Abstract

Clearance pricing and end of season inventory management are challenging and important problems in retailing. Sales rates depend upon price, seasonal effects and the remaining assortment of items available to customers. There is little time to react to observed sales, and pricing errors result in either loss of potential revenue or excess inventory to be liquidated. This chapter develops optimal clearance prices and inventory management policies that take into account the impact of reduced assortment and seasonal changes on sales rates. Versions of these policies have been implemented and tested at a number of major retail chains and these results are summarized and discussed.

Access provided by Autonomous University of Puebla. Download chapter PDF

Similar content being viewed by others

Keywords

1 Introduction

1.1 Background

As an application of management science, retail clearance pricing has been an outstanding success, Pilot studies conducted in the 1990s (Smith and Achabal 1998), found that installing a computer based clearance pricing algorithm at a major retail chain resulted in 10–15 % increases in the revenue capture rate during the clearance period. Increases in sell-through and shorter markdown cycle times also freed up capital and floor space for the retailer’s follow-on products. Similar revenue gains during the clearance period have been achieved by commercially offered clearance markdown systems (Merrick 2001). Spotlight Systems, Inc.,Footnote 1 a seller of clearance markdown software systems, reported in 2002 that the average gain in gross margin dollars for the department and specialty stores that had implemented their system amounted to about 4 % of revenue, or $40 million for every $1 billion of sales. Since U.S. department store sales now exceed $500 Billion per year, there is a very large potential dollar impact, if similar results can be obtained across the industry. More recently, Caro and Gallien (2012) reported that a system that was implemented at a major Spanish retailer (Zara) resulted in a 6 % increase in clearance sales revenue relative to the previous manual system based on managerial judgment. Major vendors of ERP systems are now making price optimization a cornerstone of their retail applications suites (Sullivan 2005). This background section discusses why clearance pricing is such an attractive application for retailers and what has allowed it to be successfully implemented through computer based models.

1.2 Trends in Retail Pricing

Retail department and specialty stores are selling an ever increasing fraction of their merchandise on markdowns, which now account for over one third of all sales.Footnote 2 This is a result of four general trends in these retailers’ merchandising strategies:

-

1.

More products in the assortment

-

2.

A greater proportion of “fashion” merchandise

-

3.

Shorter seasons and

-

4.

More private label (store brand) merchandise.

While these trends give customers a wider selection of product choices and are essential for retailers to remain competitive, they also increase the difficulty of managing the retail supply chain. Fashion and private label items tend to have long lead times for orders from the manufacturer and the total order quantity for the season is usually fixed in advance. This decision is based on the initial sales forecasts, which tend to be inaccurate for fashion and seasonal merchandise. Also, well over half of the retailer’s total order for seasonal and fashion items is usually sent to the stores at the start of the season to create an attractive presentation of the merchandise. Since inter-store transfers are often not economical, it is difficult to rebalance this inventory if the initial allocation is incorrect. When sales in a given category or group of items are lower than expected, retailers must find a way to clear the excess merchandise to make way for the new product arrivals of the coming season. The cycle time for this process becomes shorter still for “fast fashion” retailers who use very short seasons. [See, e.g., Caro and Gallien 2012.]

Clearance pricing involves two decisions: when to start clearance markdowns and how “deep” the markdowns should be, both of which depend on the remaining inventory. Traditionally, these decisions have been made by the buyer who originally chose the merchandise and ordered it from the manufacturer. This may create a disincentive for taking markdowns early enough, since an early decision to mark down really amounts to admitting that the product has underperformed. For seasonal items such as swimsuits and winter coats, demand decreases rapidly near the end of the season; thus delaying a markdown can be very costly. For simplicity, buyers have traditionally taken the same markdown at all stores, or for all stores within a region. This is suboptimal when there are significant inventory imbalances across stores. These factors tend to make clearance markdowns a very complex decision that buyers would be happy to delegate to a computer based pricing algorithm. At the same time, retail managers require a clear demonstration of the “payback,” i.e., the return on investment, for any newly implemented system. Thus, any clearance markdown pricing system needs to be able to pay for itself through improvements in gross margin dollars during the clearance period.

The computing resources necessary for clearance pricing have only recently been available to retailers. As late as the 1990s many retailers did not retain store level item sales figures for more than 90 days and sales results were often reported only in dollars of revenue. Often, there were no detailed records of how many units of each item were sold at a given price. The economics of data storage tended to be the deciding factor in these decisions, because a department store retailer with 100,000 SKUs and 1,000 stores simply could not afford to store all this transaction data for all time periods. Computing resources were also limited among retail staff members, because of the high costs of training and support. Since retail staff members tend to change job assignments frequently, it is important to standardize and document all decision making procedures, and to make the results easily understandable by retail personnel who are not technically trained in using computers. The exponential decline in the cost of data storage and the growth in popularity of personal computers that occurred during the 1990’s have removed these barriers to implementing computer based clearance pricing algorithms.

1.3 Mathematical Models for Clearance Pricing

An analytical approach to clearance markdown management requires the successful implementation of three system components:

-

1.

A sales forecasting model

-

2.

A clearance price optimization algorithm that works at the store and item level

-

3.

Financial performance measurement of the effectiveness of the system

This section discusses a number of the models in the literature that relate to these components of the clearance pricing system.

