Abstract

Weather derivatives are priced considering weather variables such as rainfall, temperature, humidity and wind as the underlying asset. Some recent researches suggest to model the amount of rain using the mean reverting process. The Ornstein Uhlenbeck Process was proposed in [29] to model the irregularity of rainfall intensity as well as duration of dry spells. By using the Feynman-Kac theorem and the rainfall indexes we derive the partial differential equation(PDE) that governs the price of an option. We apply the Lie analysis theory to solve this PDE, we provide the group classification and we use it to find the invariant analytical solutions.

Access provided by Autonomous University of Puebla. Download conference paper PDF

Similar content being viewed by others

Keywords

- Feynman-kac theorem

- Ornstein-uhlenbeck process

- Weather derivatives

- Partial differential equation

- Lie analysis

MSC 2010 Classification

37.1 Introduction

In general companies activities face risks related to changes in the weather. The agriculture industry and energetic industry are examples of sectors that their activities can be influenced by weather variables such as rainfall, snowfall, temperature, humidity and wind. For example, by turn on the cooler or the heating one makes the energy supplier sells more than the normal days. But these positive impacts, can also turn into negative since the electricity supply can be influenced negatively for example by wind. To face these risks companies must choose according of the nature of theirs activities, which kind of weather protections they must use. In agriculture for example, the crop yield can depend on quantities of rainfall. As shown, for example by Odening, Musshoff and Xu in [21] and by Stoppa and Hess in [27] there is a strong correlation between the amount of rainfall and wheat yield. Geyser in [11] also shown the strong correlation between the amount of rainfall and maize yield. So that, the crop yield will depend on an expected (normal) amount of rainfall. If the observed amount of rain is less or more than the amount required, the farmers can lose or get few crop yield than expected. If the farmers can protect themselves again adverse rainfall patterns during the critical stages of growth, the crop yield risk will substantially decrease. Geyser proposed some possible rainfall options strategies for maize yield. She suggested a options risk protection strategy called long strangle, where a long call and a long put are combined. This combination provides to the farmer a hedge traditionally associated in the financial markets with high volatility of the underlying risk exposure.

As one can see, weather risks are also managed by using the financial instruments, and they are called financial Weather contract since they are related to weather variables. Following [8], we can define a financial weather contract as a “weather contingent contract whose payoff is determined by a future weather events and the settlement value of these weather events is determined from a weather index expressed as values of a weather variable measured at a stated location”. The financial weather contract can take the form of a weather derivative (WD) or of a weather insurance (WI) contract. The significant difference between the Weather derivatives and weather insurance contracts, as appointed by [11, 27], following on regulatory and legal point of views are:

-

the insurance contracts cover only high risks, with low probability of occurrence, whereas weather derivatives also cover low risks, with high probability of occurrence;

-

the WI usually are more expensive and require a demonstration of losses whereas the WD are cheaper and do not depend on losses, it only depend on the observation of the weather indexes;

-

the payoff on weather derivatives must be proportional to magnitude of the phenomena whereas on weather insurance contracts it can only depend on the amount of losses.

So, depending on circumstances, the flexibility and efficiency of weather derivatives contracts make them more attractive than the weather insurance contracts. Weather derivatives, as financial instruments to manage a risk, are also negotiated on a formal market. The first weather derivative was executed in the United State of America in 1997, between two energy companies (Koch Industries and Enron), using a swap on temperature indexes to hedge against warm days in winter. Two years later, the expansion of the climatic contracts gave birth to an organized electronic platform launched by the Chicago Mercantile Exchange (CME) [17]. The first contracts traded were essentially degree days in temperature contracts. In 2003, the CME opened at two subsidiary respectively in Europe and in Japan. In Africa, few countries started to offer weather derivatives contracts and in very small volume. Morocco and South Africa have launched a few over-the-counter (OTC) contracts. Other initiatives by the World Bank associated with private companies to reduce natural extreme weather risks in developing countries have shown to be very important demanded by small farm holders notably for example in Ethiopia. The proportion of all type of climatic contracts negotiated was appointed by [17] to be more significantly on CME market in 2005, with \(95 \%\) of contracts against \(5 \% \) of OTC contracts. The weather derivative contract can be formulated as in [30] specifying the following parameters:

-

Contract type, if it is European or American option, Future, Swap, among others;

-

Contract period, usually 1 month or 6 months (Six months corresponds to hedging either the winter or summer season);

-

The referential point, from which the meteorological data is obtained;

-

The underlying index of the contract (can be, Temperature degree days (DD) and their variants “heat degree days (HHD) or cool degree days (CDD)”, rainfall, etc.) for each commodity;

-

Pre-negotiated threshold, or strike level for weather index (S);

-

Tick or constant payment for a linear or binary payment scheme, “\(\tau \)” (translate the payoff into monetary terms), and

-

The premium.

In most cases the rainfall is modeled through an cumulative of daily average amount of rain, [9]. But, was show for example by Odening, Musshoff and Xu in [21] that the indexes constructed by the principle similar to that of degree-days indexes used to modeling temperature derivatives, gives higher hedging effectiveness. Hence, we present two ways of modeling rainfall derivatives contracts similar to the ones used to modeling temperature derivatives by degree-days indexes. Bellow we present an adaptation from [1] of the two alternatives.

Definition 37.1

We define rain defice day and denote RDD as the number of millimeters by which the daily average rain \(X_{t}\) is below the base rain \(X_{ref}\) i.e:

Definition 37.2

We define rain excess day and denote RED as the number of millimeters by which the daily average rain \(X_{t}\) is above the base rain \(X_{ref}\) i.e:

The “RDD” can be thought in terms of necessity of water in non raining periods, whereas, “RED” can be thought in terms of existence of more water than required in raining periods. Hence, an investor wants to protect himself against higher levels of rain, he can take position on RED contracts and the payment has a payoff defined according to the Eq. (37.2). On the other hand if the protection is against lower levels of rain he can take position on RDD contracts and contract will pays according to the Eq. (37.1). For the strategy proposed in [11] with the expected amount of rainfall per year between 200 and \(800\,\mathrm{mm}\), the investors must take position on both RDD and RED contracts, considering the annual base raining of \(200\,\mathrm{mm}\) for RDD contracts and the annual base raining of \(800\,\mathrm{mm}\) for RED contracts.

