Abstract

Among the vast number of regional growth forecasting models, the past 15 years witnessed the emergence of the MAcroeconomic, Sectoral, Social, Territorial (MASST) model. The MASST model aims at merging macroeconomic elements with territorial features for forecasting regional growth trajectories. In fact, the model was created with the aim to overcome the dichotomous approaches interpreting regional growth either as a bottom-up process without macroeconomic elements, or a top-down one, whereby national growth rates are reassigned to regions according to their weights, neglecting any role that regional propulsive forces may have. The model has now reached its fourth generation. The aim of this chapter is first to present a discussion of the theoretical framework where the MASST model was first conceived, and then to highlight the advances of the model. Each new version was inspired by crucial events that influenced the structural relationships estimated in the model. The paper concludes highlighting the model’s predictive power for assessing possible future growth patterns of European regions, and hinting at possible research directions for the next generation of the model.

Access provided by Autonomous University of Puebla. Download chapter PDF

Similar content being viewed by others

Keywords

JEL Classification Codes

1 Introduction

The need for anticipatory and far-seeing strategies on economic dynamics has always induced economists to look for reliable methodologies with which to produce insights on what the future will look like. With this aim, several regional forecasting growth models have been created. Among these models, the MAcroeconomic, Sectoral, Social, Territorial (MASST) model is among the longest-standing in present-day regional economics.

The MASST model was conceived with the aim to fill a gap in the existing literature on forecasting regional growth models. In fact, the landscape of available toolboxes was made up of two classes of models. On the one hand, some forecasting regional growth models were based on a distributional logic whereby national growth rates simulated or forecasted in macro models were reassigned to regions constituting the countries modelled using regional GDP and employment shares as weights. In more sophisticated versions, this redistribution could take place by means of input-output linkages. On the other hand, other forecasting regional growth models focused on the purely regional component, relatively ignoring the important consequences that macro shocks could exert on regional growth rates.

MASST was conceived as a way to overcome this dichotomy and interpret regional growth as both a top-down and bottom-up process. This implied, from a theoretical perspective, a marriage between two opposing views on regional growth; a bottom-up/top-down regional growth view, on the one hand, and a demand-side/supply-side view, on the other hand. In other words, it had the aim to create a new model whereby national and regional growth would have to feed back to one another, thus truly striking a balance between the two theoretical approaches.

The MASST model has now reached its fourth generation and provides a valuable toolbox for assessing possible future growth patterns of European regions within complex scenario frameworks. This paper presents the original structure of the model, and a critical overview of the evolution of the MASST model, highlighting the reasons that led to four generations for this toolbox. Each new version, in fact, superseded the previous one by answering the need to interpret specific stylized facts taking place in Europe. The main goal of each version is to update the model with a more comprehensive structure of interrelated equations, capable of modeling new causal changes emerging from new stylized facts, so as to guide policy makers in replying the most urgent European debates emerging over time.

When the model first appeared, a clear gap existed in the forecasting tools, that is, the lack of models able to integrate the regional and national components driving regional growth, and this happened despite stylized facts suggesting the paramount importance of both regional and national aspects. For instance, in 2015, the first year with full availability of data for all EU28 Countries, Luxembourg produced per capita roughly 5.6 times as much as Bulgaria, the most and least productive Country in the EU, respectively.Footnote 1 These differences were reflected in econometric exercises in which the national effects explained at least around 50% of the regional growth variance, suggesting that regional growth is first of all the result of a national trend. At the same time, also regional differentials should be explained in front of data suggesting that the average inhabitant of the most productive region in Europe (Inner London) produced 21.2 times more than its peer in the Bulgarian region of Severozapaden, and that also within the same Country, regional disparities could be quite staggering: London itself produced ten times as much as the least productive region in the UK (southern Scotland).

The first version of the MASST model provided an original and comprehensive toolbox to interpret regional growth as the result of both national dynamics and local competitiveness. The subsequent advances of the model were mainly driven by the reinforcement of interpretative elements that were left in the shades in this first version of the model and that instead became fundamental in specific periods of time for modelling urgent policy issues (e.g. the debate on the need for reindustrialization of the European Union, and the role of large versus small-medium-sized cities in European growth) and the new events that were destined to change the cause–effect relationships in an economic system (e.g. the economic crisis, and Brexit). As an example, the industrial dimension was reinforced when the debate on the need for the reindustrialization of Europe started. Instead, on the national side, the need to endogenize the dynamics of public expenditure and the mechanisms of its funding became evident with the appearance of the 2007–2008 crisis provoking spatially heterogeneous impacts. For instance, 2008–2017 per capita GDP growth grew on average by 8% in the region of southern Ireland, but decreased by 3.35% in the Greek region of Voreio Aigaio. These differences appear quite robust and stable over the medium term and are difficult to reconcile with (in particular spatial) general equilibrium models that work under several assumptions of equilibrium clearance of all markets and of perfect information on relative prices.

This chapter explains in depth the stages of the evolution of the MASST model, and its functioning. In Sect. 3.2, the theoretical framework within which the MASST model was first conceived is presented. Next, Sects. 3.3, 3.4, 3.5 and 3.6 present the advances of the model for each of the major steps it developed through. The chapter concludes in Sect. 3.7, hinting at possible research directions for the next generation of the MASST model.

2 Regional Growth Theories: The Scientific Debate and the Positioning of the MASST Model

Over the past century, forecasting regional growth models have always remained on top of the agenda in applied regional economics research. Different forecasting modelsFootnote 2 embrace different regional growth theories, and reflect the evolution of the economic thinking and the debate that came with it.

