Abstract

In this paper, we empirically analyze the determinants of excess inventory announcement and the stock market reaction to the announcement in the US retail sector. We examine if the firm’s operational competence, as measured by total factor productivity (TFP), can explain the retailer’s excess inventory announcement. We also investigate if the stock market reaction to such announcements is conditional on the operational competence of the announcing firm. We use a combined dataset on excess inventory announcements, annual financial statements, and daily stock prices of publicly traded retailers in the USA between 1990 and 2011. We find that operationally competent retailers have a lower probability of announcing excess inventory in the following year. In addition, the stock market penalizes excess inventory announcements made by operationally competent retailers more severely than those made by their less competent peers. Finally, providing action information, which the firm has taken or plans to take to deal with the excess inventory, moderates the negative association between firm’s operational competence and abnormal returns due to the announcement, whereas we do not find such moderating effect with reason information.

Access provided by Autonomous University of Puebla. Download chapter PDF

Similar content being viewed by others

Keywords

1 Introduction

On May 28, 2015, Abercrombie and Fitch Co. (Ticker: ANF) announced that it had accumulated excess inventory, so it was writing-down $26.9 million of inventory. Abercrombie’s management blamed sluggish sales as the reason for its excess inventory. Abercrombie’s management was not alone; blaming sluggish sales for the buildup of excess inventory is the most popular reason given by retail managers. Hendricks and Singhal (2009) note that 67.59% of firms that provided a reason for their excess inventory announcements during 1990 to 2002 claimed sluggish demand as the primary reason. If unexpected softening of demand is the primary reason for excess inventory announcements, then likelihood of retailers making such announcements should be independent of whether they are operationally competent or not.

Prima facie, there is theoretical basis behind such a claim. In the commonly used newsvendor model, left-over inventory occurs when realized demand is lower than the forecasted demand. So, excess inventory announcements may be an inevitable outcome of demand uncertainty. Furthermore, we observe that excess inventory announcements are made even by firms that are renowned for their operational excellence. Toyota, for example, announced that it cut down production in order to reduce excess inventory in 2009 (Linebaugh 2009), while Wal-Mart announced that excess inventory had accumulated in its apparel products’ category (McWilliams and Dodes 2007). So, it is not clear whether there is a link between operational competence and excess inventory announcements. Our first research question explores the presence of this link.

More importantly, it is unclear whether the stock market believes the retailers’ explanation for excess inventory. In other words, does the stock market treat these announcements as the outcome of a bad draw from a random demand and penalize all excess inventory announcements similarly or is the stock market response to excess inventory announcements conditional on operational competence of the announcing firm? If it is the latter, then does the stock market penalize highly competent firms more for the disappointing announcement or does it penalize the low competent firms more as they are skeptical of their ability to manage the excess inventory and take appropriate actions to overcome the problem? Our second research question examines if the stock market reaction to such announcements is conditional on the operational competence of the announcing firm.

We study these two questions for the following reasons. Excess inventory announcements have generated considerable interest in the business press and academic research because of their large negative impact on firm performance (Hendricks and Singhal 2009). Since excess inventory announcements are the result of supply–demand mismatches, many researchers have emphasized operational improvements to reduce their occurrences (Fisher et al. 2000; Billington et al. 2002; Chopra and Sodhi 2004; Narayanan and Raman 2004; Tang 2006). For example, Fisher et al. (2000) show that four elements—forecasting; supply-chain speed; inventory planning; and accurate, available data—form the foundation of rocket science retailing to achieve “Right Product in the Right Place at the Right Time for the Right Price.” Yet a direct link between operational performance and excess inventory announcements has not been established so far. Such a link, if present, needs to be established, so we could demonstrate the value of operational improvements to managers.

In addition, we scrutinize the stock market response to excess inventory announcements to glean insights on whether the stock market holds a premium for operationally competent firms. If so, we would expect a sharper decline in stock market valuation when an operationally competent firm announces excess inventory as the market is likely to be more disappointed than if a less competent firm made such an announcement.

Recent literature has pointed to several disadvantages of using inventory turnover (IT) as a metric of inventory productivity (Gaur et al. 2005), so we use a different measure of operational competence to study these two questions. We measure operational competence using the total factor productivity (TFP) metric. We choose TFP as our primary measure of operational competence as it is a well-studied metric across multiple fields and there exists strong evidence that higher TFP is associated with better operations through various internal drivers such as management practices, employee knowledge, and information technology (see Syverson 2011 for a review). Using data from 245 stores of a UK retailer, Siebert and Zubanov (2010) find that different skills of store manager explain about 27–35% of variation in store-level TFP. In addition, we use inventory turnover, adjusted inventory turnover (AIT) metric from Gaur et al. (2005), and gross margin return on inventory (GMROI) as alternate metrics of operational competence.

We focus on the US retail sector and collect data from three separate databases to perform our analysis. The first, obtained from Compustat through Wharton Research Data Services (WRDS), includes firm-level financial data during 1962 to 2011 such as sales; operating income before depreciation and amortization; the number of employees; gross, property, plant, and equipment; and capital expenditure. We collect our sample from 1962 because Compustat data for earlier than 1962 have a serious selection bias (Fama and French 1992). We supplement this data with output and investment deflators from the Bureau of Economic Analysis (BEA) and annual average wage index from the Social Security Administration (SSA). Estimated firm-level TFP, using Compustat data, is merged with two other datasets to investigate whether the firm-level TFP is associated with excess inventory announcement. The second dataset, obtained from Factiva, collects 85 excess inventory announcements made by publicly traded US retailers in the Wall Street Journal (WSJ) and Dow Jones News Service (DJNS) during 1990 to 2011. It allows us to use the event study methodology to examine the stock market’s reaction on excess inventory announcement. In order to conduct the event study methodology, we used the last dataset which gathered information on daily stock prices from the Center for Research on Stock Prices (CRSP).

Our primary findings are as follows. We find support for our argument that operationally competent retailers have fewer excess inventory announcements. High TFP retailers, those in the top 90th percentile of TFP, are 3.53 times less likely to report excess inventory in the following year compared to low TFP retailers, those in the bottom 10th percentile. Therefore, we conclude that operationally competent retailers manage inventory better, thus having fewer excess inventory announcements than their less competent peers. We obtain consistent results even when we measure operational competence using IT but TFP appears to be a better predictor of excess inventory announcements than IT. These results cast doubt on managers’ attribution of excess inventory to sluggish sales.

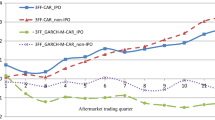

Our stock market response analysis yields the following results. Consistent with Hendricks and Singhal (2009), we find that excess inventory announcements are associated with 2.53% decline in stock market valuation over a 2-day period (the day of the announcement and the day before the announcement) in the retail sector. However, we find that the market penalizes excess inventory announcements made by high TFP retailers much more severely than those made by low TFP retailers. Our analysis shows that an increase in 1-year-lagged mean-adjusted TFP by one-standard-deviation is associated with −4.14% in the stock return over a 2-day period. This result contrasts with prior findings that the stock market does not penalize high and low IT retailers differently (Hendricks and Singhal 2009). Our results suggest that when high TFP retailers announce excess inventory, the market might be more disappointed as it had higher expectations from these firms. Thus, we find that the stock market does not fully believe excess inventory announcements to be the results of a bad draw of a random demand, as claimed by retail managers.

Interestingly, we observe that over 47% of retailers had positive increase in stock price following the excess inventory announcement. In other words, there is considerable heterogeneity in the market’s response to the announcement. To explain this anomaly, we also considered the information provided by the retailers for the reasons for excess inventory accumulation and the actions that they have taken or plan to take to handle the excess inventory. Our analysis shows that providing follow-up actions moderates the negative association between firm’s operational competence and abnormal stock returns due to excess inventory announcement. Retailers in the top 50th percentile of TFP face a −3.78% (median) decline in stock returns when they announce excess inventory without providing follow-up actions but face a 1.74% (median) increase in stock returns when they provide follow-up actions. We conjecture that the market trusts the competent companies to turn around their operations when provided with a definite plan of action. In contrast, we do not find any difference in stock market reaction to whether retailers in the bottom 50th percentile of TFP provide follow-up actions or not to fixing the excess inventory problem.

