Abstract

Because innovation processes are complex, uncertain and highly dimensional, modelling innovation paths is a very challenging task. As traditional regression models fail to address these issues, here we propose a novel approach for the modelling. The approach integrates Balanced Scorecard, a method used for strategic performance measurement, and fuzzy set qualitative comparative analysis. In addition to key performance indicators, strategic goals are taken into consideration in the modelling. We provide empirical evidence for the effectiveness of the approach on a large dataset of European firms. We show that several innovation pathways can be identified for these firms, depending on their strategic goals. These results may be of relevance for the decision making of innovative firms and other actors of innovation system.

Access provided by Autonomous University of Puebla. Download chapter PDF

Similar content being viewed by others

Keywords

1 Introduction

Business managers have been trying to increase the competitive advantage of both businesses and entire industrial sectors over the last 100 years. It was proved (by the developments of scientific knowledge, and also by the practice), that the firm’s competitive advantage depends not only on the availability and the volume of capital. Nowadays, the competitiveness of a firm depends also on a number of other “soft” inputs such as knowledge, quality, creativity, learning ability, ability to cooperate and use different factors in the minimum time and cost savings. These factors are crucial to the ability of an enterprise to create innovative products and succeed in international (but often in national) markets. Therefore, the performance (or competitiveness) management of innovation activities is the topic of many studies [13]. Specifically, researchers and managers are interested in which of the factor in socio-economic environment has a significant positive effect on the innovation performance.

Scholars agree on the importance of organizational innovation for competitiveness. This form of innovation is perceived as prerequisite as well as facilitators and mainly also as immediate sources of competitive advantage in the business environment [8]. Hult et al. [18] stated that organizations’ culture competitiveness is based on four factors—entrepreneurship, innovativeness, market orientation and organizational learning. Study of [29] confirmed that organizational culture, the environment embedded in corporate strategy has a positive impact on performance. Company strategy should be the result of strategic planning and application of various aggregated activities. Value chain is created, in whose conceptual structure it is possible to analyze the sources of competitive advantage [32].

Thanks to the rapid ability of the firms to introduce innovation and to high pressure to reduce costs, firms must increasingly assess their performance and be subject to benchmarking [9]. There is a growing need for continuous improvement. This principle must be an integral part of strategic management activities and it is also one of the parameters of multifaceted performance [33]. Managers’ efforts to balance corporate strategies, the need for detailed knowledge of production inputs, and the precise knowledge of customer requirements have resulted in the use of the Balanced Scorecard (BSC) model. This familiar tool is helping to balance the firm strategy and define performance multifaceted indicators.

When we want to measure a multifaceted performance we need to use non-financial indicators which are not free of limitations. As [6] stated, some non-financial performance indicators may be difficult to measure accurately, efficiently, or in a timely fashion. According to Ittnerr and Larcker [19], other limitations are that they may be biased or ambiguous, easier to manipulate, measured in many ways that may change over time, time-consuming, and expensive. Because innovations most of the time track intangible assets, their measurement remains a challenge for most of the enterprises as well as academics [20]. To date, no rigorous model for innovation performance measurement has been found due to complexity and uncertainty present in innovation processes [14]. To overcome these problems, here we develop an integrated approach that combines strategic innovation performance assessment with qualitative comparative analysis. This approach enables finding innovation pathways within the BSC framework, thus connecting the performance criteria with corporate strategic priorities.

The remainder of this paper is structured as follows. In the next section, we present the theoretical background for BSC model and its use in the strategic management of innovation processes in companies. Section 3 provides the characteristics of the dataset and the research methodology. Section 4 presents the experimental results. In Sect. 5, we discuss the results that were obtained and conclude the paper with suggestions for future research.

2 Theoretical Background

In a rapidly changing environment, enterprises must continuously innovate, develop new processes and deliver novel products or services to achieve and maintain a competitive advantage [36]. Hence nowadays, it is not about whether to innovate or not, but how to innovate successfully. In this context, innovation management itself is evolving and presents enterprises with tough challenges in performance measurement [7].

