Abstract

More than 68 million persons globally are currently forcibly displaced, of which over 23 million are refugees. Conflicts are increasing, and existing ones are becoming more protracted; a refugee remains a refugee for over 10 years (World Bank, Forcibly displaced: Toward a development approach supporting refugees, the internally displaced, and their hosts. World Bank, Washington, DC, 2017). The current modalities used to fund refugee emergencies are not sustainable, and will become even less so as health needs increase and health services become more expensive.

Given the current number of complex conflicts and the magnitude of displacement, new sources of funding and innovative financing instruments for refugee care are needed. This chapter discusses current challenges in humanitarian financing, argues for better integration of refugee healthcare services, and assesses various innovative health financing tools for these services. If done thoughtfully, integrating refugees into a host country’s health system should improve health services and outcomes for both nationals and refugees. Addressing the increasing health needs of refugees requires a sophisticated financing toolkit that can be adapted to different refugee contexts, including pre-emergency and multi-year planning, health insurance, bonds, concessional loans, and pay for performance. These modalities need to be employed according to specific refugee contexts and consider potential risks.

In conclusion, innovation in humanitarian healthcare will require traditional and non-traditional partners to work together to pilot different financial schemes. Donors and investors need to be prepared to experiment and accept failure of some models in certain contexts. Ultimately, different innovative financing models will be able to provide more sustainable and effective health services to refugees and their host populations in the near future.

Access provided by Autonomous University of Puebla. Download chapter PDF

Similar content being viewed by others

Keywords

- Refugees

- Emergencies

- Disasters

- Health financing

- Innovative financing

- Humanitarian relief

- Health systems

- Health services

- Refugee health

Introduction

In 2017, there were 68.5 million forcibly displaced persons and 23.2 million refugees worldwide (Urquhart and Tuchel 2018). Whether refugees live in camps or are integrated into host populations, and whether they are settled in low-income or middle-income countries, governments often struggle to meet the health needs of these populations. Host countries’ existing health systems are often weak, and the added burden of providing for refugees can make them even more fragile.

An important and relatively new goal of humanitarian health assistance is to have a healthcare system for refugees that is integrated into a functioning national system; if implemented correctly, this integration will be beneficial to the refugees and the host populations. Providing sustainable healthcare to refugees (as well as other displaced populations) requires facilitating their access to existing health systems, improving the capacity and quality of such services to ease the strain on host countries, and addressing the financing of these services. Health financing refers to (1) raising monetary resources; (2) the flow of money into the system; and (3) the allocation of monetary resources by public or private means. Innovative financing mechanisms are defined as non-traditional applications of overseas development assistance (ODA), joint public–private mechanisms, and flows that fundraise by tapping new resources or that deliver new financial solutions to humanitarian and/or development problems on the ground (World Health Organization 2009).

This chapter concerns itself primarily with refugees in low- and middle-income countries (LMICs), but many of its conclusions may be applicable to other displaced populations and high-income countries. Refugee contexts and their various attributes can be categorised in numerous ways (Table 3.1). For this chapter, we created the following framework:

How and what type of refugee healthcare is established in a host country depends upon some of the factors listed above. For example, types of services and their quality may differ between the acute emergency phase, where this is often limited capacity and security, compared with the protracted phase, where there is more stability. Parallel health systems are often established in camp settings compared with out-of-camp settings, where refugee healthcare is often integrated within existing national systems. Types of services and ability to refer may differ between urban and rural settings as well as low-income countries and middle-income countries. Although it is difficult to clearly define functioning and non-functioning national or district health systems, district or regional health services have differing abilities to integrate refugees while providing sufficient access and quality of services, and so may require parallel services for refugees. Given the variety of contextual factors, humanitarian health financing is diverse and adaptive. As a result, each financing tool must be evaluated by governments, international organisations, and stakeholders as appropriate for a certain displaced population in a specific country before implementation.

The objective of this chapter is to explore different innovative humanitarian financing mechanisms for refugee health care, emphasising the need for integrating refugees into host country health systems. It focuses on varied sources of funding and a broad range of financial instruments that can provide health services to refugees in an integrated and sustainable manner. The contents of this chapter were modified from the report to the World Bank Group on this topic as well as the published paper (Spiegel et al. 2017).

Challenges in Traditional Humanitarian Funding

Refugees, like all other persons in the world, have a right to equitable, high quality healthcare. But the humanitarian health response is currently overstretched and underfunded, and cannot meet the current demands of multiple and increasingly protracted humanitarian emergencies (Bennet 2016). International humanitarian assistance funding has grown, rising from $18.4 billion in 2013 to $27.3 billion in 2017. But, as overall humanitarian funding increased, the requested needs and contributions to UN-coordinated appeals also increased. As a result, in 2017 there was a humanitarian assistance funding shortfall of 40% or $10.3 billion, the largest amount to date (Urquhart and Tuchel 2018). Moreover, between 2016 and 2017, contributions from EU institutions and governments stagnated while contributions from private donors grew. Thus, as public contributions stagnate and shortfalls increase, need for new, additional financing continues to rise.

