Abstract

Following the introduction of the JOBS Act in 2016, equity-based crowdfunding has become an alternative e-Business model for startups to fund their companies. Since then, the number of platforms that offer equity-based crowdfunding as well as the total investment in equity-based crowdfunding has steadily increased. Yet, empirical research on equity-based crowdfunding has been lagging, and the empirical evidence has suggested some inconsistent findings across different contexts. Against this backdrop, this paper investigates the success factors for equity-based crowdfunding campaigns. Using a dataset collected from the EquityNet and CrunchBase platforms, we find that lack of prior experience with fundraising is the most important factor that helps equity-based crowdfunding campaigns attract any capital at all from investors; while the number of social networking connections of the core management team and the company valuation will determine the amount of capital that a business can raise through equity-based crowdfunding. Our findings call for additional research that looks at success factors for different types of outcomes in equity-based crowdfunding.

Access provided by Autonomous University of Puebla. Download conference paper PDF

Similar content being viewed by others

Keywords

1 Introduction

Equity-based crowdfunding (ECF) refers to the process of fundraising through Internet-based platforms and by offering equity stakes to investors in exchange for capital [2, 16]. In recent years, across countries, ECF has increasingly become an important fundraising means for startups, especially technology firms, to obtain capital from the general public [6, 11, 15]. In the United States, title II of the JOBS Act legalized ECF for accredited investorsFootnote 1 in 2012; and in 2016, title III of the JOBS Act expanded the scope of ECF to the general public. Since then, the ECF market has steadily grown to be one of the stable investment choices besides other types of investments such as traditional venture capital or other types of crowdfunding (e.g., reward-based crowdfunding). Within a year, total ECF investment in the US grew from $27 million in 2016 to $76 million in 2017, with a projection of up to $1 billion in the next five years [10].

There are several factors that make it important to study ECF campaigns. First, compared to other types of investment, ECF has some distinctive characteristics. Unlike investors in traditional fundraising methods (e.g., venture capital), ECF investors typically are less knowledgeable and conduct less due diligence in assessing investment opportunities [1, 22]. Compared to other types of crowdfunding, ECF investors are motivated by equity stakes rather than by products (reward-based crowdfunding) or interest payments (loan-based crowdfunding) [16]. Second, empirical findings about ECF success vary across different contexts. For example, Ahlers et al. [2] found that social capital factors had no impact on funding success for ECF campaigns, while Vismara [23] found that social capital factors had significant impact on success for ECF campaigns. Yet, to date, while the number of empirical studies of ECF is growing, the findings are inconsistent in IS literature.

Against this backdrop, it is important to conduct additional empirical research on ECF to understand what contributes to the success of ECF campaigns. In this paper, we investigate the research question: What are the success factors for ECF campaigns? Drawing from prior studies, we use social networking theory and signal theory to study ECF success factors. We examine a dataset of 99 ECF campaigns in the EquityNet platform, one of the leading ECF platforms in the US. The findings suggest that ventures are likely to raise some capital from ECF if they have had less prior experience with fundraising campaigns. In addition, among ventures that have raised capital from ECF, their social networking connections and financial valuation can significantly increase the amount of capital that they can raise through ECF.

This paper makes several contributions to the ECF research. First, we distinguish different possible outcomes for ECF success and find that different signals are associated with different outcomes. In light of prior studies which suggest that there are intangible outcomes for ECF such as company valuation and validation [5], our findings call for additional research on success factors for a range of other possible ECF outcomes (e.g., raising some but not all capital, follow-on funding, social and intangible benefits). Secondly, our findings suggest the possibility of investigating the development stages that lead to the adoption of ECF as a strategy for fundraising. That is, how and why entrepreneurs decide to take on ECF as opposed to other types of fund-raising approaches. To date, this has only received limited attention from researchers.

The rest of the paper is organized as follows. We first provide a background on crowdfunding and ECF, then develop a research model and research hypotheses based on prior studies. Next, we present our method and findings of the study. We conclude with discussions of the findings regarding current theory and practice of ECF campaigns.

