Abstract

Many firms have an array of available approaches for reducing financial losses caused by commodity price changes. This chapter provides guidance for more accurately measuring the potential financial effects of commodity price risk mitigation approach selection. Based upon two prominent methodologies, namely total cost of ownership (TCO) and real options approach (ROA), this chapter illustrates how commodity price risk mitigation strategies can be analyzed with respect to their effect on costs and performance. A practical example is provided to illustrate how TCO and ROA can provide useful insight into measuring the costs and benefits related to mitigating the effects of commodity price volatility.

Access provided by Autonomous University of Puebla. Download chapter PDF

Similar content being viewed by others

1 Introduction

Most organizations purchase commodities in some form as part of its firm’s operations. Commodities including metals, energy, and agricultural products can be acquired directly as raw material inputs to a firm’s bill of materials, indirectly as components of purchased items from a firm’s suppliers, and/or as part of a firm’s operations and overhead expenses (Zsidisin et al. 2013). Commodities are a significant input affecting many industries: steel for automotive or electronics companies, lead for battery manufacturing, agricultural commodities for food companies, and jet fuel in the airlines industry are just a few examples. When an extensive portion of the firm’s overall purchases consists of price-volatile commodities, a key concern is commodity prices changing sharply, putting the company’s economic viability at risk. Significant commodity price volatility puts top-line revenues and cost structure at risk, thus potentially excessively reducing net cash flows and profitability (Finley and Pettit 2011). If not effectively managed, commodity price volatility (CPV) may severely undermine the ability of a firm to meet customer requirements, creating challenges for product pricing decisions, budget planning, and net cash flow management (Matook et al. 2009; Finley and Pettit 2011).

During the last few years, different approaches have been discussed for mitigating CPV. Several risk mitigation strategies have been identified from the financial literature, namely financial hedging which relies on the use of derivative contracts as futures, options, and averages. Despite the great number of works discussing the use of financial hedging to offset future commodity price changes (Pindyck 2001; Guay and Kothari 2003; Nissanke 2010), its use seems to be somewhat limited in business practice. The empirical evidence reveals that some industrial firms do not use financial hedging due to a lack of knowledge and experience (Zsidisin et al. 2015).

More recently, the proposal of other approaches to manage price volatility from the supply chain risk management literature has been increasingly fostered. Specifically, they are as follows: (1) sourcing approaches, such as forward buying, switching suppliers, substituting commodities, vertical integration, and (2) contracting strategies such as escalator clauses, staggering contracts, and passing price increase to customers (Zsidisin et al. 2013). Table 1 reports a brief description of each strategy (see Gaudenzi et al. 2018 for a detailed taxonomy of commodity price risk mitigation strategies and factors that may influence their adoption).

Although recent research has identified approaches beyond financially hedging CPV, it is not clear how effective these strategies are in mitigating this form of price risk. The supply chain risk management strategies briefly outlined are in fact characterized by different thresholds between costs and benefits, which need to be carefully evaluated before implementing measures to mitigate this form of risk.

Evaluating supply chain risk management strategies means accounting for the trade-off between the investment required for mitigation actions and the reduction of loss or the exploitation of advantages caused by the uncertainty over a significant planning horizon (Ho et al. 2015). Building the mitigation capability is costly (Prater et al. 2001) since it often requires dedicated investments in multi-skilled workforce, versatile equipment, multiple suppliers, and/or flexible contracts with suppliers (Tang and Tomlin 2008; Carbonara and Pellegrino 2017). Due to the higher investment required for building mitigation capabilities, firms may have concern with these investments if clear cost–benefit estimates associated with different actions lack.

CPV requires firms to adopt appropriate risk mitigation strategies for reducing the negative effects CPV may have on their economic viability. However, there is a lack of structured tools benchmarking commodity price risk mitigation strategies for understanding which approaches are more effective and efficient in mitigating commodity price risk and to understand the conditions in which some strategies perform better than others. The lack of models that explicitly consider the economic dimension of risk mitigation strategies deprives managers of decision-making tools for choosing the appropriate ones, thus precluding companies to widely adopt them (Deloitte Development LLC 2013). Therefore, this chapter develops a conceptual approach to study CPV and risk mitigation strategies, recognizing in particular how the choice of risk mitigation strategy may affect the firm’s financial performance. It is based upon two prominent approaches, namely total cost of ownership (TCO) and real options approach (ROA).

