Abstract

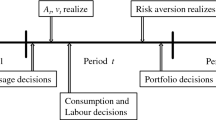

In this paper, we study the risk-aversion behavior of an agent in the dynamic framework of consumption/investment decision making that allows the possibility of bankruptcy. Agent’s consumption utility is assumed to be represented by a strictly increasing, strictly concave, continuously differentiable function in the general case and by a HARA-type function in the special case treated in the paper. Coefficients of absolute and relative risk aversion are defined to be the well-known curvature measures associated with the derived utility of wealth obtained as the value function of the agent’s optimization problem. Through an analysis of these coefficients, we show how the change in agent’s risk aversion as his wealth changes depends on his consumption utility and the other problem parameters, including the payment at bankruptcy. Moreover, in the HARA case, we can conclude that the agent’s relative risk aversion is nondecreasing with wealth, while his absolute risk aversion is decreasing with wealth only if he is sufficiently wealthy. At lower wealth levels, however, the agent’s absolute risk aversion may increase with wealth in some cases.

Access this chapter

Tax calculation will be finalised at checkout

Purchases are for personal use only

Preview

Unable to display preview. Download preview PDF.

Similar content being viewed by others

References

Arrow, K. J. (1965). Aspects of the Theory of Risk-Bearing, (Yrjo Jahnsson Lectures), Yrjo Jahnssonin Saatio, Helsinki.

Epstein, L. G. (1983). Decreasing Absolute Risk Aversion and Utility Indices Derived from Cake-Eating Problems. Journal of Economic Theory 29 245–264.

Lehoczky, J., Sethi, S. P. and Shreve, S. (1983). Optimal Consumption and Investment Policies Allowing Consumption Constraints and Bankruptcy. Mathematics of Operations Research 8 613–636; Chapter 14 in this volume.

Karatzas, I., Lehoczky, J., Sethi, S. P. and Shreve, S. (1986). Explicit Solution of a General Consumption/Investment Problem. Mathematics of Operations Research 11 261–294.

Lippman, S. A., McCall, J. J. and Winston, W. L. (1980). Constant Absolute Risk Aversion, Bankruptcy, and Wealth-Dependent Decisions. Journal of Business 53 285–296.

Merton, R. C. (1971). (1973). Optimum Consumption and Portfolio Rules in a Continuous-Time Model. Journal of Economic Theory 3 373–413. Erratum. Journal of Economic Theory 6 213-214.

Neave, E. H. (1971). Multiperiod Consumption-Investment Decisions and Risk Preferences. Journal of Economic Theory 3 40–53; also reprinted in Stochastic Optimization Models in Finance, W. Ziemba and R. Vickson (eds.) (1975), Academic Press, New York, 501-515.

Pratt, J. W. (1964). Risk Aversion in the Small and in the Large. Econometrica 32(1-2) 122–136.

Sethi, S. P. and Taksar, M. (1988). A Note on Merton’s “Optimum Consumption and Portfolio Rules in a Continuous-Time Model”. Journal Economic Theory 46 395–401.

Rights and permissions

Copyright information

© 1997 Springer Science+Business Media New York

About this chapter

Cite this chapter

Presman, E.L. (1997). Risk-Aversion Behavior in Consumption/Investment Problems. In: Optimal Consumption and Investment with Bankruptcy. Springer, Boston, MA. https://doi.org/10.1007/978-1-4615-6257-3_5

Download citation

DOI: https://doi.org/10.1007/978-1-4615-6257-3_5

Publisher Name: Springer, Boston, MA

Print ISBN: 978-1-4613-7871-6

Online ISBN: 978-1-4615-6257-3

eBook Packages: Springer Book Archive