Abstract

This chapter presents an application of a two-stage network data envelopment analysis (DEA) for examining the performance of 30 U.S. airline companies. The airline industry is a subject of concern because the industry is a major contributor to a country’s or even global economic development. Although a number of studies have explored airline performance using DEA, relatively few studies have applied a two-stage DEA model. The current chapter examines production efficiency and marketing efficiency through an additive two-stage network DEA model. This approach allows the black-box of the performance measurement process to be assessed, thus, providing a new direction in measuring airline performance. The chapter includes a managerial decision-making matrix and makes suggestions to help airline managers improve performance for airlines. In addition, a regression analysis of the effect of corporate governance mechanisms on airlines performance is conducted. Given the volatility of growth in the airline industry, it is expected that we will see more research related to performance management in the industry.

Access provided by Autonomous University of Puebla. Download chapter PDF

Similar content being viewed by others

Keywords

- Two-stage data envelopment analysis (DEA)

- Truncated regression

- Corporate governance

- Managerial decision-making matrix

21.1 Introduction

Since the United Stated Congress passed the Airline Deregulation Act in 1978, the air transport market has seen significant changes. This Open Skies policy allowed low-cost carriers (LCCs) to enter the air transport market. LCCs use a simple type of aircraft, secondary airports and simplified routes to reduce their operating costs, which allows them to provide lower fares to customers. The rapid expansion of LCCs has caused traditional airlines to confront fierce competition. Rising labor costs and volatile fuel prices affect all airlines. Competition in the airline industry is at an all-time high, challenging providers to reduce costs while improving quality. In this environment, the ability to attract new customers while retaining existing ones through superior customer service is not only a key competitive differentiator, but a necessity. Obstacles met in the search for flight information can diminish customers’ perceptions of an airline's capability, decrease the opportunity for future revenue, and open the door for other carriers to win their business. In today’s highly competitive market, airlines are deploying a range of innovations in terms of customer service and support in order to improve operating performance. The focus has moved from attempts to characterize performance in terms of a simple indicator, e.g., revenues, to a multi-dimensional systems perspective.

The Data Envelopment Analysis (DEA) is a linear programming based technique that converts multiple output and input measures into a single comprehensive measure of performance. This is attained through the construction of an empirical-based production or resource conversion frontier, and by the identification of peer groups. The philosophy behind DEA is predicated on the fact that a frontier transformation function empirically captures the underlying process defining firms’ production activities. The application of DEA is strongly supported in the multitude of empirical analysis methods in different fields of profit (Seiford 1997; Zhu 2000; Gattoufi et al. 2004; Cooper et al. 2006). DEA has also been widely applied in evaluating airline performance (Sengupta 1999; Barbot et al. 2008; Barros and Peypoch 2009). The traditional DEA model is based on one-stage activities, which neglect intermediate measures or linking activities (Fare and Whittaker 1995; Chen and Zhu 2004; Tone and Tsutsui 2009). This study establishes a two-stage DEA model to overcome the shortcomings of the traditional one-stage DEA. While production efficiency indicates the relative efficiency of a firm in the production process, marketing efficiency reflects the relative performance of a firm in the marketing process. This study evaluates the relative efficiency of airlines in the US, in response to the changing nature of the airline market.

Corporate governance is a multi-faceted subject. An important theme of corporate governance is the nature and extent of accountability of particular individuals in the organization and mechanisms that try to reduce or eliminate the principal-agent problem. A related, but separate, thread of discussions focus on the impact of a corporate governance system on economic efficiency, with a strong emphasis on shareholders’ welfare; this aspect is particularly present in contemporary public debates and developments in regulatory policy. Since the failures of well-known companies such as Enron, WorldCom, Tyco and Merck, academics and practitioners have shown increasing interest in corporate governance. Corporate governance is the set of processes, customs, policies, laws, and institutions affecting the way a corporation (or company) is directed, administered or controlled. Corporate governance also includes the relationships among the many stakeholders involved and the goals for which the corporation is governed. In contemporary business corporations, the main external stakeholder groups are shareholders, debt holders, trade creditors, suppliers, customers and the communities affected by the corporations’ activities. Internal stakeholders include the boards of directors, executives and other employees. Chiang and Lin (2007), Bennedsen et al. (2008), Carline et al. (2009) and Sueyoshi et al. (2010) demonstrate that corporate governance is correlated with organizational performance. Gompers et al. (2003) illustrate that good governance positively affects a firm’s performance. Several governance factors may affect the performance of airlines. To explore the impact of exogenous factors on corporate performance, Simar and Wilson (2007) verify that truncated regression is more appropriate than Tobit regression.

This study adopts bootstrapped DEA scores with truncated regression to analyze the relationship between corporate governance and airline performance. The significant difference between the present study and the studies mentioned above is that the former adopts a two-stage DEA to explore airline performance and addresses production efficiency and marketing efficiency in order to better understand intermediate measures or linking activities. Additionally, this study uses a managerial decision-making matrix in order to help airline managers rapidly improve corporate efficiency or strategies. Finally, this study uses truncated regression in order to analyze the relationship between corporate governance and performance and to guide managers toward competitiveness in the airline industry. The important contributions of this study include: (1) developing an innovative two-stage production process that includes production efficiency and marketing efficiency in order to assess the operating performance of airlines; (2) implementing truncated regression (Simar and Wilson 2007) in order to investigate whether or not corporate governance affects airline performance; (3) integrating production efficiency and marketing efficiency in order to address managerial decision-making. As a result, management could use the managerial decision-making matrix to set up improvable strategies.

The remainder of this chapter is organized as follows: Sect. 21.2 presents a literature review; Sect. 21.3 describes the research design, including our two-stage DEA methodology, truncated regression, collection of the sample data and the criteria for variables to evaluate performance; Sect. 21.4 presents empirical data and analyzes the results; and Sect. 21.5 presents the conclusion.

21.2 Operating Performance Measurement Approaches in the Airline Industry

In today’s globalized world, air transportation systems play the role of providing a service to connect virtually all countries around the world. Over the last decade, the airline industry has experienced the fastest growth and has contributed to the creation of economies worldwide. However, the industry was greatly affected by economic challenges such as increased competition and volatility. The September 11 attacks in 2001 and the severe acute respiratory syndrome (SARS) in 2002 and 2003 caused the 2001/2003 aviation crisis, and the recent global financial crisis of 2007–2009 caused the 2008/2009 aviation crisis (Franke and John 2011). During these periods, even the most lucrative airlines lost money and this implies that airline managers have to take extra caution in choosing information that reflects their operating performance (Gramani 2012). Therefore, it is no surprise that there has been a recent spate of interest in the study of airline performance as researchers have applied an arsenal of tools to evaluate airline performance.

21.2.1 Uni-dimensional Measures

There is a long-standing debate over which measures reflect operating performance well. Among performance measurement technique, Francis et al. (2005) document that benchmarking is the most used method in the aviation industry. In the academic field, researchers have used various measures as indicators of the operating performance of airlines, including ratio analysis on accounting-based performance and market-based performance.

The traditional ratio measures are simple and easy to understand with each indicator providing a single dimensional measure of operating performance. Various ratios have been used in prior studies (see for example, Feng and Wang 2000). An example of a market-based ratio measure used is Tobin’s Q. Lee et al. (2013) used approximate q, which is calculated as the summation of a firm’s market value, liquidating value of outstanding preferred shares, and value of short-term liabilities. Raghavan and Rhoades (2005) employed an operating profit margin to indicate the profitability of the U.S. airlines. In examining the performance of international airlines, Backx et al. (2002) used several ratios, such as return on sales, return on assets, and employee productivity. Despite the prevalent use of ratio measures, Chuang et al. (2008) argue that the use of traditional performance measures like the Sharpe ratio could provide wrong information to investors regarding the stock performances of airlines.

