Abstract

This chapter aims to explore how configurations of stakeholder engagement influence the generation of sustainable innovations (SIs). More specifically, by assessing a sample of agro-food Italian companies, the study contributes to (1) identifying different SI strategies and (2) exploring the role of cultural and managerial attributes related to stakeholder engagement in supporting the development of SI strategies. A cluster analysis was conducted on a sample of 72 companies in Italy, revealing the existence of three bundles, each characterized by differences in the degree and types of SI. A variance analysis of business practices among the three clusters highlights the critical role played by stakeholder engagement in supporting the development of SI strategies.

Access provided by Autonomous University of Puebla. Download chapter PDF

Similar content being viewed by others

1 Introduction

Emerging socioeconomic pressures, environmental problems, and transformative technologies make sustainability important for innovation. Sustainability pressures drive companies to rethink their products, processes, relationships, and business models in order to achieve competitive advantages in terms of cost-efficiency or sustainable value differentiation, compete in a transforming business environment, and make their contributions to sustainable development (Seebode et al. 2012; Nidumolu et al. 2009).

Generally, a sustainable innovation (SI) is conceived as an innovative solution aimed at improving long-term environmental, social, and/or economic performance (Ketata et al. 2015; Juntunen et al. 2018). More specifically, in this book, SI is defined as “any incremental or radical change in the social, service, product, governance, organisational, system and marketing landscape that leads to positive environmental, economic and social transformations without compromising the needs, welfare and wellbeing of current and future generations” (Popper et al. 2016, see also Chaps. 1 and 2).

The management of SI can be particularly challenging for companies due to its multidimensional nature and purposes (Ketata et al. 2015; Seebode et al. 2012). Indeed, SI is widely recognized as more complex than traditional innovation by the requirement to integrate diverse resources, knowledge, and problem-solving approaches relating to economic, environmental, and social issues (Adams et al. 2016; Hansen et al. 2009; Iñigo and Albareda 2016; Ketata et al. 2015). Previous studies identified some specific practices to manage the complexity of SI (e.g., Ayuso et al. 2011; Hansen et al. 2009; Kazadi et al. 2016; Ketata et al. 2015; Mousavi and Bossink 2017). In particular, the integration of the sustainability purposes into a clear innovation strategy is important for recognizing and taking advantage of opportunities for SI generation (Amui et al. 2017; Mousavi and Bossink 2017). Firms need innovation strategy to clarify objectives and priorities, to align innovation efforts with their corporate strategies and among various groups of stakeholders (Pisano 2015). SI is increasingly acknowledged as a result of strategies and activities that are collaborative and open to solution co-creation with various stakeholders who are sources of inspiration and knowledge (Iñigo and Albareda 2016; Goodman et al. 2017; Juntunen et al. 2018; Kazadi et al. 2016). Thus, the literature on SI management suggests that dialog, involvement, and collaboration with various stakeholders are essential ingredients for developing successful SI (e.g., Goodman et al. 2017; Juntunen et al. 2018).

However, studies focused on the role of collaborative stakeholder engagement in the development of SI strategies are scarce (Goodman et al. 2017). There is a little understanding of how companies manage collaboration with stakeholders, especially the interplay of business practices that can influence the development of SI strategies (Juntunen et al. 2018).

This chapter aims to explore the role of stakeholder engagement for the development of SI strategies. The literature on open and collaborative innovation among different stakeholders identifies conditions for successfully involving stakeholders in SI strategy, but more research that adopts a collaborative perspective on stakeholder relationships is needed (Goodman et al. 2017). This study builds on the CASI-F Framework for the assessment and management of SI (Popper et al. 2017) and analyzes the stakeholder engagement of a sample of agro-food Italian companies. The study contributes to (1) identifying different SI strategies and (2) exploring the role of cultural and managerial practices related to stakeholder engagement in supporting the development of SI strategies.

Some practices have been studied that relate to the management of stakeholders’ relationships, including the choices of types and number of involved stakeholder groups and the use of collaboration tools (Juntunen et al. 2018). Moreover, different practices related to Corporate Social Responsibility (CSR) aim to integrate social and environmental issues into business activities and improve relationships with stakeholders. The empirical study presented in this chapter focuses on agro-food sector, which was selected due to its relevance for both the Italian economy and the achievement of the 2030 Sustainable Development Goals concerning poverty, hunger, climate change, and natural resources.

The chapter is structured as follows. The topic of SI strategies at company level is introduced, followed by a literature review highlighting the potential role of different CSR practices and tools for collaboration with stakeholders for the development of SI strategies. Next, the methodology used for data collection and analysis is illustrated. The main results of the study are then presented. One noteworthy result is the existence of a critical relationship between the adoption of proactive SI strategies and activities for engaging and collaborating with different stakeholders. The chapter concludes by discussing this and other findings.

2 Theoretical Framework

2.1 A Classification of SI Strategies

A review of SI literature revealed a scarcity of studies on SI strategies. However, some studies do explore the deep connection between corporate strategy and the implementation of SI initiatives (e.g., Adams et al. 2016; Berkhout 2014; Bos-Brouwers 2010; Klewitz and Hansen 2014). Indeed, the level and success of SI depend on the degree of integration of sustainability issues into a clear and overall corporate strategy (Amui et al. 2017). Thus, this study considers both the large literature on corporate sustainability strategies and the literature on the strategic management of SI.

The corporate sustainability strategies concern the integration and embedding of sustainability into the core strategic goals of the firms (Baumgartner and Ebner 2010; Berkhout 2014). Various models describe the transition toward corporate sustainability strategies. These models converge on the idea that firms can move from a defensive to a proactive strategic approach (e.g., Baumgartner and Ebner 2010; Buysse and Verbeke 2003; Bos-Brouwers 2010; Dunphy 2011; Klewitz and Hansen 2014; Schaltegger et al. 2012). It is possible to highlight three main strategic approaches to sustainability. First, the defensive or compliance-oriented strategy is employed by companies that consider sustainability as a risk. These companies do not really innovate for sustainability purposes, and when they do implement sustainable changes, it is only to comply with regulation or meet external certifications and standards requirements. Second, the cost-effectiveness strategy is adopted by companies that consider sustainability issues linked to the internal changes for achieving cost reductions and increased efficiency. These companies alter their processes for cost savings through innovation aiming at smart and efficient use of resources. Third, the proactive strategy emerges when companies see sustainability as a key opportunity for competing in the market and contributing to sustainable development.

