Abstract

Past research shows that inventory turnover varies substantially across firms as well as over time. A significant portion of this variation can be explained by gross margin, capital intensity, and sales surprise (the ratio of actual sales to expected sales for the year). We extend econometric models of inventory turnover by investigating the effects of firm size and sales growth rate on inventory turnover using data for 353 public listed US retailers for the period 1985–2003. With respect to size, we find strong evidence of diminishing returns to scale. With respect to sales growth rate, we find that inventory turnover increases with sales growth rate, but its rate of increase depends on firm size and on whether sales growth rate is positive or negative. Our results are useful in (1) helping managers make aggregate-level inventory decisions by showing how inventory turnover changes with size and sales growth, (2) employing inventory turnover in performance analysis, benchmarking and working capital management, and (3) identifying the causes of performance differences among firms and over time.

Access provided by Autonomous University of Puebla. Download chapter PDF

Similar content being viewed by others

Keywords

1 Introduction

Inventory management is critical to the success of a retailer, whether brick-and-mortar or online, for several reasons. First, inventory constitutes a significant fraction of the assets of a retail firm. Specifically, it is the largest asset on the balance sheet for 57 % of publicly traded retailers in our dataset.Footnote 1 The ratio of inventory to total assets averages 35.1 % with buildings, property, and equipment (net) constituting the next largest asset at 31 %. Moreover, the ratio of inventory to current assets averages 58.4 %. Second, inventory, being a current asset, is typically the largest use of working capital of a retailer. Therefore, inventory management is an important determinant of liquidity risk of a retailer. Third, inventory is not only large in dollar value but also critical to the performance of retailers because a retailer cannot sell what it doesn’t have. For example, according to Standard & Poor’s industry survey on general retailing (Sack 2000), “Merchandise inventories are a retailer’s most important asset, even though buildings, property and equipment usually exceed inventory value in dollar terms.” Thus, the importance of improving inventory management in retail trade cannot be overemphasized.

At the firm level, managers and analysts commonly use either inventory turnover (defined as the ratio of cost of goods sold to average inventory) or its reciprocal—days of inventory, as a measure to assess how well a retailer is managing its inventory. The statistics for inventory turnover are publicly available from the financial statements of those retailers that are listed on the stock exchange (NYSE, AMEX or NASDAQ), making it an attractive metric for retailers as well as analysts.

However, Gaur, Fisher and Raman (2005), henceforth referred to as GFR, show that inventory turnover varies widely not only across firms but also within firms over time. They further show that a large fraction of the variation in inventory turnover can be explained by three performance variables obtained from public financial data: gross margin (the ratio of gross profit net of markdowns to net sales), capital intensity (the ratio of average fixed assets to average total assets), and sales surprise (the ratio of actual sales to expected sales for the year). They use the estimation results to propose a metric, adjusted inventory turnover, for benchmarking inventory productivity of retail firms.

In this paper, we extend the model of GFR to investigate the effects of firm size and sales growth rate on inventory turnover performance of U.S. retailers. The EOQ and newsvendor models, commonly used in theoretical operations management, show that inventory turnover should increase with the size of a firm due to economies of scale and scope. Several factors contributing to economies of scale and scope have been studied in the operations management literature, including statistical economies of scale (Eppen 1979, Eppen and Schrage 1981), fixed costs in inventory and transportation models, and demand pooling effects in product variety. However, to our knowledge, there are no research papers using real data to estimate the effect of size on inventory turnover. Our results provide such estimates for retailers.

The relationship between sales growth rate and inventory turnover, while not directly studied in the academic literature, is commonly tracked by managers and analysts. For example, the aforementioned industry survey on general retailing by Standard & Poor’s (Sack 2000) states that year-over-year growth in inventory should be in line with sales growth rate; if inventory growth exceeds sales growth rate, then it may be a warning that stores are over-stocked and vulnerable to markdowns. Raman et al. (2005) present a case study of a hedge fund investor who uses the ratio of sales growth rate to inventory growth rate as one of the metrics in making investment decisions on retail stock. The case presents several examples from financial performance of firms to illustrate this metric. It also makes a separate point that this relationship is ignored by financial investors. In this paper, we focus on examining evidence for the relationship of sales growth rate with inventory turnover, but do not assess its use by investors. We motivate this relationship using the operations management literature by using an instance of the newsboy model. For our analysis, we do not directly work with sales growth rate because we use a logarithmic regression model which precludes negative values of sales growth rate. Instead, we conduct our analysis using sales ratio, which we define as the ratio of sales in the current year to sales in the previous year.

The main results of our paper are as follows. First, we find that inventory turnover is positively correlated with firm size where size is defined as annual firm sales in the previous year. On average, in our data set, a 1 % increase in firm size is associated with a 0.035 % increase in inventory turnover (statistically significant at p < 0.0001). We find evidence of diminishing returns to size: inventory turnover increases with size at a slower rate for large firms than for small firms. These results present evidence in support of the existence of economies of scale and scope in a retail setting.

Next, we find that inventory turnover is positively correlated with sales ratio. A 1 % increase in this ratio is associated with a 0.38 % increase in inventory turnover in our data set. We also find that inventory turnover is more sensitive to sales ratio when a firm is experiencing sales decline than when a firm is experiencing sales growth. A 1 % increase in sales ratio is associated with 0.67 % increase in inventory turnover when sales are declining and with 0.19 % increase in inventory turnover when sales are increasing. Our results suggest that firms would find it harder to improve inventory turnover performance during periods of sales decline than during periods of sales growth. Thus, firms should use their forecast of future sales ratio to determine the amount of attention to give to inventory management.

The third main result of this paper is achieved through re-testing the hypotheses in GFR regarding gross margin, capital intensity and sales surprise on our data set. We test these hypotheses again because we use a larger and more recent data set than GFR. Our results for these tests are consistent with those obtained by GFR. We find that inventory turnover is negatively correlated with gross margin and positively correlated with capital intensity and sales surprise.

Our paper contributes to the academic literature by extending the methodology in GFR for empirical research on inventory productivity in retailing. We find that a significant fraction of the variation in inventory turnover for retailers can be explained by the selected performance variables. The models used in this paper and in GFR are useful to retail managers for comparing inventory turnover performance across firms and for a firm over time. They are also useful in helping retailers estimate inventory turnover as a function of their future growth, profit margin, and capital investment projections. With respect to the effects of firm size and sales ratio on inventory turnover, we describe several factors, based on the literature, which would imply either positive or negative correlations between size and inventory turns as well as between sales ratio and inventory turns. Thus, we set up competing hypotheses, and our tests enable us to state which of these effects will dominate. We believe that there is considerable scope for future research on these topics, and our results represent a first step.

