Abstract

Contemporary business environment is becoming more complex and globalized. In order to maintain its competitive advantage, the organization has to develop effective long-term relationships and innovative approaches with its stakeholders, based on innovative research and methodologies. These relationships can be capitalized by maximizing customer lifetime value, customer profitability and by adopting innovative and creative approaches in the service marketing. Oftentimes even large corporations have a vague knowledge of marketing, especially in the service industry, and tend to operate with traditional and mostly transactional tools. Due to today’s competitive environment, the customers’ increased capabilities of choice and specialization, the importance of innovation in service marketing has never been as high. Developing an integrative model of work between the relationship marketing and innovation in telecom service industry will enable the company to achieve superior efficiency and build long-term competitive advantages. Aim of this chapter is to provide a conceptual and methodological framework for innovative relationship market approaches for telecom industry in Romania. Moreover, the purpose of the work is to provide a broad perspective on a dynamic industry within an emerging market. The key determinants, particular challenges and factors relative to the national telecom-leading players are underlined.

Access provided by Autonomous University of Puebla. Download chapter PDF

Similar content being viewed by others

Keywords

- Innovation

- Integrative model

- Relationship marketing

- Service marketing

- Value

- Telecommunications

- Key account management

- Romania

1 Introduction

Relationship marketing represents a marketing strategy that is based on relationships between provider and customers. This strategy is already widely used in business and implemented from the perspective of both the provider and customer. However, not much research has been conducted on the implications of its initiatives, such as the integration of relationship approaches with innovations, especially in the service industry. The marketing of the twenty-first century is marked by the relational orientation that directs the company’s efforts towards increasing performance metrics through developing long-term relationships and acquiring mutual benefits for all stakeholders—clients, suppliers and a selection of competitors.

Further, as the complexity of exchange relationships and the increased importance of long-term and durable exchanges, there can be identified new and innovative changes in the processes of customer value. The changes take place at a micro-level—change in internal processes and policies, change in employee mentality towards customer relationship and satisfaction—and at macro-level—changes in business environment and social responsibility. In this context, Kotler (2009) introduced the holistic orientation of contemporary marketing. The innovative concept is that of integrated marketing that is comprised, first of relationship marketing—where the relationship with stakeholders is based on trust, mutual respect and win–win relationship—and second of internal marketing that presumes the interaction with the marketing department as well as the integration of all the company’s functions.

Goal of business partners nowadays in a service context is mutual value creation, while the service itself represents a mediating variable for (Gronoroos 2010) accomplishing this and enhancing the overall quality of interactions and relationship between partners.

2 Profile of Romanian Telecommunications Market

The Romanian telecommunications market represents one of the most competitive in the European Union. This is a direct consequence of several important factors. First of all, due to the fact that in the post-communist era (after 1989), there was only the fixed telecommunications provider that had monopoly for over a decade, the market was in the need to better and mobile communicate. This fact provided a good market for the mobile network development and an increase in demand. Second, the investments in the telecommunications sector over the years have increased exponentially, so that the potential market was an important market driver. This led to the mobile phone penetration of over 110 % of the market in 2009, so that the average Romanian businessperson now has 1.9 mobile phones. The increase in investments in coverage and network development meant the need of growing market share, and thus, the Romanian telecommunications companies have launched a massive campaign of gaining customers’ at all costs. This means that the average revenue per unit (ARPU) decreased. In the latest years, due to the decrease in prices and reaching the lowest revenue per user in the whole European Union, the telecommunications companies realized that they need to focus more on the relational side of the business, they need to better innovate both the products and services and the ways these are offered to the customer. More importantly, companies understood the importance of customer retention and loyalty in terms of business previsioning and forecasting. The third factor is the Romanian low buying power. Due to one of the lowest average income per capita in the European Union and to a low competitiveness of economical medium, the buying power of potential customers is limited. This fact determines a low price expectation and because of high competition and market penetration to high demand. This paradox low price–high product expectation determines a low margin for telecommunication companies operating on Romanian market.

In discussing retention and loyalty in the telecommunications sector, we must take in consideration of two important factors. The first one is the continuous contractual transactional side of the business (Gerpott et al. 2001). Every contract is signed for a specific period of time, usually 1–2 years. During this period, the customer is required to pay a certain amount of time and in return he expects to benefit from a constant service quality. In the same time, the network provider sets up barriers of exit for the customer out of the network in the form of early termination fees (ETF). These represent the cost of the relationship and the cost of opportunity, on one side, and on the other side, a potential threat to the customers that want to exit out of the network. The second factor that is important for the telecommunications sector is the different approaches to the residential sector and the business sector. Each of these segments of customers have different expectations, different buying behaviours and require different relational approaches. For each segment, the telecommunications company must design and implement different retention and loyalty programs. In this chapter, we will address the business sector and more specifically the retention and loyalty approaches to key accounts.

