Abstract

Food and agriculture is an industrial sector with complex supply chains and electronically aided information and logistics systems. The center of decision-making has shifted from farmers to processors to retailers as mega-sized supermarkets introduced price competition and drove down the price local and global suppliers could charge. Economies of scale necessitated technical and dynamic efficiencies through horizontal mergers and acquisitions and vertical coordination all along the supply chain.

Vastly heterogeneous consumers present food preferences that not only vary by culture, income, and taste, but by social responsibility mores. Positioning food and health as a single thought changes the priorities for food choice.

Altogether, the food system is a web of international laboratories, producers, processors, logistics companies, retailers, cooks, and consumers. Government oversight of its safety practices, trade agreements, information and advertising, competitiveness, and sustainability comprises another vast web, one of state and federal agencies, inspectors, and activities. Public policy serves to promote a healthy agricultural sector and a healthy population through food security programs and economic safety nets.

Access provided by Autonomous University of Puebla. Download chapter PDF

Similar content being viewed by others

Keywords

These keywords were added by machine and not by the authors. This process is experimental and the keywords may be updated as the learning algorithm improves.

Introduction

Providing for the health and welfare of its population with abundant, safe, and affordable food has long been the goal of the food and agricultural system in the United States. Corresponding goals are ensuring that farmers receive an income sufficient to encourage adequate production and support economically viable rural communities. The food system is a combination of private enterprises—from farm input suppliers, through food processing and retailing companies, on to consumers—and public policies that monitor and incentivize production. Public policies reward farmers with support prices, guaranteed markets, crop insurance, export markets, and protective regulations. The system includes infrastructure for energy, communication, price information, market coordination, financing opportunities, and tax benefits. Transportation of large-scale crop and livestock production to distant markets depends on publically provided air, sea, river, and land transportation. Barges and railroads played a key role in the development of large-scale farming. Technology and innovation that enabled the move from agrarian to commercial agriculture came primarily from public investment in basic and applied research until about the mid-1990s when much of the innovative research shifted to private laboratories. The food and agricultural system also delivered relatively safe food due to credible regulations by USDA (meat, poultry, and processed eggs) and FDA (all other food). The development of national and international food brands also contributed greatly to food safety, since large companies work hard to prevent any food safety scandal that would diminish the value of their brand. Food safety is, however, an ongoing challenge with new processes and products, increased imports, globally sourced ingredients, multiple types of final products and retail outlets. In the last century public education about food preservation, cooking skills, nutrition, and healthy eating proliferated in public schools and youth programs such a 4-H. These efforts helped ensure that consumers benefit from this elaborate and technically efficient production system; in turn they would demand and utilize the food produced, encouraging the development of commercial agriculture. Thus, the full supply chain of food production, processing, marketing, and utilization developed to ensure the nutritional health and productivity of the population as well as the health of agricultural industries and rural communities.

Government programs and regulations almost always lag behind technology and private market innovation in the real world but in agriculture, there has been a close coordination between government support and the success of the sector. Realizing large economies of scale that were encouraged by government price supports, protective tariffs and quotas, coordinated markets (marketing orders, cooperatives), and technical innovation, the cost of producing food declined throughout the twentieth century and farmers soon produced more than adequate food for the US population. In fact, the portion of consumers’ incomes spent on food declined steadily leveling out at about 12–13% in the 2000s. Surplus food was used in government food distribution programs for the poor, for school lunch/breakfast programs, and to improve the US trade balance with a steady stream of commodity exports.

Some argue that the largess of the food and agricultural programs led to an over abundance of food at prices so low that we have ended up with an unhealthy, obese population. Others argue that government support of basic crops and livestock at the expense of fruits and vegetables has skewed agricultural output towards food high in carbohydrates and fat and relatively low in other essential nutrients. Although this may be a contributing factor in people’s health, food processors and manufacturers can take a lot of credit for adding variety, texture, and flavor to basic foods and delivering them in convenient and affordable forms such that overeating is hard to resist.

As consumers’ need for basic nutrition and desire for convenience and flavor is met, they upgrade their preferences to include variety, prestige, and sensitivity to social and environmental causes, promoting health and vigor and preventing disease. This leads to a plethora of subindustry sectors with everyone in the food supply chain trying to meet heterogeneous consumer demands. Since price remains important, meeting these diverse demands in a cost-effective way remains a priority. Consumers want it all and the food systems, led by retailers, compete fiercely to deliver at the lowest possible cost.

The first part of this chapter defines the food system as it has developed in the United States and globally, illustrating the trends in production, distribution, and consumption by types of food, sources, and market shares. The supply chain for various foods determines the efficiency with which food is delivered to consumers. Government support and regulations determine, in large part, the size of each channel and its value to producers and consumers. Part two of this chapter explores changes in consumer preferences across income categories and how they determine the direction agricultural producers and food processors take.

Food Supply Chain: Who’s in Control?

In the 1910, 1920, and1930s, the farm sector dominated the decisions about what was produced. It was also the focus of public policy, which was aimed at incentivizing agricultural production and providing food security for the nation. The Agricultural Adjustment Act of 1933 provided financial support for farmers so they could purchase the needed inputs and “to protect the consumers’ interest by readjusting farm production at such level as will not increase the percentage of the consumers’ retail expenditures for agricultural commodities, or products derived there from…,” (National Agricultural Law Center 2009). The path of food between farm and fork was largely taken for granted and in many circles there is still astonishing little appreciation or knowledge of the many processes and logistic steps involved in moving food to final consumption. By the middle of the twentieth century food processors (manufacturers) exerted a strong influence over the food supply chain as they began to process commodities, create food products for the mass market, and introduce commercial convenience into the supply chain. National and international brands such as General Mills, Kraft, Nestlé, and Sunkist became trusted partners in feeding families. Their need for consistent and reliable quality and quantity ingredients introduced a new model of contract farming and enhanced the returns to larger, well-managed farming operations. As food processing began to concentrate regionally (e.g., flour milling in the Midwest) and firms grew in size, they needed help to distribute products across the nation. With the development of interstate highways and nationwide markets in the 1960s, wholesalers became prominent players in the food supply chain. They are the link between grower shippers (in the case of fresh produce), other first line handlers, food manufacturers, and the retail sector. Initially, they provided the capital for inventory in the system. They acted as the brokers connecting food from a growing number of food manufacturers to a growing number of grocery stores and foodservice places. Simultaneously, some large regional retail food companies such as A&P and Kroger developed their own distribution centers bypassing the full line wholesalers. They were the technical and logistics forerunners of the very large self-distributing supermarkets and super stores such as Wal-Mart.