Other measures that have been previously used are aggregate measures (Gorin and Belobaba 2004), activity-based costing (Lin 2012), an integrated approach of an analytic hierarchy process (AHP) and fuzzy TOPSIS method (Aydogan 2011), benchmarking (Francis et al. 2002), a multi-attribute decision making model (Chang and Yeh 2001) and even newly-developed explanatory frameworks (Tan and Rae 2009).

21.2.2 Data Envelopment Analysis

Prior studies document that DEA is superior to traditional methods, such as ratio analysis (Lu et al. 2014). Zhu (2000) argues that the single output to input financial ratios may not characterize the financial performance of a company that is complex in nature. Instead of using mere ratios or other individual financial variables, various attributes can be accommodated so that possible interactions between them can be captured in order to derive the efficiency scores of decision making units (DMUs) under DEA (Yeh 1996; Homburg 2001; Biener and Eling 2011; Lu and Hung 2011; Premachandra et al. 2011; Fang et al. 2013; Matthews 2013; Yang and Morita 2013). This means that DEA provides additional information through the computed efficiency scores of financial measures aggregation as compared to such financial ratios as return on assets that are uni-dimensional and have subjective problematic interpretations (Feroz et al. 2003). Moreover, comparing multiple inputs and outputs of DMUs for measuring relative DMU’s efficiency allows for the identification of benchmarking. Other advantages of DEA include the identification of sources and the amount of inefficiency in each input and each output for a DMU as well as its ability for benchmarking purposes (Cooper et al. 2006).

Contemporary research in the aviation industry has applied DEA in order to evaluate organization performance. Through a rigorous analysis, Liu et al. (2013b) provide a summary of five major DEA application areas, among which is transportation. In air transportation, Schefczyk (1993) is the leading article measuring the operational performance of airlines. Using data from 15 airlines, the author uses DEA to analyze the operational performance of airlines and concludes with an analysis of the strategic factors of high profitability and performance in the airline industry.

Sengupta (1999) evaluates the performance of seven major airlines between 1988 and 1994 by using the DEA method. The results of this study showed that techniques and the allocation efficiency of the airlines changed significantly during this period. Scheraga (2004) investigates whether relative operational efficiency implied superior financial mobility. He used DEA to derive efficiency scores for 38 airlines in North America, Europe, Asia and the Middle East, and found that relative operational efficiency did not inherently imply superior financial mobility.

Chiou and Chen (2006) employ DEA to evaluate 15 Taiwanese domestic air routes from three perspectives proposed by Fielding et al. (1978). The results of the DEA model suggest that ten routes were relatively cost efficient, five routes were relatively cost effective and four routes were relatively service effective. The study also performed clustering analysis to categorize the routes into four clusters. Based on the characteristics of each route, the authors addressed directions for improvement.

Barbot et al. (2008) use DEA and total factor productivity (TFP) to analyze the efficiency and productivity of the 49 member airlines of IATA. The study found that low-cost carriers perform more efficiently than full-service carriers, and larger airlines are more efficient than smaller ones. With respect to geographic areas, the author noted that the European and American carriers were more effective than airlines in Asia Pacific and China/North Asia. The results of the DEA analysis illustrate that efficiency and effectiveness are not always correlated. The results of the TFP analysis show that the airlines operating within more homogeneous and regulatory structured areas, like North America, are more uniform in their productivity.

Greer (2008) uses DEA and the Malmquist productivity index to examine changes in the productivity of the major U.S. passenger airlines from 2000 to 2004. The study suggests that there was a significant improvement in the productivity of the carriers during this period. Most of the productivity improvements came from the efficiency laggards’ catching up with efficiency leaders in the industry. Barros and Peypoch (2009) apply DEA to evaluate the efficiency of 27 airlines in the Association of European Airlines (AEA), from 2000 to 2005. The study found that almost all European airlines operate at a high level of pure technical efficiency and scale efficiency. In the second stage, the study used bootstrapped truncated regression and noted that population and network alliances are the most important influences on the efficiency of airlines.

Hong and Zhang (2010) use DEA to analyze the operations of 29 airlines from 1998–2002 in order to explore whether a high degree of cargo business improves the operational efficiency of mixed passenger/cargo airlines. It was found that airlines with a high degree of cargo business are significantly more efficient than ones with a low degree of cargo business. Moreover, the authors found no statistically significant difference between airlines with similar degrees of cargo business.

Merkert and Hensher (2011) evaluate key determinants of 58 passenger airlines’ efficiency using bootstrapped DEA scores in the first stage and partially bootstrapped random effects Tobit regressions in the second stage. They show that airline size and fleet mix characteristics have positive impacts on technical, allocative and cost efficiencies. Although the age of an airline’s fleet does have a positive impact on its allocative and cost efficiency, it has no significant impact on its technical efficiency, which means that an old fleet can possibly achieve higher efficiency than a young fleet. Merkert and Williams (2013) also apply a two-stage approach to measure the efficiency of 18 European public service obligations airlines. In the first stage, they document a bootstrapped DEA analysis to compute the technical efficiency of the sample airlines. In the second stage, they regress the first-stage DEA efficiency scores against explanatory variables (determinants of airline performance).

Wang et al. (2011) also apply a two-stage approach, where they use DEA to assess the operating performance of 30 airlines in the U.S. and regress the first-stage DEA efficiency scores against corporate governance mechanisms. They assess competitive advantages of airlines through efficiency decomposition, cluster analysis, and multidimensional scaling. Their truncated regression analysis shows that airline performance is related to their characteristics and corporate governance mechanisms. Studying 17 European airlines, Lozano and Gutiérrez (2011) employ a multi-objective DEA approach to determine the trade-offs among environmental impact, fleet cost and operating cost, and a Slacks-Based Measure (SBM) of DEA to assess the technical efficiency of each airline. Their results show that approximately 50 % of the airlines are technically inefficient.

The study of Gramani (2012), which is closely related to our study, applies a two-phase data envelopment analysis approach to examine the operational and financial performances for Brazilian and American airlines from 1997 to 2006. The intermediate input in their study is the inverted efficiency scores obtained in the first phase. In contrast, our study is set in a different research setting in which we establish a two-stage DEA model with intermediate measures in a single implementation. This is consistent with that of Zhu (2011), who examined the performance of fleet maintenance in the first stage and the performance of revenue generation in the second stage through an application of the centralized model developed by Liang et al. (2008).

In summary, prior studies have considered different inputs and outputs with no unanimous orientation. That is, input-oriented, output-oriented, and non-oriented models have been applied in prior studies. With respect to the assumption on returns to scale, they assume either constant returns to scale (CRS) or variable returns to scale (VRS). Both radial and non-radial methods have been employed. A drawback of traditional DEA models is that they ignore intermediate measures or linking activities. To overcome this problem, an integrated additive two-stage DEA model is discussed in the next section.

21.3 Research Design

From the influential study of Charnes et al. (1978), the first outcome of note is the definition of DEA: a “measure of the efficiency of any decision making unit (DMU) is obtained as the maximum of a ratio of weighted outputs to weighted inputs subject to the condition that the similar ratios for every DMU be less than or equal to unity” (Charnes et al. 1978). DEA, a widely used linear-programming-based composite tool, is a non-parametric mathematical technique for measuring the relative efficiency of DMUs, in particular the efficiency of the DMUs in transforming inputs into outputs. Particularly, DEA first establishes an “efficient frontier” formed by a set of DMUs that exhibit best practices and then assigns the efficiency level to other non-frontier units according to their distance from the efficient frontier. Put differently, a company is technically efficient if it cannot improve any of its inputs or outputs without reducing some of its other inputs or outputs (Cooper et al. 2004).

DEA has been in existence for more than 30 years. Since the publication of the seminal paper by Charnes et al. (1978), the number of DEA-related published research articles has exceeded 4,000 entries up to year 2007 (Emrouznejad et al. 2008) and has accumulated approximately 4,500 papers in the ISI Web of Science database up through the year 2009 (Liu et al. 2013a). The usefulness of DEA is evident in its wide acceptance, in which it has been widely applied to various industrial and non-industrial contexts, such as transportation, banking, education, etc. in the academic field. Furthermore, almost no one in the DEA research community is cognizant of the development and application of DEA to real world scenarios in countries such as China and UAE (Liu et al. 2013b). That is, DEA has become a widely used tool for evaluating corporate performance in the study of management and related disciplines (Seiford and Zhu 1999; Zhu 2000; Banker et al. 2004; Wang 2005; Lu and Hung 2010; Sueyoshi and Goto 2010; Chang et al. 2008).