Telecommunications market in Romania has also known a rapid development in the last two decades. The post-communist Romania with its main economic undertakings, challenges associated with transition to a functional market economy and its milestones for the last two decades (NATO joining in 2004, and European Union accession in 2007) privatization process definitely exhibits particularities of a fairly sizable emerging economy for the Central and South-Eastern European region. Telecommunication sector while a vital one in the overall economy is also a fairly accurate barometer for the entire national economy, and a very dynamic one, where the privatization process of both mobile and fixed telecom companies definitely had an early positive upturn in Romania. Business climate on this market converges rapidly towards a more predictable and an international standards business practices regulated environment.

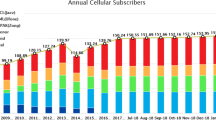

The Romanian telecom market also has a series of differences from European market. From 1992 to 2007, the telecom market has grown from 0.1 million users to over 22 million users. Then from the 2009 until 2012, the market has stalled, mainly because of the decrease in purchasing power and structural economical problems of the country (Fig. 1).

Romanian telecom market evolution—number of customers Source www.ancom.org.ro

While the customer’s number remained almost the same, the traffic generated by calls and especially data has grown significantly. Voice traffic in own network grew with 18, 14, 3 and 9 % yearly from 2009 to 2011 (quarterly). To other networks, the traffic also grew with 8, 4, 40 and 12 %, indicating that the decrease in prices and promotional offers influenced the customers to increased their data and voice traffic. This is not much different that what typically has been accomplished in the other telecom markets of the emerging, post-communist economies in the region indicating that the Romanian market is still a relatively young and underdeveloped market that is still far from a mature one (Fig. 2).

Romanian telecom data and voice evolution (from 2009–2011 quarterly) Source www.ancom.org.ro

The post-European Union accession stage definitely poises Romanian overall economy, with its telecommunication sector for robust growth, provided the present challenges will be converted into real market opportunities, based on relational approach, service dominant view from the providers in an entrepreneurial manner, presented in here.

3 Customer Retention and Loyalty: Antecedents and Consequences

3.1 Literature Review

In this section, we will review the literature regarding the conceptual model proposed. We will first address the antecedents in the model—relationship marketing and innovation orientation. We will then address the customer retention and loyalty approaches of the organization as the main focus point of the conceptual model. The consequences of relationship marketing influence and innovation orientation over retention and loyalty approaches are considered to be an increased customer satisfaction and superior organizational performance.

3.1.1 Antecedents: Relationship Marketing and Innovation Orientation

Gummesson notes (Gummesson 1997) that search for a global definition of relationship marketing is in essence a “ghost hunt”, while fact of building business relationships is the tantamount for conducting businesses. Other researchers view relationship marketing as a distinct sub-discipline that parallels service marketing (Grove et al. 2003), which is not commonly accepted although there is common ground between the two fields. Relationship marketing, although a widely studied concept, is still viewed as an emergent field and its existence can be traced back to the preindustrial era (Sheth and Parvatiyar 2002).

Relationship marketing is defined as the process of establishing, maintaining and enhancing, and when necessary terminating relationships with customers, for the benefit of all involved parties, through a process of making and keeping promises (Gronroos 2007). Making promises requires the provider firm to connect with customers’ processes (sales, marketing communication, offers, etc.) while keeping promises is related to provider’s continual support for various processes that are relevant for customers (inquiries, payments, complaint management, etc.).

Scholars (Sheth et al. 1995) pinpoint some of the major economical factors that influenced the rebirth of relational approaches leading relationship marketing philosophy rapid developments of technology, adopting TQM programs, increased importance of services in economy, creating specialized teams of account managers and increased competition and focus on customer retention. Undoubtedly, this view has represented a renaissance in marketing and paradigmatic change; however, its application faced some serious challenges especially when it comes to services in nowadays complex and dynamic playfield.

One of the most important macro-economical force that eventually led to the rebirth of relational approaches, especially in the area of service industry, was the increased focus on customer retention (Seo et al. 2007). Unprecedented growth in the telecom and wireless telecommunication market, increased competition and due to the fact wireless services are not one time sale items led to the increased importance of customer retention and satisfaction. Over the total lifetime of the customer, the service provider can offer additional services in order to generate more revenues. There are four key players operating on the Romanian telecom market that generate yearly consolidated revenues in excess of 4 billion Euros. Two-thirds of the revenue are coming from SMEs and large companies and are rather based on a long-term relationship with their providers and effective retention and loyalty programs (Capital 2010).

Earliest developments of services marketing began to take shape in the 1970s and emerged as a genuine field of marketing by the mid-1980s (Berry and Parasuraman 1993), while the last two decades have recorded a phenomenal development of interest, instruments and innovative ways services marketing. Service marketing began to conceptualize as a different concept in the field of marketing in the beginning of the 1970s (O’Malley and Tynan 2008). The attempts of applying general marketing concepts and production approaches in the field of service marketing were doomed, as products need a different micro- and macro-approach of marketing.

Although the service marketing literature began as a distinct perspective from the conceptual domain of traditional marketing, we can identify different elements that in time have been adopted as part of relationship marketing (Table 1).