The food industry was a leader in developing the now ubiquitous Uniform Product Codes (bar codes) and in the development of electronic data interchange (EDI) in 1972. Although the bar code, along with scanners and computers, led to giant leaps in technical efficiency and inventory management, many retail food stores did not adopt the scanning technology until well into the 1990s and most retail food stores did not exploit the power of the data they were collecting. Capturing detailed data on customer purchases in real time, coordinating inventory orders with venders, and implementing customer loyalty programs came much later. In a 2003 survey of US retail food stores, 85% of the largest supermarkets (in chains with more than 750 stores) were using customer loyalty programs, but less than one quarter of other retail food stores were so engaged (Kinsey et al. 2003). In a 2007 survey of retail food stores between 34 and 48% of stores in chains with more than ten stores reported using vendor-managed inventory; only 43% of the largest supermarkets reported using scanner data for automatic inventory refill (Chung et al. 2010).

In the middle 1980s Wal-Mart demonstrated the ability to reduce the inventory held in their general merchandise stores by building massive computerized databases (based on EDI sales data), analyzing sales by categories and items, building their own proprietary warehouses (called distribution centers) and taking deliveries from manufacturers only in the amounts needed for the next few days or weeks. They were able to cut operating costs below other retailers. Traditional food retailers sought to blunt the advances of Wal-Mart into the food business by collaborating through the Food Marketing Institute in 1992 to develop an upgraded electronic system dubbed “Efficient Consumer Response (ECR)” (Food Marketing Institute 1995). Working perfectly, it would mimic the “just-in-time” inventory management system instituted by the automobile industry. It never achieved that goal, but it did bring the retail food companies into the new age of information rich, computerized decision-making and ordering. ECR was soon replaced by a new slogan—Cooperative Planning, Forecasting and Replenishment (CPFR)—but the goal was the same. It was the dawning of the age of dynamic efficiency in the food supply chain and the rise of powerful retailers. By the mid-1990s, retailers with information age technologies became the dominant parties in the food supply chain. Superior information about consumer sales gave them new buying power that rewarded large-scale operations, enabled them to determine what inventory they needed on a flow basis, and kept store inventories as lean as possible. Pushing inventory back up the supply chain became a strategy for lowering costs and for controlling turnover of products on the shelves. Tracking consumer purchases and responding by demanding the best selling products from all food suppliers put retailers in the position of the gatekeeper of the food supply chain by the turn of the twenty-first century. The largest chains could well hold monopsony power; they compete fiercely with each other on retail price at the local level and bargain hard with global suppliers for the lowest cost product. By 2002 the top ten supermarket chains with 13,912 stores (6%) had 50% of all retail food store sales totaling $570 billion (Supermarket News 2003). In 2010, twenty buyers are estimated to control roughly two thirds of the value of groceries sold nationally (Cook 2011).

Regardless of the type of food or the production practices used (organic, genetically modified crops, commercial), or the position of the food business in the supply chain, there is a consistent trend towards bigger companies and larger market share. This trend is consistent with technical and dynamic efficiency even though a counter trend towards small, local production has received considerable attention. Small production units serve local and unique customers quite well but cannot realize the economies of scale that large units enjoy and often become hobbies or niche operations. Many eventually merge with larger companies or go out of business; they are rarely economically sustainable.

Food System from Laboratory to Consumption

The US food and fiber sector comprised 4.8% of the Gross Domestic Product (GDP), 18% of the employment, 4% of imported goods, and 11% of exports in 2011 (USDA ERS 2011a). The food industry is integral to national security as well as essential for the health and welfare of the nation’s people. The scope of the food industry stretches from scientific laboratories in universities, life science companies, and government agencies, through small and large producers, a labyrinth of commodity markets, packers, shippers, processors, manufacturers and distributors, and on to more than 225,000 retail food stores and 960,000 foodservice establishments. The food industry must be considered as a whole system from the science of breeding and genetics to the consuming of food. Unlike most industrialized goods, food can be handled or consumed by the final consumer in various states of processing from seeds to ripe fruit, from raw to cooked, from fresh and natural to preserved and manufactured, from local gardens to foreign imports. Figure 2.1 illustrates the complexity and size of the food system as it integrates with the world market. Each major sector of the supply chain of the food industry is presented, herein, in terms of its contribution to the national economy.

Retail

Retail sales revenue in the food industry was over $1.2 trillion a year in 2010, more than 24% of all US retail sales, making it the largest of any retail sector including automobiles. Food expenditures for food-at-home in retail food stores are higher than in foodservice establishments ($625.3 B. vs. $544.4 B. in 2010). Sales have been growing faster in the foodservice sector. The share of consumers’ food dollar spent in foodservice establishments wavers between 43 and 49%. Consumers in the United States spend about 6% of their disposable income on food in a retail food store and 12–14% on food overall, less than in any other country in the world (USDA ERS 2010a). Data from the Bureau of Labor Statistics indicates that households spend 5% of their total expenditures on food away from home and 8% on food at home (purchased in a grocery store of some type) (U.S. Dept. Labor 2011).

There are more than 210,000 traditional and nontraditional food retailers including supercenters. There are another 22,000 nontraditional retail food stores including convenience stores. Together they employ 2.8 million people, almost 2% of all employment (in 2010) (U.S. Dept. Labor 2010). Traditional retail food stores and supercenters capture 90% of the sales. General merchandise discounters entered the retail food business in order to bring more customers into their stores more frequently even though the profit margins on food are only 1–2%—much lower than on general merchandise. Consumers shop for groceries 1.7 times per week on average and go to general merchandise stores only once every 2 weeks (Food Mktg Inst 2010). Sales in non-traditional retail food stores are also increasing faster than in traditional supermarkets. Non-traditional stores are those that focus on specific target markets such as those with organic foods, limited assortments of private label products, or require membership. Traditional supermarkets with undifferentiated products and services have high costs and are struggling to survive the competition from big-box stores who do not necessarily depend on food sales to drive their profits. Competition also comes from other types of retailers: restaurants with drive-up/pick-up windows, farmers-markets, drug stores, and online shopping.