2 Total Cost of Ownership

2.1 Overview

Total cost of ownership is the term used to describe “all costs associated with the acquisition, use, and maintenance” of a good or service (Ellram and Siferd 1993). TCO examines the cost associated with purchased goods and services throughout the entire supply chain, including all the costs from the idea of the product/service through warranty claims due to that part once the final product is used by the customer (Ellram 1993).

According to the TCO approach, the buying firm needs to base sourcing decisions not just on adopting a “price only” focus, as found in the traditional approaches to supplier selection. Rather, firms need to determine which costs it considers most important or significant in the acquisition, possession, use, and subsequent disposition of a good or service. Hence, in addition to the price paid for the item, a TCO approach may include other elements such as—for example—order placement, research, and qualification of suppliers, transportation, receiving, inspection, rejection, replacement, downtime caused by failure, and disposal costs, among many others.

The two primary conceptual insights provided by TCO approach are (1) the evaluation of a broader spectrum of all the costs related to a “total cost of ownership” perspective, considering acquisition costs, all the costs related to suppliers, and generally all internal costs; (2) the evaluation of life cycle costs, which consider all the costs associated with using a given item from a given supplier during the entire life of the item, including costs incurred when the item is in use.

2.2 TCO Approach for Commodity Price Risk Mitigation Strategies

Several models have been suggested for understanding TCO associated with purchasing a product or service. One of this consists in looking at costs based upon the order in which the cost elements are incurred, following the transaction sequence: pretransaction, transaction, and posttransaction (LaLonde and Zinszer 1976). Following this TCO approach, Table 2 reports some costs elements associated with the commodity purchase under different commodity price risk mitigation strategies, classified as pretransaction, transaction, and posttransaction.

The analysis of the cost components related to the risk mitigation strategies—conducted through a TCO approach of commodity purchases—reveals many additional costs arise beyond the purchase price. This fact highlights the need to carefully revise the decision-making processes regarding risk mitigation strategies based on purchase price.

When organizations create their commodity purchasing strategy, there is a risk to pay limited attention to a detailed ex-ante analysis of the consequences and benefits stemming after its implementation. A purchase price comparison is often the key criteria driving the purchasing strategy, although the practice may highlight additional expenses might occur, such as negotiating and contracting price adjustments, qualifying new suppliers, and personnel travelling costs, for example. Furthermore, uncertainties and risks might increase, such as the risk of supply chain disruptions and the risk related to CPV. For these reasons, the commodity purchasing strategy should holistically consider the costs related to the purchasing process, the risks generated by CPV, and the total costs related to implementing commodity price risk mitigation strategies.

3 Real Options Approach

3.1 Overview

Real options approach has been introduced in the literature as an approach that overcomes the limits of traditional methodologies for evaluating investment opportunities in uncertain environments. Traditional methods, such as those based on discounted cash flows (DCF)—net present value, internal rate of return, discounted pay back period—implicitly assume investment benefits and, therefore, the “expected scenario” of cash flows are known and presume management’s passive commitment to a certain operating strategy (Boute et al. 2004). During project management and operations, especially in highly uncertain and dynamic environments, managers may make different choices about operating actions when a new information from the market is available. This managerial flexibility to react to uncertainties represents a real option, which, in analogy to a financial option, is defined as the right, but not the obligation, to do something in the future whenever it proves convenient (Dixit and Pindyck 1995). This kind of flexibility is usually acquired at an initial cost—the option cost, which is the sunk cost for developing the flexible system—while the decision of exploiting such a flexibility is a matter of a future date and depends on the evolution of the uncertainty and the net benefits associated to decision—the option payoff.

This flexibility affects not only the future decisions—will the flexibility mechanism be exploited based on the uncertainty evolution?—but also the present one—do the benefits created by the flexibility offset the higher costs for building it? ROA provides a tool for quantifying the value of the managerial flexibility of the decision maker to adapt its decisions as the uncertainty resolves. A broad variety of real options have been studied in the literature including, for example, the option to defer production, temporarily shut down production, hold or abandon a project, decide the timing of investment, choose the production technology, inputs and outputs, and to change a project’s output mix (e.g., McDonald and Siegel 1986; Majd and Pindyck 1987; Trigeorgis 1998; Amram and Kulatilaka 1999).