Although not sufficiently researched, most revenue for refugee health financing comes from three sources post-emergency: (1) the host government’s social spending; (2) Western government donations; and (3) refugees’ out-of-pocket expenses (Spiegel 2017). Most government donations are managed by UN agencies, international and national nongovernmental organisations (NGOs), and faith-based organisations. But, due to limited international funding, host governments often end up paying significant amount of money from their own budgets to provide health care for refugees, particularly out-of-camp refugees. For example, in Jordan , the burden of Syrian refugees on the health care system and the amount of money the Jordanian government was providing for services to refugees was extremely high (JOD 34 million). Ultimately, the Jordanian government changed its policy and stopped providing free health care to Syrian refugees at the end of 2014 (Malkawi 2014).

Once international and host country financing is depleted, it is left to refugees to pay for their care on their own. Various health access and utilisation surveys show that refugees pay out-of-pocket expenses for their health care, particularly refugees living outside of camps. A rather extreme example is in Jordan , where the non-Syrian refugees pay expensive non-Jordanian health care rates as opposed to the Syrian refugees. According to a survey conducted in December 2016, 44% of non-Syrian refugee households spent almost half of their monthly income in the past month on healthcare. (United Nations High Commissioner for Refugees 2016).

While the burden for financing their healthcare falls on refugees if governments and international actors cannot pay, they face additional barriers to earning an income. In many countries, refugees are not officially allowed to work, so they get their money from unofficial work, borrowing, and remittances. A “remittance agency” refers to money transfer agencies or other financial service providers. Anti-money laundering laws often require proof of identity to remit money. In certain settings, refugees may not have sufficient documentation, or the identification provided (e.g. from the host government or an international agency) may not be recognised by the remittance agency. In some circumstances, remittances may be transferred via telecommunication technology instead of a remittance agency. But some refugees do not have access to mobile telephones, although this situation is rapidly changing. All of the above limits refugees’ ability to pay for their healthcare if the international and government cannot.

This enormous financing gap and burden not only perpetuates health disparities between refugees and their host populations, but also creates global disparities among refugees: a few high-priority emergencies consume the majority of humanitarian financing, meaning small but serious emergencies are under-resourced. In 2016, the top ten recipients accounted for 60% of all humanitarian funding, with Syria receiving the most ($2.6 billion) (Urquhart and Tuchel 2018). The top three recipients of humanitarian assistance financing in 2018, Syria, Yemen, and South Sudan, alone received one-third (36.9%) of all humanitarian funding (Financial Tracking Service 2018), a substantial increase from 2012 (Urquhart 2018). As a result, many emergencies have been chronically and increasingly underfunded for years.

In addition to having scarce resources, humanitarian health financing donors do not provide multi-year funding to allow for predictable and sustainable programming. The vast majority (86%) of all humanitarian aid goes to countries facing medium- and long-term crises (Urquhart and Tuchel 2018). Multi-annual humanitarian planning and financing would greatly benefit humanitarian responses in these countries, by allowing actors to think in the long-term as well.

Moreover, there is no large-scale assessment of the costs, effectiveness, or efficiency of different refugee healthcare delivery models (Fig. 3.1). At present, financing parallel service delivery for refugees is the norm—but is not sustainable. However, integrating humanitarian healthcare delivery into domestic healthcare could impact the quality and cost of health services provided to the host country population, as short-term supply is fixed but demand increases rapidly with the inclusion of refugees. If done poorly, integrating services could overburden medical personnel, deplete healthcare resources, or create long waiting lists for care. The relative economic and social costs of providing integrated service delivery versus parallel services are unknown and need to be researched.

Finally, the type and channel of funding available for humanitarian relief is often suboptimal. Humanitarian financing is overwhelmingly for post-emergency response and rarely goes directly to the host governments or local NGOs providing services to refugees. Instead, multilateral organisations received 49% of all humanitarian relief financing in 2016. An additional 20% went to NGOs, but only 5.3% went to the public sector and 0.4% to national and local NGOs (Urquhart and Tuchel 2018). Moreover, the majority of humanitarian financing is earmarked. Moving from earmarked to unearmarked humanitarian relief financing would result in quicker responses, better accountability, lower administrative costs, and less reporting (Lattimer 2016). However, unearmarked humanitarian relief funding given to UN agencies actually decreased between 2013 and 2017, from 22% to 18% (Urquhart and Tuchel 2018).

In short, traditional funding for humanitarian emergencies is insufficient and unsustainable. New approaches to financial planning, new sources of funding, and new ways of resource allocation, are essential if the needs of persons affected by humanitarian emergencies are to be met.

Financing Integrated Health Care for Refugees

Host governments must accept that refugees will likely be on their soil for many years and integrate refugees into existing health services. If planned and implemented well, then integration should improve health services for host country nationals and refugees alike by combining national and international financing for a single health service delivery system (see also Chap. 5 “Health Financing for Asylum Seekers in Europe: Three Scenarios Towards Responsive Financing Systems”). Doing so requires multi-year funding from donors addressing humanitarian emergencies, collaboration with national and international actors, and a nuanced toolkit of innovative financing mechanisms.

If a health system cannot integrate services for refugees, even with support from international organisations, only then alternatives should occur, such as providing parallel services. This may be due to national health systems at the regional or district level not being functional or able to address the emergency needs of refugees. Entities providing parallel services include the UN, international nongovernmental organizations (INGOs), faith-based organisations, and in some rare circumstances the private sector (e.g. mostly privatised health systems, such as Lebanon ). Private sector participants would have to earn a profit to cover operational costs, making adverse selection a problem, and should be avoided if possible. Since refugees should eventually be integrated into the national health system, incentives and agreements should be put into place to ensure that once the situation is more stable, refugees will move from these “parallel” systems to national systems. Most likely, doing so will also require capacity building the latter.