Retail food stores have traditionally operated on high volume sales of undifferentiated products, selling mostly national brands of food and consumer packaged goods, items that can be purchased in almost every grocery store. Their core competency has been selling high volumes of low margin goods at competitive prices. At least it was, until Wal-Mart undercut almost everyone’s ability to compete on price. Wal-Mart was able to do this with a business model where low or no margin food was sold in the same stores with high margin general merchandise. In addition, they could use their buying power to bargain hard with their vendors to supply them with the fastest selling varieties and sizes at predetermined times, locations, quantities, and cost. Wal-Mart’s economies of scale swamped the competition and allowed them to sell food products at about a 15% lower price than other retail food stores. Now, the retail food store business is about competing with some differentiating feature whether it is a unique store label, a special service, or exquisitely prepared deli food.

On the foodservice side there are over 960,000 restaurants and commercial foodservice places (hospitals, prisons, schools, caterers, etc.). Eating and drinking places (commercial bars, full-service and fast food restaurants) garner about 77% of all foodservice sales. The rest of the commercial foodservice industry is comprised of lodging places with eating facilities and a variety of managed services such as those for airlines, colleges, and hospitals. In addition, there are noncommercial foodservice businesses that include public schools and colleges, hospitals, nursing homes, and the military. The $544 billion sales in 2010 made up 4% of the US GDP. Foodservice is a labor-intensive industry with 9.3 million foodservice employees—6% of the total US workforce—the largest US employer outside of the government (U.S. Dept. of Labor 2010). The fastest growing segments of foodservice are coffee bars and casual dining or limited service places.

More than 40% of food expenditures for takeout food are spent at limited service restaurants. Another 40% is divided among carryout places (15%), full service restaurants (11%) and food delivery (14%). Grocery stores capture another 6% of this takeout market (Mills 1998). The rapid rise in takeout food from restaurants and delis of all types indicate a dramatic trend in the lifestyle and preferences of consumers.

Wholesale/Distribution

Following the supply chain back to primary producers the wholesale food and distribution sector come next. Brokers, traditional wholesalers, self-distributing retailers, and logistics companies occupy this sector employing about 942,000 people in 2010, 0.7% of all employment (see Fig. 2.2). There are two distinct channels of wholesale food distribution, one for retail food stores and the other for foodservice; they are developing in opposite directions. On the retail food store side, the third-party full-line wholesalers are diminishing, as the larger retail food chains become “self-distributing chains” following the early model of A&P and competition from Wal-Mart. When a retail chain owns its own distribution center (DC) that distributor aggregates orders across all their own stores and buys directly from food processors often on prearranged contracts. Self-distributing chains also contract with third-party logistics companies who take no ownership of product but locate (called sourcing), pick up, and deliver product that match specified standards. There it is resorted, stored for as short a time as possible, sometimes cross-docked and hauled to individual stores, eliminating the need for a third-party wholesaler. The remaining wholesalers are serving a smaller number of smaller retail food chains and independents (those with ten or fewer stores) and are largely regional businesses. At least 50% of product movement is through self-distributing centers; Wal-Mart alone sells roughly 30% of all products that move through food and general merchandise stores in the US. Manufacturers deliver about one-third of food products directly to stores. This is called direct store delivery (DSD) and is used primarily by beverage and salty snack companies.

While third-party wholesalers in the retail food distribution channel are struggling, parallel operations in the foodservice channel, called “broadliners,” are growing. They have more than 50% of the food and sundry delivery business to foodservice establishments while the system distributors (analogous to the self-distributing retail chains) have only 12% and specialty distributors with bakery, meats, and fresh produce deliver the remaining 32%. Different trends in the distribution sectors of the food supply chain can be attributed to the nature of the retail customers they serve. Food delivered to a retail store reflects the fact that it will be resold in small units: a few cans, a few ounces, or a few boxes each. The food delivered to a foodservice establishment is delivered in large containers ready to be used in cooking large volumes of food by the immediate purchaser.

In the restaurant business, every final consumer has an individual order; food service is all about tailoring each customer’s order, providing innovative variety, memorable experiences, and individual attention. Seventy percent of the eating and drinking places are single-unit (independent) operators. They need third-party, full-service “broadliners” or specialty distributers to supply their needs for food as well as utensils and dinnerware. Most do not have the scale of operation to establish an exclusive distribution channel with food vendors. The exceptions are the quick service (fast food) restaurants, where consistent quality of food is a virtue and system distributors dominate. The large chain (mostly quick service) restaurants develop dedicated suppliers known as system distributors. These are analogous to the self-distributing supermarket chains that buy directly from a food (ingredient) provider who arranges for delivery.

One of the challenges in the distribution of food is the speed necessary to deliver fresh product. Other challenges are the maintenance of sanitation, food safety, and the proper temperature of various food products. Food safety is paramount in this business and maintaining a proper “cold-chain” is essential to both the quality and safety of food products. This means that food distribution centers and transportation vehicles have up to four temperature zones: ambient, chilled down to 50° Fahrenheit, refrigerated, and frozen. These special handling requirements put special demands and liabilities on the logistics companies and their employees.

Food Manufacturing and Processing

Next in the food supply chain are some 30,000 processing and manufacturing sites in the United States and at least another 94,000 foreign sites. These are the plants that take raw ingredients like potatoes or chickens and make potato chips, chicken nuggets, and chicken noodle soup. In 2009 the value of shipments from all food manufacturing facilities was $628.5 billion, about 14% of all US manufacturing sales. They employed 1.3 million people, about 13% of all manufacturing employment (U.S. Dept. of Labor 2010; U.S. Census Bureau 2012).

Issues for this sector of the food industry are the rise in private label products and growing consumer preferences for fresh and natural/organic products. Historically, this sector was dominated by national and international brands. Private labels now make up more than 19% of sales and 23% of unit volume sold in retail food stores (The Food Institute Report 2011). This is up from less than 10% at the turn of the twenty-first century. Mergers of retail food chains and the development of the self-distributing retail chains with significant buying power forced many a food manufacturer to produce and package food under private label brands alongside their own brand. Concentration was enhanced in this segment of the supply chain as large retailers demanded special attention, dedicated supplier relationships, vendor logistics plans, and cost reduction (USDA ERS 2010d). Economies of scale grew throughout the food system as competition forced costs down.

Major food manufactures participate in the growing demand for organic foods. They have created packaged food products from organically grown ingredients and/or have purchased smaller start-up organic food companies. Examples are General Mills purchasing Cascadian Farms and Groupe Danone purchasing Stony Brook Farms. This has enabled organic foods to penetrate a large share of the market, but it has also produced a backlash among organic food aficionados who deem this to be an industrialization of organic food and counter to the values and purposes of the organic food movement. The newest wave of demands is for “natural food” and “locally grown” food or food that has not traveled too many miles between the primary production site and the consumer. This concern is discussed in terms of “food miles” or the “carbon footprint.” The later is partially a response to global warming and calls for reduction in carbon output. It is partially a reaction against global food sourcing and a desire to have more control over, and knowledge of, the food we eat. It is, however, a source of concern for food manufacturers as processed food is sometimes demonized for its alleged effects on health by delivering excess sodium, sugar, calories, allergens, and misunderstood chemicals.

