion revenue does not cover the full investment cost, due to the existence of fixed costs. On the other hand, the capacity procured under the MS is now reduced to \(690\,{\text{MW}}\), to ensure that the congestion revenue covers the full investment cost (Sect. 4.3). This result suggests that condition A1 (zero fixed investment costs) is a necessary condition for the CS and MS to coincide.

4.5 Case Studies on 3-Node System

The considered 3-node system along with its relevant generation and demand data (Kirschen and Strbac 2004) is illustrated in Fig. 5. It is assumed that the existing capacity of the three branches is zero, their investment costs are equal and their reactances after any capacity addition are equal. The operational timescale of the planning problem includes two time periods with weighting factors \(w_{1} = 0.25\) and \(w_{2} = 0.75\). Generation costs are assumed to be quadratic functions of the respective power productions and demands are assumed inelastic. Four different cases have been examined, with the respective CS and MS presented in Table 12.

Case 2.1: The investment cost includes only a variable component \(T_{m}^{V} = 3.42\,\pounds{\text{/MWh}},\forall m\), while fixed costs are neglected. In contrast to Case 1.1, the CS and MS are different (Table 12). As discussed in Sect. 4.3, while the equality between congestion revenue and investment cost holds for each individual network branch under the MS, the same does not hold under the CS. This result suggests that condition A2 (no network loops) and/or condition B1 (single period in the operational timescale) is/are necessary condition(s) for the CS and MS to coincide.

Case 2.2: In order to investigate which of the conditions A2 and B1 is critical for the equivalence between the CS and MS, we consider a case where capacity can be added only on branches 1 and 2, imposing \(F_{3} = 0\) in the two optimization problems. All the other parameters remain the same as in Case 2.1. In this scenario, the CS and MS are identical (Table 12). This suggests that A2 is a necessary condition for the CS and the MS to coincide, since in this scenario the network is radial and does not include loops. On the other hand, it also demonstrates that condition B1 is not necessary for the CS and MS to coincide.

Case 2.3: In order to further explore this interesting result, we consider a theoretical scenario where capacity can be added on all three branches but Kirchhoff’s voltage law (KVL), expressed through (7), is neglected in both optimization problems. All the other parameters remain the same as in Case 2.1. In this theoretical scenario, the CS and MS are again identical (Table 12). This result suggests that the physical reason behind the necessity of condition A2 lies in the unavoidable consideration of the KVL in meshed networks. As already noted for Case 2.2, it seems that condition B1 is not necessary for the equivalence between the CS and MS.

Case 2.4: The KVL is neglected as in Case 2.3 but the investment cost also includes a fixed component \(T_{m}^{F} = 2283\,\pounds{\text{/h}},\forall m\). In contrast to Case 2.3, the CS and the MS do not coincide. As discussed in Sect. 4.3, while the total congestion revenue covers the total investment cost under the MS, the same does not hold under the CS due to the existence of fixed costs. Like in Case 1.2, this result suggests that A1 is necessary for the CS and MS to coincide.

4.6 Case Studies on IEEE 24-Node System

Although the case studies of Sects. 4.4 and 4.5 validate the theoretical analysis of Sect. 4.3, demonstrating the criticality of conditions A1 and A2 for the equivalence between the CS and MS, they are carried out on very simple 2-node and 3-node systems, respectively. In order to establish that these insights are still valid in larger, more realistic systems, the IEEE 24-node system is examined in this Section. This system along with its relevant network, generation and demand data (Conejo et al. 2010), is illustrated in Fig. 6. All lines represent existing branches that can be expanded. The operational timescale of the planning problem includes a single time period. Generation costs and demand benefits are assumed to be quadratic functions of the power productions and consumptions, respectively. Three different cases have been examined, with the respective CS and MS presented in Table 13. For compactness reasons, branches with zero capacity additions in all three cases have been omitted from Table 13.

Case 3.1: The investment cost includes only a variable component (presented in Fig. 6 for each branch), while fixed costs are neglected. As in Case 2.1, the CS and MS are different (Table 13), suggesting that condition A2 (no network loops) and/or condition B2 (zero existing capacity on every branch) is/are necessary condition(s) for the CS and MS to coincide.

Case 3.2: In order to investigate which of the conditions A2 and B2 is critical for the equivalence between the CS and MS, following the rationale of Case 2.3, we consider a theoretical scenario where the KVL is neglected. As in Case 2.3, the CS and MS are identical (Table 13). This result again supports the idea that condition A2 is necessary for the CS and MS to coincide. On the other hand, it also demonstrates that condition B2 is not necessary for the CS and MS to coincide.