Taken together, applying DEA, a multi-factor performance measurement model, to measure corporate performance is more advantageous than traditional performance measures and can better capture managerial efficiency in managing organizational resources. Those publications noted earlier are definitely great examples to illustrate the pros of using DEA to address real world problems or corporate performance.

However, the traditional DEA model, which is based on a one-stage approach ignores intermediate measures or linking activities (Chen and Zhu 2004; Tone and Tsutsui 2009). That is, the conventional DEA model treats each DMU as a “black box” where only initial inputs and final outputs are assessed for efficiency measurement (Chen and Yan 2011). A two-stage DEA model is able to overcome the shortcoming of the traditional one-stage DEA model.

21.3.1 Two-Stage Transformation

Evaluating organizational performance is a complex process that cannot take into account just one criterion or just one dimension. A number of studies have applied DEA, which converts multiple inputs and outputs into a single efficiency score in order to evaluate the performance of organizations (Seiford 1997; Gattoufi et al. 2004; Emrouznejad et al. 2008).

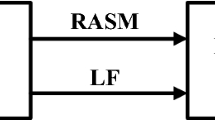

One disadvantage of traditional DEA models is that they neglect intermediate measures or linking activities (Fare and Whittaker 1995; Chen and Zhu 2004; Tone and Tsutsui 2009). In order to adequately evaluate the operating performance of airlines, this study proposes a two-stage production process that includes production efficiency and marketing efficiency, as shown schematically in Fig. 21.1.

In each stage, input and output variables are chosen based on the literature from studies on the field of aviation (Schefczyk 1993; Charnes et al. 1996; Ray and Hu 1997; Alam et al. 1998; Sengupta 1999; Scheraga 2004; Barbot et al. 2008; Greer 2008). In the first stage, each airline uses six inputs to produce two outputs, which are then used as inputs in the second stage to produce two further outputs. The input, intermediate and output variables used in this study are defined as follows.

Input variables:

-

Employees (FTEs): The number of full-time equivalent employees (FTEs)

-

Fuel Consumed (FUEL): The total gallons of fuel consumed during the current period

-

Seating Capacity (SEATS): The total number of seats in all aircraft

-

Flight Equipment (FLIGHT): The cost of flight equipment

-

Maintain Expense (MAINEXP): The maintenance, materials and repairs expenses in the income statement

-

Ground Property & Equipment (GROPROEQ): The cost of equipment and property minus that of flight equipment

Intermediate variables:

-

Available Seat Miles (ASMs): The total number of seat miles that were available to passengers (i.e. aircraft miles flown times the number of seats available for revenue passenger use)

-

Available Ton Miles (ATMs): The sum of the products obtained from the number of tons available to carry revenue load passengers, freight and mail on each flight stage multiplied by miles flown

Output variables:

-

Revenue Passenger Miles (RPMs): The scheduled revenue miles flown by passengers (i.e. revenue passengers carried times miles flown)

-

Non-Passenger Revenue (NPR): The total amount of passenger revenue subtracted from gross sales

21.3.2 Data Collection and Descriptive Statistics

The data were extracted from the Compustat database, the Bureau of Transportation Statistics (BTS), annual reports, and proxy statements published in 2006. The study first selected 36 airlines listed on the US stock exchanges, including 26 US airlines and 10 American Depositary Receipt (ADR) airlines. Each airline is treated as a DMU in the DEA analysis. The samples included an additional consolidated statement from a different source, while airlines that were missing data were eliminated. As a result, the final sample list contained 30 airlines, including 21 US airlines and 9 ADR airlines. We examined the efficiency of the airlines with the two-stage production process, in which all of the outputs from the first stage were used as inputs to the second stage. Furthermore, we explored whether characteristics of corporate governance affected airline performance.

Descriptive statistics for the 30-airline sample are provided in Table 21.1. Panels B and C in Table 21.1 show the correlation coefficients for inputs and outputs in the two stages. The results reveal a significantly positive relation between inputs and outputs. The data set satisfies the assumption of isotonicity, that is, an increase in any input should not result in a decrease in any output. Besides, DEA requires that the number of DMUs be at least twice the total number of input and output variables (Golany and Roll 1989). In this study there are six inputs and two outputs in stage one, with two inputs and two outputs in stage two. Each stage meets the criterion, i.e., 30 > 2(6 + 2) in the first stage and 30 > 2(2 + 2) in the second stage. The DEA model of this study is thus deemed valid.

21.3.3 Additive Efficiency Decomposition in Two-Stage DEA

A number of studies (Seiford 1997; Gattoufi et al. 2004; Emrouznejad et al. 2008) have employed two-stage processes to evaluate the operating efficiency of peer organizations using different DEA models. In general, DEA models can be sub-divided into four categories: separate DEA models (SDEA; e.g., Karlaftis 2004; Chiou and Chen 2006), separate two-stage DEA models (STDEA; e.g., Seiford and Zhu 1999; Keh et al. 2006), network DEA models (NDEA; e.g., Yu and Lin 2008; Yu 2008; Kao 2009; Tone and Tsutsui 2009; Cook et al. 2009), and integrated two-stage DEA models (ITDEA; e.g., Kao and Hwang 2008; Chen et al. 2009; Cook et al. 2010). The SDEA cannot conduct the two-stage efficiency, with intermediate measures, in a single implementation. Hence, because of intermediate measures, the performance improvement of one stage affects the efficiency status of the other.

The lack of interrelated performance among different stages in SDEA may be solved by the NDEA or ITDEA models. However, due to the complexity of the modeling, the scale economy and slack values for each DMU are hard to compute using the NDEA model proposed by Yu and Lin (2008), Yu (2008) and Kao (2009), which is only applicable to the case of constant returns to scale. The NDEA model (Tone and Tsutsui 2009) does not show the relative importance or contribution of the performances of individual stages to the overall performance of the entire process. The ITDEA model proposed by Chen et al. (2009) and Cook et al. (2010) can be applied to both technologies of variable and constant returns to scale and represents the relative importance or contribution of the performances of individual stages to the overall performance of the entire process. One reasonable choice of the weights for each stage is by the relative size of each stage.

Therefore, this study adopts the additive efficiency decomposition of Chen et al. (2009) and Cook et al. (2010) by establishing a two-stage DEA model with intermediate measures in a single implementation. Consider the two-stage production process presented in Fig. 21.1. Assume we have n airlines and that airline j uses m inputs (x ij , i = 1, …, m) to produce d outputs (z pj , p = 1, …, d) in the first stage; these are then used as inputs in the second stage to produce s outputs (y rj , r = 1, …, s). The efficiency measure for stages 1–2 of the process under VRS for an observed airline becomes β 1 and β 2.

The overall efficiency measure of the two-stage process can reasonably be represented as a convex linear combination of the two stage-level measures, namely,

The weights (w 1 and w 2) are intended to represent the relative importance or contribution of the performances of individual stages to the overall performance of the two stage process. The weights (w 1 and w 2) in each stage are determined based on the relative size of that stage. To be more specific, (\( {\sum}_{i=1}^m \) v i x io + \( {\sum}_{i=1}^m \) η p z po ) represents the total size of, or total amount of, resources consumed by the two stage process. Assume that w 1 and w 2 are defined as the proportion of the total input used at each stage, then

Thus, the overall efficiency θ is in the form

The overall efficiency θ of the two stage process can be optimized, subject to the restrictions that the individual measures (β 1 and β 2) must not exceed unity in the linear programming format, after making the usual Charnes and Cooper transformation (1962). The linear programming problem of additive efficiency decomposition in the two-stage DEA under the VRS model is as follows.