The proactive strategy seeks to achieve sustainable value creation through product and service innovation. A more proactive strategic approach to sustainability can contribute to sustainable business model innovations to achieve long-term economic, social, and environmental performance (Klewitz and Hansen 2014; Schaltegger et al. 2012). When firms develop a more proactive strategic approach, they become more aware of and concerned about their environmental and social impacts, and thus they improve the integration of sustainability into their innovation strategies, and transform their business activities (Adams et al. 2016; Baumgartner and Ebner 2010; Dunphy 2011; Schaltegger et al. 2012). The evolution of corporate strategies toward a proactive strategic approach increases the SI opportunities for processes, products, services, and entire business models (Klewitz and Hansen 2014; Schaltegger et al. 2012).

The literature also reveals that some reactive companies entirely ignore or refuse to engage on environmental and social issues. Reactive companies do not innovate on sustainability. Some researchers have observed that firms with a proactive strategic approach show more SI activities and achieve better triple-p performance (people, planet, and profit) that integrates economic, social, and environmental issues. Firms with a compliance-oriented strategy are hardly innovative because they limit innovation to what they must do (Bos-Brouwers 2010; Schaltegger et al. 2012).

Thus, the review of the literature reveals a connection between corporate sustainability strategies and the strategic choices a firm makes regarding its SI activities. In this chapter, SI strategies are defined by strategic decisions firms made regarding types and degree of SI introduced. In particular, SI strategies are understood as the integration of sustainability into products and/or processes innovation that generate business model innovations changing how businesses create and deliver value to and with their stakeholders.

2.2 Stakeholder Engagement as a Potential Driver of SI Strategies

The barriers and drivers of SI are a topic of interest for both academics and practitioners in the SI field. Although previous research has focused on this topic, there is a need to better explore which factors lead to more proactive SI strategies (Iñigo and Albareda 2016).

Through analyzing the literature in the SI field, it is possible to identify external and internal factors that can drive or inhibit SI (e.g., Ketata et al. 2015; Przychodzen and Przychodzen 2018; Doran and Ryan 2016). The external factors of the business environment include the institutional and socioeconomic characteristics of the local context and of the industry sector, sustainability-related public policies, environmental regulations, pressures of social and environmental movements, and consumer demand for sustainable products and production processes (e.g., Bossle et al. 2016; Doran and Ryan 2016; Ketata et al. 2015; Klewitz and Hansen 2014; Przychodzen and Przychodzen 2018). There is increasing research interest in understanding the internal factors that can influence and foster a company’s SI. Internal factors include the company’s cultural factors like values and norms that influence CSR (Altenburger 2018; Bocquet et al. 2013; MacGregor and Fontrodona 2008; Martinez-Conesa et al. 2017), sustainability orientation and organizational culture, and the motivation and values of owners/managers (Bos-Brouwers 2010; Fellnhofer 2017). Internal factors also include organizational factors like the size of a company, its level of internationalization, and its position in the value chain (Klewitz and Hansen 2014; Przychodzen and Przychodzen 2018; Doran and Ryan 2016). Other important internal factors include managerial practices and abilities at the firm or individual levels, such as stakeholder engagement, knowledge management, human resource management, communication, sustainable accountability, environmental management, the manager’s skills and visionary leadership, and strategic attitude (e.g., Ayuso et al. 2011; Bossle et al. 2016; Klewitz and Hansen 2014; Fellnhofer 2017).

Stakeholder engagement is widely recognized as a leading factor in the development of innovation, particularly for successful SI (Ayuso et al. 2011; Buysse and Verbeke 2003; Goodman et al. 2017; Watson et al. 2018). A stakeholder is defined as “any group or individual who can affect or be affected by the achievement of the organization’s objectives” (Freeman 1984). Stakeholder engagement can be understood in a broad sense as the positive interaction and/or involvement of stakeholders in the activities of an organization (Greenwood 2007). These activities include the company’s innovation processes and strategies (Goodman et al. 2017; Juntunen et al. 2018).

According to traditional stakeholder theory, SI needs to consider many disparate stakeholders who advance their different, and often contradictory, demands (Hall and Vredenburg 2003). Debates about the role of stakeholders for SI originally focused on different stakeholder pressures and managing stakeholder expectations about controversial issues (Goodman et al. 2017). More recent studies adopt a collaborative perspective on stakeholder theory and explore engaging stakeholders as sources of inspiration and knowledge for SI (e.g., Goodman et al. 2017; Juntunen et al. 2018; Kazadi et al. 2016).

Innovation has undergone evolutionary steps from the traditional paradigm of closed innovation to new paradigms like open innovation (Chesbrough 2003), user innovation (Von Hippel 2009), open collaborative innovation (Baldwin and Von Hippel 2011), and co-innovation (Lee et al. 2012). All these paradigms converge on the idea that no firm can innovate alone but need to engage with a wide range of stakeholders to gather ideas and resources beyond its boundaries. This can help the firm to sustain a competitive advantage and face the complex challenges of a rapidly changing environment (Altenburger 2018).

SI is increasingly conceived as a collaborative effort, more customer-oriented, and more open to knowledge co-creation than traditional innovation (Adams et al. 2016; Goodman et al. 2017; Ketata et al. 2015; Iñigo and Albareda 2016). SI is an open innovation because it requires a more open approach to knowledge management and innovation processes, involving various internal and external actors as sources of new ideas and knowledge (Chesbrough 2003). SI is collaborative innovation because it is a result of multi-stakeholder engagement effort, in which the firm facilitates the active involvement of stakeholders and the sharing of ideas, knowledge, experiences, competences, and opportunities (Goodman et al. 2017; Ketchen Jr et al. 2007).