One of the recurring themes in service marketing for future will be setting its boundaries and rethinking its domain, as marketing for products becomes increasingly service intensive. The four key factors intangibility, heterogeneity, inseparability and perishability used to differentiate services from physical goods are considered simplistic to capture the nature of service offering given the pace of developments (Grove et al. 2003).

The concept of innovation can be defined from at least two perspectives. From one point of view, innovation represents new products and processes, new organizational forms and sources of raw materials. This perspective identifies the term innovation with invention, which represents a completely new idea or product/service. From another point of view, innovation is identified with everything new in an organization. Innovation is the end of a complex process of identifying a new solution—technical, managerial or organizational (Drucker 1993)

The contributions of researchers and scholars in the area of innovation came from different perspectives. Avlontis et al. (2001) concentrated on the service itself and the degree that service-oriented organizations innovate. On the other side, Gadrey et al. (1995) implies that innovation in the service industry cannot remain in the area of new products and services but must first focus on the redesign and organization of existing procedures in the presentation of the service. Innovation in the service sector can be defined as the continuous process of improving existing activities of service delivery that will lead to increased customer interaction and satisfaction. De Brentani (2001) focuses on discontinuous innovations—defined as innovations, mainly in the technological areas, that have a high degree of newness—represent a competitive advantage for the organization.

3.1.2 Customer Retention and Loyalty

Customers’ retention, loyalty and satisfaction are some of the main purposes of a profit-oriented organization. In order to maximize results, the organization is to focus on new customer acquisition, as Peter Drucker mentioned—the main purpose for a business is to generate new customers—however, within the current market circumstances, organizations are to give the same degree of importance, if not an even larger one to the current customers retention and their loyalty.

Technological advancements and the adoption of new telecommunications methods—fixed digital telephony and mobile telephony—telecommunications sector have emerged into a dynamic and important economic area, which generates significant revenues (Gerpott et al. 2001). This reality has determined an exponential development of telecommunications operators (both for fixed and mobile areas) and also a rise of the rivalry among players. National monopolies elimination from this field, especially within fixed telephony sector and also an increasing importance of communication in the overall economy, have led to a superior importance of this area in the national and global interconnected context.

Such concepts as customer retention and loyalty are exchangeable within the literature, especially when addressing the customer satisfaction broader theme (Gerpott et al. 2001). Related elements as retention, loyalty, customer satisfaction, trust and customer obligation to continue business relationships with a specific supplier are often jointly approached within the literature treated as a whole. According to Bruhn (1998), customer satisfaction is a factor with a major influence in the customer loyalty gaining process, which is posing a major influence on the customer retention process.

Customer retention defines the final construct between satisfaction, loyalty and retention mechanisms and can be defined as “the process that focuses on maintaining existing business relationships between suppliers and customers” (Gerpott et al. 2001). Based on this perspective, customer retention is the process through which supplier builds different barriers aimed at keeping the customer part of the current business relationship. Customer retention can be accomplished through repetitive acquisitions of the customers, or in the telecommunications by extending the contractual duration. In most cases, automatic contractual extension can generate a legal bond between the two parties; however, at the personal level can generate discomfort due to obligation factor imposed by such a practice. Another way of customer retention achievement is via the introduction of associated contractual elements with a high degree of innovation so as the customer will hardly identify a more viable alternative to the current offering. Nonetheless, deregulation services process—which represents the possibility to port out the telephone numbers to another provider—has significantly influenced the way that telecommunications operators are approaching customers’ retention and loyalty. This way, customer can have the flexibility of keeping the same telephone number—factor of crucial importance when is evaluating the possibility of contractual relation cessation with the current provider—significantly contributed to an increased relevance of customers’ loyalty programs at the expense of the retention ones.

While retention processes consist in most of the cases of stopping customer migration or avoid ending of relationship between the two entities, the loyalty processes consists of ways to identify and influence customer behaviour so as this will have a positive attitude towards the current telecommunications services supplier and will generate a favourable attitude towards business relationships continuation.

Bruhn’s (1998) conceptual model emphasizes the customer satisfaction as the final element of the retention and loyalty processes. The author states that customer satisfaction is “an assertion founded on customer experience associated with the product/service provided by the current supplier and vis-à-vis the degree to which the present offering meets customer’s expectations in terms of individual and functional characteristics of the product/service” (Bruhn 1998).

One of the most important surveys regarding Germany’s telecommunications market (Gerpott et al. 2001) underlines four situations within customer retention and loyalty processes. The model exhibits four such customer types that react differently to retention and loyalty mechanisms (Fig. 3).

Customer retention conceptual model Source Gerpott et al. (2001), p. 255

The literature identifies development directions for the retention and loyalty mechanisms and a series of management practices for the internal processes, as well. A first step is represented by the customer total satisfaction measurement (Ang and Buttle 2006). The premise is that total satisfaction measurement has to be effectively planned in time and fully integrated with different methods and moments of customer interaction. This step is of crucial importance, considering satisfaction relevance when it comes to retention and loyalty of the customers, in securing a customer portfolio.

