Abstract

The present study revisits the trade-off between economic growth and pollutant emission popularly known as the EKC hypothesis. This study distinct from the bulk of study in the literature by circumventing for omitted variable bias by the addition of total natural resources rent. Empirical investigation is conducted on an annual frequency data from 1971 to 2015. Conventional unit root test of Augmented Dickey-Fuller (ADF) and Phillips Perron (PP) unit root to establish stationarity properties. For long run (equilibrium) analysis the Pesaran’s ARDL bounds test traces equilibrium relationship between the outlined variables. The ARDL regression suggest that 1% increase in real income increases pollutant emission by 79.33% and 117.18% in short run and long run, respectively, while the electricity consumption positively increases pollutant emission in Nigeria. Interestingly, FDI inflow improves the quality of the environment by dampening emission. The current study validates the EKC hypothesis of the case of Nigeria. This suggests that the country is still at her scale stage of her economic growth trajectory where emphasis is placed on economic growth relative to quality of the environment. These outcomes are indicative to government administrators and environmental economists to be cautious on strategies to disentangle economic expansion from pollutant emissions there by necessitating the need for a paradigm shift to clean energy mix like renewable energy sources, which are globally recommended and environmental friendly.

Access provided by Autonomous University of Puebla. Download chapter PDF

Similar content being viewed by others

Keywords

11.1 Introduction

The development of all sectors within an economy requires a stable and reliable energy source. For any country, the direct and indirect effect of electricity utilization cannot be over emphasized as it is closely linked to economic growth (Balcilar et al. 2019). The United States Energy Information Administration (EIA 2018) established that there is a close link between a country’s economic growth and energy use. Electricity use is positively correlated with economic growth for both developed and developing economies, a great length of studies have focused on the relationship between economic growth and energy consumption. In the literature, some studies concluded that electricity (energy consumption) plays a vital role in economic growth (Masih and Masih 1998; Ferguson et al. 2000), some argued that there exist a conservative hypothesis because causality runs from economic growth to energy consumption (Jumbe 2004; Wolde-Rufael 2005) while others revealed that there is no causality or relationship between economic growth and energy consumption (Akinlo 2008; Akpan and Akpan 2012; Tsaurai 2013).

The 2019 world energy outlook reports that about 850 million people globally still do not have access to electricity (IEA 2019), this is a huge improvement when compared to the 2010 report which estimated that 1.4 billion people over 20% global population do not have access to electricity (IEA 2010). This global improvement is due to expansion of electricity generation from wind and solar PV resulting in an overtake of coal by renewable electricity generation source in the power generation mix. Despite the global outlook, about 600 million people within Sub-Sahara Africa still do not have access to electricity and this number is expected to decline just slightly to 530 million by year 2030 as expansion of electricity generation is not sufficient to lead to sustainable and affordable electricity within this region.

For Nigeria, in 2018, about 20 million households do not have access to electricity, although the government already privatize the power sector to decrease this number by increasing the generation capacity to 12,522 MW (thermal generation capacity: 10,142 MW and hydro-generation capacity: 2380 MW) yet the country only generates about 4000 MW per day which results in epileptic power supply. The country’s electricity market is mainly supplied by the Power Holding Company of Nigeria (PHCN) which was divided into separate entities in 2013 called the Local Electric Distribution Companies (LDC) in which each company or entity is responsible for handling the distribution of electricity in each state or region. Yet these companies have not been able to provide minimum required international standard electricity across the nation. Nigeria being the giant of Africa, the statistical evidence from 2018 world bank database revealed that the country’s population is almost 200 million, with average growth rate of 6.67% in 2013, 6.3% in 2014, just 1.94% and 2.1% in 2018 and 2019, respectively. Despite the positive growth rate, the supply of electricity has remained inconsistent and irregular; this has led households and industries to seeking alternative source of power that mainly required fossil fuels and increase in carbon dioxide emission level. To make up for the power shortage, industries and households continuously make use of power generating sets; NDC (2016) reports that an estimated 60 million Nigerians owns electricity power generating sets and spend almost $13.35 million to fuel these equipment’s annually. Shuaibu and Oyinlola (2013) reported that the total CO2 emissions from combustion fuels is 41.2%, from electricity and heat generated is 8.2%, from manufacturing and construction sectors is 3.1%, from energy industry is 4.5%, from transport sector is 24% while from other sectors is 2%.