The modeling assumptions in this paper were motivated by discussions with buyers who manage clearance markdowns at several retail department and specialty store chains. The author also assisted three major retailers in designing computer-based systems that incorporated these models. One unique aspect of this chapter’s pricing model is that sales depend explicitly on the retailer’s on-hand inventory. The pricing analysis implies that when the rate of sale is sensitive to the inventory level, it is optimal to have higher prices early in the season, followed by deeper markdowns later in the clearance period. Furthermore, inventory sensitivity in the demand makes it optimal to have some amount of leftover merchandise at the end of the clearance period. This leftover inventory, which is typically found in department store chains, may be sold to a discounter, transferred to other channels operated by the retailer or possibly donated to charity. Many retailers recognize the advantage of setting clearance prices at the store level to account for the variation in inventory levels and sales rates across stores. Due to the complexity and time consuming nature of localized pricing, computer-based clearance pricing algorithms are required to implement these store level markdown decisions.

2 Related Research

In general, optimal clearance pricing for retailers involves some type of dynamic pricing. Surveys on dynamic pricing policies appear in papers by Elmaghraby and Keskinocak (2003) and by Bitran and Caldenty (2003), and are also included in the monograph by Talluri and van Ryzin (2004). The surveyed papers include a variety of factors such as seasonally varying or declining demand, varying customer response to price changes, demand uncertainty, inventory dependent demand and simultaneous pricing and inventory decisions. Since no tractable model can incorporate all of these factors simultaneously, the choice of modeling assumptions requires tradeoffs. The literature summary below focuses on specific subsets of the pricing literature in marketing, economics and inventory management that are relevant to the retail clearance pricing application.

Intertemporal pricing issues similar to those found in clearance markdowns are studied in a deterministic setting by Stokey (1979), Kalish (1983), Dhebar and Oren (1985), Rajan et al. (1992), Braden and Oren (1994). Stokey’s analysis considered a family of customer utility functions that decline with time and identified conditions under which the optimal price trajectory is constant or decreasing. Kalish (1983) considered sales rates that vary with both price and cumulative sales-to-date and obtained conditions on sales rate and production cost that determine whether the optimal price trajectories are increasing or decreasing. Dhebar and Oren (1985) determined the optimal price trajectory when there is a positive network externality and decreasing supply cost. Khmelnitsky and Gerchak (2002) applied an optimal control model to a production system in which demand is positively influenced by inventory level, but with a predetermined constant price. The other two papers are discussed below.

Demand uncertainty has been included in dynamic pricing models in a variety of ways. Lazear (1986) and Pashigian (1988) considered clearance markdowns for a single item sold to heterogeneous customers who have a time invariant probability distribution of reservation prices. Gallego and van Ryzin (1994) developed a continuous time optimal pricing model in which demand is generated by Poisson arrivals. Feng and Gallego (1995) develop a continuous time Markov process formulation with stochastic demand that determines the optimal timing and duration of a single price reduction. Bitran et al. (1998), Bitran and Mondschein (1997) and Zhao and Zheng (2000) generalize this by modeling customer demand as Poisson arrivals whose reservation prices change over time. The net result is a nonhomogeneous Poisson process multiplied by a price sensitivity function. While these models capture demand uncertainty, they do not include the influence of inventory level on demand, which we found was often significant in retail sales. Significant effects of inventory levels on retail sales have been found by Wolfe (1968), Bhat (1985), Smith and Achabal (1998) and Caro and Gallien (2012).

Learning can play a role in dynamic pricing for either the buyer or the seller. Lazear (1986) allowed the seller to infer customers’ reservation prices through their responses to a decreasing sequence of discrete prices. Braden and Oren (1994) derive an optimal nonlinear price structure that improves the seller’s information about the distribution of heterogeneous customers’ price sensitivities. Lariviere and Porteus (1999) considered a multi-period pricing and inventory model with learning, in which the seller uses varying inventory levels as opposed to price changes to obtain information.

The impact of strategic customers on retail pricing decisions has also been analyzed in a variety of contexts. Besanko and Winston (1990) investigated the role of customers’ knowledge of future prices in intertemporal pricing. Cachon and Swinney (2009) consider the impact of strategic customers on the retailer’s purchasing and pricing decisions.

The marketing literature on price promotions provides a number of empirically tested functional forms for price response. (See e.g., Gaur and Fisher 2005.) This paper adopts a multiplicative form with exponential price sensitivity, which has been analyzed and empirically tested by Narasimhan (1984), Russell and Bolton (1988), Bolton (1989), Achabal et al. (1990), Smith et al. (1994) and Kalyanam (1996). Exponential sensitivity is also applicable for modeling how price influences purchases of consumer durables; Kalish (1985) compared several variations.

