Abstract

Product assortment is of significance importance to omnichannel fashion products vendors. These vendors must make assortment decisions well ahead of their selling season and across channels that face distinct types of demand and comprise different fulfillment capabilities. Because of differences in operational costs and margins across channels, assortment decisions are likely to affect vendors’ top and bottom lines, ultimately affecting their profitability. In this book chapter, we use data from an omnichannel fashion product vendor to empirically assess the likelihood and the sales volume of a product according to its characteristics in two channels, wholesale and dropshipping. Establishing demand profiles based on fashion product characteristics allows vendors to evaluate jointly channel choice and stocking decisions for assortment integration across multiple channels.

Access provided by Autonomous University of Puebla. Download chapter PDF

Similar content being viewed by others

Keywords

1 Introduction

The interaction between product assortment—i.e., types, number, and inventory levels of products in a line—and consumers’ channel choice plays a critical role in retail operations (Hoch et al. 1999). Within the fashion retailing sector, product assortment decisions are particularly important and challenging for vendors participating in omnichannel initiatives (Mantrala et al. 2009). Omnichannel fashion products vendors (OFPVs) must make assortment decisions for these inventories well ahead of their selling season, with the goal of ensuring product availability throughout the season and minimizing inventory overages by the season’s end. Moreover, OFPVs must make these decisions across channels that face distinct types of demand and comprise different fulfillment capabilities—i.e., storing, picking, packing, and shipping. If OFPVs were able to replenish their own inventory after observing actual demand, they could resort to existing models of consumer channel choice to make individual channel assortment decisions (Aviv and Pazgal 2008; Cachon and Swinney 2009; Levin et al. 2009; Cachon et al. 2005). However, this option is not typically available because OFPVs’ selling seasons are commonly much shorter than the lead times required to source fashion products, as most of these products are typically manufactured overseas. Thus, in making their assortment decisions, OFPVs must decide which products and how many units of them to allocate across channels, well before observing actual demand.

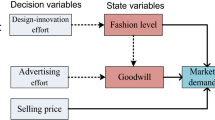

In this chapter, we present an omnichannel assortment integration model to assist OFPVs in this task. To that end, we build on the literature on choice modeling (Guadagni and Little 1983) to identify product attributes that (1) make a given product more likely to be sold across channels and (2) increase its sales volume in each channel. We focus on assortment decisions faced by an OFPV when choosing between traditional wholesale and drop-shipping channels to fulfill end-consumer demand. Through the drop-shipping channel, the vendor stocks and owns inventory and ships products directly to consumers to fulfill their online orders at the retailers’ request. Conversely, through the wholesale channel, the vendor sells products directly to the retailers who, in turn, will sell these items to consumers through their physical stores.

Drop-shipping has become a popular alternative among firms that wish to increase their assortment variety without having to invest in additional assets and fulfillment capabilities (Netessine and Rudi 2006; Rabinovich et al. 2008). Extant literature on omnichannel assortment integration has recognized the importance of drop-shipping to develop analytical models of consumer choice that inform assortment decisions (Kök et al. 2015). Although such frameworks purportedly work well in generalizable settings, they are unable to account for salient differences among fashion product attributes that could make some items more suitable for sale in the drop-shipping channel than in the wholesale channel.

We present an empirical analysis to tackle this issue. Rather than attempting to build an analytical choice model, we adopt an attribute-based modeling approach (Hoch et al. 1999; Fader and Hardie 1996; Boatwright and Nunes 2001). We collected data from an OFPV in order to make inferences regarding the allocation of on-hand inventory for an upcoming selling season across both the drop-shipping and the wholesale channels. We observed that products that are more suitable for demand fulfillment via the drop-shipping channel require less effort by consumers to ascertain their characteristics and are less easily substitutable. We also observed that demand in the drop-shipping channel tends to converge around products that are more difficult to substitute by consumers and sales in this channel cluster around products that have substitutes with highly dissimilar prices. Conversely, in the wholesale channel, products that are easier to substitute by consumers sell more, and sales converge among products that have substitutes with more homogeneous prices. We further observed that product price is a key variant in the degree of substitutability and sales among products in both drop-shipping and wholesale channels. These findings serve to inform tradeoffs in assortment decisions across both channels.

2 Background

Demand modeling, including consumer choice and substitution analyses, constitutes a fundamental platform for the assortment planning literature (Fisher and Vaidyanathan 2014). Exogenous demand models and utility-based consumer choice models such as the multinomial logit (Guadagni and Little 1983; Mahajan and Van Ryzin 2001) and locational choice models (Hotelling 1929; Lancaster 1975; Gaur and Honhon 2006) dominate this literature. Although assortment planning models have predominantly hinged on product-based approaches (Kök et al. 2015), there is an awareness among researchers that consumers can also evaluate and integrate different product attributes in making choice decisions instead of focusing on direct preferences for particular products in a category. Therefore, attribute-based approaches can assist firms in predicting sales and optimizing their assortments.

The assortment literature on attribute-based approaches has developed models of consumer preferences as a response to a group of attributes for products within categories. For instance, Fisher and Vaidyanathan (2014) estimated demand and substitution probabilities at the attribute level based on sales to propose heuristics for product assortments. In a similar vein, Rooderkerk et al. (2011) developed a normative model that provides optimal category assortment solutions for a retailer’s stores. In their estimation procedure, they decompose the sales of a product into an attribute-based baseline component that remains unaffected by the presence of other products in the category, the effects of the store’s own marketing mix, and the cannibalizing effects of substitute products carried and promoted by the store. According to the authors, the use of an attribute-based approach enables their model to handle the sale of large sets of products and still predicts sales for all of them, even those not yet available for sale, assuming that they have certain existing attributes. In a follow-up study, Rooderkerk et al. (2013) demonstrate that the use of their heuristics increases expected profits compared with current assortment practices. For comprehensive reviews of the vast literature on assortment planning, see Kök et al. (2015) and Mou et al. (2018).