This study makes several contributions to the literature. First, we undertake, to the best of our knowledge, the first empirical examination on determinants of excess inventory. Although excess inventory has been well studied, what drives excess inventory has been remained unclear. In this paper, we attempt to fill this gap by showing empirical evidence that operationally competent retailers have fewer excess inventory announcements than their less competent peers. This finding is important as it shows that excess inventory is not a random phenomenon merely driven by demand uncertainty, which is typically harder for managers to control, but by management practices.

Second, our paper contributes by expanding the literature on the relationship between operational performance and financial performance. Previous literature shows that excess inventory has a negative financial impact on stock market valuation (Hendricks and Singhal 2009). We find heterogeneity in such negative financial impact of excess inventory announcement on stock returns. Specifically, high TFP retailers are impacted more negatively by such an announcement compared to low TFP retailers.

Third, recent literature has shown that investments based on inventory turns yield higher abnormal stock market returns (Kesavan and Mani 2013; Alan et al. 2014). There are two possible explanations offered for this finding. The stock market might not be fully incorporating inventory information in pricing stocks (Kesavan et al. 2010; Kesavan and Mani 2013), or high IT retailers could be riskier than the low IT retailers as they have higher returns (Alan et al. 2014). Our study provides evidence for the former and against the latter. By contrasting with TFP, our study finds that the stock market reaction differs across high TFP and low TFP retailers, but there is no significant difference in market reaction to announcements from high IT and low IT retailers. This result suggests that the stock market may not be distinguishing between high IT and low IT retailers, leading to abnormal returns in the future. In addition, we show that the low IT retailers are potentially riskier than high IT retailers because they have a greater likelihood of announcing excess inventory compared to high IT retailers.

The rest of the paper is organized as follows. The relevant literature is presented in Sect. 2. In Sect. 3, we develop our main hypotheses of the paper. Section 4 deals with the first main research question: the determinants of excess inventory announcement. It contains the estimation of the firm-level TFP, data description with econometrics model, and results. The second research question about the market reaction to excess inventory announcement is investigated in Sect. 5. It includes event study methodology, model specification, and results. Section 6 concludes the paper.

2 Literature Review

We first look at the firm-level productivity literature. One of two common findings in the productivity literature is that large and persistent differences in estimated productivity levels across firms are ubiquitous. This finding has fueled diverse research questions in a number of fields: microeconomics, industrial organization, trade, and labor in economics literature (Syverson 2011); information technology (Brynjolfsson and Hitt 1996; Dewan and Kraemer 2000), organizational change (Bertschek and Kaiser 2004), and inventory (Lieberman and Demeester 1999) in business literature. The main focus of such productivity literature has been shifted from “what?” question to “why?” question since Bartelsman and Mark (2000) first surveyed the micro-data productivity literature. Drivers of productivity, also, have been well documented and classified by internal and external factors (Syverson 2011). Especially, in the internal factors, previous literature shows that productivity is closely related to management practices (Bloom and Van Reenen 2007); managerial ability (Bertrand and Schoar 2003); worker’s education (Ilmakunnas et al. 2004); and information technology (Brynjolfsson and Hitt 1996; Dewan and Kraemer 2000). These factors, especially information technology, have also been identified as drivers of good inventory management (e.g., Barua et al. 1995; Mukhopadhyay et al. 1995). However, the link between productivity and better inventory control has been sparsely studied. So, we examine if productive (i.e., high TFP) firms have fewer excess inventory announcements compared to low TFP firms.

We aware of one paper that shows the link between labor productivity and better inventory control. By studying 52 Japanese automotive companies, Lieberman and Demeester (1999) show that reducing work-in-process (WIP) inventory increases labor productivity. Unlike Lieberman and Demeester (1999), we do not study the antecedents of productivity but whether high productivity firms have fewer excess inventory announcements. We also consider retail sector, as opposed to manufacturing that was studied by Lieberman and Demeester (1999), and use total factor productivity (TFP) which is commonly regarded as a more appropriate measure of productivity rather than single-factor-productivity measures such as labor productivity.

There has been huge interest in empirically showing the link between inventory performance and financial performance measures. Rumyantsev and Netessine (2007), for instance, observe that inventory responsiveness is positively associated with profitability, but not inventory leanness by analyzing panel data for a sample of more than 700 firms. Some research has used stock returns as a financial performance metric. For example, Thomas and Zhang (2002) and Chen et al. (2005) investigate the relationship between long-term stock returns and levels of inventory turnover. They analyze the long-term stock returns based on annual data covering more than 20 years. In contrast, other researchers analyze the short-term stock returns around the time when firms announce some events by conducting the event study methodology (e.g., Hendricks and Singhal 2009; Thirumalai and Singha 2011). For example, Hendricks and Singhal (2009) find significant negative impact of excess inventory announcement on stock returns. Based on a sample of 276 excess inventory announcements made during 1990–2002, they find −6.79% to −6.93% abnormal returns over a 2-day period.

To answer our second research question, we also examine the market reaction to excess inventory announcement by using the event study methodology. However, our work is different from Hendricks and Singhal (2009) in the following aspects. First, Hendricks and Singhal (2009) include growth prospect, firm size, and IT in their econometrics model to see the different market reaction to excess inventory announcement under a certain condition. On the contrary, in addition to growth rate, firm size, and IT, we also contain TFP as a proxy of firm’s operational competence to examine whether the market reacts differently to excess inventory announcement based on the announcing firms’ operational competence. Second, our analysis considers the moderating role of specific information (i.e., action) in the announcement to the adverse association between TFP and abnormal returns due to excess inventory announcement. Although Hendricks and Singhal (2009) explore the main effect of various actions and reasons on abnormal returns, they do not consider moderating impacts on the relationship between the announcing firm’s operational competence and abnormal returns. Third, the sample used in this paper is different from that in Hendricks and Singhal (2009). While they use a sample of 276 excess inventory announcements from all sectors during 1990–2002, we use a sample of 85 excess inventory announcements from only retail sector during 1990–2011.

Our paper is also related to the body of literature that has shown that investments based on IT yield higher abnormal stock market returns (Kesavan and Mani 2013; Alan et al. 2014) although Gaur et al. (2005) documented several disadvantages of using IT as a metric of inventory productivity. There are two possible explanations offered for this finding. One is information-based argument: the stock market might not be fully incorporating inventory information in pricing stocks (Kesavan et al. 2010; Kesavan and Mani 2013). The other is risk-based argument: high IT retailers could be riskier than low IT retailers as they have higher returns (Alan et al. 2014). Such a risk-based argument, in the opposite direction, has been offered for the abnormal returns observed when investing in TFP-based portfolios where low TFP retailers yield higher returns and are expected to be riskier compared to high TFP retailers (Imrohoroglu and Tuzel 2014). By studying the predictors of excess inventory announcement and the market response to the announcement, we provide evidence for the information-based argument and against the risk-based argument for investment in IT; but our paper supports for the risk-based argument for investment in TFP.

By using quarterly firm-level data of 183 US retailers between 1985 and 2012, Kesavan et al. (2016) have shown that low IT retailers have larger abnormal inventory growth compared to high IT retailers. However, the paper does not use excess inventory announcements. Our paper shows that low IT retailers are more likely to announce the buildup of excess inventory in the following year, which is consistent with the finding of Kesavan et al. (2016).