There are a number of related papers that develop combined strategies for pricing and inventory management. Eliashberg and Steinberg (1987) considered pricing, inventory and production management policies for a marketing channel subject to seasonal variations. Rajan et al. (1992) considered dynamic pricing and inventory decisions with a variable time horizon and shrinkage costs. Bitran et al. (1998) consider the coordination of prices and inventories across multiple retail outlets in which there are initial allocations of inventories and a further reallocation to rebalance inventories in response to sales. This formulation includes many of the aspects of retail markdown pricing, but the result is a dynamic programming problem with such a large state space that it is likely to be intractable. The authors propose and test some myopic heuristics for approximate solutions. Mantrala and Rao (2001) discuss a decision support system called MARK, which determines discrete prices and inventory levels based on a time varying elasticity demand model. Monahan et al. (2004) analyze a newsvendor model with combined pricing and inventory decisions at discrete time points. Cheng and Sethi (1999) develop a Markov decision model to determine promotion and inventory decisions in a discrete periodic review system. Ray et al. (2005) develop a combined pricing and inventory management model for a two echelon serial supply chain using a demand function with an additive uncertainty term and random delivery times. Netessine (2004) models price and inventory changes at discrete time points, considering the optimization of both prices and the discrete timing of the price changes. Caro and Gallien (2012) consider a clearance markdown model that incorporates inventory effects, discrete price choices and groupings of similar items to facilitate clearance management. They also give a detailed description of a successful estimation and implementation of the model at Zara.

In summary, the model in this chapter differs from those discussed above in that it combines seasonal variations and demand dependence on inventory level with a price trajectory optimization based on optimal control theory. At the same time, this paper’s model requires the time horizon to be fixed, and ignores time dependent inventory costs and discounting. It allows a single inventory level adjustment, while a number of the previous papers on combined dynamic policies consider more general inventory strategies. Also, this chapter’s pricing model does not explicitly include demand uncertainty. However, the updating of the clearance price at discrete time points, as discussed in the last section, provides an approximate myopic solution to the dynamic pricing problem with demand changes. Also, the deterministic optimization formulation allows a closed form pricing solution to be obtained from optimal control theory. For the retail clearance markdown application, it appears that these modeling assumptions are a good compromise that results in a workable clearance pricing model.

This chapter extends the specific results in Smith and Achabal (1998) in several ways. First, it discusses the highly successful application results that have been achieved by commercially available clearance markdown systems since the publication of the original paper. Second, it extends the earlier model to obtain FONC and approximate solutions for the case in which prices change only at pre-assigned discrete time points. An approximate discrete pricing solution is developed, and the continuous solution is used to obtain bounds on the maximum error associated with the approximation. Finally, it obtains closed form expressions for the maximum profit function and presents illustrative numerical analyses for the discrete pricing case.

3 Model Specifications and Optimality Conditions

In developing a decision making framework for clearance markdowns, it is important to note three ways in which clearance prices differ from other types of retail pricing decisions: (1) clearance markdowns are permanent, i.e., prices are not permitted to increase later, (2) demand tends to decrease at the end of the clearance period due to items becoming “out of season,” as well as incomplete assortments and reduced merchandise selection, (3) optimal clearance prices typically differ by location due to inventory imbalances.

Motivated by these observations, the modeling assumptions are as follows:

-

Sales rate depends explicitly on price, seasonal variations and inventory level.

-

Competition, demand uncertainty, time discounting and time dependent holding costs are not explicitly included in the model.

These modeling choices can be explained as follows. Price dependence specifies the change in sales rate as a function of the percentage markdown. Seasonal variations capture the increase in sales rate that tends to occur during certain prime shopping periods such as Christmas and back-to-school, and the decrease that occurs at the end of the product’s season. When the on-hand inventory is too low at a given store, the sales rate may also drop. This is especially true for apparel when there is an incomplete selection of sizes and colors. Additionally, for some items, it is important to have sufficient inventory to create an attractive in-store display to draw customers’ attention to the product.

Retailers tend to intentionally schedule larger deliveries during periods with high sales forecasts, e.g., during promotions. In analyzing the corresponding sales data after the fact, this may sometimes seem to imply a false “causality,” in that the higher sales during promotions should not be attributed to higher inventories, even though a positive correlation exists. On the other hand, most buyers seem to feel that low inventories do reduce sales, which was supported by our regression results. Retailers often define a minimum on-hand inventory for each product, sometimes called “fixture fill,” which is the quantity required for adequate presentation. This is used as a reference level in defining the inventory effect in the model.

Competition and demand uncertainty are not explicitly captured in the sales rate model. However, sales lost to competitors are implicitly reflected in the retailer’s seasonally adjusted rate of sale. This is appropriate as long as the competitors do not react directly to the retailer’s price changes. For clearance markdowns taken at the store level, competitive reactions seem unlikely, given that most retail chains have hundreds of stores, each with different local competitive environments.

Demand uncertainty clearly exists, but modeling it complicates the analysis to a great extent. Optimal clearance pricing in the presence of gradually decreasing demand uncertainty would require multistage pricing decisions, which would need to be jointly optimized by stochastic dynamic programming. The state space for this problem is extremely large, because it must capture all the possible changes in the states of information that influence each update of the pricing policy. Because the clearance period is relatively short and sales rates are declining, the early clearance markdowns tend to be the dominant decisions economically, thus reducing the importance of multi-stage optimization. The short clearance period also justifies the lack of time discounting and time dependent inventory costs in this model. We therefore develop a deterministic pricing formulation without discounting.