Researchers examining assortment across channels have noted that most omnichannel firms offer larger assortments online than offline, and many allow and encourage consumers to purchase online when an item is not available offline. The reason for these differences in assortment is that the Internet lowers asymmetries in information availability that consumers face offline when choosing among different products. This makes it possible for consumers buying online to incur much lower search costs than those they encounter offline, where information is scattered across physical locations (Bakos 1997).

This phenomenon is particularly critical in fashion retailing supply chains. These supply chains handle a wide variety of products with very short life cycles, facing highly elastic consumer demand with respect to retail prices and high-demand variability in prices, colors, and styles (Pashigian and Bowen 1991). Historically, retailers and their vendors have adopted practices such as flexible manufacturing (Fisher et al. 1994) and dynamic pricing, including markdowns (Namin et al. 2017), to increase availability of products at competitive prices, particularly in the presence of strategic consumers, who will wait until the end of the season to buy products at a discount (Su and Zhang 2009). However, such practices have proven to be suboptimal at best, since they increase supply chain complexity and are not guaranteed to meet consumers’ expectations regarding pricing and product choice (Franke et al. 2009).

This is partly why retailers have turned to drop-shipping to segment demand fulfillment. Retailers can choose to carry less risky items downstream in the supply chain (e.g., at retailers’ stores and warehouses) and use drop-shipping to market online newly introduced items and other high-risk products located at their vendors’ facilities upstream in the supply chain. Drop-shipping is also scalable. It allows retailers to increase product variety beyond what might be available through mass customization initiatives implemented in collaboration with vendors. In drop-shipping arrangements, retailers leverage their vendors’ inventory management and fulfillment capabilities, thereby making no investments in logistics capabilities and associated manufacturing flexibility. Furthermore, these arrangements offer retailers the possibility of tapping into the readily available products already stocked at their vendors’ facilities.

For vendors, participation in drop-shipping offers valuable opportunities, since transaction costs and double marginalization yield lower margins for products marketed through traditional wholesale channels than through drop-shipping channels (Rabinovich et al. 2003). However, drop-shipping also poses a risk to vendors, as they must own and hold inventory to satisfy highly unpredictable demand. This, in turn, can induce vendors to make suboptimal inventory ordering decisions regarding these products (Netessine and Rudi 2004).

In spite of an increasing interest in the subject area of drop-shipping operations, research on omnichannel assortment integration under this subject area has been rare. In essence, drop-shipping is an application of the postponement-speculation principle (Rabinovich et al. 2008), in which a firm shifts the risk of owning goods to another organization. As such, a retailer postpones inventory when it enters a drop-shipping arrangement with a vendor. Conversely, when a retailer carries inventory in its stores instead of drop-shipping it, it takes on the risk of owning the inventory. The decision by a retailer and a vendor to either postpone or speculate will hinge on the tradeoff between the costs of holding the inventory by one party versus the other (Bucklin 1965).

The principle of postponement-speculation has informed drop-shipping studies because it offers a means to predict the type of channel structure that will arise to sell a particular product. For instance, Netessine and Rudi (2006) developed an analytical model and conducted a numerical assessment to investigate the use of both wholesale and drop-shipping channels in tandem for the sale of commodities that get replenished. In a related study, Randall et al. (2006) used data from Internet retailers to investigate when they invest in fulfillment capabilities instead of adopting a drop-shipping approach with their vendors. They found that Internet retailers are more likely to invest in such capabilities when they sell small, high-margin products, offer lower levels of product variety, and face low-demand uncertainty. Finally, Rabinovich et al. (2008) used data from an Internet retailer of handbags, luggage, and accessories to investigate the relationship between product margins and service promises to consumers.

The postponement-speculation literature informs this chapter inasmuch as it provides an understanding of the risks involved in postponement by stocking products upstream, in the drop-shipping channel, or in speculation, by stocking products downstream in the supply chain, in the wholesale channel. By choosing to stock more units of inventory for drop-shipping, an OFPV will postpone the movement of products away from facilities closer to the consumer markets (i.e., retail stores). The risk–benefit tradeoff to the OFPV manifests itself in the form of higher carrying costs, as well as salvaging costs of unsold units of inventory, versus higher margins obtained by selling directly to end consumers in the drop-shipping channel. In turn, by choosing to push more units downstream to the retailers in the wholesale channel, the vendor will sell products at lower margins while avoiding the risks of holding too much inventory.

3 Omnichannel Assortment Integration Model

We structured the model for omnichannel assortment integration for an OFPV in the following way. Before the start of the selling season, the OFPV receives the entire inventory assortment, in full, from its overseas suppliers. At that point, when the OFPV is still unable to observe actual demand, they must decide (1) which products to allocate for sale in each channel and (2) how much inventory to reserve to satisfy demand in each channel. Products sold exclusively through a single channel have their entire inventories allocated to the channel and, as a result, require no further consideration. Reserving inventory of products sold across both channels is important because, as described above, channels require different fulfillment capabilities, so products are stored, picked, packed, and shipped in different ways. Once a unit of inventory is reserved to a particular channel, it cannot be sold in the other channel before the clearance season.

Consistent with extant attribute-based modeling approaches, we derive the omnichannel assortment integration model according to the observed choices made by customers. We adopt a parsimonious approach to identify meaningful attributes to enter the model. There are typically three important criteria to determine what would constitute a meaningful product attribute (Fader and Hardie 1996). First, a product attribute must be immediately observable to the consumer, i.e., it must be recognizable. Second, it must be objective, i.e., precise. Third, it must be collectively exhaustive, i.e., it must apply to every product in the line. Our choice of attributes follows the three aforementioned criteria and hinges on the nature of fashion products and the differences that exist between the wholesale and the drop-shipping channels.

3.1 Channel Choice

We consider the likelihood of a product getting drop-shipped to elaborate on consumer channel choice in the attribute-based omnichannel assortment integration model. According to the information economics literature, consumers face much lower search costs when shopping online than when shopping in traditional bricks-and-mortar settings (Bakos 1997). This allows consumers to find more obscure items online (Brynjolfsson et al. 2011). Because of such differences in search costs across channels, the distribution of sales across products is much less concentrated in online channels than in offline ones (Brynjolfsson et al. 2003). Thus, we expect that the distribution of sales will be much less concentrated in the drop-shipping than in the wholesale channel.