The enduring value of food processing and manufacturing is still, and will remain, the preservation of food for its safe and economical storage, transport, and convenience. These continuing virtues of food manufacturing guarantee the importance of this segment of the food supply chain even though it has many challenges related to shifting consumer preferences and increased concerns about the healthiness of processed food, particularly about foods that bear little resemblance to their original form. In their success at creating foods that have extremely long shelf lives, which are convenient to store and use and are inexpensive, food manufactures have become vulnerable to criticism for selling “artificial food.” This has led to a serious examination of the composition of many processed foods, and changes, where feasible, by the food manufacturers themselves. This reconfiguration of ingredients and processes for some foods will disrupt efficient systems and lead to some higher prices, but it is what many consumers and public health advocates are demanding with an implicit willingness to pay for “better” food. This is, in effect, an internalization of some externalities and driving the marginal product costs and marginal social costs closer together. It should lead to better allocative efficiency in the food system.

Farms

Ninety-eight percent of the 2.1 million farms in the United States are family owned. The definition of a farm is any place that sells at least $1,000 of farm products a year. There are five categories of farms distinguished by their level of sales and contribution to total output. First, small farms with sales of less than $250,000 per year are divided into two categories: (1) those where the owners consider farming to be their primary occupation and (2) residential farms, where owners’ primary occupation is off-farm. Residential farms, sometimes called hobby farms, make up 45% of all farms but contribute only 4% of the total output. Small commercial farms, where the occupants consider farming to be their primary occupation make up 25% of all farms and contribute 11% of the output. Second is the large, commercial, family owned farms selling more than $250,000 a year in farm products. They make up only 9% of the number of farms but contribute 66% of total output. The remaining 2% of farms are owned by corporations, which can also be families, or cooperatives. This 2% of farms produce 18% of US agricultural output (USDA ERS 2010c). Though the total number of farms declined dramatically in the last century, the total acres in farm production grew and then declined. For a number of reasons including urbanization, farmed acres declined about 20% since 1945 (Dimitri and Effland 2005). The importance of the farming sector to the food industry is clearly not measured by the less than 2% of US employment or the less than 1% contribution to GDP. Farms are the foundation of the rest of the food economy and they are the basis for a nation of healthy, well-fed people. Farming is one business that no nation will go without; all people have to eat and every nation strives to be able to feed its own people. Farm production, therefore, is supported heavily by government subsidies. Sixty-two percent of government payments of about $27 billion in 2009 went to the 12% of the largest farms measured by gross receipts (USDA ERS 2011b).

The Volume of Food

The quantity of food produced and sold through the US food system is illustrated in Fig. 2.3. The flow of food commodities to export, animal feed, and food processors illustrates the magnitude of food and its complex paths to our tables. The figures are approximated using USDA, ERS food availability data (USDA ERS 2011). All quantities are converted to billions of pounds. The first observation is that about one-third of the 1,259.3 billion pounds of crop production is used for animal feed which leads to 152 billion pounds of animal products being produced for human consumption. Eighteen percent of crops are exported as bulk commodities. This export market has been a source of economic growth and stability for the country and the producers. The technically efficient commodity production and distribution system is facilitated by several public policies including foreign trade agreements, foreign aid, and government support prices and crop insurance that yield competitive prices on the world market. When the food demand for these commodities was not sufficient to justify their production, the federal government purchased them and stored them for future use. Some grains are deliberately stockpiled for future food security.

The other half of the crop production is destined for food processing and manufacturing. Of the various groups of commodities only the fruits and vegetables have significant portions consumed raw (fresh/natural) and even they are subjected to washing, sorting, waxing, storing, and transportation through the commercial supply chain. An increasing portion of food and agricultural exports are processed, high value products. Food imports are increasingly important for year around consumption of fresh fruits and vegetables. The NAFTA trade agreement enhanced our ability to import fruits and vegetables from Mexico and South America. Year around access to tropical and other fruits and vegetables is now common in US supermarkets.

It is often exclaimed that we lose 30–50% of the food produced along the supply chain, somewhere between field and fork. This seems like a big number and an incredible waste. However, of interest on Fig. 2.3 is the fact that the 664.1 billion pounds of beverages and edible food is 65% of the total crop production minus bulk exports (1028.7 billion pounds). This implies a 1/3 loss between production and retail, ignoring imports and exports. Some of this loss is due to field trimming and storing. Other loses come in manufacturing as raw animal products are trimmed of fat and bone, hides, hair, and internal organs and raw plants are peeled, cooked, dried, and stored. Inevitably, spoilage occurs, especially in the transport and storage of raw products (Buzby et al. 2009; Kantor et al. 1997). Without the advanced methods of harvesting and storage and transportation available in the United States this loss would be even greater as is witnessed in many developing countries. Other losses occur after the retailer or restaurateur sells the food. In restaurants and catering operations public health laws demand that any uneaten food not be re-cycled to other human beings. In homes, consumers often throw out a portion of the food they buy because it spoils before they cook it or they just don’t like it. This post retail loss has also been estimated to be at least 30% (Kantor et al. 1997).

Animal Products

Notwithstanding the growing popularity of being a vegetarian, only 2% of the more than 10,000 respondents to a US diet and health survey reported being a vegetarian in 2008 (Center for Disease Control 2008). Animal products are prized for their taste and nutritional value, especially the complete proteins they supply to the diet. They have provided a substantial part of the US diet for decades and an increasing portion of diets in emerging economies. US households spend almost 23% of their food-at-home budget on animal products including 7% on dairy (Blisard et al. 2003). The meat and seafood departments were rated the highest for increased traffic and sales in 2011 by industry surveys reported in Progressive Grocer (2011). Over half of the agricultural cash receipts in the United States are in the livestock and poultry sector, often exceeding $100 billion per year (USDA ERS 2009). The livestock sector contributes 45% of the total value added to the economy by all the crop and livestock production (USDA ERS 2011a). Trade in this sector, excluding fish and seafood, accounts for 11% of agricultural exports and 4% of agricultural imports (USDA ERS 2011a). Sixteen percent of the value and 75% of the volume of fish and seafood in the United States are imported, primarily from Canada followed by China, Thailand, and Chile (Jerardo 2008). The value of these imports increased 60% between 1998 and 2007 (Brooks et al. 2009).