Two main debates in the way in which regional growth is foreseen influenced the creation of regional growth forecasting models. The first debate relates to whether regional growth is to be seen as a bottom-up or a top-down process. The second debate pertains instead to the dichotomy between supply-side and demand-side approaches to regional growth.

The debate whether growth is a bottom-up or a top-down process is a long-standing dispute in regional science. This dichotomy translates into two opposing fields (Richardson 1969): advocates of top-down approaches believe that regional growth is the result of a national growth that is, ex post, allocated among regions according to their participation in the national economy. This way of reasoning translates into focusing on national factors of growth, allocating to regions a national growth on the basis of their weight in the national economy (Stevens and Moore 1980). Supporters of bottom-up approaches hold instead that regional economic performance is mostly a matter of local economic factors, in a process of spatial competition for resources eventually causing the most efficient areas to excel, and, thus, grow faster than other regions and the nation itself (Stöhr and Taylor 1980). In this view, national growth is the result of the weighted sum of the growth of single regions belonging to the nation.

This dichotomy translates into a major bifurcation in the way regional growth is interpreted. In the first case, the explanation lies exclusively in the national dynamics, in that regional economic performance is mostly due to the pull effect exerted by the Country and by rest of the world, leaving exogenous factors explaining regional growth. In the second case, the other extreme circumstance takes place, and national growth plays no role in interpreting regional dynamics, for local endogenous factors represent the sources of regional competitiveness. In this sense, it is clear that a more balanced approach is needed, so as to accommodate both national and regional elements in regional growth modelling.

A second fundamental dichotomy in the way regional growth models interpret and explain growth patterns is due to the focus on the supply-side or the demand-side as the main driver of regional economic performance. Advocates of bottom-up approaches believe regional growth is mostly due to the presence in a region of growth-enhancing factors, what in the literature has been termed territorial capital, a term defining all tangible and intangible endogenous assets, of public and private nature, that constitute the development potentials of an area (Camagni 2009). On the contrary, supporters of demand-side approaches believe that regional economic performance is mostly due to external demand factors that, through consumption multiplier effects on local income, drive regional economic performance (for a debate, see Capello 2015).

Models of regional growth based on external demand are built upon a Keynesian approach to economic theory. The classical textbook example is the economic base model (North 1955), whereby external demand triggers regional economic performance through a local multiplier effect. Another celebrated class of demand-driven models includes the Myrdal-Kaldor-Dixon-Thirlwall model, where a cumulative demand–supply causal effect of growth is explained, leading to divergent regional trends (Myrdal 1957; Kaldor 1970; Dixon and Thirlwall 1975).Footnote 3

Both theoretical debates translate into different approaches to modelling regional growth for forecasting purposes, in which the two dichotomies are intertwined. When a demand-side theoretical approach is embraced, forecasting regional growth models are produced, which portray regional economic dynamics as the result of positive external demand shocks, and therefore as the counterpart of macro systems’ growth.Footnote 4 When a supply-side, bottom-up theoretical approach is instead embraced, regional growth forecasting models are built in which regional economic dynamics is obtained as the result of endogenous forces, and the national growth is obtained as the weighted sum of regional growth.Footnote 5

Over time, an effort has been made in the economic literature on how to endogenize sources of economic growth in formalized aggregate (neoclassical) economic growth models as drivers of growth. The celebrated Solow–Swan model (Solow 1956; Swan 1956)—driven by exogenously determined capital accumulation rates and technological levels—has in fact been extended to accommodate the role of endogenous growth drivers such as human capital accumulation (Romer 1986), entrepreneurship (Aghion and Howitt 1992), learning by doing (Young 1993), and technological progress of nearby regions through spillovers effects (Ertur and Koch 2007).Footnote 6 This last extension allowed conceptualizing regions not as isolated islands, but as parts of larger economic systems, whose single constituents influence one another. The main channel of inter-regional interdependence was at first highlighted in the geographical proximity among regions; in later elaborations, inter-linkages were expected to occur also through non-geographical proximities, like cognitive, social and sectoral proximities, through channels such as reverse engineering or commuting (Boschma 2005; Caragliu 2015).

Although these theories made an advancement by identifying endogenous forces and interdependence in regional growth models, they did not adopt a solid territorial approach to regional growth. In the endogenous growth theory, the laws for a cumulative local growth are definitely a-spatial, in that they work in the same way, irrespective of the type of area (region or city) where they take place.

Instead, theories able to interpret territorial capital elements in regional dynamics pertain to local endogenous development models, conceptualized already in the 1970s (Becattini 1975, 1979). These models emphasize the role of territory as an active resource for local development, through agglomeration economies explaining the static and efficiency gains of a local area, and through local context specificities explaining regional differentials with respect to a national trend. However, they do this by neglecting the formalized nature of growth theories, and by denying a role to the macroeconomic environment in which a region lies (Capello 2019).

Since its inception, the MASST model has aimed at filling these gaps. Firstly, it combines bottom-up with top-down approaches, on the one hand, and supply-side with demand-side ones, on the other hand. Secondly, it merges the insightful interpretation of the complexity of economic phenomena taking place at territorial (local) level provided by qualitative local development models with the rigour and precision of the formalized analytical macroeconomic models. In so doing, the model is able to interpret regional growth through local context specificities without neglecting the macroeconomic environment in which a region lies. The result is a tool with an unprecedented interpretative power: the MASST model.