The inter-relationship between energy consumption, economic growth, and carbon dioxide (CO2) emission has been researched extensively in the literature over the past decades. Nevertheless, there has been mixed results regarding the flow of causality among these variables ranging from bi-directional causality, to unidirectional and no causality at all. This mixed results might be attributed to difference in methodology, difference in period of study, and difference in countries studied as well. Furthermore, this study advances the frontiers of knowledge by underpinning the determinant of greenhouse gas emission (GHG), especially in Nigeria where there is huge energy intensification. Thus, the present study augment the traditional EKC framework by the addition of total natural resources rent to a carbon-income regression function. This hypothesized model comes pertinent on the premise to determine the environmental cost implication of extraction of the total natural resources from the primary stage to its final rent stage. Studies of this sort are not only timely but also essential for policymakers and environmental practitioners, given the global consciousness for cleaner and ecosystem energy consumption.

Table 11.1 provides an overview of empirical works that examined the relationships between energy consumption, economic growth and CO2 emission within Africa. Similarly, Table 11.2 provides an overview of energy consumption growth nexus for African country studies. But there is not any study on Nigeria that examined the impacts of natural resource rent, foreign direct investment alongside with electricity consumption and economic growth on CO2 emission. Therefore, this study aims to fill this gap by contributing to existing literature. Most studies as summarized in both Tables 11.1 and 11.2 confirmed a unidirectional causality between economic growth and CO2 emission, electricity consumption and CO2 emission, on the other hand, a few of the studies posits causality flowing from CO2 to economic growth.

The remaining part of this study is structured as follows: Sect. 11.2 presents a brief review of empirical literature, Sect. 11.3 presents the data and methodology used, and Sect. 11.4 presents result discussion while Sect. 11.5 concludes and offer policy implication based on the findings.

11.2 Literature Review

The literature review will be in twofolds, the first aspect will focus on economic growth and energy/electricity consumption while the second aspect will focus on economic growth, energy consumption, and carbon dioxide emission. Starting with the first focus, the literature is flooded with studies on economic growth and energy/electricity consumption. The premier study of seminal paper presented by Kraft and Kraft (1978) investigate the causal relationship between economic growth and energy consumption, for USA for the period 1947–1974 and the findings of the paper postulated a causal relationship that runs from economic growth to energy. The same result emerge from the work of Yu and Choi (1985) for the Philippines, similar result for Taiwan was reported by Cheng and Lai (1997) using Hsiao’s version of co-integration and granger causality test on data for periods 1955–1993. Furthermore, Aqeel and Butt (2001) revealed for Pakistan that causality runs from economic growth to energy consumption. Mehrara (2007) also investigated the causal link between per capita GDP and per capita energy consumption for 11 selected oil exporting countries using panel unit root tests and panel co-integration analysis; the result revealed a strong unidirectional causality flow from economic growth to energy consumption.

Akinlo (2008) studied the relationship between energy consumption and economic growth for eleven Sub-Saharan African countries using autoregressive distributed lag (ARDL) bounds test, granger causality test based on vector error correction model (VECM); the result revealed causality flowing from economic growth to energy consumption for Sudan and Zimbabwe, bi-directional flow for Senegal, Gambia and Ghana. For Cote d’Ivoire, Kenya, Nigeria, Cameroon and Togo, the result confirmed a no causal directional flow.

Many studies have tried to examined the causal link and direction of causal flow between economic growth and energy/electricity consumption just to mention a few: Soytas and Sari (2003), Shui and Lam (2004), Wolde-Rufael (2005), Ang (2008), Esso (2010), Bekun and Agboola (2019), Balcilar et al. (2019). For Nigeria, studies posit a positive relationship between economic growth and energy consumption the works of Adeniran (2009), Odularu and Okonkwo (2009), Omotor (2008), Omisakin (2008) and Onakoya et al. (2013), are case in point.