If κ A = κ B = 0 in (21.4), then the technology is said to exhibit CRS.

The dual model of (21.4) under the VRS model is as follows:

The solution based on formula (21.5), λ jk can be utilized to determine whether unit j is a peer of the observed unit k in the first stage. If it is zero, then unit j is not a peer, otherwise, λ jk serves as an indication of how much unit j is to be learned by the observed unit k. The larger λ jk which is the stronger unit j , is related to the observed unit. μ jk plays the same role in the second stage.

Once we obtain the overall efficiency, models similar to (21.4) can be developed to determine the efficiency of each stage. Specifically, assuming the pre-emptive priority of stage 1, the following model determines that stage’s efficiency TE 1 k , while maintaining the overall efficiency score at θ k calculated from (21.6),

Similarly, if stage 2 is to be given pre-emptive priority, the following model determines the efficiency TE 2 k for that stage, while

21.3.4 Truncated Regression

In the DEA literature, Tobit regression has been used to investigate whether performance is affected by exogenous factors. This chapter assumes and tests the regression condition as:

In (21.8), α is the intercept, ε j is the residual value, and X j is a vector of observation-specific variables for airline j that is expected to be related to the airline’s efficiency score, represented by TE j . Nevertheless, Simar and Wilson (2007) illustrate that Tobit regression is inappropriate to analyze the efficiency score under DEA. They also developed a truncated-regression model with bootstraps instead of the Tobit model, and illustrate satisfactory performance in Monte Carlo experiments.

This study follows the approach of Simar and Wilson (2007) by adopting the exogenous factors (corporate governance proxy variables) that would affect the performance of airlines. It is noted that the distribution of ε j is restricted by the condition ε j ≥ 1 − α − X j β in (21.8). This study modifies (21.8) and assumes that the distribution before truncation is truncated normal with zero mean, unknown variance, and truncation point, which are determined by different conditions. Equation 21.9 is the result after modification.

where ε j ~ N(0, σ 2 ε ), such that ε j ≥ 1 − α − X j β, j = 1, …, n. This study uses the regression process of parametric bootstrapping to estimate parameters (β, σ 2 ε ), estimates (21.8) by maximizing the corresponding likelihood function and gives heed to (β, σ 2 ε ). Readers not familiar with the details of the estimation algorithm are referred to Simar and Wilson (2007).

21.4 Empirical Results

This section presents the empirical results of the two-stage DEA approach and truncated regression. In the first phase, we examine the production and marketing performances. Combining production efficiency and marketing efficiency, we construct a decision-making matrix to identify the relative positions of our sample airlines. In the second phase, we further help airline managers to improve their operating performance through regression analysis. That is, we regress production efficiency and marketing efficiency (dependent variables), respectively, on a number of corporate governance mechanisms and control variables (explanatory variables).

21.4.1 Measuring Production and Marketing Performances

Based on the controllable aspect of a manager, this study adopts additive efficiency decomposition (Chen et al. 2009; Cook et al. 2010) under the assumption of input minimization (also known as input orientation) to measure the operating performance of the multi-stage production of airlines, with intermediate measures, in a single implementation model. One opting for DEA analysis should choose either the CRS or VRS model. As Avkiran (2001) suggests, the way to choose between CRS and VRS is to run the performance models under each assumption and compare the efficiency scores. In this study, a Wilcoxon Matched Pairs Test is applied to perform the evaluation. The mean of the paired differences between CRS and VRS scores are not significantly greater than zero, thus supporting the CRS assumption in the efficiency assessment. The ‘Production Efficiency,’ ‘Marketing Efficiency’ and the relative importance of individual stages to the overall performance of the entire process are presented in Table 21.2.

DEA efficiency scores do not measure the productive efficiencies of the decision-making units in an absolute sense. Instead, they measure their efficiencies relative to ‘the efficient’, meaning the best existing empirical practice and decision-making units in the dataset, i.e. those that receive a DEA efficiency score of 1. This does not preclude the existence of some inefficiency among the most efficient decision-making units, so the efficient ones need not be completely efficient in an absolute sense. DEA is a frontier analysis, where the boundary of the production possibilities set (sometimes called the “efficiency frontier”) is specified by linear combinations of the input–output vectors of the efficient firms. Firms that are not found to be efficient receive efficiency scores of less than one (in an input-oriented DEA model), with the extent to which their scores fall short of one measures how inefficient they are relative to the efficient firms. An average efficiency score for the decision-making units in a dataset essentially measures how inefficient, on average, the firms in the dataset are compared to the efficient firms.

The score of relative efficiency ranges from 0 to 1. An airline with the score of one is relatively efficient; otherwise, one with a score of less than 1 is relatively inefficient. Table 21.2 shows that the mean scores of production efficiency and marketing efficiency are 0.907 and 0.896, respectively. This finding indicates that, in the area of production efficiency, there are smaller differences in the relative efficiencies of the carriers than there are in their marketing efficiencies. This result suggests that the policy-makers in these airlines should focus first on improving marketing strategies and then proceed to improving their revenue passenger miles and non-passenger revenue.

To determine whether differences exist in various operating characteristics, including carrier type (either full-service carriers or low-cost carriers) for production and marketing efficiencies, a non-parametric statistical analysis (Mann–Whitney test) is used (Brockett and Golany 1996) for unknown distribution scores. Table 21.2 shows that the low-cost carriers have higher production efficiency than the full-service ones, with scores of 0.959 and 0.876 respectively. However, the full-service carriers have higher marketing efficiency than the low-cost ones, 0.904 and 0.883 respectively. Most low-cost carriers do not carry cargo or provide other services. Their main source of revenue comes from passengers. We speculate that the marketing inefficiency of low-cost carriers is due to lower non-passenger revenue. Due to the small sample size, the result of the Mann–Whitney test shows no significant difference at the 5 % level.

21.4.2 Managerial Decision-Making Matrix

To identify the relative positions of the 30 airlines, we constructed a decision-making matrix by combining production efficiency and marketing efficiency to help airline managers and boards of directors improve corporate efficiency. The horizontal axis of the matrix measures production efficiency, while the vertical axis of the matrix measures marketing efficiency. A large value indicates better marketing efficiency. In contrast, a small value indicates a lower marketing efficiency.

Each airline is classified into a quadrant by examining (1) whether the production efficiency is equal to or less than 0.95, and (2) whether the marketing efficiency is greater than or smaller than 0.95. The decision-making matrix, shown in Fig. 21.2, is divided into four quadrants, according to the importance and urgency of the decision-making process. In order to find information indicating by how much and in what areas an inefficient airline needs to improve, a non-zero slack analysis was used to find targets and potential improvements for the inefficient airlines. Such analysis can identify marginal contributions in efficiency ratings with an additional decrease in specific input amounts. Table 21.3 reports the results of our slack analysis. Based on the results shown in Table 21.3, the inefficient DELTA AIR LINES, as an example, can decrease its number of employees (FTEs) by 10.35 %, its fuel consumed (FUEL) by 10.35 %, its seating capacity (SEATS) by 10.35 %, its flight equipment (FLIGHT) by 10.35 %, its maintenance expenses (MAINEXP) by 31.6 %, its ground property and equipment (GROPROEQ) by 56.95 %, its available seat miles (ASMs) by 10.35 % and its available ton miles (ATMs) by 53.37 %, so as to be as efficient as its peer group. This result suggests that DELTA AIR LINES is seriously over-utilizing operational efficiency and should enhance its management’s ability operate. The total potential improvement also indicates that the inefficient DELTA AIR LINES has the greatest potential to decrease their inefficiency. Therefore, managers should expect to spend most of their efforts in this area.

The purpose of this study is to understand the utilization of resources and the decision-making orientation of each airline. We also propose a number of methods to improve the airlines’ efficiency. The airlines located in the four zones are described as follows.

