Abstract

In the past decade, many economists have discussed a phenomenon called the middle-income trap as the share of middle-income economies are growing. The trap is known as a condition of stagnant economic growth that prevents economies from reaching high-income level. In recent years, ASEAN countries have successfully reached the middle-income level. This study aims to understand the relationship between innovation and per capita income for ASEAN countries and understand the role of innovation in supporting ASEAN countries to switch towards a higher income level. This study found that innovation along with foreign direct investment and productivity contributes positively towards per capita income. Innovation was also found to increase the probability of moving up the income ladder, specifically for lower middle-income level toward upper middle-income level. Productivity was found to strongly influence the probability of moving up to a higher income level on any level of initial income group. Furthermore, we found that there is a curvilinear relationship between growth factors and per capita income, which indicates that the contribution of growth factors comes with diminishing marginal effects. As income per capita grows toward a higher income level, growth factors contribute towards income at a decreasing rate, which suggests heightened difficulty when moving up the income stages.

Access provided by Autonomous University of Puebla. Download chapter PDF

Similar content being viewed by others

Keywords

Introduction

More or less, every country is on a path toward growth as sustainable economic growth is always an objective of every country to achieve and maintain welfare. Until today, several economies prosper while others stagnate. As per July 2017, the World Bank states 78 out of 218 countries have reached the upper-tier economy classified as high-income countries, 31 countries are classified as low-income countries, while 109 countries fell into the middle-income category, which makes up 50% of the world. A phenomenon called the middle-income trap has been discussed by many economists in the past decade as the share of middle-income economies are growing. The term was first introduced by Gill and Kharas in 2006 where the “trap” is characterized when economic growth is below potential. The trap is perceived as a risk toward growing economies, triggered by a country’s inability to increase sufficient input and productivity causing middle-income economies to fail in transitioning toward high-income status.

Many economists had offered several definitions of the middle-income trap. Egawa (2013) recognizes the middle-income trap as a long-term economic stagnation hindering the economy to boost further toward a high-income economy. Van Tho (2013) describes the middle-income trap as a condition where an economy is stuck in between low-income countries that dominate the labor-intensive industries and high-income countries that dominate innovation and technology. On the same notion, Paus (2017) characterizes the middle-income trap as a condition where an economy can no longer compete internationally in standardized labor-intensive commodities due to rising wages, however also unable to compete in higher value-added activities due to relatively low productivity. Hence, when attempting to reach high-income level, countries need to inject sufficient input for continuous economic growth.

Following the neoclassical growth theory (Solow 1956), the output of an economy is produced through a production function that consists of capital and labor. However, the Solow model claims that continuous rise in capital will only temporarily increase the growth rate due to increasing capital to labor ratio, which eventually will reflect diminishing marginal productivity of both capital and labor.

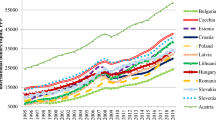

Figure 3.1 confirms the concept of diminishing marginal effects, where we can see that rapid growth only occurs in the recovery of a crisis, while in times where the economy is stable, growth appears to be declining. Due to this diminishing marginal effect, emerging economies are prone to being stuck in the middle-income stage leading them to the middle-income trap if they fail to increase adequate input and productivity to preserve sustainable economic growth. Another central key of the neoclassical growth theory claims that the diminishing rates will eventually bring economies to reach the “steady state”, where additional capital will no longer improve productivity. The neoclassical growth model predicts that every country will ultimately converge once they have reached the steady state, implying that growth of high-income countries and poorer countries will eventually converge. In reality, capital is utilized differently in each country depending on human capital quality and their productivity level. As reflected in Fig. 3.1, the economic growth between income groups does not converge although they move in the same pattern. The failure to converge with high-income countries also signals a country’s vulnerability to fall into the middle-income trap.

In order to reach high-income economy, sustainable economic growth must be maintained. Fundamentally, there are two ways to magnify output of an economy, either by increasing input that goes in the production process or by inventing new ways to generate greater output with the same level of input (Rosenberg 2004), or in other words creating new innovation. Many economists have suggested innovation as a remedy to maintain sustainable economic growth and overcome the middle-income trap as it increases productivity and economic expansion. The Schumpeterian growth paradigm (Aghion et al. 2013) states that innovation has the primary ability to create long-term economic growth through improvements in productivity as well as expansion in investments, consumption, and exports. As innovations are invented through entrepreneurial investments in R&D, training, and education, the labor quality must be refined toward high-skill intensive labors and productivity must be intensified to enable growth in the industrial sector. Additionally, capital and investment are necessary to support innovation, technology, and infrastructure needed to stimulate further economic growth.