2 Background on Equity-Based Crowdfunding

Crowdfunding is an umbrella term that describes a form of fundraising through Internet-based platforms, whereby a group of people pool money in individual contributions to support a particular goal [2]. Compared to other traditional methods of fundraising such as venture capital or business angels, crowdfunding typically attracts unsophisticated investors, many of whom have limited investment experience but seek alternative ways to leverage their capital [1]. In fact, studies of crowdfunding investors in the UK show that most investors have a small investment portfolio (below £5,500) that comes mostly from their savings rather than investment budgets [22]. Due to their lack of experience and capability, crowdfunding investors often conduct less due diligence in studying investment opportunities, while the traditional fundraising methods often involve extensive due diligence processes (e.g., face-to-face interactions, multiple rounds of presentations) before decisions are made [2, 22, 23]. This leads to the classic information asymmetry problem which often prompts crowdfunding investors to exhibit herding behaviors and rely on crowd wisdom in their decision making [1].

In general, there are four types of crowdfunding: donation-based, loan-based, reward-based, and equity-based [4, 14,15,16]. They are different in terms of motivations and risks (see Table 1). In donation-based crowdfunding, investors have altruistic motivations to donate charitable contributions in support of good causes (e.g., paying for an expensive surgery in GoFundMe) [15]. In these fundraising campaigns, investors do not expect monetary returns and often find satisfaction in supporting campaigns that resonate with their intrinsic values [7, 8] or those that advance a specific social cause [14]. Loan-based or debt-based crowdfunding offers peer-to-peer lending opportunities in which a group of lenders would pool money together as a loan to individuals or businesses with the expectation that the loan will be paid off together with the interests added [16]. It accounts for the largest amount of total crowdfunding volume in 2014, totaling up to 68% of global market share [14]. Unlike donation-based crowdfunding, which expects no return and suffers little risk, loan-based crowdfunding investors expect a small return on investment in the form of interest paid on the original loan while incurring a risk of losing the principal amount in the event of default by borrowers.

Reward-based crowdfunding offers non-monetary rewards to investors, either through products or services. Thus, reward-based campaigns often attract early innovation adopters who are motivated by the access to new and sophisticated gadgets that are not yet available to the public [15, 16]. Because this type of fundraising often relies on the ability of entrepreneurs to deliver new and innovative products or services, it is highly receptive to the risk of fraud or the incompetency of the entrepreneurs to deliver their promises [1]. Equity-based crowdfunding, on the other hand, offers equity share of a business in exchange for contributions. In this regard, it is similar to traditional fundraising methods because investors are incentivized by equity shares in the target business [15]. However, unlike the case with traditional methods, equity-based crowdfunding entrepreneurs disclose their information on Internet-based platforms instead of through face-to-face interactions, and have limited opportunity to defend their campaigns through outside assistance such as reputations of intermediaries and financial analysts [23].

In this paper, we are particularly interested in equity-based crowdfunding and its success factors for several reasons. First, as a phenomenon, equity-based crowdfunding is relatively new and has distinctive characteristics compared to the other types of fundraising methods. Equity-based crowdfunding investors are usually young and inexperienced individuals who lack the due diligence in examining investment opportunities [22]. As a result, they rely heavily on social clues and crowd due diligence to assist their decision making [1, 2]. In addition, because equity-based crowdfunding investors are incentivized by equity shares rather than by sophisticated and new products (rewarded-based crowdfunding), or by monthly interest payments (loan-based crowdfunding), it is likely that their decision making is informed by different criteria than other types of crowdfunding. Indeed, several studies have highlighted various success factors for equity-based crowdfunding success that depart from traditional factors found in venture capital investments or by other types of crowdfunding campaigns [2, 4, 7, 8, 15, 16, 23].

Second, from the theoretical perspective, empirical studies on equity-based crowdfunding are lagging compared to other streams of fundraising research. Because equity-based crowdfunding was only recently made legal in the US, with the enactment of Title II of the JOBS Act in 2012 (for accredited investors) and Title III of the JOBS Act in 2016 (for the general public), the amount of research on equity-based crowdfunding is still limited. In addition, prior studies hint at some inconsistent findings across different contexts. Some suggest that social capital from networks and business linkages has a positive impact on the success of an equity-based crowdfunding campaign [15, 23], while others show that social capital has little to no impact on crowdfunding success [2]. Moreover, both Ahlers et al. [2] and Mamonov and Malaga [16] found that intellectual capital—measured by the number of patent holdings—has no impact on crowdfunding success; while Ralcheva and Roosenboom [21], in agreement with studies of venture capital firms, found that patent holding can significantly increase the chance of success for equity-based crowdfunding campaigns.