The rest of this paper is organized as follows. Section 2 reviews the relevant literature; Sect. 3 describes our data set; and Sect. 4 summarizes the empirical model and findings from GFR that are useful in this paper. Section 5 presents our hypotheses, followed by the estimation model in Sect. 6, and the estimation results in Sect. 7. Finally, Sect. 8 discusses the limitations of our analysis and directions for future research.

2 Literature Review

The recent years have seen the emergence of a rich literature on econometrics-based research in inventories within Operations Management. Research papers in this area have targeted three types of applications:

-

1.

Performance benchmarking: This involves developing methods for benchmarking inventory-related performance in a cross-section or time-series of data.

-

2.

Generation of descriptive insights: Researchers have tested hypotheses from inventory theory and investigated the effects of characteristics such as capital intensity, demand uncertainty, and gross margin on inventory data. Recent papers have also developed methods to impute inventory-related costs from structural models of optimal inventory decisions.

-

3.

Prediction of future performance: While the above applications treat inventory as the dependent variable, some research papers have treated inventory as a lagged explanatory variable and investigated its information content for predicting future sales, earnings, or stock returns.

The data used in this area of research are typically at an aggregated level, either the firm-level or the industry-level, with a few exceptions. The usage of such aggregated data has been common in economics to study business cycles and production smoothing. In operations, it contrasts with item-level models that have been the subject of much research in inventory theory. However, aggregate-level models are nevertheless valuable in many ways:

-

1.

Firms make many decisions at the aggregate level, such as the fraction of the budget to be set aside for inventory in a given quarter, the bonus to be given to logistics managers based on the performance of a group of products, or whether to discontinue a product line or close a store or a warehouse. Some of these decisions are required in the Sales and Operations Planning (S&OP) processes in firms. Aggregate-level econometric models are useful for making such decisions.

-

2.

Aggregate firm-level data are typically the only kind of inventory data available to analysts, investors, and lenders. Aggregate-level models are useful to such stakeholders.

-

3.

A firm, while possessing detailed internal data for its own products, has access to only aggregated data for other firms in its marketplace. Therefore, it must use an aggregate-level model to utilize information from a panel of other firms in its own operations.

Our paper focuses on performance benchmarking using firm-level data. We review the relevant literature in this section, first discussing descriptive models, then summarizing predictive models of inventory.

Cachon et al. (2007) examine evidence for the occurrence of the bullwhip effect using industry-level data from the U.S. Census Bureau. They find that wholesale trade industries exhibit the bullwhip effect, whereas retail trade and most manufacturing industries do not. They show that seasonality of demand mediates this result—industries smooth seasonally unadjusted data but amplify the volatility of deseasonalized data. Rajagopalan and Malhotra (2001) use industry-level time-series data from the U.S. Census Bureau for 20 industrial sectors for the period 1961–1994 to investigate whether inventory turns for manufacturers have decreased with time due to the adoption of JIT principles. They find that raw material and work-in-process inventories decreased in a majority of industry sectors, but do not find any overall trends in finished good inventories.

Chen at al. (2005) use firm-level inventory data from publicly traded manufacturing firms for the period 1981–2000 to study trends in inventory levels for each of raw material inventory, work-in-process inventory and finished-good inventory. They find that raw-material and work-in-process inventories have declined significantly while finished-goods inventory remained steady during this period. These results are consistent with Rajagopalan and Malhotra (2001) although, notably, the two papers use data with different granularity.

Gaur et al. (2005) find wide variation in within-firm inventory turnover of U.S. public-listed retailers, and argue that changes in inventory turnover cannot be directly interpreted as performance improvement or deterioration because they may be caused by changes in product portfolio, pricing, demand uncertainty, and many other firm-specific and environmental characteristics. They propose a benchmarking methodology that combines inventory turnover, gross margin, capital intensity and sales surprise to provide a metric of inventory productivity, which they term as adjusted inventory turnover.

Rumyantsev and Netessine (2007) use quarterly data from over 700 public US companies to test some of the theoretical insights derived from classical inventory models developed at the SKU level. They use proxies for demand uncertainty and lead time, and conduct a longitudinal study to show that inventory levels are positively correlated with demand uncertainty, lead times, and gross margins. The authors also find evidence for economies of scale as larger firms carry relatively lower levels of inventory compared to smaller firms.

Olivares and Cachon (2009) and Cachon and Olivares (2010) study finished goods inventory productivity in the automotive supply chain by using stock data at the dealership level. The first paper examines the effect of local competition among dealerships on inventory holdings by using instrument variables to disentangle two effects—a sales effect of the entry or exit of a competitor, and a service-level effect due to a change in the optimal service level for a dealer due to competitive changes. The second paper compares the level of finished goods inventory across automotive firms and traces their differences to the number of dealerships in the network and production flexibility.

While the above papers develop increasingly sophisticated single-equation panel data models, Olivares et al. (2008) propose a method to conduct a structural estimation of unobserved cost parameters of a newsvendor model from observed data on inventory levels and sales, assuming that the decision-maker optimizes inventory. Bray and Mendelson (2012) conduct the structural estimation of a multi-period inventory model with time-varying demand with the object of determining the information lead time of inventory procurement decisions. Applying this model to quarterly firm-level data for U.S. public-listed firms, they assess the occurrence of the bullwhip effect and decompose it into information transmission leadtime components. Kesavan et al. (2010) present a simultaneous equations model of inventory, sales, and gross margin to represent contemporaneous relationships among these three variables. That is, increase in inventory fuels an increase in sales and a decrease in margin; an increase in sales leads to larger investment in inventory and an increase in margins; finally, an increase in margins leads to a decrease in sales and an increase in inventory. Kesavan et al. (2010) test this model on data for U.S. public listed retailers. Jain et al. (2013) extend this simultaneous equations model to examine the effect of outsourcing on inventory levels. They merge financial data for public-listed firms with international trade transaction data from the U.S. Customs Department and examine the effect of location of sourcing and use of multiple suppliers on the inventory levels of firms.

The above series of papers have led to an evolution of increasingly sophisticated descriptive models of inventory. The interaction of inventory with sales and gross margin suggests that inventory data may contain unique information predictive of future financial performance of firms. Indeed, such a hypothesis is suggested by the case study Raman et al. (2005), which examines the usefulness of inventory data for forecasting future stock returns of firms. Investigating this hypothesis, Kesavan et al. (2010) augment time-series sales forecasting methods with inventory data and show that the resulting 1-year-ahead sales forecasts improve upon benchmark sell-side equity analysts. They further show that lagged inventory data are predictive of bias in those analysts’ forecasts. Kesavan and Mani (2013) build on this result and show that lagged inventory is predictive of 1-year-ahead future earnings of U.S. retail firms.