3.1 Model Formulation

The model is specified as a continuous function of time with the following parameters

-

t 0 = current time of the season

-

t e = end of the season, sometimes known as the “outdate”

-

t = an arbitrary time t 0 ≤ t ≤ t e

-

I 0 = on hand inventory at time t 0

-

p ( t ) = price trajectory at time

-

s ( t ) = cumulative sales from time t 0 to time t

-

I ( t ) = I 0 − s ( t ) = the on-hand inventory at time t

-

s e = total units sold by the outdate t e

-

x ( p,I,t ) = the sales rate at time t, with price p and on-hand inventory I.

-

c e = salvage value per unit at the end of the season

-

c ( I 0 ) = cost of adjusting I 0 , if changes are permitted

-

R ( I 0 ) = total revenue obtained from the I 0 units

The total sales s ( t ) up to time t clearly satisfies

which implies the differential equation

It is also required that s e ≤ I 0 , where the unsold units I 0 − s e = I ( t e ) are salvaged.

In general, the retailer’s objective is to maximize total revenue during the clearance period, since the cost of ordering I 0 is a sunk cost. However, changes in I 0 with costs captured by the function c(I 0 ) may be permitted in some cases. The net profit can then be expressed as:

This objective function can be optimized using optimal control methods, as discussed in detail in Smith and Achabal (1998). These results will be summarized below and then extended to develop exact and approximate solutions for the discrete pricing case.

First order necessary conditions (FONC) for maximizing (14.3) with respect to p ( t ), subject to the stated constraints can be obtained by forming the Hamiltonian H = ( p − λ) x and treating I ( t ) as the state variable and p ( t ) as the control (see, e.g., Kamien and Schwartz 1981, pp. 143–8). The Lagrange multipliers are

θ = the Lagrange multiplier for the constraint I 0 − s e ≥ 0

λ ( t ) = the Lagrange multiplier for I′ ( t ) = − x ( p ( t ),I ( t ),t ) at time t.

The FONC for the optimal control p ( t ) and the corresponding state variable I ( t ) areFootnote 3:

with the boundary condition

Eliminating p − λ from the two partial derivative equations gives

Evaluating (14.6) at t = t e and combining with (14.5) yields the boundary condition for θ

3.1.1 The Separable Sales Rate Case

Specific assumptions concerning the functional form of the sales rate allow (14.6) and (14.7) to be solved explicitly for the optimal price trajectory. For this paper, a multiplicative, separable function with exponential price sensitivity is assumed,

where k ( t ) = the seasonal demand at time t

y ( I ) = the inventory effect when on-hand inventory is I

γ = the price sensitivity parameter for demand.

Although much of this paper’s development can be carried through for a more general demand function, a closed form solution can be obtained only for a separable demand function like (14.8). A slightly different closed form solution can also be obtained for constant elasticity price dependence of the form p −γ . Both exponential price sensitivity and constant elasticity demand functions have been widely studied in marketing. These have generally been found to be superior to linear price sensitivity in empirical studies. [See, e.g., Kalyanam (1996) and Smith et al. (1994) for references.]

For the separable form (14.8), we have that x/x p = −1/γ is a constant. From (14.6), it therefore follows that p′ ( t ) = λ′( t ). Thus, (14.6) yields an ordinary differential equation that can be solved for p ( t )

Mathematically similar formulations have been studied in other contexts. Kalish (1983), Dhebar and Oren (1985) and Mahajan et al. (1990) developed formulations that are sensitive to experience effects rather than inventory, which lead to similar necessary conditions for the optimal price trajectories. Rajan et al. (1992) obtained optimal price solutions for a separable demand form that is analogous to (14.8), but with a time varying γ. Gallego and van Ryzin (1994) obtained an optimal price trajectory for the case of exponential price sensitivity and Poisson demand arrivals. These formulations do not consider the dependence of sales on the current inventory level or seasonal variations, however.

Rajan et al. allow a variable cycle length and they explicitly consider shrinkage and other inventory costs. They obtain closed form optimal price trajectories for the cases of linear and exponential price sensitivities. Variable cycle length is used for clearance pricing of some discontinued non-seasonal items, but seasonal items, which constitute the bulk of retail clearance items, have a fixed clearance calendar to coincide with the planned arrival of new merchandise.

3.1.2 Compensating Prices

Equation (14.9) can be solved by proving that the optimal p(t) adjusts the sales rate so as to exactly compensate for any reduction in sales due to y(I(t)). This result is stated as the following lemma.

Lemma 1

For the multiplicatively separable sales rate function given by ( 14.8), (14.9) implies that the optimal policy is to adjust p(t) so that sales remain proportional to k(t).

Proof

We wish to show that for the optimal p ( t )

Suppressing the dependence on t and I and differentiating, we have

from (14.9), after substituting \( {I}^{\prime }=-ky{e}^{-\gamma p} \) from (14.2).■

Lemma 1 implies that the price p ( t ) at any time t can be expressed in terms of the final price p ( t e ) and the ending inventory I ( t e )) as follows

Equation (14.11) also shows that the optimal price depends upon I ( t ) but not upon t. Therefore, by defining a new function P ( I ( t )) = p ( t ), (14.9) can be solved for the price trajectory as a function of the inventory level

The total sales s e must satisfy from (14.1)

One of two possible cases must hold at time t e . Either θ ≥ 0 and s e = I 0 , or θ = 0 and thus p(t e ) = c e + 1/γ from (14.7). If θ = 0, we determine s e from the relationship

This has a unique solution since y(I o − s e ) is decreasing in s e .