In sum, the distinctive characteristics of ECF, the lack of empirical studies in IS literature, and the inconsistent findings present a research opportunity to further investigate the success factors of equity-based crowdfunding. Next, we develop our research model.

3 Research Model and Hypotheses Development

Drawing from the extant literature, and given that ECF often draws inexperienced investors who are susceptible to social influences, we argue that campaign characteristics and social signals can increase the chance of crowdfunding success. Our research model is presented in Fig. 1.

Crowdfunding success is a multifaceted concept, and prior research has considered a wide range of possible success measures such as whether a campaign is fully funded, whether the campaign raised the minimum amount of capital that was sought, the amount of capital raised, the number of investors, and speed of investment [2, 15, 16, 23]. In this study, we focus on two success measures: the amount of capital raised, and whether a campaign was able to raise any capital. By targeting these two success measures, we focus on crowdfunding platforms that allow entrepreneurs to keep any amount of the capital that they raised (i.e., flexible funding) instead of platforms that require entrepreneurs to meet their goal to gain access to the raised capital (i.e., all-or-nothing funding). This mechanism is called provision point which is designed to reduce coordination and free-riding problems in crowdfunding campaigns [1, 6]. By focusing on campaigns without a provision point mechanism, we can examine how other factors influence investors’ decisions. In addition, Brown et al. [5] suggest that there are various intangible benefits of crowdfunding. Nearly all respondents from among 42 UK entrepreneurs who have successfully obtained capital through ECF acknowledged intangible benefits such as access to new customers, media and press attention, and validation of their products/services and business model. In other words, gaining any amount of capital through crowdfunding can potentially provide additional benefits to the entrepreneurs. Thus, our success measures allow us to be more sensitive to situations when a campaign does not meet its goal (i.e., does not meet the provision point) but is still able to gain some capital and therefore gain intangible benefits through ECF.

Prior studies suggest that campaign characteristics can determine campaign success [2, 13, 16]. Because ECF campaigns target the general public, the role of a business’s social network capital has been found to be a significant success driver [15, 18, 23]. The social network capital refers to the strengths that come from the social connections and networks of a business’s management team (e.g., LinkedIn network, MBA graduate network). Social network connections help a business spread information, generate worth-of-mouth, and solicit early contributions that jumpstart the campaign. This is especially true for crowdfunding campaigns in which many investors lack due diligence and rely on social clues and crowd due diligence to augment their decisions [1]. Among other types of crowdfunding, studies have found evidence of social capital in early contributions in reward-based crowdfunding campaigns [9, 18, 19], or social network effects and activity in donation-based crowdfunding campaigns [20]. Thus, we propose:

Hypothesis 1: A business’s social network connections are positively associated with (a) the probability of raising capital, and (b) the amount of capital raised through equity-based crowdfunding.

Prior crowdfunding research has examined the various signals that a business can include in their crowdfunding campaign to reduce information asymmetries and uncertainty for potential investors [1, 2, 18, 19]. Because a majority of ECF investors are inexperienced and lack due diligence in accessing investment opportunities [1, 17, 22], the more effective signals that a business can provide, the more likely that the business can successfully raise capital through crowdfunding campaigns [2]. Of the many signals, financial signals can be a clear indicator of success as they directly communicate to investors how the business conducts itself financially, and whether the business is projected to succeed in the future [16]. These financial signals are especially important for ECF campaigns in which investors are incentivized by financial motives [5, 8]. Thus, we suggest:

Hypothesis 2: A business’s financial signal is positively associated with (a) the probability of raising capital, and (b) the amount of capital raised through equity-based crowdfunding.