Researchers have also related inventory turnover performance with stock returns in both contemporaneous and predictive models. Gaur et al. (1999) conduct a long-term contemporaneous analysis, and show that for time periods varying in length from 5 to 20 years, the cross-section of average stock returns is significantly positively correlated with average annual inventory turnover over the same period (controlling for gross margin). Chen et al. (2005, 2007) investigate whether abnormal inventory predicts future stock returns. Using the three-factor time-series regression model of stock returns (Fama and French 1993), they find that abnormally high and abnormally low inventories in the manufacturing sector are associated with abnormally poor long-term stock returns. The results for wholesale and retail trade sectors, however, differ from the manufacturing sector. Alan et al. (2014) build on this research and investigate whether inventory productivity is predictive of future stock returns for U.S. public-listed retailers using different measures of inventory productivity and a non-parametric portfolio formation method. They find that inventory turnover and adjusted inventory turnover is strongly predictive of future stock returns using both level- and change-based metrics.

Several researchers have studied the effects of specific operational decisions on firm performance. For example, Balakrishnan et al. (1996) study the effect of adoption of just-in-time (JIT) processes on return on assets (ROA). They compare a sample of 46 firms that adopted JIT processes against a matched sample of 46 control firms that did not. They do not find any significant ROA response to JIT adoption. Billesbach and Hayen (1994), Chang and Lee (1995), and Huson and Nanda (1995) study the impact of adopting JIT processes on inventory turns. Lieberman and Demeester (1999) study the impact of JIT processes on manufacturing productivity in the Japanese automotive industry. Their study suggests that reduction in inventory brought about by JIT practices enabled the firms to improve their productivity.

Our paper contributes to this research stream by extending Gaur et al. (2005) and Rumyantsev and Netessine (2007). We discuss various factors that could cause positive or negative correlations of size and sales growth rate with inventory turnover, and provide evidence regarding the existence of economies of scale and scope in retailing as well as the effect of growth rate of firms on their inventory turnover performance. Our results are useful to retailers to assess their performance changes over time.

3 Data Description

We use financial data for all publicly listed U.S. retailers for the 19-year period 1985–2003 drawn from their annual income statements and quarterly and annual balance sheets. These data are obtained from Standard & Poor’s Compustat database using the Wharton Research Data Services (WRDS).

The U.S. Department of Commerce assigns a four-digit Standard Industry Classification (SIC) code to each firm according to its primary industry segment. For example, the SIC code 5611 is assigned to the category “Men’s and Boys’ Clothing and Accessory Stores”, 5621 is assigned to “Women’s Clothing Stores”, 5632 to “Women’s Accessory and Specialty Stores”, etc. We group together firms in similar product groups to form ten segments in the retailing industry. For example, all firms with SIC codes between 5600 and 5699 are collected in a single segment called apparel and accessories. Table 3.1 lists all the segments, the corresponding SIC codes, and examples of firms in each segment.

Figure 3.1 presents a simplified view of an income statement and balance sheet that emphasizes the principal variables of interest in this paper. From Compustat annual data for firm i in segment s in year t, let Ssit denote the sales net of markdowns in dollars (Compustat annual field Data12), CGSsit denote the corresponding cost of goods sold (Data41), and LIFOsit be the LIFO reserve (Data240). From Compustat quarterly data for firm i in segment s at the end of quarter q in year t, let GFAsitq denote the gross fixed assets, comprised of buildings, property, and equipment (Compustat quarterly field Data118), and Invsitq denote the inventory valued at cost (Data38). From these data, we compute the following performance variables:

-

Inventory turnover (also called inventory turns), \( I{T}_{sit}=\frac{CG{S}_{sit}}{\left({\displaystyle \frac{1}{4}\sum_{q=1}^4 In{v}_{sit q}}\right)+LIF{O}_{sit}} \),

-

Gross margin, \( G{M}_{sit}=\frac{S_{sit}-CG{S}_{sit}}{S_{sit}} \),

-

Capital intensity, \( C{I}_{sit}=\frac{{\displaystyle \sum_{q=1}^4GF{A}_{sit q}}}{{\displaystyle \sum_{q=1}^4 In{v}_{sit q}+4\cdot LIF{O}_{sit}+}{\displaystyle \sum_{q=1}^4GF{A}_{sit q}}} \), and

-

Sales ratio, \( {g}_{sit}=\frac{S_{sit}}{{\mathrm{S}}_{si,t-1}} \) .

It is useful to note the following aspects of the measurement of these variables.

-

1.

The Compustat database identifies ten methods for inventory valuation. Four of these are commonly used by retailers: FIFO (first in first out), LIFO (last in first out), average cost method, and retail method. The LIFO reserves of a firm vary depending on the method of valuation used, and adding back the LIFO reserves provides us a FIFO valuation of inventory.

-

2.

The cost of goods sold line on the income statement comprises a number of expenses other than the purchase cost of merchandise. Costs of warehousing, distribution, freight, occupancy, and insurance can all be included in CGSsit. Further, the components of CGSsit may vary from company to company. Most commonly, occupancy costs may be a separate line item on the income statement rather than being included in CGSsit. This lack of uniformity in reporting reduces the comparability of results among retailers. Thus, we restrict our analysis to comparisons within firm. Compustat indicates whether a firm changed its accounting policies with respect to a particular variable during a year; it provides footnotes to variables containing this information. We use these footnotes to identify firms that underwent accounting policy changes, and exclude them from our sample.

-

3.

In the computation of inventory turns and capital intensity, we calculate average inventory and average gross fixed assets using quarterly closing values in order to control for systematic seasonal changes in these variables during the year. LIFO reserves are reported annually. We add the annual LIFO reserves to the average quarterly inventory to compute average inventory.

After computing all the variables, we omit from our data set those firms that have less than five consecutive years of data available for any sub-period during 1985–2003; there are too few observations for these firms to conduct time-series analysis. These missing data are caused by new firms entering the industry during the period of the data set, and by existing firms getting de-listed due to mergers, acquisitions, liquidations, etc. Further, we omit firms that had missing data or accounting changes other than at the beginning or the end of the measurement period. These missing data are caused by bankruptcy filings and subsequent emergence from bankruptcy, leading to fresh-start accounting.