Simply put, a product’s likelihood of getting drop-shipped involves differences in product variety across channels. Prior literature suggests that product variety in the drop-shipping channel will be wider than in the wholesale channel, ceteris paribus. Positioning inventory upstream in a supply chain, at a vendor’s facilities, allows retailers to offer a broader array of products because of the inherent space limitations in a retail store, as long as they can meet their end-consumers’ expectations, both in terms of service promises and prices (Rabinovich et al. 2003, 2008). Moreover, since product variety refers to a product’s degree of substitutability (Lancaster 1990), the literature suggests that the drop-shipping channel will exhibit higher product variety and consequently product substitutability than the wholesale channel.

A product’s likelihood of getting drop-shipped will hinge on the number of substitutes for it. The more substitutes, the more likely a product will get drop-shipped, since there are just as many slots for product displays at a retail store. In the context of fashion products, substitutability is a measure of the number of colors and styles in which a particular product is offered (Pashigian and Bowen 1991). Thus, we expect that a product will be more likely to get drop-shipped as it will be offered in more colors and styles.

Moreover, fashion products are experience goods (Huang et al. 2009) for which consumers can ascertain attributes only upon consumption (Nelson 1970). Specifically, when purchasing a fashion product online, consumers may find it difficult to assess whether it will match their preferences. This is particularly true for colored products (i.e., those that are neither white nor black), since consumers can see colors on their screens differently from the ones for the physical products themselves. Therefore, consumers should be more likely to shop for colored products in store than online. That is, we should expect that a colored product will be less likely to get drop-shipped than a non-colored one.

Product size is another important attribute for drop-shipping consideration. Like colored products, those that come in too small or too large sizes may require greater inspection by consumers to find a perfect fit. As such, consumers should be more likely to shop for such products that come in irregular sizes in store than online. This should make irregular-sized products less likely to get drop-shipped.

Finally, studies have shown that product margins are an important factor in drop-shipping arrangements (Netessine and Rudi 2006; Randall et al. 2006; Rabinovich et al. 2008). Drop-shipped products tend to exhibit much lower costs, hence higher margins, because of the disintermediation effects (Spulber 1996) stemming from positioning inventory upstream in the supply chain. Thus, we expect to observe that a product will be more likely to get drop-shipped as its margin will increase.

3.2 Channel Sales Volume

Demand for fashion products is highly elastic with respect to retail prices. As such, we expect to observe decreasing levels of demand with increasing prices for a given product in both channels. Moreover, this effect will be stronger in the drop-shipping channel compared to the wholesale channel. This is because of the lower search costs faced by consumers when shopping for products online (Bakos 1997; Brynjolfsson et al. 2011), as we discussed above. On the Internet, consumers can easily compare prices across distinct websites and switch to the one charging the lowest price for the same product/service.

Regarding product substitutability, there is a debate in the literature on whether cannibalization occurs when consumers face more options. Some studies suggest that a greater level of product differentiation reduces the rate of cannibalization (Hamilton and Richards 2009), whereas others recommend assortment reduction to avoid cannibalization and optimize individual products sales (Ryzin and Mahajan 1999; Raghavan Srinivasan et al. 2005). In the fashion sector, this issue still requires empirical scrutiny. Hence, the effect on demand of the introduction of color and style substitutes on consumer demand for a given product in the wholesale channel may be either positive or negative.

This is not necessarily the case in the drop-shipping channel, however. Because the Internet makes it easier for consumers to search for and find products, including the most obscure ones, introducing product substitutes may increase a product’s sales. This is because consumers may decide to purchase a product that comes in a different color or style than the one they found when shopping online, as switching is costless in online environments (Brynjolfsson and Smith 2000). Therefore, an increase in the number of substitutes for a product should cause higher increases in demand in the drop-shipping as compared to those in the wholesale channel.

Furthermore, we expect that pricing decisions for product substitutes will affect consumer choice in the wholesale channel. Specifically, when consumers face higher degrees of price dispersion among substitute products in a retail store, they are likely to concentrate their purchases around the most popular and usually cheaper products (Salop and Stiglitz 1977). This is particularly applicable to experience goods, such as fashion products, since consumers lack familiarity with the products’ characteristics, making it more difficult to assess, contrast, and compare them. Therefore, we expect that demand will decrease as products display higher degrees of price dispersion across colors and styles. Finally, consistent with the notion that online channels offer consumers lower search costs, we expect that such effect of increases in price dispersion among colors and styles will cause a stronger decrease in a product sales in the drop-shipping channel than in the wholesale channel, ceteris paribus. This is because consumers are better able to contrast and compare prices when shopping online than offline and, as such, should concentrate their purchases on the product whose color or style will be the cheapest.

4 Empirical Methodology

4.1 Data Collection

We collected data from an omnichannel vendor of outdoor apparel. The dataset comprises all orders received by the vendor from its retail customers in the USA in fiscal years 2015, 2016, and 2017. Each order corresponds to a single product requested by each retailer. Order details include a description of the product (e.g., UPC, style, color, size, selling price, and net margin), the amount of units of that product requested by the retailer, the order date, and the channel through which the vendor must fulfill the order (i.e., wholesale or drop-shipping). Typically, the vendor will use the inventory allocated to the wholesale channel to fulfill large orders placed before the start of the season by retailers to stock their stores. Retailers rely on demand forecasts to place these initial orders. However, it is common for the vendor to tap into that inventory to satisfy additional smaller orders, albeit bulky, which the retailers place during the season to replenish their stores, after they are able to observe demand. In turn, retailers will place drop-shipping orders sporadically throughout the season. Typically, these are single-unit orders to satisfy end-consumer purchases made through the retailers’ websites, which the vendor must send directly to the end-consumers’ homes.