The planning of the customer retention and loyalty processes represents a second step of the overall process. While for the new customer acquisition actions companies are willing to invest up to 80 % or more out of the total marketing budgets (Weinstein 2006), a much lower allocation is destined to retention and loyalty processes. During the last several years, the companies have started to invest increasingly in the orientation and focus towards maintaining and development of the relationships with the existing customers, especially due to relatively reduced capacity of continual development for new customer portfolio. Nonetheless, an intensified level of rivalry among players and the deregulation of telecommunications markets have facilitated the possibility to select from a significant number of suppliers for a vast percentage of the customer portfolio.

A third step for the process is the quality assurance. During this stage, the supplier seeks to identify the weaknesses of the internal processes that ensure a consistent quality to the overall offering. As the emphasis is placed on the long-term stability within the business relationships, the customers will have a preference for a constant and predictable level of quality.

The fourth step is the regaining of the lost customers who migrated to direct competitors. In spite of the fact that this process has no associated cost to the organization, this has the advantage of an existing previous relationship with the customer and a superior knowledge vis-à-vis the customer. The customer regaining process also presents an extensive revenue increase potential, through the expansion of the customer base.

The customers’ claims management gives the last phase of the process. This last mechanism is a vital one for the customer retention and loyalty process first of all due to superior satisfaction ensuring possibility. There are surveys that show (Ang and Buttle 2006) that organizations reaching an efficient identification and handling customer claims process can provide a superior value to their clients through a high emphatic degree vis-à-vis their customers and a proactive capability of meeting their ever changing needs.

The customer retention and loyalty processes require identification of customer segments that are most suitable as targets for these programs and also outcome measurement. Customer segmentation and targeting those, which are significantly contributing to organization objective reaching, revenue and profitability growth, would have to become a priority for the organization. Not all the customer segments are contributing to the same degree to the revenue increase, and some of them act as “question marks” for profitability. Thus, selecting the appropriate target segments towards which specific retention and loyalty efforts and resources are deployed would ensure an efficient allocation. The measurement and quantification of the outcomes display an organizational dilemma. On the one hand, the customer retention and loyalty strategy has to be quantifiable, and its efficiency has to be determined in terms of its outcomes, on the other hand, not all retention and loyalty efforts are measurable on the short run, so as the entire process could be rigorously evaluated. The studies on defining and measuring retention and loyalty processes (Aspinall et al. 2001) identified two ways of correlating the organizational performance indicators—key performance indicators (KPI). Firstly, there are general measurements of retention that are not taking into account profitability or the revenue generated by the individual customers. From this perspective, all the customers are to be retained, and retention is defined as a rate of retained customers in the portfolio, regardless of the revenue generated by the individual customers. Secondly, there are sales- and profit-based figures, which allocate each customer to a different profitability category and different value levels are defined. Depending on the organization’s objectives, there will be selected those customers with a high degree of profitability and significant sales volumes so as the retention and loyalty will be aimed towards these. Moreover, the importance of customer migration management to different levels of value has been underlined. The overall customers’ tendency over time is not to cease relationship with the supplier, but to purchase lower values and lesser amounts. Customer migration management towards lower levels becomes as such an important component within retention and loyalty efforts.

Researches on customer retention and loyalty (Coyles and Gokey 2005) show that organizational efforts aimed only at retaining the customer in the relationship are not adequate. In order to increase customer loyalty degree, the companies are to reach a deep understanding of the attitudes, motivations and, moreover, to identify the changes related to customer needs. Moreover, customer migration towards inferior segments of the market is posing a major threat to retention and loyalty programs. However, customer migration management brings also an opportunity for the supplier, due to a superior knowledge of the customers and their motivations that have led to a shift in their needs mix.

3.1.3 Consequences: Increase in Satisfaction and Profitability

Customer satisfaction has been linked to internal marketing, within holistic marketing view (Kotler 2009). Within the process, internal marketing has the role of building internal customer satisfaction. Whether we take into consideration the teams directly involved in the customer relationships, or the indirect staff members, a higher degree of satisfaction of the internal customers will definitely lead to an increase in personnel performance and an organization enhanced performance in its relationships with external customers. A positive performance perception of the external customers can lead to their superior satisfaction.

Empirical surveys have shown also that there is a direct influence between organizational performance and its efficiency in providing the offerings on one side, and in customer satisfaction on the other side (Hwang and Chi 2005). As Theodore Levitt asserted, “the businesses goal is to create and maintain customers” (Blythe 1999). Once the customer base has been generated, it is vital that customers are satisfied through quality, value and superior services offerings, without losing from consideration that customer base generation is a dynamic process, as well. Literature identifies direct relationship between development and maintaining a high level of internal customers’ performance and the rise of the external customers’ satisfaction, and as such the improvement of the overall organization performance.