3 Hypothesis Development

3.1 Determinants of Excess Inventory Announcement

We derive our null hypothesis from theoretical operations management literature and observations in practice. In the commonly used newsvendor model, left-over inventory occurs when realized demand is lower than the forecasted demand. So, excess inventory announcements may be an inevitable outcome of demand uncertainty. This is supported by anecdotal evidence from practice where we observe majority of retailers claiming sluggish demand as the reason for excess inventory announcements. So, high and low operationally competent retailers have similar likelihoods of excess inventory announcements.

Alternatively, it is possible that operationally competent retailers have fewer excess inventory announcements. Excess inventory announcements are the result of supply–demand mismatches, and many researchers have emphasized operational improvements to reduce their occurrences (Fisher et al. 2000; Billington et al. 2002; Chopra and Sodhi 2004; Narayanan and Raman 2004; Tang 2006). For example, Fisher et al. (2000) show that four elements—forecasting; supply-chain speed; inventory planning; and accurate, available data—form the foundation of rocket science retailing to achieve “Right Product in the Right Place at the Right Time for the Right Price.” However, a direct link between operational competence and excess inventory announcements has not been established so far. Accordingly, we develop our first hypothesis as follows:

Hypothesis 1 (H1)

High operationally competent retailers have fewer excess inventory announcements compared to low operationally competent retailers.

3.2 Market Response on Excess Inventory Announcement

The negative impact of excess inventory announcement on the stock returns has been well documented (Hendricks and Singhal 2009). If the stock market considers excess inventory announcements to be outcomes of randomness in demand, then its negative reaction should not vary across high and low competent retailers. On the contrary, if the market believes such announcements to signal operational (in)competence of the announcing firm, then its reaction could vary based on the type of firm. We argue for two possible reactions based on the type of firm.

One may argue that the market penalizes excess inventory announcements made by high operationally competent retailers more severely than those made by their less competent peers. This is because the stock market on average could have a high expectation for operationally competent retailers and a low expectation for less competent retailers. So, when operationally competent retailers announce excess inventory, the market may be surprised by it, resulting in a sharp drop in the stock price. In contrast, when their less competent peers announce excess inventory, the market may have been expecting it so the stock price decline may not be too severe.

Alternatively, it is possible that the market might react more negatively to excess inventory announcements made by low competent retailers for the following reason. Excess inventory announcement only implies that the firm has excess inventory. The market may expect operationally competent retailers to recover from excess inventory problem sooner than their less competent peers. Hence the market does not penalize severely when high operationally competent retailers announce excess inventory while it may severely penalize when low operationally competent retailers announce an accumulation of excess inventory. Following above explanations, therefore, we develop two competing hypotheses as follows:

Hypothesis 2A (H2A)

The stock market reaction to excess inventory announcements will be more negative for high operationally competent retailers compared to low operationally competent retailers.

Hypothesis 2B (H2B)

The stock market reaction to excess inventory announcements will be less negative for high operationally competent retailers compared to low operationally competent retailers.

4 Determinants of Excess Inventory Announcement

To study the impact of operational competence on excess inventory announcement, we first explain why we measure operational competence by TFP, and then how to estimate it in the following section.

We choose TFP as our primary measure of operational competence because it is a well-studied metric across multiple fields, and there exists strong evidence that higher TFP is associated with better operations through various internal drivers such as management practices, employee knowledge, and information technology (Syverson 2011). Using data from 245 stores of a UK retailer, Siebert and Zubanov (2010) find that different skills of store manager explain about 27–35% of variation in store-level TFP. As the firm-level TFP is a sum of store-level TFP, we expect to capture retailer’s operational competence such as a capability of store management team by considering the firm-level TFP. In addition, we use inventory turnover, adjusted inventory turnover (AIT) metric from Gaur et al. (2005), and gross margin return on inventory (GMROI) as alternate metrics of operational competence.

4.1 Estimation of TFP

Total factor productivity (TFP) is a measure of overall efficiency in operations: how much output (e.g., revenue) is obtained from a given set of inputs such as capital, labor, and intermediate materials. It is also called multifactor productivity, which is conceptually opposite to single-factor productivity. Unlike single-factor productivity, TFP does not suffer from the different intensity problem of excluded input usage. For example, suppose that we estimate labor productivity for firm A and B, where firm A is a high technology firm while firm B is not. In this case, although firm A and B have exactly same labor level, labor productivity is affected by both labor and different intensity of excluded input such as technology because the importance of labor for firm A is relatively smaller than that of firm B.

The most popular way to measure the firm-level TFP is to get a residual, which is the deviation between the observed output and predicted output, from the Cobb–Douglas production function estimated by ordinary least square (OLS). However, such estimation may suffer from simultaneity bias (Marschak and Andrews 1944). Olley and Pakes (1996, abbreviated as OP) and Levinsohn and Petrin (2003, abbreviated as LP) introduce methods to control such bias so that allowing us to estimate consistent parameters of the production function, and thus obtain reliable TFP estimates.

The main difference between two approaches is that OP use investment while LP use intermediate inputs like energy and materials used in operations to control for correlation between inputs (i.e., explanatory variables) and the unobserved productivity shock (i.e., error term). Investment is a good proxy for the firm which has positive investment, but as LP pointed out there is a “zero investment” problem. In this case, investment proxy may not smoothly respond to the productivity shock, violating the consistency condition. Therefore, we use LP as a main method to estimate the firm-level TFP although we report all result with OP as a robustness check.

We estimate the production function based on labor and physical capital as two main inputs. The production function is given by:

where y it is the log of value added for firm i in period t (We use value-added, total output—intermediate materials, as an output. Therefore, we exclude intermediate materials from a set of inputs.); l it and k it are log of labor and capital inputs; and ϵit is an error term. The error term is a sum of two errors: Ωit, the TFP, and η it, an unexpected idiosyncratic productivity shock. Both LP and OP assume that TFP, Ωit, is observed by the decision-maker in the firm before the firm makes its input decisions, which gives rise to the simultaneity problem. That is, inputs are correlated with the realization of the TFP. Specifically, labor, l it, is the only variable input, thus its value can be affected by current TFP, Ωit, while capital, k it, is a fixed input at time t, and its value is only affected by the conditional distribution of Ωit at time t − 1. Therefore, Ωit is a state variable which has an impact on firms’ decision-making. For example, firms that observe a positive productivity shock in period t will consume more intermediate inputs, m it, and hire more labor, l it, in that period. Note that OP uses investment instead of intermediate inputs with the similar logic.

Demand for the intermediate input, m it, is assumed to depend on the firm’s state variables, Ωit and k it:

This intermediate input equation is based on the assumption that future TFP is strictly increasing in current TFP, Ωit, so firms which observe a positive productivity shock in period t will require more intermediate inputs in that period, for any capital, k it. This assumption is supported by the fact that TFP is not fleeting. For example, autoregressive coefficient of TFP is 0.64 in the US retail sector. Since m it is strictly positive, we can write the inverse function for the unobserved productivity shock, Ωit, as

which is strictly increasing in m it. The unobservable TFP is now expressed solely as a function of two observed inputs, m it and k it.

LP further assume that TFP is governed by a first-order Markov process

where ξit is an innovation to TFP that is uncorrelated with k it, but not necessarily with l it; this is one source of the simultaneity bias.

Using Eqs. (1), (2), and (4), we can obtain

where ϕ it(m it, k it) = β 0 + β k k it + h(m it, k it), and approximate ϕ it with a third-order polynomial series in capital and intermediate inputs. Approximation with a higher order polynomial does not significantly change the results. This first-stage estimation results in an estimate for \( {\hat{\beta}}_l \) which controls for the simultaneity problem.

However, the first stage does not identify β k. To do that, we begin by computing the estimated value for ϕ it using

For any candidate value \( \overset{\sim }{\beta_k} \), we can compute (up to a scalar constant) a prediction for Ωit for all periods t using

Using these values, a consistent (nonparametric) approximation to \( \mathbb{E}\left[{\Omega}_{it}\left|{\Omega}_{i,t-1}\right.\right] \) is given by the predicted values from the regression

which LP call \( \hat{\mathbb{E}\left[{\Omega}_{it}\left|{\Omega}_{i,t-1}\right.\right]} \).