The highest recorded per capita availability (consumption) of red meat was in 1971 when each American had 136.1 pounds of red meat available and 181.5 pounds of red meat, plus poultry plus fish and seafood. By 2009 total per capita availability of these sources of protein was 190.9 pounds, 5% greater that 1971 with the per capita availability of red meat down 22%, poultry up 104%, and fish and seafood up 37% (USAD ERS 2011). The fall in red meat consumption has been attributed to numerous health warnings tying red meat consumption to heart disease, obesity, and cancer and to price increases relative to poultry.

Major changes in this sector include consolidation in response to economies of scale that comes with new technology, vertical integration, downstream contracts, and feedback from consumers and retailers. Buhr and Ginn (2011) report that 85% of hogs and 57% of cattle are purchased on some sort of forward contract. In addition to allowing producers to reduce price risk, contracts with food manufacturers and large retailers facilitate information about changing consumer preferences. An increasing demand for social responsibility on the part of food firms includes concerns for animal welfare, excessive use of antibiotics, environmental pollution, and food safety. Larger retailers such as McDonald’s and Wal-Mart enforce social responsibility and food quality and safety standards with their suppliers. For example, McDonald’s reports that 60% of their global suppliers comply with their antibiotics policy (Buhr et al. 2011). McDonald’s says it purchases 1% of the pork produced in the United States and they, along with other foodservice companies such as Burger King and Chipotle Mexican Grill, are asking suppliers to stop using small gestation stalls for hogs and adopt sustainable animal welfare practices (Tomson and Jargon 2012). Given the large volume of product large retailers purchase, they act as gatekeepers representing consumer interests. This encourages suppliers to consolidate to achieve the economies of scale needed to meet these demands.

Technology developments in packaging and processing methods led to a major shift in the meat supply chain. “Boxed beef” which is case-ready meat products prepared at the packing plant, rather than at the retail store, led to efficiencies in distribution and wholesaling, greater food safety, and lower retail costs. It was a signature breakthrough in this industry negating most retail butcher operations and developing dedicated supply chains for specific retailers.

Other technological advances include genomics and genetic markers that allow animals and meat products to be traced from retailers back to the producing farm and even to a specific animal. This has allowed food safety incidents to be traced to their source and identified in order to help prevent the spread of disease.

Ward (2010) writes “one of the driving forces in market structure was the need to be a low-cost slaughterer and processor.” Although the meat industry is not particularly concentrated by industrial standards, considerable concentration has taken place in the processing sector. Buhr and Ginn (2011) provide an instructive graph (Fig. 2.4) representing a simplified supply chain with the level of concentration of various sectors of the meat industry using the Herfindahl–Hirschman Indexes (HHI). The HHI is defined as the sum of the squared market shares of the top four firms in the sector where a score of less than 1,000 is considered to represent “unconcentrated firms.” By this measure, only the crop genetics sector is highly concentrated, with meat packing and retailing reaching up into the moderately concentrated range.

Fruits and Vegetables

Fresh fruits and vegetable consumption soared with the advent of numerous health messages about the healthfulness of these foods relative to meats, fats and oil, refined grains, and processed foods in general. Table 2.1 shows that the per capita availability (consumption) of fresh fruits increased 11.5% and fresh vegetables increased 8.6%, while processed fruits and vegetables declined 10.3 and 9.2% per capita respectively between 1990 and 2009. Adjusting for the increase in the population, fresh fruits and vegetable available on the market increased 35 and 29% respectively. Households spend about 11% of their retail food dollar on fruits and vegetables (Blisard et al. 2003). The fresh produce department was rated the second highest for increased traffic and sales in 2011 by industry surveys reported in Progressive Grocer (2011).

Rising incomes and international trade agreements such as NAFTA have also supported an increase in fresh fruit and vegetable consumption. It is consistent with the trend toward organic food and local food, even though these products command less than 5% of market sales. Fresh fruits and vegetables are being demanded for healthy school lunches. They became available to users of food stamps at Farmer’s Markets and to recipients of federal food aid via the Women, Infants and Children Program (WIC) over the past 5 years. Fresh produce is the leading edge of food trends for healthy and prestigious diets.

All is not perfect, however, in the fresh produce market. Incidents of microbial contamination in products like cantaloupe, spinach, and sprouts continue to remind us that, because it is fresh, there is no “kill step” for contaminants and that sometimes even washing is not enough to make them safe. Fresh produce is perishable. It needs extra care in handling and transport to ensure it is clean, safe, and chilled to a proper storage temperature throughout the supply chain. Shipping is also specialized by types of products so that fruits producing ethylene (tomatoes, avocados, bananas) do not damage leafy greens and those requiring temperatures above 50° Fahrenheit (bananas) are not damaged in a colder environment (Cook 2011).

Food retailers and foodservice channels demand consistently large volumes of high quality fresh produce; it is often a point of differentiation for retail stores seeking customers who demand the best fresh produce. Defying the natural seasonality of fresh fruits and vegetables, consumers and retailers demand year around supply of the full range of known produce. This has led to contracts with “preferred suppliers” and to consolidation among grower-shippers who are the gatekeepers for their retail customers. Grower-shippers monitor the product quality and safety, traceability mechanisms, Good Agricultural Practices (GAP), and environmental responsibility at this first-handler stage of the supply chain. They procure produce locally and internationally as the season and market demands. There were 3,214 total shippers in the United States in 2011 (Cook 2011). They tend not to be publically traded companies and operate regionally, specializing in particular types of produce. Multinationals specializing in bananas such as Dole are the exceptions.

The value added to the US economy by the fruit and vegetable sector was $56.6 billion in 2010; one third of the value of all crop production and 18% of the total value added by crops and livestock. Fruits and vegetables, including juices and processed product, comprised 13% of the value of agricultural exports and 23% of the imports in 2011. By volume, 32% of fruits and nuts and 8% of vegetables were imported between 2000 and 2005 (Jerardo 2008). Major export partners are Canada and Mexico; Mexico supplies about two-thirds of imported fresh vegetables and two-thirds of the value of imported fresh fruit followed by Chile at 26% (Cook 2011; Brooks et al. 2009).