Moreover, for the analysis regarding the difference between customers’ expectations on one side and perceived quality and satisfaction on the other side, scholars are identifying a series of discrepancies that may occur within the customer satisfaction process (Parasuraman et al. 1985). One of the most important such discrepancy is that between customer’s real expectations and those identified by the supplier. Whenever the provider is not correctly identifying customer’s real expectations, the offering will not lead to customer satisfaction. A decisive role for effective expectations identification is played by the marketing research. Another major discrepancy that substantially influences customer satisfaction is that between promised performance and the real performance that the customer ultimately obtains. This may be generated as a result of inadequate communication among departments, or erroneous product/service details or simply due to the underdeveloped quality control policies.

Satisfaction represents a customer’s feeling that results from comparing perceived performance or results with the initial expectations (Kotler 2009). Customer-perceived satisfaction is formed by the reactions referring to any discrepancy between expectations regarding service offering and experience associated with the acquired service. A superior degree of customer satisfaction is often resulting in customer loyalty (Futrell 2010) (Fig. 4).

The defining process of the service customers’ satisfaction has undergone through a wide array of approaches and directions (Ekinci et al. 2008). The literature records at least two main conceptual models of the service customers’ satisfaction: satisfaction specific to the transaction and general service satisfaction. The later refers to evaluating customer’s satisfaction as a result of a distinct experience related to a purchase that cannot be repeated and that can be best recorded in the post-acquisition phase. In spite of the repeated interaction with the purchased service, does not represent an individual transaction in time, the evaluation of customer satisfaction and behaviour is best conducted as soon as possible post-acquisition. With regard to general satisfaction of utilizing the service, it represents a more subjective evaluation in nature, which is realized at a significant longer time after purchasing moment. This satisfaction is a function of evaluating multiple moments and transactions over time and captures the perceptions and general service performance, through comparison with a series of standards from the previous customer’s experiences.

The satisfaction literature also records analyses conducted from the standpoint of positive influences towards customers’ behaviours (Soderlung 1998). On the one hand, a direct relationship has been identified between a high level of customer satisfaction and loyalty. The higher the service satisfaction, the higher the likelihood, the customer will remain loyal to the providing organization. Moreover, there has been identified a direct link between satisfaction and propensity of customers to make referrals. Recommending the supplier’s services is an advantage to the organization, as it reduces promotion costs and increases potential customer base and its revenue.

Satisfaction has been considered in the literature as an antecedent of customer relative attitude towards the service offering (Wu 2011). Satisfaction or dissatisfaction with service influences customers’ attitude and can lead to loyalty achievement vis-à-vis service or the provider organization. Whenever service performance is higher than customer expectations, this will lead to a satisfied customer, and conversely, whenever customer demands are not met, this will generate dissatisfaction. Satisfaction evaluation is also realized through the past and present customer experiences with the service or the providing organization.

The current paper approaches satisfaction with its three main dimensions: satisfaction provided by the organization, satisfaction provided by the personnel and service provided satisfaction.

3.2 Conceptual Model Proposed

Innovation and relationship marketing have been studied for a long time as distinct functions of a company. Associated services and support were also used in customer retention, satisfaction and to increase the trust between parties involved in the relationship.

The premise of this proposed model is that by strategically integrating innovation in the process of creation and delivery of a service in a relationship marketing–oriented company, the result will be increased customer retention, loyalty and satisfaction, leading inevitably to overall increased company performance (Fig. 5).

In a key business relationship, an extended service offering is an interactive process consisting of several sub-processes and resources supporting corresponding customer practices in a way that helps the customer create value in all its practices (operational efficiency), and through this ultimately has a value-creating impact on the customer’s business process (business effectiveness) (Gronroos 2010). In the final analysis, within the relationship, the provider operates as an integrated part of the customer’s process, while the customer operates as an integrated part of the supplier’s process. A crucial factor in determining the relationship outcome is the quality of the interactions between parties (Fyrberg and Jüriado 2009). Value for customers, which represents the focus orientation of relationship marketing, “means that they (customers), after having been benefited from the provision of resources or interactive processes, are or feel better off than before” (Gronoroos 2008). Value for customers (customer’s value) can definitely be measured in monetary terms, and in addition has a perception dimension to it, influenced by factors as trust, commitment, and attraction (Gronroos 2010).

The integrative model has also an internal dimension within the company, as implications for management are extensive in this area. Traditionally, marketing was responsible only for promotion (making the promise) while keeping the promise and generating customer loyalty phases were under responsibility of other functions (Brown 2005). When execution of functions as customer service or problem solving is integrated in the marketing process, marketing becomes pivotal in promise keeping and creating loyalty. During processes of development, design, delivery and follow-up stages, simultaneously customer and provider participate into each other’s operation as co-developers.

4 Research Methodology

The research methodology that we are proposing is mainly a qualitative in nature based on an in-depth interview with seven key accounts from the Romanian telecommunications market. These customers have all met the research criteria (as further defined) and were willing to answer to our questions and discuss in detail perspectives.