Different empirical studies have shown manifold benefits of involving and collaborating with stakeholders in SI. The integration of different voices and perspectives in the innovation process facilitates better understanding of the firm’s local context, including social needs and natural environmental problems and the anticipation of market opportunities in a dynamic business environment characterized by rapid changes (Ayuso et al. 2006, 2011). By developing mutual and trusting relationships with stakeholders, firms compensate their lack of resources with access to new and complementary sources of information and knowledge to support SI (Adams et al. 2012; Bos-Brouwers 2010; Kazadi et al. 2016). From a creative point of view, the involvement of committed internal and external stakeholders may enhance the firm’s problem-solving capacity and generate new innovative solutions that benefit both the firm and its stakeholders and contribute to sustainable development (Ayuso et al. 2006, 2011; Bos-Brouwers 2010). Moreover, the collaboration with stakeholders helps companies to achieve shared goals and develop common criteria for assessing SI strategies, and thus enhancing the organization’s legitimacy (Achterkamp and Vos 2006; Adams et al. 2016; Desai 2018).

The literature has also identified some disadvantages that make stakeholder engagement challenging for companies. Engaging with stakeholders requires resources and time. Each company should identify the groups of stakeholders that are relevant for developing SI in order to avoid spending excessive time and resources on interacting with stakeholders with little to contribute to their innovation processes (Kazadi et al. 2016). Moreover, the engagement of many stakeholders in SI processes is rarely conflict-free because various stakeholders often have different competing values and frames: they may interpret the same situation differently, and tensions may arise (Goodman et al. 2017; Hall and Vredenburg 2003; Watson et al. 2018). When the firm is unable to manage and solve conflicts between stakeholders, stakeholder diversity may slow down or impede decision-making (Ayuso et al. 2006; Juntunen et al. 2018). The integration of stakeholders may not foster SI if the firm lacks capabilities to collaborate with stakeholders and absorb the knowledge and resources located in diverse stakeholder groups (Ayuso et al. 2011; Kazadi et al. 2016).

The recent literature focuses on the dynamic capabilities for stakeholder dialog and engagement in SI (Ayuso et al. 2011) or environmental innovation (Watson et al. 2018) and for knowledge creation among multiple actors in the innovation processes (Kazadi et al. 2016; Ingenbleek and Dentoni 2016). Although the advantages and disadvantages related to stakeholder engagement in the SI field are known, the issue of how companies can effectively engage stakeholders remains underexplored (Ayuso et al. 2011; Goodman et al. 2017; Juntunen et al. 2018). Thus, this chapter aims to better comprehend the relationship between SI strategies and stakeholder engagement. For this purpose, the chapter focuses on different configurations of business practices and tools that describe cultural or managerial attributes related to how companies engage their stakeholders.

2.3 Managerial and Cultural Attributes of Stakeholder Engagement

Existing studies of stakeholder engagement and SI consider the number and types of stakeholders involved, as well as the quality of organizational engagement (Juntunen et al. 2018). The stakeholders categorized as primary stakeholders are directly involved in economic transactions with the firm and are essential for its existence (e.g., shareholders, employees, customers, and suppliers). Secondary stakeholders are not directly involved in economic transactions but can play an important role in the organization’s credibility and legitimization (such as CSOs/activists, communities, governments, academic institutions, and competitors) (Clarkson 1995). Previous research in the SI field has focused on the engagement of primary stakeholders (e.g., employee commitment, customer engagement, or the involvement of supply chain members). However, the role of secondary stakeholders is potentially more relevant than that of primary stakeholders in leading SI (Goodman et al. 2017; Hall and Vredenburg 2003; Ingenbleek and Dentoni 2016). Encompassing economic, social, and environmental issues in a long-term view, SI needs to consider a wider range of both primary and secondary stakeholders (Ayuso et al. 2011; Hall and Vredenburg 2003; Goodman et al. 2017).

Once the stakeholders have been identified, the firm needs to decide how to manage its relationships with stakeholders using a set of mechanisms, tools, and CSR practices that aim to create and maintain fruitful relationships (Greenwood 2007; Juntunen et al. 2018). As mentioned above, initial studies about the role of stakeholders in the sustainability field have embraced the traditional approach of stakeholder engagement for mitigating risks related to stakeholders’ conflicting demands and different degrees of influence over the firm. This approach considers stakeholders as a source of risk and suggests controlling and managing stakeholders through monitoring and communication, including listening to stakeholders’ concerns and informing them about corporate objectives, activities, and performance (Sloan 2009).

However, the traditional approach to stakeholder engagement seems to be less effective in the SI field because it leads to passive involvement that reduces opportunities for effective organizational changes and innovation (Sloan 2009). Open and collaborative innovation suggests a different approach based on dialog, involvement, and collaboration with various stakeholders recognized as potential sources of knowledge and ideas for SI (see Ayuso et al. 2011; Goodman et al. 2017; Kazadi et al. 2016). This collaborative approach to stakeholder engagement is argued to be more effective because it stimulates innovation and transformational changes (Sloan 2009). It is consistent with responsible stakeholder engagement by enabling cooperation in mutually beneficial relationships (Greenwood 2007).

Firms can use different tools to interact and collaborate with various stakeholders (e.g., online consultation, dedicated listening lines, and focus groups or workshops). These instruments range from simple activities aimed at collecting stakeholders’ suggestions during decision-making processes (Goodman et al. 2017; Luyet et al. 2012) to more active and creative involvement that needs to be structured and facilitated by the innovators (Goodman et al. 2017; Piller et al. 2011). Following the collaborative approach, stakeholder engagement should be considered as an effective managerial practice to collect, integrate, and produce new information and knowledge as a critical component of successful SI.

These instruments represent the concrete operationalization of stakeholder engagement and thus help to explain how firms manage their stakeholder relationships in practice (Ayuso et al. 2011; Steurer et al. 2005). However, to discuss the role of stakeholder engagement for the development of SI strategies, it is important to consider the adoption of CSR practices that help to explain relationships between the company and its multiple stakeholders.

According to its early formulations, CSR goes beyond the firm’s economic and legal obligations and encompasses society’s ethical and philanthropic expectations of the company (Carroll 1979). Over the past 40 years, the CSR concept has evolved and been progressively linked to the study of stakeholder engagement (e.g., Branco and Rodrigues 2007; Carroll 2015; Greenwood 2007; O’Riordan and Fairbrass 2014). A later formulation views CSR as “the responsibility of enterprises for their impacts on society” that requires “close collaboration with their stakeholders with the aim of maximising the creation of shared value for their owners/shareholders and for their other stakeholders and society at large; identifying, preventing and mitigating their possible adverse impacts” (EU Commission 2011).