Many discussions about the middle-income trap in the past focus on Latin America and Africa where the middle-income trap phenomenon is prevalent. Whilst according to recent World Bank data, majority of ASEAN countries have currently reached middle-income economy with the exception of Brunei Darussalam and Singapore. Majority of ASEAN member states are facing the global risk of the middle-income trap, however their abilities differ in terms of how they are addressing it and their efforts to avoid the trap. Hence, this study aims to (1) identify the role of innovation in avoiding the middle-income trap, (2) identify the role innovation plays on the probability of switching into a higher income level, and (3) discover which countries are trapped among ASEAN member states. Failure in overcoming the middle-income trap may restrain a country’s full economic potential. If other countries are capable in reaching high-income status, by all means being stuck in the middle-income trap shows that an economy signals inefficiency of a country and the trap is hindering an economy to unlock its full potential. The remainder of the chapter is structured as follows: Section “Theoretical Basis” discusses the theoretical basis of the middle-income trap, section “Data and Methodology” explains methodology and data description used in the study, section “Results and Discussion” discusses results and findings, and lastly section “Conclusion and Limitations” concludes results, and limitations of the study.

Theoretical Basis

Defining the Middle-Income Level

Two well-known approaches are often discussed on how to define the middle-income level. The first one is a relative measure called the catch-up index (CUI) proposed by Athukorala and Woo (2011) which uses relative percentage of the US per capita GDP. The CUI defines high-income level if GDP per capita is higher than 55% of US GDP per capita, middle-income level 20%–55% of US GDP per capita, and low-income level lower than 20% of US GDP per capita. However, using the CUI approach would leave most ASEAN countries to be categorized as low-income level due to substantial differences in magnitude of economies between US and ASEAN countries. Another measure to define income levels is through absolute approach established by the World Bank which is more universal and consistent rather than relying upon one single country whose GDP may fluctuate over time. The World Bank uses gross national income (GNI) per capita which is revised annually based on income growth, population changes, inflation, and exchange rates. In this study, the absolute approach developed by the World Bank will be used to define the middle-income level. By using the absolute approach, we allow the economic status of countries to be independent of the status of other countries.

In mid-2017, the World Bank published the latest income level classifications for 2017–2018 fiscal year. The World Bank classifies countries earning less than $1005 as low-income countries, countries earning $1006–$3955 as lower middle-income countries, countries earning $3956-$12,235 as upper middle-income countries, and countries earning more than $12,235 as high-income countries. Hence according to these thresholds, Table 3.1 shows income classification for ASEAN countries in accordance with the World Bank income classification.

Defining the Middle-Income Trap

As previously discussed, the middle-income trap is a situation where economic growth of a country stagnates. However, no universal threshold has been developed of how many years it takes to consider a country as being trapped in the middle-income economy. Bordans and Teinemaa (2016) proposed their own definition of the middle-income trap where they consider a country is considered trapped in a specific year if they are under three specific conditions. According to their definition, if a country’s GDP per capita growth is below the average of global GDP per capita in its respective income level, its respective region’s average growth, and also the weighted average growth of each country’s trading partner, a country is considered trapped in the middle-income level. Despite their comprehensive approach on defining the middle-income trap, there is still a need for specific amount of years to be able to distinguish whether the growth of a country is considered growing normally or too slow. Consequently, the question on how many years is considered too long for a country to generate static growth remains unclear.

Felipe (2012) also offered a definition of the trap by conducting an arbitrary approach to calculate the number of years to be set as a threshold for a country to be trapped in the middle-income level. He did so by taking the median of the sample countries spent in their income categories before transcending onto the next category. His sample consists of 124 countries including 40 low-income countries, 52 middle-income countries (38 lower middle-income countries and 14 upper middle-income countries), and 32 high-income countries in 2010. The middle-income level range used in his study adopts the value GDP per capita in 1990 Purchasing Power Parity (PPP) dollars adjusted through polychoric correlation to mimic the World Bank income classification in 2010. His calculation resulted in a threshold of 28 years for the lower middle income and 14 years for the upper middle income. Following his threshold, a country must grow fast enough to reach the GNI per capita of the next income classification by at most 28 years for the lower middle-income, and 14 years for upper middle-income economy. However, Felipe’s method is an arbitrary approach where the threshold is dependent on the number of years the sample countries are in the middle-income economy, thus, if samples were to differ, threshold may be subject to change.

In addition, Felipe implies that lower middle-income economy (i.e. that reaches $2000 per capita income) has to attain an average growth rate of per capita income of at least 4.7% per annum to avoid falling into the lower middle-income trap (i.e. to reach $7250, the upper middle-income level threshold); and an upper middle-income economy (i.e. that reaches $7250 per capita income) has to attain an average growth rate of per capita income of at least 3.5% per annum to avoid falling into the upper middle-income trap (i.e. to reach $11,750, the high-income level threshold).