At present, many refugee camps throughout the world continue to provide parallel health services to refugees. Some are located in remote areas, while others are near more populated locales. The United Nations High Commissioner for Refugees (UNHCR) continues to provide funding for those parallel health services, primarily to NGOs. For the most part, refugees have limited or no livelihoods in these camps (World Bank 2017), and thus health services remain free of charge. They rely on predominantly post-emergency donations for revenue. In long-term protracted refugee camps, compared to host country nationals refugee morality rates are generally lower and maternal-child health outcomes are generally better (Hynes 2002, Spiegel 2002). Consequently, in many of these camps, between 5% and 20% of patients are nationals themselves (Spiegel 2017).

In the past, missions have been undertaken in various African countries to turn these camps into “villages”. The objective is to integrate services for refugees into national health and educational systems, which in turn should improve those services for nationals. There is the possibility that the quality of services for refugees would fall as the parallel services provided by NGOs and funded by UNHCR are stopped. However, the principle is to provide a comparable level of care to refugees and host country nationals (Urquhart and Tuchel 2018, United Nations High Commissioner for Refugees, 2014).

There are many complex considerations for providing refugee services in general, let alone moving from parallel to integrated services in these long-term refugee camps. Refugee demand for health services is also shaped by a myriad of incentives: costs, preferences, knowledge, various social determinants, and culture. Refugees are unwilling to purchase health services if they are too costly, if they are socialised to believe it is unimportant, or if they lack knowledge about the services available to them.

If social and political complications are surmounted, experience suggests that in some settings an initial injection of funds is necessary; although there is insufficient documentation as to the cost of undertaking such a process. This would generally not be undertaken in isolation, but rather in conjunction with education and the development plans for that region of the country. Existing health systems, whether functional or semi-functional, will likely need increased capacity and support from the UN and INGOs. When possible, disbursed funds should go to national, regional, or district level offices that manage national health systems and are responsible for integrating refugees.

Other policies support the integrating of health services for refugees as well. Allowing refugees to work will provide them with a means to cover their costs. Subsidies for vulnerable refugees should match those for nationals. If health insurance is mandatory for nationals, incorporating refugees in the insurance scheme can increase the risk pool sufficiently to support their inclusion. If national health systems cannot provide health insurance to both nationals and refugees, then external financial assistance and expertise may help some national systems improve sufficiently to provide health insurance for their citizens and refugees. Numerous countries in Africa have included universal health care into their national frameworks, but progress towards implementation is challenging. As more countries in Africa transition to UHC, the more feasible it will be for refugees to integrate into such systems.

A unique example of a combination or parallel and integrated service delivery purchasing occurred in Lebanon , due to its highly privatised health care system (see also Chap. 4 “Health Financing for Refugees in Lebanon”). A third-party auditor was contracted by UNHCR to control costs incurred by UNHCR for secondary health care in Lebanon, while ensuring an appropriate level and quality of care was provided. This was the first time UNHCR has undertaken such a process due to the unique circumstances of Lebanon. However, such a system may be considered in the future in countries that have a highly privatised health care system (Box 3.1).

A wide variety of financing instruments are available to encourage integrating refugees into host county health systems.

Box 3.1 Third-Party Auditor for Healthcare Delivery in Lebanon to Syrian Refugees

The health care system in Lebanon is complex and highly privatised. As part of the 2013 partnership agreements with UNHCR, partners were tasked to assist refugees with access to secondary health care by providing the following sets of activities: (1) validating entitlements, getting pre-treatment approval, conducting peer reviews, and auditing hospital bills; (2) paying hospitals for hospitalisation/treatment services based on the audited bills; and (3) ensuring hospitals bills for refugees would not exceed the Ministry of Public Health flat rates.

As a result of various challenges, including the complex hospital care system in Lebanon and the limited capacity of UNHCR Lebanon partners to provide secondary health care to refugees, a competitive bidding process was undertaken by UNHCR and a third-party auditor was selected. This company was a private for-profit company.

This company was used by many Lebanese to control their health care costs. In effect, it acted as an HMO to control costs incurred by UNHCR for secondary health care in Lebanon , while ensuring an appropriate level and quality of care was provided.

Innovative Humanitarian Health Financing

Financing tools for humanitarian healthcare have two components: risk and timing. Risk is defined as the potential for or probability of a loss, while timing refers to when the risky outcome occurs. Risk-retention tools hold host countries responsible for risk, which allows host countries to spend at their discretion (and within their budgets) during emergencies. Risk-transfer tools allow host countries to transfer risk to another entity, so host countries no longer shoulder the costs of emergencies. In general, risk-retention instruments are more appropriate for recurrent losses and risk-transfer instruments are preferable for occasional, larger losses (Clarke and Dercon 2016). Both types of tools vary in their timing, some relying on pre-emergency planning while others only include post-emergency response (Clarke and Dercon 2016).

There are a variety of financing instruments available for preparing and responding to humanitarian emergencies, which combine different features of timing and risk (Clarke and Dercon 2016). Below are several examples (Table 3.2).

Deciding which tool to use when is the responsibility of governments and international actors. Each instrument should be assessed according to context, so that it considers available financing and sustainability, appropriate responsibilities for implementers, the needs and priorities of beneficiaries, and quickness of response.