Zone I: The airlines in this zone demonstrate higher efficiency in both production and marketing than airlines in other zones. There are five airlines in this zone: HAWAIIAN HOLDINGS, UAL, JETBLUE AIRWAYS, AIR FRANCE-KLM-ADR, and ALLEGIANT TRAVEL. In both stages, these airlines were found to be superior to other airlines, and are regarded as benchmarks because of their outstanding efficiency. If they manage and control resources effectively, they will be able to maintain their leading position.

Zone II: There are three airlines in this zone: EXPRESSJET HOLDINGS, NORTHWEST AIRLINES and DEUTSCHE LUFTHANSA AG-ADR. They were found to be not as efficient as the airlines in Zone 1. Despite their relatively inferior production efficiency, they performed remarkably in marketing. These airlines should improve their ability to reallocate ASMs and ATMs in order to achieve more effective outcomes in the production process.

Zone III: This zone contains nine airlines: DELTA AIR LINES, SOUTHWEST AIRLINES, SKYWEST, ALASKA AIR GROUP, AMR CORP/DE, CHINA EASTERN AIRLINES-ADR, LAN AIRLINES SA-ADR, MESA AIR GROUP and GREAT LAKES AVIATION LTD. Both their production efficiency and marketing efficiency were found to be inferior, with China Eastern Airlines bearing the lowest score. All of these airlines should attempt to increase both production efficiency and marketing efficiency. In addition to enhancing managerial capabilities and reorganizing resources, these airlines should concentrate on substantive issues and effective strategies.

Zone IV: There are 13 airlines in this zone, MAIR HOLDINGS, CONTINENTAL AIRLS INC-CL B, REPUBLIC AIRWAYS HLDGS, COPA HOLDINGS SA, CHINA SOUTHN AIRLS LTD-ADR, BRITISH AIRWAYS PLC-ADR, GOL LINHAS AEREAS INTEL-ADR, RYANAIR HOLDINGS PLC-ADR, TAM SA-ADR, PINNACLE AIRLINES, FRONTIER AIRLINES HOLDINGS, US AIRWAYS GROUP and AIRTRAN HOLDINGS. They had better production efficiency, but lower marketing efficiency. This suggests that all policy-makers in these airlines should focus first on improving marketing strategies and then proceed to improving their revenue passenger miles and non-passenger revenue.

To summarize, we find that almost all variables are maximized in Zone I. Thus, we can say that these airlines use resources efficiently. One input resource might be further reduced in Zone II. Boards and management could focus on how to reduce maintenance costs through communication and discussion. For example, if they leased newer aircraft, maintenance expenses could be reduced. In Zone III, the output resources are relatively smaller than those in other zones. Thus, managers could revise their strategies in order to increase output resources (ASMs, ATMs and RPMs). They could learn about management strategies from those airlines with the best practices in Zone I. Non-passenger revenue is the smallest in Zone VI. Boards and management could improve their strategy by adding other non-passenger services. If these services were incorporated, then these airlines could move up to Zone I.

21.4.3 The Relationship Between the Airlines’ Performance and Corporate Governance

Jensen (1993) and Chiang and Lin (2007) point out that large board sizes can lead to some problems, such as coordination and communication, allow the CEO to control the board easily and so give rise to certain agency related problems. However, more directors in the board can allow for more specialists from different fields and therefore higher-quality decision-making. Furthermore, resource dependent theory demonstrates that board size is associated with a firm’s ability to acquire key resources from outside (Zahra and Pearce 1989; Xie et al. 2003). Committees are established by the board. There are four common types of committees: audit, nominating, remuneration and executive. Vafeas (1999) found that committees and a firm’s performance were negatively related, but the relation was not significant. In terms of boards’ internal functions, one of their major tasks is deciding the frequency of meetings (Vafeas 1999). Andres and Vallelado (2008) demonstrate that meetings provide board members with ways to discuss and exchange ideas about how they wish to monitor managers. Jensen (1993), however, indicates that board meetings were not necessarily helpful to performance.

With respect to composition and independence, there can be two types of directors: executive and non-executive. Non-executive directors’ major duties include monitoring, disciplining and advising managers; therefore, they can reduce conflicts of interest between insiders and shareholders (Harris and Raviv 2008). Andres and Vallelado (2008) point out that an appropriate, not excessive, number of non-executive directors would be more efficient in monitoring and advising functions and thus would improve performance. Nevertheless, Yermack (1996) shows that firms with a high percentage of non-executive directors have inferior performance. Baliga et al. (1996) and Bhagat and Bolton (2008) showed that when a firm separates the functions of the CEO and the chairman, performance is better than those with CEO duality. Nevertheless, Jensen (1993) observes that in CEO duality, the CEO can control information more effectively than the other board members and so can impede monitoring. Sonnenfeld (2002) argues that the average age of directors can be used as a proxy for experience. Older directors have more professional experience in firms and industries and so board quality can be promoted. However, Stathopoulos et al. (2004) suggests that older directors are less effective in ensuring firm performance. With respect to managerial ownership, Jensen and Mecking (1976) point out that when managerial ownership increases, the interests of managers and shareholders become more similar. Therefore, managerial ownership is significantly positively related to performance.

To summarize, prior studies have rarely explored whether the characteristics of corporate governance affect an airline’s performance. Therefore, in this section, we will explore whether corporate governance affects airline performance.

For the dependent variable of the study, we apply the efficiency results from the two-stage DEA in the first part. For independent variables, we use Board size (BOASIZE), Committee (COMNUM), Meetings (MEETYEA), Non-executive director (NEXDIR), CEO duality (CEODUALITY), Directors’ age (DIRAGE) and Executive officers ownership (EXEOWN) to represent corporate governance. As proposed by Backx et al. (2002) and Barros and Peypoch (2009), this study uses five control variables.

Corporate governance variable

-

Board size (BOASIZE): The number of directors on the board including executive and non-executive directors

-

Committees (COMNUM): The number of committees established by the board, for instance, auditing, nominating, remuneration and executive committees.

-

Meetings (MEETYEA): The annual number of board meetings for each airline

-

Non-executive director (NEXDIR): The number of independent non-executive directors on the board

-

CEO duality (CEODUALITY): A dummy variable for airlines, which equals 1 if the CEO is also chairman of the board, and 0 otherwise

-

Directors’ age (DIRAGE): The average age of the board directors

-

Executive officers ownership (EXEOWN): The percent of the firm’s outstanding shares owned by the executive officers

Control variable

-

Average age of aircraft (AVGAGE): The average age of all aircraft

-

Average aircraft size (AVGSIZE): The average number of seats on the aircraft

-

Average stage length (AVGSTAGE): The average distance flown on each segment of every route

-

Dummy International (INTER_DUM): A dummy variable for airlines, which equals 1 if the airline has international flights and 0 otherwise

-

Dummy low cost carrier (LCC_DUM): A dummy variable for airlines, which equals 1 if the airline is a low-cost carrier and 0 otherwise

To explore whether characteristics of corporate governances affect an airline’s performance, we estimate the truncated-regression model as follows:

TE represents the empirical result of the efficiency score obtained from the production efficiency or marketing efficiency of the two-stage DEA efficiency scores. This study also performs a simulation test, which includes 3,000 experimental observations, in order to confirm the fitness of the truncated-regression model. To enhance the robustness of our empirical results, the following additional analyses were completed. First, we used the variance inflation factors’ diagnostics (Neter et al. 1985) for collinearity analysis. No evidence of collinearity between independent variables was found in our regression models. Next, the White test (White 1980) was used to check the heteroskedasticity of the residuals, and evidence of heteroskedasticity could be found. Finally, the heteroskedasticity-robust standard error was used to construct a heteroskedasticity-robust t statistic. Table 21.4 presents the regression results of the separate efficiency by using the heteroskedasticity-robust standard error.

In terms of production efficiency, the results of a truncated-regression suggested that the independent variables BOASIZE and COMNUM are significantly related to airline performance at 5 % levels. They also indicated that BOASIZE and MEETYEA have an inverse relation with airline performance, while COMNUM has a positive significant relationship with airline performance.