Thus, the CSR concept emphasizes the motivations and responsibilities that drive a company to act in the interests of and engage with legitimate primary and secondary stakeholders.

Some authors distinguish different CSR culture profiles with respect to stakeholder engagement and the co-creation of value: (1) a compliance culture, where the company overlooks the engagement of stakeholders; (2) an instrumental relationship management culture, where the company recognizes the instrumental value of the engagement of immediate stakeholders; and (3) a sustainable organization culture, where the company collaborates with a variety of stakeholders to maximize the creation of value in economic, social, and environmental terms (Wheeler et al. 2003).

Many studies have emphasized CSR practices as potential drivers for SI, but the results of studies about the relation between social responsibility and the level of innovativeness are inconsistent (Mithani 2017; Martinez-Conesa et al. 2017). CSR is considered as a good proxy of moral motivations or cultural issues that underlie stakeholder engagement, as it concerns values, beliefs, and assumptions that can drive a firm toward better integration of sustainability issues, together with better engagement of both primary and secondary stakeholders in business activities (Greenwood 2007; Steurer et al. 2005; Wheeler et al. 2003). Therefore, in this chapter, CSR will be measured by considering the implementation of various CSR practices that may help to create and maintain good relationships with various stakeholders.

Companies can develop a formal and well-integrated CSR system or undertake different practices associated with social and environmental responsibilities (e.g., social and environmental reports, use of renewable resources, reductions of emissions, treatment of women and minorities, etc.). The role of sustainable accountability is also emphasized by CSR studies as important to establish and maintain transparent and open communication with stakeholders (Lim and Greenwood 2017), as well as to foster awareness of sustainable actions and collaboration for SI (August 2018). In this sense, sustainable accountability is a means by which stakeholders can participate in company activities. The most common and widespread type of sustainability communication is to promote externally the company’s social and sustainability efforts through external certifications that independently confirm the firm has improved its processes. These standard certifications may also be used inside the firm as a guide to continually improve and innovate processes. Moreover, firms can implement their own systems to assess the environmental and social impacts of their efforts. For this chapter, the adoption of various CSR practices is considered to indicate an organizational culture that focuses on the creation of value with stakeholders in economic, social, and environmental terms (Wheeler et al. 2003).

3 An Empirical Study in the Agro-Food Sector

3.1 Data Collection and Analysis

As a partner in the CASI project, the authors of this chapter decided in 2015 to extend previous research conducted within the EU project by focusing on agro-food clusters in Italy. Starting from prior evidence that emerged from the case mapped in CASIPEDIA (2017) and building on the CASI-F (see Popper et al. 2017 and Chap. 1), a study was conducted to explore the status and potential of companies within the agro-food clusters to support the sustainable development challenge.

The reference population was identified from the AIDA BureauVan Dijk database, from which a sample of 1470 companies was extracted of firms belonging to “agriculture,” “food industry,” and “large retail.” Smaller companies (those with an annual turnover of less than 20 million euros), were excluded from the sample, as their choices and behavior might be quite specific, thus reducing their comparability with larger companies.

An online questionnaire was administered between June and July 2015 to 1108 companies and targeted to people who deal with issues related to sustainable innovation and CSR in each company. Building on CASI-F, the questionnaire was structured in three sections that identified SIs introduced by the company and the business practices adopted with reference to CSR and stakeholder engagement.

Seventy-two completed questionnaires were collected from external relations managers, marketing and communication managers, quality managers, human resource managers, deputy directors, and/or entrepreneurs. The final sample included 54 (75%) “food industry” companies, 13 (18.1%) “agriculture” companies, and 5 (6.9%) “large retail” companies. Thirty-six companies (50%) had between 50 and 249 employees, 21 between 10 and 50 (29.2%), and 15 had more than 249 employees (20.8%) at the time of the interviews. More than 70% of the companies in the sample were located in northern Italy (47.2% in the northeast and 23.6% in northwest), while 12.5% were in the center (12.5%) and 16.6% in the south or on the islands.

The full list of variables considered in this study is presented below:

-

Clustering variables. Respondents were asked to list all SIs, defined as any change in products and/or processes introduced in the last 3 years which had an impact on environmental and/or social performance, both inside and outside the company. Answers were then grouped by the authors and the final set included 12 macro-types, as reported in Table 4.1. Each variable practice was then coded as a dummy variable, where 1 = introduced (in the last 3 years), and 0 = otherwise. Table 4.1 lists the types of SI.

-

Companies’ structural characteristics. A dummy variable was created for each of the four national local areas where the company operates (northwest, northeast, center, and south and islands) and the three industries they belong to (agriculture, food production, and large retail). Organization size was measured by the total number of employees. Responses were coded as categorical variables, where 1 = small (less than 50 employees), 2 = medium (between 50 and 249 employees), and 3 = large (250 employees or more). For the scope of the study, a dummy variable was created for each size category, where 1 = yes, and 0 = otherwise.

-

Corporate social responsibility (CSR). Respondents were asked if their company had introduced a complete CSR system. Responses were then coded as a dummy variable, where 1 = introduced, and 0 = otherwise. The questionnaire also included questions to understand which models, guidelines, and tools were used by companies to improve their image among stakeholders and direct their choices toward greater social, environmental, and ethical responsibility. Whether each company had a social report, renewable resources, management of environmental impact, and social marketing was analyzed, and responses were coded as dummy variables for each tool, where 1 = used, and 0 = otherwise.

-

Indirect sustainable accountability. Respondents were also asked about the adoption of certifications and standards, distinguishing between quality standards (ISO 9000), environmental certifications (ISO 14000; EMAS; 5000), social certifications (SA 8000; OHSAS; ISO 18001; SGSL; UNI-INAIL; ISO 26000; Q-RES), and sectoral certifications (IFS; BRC; ISO 22000). A dummy variable was created for each type of certification, where 1 = used, and 0 = otherwise.