In addition, the level of uncertainty of a business will impact the likelihood that an investor will invest in a new venture. Given that ECF is a new type of investment, many investors will use existing information to ascertain the likelihood for success of the company. Prior studies have found that previous success with fundraising campaigns is a strong success factor for crowdfunding campaigns [16]. This is especially true for ECF when many investors are non-professionals and inexperienced, and rely on easy-to-understand information to determine the likelihood for success of a company [1, 2, 23]. Prior success will lower uncertainty for these investors and assure them of future success. In addition, entrepreneurs who have prior experience with fundraising will be able to apply lessons learned from their experience and thus will be likely to avoid common mistakes and make their projects more appealing to investors. Thus, we suggest:

Hypothesis 3: A business’s previous experience with fundraising campaigns is positively associated with (a) the probability of raising capital, and (b) the amount of capital raised through equity-based crowdfunding.

4 Methods

4.1 Data Collection

We collected data from multiple existing databases including CrunchBase and EquityNet for this study. CrunchBase is the largest public database of private startup companies, containing information on startups’ founders, products, funding, investors, news, board of directors, and top managers, among others. The second database, EquityNet, is one of the top crowdfunding platforms for entrepreneurs to raise money, and for investors to find potential startups to invest money. However, unlike similar platforms such as Indiegogo or Kickstarter, EquityNet is less restricted and more flexible for entrepreneurs to create an ECF plan.

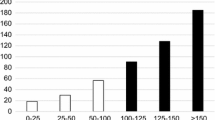

First, we used the CrunchBase database to obtain the list of US startup companies that have used ECF as one of their fund-raising campaigns from the launch of the database to May 1st 2017. Our data consist of 2,657 US private startups that have at least one ECF activity in their fund-raising history. For each startup, we collected data about fundraising experience, startup maturity, top management team members, and board members. Next, we used publicly available information on the EquityNet database to cross check our data to make sure that the startups have fund-raising campaigns listed in the EquityNet database, and collected data on each startup’s ECF campaigns. Detailed information about ECF campaigns such as amount of capital raised, campaign funding goal, startup valuation, and popularity rating has been gathered from EquityNet. After verifying and eliminating all missing data, our data were reduced to 454 startups that have information about each company’s profile and ECF campaign.

Second, for each startup, to collect social network connection data, we tracked the LinkedIn connections (i.e., number of followers) for each member of the top management team, and board and advisor teams. We then averaged the LinkedIn connections to calculate the social network connections for each startup. During our data collection from LinkedIn, all profiles that have hidden data or an arbitrary number of followers (e.g., 500+) are excluded from our calculation. After filtering out all missing data from CrunchBase, EquityNet, and LinkedIn, our final sample data include 99 companies with a total of 343 profiles of top management team members and board of advisor team members that have been collected from LinkedIn. The variables are described and explained in the following subsections.

4.2 Dependent and Independent Variables

To measure ECF success, we use two variables, Campaign Funded and Amount of Capital Raised, as our main dependent variables.

Campaign Funded.

We used the probability of whether ECF raised any funding as one proxy for ECF success. If startups successfully raised any money during their campaign, the campaign funded has a value of 1, and 0 otherwise.

Amount of Capital Raised.

The second proxy of ECF success was operationalized by the total amount of funding raised during the ECF campaign.

Our primary independent variables include fundraising experience, startup valuation, and social network connections. These measures are based on equity campaign characteristics and equity campaign signals.

Fundraising Experience.

We operationalized startups’ previous experience with fundraising by capturing the total number of fundraising rounds that the startups have had prior to their ECF campaigns. Within our dataset, no company has had more than one round of ECF. A higher number of fundraising experiences means that the startups have received funding from previous funding rounds such as seed rounds, series A, series B, series C, and so on. A ‘0’ value of fundraising experience means that the startups use ECF to fund their seed round.

Startup Valuation.

We measured each startup’s financial signal by capturing its company valuation, the log of the current value of the startup as evaluated by the founder(s) during the ECF campaign. The valuation of startups is submitted by the founder(s) as one of the requirements to raise funding in EquityNet.

Social Network Connections.