3.1.3 Determining Optimal Inventory and Maximum Profit

We can use the change of variable I = I(t) and the price function P(I) to rewrite the integral in the total revenue as

Substituting for P(I) from (14.12), we have

This allows us to compute the revenue that will be obtained by using the optimal pricing policy.

Equation (14.16) can also be used to solve for the optimal I 0 , if it is a decision variable, subject to the relationships between I 0 and s e specified above. For the case in which y(0) = 0, FONC can be obtained by maximizing R(I 0 ) − C(I 0 ) with respect to I 0 and s e , subject to (14.14). Letting η be the Lagrange multiplier for (14.14), it can be shown that the FONC imply that η = −1/γ and that

This can be solved simultaneously with (14.14) to obtain the optimal I 0 and s e .

Conceptually, it is also possible to use the solution of (14.17) and (14.14) to optimize the initial inventory purchase at the beginning of the season. However, there are practical reasons why this is generally not advisable. Expanding the size of the time interval [t 0 , t e ] to include the whole season implies that the same exponential price sensitivity must hold for the demand during the entire time interval. Intuitively, it seems unlikely that this will be true, since price sensitivity may increase or decrease or even require different functional forms during different parts of the season. Thus, it does not seem appropriate to include the original inventory purchase as a decision variable in the context of the clearance pricing model. Smith and Achabal (1998) discuss some adjustments in on-hand inventory that may be possible during the clearance period.

3.1.4 Adding Demand Uncertainty to the Model

Let us consider the case in which demand at time t has a multiplicative uncertainty factor given by the random variable ξ(t). Let us also that there is a common unknown parameter w such that the conditional random variables ξ(t∣w) are independent of each other across time. so that assume that the ξ(t) values are independent of each other. Let Ω(t) be the expected value of ξ(t)

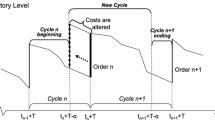

4 Discrete Price Changes

In practice, retailers change prices at discrete points in time, rather than continuously. In this section, optimal discrete pricing will be derived and compared to the results for continuous pricing. The discrete pricing case is considerably more complex to solve than the continuous case. However, an approximate discrete solution and error bound can be derived.

An approximate solution for the discrete case can be obtained by choosing prices in each time interval that yield the same unit sales as the continuous case for that time interval. It is shown that the typical revenue losses from this approximation are no more than 1–2 % for two or more price points. The continuous solution is used to bound the maximum error for the approximate discrete solution, since the exact discrete solution can never be better than the continuous solution.

Suppose the retailer may change prices at n previously set times, e.g., once per week. Let

-

t i = time of the ith price change

-

p i = price for time period i

-

s i (t) = cumulative sales up to time t for t i−1 ≤ t ≤ t i

-

s i = s i (t) = cumulative sales to the end of period i.

The continuous functions s i (t), i = 1, …, n satisfy the differential equation

with boundary conditions s i (t) = s i for i = 1, …, n. The discrete optimization problem is

subject to (14.18) and its boundary conditions. The variables separate in (14.18), to yield

The differential equation in (14.20) can be solved for a specific function y(I), if the left hand side can be integrated. The optimization problem can then be solved by a discrete search over the vector of prices p 1 , …, p n , subject to the functions s i (t) obtained from (14.20).

4.1 Solution for the Power Function Form

In this section, we will solve the special case in which the inventory sensitivity follows a power functionFootnote 4 of the form

This form gives considerable flexibility since for various choices of α, it can be either convex, concave or a linear function of the on-hand inventory. This form has y(0) = 0, which implies that θ = 0 in (14.7) and s e is determined from (14.14). Thus, there will be left over inventory to be salvaged at the end of the season in this case. In practice, this occurs for virtually all clearance items. Also, \( p\left({t}_e\right)={p}_e={c}_e+1/\gamma \) from (14.7) for θ = 0.

Sometimes in (14.21) the effect of inventory dependence can be truncated at I = I r . This assumes that inventory larger than I r , does not affect sales. This may often be an appropriate assumption because, as noted previously, higher inventories may sometimes falsely appear to cause higher sales. Thus, whether or not to truncate the inventory effect is really a judgment call, based on the nature of the sales environment that is being analyzed.

For the power function (14.21), the fraction of units sold

is related to I 0 from (14.14) as follows

The price and total revenue equations then can be written as

Note that in (14.24) and (14.25) I r and K do not appear, but f e depends on I 0 /I r and K/I 0 through (14.23).

Some of the characteristics of these functions can be summarized as follows:

Lemma 2

The fraction f e of the inventory sold is decreasing in I 0 for α < 1, increasing in I 0 for α > 1 and constant for α = 1. For α = 1, we have

Thus, the revenue R(I 0 ) is linear in I 0 for α = 1.

Proof:

Taking the total derivative of (14.23) and rearranging terms, we obtain

This shows the behavior of f e , with respect to changes in I 0 , based on the term α − 1 in the numerator. ■

4.1.1 Optimal Discrete Pricing

The differential equation (14.18) can be solved by integration for the special case (14.21) to obtain

where Z i is the constant for the function s i (t) and K(t) is the cumulative seasonal coefficient function from (14.13). At the initial condition t = t i−1 in (14.28) s i (t i−1) = s i−1 and we obtain the constant term

Equation (14.28) then acts as a constraint in solving the optimization problem (14.19). No closed form solution can be obtained, but the optimal p 1 , … p n can be determined by numerical methods.