The second aspect of the review examined the relationship between economic growth, energy consumption and CO2 emission. Several empirical studies with the use of different methodologies and divers sample sizes investigated energy-economic-environment nexus. Ang (2007) for France examined this relationship using co-integration and vector error-correction modeling techniques on data for periods 1960–2000 and the result revealed a support for the argument that causality flows from economic growth to energy use and pollution in the long run. Similarly, Soytas et al. (2007) for USA using granger causality approach and found that in the long run income does not granger causes carbon dioxide emission but energy use does.

Also, for selected 19 European countries Acaravci and Ozturk (2010) using autoregressive distributed lag (ARDL) approach and error-correction granger causality test on data covering periods 1960–2005 found long run relationship with unidirectional causality between the three variables for Greece, Portugal, Germany, Switzerland, Denmark, Iceland, and Italy. Apergis and Payne (2009) for a group of Commonwealth independent states found that causality flows from economic growth and energy consumption to carbon emission in the short run but a bi-directional flow between energy consumption and CO2 emission in the long run. For South Africa, Menyah and Wolde-Rufael (2010) examined the causality flow between the energy consumption, economic growth, and pollutants using ARDL approach bound test on data for period 1995–2006, their finds revealed a long run unidirectional relationship flowing from energy consumption and pollutant emissions to economic growth and from energy consumption to pollutant emissions.

For India, Alam et al. (2011) reported a long run bi-directional causality flow between carbon dioxide emission and energy consumption; no causality between energy consumption and economic growth and between CO2 emission and economic growth as well. For the same country, Ohlan (2015) using ARDL approach on data period 1970–2013 examined the impact of energy consumption, trade openness, economic growth, and population density on carbon dioxide emission. The study revealed both short and long run positive relationships between the variables of interest and CO2 emission while the main contributor to this emission is population. For Iran, Lotfalipour et al. (2010) examined the causality flow between fossil fuel, economic growth, and carbon dioxide emission. Using Toda-Yamamoto causality test, the study concluded that a causality flows from energy consumption and GDP to carbon emission and that carbon dioxide emission and energy consumption does not lead to economic growth. Sulaiman and Abdul-Rahim (2014), applying ARDL method examined the causality link between economic growth, CO2 emission and energy consumption for Malaysia using data for the period 1975–2015 and their findings also state that economic growth is not influenced by energy consumption or carbon dioxide emissions. For 12 selected MENA countries, Arouri et al. (2012) examined the relationship between economic growth, CO2 emission and energy consumption for the period 1981–2005 using bootstrap panel method with result revealing CO2 emission positively impacted by energy consumption.

Many studies have tried to examine the causal link and direction of causal flow between economic growth, energy/electricity consumption and carbon dioxide emission just to mention a few: Zhang and Cheng (2009), Odhiambo (2009a), Ogundipe and Apata (2013), Shahbaz et al. (2013), Apergis and Ozturk (2015), Al-Mulali et al. (2015). Olarinde et al. (2014), Vadyarthi (2013), Albiman et al. (2015) Manu and Sulaiman (2017). For Nigeria, Akpan and Akpan (2012) revealed that economic growth leads to increase carbon dioxide emission and are further increased by electricity consumption. Also, Chukwu and Nnaji (2013) also support the claim that economic growth lead to an increase in carbon emission and similar submission emerges from the study of Chindo et al. (2015). Chindo and Abdul-Rahim (2018) revealed that in the long run economic growth is the only determining variable while in the short run all variables economic growth, energy consumption, and population growth are significant variables.