Theories of Economic Growth

In order to avoid the middle-income trap, sustainable economic growth must be maintained. The Solow growth model is one of the most well-known neoclassical theories explaining the mechanics of economic growth. Solow (1956) explained that output is generated through the use of capital and labor. Solow suggests that these factors exhibits diminishing returns, continuous rise in capital will only temporarily increase the growth rate due to increasing capital to labor ratio, which eventually reflects diminishing marginal productivity of capital and labor. Solow adds technological process in the model after discovering residuals treated as exogenous factor that explains economic growth other than capital and labor. However a major key assumption in the neoclassical theory is that it views technology as a public good, thus every country has the same level of technology and all are able to consume and benefit from that good. In contrary, the new economic growth theory views technological progress in a different perspective. Firstly, the new economic growth theory developed by Romer (1990) views economic growth as a result from an endogenous function rather than a result of exogenous factors. The endogenous growth theory senses that technological changes provides incentive for continuous capital accumulation which leads to productivity, thus, technological change only occurs to those who responds to the market incentives. In effort to stimulate advancement of technology responsive to economic incentives, human capital quality needs to be emphasized through increased knowledge, education, and trainings alongside with governmental support. Mankiw (1989) on the other hand found that output growth moves in the same pattern as the Solow residuals (technological change), which suggests that technological change plays an important role as a source of business cycle fluctuations. Hence, the business cycle requires technological changes in order to stimulate economic growth.

Innovation and Economic Growth

Baragheh et al. (2009) defined innovation as a transformation of knowledge and ideas to improve an existing product or to introduce a new product to the market. As mentioned in the previous section, innovation provides great means to induce economic growth as it elevates productivity and economic expansion. Rosenberg (2004) states there are two methods to elevate output of an economy, either by increasing input that goes in the production process or by inventing new ways to generate greater output with the same level of input, or in other words creating new innovation. Many economists glorify innovation as a key driver of sustainable economic growth and development which was mainly contributed by the Schumpeterian growth theory. The Schumpeterian growth paradigm is constructed upon three main ideas (Aghion et al. 2013). First, long-run growth is achieved primarily through innovation, following Solow’s theory that sustainable technological change is required for long-term economic growth. Second, following the endogenous growth theory, innovation is derived from investments in research and developments from firms that responds to the economic incentives that results from economic policies and institutions. Hence, government quality and support is needed to promote innovation. Lastly, innovation provokes creative destruction as Schumpeterian growth is perceived as a competition between the old and the new in the sense that new technology replaces old technology. With such pattern, it is believed that innovation has been responsible for continuous rise in standards of living (Grossman and Helpman 1994) as there is perpetual replacement of old technology with new technology. Continuous innovation has the benefit of improved productivity as well as expansion in consumption, investment, and exports (Ambashi 2017). However, the impact of innovation itself relies on the creativity of its eventual users, thus knowledge and education play an important role on adapting toward new innovation. Ambashi (2017) created a typology of innovation stages of ASEAN countries (Table 3.2):

Referring to the typology above, we can infer that most ASEAN countries are beginners regarding innovation involvement. Newly lower middle-income countries (i.e. Cambodia, Laos, and Myanmar) are in the initial stage of innovation involvement where they start to develop demand for innovation and technology, while countries which have been longer in the lower middle-income stage (i.e. Indonesia, Philippines, and Vietnam) and Thailand which had reached the upper middle-income level in 2008 are in the learning stage where they benefit from imitation of imported technology. Malaysia who has been an upper middle-income country quite a while is catching up with high-income countries through initiation of creative destruction. Singapore on the other end is the leading innovation frontier in ASEAN, becoming a knowledge generator and technology shaper. This typology excluded Brunei Darussalam due to its heavy reliance on oil and gas as the main contributor to its economy, hence the country does not suit any of the stages in the innovation typology. Thus, we can conclude when it comes to innovation, ASEAN countries are still passive players that rely on market forces for new innovations.

When measuring innovation, patents and trademarks usually go hand in hand as a proxy to quantify innovation; however patents lean more toward inventions (specifically technological inventions), while trademark denotes legal differentiation between products. As seen from the innovation typology, majority of ASEAN countries are still beginners when it comes to innovation, especially technological innovation. Therefore, using patents when attempting to capture innovation will fail to capture all innovative activities within a country because it focuses more on inventions rather than innovation. Since we are discussing about the middle-income economies which are squeezed between labor-intensive industries and high-skilled intensive industries that dominate innovation in technology, middle-income economies by nature are likely to lack in innovation that directs toward technology. Thus, the use of patents will fail to capture full innovation activities in a country. To measure the translation of R&D activities and patents into an actual innovation output that can be used by users, trademark has the ability to capture commercialization of new inventions used by firms to signal new products in the market (Castaldi 2014). In addition, the use of trademark also enables to capture non-technological innovation such as organizational innovation, service innovation, marketing innovation, and as well as innovation in low-tech sectors. Consequently, by using trademark in the literature will enable us to fully capture technological and non-technological innovation altogether that inflates economic growth.

Data and Methodology

Variable and Data Description

This study uses a quantitative approach using secondary data from official sources. Data are obtained in the form of panel data, a combination of annual time series data from 15 countries. Table 3.3 lists the countries that are included in the study.