4.1.1.1 Discrete Pricing to Match the Optimal Continuous Sales

An approximate pricing solution can be obtained by choosing p i so that the sales in period i match those obtained for the continuous pricing case. That is, we calculate the cumulative sales obtained up to time t i in the continuous case

Using this s i , we determine the corresponding prices by solving the relationships

from (14.28) for p 1 , … p n . Here it is convenient to express the p i in terms of

f i = the fraction of units sold up to time t i .

Because of the compensating price property, it follows that

when the optimal price trajectory P(I) is used. Thus, once f e is determined from (14.23), the f i follow immediately from (14.31). Therefore

The total revenue obtained using this discrete pricing is then given by

Since the maximum revenue R(I 0 ) obtained with the optimal continuous pricing solution is greater than or equal to the revenue that can be obtained with any discrete solution, it bounds the maximum discrete revenue obtained from (14.30) as well as the revenue obtained with the approximate solution in (14.33). Thus we have proved the following lemma.

Lemma 3

The percentage profit loss from using the approximate discrete prices obtained from ( 14.30 ) in place of the exact discrete price solution obtained from ( 14.28 ) is bounded as follows

Furthermore, the profit loss from using optimal discrete pricing obtained from (14.19) instead of optimal continuous pricing from (14.12) has this same upper bound. It is illustrated in the next section that this percentage loss is less than 1–2 % for typical parameter values.

5 Numerical Examples

In this section, we compute the price trajectories, total sales and total revenue for some parameter values to gain insights about the sensitivity of the results to the various input parameters. We will also compare the continuous and discrete pricing solutions.

To reduce the number of variables, all cases use the values

I 0 = I r = 1,000 U, t 0 = 0, t e = 1 and K(t) = tK.

That is, we assume that there are no seasonal variations and the on hand inventory exactly equals I r . The solutions can be extended to other I 0 values from (14.24) and (14.25). The time unit scale can be chosen arbitrarily, since all time variations can be expressed as functions of the inventory level I. Solutions are obtained by solving (14.23) for s e by a one dimensional search, e.g., the Excel Goal Seek function, and then computing the prices and total revenues from (14.24) and (14.25).

Different demand rates can be tested by changing K or by changing the ratio K/I 0 . Since K is difficult to interpret intuitively, we define the Base demand parameter

which corresponds to the total unit demand at the minimum price p e with no inventory effect (α = 0). Also note that p e = c e + 1/γ is the optimal price when α = 0 and inventory can be obtained at a unit cost c e . We will use a retail price of p 0 = $10.00 as a reference value and write all other costs and revenues as multiples of p 0 . For these graphs, I 0 is not a decision variable, so c(I 0 ) is a sunk cost that can be omitted from this numerical analysis.

For the first set of graphs, we use the following parameter values, which represent typical numbers for an apparel item

c e = 20 %, γ = 3.33 , α = 0.5, 1.0 or 1.5 and Base = 500–1,500.

Let us first consider the total sales s e = f e I 0 in Fig. 14.1 as a function of the Base values and α = 0.5, 1.0 and 1.5. These curves are concave increasing, as one might expect, and the smaller values of α give the largest total sales in every case. This is because the negative effects of inventory on sales are less for smaller values of α.

Now let us consider Fig. 14.2, the optimal price trajectory for the single fixed Base Demand = 1,000. From Fig. 14.1, the total sales for α = 0.5, 1.0 and 1.5 are 838, 677 and 578, respectively. Each curve in Fig. 14.2 shows the compensating behavior of the optimal price trajectory, as more inventory is sold. Also, we know from Fig. 14.1 that α = 1.5 corresponds to the least total inventory sold. In all cases, it is best to price higher initially and then gradually decrease the price to compensate for the increasing inventory effect, as described by (14.24). The crossing patterns of the price curves in Fig. 14.2 can be explained as follows. We know that α = 1.5 must have the steepest drop, because it compensates for the largest inventory effect, while α = 0.5 must yield the flattest curve. All curves must have the same terminal price p e . The highest initial price therefore occurs for α = 1.5. Figure 14.3 shows the behavior of the optimal initial price p(I 0 ) for other values of Base Demand.

Figure 14.4 shows the total revenue obtained by using the optimal price trajectory (14.24) in each case. It is interesting to note in Fig. 14.4 that the revenues generated for the three values of α are fairly close to each other. This implies that if inventory effects are modeled correctly, then the almost the same revenue can be obtained through appropriate pricing. For larger α values, higher prices maximize the profit by selling fewer units.