In order to price weather derivatives one need to consider that the underlying variable is non trad-able asset and that the weather models do not follow Geometric Brownian motion (see [1]), therefore Black-Scholes methodology can not be implemented directly for weather derivative pricing. Alternative methods based on arbitrage-free pricing methods [25, 26], equilibrium models [5] and actuarial approach [3] was proposed. But their technical inefficiency and limitation for weather risk management still makes necessary to develop efficient schemes of pricing. The methods based on partial differential equations (PDEs) were suggested to model temperature derivatives by Pirrong and Jermakyan in [25] and posteriori adopted by other researchers, such as [1, 2, 18, 26]. The arbitrage-free prices of weather options are determined using the market prices of risk from the quotations of the weather futures, since the underlying is non-tradable asset, and then the price is determined under the theory of incomplete markets. The mean reverting process model was proposed to model rainfall by Emmerich, Günther, and Nelles in [9], they were based on the fact that as well as the other Weather variables the rainfall exhibits seasonal patterns and usually reverts to the mean. Additionally the value of the mean is dependent on the time of the year and does not grow or fall indefinitely. Unami, Abagale, Yangyuoru, Alam and Kranjac-Berisavljevic in [29] proposed the Ornstein-Uhlenbeck process, the simplest model having the mean reversion property, as a model to assessing drought and flood risks. They proposed numeric schemes to price weather derivatives. The efficiency of these numeric schemes can be improved by providing analytical solutions of associated equations.

The Lie group analysis, is used to analyze symmetries of differential equations and construct their analytical invariant solutions. It was introduced by Sophus Lie in 1880. In his paper, “On integration of a class of linear partial differential equations by means of definite integrals” [19], Lie identified a set of equations that could be integrated or reduced to a lower-order equations by group theoretic algorithms and proposed the group classification of the linear seconder-order partial differential equation with two independent variables. He pointed that all parabolic equations admitting the symmetry group of the highest order could be reduced to the heat conduction equation. The collections of Lie results on regard to group analysis of differential equation can be found in [16].

In financial mathematics the Lie analysis was applied firstly by Gazizov and Ibragimov in [10]. They started by analyzing the complete symmetry of one dimensional Black-Scholes model and showed that this equation is included in Sophus Lie’s classification of linear second-order partial differential equation with two independents variables, and it can be reduced to the heat equation. For Jacobs-Jones models, they carried out the classification according to their symmetry groups, providing a theoretic background for constructing exact (invariant) solutions for this equation, since it does not admit the symmetry group of the highest order. More research on this area have been developed, for example by Paliathanasis, Krishnakumar, Tamizhmani, and Leach in [24] who provided a Lie group classification of the Lie point symmetries for the Black-Scholes-Merton Model for European options with stochastic volatility. The volatility was defined following stochastic differential equation with an Orstein-Uhlenbeck term. In this model, the value of the option is given by a linear \((1 + 2)\) dimensional evolution partial differential equation. They found that for arbitrary functional form of the volatility, the evolution PDE always admits two Lie point symmetries in addition to the automatic linear symmetry and the infinite number of symmetries solution. However, for a particular value of the functional volatility and the price of the option depending on the second Brownian motion in which the volatility is defined, the evolutionary PDE is not reduced to the Black-Scholes-Merton equation. The model admits five Lie point symmetries in addition to the linear symmetry and the infinite number of symmetries solution. By applying the zero-order invariants of the Lie symmetries they reduced the \((1 + 2)\) dimensional evolutionary PDE to a linear second-order ordinary differential equation. They studied the Heston model and the Stein-Stein model. Lo and Hui in [20], applying Wei-Norman theorem derived the analytical closed-form for pricing weather derivatives by exploiting the dynamical symmetry of the \((1+1)\) dimensional pricing PDE describing financial derivatives with time-dependent parameters.

On this paper, we propose to solve the PDE of mean reverting Ornstein-Uhlenbeck process, by applying the theory of Lie analysis. We get a group classification of the PDE, and we seek for some invariant analytical solutions under the group generated by particular generators. We also find the generators which are compatible with boundary conditions.

37.1.1 Model Description

Some recent researches suggest to model the amount of rain using the mean reverting process, see for example [9]. The Ornstein-Uhlenbeck process, particular case of mean reverting process, was suggested in [29] to model the irregularity of rainfall intensity as well as duration of dry spells. We consider the deterministic mean reverting Ornstein-Uhlenbeck process

where k is the rate of the mean reversion, \(\sigma _t\) the volatility of the rainfall, \(dW_{t}\) representing the Brownian increment under the real probability and \(\theta (t)\), the long term mean of the process, is given by

The \(\upsilon \) represent the shift of the X-axis (to scale up to months we divide by 12), \(\alpha \) determines the oscillation and m is the mean of the sine curve.

Under the risk neutral measure Q, characterized by the market price of risk \(\lambda ,\) the Eq. (37.3) takes the form

where \(dW_{t}^Q\) is the Brownian increment under risk neutral measure Q, see [18, 25, 26]. The market price of risk is the difference between the expected rate of return of the underlying and the risk-less interest rate, reported to the quantity of risk measured by the volatility [12]. It can be extracted from quotations of the weather futures, as suggested by Pirrong and Martin in [25, 26]. Weather derivative incomes depend on the evolution of an underlying meteorological index [12]. The cumulative index \(Y_t,\) of the underlying weather variable can be described by the following equation (see for example, [18])

In this case the indexes \(Y_t\) represents the amount of rainfall over all period \(t \in [0,T]\). The index is a quantity of RDD or RED over all considered period. Additionally, we consider \(t \ge 0\), \(k\ge 0 \) and the initial condition \(X_{0} = x_{0}\).

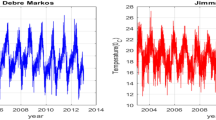

The mean reverting model of the rainfall process was proposed by Emmerich, Günther, and Nelles in [9] and its simplest case, the Ornstein-Uhlenbeck process, suggested in [29]. The Ornstein-Uhlenbeck process was also suggested by Alaton, Djehiche and Stillberger in [1] and by Li in [18] to model temperature process. The number of sine terms can be found individually by analyzing the data from the weather station which will be used to estimate the parameters and the appropriate choice was shown to be \(n = 3.\) For simplicity we will consider the case when \(n = 0\) (one sine term). Then the deterministic function \(\theta (t)\) is defined as

The derivative of \(\theta (t)\) is

Using financial theory, from the rainfall model, one can measure the amount of the rainfall in certain weather station and period, with this, depending on the contract (RDD or RED) one can use Eq. (37.1) or (37.2) as the payoff functions. Under risk neutral probability measure, a contingent claim, for example an option price \(V(X_t, Y_t,t)\) can be given as discounting conditionally expected payoff at maturity. For such complex model it is not easy to compute the conditional expectation. In order to avoid a lot of computation one can apply the Feynman-Kac theorem, and the value of the weather option \(V(X_t, Y_t,t)\) should satisfy the following bivariate PDE,

where \(\gamma (x,t) = k(\theta (t) - X_{t}) + \theta '(t) - \lambda \sigma _{t}\), and the terminal conditions, depends on derivatives to be analyzed. The payoff is defined as \(f(x,t) = f(x)\).

When the underlying variable follow Ornstein-Uhlenbeck process, if one consider some weather indexes, the prices for weather derivatives can be governed by a convection-diffusion equation (37.9), that belongs to the wider class of Kolmogorov backward equations. The diffusion effects are much smaller than the convection effects. Pirrong and Jermakyan [25] suggested a method based on PDEs to price weather derivatives. They obtained the arbitrage-free prices of weather options by inducing the market prices of risk from the quotations of the weather futures, considering the liquidity of the weather options market.