We excluded from the dataset all canceled orders or orders that served purposes other than satisfying the retail customers’ actual demand, such as requests for samples or gifts. This yielded 392,758 orders across the three fiscal years. The dataset covers 15,191 unique products, among which 5408 are drop-shipped at least once (i.e., 35.6% of the products are samples). The drop-shipping channel is responsible for just 4.33% of the orders and 1.89% of the requested items. The number of orders and the volume of items requested in the drop-shipping channel are relatively much smaller than those in the wholesale channel. This is consistent with the rest of the retail industry in the USA (Smith 2017).

The dataset exhibits variability among products caused by the vendor’s introduction of new patterns and colors at different prices for each year’s selling season. Moreover, the dataset includes 17 retail customers with stores in over 600 locations across all regions in the USA. Among these customers, 60% are specialty stores and the remainder general merchandise stores. This provides us with a representative cross-section of retail demand that furthers the generalizability of this study. Finally, the vendor sells products across multiple styles (i.e., top, bottom, base layer, insulator, and fleece) and in multiple colors and sizes. Such variability in the dataset is important as it provides us a wide range of ordered items and an ample set of product attributes to operationalize measures and carry out statistical analyses (please refer to Table 1).

4.2 Statistical Model

The dual consumer choice that informs the omnichannel assortment integration model is mutually dependent. Sales of a product can only occur in a certain channel if the channel has been selected to fulfill demand for that product in the first place. We focus on a scenario in which we will be able to assess both the likelihood of a product getting drop-shipped as well as its sales volume in each channel. To that end, we present a “switch” and an “outcome” model, respectively (Miranda and Rabe-Hesketh 2006). We draw from Heckman (1979) and Miranda and Rabe-Hesketh (2006) and employ a system of simultaneous equations to deal with the mutual dependence.

Equation (1) represents the likelihood of a product getting drop-shipped, based on its unique attributes:

The dependent variable, \( {\mathrm{dropshipped}}_{iy}^{\ast } \), represents a latent continuous variable, where

Thus, Eq. (1) represents a binary probit model that assesses product i’s drop-shipping likelihood in fiscal year y (y = 2015, 2016, or 2017). Equation (1) also includes a vector of covariates, \( {x}_{1 iy}^{\prime } \), consisting of an intercept and five unique product attributes: p_coloredi, p_irregulari, p_marginiy, p_color_substitutesiy, and p_style_substitutesiy. In addition, Eq. (1) includes a vector of controls, \( {z}_1^{\prime } \), consisting of two measures, FY15 and FY16, as well as a random error term, ν iy.

Equation (3) represents the sales volume of a product across channels, based on its unique attributes:

Because the variable of interest in Eq. (3) is a count, a latent variable model is not suitable (Miranda and Rabe-Hesketh 2006). We assume, instead, that the count c_unitsiyc, representing the total sales of product i in fiscal year y in channel c, follows a Poisson distribution with mean μ iyc. This allows for the development of a log-linear model.

Equation (3) includes a vector of covariates, \( {x}_{2 iyc}^{\prime } \), consisting of an intercept and five measures: c_priceiyc, c_color_substitutesiyc, c_style_substitutesiyc, c_color_Price_Dispersioniyc, and c_style_Price_Dispersioniyc. In addition, it includes interaction terms involving the dummy c_dropshippingiyc. These interaction terms capture the differential effect of the measures in the demand in the drop-shipping channel as contrasted with the demand in the wholesale channel. Equation (3) also includes a vector of controls, \( {z}_2^{\prime } \), consisting of three measures: c_ordersyc, FY15, and FY16. Finally, Eq. (3) includes a random error term, ε i, which follows the standard normal distribution.

To ensure the mutual dependence between the assortment decisions represented in Eqs. (1) and (3), we use ε iy as a shared random term. To that end, we write v iy in Eq. (1) as:

The factor loading λ is a free parameter and ζ iy follows the standard normal distribution and is independent from ε iy. We thus can rewrite Eq. (1) as:

The total variance in our simultaneous equation model represented by Eqs. (1′) and (3) is λ 2 σ 2 + 1, where σ 2 = Var(ε iy) determines the amount of overdispersion in the counts. When σ = 0, overdispersion is not a concern, so we can use standard generalized linear models to estimate Eq. (3). Also, when λ = 0, we can estimate Eq.(1′) using ordinary probit regression. Finally, the correlation between the residuals in Eqs. (1′) and (3), ρ, is:

Following Miranda and Rabe-Hesketh (2006), we stack the responses p_dropshippediy and μ iyc in one variable, q jiyc. We then view the binary response in the switch model (j = 1) and the count response in the outcome model (j = 2) as clustered within products. We define the dummies d 1jiyc = 1 if j = 1 and d 2jiyc = 1 if j = 2. Next, we specify q jiyc as having a binomial distribution with a probit link g 1(.) if j = 1 and a Poisson distribution with a log link g 2(.) if j = 2. We can thus write our main nonlinear model for the conditional mean of q ji as:

4.3 Measures

4.3.1 Product-Specific Attributes

Tables 2 and 3 report the descriptive statistics and correlation coefficients for our measures. The dependent variable in Eq. (1′) is p_dropshippediy, a binary measure representing whether product i is ordered in the drop-shipping channel at least once in fiscal year y. The distinction in getting drop-shipped across years is important because retailers are likely to change their stocking decisions seasonally. Retailers may prefer not to carry a particular product in their stores to test whether consumers will demand it via the drop-shipping channel, in which case they may decide to stock the product in the following years to benefit from higher margins. Conversely, retailers may decide to drop a particular product from their stores in case in-store consumer demand for it fails to reach a desired level.

The measure p_marginiy captures the average net margin of product i in fiscal year y across all retail customers. A product’s margin may vary because of differences in fulfillment costs, since the vendor ships a variable amount of products from a single facility in the USA to the customers’ distribution centers and end-consumers’ homes, whose numbers and distances to that single facility vary considerably. Costs also vary because of differences in sales representatives commissioning and discounts offered to individual retail customers. In addition, the measure p_color_substitutesiy captures product i’s substitutability according to the number of identical products in size and style, but not color, offered by the vendor in fiscal year y (e.g., the same pant comes in different colors). In a similar vein, p_style_substitutesiy captures product i’s substitutability according to the number of products of identical color and size in its corresponding style in fiscal year y (e.g., pants that only differ in their cut). Finally, the dummy variable p_coloredi captures whether product i is neither black nor white, whereas the dummy variable p_irregulari captures whether product i is of irregular size.Footnote 1 These two latter variables are time-invariant.