The selection of the chosen countries are aimed toward emerging countries who are currently classified as middle-income countries (primarily members of ASEAN), and those who succeeded to transcend to high-income level in recent years. In the past, South Korea and a few Latin American countries spent quite some time in the middle-income level however managed to move up the income ladder in recent years. Thus, for a better cross-country comparison and variation, South Korea and Latin American countries are perfect examples of countries which recently succeeded on acquiring high-income status. Due to limited availability, data were only acquired from 1989 up until 2016. Selected data are analyzed through the chosen econometric model. Table 3.4 presents the summary statistics of the data. Two variables were rescaled due to a wide range of value compared to other variables. Initially, the number of trademark ranges from 577 to 332,929 and productivity per person employed ranges from 600 to 84,515. Thus, these variables were rescaled by dividing them by 1000 in the regression analysis. Hence, one unit of each of the rescaled variables corresponds to 1000 units in the regression analysis.

Dependent Variables

The dependent variable of this study is the GNI per capita in current US$, which is the gross national income divided by the midyear population. The GNI per capita calculated by the World Bank does not only reflect income, however it also takes into consideration non-income aspects of welfare such as life expectancy at birth, mortality rates, and school enrollment rates.Footnote 1 The use of log transformation is due to large differences in value between countries. Furthermore, the World Bank classifies countries based on their GNI per capita into four levels: low income, lower middle income, upper middle income, and high income (Table 3.5).

Independent Variables

Following the Solow growth model that requires capital, labor, and innovation as a function of economic growth, variables mentioned are chosen to represent components of the growth function (Table 3.6):

-

Trademark (as a measure of innovation): Although patent has been widely used as a proxy for innovation in prior studies, a major pitfall expressed by Ozturk (2015) is that patent fails to capture all innovative activities within a country because it focuses more on inventions rather than innovation. Since we are discussing about the middle-income economies which are squeezed between labor-intensive industries and high-skilled intensive industries that dominate innovation in technology, middle-income economies by nature are likely to lack in innovation that directs toward technology. Thus, the use of patents will fail to capture full innovation activities in a country. To measure the translation of R&D activities and patents into an actual innovation output that can be used by users, trademark has the ability to capture commercialization of new inventions used by firms to signal new products in the market (Castaldi 2014).

-

FDI intensity: Inflows of foreign direct investment (FDI) as a percentage of gross domestic product (GDP). The Euromonitor definition of FDI is an investment made to obtain lasting interest or to have effective control of an enterprise operating outside the economy of the investor.

-

Productivity refers to labor productivity per person employed defined as output (gross value added) of goods and services in the economy divided by the total employed population.

Model Specification

This study uses quantitative analysis to describe the relationship between dependent and independent variables through an econometric model of panel data estimation. This study aims to specifically examine the relationship between per capita income and innovation along with foreign direct investment and productivity in emerging countries across a period of time. Additionally, control variables which are believed to influence economic growth such as human capital, governmental, and macroeconomic variables are added to the model. Furthermore, an ordinal logistic regression is used to see how the variables of interest influence the probability of a country to move up the income category.

Quadratic Model

The model used in this estimation refers to Ozturk’s (2015) research where she uses quadratic model to examine the curvilinear relationship between key variables along with control variables on per capita income. The quadratic form of growth factors will depict the marginal effects of improvement in growth factors. Since majority of ASEAN countries are middle-income countries, the model is suitable to detect whether there is an occurrence of diminishing marginal effects at this stage, specifically for ASEAN countries. Furthermore, the Hausman test will be used to determine whether fixed-effect model or random-effect model is more appropriate for the analysis. Below is the quadratic model:

Where:

-

log(GNI per Capita): log GNI per capita in current US$

-

Trademark: Trademark (as a measure of innovation) applications at the national office

-

FDI: Inflows of foreign direct investment as a percentage (%) of total GDP

-

Productivity: USD per person employed in constant prices

-

xδ: Other control variables

Generalized Ordered Logistic Regression

An ordered logistic regression fits ordered logit model of an ordinal variable on independent variables. As the income levels possess the characteristic of a having larger value in higher categories, it is logical to use the model as we are attempting to examine the role of key growth factors on the probability of countries on graduating to the next higher income level. The ordered logit regression requires the parallel lines/proportional odds assumption to be fulfilled. However, the parallel lines/proportional odds assumption is very restrictive that requires βs to be constant for each value of j. The Brant test is commonly used to determine whether the assumption has been violated or not. Williams (2006) argued that the requirement is overly restrictive and often violated, it is common for βs to differ across each values of j. The generalized ordered logit model which relaxes the requirement of the parallel lines/proportional odds assumption (Williams 2006), which can be written as

where we can see that the βs allowed to differ in contrast to the usual ordered logit model. The generalized ordered logit model is believed to provide more interpretable and reliable results compared to other non-ordinal alternatives such as multinomial logistic regression.