Improving financing for humanitarian emergencies requires a paradigm shift: moving from post-emergency financing to pre-emergency planning. An innovative health financing plan would establish funding mechanisms prior to emergencies, setting rules for pay out. It would specify actors and roles, triggers for payment, and allow for flexibility in response according to context (Clarke and Dercon 2016). These rules, responsibilities, and triggers must also mitigate moral hazard, in which countries allow populations to be displaced because they know there will be financing for it. Moreover, the plan must be adaptable to various post-emergency conditions and scalable in LMIC contexts. For example, if a humanitarian financing plan will establish an insurance scheme or specific services, it should define who is covered and for what services, clear inclusion or exclusion for pre-existing conditions, who delivers services and how, and which actors pay for which aspects of coverage. The development of an innovative health financing plan is the first step towards improving humanitarian response funding.

Planned or otherwise, innovative financing mechanisms that create revenue address the immediate challenge of a financing shortfall. Many revenue generation tools exist, but only loans, bonds, solidarity levies, and remittances will briefly be discussed here, as they are the most politically viable tools available.

Many development institutions and banks offer loans to LMICs for improving domestic social services. A loan transfers money from one party to another, with the promise of repayment with interest. Concessional loans have lower interest rates and more flexible repayment terms than market loans, and are often the kind made by development institutions to governments. Concessional loans are not in widespread use for financing refugee healthcare, as they require repayment from host governments. If a host government took a loan for providing refugee health services, it must use its tax revenue to pay the loan back. Doing so is often politically untenable, since LMICs would have to justify to constituents spending scarce resources on non-citizens rather than citizens.

As a result, concessional lending is not politically viable for providing parallel services for refugees. However, if refugees are integrated into existing services, then a loan for refugee healthcare would improve domestic health services in general and benefit host country nationals as well. In 2016, the International Development Association pledged $2 billion for 3-year grants and concessional loans to low-income countries hosting refugees. As the IDA18 progresses, these concessional loans may prove an appropriate vehicle to allow for such a transition from camps to “villages” with integrated services for nationals and refugees, particularly in Africa where many long-term camps exist.

Development institutions, like the World Bank, also use bonds to support developing countries facing large scale disasters. Bonds are a common capital market tool that can be used to finance responses to humanitarian emergencies. A creditor loans money to a public, corporate, or other entity, which issues them a bond. The bond lasts until a pre-set date (maturity date), and once matured then the loaned funds (bond principal) are returned. Interest is usually paid out periodically until maturity. Bonds have either a set or variable interest rate (coupon).

Box 3.2 Example of a Solidarity Levy (Unitaid 2016)

Governments participating in the Unitaid solidarity levy charge a small fee on airline passengers and then donate the proceeds to Unitaid. Currently, ten countries collect air ticket levies for Unitaid: Cameroon, Chile, Congo, France , Guinea, Madagascar, Mali, Mauritius, Niger, and the Republic of Korea (Unitaid 2017b). Since 2006, France has contributed more than €1 billion through the solidarity tax (Unitaid 2013), and overall levy proceeds constitute more than half of Unitaid’s budget (Unitaid 2017a)

Catastrophe bonds are special type of bond, in which a public entity, insurance company, or other organisation issues a bond to an investor, with a high coupon rate, usually to reinsure another party. If a catastrophe (currently, most are for natural disasters) occurs, the investor defers or forfeits payment of the interest and/or principal. Instead the money is used to address the catastrophe. If there is no catastrophe, the bonds typically mature within three years, and investors are paid back the principal with interest. Catastrophe bonds are high risk for investors, and as a result can be difficult to find financing for. However, development institutions have successfully implemented them to mitigate natural disasters, and may able to do so with other humanitarian emergencies.

Another common tool is a solidarity levy. A solidarity levy is a government-imposed tax, levied on consumers or tax payers to provide funding towards set projects. The tax can be paid by individuals, business owners, or corporations. The air ticket levy is one such example (Box 3.2) (UNITAID n.d.). While a solidarity levy may be one mechanism to increase revenue for refugee health services, there is much competition. Many international agencies and causes would also like to use this mechanism and that may limit its efficacy.

Finally, remittances are an important and untapped flow of revenue to and from displaced populations. Migrants sent earnings to families and friends living in developing countries at levels above $441 billion in 2015, which was three times the volume of official aid flows (World Bank 2016). Remittances constitute more than 10% of GDP in approximately 25 developing countries (World Bank 2016).

Research on remittances during humanitarian emergencies is scarce, but it is assumed that remittances have a positive impact on the well-being of those receiving them. Remittances may help refugees pay user fees or for medicines, but they should not be relied on as a substitute for health financing. Rather, facilitating remittances can complement other initiatives. It is important to note that, in some cases, refugees may be the ones remitting back home.

Little is known about the flow of and channels for remittances in refugee contexts, but certain actions should be explored to make remittances flow more fluidly and efficiently in such settings. While refugee healthcare should not rely on remittances for funding, international actors could encourage remittances to partially finance refugee healthcare. Agencies could work with partners to reduce or eliminate transfer surcharges specific to refugees; match refugee remittances; ensure that remittance agencies accept certain types of refugee identification; provide mobile phones to refugees; and collaborate with host governments to create appropriate national policies and regulations (Humanitarian Policy Group 2007). All would increase the amount of revenue available for refugee healthcare.

