Abstract

Transport infrastructure investments are often large, capital-intensive projects that have significant up-front costs, but the benefits or returns accrue over very long periods of time, often many decades. This longevity and the associated difficulty of ascertaining adequate returns over such a long horizon can pose a challenge to private financing and provision. Strong focus on reducing potential inefficiencies in the investment process, such as poor project selection, implementation, and monitoring, is therefore crucial in order to avoid nonproductive infrastructure, to limit the long-term output gains, and to prevent an unclear balance between private and public expenditures. This chapter focus on the future developments in the transport infrastructure sector in the perspective of the European context. The research briefly describes the main aspects affecting mobility demand trends such as demographic and trade patterns and supply trends such as technological, organisational factors or political and regulatory aspects at European level. The aim is to contribute to a better understanding of some of the major megatrends affecting the sector that could have potential implications for long-term private financial investors, with a specific focus of the probable impacts on airports, ports and railways infrastructures.

Access provided by Autonomous University of Puebla. Download chapter PDF

Similar content being viewed by others

3.1 Introduction

The European transport infrastructure sectors will have to face probable evolutions due to macro-trends which, at different speeds, will influence the characteristics of freight and passenger demand and the suppliers of mobility services. The general political framework in the sectors is focused on offering safer, smarter and greener mobility services, but the economic and social costs of change are slowing the possible opportunities. In the coming decades, governments will rely more heavily on technology innovation to reach their policy objectives (e.g. decarbonization), within economic and social constraints, and to resolve any conflicting elements of said objectives. The push for strong, continuous GDP growth, for instance, is often at odds with the need to reduce consumption of resources and avoid major climate changes. Such contrasting challenges provide powerful incentives for the creation of innovative and balanced solutions in the transport infrastructure sectors.

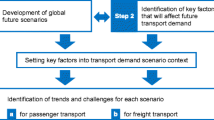

The analysis carried out in this chapter deals with the probable rather than the possible and presents some specific cases as examples of the potential implications for long-term financial investors. This study of the macro-trends affecting the future of transport infrastructure investments is organized in four steps:

-

1.

Demographic, economic and geopolitical macro-trends

-

2.

The technological and organizational challenges to innovation

-

3.

The role of the political and regulatory context at European level

-

4.

Probable evolution of the transport infrastructure sectors and potential implications for long-term financial investors

The first part of this research briefly describes the main aspects affecting mobility demand trends. These are related to demographic factors (e.g. population growth, ageing, urbanization, regional differentiations) passenger demand and trade patterns for freight demand (e.g. the slow-moving domestic demand, the unequal and uncertain pattern of the growth of international trade,Footnote 1 the movement of the earth’s economic centre of gravity towards the East at European and international scale, the role of containerization for ports and the role of tourism in major destinations). These trends are affecting the evolution of the transport infrastructure investments and the decisions of long-term investors.

The second part of the analysis will be dedicated to understanding the technological and organizational trends affecting transport infrastructures and interdependencies between digital and physical infrastructure. For instance, e-mobility service providers and LNG suppliers are partnering with technology providers to power their businesses. Specific focus centers on EU tourism trends influencing transport nodes that handle international flows.

The third part of the research summarizes the main goals of the transport infrastructure policies at European level (e.g. Connecting Europe Facility program) and the main regulations requiring new investments (e.g. Alternative Fuel Initiatives, completion of the liberalization process at EU level, safety regulations affecting the advent of autonomous vehicles). One of the constraints in implementing public policies is the growing public debt that is affecting the capacity of governments to respond to all the challenges they face as discussed by Gatti and Chiarella in the Introduction.

Lastly, the final part of the paper addresses the implications for financial investors of the macro-trends analyzed in the previous chapters, with a summary of the probable impacts on airports, ports and railways infrastructures.

3.2 The Demographic Megatrends Influencing Investments in Transport Infrastructures at EU Level

At European level, two of the most relevant global demographic megatrends do not prove particularly significant in terms of influencing the distribution of transport infrastructure investments. In fact, the general population growthFootnote 2 and the new urbanizationFootnote 3 are the main characteristics of the demographic trends in Asia or Africa; however, these factors are not playing an important role in determining the amount and type of infrastructure needed in Europe. Table 3.1 shows the results of the United Nations probabilistic population projections for the major world areas.

According to Eurostat, the overall size of the population in EU27 is projected to be somewhat larger by 2040 than in 2016; after that it will drop slightly. The EU27 population is projected to increase only by about 1.8% between 2016 (445.3 million) and 2040 (at 453.3 million) when it will peak,Footnote 4 to then remain almost stable until 2050 and thereafter decline to 439.2 million in 2070. These almost stable general demographic trends in Europe are more articulated at national level. In fact, the global population dynamics are much more complex and differentiated among nations as detailed in the EU Institutional Paper 65/17 “The Ageing Report 2018”.

While the total EU27 population will decrease by 1.4% over 2016–2070, there are wide differences in population trends across member states, with the population rising in half of the EU countries and falling in the other half. The total population change between 2016 and 2070 for the top five most populated EU countries is heterogeneous. Germany, Italy and Poland will observe a decline, respectively −3.9%, −9.7% and −18.7%, while France and Spain will have a population growth of 15.3% and 7.4%. In absolute terms, Poland will have the largest drop in population: −7.1 million inhabitants, while Italy will lose 5.9 and Germany 3.3 million. In the same period, France and Spain will see a rise of 10.2 and 3.5 million residents, respectively. In 2070, Germany will have 79.2 million inhabitants while France will have 77 million, with a difference of just 2.2 million; in 2016 the difference was 15.7 million.

3.2.1 Demographic Determinants

Demographic determinants are:

-

1.

The fertility rate

-

2.

The mortality rate

-

3.

The level of net migration

As far as fertility and mortality are concerned, it is assumed that these two factors tend to converge to that of the “forerunners”. The fertility rate is projected to increase over the projection period in all member states except for France (the country with the highest total fertility rate (TFR) in 2016, namely 2.01). However, fertility rates in all countries are expected to remain below the natural replacement rate of 2.1 in the period to 2070. Table 3.2 reports the projection of total fertility rates between 2016 and 2070 for the major EU countries. The TFR is projected to rise from 1.58 in 2016 to 1.81 by 2070 for the EU as a whole. In the euro area, an increase of similar magnitude is projected, from 1.56 in 2016 to 1.79 in 2070.

The projections show higher life expectancy at birth being sustained during the projection period, albeit with considerable diversity across member states. In the EU, life expectancy at birth for males is expected to increase by 7.8 years over the projection period, from 78.3 in 2016 to 86.1 in 2070. Table 3.3 reports the projection of life expectancy at birth between 2016 and 2070 for the major EU countries. For females, life expectancy at birth is projected to be extended by 6.6 years, from 83.7 in 2016 to 90.3 in 2070, implying a convergence of life expectancy between males and females. The largest increases in life expectancies at birth, for both males and females, are projected to take place in the member states with the lowest life expectancies in 2016.

Assumptions on net migration typically are the most methodologically difficult, with high volatility over time and countries. Table 3.4 shows the projection of net migration as a percentage of population between 2016 and 2070 for the major EU countries. For the EU as a whole, annual net inflows are projected to decrease from about 1.5 million people in 2016 (0.3% of the EU population) to 805,000 people by 2070 (0.2% of the EU population). Cumulatively, net migration inflows during the period 2016–2070 are forecast to equal 11.3% of the total EU population and 12.8% of the total population of the euro area.