According to [10] most enterprises do not measure the benefits created by their innovation projects, many of them do not have internal structures to measure innovation and do not pay sufficient attention to the process of innovation management. This fact is confirmed by a number of surveys, for example The Boston Consulting Group’s survey revealed that 74% of the executives believed that their company should track innovation as rigorously as core business operations, but only 43% of the companies actually measured innovation [2]. Dewangan and Godse [7] state that less than 41% of enterprises regard their Innovation Performance Measurement (IPM) systems as effective and a large majority of enterprises have felt the need to improve their IPM system. According to [21] the real issue is a lack of metrics and measurements which cause that companies measure too little, measure the wrong things or not measure innovation at all.

The main reason why a number of enterprises are still struggling with problems in this area is that measurement of innovation is intangible by nature. Innovations typically create much more intangible than tangible value, and intangible value cannot be measured using traditional financial methods [10]. Adams et al. [1] stress the absence of the frameworks for innovation management, measurement indicators as well as the relatively small number of empirical studies on measurement in practice. Still, we can find studies dealing with innovation performance measurement [15].

The measurement of innovation is also crucial issue for an academic research. As stated Adams et al. [1] unless constructs relating to the phenomenon are measurable using commonly accepted methods, there is a risk that different operationalization of the same effect will produce conflicting conclusions, and that theoretical advances become lost in the different terminologies.

In literature we can find three types of innovation performance models that are based on different methodologies including empirical ones like firms survey [30], case study [25] and theoretical approaches [38]. Recent frameworks used for innovation measurement are also diverse and often built with operations research tools such as Data Envelopment Analysis (DEA) or multi-criteria analysis tools such as Analytic Hierarchy Process (AHP) [28]. DEA is appropriate for innovation efficiency calculation and for benchmark [34, 35] and AHP for innovation portfolio management [24]. However, traditional models and frameworks for innovation measurement are mainly oriented on past performance and stressing more control than process of innovation management.

Currently Balanced Scorecard is considered the most comprehensive model for the continuous improvement of the organization’s performance. BSC can be used also to measure the performance of the innovation processes. The authors of the BSC concept itself state that the recent BSC provides a richer, more holistic view of the organization, and the model can be used with any selection of perspective appropriate to a particular exercise [17]. The fact that it can be adapted according to the needs of the organization in any of its areas, makes from BSC the most appropriate tool for introducing a complex system of measuring innovation performance [10, 15, 20].

In the context of innovation measurement a key improvement of BSC is the linkage of measurement to a strategy map; this tighter connection between the measurement system and the strategy map elevates the role of nonfinancial measures in strategy implementation and strategy evaluation [22]. Strategic alignment determines the value of intangible assets and strategy map is designed to help execute strategy and bring predictive qualities to key performance indicators [5]. Only by considering the cause-effect relationships, it is possible to switch from innovation performance measurement to innovation performance management.

One of the first authors that suggested BSC as an integrated performance measurement system for research and development were Kerssens-van Dronglene and Cook [23]. Later Bremser and Barsky [4] extended their work by integrating Stage-Gate approach to R&D management with the BSC to present a framework to show how firms can link resource commitments to these activities and strategic objectives. Gama et al. [10] proposed an Innovation Scorecard based on innovation metrics and the traditional BSC in order to measure the value added by innovation and tested the pilot in a large industrial company. Saunila and Ukko [37] introduce a conceptual framework of innovation capability measurement based on the literature review of performance measurement frameworks and assessment models. Ivanov and Avasilcăi [20] developed new model on the basis of detailed analysis of four most important performance measurement models (BSC, EFQM, Performance Prism and Malcolm Baldrige) that tries to emphasize the most important characteristics that have to be analyzed when innovation performance is measured. Zizlavsky [44] proposed an Innovation Scorecard based specifically on project management, BSC, input-process-output-outcomes model and Stage Gate approach. Above presented models and frameworks are theoretical or based on the analysis of one or few case studies and the results have not been verified on a large data set.

When using non-financial measures, we need to often deal with the data vagueness and ambiguity. The contemporary research reveals that the fuzzy set and the fuzzy logic theory are the appropriate theoretical background to solve this issue. Recently, many researchers have been developed and modified fuzzy linguistic approach in order to apply in diverse domains, some of them integrated fuzzy linguistic also in BSC structure [15, 27].

In one of the oldest works are BSC and Fuzzy logic combined into a methodology and a software tool that is able to help executives to optimize the strategic business processes [12]. Later on, several scholars integrates BSC with Fuzzy AHP to calculate the relative weights for each performance measure [26, 39]. More recent studies propose approaches to analyze strategy map using BSC-FAHP to asses each aspects of strategy or impact of changes in the mission and vision of the organization [31, 40]. Interesting is also the approach of [3] that provide a first semantic fuzzy expert system for the BSC. Its knowledge base relies on an ontology and its inference system derives new knowledge from fuzzy rules.