In addition to generating more revenue, there are other pre-emergency financial management practices that will allow humanitarian funding to go father. Pooling revenue allows funds to be held in one place and managed by one entity, and sets rules for how people can access those funds. Pooling does not increase the amount of financing available, but more evenly distributes financing and facilitates pre-emergency planning. Pooled funds can be deployed faster and with greater discretion than post-emergency aid.

Box 3.3 UN Pooled Funds

The United Nations Central Emergency Response Fund sets aside donations and aid money to be immediately available to UN agencies and the International Organization for Migration for emergency responses to humanitarian crises. Between 2010 and 2015, around one-third of the UN’s pooled funds for humanitarian relief were from CERF, all of which supported humanitarian relief operations in 45 countries (Lattimer 2016). Roughly half of CERF funding is used for purchasing supplies, with the rest evenly allocated as funding to UN agencies or as partner sub-grants (Urquhart and Tuchel 2018).

Global contingency funds set aside money to cover possible humanitarian emergencies or disease outbreaks, removing the financial burden from host countries. One example is a United Nations pooled fund called the Central Emergency Response Fund (CERF) (see Box 3.3). It is and will remain an important source of funds for the UN and UN-partners at the beginning of an emergency.

Another unique initiative that leverages financing is Pay for Success (P4S). The Pay for Success model is also referred to as “pay for performance”, “social impact bonds”, and “development impact bonds” among other names. However, the latter terms are confusing because P4S contracts are not truly bonds; they are more like loans.

P4S contracts with investors, governments, bilateral or multilateral donors, and service providers to improve service delivery outcomes. Investors provide financing for a program that is guaranteed by a payer (usually a government). The program has predefined service delivery targets for providers to achieve; in theory, repayment to investors only occurs if the targets are met and the program is successful, so investors assume the risk (Nonprofit Finance Fund 2018). All program outcomes must be verified by an independent agency. As achieving these targets not only improves service delivery but should also reduce costs, the savings generated by the program could be used for repayment, creating sustainability.

As a result, P4S links payments for service delivery to the achievement of impact indicators (not process indicators, which is what is often measured in such settings) (Nonprofit Finance Fund 2018). Depending upon who provides the revenue, P4S could provide much-needed funding from non-traditional donors, particularly the private sector.

There is mixed evidence that P4S improves service delivery quality, and none that it reduces costs. Moreover, P4S requires time to undertake in-depth assessments requiring significant data, set up the financial arrangements, and negotiate among the various partners. Consequently, P4S is not a panacea but rather one potential option for improving refugee healthcare purchasing.

P4S is only appropriate in protracted refugee settings, particularly camps, when addressing specific health interventions, but not broad health systems issues. P4S requires a great deal of preparation, specific data, and measurement of impact indicators that are rarely available at the beginning and early stages of an emergency. Furthermore, during the acute phase of an emergency, one must address the whole health system in a comprehensive manner, which makes it difficult for P4S to be applied to specific interventions. For example, the causal pathways for the ultimate impact indicator of reducing mortality are often not easily attributable to specific interventions, but rather are due to a combination of complex and interdependent factors.

Consequently, P4S should be used for specific interventions that are relatively easy to measure and where evidence already exists of their efficacy and effectiveness. These include increasing vaccination coverage (measured as fewer measles or cholera outbreaks), improved birth outcomes (measured as deliveries with a skilled birth attendant), and reducing deaths due to a malaria (measured as spraying, bed nets, rapid diagnostic tests, following treatment protocols, etc.). These specific interventions all are possible to implement and measure in protracted refugee settings, particularly in refugee camps. Measurement of numerators and denominators is more easily obtained than in out-of-camp settings, and partners are often international or national NGOs with clear roles and responsibilities. Refugees also have fewer choices regarding services in camps than out of camp. Therefore, P4S has an important but relatively limited role in the delivery of specific health interventions in protracted refugee settings, particularly camps.

Box 3.4 The African Risk Capacity (ARC) (African Risk Capacity n.d.)

The ARC, managed by the African Union, requires participating governments to buy into a risk pool and maintain disaster response plans, thus guaranteeing financing and timely response for catastrophic extreme weather events. The ARC uses a tool called Africa RiskView, which compiles weather, crop, cost, and population data to set thresholds for ARC payment. If the estimated cost of a disaster response crosses a specified threshold, then the participating government will receive funding from the pool. The ARC was founded in 2014 and currently has 33 member states, five of which formed a risk pool in 2017/2018.

Box 3.5 The Caribbean Catastrophe Risk Insurance Facility (CCRIF) (Caribbean Catastrophe Risk Insurance Facility 2015)

Founded in 2007, CCRIF offers insurance coverage to Caribbean governments for natural disasters, combining it with capital market instruments and a parametric index. Initially a public–private partnership supported by the World Bank and other donors, the CCRIF covers 20 countries for earthquakes, hurricanes, and excessive rainfall. Countries purchase insurance annually and are insured for up to $100 million. If an event occurs, payouts disburse within 2 weeks. The CCRIF uses individual portfolios to manage risk while maintaining a single operational structure. In addition to offering insurance, the CCRIF finances itself through the reinsurance market, catastrophe bonds, and catastrophe swaps.