Future transport infrastructure investment needs are closely linked to the rate at which populations grow (McKinsey 2017). As such, forecasts of economic and demographic variables are crucial in understanding how infrastructure demand will develop over the coming years. A country that faces major population increases over the next 25 years, for example France or Spain, is likely to need to invest more heavily to provide for that population upsurge, compared to one in which the population is expected to remain stable or decline in the coming years, like Germany or Italy. In fact, Italy has already lost 311,000 inhabitants in the period from 1 January 2015 to 31 December 2017 (Barbiellini et al. 2018; ISTAT 2018).

3.2.2 Urbanization

Globally, more people live in urban areas than in rural ones, as discussed by Gatti and Chiarella (2020) in Chap. 6, with 55% of the world’s population residing in cities in 2018. In 1950, 30% of the world’s population was urban, and by 2050 that figure is projected to rise to 68%. According to the World Bank World Development Indicators, the tendency of residents to gravitate towards urban areas to take advantage of the economic and social opportunities they offer has already been recorded in all the main European countries from 1960 to 2016. In 2016 in Europe the share of the population living in urban areas was close to 72% on average, with some differences among countries (Belgium 98%, Denmark 88%, France 80%, Germany 76%, Italy 69%, Poland 61%, Spain 80%). It is estimated that this percentage will reach 74% in 2040. Therefore, the role of new urbanization is limited in Europe 2040 scenarios for infrastructure investments. In fact, according to Eurostat data, metropolitan regions with at least one million inhabitants already provide homes to 39% of the EU population, employment to 41% of the EU’s workforce and generate 47% of the continent’s gross domestic product.

According to the 2018 ESPON project “European Territorial Reference Framework” (ESPON EGTC 2019), in aggregate terms, European spatial development patterns are not expected to change significantly in the coming decades. Land-taken will be reduced gradually, and towards 2050 most spatial development processes will involve regeneration. In fact, the general EU demographic trends do not favour a growth of urban population in most countries. However, regional disparities in adopting new technologies and the skill level of the work force will further advance regional and urban/rural differences. This trend will be reflected in disposable income data and mobility indicators.

3.2.3 Ageing

AgeingFootnote 5 is certainly one of the most relevant demographic trends to influence investment decisions in the transport infrastructure sectors at European level; this in light of the fact that the 15–64 population will decline, as discussed by Gatti and Chiarella (2020) in Chap. 6. In EU27, according to the European Commission document “The Ageing Report” (European Economy Institutional Paper 065/2017 and European Economy Institutional Paper 79/2018) the working age population will decrease from 290 million in 2016 to 262 million in 2040 (−9.6%). This will require a major increase in labour productivity and therefore more efficient mobility for commuters and business travellers.

The age breakdown of the EU27 population is projected to change significantly in the coming decades. Moreover, while in 2015 the largest cohort for both males and females is 45–49 years old, in 2070 it will be 70–74 for women and 50–54 for men. Overall, the median age will rise from 42.4 years old in 2015 to 46.7 in 2070. These projections are based on historical national parameters, fertility rates, life expectancy at birth and net migration. The structural changes related to the progressive rise in the segment of the population 65 years old and over are common to all the EU 27 countries. The percentage of the cohort of over-65 s will grow from 19.6 to 29.6 of the total EU27 population between 2016 and 2070 (in 2040 this figure will be 27.8%). This means in absolute terms the number will jump from 87 to 132 million (+45 million, +52%), but this percentage will be higher in countries like Portugal (34%), Italy and Poland (in both cases 33%) and lower in nations like Sweden and France (25% and 26% respectively).

As far as the implications of this ageing process for the EU and the euro area, the working age population (15–64 year olds) is projected to shrink during the period in question as a share of the total population, declining from 65.3% in 2016 to 55.9% in 2070.Total labour supply for people from age 20 to 64 in the EU is expected to fall by 9.6% from 2016 to 2070, of which 2% during 2016–2030 and a further 7.8% between 2030 and 2070. Because of these trends in Germany, Italy and Poland, the overall demand for mobility will generally drop and the number of car drivers and public transport users who are getting old or very old will multiply. On the contrary, in Sweden and France the role of demography on the overall passenger demand will be positive and will contribute to the need for new solutions for a rising and differentiating demand.

The impact of ageing on the transport infrastructure sectors will have different signs depending on the specific European context. In some major European countries (e.g. Germany, Italy and Poland), the combination of the two trends (a decline in the population and a proportional growth in the number of elderly people) will emerge as a constraint on public budgets. This in turn, due to higher social expenses, will lead to an accelerating contraction in remaining public funds for future infrastructure spending. Therefore, the proliferation of participation among long-term private investors in financing infrastructure assets seems to be of growing importance. The contract period of concession holdings or partnerships can be longer compared to the present 20–30 years, because more time is needed to amortize the investment in a context with limited macro-economic and demand growth (Roumboutsos et al. 2018).

In the medium-long term, in Germany, Italy and Poland public investments in transport will be more concentrated on maintenance, reducing traffic congestion and improving the safety and environmental sustainability of existing transport networks. New projects dedicated to responding to new flows in demand will take a back seat.Footnote 6 This is due to a diminishing population and the ageing factor. For instance, in Germany it was found that after accounting for retirement and reported mobility impairments, seniors still experience a steady decline in mobility as they age. In fact, on average, seniors travel about 100 fewer meters per day for each additional year of age over 65 (Institute for Mobility Research 2017). This decline stems from small gradual changes in lifestyle or incremental increases in health issues associated with ageing. In Italy, seniors over 65 have an Expressed Mobility Index (EMI) that is 31% lower than the average population (ISFORT 2017) while on average working people have an EMI that is 20.8% higher than the national mean. If the EMI for the different cohorts of the population does not change in the coming years, the Italian demographic trends (aging and shrinking of the working age population) will reduce the total mobility of the Italians by approximately 8.3% in the 2016–2040 period. This is a much higher rate compared to the population decline in the same period (−1.3%).

The growing public sensitivity to the needs of the ageing population will also have relevant effects on many other aspects of the mobility sector, especially with regard to technological innovations that can help offer new solutions to people with reduced mobility. Box 3.1 reports a synthesis of the consequences of ageing in terms of the technological aspects of mobility infrastructures.

Box 3.1 The Consequences of Ageing in Terms of the Technological Aspects of Mobility Infrastructures

For sensory, motory and cognitive reasons, mobility is becoming increasingly difficult with age. For the elderly, the possibility of maintaining or recovering mobility in satisfactory conditions of effectiveness, comfort and safety is a major challenge to sustain the social bond and meet the most elementary need for autonomy. To succeed, it is more and more necessary to take the needs and anatomical and functional characteristics of the elderly into account in designing infrastructure, equipment and services. This is a problematic issue in a physical and informational environment which is becoming increasingly complex (GOAL Consortium 2013).

The first response to these trends will probably be an expansion of “on demand” public services (like taxis, Uber, and Demand Responsive Transport Service). However, the development of new technologies in all fields may be an opportunity, if related innovations are suitably adapted and play a genuine palliative role with respect to age-related issues. For instance, advances in technology in recent years mean that it is becoming more common for new cars to be equipped with features such as rear-view cameras for reversing, blind-spot warning systems and even auto-parking technology. For older drivers with limited upper-body mobility, this can ensure their independence by giving them more driving years whilst keeping them and other road users safe. Moreover, the rapid advancement of technology means that driverless cars are now a real possibility; these vehicles are likely to be on the roads in a matter of years, rather than decades.

Most European governments are committed to the development of driverless car technology, recently authorizing testing on public roadsFootnote 7 (UK Department for Transport 2015 and German Federal Government 2017). In the context of an ageing society, although in relatively early stages, this experimentation will potentially benefit the society as a whole, but older people will gain the major advantages of this evolution and will politically support it.