Malhotra (2010) underlines the main differences between qualitative and quantitative researches, and this is our theoretical basis on why choosing a qualitative method as a starting point represents an advantage (Table 2).

In this present study, we opted for the semi-structured interview on key accounts in the business sector. As defined by the Nordic School (Schmidt and Hollensen 2007), the in-depth interview represents a research methodology that gives very few directions to the sample, giving them full liberty to express their opinions and feelings, and in the same time offers the researchers the opportunity to meet their research objectives better. In the same time, the interview can obtain information more freely and through a direct approach can capture motivational and emotional perspectives better. The interview was based on the conversational guide that was not limitative. The sample was given the freedom to add new elements and perspectives to the discussion.

In-depth interview, as presented in the literature, can be used in different research approaches (Kates 2000). On the one hand, the interview can be used when the researcher is identifying new information that can be the basis of a later quantitative research. This instrument is mainly utilized in the exploratory researches. On the other hand, the in-depth interview can be used as a single instrument in a research. This is mainly recommended when researching not so easily accessible groups and groups with high competitiveness between them.

Research objective was to identify the different concepts presented in the literature review, the interactions between them and to validate or invalidate the conceptual model proposed. We firstly wanted to underline the importance of the two antecedents—relationship marketing and innovation orientation—over the retention and loyalty approaches of telecommunications companies. On the other hand, we focused on the importance of retention and loyalty programs and their influence on the customer perception of service offered. As a result or consequence of this influence, we identified the two results: increased customer satisfaction and profitability.

Research has been conducted in the period of June–July 2012 at the level of business customers defined as key accounts of telecommunications companies in Romania. All interviews were taken at the accounts location.

Selection process of the sample was based on the literature recommendations and sample availability. The first criterion was that of customer buying power, respectively, of how much money they spent on telecommunication services. As defined in the Romanian market, the key accounts usually spend over 1,500 euro/month for this type of services. In the same time, we identified a direct link between the customer invoices and the relational and retention programs telecom companies undergone. The third criterion was that of customer lifetime with the provider—over 3 years—because we wanted to observe the evolution of relation over time and the effectiveness of retention and loyalty programs.

4.1 Information Analysis and Results Interpretation

The results from the seven key accounts identified were compiled, and their names were given confidentiality as required by the sensitive information and personal interpretation of perceptions. All the seven key accounts met the established criterion. In regard to quantity of services acquired from telecom companies and invoice size, all of them had invoices of over 1,500 euro per month, one of them with invoice of over 20.000 euro per month. Also, all of them had and experience with the current provider or providers of over 3 years.

In regard to innovation orientation, all the customers have stated that in the Romanian telecom market, at the product and technological level, they are satisfied. This comes as a confirmation that customers appreciate the investments made in the network by the providers. In regard to the support services and customer relationship management, key account #2 underlines “When we installed our VPN service in all our six locations we had mixed feelings. On one side, we were satisfied with the service technical capacities and with our excellent relationship with the account manager. The offer was presented to us in a professional manner and we agreed on a fair price for the service. On the other side, when it came to the implementation of the contract, the implementation department was not tuned with all our requirements. The first team that came to our office did not call first, so we could not synchronize with out IT department. Then, they were late 2 h on the next appointment and later on they messed up with our IP’s”. Such an opinion, even if satisfied on the technological capabilities of the service provided and the price offered implies that it is very important the relational perspective of the service. This will influence the capability of the provider to extend the contract period (create a retention process) and the availability of the customer to voluntarily remain in the relationship (loyalty).

The relational perspective was emphasized by four of the seven key accounts that were interviewed. They pointed out that 90 % of the retention capabilities of the supplier organization lay in the personal relationship between the people on both sides. More importantly, because of the relational approach, in all seven cases 85 % of the respondents had their services secured with the provider for another 12 months. The key account #4 said “We are always looking to the relationship we have with the organization and more important with our account manager. When we buy a service we buy a relationship and we want to know that every problem—and even with the best service there will be problems—we know that we have a direct communication, we are always being assisted to overcoming the difficulties”. Another respondent, key account #3 pointed out that he refused an offer from the competitor of the current internet provider with 40 % discount based only on the relationship with the current account manager.

In terms of customer retention and loyalty programs and approaches in all the seven cases, the respondents agreed that there would always be a lower price alternative than the current one. In the nowadays business environment, every company wants to reduce costs and increase efficiency, but in the same time, the important businesses will always recognize the importance of quality and the rewards that a long-term relationship offers. As key account #5 points out “Our current provider did not think good of us for a long time. Then, over 5 years ago, we moved all our services to their competitor. We did not take this move because it was a tariff reduction, but because we did not feel that they wanted us and invested in keeping us happy. After 24 long months, when the account manager of our old provider approached us every month, we decided that we want to come back. It was a more flexible approach from the provider and we now benefit from a complex loyalty and reward program, we have our dedicated account manager and we feel that we each appreciate what we get from the other side”. This is a very important perspective especially for the Romanian market where the traditional view is that the smaller the price the better the chances in wining a customer. Even if Romanian businesses are struggling with increased competition and efficiency issues, for strong business owners it is very important to feel that the provider is backing them up and offering the best service at a competitive price.