However, none of them, to the best of our knowledge, utilized the advantages of fuzzy sets to model innovation paths within the BSC framework.

3 Research Methodology

In this section, we first introduce a BSC for evaluating firm innovation performance. Specifically, we adapted the model proposed in [13] that provides a set of indicators for each perspective of BSC. Our contribution is the inclusion of vision and strategy effect on all four BSC perspectives (Fig. 1). More precisely, five strategies were considered: (1) developing new markets; (2) reducing costs; (3) introducing or improving goods or services and their marketing; (4) increasing organization flexibility; and (5) building alliances with other firms and institutions. The causal effects in the BSC model also represent the theoretical framework for further detection of innovation paths.

The indicators used to evaluate firm innovation performance and their innovation strategies are presented in Table 1. Note that both quantitative and qualitative indicators were included and that these were fuzzified to [0, 1] interval for further qualitative comparative analysis. Note that the values are regularly distributed in the [0, 1] to make the fuzzification as objective as possible. The source of the data was the CIS (Community Innovation Survey) harmonized questionnaire, for details see the questionnaire available at: http://ec.europa.eu/eurostat/documents/.

The data used in this study come from the CIS survey for the period 2010–2012. To collect the data, CIS is based on the combination of exhaustive surveys and stratified random sampling of firms with at least ten employees. Overall, we were able to collect the data for 17,586 firms. The following countries were included in the dataset: Germany (5,777 firms), Portugal (3,341), Bulgaria (2,409), Hungary (1,182), Croatia (944), Romania (829), Estonia (771), Slovenia (733), Lithuania (653), Slovakia (560) and Cyprus (388). To impute missing data, median values of the respective industry was applied [28, 43].

As the data available at the Eurostat upon request, we report only their main characteristics here. Most firms in the dataset were SMEs (small and medium enterprises), introducing mostly product innovations out of the four innovation types. About half of the firms were innovative, with more than 20% turnover from innovative products. Suppliers were the most frequent cooperation partners. Regarding the innovation strategies, reducing costs was the most important one and increasing flexibility placed second. In contrast, building alliances and developing new markets were the least important strategies.

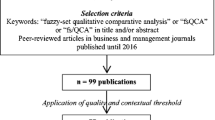

To model the innovation paths, we adopted the approach used in earlier studies for this task [11, 41] and used fuzzy set qualitative comparative analysis [42]. This method is suitable for modelling complex decision-making processes and detects also asymmetrical dependencies in the data [42]. This is done by examining all possible input-output combinations. Thus, necessary and sufficient conditions can be identified for each output. Those paths that are consistent with the data (with conditions covered by the output) and that cover sufficient data instances are stored in the solution. To calculate the fuzzy set membership of the path configuration, Gödel’s t-norm was used for logical AND, this is the minimum operation was performed over the conditions. To obtain the consistency (cons) and coverage (cov) of the solutions, the following equations were used [42]:

4 Experimental Results

To perform the modelling of innovation paths, we used the freely available fsQCA software. For the sake of space, here we present only the most important path configuration, with the financial perspective f1 as the output and the remaining perspectives and strategies as the input variables. Consistency cutoff was set to 0.5 to discard less consistent pathways.

The results of the modelling included 11 paths as follows:

-

Path 1: c1 and ~c2 and ~l1 and ~l3 and ~i1 and ~i2 and ~i3 and s1 and s2 and s3 and s4 with cov = 0.20 and cons = 0.51,

-

Path 2: c1 and ~c2 and ~l1 and ~i1 and ~i2 and ~i3 and s1 and s2 and s3 and s4 and s5 with cov = 0.15 and cons = 0.52,

-

Path 3: c1 and c2 and l1 and l3 and i1 and i2 and i3 and s2 and s3 and s4 with cov = 0.10 and cons = 0.57,

-

Path 4: c1 and c2 and l1 and l3 and i1 and i3 and s1 and s2 and s3 and s4 and s5 with cov = 0.10 and cons = 0.57,

-

Path 5: c1 and ~c2 and ~l1 and ~l2 and ~l3 and ~i1 and ~i2 and ~i3 and s1 and s2 and s3 and ~s5 with cov = 0.11 and cons = 0.50,