Government policies have not provided direct price supports to growers of fruits and vegetables, but there is a long-standing practice of state and/or federal “marketing orders.” Marketing orders are legal instruments authorized by the US Congress through the Agricultural Marketing Agreement Act of 1937. They function like a legalized cartel of producers and shippers of like products, such as pears or almonds. The members contribute self-assessed funds to administer the marketing order and agree to abide by decisions taken each year that will control the size, quality, and quantity of produce that can be offered for sale in the upcoming season. The end game is to manage the volatility of the market and growers’ income by controlling the supply and keeping the price sufficiently high to reward growers and keep them in the business. Some of these marketing orders have close relationships with nonprofit cooperative companies. Sunkist is the largest marketing cooperative in the fruit and vegetable industry; they control a large portion of the market for citrus fruit in the United States having started as the California Fruit Grower Exchange in 1893 and taking the Sunkist name in 1908 (Sunkist 2012). Paggi and Nicholson (Chap. 6) provide much more detail on marketing orders and their role in the food industry.

Since many fruits are perennial crops, marketing orders help to smooth out incomes in times of bad weather or blight. They may also hold the price of fresh produce higher than would otherwise be the case and are at least partially responsible for the high cost of fresh produce relative to most other foods. Marketing orders also fund research and development leading to new varieties and innovations in harvesting, storage and technology as well as generic advertising for their commodity—the most famous of which is the dairy industry’s “Got Milk” campaign.

Innovation in genomics of fruits and vegetables raises the promise of producing disease prevention or even cures. This will depend on consumers’ acceptance of genetically modified fruits and vegetables and a proven efficacy of the alleged medical benefits. Such futuristic innovations could turn already healthy and delicious foods into super-foods for health and strength.

Trends in Food Availability

About one-third of the volume of the available, edible foods and beverages and 47% of the retail sales are through the food-away-from-home channel. Two-thirds of the volume and 53% of the sales go through the food-at-home channel. Table 2.1 presents the per capita pounds of food available for US consumers in 2009 and the change in that figure since 1990. This has often been referred to as per capita consumption, but it is more truly the amount of food available at the retail juncture of the food supply chain. Consistent with the discussion above, it has historically been known that this per capita (consumption) availability number is roughly 30% more than the food reportedly consumed in individual food consumption survey data.

The last column on Table 2.1 illustrates the percentage change in the amount of food on the market in 2009 vs. 1990. Since the population grew by 307.4 million people or 23% over that time the amount of edible food would also be expected to grow by 23% if the per capita availability were distributed the same in both years. However, a change in food production, imports, exports, and consumer demand over the years leads to a different mix of food being available. Nine of the categories increased less than the change in the population, consistent with declines in the per capita availability. Only one category—oats—declined overall. The lesson from this table is that one cannot infer the percentage change in the edible food market from the per capita data. The three largest decreases in per capita availability are in alcoholic beverages, milk and dairy products, and processed fruits. The largest increases are in fresh fruit, poultry, and vegetable fats—especially olive and canola oils. In the market, the largest increases are in rice, barley, tree nuts, and animal fat.

As consumers’ preferences change over time, they signal food retailers who signal food manufacturers and ultimately producers about how much of which foods they will purchase. The market works through the exchange of information to allocate resources to the right foods—eventually. The next section explores how changes in consumer expectations help to drive changes in the food system.

Trends in Consumer Expectations Drive Food Production

Evolving consumer preferences and public policy, which adjusts to these changes, combine to drive expectations of the food production and marketing system.

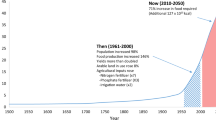

Sustainable Consumer Preferences

Consumer preferences and expectations for food types and quality evolve as consumers, individually or as a society, experience improved nutrition, good tasting food, and acquire resources to explore additional food amenities. This progression in food preferences follows a pattern similar to Maslow’s Hierarchy of psychological needs (Maslow 1943). As illustrated in Fig. 2.5 the base of the food hierarchy represents the daily necessities of life. The needs are for basic nutrition (starches, sugars, fats, protein, water) that is safe, life sustaining, and readily available. In the United States, availability is mostly a function of convenience and affordability, although about 4% of people are estimated to live in a “food dessert,” with over 80% of them in rural areas (Ver Ploeg and Williams 2011).

Convenience

The preference for convenience permeates food choices at all levels of the pyramid and cuts across all cultures. Faced with immediate hunger, time pressed schedules, and limited cooking facilities or skill, convenience trumps all. The quest for convenience has led to the development and acceptance of “fast food” and quick service restaurants. Processed food is shelf stable and convenient for long distance transportation, long-term storage for home, office and restaurant consumption, to say nothing of the needs of the military, outer-space travel and disaster emergency supplies. Consumers have largely outsourced the tasks of food preparation to major food manufacturers or restaurants. Half of all restaurant food is taken-out (The Food Institute Report 2006). Twelve percent of casual dining restaurants and 70% of McDonald’s business is takeout food (The Food Institute, Report 2007a, b). Food retailer, Safeway, reported that 8% of its sales were for precooked meals in 2006 (The Food Institute 2006). Clearly many are asking someone else to cook their food and are relying on its safety and integrity. Meeting the desire for convenience has led to the ubiquitous presence of food for sale in all types of stores and public places, and to eating while meeting, talking, and walking—a characteristic American habit. Eating is often one of several activities coupled with working, watching TV, and interacting with the Internet, e-mail, or telephones. It has allegedly led to the demise of the “family meal” where everyone in a household shares a meal together and eats the same type of food, on a regular basis. A study by the Hartman Group (2011) found that consumers prefer to eat in front of the computer, TV, or video game than at the dining room table. Still, about half of people and families report eating dinner at home almost every evening.

Safety

We have come to take for granted that food is, by definition, safe. That is, it does not make us ill in the short run or the long run. The Center for Disease Control’s (CDC) FoodNet is a system whereby state health departments’ laboratories report incidents to a central location. It tracks short run illnesses caused by food borne microbiological contamination. Although new estimates show a decrease in the number of foodborne illnesses (to 48 million ill people and 3,000 deaths per year), with vigorous reporting of foodborne illness outbreaks, the public becomes aware of these events in real time (Center for Disease Control 2011).

Media coverage of foodborne illness events in the US benefits public health by alerting consumers to stop eating and discard contaminated foods, but it also erodes the confidence that consumers have in the safety of their food supply. That confidence went from about 70% in the late 1990s to about 30% by 2008 (Kinsey et al. 2009). This erosion of confidence contributed to the passing of new food safety legislation in 2011, the Food Safety Modernization Act. PL 111-353 (Food and Drug Admin 2011). Studies of consumer’s expectations about who along the food supply chain should be responsible for food safety show that food processors/manufacturers are expected to be the primary responsible parties followed by government (Degeneffe et al. 2009; Kinsey 2006).