Given \( \hat{\beta_l} \), \( \overset{\sim }{\beta_k} \), and \( \hat{\mathbb{E}\left[{\Omega}_{it}\left|{\Omega}_{i,t-1}\right.\right]} \), LP write the sample residual of the production function as

We can estimate \( \hat{\beta_k} \) by solving

Finally, the TFP is estimated by:

By using all data available up until that year, we estimate the production function parameters every year to eliminate a potential look-ahead bias in the TFP estimates. We calculate the firm-level TFP for each year using that year’s data (y it, l it, k it, and m it) and the corresponding production function parameters for that year (\( \hat{\beta_l} \) and \( \hat{\beta_k} \)). For example, to calculate TFP values for 2010, we use all data up to and including 2010 to estimate parameters and then use the 2010s data to calculate TFP value for each firm. These values would then be used to predict the likelihood of announcing excess inventory in 2011.

Our estimation of TFP is consistent with prior literature that has shown large and persistent differences in productivity (Syverson 2011). For the large differences in TFP, we find a significant dispersion in the firm-level TFPs in the US retail sector. The overall 90–10 TFP ratio in the US retail sector is 2.54 (2.04 in OP). Prior study has shown the similar differences. For example, Syverson (2004) finds the average 90–10 TFP ratio of 1.92 in the US manufacturing sector, and Imrohoroglu and Tuzel (2014) report the same measure of 1.8 in all US sectors. For the persistent differences in TFP, we find the autoregressive coefficient of 0.64 (0.73 in OP) in the retail sector. It is robust with productivity literature, which ranges autoregressive coefficients between 0.6 and 0.8 (e.g., Abraham and White 2006; Foster et al. 2008).

4.2 Data and Variables

We use three different databases to test our hypotheses.

4.2.1 Firm-Level TFP

The first main data source for estimating TFP (explained above in Sect. 4.1) is Standard and Poor’s Compustat from Wharton Research Data Services (WRDS). We use the Compustat fundamental annual data from 1962 to 2011. Our sample for production function estimation is comprised of all US retail firms by SIC code between 5200 and 5999. The sample is an unbalanced panel with approximately 1773 distinct retail firms; the total number of firm-year observations is approximately 18,281. This is only for estimating TFP. The sample size reduces after we merge the Compustat data with other datasets such as Factiva and daily stock price to test our hypotheses.

The key variables for estimating the firm-level TFP are the value added (y it), employment (l it), and physical capital (k it). Firm-level financial data is supplemented with three additional data: (1) price index for gross domestic product (GDP) as deflator for the value added; (2) price index for private fixed investment as deflator for capital, both from the Bureau of Economic Analysis (BEA); and (3) national average wage index from the Social Security Administration (SSA).

We use revenue-based measure of TFP, which is highly correlated with physical quantity-based measure (Foster et al. 2008), so value added (y it) is calculated as Sales–Materials, deflated by the GDP price index. Sales is net sales (SALE in Compustat), which is gross sales minus cash discounts, returned sales, etc. Materials (m it) is measured as total expenses minus labor expenses where total expenses is approximated as Sales minus Operating Income Before Depreciation and Amortization (OIBDP in Compustat), and labor expenses is calculated by multiplying the number of employees (EMP in Compustat) by average wage index from the SSA. Thus our value-added definition is proxied by Operating Income Before Depreciation and Amortization plus labor expenses.

The labor input (l it) is computed by the number of employees (EMP in Compustat). The capital stock (k it) is measured by gross property, plant, and equipment (PPEGT in Compustat) and deflated by the price index for private fixed investment (Brynjolfsson and Hitt 2003).

4.2.2 Excess Inventory Announcement

The second dataset, obtained from Factiva, collects excess inventory announcements made by publicly traded US retailers in the Wall Street Journal (WSJ) and Dow Jones News Service (DJNS) during 1990 to 2011. We use a set of keywords to search for announcements regarding excess inventory based on Hendricks and Singhal (2009). Specifically, we collect announcements which have the word “inventory or inventories” within five words of terms such as “obsolete, excess, glut, buildup, reduce, bloated, charge, adjust, loss, write-off, write-down, liquidate, accumulate, or revalue.” More details about searching algorithm which used in this paper are available on the Online Supplement of Hendricks and Singhal (2009). We obtain exactly the same number of announcements, 4612 (as reported in Hendricks and Singhal 2009), when we follow their algorithm to check consistency.

The final sample consists of 85 excess inventory announcements (73 unique firms) for retail firms in the USA between 1990 and 2011. We found 95 announcements initially, but after merging with other datasets, we end up having 85 announcements because of missing data, bankruptcy, etc. Here are some examples of announcement:

-

Best Buy Co. has started 12-month no-interest financing specials to trim PC inventory which will become obsolete when new technology arrives. (WSJ, 19 December 1996)

-

Gap Inc. cuts prices to spark slow sales and reduces inventory which results in flat gross profit margins. (WSJ, 5 May 2000)

-

Wal-Mart’s inventories jumped 10.3% in the fiscal first quarter, ended April 30, to $35.2 billion from a year earlier, driven by unsold apparel, home decor, and outdoor products. (WSJ, 21 May 2007)

Figure 1 shows the number of announcements by year. Nearly 52% of announcements are made during 1990s and 48% are during 2000s. Further investigation of the timing of announcement indicates that more announcements are reported during the first and the fourth quarters (i.e., from October to March), with 32.94%, 18.82%, 18.82%, and 29.41% in the first, second, third, and fourth quarters, respectively. This result differs from an observation made by Hendricks and Singhal (2009) which has nearly equally distributed across the four quarters. Different fiscal year across industries may cause this variation. Considering retailer’s fiscal year, which ends in general at the end of January and earnings report date is couple of months later, our sample represents retailers’ tendency to announce excess inventory before earnings report date. Based on the National Bureau of Economic Research, our sample embraces two recession periods: (1) March 2001 to November 2001; and (2) December 2007 to June 2009. Our data show that 9.41% of our announcements (8 out of 85 announcements) are made during the recession period. We test the effect of recession on our main models as a robustness check, but we do not find any statistically significant difference between recession and non-recession periods.

Our sample consists of firms in retail sector from eight different industries based on two-digit standard industrial classification (SIC) codes between 5200 and 5999. Table 1 illustrates the distribution of excess inventory announcements by industry. Since our sample does not have any excess inventory announcement in SIC 58, we exclude it from our analysis. Miscellaneous retail (SIC 59) represents 32.94% of the sample, while Food stores (SIC 54) represents 1.18% of the sample.

Some announcements provide detail information including the reasons of accumulating excess inventory (Table 2) and the actions that a firm has taken or plans to take to deal with excess inventory (Table 3). 35.42% of the sample mentions sluggish sales and 5.21% of the sample mentions obsolete and discontinued inventory as a main reason of excess inventory buildup. Interestingly, many firms (35.42%) blame external factors such as sluggish sales as a main reason of building excess inventory, whereas very few firms (4.71%) mention internal factors such as internal inefficiency and poor execution as a main reason of excess inventory, suggesting that the randomness in demand is the key driver of excess inventory, but not operational incompetence. For action information, 38.61% of firms states markdowns and promotions and 23.76% of firms states inventory write-down as their primary actions to cope with excess inventory problem. As action is verifiable by the market, but reason is not, the stock market may respond differently by action but not reason. We explore this idea in Sect. 5.4.

4.2.3 Daily Stock Price

Final dataset is obtained from CRSP, which provides daily stock prices for all public firms. Using them, we estimate the expected return during the event window for each of announcing firms when they announce excess inventory. See the details about the event study methodology in Sect. 5.1.

4.2.4 Variables

To test our hypothesis, we generate the following variables for our analysis.