11.3 Data and Methodology Sequence

The present study made use of secondary time series frequency data comprising foreign direct investment (net inflow), economic growth (constant 2010$), electricity consumption (energy power consumption in Kw/h), total natural resources rent (%GDP), and carbon dioxide emissions (Kilotons) as proxy for environmental degradation. All data were retrieved from the World Development Indicators betweenFootnote 1 the periods of 1971–2015. The empirical sequence of the present study follows four paths, namely first, investigation of unit root properties to ascertain the stationarity status of the outlined variables. This is pertinent to avoid variables integrated of order 2 ~ I(2) and misleading inferences. Second, test for equilibrium relationship (co-integration) relationship between choice variables. Third, ARDL regression and finally, detection of causality test to detect the direction of causality flow for proper policy implications.Footnote 2

11.4 Empirical Results and Discussion

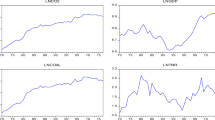

This section focuses on the discussion of study empirical simulations. First, preliminary analysis of visual plot of all variables under consideration and subsequently basic summary statistics and then correlation matrix analysis. Figure 11.1 shows the graphical plot of the variables under review with energy consumption (electricity consumption) and economic growth (GDP) showing a positive correlated trend over the sampled period. Foreign direct investment (FDI) and total natural resources rent also exhibited positive relationship over sampled period. Furthermore, Table 11.3 highlights the basic summary statistics with economic growth having the highest average with highest maximum and minimum, while economic growth and FDI are positive skewedness relative to total natural resources rent pollutant emission and electricity consumption were negatively skewed over investigated period. Subsequently, Table 11.4 presents the Pearson correlation matrix analysis of the outlined variables shows the linear relationship between the variables that shows positive significant relationship between pollutant emission and economic growth over considered period. These outcomes suggest that growth in Nigeria is pollution driven. Similar trend is reveal between FDI and pollutant emission. However, total natural resources rent shows negative relationship with pollutant emission. The need for more analysis is pertinent to substantiate the position of the correlation analysis.

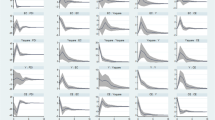

The need for stationarity analysis is essential in time series modeling to circumvent for spurious outcomes. The present study adopted the use of conventional unit root test of ADF and PP to investigate the unit root properties as revealed in Table 11.5. The test shows that all examined variables are integrated of mixed order. Subsequently, the co-integration analysis was conducted by the Pesaran Bunds test (see Appendix Table 11.8) that shows long run equilibrium relationship among the investigated series and the parsimonious optimum lag order (see Appendix Table 11.9). To conduct the magnitude of the co-integration analysis the long run regression in Table 11.6. The ARDL regression shows a high convergence speed with the contribution of economic growth, energy consumption, FDI, and total natural resources rent. Further analysis shows that a 1% in economic growth and the square of GDP show 79.33% and 117.18% in both short and long run, respectively. The results affirm the presence of the EKC hypothesis for the case of Nigeria. This implies that the growth in Nigeria is driven by pollutant emission. This suggest that the growth trajectory in Nigeria is still at her scale stage of her growth path where emphasis is on higher income level rather than environmental degradation (Bekun et al. 2019a). Furthermore, energy consumption is seen to increase pollutant emission with an elasticity of 042 and 0.77% in both short and long run. Interestingly, total natural resources rent reveals positive effect in short run and negative impact in the long run, this implies that exploration of natural rent in the long run will enhance the quality of the environment. This is quit shocking know that most extraction process are primary and crude which has its cost implication. Similar trend with FDI, the effect of FDI dampens the quality of the environment. This implies that the FDI inflow helps to improve the environment. This suggests that FDI attraction in Nigeria is environmentally friendly thought not energy (electricity) consumption over the investigated period. The outcomes of energy-induce pollutant emission are insightful given the need for paradigm shift for more renewable energy source consumption that are reputed to more ecosystem friendly and cleaner. Furthermore, Table 11.7 reports the modified Wald test of causality and validates the energy-induced growth hypothesis. As a one-way directional causality is running from energy (electricity consumption) to GDP. This outcome resonates with the study of Emir and Bekun (2019) in Romanian economy. This implies that the energy conservative policy cannot be implemented for the case of Nigeria. Similar trend of unidirectional causality is observed for the case of FDI inflow and total national resources rent (Bekun et al. 2019b). These outcomes have inherent policy decision. The regression conducted were free from model specification bias, serial correlation issues and normally distributed and suitable for policy direction. The model stability test carried by CUSUM and CUSUMsq test are presented in Figs. 11.2 and 11.3, respectively.