We operationalized startups’ social network connections by capturing the log of the average of LinkedIn connections of startups’ top management team, and board and advisor team. This measure is based on external connections outside of the startups upon the nodes of the top management team, and board of advisor team. The higher the number, the more external connections startups have.

4.3 Control Variables

We use popularity rating and startup maturity to control for campaign heterogeneity.

Popularity Rating.

This number shows the level of interest that the startup has received from the public compared to other peer startups. These data are calculated by EquityNet based on how many times the equity campaign documents were viewed and downloaded, how fast the startups responded to inquiries, and the amount of funding raised compared to the funding goal.

Startup Maturity.

This number shows the total number of years from a startup’s founding date to the ECF campaign’s starting date. A higher number means the startup began an ECF campaign later in their funding lifecycle (e.g., series A, series B etc.). A negative number means the startups began an ECF campaign before the startup’s official founding date (Table 2).

5 Results

Because our dependent variable for H1a, H2a, and H3a is binary, we performed a standard logit regression analysis for all 99 startups in our final sample data. Out model can be written as:

To test for our H1b, H2b, and H3b, we performed a multilinear regression analysis only for startups that received funding. Out of 99 startups, 63 firms are used for the second model. Our multilinear regression model can be written as:

Table 3 presents the parameter estimates of our models. Overall, model 1 is significant (likelihood ratio \( \chi^{2} = 14.89 \)). The explanatory power of the logit model is 0.1127. From model 1, social network connections and startup valuation have an insignificant impact on an equity campaign being funded \( (\alpha_{1} = 0.013, p\, > \,0.05;\alpha_{2} = 0.086, p\, > \,0.05) \). Thus, H1a and H2a are unsupported. On the other hand, the results suggest that fundraising experience has a significant negative impact on whether the campaign is funded \( (\alpha_{3} \, = \, - 0.957, p\, < \,0.01) \). In other words, the less fundraising experience startups have, the more likely they can raise capital through ECF. It means that our H3a is partially supported.

In our model 2, the explanatory power of the multilinear regression is 0.4672. Both social network connections and startup valuation have significant positive impact on the amount of capital raised \( (\alpha_{1} \, = \,0.242, p\, < \,0.05;\alpha_{2} = 0.485, p\, < \,0.01) \). Thus, H1b and H2b are supported. Our results also suggest that fundraising experience has insignificant impact on amount of capital raised \( (\alpha_{3} \, = \,0.235, p\, > \,0.05) \). It means that our H3b is unsupported.

6 Discussion

Given the rapid development of ECF, increasingly research has examined success factors of ECF campaigns. This study contributes to the growing body of ECF literature by examining how social network connections, startup valuation, and fundraising experience affects ECF. The findings offer several contributions to theories and practices of ECF.

First, we examined ECF success by measuring whether the campaign is funded at all as well as the amount of capital the campaign can raise. We showed that how different factors of ECF campaigns, that is, ECF campaign characteristics and ECF campaign signals, affect these success outcomes differently. Our results indicate that in order to receive any funding, startups that had less traditional funding rounds are more likely to receive funding through ECF. Social network connections and startup valuation, on the other hand, have no impact on whether a startup receives funding from ECF. This finding is couternintuitive and contradicts previous studies [16] which suggested that previous crowdfunding experience has a positive impact on future funding because it is an indicator of startups’ high performance. However, our finding suggests that in the US market where ECF is a relatively new and disruptive phenomenon for startups to raise capital, having too much experience in traditional funding rounds can be a negative factor. Because most investors of ECF are individuals rather than organizations, they tend to be non-professional and inexperienced in evaluating a new crowdfunding method such as ECF [1, 2, 23]. Thus, they are often looking for a short-term investment with high reward and high risk—a phenomenon that is known as the expected utility hypothesis in economics research [3, 12]. According to this hypothesis, individuals can make “irrational” choices with high uncertainty and high risks to maximize potential returns. Thus, startups with less experience in fundraising are considered as potential targets for ECF investors due to the odds of high returns in spite of the associated high risks.