Two key insights underlie the application of ROA. First, the ROA builds upon the assumption that opportunity costs are associated with irreversible investments under uncertainty. Many investments are irreversible since being industry or firm specific, since they cannot be or since not being able to be used in a different industry or by a different firm. Hence, they are a sunk cost. This implies the possibility to defer committing resources under uncertainty, namely the possibility of waiting for new information affecting the desirability or timing of the expenditure, is worthwhile (Pindyck 1986; Trigeorgis 1998). Second, the ROA approach recognizes that many investments create valuable follow-on investment opportunities (Amram and Kulatilaka 1999).

These insights suggest that certain upfront investments enable management to capitalize on favorable opportunities and mitigate negative events by proactively managing uncertainty over time in a flexible way (Kogut 1991) rather than by attempting to avoid uncertainty. This managerial flexibility may be exploited, for example, when new information regarding market demand, competitive conditions, or the viability of new processes technologies is available (Leiblein 2003).

3.2 ROA for Commodity Price Risk Mitigation Strategies

Investments in creating supply chain flexibility can serve as an approach for mitigating the detrimental effects of commodity price volatility. We define flexibility in terms of the firm’s ability to proactively react to environmental changes with a little or negligible penalty and sacrifice in terms of time, operational efforts, cost, or performance (Upton 1994; Pérez Pérez et al. 2016; Lu et al. 2018). The choice of the mitigation strategies requires not only a deep understanding of all the costs associated with the strategies itself, beyond the purchase price but also the assessment of the value created by the flexibility itself.

The two flexibility-based commodity price risk mitigation strategies examined in this chapter are Switching suppliers and Substituting Commodities. In both cases, the mitigation capability comes from the development of a second source, namely the alternative supplier or commodity, that enables the firm to react to the uncertainty—in this case price fluctuation—by using the alternate source. It is a well-known and widely accepted procedure for mitigating supply chain disruptions in supply chain risk management literature and in business practice (Costantino and Pellegrino 2010; Pochard 2003; Tang and Tomlin 2008; Ho et al. 2015; Pellegrino et al. 2018). These two strategies can be analyzed by operationalizing them from a ROA perspective.

Switching suppliers provides a firm the ability, but not the obligation, to reconsider its cost structure in response to commodity price changes. The company will switch suppliers when the cost efficiency gains outweigh the aggregate transaction costs of setting up operational flexibility. Similarly, Substituting commodities gives a firm an option to react to CPV by making the commodity substitution when there are favorable conditions, i.e., when the benefits gained through the substitution are greater than its costs. At the same time, however, to open an option, such as making a substitution technically and commercially viable, there is the need for upfront investments in R&D, market research, and material/supplier qualification, as well as the need for sustaining on-going supply chain costs to manage such flexibility. Table 3 describes both strategies from the perspective of ROA.

Each of these measurement approaches has their benefits and drawbacks. A summary of these pros and cons can be found in Table 4. The next section provides a grounded example of how these approaches are applied.

4 Measuring the Financial Effects of Mitigating Commodity Price Risk: TCO and ROA

To provide a practical example, we derive insights from a Fortune 500 company in the fast-moving consumer goods (FMCG) industry. It is a multinational company offering a broad range of products across the world. The identity of this firm is concealed for confidentiality reasons. In this example, the company was exposed to commodity price volatility in the Europe, Middle East and Africa (EMEA) region, where the company buys surfactants, namely those products which make a detergent an effective cleaning product, to be used in personal care and detergent, cosmetics, cleaning agents, and detergents. In this example, we consider realistic operational conditions and market values, adjusted by a specific coefficient for reason of confidentiality.

For mitigating commodity price risk, the company is interested in exploring the opportunity for substituting a commodity by using a natural surfactant—Commodity A, which is made with organic ingredients, or a synthetic one—Commodity B, which is derived from petroleum-based raw materials. The base case considers a total volume of 10 kt of surfactants, a total option cost investment of 0.1 Mio. USD to implement the flexible system able to switch from one material to the other and a switching cost, also referred as an exercise price, from natural surfactant to synthetic one and vice versa of 0.2 Mio. USD.