11.5 Conclusion

The consistent pressure by human activities has impact on the environment and biocapacity of the ecosystem. These consequences on the environment have been of great concerns among energy practitioners, environmentalist, and government administrators who formulate energy framework and strategies. This topical debate is still on-going since the pioneering study of Kraft and Kraft (1978) for the USA, and several other studies have been documented in the related literature. However, there been no consensus in the energy economics literature, especially, for the case of Nigeria, which has received little documentation. It is on this premise, the present study explores the interaction between real income, square of real income, pollutant emissions proxy by environmental degradation, and electricity consumption. This country specific study built on the already existing preposition of Simon Kuznets (1955) on the trade-off between the nexus inequality and economic growth. This concept over the years has metamorphosed in the energy literature to conceptualize the EKC. The EKC ideology explains the trade-off between economic growth and pollutant emission, which was made popular by Grossman and Krueger (1991). Over the years plethora of studies have emerge validating the EKC hypothesis.

Empirical findings trace a long run equilibrium relationship between the outlined variables over the study framework. The study structure was investigated in a carbon-income function with the incorporation of total natural resources rent and FDI inflow into the conventional EKC setting. Our study empirical finding suggests that energy (electricity) consumption in Nigeria is dirty and increase pollutant emission (CO2). Although past studies have validated the pivotal role of energy consumption to economic growth. The present study joins strands of study that finds empirical support for energy-induced economic growth as revealed by the causality analysis. However, this outcome does not go without its environmental cost where the energy also drives pollution emission. Thus, from a policy standpoint from this study, there is the need to drift from energy from fossil fuel consumption to cleaner energy sources like photovoltaic, wind, biomass, hydro-energy among other renewable energy consumption. The need to tighten environmental commitment is key given global consciousness for cleaner ecosystem like the Kyoto protocol.

Notes

- 1.

- 2.

For brevity, equations of estimation test are available on lead papers given they well established in the literature for interested readers.

References

Acaravci, A., & Ozturk, I. (2010). On the relationship between energy consumption CO2 emissions and economic growth in Europe. Energy, 35(12), 5412–5420.

Adeniran, O. (2009). Does energy consumption cause economic growth? An empirical evidence from Nigeria (Doctoral Thesis). University of Dundee, Scotland.

Akinlo, A. E. (2008). Energy consumption and economic growth: Evidence from 11 Sub-Sahara African countries. Energy Economics, 30(5), 2391–2400.

Akinlo, A. E. (2009). Electricity consumption and economic growth in Nigeria: Evidence from co-integration and co-feature analysis. Journal of Policy Modelling. https://doi.org/10.1016/j.jpolmod.2009.03.004.

Akinwale, Y., Jesuleye, O., & Siyanbola, W. (2013). Empirical analysis of the causal relationship between electricity consumption and economic growth in Nigeria. British Journal of Economics, Management & Trade, 3, 277–295. https://doi.org/10.9734/BJEMT/2013/4423.

Akomolafe, K. J. (2019). Electricity consumption and economic growth in Nigeria: A sectoral analysis. World Journal of Business and Management, 5(1) ISSN 2377-4622.

Akpan, G. E., & Akpan, U. F. (2012). Electricity consumption, carbon emissions and economic growth in Nigeria. International Journal of Energy Economics and Policy, 2(4), 292–306.

Alam, M. J., Begum, I. A., Buysse, J., Rahman, S., & Huylenbroeck, G. V. (2011). Dynamic modeling of causal relationship between energy consumption, CO2 emissions and economic growth in India. Renewable and Sustainable Energy Reviews, 15, 3243–3251.

Albiman, M. M., Suleiman, N. N., & Baka, H. O. (2015). The relationship between energy consumption, CO2 emission and economic growth in Tanzania. International Journal of Energy Sector Management, 9(3), 361–375.

Alege, P. O., Adediran, O. S., & Ogundipe, A. A. (2016). Pollutants emissions, energy consumption and economic growth in Nigeria. International Journal of Energy Economics and Policy, 6(2), 202–207.