Customer satisfaction was emphasized by all seven interviewed organizations. Service quality and satisfaction is an important aspect of the business and is influenced by innovative approaches, relational perspectives of supplier and the retention and loyalty programs. The respondents also underlined the importance of functional quality—the increased quality over time—but more importantly, the continuous development of long-term relational satisfaction. Increased satisfaction leads to superior levels of retention and loyalty and ultimately to an increased expenditure on telecommunication services. Satisfied telecom customers will tend to remain with the current provider for a longer period of time and have an increasing potential of developing new business areas with the provider.

5 Conclusions and Implications

Current paper lays out a comprehensive and solid foundation of conceptual and methodological innovative approaches and relationship orientations towards improving customer retention and loyalty, with the ultimate purpose of improving customer satisfaction and organizational performance. It can be asserted that in the current stage, there are new opportunities for long-term successful partnerships development for large telecom companies that are facing a highly competitive environment. Providers that engage in a mutual partnership with customers adopting a proactive role for value creation are enabled not only to make value propositions, as was the case in the traditional paradigm, but also to engage and direct keeping the promises that were made.

Relational interactions between service providers firms and their customers always pose a set of managerial tasks and challenges. Provider is to proactively and directly engage into value creation activities seeking to attain synergies internally (intra- and inter-departments) and externally with the partner. Integrating departments and activities will need continual adjustment, investment efforts and improvements. On this basis, a service company can develop new solutions, pricing models and ways to effectively communicate with partners on the basis on its extended service offering. Effective management of people, activities and financial resources can ensure successful implementation of relationship marketing paradigm, which can be very costly if is improperly implemented, monitored or controlled.

In regard to the proposed antecedents, relationship marketing and customer innovation, we can assert several important aspects of Romanian telecom market. First, the relational approaches in the telecom market focus on the key accounts, which are the most important segment of customers. They have the largest acquisition budgets and financial allocations and bring high revenues to the providers and thus are the most targeted segment in the whole telecom market. The importance of relationship marketing and relational approaches is underlined by the answers of the questioned sample of key accounts. They all agreed on the importance of relationships in the process of retention and building customer loyalty. Romanian telecom companies must also understand that they need to invest in creating, building and sometimes ending relationships with these accounts for a long term in order to develop high levels of loyalty and ultimately an increased profitability rate. On the other hand, the Romanian telecom sector invests in the area of product and network innovations, but lacks the innovation in terms of service offering and people management innovations. Some respondents identified the need for providers to better innovate at the organizational level and better integrate business functions, so that the customer can better benefit from this synergetic effect.

In terms of improving retention and loyalty programs and approaches, the Romanian telecommunications market suffers from the same myopia that is so evident in the global market. The main focus is on retaining customers—by creating high barriers of exiting the network and by signing contracts for longer periods of time (in many occasions over 3 years). By creating such retention programs, there is a risk that customers develop an adversity towards the existing provider and can ultimately choose to end the contractual relationship against all costs. The influence of innovation and relationship marketing can better influence the loyalty programs that have the capability to create a positive perception of customers towards existing providers. By strategically integrating innovation, relational approaches and loyalty programs, the telecommunication organizations can benefit in the long term. In the context of high competition and cost focusing, creating long-term loyalty in the key accounts segment can assure that revenue provisioning can be more accurate.

Customer satisfaction is the most important effect of loyalty. By offering a superior customer satisfaction because of a better and innovative product and associated services, by developing a series of networked relationships between different business functions of the provider and customers and by designing better loyalty and retention programs, attaining customer satisfaction is a more realistic goal. As a by-product of increased and superior customer satisfaction, the provider organization can benefit from increased revenue base and profitability.

In terms of the present research, we believe that our main goal of validating our proposed conceptual model has been achieved. Further research avenues will have to take into account other functions responsible for creating, maintaining and development of customer retention and loyalty. We believe that entrepreneurial orientation (Foltean and Feder 2009) can also offer a positive influence over customer satisfaction and loyalty. Romanian telecommunications industry with its particularities and challenges is definitely suitable to a rigorous relationship marketing approach, in the context of an emerging market.