The results indicate that smaller boards lead to better airline performance. Provan (1980) found that board size is positively related to performance and argued that board size is related to the company’s ability to acquire key resources such as budgets, external funding and leverage. Zahra and Pearce (1989) and Kiel and Nicholson (2003) propose that larger boards are likely to be heterogeneous in their industrial background and expertise, which improves the company’s decision making and thus enhances its performance. Xie et al. (2003) reported that larger boards can mitigate earnings management. The results of the current study are contrary to their findings. We speculate that too many directors on the board may lead to greater personnel compensation, which in turn makes it more difficult to integrate management decisions. With respect to COMNUM, the results indicate a significantly positive relationship with production performance. Vafeas (1999) found a negative but not significant relationship between performance and the number of committees. The more committees established by the board (for instance, auditing, nominating, remuneration and executive committees), the tighter control will be.

The study shows that MEETYEA has no significant negative relation with production performance, while CEODUALITY showed no significant relation to performance. When the CEO is also the chairman of the board, serious agency problems can arise, and monitoring by the board can be reduced (Fama and Jensen 1983). Baliga et al. (1996) showed that a firm with separate CEO and chairman of the board positions performed better than a firm with CEO duality. DIRAGE is a proxy for experience, and older directors may be familiar with the firm and industries. The results show that older directors have more experience and contribute to the airline’s performance. EXEOWN had positive relations with performance. This is consistent with the findings of Jensen and Mecking (1976) in which they show a positive relation between performance and stock ownership by executive officers.

Regarding marketing efficiency, the truncated-regression analysis shows that the independent variables NEXDIR and EXEOWN are significantly positively related to airline performance at 5 % levels. Non-executive directors should scrutinize the performance of management in meeting agreed goals and objectives, in monitoring, and where necessary, removing, senior management, and in succession planning. Directors may be recruited for their ability to offer support and advice in specialized areas such as marketing, product development or financial restructuring. On the other hand, BOASIZE and DIRAGE were found to be negatively related to airline performance. Board size refers to the number of directors serving in a firm’s board. Large boards may destroy corporate value. The result here suggests that some boards may be larger than optimal and that it may be worthwhile for some airlines to reevaluate their optimal board size. Besides, a high level of executive officer ownership reflects too many chiefs in an airline, which in turn may spoil the company.

While previous studies have discussed the influence of control variables, this study shows that some control variables are significant. AVGSIZE and AVGSTAGE are significant in the production model, and AVGAGE, AVGSIZE and INTER DUM are significant in the marketing model. These airlines should increase the average number of seats on an aircraft and the average distance flown on each segment of every route to improve production efficiency, and decrease the average number of seats on an aircraft and the average distance flown on each segment of every route and increase international flights in order to improve marketing performance.

Finally, it should be noted that the use of variables measured in monetary terms in arriving at the DEA efficiency scores may render the scores somewhat questionable as measures of the relative production and marketing efficiencies of the carriers in the dataset. Variables such as the FLIGHT, MAINEXP, GROPROEQ and NPR are measured in United States dollars, while the remaining variables are measured in their physical units, which is how they should be measured when evaluating the relative productive efficiency of a decision-making unit. Different carriers in the dataset pay different prices for each unit of flight equipment, for their maintenance services, and for each item in their ground property equipment, and receive different prices for each ton of freight and mail they transport, especially since the carriers used in the dataset are based in different countries (France, Germany, China, Brazil, the United States, etc.). The currency exchange rate from one country to another may lead to different operational costs for firms in different geographical regions, and so the relative DEA efficiency scores may not actually track differences in the relative efficiencies of the carriers. This will be the topic of our future research.

21.5 Conclusion

While transport industries have become increasingly important in the global economy, issues in the aviation industry are especially important for a large, free market economy like the United States, because they can influence both global economic development and international politics. Although the efficiency of the aviation industry has been widely discussed in previous literature, and the DEA technique is frequently used to evaluate efficiency, there are still some important points not previously explored. As a research topic, the issue of corporate governance in the aviation industry has rarely been investigated. From the perspective of research methods, the problem with the traditional DEA model is the concept of a one-stage process, which neglects intermediate measures or linking activities. The concept of a two-stage process has been applied infrequently at best in previous studies of the aviation industry. Therefore, this chapter aimed to establish a two-stage DEA to measure efficiency, to discuss corporate governance and to evaluate the benchmarks of airlines from a more complete viewpoint. The results of this study can provide United States airlines with insights into resource allocation and competitive advantage, and can help them to improve their strategic decision-making, specifically regarding operational styles, under fierce competition in the aviation industry.

The findings can briefly be described as follows. First, the 30 airlines researched had an average production efficiency of 63 % and an average marketing efficiency of 33 %. This suggests that managers should focus first on improving the inefficient allocation of resources in production and then their marketing efficiency. Secondly, low-cost carriers are more efficient, on average, than full-service ones in production. This finding is consistent with the findings of Barbot et al. (2008). On the other hand, full-service carriers are more efficient, on average, than low-cost carriers in marketing. Thirdly, we can state that corporate governance influences firm performance. The results of truncated regression on board size, average age of directors, and percentage of outstanding shares owned by executive officers all show significant, positive relations to performance. Number of committees and CEO duality both present significant negative relations with performance. This means that these airlines can modify corporate governance to strengthen their efficiency and competitiveness. Finally, we used the managerial decision-making matrix to find benchmark airlines in order to help managers improve corporate performance.

Our findings can provide guidelines for coping with corporate governance issues in the aviation industry. Future research might use Malmquist productivity change index techniques to examine long-term variance in airline performance. It could also prevent the results from being affected by external, short-term factors. Such an approach would allow a dynamic view of the multidimensional performance of airlines. It is also hoped that the models and methods implemented in this study can help to bring about related research in other industries.

ReferencesÎ

Alam, I., Semenick, M., & Sickles, C. (1998). The relationship between stock market returns and technical efficiency innovations: Evidence from the US airline industry. Journal of Productivity Analysis, 9(1), 35–51.

Andres, P. D., & Vallelado, E. (2008). Corporate governance in banking: The role of the board of directors. Journal of Banking & Finance, 32(12), 2570–2580.

Avkiran, N. (2001). Investigating technical and scale efficiencies of Australian universities through data envelopment analysis. Socio-Economic Planning Sciences, 35(1), 57–80.

Aydogan, E. K. (2011). Performance measurement model for Turkish aviation firms using the rough-AHP and TOPSIS methods under fuzzy environment. Expert Systems with Applications, 38(4), 3992–3998.

Backx, M., Carney, M., & Gedajlovic, E. (2002). Public, private and mixed ownership and the performance of international airlines. Journal of Air Transport Management, 8(4), 213–220.

Baliga, B., Moyer, R., & Rao, R. (1996). CEO duality and firm performance: What’s the fuss? Strategic Management Journal, 17(1), 41–53.

Banker, R. D., Janakiraman, S., & Natarajan, R. (2004). Analysis of trends in technical and allocative efficiency: An application to Texas public school districts. European Journal of Operational Research, 154(2), 477–491.

Barbot, C., Costa, A., & Sochirca, E. (2008). Airlines performance in the new market context: A comparative productivity and efficiency analysis. Journal of Air Transport Management, 14(5), 270–274.

Barros, C. P., & Peypoch, N. (2009). An evaluation of European airlines’ operational performance. International Journal of Production Economics, 122(2), 525–533.

Bennedsen, M., Kongsted, H. C., & Nielsen, K. M. (2008). The causal effect of board size in the performance of small and medium-sized firms. Journal of Banking & Finance, 32(6), 1098–1109.

Bhagat, S., & Bolton, B. (2008). Corporate governance and firm performance. Journal of Corporate Finance, 14(3), 257–273.

Biener, C., & Eling, M. (2011). The performance of microinsurance programs: A data envelopment analysis. The Journal of Risk and Insurance, 78(1), 83–115.