4.1 The Application of a TCO Approach in the Case Study

The analysis of the costs adopting the Substituting Commodity strategy according to the TCO approach (as presented in Table 2) is reported in Table 5, where the prices of commodities A and B have been estimated averaging the historical data of commodity prices paid by the company for the two sources.

As shown in Table 5, the TCO approach provides a more holistic understanding of the costs associated to the adoption of Substituting Commodity strategy, beyond the pure purchase price. In the specific case, this analysis is useful since it alerts the manager to the presence of pretransaction cost components as well as a transaction cost components. An interesting observation, which is not prominent from the TCO analysis, is the pretransaction component represents a sunk cost, while, contrarily, the transaction component is actually recurrent (this cost is charged anytime there is a commodity substitution). In addition, the TCO approach does not provide any information about the potential economic advantages the substitution of commodity delivers to the firm. In other words, beyond the total cost associated with adopting the Substituting Commodity strategy, the value created by using the Substituting Commodity strategy is not clear. Therefore, there are some limits with using TCO for understanding the overall financial implications for investing in flexibility.

4.2 The Application of a ROA Approach in the Case Study

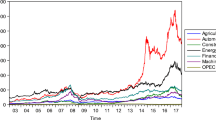

Using a ROA, we simulated the forecasted values of the two commodities prices (Commodity A and B) for a timeframe of 12 months based on the historical data of commodity prices paid by the company. In running this simulation, in congruence with the literature (Pellegrino et al. 2018), we assume price to vary stochastically in time with the tendency to return back to a long-run mean, following a mean-reverting process (MRP). The key parameters of the MRP related to the long-run mean, annual volatility, mean reversion rate, and the initial values are reported in Table 6. The outcome of the mathematical model in terms of total value of the flexibility is the probability distribution shown in Fig. 1.

Results show that against the initial price to develop the flexible system, the net benefits associated to Substituting Commodity strategy are positive with a certain risk level (measured by the probability that the value of the flexibility is lower than 0). In particular, given the initial parameters considered as inputs of the model, we found that there is a chance of about 17% that this strategy positively impacts on the firm’s profit delivering value up to 2.160 Mio. USD. In the remaining 83% of cases, the strategy produces a loss for the firm up to −0.138 Mio. USD.

We also carried out a sensitivity analysis on the switching cost (i.e., the exercise price of the option). The findings are depicted in Fig. 2, while the statistics of the distributions are summarized in Table 7.

As the findings highlight, the Substituting Commodity strategy becomes more effective in mitigating CPV by providing greater value when the switching cost decreases: both the mean value of the flexibility and the probability of NPV being positive increase. In other words, the impact of the strategy adoption on the firm’s profit becomes more positive when the switching cost is lower: the mean value of the flexibility passes from being negative to positive, as shown with a loss of −0.0085 Mio. USD when switching costs are 0.2 Mio. USD, and a gain of 0.19 Mio. USD when switching costs are 0.05 Mio. USD. At the same time, the risk Substituting Commodity produces a loss for the company decreases from 83% to 43%. The reason is when switching cost decreases the chances to exercise the option, namely substitute commodity, increase. As described in Table 3, the rule for the option exercise is substituting commodity any time the saving from using the alternate source (Underlying asset) overcomes the cost of making the switch (Exercise price). This implies that every time there is an inversion of the price of commodities, if the switching costs were null, it would be always convenient to exercise the option exercise. This leads to an increase of the value of flexibility, but also to an increase in risk exposure. The standard deviation, which is a measure of the amount of variation or dispersion of the dataset relative to its mean, increases: the more a strategy’s returns vary from the strategy’s average return, the more volatile the value of the strategy.

Three main insights may be drawn from the ROA application for commodity price risk mitigation strategies. First, it is interesting to observe the net benefit associated with these strategies is positive with a certain risk level, measured by the probability that the value of flexibility is lower than 0. Beyond the specific numbers found for the value of flexibility in the discussed case, the findings show flexibility-driven strategies may be effective in mitigating CPV since they may positively contribute to the firm’s cash flow and profits.

Second, the findings highlight that it is crucial for companies to carefully assess the value of these strategies before their implementation since they are characterized by high implementation costs that need to be justified by the materialized cost savings. In fact, there is still a chance the value of the flexibility is less than 0. It is absolutely essential to consider the value of the managerial flexibility to decide whether it is convenient to switch sourcing options. This shows the importance of adopting ROA to model such managerial flexibility and account for its value. A proper assessment of flexibility value in using a second source for responding to price uncertainty will also enhance the confidence in negotiations by offering the risk averse purchasing manager an effective best alternative to a negotiated agreement (BATNA) (Cannella et al. 2018).