3 Merging Macroeconomic and Territorial Drivers of Regional Growth: The MASST1 Model

The MASST model is a macroeconometric regional growth model built to simulate regional growth in the medium and the long run.Footnote 7 The acronym contains the different dimensions—Macroeconomic, Sectoral, Social and Territorial—on which the model is built. Regional growth is in fact explained by macroeconomic elements that play a prominent role in national growth trajectories, capturing the national/global demand framework which involves all regions. However, macroeconomic conditions are only part of the story, and in particular regional competitiveness, that is, the supply-side of growth, is explained by the sectoral, social and territorial aspects characterizing the region. In particular, regional competitiveness is explained by:

-

Single quantified tangible and intangible elements: different assets of territorial capital, especially those with an intangible nature, linked to the ways in which actors’ perceptions, to relational elements, and to cooperation attitudes that arise and grow due to local socio-economic specificities present in the local context explain regional competitiveness

-

Territorial complexity: the set of context specificities and synergies that characterize regional growth, like differentiated territorial patterns of innovation, regional urban structure, net agglomeration economies, urban structural dynamics are captured through specific regional equations explaining, in their turn, regional competitiveness

The model runs across two stages. In an estimation stage, structural relations between explanatory and dependent variables in various national and regional equations are estimated over a long-run time span through a set of equations included in the model. In the simulation stage, instead, estimated coefficients are employed for simulating likely future growth patterns (usually, over a 15–20 years’ horizon), and given an internally coherent sets of assumptions forming regional growth scenarios.

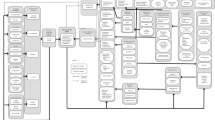

Figure 3.1 presents the structure of the model in its most updated version. Figure 3.1 also shows the evolution of the structure that took place over time, by highlighting the different sets of equations that were added at the time of the different versions of the model. The dashed shapes in Fig. 3.1 mark the first and basic structure of the model. The model merges national and regional growth-enhancing factors by explaining regional growth (∆Y r) as a decomposition between a national growth rate (∆Y N) and a regional differential shift (s) (Eq. 3.1) (Capello 2007):

Structure of the MASST4 model. (Source: Capello and Caragliu (2020), Authors’ elaboration)

The national sub-model is based on a Keynesian quasi-identity, whereby GDP growth (∆Y N) depends on the growth rates of consumption, investment, public expenditure, export and import. The national sub-model aims at capturing macroeconomic/national determinants of regional growth within a partial equilibrium setting. This part of the model captures macroeconomic (national) effects generated by exogenous trends and/or policies for regional growth; macroeconomic policies and trends in interest rates, in public expenditure, in inflation rates, in investment rates differ radically among European Countries (especially between Eastern and Western Countries, and between Northern and Southern Countries). The national growth component allows capturing individual Country effects on local growth.

The regional differential shift (s) is instead explained by regional competitiveness, measured as efficiency of local resources, increases in the quality and quantity of production factors, such as human capital and population, infrastructure endowment, energy resources, European funds, and, finally, interregional spatial linkages, capturing the growth externalities that influence a region located close to fast-growing areas.

This first generation of MASST already embeds several features of the present-day model, and is characterized by the effort to merge the separated blocks of theories discussed in Sect. 3.2. Regional growth is here interpreted as:

-

1.

A competitive bottom-up process, since supply-side aspects defining competitiveness levels are hosted in the regional sub-model.

-

2.

A territorial process, since growth depends on tangible and intangible regional assets and on agglomeration economies (Aydalot 1986; Camagni 1991). Territorial features represent in fact at the same time the propulsive forces of regional growth and the factors that explain local responses to exogenous aggregate trends.

-

3.

A spatial process, in that the model conceptualizes regional dynamics as the result also of the influence the region receives from its surroundings (other regions) via growth spillovers.

-

4.

An interactive process between regional and national growth. National macroeconomic trends generate an effect on both national and regional growth; at the same time regional elements affect both regional and national performance in an interactive national-regional manner. Complex vertical feedbacks between the regional and national economy are taken into consideration without imposing a complex system of interlinked equations.

-

5.

An endogenous process, being local, growth takes place as the effect of endogenous mechanisms and forces behind local competitiveness.

Because of this structure, the MASST model is top-down and bottom-up at the same time, through horizontal feedbacks (among regions, in the form of growth spillovers) and vertical ones (between nations and their regions, and vice versa). National shocks influence national GDP growth rates through the national GDP growth (Fig. 3.2, link I). National shocks propagate to the regional level since regional GDP growth is obtained as the sum of the national GDP growth and the regional differential GDP growth (Fig. 3.2, links II). The latter is distributed differently among regions via spillover effects and territorial dummies. Regional shocks, and regional feedbacks, propagate on regional GDP growth thanks to the shift equation: regional shocks differ among regions thanks to spillovers dummy variables and different levels of the control variables (Fig. 3.2, link III). Regional shocks propagate to the national level through the sum of the regional GDP levels which defines the annual national GDP growth (Fig. 3.2, link IV) (Capello 2015).

National-regional linkages in MASST. (Source: Capello 2015)

This structure allows to model competitiveness and cooperation among regions at the same time. Regions compete since they grow thanks to their internal characteristics. At the same time, cooperation is modelled through the presence of growth spillovers: a region grows because of the economic performance of nearby regions, and vice versa.

4 Strengthening the Role of Industrial Specialization and Intangible Elements in Regional Growth: The MASST2 Model

The MASST model mostly advances our capacity of forecasting regional growth with the substantial focus on the regional side. In its first generation, this aspect was still in its infancy; for this reason, a second generation (Capello and Fratesi 2012; Capello et al. 2011) of the model offers some relevant advances, identified with dotted shapes in Fig. 3.1.