4.2.4.1 Dependent Variables

4.2.4.2 Independent Variables

We use mean-adjusted variables for the measure of operational competence such as TFP and IT for the following reasons. First, different industries within the US retail sector have different levels of TFP and IT. Our data show that the estimated firm-level TFP (both LP and OP) varies significantly by two-digit SIC Table A1 in the Online Supplement. Overall mean TFP by LP is 2.54 with standard deviation of 0.35. Heterogeneity in IT across industries in the US retail sector is well documented by Gaur et al. (2005). Second, firm’s TPF and IT may vary over time even in the same industry by, for example, introducing new technology or changing the top management team. To account for heterogeneities both across industries and across years, we calculate the mean TFP and IT for each year in each industry, then subtract them from raw values. Hence, we use mean-adjusted variables (i.e., MeanAdjTFP it and MeanAdjITit) in our analysis. For a robustness check, we also report the results with (1) median-adjusted and (2) raw values of TFP and IT without any adjustment.

Summary statistics and the Pearson correlation coefficients among all variables used in our analysis are provided in Tables 4 and 5, respectively. Mean-centered variables are used to compute the correlation coefficients because of panel structure of our data. We note that correlation between mean-adjusted TFP estimated by LP and that by OP is 0.95, indicating that both estimates are robust each other. We trim the top 1% and bottom 1% of observations based on TFP by LP and OP, IT, sales growth, and market value of the firm’s common equity. This approach ensures that our analyses are not influenced by extreme outliers.

4.3 Model Specification and Analysis

This section presents the econometrics model to test Hypothesis 1 about the impact of operational competence on excess inventory announcement. We propose the following probit model:

where Φ denotes standard normal cdf and X is a vector of covariates including two-digit SIC industry fixed effect (b I), year fixed effect (a t), main variables of interest to measure firm’s operational competence (MeanAdjTFPi, t − 1 and MeanAdjITi, t − 1), and two control variables (Sales Growthi, t − 1 and Market Valuei, t − 1).

In our empirical model specification, we include year-specific dummies (a t) and two-digit SIC industry-specific dummies (b I) to account for time- and industry-specific unobserved heterogeneity (i.e., selection on observables). By using all explanatory variables in a lagged form (i.e., imposing pre-existing condition), we can minimize the concern of simultaneous problem and estimate conditional probability of announcing excess inventory at time t, given all the information available at time t−1. Two control variables other than time fixed and industry fixed effects are used: sales growth controls for different growth rate across retail firms; and market value of firm’s common stock controls for firm size.

We run a random effect probit model instead of fixed effect for the following reasons. First, our dependent variable, an indicator of excess inventory announcement, has only 85 observations (73 unique firms) with value 1. If we use a fixed effect model, we cannot use the firms that only have one value of dependent variables (i.e., no time variation over time). For example, if firm A does not report any excess inventory announcement, firm A is omitted from our sample to run a fixed effect model because all observations of dependent variable in firm A are 0. Thus, we have to use a small sample of 73 unique firms if we run a fixed effect model, which result in a huge loss in sample size. Second, recent papers in economics literature (Arellano and Honore 2001; Hahn 2001; Laisney and Lechner 2003; Greene 2004; Cerro 2007), by analyzing the fixed effects model on binary choice dependent variable (e.g., probit model), show that the fixed effect estimator is inconsistent and substantially biased away from zero. Third, an analysis of decomposed overall variation into between and within variations supports our use of random effect model. In Table 4, all explanatory variables have larger between-variation than within-variation. We use probit model as a main model; however, we also check the robustness of our result with different model specifications such as logit and complementary log-log models.

4.4 Results

4.4.1 Results: Determinants of Excess Inventory Announcement

Table 6 presents regression results to unveil determinants of excess inventory announcement. We report the result with only control variables in column (1), and then add TFP and IT in columns (2) and (3), respectively. Finally both TFP and IT are entered in column (4).

Consider the results from column (2) that support our conjecture that operationally competent retailers have fewer excess inventory announcements. The coefficient of 1-year-lagged mean-adjusted TFP captures the impact of operational competence on the probability of announcing excess inventory in the following year. As we expected, we find that 1-year-lagged mean-adjusted TFP has negative impact on the probability of announcing excess inventory (−1.24, p < 0.01). High TFP retailers, those in the top 90th percentile of TFP, are 3.53 times less likely to announce excess inventory than low TFP retailers, those in the bottom 10th percentile. Thus, we find evidence supporting Hypothesis 1 and conclude that TFP is a predictor of excess inventory announcement. While the direction of this result is intuitive, it is still useful to not only document this finding but, more importantly, the large magnitude we observe.

When we use IT as a measure of operational competence as shown in column (3), we find that 1-year-lagged mean-adjusted IT has negative impact on the probability of announcing excess inventory (−0.03, p < 0.05). High IT retailers, those in the top 90th percentile of IT, are 2.33 times less likely to report excess inventory than low IT retailers, those in the bottom 10th percentile. When we use IT and TFP in the same model as shown in column (4), we find that the coefficients of both IT and TFP remain similar indicating that this pair of variables have low correlation, confirmed in Table 5, but we find that significance of IT reduces to 10% level. So, it appears that TFP is a better predictor of excess inventory announcement than IT.

We note that the coefficients’ estimates of the control variables are in the expected direction. The year fixed effect and two-digit SIC industry fixed effect are significant in the entire models, implying that unobserved year-specific error and industry-specific error (i.e., selection on observables) should be controlled. The market value of the firm’s common stock, which is the proxy for firm size, and sales growth are not significantly associated with the chance of reporting excess inventory in our data.

4.4.2 Robustness Checks

We perform a number of tests to show the robustness of our result, namely the negative impact of operational competence on excess inventory announcement (Table 7).

Alternative Model Specifications

We examine the stability of the results using different model specifications. In the main model, we use probit model (Eq. (13)) where we assume the cumulative standard normal distribution as a link function. We can alternatively use logit model where a link function is assumed by the cumulative logistic distribution (i.e., \( \Pr \left({EI}_{it}=1|\boldsymbol{X}\right)={\left[1+{e}^{-{\boldsymbol{X}}^{\prime}\beta}\right]}^{-1} \)). As the binary dependent variable in our data is asymmetric, we can also use a complementary log-log model specification which assumes \( \Pr \left({\mathrm{EI}}_{it}=1|\boldsymbol{X}\right)=1-{e}^{-{e}^{{\boldsymbol{X}}^{\prime}\beta }} \)as a link function. Columns (1) and (2) in Table 7 show the results with logit model and complementary log-log model, respectively. The results are very similar to the ones obtained with probit model (Table 6). This shows that our substantive results are no artifact of the specific model chosen in the analysis.

Alternative Data Adjustments

We test the validity of our theoretical model using alternative adjustments for TFP and IT. In the main model, we adjust TFP and IT by their mean values calculated by each industry in each year. It helps us control for both heterogeneities across industries and across years. The mean, however, is sensitive to extreme values and median is preferable in this case. Hence we use median-adjusted TFP and IT instead of mean-adjusted TFP and IT. As a further robustness check, we also report the result using raw variables without any adjustment. As seen in columns (3) and (4) in Table 7, the conclusions remain unchanged, indicating that our main result is not affected by extreme values.

Alternative TFP

We examine the sensitivity of the results to an alternative measure of TFP introduced by Olley and Pakes (1996). As we discussed in Sect. 4.1, OP is an alternative way of measuring the firm-level TFP. Since the correlation between mean-adjusted TFP estimated by OP and that by LP is 0.95 (shown in Table 5), we expect to see robust results. The main conclusions do not change with TFP estimated by OP (column (5) in Table 7).

Alternative Inventory Efficiency

We repeat our analysis with alternative proxies of inventory efficiency. We use two additional metrics other than IT: growth margin return on inventory (GMROI) and adjusted inventory turnover (AIT). See Alan et al. (2014) for details of definition and computation. The results are reported in columns (6) and (7) in Table 7 for mean-adjusted AIT and GMROI, respectively. Our main finding, the negative impact of TFP on the probability of announcing excess inventory, is still consistent. Interestingly, the both proxies for inventory efficiency are not significantly associated with the likelihood of announcing excess inventory any more. Using other adjustments such as median-adjusted or raw variables still estimate insignificant coefficients for the proxies of inventory efficiency.