Brockett, P. L., & Golany, B. (1996). Using rank statistics for determining programmatic efficiency differences in data envelopment analysis. Management Science, 42(3), 466–472.

Carline, N. F., Linn, S. C., & Yadav, P. K. (2009). Operating performance changes associated with corporate mergers and the role of corporate governance. Journal of Banking & Finance, 33(10), 1829–1841.

Chang, Y.-H., & Yeh, C.-H. (2001). Evaluating airline competitiveness using multiattribute decision making. Omega International Journal of Management Sciences, 29(5), 405–415.

Chang, D. S., Kuo, Y. C., & Chen, T. Y. (2008). Productivity measurement of the manufacturing process for outsourcing decisions: The case of a Taiwanese printed circuit board manufacturer. International Journal of Production Research, 46(24), 6981–6995.

Charnes, A., & Cooper, W. W. (1962). Programming with fractional functionals. Naval Research Logistics Quarterly, 9(3–4), 181–186.

Charnes, A., Cooper, W. W., & Rhodes, E. (1978). Measuring the efficiency of decision making units. European Journal of Operational Research, 2, 429–444.

Charnes, A., Galleegos, A., & Li, H. (1996). Robustly efficient parametric frontiers via multiplicative DEA for domestic and international operations of the Latin American airline industry. European Journal of Operational Research, 88(3), 525–536.

Chen, C., & Yan, H. (2011). Network DEA model for supply chain performance evaluation. European Journal of Operational Research, 213(1), 147–155.

Chen, Y., & Zhu, J. (2004). Measuring information technology’s indirect impact on firm performance. Information Technology & Management Journal, 5(1–2), 9–22.

Chen, Y., Cook, W. D., Li, N., & Zhu, J. (2009). Additive efficiency decomposition in two-stage DEA. European Journal of Operational Research, 196(3), 1170–1176.

Chiang, M. H., & Lin, J. H. (2007). The relationship between corporate governance and firm productivity: Evidence from Taiwan’s manufacturing firms. Corporate Governance, 15(5), 768–779.

Chiou, Y. U., & Chen, Y. H. (2006). Route-based performance evaluation of Taiwanese domestic airlines using data envelopment analysis. Transportation Research Part E, 42(2), 116–127.

Chuang, I. Y., Chiu, Y.-C., & Edward Wang, C. (2008). The performance of Asian airlines in the recent financial turmoil based on VaR and modified Sharpe ratio. Journal of Air Transport Management, 14(5), 257–262.

Cook, W. D., Liang, L., & Zhu, J. (2009). Measuring performance of two-stage network structures by DEA: A review and future perspective. Omega International Journal of Management Sciences, 38(6), 423–430.

Cook, W. D., Zhu, J., Yang, F., & Bi, G.-B. (2010). Network DEA: Additive efficiency decomposition. European Journal of Operational Research, 207(2), 1122–1129.

Cooper, W. W., Seiford, L. M., & Zhu, J. (2004). Data envelopment analysis: History, models and interpretations. In W. W. Cooper, L. M. Seiford, & J. Zhu (Eds.), Handbook on data envelopment analysis. Boston: Kluwer Academic.

Cooper, W. W., Seiford, L. M., & Tone, K. (2006). Introduction to data envelopment analysis and its uses: With DEA-solver software and references. New York: Springer.

Emrouznejad, A., Parker, B. R., & Tavares, G. (2008). Evaluation of research in efficiency and productivity: A survey and analysis of the first 30 years of scholarly literature in DEA. Socio-Economic Planning Sciences, 42(3), 151–157.

Fama, E. F., & Jensen, M. C. (1983). Separation of ownership and control. Journal of Law and Economics, 26(2), 301–324.

Fang, H.-H., Lee, H.-S., Hwang, S.-N., & Chung, C.-C. (2013). A slacks-based measure of super-efficiency in data envelopment analysis: An alternative approach. Omega International Journal of Management Sciences, 41(4), 731–734.

Fare, R., & Whittaker, G. (1995). An intermediate input model of dairy production using complex survey data. Journal of Agricultural Economics, 46(2), 201–213.

Feng, C.-M., & Wang, R.-T. (2000). Performance evaluation for airlines including the consideration of financial ratios. Journal of Air Transport Management, 6(3), 133–142.

Feroz, E. H., Kim, S., & Raab, R. L. (2003). Financial statement analysis: A data envelopment analysis approach. Journal of the Operational Research Society, 54(1), 48–58.

Fielding, G. J., Glauthier, R. E., & Lave, C. A. (1978). Performance evaluation for bus transit. Transportation Research Part A, 19(1), 73–82.

Francis, G., Humphreys, I., & Fry, J. (2002). The benchmarking of airport performance. Journal of Air Transport Management, 8(4), 239–247.

Francis, G., Humphreys, I., & Fry, J. (2005). The nature and prevalence of the use of performance measurement techniques by airlines. Journal of Air Transport Management, 11(4), 207–217.

Franke, M., & John, F. (2011). What comes next after recession? – Airline industry scenarios and potential end games. Journal of Air Transport Management, 17(1), 19–26.

Gattoufi, S., Oral, M., & Reisman, A. (2004). Data Envelopment Analysis literature: A bibliography update (1996–2001). Socio-Economics Planning Sciences, 38(2–3), 122–159.

Golany, B., & Roll, Y. (1989). An application procedure for DEA. Omega International Journal of Management Sciences, 17(3), 237–250.

Gompers, P. A., Ishii, J. L., & Metrick, A. (2003). Corporate governance and equity prices. Quarterly Journal of Economics, 118(1), 107–155.

Gorin, T., & Belobaba, P. (2004). Impacts of entry in airline markets: Effects of revenue management on traditional measures of airline performance. Journal of Air Transport Management, 10(4), 257–268.

Gramani, M. C. N. (2012). Efficiency decomposition approach: A cross-country airline analysis. Expert Systems with Applications, 39(5), 5815–5819.

Greer, M. R. (2008). Nothing focuses the mind on productivity quite like the fear of liquidation: Changes in airline productivity in the United States, 2000–2004. Transportation Research Part A, 42(2), 414–426.

Harris, M., & Raviv, A. (2008). A theory of board control and size. Review of Financial Studies, 21(4), 1797–1832.

Homburg, C. (2001). Using data envelopment analysis to benchmark activities. International Journal of Production Economics, 73(1), 51–58.

Hong, S., & Zhang, A. (2010). An efficiency study of airlines and air cargo/passenger divisions: A DEA approach. World Review of Intermodal Transportation Research, 3(1–2), 137–149.

Jensen, M. C. (1993). The modern industrial revolution, exit, and the failure of internal control systems. Journal of Finance, 48(3), 831–880.

Jensen, M. C., & Meckling, W. H. (1976). Theory of the firm: Managerial behavior, agency costs, and ownership structure. Journal of Financial Economics, 3(4), 305–360.

Kao, C. (2009). Efficiency decomposition in network data envelopment analysis: A relational model. European Journal of Operational Research, 192(3), 949–962.

Kao, C., & Hwang, S. N. (2008). Efficiency decomposition in two-stage data envelopment analysis: An application to non-life insurance companies in Taiwan. European Journal of Operational Research, 185(1), 418–429.

Karlaftis, M. G. (2004). A DEA approach for evaluating the efficiency and effectiveness of urban transit systems. European Journal of Operational Research, 152(2), 354–364.

Keh, H. T., Chu, S., & Xu, J. (2006). Efficiency, effectiveness and productivity of marketing in service. European Journal of Operational Research, 170(1), 265–276.

Kiel, G. C., & Nicholson, G. J. (2003). Board composition and corporate performance: How the Australian experience informs contrasting theories of corporate governance. Corporate Governance, 11(3), 189–205.

Lee, S., Seo, K., & Sharma, A. (2013). Corporate social responsibility and firm performance in the airline industry: The moderating role of oil prices. Tourism Management, 38, 20–30.

Liang, L., Cook, W. D., & Zhu, J. (2008). DEA models for two-stage processes: Game approach and efficiency decomposition. Naval Research Logistics, 55(7), 643–653.