The main improvement in this second generation lies in the extension of the industry composition of the employment equation of the model, influenced by the debate on the need of a reindustrialization process for Europe, also known as the Industrial Renaissance of the European Union (BCG 2013; Foresight 2013; European Commission 2013) to counterbalance the unbundling process (Baldwin 2016) that was taking place since many years. Within the first version of MASST, in fact, employment was modelled in one equation highlighting the determinants of employment growth taken altogether. From the second generation of the model, instead, MASST is capable of capturing the differentiated effects on the manufacturing or service industry to external shocks (Autor et al. 2013), by providing simulation outputs separately for manufacturing and service employment growth rates.

Moreover, within each of the two equations describing manufacturing and service employment growth rates, initial specialization levels of various industries within each region allow the MASST model to encompass within-industry effects (in classical regional growth models, these are labelled MIX effects). Maintaining inter-sectoral productivity elements (i.e. the DIF component in the classical shift-share analysis), the second generation of the MASST model became capable of breaking down sources of regional growth with a structure following the classical Hoover classification of localized externalities (scale, specialization, and urbanization economies, respectively; Hoover 1937).

With this major advance, a mechanism to readjust predicted employment levels in the simulation stage became needed. This mechanism has been built through the simulation of the constant term in both the manufacturing and service employment growth rates, as described in Eq. (3.2):

where E i is total employment in industry i at the European level and E EU is total employment in the EU. Equation (3.2) decomposes the increase of total manufacturing (service) employment within each region into an exogenous increase in European employment growth rates within industry i (∆E iEU), weighted by the specialization of the region in industry i and the relative importance of industry i on total EU employment. Within the classical shift-share approach, Eq. (3.2) represents the so-called MIX effect.

In the simulation stage, the addition of this important module in the MASST model allows simulating the impact of exogenous industry-specific shocks—important at the time this was introduced, even more important right now, given the increasing pervasiveness of general purpose technologies and the shift to a new technological paradigm, labeled Industry 4.0 (Autor and Dorn 2013; Acemoglu and Autor 2011; Capello et al. 2019).

In the second generation of the MASST model, another important improvement lies in an extended role played by external (to the EU) demand for goods. This is formally modelled by including the growth rates of the United States and Japan’s GDP in the exports equation within the national sub-model. In fact, even the European economy reacts to external demand shocks which enhance, or hamper, the growth rates of its national economies.

Lastly, the MASST2 model also allows regional trust, as a proxy for social capital, to play a role in determining the regional differential shift. This addition is also relevant in that it further strengthens the capacity of the model to interpret regional growth as a territorial process, one based on place-specific features characterized by imperfect mobility.

5 Between Competitiveness and Austerity: The MASST3 Model

When the MASST2 model reached maturity, a major breakthrough in world economies took place, namely the financial crisis that took off in 2008 from the United States after the closure of Lehman Brothers and rapidly extended to the rest of the world (Hausman and Johnston 2014). The financial crisis turned quickly into an economic crisis, which brought several macroeconomic factors to the center of the stage, while also showcasing structural breaks in economic relations, which could no longer be modelled on the basis of pre-crisis structures. This prompted research on a third generation of the MASST model, capable of better modelling the regional distribution of exogenous shocks at the Country level.

Among the many risk factors in the renewed financial climate emerging from one of the largest global crises after the 1929 stock crash (Bordo and Landon-Lane 2010), one major feature is the breakdown of the expectations channel on Eurozone public debts, leading to the (downward) convergence of ten-year government bonds towards German Bunds, typically considered as the risk-free benchmark.

Prior to the crisis, and since when the Euro was created in 1999, interest rates on public debts in Countries members of the Eurozone quickly converged towards the low levels until then recorded only for historically solvable countries, such as Germany. This happened mainly because of the elimination of exchange rate risk and the adoption of a common monetary policy (Ehrmann et al. 2011). The 2007–2008 crisis exposed instead some potential weaknesses in this mechanism. Markets suddenly stopped believing that the Eurozone as a whole would be solvable in case of Country-specific debt crises; consequently, the cost of servicing public debt in several EU economies rose to substantially higher levels (although for many of them, interest rates never reached pre-crisis levels). Eventually, one such Country (Greece) applied a partial (50%) haircut to its nominal public debt, in order to avoid full bankruptcy.

Consequences of this major global event are still visible more than ten years after the inception of the crisis. Several EU economies still register levels of debt substantially higher than pre-crisis levels, while others have not yet recovered pre-crisis per capita GDP levels. While the role of territorial features in explaining the geographical breakdown of crisis effect cannot be ignored (Capello et al. 2015), the MASST model needed a major restructuring in order to strengthen the national sub-component and enhance the model’s interpretative and simulation power when dealing with macroeconomic shocks.

This main goal was pursued with MASST3 (Capello et al. 2017). In its third generation, the MASST model has been enhanced with two major improvements, namely the inclusion of the estimates for the period of crisis, and the endogenization of public expenditure in the national sub-model (Fig. 3.1, long dashed shapes).

In order to model the crisis, MASST3 was re-estimated to cover two time periods, the pre-crisis and the crisis ones. In the new estimates, a dummy variable for the crisis period was added and interacted with other independent variables, so as to capture differences in the relationships among economic variables in ordinary or crisis periods. In addition, the simulation procedure was modified to allow modellers to choose the pre-crisis or crisis coefficients, according to assumptions on the length of the crisis formulated in each scenario.

The endogenization of public expenditure is summarized in Fig. 3.3. As Fig. 3.3 illustrates, public budget (net deficit or debt) has on purpose not been fully endogenized in the model. This structure allows the modeller to hold control of fundamental public policy instruments. This in particular applies to macroeconomic variables such as national tax rates, EU targets in national public deficits, and interests on public bonds; however, the effects of these exogenously determined levers on public expenditure and national GDP are in MASST3 fully endogenous to the model.