4.3.2 Product-Channel-Specific Attributes

The dependent variable in Eq. (2) is c_unitsiyc, a count measure representing the total amount of units of product i ordered in fiscal year y in channel c (c = wholesale or drop-shipping). In addition, the measure c_priceiyc captures the average selling price of product i in fiscal year y in channel c. Similar to the net margins, prices may vary for a same product because of differences in fulfillment costs, commissions, and discounts. The measure c_color_price_dispersioniyc captures the observed variability in selling prices across products that differ only in color. To operationalize it, we compute the coefficient of variation of the selling price across all products with the same size and style as product i’s, but with different colors, in fiscal year y in channel c. The coefficient of variation captures the dispersion of a measure. It is computed as the measure’s average divided by its standard deviation. Similarly, c_style_price_dispersioniyc captures the observed variability in selling prices across products that differ only in style (i.e., cut and shape). We operationalize c_dropshippingiyc as a dummy variable to capture whether the information used in our model for product i corresponds to the drop-shipping or the wholesale channel (the latter being the baseline) in fiscal year c. The measure c_ordersiyc controls for the total number of orders for product i in fiscal year y in channel c. Finally, the dummy variables FY15 and FY16 control for year-specific fixed effects, where fiscal year 2017 serves as a baseline.

5 Results

Sample selection bias is a serious concern in this study because both drop-shipping eligibility and stocking amount decisions are mutually dependent and the process is not fully randomized. Accounting for such sample selection bias in the dataset is not trivial because we use a nonlinear model to fit the data. As such, two-stage procedures analogous to individual equation estimation or the Heckit method (Heckman 1979) are only approximate, and no appropriate distribution results for the estimators are available. Hence, inference based on such procedures may lead to imprecise conclusions (Wooldridge 2002). As a result, we need to use maximum likelihood techniques or two-stage method of moments to estimate our model.

We chose to estimate Eq. (6) using the generalized linear latent and mixed models (GLLAMM) procedure in Stata. The procedure fits a generalized linear model that contains an endogenous dummy among its observed covariates and a latent random term. The GLLAMM procedure accounts for overdispersion and the correlation between the random terms of both switch and outcome models by adjusting the parameter estimates. It does so by dividing them by the square root of the total variance in the model (i.e., \( \sqrt{\lambda^2{\sigma}^2+1} \)). Finally, it performs the maximum likelihood estimation by using either ordinary Gauss–Hermite quadrature or adaptive quadrature in the Newton-Raphson optimization algorithm (Rabe-Hesketh et al. 2002, 2003, 2004, 2005).

Table 4 reports the results of our GLLAMM estimation. The results suggest that sample selection is indeed a concern in this study. Specifically, the parameter ρ, corresponding to the correlation between the residuals, is significant at the 0.01 level. This indicates that there is variation in shared random effects between the two error terms. The results also suggest that overdispersion is present in the sample because the parameter σ is significant at the 0.01 level. Therefore, the null hypothesis of σ = 0 is rejected. Taken together, these results lend credence to the approach that considers a joint estimation of both switch and outcome models, accounting for their types.

Concerning the switch model, the results suggest that colored products are less likely to get drop-shipped than non-colored ones, since the parameter estimate for p_colored is negative (β 11.1 = −0.220, p < 0.01). The same applies to irregular-sized products, which are less likely to get drop-shipped than those that come in regular sizes, as suggested by the negative parameter estimate for p_irregular (β 11.2 = −0.175, p < 0.01). Conversely, products become more likely to get drop-shipped as the number of their color substitutes increases, as suggested by the positive parameter estimate for p_color_substitutes (β 11.3 = 0.044, p < 0.01). However, products become less likely to get drop-shipped with increases in their style substitutes, as indicated by the negative parameter estimate for p_style_substitutes (β 11.4 = −0.001, p < 0.01). Finally, products are more likely to get drop-shipped as their net margin increases, as suggested by the positive parameter estimate for p_margin (β 11.5 = 2.243, p < 0.01).

With respect to the outcome model, the results suggest that demand for a product in the wholesale channel decreases as its average selling price increases. In addition, the negative coefficient for c_price (β 21.1 = −0.002, p < 0.01) suggests that an increase of 1% in a product’s average selling price will lead to a reduction in 2/1000 units in the demand for it in the wholesale channel. Conversely, the coefficients for c_color_substitutes and c_style_substitutes (β 21.2 = 0.039 and β 21.3 = 0.001, respectively; p < 0.01) suggest an increase in 4/100 units (1/100 units) in demand for a given product in the wholesale channel for each introduced color (style) substitute. These results suggest that retailers tend to request more units of products offered in multiple colors and of different styles in an attempt to ensure that end consumers will find their “ideal match” when lured into a retail store. Interestingly, as price dispersion increases across colors and styles, the demand shifts in different ways. On one hand, retailers tend to order fewer units of a product when the observed variability in prices across its colors increases, as suggested by the negative coefficient for c_color_price_dispersion (β 21.4 = −0.735, p < 0.01). On the other hand, retailers tend to order more units of a product when the observed variability in prices across its styles increases, as suggested by the coefficient for c_style_Price_Dispersion (β 21.5 = 0.496, p < 0.01).