Descriptive Analysis

To answer the last research question, a descriptive analysis will be conducted using secondary data and previous studies. The latest World Bank income classification will be used along with GNI per capita sourced from the World Bank. Furthermore, we will use Felipe’s method to analyze which countries are considered trapped in the middle-income level in accordance with the data obtained from the World Bank.

Results and Discussion

Analysis of Growth Factors Toward Per Capita Income

The results of the Hausman test shows a p-value of 0.0000, thus we reject the null hypothesis and conclude that fixed-effects model is more appropriate than random-effects model. Table 3.7 shows the results of the quadratic fixed-effects regression. The model is statistically significant (F13, 237 = 77.93, p < 0.001), and a within R-squared of 0.8104. All of the main variables of interest are statistically significant and has a positive relationship toward income per capita.

If we take a look on the quadratic forms of the three key variables, they show a statistically significant negative relationship with per capita income which exhibits diminishing marginal effects of the key variables on per capita income. Consistent with the findings of Ozturk (2015), the key factors contributes positively toward per capita income, however at a decreasing rate as income per capita grows to a higher level. This decreasing rate heightens the difficulty for countries to grow toward higher level of income. As the marginal rate decreases, it is more difficult to progress with the same amount of growth factors. The diminishing marginal effect concept from the convergence hypothesis is confirmed in our findings, however it occurs in the middle-income level rather than in high-income level causing middle-income countries to reach the “steady state” too early (in middle-income level), which leads to the middle-income trap.

In context of innovation, trademark exhibits positive and statistically significant relationship with income per capita. The regression results show that one unit increase in trademark application (i.e. 1000 trademark applications) is predicted to increase GNI per capita by 1.68% holding other factors constant. The quadratic form of trademark shows significant negative effect toward per capita income with a coefficient of −0.0001026. FDI intensity also exhibits positive and statistically significant relationship toward income per capita with 1% increase in FDI intensity increases GNI per capita by 1.65% all else constant, again with a diminishing rate of −0.0004495. Lastly, one unit increase in productivity (i.e. $1000) increases GNI per capita by 16% all else constant, also with a diminishing rate of −0.0012104.

Majority of the control variables indicate statistically significant positive relationship with income per capita. Literacy rate and life expectancy reflect the human capital quality in a country through education and healthcare. One percent increase of the population who are literate increases GNI per capita by 6% all else constant, while one-year increase in life expectancy increases GNI per capita by 5%, holding other factors constant. For governmental indicator, regulatory quality was found to be positively significant toward GNI per capita, meaning that the better the ability of a country’s government to formulate and implement sound policies that induces economic development has a positive impact on per capita income. One point increase in regulatory quality score increases GNI per capita by 27%, all else constant. Lastly, 1% increase in gross savings increases GNI per capita by 1.5%, all else constant. The ability of a country to save indicates that they do not engage in excessive debt, and they are able to alter savings toward investment, which in turn prompts positive significant impact toward per capita income.

Analysis of Growth Factors on the Probability of Moving Up the Income Ladder

As previously mentioned, the ordered logit regression requires the fulfillment of the parallel lines/proportional odds assumption which is often violated. The Brant test shows that the parallel lines/proportional odds assumption is violated specifically for productivity (p-value = 0.00000), while trademark and FDI intensity was able to meet the parallel lines/proportional odds assumption (p-value = 0.208 and p-value = 0.172, respectively). Therefore, we will use the generalized ordered logit model to examine the role of key growth factors on the probability of countries on graduating to the next higher income level. Table 3.8 shows the estimation results from the generalized ordered logit estimation with a p-value <0.001 and pseudo R2 of 0.6925.

The positive signs of all key variables indicate that innovation, foreign direct investment, and productivity contribute positively for emerging countries to move forward the income categories. Interestingly, trademark in context of innovation was only significant for lower middle-income economies on the probability of moving up to upper middle-income level. In line with the innovation typology proposed by Ambashi (2017), the initiation of creative destruction does not start directly at the initial stage, rather later when economies have sufficient demands for innovation and have learned enough knowledge from imported technologies to actually implement innovation. Second, foreign direct investment was found to be significant only for the probability of low-income economies to move up to lower middle-income level. This shows the need of additional capital inflows for lower income levels in order to step up onto the next income level, as capital circulating in a low-income level country is presumably low to begin with. Lastly, productivity showed to be significant and it strongly influences the probability of moving up to a higher income level on any level of initial income group.

From these results, we can infer that countries specifically belonging to the middle-income level should take innovation into consideration when aiming to move up the income ladder. Innovation is one of the key drivers in economic progress that results in new productive and efficient ways in expanding the economy. The use of trademark instead of patents also shows that it is not only technological innovation that matters, it is rather the translations of these inventions into a matter that is marketable and can be utilized to increase productive efforts. This also shows that other types of non-technological innovations such as organizational and service innovations also plays a significant role toward further economic growth middle-income countries. While productivity also shows great contribution toward per capita income, innovations should possess quality characteristics that have the ability to improve effectiveness of economic activities. Accordingly, meaningful innovation and productivity should be attained by improving human capital quality through education, training, and R&D, as well as government policies that promotes new innovations along with a stable macroeconomic condition that supports economic development.