Lastly, traditional insurance, indexed insurance, and reinsurance are not new, but are key to financing efficient and effective health services. Insurance schemes can cover regions, nations, communities, or individuals, and many already offer protection from natural disasters or catastrophes (Lattimer 2016). Insurance mutualises risk, so that when a loss occurs its costs are shared among participants. Governments, businesses, communities, or multilateral agencies create insurance schemes to protect populations against humanitarian crises, linking payment to emergencies, pandemics, or natural disasters (Urquhart 2018, Clarke 2016).

Some examples of insurance combine indexed insurance and catastrophe bonds to respond to natural disasters. These include the African Risk Capacity group and the Caribbean Catastrophe Risk Insurance Facility, and are described in Box 3.4 (African Risk Capacity n.d.) and Box 3.5 (Caribbean Catastrophe Risk Insurance Facility 2015).

Following the recent Ebola epidemics in West Africa, the World Bank together with the World Health Organization (WHO) and other partners are establishing a Pandemic Emergency Financing Facility that has specific triggers for specific pandemics. There is an insurance, bond, and cash window (Box 3.6) (World Bank n.d.).

Box 3.6 Pandemic Emergency Financing Facility (PEF) (World Bank n.d.)

The PEF is an innovative insurance-based mechanism that provides grants to low income countries to respond to uncommon but serious disease outbreaks as a means of averting pandemics. It targets vulnerable countries with an injection of funds to improve their response capacity and timing before an outbreak occurs. It is a joint project between the World Bank and the World Health Organization, as well as other private and public sector actors.

PEF includes an insurance/bond window and a cash window. The insurance window covers a maximum amount of $425 million, through catastrophic (pandemic) bonds and pandemic insurance paid by development organisations. Payment is capped, linked to parametric indices, which consider outbreak size, seriousness, and area, and is trigged by a severe regional outbreak from a specified list of diseases.

The cash window covers $61 million, replenished annually by donations. The cash window provides financing for disease outbreaks that have exhausted the insurance window, are limited to one country, are not included on the specified list of diseases, and require rapid response. These funds are released by approval from PEF’s governance, after expert review.

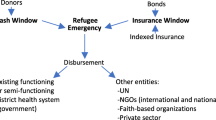

Creating a similar global insurance mechanism for refugee healthcare would greatly increase available financing, as well as facilitate fast and appropriate service provision. One proposition is a “Refugee Health Financing Emergency Facility”. Similar to PEF, resources could be mobilised through cash and insurance windows. Fig 3.1 goes here

The Refugee Health Financing Emergency Facility would provide funding, from diverse sources using a variety of financing mechanisms, to health systems for refugees during the acute phase of an emergency. The cash window will be UN pooled funds; a mechanism that exists already. Existing rules of disbursement need to be re-examined and decisions more evidence-based and transparent.

The insurance window will consist of bonds financed from the private sector with clear parametric indices. Bonds could be short term, in that they are meant to bridge a gap due to insufficient funds at the beginning of an emergency. Guarantees from donors or UN agencies to repay the bond at specific time could be provided to reduce risk. However, with this mechanism, funds from different sources, likely more traditional ones, would have to be found to eventually pay back the bond holders. Or, bonds could be longer-term with no guarantee of repayment of principle. These bonds may have higher yields than the “short-term” bonds discussed above.

The insurance window will consist of insurance financed from the private sector, donors, and UN agencies (e.g. UNHCR) with clear parametric indices. (UNHCR expends hundreds of millions of dollars each year on health services for refugees. Some of these funds could be “set aside” for health insurance pre-emergency.) Indices considered could include the Fragile States Index produced by the Fund for Peace. It is a critical tool in highlighting not only the normal pressures that all states experience, but also in identifying when those pressures are pushing a state towards the brink of failure. Another potential index would be a certain number of refugees crossing a border. However, it is important to note that academics and actuaries would need to undertake considerable analysis to decide if the risk is measurable and predicable.

In addition to a global insurance mechanism, another option is traditional insurance for refugees. At the country level, insurance companies pool risk by having the insured pay premiums. Should any insured entity suffer a loss, the insurance company will cover them. Insurers also often buy reinsurance from a third party. Reinsurance shares risk (and gain) and reduces loss in the case of an extreme event that the insurer cannot pay for.

A government or organisation looking to insure for humanitarian emergencies needs to determine how much risk it retains and how much it transfers. There are various types of insurance schemes, which can be publicly or privately funded, be managed by public, for-profit or non-profit organisations, and have mandatory or optional participation (Sekhri 2005). In protracted settings, when the health situation is relatively stable, health insurance for refugees should be considered. UNHCR developed a guidance note on health insurance schemes for refugees and other persons of concern to UNHCR that provides strong direction ((United Nations High Commissioner for Refugees, 2012). Providing refugees with voluntary health insurance protects them from catastrophic health expenses, while securing much-needed health services and a card as proof of identity (Box 3.7). However, care would need to be taken to guarantee equity, as the most vulnerable or those with pre-existing conditions could be excluded from the risk pool.

For health insurance for refugees to be feasible and sustainable, however, refugees must earn livelihoods to pay for their premiums and co-share costs. The issue of livelihoods is complex and will not be discussed in detail here. However, they are essential to reduce refugee dependency as well as the amount of donor assistance. The World Bank’s 2016 report entitled “Forcibly displaced: toward a development approach that supports refugees, the internally displaced, and their hosts” shows that refugee influxes often benefit the local economy, although who benefits within that community is more nuanced.