-

Direct sustainable accountability. Respondents were asked to specify if their company used measures for monitoring and assessing the environmental and social impact of businesses practices. According to the answers, two dummy variables were derived, one for environmental assessment and one for social assessment, where 1 = used, and 0 = otherwise.

-

Stakeholder engagement and collaboration. Respondents were asked to indicate which type of stakeholders were engaged in the company’s business activities distinguishing four main groups: employees, clients, providers, and local community actors (government, NGO, civil society, etc.). A dummy variable was created for each stakeholder group, where 1 = engaged, and 0 = otherwise. An ordinal variable was derived by considering the number of stakeholder groups involved by the company. Respondents were asked to indicate whether they used the following tools for interacting and collaborating with different stakeholders: online consultation, dedicated listening lines, and focus groups/workshops. A dummy variable was created for each of the tools, where 1 = used, and 0 = otherwise.

To verify the existence of different SI strategies within the companies of the agro-food clusters, a hierarchical cluster analysis was carried out following the methodological instructions provided by Ketchen and Shook (1996). Ward’s method and Euclidean distance were used to identify clusters and similarities between models. The data were processed with IBM Statistics SPSS 25 software.

Three clusters were identified as the best solution, using the criteria of size and interpretability of the clusters (considering the significance of each clustering variable). To test the validity of the three clusters solution, contingency tables were developed by matching variables used for classification together with the identified clusters. The results of the contingency analysis confirm that the three clusters vary significantly according to the clustering variables used.

To identify the differences between the three groups in terms of companies’ structural characteristics and their business practices, different tests for variance were performed. More specifically, the Pearson Chi-Square has been considered for categorical variables, while the one-way ANOVA was used for ordinal variables, and two significance levels were considered: 99% (p < 0.01) and 95% (p < 0.05).

3.2 Types of SI Strategies

The results of the cluster analysis are shown in Table 4.1. As already stated, data analysis identified three different clusters of companies according to the type of SI introduced, distinguishing three main SI strategies. The three clusters were then labelled as “conservatives,” “optimizers,” and “anticipators.” The respective percentages do not sum to 100% due to the presence of deviating cluster members. As further explained below, the three clusters offer empirical evidence of different inactive, active, or proactive SI strategies, and these strategies resemble the defensive strategy, cost-effectiveness strategy, and proactive strategy found in the analysis of previous studies in this field (e.g., Bos-Brouwers 2010; Klewitz and Hansen 2014; Schaltegger et al. 2012).

-

Companies that adopt a “conservative” strategy are those that innovate little (or not at all) regarding sustainability, not having foreseen significant changes in this direction for products offered on the market or for production processes. Within this cluster, 6.0% of companies have introduced nontoxic/hypoallergenic products, 15.1% have invested in organic/recyclable products, while a slightly higher percentage have reduced product packaging and/or replaced polluting components of products with low-environmental-impact raw materials (24.2% and 27.2%, respectively). Low percentages also emerged when considering the list of process innovations. Interestingly, the optimization of resource management in production processes by using renewable energy sources is quite widespread within conservative companies (42.4% have introduced this innovation), although most in this group have not yet innovated their production process in the sustainable direction.

-

Companies that belong to the group of “optimizers” are those that have almost exclusively introduced process innovations. These companies have invested considerably in the optimization of resource management in the production process through the use of zero-kilometer suppliers and/or the use of renewable energy sources (78.9%, respectively) and even in the recycling and reuse of raw material (63.1%). Particularly relevant is the number of companies that have invested in eco-compatible technology for reducing energy consumption, waste, and atmospheric pollution (84.2%), and/or in technologies for dematerialization of information (68.4%). While “optimizers” tend to innovate on processes, they do not innovate on products. Although relatively large percentages of companies within this group have introduced nontoxic/hypoallergenic products and/or reduced product packaging (42.1% respectively), most of them have not changed their products to make them more sustainable.

-

Companies in the “anticipators” group have innovated their products and processes toward sustainability. With regard to product innovations, all companies have reduced packaging, 85% have replaced polluting components with ones of less environmental impact, and 70% have introduced organic and recyclable products. “Anticipators” have also innovated their production processes toward sustainability by reusing raw materials (75%), introducing renewable energy sources (80%), adopting eco-compatible technology for reducing energy consumption, produced waste, and atmospheric pollution (85%), and dematerializing information or reducing products’ packaging (70%). Finally, 70% of the companies in this group have improved the sustainability of their distribution processes by modifying packaging of products.

Table 4.2 shows that no significant differences emerge between companies of the three strategic groups regarding their industries (agriculture, food production, and large retail), organization size (small, medium, and large), and location (northwest, northeast, center, and south and islands) (p > 0.05). Indeed, the distribution of companies within the three strategic bundles is quite similar in terms of structural characteristics.

3.3 Stakeholder Engagement and Collaboration

Table 4.3 shows that the adoption of a complete CSR system is slightly more common among “optimizers” and “anticipators.” However, and counterintuitively, the adoption of a CSR system does not significantly discriminate companies within the three strategic groups (p < 0.05).

“Anticipators” and “optimizers” make greater use of tools for managing indirect sustainable accountability, unlike companies who have not introduced SIs. Most “optimizers” and “anticipators” make use of renewable resources (73.7% and 90.0%, respectively) or adopt tools for managing their environmental impacts (84.2% and 80.0%, respectively), compared to just over half of “conservatives” (p < 0.05). Conversely, drawing up a social report and/or dealing with social marketing initiatives to influence the behaviors of specific target groups are not widespread in all strategic groups.

The practice of adopting certifications and standards attesting to the company’s commitment to respect the environment and ensure the quality of agro-food products is quite diffused among all three strategic groups. The only exception concerns the Quality Management Standard (ISO 9000) that typically outlines the requirements a company must maintain in its process and product quality system. The shares of users of ISO 9000 are significantly higher among “anticipators” and “optimizers” (85% and 73.7%, respectively) than among “conservatives” (51.5%) (p < 0.05).