As ASEAN countries are still passive in terms of innovation, these countries should become more active in contribution toward innovation whether it is through a push or pull strategy. What we can learn from the experience of Latin America is that both market and government must contribute toward innovation, relying solely on one party will not result an effective economy. Stimulating innovation through market demand should require enhancement in human quality through secondary and tertiary education which leads to increased demand for innovation in an economy for a more efficient economy and higher standard of living. At the same time, government and corporations ought to push innovation through continuous R&D and also provide incentives to promote innovations such as funding, tax incentives, and development grants. With simultaneous efforts, middle-income countries should be able to gradually move up the innovation typology.

The Middle Income Trap Among ASEAN and Other Emerging Countries

As previously discussed, many ASEAN countries recently succeeded to exit low-income level and reached the middle-income level. In contrast, several Latin American countries recently graduated onto the high-income level after spending quite some time in the middle-income level. Figure 3.2 shows income-level movements of these countries between 1989 and 2016.

Among ASEAN member states, only two countries belong to the high-income level, namely Brunei Darussalam and Singapore. Other ASEAN countries started to surpass the low-income level in this period, Philippines in 1995, Indonesia in 1996, Vietnam in 2009, Laos and Myanmar in 2011, lastly Cambodia in 2014. Malaysia and Thailand on the other hand have been categorized in the middle-income range over the whole observed period of 27 years. If we look deeper into past data, Thailand has spent 20 years in the lower middle-income level from 1988 until 2008, and 8 years in the upper middle-income level, which exempts Thailand from being considered trapped in the middle-income level. Meanwhile, Malaysia actually entered the lower middle-income level in 1979 and entered the upper middle-income level in 1995, which translates to 16 years in the lower middle-income level, and 21 years in the upper middle-income level. Corresponding to Felipe’s income threshold, we can conclude that Malaysia is trapped in the upper middle-income level.

Quah (1993) discovered that there is a tendency of thinning of the middle-income level in favor of very poor and very rich countries. Low-income levels tend to have downward mobility in which they are more likely to become poorer, although the possibility of upward mobility is still possible. While high-income levels seize balance between upward and downward mobility, in which they are more likely to persist in high-income level. Although the tendency of thinning of the middle-income level does not seem to occur in ASEAN countries as many of their members just recently reached the middle-income level, the downward mobility is still a risk that is faced by every country. The downward mobility can be found in Fig. 3.2 where several countries (Indonesia, Malaysia, and South Korea) were vulnerable to fall down toward their previous income level in a deteriorating economy from the Asian financial crisis in 1998. Indonesia specifically suffered greatly in the 1998 Asian financial crisis compared to the 2008 global financial crisis. The 1998 crisis includes depreciation of the rupiah which affects exports and imports and also rising costs of foreign debts. During this time period, Indonesia just recently reached the lower middle-income level in 1996. As poverty increased due to the crisis, Indonesia fell back to the low-income level. However, we can see that Indonesia fared better in the 2008 crisis maintaining its position in the lower middle-income level. Tambunan (2010) studied that the resilience was due to more steady policies, better government housekeeping, and stronger financial sectors. Thereof, as it is easier for a country to descend toward lower income levels, countries must be able to inject adequate input and productivity circulating in the economy and strategize economic policies in order to move up the income ladder or maintain current income level. This is proven by the resilience of Thailand and Vietnam from the global financial crisis in 2008 where the two countries were able to move up toward higher income status in spite of the crisis.

According to Nidhiprabha (2011), the limited impact of the global financial crisis in Thailand was attributed to financial refinement subsequent to the Asian financial crisis which results in better banking structure and low exposure on subprime assets, supporting macroeconomic conditions also helped credit expansion that accelerates economic recovery. Similarly, Vietnam was not directly affected by the 2008 crisis due to its low exposure to international financial markets where 50% of its banks are state-owned (Le 2009). Additionally, informalization of sectors are big in Vietnam, and the crisis induced informalization even further (Cling et al. 2010) which provides alternative source of income keeping them from poverty. Therefore, the resilience of the two countries in times of crisis shows the need for sound economic policies and an active government role that induces smooth economic recovery and preventing countries to move backward toward a lower income level.

To understand the economic growth of each ASEAN countries, Table 3.9 shows the most recent GNI per capita growth for ASEAN countries.