There will always be vulnerable populations in all societies that cannot afford to pay for health insurance . Decisions as to who is vulnerable and who will help to pay (fully or partially) for these vulnerable persons will need to be made. Depending upon the number of refugees contributing to the national system, the risk pool may have sufficiently grown to allow for subsidising the insurance premiums and co-payments for these refugees as occurs with nationals. Other sources of revenue could come from UNHCR, which is currently funding hundreds of millions of dollars in health care services via government and NGOs, many of which are parallel services.

The provision of private health insurance for refugees is also a possibility, but it is generally significantly more expensive than national health insurance for refugees. In general, any parallel services for refugees should be comparable to that of the “average” national (United Nations High Commissioner for Refugees 2014). In most countries where refugees are located, it is unlikely that the “average” national can afford private health insurance. Thus, it is unlikely that refugees will be able to afford private health insurance. In summary, health insurance for refugees in protracted settings may be an option for many host countries.

In addition to health insurance, cash transfers may encourage refugees to utilise domestic health services. Unconditional cash transfers (UCTs) give money to individuals or families without making receipt conditional on using specific services or behaviours. Evidence remains scarce, but appropriately timed UCTs (e.g.: immediately before birth) may incentivise families to purchase health services ((United Nations High Commissioner for Refugees, 2015). Conditional cash transfers (CCTs), on the other hand, demonstrably improve health outcomes by tying receipt to certain actions or services. Similar to CCTs, vouchers require participants to redeem their vouchers for specific services. Consequently, they may improve health outcomes while simultaneously strengthening the financial stability of the health marketplace (United Nations High Commissioner for Refugees, 2015). All three must offer an appropriate amount, couple their program with marketing, and target a clearly defined population to be effective. As both CCTs and vouchers are tied to a specific service, they are most appropriate for preventative, primary, and chronic care (United Nations High Commissioner for Refugees, 2015).

Moreover, Islamic social finance is a nascent and underutilised financing opportunity. Traditional Muslim finance instruments, such as the waqf (endowment), zakat (charity), and sukuk (bonds), have rarely been used to raise revenue for refugee health relief (World Humanitarian Summit 2016), despite the fact that Yemen, Syria , and Iraq received the most humanitarian health aid in 2016. Harnessing Islamic social finance for humanitarian relief would open both culturally appropriate and previously ignored capital (World Humanitarian Summit 2016).

Box 3.7 Refugee Health Insurance in the Islamic Republic of Iran

The Islamic Republic of Iran and UNHCR launched the health insurance scheme for Afghan refugees in 2011 through a semi-private insurance company (HISE). HISE was made available to registered refugees on an individual and voluntary basis with the overall goal of improving equity and financial access to in-patient services, with a special focus on vulnerable populations. Launching of HISE also aimed at generating additional opportunities for further improvement of refugees’ access to healthcare and creating a positive impact on their health status. Through minimising the financial burden of vulnerable refugees, HISE also aimed at indirectly generating positive impacts on the prevention of gender-based violence, school drop-outs, and other issues. The scheme provided complementary health insurance coverage to 331,003 Afghan refugees, including 214,652 vulnerable persons and 116,351 non-vulnerable refugees. Registered refugees in Iran have the possibility to have work permits and thus livelihoods. This allows some of them to pay for their premiums and co-payments themselves. For those who could not but fit the vulnerability criteria, UNHCR covered their costs.

In 2015, negotiations were concluded with the government to allow refugees access to the national health insurance scheme.

Conclusion

There are innovative health financing instruments that currently exist for development and natural disaster settings that could be adapted to refugee health settings, according to different contexts (see also Chap. 5 “Health Financing for Asylum Seekers in Europe: Three Scenarios Towards Responsive Financing Systems”). Recent developments show that innovative health financing mechanisms are feasible and there is strong interest by donors and the private sector.

Furthermore, primarily due to the Syrian crisis, bilateral and multilateral organisations are re-thinking how humanitarian aid and development assistance are provided. All of this provides a fertile environment to proactively consider how innovative humanitarian health financing can be explored and implemented in refugee settings. Innovative health financing mechanisms will increase access to care, but equally importantly, they will allow host country healthcare providers and health authorities to set up operational contracts that allow them to plan the provision of health services over the long run. In time, doing so will help to control costs without impacting the quality of services.

There remain, however, many unanswered questions that need to be explored. This chapter marks the beginning of discussing innovative financing for refugee healthcare.

Abbreviations

- CCRIF:

-

Caribbean Catastrophe Risk Insurance Facility

- CCT:

-

Conditional cash transfer

- CERF:

-

Central Emergency Response Fund

- FTS:

-

Financial Tracking Service

- INGO:

-

International nongovernmental organization

- LIC:

-

Low-income country

- LMIC:

-

Low- and middle-income country

- MIC:

-

Middle-income country

- NGO:

-

Nongovernmental organisation

- ODA:

-

Overseas development assistance

- OECD:

-

Organisation for Economic Co-operation and Development

- P4S:

-

Pay for success

- PEF:

-

Pandemic Emergency Financing Facility

- UCT:

-

Unconditional cash transfer

- UHC:

-

Universal healthcare coverage

- UNHCR:

-

United Nations High Commissioner for Refugees

- WHO:

-

World Health Organization

References

African Risk Capacity. (n.d.). How the African risk capacity works [Online]. Retrieved 14 July, 2019, from https://www.africanriskcapacity.org/about/how-arc-works/

Bennet, C., Foley, M., & Pantuliano, S. (2016). Time to let go: remaking humanitarian action for the modern era. London: Humanitarian Policy Group.