The interaction terms involving the dummy variable c_drop-shipping provide insights regarding the differential effect on demand caused by offering a product via the drop-shipping channel in addition to the wholesale channel. The demand for a given product increases further in the drop-shipping channel than in the wholesale channel as its average selling price will increase, as suggested by the coefficient for the interaction term involving c_price (β 22.1 = 0.002, p < 0.01). Demand for a given product will increase in the drop-shipping channel as color substitutes for that product are introduced, as suggested by the coefficient for the interaction term involving c_color_substitutes (β 22.2 = 0.028, p < 0.01). The introduction of style substitutes further increases demand for a product in the drop-shipping channel, according to the coefficient for the interaction involving c_style_substitutes (β 22.3 = 0.002, p < 0.01). Finally, price dispersion across colors and styles further decreases demand for a given product in the drop-shipping channel as compared to the decreases observed in the wholesale channel, as suggested by the coefficients for the interaction terms involving c_color_price_dispersion and c_style_price_dispersion (β 22.4 = −1.48 and β 22.5 = −0.947, respectively; p < 0.01).

6 Discussion and Implications

This study bridges an important gap between the marketing and the inventory management literatures in the domain of omnichannel retailing. While marketing studies have focused on product attributes to explore the channels through which vendors might offer fashion products, inventory management studies have focused on optimal stocking quantities for this kind of products according to the chosen channel. This study is among the first to establish demand profiles based on product characteristics to evaluate jointly channel choice and stocking decisions for assortment integration across multiple channels. We presented an omnichannel assortment integration model for fashion products and empirically assessed it using a rich dataset and a novel statistical technique. We focused on fashion products sold through both wholesale and drop-shipping channels because of those products’ importance in the growth of drop-shipping operations in retailing. The generalizability of our findings extends to other seasonal product categories that share commonalities with fashion products. Demand for products in these categories is hard to predict because of a lack in historical data to fit traditional forecasting models (e.g., newsvendor) and constrained supply because of long lead times in the products’ supply chains. This study provides a starting point for additional research on omnichannel assortment integration strategies for product segments whose vendors must decide a priori, before the start of the season, how to allocate inventory to satisfy demand, which will be observable only after the start of the season. Because of differences in operational costs and margins across channels, these decisions are likely to affect vendors’ top and bottom lines, ultimately affecting their profitability.

6.1 Academic Contribution

Ours is among the first empirical investigations of drop-shipping in an omnichannel setting. We present an omnichannel assortment integration model based on channel and fashion products characteristics and identify cross-channel effects in demand between the wholesale and the drop-shipping channels for this category of products. The findings underscore the importance of deciding which products to drop-ship and how many units to allocate to satisfy demand in both drop-shipping and wholesale channels in tandem, thereby providing a much more nuanced understanding of omnichannel assortment integration.

Specifically, our study shows that fashion products that are colored and that come in irregular sizes are less likely to get drop-shipped. These findings corroborate the notion that retailers should offer consumers the possibility of trying on fashion products with distinctive features. However, the mixed results for product substitutability as a determinant of drop-shipping likelihood had greater nuance. We observed that products offered in more colors are more likely to get drop-shipped, whereas those offered in more styles are less likely to get drop-shipped. These results suggest that retailers are interested in competing in different ways: they seek to limit the in-store choice of colors while expanding the in-store choice of styles. Finally, the finding that retailers will be more likely to drop-ship a fashion product as its net margin increases points to an interesting aspect of omnichannel assortment integration, retailers are increasingly relying on the drop-shipping channel to ensure availability of higher-margin fashion products. Given that online retailers are commanding increasing amounts of sales of fashion products in the USA (Kapner 2017a), the results of this study suggest that competition for margins has significantly shifted to online channels. This, in turn, implies a diminishing role of the retail store as a source of higher margins and, consequently, suggests that the retail store will play a different role in the fashion sector. Not surprisingly, bricks-and-clicks retailers, like Nordstrom and Sears, have increasingly repurposed their stores to become not only a space of purchases but mainly a gathering place for consumers (Kapner 2017b).

The results also point to different directions regarding the inventory amounts available across channels. We observed that retailers will carry fewer units of a given product as its price increases. Because, as discussed above, retailers are less likely to carry a product as its net margin increases, we infer that risk aversion for fashion products is more strongly related to the likely costs incurred in overstocking than in understocking. That is, retailers favor carrying in-store more units of less expensive, lower-margin products.

Also interesting is the association between the number of substitutes and the ordering amount for a given product. The results suggest that retailers will strive to ensure that walk-in consumers will be able to find the exact product to try on among a highly diversified assortment in store. However, pricing different colors and styles of a same product will have different effects on demand. On one hand, retailers order fewer units of a given product when the observed variability in prices across its multiple colors will increase. On the other hand, they order more units of a given product when the observed variability in prices across its multiple styles will increase. We infer that retailers expect that walk-in consumers will be less informed about styles than colors. Thus, they will flock to the more popular and less costly colors, whereas they will shop randomly across different styles.

Regarding stocking amounts based on online orders in the drop-shipping channel, consumers buy more units of a given product as its price increases. This points to strong cross-channel effects, in which retailers are deliberately shifting demand for higher-ticket products to the online channel away from their stores in order to avoid the risks of overstocking those products. In addition, online demand for a product will be higher if it has more substitutes, both in terms of colors and styles. This suggests that it is easier for shoppers to browse retailers’ assortments online to find a particular product and then choose among its different options. Finally, consumers tend to purchase fewer units of a given product online as the observed variability in prices across its colors and styles increases. This corroborates the notion that online shoppers converge to the more popular and cheaper products among those that differ only in color or style.

6.2 Managerial Contribution

Based on the results of this study, products with higher variety in color (style) are more (less) likely to get drop-shipped. Given the costs associated with carrying substitutable products in store to satisfy walk-in demand, our results point to drop-shipping as an interesting alternative for omnichannel sellers. Specifically, demand shifts from the wholesale to the drop-shipping channel with the introduction of more colors. Also, the results point for the significance of drop-shipping as a preferred channel to sell high-margin products, although demand may significantly decrease with increases in prices.

However, as firms begin to incorporate high-margin/high-price products in their drop-shipping channel, they become more exposed to risk. Such products may entail higher operational costs, including ordering, handling, holding, picking, packing, and shipping. In addition, excess inventory for these products will lead to salvage costs at the end of the season.