Recession Period

We rerun the regression with recession dummies instead of year-specific dummies. The main result is unchanged and recession dummies are not statistically significant (table is omitted), implying that the probability of announcing excess inventory does not differ from recession period to non-recession period.

To sum up, we find that excess inventory announcement is not just a function of randomness in demand; it is systematically correlated with the announcing firm’s operational competence. We also find that TFP is a better metric of overall operational competence than IT.

5 Market Reaction

5.1 Event Study Methodology

Our main measure for the second research question about market reaction is the short-term abnormal returns (AR) accruing from excess inventory announcements to the focal firm, estimated by the event study methodology (see Brown and Warner 1985 for a review of this methodology). Using stock price (i.e., shareholder value) as a performance metric has several advantages: It is forward looking, integrates multiple dimensions of performance, and is less easily manipulated by managers than other measures (Gielens et al. 2008). Event studies usually enable (1) to test for the existence of information effects of event (e.g., the impact of the excess inventory announcement on market value of stock price) and (2) to identify factors that enlighten changes in market value of stock price (e.g., announcing firm’s operational competence).

Consistent with the approach used in many event studies (Brown and Warner 1985), we measure abnormal returns over a 2-day event period (i.e., the day of the announcement and the day before the announcement date). If the excess inventory announcement is made before 4 p.m. Eastern Standard Time (EST), the event window includes the day of announcement and the preceding trading day to account for the possibility that the information about the event may have been released the day before the announcement. If the excess inventory announcement is made after 4 p.m. EST, then the event window consists of the day of the announcement and the trading day after the announcement to account for the fact that the market cannot act until the next trading day. We translate calendar days into event days as follows. For announcements made before 4 p.m. EST, the announcement calendar day is Day 0 in event time, the next trading day is Day +1, and the trading day before the announcement is Day −1, and so on. For announcements made after 4 p.m. EST, the announcement calendar day is Day −1 in event time, the next trading day is Day 0, and the trading day before the announcement is Day −2, and so on. In addition to a 2-day event period, we also use a 3-day event window (from Day −1 to 1) as a robustness check.

The information effects of excess inventory announcements are assessed by computing the difference between the observed return, R id, on the event date and the expected return, \( \mathbb{E}\left[{R}_{id}\right] \), estimated on a benchmark model.

The observed return, R id, is expressed as the percentage change in stock price:

where P id is the closing stock price for announcing firm i on day d. The price P id incorporates the long-term impacts of the additional information becoming public on the day d. It follows the “efficient market” (or “rational expectation”) paradigm which assumes a complete and immediate investor response to any available information. Consistent to the literature (e.g., Kalaignanam et al. 2013; Hendricks et al. 2014), we estimate the expected return, \( \mathbb{E}\left[{R}_{id}\right] \), using the Fama-French four-factor model that includes the three factors identified by Fama and French (1993) and the momentum factor identified by Carhart (1997):

where R md is the stock return of the benchmark market portfolio, SMBd is the difference between rate of returns of small and big stock firms, HMLd is the difference in returns between high and low book-to-market ratio stocks, and UMDd is the momentum factor defined as the difference in returns between firms with high and low past stock performance.

We estimate the expected daily stock returns for each firm using OLS regression over the estimation period from day −220 to day −21. In estimating the parameters we require that a firm must have a minimum of 40 stock returns during the estimation period of 200 trading days. Abnormal returns are estimated as the difference between the observed returns, R id, and the expected returns,\( \mathbb{E}\left[{R}_{id}\right] \):

The abnormal returns are aggregated for a firm over an event window [−d 1, d 2] and are given by

When information leakage (for d 1 days before the event) and/or dissemination over time (for d 2 days after the event) occur, the abnormal returns for a firm are aggregated over the “event window” [−d 1, d 2] into a cumulative abnormal return (CAR). Because the event study is conducted across N different events, the individual CARs can be averaged into a cumulative average abnormal return (CAAR).

5.2 Model Specification

This section presents the econometrics model to test our hypotheses about the market response to excess inventory announcements. We propose the following model:

Similar to the previous model in Eq. (13), we include two fixed effects. First, year fixed effect (a t) is included to account for the unobservable yearly shock which can impact on multiple announcements made in a specific year. Second, industry fixed effect (b I) is added to account for the unobservable industry shock which can impact on announcements made in a specific industry. Two control variables are used: sales growth controls for different growth rate across retailers and natural logarithm of sales for firm size. Note that we ensure that all explanatory variables are in the most recent fiscal year completed before the date of the excess inventory announcement (i.e., typically 1-year-lagged form).

5.3 Results

5.3.1 Results: Main Effect of Excess Inventory Announcement on Stock Price

We examine the cumulative average abnormal returns for the 85 excess inventory announcements across different event windows. We find a statistically significant abnormal return on the announcement day (−2.18%, p < 0.01). Table 8 shows the results for four different event windows using the four-factor model with statistics such as the cross-sectional variance-adjusted Patell test statistic. Notice that all four event windows show significantly negative mean abnormal returns. For example, CAAR[−1, 0] is −2.53% (p < 0.01), meaning that the stock market reflects the information of holding accumulated inventory by penalizing the announcing firm’s stock price. Although 47.06% of the companies are positively affected, the CAR is negative for 52.94%. To reduce the influence of outliers, we supplement the t-statistic with nonparametric test, the Wilcoxon signed-rank test. It shows that the median abnormal return is statistically different from zero (p < 0.10).

We find two interesting observations. First, 47.06% of the retailers have positive abnormal stock market returns around the excess inventory announcement. Hendricks and Singhal (2009) observed only 27% of firms to have positive stock market reaction. In other words, there is considerable heterogeneity in the market’s response to the announcement. To explain this anomaly, we consider the information provided by the retailers for the reasons for excess inventory buildup and actions that they have taken or plan to take to handle the excess inventory, later in the Sect. 5.4.

Second, comparing to Hendricks and Singhal (2009) that show the decline in the stock price by −6.79% to −6.93% due to excess inventory announcement, our finding is smaller in magnitude. This is because we focus on the retail sector, whereas Hendricks and Singhal (2009) study all sectors in the USA. It may indicate that the stock market perceives the excess inventory announcement more negatively when non-retailers announce it. In fact, Hendricks and Singhal (2009) show that if the excess inventory is with customers, the announcing firm has additional penalty of approximately 2.5% in the stock price. As retailers are the customer of other firms, but not the opposite, we expect to observe a smaller decline in the stock price when retailers announce excess inventory. Hence, our finding is consistent with Hendricks and Singhal (2009).

5.3.2 Results: Market Reaction Across the Announcing Firm’s Operational Competence

Consistent with the approach used in many event studies (e.g., Brown and Warner 1985; Hendricks and Singhal 2009; Kalaignanam et al. 2013; Hendricks et al. 2014), we use a CAR measure in 2-day event period as a dependent variable in our cross-sectional analysis. We estimate Eq. (20). In order to reduce the endogeneity issue, we ensure that all explanatory variables are in the most recent fiscal year completed before the date of the excess inventory announcement (i.e., 1-year-lagged form). The results are presented in Table 9. We initially include TFP (i.e., MeanAdjTFPi) and IT (i.e., MeanAdjITi) separately in columns (1) and (2), respectively, and then add both metrics in column (3). As a robustness check, we also report results with a 3-day event window (i.e., CARi[−1, 1]) in columns (4)–(6).