-

Path 6: ~c2 and ~l1 and ~l2 and l3 and ~i1 and i2 and ~i3 and s1 and s2 and s3 and s4 and s5 with cov = 0.09 and cons = 0.55,

-

Path 7: c1 and c2 and l1 and l2 and l3 and i1 and i2 and i3 and s1 and s2 and s3 and s4 with cov = 0.08 and cons = 0.64,

-

Path 8: c1 and l1 and l2 and l3 and i1 and i2 and i3 and s1 and s2 and s3 and s4 and s5 with cov = 0.09 and cons = 0.63,

-

Path 9: c1 and c2 and l1 and l2 and l3 and i2 and i3 and s1 and s2 and s3 and s4 and s5 with cov = 0.08 and cons = 0.64,

-

Path 10: c1 and ~c2 and ~l1 and l2 and ~l3 and ~i1 and ~i2 and ~i3 and ~s1 and ~s2 and ~s3 and ~s4 and ~s5 with cov = 0.04 and cons = 0.57,

-

Path 11: c1 and ~c2 and l1 and l2 and l3 and ~i1 and i2 and ~i3 and s1 and s2 and s3 and s4 and s5 with cov = 0.06 and cons = 0.62,

where cov denotes coverage, cons is consistency and ~ indicates negation operator ~x = 1 − x. For the complete solution of the model, we obtained the consistency of 0.52, which can considered sufficient relative to previous literature [26]. In addition, the solution had a high coverage of 0.39.

Path 1 and Path 5 state that high turnover from innovative products can be achieved by introducing product innovation only. However, those paths are not suitable for firms aiming to build strategic alliances. Overall, we can state that product innovation is a necessary condition to yield financial profit from innovation activities. As suggested by Path 2, this holds irrespective of the strategic goals. What is more interesting is the fact in Path 6 this condition is not met, and product innovation is replaced by knowledge acquisition and innovation co-operation by those firms. Firms following Path 3 introduced all the four types of innovations during the monitored period, which required both the innovation co-operation and training for innovative activities combined with knowledge acquisition. Path 4 represents a similar solution but for firms seeking for collaborative partners and new markets.

Interestingly, expenditure on innovation activities was not a necessary condition to achieve high share of turnover from innovative products in Paths 1–6, suggesting that these represent the configuration paths taken by SMEs. In contrast, the expenditure was present in Paths 7–11, which provided more consistent solutions. We can observe that high expenditure on a firm’s innovation activities is often accompanied with intensive training and knowledge acquisition, this is a coordinated effort for learning and future growth. Also note that Path 10 suggests that the five strategies included in the data did not provide an exhaustive listing. Additional strategies can be considered, such as reducing consumption of raw materials or improving working conditions.

To further study the firms taking the identified path configurations, we investigated their countries of origin and industry classification. For the former, we classified the countries according to the EIS (European Innovation Scoreboard) categories into modest innovators, moderate innovators, strong innovators and innovation leaders. Regarding the latter, we used the Eurostat definition of knowledge-intensive industries (i.e., those for which tertiary educated employees represent more than 33% of the industry employment). Based on these classifications, we found that Paths 1, 5 and 6 were taken by firms from less performing countries and knowledge-non-intensive industries. Paths 3, 4, 7 and 10 represent knowledge intensive industries from less performing countries. Finally, Paths 8, 9 and 11 were taken by firms from well performing countries and knowledge-intensive industries primarily.

5 Conclusion

In conclusion, we proposed a novel approach to modelling innovation paths that integrates innovation BSC with qualitative comparative analysis. We have outlined the BSC model, taking into account both the importance of firms’ innovation strategies and the qualitative assessment of many innovation indicators. A large dataset of European firms was used to validate our approach. The findings of this study imply that strategic priorities are crucial for the selection of firms’ innovation pathways. In addition, the results suggest that are eleven consistent innovation paths present in the dataset.

Prior research has indicated that expenditure on innovation activities is the most important determinants of innovation outcomes [16]. Indeed, we demonstrated that the expenditure is a necessary condition in highly innovative countries. However, the economic outcomes of innovation activity can also be achieved by introducing product innovation in less performing countries, when appropriate innovation strategy is taken. We believe that this research will serve as a base for future studies focused on individual countries and industries. The model proposed here may be applied to different CIS datasets without limitations. Moreover, the set of the BSC indicators, as well as the fuzzification procedure, may be adjusted to consider country/industry specifics. On the one hand, the variety of firms included in our dataset provided an extensive empirical support to our approach. On the other hand, more consistent results can be achieved in future studies when investigating a more specific sample of firms.