Second, we extend our research question to examine what factors contributed to the amount of capital raised through ECF. This question is particularly important given a number of ECF platforms use a flexible funding model without a provision mechanism point [1, 6]. In situations in which startups can keep all capital raised, our results suggest that social network connections and startup valuation are indeed significant predictors of the amount of capital raised through ECF—a striking difference from the previous outcome. This implies that to reach their fundraising goal, startups need to have strong social connections with external investors, and the company has to show high potential for return investment back to investors. This aligns with previous studies of crowdfunding that find strong worth-of-mouth and high startup valuation are strong indicators of online funding campaign success in which many investors lack due diligence and rely on social clues and crowd wisdom to augment their decisions [1].

Finally, our findings together suggest that there are different success factors for different outcomes of an ECF campaign: to raise any capital at all, prior experience with traditional fundraising and the “newness” of the startup are important, while to increase the amount of capital raised, startups need to focus on their social network connections and valuation. In light of prior studies which suggest that there are intangible outcomes for ECF such as company valuation and validation [5], and that the provision point mechanism, which only allows fund withdrawal when a campaign goal is met, is critical to campaign success [1, 6], our findings call for additional research on success factors for other possible outcomes (e.g., raising some but not all capital, follow-on funding, social and intangible benefits). This also suggests a promising line of research on the development stages that lead to the adoption of ECF as a strategy for fundraising. That is, how and why entrepreneurs decide to take on ECF as opposed to other types of fundraising approaches.

6.1 Managerial Implications

Our findings offer several implications to ECF practices. First, our findings provide different strategies for startup managers to adopt ECF as a strategy for fundraising. Given that most investors for ECF are looking for high reward/high return startups to invest in, startups in early stages have a greater chance to receive funding than those in later stages and therefore should explore ECF as an alternative channel for seed funding. In addition, startups need to allocate resources to increase the external company network to outside investors and raise valuation through innovative products. Online ECF platforms such as EquityNet are excellent resources for startups to reach more capital, while other crowdfunding platforms such as Indiegogo or Kickstarter are more competitive nowadays to raise funding.

For platform designers, our findings suggest that platforms should pay attention to different enabling factors to help ECF campaigns. Particularly, platforms with a focus on all-or-nothing funding models should offer ways to allow startups to highlight and leverage social network connections and company valuation. Mechanisms such as quality signals, feedback systems, and trustworthy intermediaries can be of great value [1]. On the other hand, platforms that have a flexible funding model can implement features that highlight the novelty and innovativeness of the startups to attract investors. Prior studies have suggested mechanisms such as videos or quality of project description can be significant predictors of success [18].

The study is not without limitations. Our data are based on existing databases that are populated by self-report data from startups, entrepreneurs, and volunteers. Thus, there are limits to the data. Future studies are encouraged to duplicate our study, or combine it with additional data collection methods (e.g., survey, interviews) to enrich the insights suggested in this study.

7 Conclusion

In recent years, crowd markets have grown significantly and become a global phenomenon. Startups are increasingly turning to platforms such as Kickstarter to raise capital, bootstrap their customer base, and connect to potential investors. In the US market, ECF is still a relatively new fundraising channel as it was only legalized to the general public in 2016. To further understand this new phenomenon, this study examines success factors of ECF campaigns among US startups. Our findings suggest that depending on different funding outcomes, different factors will play different roles. This calls for further research to understand this phenomenon and how it impacts the design of ECF platforms as well as the structure of ECF campaigns.

Notes

- 1.

Accredited investors are individuals who either have more than $200,000 in income per year or have at least $1 million in assets.

References

Agrawal, A., Catalini, C., Goldfarb, A.: Some simple economics of crowdfunding. Innov. Policy Econ. 14(1), 63–97 (2014)

Ahlers, G.K.C., Cumming, D., Günther, C., Schweizer, D.: Signaling in equity crowdfunding. Entrepreneurship Theor. Pract. 39(4), 955–980 (2015)

Bell, D.E.: One-switch utility functions and a measure of risk. Manage. Sci. 34(12), 1416–1424 (1988)

Belleflamme, P., Lambert, T., Schwienbacher, A.: Crowdfunding: tapping the right crowd. J. Bus. Ventur. 29(5), 585–609 (2014)