Long-run chronic illnesses, which are attributed to (over) consumption, present a dilemma for public policy and for individuals. Looking at the pyramid of food preferences good taste spars with convenience for one of the most important choice criteria. Repeated choice of the same food depends on it tasting good (flavor, texture, odor, mouth feel). Most processed foods use some combination of salt, sugar, and/or fat to enhance taste and/or to extend the shelf life of a product. Some will argue that the intense and repeated use of salt, fat, and sugar makes foods taste so good that they are habit forming and that their repeated consumption has led to obesity, cardio-vascular diseases, diabetes, and shortened life spans (Kessler 2009). Retraining the American palette to expect and accept foods and beverages with less salt and sweetener is under way by many food companies at this writing, but it progresses slowly. Many food manufacturers are engaged in reformulating products with less sodium as public health concerns, and in some cases local laws, are demanding this change. The National Salt Reduction Initiative (2011) has enlisted the cooperation of companies such as Target and Campbell Soup and several restaurants, to cut the sodium content in prepared food by 20% by 2015. In addition many local school districts have banned the sale of sugared drinks in their school’s vending machines to try and reduce obesity among children.

There is widespread concern and criticism of the foods in the American diet. Slowly, a variety of foods, which claim to be “healthier,” are penetrating the available ood supply. As a stream of media stories about the impact of particular nutrients and food ingredients on human health continues, consumers dietary habits change. Some of these stories are grounded in sound science and some are grounded in marketing strategies; either way they penetrate the consciences of food consumers and alter their choices.

Health: Obesity

Studies about how food and agricultural policies relate to the dilemma of obesity and food-related diseases, other than foodborne illness, are relatively new in the literature, but there are studies about policies related to obesity (Muth 2010) and to sweeteners (Runge 2010; Todd and Zhen 2010). Sugar prices have been kept relatively high through trade barriers (tariffs) on imported sugar for many years. Thus, food and beverage manufacturers sought cheaper alternative sweeteners and found them in high fructose corn syrup (HFCS). Public policies that supported the farm price of corn and/or farm incomes not only made feed for animals and meat more affordable but also made HFCS more affordable. A recent controversy about whether HFCS metabolizes differently than cane or beet sugar, and thus contributes to greater obesity, goes on at this writing. Historically, the USDA grading of meat and the milk marketing orders rewarded the production of high fat meat and milk. This has changed as consumer demand for lower fat products grew widespread, but it illustrates how food and agricultural policies that were appropriate in the last century need to be updated in the face of changing consumer needs and lifestyles.

A widely held opinion among the public and health advocates is that government should “subsidize” fruit and vegetable production in order to make more fresh fruits and vegetables available at more affordable prices. Compared to government support for many other commodities (corn, soybeans, grains, dairy, sugar) fruits and vegetables have not received much incentive to increase production or to lower retail prices. This sentiment comes mostly from healthy diet and nutrition advocates and the USDA dietary guidelines and not from the producers themselves. But the pressure to increase fresh produce consumption by individuals and for school lunch programs as well as other federal food programs puts the spotlight on produce availability and affordability.

Variety

As consumers’ incomes increase their preference for variety also increases. Through travel, eating in restaurants, and media exposure they discover new types of food. This tendency is evident even in very poor countries where poor family’s diets can be monolithic and repetitive. As soon as incomes start to rise and animal proteins become available they begin to replace staple grains and starches (Jensen and Miller 2011). As soon as modern supermarkets enter the economy, consumers shift from local roadside markets to more convenient and attractive new foods inside the supermarket (Minten and Reardon 2008). An illustrative story comes from a Chinese graduate student who told the author in 2002 that her mother in Beijing had switched from the street markets to the supermarket because the food in the supermarket was safer, more readily available, more reliable and, it was a “feast for the eyes.”

In the US food manufacturers have responded to this preference for variety with multiple new and “improved” products every year. There was an annual average of 21,519 new food and beverage products introduced between 2006 and 2009 (USDA ERS 2010b) with 20,143 in 2011 (The Food Institute Report 2011). This practice also serves to meet the needs of an increasingly diverse population and a diverging set of preferences. To add to this trend, individual supermarket companies have increased “store brand” foods in order to build store loyalty. While this certainly increases variety and choice overall, and may reduce price, extensive brand and packaging extensions proliferate shelf facings in stores and can lead to shoppers’ confusion and increase shopping time. Studies by Iyengar and Lepper (2000) show that as the number of choices of the same product (jam or chocolates) increases from 6 to 24, consumers spend more time to make a decision. With too many choices, only a small percentage make a purchase at all. They conclude that having “too much” choice hampers motivation to purchase. Store brand sales rose from about 15% in 2007 to over 25% in the larger US supermarkets by 2010 (Kroger 2010). Some of the largest retailers—Wal-Mart, Target, Costco, Aldi, and Trader Joes—heavily promote their own store brands.

Extreme Health

As scientific information (legitimate and popular) becomes available and consumers discover that diet composition directly influences their day-to-day health and vigor, the desire for food as preventative medicine gains importance in food production, distribution, and demand. Producers seek seed and meat varieties that allow them to claim special health benefits as a competitive advantage. Examples are eggs high in omega-3 or high lysine corn. It includes new forms of fortification with health enhancing ingredients such as probiotics, vitamin D, and extra calcium in foods where it does not naturally exist such as in orange juice. High energy and vitamin-enriched drinks further promise to deliver vitality. Scientific discoveries have led to biofortification through genomics and selective breeding that enhances the micronutrient benefits of foods in both developing and high-income countries. All these developments lead to new forms of food production and processing aimed at making people healthier, reducing suffering, and cutting health care costs.

Status

At the top of the hierarchy of food preferences are “status and social causes.” It is at this level that much of the recent rhetoric about problems with the established commercial, global food system takes place. It is also where status-seeking consumers gravitate as (formerly) premium products expand their market share and move from elite shops to the mass market and no longer have “snob” appeal. Jeff Gordinier (2011) writes about the “connoisseur culture” in which only the newest and most expensive products are considered acceptable; “old favorites” are eschewed. Among these trendsetters, artisanal and hand crafted foods are considered necessary for self-esteem and social prestige. This behavior resembles the “conspicuous consumption” explored by Thorstein Veblen in (1899). But then and now, these trendy foods (and other goods) tend to gravitate into the mass market and are, thus, worth watching in terms of future consumer demand.