Caribbean Catastrophe Risk Insurance Facility. (2015). Understanding CCRIF: A collection of questions and answers [Online]. Retrieved 14 July, 2019, from https://www.ccrif.org/sites/default/files/publications/Understanding_CCRIF_March_2015.pdf

Clarke, D., & Dercon, S. (2016). Dull disasters? How planning ahead will make a difference. New York: Oxford University Press.

Financial Tracking Service. (2018). Global overview: Total reported funding 2018 [Online]. United Nations Office of the Coordination of Humanitarian Affairs. Retrieved 14 July, 2019, from https://fts.unocha.org/global-funding/overview/2018

Humanitarian Policy Group. (2007). Remittances during crises: Implications for humanitarian response. In K. Savage & P. Harvey (Eds.), HPG report 25. London: Humanitarian Policy Group.

Hynes, M., Sheik, M., Wilson, H. G., & Spiegel, P. (2002). Reproductive health indicators and outcomes among refugee and internally displaced persons in postemergency phase camps. JAMA, 288, 595–603.

Lattimer, C. (2016). Global humanitarian assistance report.

Malkawi, K. (2014). Gov’t had no other choice but to stop providing free healthcare to Syrians–Hiasat [Online]. Retrieved 14 July, 2019, from http://www.jordantimes.com/news/local/govt-had-no-other-choice-stop-providing-free-healthcare-syrians-%E2%80%94-hiasat

Nonprofit Finance Fund. (2018). What is pay for success? [Online]. Retrieved 14 July, 2019, from http://www.payforsuccess.org/learn/basics/

Sekhri, N., & Savedoff, W. (2005). Private health insurance: Implications for developing countries. Bulletin of the World Health Organization, 83, 127–134.

Spiegel, P. (2017). RE: Personal communication.

Spiegel, P., Chanis, R., & Trujillo, A. (2018). Innovative health financing for refugees. BMC Medicine, 16, 90–99.

Spiegel, P., Chanis, R., Trujillo, A., & Doocy, S. (2017). Innovative humanitarian health financing for refugees.

Spiegel, P., Sheik, M., Gotway-Crawford, C., & Salama, P. (2002). Health programmes and policies associated with decreased mortality in displaced people in postemergency phase camps: A retrospective study. The Lancet, 360, 1927–1934.

Unitaid. (2013). French levy on airline tickets raises more than one billion euros for world’s poor since 2006 [Online]. Unitaid. Retrieved 14 July, 2019, from https://unitaid.org/news-blog/french-levy-on-airline-tickets-raises-more-than-one-billion-euros-for-worlds-poor-since-2006/#en

Unitaid. (2016). Innovation for global health. Geneva: Switzerland.

Unitaid. (2017a). Strategy 2017-2021. Unitaid.

Unitaid. (2017b). Unitaid: Accelerating innovation in global health [Online]. Unitaid. Retrieved 14 July, 2019, from http://unitaid.org/assets/factsheet-about-unitaid-en.pdf

Unitaid. (n.d.). Innovative financing: The air ticket levy [Online]. Retrieved 14 July, 2019, from http://www.unitaid.eu/en/how/innovative-financing

United Nations High Commissioner for Refugees. (2014). Global strategy for public health: A UNHCR strategy 2014-2018.

United Nations High Commissioner for Refugees. (2016). Health access and utilization survey: Access to health services in Jordan among refugees from other nationalities.

Urquhart, A., & Tuchel, L. (2018). Global humanitarian assistance report.

World Bank. (2017). Forcibly displaced: Toward a development approach supporting refugees, the internally displaced, and their hosts. Washington, DC: World Bank.

World Bank. (n.d.). Pandemic emergency facility: Frequently asked questions [Online]. Retrieved 14 July, 2019, from http://www.worldbank.org/en/topic/pandemics/brief/pandemic-emergency-facility-frequently-asked-questions

World Health Organization. (2009). Progress report to taskforce. In Taskforce for Innovative International Financing for Health Systems (Ed.), Working group 2: Raising and channelling funds. Geneva: WHO.

World Health Organization. (2016). UHC in Africa: A framework for action. Geneva: WHO.

World Humanitarian Summit. (2016). High-level panel on humanitarian financing report to the secretary-general: Too important to fail - addressing the humanitarian financing gap.

Acknowledgments

This chapter was developed in part with funds from the World Bank Group.

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2020 Springer Nature Switzerland AG

About this chapter

Cite this chapter

Spiegel, P., Chanis, R., Scognamiglio, T., Trujillo, A. (2020). Innovative Humanitarian Health Financing for Refugees. In: Bozorgmehr, K., Roberts, B., Razum, O., Biddle, L. (eds) Health Policy and Systems Responses to Forced Migration. Springer, Cham. https://doi.org/10.1007/978-3-030-33812-1_3

Download citation

DOI: https://doi.org/10.1007/978-3-030-33812-1_3

Published:

Publisher Name: Springer, Cham

Print ISBN: 978-3-030-33811-4

Online ISBN: 978-3-030-33812-1

eBook Packages: MedicineMedicine (R0)