The role of new generation telecom technology infrastructures dedicated transport information transmission (5G networks, wireless, fibre optics, etc.) will increase in tandem with automated and connected driving, as discussed by Sacco (2020) in Chap. 4. These long-term trends will shape opportunities for financial investors who are interested in the telecom sector.

3.3 The Role of International Tourism in the Transport Infrastructure Sector

As emphasized in the previous paragraphs, the role of population growth and urbanization will be limited at EU level compared to what is happening in the world. But this does not mean that mobility demand will generally decline; in fact, non-systemic transport demand will probably grow in the main urban areas of the EU, as people visit friends and relatives and tourist visit different cities.

Over the past few decades, tourism has become a key driver of socio-economic progress through the generation of jobs, export income and infrastructure development for many destinations around the world. Since the end of World War II, international tourist arrivals (overnight visitors) have experienced continued growth worldwide, reaching 1323 million in 2017 (84 million more than in 2016, +6.7%). This is compared to 25 million arrivals in 1950, according to statistics from the United Nations World Tourism Organisation (UNWTO). By UNWTO region, Europe accounts for the largest share of international tourist arrivals, with 619 million recorded in 2016, or 50% of the world’s total. This represents a 2% increase from 2015, with rather mixed results at the destination level.

Within Europe, the 28 countries of the European Union welcome the flow of international arrivals in Europe. The EU accounts for 40% of international tourist arrivals and 31% of international tourism receipts worldwide. The Schengen Area, which allows travellers to move freely across 22 EU countries and four extra-EU countries, greatly fosters intraregional tourism. The common currency shared by 19 of the 28-member states also facilitates tourism significantly. As in other world regions, inbound trends in EU destinations are driven to a large extent by outbound demand from EU source markets.

Air travel is the dominant mode of transport for EU destinations, with 55% of international tourists travelling by air in 2016 compared to 45% by land or water. In 1995 the market share of air travel was 38%. By group of countries, air travel is highest in EU destinations in Northern Europe (75% of arrivals), followed by those in Southern and Mediterranean Europe (67%), in Western Europe (44%) and in Central and Eastern Europe (28%).

In the EU, tourism is concentrated in coastal regions (principally, but not exclusively, in the Mediterranean), Alpine regions, and some of the EU’s capital cities. The top 20 European NUTS 2 regions of destination account for 36% of all nights spent in European accommodation establishments. Of these NUTS 2 regions, 6 are in Italy, 5 in both Spain and France, 2 in Germany, 1 in Croatia and 1 in Austria. Within the EU-28, domestic tourists accounted for 54.6% of the total number of nights spent in tourist accommodation establishments in 2015, with the remaining 45.4% consisting of international tourists who may have travelled from other EU Member States or from outside of the EU (European Parliamentary Research Service 2015).

In order to understand the role of international transport, it is interesting to note that there are considerable regional disparities between the number of nights spent by domestic tourists and international tourists. Often in the 22 multi-regional EU member states we see a pattern of international tourists being particularly attracted to capital city regions. These developments may be driven by business travel as well as personal travel. In 14 of these 22 member states, the capital city region registered the highest proportion of overnight stays by international tourists in 2015.

The share of nights spent by domestic tourists in tourist accommodation establishments was relatively low for most capital city regions; this may be explained by the concentration of international tourists visiting capital cities, while domestic tourists may choose to explore other regions of their country which may be less well-known internationally. The clearest example of this trend was in the United Kingdom, where domestic tourists accounted for less than one in five (17.8%) of the total nights spent in London, while they made up almost two thirds (65.3%) of the total nights spent across the whole of the United Kingdom. In a similar vein, the shares of domestic tourists in the total number of overnight stays in Prague and Bucharest/Ilfov were approximately 40 percentage points lower than the shares of domestic tourists in the total number of nights spent across the whole of the Czech Republic and Romania.

Indeed, domestic tourists generally accounted for a much higher share of the total nights spent outside of capital city regions. They represented at least 50% of the overnight stays in every region outside of the capital city in Denmark, Germany, Ireland, France, Hungary, the Netherlands, Poland, Romania, Slovenia, Slovakia, Sweden and the United Kingdom. What is more, in four of these countries (Germany, Ireland, Poland and Sweden) domestic tourists made up a majority of the overnight stays in the capital city region too. By contrast, the total number of nights spent by international tourists outnumbered those of domestic tourists in both Croatian regions, as well as in five out of the six (relatively small) mono-regional EU Member States (Estonia, Cyprus, Latvia, Luxembourg and Malta) the exception being Lithuania.

There tended to be a relatively high concentration of international tourism within the most popular regions, whereas domestic tourism was often more dispersed across regions. This pattern was particularly apparent in some of the larger EU Member States and may be explained, at least in part, by a high share of international (first-time) visitors choosing to focus their trips on the most popular or well-known tourist sites. For example, in 2015 Île de France (the capital city region) hosted approximately one-third (33.1%) of the total nights spent by international tourists in the whole of France, whereas the southern region of Provence-Alpes-Côte d’Azur accounted for 12.8% of the total nights spent by domestic tourists. In a similar vein, Prague (the capital city region) counted 61.6% of the total nights spent by international tourists in the Czech Republic, while the most popular region for domestic tourists was Severovýchod (24.3% of the national total).

EU destinations reported 500 million international tourist arrivals in 2016. By region of origin according to UNWTO’s classification (UNWTO et al. 2018), it is estimated that a total of 417 million arrivals (83%) came from Europe, of which 361 million (72%) from EU source markets and 56 million (11%) from European source markets outside the EU. The remaining 83 million arrivals originated from outside Europe (17%), of which 39 million from the Americas (8%) and 32 million from Asia and the Pacific (7%), while Africa and the Middle East accounted for respectively 6 million and 5 million of EU arrivals (1% each). Arrivals in the EU from source markets outside the Union, both extra-EU countries in Europe and markets outside Europe, totalled 139 million in 2016, up from 80 million in 2005.The 28 countries of the European Union recorded an extraordinary 8% increase in international tourist arrivals in 2017, following 5% growth in 2016. While arrivals from intra-EU source markets rose by 2% a year on average between 2005 and 2016, arrivals from outside markets ticked up at a rate of 5% a year. Growth has been strongest for arrivals from the Middle East at almost 10% a year on average, but from a comparatively small base volume. Arrivals from Asia and the Pacific and from Africa were both up by 7% a year on average, while arrivals from the Americas increased by 4% a year (UNWTO 2018).

According to the UNWTO scenario (UNWTO et al. 2018) advanced economy destinations in the EU are projected to see arrivals grow by 7 million a year on average, to reach 487 million in 2030. A total of 443 million arrivals were recorded in this group of destinations in 2016. Emerging economies are expected to see an increase of 2 million a year, hitting 75 million in 2030. Arrivals in EU destinations from European source markets are expected to rise by 1.9% a year on average through 2030, of which from markets within the EU by 1.6% a year and from extra-EU by 3.5% a year. Interregional arrivals are projected to increment by 2.4% a year, with the fastest growth expected to come from Africa (4.3% a year) though from a low base, followed by Asia and the Pacific (3.1% a year) and the Middle East (2.6% a year). The slowest growth is expected to come from the Americas (1.6% a year). As result of the relative acceleration of arrivals from outside the EU, the share of arrivals in EU destinations from EU source markets is expected to decrease slightly to 70% by 2030, while the share of extra-EU source markets in Europe will have increased to 13% and those from interregional source markets to 15%.