In practise the weather option contract does not have a negotiable underlying index, and the model is still far from the reality. For practical uses, improvements of weather derivatives pricing by PDEs can be found for example in Broni [4]. Assuming mean-self financing portfolio and partial hedging Broni derived a PDE introducing a hedging instrument H that is imperfectly correlated with the underlying index. Another improvement of (37.9), can be made if one consider a stochastic volatility, which will allow to compute the market prices of risk instead of extracting them from quotations, but it is still necessary to have available quotations of the weather contracts in order to extract a risk-neutral distribution. Both risk-neutral distribution and market prices of risk requires the liquidity of the quoted weather contracts [12].

The rain risk can be managed buying RDD or RED (American, Asian or European) options, taking short or long positions. The limit on the financial gains or losses are defined by the following terminal condition:

-

for an RDD European put

$$\begin{aligned} V(x,y,t) = tick \times (S - y(T))^{+} \end{aligned}$$(37.10) -

and, for an RDD European call

$$\begin{aligned} V(x,y,t) = tick \times (y(T) - S)^{+} \end{aligned}$$(37.11)

where y(T) is the value of RDD or RED index at maturity, S is strike level (that is defined at time t) and “tick” is used to convert the quantity \((y(T) - K)^{+}\) into monetary terms, see for example [4, 25, 26, 28].

Our aim in this paper is to make a Lie group classification for the PDE (37.9). By making a group classification one can realize that the PDE can be reduced to the heat equation and if not we can use the subalgebras to find their invariant solutions.

Some PDEs can be reduced to the heat equation by change of variables if they have a symmetry of highest order [19]. As we know the heat equation has a known fundamental solutions. If we are interested to find the solution for a PDE, we can reduce it to heat equation, but some times, as illustrated by Craddock and Grasselli [6] on the boundary, if it is a boundary value problem, the solutions produced may not be necessary a probability density. In order to show this, they considered a problem which vanish in the boundary, but by changing the variables they found that some fundamental solution were not defined in the boundaries. Also by making further change of variables they produced a problem which was more complicated than the original, showing the importance of the techniques which allows to solve PDE avoiding change of variables. One way to do so, is to consider all the symmetries admitted by the PDEs and find the ones mapping the boundary and final conditions to the values of the original problem. This will be the technique that we will implement in order to solve (37.9).

This paper is divided in 4 sections. After the introduction in Sect. 37.1 we present in Sect. 37.2 a brief background of the Lie group analysis. Section 37.3 is divided in 3 parts where we present some basic transformations of the PDE (37.9). We present also the result of the Lie group classification of the equation with the coefficients satisfying the restrictions \(\sigma \ne 0,\,k(k^2 + \pi ^2) \ne 0\), showing that the dimension of the symmetry group depends on the values of the parameters \(\sigma \) and k. We present the constructions of invariant solutions and we end Sect. 37.3 with the determination of the one dimensional optimal system. We finalize the paper in Sect. 37.3 where we present the conclusions.

37.2 Outline of Lie Symetries Method for PDEs

In this section we provide a summary of concepts and main theorems of Lie symmetry theory for PDEs. We gives the general description of the Lie symmetry method, explaining how to compute the infinitesimal symmetries and the invariant solutions of the PDEs. Furthermore, one can refer for more details to [14, 15, 22, 23].

37.2.1 Infinitesimal Symmetries

Consider a partial differential equation

where \(u = (u^{1},\ldots ,u^{m})\) is a function of the independent variable \(x = (x^{1}, \ldots , x^{n})\). \(u^{1},\ldots ,u^{m}\) are the sets of all first, second up to kth-order partial derivatives:

\(\alpha = 1, \ldots , m\) and \(i, j, i_{1}, \ldots , i_{k} = 1,\ldots , n\). Since we assume that \(u^{\alpha }_{ij} = u^{\alpha }_{ji}\), \(u_{(2)}\) contains only the terms \(u^{\alpha }_{ij}\) for which \(i \le j\), \(u_{(3)}\) contains only the terms for which \(i \le j \le k\), and so on for \(u_{(4)}\), \(u_{(5)}\), \(\ldots \). There is a natural ordering in \(u_{(k)}\) and the number of elements is \(m \left( ^k_{n+k-1}\right) \).

Recall that the system (37.12) admits the invertible transformation of the variables x and u, i.e.,

if it is form-invariant in the new variables \(\bar{x}\) and \(\bar{u}\), i.e.,

whenever (37.12) holds. The invertible transformations, are said to be a symmetry transformation of the system (37.12) and, the set of all these transformation are defined by

where a is real continuous parameter from a neighborhood of \(a = 0\) and \(f^{i}\), \(\phi ^{\alpha }\) are differentiable functions that forms a local continuous one-parameter Lie group of transformation G in \(\mathbb {R}\).

If the transformation (37.15) of a group G, are symmetry transformations of (37.12), then G is called a symmetry group of (37.12) and (37.12) is said to admit G as a group.

According to Lie’s theory, the construction of a one-parameter group G is equivalent to the determination of the corresponding infinitesimal transformations obtained by the Taylor series expansion in a of the Eq. (37.15) about \(a = 0\), taking into account the initial conditions, i.e:

The infinitesimal transformations are:

where

By introducing the operator

the infinitesimal transformation (37.17) can be written as:

The operator (37.19) is known as the infinitesimal operator or generator of the group G. Therefore, if G is admitted by (37.12), X is also admitted operator of (37.12).

The one-parameter groups are obtained trough their generators as said on the Lie’s theorem bellow.

Theorem 37.1

Given the infinitesimal transformations (37.17) or X, the corresponding one-parameter group G is obtained by solution of the Lie equations,

subject to the initial conditions (37.16),

In the space \((x,u,u_{(1)}, u_{(2)},u_{(3)}, \ldots , u_{(k)})\), the infinitesimal transformation are obtained by constructing the prolonged group \(G^{[k]}\) of G, where k is the highest order of the derivatives in the system (37.12). For example if one consider the space \((x,u,u_{(1)})\), the prolonged group will be \(G^{[1]},\) and if the space considered is \((x,u,u_{(1)},u_{(2)})\) then the prolonged group will be \(G^{[2]}\).