Figure 14.5 shows the bound on the profit loss as a result of approximating the optimal continuous price trajectory with the discrete prices (14.32) that match the continuous sales at the discrete points. That is, the percentage losses in Fig. 14.5 are obtained from (14.34). The other assumptions behind Fig. 14.5 are as follows. For α ≤ 1, it is intuitively clear that α = 1 yields the worst percentage loss, since the price drops more rapidly for higher α. This was also verified by extensive calculations. Second, c e = 0 is also the worst case for percentage loss, because with no salvage value the price trajectory drops must achieve all the profits. But with c e = 0, we see that the factor I 0 /γ appears in both (14.25) and (14.33), and so I 0 /γ cancels out in (14.34). Thus, the curve in Fig. 14.5 holds for all I 0 and γ as well. It is clear from Fig. 14.5 that errors are generally less than 1 or 2 % if at least two price points are used. The worst case occurs for Base/I 0 = 9.2, which corresponds to the lowest demand level that requires an optimal price higher than the base price of p 0 = $10.00.

6 Conclusions

Both practical and theoretical insights can be drawn from the experiences with the clearance markdown methodology described in this paper. From a practical standpoint, improvements in clearance markdown policies have had major financial impacts on a number of firms because clearance sales volumes are substantial and any increased revenues from improved clearance policies go directly to the bottom line. Clearance markdown algorithms are now a key component of merchandise pricing for many retail chains, which are part of a sector with sales exceeding $500 billion per year.

The markdown response model in this chapter differs from other dynamic pricing models in that it includes a dependence on inventory level. Retail buyers in the initial studies, particularly for apparel products, felt that having adequate inventory for presentation strongly affects sales. Regression analyses have also found that low inventories are highly correlated with reduced sales. Adopting a multiplicative, exponential price response function, which has previously been successful in modeling the response to promotional markdowns, leads to an optimal clearance price trajectory that exactly compensates for the effects of reduced inventory, independent of the form of the inventory sensitivity.

General properties of the optimal pricing policy for merchandise that is sensitive to inventory level can provide guidelines for developing corporate strategies for these products. Inventory sensitivity implies that prices should be set higher before the clearance period begins, and then reduced gradually during the clearance period. For many products, it is optimal to leave some quantity of merchandise unsold at the end of the season, especially if it has a salvage value. At the same time, our pricing studies indicated that the initial clearance markdowns should be deeper than buyers were accustomed to taking, while excessive markdowns at the end of the season should be avoided in favor of salvaging, or even discarding, unsold merchandise.

One of the implementation requirements is parameter estimation. Smith and Achabal (1998) discuss some regression based approaches for estimating the parameters for sales forecasting and markdown response models. These methods have often been combined with subjective estimation of certain response parameters, or use of seasonal variations that were computed at a higher level of aggregation. While these estimation methods based partially on subjective choices, they have been sufficiently accurate to achieve significant improvements in operating results at a number of retailers.

This model can also provide a basis for further research in pricing policies that include dependence on inventory effects. Possible enhancements, which have been considered in other related research, include time discounted cash flows and time dependent inventory holding costs. When the clearance markdown period is longer, these time dependent aspects become more important. Another interesting generalization is the use of initial clearance prices to elicit information about the customer markdown response parameters. When combined with the sensitivity of sales to inventory, this remains an unsolved problem to the author’s knowledge. Finally, these successful practical applications should encourage others to apply management science models in situations that require a combination of regression analysis and subjective parameters choices.

Notes

- 1.

Spotlight Systems was acquired by Profit Logic, Inc. in 2003, which was in turn acquired by Oracle Corporation in 2005.

- 2.

National Retail Federation data for Department and Specialty Stores.

- 3.

Subscripts p and I denote partial derivatives and the independent variable t has been suppressed for notational compactness.

- 4.

In Smith and Achabal (1998), additional solution details are given for the general function y(I) and numerical analyses are performed for a linear function y(I).

References

Achabal, D., McIntyre, S., & Smith, S. (1990, Winter). Maximizing profits from department store promotions. Journal of Retailing, 66(4), 383–407.

Besanko, D., & Winston, W. L. (1990, May). Optimal price skimming by a monopolist facing rational consumers. Management Science, 36(5), 555–567.

Bhat, R. R. (1985). Managing the demand for fashion items. Ann Arbor, MI: UMI Research Press.

Bitran, G. R., & Caldenty, R. (2003). An overview of pricing models for revenue management. Manufacturing and Service Operations Management, 5(3), 203–229.

Bitran, G., Caldenty, R., & Mondschein, S. (1998). Coordinating clearance markdown sales of seasonal products in retail chains. Operations Research, 46, 609–624.

Bitran, G. R., & Mondschein, S. V. (1997, January). Periodic pricing of seasonal products in retailing. Management Science, 43(1), 64–79.

Bolton, R. N. (1989, Spring). The relationship between market characteristics and promotion price elasticities. Marketing Science, 8(2), 153–169.

Braden, D. J., & Oren, S. S. (1994, Summer). Nonlinear pricing to produce information. Marketing Science, 13(3), 310–326.

Cachon, G., & Swinney, R. (2009). Purchasing, pricing, and quick response in the presence of strategic consumers. Management Science, 55(3), 497–511.

Caro, F., & Gallien, J. (2012, Nov–Dec). Clearance price optimization for a fast fashion retailer. Operations Research, 60(6), 1404–1422.

Cheng, F., & Sethi, S. P. (1999). A periodic review inventory model with demand influenced by promotions decisions. Management Science, 45(11), 1510–1523.

Dhebar, A., & Oren, S. (1985). Optimal dynamic pricing for expanding networks. Marketing Science, 4(Fall), 336–351.