The use of measures of direct sustainable accountability distinguishes the “anticipators” from “optimizers” and “conservatives.” More specifically, 85% of anticipators make regular use of measures for monitoring and evaluating the environmental impact of their activities, while these are adopted by only one-third of “optimizers” and “conservatives” (p < 0.001). These measures are usually developed ad hoc by the company, or even “proposed” by quality certifiers, and these measures allow companies to regularly monitor their overall resource consumption, energy consumption, waste management, and emissions of CO2 and other polluting gases. On the contrary, the use of measures aimed at detecting social impact is generally less widespread but greater among “anticipators” (35%) than “conservatives” and “optimizers” (3% and 0%, respectively, p < 0.001).

Statistically significant differences emerge when comparing stakeholder engagement initiatives among the three clusters, suggesting the existence of a relationship with SI strategies. Table 4.4 reveals that the most significant differences concern “anticipators,” when compared with “conservatives” and “optimizers.”

The number of stakeholder categories engaged by companies is, on average, higher among “anticipators” than “conservatives” and “optimizers.” While “anticipators” engage 3.2 stakeholder categories on average, the mean is only about 1.7 for both “conservatives” and “optimizers” (p < 0.01). Moreover, while almost all “anticipators” engage clients in their business activities (95.0%), only 57.6% of “conservatives” and 47.4% of “optimizers” do likewise (p < 0.01). In addition, 80% of “anticipators” engage and collaborate with suppliers, against 39.4% of “conservatives” and 42.1% of “optimizers,” while 70% engage other societal actors (with a lower percentage among both “conservatives” and “optimizers”) (p < 0.10).

“Anticipators” involve different types of stakeholders in their business activities and use innovative tools to promote collaboration and knowledge exchange with them. For example, 80% of “anticipators” use online consultation mechanisms—mail, (corporate) websites, and portals dedicated to corporate sustainability issues, internal social networks, and virtual training sessions—to interact with different stakeholders.

By contrast, online consultations are adopted by just one quarter of “conservatives” and “optimizers.” Furthermore, 85% of anticipators use dedicated listening lines, against 57.6% among “conservatives” and 47.4% among “optimizers” (p < 0.05). These communication channels include individual interviews, group meetings, free-phone lines, courtesy calls, and questionnaires that companies use to interact with customers, employees, and suppliers. Finally, 60% of “anticipators” organize focus groups and workshops, where customers, employees, suppliers, and societal actors can participate jointly or separately. Only 21.1% of “optimizers” and 27.3% of “conservatives” use focus groups and workshops (p < 0.05).

4 The Role of Stakeholder Engagement for Developing SI Strategies

This study reveals the existence of three different strategic groups of companies in the agro-food sector with respect to SI. These groups have been labelled as “conservative,” “optimizer,” and “anticipator,” thus distinguishing different strategic approaches to SI.

In the first group, companies adopt a “conservative” approach to SI, producing the same things in the same way and limiting them to respecting existing regulation. The second and intermediate group of “optimizers” includes companies that have innovated toward sustainability, mainly to increase the efficiency of their production processes. Finally, the group of greater development for SI is the “anticipators,” including those companies that, besides substantially changing their processes, also change, or rather diversify, their core businesses by introducing sustainable products. These strategic groups are similar to those found in previous studies in the literature on corporate and SI strategies (see, e.g., Baumgartner and Ebner 2010; Buysse and Verbeke 2003; Bos-Brouwers 2010; Dunphy 2011; Klewitz and Hansen 2014; Schaltegger et al. 2012).

Each strategic group embeds different strategic choices about the type and level of diffusion of SI activities. The proactive “anticipators” group shows a high degree of SI in terms of the number and variety of SI types implemented. In all the strategic groups, SI concerns mainly the environmental dimension, while process and product innovations with a focus on social impact are almost entirely absent. This result could be partly due to the sector considered in this study: food entrepreneurs appear to have an approach to sustainability that focuses largely on the environmental dimension.

Exploring the differences among the three strategic bundles shows that the degree of SI is substantially independent of companies’ economic sector, size, and geographical location. Thus, it can be supposed that company innovativeness and sustainability orientation are not mediated by structural factors, but internal business practices related to stakeholder engagement play a critical role.

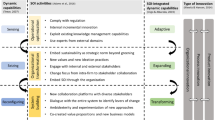

Table 4.5 summarizes the key results related to the main characteristics differentiating each strategic group, as described in the previous section.

Although these results are not unique, they suggest that the cultural attributes of stakeholder engagement, synthesized by using a set of CSR practices, can drive the development of SI strategies. Indeed, companies which innovate toward sustainability—both “optimizers” and “anticipators”—make greater use of CSR tools, indirect sustainability accountability, and quality standards when compared to “conservatives.” However, the adoption of a complete CSR system does not emerge as potential driver for SI. This may be explained by the fact that most companies in the sample were small, and so might prefer to adopt specific CSR practices rather than develop an integrated strategic CSR system. Another notable result is that only the “anticipators” implement direct sustainable accountability. In this case, direct sustainability accountability could be considered a consequence, rather than a driver, of companies’ sustainability orientation. Indeed, more proactive companies could also be more incentivized and have greater need to assess the environmental and social impact of their activities.

The results suggest that culture issues can play an important role for innovators in fostering the integration of sustainability issues into innovation strategies. However, culture is not enough for the development of successful SI strategies.

Indeed, this empirical study shows that what differentiates anticipator strategies is the company’s capability to involve and collaborate with a greater number of primary and secondary stakeholders. “Anticipators” are companies that involve different primary and secondary stakeholders in their business activities and also make greater use of engagement tools—such as online consultation, dedicated lines, and workshops—to support dialog, collaboration, and sharing of different ideas, knowledge, and expertise with various stakeholders. In other words, “anticipators” are companies that engage a wider range of stakeholders through mechanisms of listening and dialog that open channels of collaboration in order to capture various ideas and interdisciplinary knowledge and competencies, and convert them into innovative products, services, and processes. Growing numbers of companies are discovering that the locus of knowledge generation, SI, and ultimately value creation is located outside their boundaries, for which reason they need to open their innovation processes and collaborate with other actors (Altenburger 2018). Stakeholder engagement thus concerns the firm’s capability to seek engagement and collaboration with the quadruple helix of stakeholders that can enhance mutual learning and mobilization of knowledge and drive the success and effectiveness of SI strategies.