Product size is also an important attribute to be considered in omnichannel assortment decisions. According to our results, regular-sized products are more likely to get drop-shipped. Because these products are in general very similar and stocked in large quantities, inattentive employees tend to pick the wrong product, which is a main source of inventory record inaccuracies. Past research (Kull et al. 2013) has indicated that such inaccuracies are pervasive in distribution centers and has a negative effect on inventory performance. As such, omnichannel vendors should consider the tradeoffs between carrying similar items, which lead to increases in efficiency by making their processes in the distribution center uniform while inducing operational errors.

In addition, observed variability in prices is a significant factor that will influence assortment integration. Vendors and retailers will choose to carry more items of a given product when prices are less disperse across its color and style substitutes. However, the inventory amount of each product is limited and determined a priori, before the start of the season. As a result, vendors and retailers are likely to engage in competition for such inventory, for instance, by placing larger orders before the start of the season for those products. Such rationing game is likely to induce inventory overages, which will ultimately lead to suboptimal operational results.

7 Conclusion

This study suggests that the retail store still has a role to play in retailing. This is particularly the case for the fashion retailing sector. Consumers, in general, must try on fashion products. This study also underscores the ancillary role played by the drop-shipping channel to balance risk and facilitate the matching of supply with demand for fashion products. It will be interesting to observe, in the coming years, the usefulness of the model presented in this study, as new retailing models will emerge. For instance, Amazon just launched its “Prime Wardrobe” service, in which consumers receive apparel products at home and can return them, free of charge, in case they are not satisfied with their fit (Zakrzewski 2017). This has the potential to change the way consumers shop for and purchase seasonal apparel products and may challenge the role of the retail store for this type of product (Kapner 2017a).

In this book chapter, we provide a starting point for additional research on omnichannel assortment integration for the unique fashion product segment, in which vendors must decide a priori, before the start of the season, how to allocate inventory to satisfy demand that will be observable only after the start of the season. Specifically, using a richer dataset, further research could investigate share of business fulfilled by the focal vendor for each of the order-receiving retailers. Such analyses would provide a clearer picture of how to serve and focus on each of those retailers in order to improve the drop-shipping business and long-term relationships with them. Because of differences in operational costs and margins across channels, these decisions are likely to affect supply chains’ top and bottom lines, ultimately affecting their profitability.

Notes

- 1.

We consider “too small” those sizes starting with letter “X,” below small, and “too large” those starting with letter “X,” above large.

References

Aviv, Y., & Pazgal, A. (2008). Optimal pricing of seasonal products in the presence of forward-looking consumers. Manufacturing & Service Operations Management, 10, 339–359.

Bakos, J. Y. (1997). Reducing buyer search costs: Implications for electronic marketplaces. Management Science, 43, 1676–1692.

Boatwright, P., & Nunes, J. C. (2001). Reducing assortment: An attribute-based approach. Journal of Marketing, 65, 50–63.

Brynjolfsson, E., Hu, Y. J., & Simester, D. (2011). Goodbye Pareto principle, hello long tail: The effect of search costs on the concentration of product sales. Management Science, 57, 1373–1386.

Brynjolfsson, E., Hu, Y. J., & Smith, M. D. (2003). Consumer surplus in the digital economy: Estimating the value of increased product variety at online booksellers. Management Science, 49, 1580–1596.

Brynjolfsson, E., & Smith, M. D. (2000). Frictionless commerce? A comparison of Internet and conventional retailers. Management Science, 46, 563–585.

Bucklin, L. P. (1965). Postponement, speculation and the structure of distribution channels. Journal of Marketing Research, 2, 26–31.

Cachon, G. P., & Swinney, R. (2009). Purchasing, pricing, and quick response in the presence of strategic consumers. Management Science, 55, 497–511.

Cachon, G., Terwiesch, C., & Xu, Y. (2005). Retail assortment planning in the presence of consumer search. Manufacturing and Service Operations Management, 7, 330–346.

Fader, P. S., & Hardie, B. G. (1996). Modeling consumer choice among SKUs. Journal of Marketing Research, 33, 442–452.

Fisher, M. L., Hammond, J. H., Obermeyer, W. R., & Raman, A. (1994). Making supply meet demand in an uncertain world. Harvard Business Review, 72, 83–83.

Fisher, M., & Vaidyanathan, R. (2014). A demand estimation procedure for retail assortment optimization with results from implementations. Management Science, 60, 2401–2415.

Franke, N., Keinz, P., & Steger, C. J. (2009). Testing the value of customization: When do customers really prefer products tailored to their preferences? Journal of Marketing, 73, 103–121.

Gaur, V., & Honhon, D. (2006). Assortment planning and inventory decisions under a locational choice model. Management Science, 52, 1528–1543.

Guadagni, P. M., & Little, J. D. (1983). A logit model of brand choice calibrated on scanner data. Marketing Science, 2, 203–238.

Hamilton, S. F., & Richards, T. J. (2009). Product differentiation, store differentiation, and assortment depth. Management Science, 55, 1368–1376.

Heckman, J. J. (1979). Sample selection bias as a specification error. Econometrica, 47, 153–161.

Hoch, S. J., Bradlow, E. T., & Wansink, B. (1999). The variety of an assortment. Marketing Science, 18, 527–546.

Hotelling, H. (1929). Stability in competition. Economic Journal, 39, 41–57.

Huang, P., Lurie, N. H., & Mitra, S. (2009). Searching for experience on the web: An empirical examination of consumer behavior for search and experience goods. Journal of Marketing, 73, 55–69.

Kapner, S. (2017a). Amazon’s new wardrobe service is latest threat for apparel stores. Wall Street Journal. https://www.wsj.com/articles/amazons-new-wardrobe-service-is-latest-threat-for-apparel-stores-1497978320

Kapner, S. (2017b). Nordstrom tries on a new look: Stores without merchandise. Wall Street Journal. https://www.wsj.com/articles/nordstrom-tries-on-a-new-look-stores-without-merchandise-1505044981

Kök, A. G., Fisher, M. L., & Vaidyanathan, R. (2015). Assortment planning: Review of literature and industry practice. In N. Agrawal & S. Smith (Eds.), Retail supply chain management. Boston, MA: Springer.