Al-Mulali, U., Saboori, B., & Ozturk, I. (2015). Investigating the environmental Kuznets curve hypothesis in Vietnam. Energy Policy, 76, 123–131.

Ang, J. B. (2007). CO2 emissions, energy consumption, and output in France. Energy Policy, 34, 4772–4778.

Ang, J. B. (2008). Economic development, pollutant emissions and energy consumption Malaysia. Journal of Policy Modelling, 30, 271–278.

Apergis, N., & Ozturk, I. (2015). Testing environmental Kuznets hypothesis in Asian countries. Ecologival Indicators, 52, 16–22.

Apergis, N., & Payne, J. E. (2009). CO2 emissions, energy usage, and output in Central America. Energy Policy, 37, 3282–3286.

Aqeel, A., & Butt, M. S. (2001). The relationship between energy consumption and economic growth in Pakistan. Asia Pacific Development Journal, 8, 101–110.

Arouri, M. E. H., Youssef, A. B., M’henni, H., & Rault, C. (2012). Energy consumption, economic growth and CO2 emissions in Middle East and North African Countries. Energy Policy, 45, 342–349.

Bah, M. M., & Azam, M. (2017). Investigating the relationship between electricity consumption and economic growth: Evidence from South Africa. Renewable and Sustainable Energy Reviews, 80, 531–537.

Balcilar, M., Bekun, F. V., & Uzuner, G. (2019). Revisiting the economic growth and electricity consumption nexus in Pakistan. Environmental Science and Pollution Research, 26, 12158–12170. https://doi.org/10.1007/s11356-019-04598-0.

Bekun, V. F., & Agboola, M. O. (2019). Electricity consumption and economic growth Nexus: Evidence from Maki co-integration. Inzinerine Ekonomika-Engineering Economics, 30(1), 14–23.

Bekun, F. V., Alola, A. A., & Sarkodie, S. A. (2019a). Toward a sustainable environment: Nexus between CO2 emissions, resource rent, renewable and nonrenewable energy in 16-EU countries. Science of the Total Environment, 657, 1023–1029.

Bekun, F. V., Emir, F., & Sarkodie, S. A. (2019b). Another look at the relationship between energy consumption, carbon dioxide emissions, and economic growth in South Africa. Science of the Total Environment, 655, 759–765.

Belloumi, M. (2009). Energy consumption and GDP in Tunisia: Co-integration and causality analysis. Energy Policy, 37(7), 2745–2753.

Chindo, S., Abdulrahim, A., Waziri, S. I., Huong, W. M., & Ahmad, A. A. (2015). Energy consumption, CO2 emissions and GDP in Nigeria. GeoJournal, 80(3), 315–322.

Cheng, S. B., & Lai, T. W. (1997). An investigation of Co-integration and causality between energy consumption and economic activity in Taiwan. Energy Economics, 19(4), 435–444. https://doi.org/10.1016/S0140-9883(97),01023-2.

Dantama, Y. U., Umar, Y., Abdullahi, Y. Z., & Nasiru, I. (2012). Energy consumption—Economic growth Nexus in Nigeria: An empirical assessment based on ARDL bound test Approach. European Scientific Journal, 8(12), 141–157. https://doi.org/10.1016/j.eneCO210.08.003.

Dlamini, J., Balcilar, M., Gupta, R., & Inglesi-Lotz, R. (2015). Revisiting the causality between electricity consumption and economic growth in South Africa: A bootstrap rolling-window approach. International Journal of Economic Policy in Emerging Economies, 8(2), 169–190.

Dogan, E. (2014). Energy consumption and economic growth: Evidence from low-income countries in Sub-Saharan Africa. International Journal of Energy Economics and Policy, 4(2), 154–162.

EIA. (2018). Energy Information Administration (EIA). Available at https://www.eia.gov/ access date 05.01.2020.

Emir, F., & Bekun, F. V. (2019). Energy intensity, carbon emissions, renewable energy, and economic growth nexus: New insights from Romania. Energy & Environment, 30(3), 427–443.