Logic of the endogenization of public expenditure in MASST3. (Source: Capello et al. 2017)

The dual (bottom-up and top-down) nature of MASST allows breaking down of the potential effects of exogenous shocks to the macro component of the model into simulated regional impacts, through the regional differential shift linkage between the macro and regional sub-models.

Despite the paramount importance of this additional component of the model, MASST3 also presents advances with respect to prior generations of the model along several regional dimensions. In particular, on the regional side, the model was strengthened in order to take into account the territorial complexity that characterizes local economic patterns, by highlighting the set of context specificities and synergies that characterize regional growth.

In this vein, the model attributes a distinctive role to context conditions that give rise to different innovation growth patterns (Capello and Lenzi 2013a, b). The idea behind this approach is to spatially break down the possible variants of the knowledge/invention/innovation/development logical path, on the basis of the local endowment of preconditions for knowledge creation, knowledge attraction, and innovation. In this way, peculiarities in the mode regions innovate are highlighted. The dependent variable of this additional module of the MASST model, that is, regional innovation, becomes a fully endogenous explanatory factor of the simulated regional differential shift, explained through differentiated regional innovation patterns stemming from different local context conditions.

Moreover, the model attributes a distinctive role to advantages stemming from an urban environment: advantages which, in their turn, depend on the specificities of single cities, and of the regional urban system as a whole. This source of externalities is included in the model through a sub-model which defines an equilibrium size for each city reached as marginal location costs equal marginal location benefits (Camagni et al. 2013). Both benefits and costs depend, in their turn, on the specificities of single cities: amenities, industrial diversity, and high-level functions explain the benefits, while urban land rent, social conflicts and sprawl explain the costs (Rosen 1979; Roback 1982).

A last important addition to the regional sub-model is related to the endogenization of unemployment rates. This advance nicely fits with the regionalization of the macroeconomic shocks also modelled by means of endogenizing public expenditure, and provides a convenient lever to identify the spatial distribution of macroeconomic impacts of major Country- and EU-wide shocks.

Taken together, the three additions to the regional sub-model imply a major surge in the interpretative power of the MASST model. Still, as a chiefly territorial tool, the MASST model is amenable to several tweaks to the regional component, some of which have been undertaken in the fourth generation.

6 Reinforcing Territorial Determinants of Regional Growth: The MASST4 Model

The main goal of MASST4 has been to strengthen the link between macroeconomic and regional components with respect to both prior versions of the model and other similar macroeconometric regional growth models.Footnote 8 When the MASST3 version came to its maturity, a post-crisis period was reached, and an update of the estimates was needed. The updating exercise came with a substantial improvement also of the regional side of the model and its territorial characteristics, along with a further integration with the national sub-model. Integration took place through several substantial additions to the complexity of the structure of the model: this section details these advances, identified with continuous shapes in Fig. 3.1.

The update of the model for the first time allowed MASST4 to be estimated in panel form both for the national (with yearly data from 1995 to 2018) and for the regional (in three periods: pre-crisis, crisis, and after-crisis) sub-models. This has allowed testing, for both sub-models, the assumption that EU economies exited the crisis quite differently from how they entered it, and that these changes had a structural nature.

The first structural break identified by means of these panel estimates relates to what has been termedFootnote 9the 4.0 industrial revolution. While prior to the crisis, and following global trends in advanced Countries, Europe had been deindustrializing (Rodrik 2016), after the end of the crisis (by convention identified in MASST4 in 2012 for all EU Countries), several EU economies witnessed a renewed acceleration in manufacturing employment growth, driven by the new technological paradigm labeled Industry 4.0. The new paradigm is shifting the technological frontier in a few selected hotspots capable of both efficient production and diffusion of these new technologies centred on general purpose technologies whose adoption cuts across several manufacturing industries. In MASST4, this process is modelled with an enhanced component of the regional sub-model explaining the probability of a region to experience a structural evolution in its territorial innovation patterns (Sect. 3.5; Capello and Lenzi 2018).

The second major trend that can be detected in post-crisis estimates refers to the strain through which economic and political institutions in several EU Countries are presently walking. The most important example is the relatively recent decision by the UK to leave the European Union (henceforth, Brexit). After holding a close-call referendum on June 23, 2016, UK decided to withdraw its membership of the European Union, which it had achieved after roughly 12 years of negotiations beginning in 1961 and ending in 1973 with the UK’s admission to the EU (UK and EU 2018). The MASST4 model has been updated in order to allow the modeller to assess the regional effects of Brexit, while also leaving the chance to model similar events for other EU Countries (Capello et al. 2018).

A third and fundamental trend is related to the growing role of cities as engines of national growth. After a two-decade renaissance of research on empirical urban economics and in particular on the nature and extent of agglomeration economies, a relatively recent debate has been sparked over whether large (capital) cities catalyze economic growth, which then diffuses to the rest of their Countries, or whether instead these large agglomerations, more directly hit by the crisis, actually slow down full recovery at Country level (Parkinson et al. 2015; Capello et al. 2015; Dijkstra et al. 2015).

MASST4 incorporates this debate and models the role of cities in stimulating national economies through their capability to meet new challenges. Empirically, this translates into estimating an additional equation whereby urban agglomeration economies (measured by urban land rent) depend on high-quality functions hosted, on the quality of local institutions, and on the capability of cities to cooperate with other cities (Camagni et al. 2016). Agglomeration economies estimated by this module enter then the regional differential shift as an additional explanatory factor.