Since the transformation (37.15) is a symmetry group G of the system (37.12), the function \(\bar{u} = \bar{u}(\bar{x})\) satisfies (37.14), whenever the function \(u = u(x)\) satisfies (37.12). The transformation of the derivatives \(\bar{u}_{(1)}, \bar{u}_{(2)},\bar{u}_{(3)}, \ldots , \bar{u}_{(k)}\), are found from (37.15) by using the formulae of change of variables in the derivatives with respect to each of the parameter \(x^{i}\),

where

is the total derivative operator with respect to \(x^{i}\) and \(\bar{D}_{j}\) is likewise given in terms of the transformed variables. If we consider

and apply (37.22) in \(\bar{u}^{\alpha }\), (37.15) can be written as

Taking the first and the last terms of (37.24), we get

By solving (37.25) with respect to \(u_{i}^{\alpha }\), since it is locally invertible equation, we found the transformation of the derivatives \(u_{i}^{\alpha }\) in \(u_{i}^{\alpha }\), given by

The transformation of \(u_{(1)}\) on \(\bar{u}_{(1)}\) together with transformations of (x, u) on \((\bar{x},\bar{u})\) will form the first prolongation of the one-parameter group \(G^{[1]}\) acting in the space \((x,u,u_{(1)})\). From the first prolongation by using the total derivatives, we obtain the second prolongation one-parameter group \(G^{[2]}\) acting in the space \((x,u,u_{(1)},u_{(2)})\) and successively we obtain the kth prolongation one-parameter group \(G^{[k]}\) acting in the space \((x,u,u_{(1)}, \ldots , u_{(k)})\).

Since we have the prolonged groups \(G^{[1]}\) to \(G^{[k]}\), we have to find their infinitesimal transformation. Remember that the infinitesimal transforation for (x, u) is given by (37.17). For (37.26), if we apply the Taylors series expansion, in the neighborhood of \(a =0\) and taking into account the initial conditions \(\psi _{i}^{\alpha }\mid _{a = 0} = u_{i}^{\alpha }\), we will get:

Now we have to find the functions \(\zeta _{i}^{\alpha }\), \(\zeta _{ij}^{\alpha }\) and \(\zeta _{i_{1}\cdots i_{k}}^{\alpha }\). Taking Eq. (37.25), considering only the expressions in the second line, taking into account the values of \(f^{j}\) and \(\phi ^{\alpha }\) from (37.17), and of \(\bar{u}_{j}^{\alpha }\) from (37.28), consider that

Also we considered the fact that this transformation is local, i.e., a is very small and \(a^{2}\) will be smaller and we take it out. We obtain:

By simplification we find \(\zeta _{i}^{\alpha }\), which is \(\bar{u}_{i}^{\alpha }\), on the first prolongation formula (37.28). Higher prolongation formulas, are obtained by introducing the Lie characteristic function \(W^{\alpha } = \eta ^{\alpha } - \xi ^{j}u_{j}^{\alpha }\), giving

From (37.28) and (37.29), we can conclude that the functions \(\zeta _{i}^{\alpha }\), \(\zeta _{ij}^{\alpha }\) and \(\zeta _{i_{1}\cdots i_{k}}^{\alpha }\) in the Eq. (37.28), are given recursively by the prolongation formulas:

The generators of the prolonged groups are determined in the same way using Eq. (37.19) to obtain the generator of the group G, which are also referred to as the k-th prolonged generators,

37.2.2 Exact Solutions

By considering the symmetry transformation of (37.12), one can use some solutions of the system to obtain general solutions of the system (group transformation of known solutions). If the solutions are not known, one can look for the solutions that are invariant of the group generated by the particular X (invariant solutions). In order, let us consider first some definitions and theorems about invariant points and invariant functions:

Definition 37.3

A point \((x,u) \in \mathbb {R}^{n+m}\) is an invariant point if it remains unaltered by all transformation of the group G, i.e, \((\bar{x},\bar{u}) = (x,u)\) for all values of \(a\in D' \subset D\).

Theorem 37.2

A point \((x,u)\in R^{n+m}\) is an invariant point of a group G with generator given by (37.19) if and only if \(\xi ^{i}(x,u) = \eta ^{\alpha } = 0\).

Definition 37.4

A function F(x, u) is an invariant of a group G if and only if \(F(\bar{x},\bar{u}) = F(x,u)\), \(\forall \) x, u and \(a\in D'\subset D\).

Theorem 37.3

A function F(x, u) is an invariant of group G with generator given in (37.19) if and only if

The Eq. (37.32) is a linear PDE and can be solved using method of characteristics that will give the invariant curves which are tangent to the vector \((\xi ^{i},\eta ^{\alpha })\), for \(i = 1,\ldots ,n\) and \(\alpha = 1,\ldots ,m\). The local invariant surface u(x), which is a solution of a PDE will be a union of these invarian curves in the neighborhood of the point \(a=0\). The characteristics equations are:

Equation (37.33) holds for exactly \(m+n-1\) functionally independent first integrals, invariants of a one-parameter group G, called basis of invariants

where \(i = 1, \ldots m+n-1\) and \(c_{i}\) are constants. But there are other invariant functions which are given by the general solution

for an arbitrary function \(\varLambda \).

Let us now define and present theorems for the invariant points and invariant functions for prolonged groups.

Definition 37.5

A differential function \(F(x,u,\ldots ,u_{p}), \,\,\, p\ge 0\), is a pth-order differential invariant of a group G if

i.e., if F is an invariant under the prolonged group \(G^{[p]}\), for \(p = 0, \,\,\, u_{0} \equiv u\) and \(G^{[0]} \equiv G\).

Theorem 37.4

A differential function \(F(x,u,\ldots ,u_{(p)}), \,\,\, p\ge 0\), is a pth-order differential invariant of a group G if,

\(X^{[p]}\) is the pth prolongation of X and for \(p = 0, \,\,\, X^{[0]} = X\).

Similarly, we will write down the characteristic system corresponding to the linear PDE on Theorem 37.5 and solve it for the differential invariants. To compute the symmetries of the system (37.12), we start by applying (37.17) in (37.28) i.e.,

For the invariant of (37.12) as can be seen in (37.34) we require that

whenever (37.12) is satisfied. The converse also applies.

Theorem 37.5

Equation (37.35) define all infinitesimal symmetries of the system (37.12).

Equation (37.35) are called the determining equations of (37.12). They are compactly written as

where \(\mid _{(37.12)}\) means that the equation is evaluated on the surface (37.12). Generally the transformations \(\varGamma _{a}\) generated by the Lie equations (37.12) are a result of a composition of r one-parameter groups, as we can see in the following theorem.

Theorem 37.6

Let \(\mathcal {L}_{r}\) be an r-dimensional vector space of operators

The product \(\varGamma _{a} = \varGamma _{a_{r}}\cdots \varGamma _{a_{1}}\) of r one-parameter groups of transformations \(\varGamma _{a_{l}}\) generated by each \(X_{l}\) via the Lie equations

subject to the initial conditions

is a local r-parameter group \(G_{r}\) if and only if \(\mathcal {L}_{r}\) is a Lie algebra.

If we consider that a multi-parameter group is a composition of a various one-parameter groups, its invariants can be defined as Definition 37.4. Thus, a function F(x, u) is an invariant of an r-parameter group \(G_{r}\) with generators

if and only if

37.2.3 Group Classification

The treatment given to the equations without arbitrary elements is different from the one given to the equations with arbitrary elements. If the equation or system does not contain arbitrary elements, the Lie group analysis will be merely to calculate its full group (the full Lie algebra of operators) and, if the equation or the system contains parameters, we have to realize a group classification relative to these parameters. Consider the class of generalized (\(1+2\)) dimensional equations of form (37.9).