Eliashberg, J., & Steinberg, R. (1987, August). Marketing-production decisions in an industrial channel of distribution. Management Science, 33, 981–1000.

Elmaghraby, W., & Keskinocak, P. (2003, October). Dynamic pricing in the presence of inventory considerations. Management Science, 49(10), 1287–1309.

Feng, Y., & Gallego, G. (1995, August). Optimal starting times for end-of-season sales and optimal stopping times for promotional fares. Management Science, 41(8), 1371–1391.

Gallego, G., & van Ryzin, G. (1994, August). Optimal dynamic pricing of inventories with stochastic demand. Management Science, 40(8), 999–1020.

Gaur, V., & Fisher, M. (2005). In store experiments to determine the impact of price on sales. Production and Operations Management, 14(4), 377–387.

Kalish, S. (1983, Spring). Monopolistic pricing with dynamic demand and production cost. Marketing Science, 2(2), 135–159.

Kalish, S. (1985, December). A new product adoption model with price, advertising and uncertainty. Management Science, 31(12), 1569–1585.

Kalyanam, K. (1996). Pricing decisions under demand uncertainty: A Bayesian mixture model approach. Marketing Science, 15(3), 207–221.

Kamien, M. I., & Schwartz, N. (1981). Dynamic optimization. New York: North Holland.

Khmelnitsky, E., & Gerchak, Y. (2002). Optimal control approach to production systems with inventory dependent demand. IEEE Transactions on Automatic Control, 47(2), 289–292.

Lariviere, M., & Porteus, E. (1999, March). Stalking information: Bayesian inventory management with unobserved lost sales. Management Science, 45(3), 346–363.

Lazear, E. P. (1986, March). Retail pricing and clearance sales. The American Economic Review, 76, 14–32.

Mahajan, V., Muller, E., & Bass, F. (1990, January). New product diffusion models in marketing: A review and directions for research. Journal of Marketing, 54, 1–26.

Mantrala, M. K., & Rao, S. (2001). A decision support systems that helps retailers decide order quantities and markdowns for fashion goods. Interfaces, 31(3), S146–S165.

Merrick, A. (2001, August 7). Priced to move: Retails attempt to get a leg up on markdowns with new software. Wall Street Journal, A1, A6.

Monahan, G., Petruzzi, N., & Zhao, W. (2004). The dynamic pricing problem from a newsvendor’s perspective. Manufacturing and Service Operations Management, 6(1), 73–91.

Narasimhan, C. (1984, Spring). A price discrimination theory of coupons. Marketing Science, 3(2), 128–147.

Netessine, S. (2004). Dynamic pricing of inventory/capacity with infrequent price changes. European Journal of Operations Research, 174(1), 553–580.

Pashigian, B. P. (1988, December). Demand uncertainty and sales: a study of fashion and markdown pricing. The American Economic Review, 78(5), 936–953.

Rajan, A., Rakesh, A., & Steinberg, R. (1992, February). Dynamic pricing and ordering decisions by a monopolist. Management Science, 38(2), 240–262.

Ray, S., Li, S., & Song, Y. (2005). Tailored supply chain decision making under price sensitive demand and delivery uncertainty. Management Science, 51(12), 1873–1891.

Russell, G. J., & Bolton, R. N. (1988, August). Implications of market structure for elasticity structure. Journal of Marketing Research, 25(3), 229–241.

Smith, S. A., Achabal, D., & McIntyre, S. (1994). A two stage sales forecasting procedure using discounted least squares. Journal of Marketing Research, 31(February), 44–56.

Smith, S. A., & Achabal, D. D. (1998). Clearance pricing and inventory policies for retail chains. Management Science, 44(3), 285–300.

Stokey, N. (1979, August). Inter-temporal price discrimination. Quarterly Journal of Economics, 93, 355–371.

Sullivan, L. (2005, November 28). Getting the price right: SAP goes shopping. Information Week.

Talluri, K. G., & van Ryzin, G. (2004). The theory and practice of revenue management. New York: Springer.

Wolfe, H. B. (1968, Winter). A model for control of style merchandise. Industrial Management Review [now Sloan Mgt. Rev.], 9, 69–82.

Zhao, W., & Zheng, Y.-S. (2000). Optimal dynamic pricing for perishable assets with nonhomogeneous demand. Management Science, 46(3), 375–388.

Acknowledgement

The author is especially indebted to Professor Dale Achabal, Director of the Retail Management Institute at Santa Clara University, for initiating the clearance markdown research, and for leading the projects that resulted in the successful implementations of clearance pricing.

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2015 Springer Science+Business Media New York

About this chapter

Cite this chapter

Smith, S.A. (2015). Clearance Pricing in Retail Chains. In: Agrawal, N., Smith, S. (eds) Retail Supply Chain Management. International Series in Operations Research & Management Science, vol 223. Springer, Boston, MA. https://doi.org/10.1007/978-1-4899-7562-1_14

Download citation

DOI: https://doi.org/10.1007/978-1-4899-7562-1_14

Publisher Name: Springer, Boston, MA

Print ISBN: 978-1-4899-7561-4

Online ISBN: 978-1-4899-7562-1

eBook Packages: Business and EconomicsBusiness and Management (R0)