One last relevant addition to the regional sub-model represents a landmark in the evolution of MASST. In fact, until the third generation, labour productivity was exogenously determined by the modeller and represented a lever that exogenously determined the simultaneous covariation between employment and GDP growth. MASST4 made a significant leap forward in endogenizing regional labour productivity, with major normative implications: from a regional economics perspective, employment and wages adjust to national and global shocks through a geographical reallocation that guarantees spatial equilibrium. This crucial determinant of the observed spatial variability in economic growth rates is now fully absorbed by the model.

7 Conclusions and Future Research Avenues

The MASST model has now reached its fourth generation, and has gained a firm reputation among other important regional growth models used to interpret regional growth in European Countries. Its interpretative power has been tested through its application to a baseline scenario forecasting GDP growth for 2030 that was run at the end of 2013. In this simulation, the MASST model forecasted the emerging trend of divergence in GDP growth among European regions, in a period in which macroeconomic forces were forcing superior (but regionally differentiated) constraints to all regions (national fiscal crises, austerity measures, exchange rate devaluations and internal devaluations). Secondly, comparing two scenarios driven respectively by mega-cities and by medium and medium-large cities, the latter scenario proved to be at the same time the most expanding and the most cohesive (Camagni et al. 2015). In the same vein, MASST has been applied to several scenario-building exercises, from the costs of an enduring crisis (Capello et al. 2015, 2016), to the costs of a dismembering process in the EU (Capello et al. 2018), providing sound messages and raising awareness of the risks embedded in political and economic turmoil.

This chapter has documented several advances of the model, each of which supersedes previous versions by filling gaps or by complexifying the structure of the model in order to endogenize additional economic relations. Nevertheless, future challenges lie ahead, which promise to deliver further enhances of the model.

A first possible research avenue relates to the endogenization of markets that at present are not formalized in the model. While the objective of this exercise cannot be to reach the status of full Computable General Equilibrium (CGE) model, which would change the very nature of the MASST model, the latter can still endogenize some markets that are typically very important for interpreting the geographical distribution of economic growth. The labour market is one such example, since, even in presence of imperfect labour mobility, relocation decisions represent an important mechanism for regional economies to adjust to national and global demand shocks. The medium to long-run periods covered by MASST allow to safely assume that some relocation could take place both locally (across sectors) as well as nationally (or at the supranational level) in response to the increase (or decrease) of demand in some industries, both because of local supply-side (technological) shocks, as well as due to increased global demand.

A second market that could be considered for clearing is the money one. At national level, the pervasive importance of monetary policies, especially with the abundance of savings and in a context of limited growth in advanced Countries, represents a relevant context condition that is shaping the debate on economic growth even after the 2007–2008 financial crisis ceased to exert its (sharpest) effects. This second possibility walks on an edge, though, since the way money is presently managed as a scenario lever in the model allows the modeller to keep partial control of the logical chain behind macro shocks.

A third possible future development of the model is linked to the possibility of running individual simulations on single markets, in order to assess the likely effects of individual policies, that are instead presently difficult to model with MASST because of its very nature of scenario building model. This third point is a direct consequence of the full endogenization of specific markets hinted at earlier.

With its fifteen years of history, and with the possible enlargements just mentioned, MASST appears to be getting close to full maturity. Regional growth still presents many important issues to be explained and interpreted, and MASST will likely provide many additional insights in the years to come.

Notes

- 1.

Source of raw data: EUROSTAT. Productivity measured as per capita GDP in PPS.

- 2.

The most celebrated regional growth forecasting models include the GMR model, the RHOMOLO and REMI models, and the MASST model presented in this chapter. For a critical review of these models, see Brandsma et al. (2015); Gori and Paniccià (2015); Varga and Sebestyén (2017); and Capello et al. (2017).

- 3.

For a thorough discussion of the features of demand-driven models, see Cochrane and Poot (2014).

- 4.

For this kind of forecasting models, see, e.g. the RHOMOLO model (Lecca et al. 2019).

- 5.

- 6.

These theoretical models have been translated into micro-founded testable growth equations by Mankiw et al. (1992).

- 7.

The first version of the model is presented in detail in Capello (2007).

- 8.

The MASST4 version is presented in details in Capello and Caragliu (2020).

- 9.

Possibly a bit of an overstatement.

References

Acemoglu, D., & Autor, D. (2011). Skills, Tasks and Technologies: Implications for Employment and Earnings. In O. Ashenfelter & D. Card (Eds.), Handbook of Labor Economics (Vol. 4B, pp. 1043–1171). San Diego, CA: Elsevier.

Aghion, P., & Howitt, P. (1992). A Model of Growth Through Creative Destruction. Econometrica, 60(2), 323–351.

Autor, D., & Dorn, D. (2013). The Growth of Low-Skill Service Jobs and the Polarization of the US Labor Market. American Economic Review, 103(5), 1553–1597.

Autor, D., Dorn, D., & Hanson, G. (2013). The China Syndrome: Local Labor Market Effects of Import Competition in the United States. American Economic Review, 103(6), 2121–2168.

Aydalot, P. (Ed.). (1986). Milieux innovateurs en Europe. Paris: GREMI.

Baldwin, R. (2016). The Great Convergence. Cambridge, MA: Harvard University Press.

BCG. (2013). Plan estratégico para el fortalecimiento y desarrollo del sector industrial en España. Informe para el Ministerio de Industria, Energía y Turismo del Gobierno de España.

Becattini, G. (Ed.). (1975). Lo sviluppo economico della Toscana. Con particolare riguardo all’industrializzazione leggera. Istituto regionale per la programmazione economica della Toscana-Irpet.

Becattini, G. (1979). Dal settore industriale al distretto industriale. Alcune considerazioni sull’unità di indagine dell’economia industriale. Bologna: Il Mulino.