Finally, the sensitivity analysis of flexibility value with regard to switching costs shows how the value of such strategies is not just dependent on the CPV, but also on the structural characteristics of such strategies and on the costs needed to develop flexibility. The effectiveness of the strategy in mitigating CPV increases when the switching cost decreases.

5 Conclusions

Creating a portfolio of flexible commodity price risk mitigation strategies provides a strategic choice for companies exposed to financial risk from CPV. This chapter describes how commodity price risk mitigation strategies can be analyzed under the perspective of their costs and performance. Two approaches have been adopted in this chapter to address the effective and efficient selection of commodity price risk mitigation: the TCO and ROA approaches. A case study completes the theoretical analysis, providing a practical example.

The contribution of this chapter is to allow purchasing managers, supply chain managers and risk managers to practically improve the effectiveness of the commodity price risk mitigation strategies. In doing so, managers need to collect external historical data regarding commodity price volatility as well as internal data regarding the impact that these fluctuations generated on costs.

This work begins to address an existing gap regarding the use of structured tools for analyzing the effectiveness of approaches in mitigating the effects of CPV. We hope this also provides chief purchasing managers and supply chain professionals useful guidance for measuring the costs and benefits related to these strategies. Although empirical evidence reveals managers are aware of the risk associated with CPV as well as of its impact on firm profitability, they are often reluctant to invest in mitigation capabilities such as flexibility. The reason is that supply chain flexibility is a key organizational and supply chain capability but requires investments that are considered sunk costs. When managers are not able to tie these investments up to the expected advantages/economic benefits, they are averse to invest. Holistically measuring the financial effects of flexibility investments is imperative for gaining executive management support in mitigating commodity price volatility. Utilizing TCO and ROA for measuring the effectiveness of commodity price risk mitigation approaches ex-ante is a step toward this direction.

References

Amram, M., & Kulatilaka, N. (1999). Real options: Managing strategic investment in an uncertain world. Boston, MA: Harvard Business School Press.

Boute, R., Demeulemeester, E., & Herroelen, W. (2004). A real options approach to project management. International Journal of Production Research, 42(9), 1715–1725.

Cannella, S., Di Mauro, C., Dominguez, R., Ancarani, A., & Schupp, F. (2018). An exploratory study of risk aversion in supply chain dynamics via human experiment and agent-based simulation. International Journal of Production Research. https://doi.org/10.1080/00207543.2018.1497817.

Carbonara, N., & Pellegrino, R. (2017). How do supply chain risk management flexibility-driven strategies perform in mitigating supply disruption risks? International Journal of Integrated Supply Management, 11(4), 354–379.

Costantino, N., & Pellegrino, R. (2010). Choosing between single and multiple sourcing based on supplier default risk: A real options approach. Journal of Purchasing and Supply Management, 16(1), 27–40.

Deloitte Development LLC. (2013). The ripple effect: How manufacturing and retail executives view the growing challenge of supply chain risk. http://deloitte.wsj.com/cfo/files/2013/02/the_ripple_effect_supply_chain.pdf.

Dixit, A.K., & Pindyck, R.S. (1995). The options approach to capital investment. Harvard Business Review, 105–115.

Ellram, L. M. L. (1993). Total cost of ownership: Elements and implementation. International Journal of Purchasing and Materials Management, 29(4), 3–12.

Ellram, L. M., & Siferd, S. P. (1993). Purchasing: The cornerstone of the total cost of ownership concept. Journal of Business Logistics, 14(1), 163–184.

Finley, B., & Pettit, J. (2011). Creating value at the intersection of sourcing, hedging and trading. Journal of Applied Corporate Finance, 23(4), 83–89.

Gaudenzi, B., Zsidisin, G. A., Hartley, J. L., & Kaufmann, L. (2018). An exploration of factors influencing the choice of commodity price risk mitigation strategies. Journal of Purchasing and Supply Management. https://doi.org/10.1016/j.pursup.2017.01.004.

Guay, W., & Kothari, S. P. (2003). How much do firms hedge with derivatives? Journal of Financial Economics, 70, 423–461.