Our final data set contains 4,246 observations across 353 firms, an average of 12.03 years of data per firm. Table 3.2 presents summary statistics by retailing segment for the performance variables used in our study. It lists the mean, median and standard deviation by segment for each variable. Observe that food retailers have the highest median inventory turns of 10.0 and the lowest median gross margin of 0.26. On the other hand, jewelry retailers have the lowest median inventory turns of 1.54 and the highest median gross margin of 0.46. Also note that the coefficient of variation of inventory turnover (the ratio of standard deviation of ITsit to mean ITsit) is quite high: it is larger than 50 % for six out of ten retail segments and its average value across all segments is 74 %. This statistic shows that inventory turnover has a large variation even within each retail segment. Table 3.3 shows the Pearson correlation coefficients for (log ITsit − log ITsi), (log GMsit − log GMsi), (log CIsit − log CIsi), (log Ssi,t-1 − log Ssi) and (log gsit − log gsi) for our data set. Here, we use log-values of all variables because we shall construct a multiplicative regression model in the rest of this paper. We compute the correlation coefficients for mean-centered log-values of variables because our model seeks to explain intra-firm variation in inventory turns. Mean centering is done by subtracting out the mean for each variable for each firm from the data columns; for example, log ITsi denotes the average of log ITsit for firm i in segment s. Notice that (log ITsit − log ITsi) is negatively correlated with (log GMsit − log GMsi) and (log Ssi,t − 1 − log Ssi), and positively correlated with (log CIsit − log CIsi) and (log gsit − log gsi). Testing hypotheses on these correlations will require a multivariate model which is discussed in subsequent sections.

4 Adjusted Inventory Turnover

GFR study the correlation of inventory turnover with gross margin, capital intensity and sales surprise using data for 311 publicly listed U.S. retailers for the period 1985–2000. In their paper, gross margin, and capital intensity are defined as shown in Sect. 3. Sales surprise, denoted SSsit, is defined as the ratio of current year sales to the forecast of current year sales, where the forecast is computed by GFR using a time-series forecasting method. GFR hypothesize that inventory turnover is negatively correlated with gross margin, and positively correlated with capital intensity and sales surprise.

GFR use the following empirical model to test their hypotheses:

Here, Fi is the time-invariant firm-specific fixed effect for firm i, ct is the year-specific fixed effect for year t, b1 s, b2 s, b3 s are the coefficients of log GMsit, log CIsit, and log SSsit, respectively, for segment s, and εsit denotes the error term for the observation for year t for firm i in segment s. The hypotheses of GFR imply that, for each segment s, b1 s must be less than zero, and b2 s and b3 s must be greater than zero. The main features of this model are as follows:

-

1.

The model has a log-linear specification. Thus, it is assumed that a multiplicative model is suitable to represent the relationship between inventory turns, gross margin, capital intensity and sales surprise. This assumption is supported in GFR with simulation analysis.

-

2.

The model includes an intercept for each firm in order to control for differences across firms. Note from the discussion in Sect. 3 that inventory turnover may not be comparable across firms due to differences in accounting policies for cost of goods sold. Other factors that can confound comparisons across firms include differences in managerial efficiency, marketing, real estate strategy, etc. Since data on these factors are omitted in GFR, attention is focused on year-to-year variations within a firm only. We call such a model an intra-firm model.

GFR find strong support for all three hypotheses in their data set. Based on these results, they propose a tradeoff curve that computes the expected inventory turnover of a firm for given values of gross margin, capital intensity, and sales surprise. They term the distance of the firm from its tradeoff curve as its Adjusted Inventory Turnover, denoted AIT, and use it as a metric for benchmarking inventory productivity of retailers by controlling for differences in gross margin, capital intensity, and sales surprise. The value of AIT for firm i in segment s in year t is computed as

or, equivalently, as

Note that log AITsit is equal to the sum of the fixed effects terms, Fi and ct, and the residual error, εsit, in Eq. (3.1). Thus, it captures the amount of variation in log ITsit that is not explained by the regressors in Eq. (3.1). According to these results, managers of firms with low AIT should investigate whether their firms are less efficient than their peers, and identify steps they might take in order to improve their inventory productivity.

We employ the methodology from GFR in this paper. In particular, we use an intra-firm model with a log-linear specification. We use log GMsit and log CIsit as control variables for testing our hypotheses because GFR found them to be correlated with log ITsit and they may further be correlated with firm size and sales ratio. We, however, do not use sales surprise in our model because data on managements’ forecasts of sales are not available to us. If we were to estimate sales forecasts using our own time-series forecasting methods, then log SSsit and log gsit would be highly correlated and cause collinearity in the model. Hence, in the model in this paper, we replace log SSsit by log gsit.

5 Hypotheses

In this section, we discuss various reasons why inventory turnover can be correlated with firm size and sales ratio. We find that there are arguments in favor of both positive and negative correlation between inventory turns and size as well as between inventory turns and sales ratio. We also find that the effects of size and sales ratio on inventory turnover can vary across firms depending on their supply chain characteristics, business environment and growth strategy. Thus, we identify the mediating variables that are expected to cause size and sales ratio to be correlated with inventory turnover. Since we do not have data on the mediating variables, our hypotheses are limited to testing which effects dominate, positive or negative. We set up competing hypotheses to test these effects. The task of identifying the causes of these correlations is deferred to future research.

5.1 Effect of Firm Size on Inventory Turnover

We explain arguments for inventory turnover to be positively correlated with size using the effects of economies of scale and scope. We also discuss hindrances to economies of scale and scope that may reduce their effect or cause a negative correlation. Subsequently, we frame competing hypotheses to test the sign of correlation between inventory turnover and size. We measure size by the mean annual sales of the retailer lagged by 1 year, i.e., Ssi,t − 1 is the measure of size for year t for firm i in segment s.

Economies of scale and scope can manifest themselves for each item, or in a growth of number of stores, or in a growth of number of items at each retail location. In all three cases, we would expect inventory to increase less than linearly in sales, so that size and inventory turnover would be positively correlated. In the first case, if the mean demand for items at a retail location increases and the retailer maintains a fixed service level, then its safety stock requirement at the location increases less than proportionately because standard deviation of demand typically increases in the square root of mean demand. This relationship is precise when demand follows a Poisson distribution. For other distributions, this relationship has been tested by estimating the first two moments of the distribution. For example, Silver et al. (1998: p.126, 342) estimate the standard deviation of demand as σ = a⋅(mean)b. They state that 0.5 < b < 1 is typical and “this relationship has been observed to give a reasonable fit for many organizations.”Footnote 2 As another example, Gaur et al. (2005) estimate the relationship among analysts’ forecasts of total sales of firms, actual sales realizations and standard deviation of total sales. Their results are consistent with Silver et al. (1998), with the average estimated value of b across several data sets being 0.71. Therefore, if safety stock increases less rapidly than cycle stock as sales increase, then inventory turnover should increase with the size of each location due to economies of scale.

Second, inventory turnover should increase with sales when a retailer expands its geographical market by opening new retail locations which are served by existing warehouses or distribution centers. Eppen (1979) and Eppen and Schrage (1981) showed how pooling inventory in a centralized location can lead to a reduction in safety stock due to risk pooling. In their models, safety stock grows as √n in the number of locations n if inventory is pooled at a central location rather than distributed across the n locations. Thus, as a firm adds new retail locations, it can achieve a more than proportionate reduction in its inventory level, and a corresponding increase in inventory turnover due to economies of scale in its distribution network.