Kull, T. J., Barratt, M., Sodero, A. C., & Rabinovich, E. (2013). Investigating the effects of daily inventory record inaccuracy in multichannel retailing. Journal of Business Logistics, 34, 189–208.

Lancaster, K. (1975). Socially optimal product differentiation. The American Economic Review, 65, 567–585.

Lancaster, K. (1990). The economics of product variety: A survey. Marketing Science, 9, 189–206.

Levin, Y., McGill, J., & Nediak, M. (2009). Dynamic pricing in the presence of strategic consumers and oligopolistic competition. Management Science, 55, 32–46.

Mahajan, S., & Van Ryzin, G. (2001). Stocking retail assortments under dynamic consumer substitution. Operations Research, 49, 334–351.

Mantrala, M. K., Levy, M., Kahn, B. E., Fox, E. J., Gaidarev, P., Dankworth, B., & Shah, D. (2009). Why is assortment planning so difficult for retailers? A framework and research agenda. Journal of Retailing, 85, 71–83.

Miranda, A., & Rabe-Hesketh, S. (2006). Maximum likelihood estimation of endogenous switching and sample selection models for binary, count, and ordinal variables. The Stata Journal, 6, 285–308.

Mou, S., Robb, D. J., & DeHoratius, N. (2018). Retail store operations: Literature review and research directions. European Journal of Operational Research, 265, 399–422.

Namin, A., Ratchford, B. T., & Soysal, G. P. (2017). An empirical analysis of demand variations and markdown policies for fashion retailers. Journal of Retailing and Consumer Services, 38, 126–136.

Nelson, P. (1970). Information and consumer behavior. Journal of Political Economy, 78, 311–329.

Netessine, S., & Rudi, N. (2004). Supply chain structures on the internet. In D. Simchi-Levi, S. D. Wu, & Z.-J. M. Shen (Eds.), Handbook of quantitative supply chain analysis. Boston: Springer.

Netessine, S., & Rudi, N. (2006). Supply chain choice on the internet. Management Science, 52, 844–864.

Pashigian, B. P., & Bowen, B. (1991). Why are products sold on sale?: Explanations of pricing regularities. The Quarterly Journal of Economics, 106, 1015–1038.

Rabe-Hesketh, S., Skrondal, A., & Pickles, A. (2002). Reliable estimation of generalized linear mixed models using adaptive quadrature. The Stata Journal, 2, 1–21.

Rabe-Hesketh, S., Skrondal, A., & Pickles, A. (2003). Maximum likelihood estimation of generalized linear models with covariate measurement error. The Stata Journal, 3, 386–411.

Rabe-Hesketh, S., Skrondal, A. & Pickles, A. (2004). GLLAMM manual. http://www.gllamm.org/docum.html

Rabe-Hesketh, S., Skrondal, A., & Pickles, A. (2005). Maximum likelihood estimation of limited and discrete dependent variable models with nested random effects. Journal of Econometrics, 128, 301–323.

Rabinovich, E., Bailey, J. P., & Carter, C. R. (2003). A transaction-efficiency analysis of an Internet retailing supply chain in the music CD industry. Decision Sciences, 34, 131–172.

Rabinovich, E., Rungtusanatham, M., & Laseter, T. (2008). Physical distribution service performance and Internet retailer margins: The drop-shipping context. Journal of Operations Management, 26, 767–780.

Raghavan Srinivasan, S., Ramakrishnan, S., & Grasman, S. E. (2005). Identifying the effects of cannibalization on the product portfolio. Marketing Intelligence & Planning, 23, 359–371.

Randall, T., Netessine, S., & Rudi, N. (2006). An empirical examination of the decision to invest in fulfillment capabilities: A study of internet retailers. Management Science, 52, 567–580.

Rooderkerk, R. P., Van Heerde, H. J., & Bijmolt, T. H. (2011). Incorporating context effects into a choice model. Journal of Marketing Research, 48, 767–780.

Rooderkerk, R. P., Van Heerde, H. J., & Bijmolt, T. H. (2013). Optimizing retail assortments. Marketing Science, 32, 699–715.

Ryzin, G. V., & Mahajan, S. (1999). On the relationship between inventory costs and variety benefits in retail assortments. Management Science, 45, 1496–1509.

Salop, S., & Stiglitz, J. (1977). Bargains and ripoffs: A model of monopolistically competitive price dispersion. The Review of Economic Studies, 44, 493–510.

Smith, J. (2017). ‘Drop shipping’ looks set to go mainstream as more retailers get on board. The Wall Street Journal. https://www.wsj.com/articles/drop-shipping-looks-set-to-go-mainstream-as-more-retailers-get-on-board-1485453446

Spulber, D. F. (1996). Market microstructure and intermediation. The Journal of Economic Perspectives, 10, 135–152.

Su, X., & Zhang, F. (2009). On the value of commitment and availability guarantees when selling to strategic consumers. Management Science, 55, 713–726.

Wooldridge, J. M. (2002). Econometric analysis of cross section and panel data. Cambridge: The MIT Press.

Zakrzewski, C. (2017). Amazon’s next battleground is the fitting room. Wall Street Journal. https://www.wsj.com/articles/amazons-next-battleground-is-the-fitting-room-1498011759

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2019 Springer Nature Switzerland AG

About this chapter

Cite this chapter

Sodero, A.C., Rabinovich, E. (2019). Omnichannel Assortment Decisions in a Fashion Retailing Supply Chain. In: Gallino, S., Moreno, A. (eds) Operations in an Omnichannel World. Springer Series in Supply Chain Management, vol 8. Springer, Cham. https://doi.org/10.1007/978-3-030-20119-7_8

Download citation

DOI: https://doi.org/10.1007/978-3-030-20119-7_8

Published:

Publisher Name: Springer, Cham

Print ISBN: 978-3-030-20118-0

Online ISBN: 978-3-030-20119-7

eBook Packages: Business and ManagementBusiness and Management (R0)