Case 3.3: The KVL is neglected as in Case 3.2 but the investment cost also includes a fixed component \(T_{m}^{F} = 50\, \pounds/ {\text{h}},\forall m\). In contrast to Case 3.2, the CS and the MS are different. As in Cases 1.2 and 2.4, this suggests that condition A1 is necessary for the CS and MS to coincide.

5 Conclusions and Future Work

Merchant transmission investment planning has recently emerged as a promising alternative or complement to the traditional centralized planning paradigm and it is considered as a further step toward the deregulation and liberalization of the electricity industry. However, its widespread application requires addressing two fundamental research questions: which entities are likely to undertake merchant transmission investments and whether this planning paradigm can maximize social welfare as the traditional centralized paradigm. Unfortunately, previously proposed approaches to quantitatively model this new planning paradigm do not comprehensively capture the strategic behavior and decision-making interactions between multiple merchant investors.

This Chapter has proposed a novel non-cooperative game-theoretic modeling framework to capture these realistic aspects of merchant transmission investments and provide insightful answers to the above research questions. More specifically, two different models, both based on non-cooperative game theory, have been developed.

The first model adopts an equilibrium programming approach. The decision-making problem of each merchant investing player is formulated as a bi-level optimization problem, accounting for the impacts of its own actions on locational marginal prices (LMP) as well as the actions of all competing players. This bi-level problem has been formulated for different types of players that can potentially participate in merchant investments (merchant transmission companies, generation companies, and demand companies) and solved after converting it to a mathematical program with equilibrium constraints (MPEC). An iterative diagonalization method is employed to search for the likely outcome of the strategic interactions between multiple players, i.e., Nash equilibria (NE) of the game.

Case studies on a simple 2-node system have provided the following answers to the above research questions:

-

(i)

Which entities are likely to undertake network investments under the merchant planning paradigm?

Networks investments will be mostly undertaken by generation companies in areas with low LMP and demand companies in areas with high LMP (higher-motivated players), as apart from collecting congestion revenue they also increase their energy surpluses. Merchant transmission companies, generation companies in areas with high LMP and demand companies in areas with low LMP (lower-motivated players) could also be motivated to invest by the collection of congestion revenue under certain circumstances. Case studies have illustrated the interdependencies between the different players’ decisions; in certain cases, the large network capacity desired by higher-motivated players reduces the obtainable congestion revenue by lower-motivated players and thus prevents the latter from investing in capacity.

-

(ii)

Is the merchant planning paradigm able to achieve the same (maximum) social welfare as the traditional centralized planning approach?

The merchant planning solution approaches the centralized one as the number of competing players increases. The largest deviations from the centralized solution are observed in the case where the set of participating players includes only merchant transmission companies, as they procure significantly lower capacity in order to increase their profits through higher LMP differentials.

However, because of its iterative nature, this first model cannot guarantee convergence to existing NE, especially as the number of players and the size of the network increase; as a result, the examined case studies are limited to a 2-node system with up to 10 players. In other words, although this model provides insightful answers to the first question, it cannot establish whether the merchant planning solution yields the same solution as centralized planning under the participation of a “sufficiently large” number of competing investors, as it cannot deal with a large number of players, especially in large networks.

In order to address this challenge and provide insightful answers to this second research question, a second model has been developed, where the set of merchant investors is approximated as a continuum. The proposed approximation makes the impact of each infinitesimal player’s decisions on system quantities negligible, allowing us to derive mathematical conditions for the existence of a NE solution in an analytical fashion.

Based on this model, we have performed an analytical comparison of the merchant planning solution under the participation of a “sufficiently large” number of competing investors against the one obtained through the traditional centralized paradigm, as well as a numerical comparison through case studies on a 2-node, a 3-node, and a 24-node system. These comparisons have demonstrated that merchant planning can achieve the same (maximum) social welfare as the centralized planning approach only when the following conditions are satisfied:

-

(a)

fixed investment costs are neglected, and

-

(b)

the network is radial and does not include any loops.

As these conditions do not generally hold in reality, our findings suggest that even a fully competitive merchant transmission planning framework, involving the participation of a very large number of competing merchant investors, is not generally capable of maximizing social welfare, as implied by previous work.

This conclusion implies that some sort of regulatory interventions will be required to align the outcome of merchant transmission investment planning with social optimality. However, these interventions need to remain at a minimum level, in line with the vision of deregulation. The analytical design of such regulatory measures constitutes a significant challenge for future research.

Furthermore, the two models of merchant planning developed in this Chapter—as well as the rest of the models in the relevant literature—assume a fixed generation mix and do not consider generation expansion decisions. In reality, however, transmission and generation expansion decisions are interdependent. In this context, future work aims at developing an integrated transmission and generation planning framework and comparing the impacts of centralized and merchant transmission planning on generation expansion decisions.