International arrivals have exceeded the expectations of the projection in the period from 2010 to 2016, particularly in the EU (European Parliamentary Research Service 2018). This trend is fuelled by stronger-than-expected intraregional demand and a robust economic recovery. Enhanced air and rail connectivity, more affordable travel and the rise of new tourism and information services through digital platforms have contributed to this remarkable upsurge. Weaker growth in North Africa and the Middle East has also partly redirected tourism flows to Europe, much of which to Southern and Mediterranean Europe.

The cruise sector is a specific niche of the tourism market which is particularly relevant for Italy and Spain (+18.1% passenger movements in Mediterranean ports from 2008 to 2017, passing from 21.8 to 25.9 million). According to a survey by the Cruise Lines International Association (CLIA), in 2017 the ocean cruise market in Europe expanded to count more than 6.9 million passengers, a 2.5% increase compared with 2016. European cruising has been steadily on the rise for the past 10 years led by the German, UK and Irish markets.

Tourism trends will have a relevant role in shaping new infrastructures at EU level primarily because the total number of arrivals is growing. However, another reason for this is that the tourism phenomenon is characterized by the more relevant role extra-UE tourists play. In fact, these arrivals will be concentrated for the most part in the major capitals and international and intercontinental airport and air-rail infrastructures. The uptick in the cruise market also calls for new terminals in port areas, especially in the main destinations in the Mediterranean. As in the airport market, in the cruise terminal sector the most relevant infrastructure investments are based on public-private partnerships or concessions contracts (Satta et al. 2020).

3.4 The Organizational, Technological and Regulatory Innovation Challenges in Main Transport Sectors

The long-term social trends related to tourism, the ageing EU population and middle-class growth at worldwide level described in the previous sections will have a general impact on transport infrastructure sectors, but mainly in the major metropolitan areas and more specifically in the international nodes. In order to better understand the specific drivers of potential growth in each transport infrastructure sector (airport, port, railways), it is relevant to analyze the specific peculiarities relating to organizational, technological and political aspects that characterize each sector.

3.4.1 Airports

The story of aviation in Europe has been one of continuous growth and expansion since the inception of the modern civil aviation industry, with airports across the continent collectively breaking through the 1.5 billion passenger mark in 2008 and 2 billion in 2016. The market suffered when Europe’s economies were embroiled in the global financial crisis in 2008/2009, but since then, buoyed by low fuel prices and a recovering world economy, European air passenger traffic has grown at a CAGR of 5.6% per year between 2010 and 2016. During 2017 the reported growth in traffic was the fastest in the last decade (+8.5%), with commercial airlines carrying 5.3% more passenger traffic than in 2016 and the largest low-cost carriers (LCC) in Europe reporting a rise in short-haul passenger traffic of 13.2%. These strong upward traffic trends came in the face of GDP growth in Europe of only 2.8%, suggesting that European aviation is not entirely dependent on GDP to generate traffic growth. During the first 6 months of 2018, European airports posted 6.7% more passengers, confirming the positive trend.

The vast majority of capacity growth over the past decade can be attributed to new types of carriers that have been able to diversify the service supply and reach new passenger targets.Footnote 8 Therefore at present a different classification applies to airlines in Europe compared to a decade ago: Full Service Carrier, Regional/Commuter; Charter/Leisure, Low Cost Carrier, Ultra Low Cost and, Low Cost Carrier with Long-Haul. The three low cost segments, which are the product of the evolution generated by the liberalization process completed at EU level in 1997, are responsible for the rapid and substantial growth in European air passenger traffic and are forecasted to expand unabated in the future. Box 3.2 proposes the new airline classification.

Box 3.2 The New Airline Classification, the Result of the Combination of New Technologies and New Business Models

Full-service carriers, like Lufthansa or Air France, are operating a wide national and international route network (based on the hub-and-spoke principle). The main elements of this long-standing concept are the home airports—the so-called “hubs”. Airports with a hub accommodate flights from other national and intercontinental airports (spokes); these flights are then bundled and subsequently redistributed to intercontinental connecting flights. The focus on a central air traffic intersection (hub) enables a wide flight network to operate. During the flight, full-service airlines also offer additional services (mostly free of charge), such as on-board catering, an entertainment system, seat reservations, and so forth. This business model also offers cargo and freight transport, in addition to passengers.

Regional airlines, like CityJet or Adria Airlines, operate with geographically limited coverage. This means that although in some cases these airlines offer excellent on-board service, they do not fly to the same number of destinations or offer the same service categories as the full-service airlines. Regional airlines serve a variety of functions at the local level and on many thinner routes, e.g. smaller short-haul markets that feed into larger carriers. These companies may be seen as complementary to the full-service airlines they are often linked to.

As for charter/leisure carriers, which in the literature is often synonymous with non-scheduled flight service, there is no single definition. Fundamental characteristics of traditional charter flights are related to partial or complete sales of seat capacity to organizations like tour operators, companies who sell the transportation service either on its own or as part of a package to end customers (passengers). Compared to scheduled flights, charter traffic normally offers less cabin comfort as well as less flexibility (fewer flights, less convenient flight schedules and less favorable booking and rebooking conditions). Furthermore, the price level of the charter airlines is often below that of the scheduled airlines. In addition, charter airlines like Neos or Blue Panorama are not allowed to transport air freight in the hold on passenger flights. This means that they are not able to realize economies of scope. Nevertheless, charter airlines have a cost advantage compared to scheduled air traffic airlines, as their expenses on computer booking systems, administration, sales and marketing are relatively low because they charter or sell the entire flight to tour operators. Perhaps the biggest game-changer in aviation is the huge impact of low-cost carriers (LCCs) on European aviation. This is the outcome of the liberalization process completed in 1997 and the standardization and simplification of all aspects of commercial aviation related to the web technologies and digitalization processes. The LCC segment is responsible for the rapid and substantial rise in European air passenger traffic and is forecasted to grow unabated in the future. This is due in part to the adoption of more sophisticated and differentiated business models that will be briefly described in the following paragraphs.

The traditional low-cost carriers (LCCs) offer flights on selected routes at low fares due to essential savings in sales and service costs. LCCs like EasyJet or Vueling do not operate on the hub-and-spoke principle which entails high coordination and costs. Instead LCCs offer point–to–point connections, which are direct, short to medium distance flights. Low-cost carriers often avoid major airports (and prefer regional airports instead); this allows them to have a very flexible and cost-efficient network planning and flight routes, and lower operating costs. Mainly due to a higher capacity utilization of the aircrafts, a unique fleet of aircrafts, strong cost management and focus on air transportation alone (“no frills”), LCCs can offer lower fares to customers. Passengers often have to pay for service on board (food and drink), stowed luggage and seat reservations, all of which cuts costs and at the same time opens up new sources of income.

Ultra-Low-Cost Carriers (ULCCs), like Ryanair or Wizz Air, achieve significantly lower costs than LCCs or other commercial carriers, and aggressively collect ancillary revenue for unbundled services. As a result of lower base fares, these companies realize lower unit revenues than other carriers, even when ancillary revenues are taken into account.

The fundamental characteristics of Low-Cost Carriers with Long-Haul (LCCLHs), like Norwegian, are their cost advantages on long haul flights due to a higher utilization and seating density; they also avoid the use of large hub airports. New aircraft technology like the Boeing 787, Airbus 350, and larger single-aisle aircraft, as well as evolving passenger preferences and stable fuel prices are encouraging LCCs (and restructured full service airlines) to consider new growth opportunities on long, thin routes. What were previously niche city pairs are becoming increasingly mainstream as more LCCLHs come online and disrupt entrenched business models. This makes long thin markets viable, routes that were not feasible before 2012 when new long-haul aircraft entered into the market. This is positive for secondary airports seeking to expand their long-haul networks with airlines which are operating, or have on order, new technology aircraft.