Third, as a retailer grows in size, it is able to provide more frequent shipments to its stores due to economies of scale and/or economies of scope in fixed replenishment costs as explained by the EOQ model. For example, such economies of scale and scope can be realized in transportation costs through better utilization of labor and transportation capacity. They would result in an increase in inventory turnover with the size of the firm.

The above three contributing factors may exist for different firms in different years in varying measures depending on the actions taken by the firms. For example, suppose that a firm increases size in a particular year by adding more products to its assortment without affecting the demand for existing products. For this action, the third argument would contribute to economies of scope, but the first and second arguments would not apply. Our hypotheses do not specify the above three effects separately, but instead specify the average tendency across the cross-section of retail firms for the years included in our data set. This implies that any differences in economies of scale and scope across firms or over time will contribute to the residuals in our model.

Apart from differences across firms, there could be hindrances to economies of scale and scope that may result in a negative correlation between size and inventory turns. First, economies of scale and scope require that a retailer’s supply chain infrastructure have excess capacity. For example, distribution centers should be able to meet the requirements of new stores being added, and transportation logistics should be able to handle increase in volume of shipments. If a retailer does not have excess capacity in its supply chain infrastructure, it may need to add new capacity in order to grow. Such hindrances may create diseconomies of scale, implying that size and inventory turnover may be negatively correlated with each other. Second, it is often harder to manage a large firm than a small firm because their operations are more complex. Thus, firms may be unable to exploit operational synergies as they grow in size.Footnote 3

Thus, the above discussion shows that a number of hypotheses can be formulated to estimate different drivers of economies of scale and scope effects among retailers. As a first step, we test the following hypotheses.

-

Hypothesis 1(a). Inventory turnover of a firm is positively correlated with changes in its size.

-

Hypothesis 1(b). Inventory turnover of a firm is negatively correlated with changes in its size.

Here, we use the retailer’s sales lagged by 1 year as a measure of size. Our hypotheses may also be set up using relative sales, i.e., the ratio of sales lagged by 1 year to sales at the beginning of the time horizon for the firm. Since we use an intra-firm model, these two measures of size are equivalent.

5.2 Effect of Sales Ratio on Inventory Turnover

We identify reasons why sales ratio can be either positively or negatively correlated with inventory turnover. We construct both arguments using the newsboy model.

First consider the arguments for a positive correlation between sales ratio and inventory turnover. Consider a given retailer with known sales in period t − 1 making inventory decisions for the next period, t. The retailer first determines the inventory level, q, for an item and then fulfills random demand over one period. Given the value of q, as realized demand increases, sales increase, and thus, sales ratio increases. Further, as realized demand increases, the retailer’s average inventory over the period declines. Thus, its inventory turns increase. This implies a positive correlation between sales ratio and inventory turnover. We call this reasoning the positive effect of sales ratio on inventory turnover.

Now suppose that the retailer increases q in order to target a higher sales growth rate. As q increases, expected sales increase, and thus, expected sales ratio increases. However, it can also be shown that as q increases, average inventory increases more than proportionately than sales, and expected inventory turnover declines. Alternatively, a retailer may reduce q in order to improve its cash flows. In such a case, the retailer would find its expected inventory turns increasing, but expected sales and expected sales ratio decreasing. This implies a negative correlation between sales ratio and inventory turnover. We call this reasoning the negative effect of sales ratio on inventory turnover.

We now try to characterize the situations in which one or the other of these two effects will dominate. Changes in the inventory level or the service level of a retailer can be driven by a number of factors. There is extensive literature on how firms forecast sales growth. Makridakis et al. (1998) state that organizations need to consider several factors such as overall economy, their customers, distributors, competitors, etc. Further from an operations standpoint the firm needs to take into account its inventory levels, capacity constraints, ability to procure inventory from its suppliers, etc. before forecasting sales growth. Once a sales growth rate has been forecasted for the firm it plans to meet this target. The firm has competing objectives in setting its sales growth rate. Some of the common goals are profits, return on investment, market share, product leadership, etc. Hence, it is possible that the overall strategy of the firm may dictate growth while maintaining or improving inventory turnover or it may require the firm to pursue growth at the cost of excess inventory in the short-term.

For example, suppose that a retailer has a large untapped market potential. This is not an uncommon situation because a retailer cannot realize its full market potential overnight. Instead, its growth rate is limited by its capacity to hire and train employees, add new stores, and expand various functions of its organization such as distribution logistics, merchandising, accounting, information systems, etc. Thus, the growth rate of such a retailer can be restricted by its capacity and budget constraints. We expect that for such a retailer, sales could exceed inventory hence the positive effect will dominate so that there will be a positive correlation between sales ratio and inventory turnover.

Alternatively, consider a retailer that is close to saturating its market and has a small untapped market potential. Such a retailer may try to increase its sales growth rate by pushing more inventory to its stores. For example, it may increase service levels of existing products in order to stimulate demand. Or it may open new stores or expand its product line. As the retailer saturates its market, it realizes diminishing sales growth from each new store, store expansion, or new product line. However, all these activities require a fixed inventory outlay to stock the shelves. Therefore, we expect that for such a retailer, the negative effect will dominate so that there will be a negative correlation between sales ratio and inventory turnover.

In practice, it is difficult to estimate the market potentials of retailers and classify them into one type or the other. Therefore, we shall estimate the relationship between sales ratio and inventory turnover pooled across all retailers. We set up Hypotheses 2(a)–(b) to test whether positive correlation dominates of negative correlation dominates in our data set.

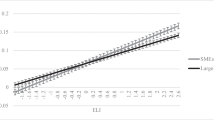

We also expect that retailers who experience sales decline will find it harder to manage inventory than retailers who experience sales growth because retailers who experience sales decline have to additionally find ways to dispose off excess inventory. Thus, we divide sales ratio into two regions: the sales expansion region where gsit ≥ 1, and the sales contraction region where 0 < gsit ≤ 1. We set up Hypothesis 3 comparing these two regions in order to test whether inventory turnover is more sensitive to decline in sales or to increase in sales. Figure 3.2 depicts the relationship proposed in Hypothesis 3.

-

Hypothesis 2(a). Inventory turnover of a firm is positively correlated with changes in its sales ratio in the sales expansion region as well as the sales contraction region.

-

Hypothesis 2(b). Inventory turnover of a firm is negatively correlated with changes in its sales ratio in the sales expansion region as well as the sales contraction region.

-

Hypothesis 3. Inventory turnover of a firm is more sensitive to sales ratio in the sales contraction region than in the sales expansion region.