Esso, L. J. (2010). Threshold co-integration and causality relationship between energy use and growth in Seven African Countries. Energy Economics, 32(6), 1381–1391. (Elsevier).

Ferguson, R. W., Wilkinson, & Wilkinson, H. R. (2000). Electricity use and economic development. Energy Policy, 28, 923–934.

Grossman, G. M., & Krueger, A. B. (1991). Environmental impacts of a North American free trade agreement (No. w3914). National Bureau of Economic Research.

IEA. (2010). World Energy Outlook. https://webstore.iea.org/download/direct/717?fileName=weo2010.pdf. Accessed January 15, 2020.

IEA. (2019). World Energy Outlook IEA, Paris. https://www.iea.org/reports/world-energy-outlook-2019.

Jumbe, C. B. L. (2004). Co-integration and causality between electricity consumption and GDP: Empirical evidence from Malawi. Energy Economics, 26, 61–68.

Khobai, H., & Le Roux, P. (2017). The relationship between energy consumption, economic growth and carbon dioxide emission: The case of South Africa. International Journal of Energy Economics and Policy, 7(3), 102–109.

Kohler, M. (2013). CO2 emissions, energy consumption, income and foreign trade: A South African perspective. Economic Research Southern Africa (ERSA) working paper 356.

Kraft, J., & Kraft, A. (1978). On relationship between energy and GNP. Journal of Energy and Development, 3, 401–403.

Kuznets, S. (1955). Economic growth and income inequality. The American Economic Review, 45(1), 1–28.

Lotfalipour, M. R., Falahi, M. A., & Ashena, M. (2010). Economic growth, CO2 emissions, fossil fuels consumption in Iran. Energy, 35, 5115–5120.

Manu, S. B., & Sulaiman, C. (2017). Environmental Kuznets curve and the relationship between energy consumption, economic growth and CO2 emissions in Malaysia. Journal of Economics and Sustainable Development, 8(16), 142–148.

Masih, A. M., & Masih, R. (1998). A multivariate co-integrated modelling approach in testing temporal causality between energy consumption, real income and prices with an application to two Asian LDCs. Applied Economics, 30(10), 1287–1298. https://doi.org/10.1080/000368498324904.

Mehrara, M. (2007). Energy consumption and economic growth: The case of oil exporting countries. Energy Policy, 35(5), 2939–2945.

Menyah, K., & Wolde-Rufael, Y. (2010). Energy consumption, pollutant emissions and economic growth in South Africa. Energy Economics, 32, 1374–1382.

NDC (2016). Nigeria’s Draft Nationally Determined Contribution (NDC). Implementation action plan for the power sector.

Nnaji, C. E., Chukwu, J. O., & Nnaji, M. (2013). Electricity supply, fossil fuel consumption, CO2 emissions and economic growth: implications and policy options for sustainable development in Nigeria. International Journal of Energy Economics and Policy, 3(3), 262–271.

Odhiambo, N. M. (2009a). Energy consumption and economic growth nexus in Tanzania: An ARDL bounds testing approach. Energy Policy, 37(2), 617–622.

Odhiambo, N. M. (2009b). Electricity consumption and economic growth in South Africa: A trivariate causality test. Energy Economics, 31(5), 635–640.

Odhiambo, N. M. (2011). Economic growth and carbon emissions in South Africa: An empirical investigation. Journal of Applied Business Research (JABR), 28(1), 37–46. https://doi.org/10.19030/jabr.v28i1.6682.

Odularu, G. O., & Okonkwo, C. (2009). Does energy consumption contribute to economic performance? Empirical evidence from Nigeria. Journal of Economics and International Finance, 1(2), 044–058.

Ogundipe, A., & Apata, A. (2013). Electricity consumption and Economic growth in Nigeria. Journal of Business Management and Applied Economics, 11(4), 1–14.

Ohlan, R. (2015). The impact of population density, energy consumption, economic growth and trade openness on CO2 emissions in India. Natural Hazards, 79, 1409–4128.

Olarinde, M., Martins, I., & Abdulsalam, S. (2014). An empirical analysis of the relationship between CO2 emissions and economic growth in West Africa. America Journal of Economics, 4(1), 1–17.