Bordo, M. D., & Landon-Lane, J. S. (2010). The Global Financial Crisis of 2007-08: Is It Unprecedented? National Bureau of Economic Research WP w16589. Retrieved September 30, 2019, from https://www.nber.org/papers/w16589.

Boschma, R. (2005). Proximity and Innovation: A Critical Assessment. Regional Studies, 39(1), 61–74.

Brandsma, A., Kancs, D. A., Monfort, P., & Rillaers, A. (2015). RHOMOLO: A Dynamic Spatial General Equilibrium Model for Assessing the Impact of Cohesion Policy. Papers in Regional Science, 94, S197–S221.

Camagni, R. (1991). Local ‘Milieu’, Uncertainty and Innovation Networks: Towards a New Dynamic Theory of Economic Space. In R. Camagni (Ed.), Innovation Networks: Spatial Perspectives (pp. 121–144). London: Belhaven.

Camagni, R. (2009). Territorial Capital and Regional Development. In R. Capello & P. Nijkamp (Eds.), Handbook of Regional Growth and Development Theories (pp. 118–132). Cheltenham: Edward Elgar Publishing.

Camagni, R., Capello, R., & Caragliu, A. (2013). One or Infinite Optimal City Sizes? In Search of an Equilibrium Size for Cities. The Annals of Regional Science, 51(2), 309–341.

Camagni, R., Capello, R., Caragliu, A., & Fratesi, U. (2015). Territorial Scenarios in Europe: Growth and Disparities Beyond the Economic Crisis. Europa Regional, 21(4), 190–208.

Camagni, R., Capello, R., & Caragliu, A. (2016). Static vs. Dynamic Agglomeration Economies. Spatial Context and Structural Evolution behind Urban Growth. Papers in Regional Science, 95(1).

Capello, R. (2007). A Forecasting Territorial Model of Regional Growth: The MASST Model. The Annals of Regional Science, 41(4), 753–787.

Capello, R. (2015). Regional Economics. London: Routledge.

Capello, R. (2016). Regional Economics. London: Routledge.

Capello, R. (2019). Regional Development Theories and Formalised Economic Approaches: An Evolving Relationship. Italian Economic Journal, 5(1), 1–16.

Capello, R., & Caragliu, A. (2020). Merging Macroeconomic and Territorial Determinants of Regional Growth: The MASST4 Model. The Annals of Regional Science, 1–38.

Capello, R., & Fratesi, U. (2012). Modelling Regional Growth: An Advanced MASST Model. Spatial Economic Analysis, 7(3), 293–318.

Capello, R., & Lenzi, C. (Eds.). (2013a). Territorial Patterns on Innovation: An Inquiry on the Knowledge Economy in European Regions. London: Routlegde.

Capello, R., & Lenzi, C. (2013b). Territorial Patterns of Innovation and Economic Growth in European Regions. Growth and Change, 44(2), 195–227.

Capello, R., & Lenzi, C. (2018). The Dynamics of Regional Learning Paradigms and Trajectories. Journal of Evolutionary Economics, 28(4), 727–748.

Capello, R., & Nijkamp, P. (2008). Regional Growth and Development Theories in the Twenty-First Century – Recent Theoretical Advances and Future Challenges. In R. Capello & P. Nijkamp (Eds.), Handbook of Regional Growth and Development Theories (pp. 1–16). Cheltenham: Edward Elgar.

Capello, R., Camagni, R. P., Chizzolini, B., & Fratesi, U. (2008). Modelling Regional Scenarios for the Enlarged Europe: European Competitiveness and Global Strategies. Berlin: Springer.

Capello, R., Fratesi, U., & Resmini, L. (2011). Globalization and Regional Growth in Europe: Past Trends and Future Scenarios. Berlin: Springer Verlag.

Capello, R., Caragliu, A., & Fratesi, U. (2015). Spatial Heterogeneity in the Costs of the Economic Crisis in Europe: Are Cities Sources of Regional Resilience? Journal of Economic Geography, 15(5), 951–972.

Capello, R., Caragliu, A., & Fratesi, U. (2016). The Costs of the Economic Crisis: Which Scenario for the European Regions? Environment and Planning C: Government and Policy, 34(1), 113–130.

Capello, R., Caragliu, A., & Fratesi, U. (2017). Modeling Regional Growth Between Competitiveness and Austerity Measures: The MASST3 Model. International Regional Science Review, 40(1), 38–74.

Capello, R., Caragliu, A., & Fratesi, U. (2018). The Regional Costs of Market Size Losses in a EU Dismembering Process. Papers in Regional Science, 97(1), 73–90.

Capello, R., Laffi, M., & Lenzi, C. (2019, August 27–30). Spatial Trends in 4.0 Technologies Across European Regions: New Islands of Creative Innovation. Paper presented at the 59th ERSA conference, Lyon.

Cappellin, R. (1975). La Struttura dei modelli econometrici regionali. Giornale degli Economisti ed Annali di Economia, 25(5–6), 423–452.

Cappellin, R. (1976). Un Modello Econometrico dell’Economia Lombarda. Giornale degli Economisti ed Annali di Economia, 25(5–6), 263–290.

Caragliu, A. (2015). The Economics of Proximity: Regional Growth, Beyond Geographic Proximity. Ph.D. Dissertation, VU University Amsterdam.

Cochrane, W., & Poot, J. (2014). Demand-Driven Theories and Models of Regional Growth. In M. Fischer & P. Nijkamp (Eds.), Handbook of Regional Science (pp. 259–276). Berlin: Springer.

Crescenzi, R., & Rodríguez-Pose, A. (2011). Reconciling Top-Down and Bottom-Up Development Policies. Environment and Planning A, 43(4), 773–780.