6 Model

We first estimate model (3.1) to re-test the hypotheses in GFR with our data set. Then, we modify the model in GFR to test our hypotheses. The model is specified as follows:

Here, Fi is the time-invariant firm-specific fixed effect for firm i; ct is the year-specific fixed effect for year t; b1, b2, b4, b5, and b6 are the coefficients of log GMsit, log CIsit, log Ssi,t − 1, log gsit, and log[max(0, gsit)], respectively; and εsit denotes the error term for the observation for year t for firm i in segment s. Hypothesis 1(a) implies that b4 > 0, Hypothesis 2(a) implies that b5 > 0 and b5 + b6 > 0, and Hypothesis 3 implies that b6 < 0. The main features of this model are as discussed in Sect. 4.

We estimate several variations of Eq. (3.4) to test our hypotheses. For example, we add the quadratic term, [log Ssi,t − 1]2, to test whether the effect of firm size on inventory turnover shows decreasing or increasing economies of scale. We also partition our data by firm size in order to study whether sales ratio has different effects on inventory turns for large and small firms. In another modification, we estimate the coefficients of the explanatory variables separately for each segment to test if the results are consistent across all segments or are driven by only a few of the segments in the data set. We use ordinary least squares estimation for simplicity. The estimators thus obtained are consistent in the presence of heteroscedasticity.

7 Results

Table 3.4 shows the results for model (3.1). The three hypotheses in GFR are supported for our larger and more recent data set. The coefficient of gross margin is −0.287, the coefficient of capital intensity is 0.633, and the coefficient of sales surprise if 0.034. All three coefficients are statistically significant at p < 0.0001.

Table 3.5 shows the fit statistics and coefficients’ estimates for model (3.4) in columns (2)–(4). The F-statistic for the model is significant at p < 0.0001, and the R2 value is 92.5 %. The rest of this section discusses the support for hypotheses regarding size and sales ratio.

First, consider the test of Hypotheses 1(a)–(b). We find that inventory turns are positively correlated with size, supporting Hypothesis 1(a). A 1 % increase in the size of a firm leads to a 0.035 % increase in inventory turns (p < 0.0001).Footnote 4 Note that the effect of size on inventory turns appears to be small compared to other explanatory variables. This may be so because log Ssi,t − 1 has a higher standard deviation than the other explanatory variables. In order to control for this difference, we compute the standardized coefficient estimates as shown in column (4) of the Table 3.5 (see Schroeder et al. (1986, p. 31–32) for a description of standardized coefficients). The standardized coefficient of log Ssi,t − 1 is 0.078; thus, size still has a smaller effect on inventory turns compared to other variables in our model.

We now investigate whether the coefficient of log Ssi,t − 1 differs across firms and across model specifications. The object of this analysis is to characterize how the effects of economies of scale and scope vary across our data set. We first investigate the presence of diminishing economies. Since we have so far shown a linear relationship between log ITsit and log Ssi,t − 1, the coefficient of log Ssi,t − 1 in this model can be biased downwards if there are diminishing economies of scale and scope. To address this possibility, we add a quadratic term, [log Ssi,t − 1]2, to model (3.4). Columns (5)–(7) in Table 3.5 show the estimation results for this model. We find that the coefficient of log Ssi,t − 1 increases from 0.035 to 0.105, and the coefficient of [log Ssi,t − 1]2 is −0.006 (p < 0.01). Thus, we see that the quadratic model supports the hypothesis that there are diminishing returns to scale as firm size increases.

Another way to identify diminishing economies of scale is to perform the regression separately for small and large firms. We classify firms as small or large using the following approach. We compute the median of log Ssi,t − 1 for every firm, and then use these values to compute the 25th percentile and the median of log Ssi,t − 1 for each segment. In the first regression, firms whose median value of log Ssit falls below the 25th percentile are classified as small firms and the remaining as large firms. In the second regression, the cut-off point is set at the median. Table 3.6 shows the results for the first regression in columns (2)–(5) and for the second regression in columns (6)–(9). We see that in the first regression, the coefficient of log Ssi,t − 1 is 0.11 (p < 0.0001) for small firms, and is not statistically significant for large firms. In the second regression, the coefficient of log Ssi,t − 1 is 0.06 (p < 0.0001) for small firms, and is again not significant for large firms. The comparison of estimates between small and large firms is consistent with the results from the quadratic model, and provides strong support for the hypothesis that there are diminishing economies of scale as firm size increases. Note that the decrease in the coefficient estimate for small firms from 0.11 to 0.06 when we increase the set of small firms from the first quartile to the first two quartiles of size distribution is also consistent with the diminishing economies to scale argument.

The coefficient of log Ssi,t − 1 may also differ across retail segments. To investigate this possibility, we estimate the coefficients of the model separately for each retail segment. Table 3.7 shows the results obtained. We find that four of the ten segments have positive and statistically significant (p < 0.01) coefficient estimates, one segment has negative and statistically significant (p < 0.01) coefficient estimate, and the remaining five segments do not show any statistical relationship. Where positive, the coefficient estimate ranges between 0.06 and 0.16. Jewelry stores have a negative and statistically coefficient estimate of −0.223. We find that the result for jewelry stores is not caused by the presence of any outliers, rather it holds consistently across firms. This suggests that the arguments for economies of scale and scope may not apply to jewelry products because the costs of distribution and logistics that these arguments are based on may not be critical to jewelry retailers.

In summary, we have shown two important relationships between firm size and inventory turnover. The first relationship supports the hypothesis that inventory turnover increases with size. The second relationship relates to diminishing returns to scale.

We now consider the tests of Hypotheses 2(a)–(b) and 3. The results in columns (2)–(4) of Table 3.5 show that inventory turnover is positively correlated with sales ratio in model (3.4). The coefficient of log gsit is 0.67 and the coefficient of max{0, log gsit} is −0.48. This implies that a 1 % increase in gsit is associated with a 0.67 % increase in inventory turns in the sales contraction region and with a 0.19 % (=0.67 − 0.48) increase in inventory turns in the sales expansion region. Both these coefficients are statistically significant at p < 0.0001. Thus, we find that inventory turnover is positively correlated with sales ratio in both the regions, providing support for Hypotheses 2(a). Moreover, the coefficient of max{0, log gsit} is negative and statistically significant, providing strong support for Hypothesis 3. The average value of the coefficient of log gsit obtained by doing a regression omitting the variable max{0, log gsit} is 0.38.

Columns (5)–(7) in Table 3.5 show the coefficient estimates for sales ratio when the model is quadratic in firm size. We find that the estimates and standard errors of these coefficients are similar to those obtained when the model is linear in size. Therefore, they also support Hypotheses 2 and 3. The results from the separate regressions for small and large firms in Table 3.6 also support our hypotheses.