Lin, W.-C. (2012). Financial performance and customer service: An examination using activity-based costing of 38 international airlines. Journal of Air Transport Management, 19, 13–15.

Liu, J. S., Lu, L. Y. Y., Lu, W.-M., & Lin, B. J. Y. (2013a). Data envelopment analysis 1978–2010: A citation-based literature survey. Omega International Journal of Management Sciences, 41(1), 3–15.

Liu, J. S., Lu, L. Y. Y., Lu, W.-M., & Lin, B. J. Y. (2013b). A survey of DEA applications. Omega International Journal of Management Sciences, 41(5), 893–902.

Lozano, S., & Gutiérrez, E. (2011). A multiobjective approach to fleet, fuel and operating cost efficiency of European airlines. Computers & Industrial Engineering, 61(3), 473–481.

Lu, W.-M., & Hung, S.-W. (2010). Assessing the performance of a vertically disintegrated chain by the DEA approach – A case study of Taiwanese semiconductor firms. International Journal of Production Research, 48(4), 1155–1170.

Lu, W.-M., & Hung, S.-W. (2011). Exploring the operating efficiency of Technology Development Programs by an intellectual capital perspective – A case study of Taiwan. Technovation, 31(8), 374–383.

Lu, W.-M., Wang, W.-K., & Kweh, Q. L. (2014). Intellectual capital and performance in the Chinese life insurance industry. Omega International Journal of Management Sciences, 42(1), 65–74.

Matthews, K. (2013). Risk management and managerial efficiency in Chinese banks: A network DEA framework. Omega International Journal of Management Sciences, 41(2), 207–215.

Meckling, W. H. (1976). Theory of the firm: Managerial behavior, agency costs and ownership structure. Journal of Financial Economics, 3(4), 305–360.

Merkert, R., & Hensher, D. A. (2011). The impact of strategic management and fleet planning on airline efficiency – A random effects Tobit model based on DEA efficiency scores. Transportation Research Part A: Policy and Practice, 45(7), 686–695.

Merkert, R., & Williams, G. (2013). Determinants of European PSO airline efficiency – Evidence from a semi-parametric approach. Journal of Air Transport Management, 29, 11–16.

Neter, J., Wasserman, W., & Kutner, M. H. (1985). Applied linear statistical models: Regression, analysis of variance, and experimental designs. Homewood: R.D. Irwin.

Premachandra, I. M., Chen, Y., & Watson, J. (2011). DEA as a tool for predicting corporate failure and success: A case of bankruptcy assessment. Omega International Journal of Management Sciences, 39(6), 620–626.

Provan, K. G. (1980). Board power and organizational effectiveness among human service agencies. The Academy of Management Journal, 23(2), 221–236.

Raghavan, S., & Rhoades, D. L. (2005). Revisiting the relationship between profitability and air carrier safety in the US airline industry. Journal of Air Transport Management, 11(4), 283–290.

Ray, S. C., & Hu, X. (1997). On the technically efficient organization of an industry: A study of U.S. airlines. Journal of Productivity Analysis, 8(1), 5–18.

Schefczyk, M. (1993). Operational performance of airlines: An extension of traditional measurement paradigms. Strategic Management Journal, 14(4), 301–317.

Scheraga, C. A. (2004). Operational efficiency versus financial mobility in the global airline industry: A data envelopment and Tobit analysis. Transportation Research Part A, 38(5), 383–404.

Seiford, L. M. (1997). A bibliography for Data Envelopment Analysis (1978–1996). Annals of Operations Research, 73, 393–438.

Seiford, L. M., & Zhu, J. (1999). Profitability and marketability of the top 55 U.S. commercial banks. Management Science, 45(9), 1270–1288.

Sengupta, J. K. (1999). A dynamic efficiency model using data envelopment analysis. International Journal of Production Economics, 62(3), 209–218.

Simar, L., & Wilson, P. (2007). Estimation and inference in two-stage, semi-parametric models of production processes. Journal of Econometrics, 136(1), 31–64.

Sonnenfeld, J. A. (2002). What makes great boards great. Harvard Business Review, RO209H.

Stathopoulos, K., Espenlaub, S., & Walker, M. (2004). U.K. executive compensation practices: New economy versus old economy. Journal of Management Accounting Research, 16, 57–92.

Sueyoshi, T., & Goto, M. (2010). Measurement of a linkage among environmental, operational, and financial performance in Japanese manufacturing firms: A use of data envelopment analysis with strong complementary slackness condition. European Journal of Operational Research, 207(3), 1742–1753.

Sueyoshi, T., Goto, M., & Omi, Y. (2010). Corporate governance and firm performance: Evidence from Japanese manufacturing industries after the lost decade. European Journal of Operational Research, 203(3), 724–736.

Tan, K. H., & Rae, R. H. (2009). Uncovering the links between regulation and performance measurement. International Journal of Production Economics, 122(1), 449–457.

Tone, K., & Tsutsui, M. (2009). Network DEA: A slacks-based measure approach. European Journal of Operational Research, 197(1), 243–252.

Vafeas, N. (1999). Board meeting frequency and firm performance. Journal of Financial Economics, 53(1), 113–142.

Wang, W.-K. (2005). A knowledge-based decision support system for measuring the performance of government real estate investment. Expert Systems with Applications, 29(4), 901–912.

Wang, W.-K., Lu, W.-M., & Tsai, C.-J. (2011). The relationship between airline performance and corporate governance amongst US Listed companies. Journal of Air Transport Management, 17(2), 148–152.

White, H. (1980). A heteroskedasticity-consistent covariance matrix estimator and direct test for heteroskedasticity. Econometrica, 4, 817–838.

Xie, B., Davidson, W. N., & DaDalt, P. J. (2003). Earnings management and corporate governance: The role of the board and the audit committee. Journal of Corporate Finance, 9(3), 295–316.

Yang, X., & Morita, H. (2013). Efficiency improvement from multiple perspectives: An application to Japanese banking industry. Omega International Journal of Management Sciences, 41(3), 501–509.

Yeh, Q. J. (1996). The application of data envelopment analysis in conjunction with financial ratios for bank performance evaluation. The Journal of the Operational Research Society, 47(8), 980–988.

Yermack, D. (1996). Higher market valuation of companies with a small board of directors. Journal of Financial Economics, 40(1), 185–211.

Yu, M. M. (2008). Assessing the technical efficiency, service effectiveness, and technical effectiveness of the world’s railways through NDEA analysis. Transportation Research Part A, 42(10), 1283–1294.

Yu, M. M., & Lin, E. T. J. (2008). Efficiency and effectiveness in railway performance using a multi-activity network DEA model. Omega International Journal of Management Sciences, 36(6), 1005–1017.

Zahra, S. A., & Pearce, J. A. (1989). Boards of directors and corporate financial performance: A review and Integrated model. Journal of Management, 15(2), 291–334.

Zhu, J. (2000). Multi-factor performance measure model with an application to Fortune 500 companies. European Journal of Operational Research, 123(1), 105–124.

Zhu, J. (2011). Airlines performance via two-stage network DEA approach. The Business and Economics Research Journal, 4(2), 260–269.

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2014 Springer Science+Business Media New York

About this chapter

Cite this chapter

Lu, WM., Hung, SW., Kweh, Q.L., Wang, WK., Lu, ET. (2014). Production and Marketing Efficiencies of the U.S. Airline Industry: A Two-Stage Network DEA Approach. In: Cook, W., Zhu, J. (eds) Data Envelopment Analysis. International Series in Operations Research & Management Science, vol 208. Springer, Boston, MA. https://doi.org/10.1007/978-1-4899-8068-7_21

Download citation

DOI: https://doi.org/10.1007/978-1-4899-8068-7_21

Published:

Publisher Name: Springer, Boston, MA

Print ISBN: 978-1-4899-8067-0

Online ISBN: 978-1-4899-8068-7

eBook Packages: Business and EconomicsBusiness and Management (R0)