References

Adams R, Bessant J, Phelps R (2006) Innovation management measurement: a review. Int J Manag Rev 8(1):21–47

Andrew JP, Manget J, Michael DC, Taylor A, Zablit H (2010) Innovation 2010: a return to prominence—and the emergence of a new world order. The Boston Consulting Group, pp 1–29

Babillo F, Delgado M, Gómez-Romero J, López E (2009) A semantic fuzzy expert systome for a fuzzy balanced scorecard. Expert Syst Appl 36:423–433

Bremser WG, Barsky NP (2004) Utilizing the balanced scorecard for R&D performance measurement. R&D Manag 34(3):229–238

Buytendijk F, Hatch T, Micheli P (2010) Scenario-based strategy maps. Bus Horiz 53:335–347

Chow ChV, Van der Stede WA (2006) The use and usefulness of nonfinancial performance measures. Manag Account Q 7(3):1–8

Dewangan V, Godse M (2014) Towards a holistic enterprise innovation performance measurement system. Technovation 34(9):536–545

Donate MJ, de Pablo JDS (2015) The Role of knowledge-oriented leadership in knowledge management practices and innovation. J Bus Res 68(2):360–370

Estampe D, Lamouri S, Paris JL, Brahim-Djelloul S (2015) A framework for analysing supply chain performance evaluation models. Int J Prod Econ 142(2):247–258

Gama N, Silva MM, Ataíde J (2007) Innovation scorecard: a balanced scorecard for measuring the value added by innovation. In: Cunha PF, Maropoulos PG (eds) Digital enterprise technology. Springer, Boston, MA, pp 417–424

Ganter A, Hecker A (2014) Configurational paths to organizational innovation: qualitative comparative analyses of antecedents and contingencies. J Bus Res 67(6):1285–1292

Haase VH (2000) Computer models for strategic business process optimisation. In: Proceedings of the 26th euromicro konference, vol 2, pp 254–260

Hajek P, Henriques R (2017) Modelling innovation performance of european regions using multi-output neural networks. PLoS ONE 12(10):e0185755

Hajek P, Henriques R, Castelli M, Vanneschi L (2019) Forecasting performance of regional innovation systems using semantic-based genetic programming with local search optimizer. Comput Oper Res. https://doi.org/10.1016/j.cor.2018.02.001 (2019)

Hajek P, Striteska M, Prokop V (2018) Integrating balanced scorecard and fuzzy TOPSIS for innovation performance evaluation. In: PACIS 2018 proceedings, pp 1–13

Hashi I, Stojčić N (2013) The impact of innovation activities on firm performance using a multi-stage model: evidence from the community innovation survey 4. Res Policy 42(2):353–366

Hoque Z (2014) 20 years of studies on the balanced scorecard: trends, accomplishments, gaps and opportunities for future research. Br Account Rev 46:33–59

Hult GTM, Snow CC, Kandemir D (2003) The role of entrepreneurship in building cultural competitiveness in different organizational types. J Manag 29(3):401–426

Ittner CD, Larcker DF (2011) Assessing empirical research in managerial accounting: a value-based management perspective. J Account Econ 32:349–410

Ivanov CI, Avasilcăi S (2014) Measuring the performance of innovation processes: a balanced scorecard perspective. Procedia Soc Behav Sci 109:1190–1193

James PA, Knut H, David CM, Harold LS, Andrew T (2008) A BCG senior management survey—measuring innovation 2008: squandered opportunities (2008)

Kaplan RS, Norton DP (2014) The strategy map: guide to aligning intangible assets. Strat Leadership 32(5):10–17

Kerssens-van Drongelen IC, Cook A (2007) Design principles for the development of measurement systems for research and development process. R&D Manag 27(4):345–357

Khaksari S (2017) AHP and innovation strategy as project portfolio management. Polytechnic University of Turin (2017)

Lazzarotti V, Manzini R, Mari L (2011) A model for R&D performance measurement. Int J Prod Econ 134(1):212–223