Abbreviations

- \(i \in I\) :

-

Index and set of merchant investors

- \(l \in L\) :

-

Index and set of network loops

- \(m \in M\) :

-

Index and set of network branches

- \(n \in N\) :

-

Index and set of network nodes

- \(t \in T\) :

-

Index and set of time periods in the operational timescale

- \(n_{m}^{s}\) :

-

Reference sending node of branch m

- \(n_{m}^{r}\) :

-

Reference receiving node of branch m

- \(\varvec{\Phi}\) :

-

Matrix of sensitivities \(\varphi_{n,m}\) for power outflow from node n with respect to power flow on branch m

- \(\varvec{\Psi}\) :

-

Matrix of sensitivities \(\psi_{l,m}\) for voltage drop of loop l with respect to power flow on branch m

- \(F_{m}^{0}\) :

-

Existing capacity of branch m (MW)

- \(T_{m}^{F}\) :

-

Fixed investment cost of branch m (£/h)

- \(T_{m}^{V}\) :

-

Variable investment cost of branch m (£/MWh)

- \(a_{n}^{G}\) :

-

Quadratic cost coefficient of generation company of node n (£/MW2h)

- \(b_{n}^{G}\) :

-

Linear cost coefficient of generation company of node n (£/MWh)

- \(G_{n}^{ \hbox{max} }\) :

-

Maximum generation limit of generation company of node n (MW)

- \(a_{n}^{D}\) :

-

Quadratic benefit coefficient of demand company of node n (£/MW2h)

- \(b_{n}^{D}\) :

-

Linear benefit coefficient of demand company of node n (£/MWh)

- \(D_{n}^{ \hbox{max} }\) :

-

Maximum demand limit of demand company of node n (MW)

- \(w_{t}\) :

-

Weighting factor of period t

- u :

-

Vector of binary variables \(u_{m}\) expressing whether new capacity is added on branch m (\(u_{m} = 1\) if it is \(u_{m} = 0\) if it is not)

- F :

-

Vector of continuous variables \(F_{m}\) expressing the total capacity addition on branch m (MW)

- \(\varvec{F}\left( \varvec{i} \right)\) :

-

Vector of continuous variables \(F_{m} \left( i \right)\) expressing the capacity addition by merchant investor i on branch m (MW)

- \(f_{m,t}\) :

-

Power flow on branch m and period t (MW)

- \(G_{n,t}\) :

-

Power generated at node n and period t (MW)

- \(D_{n,t}\) :

-

Power consumed at node n and period t (MW)

- \(p_{n,t}\) :

-

Net power outflow from node n at period t (MW)

- \(\lambda_{n,t}\) :

-

Locational marginal price at node n and period t (£/MWh)

- \(T_{m} \left( \cdot \right)\) :

-

Investment cost of branch m (£/h)

- \(C_{n,t} \left( \cdot \right)\) :

-

Operating cost of generation company of node n at period t (£/h)

- \(B_{n,t} \left( \cdot \right)\) :

-

Benefit of demand company of node n at period t (£/h)

- \(J_{i} \left( {i, \cdot } \right)\) :

-

Surplus of merchant investor i (£/h)

References

R.J. Aumann, Markets with a continuum of traders. Econometrica 32(1/2), 39–50 (1964)

R.J. Aumann, Existence of competitive equilibria in markets with a continuum of traders. Econometrica 34(1), 1–17 (1966)

M.S. Bazaraa, H.D. Sherali, C.M. Chetty, Nonlinear Programming: Theory and Algorithms (Wiley, Hoboken, 2006)

J.B. Bushnell, S.E. Stoft, Electric grid investment under a contract network regime. J. Regul. Econ. 10(1), 61–79 (1996)

J.B. Bushnell, S.E. Stoft, Improving private incentives for electric grid investment. Resource Energy Econ. 19(1–2), 85–108 (1997)

A.J. Conejo, M. Carrion, J.M. Morales, Decision Making Under Uncertainty in Electricity Markets (Springer, Berlin, 2010)

R. Couillet, S.M. Perlaza, H. Tembine, M. Debbah, Electrical vehicles in the smart grid: a mean field game analysis. IEEE J. Sel. Areas Comm. 30(6), 1086–1096 (2012)

A. De Paola, D. Angeli, G. Strbac, Distributed control of microstorage devices with mean field games. IEEE Trans. Smart Grid 7(2), 1119–1127 (2016)