De Grauwe, P. (2010). Top-Down Versus Bottom-Up Macroeconomics. CESifo Economic Studies, 56(4), 465–497.

Dijkstra, L., Garcilazo, E., & McCann, P. (2015). The Effects of the Global Financial Crisis on European Regions and Cities. Journal of Economic Geography, 15(5), 935–949.

Dixon, R., & Thirlwall, A. P. (1975). A Model of Regional Growth-Rate Differences on Kaldorian Lines. Oxford Economic Papers, 27(2), 201–214.

Döring, T., & Schnellenbach, J. (2006). What Do We Know About Geographical Knowledge Spillovers and Regional Growth?: A Survey of the Literature. Regional Studies, 40(3), 375–395.

Ehrmann, M., Fratzscher, M., Gürkaynak, R. S., & Swanson, E. T. (2011). Convergence and Anchoring of Yield Curves in the Euro Area. The Review of Economics and Statistics, 93(1), 350–364.

Ertur, C., & Koch, W. (2007). Growth, Technological Interdependence and Spatial Externalities: Theory and Evidence. Journal of Applied Econometrics, 22(6), 1033–1062.

European Commission. (2013). Competing in Global Value Chains. EU Industrial Structure Report 2013. Publication Office of the European Union. Luxembourg.

Foresight. (2013). The Future of Manufacturing: A New Era of Opportunity and Challenge for the UK, Project Report. The Government Office for Science, London.

Gori, G. F., & Paniccià, R. (2015). A Structural Multisectoral Model with New Economic Geography Linkages for Tuscany. Papers in Regional Science, 94, S175–S196.

Hausman, A., & Johnston, W. J. (2014). Timeline of a Financial Crisis: Introduction to the Special Issue. Journal of Business Research, 67(1), 2667–2670.

Hayek, F. A. (1945). The Use of Knowledge in Society. The American Economic Review, 35(4), 519–530.

Hoover, E. M. (1937). Location Theory and the Shoe and Leather Industries. Cambridge, MA: Harvard University Press.

Kaldor, N. (1970). The Case for Regional Policies. Scottish Journal of Political Economy, 17(3), 337–348.

Lecca, P., Christensen, M., Conte, A., Mandras, G., & Salotti, S. (2019). Upward Pressure on Wages and the Interregional Trade Spillover Effects Under Demand-Side Shocks. Papers in Regional Science. https://doi.org/10.1111/pirs.12472.

Mankiw, N. G., Romer, D., & Weil, D. N. (1992). A Contribution to the Empirics of Economic Growth. The Quarterly Journal of Economics, 107(2), 407–437.

Myrdal, G. (1957). Economic Theory of Under-Developed Regions. London: General Duckworth & Co.

North, D. (1955). Location Theory and Regional Economic Growth. Journal of Political Economy, 63(3), 243–258.

Parkinson, M., Meegan, R., & Karecha, J. (2015). City Size and Economic Performance: Is Bigger Better, Small More Beautiful or Middling Marvellous? European Planning Studies, 23(6), 1054–1068.

Richardson, H. W. (1969). Regional Economics; Location Theory, Urban Structure, Regional Change. New York: Praeger Publishers

Richardson, H. W. (1985). Input-Output and Economic Base Multipliers: Looking Backward and Forward. Journal of Regional Science, 25(4), 607–661.

Roback, J. (1982). Wages, Rents, and the Quality of Life. Journal of Political Economy, 90(6), 1257–1278.

Rodrik, D. (2016). Premature Deindustrialization. Journal of Economic Growth, 21(1), 1–33.

Romer, P. M. (1986). Increasing Returns and Long-Run Growth. Journal of Political Economy, 94(5), 1002–1037.

Rosen, S. (1979). Wage-Based Indexes of Urban Quality of Life. In P. Mieszkowski & M. Straszheimand (Eds.), Current Issues in Urban Economics (pp. 74–104). Baltimore, MD: John Hopkins University Press.

Solow, R. M. (1956). A Contribution to the Theory of Economic Growth. The Quarterly Journal of Economics, 70(1), 65–94.

Stevens, B. H., & Moore, C. L. (1980). A Critical Review of the Literature on Shift-Share as a Forecasting Technique. Journal of Regional Science, 20(4), 419–437.

Stöhr, W., & Taylor, D. R. F. (Eds.). (1980). Development from Above or Below? A Radical Reappraisal of Spatial Planning in Developing Countries. London: Wiley.

Swan, T. W. (1956). Economic Growth and Capital Accumulation. Economic Record, 32(2), 334–361.

UK and EU. (2018). When Did Britain Decide to Join the European Union? Retrieved July 17, 2018, from http://ukandeu.ac.uk/fact-figures/when-did-britain-decide-to-join-the-european-union/.

Varga, A., & Sebestyén, T. (2017). Does EU Framework Program Participation Affect Regional Innovation? The Differentiating Role of Economic Development. International Regional Science Review, 40(4), 405–439.

Young, A. (1993). Invention and Bounded Learning by Doing. Journal of Political Economy, 101(3), 443–472.

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2021 The Author(s)

About this chapter

Cite this chapter

Capello, R., Caragliu, A. (2021). Modelling and Forecasting Regional Growth: The MASST Model. In: Colombo, S. (eds) Spatial Economics Volume II. Palgrave Macmillan, Cham. https://doi.org/10.1007/978-3-030-40094-1_3

Download citation

DOI: https://doi.org/10.1007/978-3-030-40094-1_3

Published:

Publisher Name: Palgrave Macmillan, Cham

Print ISBN: 978-3-030-40093-4

Online ISBN: 978-3-030-40094-1

eBook Packages: Economics and FinanceEconomics and Finance (R0)