Lee AHI, Chen W-CH, Chang Ch-J (2008) A fuzzy AHP and BSC approach for evaluating performance of IT department in the manufacturing industry in Taiwan. Expert Syst Appl 34:96–107 (2008)

Lin QL, Liu L, Liu H-C, Wang DJ (2013) Integrating hierarchical balanced scorecard with fuzzy linguistic for evaluating operating room performance in hospitals. Expert Syst Appl 40:1917–1924

Mbassegue P, Nogning FL, Gardoni M (2016) A conceptual model to assess KM and innovation projects: a need for an unified framework. In: Bouras A, Eynard B, Foufou S, Thoben KD (eds) Product lifecycle management in the era of internet of things. PLM 2015. IFIP advances in information and communication technology. Springer, Cham, vol 467

Naranjo-Valencia JC, Jiménez-Jiménez D, Sanz-Valle R (2016) Studying the links between organizational culture, innovation, and performance in Spanish companies. Revista Latinoamericana de Psicología 48(1):30–41

OECD (2005) OECD SME and entrepreneurship outlook 2005. OECD Publishing, 416 pp

Peréz CÁ, Montequín VR, Fernández FO, Balsera JV (2017) Integration of balanced scorecard (BSC), strategy map, and fuzzy analytic hierarchy process (FAHP) for a sustainability business framework: a case study of a spanish software factory in the financial sector. Sustainability 9:527

Porter ME (1997) Competitive strategy. Meas Bus Excel 1(2):12–17

Poveda-Bautista R, Baptista DC, García-Melón M (2012) Setting competitiveness indicators using BSC and ANP. Int J Prod Res 50(17):4738–4752

Prokop V, Stejskal J (2019) Different influence of cooperation and public funding on innovation activities within German industries. J Bus Econ Manag 20(2):384–397

Prokop V, Stejskal J, Hudec O (2019) Collaboration for innovation in small CEE countries. E a M: Ekonomie a Management 22(1):130–140

Rejeb HB, Morel-Guimaraes L, Boly V, Assielou NG (2008) Measuring innovation best practices: improvement of an innovation index integrating threshold and synergy effects. Technovation 28(12):838–854

Saunila M, Ukko J (2012) A conceptual framework for the measurement of innovation capability and its effects. Balt J Manag 7(4):355–375

Schentler P, Lindner F, Gleich R (2010) Innovation performance measurement. In: Gerybadze A, Hommel U, Reiners HW, Thomaschewski D (eds) Innovation and international corporate growth. Springer, Heidelberg, pp 299–317

Sohn MH, You T, Lee S-L, Lee H (2003) Corporate strategies, environmental forces, and performance measures: a weighting decision support system using the k-nearest neighbor technique. Expert Syst Appl 25:279–292

Sorayaei A, Abedi A, Khazaei R, Hossien Zadeh M, Agha Maleki SMSA (2014) An integrated approach to analyze strategy map using BSC–FUZZY AHP: a case study of dairy companies. Eur Online J Nat Soc Sci 2:1315–1322

Stejskal J, Hajek P (2019) Modelling collaboration and innovation in creative industries using fuzzy set qualitative comparative analysis. J Technol Transf 1–26

Woodside AG (2014) Embrace perform model: complexity theory, contrarian case analysis, and multiple realities. J Bus Res 67(12):2495–2503

Zhang Z (2016) Missing data imputation: focusing on single imputation. Ann Transl Med 4(1):1–8

Zizlavsky O (2016) Innovation scorecard: conceptual framework of innovation management control system. J Glob Bus Technol 12(2):10–27

Acknowledgements

This work was supported by a grant provided by the scientific research project of the Czech Sciences Foundation Grant No. 17-11795S.

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2020 Springer Nature Switzerland AG

About this chapter

Cite this chapter

Hájek, P., Stejskal, J., Kotková Stříteská, M., Prokop, V. (2020). Modelling Innovation Paths of European Firms Using Fuzzy Balanced Scorecard. In: Pham, H. (eds) Reliability and Statistical Computing. Springer Series in Reliability Engineering. Springer, Cham. https://doi.org/10.1007/978-3-030-43412-0_3

Download citation

DOI: https://doi.org/10.1007/978-3-030-43412-0_3

Published:

Publisher Name: Springer, Cham

Print ISBN: 978-3-030-43411-3

Online ISBN: 978-3-030-43412-0

eBook Packages: EngineeringEngineering (R0)