As previously discussed, Felipe calculated the required growth per annum in order not to fall into the middle-income trap for each middle-income category. We can see that growth is larger for lower income levels where they still have room to expand. In line with convergence hypothesis, higher income countries experience larger diminishing marginal effects in growth factors compared to lower-income countries; thus its growth is limited. Majority of lower middle-income countries grew adjacent around the required growth, except for Indonesia. However, in terms of years, Indonesia is not considered trapped in the middle-income level yet, hence Indonesia must be able to compensate for the sluggish growth in the upcoming years before it is considered trapped in the lower middle-income level. Thailand and Malaysia also yielded growth lower than required, although Thailand still has time before it is considered trapped in the upper middle income, it seems like it is harder for countries to exit the upper middle-income level. Latin American countries who recently reached the high-income level were actually trapped in the upper middle-income level as well in the past. However, with increased innovation efforts, foreign direct investment and productivity, they managed to reach high-income level.

Figure 3.3 shows the average total trademark application for ASEAN and Latin American countries as well as South Korea.

The figure shows synchronized movements between growth of trademark application and the shifts of a country’s income level. For instance, innovation for ASEAN countries seems to peak in 2002 and 2014 where several of its members (Vietnam, Laos, Myanmar, and Cambodia) moved up the income ladder from low-income level toward lower middle-income level around the same period. Similarly, middle-income Latin American countries reached high-income level as their innovation rapidly grew in 2014. South Korea also exhibits the same pattern, where it reached high-income level for the first time in 1995, however slipped back to upper middle-income level in the 1998 crisis period as their innovation capacity also plummets. Shortly after, South Korea managed to quickly recover, boosting its innovation efforts after the crisis and attained high-income level in 2002. From the two groups of countries, we can see that the rate of innovation in Latin American countries is approximately double the number of ASEAN countries. This shows the contrast between the newly high-income countries and the newly middle-income countries. Hence, ASEAN countries should double their innovation efforts in order to achieve high-income level.

Foreign direct investment reflected in Fig. 3.4 shows that higher income countries tend to have lower levels of FDI intensity. This may be due to the fact that foreign direct investment is more critical for emerging countries to fund the economy and gain expertise from foreign multinationals. Therefore, emerging countries like most ASEAN countries become large recipients of foreign direct investment to induce economic growth compared to higher income countries such as South Korea and high-income Latin American countries.

Average productivity reflected in Fig. 3.5 shows divergence between the level of productivity between ASEAN and Latin American countries. The average productivity level for ASEAN countries seems to be declining with no signs of rapid growth, while Latin American countries are slowly escalating their productivity level. As previously mentioned, the reason of the middle-income trap in Latin America was due to a lack of domestic innovation capabilities which in turn translated to low productivity growth (Paus 2017). This further pronounces the need for sturdy growth in innovation and productivity in moving up the income level. Therefore, stagnant or insufficient growth in key growth factors will result inadequate inputs for economic growth, which may lead to the middle-income trap, or worse, downgrading the income ladder.

Conclusion and Limitations

Concluding Remarks

In summary, this study aims to examine the role of innovation in avoiding the middle-income trap for ASEAN member states. From the descriptive and empirical evidence, we can conclude that innovation along with foreign direct investment and productivity contributes positively toward per capita income. Innovation was also found to increase the probability of moving up the income ladder, specifically for lower middle-income level toward upper middle-income level. As many ASEAN countries are categorized in the lower middle-income level, innovation should be used as a tool to graduate onto the upper middle-income level. Whereas for upper middle-income countries, productivity seems to be the key driver on moving forward toward high-income level. As productivity was found to be strongly influential toward every level of income stages, innovation efforts should possess quality characteristics that enhance productivity and effectiveness of economic activities.

This study also found a curvilinear relationship between growth factors and per capita income, which indicates that the contribution of growth factors comes with diminishing marginal effects. At initial stages of growth, key factors contribute positively toward per capita income, but only up to a certain point. As income per capita grows to a higher level, growth factors contribute toward income at a decreasing rate. As the marginal rate decreases, it is more difficult to progress with the same amount of growth factors. The diminishing marginal effect concept from the convergence hypothesis is confirmed in our findings, however it occurs in the middle-income level rather than in high-income level causing middle-income countries to reach the “steady state” too early, which may lead to the middle-income trap.

As discussed in the previous chapter, innovation efforts and productivity of ASEAN countries are approximately half of high-income Latin American countries. Thus, ASEAN countries must strive to double its innovation efforts and productivity in order to avoid the middle-income trap. Another lesson that can be taken from the experience of Latin American countries is that there is a need for pro-active government policies to promote meaningful innovation and productivity. However, government policies alone cannot function without the appropriate market mechanism. Thus, improvements in innovation and productivity require a better knowledge-based human capital and market incentives from the government.

Although only one ASEAN member country is considered trapped in the middle-income level (i.e. Malaysia), Thailand and Indonesia are also prone to the middle-income trap due to its undesirable income growth. The middle-income trap should be seen as a risk for every middle-income country. The middle-income level is a vulnerable phase in which an economy may easily fall back to low-income level, however difficult to go beyond toward high-income level. Other ASEAN middle-income countries should aim to overcome the middle-income trap while they still have time to boost their economic growth before they are considered trapped.