The coefficients of log gsit and max{0, log gsit} in Tables 3.5 and 3.6 show that the effect of a change in sales ratio on inventory turnover is significantly lower when gsit > 1 than when gsit ≤ 1. In Table 3.5, the coefficient of log gsit is lower in the sales expansion region than in the sales contraction region by 0.48 in the linear model and by 0.454 in the quadratic model. This result confirms our intuition that firms would find it harder to improve inventory turnover during periods of sales decline than during periods of sales growth. Further, Table 3.6 shows that the coefficient estimates of log gsit differ significantly across small and large firms in the sales contraction region, but are statistically similar in the sales expansion region. For example, when the smallest 25 % of firms are classified as small, the coefficient estimates for small and large firms are 0.773 and 0.502, respectively, in the sales contraction region, and 0.180 (=0.773 − 0.593) and 0.219 (=0.502 − 0.283), respectively, in the sales expansion region. Thus, we observe that during periods of sales decline, inventory turns for small firms are more sensitive to sales ratio than for large firms. But during periods of sales expansion, there is no significant difference in the coefficient of sales ratio between small and large firms. The coefficients’ estimates for the case in which small and large firms are defined by the median tell the same story.

We explain this result with an example. Consider the effect of volatility in sales growth on the inventory turnover of a firm over a period of 1 year. Table 3.8 shows two growth scenarios for the firm and their effects on inventory turnover. In both scenarios, the firm’s expected sales ratio is zero (i.e., E[gsit] = 1). The scenarios differ in the standard deviation of sales ratio. We examine each scenario using the coefficients’ estimates for a small firm and for a large firm obtained from Table 3.6. For example, in scenario A, we find that the expected inventory turnover of the firm is 93.8 % of what it would have been if gsit were a constant equal to 1. We make the following observations by comparing all the cases in this example:

-

1.

The firm’s expected inventory turnover declines in each case even though its total expected sales are equal to the sales in the previous year. Thus, volatility in sales has a negative effect on inventory turnover.

-

2.

The decline in expected inventory turnover is higher if the firm experiences more variation in gsit (i.e., Scenario A) than if the firm experiences less variation in gsit (i.e., Scenario B). For example, for a small firm, expected inventory turns decline by 6.2 % in Scenario A and by 3.0 % in Scenario B.

-

3.

The decline in inventory turnover is higher if the firm is small than if the firm is large. Further, the difference between large and small firms increases as the standard deviation of gsit increases.

Thus, this example shows the effect of volatility in sales ratio on inventory turnover using our results. Interestingly, the inferences from the example are analogous to those from the newsboy model in inventory theory. Further, it shows that a firm with more volatile sales has two ways to improve its inventory turnover: either it should target a sufficiently high growth rate that compensates for the effect of volatility in sales ratio on inventory turnover, or it should reduce its inventory and offer a lower service level.

As with firm size, we analyze whether the coefficient of log gsit is consistent across segments. Table 3.7 shows the coefficients’ estimates obtained for each segment. We find that the coefficient of log gsit varies significantly across segments (p < 0.0001). However, sales growth consistently has a large positive coefficient for each segment. Its value ranges between 0.22 for variety stores to 0.56 for Drug and Proprietary stores.

In summary, we find strong support for the hypotheses that inventory turnover is positively correlated with sales ratio and that inventory turnover is more sensitive to sales ratio in the sales contraction region than in the sales expansion region. We also find that the latter effect is stronger for small firms than for large firms.

8 Conclusions and Directions for Future Research

Our paper highlights the importance of understanding inventory turnover performance of retailers. Like GFR, we find that inventory is a significant proportion of the assets of a retailer. However, inventory turnover varies widely across retailers and for a retailer over time. We have shown that a significant proportion of the within-firm variation in inventory turnover is explained by changes in firm size, sales ratio and variables identified by GFR. In particular, inventory turnover of a firm is positively correlated with both size and sales ratio. Our results support the arguments of economies of scale and scope studied in the operations management literature. We use a data set of 353 publicly listed U.S. retailers for the period 1985–2003 in our analysis. This data set is larger and more recent than that used by GFR. Thus, we also examine the hypotheses formulated in GFR regarding the correlations of inventory turnover with gross margin, capital intensity and sales surprise. We find that inventory turnover is strongly negatively correlated with gross margin and positively correlated with capital intensity in our data set. These results are consistent with those obtained in GFR.

Our results are useful to retailers for benchmarking their inventory turnover performance against their peers. Since the correlations estimated by us are based on a large set of firms, they provide estimates of the average change in inventory turnover associated with given changes in gross margin, capital intensity, size and sales ratio. A positive residual for a firm in our model indicates that the firm achieved higher inventory turnover than its peer group after controlling for differences in the explanatory variables, while a negative residual indicates otherwise. Thus, managers may use these residuals to investigate reasons for differences in inventory turnover performance across firms or for a firm over time. The fixed effects in our model may be used similarly by managers for benchmarking. Another application of our results is related to the difference between the coefficients of sales ratio during periods of sales growth and sales decline. This result shows that aggregate retail inventory changes with sales in a manner that is consistent with the newsboy model in inventory theory. This result also implies that managers should pay more attention to managing inventory when a firm is small, or when a firm is going through a period of sales decline, or when a firm faces more volatility in sales.

Our paper suggests three possible directions for future research on aggregate-level inventory management in retailing.

-

1.

Modeling of aggregate-level inventory decisions: Even though the variables in our model are statistically significant, there is still a considerable amount of variation in inventory turnover that remains unexplained. For example, we find that the residuals from our model show differing patterns across firms. There are firms whose residuals have consistently improved over time after controlling for changes in all the explanatory variables, and other firms whose residuals show a consistently declining trend. To illustrate this, Fig. 3.3a, b show time-series plots of residuals from our model for Best Buy Stores, Inc. and Jennifer Convertibles, Inc., respectively. Notice that the residuals for Best Buy trend upwards with time while those for Jennifer Convertibles trend downwards. These unexplained but systematic differences suggest that there is scope for future research to better understand retailers’ inventory turnover performance. There has been considerable advancements in econometric models of inventory in the recent years, which could be applied to retailers to help them decipher variations in inventory turnover.

-

2.

Explaining the drivers of inventory productivity using augmented data sets: Several operational factors can be said to contribute to the relationships of gross margin, capital intensity, firm size and sales ratio with inventory turnover. Since public financial data do not capture these operational factors, it is not possible to identify the drivers of inventory turnover using these data. A richer data set may be used in future research to examine the aforementioned relationships more closely. For example, the discussion in Sect. 5 identifies many variables that may be included in such a data set, for example, number of store locations, their store formats and square footage, number of warehouses and their square footage, same stores sales growth rates, etc. In a recent paper, Kesavan et al. (2010) construct such a data set by incorporating number of store locations, accounts payables, and several other variables. They apply a simultaneous equations model to estimate causal effects of sales, inventory and gross margin on each other. They further show that their model provides more accurate forecasts of sales than standard time-series models as well as equity analysts.

-

3.