The European passenger market is the most advanced and fragmented at global level and therefore the most resilient to possible crises.

Airbus’ Global Market Forecast (GMF) for 2018–2037 offers a forward-looking view of the air transport sector’s evolution. This forecast takes into account factors such as demographic and economic growth, tourism trends, oil prices, and the development of new and existing routes. Ultimately this report highlights demand for aircraft covering the full spectrum of sizes from 100 seats to the very largest aircraft over 500 seats. For the 20-year period in question, the compound average growth rate for passenger traffic in the European market is projected at 3.3%. All three major flows connecting Western Europe are expected to develop: Western-Europe–USA; Intra-Western Europe, expected to grow 1.7 times (corresponding to a CAGR of 2.8%) and Western-Europe–Middle East, 2.6 times respectivelyFootnote 9 (CAGR of 5%).

According to the best available information, the long-term growth will not slow down in the coming decades. Therefore, airport capacity constraints are becoming more widespread and evident. The lack of airport capacity, in fact, is the number one challenge for European aviation, according to the European Commission and Eurocontrol. The 2018 “Challenges of growth” by Eurocontrol (2018) in the most likely scenarios underscores that traffic in Europe is expected to grow to just over 16 million flights in 2040 with a total increase of 53% compared to 2017. That is an average increment of 1.9% per year. Eurocontrol emphasized that 111 of the most important European airports are planning a 16% increase in capacity between them, which equates to 4 million more runaway movements. This upward trend is focused on the top 20 airports, which are planning for growth of 28%, or 2.4 million runaway movements, nearly two-thirds of the expansion in total capacity. These 20 airports saw 53% of all flights as arrivals or departures in 2017, although they account for only 35% of the available capacity.

The airport expansion at European level is more concentrated in major airports, despite it being more difficult to create additional capacity at these sites, because many of the easier initiatives have already been taken. These new investments include the additional runaway at Heathrow, with a completion date set for 2026, and the opening of the Berlin Brandeburg Airport (end 2020). It is not surprising that all the major infrastructure funds have recently been involved in specific investments in this sector.Footnote 10

Yet despite planned European airport capacity expansions, they are not considered sufficient. Eurocontrol underscores that by 2040 there will be demand for 1.5 million more flights than can be accommodated, 8% in the most likely scenario. That is 160 million passengers unable to fly. The gap is spread across 17 countries, and even with their ambitious capacity expansion plans, both Turkey and the United Kingdom are still forecast to have additional capacity gaps. Even with 8% of flights lost (that could double to 16% in the higher scenario, with a gap of 3.7 million flights), in 2040 in Europe there will be 16 airports that are as congested as Heathrow is now.

The new growth drivers are related to technological, organizational and social aspects:

-

New aircraft types, new carriers and “de-constructed fares” enhance variety and reduce the cost of long-haul travel, boosting demand.

-

Growing economies continue to drive both European and in-bound tourism.

-

There is a higher propensity to fly among a more mobile millennial generation that expects to travel more often.

-

Middle-class growth creates a larger population with more disposable income.

Among the driving forces in the sector, there is also the technology evolution, which will reduce costs both for airlines and airports and therefore push up demand.

In particular, the new aircraft technologies proposed by Boeing and Airbus such as the B787, A350, B737 MAX, A330 and A320 Neos have been developed for extended range and fuel efficiency. Boeing claims that state the B787 is 20% more fuel efficient than the B777 (Boeing 2018). This makes long thin markets viable, routes that previously were not. In addition, this is could be positive for secondary airports (i.e. not the top 20) seeking to expand their long-haul network with airlines who are operating or have on order the new technology aircraft (for instance Norwegian or Air Italy). Moreover, it is clear from the current order books and forecasts that there are thousands of aircraft required to fulfill traffic growth over the coming years. For instance, in 2018 the two biggest European low-cost carriers had record orders (Easyjet: 140 A320s and A321s, and Ryanair: 135 firm orders and 75 options on B737–200 max). The technology evolution of long-range planes (like B787 or A350 or A321LR) will contribute to the fragmentation of the long-haul passenger market which is currently very concentrated with more than 90% in only 65 cities in the world. Therefore, new airports (secondary hubs or new generation hubs) will also benefit from this evolution. The emergence of the business model of Low-Cost Carriers with Long-Haul (LCCLH) is driving an upsurge in traffic and a fragmentation of non-stop city pairs on Europe–North America routes. The LCCLH share of North Atlantic departures grew from 1.1% in summer 2012 to 6.3% in summer 2017. The number of unique city pairs served non-stop by LCCLH similarly escalated from ten in summer 2012 to 64 in summer 2017.

Getting the most out of existing airport infrastructures will require a search for new sources of revenues that could come from extending the role of transport nodes, with valued added services to the passenger. These services could relate to enlarging the catchment area through new types of intermodal links or technologies and organizational innovations. Box 3.3 reports a case of a new type of air-rail intermodal link.

Box 3.3 How to Extend the Airport Catchment Area: The Case of the Marconi Express in Bologna

An interesting example of the potential role of a PPP transport infrastructure that could augment revenues for airport operators is the Marconi Express, a monorail shuttle that will link Bologna Central Station to Marconi Airport (5 km) in 7 min 20 s running mainly in a viaduct. From March 2020 there will be a Central Station/Airport integrated platform. A multi-modal platform of this kind represents an important competitive factor because it improves the accessibility of the metropolitan area thanks to an automated people mover that will link one of the most important high-speed railway network nodes at national level with an airport that sees more than 8 million passengers. Design, construction and management of the service are delegated to the Marconi Express project company, constituted by the CCC (Consorzio Cooperative di Costruzione) for a 75% share, and by TPER (public company for Emilia-Romagna Transport) for the remaining 25%. The construction company owning the majority of the special purpose vehicle will probably sell its shares in a few years after the completion of the works, offering opportunities for long term financial investors.

At world level, more than 80 airports have rail or people-mover links under construction or in the advanced planning stage.

Among airport technologies, self-check-in and baggage drop-off enable passengers to spend significantly less time at the airport before boarding their flight. At home or at work, passengers can check-in for the flight, check their luggage, pay for additional services and at the airport simply print their boarding passes and drop off their suitcases at the baggage self-check counter. It only takes a minute. Then they can proceed through security. The implementation of these new bag-drop technologies is part of investment programs in many airports which aim to support automated and paperless service technologies. More and more airports are installing eGates that allow passengers to independently pass through security controls at the entrance to the departure zone, or to board the aircraft by scanning their mobile or paper boarding pass.

Automated and paperless service technologies (eGates and self-check-in) and new baggage services (home bag drop or self-drop off for commercial baggage) will change the layout of airports. This will allow for more space for commercial activities and require less time for boarding/security procedures. As a result, passengers will have more free time at the airport, which could have potential positive consequences on commercial revenues. Well-designed strategic rethinking of airport areas could generate revenue growth and cost optimization, offering new opportunities for long-term financial investors. Box 3.4 presents a specific case of new value-added services at Gatwick Airport.