References

Ang L, Buttle F (2006) Customer retention management processes: a quantitative study. Eur J Mark 40:83–99

Aspinall E, Nancarrow C, Stone M (2001) The meaning and measurement of customer retention. J Target Meas Anal Mark 10:79–87

Avlontis GJ, Papastathopoulou PG, Gounaris SP (2001) An empirically based typology of product innovativeness for new financial services: success and failure scenarios. J Prod Innov Manage 18(5):324–342

Berry LL, Parasuraman A (1993) Building a new academic field- the case of services marketing. J Retail 69(1):13–60

Blythe J (1999) Comportamentul consumatorului. Teora, Bucharest

Brown SW (2005) When executives speak, we should listen and act differently. J Mark 69:2–4

Bruhn M (1998) Customer orientation: the foundation of successful business. Bucharest Economic Publishing, Bucharest, pp 1–336

Capital.ro (2010) http://www.capital.ro/articol/orange-piata-telefoniei-mobile-a-scazut-anul-trecut-cu-14-134640.html

Coyles S, Gokey T (2005) Customer retention is not enough. J Consum Mark 22:101–105

De Brentani U (2001) Innovative versus incremental new business services: different keys for achieving success. J Prod Innov Manage 18(3):169–187

Drucker PF (1993) Innovation and entrepreneurship. Harper Business, New York, pp 1–254

Ekinci Y, Dawes P, Massey G (2008) An extended model of antecedents and consequences of consumer satisfaction for hospitality services. Eur J Mark 35-68

Foltean F, Feder E (2009) Market orientation and international entrepreneurship. Transformations Bus Econ 8(3):23–43

Futrell C (2010) ABCs of Relationship Selling. McGraw-Hill/Irwin, 11th edition

Fyrberg A, Jüriado R (2009) What about interaction? Networks and brands as integrators within a service-dominant logic. J Serv Manage 20(4):420–432

Gadrey J, Gallouj F, Weinstein O (1995) New modes of innovation: how services benefit industry. Int J Serv Indus Manage 6(3):4–16

Gerpott T, Rams W, Schindler A (2001) Customer retention, loyalty and satisfaction in the German mobile cellular telecommunications market. Telecommun Policy 25(4):249–269

Gronroos C (1990) Relationship approach to marketing in service contexts: the marketing and organizational behavior interface. J Bus Res 3–11

Gronroos C (1994) Quo Vadis Marketing? toward a relationship paradigm. J Mark Manag 4–20

Grönroos C (2007) Service management and marketing customer management inservice competition. Wiley, Chichester, p 275

Grönroos C (2008) Service logic revisited: Who creates value? And who co-creates? Eur Bus Rev 20(4):298–314

Grönroos C (2010) A service perspective on business relationships: the value creation, interaction and marketing interface. Ind Mark Manage 40(2):1–8

Grove JS, Fisk PR, John J (2003) The future of services marketing: forecasts from ten services experts. J Ser Marke 17(2):107–121

Gummesson E (1987) The new marketing - developing long-term interactive relationships. Long Range Plann 10–20

Gummesson E (1997) Relationship marketing as a paradigm shift: some conclusions from the 30 R approach. Manage Decisions 35(3–4):267–273

Hwang I, Chi DJ (2005) Relationships among internal marketing, employee job satisfaction and international hotel performance: an empirical study. Int J Manag

Kates B (2000) Go in depth with depth interviews; Quirks Marketing Research Review. 36–40

Kotler Ph, Keller KL (2009) Marketing management, 13th edn. Pearson Education International, New Jersey, pp 1–712

Malhotra N (2010) Marketing research, 6th edn. Prentice Hall, New Jersey, pp 382–387

O’Malley L, Tynan C (2008) Relationship marketing. In: Baker M, Hart S (ed) The marketing book, 5th edn. Elsevier, London, pp 1–799

Parasuraman A, Zeithaml VA, Berry LL (1985) A conceptual model of service quality and its implication. J Mark

Schmidt M, Hollensen S (2007) Marketing research, 1st edn. Pearson Education, NJ, p 22

Seo DB, Ranganathan C, Babad Y (2007) Two-level model of customer retention in the US mobile telecommunications service market. Telecomm Policy 32(3–4):182–196

Sheth JN, Parvatiyar A (1995) The evolution of relationship marketing. Int Bus Rev 4(4):397–418

Sheth JN, Parvatiyar A (2002) Evolving Relationship marketing into a discipline. J Relat Mark 1(1):3–16

Soderlung M (1998) Customer satisfaction and its consequences on customer behaviour revisited: the impact of different levels of satisfaction on word-of-mouth, feedback to the supplier and loyalty. Int J Serv Ind Manag 169–188

Weinstein A (2006) Customer retention: a usage segmentation and customer value approach. J Target Meas Anal Mark 10:259–268

Wu L (2011) Satisfaction, inertia and customer loyalty in the varying levels of the zone of tolerance and alternative attractiveness. J Serv Mark 310–322

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2013 Springer Science+Business Media New York

About this chapter

Cite this chapter

Hnatiuc, C., Mihoc, F. (2013). Antecedents and Consequences of Customer Retention and Loyalty Orientation in Romanian Telecommunications Market. In: Thomas, A., Pop, N., Bratianu, C. (eds) The Changing Business Landscape of Romania. Springer, New York, NY. https://doi.org/10.1007/978-1-4614-6865-3_16

Download citation

DOI: https://doi.org/10.1007/978-1-4614-6865-3_16

Published:

Publisher Name: Springer, New York, NY

Print ISBN: 978-1-4614-6864-6

Online ISBN: 978-1-4614-6865-3

eBook Packages: Business and EconomicsEconomics and Finance (R0)