5 Conclusions

In conclusion, this study contributes to the emerging knowledge of SI strategies by providing new evidence from the agro-food sector in a specific national context. In line with the literature on open and collaborative innovation, this study provides new evidence on the role of stakeholder engagement for the development of successful SI strategies. More specifically, it shows that the management of a wider range of stakeholder relationships, through mechanisms of collaboration and involvement, characterizes the most innovative companies that follow an “anticipator” strategy in making their business models sustainable.

If companies aspire to play a leading role in SI, they must connect collaborative stakeholder engagement to strategic SI. They have to open their innovation processes to engagement with various stakeholders to mobilize knowledge that helps the company grasp sustainability needs and create sustainable solutions.

Future research opportunities include strengthening the theoretical framework and empirical evidence on the collaborative approach to stakeholder engagement in the SI field and understanding how firms’ capabilities, strategies, and organizational cultures support the management of collaborative relationships for developing SI strategies and transforming different sources of knowledge and ideas into sustainable solutions. In this regard, CASIPEDIA may represent a valuable database for scholars to explore the relationship between SI and stakeholder engagement. Indeed, for each good practice of SI mapped in CASIPEDIA, detailed information is available on (1) the type of stakeholder involved, (2) the phase in which each stakeholder has been involved, (3) the contribution of each type of stakeholder (in each phase), and (4) the mechanisms (tools) used by innovators to collaborate with stakeholders. Acknowledging the importance of stakeholder involvement for SI, future research could exploit CASIPEDIA to study how stakeholders can be involved, which stakeholders are generally involved, what they contribute, and which are the most effective models to manage stakeholder engagement within sustainable projects.

References

Achterkamp MC, Vos JF (2006) A framework for making sense of sustainable innovation through stakeholder involvement. Int J Environ Technol Manag 6(6):525–538

Adams R, Bessant J, Jeanrenaud S, Overy P, Denyer D (2012) Innovating for sustainability: a systematic review of the body of knowledge. Network for Business Sustainability, London

Adams R, Jeanrenaud S, Bessant J, Denyer D, Overy P (2016) Sustainability-oriented innovation: a systematic review. Int J Manag Rev 18(2):180–205

Altenburger R (2018) Corporate social responsibility as a driver of innovation processes. In: Altenburger R (ed) Innovation management and corporate social responsibility. Springer, Cham, pp 1–12

Amui LBL, Jabbour CJC, de Sousa Jabbour ABL, Kannan D (2017) Sustainability as a dynamic organizational capability: a systematic review and a future agenda toward a sustainable transition. J Clean Prod 142:308–322

August HJ (2018) CSR and innovation: a holistic approach from a business perspective. In: Altenburger R (ed) Innovation management and corporate social responsibility. Springer, Cham, pp 29–73

Ayuso S, Ángel Rodríguez M, Enric Ricart J (2006) Using stakeholder dialogue as a source for new ideas: a dynamic capability underlying sustainable innovation. Corp Gov 6(4):475–490

Ayuso S, Ángel Rodríguez M, García-Castro R, Ángel Ariño M (2011) Does stakeholder engagement promote sustainable innovation orientation? Ind Manag Data Syst 111(9):1399–1417

Baldwin C, Von Hippel E (2011) Modeling a paradigm shift: from producer innovation to user and open collaborative innovation. Organ Sci 22(6):1399–1417

Baumgartner RJ, Ebner D (2010) Corporate sustainability strategies: sustainability profiles and maturity levels. Sustain Dev 18(2):76–89

Berkhout F (2014) Sustainable innovation management. In: Dodgson M, Gann DM, Phillips N (eds) The Oxford handbook of innovation management. Oxford University Press, Oxford, pp 290–315

Bocquet R, Le Bas C, Mothe C, Poussing N (2013) Are firms with different CSR profiles equally innovative? Empirical analysis with survey data. Eur Manag J 31(6):642–654

Bos-Brouwers HEJ (2010) Corporate sustainability and innovation in SMEs: evidence of themes and activities in practice. Bus Strateg Environ 19(7):417–435

Bossle MB, de Barcellos MD, Vieira LM, Sauvée L (2016) The drivers for adoption of eco-innovation. J Clean Prod 113:861–872

Branco MC, Rodrigues LL (2007) Positioning stakeholder theory within the debate on corporate social responsibility. Elect J Bus Ethics Organ Stud 12(1):5–15

Buysse K, Verbeke A (2003) Proactive environmental strategies: a stakeholder management perspective. Strateg Manag J 24(5):453–470

Carroll AB (1979) A three-dimensional conceptual model of corporate performance. Acad Manag Rev 4(4):497–505

Carroll AB (2015) Corporate social responsibility: the centerpiece of competing and complementary frameworks. Organ Dyn 44(2):87–96

CASIPEDIA (2017). State-of-the-art of sustainable innovation database [Online]. CASI work package led by the University of Manchester, CASI project. Available at http://www.futuresdiamond.com/casi2020/casipedia/

Chesbrough HW (2003) Open innovation: the new imperative for creating and profiting from technology. Harvard Business Press, Boston, MA

Clarkson ME (1995) A stakeholder framework for analyzing and evaluating corporate social performance. Acad Manag Rev 20(1):92–117

Desai VM (2018) Collaborative stakeholder engagement: an integration between theories of organizational legitimacy and learning. Acad Manag J 61(1):220–244

Doran J, Ryan G (2016) The importance of the diverse drivers and types of environmental innovation for firm performance. Bus Strateg Environ 25(2):102–119

Dunphy D (2011) Conceptualizing sustainability: the business opportunity. In: Eweje G, Perry M (eds) Business and sustainability: concepts, strategies and changes. Emerald Group Publishing, Bingley, pp 3–24

European Commission (2011) A renewed EU strategy 2011–14 for corporate social responsibility. Brussels, European Commission

Fellnhofer K (2017) Drivers of innovation success in sustainable businesses. J Clean Prod 167:1534–1545

Freeman RE (1984) Strategic management: a stakeholder approach. Pitman, Boston, MA

Goodman J, Korsunova A, Halme M (2017) Our collaborative future: activities and roles of stakeholders in sustainability-oriented innovation. Bus Strateg Environ 26(6):731–753