Ho, W., Zheng, T., Yildiz, H., & Talluri, S. (2015). Supply chain risk management: A literature review. International Journal of Production Research, 53(16), 5031–5069.

Kogut, B. (1991). Joint ventures and the option to expand and acquire. Management Science, 37(1), 19–33.

LaLonde, B. J., & Zinszer, P. H. (1976). Customer service: Measuring & measurement. National Council of Physical Distribution Management: Chicago, IL.

Leiblein, M. J. (2003). The choice of organizational governance form and performance: Predictions from transaction cost, resource-based, and real options theories. Journal of Management, 29(6), 937–961.

Lu, D., Ding, Y., Asian, S., & Paul, S. K. (2018). From supply chain integration to operational performance: The moderating effect of market uncertainty. Global Journal of Flexible Systems Management, 19, 3–20.

Majd, S., & Pindyck, R. S. (1987). Time to build, option value, and investment decisions. Journal of Financial Economics, 18(1), 7–27.

Matook, S., Lasch, R., & Tamaschke, R. (2009). Supplier development with benchmarking as part of a comprehensive supplier risk management framework. International Journal of Operations & Production Management, 29(3), 241–267.

McDonald, R., & Siegel, D. (1986). The value of waiting to invest. The Quarterly Journal of Economics, 101(4), 707–727.

Nissanke, M. (2010). Issues and challenges for commodity markets in the global economy. In M. Nissanke & G. Movrotas (Eds.), Commodities, governance and economic development under globalization (pp. 39–64). Basingstoke, UK: Palgrave/Macmillan.

Pellegrino, R., Costantino, N., & Tauro, D. (2018). Supply chain finance: A supply chain-oriented perspective to mitigate commodity risk and pricing volatility. Journal of Purchasing and Supply Management, 25, 118–133.

Pérez Pérez, M., Serrano Bedia, A. M., & López Fernández, M. C. (2016). A review of manufacturing flexibility: Systematising the concept. International Journal of Production Research, 54(10), 3133–3148.

Pindyck, R. S. (1986). Irreversible investment, capacity choice, and the value of the firm.

Pindyck, R. S. (2001). The dynamics of commodity spot and futures markets: A primer. Energy Journal, 22(3), 1–29.

Pochard, S. (2003). Managing risks of supply-chain disruptions: Dual sourcing as a real option (Doctoral dissertation). Massachusetts Institute of Technology.

Prater, E., Biehl, M., & Smith, M. (2001). International supply chain agility—Tradeoffs between flexibility and uncertainty. International Journal of Operations and Production Management, 21(5–6), 823–839.

Tang, C., & Tomlin, B. (2008). The power of flexibility for mitigating supply chain risks. International Journal of Production Economics, 116(1), 12–27.

Trigeorgis, L. (1998). Real options: Managerial flexibility in strategy and resource allocation. Cambridge, MA: MIT Press.

Upton, D. M. (1994). The management of manufacturing flexibility. California Management Review, 36(2), 72–89.

Zsidisin, G. A., Gaudenzi, B., Hartley, J. L., & Kaufmann, L. (2015). Understanding commodity price volatility mitigation from transaction cost economics: preliminary results. In Proceedings of the Paper Presented at the 24th Annual IPSERA Conference, Amsterdam.

Zsidisin, G. A., Hartley, J. L., Kaufmann, L., & Gaudenzi, B. (2013). Managing commodity price volatility and risk. CAPS Research. https://knowledge.capsresearch.org/publications/pdfs-protected/zsidisin2014priceOverview.pdf.

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2020 Springer Nature Switzerland AG

About this chapter

Cite this chapter

Pellegrino, R., Gaudenzi, B., Zsidisin, G.A. (2020). The “True” Cost of Mitigating Commodity Price Volatility: Insights from Total Cost of Ownership and Real Options Approach. In: Schupp, F., Wöhner, H. (eds) The Nature of Purchasing. Management for Professionals. Springer, Cham. https://doi.org/10.1007/978-3-030-43502-8_7

Download citation

DOI: https://doi.org/10.1007/978-3-030-43502-8_7

Published:

Publisher Name: Springer, Cham

Print ISBN: 978-3-030-43501-1

Online ISBN: 978-3-030-43502-8

eBook Packages: Business and ManagementBusiness and Management (R0)