The principal idea of group classification is, once we have calculated the determining equation, we realize that some of them depend on arbitrary elements. By solving it for arbitrary elements, we find the principal Lie algebra of the equation. The principal Lie group of the PDE, is the group admitted by all equation of the these form. But, some elements of the group, can admit extension of the principal or full Lie group. We find this extension by considering particular values of the arbitrary elements and we extend the kernel of the full Lie algebra. Then we solve this equations with respect to the arbitrary elements and we find the additional condition for infinitesimal transformation. By substitution of this conditions into the determining equation we generate the general structure of the classification equation which is responsible for the group classification of the equation or system. The values of the arbitrary elements that can extend the full Lie algebra must be the solution of the general structure(see, [23]). For further explanation about Lie group classification of PDE we refer for example to [16, 19] or [15].

37.3 The PDE of Ornstein-Uhlenbeck Process

In this section we apply the Lie symmetry method described in Sect. 37.2, to the PDE of Ornstein-Uhlenbeck process. With help of the computer subprogram of Wolfram Mathematica, SYMLie, we make a group classification of this PDE and we use its infinitesimal to find some invariant solutions and to construct its one dimensional optimal system.

37.3.1 The Basic Equation

We consider a PDE (37.9), the equation derived from the prices of rainfall derivatives, when the rainfall follow the Ornstein-Uhlenbeck Process. We consider the function

and

where \(X_{ref}\) is the reference level (the base from which the excess or deficit of rainfall is determined). Differentiating \(\theta (t)\) we will get

In order to reduce the complexity of the computation we consider the following basic mathematic transformations,

for \(\theta (t)\) and \(\theta '(t)\), the Eq. (37.9) can take the following form

t, x, y are independent variables, V is dependent variable, \(r,x_{ref},w_1,w_2,w_3, k, \sigma \) are parameters and \(w_1,w_2,w_3\) are defined by the following system of equation,

37.3.2 Infinitesimal Operators and Group Classification

We construct now the prolonged generator,

for

and we find solutions of the determined equation (the infinitesimals). This solution can be explicitly determined by hand calculation, but it requires a lot of computations that can be avoided if one use Wolfram Mathematica, SYMLie, [7]. For more details in the hand calculation, please see [23].

Generally the system of over-determined equations can contain many equations. In our case we obtained more than hundred equations. Since the determining equation are linear homogeneous PDEs of order two for the unknown functions \(\xi ^{i}\) and \(\eta \), we generate an over-determined system of algebraic equation with \(n+m = 3 + 1 = 4\) unknowns functions. By solving the over-determined system we obtain the unknowns function \(\xi ^{i}\), \(\eta \) and consequently \(\zeta _{i}\) and \(\zeta _{ij}\). The values of functions \(\xi ^{i}\) and \(\eta \), depends on different values of the parameter k and \(\sigma \). For \(a\ne 0 \wedge k (36 k^2+\pi ^2) \ne 0\) we will have:

where \(c_1,c_2,c_3,c_4,c_5,c_6,c_7\) are constants and \(\omega (x,y,t)\) satisfies (37.38). The infinitesimal generators are obtained by representing the general solutions of the determining equations as linear combinations of independent solutions defined by the constants, i.e., the number of independents solutions will depend on the number of the constants in the general solution.

The principal Lie algebra \(\mathcal {L}_p\), i.e., the Lie algebra of operators admitted by the linear PDE (37.38) containing arbitrary elements is spanned by the generators

where the function \(\omega (t,x,y)\) satisfies Eq. (37.38).

37.3.3 Extension of Principal Lie Algebra

For particular choices of the arbitrary elements, we found the possible extensions for non-degenerate PDE (37.38), satisfying the following conditions:

-

1.

\(\sigma \ne 0\) and \( (36k^2 + \pi ^2) = 0 \) (two cases, \(k = \pm i\frac{\pi }{6}\)): the principal Lie algebra \(\mathcal {L}_p\) admits extension only by one operator.

-

2.

\(\sigma \ne 0\) and \( k(36k^2 + \pi ^2)\ne 0 \): the principal Lie algebra \(\mathcal {L}_p\) admits extension by four operators.

$$\begin{aligned} \nonumber X_3= & {} - \frac{e^{kt} \partial _x}{k}+\frac{e^{k t} \partial _y}{k^2},\\ \nonumber X_4= & {} \frac{k}{\sigma ^2 \pi }\left( - k s\pi t - \pi w_3 t + \pi x + k \pi y + 6 w_2 \cos \frac{\pi t}{6} - 6 w_1 \sin \frac{\pi t}{6} \right) V\partial _V + \\ \nonumber&-\,\partial _x + t \partial _y, \end{aligned}$$$$\begin{aligned} \nonumber X_5= & {} \partial _t + \frac{\pi }{36 k^2+\pi ^2} \left[ (\pi w_1 - 6 k w_2) \cos \frac{\pi t}{6} + (\pi w_2 + 6 k w_1) \sin \frac{\pi t}{6} \right] \partial _x + \\ \nonumber&+\,\frac{1}{36 k^2+\pi ^2}\left[ (6 \pi w_2 + 36 k w_1) \cos \frac{\pi t}{6} + (36 k w_2 - 6 \pi w_1)\sin \frac{\pi t}{6} \right] \partial _y,\\ \nonumber X_6= & {} \frac{72ke^{k t}}{\sigma ^2 (36 k^2+\pi ^2)} \left( -w_3 - \frac{\pi ^2 w_3}{36k^2} - k x - \frac{\pi ^2 x}{36k} + w_1\cos \frac{\pi t}{6}\right) V\partial _V + \\ \nonumber&+\,\frac{72k e^{k t}}{\sigma ^2 (36 k^2+\pi ^2)}\left[ \frac{-\pi w_2}{6k} \cos \frac{\pi t}{6} + (\frac{\pi w_1}{6k} - w_2 ) \sin \frac{\pi t}{6}\right] V \partial _V +\\ \nonumber&+\,\frac{e^{-k t} }{k}\partial _x + \frac{e^{-k t} }{k^2}\partial _y. \end{aligned}$$ -

3.