Examining the effects of firm lifecycle and bankruptcies on model estimation: Our data set consists of only publicly listed firms that have at least five consecutive years of data available. Since these firms would be above a certain size, our coefficient estimate for size could be subjected to selection bias. Also our coefficient estimates could be subjected to survival bias since slow growing firms could exit from our data set. Future research may examine how these factors affect the relationship of inventory management with other performance variables.

Notes

- 1.

The data set consists of a large cross-section of US public listed retailers for the time-period 1985–2003. The data set is summarized in Sect. 3.

- 2.

This section of Silver et al. (1998) focuses on estimation of demand uncertainty. It does not refer to this relationship as economies of scale.

- 3.

A counter argument is that as a retailer increases in size, it might have better forecasting tools and thus, might be better able to get the right product to the right place (and therefore, increase turns). Retailers’ ability to forecast may even vary non-linearly in size: they may be really good at forecasting when they are very small (not listed publicly, and hence, omitted from our data set), have difficulty as they grow and until they have reached a size such that they have good systems in place and are incorporating sophisticated decision support tools. We incorporate such differences in systems in our model by using capital intensity as a control variable.

- 4.

Relative size, Sales(i,t − 1)/Sales(i,0), yields identical results in an intra-firm model.

References

Alan, Y., Gao, G., Gaur, V. (2014). Does inventory turnover predict future stock return? A retailing industry perspective. Management Science. (Forthcoming).

Balakrishnan, R., Linsmeier, T. J., & Venkatachalam, M. (1996). Financial benefits from JIT adoption: effects of consumer concentration and cost structure. Accounting Review, 71, 183–205.

Billesbach, T.J., Hayen, R. (1994). Long-term impact of JIT on inventory performance measures. Production and Inventory Management Journal, 62–67, First Quarter.

Bray, R., & Mendelson, H. (2012). Information transmission and the bullwhip effect: an empirical investigation. Management Science, 58(5), 860–875.

Cachon, G., Randall, T., & Schmidt, G. (2007). In search of the bullwhip effect. Manufacturing & Service Operations Management, 9(4), 457–479.

Cachon, G., & Olivares, M. (2010). Drivers of finished goods inventory in the U.S. automobile industry. Management Science, 56(1), 202–216.

Chang, D., & Lee, S. M. (1995). Impact of JIT on organizational performance of U.S. firms. International Journal of Production Research, 33, 3053–3068.

Chen, H., Frank, M. Z., & Wu, O. Q. (2005). What actually happened to the inventories of American companies between 1981 and 2000? Management Science, 51, 1015–1031.

Chen, H., Frank, M. Z., & Wu, O. Q. (2007). U.S. retail and wholesale inventory performance from 1981 to 2004. Manufacturing & Service Operations Management, 9(4), 430–456.

Eppen, G. (1979). Effect of centralization on expected costs in a multi-location Newsboy problem. Management Science, 25(5), 498–501.

Eppen, G., & Schrage, L. (1981). Centralized ordering policies in a multi-warehouse system with lead times and random demand. In L. Schwarz (Ed.), Multi-level production/inventory control systems: theory and practice (Vol. 16). North Holland, Amsterdam: TIMS Studies in the Management Sciences.

Fama, E. F., & French, K. R. (1993). Common risk factors in the returns on stocks and bonds. Journal of Financial Economics, 33(1), 3–56.

Gaur, V., Fisher, M. L., & Raman, A. (1999). What explains superior retail performance? (Working paper). Ithaca, NY: Cornell University.

Gaur, V., Fisher, M. L., & Raman, A. (2005). An econometric analysis of inventory turnover performance in retail services. Management Science, 51, 181–194.

Huson, M., & Nanda, D. (1995). The impact of just-in-time manufacturing on firm performance. Journal of Operations Management, 12, 297–310.

Jain, N., Girotra, K., Netessine, S. (2013). Managing global sourcing: inventory performance. Management Science. (Forthcoming)

Kesavan, S., Gaur, V., & Raman, A. (2010). Do inventory and gross margin data improve sales forecasts for U.S public retailers? Management Science, 56(9), 1519–1533.

Kesavan, S., & Mani, V. (2013). The relationship between abnormal inventory growth and future earnings for U.S. public retailers. Manufacturing & Service Operations Management, 15(1), 6–23.

Lieberman, M. B., & Demeester, L. (1999). Inventory reduction and productivity growth: linkages in the Japanese automotive industry. Management Science, 45, 466–485.

Makridakis, S., Wheelwright, S. C., & Hyndman, R. J. (1998). Forecasting: methods and applications (3rd ed.). New York, NY: Wiley.

Olivares, M., & Cachon, G. (2009). Competing retailers and inventory: an empirical investigation of General Motors’ dealerships in isolated U.S. markets. Management Science, 55(9), 1586–1604.

Olivares, M., Terwiesch, C., & Cassorla, L. (2008). Structural estimation of the newsvendor model: an application to reserving operating room time. Management Science, 54(1), 41–55.

Rajagopalan, S., & Malhotra, A. (2001). Have U.S. manufacturing inventories really decreased? An empirical study. Manufacturing & Service Operations Management, 3, 14–24.

Raman, A., Gaur, V., Kesavan, S. (2005). David Berman. Harvard Business School Case 605-081.

Rumyantsev, S., & Netessine, S. (2007). What can be learned from classical inventory models? A cross-industry exploratory investigation. Manufacturing & Service Operations Management, 9(4), 409–429.

Sack, K. (2000). Retailing: general industry survey. New York, NY: Standard & Poor’s.

Schroeder, L., Sqoquist, D., & Stephan, P. (1986). Understanding regression analysis. London: Sage Publications.

Silver, E. A., Pyke, D. F., & Peterson, R. (1998). Inventory management and production planning and scheduling (3rd ed.). New York, NY: Wiley.

Acknowledgement

The authors are thankful to the series editors, Naren Agrawal and Stephen Smith, and anonymous reviewers for many helpful comments on this manuscript. The questions of the effects of firm size and sales growth rate on inventory turnover were suggested to the first author by Marshall Fisher and Ananth Raman.

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2015 Springer Science+Business Media New York

About this chapter

Cite this chapter

Gaur, V., Kesavan, S. (2015). The Effects of Firm Size and Sales Growth Rate on Inventory Turnover Performance in the U.S. Retail Sector. In: Agrawal, N., Smith, S. (eds) Retail Supply Chain Management. International Series in Operations Research & Management Science, vol 223. Springer, Boston, MA. https://doi.org/10.1007/978-1-4899-7562-1_3

Download citation

DOI: https://doi.org/10.1007/978-1-4899-7562-1_3

Publisher Name: Springer, Boston, MA

Print ISBN: 978-1-4899-7561-4

Online ISBN: 978-1-4899-7562-1

eBook Packages: Business and EconomicsBusiness and Management (R0)