Consider the result from columns (1) and (4). We find that 1-year-lagged mean-adjusted TFP is significantly and negatively associated with the cumulative abnormal returns in a 2-day event window (−29.35, p < 0.05) and in a 3-day event window (−39.12, p < 0.01). This means that the stock market penalizes more severely when the announcing firm is indeed high TFP retailer. Ceteris paribus, an increase in 1-year-lagged mean-adjusted TFP by one-standard-deviation (i.e., 0.141) is associated with −4.14% in the stock return over a 2-day period (the day of the announcement and the day before the announcement) and −5.52% over a 3-day period (from the day before the announcement to the day after the announcement). Hence, we find supporting evidence of Hypothesis 2A.

Consistent with Hendricks and Singhal (2009), we find that 1-year-lagged mean-adjusted IT is not associated with the cumulative abnormal returns in 2-day and 3-day event windows (columns (2) and (5)). It can substantiate prior literature (e.g., Kesavan et al. 2010; Kesavan and Mani 2013) which finds that the stock market does not fully incorporate the information contained in inventory. When we use IT and TFP in the same model as shown in columns (3) and (6), we find that our results remain qualitatively the same, so we use it for further robustness checks.

We note that the coefficients’ estimates of the control variables are in the expected direction. The natural log of sales, which is the proxy for firm size, is negatively associated with the abnormal return (−4.21, p < 0.01). It implies that larger retailers experience more negative abnormal returns than smaller retailers. The sales growth, which is the proxy for firm’s growth rate, is not associated with the abnormal return in our data. It may imply that the market does not differentiate its response to excess inventory announcement across the growth rate of announcing firm.

5.3.3 Robustness Checks

In addition to using alternative dependent variable (i.e., CARi[−1, 1]) in columns (4)–(6) in Table 9, we perform following robustness checks for our main results, more negative reaction of the stock market to excess inventory announcement when the announcing firm is a high TFP retailer (Table 10): alternative adjustments for TFP and IT by using median-adjusted and raw variables shown in columns (1) and (2), respectively; alternative measure of TFP by using OP approach presented in column (3); alternative measure of inventory efficiency by using AIT and GMROI shown in columns (4) and (5), respectively; and using recession dummies instead of yearly dummies (omitted). The substantive conclusions remain unchanged throughout all different models, indicating that our main results are robust.

5.4 Value of Information in Excess Inventory Announcements

Another aspect to explore is whether our finding, the negative association between the announcing firm’s operational competence and abnormal returns due to excess inventory announcement, differs by the information contained in the announcement. Previous literature (Sorescu et al. 2007) shows the positive impact of the information offered in the announcement on short-term abnormal returns. They use price and time to introduction of new product as key information in the announcement as this information can reduce uncertainty on the future cash flow of the announcing firm.

In the excess inventory announcement, the actions that the firm has taken or plans to take to deal with excess inventory and the reasons of building excess inventory are potential information that investors can utilize. Providing information on follow-up actions to handle the buildup of excess inventory can reduce the investor’s uncertainty on the future cash flow of the announcing firm. The stock market might perceive this information credible as the market can verify action information provided in the announcement. The announcing firm is also likely to fulfill its claim (i.e., action) because increasing reliability (i.e., the extent to which the firm has fulfilled claims it made) is a component of firm reputation (Sorescu et al. 2007). With an expectation that operationally competent retailers have high reputation compared to their less competent peers, competent retailers are more likely to keep their promise (i.e., action) as the costs of a loss of reputation are greater. Hence, the action information may moderate the negative link that we found in the previous section so that the stock market may penalize less severely when operationally competent retailers announce excess inventory with follow-up action information compared to when they do not provide such action information.

On the contrary, providing information on why the announcing firm accumulated excess inventory might not help investors visualize the announcing firm’s future cash flow. As the true reason of holding excess inventory is not observable to the stock market, the announcing firm is less likely to reveal it. Consistent with this argument, many retailers (35.42%) blame external factors such as sluggish sales as a main reason of building excess inventory, whereas very few retailers (4.71%) mention internal factors such as internal inefficiency and poor execution as shown in Sect. 4.2.1. Knowing this, the stock market might not perceive reason information credible. Hence, the reason information may not have a moderating effect.

To formally test this idea, we create two indicator variables: Action i and Reason i. Action i (Reason i) is defined as 1 if the announcement provides action (reason) information, and zero otherwise. We also create two interaction variables with TFP. Then we re-estimate the model in Eq. (20) with those created variables. Columns (1)–(3) in Table 11 are the main results and (4)–(7) are robustness checks, respectively. We find that providing action information in the announcement moderates the negative association between firm’s operational competence and abnormal stock returns. An increase in 1-year-lagged mean-adjusted TFP by one-standard-deviation (i.e., 0.141) is associated with −6.35% in the stock returns over a 2-day period without action information, whereas it is associated with −1.61% in the stock returns over a 2-day period with action information as shown in column (1). In contrast, we do not find such moderating effect with reason information in column (2). These observations are consistent with our argument above.

Note that when we add both action and reason indicators with corresponding interactions in column (3), we have directionally the same result although main variables are insignificant due to multicollinearity and small sample. Hence, we use model in column (1) for robustness checks. We show the robustness of our result with the following tests: alternative dependent variable by using CARi[−1, 1] (column (4)); alternative adjustment of TFP and IT by using median-adjusted (column (5)) and raw variables (column (6)); and alternative measure of TFP by using OP approach (column (7)). All results are consistent.

Our results show that when high TFP retailers announce the buildup of excess inventory, they can still be largely unscathed if they can explain how they plan to tackle the problem. In other words, when an operationally competent retailer announces excess inventory and explains the follow-up action, then the market is willing to minimize the penalty. When we divide 85 announcements into four groups (high vs. low TFP and with vs. without actions), we find that retailers in the top 50th percentile of TFP face a −3.78% (median) decline in stock returns when they announce excess inventory without providing follow-up actions but face a 1.74% (median) increase in stock returns when they provide follow-up actions. We conjecture that the market trusts the competent companies to turn around their operations when provided with a definite plan of action. Hence, the worst-case scenario is really when high competent firms announce excess inventory and do not provide follow-up actions. This seeds doubts about the company’s competency and makes the stock price decline the most. In contrast, we do not find such difference in stock market reaction to whether retailers in the bottom 50th percentile of TFP provide follow-up actions or not to fixing the excess inventory problem (−0.75% vs. −1.86% in median).

6 Summary and Conclusion

In the omnichannel environments, retailers have provided a far wider variety of available products to consumers, through the online channels, compared to what they do via conventional brick-and-mortar (B&M) channels because of the phenomenon commonly known as the long tail—niche products can account for a large portion of total sales (Anderson 2006; Brynjolfsson et al. 2011). For example, Brynjolfsson et al. (2006) document that online book retailers offer over three million book titles, while typical B&M book stores carry between 40,000 and 100,000 titles. However, as retailers make more products available through both online and offline channels, it is harder for consumers to find the product they are looking for, resulting in a low demand for each product. Such high variety and the low demand for each individual product can cause supply–demand mismatch (Bell et al. 2014). So, omnichannel retailers are confronting a higher risk of having excess inventory and writing-down.

In this paper, based on an analysis of a combined dataset of excess inventory announcements, annual financial statements, and daily stock prices of publicly traded retailers in the USA during 1990–2011, we document that excess inventory announcement is negatively affected by the announcing firm’s operational competence, measured by TFP. We also show two findings from the stock market’s response to excess inventory announcements. First, the market more severely penalizes the announcing firm’s stock price when the firm is high TFP retailer. Ceteris paribus, an increase in 1-year-lagged mean-adjusted TFP by one-standard-deviation (i.e., 0.141) is associated with −4.14% in the stock returns over a 2-day period (the day of the announcement and the day before the announcement). Second, providing action information in the announcement can mitigate the negative abnormal returns when high operationally competent retailers announce excess inventory. An increase in 1-year-lagged mean-adjusted TFP by one-standard-deviation is associated with −6.35% in the stock returns over a 2-day period without action information, whereas it is associated with −1.61% in the stock returns over a 2-day period with action information.