Brown, R., Mawson, S., Rowe, A., Mason, C.: Working the crowd: improvisational entrepreneurship and equity crowdfunding in nascent entrepreneurial ventures. Int. Small Bus. J. Res. Entrepreneurship 36(2), 169–193 (2018)

Burtch, G., Hong, Y., Liu, D.: The role of provision points in online crowdfunding. J. Manage. Inf. Syst. 35(1), 117–144 (2018)

Cecere, G., Guel, F.L., Rochelandet, F.: Crowdfunding and social influence: an empirical investigation. Appl. Econ. 49(57), 5802–5813 (2017)

Cholakova, M., Clarysse, B.: Does the possibility to make equity investments in crowdfunding projects crowd out reward-based investments? Entrepreneurship Theor. Pract. 39(1), 145–172 (2015)

Colombo, M.G., Franzoni, C., Rossi-Lamastra, C.: Internal social capital and the attraction of early contributions in crowdfunding. Entrepreneurship Theor. Pract. 39(1), 75–100 (2015)

Crowdfund capital advisors: The 2017 state of regulation crowdfunding. Crowdfund Capital Advisors (2018)

De Crescenzo, V.: The role of equity crowdfunding in financing SMEs: evidence from a sample of European platforms. In: Bottiglia, R., Pichler, F. (eds.) Crowdfunding for SMEs, pp. 159–183. Palgrave Macmillan, London (2016)

Friedman, M., Savage, L.J.: The expected-utility hypothesis and the measurability of utility. J. Polit. Econ. 60(6), 463–474 (1952)

Hornuf, L., Neuenkirch, M.: Pricing shares in equity crowdfunding. Small Bus. Econ. 48(4), 795–811 (2017)

Kim, H., Moor, L.: The case of crowdfunding in financial inclusion: a survey. Strateg. Change 26(2), 193–212 (2017)

Lukkarinen, A., Teich, J.E., Wallenius, H., Wallenius, J.: Success drivers of online equity crowdfunding campaigns. Decis. Support Syst. 87, 26–38 (2016)

Mamonov, S., Malaga, R.: Success factors in title III equity crowdfunding in the united states. Electron. Commer. Res. Appl. 27, 65–73 (2018)

Mamonov, S., Malaga, R., Rosenblum, J.: An exploratory analysis of title ii equity crowdfunding success. Venture Cap. 19(3), 239–256 (2017)

Mollick, E.: The dynamics of crowdfunding: an exploratory study. J. Bus. Ventur. 29(1), 1–16 (2014)

Mollick, E., Nanda, R.: Wisdom or madness? comparing crowds with expert evaluation in funding the arts. Manage. Sci. 62(6), 1533–1553 (2016)

Ordanini, A., Miceli, L., Pizzetti, M., Parasuraman, A.: Crowd-funding: transforming customers into investors through innovative service platforms. J. Serv. Manage. 22(4), 443–470 (2011)

Ralcheva, A., Roosenboom, P.: On the road to success in equity crowdfunding. SSRN (2016)

Tuomi, K., Harrison, R.T.: A comparison of equity crowdfunding in four countries: implications for business angels. Strateg. Change 26(6), 609–615 (2017)

Vismara, S.: Equity retention and social network theory in equity crowdfunding. Small Bus. Econ. 46(4), 579–590 (2016)

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2019 Springer Nature Switzerland AG

About this paper

Cite this paper

Bui, S., “Neo” Bui, Q. (2019). An Empirical Investigation of Equity-Based Crowdfunding Campaigns in the United States. In: Xu, J., Zhu, B., Liu, X., Shaw, M., Zhang, H., Fan, M. (eds) The Ecosystem of e-Business: Technologies, Stakeholders, and Connections. WEB 2018. Lecture Notes in Business Information Processing, vol 357. Springer, Cham. https://doi.org/10.1007/978-3-030-22784-5_11

Download citation

DOI: https://doi.org/10.1007/978-3-030-22784-5_11

Published:

Publisher Name: Springer, Cham

Print ISBN: 978-3-030-22783-8

Online ISBN: 978-3-030-22784-5

eBook Packages: Computer ScienceComputer Science (R0)