Omisakin, O. A. (2008). Energy consumption and economic growth in Nigeria: A bounds testing co-integration approach. Journal of Economic Theory, 2(4), 118–123.

Omotor, D. G. (2008). Causality between energy consumption and economic growth in Nigeria. Pakistan Journal of Social Sciences, 5(8), 827–835.

Onakoya, A. B, Onakoya, A. O., Jimi-Salami, O. A., & Odedairo, B. O. (2013). Energy consumption and Nigerian economic growth: an empirical analysis.

Samu, R., Bekun, F. V., & Fahrioglu, M. (2019). Electricity consumption and economic growth nexus in Zimbabwe revisited: Fresh evidence from Maki co-integration. International Journal of Green Energy, 16(7), 540–550. https://doi.org/10.1080/15435075.2019.1598417.

Shahbaz, M., Hye, Q., Tiwari, M. A. A. K., & Leitao, N. C. (2013). Economic growth, energy consumption, financial development, international trade and CO2 emissions in Indonesia. Renewable and Sustainable Energy Reviews, 25, 109–121.

Shuaibu, M. I., & Oyinlola, M. A. (2013). Energy consumption, CO2 emissions and economic growth in Nigeria. Paper Presented at the 2013 NAEE International Conference, Lagos, Nigeria.

Shui, A., & Lam, P. (2004). Electricity consumption and economic growth in China. Energy Policy, 32(1), 47–54.

Solarin, S. A., & Shahbaz, M. (2013). Trivariate causality between economic growth, urbanisation and electricity consumption in Angola: Co-integration and causality analysis. Energy Policy, 60, 876–884.

Soytas, U., & Sari, R. (2003). Energy consumption and GDP: Causality relationship in G7 countries and emerging markets. Energy Economics, 25, 33–37.

Soytas, U., Sari, R., & Ewing, B. T. (2007). Energy consumption, income, and carbon emissions in the United States. Ecological Economics, 62, 482–489.

Sulaiman, C., & Abdul-Rahim, A. S. (2014). The relationship between CO2 emissions, energy consumption and economic growth in Malaysia: A three-way linkage approach. Environmental Science and Pollution Research, 24, 25204–25220.

Sulaiman, C., & Abdul-Rahim, A. S. (2018). Population growth and CO2 emission in Nigeria: A recursive ARDL approach. SAGE Open, 8(2), 2158244018765916.

Tsaurai, K. (2013). Is there a relationship between electricity consumption and economic growth in Zimbabwe? Corporation Ownership and Control, 10, 283–290.

Vadyarthi, H. (2013). Energy consumption, carbon emissions and economic growth in India. World Journal of Science, Technology and Sustainable Development, 10(4), 278–287.

Wanji, Y. D. F. (2013). Energy consumption and economic growth: Evidence from Cameroon. Energy Policy, 61, 1295–1304.

Wolde-Rufael, Y. (2005). Energy demand and economic growth: The African experience. Journal of Policy Modeling, 27(8), 891–903.

Yu, S. H., & Choi, J. (1985). The causal relationship between energy and GNP: An international comparison. Journal of Energy Development, 10(2), 249–272.

Zhang, X. P., & Cheng, X. M. (2009). Energy consumption, carbon emissions, and economic growth in China. Ecological Economics, 68, 2706–2712.

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2020 Springer Nature Switzerland AG

About this chapter

Cite this chapter

Bekun, F.V., Agboola, M.O., Joshua, U. (2020). Fresh Insight into the EKC Hypothesis in Nigeria: Accounting for Total Natural Resources Rent. In: Shahbaz, M., Balsalobre-Lorente, D. (eds) Econometrics of Green Energy Handbook. Springer, Cham. https://doi.org/10.1007/978-3-030-46847-7_11

Download citation

DOI: https://doi.org/10.1007/978-3-030-46847-7_11

Published:

Publisher Name: Springer, Cham

Print ISBN: 978-3-030-46846-0

Online ISBN: 978-3-030-46847-7

eBook Packages: EnergyEnergy (R0)