Box 3.4 New Value-added Services at Airport: The Gatwick Case

Gatwick Airport is considered a pilot case for the new relationship between airlines and airports that will impact infrastructure lay out and passenger experience, and therefore influence infrastructure and commercial investments. In summer 2018 EasyJet, Europe’s leading airline, launched a partnership with home bag-drop service AirPortr, giving passengers travelling from London Gatwick the option to check their luggage in online and then have it collected from their doorstep by professional drivers and taken directly to the airport. The new service was implemented because research shows that over three quarters of travelers would prefer to be luggage free on the day of their flight, which is why EasyJet and AirPortr partnered to provide this service allowing travelers to start their trips at home. AirPortr will pick up luggage from the passenger’s doorstep, and safely deliver it to easyJet’s bag drop before it is flown to one of the airline’s 110 destinations from Gatwick. Customers can then collect their baggage at their destination’s baggage reclaim. Approximately 1000 ground staff and baggage handlers working for EasyJet at Gatwick Airport, who are directly employed by the logistics organization DHL, will take care of the passengers’ baggage. AirPortr launched the world’s first fully integrated home bag check-in service with British Airways in 2016 and in 2018 Finnair, Cathay Pacific and American Airlines joined the AirPortr digital platform in London.

3.4.2 Ports

Two policy considerations are worth mentioning as a premise for the analysis of the investment opportunities in the port sector and implication for investors. The first is related to potential demand: the uncertainty arising from wide-ranging geopolitical, economic, and trade policy risks, as well as some structural shifts, have a negative impact on maritime trade. Of immediate concern are inward-looking policies and rising protectionist sentiment that could undermine global economic growth, restrict trade flows and shift trade patterns. The second is related to the geopolitical dimension of port development. This dimension strengthens the case for public funding, as the absence of related mechanisms would accelerate foreign participation in the development of critical port infrastructure. Given the emergence of China’s Belt and Road Initiative (BRI), a platform with mechanisms to provide financial support for port development, and certain Russian investments (for instance in pipelines), Europe may consider offering instruments for port financing, both for member states’ ports and for current and prospective trading partners, especially in North Africa, as initiatives to secure the geopolitical interests of the EU (European Council on Foreign Relations 2018Footnote 11).

In line with projected economic growth and based on the income elasticity of seaborne trade estimated for the 2000–2017 period, UNCTAD Review of Maritime Transport (UNCTAD 2018a, b) expects world seaborne trade volumes to expand in coming years. According to UNCTAD projections, this expansion will occur at a compound annual growth rate of 3.8% from 2018 to 2023, based on calculated elasticities and the latest figures of GDP growth forecast by the International Monetary Fund for the same period. It is expected that containerized and dry bulk commodities trade will record the fastest growth. Tanker trade volumes should see an uptick, although at a slightly slower pace than other cargo types. Dry bulk commodities are projected to experience a compound annual growth rate of 4.9% between 2018 and 2023, while containerized shipments are expected to rise by 6%, supported by positive economic trends, imports of metal ores to China and steady growth on the non-main-lane trade routes. Further, crude oil trade is forecast to grow by 1.7% from 2018 to 2023, and combined petroleum products and gas volumes by 2.6%.

UNCTAD scenarios are in line with forecasts produced by Lloyd’s List Intelligence, Clarksons Research Services, and Drewry Maritime Research. The growth of maritime flows at a global scale will also require new investments in European ports. The September 2017 European Commission “Delivering TEN-T, Facts & Figures” study reveals that European seaports (EU-27) currently face substantial investment needs of around €48 billion (€5 billion annually) for the period from 2018 to 2027. As these are mostly driven by dynamic and continuous trends, such as the rapid development of the logistics industry, port-related industry and evolving environmental requirements, port investments will remain crucial in the future.

According to the 2018 European Seaport Organization (ESPO) study, “The infrastructure investment needs and financing challenge of European ports” (ESPO 2018), investments in basic infrastructure, maritime access infrastructure, and transport-related infrastructure (transport connections to rail, road, and inland waterways) make up 65% of all port projects submitted by port authorities. Box 3.5 presents the case of a 2018 PPP transport infrastructure project which will improve the efficiency of the intermodal connections to the port of Rotterdam.

Box 3.5 The Blankenburg Port Connection PPP Project

Some maritime access infrastructure investments have been able to attract the interest of specialized infrastructure funds. One of the most recent financial closes is the €1 billion Blankenburg Connection PPP project in the Netherlands. This is a design, build, finance and maintain (DBFM) project which will improve road links between Rotterdam and its port, and is the largest PPP project awarded in the Netherlands to date. The A24 Blankenburg Connection consists in fitting a three-lane highway in between two existing highways. This large and complex project involves the DBFM of a new highway connection of approximately 4 km (linking the A15 and the A20 roads to the west of Rotterdam) including a land tunnel around 500 m long (the Holland Tunnel), an immersed tunnel of nearly 900 m (the Maasdelta Tunnel), two major flyovers and widening of the existing A20. Following a construction period of 5.5 years, the consortium will then maintain the new road connection for 20 years. The BAAK consortium—Macquarie Capital (70% of SPC), Ballast Nedam (15% of SPC) and DEME (15%of SPC)—reached financial close on 17 October 2018. The European Investment Bank provided 50% of the term loan, totaling around €330 million, backed by the European Fund for Strategic Investments (EFSI).

Port investment projects most often concern container and Ro-Ro traffic, which are both expected to grow according to forecasts commissioned by the European Union.

According to a 2018 joint research project between TT Club and McKinsey & Company (TT Club and McKinsey & Company 2018), there were some points of broad consensus on the next 25 years in the container sector. This is considered the most relevant port segment for infrastructure needs in the coming years since containers today transport 23% of dry seaborne trade tons (and close to 100% of everyday goods like televisions, toys, and clothing). According to the study, the physical aspects of the industry (containers, terminals, ships) are unlikely to change; trade flows will become more balanced between and across regions; automation will be broadly adopted; digital, data, and analytics will fundamentally shift the sources of value creation; and the industry’s leading players in 2043 may well look very different from today’s leading companies (though they may be the same or similar). Industry players can work now to ensure flexibility in the future, including paying more attention to the dynamics around the end-consumer (as e-commerce disrupts retail and last-mile logistics), building organizational discipline around monitoring the “trigger points” behind different futures, and radically digitizing and automating. Autonomous technologies available today and in the not-too-distant future are extremely promising for the industry. There remains an exceptional learning curve in terms of adopting these technologies and maximizing their value.

European ports are facing several challenges that have a major impact on the requirements for infrastructure investments:

-

New trends in the maritime industry (in the container market vessel sizes are augmenting, increasing market power through alliances);

-

Digitalization and automation;

-

The decarbonization agenda, building resilience to climate change and the overall greening of vessels.

The consequences of these macro-trends are complex and consequently there are many more requirements for developing new and adapting existing port infrastructure than simply expanding capacity.

The liner shipping industry witnessed further consolidation through mergers and acquisitions and global alliance restructuring. Three global liner shipping alliances dominate the capacity deployed on the three major east–west container routes, collectively accounting for 93% of all deployed capacity. Alliance members continue to compete on price while operational efficiency and capacity utilization gains are helping to maintain low freight rate levels. By joining forces and forming alliances, carriers have strengthened their bargaining power vis-à-vis seaports when negotiating port calls and terminal operations. Alliance restructuring and larger vessel deployment are also redefining the organization of the market: selection of ports of call, the configuration of liner shipping networks, the distribution of costs and benefits between container shipping and ports, and approaches to container terminal concessions. In particular, within ports, the buying power of the alliance carriers can create destructive competition between terminal operators and other port service providers, such as towage companies. This can lower the rates of return on investment for the port industry, resulting in the decline of minor container ports and the disappearance of smaller independent terminal operators.