The main results presented in this paper have a number of implications. First, by suggesting empirical evidence that firm’s operational competence is negatively associated with the likelihood of announcing the buildup of excess inventory in the following year, we show that excess inventory is not a random phenomenon merely driven by demand uncertainty, which is typically harder for managers to control, but by management practices. Hence, excess inventory appears to be manageable through better operations.

Second, our result shows a potential value of using the firm-level TFP as an important metric. By adding it to the current important metrics like IT, retailers may enjoy following benefits. Retailers will be able to predict the odd of announcing excess inventory as we find that TFP is a better predictor of excess inventory announcement than IT. In addition, retailers will be able to anticipate the stock market’s response in the future when they announce excess inventory for a given level of their TFP. So, retailers can make a better plan for the future.

Third, our results provide a possible explanation for an observation made in operations management literature. Recent papers have shown that investments based on inventory turns yield higher abnormal stock market returns (Kesavan and Mani 2013; Alan et al. 2014). There are two possible expositions offered for this finding. One is information-based argument: the stock market might not be fully incorporating inventory information in pricing stocks (Kesavan et al. 2010; Kesavan and Mani 2013). The other is risk-based argument: high IT retailers could be riskier than low IT retailers as they have higher returns (Alan et al. 2014). Our study provides evidence for the former and against the latter. By contrasting with TFP, our study finds that stock market reaction differs across high TFP and low TFP retailers, but there is no significant difference in market reaction to announcements from high IT and low IT retailers. This result suggests that the stock market may not be distinguishing between high IT and low IT retailers (i.e., information-based argument), leading to abnormal returns in the future. In addition, we show that the low IT retailers are potentially riskier than high IT retailers because they have a greater likelihood of announcing excess inventory compared to high IT retailers (i.e., against risk-based argument for IT). For the risk-based argument for TFP, consistent with Imrohoroglu and Tuzel (2014), we find that the low TFP retailers are riskier than high TFP retailers by providing evidence that low TFP retailers is more likely to announce excess inventory compared to high TFP retailers.

As with all studies, our work has limitations that bear noting and offer opportunities for future work. We find the heterogeneity of the firm-level and industry-level TFP in the US retail sector. This paper, however, does not describe the reasons why the firm-level TFP varies across firms and across industries as that is not the main focus of this paper and hence beyond the scope of this work. By using firm-specific and industry-specific characteristics, the future research might be able to give rigorous expositions. Moreover, what causes differences in firm-level TFP between online retailers and brick-and-mortar retailers would be fruitful avenue of future research.

Our study has a caveat on measurement that may be examined in future research. Our measure of excess inventory is a binary variable based on public announcement of excess inventory. We are unable to perform an analysis based on the magnitude of excess inventory since our data lack such information. For example, the available data only allow us to examine the probability of announcing excess inventory based on the operational competence in the previous year, but we do not know how much excess inventory the firm suffers from. If more sophisticate data are available in the future, one can extend our model to incorporate the magnitude of excess inventory into the relationship between firm’s operational competence and excess inventory announcement.

Altogether this paper fills the gap suggested by Hendricks and Singhal (2009): “It could be useful to build an understanding of some of the underlying drivers of excess inventory and to find whether the negative effect of excess inventory varies by these drivers.” We show that firm’s operational competence, measured by TFP, is an underlying driver of excess inventory, and the negative market reaction varies by it.

References

Abraham, A., & White, K. (2006). The dynamics of plant-level productivity in U.S. manufacturing. Center for Economic Studies Working Paper 06–20.

Alan, Y., Gao, G. P., & Gaur, V. (2014). Does inventory productivity predict future stock returns? A retailing industry perspective. Management Science, 60(10), 2416–2434.

Anderson, C. (2006). The long tail: Why the future of business is selling less of more. New York: Hyperion.

Arellano, M., & Honore, B. (2001). Panel data models: Some recent developments. In E. Leamer & J. Heckman (Eds.), Handbook of econometrics (Vol. 5, pp. 3229–3296). Amsterdam: North Holland.

Bartelsman, J. E., & Mark, D. (2000). Understanding productivity: Lessons from longitudinal microdata. Journal of Economic Literature, 38(3), 569–594.

Barua, A., Kribel, C., & Mukhopadhyay, T. (1995). Information technology and business value: An analytic and empirical evaluation. Information Systems Research, 7(4), 409–428.

Bell, D., Gallino, S., & Moreno, A. (2014). How to win in an omnichannel world. MIT Sloan Management Review, 56(1), 45.

Bertrand, M., & Schoar, A. (2003). Managing with style: The effect of managers on firm policies. Quarterly Journal of Economics, 118(4), 1169–1208.

Bertschek, I., & Kaiser, U. (2004). Productivity effects of organizational change: Microeconometric evidence. Management Science, 50(3), 394–404.

Billington, C., Johnson, B., & Triantis, A. (2002). A real options perspective on supply chain in management of technology. Journal of Applied Corporate Finance, 15(Summer), 32–43.

Bloom, N., & Van Reenen, J. (2007). Measuring and explaining management practices across firms and countries. Quarterly Journal of Economics, 122(4), 1351–1408.

Brown, S. J., & Warner, J. B. (1985). Using daily stock returns: The case of event studies. Journal of Financial Economics, 14(1), 3–31.

Brynjolfsson, E., & Hitt, L. M. (1996). Paradox lost? Firm-level evidence on the returns to information systems spending. Management Science, 42(4), 541–559.

Brynjolfsson, E., & Hitt, L. M. (2003). Computing productivity: Firm-level evidence. Review of Economics and Statistics, 85, 793–808.

Brynjolfsson, E., Hu, Y., & Simester, D. (2011). Goodbye pareto principle, hello long tail: The effect of search costs on the concentration of product sales. Management Science, 57(8), 1373–1386.

Brynjolfsson, E., Hu, Y., & Smith, M. D. (2006). From niches to riches: The anatomy of the long tail. Sloan Management Review, 47(4), 67–71.

Carhart, M. M. (1997). On persistence in mutual fund performance. The Journal of Finance, 52(1), 57–82.

Cerro, J. (2007). Estimating dynamic panel data discrete choice models with fixed effects. Journal of Econometrics, 140, 503–528.

Chen, H., Frank, M., & Wu, O. (2005). What actually happened in the inventories of American companies between 1981 and 2000? Management Science, 51(7), 1015–1031.

Chopra, S., & Sodhi, M. S. (2004). Managing risk to avoid supply-chain breakdown. Sloan Management Review, 45(Fall), 53–61.

Dewan, S., & Kraemer, K. L. (2000). Information technology and productivity: Evidence from country-level data. Management Science, 46(4), 548–563.

Fama, E. F., & French, K. (1992). The cross section of expected stock returns. The Journal of Finance, 47(2), 427–465.

Fama, E. F., & French, K. (1993). Common risk factors in the returns on stocks and bonds. The Journal of Financial Economics, 33(1), 3–56.

Fisher, M. L., Raman, A., & McClelland, A. (2000). Rocket science retailing is almost here. Are you ready? Harvard Business Review, 78, 115–124.

Foster, L., Haltiwagner, J., & Syverson, C. (2008). Reallocation, firm turnover and efficiency: Selection on productivity or profitability. American Economic Review, 98, 394–425.

Gaur, V., Fisher, M. L., & Raman, A. (2005). An econometric analysis of inventory turnover performance in retail services. Management Science, 51(2), 181–194.

Gielens, K., Van De Gucht, L. M., Steenkamp, J. B. E. M., & Dekimpe, M. G. (2008). Dancing with a giant: The effect of Wal-Mart’s entry in the United Kingdom on the performance of European retailers. Journal of Marketing Research, 45(5), 519–534.

Greene, W. (2004). The behaviour of the maximum likelihood estimator of limited dependent variable models in the presence of fixed effects. The Econometrics Journal, 7, 98–119.