\(\sigma \ne 0\) and \(k=0\): the principal Lie algebra \(\mathcal {L}_p\) admits extension by 6 operators.

$$\begin{aligned} \nonumber X_3= & {} -\partial _x + t \partial _y,\\ \nonumber X_4= & {} \partial _t + \left( w_1 \cos \frac{\pi t}{6} + w_2 \sin \frac{\pi t}{6} \right) \partial _x + \left( \frac{6 w_2 \cos \frac{\pi t}{6}}{\pi }-\frac{6 w_1 \sin \frac{\pi t}{6}}{\pi } \right) \partial _y,\\ \nonumber X_5= & {} \frac{2}{\sigma ^2 \pi } \left( \pi w_3t - \pi x - 6 w_2 \cos \frac{\pi t}{6} + 6 w_1 \sin \frac{\pi t}{6} \right) V \partial _V - 2 t \partial _x + t^2 \partial _y,\\ \nonumber X_6= & {} \frac{3}{\sigma ^2}\left[ 2st + w_3 t^2 - 2 t x - 2 y + \frac{12(6w_1 - w_2 t )}{\pi }\cos \frac{\pi t}{6}\right] V\partial _V + \\ \nonumber&+\,\frac{36}{\sigma ^2}(\pi w_1 t + 6 w_2 )\sin \frac{\pi t}{6}V\partial _V - 3 t^2 \partial _x + t^3 \partial _y,\\ \nonumber X_7= & {} 2 t \partial _t + \left[ 2 r t + \frac{ w_3}{a^2 \pi }\left( \pi w_3 t - \pi x - 6w_2 \cos \frac{\pi t}{6} + 6w_1\sin \frac{\pi t}{6}\right) \right] V \partial _V + \\ \nonumber&+\,\left[ -s + x + \left( 2 t w_1 + \frac{6 w_2}{\pi }\right) \cos \frac{\pi t}{6} - \left( \frac{6 w_1}{\pi } - 2 t w_2\right) \sin \frac{\pi t}{6} \right] \partial _x + \\ \nonumber&+\,\left[ 3 y - \left( \frac{108 w_1}{\pi ^2}-\frac{12 w_2 t}{\pi }\right) \cos \frac{\pi t}{6} - \left( \frac{12 t w_1}{\pi } + \frac{108 w_2}{\pi ^2}\right) \sin \frac{\pi t}{6} \right] \partial _y,\\ \nonumber X_8= & {} 2 t^2 \partial _t + 4 \left( -t + \frac{r t^2}{2} + \frac{s w_3 t}{2\sigma ^2} + \frac{w_3^2 t^2}{4\sigma ^2} - \frac{2s x}{\sigma ^2} - \frac{w_3 x t}{2\sigma ^2} + \frac{x^2}{\sigma ^2} + \frac{3w_3 y}{2\sigma ^2}\right) V\partial _V \\ \nonumber&+\,\frac{48w_3}{\sigma ^2} \left[ - \left( \frac{s w_2}{\pi w_3} + \frac{9 w_1}{2\pi ^2} + \frac{w_2 t}{4\pi } - \frac{w_2 x}{\pi w_3}\right) \cos \frac{\pi t}{6} - \frac{3( w_1^2 - w_2^2)}{2\pi ^2 w_3} \cos \frac{\pi t}{3}\right] V\partial _V \\ \nonumber&+\,\frac{24}{\sigma ^2} \left[ \left( \frac{2 s w_1}{\pi } + \frac{w_1 w_3 t}{2\pi } - \frac{9 w_2 w_3}{\pi ^2} - \frac{2 w_1 x }{\pi }\right) \sin \frac{\pi t}{6} - \frac{6 w_1 w_2}{\pi ^2} \sin \frac{\pi t}{3} \right] V \partial _V + \\ \nonumber&+\,\left[ -2 s t+2 t x-6 y + \left( \frac{216 w_1}{\pi ^2} + 2 t^2 w_1 + \frac{12 t w_2 }{\pi }\right) \cos \frac{\pi t}{6}\right] \partial _x + \\ \nonumber&-\,\left( \frac{12 t w_1}{\pi } - \frac{216 w_2 }{\pi ^2} - 2 t^2 w_2 \right) \sin \frac{\pi t}{6} \partial _x + \\ \nonumber&+\,6t \left[ y - \left( \frac{36 w_1}{\pi ^2}+\frac{2t w_2 }{\pi }\right) \cos \frac{\pi t}{6} - \left( \frac{2 t w_1}{\pi }+\frac{36 w_2 }{\pi ^2}\right) \sin \frac{\pi t}{6} \right] \partial _y, \end{aligned}$$

We can see that the Eq. (37.38) admits a maximum extension by six operators. Then, the Eq. (37.38) cannot be transformed, for any choice of its coefficients into heat equation,

since we know that the heat equation can only be extended by seven additional operators, see [10, 15].

37.3.4 Invariant Solutions

As a result of the group classification we realized that one can not reduce the PDE (37.38) to the heat equation. But we can use the Lie analysis to find the invariant (exact) solution of the Eq. (37.38). The invariant solutions are those solutions that transform into themselves under a particular group of symmetries. If Eq. (37.12) admits a Lie algebra \(\mathcal {L}_r\) of dimension \(r>1\) we could consider invariants solutions based on many (infinite) number of subalgebra of \(\mathcal {L}_r\). We consider only the symmetries generated in the case where

i.e., the volatility and the mean reverting factor are non zero. The first six symmetries generate the finite dimensional Lie algebra \(\mathcal {L}\), allow us to construct a commutator Table 37.1, where the commutator of two symmetries \(X_i\) and \(X_j\) is given by,

From the commutator Table 37.1 we see that the set of operators (or Lie point symmetry generators) \(X_1,X_2,X_3,X_4,X_5,X_6\) is anti-symmetric and closed under the product \([\cdot ,\cdot ]\). Since the commutator is bilinear and satisfy the Jacobi identity we can confirm that the set of these symmetries form the infinite dimensional Lie algebra of the PDE (37.38). The infinite dimension of the Lie algebra explain the fact that the PDE has infinitely many linearly independents solutions. The PDE (37.38) belong to a wide class of (\(1+2\)) evolutionary equation. To construct their invariant solution, we have to use two dimensional Lie subalgebra in order to use the two linearly independent invariants to reduce to an ordinary differential equation. We will apply the algorithm presented by Gazizov and Ibragimov in [10], following the steps:

-

1.

First we choose a set of n operators that are admitted by the equation which form an subalgebra (for example \(X_1\) and \(X_2\)). This algebra has n functionally independents invariants (for to the case of \(n= 2\), \(I_1\) and \(I_2\)) and their rank is n.

-

2.

We determine the invariants by the system of n differential equations

$$\begin{aligned} X_1I = 0,\ \,\,\, X_2I = 0,\,\,\, \cdots , \,\,\, X_nI = 0. \end{aligned}$$The invariants solution exists if \(rank(\partial _VI_1,\ldots ,\partial _VI_n) = 1\).

-

3.