ICT and digital infrastructures account for 4% of the projects submitted by port authorities, according to a 2018 ESPO study (ESPO 2018). Digital infrastructures, mainly Port Community Systems (PCS), enable smooth data exchange. A PCS makes intelligent and secure exchange of information possible between public and private stakeholders by allowing a single submission of data which becomes available for (selected) third parties to optimize, manage and automate port and logistics processes (e.g. documentation for exports, imports, hazardous cargo, ship manifest information, port health formalities and maritime statistic reporting). Thus, digital infrastructure is aimed at eliminating unnecessary paperwork (which can cause delays in cargo handling), improved security, cutting costs and greater environmental sustainability, thanks to the reduction of emissions due to better utilization of assets (e.g. less empty trucking). An example is NxtPort, a data-sharing platform in the Port of Antwerp. NxtPort collects and shares data across a number of actors (including shippers, forwarders, ship’s agents, carriers, terminals, insurance brokers, among many others) in order to increase participants’ operational efficiency, safety, and revenue. Another example is TradeLens, a new company owned 51% by Maersk and 49% by IBM. The digital joint venture was created at the beginning of 2018 with the aim of providing a platform connecting a large number of stakeholders in the industry, thereby covering each stage of the transportation process from shippers to ports and terminals to national authorities.

Of the various technology trends expected to contribute to operational efficiency in port areas in the long term, autonomous driving is unique. In fact, the ability of autonomous driving to have a significant impact on total cost of ownership (TCO) makes this technology a game-changer that has the potential to spur industry consolidation in some specific context (container and Ro-Ro terminals). Container terminals have been a laboratory for automation since 2000, when Rotterdam inaugurated the first terminal with a fully autonomous distribution system from shore to stock areas. But the greatest savings can be obtained if the role of autonomous equipment could be extended outside of terminal area as well. The trajectory toward full autonomy in the port sector is long—more than 20 years before trucks are expected to drive on the road to and from ports fully autonomously. However, first use cases are expected to hit the market within the next few years on some selected routes where autonomous driving and platooning (with driver on leading truck) will contribute to concrete operational efficiency. Still, there are many open questions (e.g., the legal framework, technological redundancy). On top of that, the autonomous driving playing field will be far from even. Smaller terminal operators will find it more difficult to obtain the necessary resources, and the potential entrance of new, technology-driven market players will intensify competition.

Stricter requirements on environmental performance and the uptake of alternative fuels (e.g. LNG and eventually hydrogen) could offer new opportunities in order to enlarge the spectrum of services offered by port terminals operators. The Directive on the deployment of alternative fuels infrastructure requires all maritime ports of the TEN-T Core network to be equipped with LNG refuelling points by 2025. Under the same Directive, Onshore Power Supply should be installed as a priority in these ports, and in other ports by 2025, unless there is no demand and the costs are disproportionate to the benefits. Some of the investment needs of ports are driven by international (IMO), EU and national environmental regulations; the need to invest in adequate waste reception facilities being one example. According to the 2018 Fraunhofer Institute study entitled “Digitalization of Seaports,” (Fraunhofer et al. 2018) despite today’s reluctance to deploy LNG more often in shipping, use of this alternative fuel will become more common, and require specific port investments. The main explanation for this is related to environmental regulations, but there are also technical reasons due to the high degree of reliability and the low maintenance needs of LNG engines. A comprehensive LNG bunkering network is established in the North and the Baltic Seas. Barge shuttle LNG between the LNG import terminals and the berths within the ports where the vessels are bunkered. There will also be installations in ports, supplying the vessels with electric energy. Depending on the specifics in the country and the costs of electric energy, this may also involve LNG PowerPacs and barges as electric energy suppliers. Feeder ships as well as some tugboats will use batteries or diesel-electric engines.

3.4.3 Railways

After having completed the liberalization process in the long-distance bus sector,Footnote 12 the passenger rail market is the only major EU transport sector where the process is still incomplete (UNECE 2018). Therefore, the expectations to see new entrants in the market and the necessity of new infrastructure investments are high.

A number of recent developments in EU policies, such as liberalization programs and environmental regulations, will enhance the role of railways in the transport sector. These initiatives are already leading to an upgrade in the quality and choice of services available, more responsiveness to customer needs, and greater economies of scale. Moreover, these trends are boosting the competitiveness of the railway sector by significantly reducing costs and lightening the administrative burden on railway stakeholders.

Between 2001 and 2016, four legislative packages were adopted with the aim of gradually opening up rail transport service markets for competition, making national railway systems inter-operable and defining appropriate framework conditions for the development of a single European railway area. These include charging and capacity allocation rules, common provisions on the licensing of railway undertakings and train driver certification, safety requirements, the creation of the European Agency for railways and rail regulatory bodies in each member state, as well as rail passenger rights.

The Fourth Railway Package is a set of six legislative texts designed to complete the single market for rail services (Single European Railway Area). Its overarching goal is to revitalize the rail sector and make it more competitive vis-à-vis other modes of transport. It comprises two ‘pillars’ which have been negotiated largely in parallel: the technical pillar and the market pillar. The first was adopted by the European Parliament and Council in April 2016, while the market pillar was adopted in December 2016. The market pillar is considered the most important one for the growth of the railway market because it will complete the process of gradually opening the market, a process which started with the First Railway Package. This pillar establishes the general right for railway undertakings established in one member state to operate all types of passenger services everywhere in the EU, and lays down rules aimed at improving impartiality in the governance of railway infrastructure and preventing discrimination; this pillar also introduces the principle of mandatory tendering for public service contracts in rail. Competition in rail passenger service markets will encourage railway operators to become more responsive to customer needs, improve the quality of their services and their cost-effectiveness. Competitive tendering of public service contracts will enable savings of public money for operations that could be used for investments. The market pillar is expected to deliver more choice and better quality of rail services for European citizens, these being the overriding objectives.

The market pillar regulations and directives deal with common rules for rail operator accounts (REG 2016/2337/EU), competitive tendering for public service rail contracts (REG 2016/2338/EU), and full opening of the domestic passenger market (DIR 2016/2370/EU). EU member states have until December 2018 to transpose the Directives into national legislation.

The opening of the rail passenger market has been pursued by several EU countries in advance of the legal deadlines imposed by EU law, to different degrees and with varying results. New commercial (open access) services have been introduced in the Czech Republic, Germany, Italy, Austria, Sweden and the United Kingdom. While the reasons for success or failure in operating a new rail business are diverse, a common trait is that, in the absence of safeguards against unfair practices, new entrants face serious obstacles.

In 2018, the sector was still heavily concentrated, and characterized by a low number of newcomers and the persistence of large market shares of incumbent operators. But in the coming years the completion of relevant infrastructure projects and the progress of liberalization programs at EU level will contribute to a proliferation of new services. For instance, in 2017 both Italian high-speed railways operators (Trenitalia and Italo—Nuovo Trasporto Viaggiatori) obtained from the UK Department for Transport the “UK Rail Franchising PQQ Passport.” The Passport allows the company to participate to tenders regarding rail transport throughout the UK.

Trenitalia Industrial Plan 2017–2026 emphasizes the perspective role of strengthening existing cross-border relationships (for example the Thello services to France, the Venice–Ljubljana–Belgrade service or new traffic with Switzerland following the opening of the Gotthard and Ceneri base tunnels). Also key is the introduction of new services on the most potentially lucrative European routes: Paris–Brussels, Paris–Bordeaux, Hamburg–Cologne, Milan–Zurich–Frankfurt (a link that started at the end of 2017 crossing three countries), Athens–Salonica (thanks to the purchase of Trainose) and London–Edinburgh. All of this is thanks to the liberalization of European railways, which will start in 2020 with the Fourth Railway Package.

In this new context, some national operators have already adopted low-cost strategies in order to be able to compete against new potential rivals and increase the market volume: French SNCF Ouigo and Spanish Renfe’s EVA are two examples. Also, private operators such as German Locomore, now owned by Flixbus, tried to find a place in the high-speed rail market following a low-cost strategy.