Limitations

This study has a few limitations. First, the definition of the middle-income trap is difficult to gauge. The existing thresholds used to consider a country as being trapped in the previous literatures are arbitrary approaches, which leaves some blurred lines on deciding which countries are actually considered to be in the middle-income trap. Second, this study cannot capture country-specific circumstances that are faced in each middle-income economy. Different countries may face different challenges, thus every country may need a different approaches in overcoming the middle-income trap. Future extensions of this study should examine country-specific perspectives on facing the middle-income trap along with a more clear definition of the middle-income trap.

References

Aghion, P., Akcigit, U., & Howitt, P. (2013). What Do We Learn from the Schumpeterian Growth Theory?. NBER Working Paper Series No. 18824.

Ambashi, M. (2017). Innovation Policy in/for ASEAN. Economic Research Institute for ASEAN and East Asia (ERIA). ASEAN@50 Vol. 5.

Athukorala, P.-C., & Woo, W. T. (2011). Malaysia in the Middle-Income Trap. Paper presented at the Asian Economic Panel Meeting, Columbia University, New York.

Baragheh, A., Rowley, J., & Sambrook, S. (2009). Towards a Multidisciplinary Definition of Innovation. Management Decision, 47(8), 1323–1339.

Bordans, E., & Teinemaa, M. (2016). Baltic Tigers Facing the Middle-Income Trap? Latvia: Stockholm School of Economics.

Castaldi, C. (2014). Marking Your Innovation? A Review of the Literature on Trademarks as Indicators of Innovation. A CRE8TV Project Deliverable.

Cling, J.-P., Chí, N. H., Razafindrakoto, M., & Roubaud, F. (2010). How Deep Was the Impact of the Economic Crisis in Vietnam? A Focus on the Informal Sector in Hanoi and Ho Chi Minh City. World Bank Working Paper.

Egawa, A. (2013). Will Income Inequality Cause a Middle-Income Trap in Asia? Bruegel Working Paper.

Felipe, J. (2012). Tracking the Middle-Income Trap: What Is It, Who Is in It, and Why? Part 1. ADBI Economics Working Paper Series.

Grossman, G. M., & Helpman, E. (1994). Endogenous Innovation in Theory of Growth. Journal of Economic Perspectives, 8(1), 23–44.

Le, T. T. V. (2009). The Global Crisis and Vietnam’s Policy Responses. East Asian Policy, 1, 63–74.

Mankiw, N. G. (1989). Real Business Cycles: A New Keynesian Perspective. Journal of Economic Perspectives, 3(3), 79–90.

Nidhiprabha, B. (2011). The Global Financial Crisis and Resilience of the Thai Banking Sector. Asian Development Review, 28. https://doi.org/10.2139/ssrn.2001152.

Ozturk, A. (2015). Examining the Economic Growth and the Middle-Income Trap from the Perspective of the Middle Class. International Business Review. 10.1016/j.ibusrev.2015.03.008.

Paus, E. (2017). Escaping the Middle-Income Trap: Innovate or Perish. ADBI Working Paper Series 685. Tokyo: Asian Development Bank Institute.

Quah, D. (1993). Empirical Cross-Section Dynamics in Economic Growth. LSE Working Paper.

Romer, P. M. (1990). Endogenous Technological Change. Journal of Political Economy, 98(5), S71–102.

Rosenberg, N. (2004). Innovation and Economic Growth. Stanford University.

Solow, R. M. (1956). A Contribution to the Theory of Economic Growth. The Quarterly Journal of Economics, 70(1), 65–94.

Tambunan, T. T. H. (2010). The Indonesian Experience with Two Big Economic Crises. Modern Economy, 1, 156–157.

Van Tho, T. (2013). The Middle-Income Trap: Issues for Members of the Association of Southeast Asian Nations. ADBI Working Paper Series No. 421.

Williams, R. A. (2006). Generalized Ordered Logit/Partial Proportional Odds Models for Ordinal Dependent Variables. The Stata Journal, 6(1), 58–82.

Author information

Authors and Affiliations

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2019 The Author(s)

About this chapter

Cite this chapter

Hardiana, S.N., Hastiadi, F.F. (2019). Overcoming the Middle-Income Trap: The Role of Innovation on Switching onto a Higher Income Group for ASEAN Member States. In: Hastiadi, F. (eds) Globalization, Productivity and Production Networks in ASEAN. Palgrave Macmillan, Cham. https://doi.org/10.1007/978-3-030-16510-9_3

Download citation

DOI: https://doi.org/10.1007/978-3-030-16510-9_3

Published:

Publisher Name: Palgrave Macmillan, Cham

Print ISBN: 978-3-030-16509-3

Online ISBN: 978-3-030-16510-9

eBook Packages: Economics and FinanceEconomics and Finance (R0)