We find the invariant solution in the form

$$\begin{aligned} I_n = \phi (I_1,\ldots , I_{(n-1)}). \end{aligned}$$(37.44)

By substituting the solution (37.44) into (37.38), we get a differential equation for the function \(\phi \). Considering in the case \(k\ne 0\) and \(\sigma \ne 0\), the subalgebra spanned by \(X_2, X_3\) i.e \(<X_2,X_3>\), the independent invariant solutions of these subalgebra are, \(I_1 = t\) and \(I_2 = kxe^{kt} - \ln V\). The invariant solution of (37.38) take the form,

where \(\phi (t)\) is determined by the following ordinary differential equation

This equation can be integrated by the standard methods and \(\phi \) is given by

37.3.4.1 Invariant Solutions Compatible with the Terminal Conditions

In financial application, the only relevant invariant solutions are those that are compatible with the terminal conditions. Among all symmetries, we will seek for those which satisfies the system of equation and terminal condition and we use them to find the invariant solutions. By substituting the invariant solutions into the Eq. (37.38), we find the solution consistent with the terminal condition by solving the resulting ordinary differential equation. We recall the terminal condition (37.10), and we transform it in a double conditions:

The general Lie point symmetry for maximal finite Lie algebra of the Eq. (37.38) (case: \(\sigma \ne 0 \,\, \text {and} \,\, k(k^2 + \pi ^2)\ne 0\)) will be given by

where the constants \(a_i, \,\, i = 1, \ldots , 6\) must be determined. The application of X for each terminal condition (37.48) gives:

Solving this equations, and equating the coefficients of the same powers of the variables x we get

As a solution, we have a two parameter symmetry (\(a_3\) and \(a_6\)) which is compatible with the boundary conditions (37.10). Then we can write the symmetry as the two one-parameter point symmetries:

where C is a constant equal to the coefficient of \(a_6\) on the last equation of the system (37.51). From the invariance under \(\varLambda _1\) we get

then the invariant solution of the PDE compatible with the terminal condition is \(V = \phi (t,z)\), where the function \(\phi (t,z)\) is solution of the equation

With the symmetry \(\varLambda _1\), the PDE was reduced by one independent variable. We can find the symmetries of the reduced Eq. (37.51) and we use it to find their invariants solutions, which obviously will give the solution of the Eq. (37.38).

37.3.5 One Dimensional Optimal System of the PDE

In many situations some subalgebras are similar, i.e., they are connected each other by a transformation from the symmetry group with Lie algebra \(\mathcal {L}_r\). Their corresponding invariant solutions are also connected by the same transformation. By putting into one class all subalgebra of a given dimension n, the problem of finding invariant solutions of the Lie algebra \(\mathcal {L}_r\) can be reduced to the problem of finding an optimal system of invariant solutions. The optimal system of order n, can be a set of all invariant solutions of selected representative from each class of subalgebras of dimension n. Unfortunately, there is no an efficient method which can be used to find optimal system. Some algorithms are presented in [13, 22, 23]. Suppose we have to construct two non similar sub-groups of group G, say H and K. The invariant solution S under the subgroup H will satisfy the condition \(S = hS\) for all \(h\in H\). Since H and K are non similar sub-groups, the solutions S will be transformed to \(\bar{S}\) under the sub-group K, i.e., \(\bar{S} = k\bar{S}\), for all \(k\in K\). To find k, we look for \(g\in G\) such that \(\bar{S} = gS\). Since S is invariant under H, we can make the transformation, \(\bar{S} = g(hS) = ghS = ghg^{-1}gS = ghg^{-1}\bar{S}\), and \(k = ghg^{-1}\). K is called the adjoint subgroup of H under the symmetry group G. We construct an optimal system of one dimensional subalgebra of Eq. (37.38) and apply the direct algorithm of one-dimensional optimal system presented by Yu, Li and Chen in [13]. The general operator takes the form,

and corresponded to a vector of their coefficients

The goal is to simplify as many as possible the elements \(a_i\) being zero by application of the adjoint transformation in X. We applied the direct algorithm by following the steps:

-

1.

From the commutator Table 37.1, we take the matrix of the structure of constants \(C(j), \,\, j=1,\ldots , 6\), i.e., each column determine one matrix;

-

2.

We determine all the vectors rows \((a_1, a_2, a_3, a_4, a_5,a_6)C(j), \,\, j=1,\ldots , 6\);

-

3.

The \(R - rank(K(a))\) functionally independents invariants I(a) are found by solving the linear system \(aC(j)\nabla I(a) = 0\), K(a) is the \(R\times R\) matrix whose jth row is \(aC(j), \,\, j=1,\ldots , R\) (also called Killing matrix in [23] from which the invariant is determined as a trace of \(K^2(a)\)).

-

4.

We determine the adjoint matrix

$$\begin{aligned} A(j,\varepsilon ) = \exp ^{(\varepsilon C(j))} = \varSigma _{0}^{\infty } C(j)^n\frac{\varepsilon ^n}{n!}, \,\, j=1,\ldots 6 \end{aligned}$$from the adjoint representation Table 37.2. Each row correspond to one matrix \(A(j,\varepsilon )\), by using each position to fill its rows;

-

5.

We construct the general adjoint transformation matrix \(A = \prod _{j=1}^{6}A(j,\varepsilon _j)\) and we use to simplify a, concentrate on those \(a_i\) associated with the invariants and considering all subcases. We select the simplest representative \(\tilde{X}\) by solving the adjoint transformation \(\tilde{a} = aA\) or \(a = \tilde{a}A\). X must be equivalent to \(\tilde{X}\) under the adjoint action, if the system has solution.

The following adjoint representation table was constructed by using the SYM package of the software Wolfram Mathematica, see [7], for more detail.

Solving the system \(aC(j)\nabla I(a) = 0\), we found the invariants \(I_1 = a_5\) and \(I_2 = a_4\) with degree one, then one can consider the cases, \({I_1 \ne 0, I_2 \ne 0}, \,\, {I_1 = 0,} {(I \ne 0 \vee I_2 = 0)}\) and the subcases given by the new invariant \(I = a_3a_6\) found by substitute \(a_5 = 0\) in the system \(aC(j)\nabla I(a) = 0\). The algebraic details for computation and all simplifications of \(\tilde{a} = aA, \,\, j = 1,\ldots 6\) will be omitted. The one dimensional optimal subalgebra for the Eq. (37.38) is,

Using the subalgebra \(X_3 + aX_1\), we get the following invariants for the generator,

and the invariant solution for the (37.38) is \(V =\phi (t,z)\). The substitution of V into (37.38) yields to the reduced equation by one independent variable

then, \(\phi (t,z)\) is a solution of the reduced Eq. (37.53).

37.4 Conclusion

We applied Lie analysis of the partial differential equations with three independent variables, Eq. (37.9). The PDE was derived by applying the Fayman-Kac theorem on the problem of pricing weather derivatives when the rainfall process follow the Ornstein-Uhlenbeck process with constant volatility.

By the group classification we have shown that the Lie algebra of the PDE (37.9) depends on the parameters k and \(\sigma \). The principal Lie algebra admits the symmetries \(\partial _y\), \(u\partial _u\) and \(w(x,y,t)\partial _u\), where w(x, y, t) is an solution of the Eq. (37.9). The PDE admits the maximal extension by 6 symmetries for \(\sigma \ne 0 \, \wedge \, k = 0\), extension by 4 symmetries for \(\sigma \ne 0, \, \wedge \, k(k^2 + \pi ^2) \ne 0\) and by 1 operators for \(\sigma \ne 0, \, \wedge \, (k^2 + \pi ^2) = 0 \).