Box 3.6 The Italian Experience in the High-speed Railway Service Competition

The potential of modern long-distance railway services has been underscored by the Italian market, where traffic on the high-speed line between Torino and Salerno surged from approximately 15 million of passengers per year in 2009 up to 41 million in 2017 after the completion of the high-speed line and the entrance of the new railway operator Italo—NuovoTrasportoViaggiatori. This private Italian rail company competed directly with the incumbent, and has drastically reduced its operational costs, turning into a lighter cost structure. Italo has achieved a cost per available seat kilometer (CASK) of four-euro cents, lower than the main European low-cost airlines.Footnote 13

Thanks to higher load factors due to demand growth and a more efficient commercial business model, between 2009 and 2017, national rail ticket prices have dropped by almost 40%. Travelers can find price competitive rail tickets. This is exactly what happened in the airline industry: a competitive market can drive down prices, cut journey times and improve the rail customer experience.

Thanks to EU railways liberalization the market will assist to new organizational models and new technologies implemented by railways operators and these trends will generate new demand of long-distance journeys that will partially change the target of the main central station of the major metropolitan area at EU level and increase the value of the commercial areas in and around central stations. Moreover, new high-tech depots will be necessary to repair and maintain the new high-speed trains. This type of infrastructure (stations and depots) could be an interesting infrastructure asset for concession holding companies or for public-private partnership contracts, as was the case in the airport sector. Madrid Chamartin, London St. Pancreas and Roma Termini are among the most interesting examples of new generation railways stations, where private investors were able to increase commercial and advertising revenues and generate efficiency through economies of scales and specialization in order to create value for shareholders and for transport users. An interesting example of this type of long-term investment is the one carried out by Antin Infrastructure Partners in Grandi Stazioni Retail. This company operates the long-term leasehold providing exclusive rights to the commercial leasing and advertising spaces of the 14 largest Italian railway stations. Other examples are investments by Ceetrus, prior to June 2018 known as Immochan, for Gare du Nord in Paris and for Vigo Viala in Spain.

3.5 The Role of the Political Context at European Level

Transport investment priorities at EU level are strictly related to general EU strategies and sectoral policies. In fact, transport is considered a cornerstone of European integration and is firmly linked to the establishment of the single market. As one of the first common policy areas of today’s European Union (EU), transport was seen as vital for fulfilling three of the four freedoms of a common market as established in the Treaty of Rome in 1957: the free movement of individuals, services and goods. Without smooth transport connections and networks, there would be no such movement. This is why EU transport policy has always focused on overcoming obstacles between member states and creating a single European transport area with fair competition conditions for and between the different forms of transport: road, rail, air and water. The main challenges for the transport sector in the EU include creating a modern, multi-modal and safe transport infrastructure network, and transitioning towards low-emission mobility, which also involves reducing other negative externalities of transport.

The following sub-sections will be dedicated to a summary of the main goals of the EU infrastructure and decarbonization policies. Also discussed is the role of the European Investment Bank (EIB) as the enabler to reach these goals and to increase public–private partnerships in the EU transport infrastructure sector (Regele 2018).

3.5.1 The EU Infrastructure Policy

The European Union has a tradition spanning more than 20 years (starting with the entry into force of the Maastricht Treaty in November 1993) of transport infrastructure policy with the goal of connecting the continent from East to West, North to South. The specific aims are to close the gaps between member states’ transport networks, remove bottlenecks that still hamper the smooth functioning of the internal market and overcome technical barriers such as incompatible standards for railway traffic. EU policy promotes and strengthens seamless transport chains for passenger and freight, while keeping up with the latest technological trends such as European Rail Traffic Management System (ERMTS) in the railway sectors and the use of the Galileo satellite system.

In the 2014–2020 period, the budget for the Connecting Europe Facilities (CEF) program dedicated to transport was €23 billion. This, in combination with funds from other EU sources and the European Investment Bank, should stimulate investments and ensure the successful implementation of the new infrastructure policy. The focus on environmentally friendly transport will improve the sustainability of transport systems in Europe. Selected projects are mostly concentrated on the strategic sections of Europe’s transport network (the “core network“) to ensure the highest EU added-value and impact. The largest portion of the funding has been already devoted to developing the European rail network (for projects like the Brenner or Lyon-Turin transalpine basis tunnels), decarbonizing and upgrading road transport, developing Intelligent Transport Systems and deploying Air Traffic Management (ATM) systems.

The European Commission proposal for the 2021–2027 budget for CEF Transport is €30.6 billion, including a general envelope of €12.8 billion, and a Cohesion Fund (CF) allocation of €11.3 billion. In addition, the Commission proposed that the Union enhance its strategic transport infrastructures to make them fit for military mobility. A dedicated budget of €6.5 billion has been established through the Connecting Europe Facility, therefore the proposed total budget for core and comprehensive European networks will be €37.1 billion, €14.1 billion more than the previous program (+61%). In the member states whose gross national income (GNI) per inhabitant is less than 90% of the EU average, the CEF general funds can be integrated with the Cohesion Fund (CF). The CF focuses on transport and environment infrastructure. With regard to transport, it can support the Trans-European transport networks (TEN-T) or other priority projects of European interest, as identified by the EU (such as development of rail transport or reinforcement of public transport).

3.5.2 The Role of the Decarbonization Program

The European Commission Transport White Paper (European Commission 2011) set a target of 60% lower greenhouses gases GHG emissions by 2050 compared to 1990 (or −70% compared to 2008) with the aim to be “firmly on the path towards zero.” Also, the EU’s recent general policies confirmed Europe’s path to low carbon economy and the ambition of becoming the world leader in renewable energy, growing the markets for EU-produced goods and services, for instance in the field of energy efficiency.Footnote 14 According to this general principle, in the transport sector the EU proposed a strategy for low-emission mobilityFootnote 15 that should make an important contribution to modernizing the EU economy, helping to reduce emissions from the transport sector and meeting the EU’s commitments under the Paris Agreement. EU investment instruments are geared towards supporting higher efficiency of the transport system in a technology neutral way, low-emission alternative energy for transport and low- and zero-emissions vehicles.

The investments dedicated to decarbonization will become more and more relevant, especially after April 2018 when the United Nations International Maritime Organization (IMO) adopted an initial strategy for reducing greenhouse gas emissions from ships, setting out a vision to reduce GHG emissions from international shipping. More than one hundred nations agreed to peak GHG emissions from international shipping as soon as possible and to reduce the total annual GHG emissions by at least 50% by 2050 compared to 2008. At the same time, these countries committed to pursuing efforts towards phasing them out as called for in the vision as a milestone on a pathway of CO2 emissions reduction consistent with the Paris Agreement temperature goals. As an example, in this context the establishment of LNG refueling points across the TEN-T corridors and at maritime ports is one of the public-private partnership investments strongly supported by EU general policies, CEF program and European Investment Bank (EIB) instruments.

The Cleaner Transport Facility (CTF) is a new initiative launched in December 2016 by the EIB and European Commission (EC) to assist investments, by both public and private entities, in cleaner transport projects through existing EIB products and new financial instruments. The objective of the CTF is to support the accelerated deployment of cleaner transport vehicles and help meet their associated infrastructure needs. The CTF is an umbrella that deploys the EIB’s technical and financial capacity to adapt to specific market needs in order to explore viable business models and boost opportunities to finance cleaner transport with EIB loans covering up to 50% of the project costs. Public and private entities can be borrowers e.g. public transport authorities/operators, leasing companies, vehicle manufacturers, or infrastructure operators/managers.

3.5.3 The Role of the European Investment Bank as an Early Mover in More Innovative Sectors