Greenwood M (2007) Stakeholder engagement: beyond the myth of corporate responsibility. J Bus Ethics 74(4):315–327

Hall J, Vredenburg H (2003) The challenges of innovating for sustainable development. MIT Sloan Manag Rev 45(1):61–68

Hansen EG, Grosse-Dunker F, Reichwald R (2009) Sustainability innovation cube—a framework to evaluate sustainability-oriented innovations. Int J Innov Manag 13(04):683–713

Ingenbleek P, Dentoni D (2016) Learning from stakeholder pressure and Embeddedness: the roles of absorptive capacity in the corporate social responsibility of Dutch agribusinesses. Sustainability 8(10):1026

Iñigo EA, Albareda L (2016) Understanding sustainable innovation as a complex adaptive system: a systemic approach to the firm. J Clean Prod 126:1–20

Juntunen JK, Halme M, Korsunova A, Rajala R (2018) Strategies for integrating stakeholders into sustainability innovation: a configurational perspective. J Prod Innov Manag 36(3). https://doi.org/10.1111/jpim.12481

Kazadi K, Lievens A, Mahr D (2016) Stakeholder co-creation during the innovation process: identifying capabilities for knowledge creation among multiple stakeholders. J Bus Res 69(2):525–540

Ketata I, Sofka W, Grimpe C (2015) The role of internal capabilities and firms' environment for sustainable innovation: evidence for Germany. R&D Manag 45(1):60–75

Ketchen DJ Jr, Shook CL (1996) The application of cluster analysis in strategic management research: an analysis and critique. Strateg Manag J 17(6):441–458

Ketchen DJ Jr, Ireland RD, Snow CC (2007) Strategic entrepreneurship, collaborative innovation, and wealth creation. Strateg Entrep J 1(3–4):371–385

Klewitz J, Hansen EG (2014) Sustainability-oriented innovation of SMEs: a systematic review. J Clean Prod 65:57–75

Lee SM, Olson DL, Trimi S (2012) Co-innovation: convergenomics, collaboration, and co-creation for organizational values. Manag Decis 50(5):817–831

Lim JS, Greenwood CA (2017) Communicating corporate social responsibility (CSR): stakeholder responsiveness and engagement strategy to achieve CSR goals. Public Relat Rev 43(4):768–776

Luyet V, Schlaepfer R, Parlange MB, Buttler A (2012) A framework to implement stakeholder participation in environmental projects. J Environ Manag 111:213–219

MacGregor SP and Fontrodona J (2008) Exploring the fit between CSR and innovation. Working paper WP-759, Center for Business and Society, July

Martinez-Conesa I, Soto-Acosta P, Palacios-Manzano M (2017) Corporate social responsibility and its effect on innovation and firm performance: an empirical research in SMEs. J Clean Prod 142:2374–2383

Mithani MA (2017) Innovation and CSR—do they go well together? Long Range Plan 50(6):699–711

Mousavi S, Bossink BA (2017) Firms’ capabilities for sustainable innovation: the case of biofuel for aviation. J Clean Prod 167:1263–1275

Nidumolu R, Prahalad CK, Rangaswami MR (2009) Why sustainability is now the key driver of innovation. Harv Bus Rev 87(9):56–64

O’Riordan L, Fairbrass J (2014) Managing CSR stakeholder engagement: a new conceptual framework. J Bus Ethics 125(1):121–145

Piller F, Ihl C, Vossen A (2011) Customer co-creation: open innovation with customers. In: Wittke V, Hanekop H (eds) New forms of collaborative innovation and production on the internet. Universitätsverlag Göttingen, Göttingen, pp 31–62

Pisano GP (2015) You need an innovation strategy. Harv Bus Rev 93(6):44–54

Popper R, Velasco G, Bleda M, Amanatidou E, Ravetz J, Damianova Z, Kozarev V, Chonkova B, Tsin S, Avarello A, Martin L, Morris D (2016) Sustainable innovation conceptual framework, CASI project report. Deliverable 2.2, European Commission

Popper R, Velasco G, Popper M (2017) CASI-F: common framework for the assessment and Management of Sustainable Innovation, CASI project report. Deliverable 6.2, European Commission

Przychodzen W, Przychodzen J (2018) Sustainable innovations in the corporate sector–the empirical evidence from IBEX 35 firms. J Clean Prod 172:3557–3566

Schaltegger S, Lüdeke-Freund F, Hansen EG (2012) Business cases for sustainability: the role of business model innovation for corporate sustainability. Int J Innovat Sustain Dev 6(2):95–119

Seebode D, Jeanrenaud S, Bessant J (2012) Managing innovation for sustainability. R&D Manag 42(3):195–206

Sloan P (2009) Redefining stakeholder engagement: from control to collaboration. J Corp Citizsh 36:25–40

Steurer R, Langer ME, Konrad A, Martinuzzi A (2005) Corporations, stakeholders and sustainable development I: a theoretical exploration of business–society relations. J Bus Ethics 61(3):263–281

Von Hippel E (2009) Democratizing innovation: the evolving phenomenon of user innovation. Int J Innovat Sci 1(1):29–40

Watson R, Wilson HN, Smart P, Macdonald EK (2018) Harnessing difference: a capability-based framework for stakeholder engagement in environmental innovation. J Prod Innov Manag 35(2):254–279

Wheeler D, Colbert B, Freeman RE (2003) Focusing on value: reconciling corporate social responsibility, sustainability and a stakeholder approach in a network world. J Gen Manag 28(3):1–28

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2020 Springer Nature Switzerland AG

About this chapter

Cite this chapter

Martini, M., Marafioti, E., Carminati, M. (2020). Exploring the Role of Stakeholder Engagement for the Development of Sustainable Innovation Strategies. In: Martini, M., Hölsgens, R., Popper, R. (eds) Governance and Management of Sustainable Innovation. Sustainability and Innovation. Springer, Cham. https://doi.org/10.1007/978-3-030-46750-0_4

Download citation

DOI: https://doi.org/10.1007/978-3-030-46750-0_4

Published:

Publisher Name: Springer, Cham

Print ISBN: 978-3-030-46749-4

Online ISBN: 978-3-030-46750-0

eBook Packages: Business and ManagementBusiness and Management (R0)