We realized that the PDE can not be reduced to heat equations for any values of parameters, since it admits the extension by seven symmetries. We have used some subalgebra to find some solutions of the Eq. (37.9), although the solution is not compatible with our boundary conditions. By determining the symmetries which are compatible with our boundary conditions, we found a subalgebra with only two symmetries. We used one of them and we reduced the Eq. (37.9) by one independent variable. Further, we determined the one dimensional optimal system of the algebra admitted by the PDE (37.9) through algorithm suggested by Yu, Li and Chen in [13]. The optimal system allows to dived the set of all invariant solutions of the PDE into equivalent classes. The solutions which can be mapped to the other solution by a point symmetry of the PDE, are equivalent and belong to the same class. Once we have constructed a optimal system, we need only to find one invariant solution from each class, and the whole class can be constructed by applying the symmetries.

References

Alaton, P., Djehiche, B., Stillberger, D.: On modelling and pricing weather derivatives. Appl. Math. Financ. 9, 1–20 (2002)

Balter, A., Pelsser, A.: Pricing and Hedging in Incomplete Markets with Model Uncertainty. Netspar discussion paper (2018)

Brix, A., Jewson, S., Ziehmann, C.: Weather derivative modelling and valuation: a statistical perspective. In: Risk Books (ed.) Climate Risk and the Weather Market, London, 127–150 (2002)

Broni-Mensah, E.: Numerical Solutions of Weather Derivatives and Other Incomplete Market Problems. The University of Manchester, United Kingdom (2012)

Cao, M., Wei, J.: Weather derivatives valuation and market price of weather risk. J. Futur. Mark. Futur. Options Other Deriv. Prod. 24, 1065–1089 (2004)

Craddock, M., Grasselli, M.: Lie Symmetry Methods for Local Volatility Models. Working paper, Quantitative Finance Research Centre, France (2016)

Dimas, S., Tsoubelis, D.: SYM: a new symmetry-finding package for Mathematica. In: Proceedings of the 10th International Conference in Modern Group Analysis, 64–70 (2004)

Dischel, R.S., Barrieu, P.: Financial Weather Contracts and Their Application in Risk Management. Risk Books (2002)

Emmerich, C.V., Günther, M., Nelles, M.: Modelling and simulation of rain derivatives. MS thesis, University of Wuppertal, Wuppertal, Germany (2005)

Gazizov, R.K., Ibragimov, N.H.: Lie symmetry analysis of differential equations in finance. Nonlinear Dyn. 17, 387–407 (1998)

Geyser, J.M.: Weather derivatives: concept and application for their use in South Africa. Agrekon 43, 444–464 (2004)

Hamisultane, H.: Which method for pricing weather derivatives? HAL, archives-ouvertes.fr. (2008)

Hu, X., Li, Y., Chen, Y.: A direct algorithm of one-dimensional optimal system for the group invariant solutions. J. Math. Phys. 56, 053504 (2015)

Hydon, P.E.: Symmetry Methods for Differential Equations: A Beginner’s Guide, vol. 22. Cambridge University Press (2000)

Ibragimov, N.H.: Handbook of Lie Group Analysis of Differential Equations, vol. 3. CRC Press (1995)

Ibragimov, N.H.: Lie Group Analysis of Differential Equations. CRC, II and III Boca Raton, FL (1994)

Kermiche, L., Vuillermet, N.: Weather derivatives structuring and pricing: a sustainable agricultural approach in Africa. Appl. Econ. 48, 165–177 (2016)

Li, P.: Pricing weather derivatives with partial differential equations of the Ornstein-Uhlenbeck process. Comput. Math. Appl. 75, 1044–1059 (2018)

Lie, S.: On integration of a class of linear partial differential equations by means of definite integrals. In: Ibragimov, N.H. (eds.) Handbook of Lie Group Analysis of Differential Equations, 473–508. CRC Press (1995)

Lo, C.F., Hui, C.H.: Valuation of financial derivatives with time-dependent parameters: Lie-algebraic approach. Quant. Financ. 1, 73–78 (2001)

Odening, M., Musshoff, O., Xu, W.: Analysis of rainfall derivatives using daily precipitation models: Opportunities and pitfalls. Agric. Financ. Rev. 67, 135–156 (2007)

Olver, P.J.: Applications of Lie Groups to Differential Equations, vol. 107. Springer Science & Business Media (2012)

Ovsiannikov, L.V.: Group Analysis of Differential Equations. Academic Press, New York (1982)

Paliathanasis, A., Krishnakumar, K., Tamizhmani, K.M., Leach, P.G.L.: Lie symmetry analysis of the Black-Scholes-Merton Model for European options with stochastic volatility. Mathematics 4, 28 (2016)

Pirrong, C., Jermakyan, M.: The Price of Power: The Valuation of Power and Weather Derivatives. Working paper, Oklahoma State University (2001)

Pirrong, C., Jermakyan, M.: The price of power: the valuation of power and weather derivatives. J. Bank. Financ. 32, 2520–2529 (2008)

Stoppa, A., Hess, U.: Design and use of weather derivatives in agricultural policies: the case of rainfall index insurance in Morocco. In: International “Agricultural Policy Reform and the WTO: Where are we Heading”, Capri-Italy (2003)

Tang, W., Chang, S.: A Semi-Lagrangian method for the weather options of mean-reverting Brownian motion with jump-diffusion. Comput. Math. Appl. 71, 1045–1058 (2016)

Unami, K., Abagale, F.K., Yangyuoru, M., Alam, A.H.M.B., Kranjac-Berisavljevic, G.: A stochastic differential equation model for assessing drought and flood risks. Stoch. Environ. Res. Risk Assess. 24, 725–733 (2010)

Zeng, L.: Pricing weather derivatives. J. Risk Financ. 1, 72–78 (2000)

Acknowledgements

This work was partially supported by Swedish SIDA Foundation International Science Program. Clarinda Nhangumbe thanks the Eduardo Mondlane University, Faculty of Sciences, Departmento of Mathematics and Informatics; also thanks the Department of Mathematic and Applied Mathematics, Faculty of Science, University of Cape Town for creating excellent research and educational environment.

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2020 Springer Nature Switzerland AG

About this paper

Cite this paper

Nhangumbe, C., Fredericks, E., Canhanga, B. (2020). Lie Symmetry Analysis on Pricing Weather Derivatives by Partial Differential Equations. In: Silvestrov, S., Malyarenko, A., Rančić, M. (eds) Algebraic Structures and Applications. SPAS 2017. Springer Proceedings in Mathematics & Statistics, vol 317. Springer, Cham. https://doi.org/10.1007/978-3-030-41850-2_37

Download citation

DOI: https://doi.org/10.1007/978-3-030-41850-2_37

Published:

Publisher Name: Springer, Cham

Print ISBN: 978-3-030-41849-6

Online ISBN: 978-3-030-41850-2

eBook Packages: Mathematics and StatisticsMathematics and Statistics (R0)