DUKE American Transmission Co, Zephyr Power Transmission Project a Transmission Project to Connect Wyoming Wind to the Southwestern U.S. (2017). Available: http://www.datcllc.com/projects/zephyr/

Electric Light & Power, Arizona Regulators Approve $2 billion SunZia Project in Close Vote (2016). Available: http://www.elp.com/articles/2016/02/arizona-regulators-approve-2-billion-sunzia-project-in-close-vote.html

Federal Energy Regulatory Commission, Remedying Undue Discrimination Through Open Access Transmission Service and Standard Electricity Market Design (2002). Available: https://www.gpo.gov/fdsys/pkg/FR-2002–08-29/pdf/02-21479.pdf

D. Fudenberg, J. Tirole, Game Theory (MIT Press, 1991)

H.A. Gil, E.L. da Silva, F.D. Galiana, Modeling competition in transmission expansion. IEEE Trans. Power Syst. 17(4), 1043–1049 (2002)

B.F. Hobbs, C. Metzler, J.S. Pang, Strategic gaming analysis for electric power systems: an MPEC approach. IEEE Trans. Power Syst. 15(2), 638–645 (2000)

P. Joskow, J. Tirole, Merchant transmission investment. J. Industr. Econ. 53(2), 233–264 (2005)

M.A. Khan, Y. Sun, Non-cooperative games with many players, in Handbook of Game Theory, ed. by R. Aumann, S. Hart (Elsevier Science, 2002), vol. 3, pp. 1761–1808

D. Kirschen, G. Strbac, Fundamentals of Power System Economics (Wiley, Hoboken, 2004)

G. Latorre, R.D. Cruz, J.M. Areiza, A. Villegas, Classification of publications and models on transmission expansion planning. IEEE Trans. Power Syst. 18(2), 938–946 (2003)

D.A. Lima, A. Padilha-Feltrin, J. Contreras, An overview on network cost allocation methods. Electr. Power Syst. Res. 79(5), 750–758 (2009)

S. Littlechild, Transmission Regulation, Merchant Investment, and the Experience of SNI and Murraylink in the Australian National Electricity Market (Electricity Policy Research Group, University of Cambridge, 2003). Available: https://sites.hks.harvard.edu/hepg/Papers/Littlechild.Transmission.Regulation.Australia.pdf

J.D. Molina, H. Rudnick, Transmission expansion investment: cooperative or non-cooperative game?, in IEEE Power Energy Soc. Gen. Meet., 2010, pp. 1–7

J.-S. Pang, D. Chan, Iterative methods for variational and complementarity problems. Math. Program. 24(1), 284–313 (1982)

C. Ruiz, A.J. Conejo, Pool strategy of a producer with endogenous formation of locational marginal prices. IEEE Trans. Power Syst. 24(4), 1855–1866 (2009)

E.E. Sauma, S.S. Oren, Economic criteria for planning transmission investment in restructured electricity markets. IEEE Trans. Power Syst. 22(4), 1394–1405 (2007)

G.B. Shrestha, P.A.J. Fonseka, Optimal transmission expansion under different market structures. IET Gen. Transm. Distr. 1(5), 697–706 (2007)

StarWood Energy Group, Neptune Transmission System, Financed by Energy Investors Fund and Star-Wood Energy Group, Begins Delivering Power to Long Island (2007). Available: http://starwoodenergygroup.com/wpcontent/uploads/2014/06/6 NeptuneAnnouncement.pdf

G. Strbac, M. Pollitt, C. Vasilakos Konstantinidis, I. Konstantelos, R. Moreno, D. Newbery, R. Green, Electricity transmission arrangements in Great Britain: time for change? Energy Pol. 73, 298–311 (2014)

J.D. Weber, T.J. Overbye, An individual welfare maximization algorithm for electricity markets. IEEE Trans. Power Syst. 17(3), 590–596 (2002)

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2020 Springer Nature Switzerland AG

About this chapter

Cite this chapter

Papadaskalopoulos, D., Fan, Y., De Paola, A., Moreno, R., Strbac, G., Angeli, D. (2020). Game-Theoretic Modeling of Merchant Transmission Investments. In: Hesamzadeh, M.R., Rosellón, J., Vogelsang, I. (eds) Transmission Network Investment in Liberalized Power Markets. Lecture Notes in Energy, vol 79. Springer, Cham. https://doi.org/10.1007/978-3-030-47929-9_13

Download citation

DOI: https://doi.org/10.1007/978-3-030-47929-9_13

Published:

Publisher Name: Springer, Cham

Print ISBN: 978-3-030-47928-2

Online ISBN: 978-3-030-47929-9

eBook Packages: EnergyEnergy (R0)