Needless to say, moving up this hierarchy is correlated with rising incomes, but loss of confidence in the safety and healthfulness of food (short term and long term), as well as the government’s apparent inability to ensure it, plays no small part in consumers moving up the hierarchy of preferences regardless of income. The migration of food preferences is also encouraged by global supplies, a growing distrust of large, multinational food companies, and by the desire to gain control of the most important consumable in their lives—their food.

For a whole variety of reasons a growing core of socially conscious advocates and consumers are asking the food system to deliver not only all of the traditional characteristics of food articulated in the hierarchy but they are asking that food be the vehicle through which environmental sustainability, fair wages, animal welfare, and authentic life experiences can be delivered. It is the set of preferences that are responsible for the growth of demand for organic foods, for “humane” treatment of animals and fish, for fair wages for farmers in developing countries, and for a variety of “sustainability practices” from reusable cloth grocery bags to no-till agriculture.

Increasing demands for organic and/or local or regional fresh foods have changed the way supermarkets procure and merchandise food. Although the portion of food sales comprised of organic and/or local foods is still small (2–3% of US food sales), it is a growing global trend (Dimitri and Oberholtzer 2009; Martinez et al. 2010). Tesco, a major supermarket in the United Kingdom, is contracting with farmers throughout the British Isles for items such as garlic and vegetables that it can sell as “local” (Rohwedder 2011). Wal-Mart, the largest supermarket in the United States, if not the world, has sought organic products for its very large customer base. The adoption of organic production and distribution by very large companies has disappointed many of the original organic food advocates because it counters one of the basic tenants of organic agriculture—the survival of small farms who are dedicated to environmentally sustainable practices and generally lack economies of scale.

“Local” food may or may not be organic, more nutritious, or safe. Advocates for local food claim that it is fresher, tastier, healthier, more “natural,” more trusted, and good for the local economy. It is acknowledged, however, that local food is usually more expensive and research shows that it does not necessarily have a smaller carbon footprint (King et al. 2010). More than half of “local food” sales of $4.8 billion were conducted through a third-party distributor in 2008 (Prepared Foods 2012). To the extent that more and more consumers demand food from local regions, prepared with fewer ingredients, delivered with minimal packaging, and produced in an environmentally sustainable fashion, they are signaling the demand for less technical efficiency (low cost) and a preference for nonmarket social values. They say they are willing to pay more to achieve status, meet social/environmental goals, and the (perceived) assurance of healthier, better tasting food. This, of course, leaves the poor and hungry portion of the population (about 1 in 6 adults and 1 in 3 children) with the possibility of even less affordable food. Therefore, public programs to provide nutritious food for those who cannot afford to buy status and social causes with their food will become ever more important. However, one can hope that this trend will raise the overall healthfulness of foods on the market.

Public Policy and Consumer Food Preferences

Implications for public policy involve recognizing that consumers today are not of one mind or one culture and their preferences can move up and down the pyramid of preferences as incomes and information change. The demographics of the US population are skewing towards the elderly and the non-white. The income distribution has changed. The top 20% of households (arrayed by income from lowest to highest) earned over half of all the income in the United States in 2009; their income rose 55% since 1980. The bottom 40% of households earned only 11% of all income and their incomes rose an average of 3% since 1980. The top 1% of households earned 8.3% of all the income in 1970 while in 2009, they earned 18.9% (DeNovas-Walt et al. 2010). This top 1% also had 43% of all the financial wealth and 35% of the net worth in the United States in 2007 (Domhoff 2011). The median household income ($49,445 in 2011) fell from its 2008 high of $55,303. In real terms the 2011 median income is about equal to what it was in 1997 (U.S. Census Bureau 2012). With this lack of economic progress by middle income households one will expect that food preferences will not rise up through the preference pyramid as rapidly and may actually regress to lower levels. This can explain the rise in store brands, the shrinking of package size, and other attempts to hold down food prices.

Income distribution is important for food policy because it means people in the bottom 40% of the income distribution have less than 12% of all the spending power; and many of these households have incomes below the poverty line ($22,314 for a family of four in 2011). The income eligibility for Supplemental Nutrition Assistance Program (SNAP formerly known as food stamps) is 130% of the poverty level. For a household of four persons that qualifying income was $29,008 in 2011; all of the four person households in the bottom quintile and part of those in the second income quintile of households would be eligible for SNAP (subject to asset tests.)

The poverty rate in 2010 was 15.1% of households, up from 12.5% in 2007. More than one-third of all children were living in poverty. This high rate of poverty is partly attributed to a concurrent recession and unemployment but it also illustrates a dramatic change in the gap between the richest and the poorest households in the United States. The richest 20% spent an average of $10,780 on food at, and away from, home in 2009; this was 7% of their income. The poorest 20% spent an average of $3,501 on food at, and away from, home; this was 36% of their earned income (Henderson 2011). The proportion of income spent on food rose since 2005 across all income categories. For the top 20% the increase was 0.2% points and for the lowest 20% the increase was 4.5% points. This implies that food prices will be more important for food choices and that less money will be available to spend on other consumer goods—not a recipe for national economic growth.

Food Assistance Programs

Food programs that provide food and nutrition to the poor, which may be viewed as investments in human capital and economic growth, will be in high demand as the numbers in poverty increase (USDA ERS 2011c; USDA ERS 2012). In 2010 the federal government spent $98.4 billion on food assistance programs that make up almost two-thirds of USDA’s entire budget. SNAP (food stamps) expenditures went from $56.6 billion in 2009 to $68.2 billion in 2010 comprising 72% of the food assistance program expenditures. Pressures from congress to cut federal budgets will likely reduce these expenditures at a time when they are needed more than ever. Food insecurity was the highest in 2009 since it was first measured in 1995. Fifteen percent of households have difficulty providing enough food for all their members some time during the year. About 5.7%, or 6.8 million households, had severe food insecurity (hunger) (Nord et al. 2011). Federal food programs like SNAP and WIC provide funds to qualifying households to purchase food at their local food stores. Eligible households of two with an income below $18,947 per year could receive $367 per month to purchase food (not ready to eat). If there were four persons in the household they could receive $668 per month.

SNAP and other food programs that distribute food to the poor, hungry, and malnourished combine allocative and dynamic efficiency. Clearly they respond to changing economic conditions and allocate food to people who need it—food that would not otherwise be purchased or consumed. This activity improves the welfare of the recipient and saves other costs to the whole community. To the extent that it pulls more supply from the food system (increases demand) it optimizes the efficient allocation of produced food. Because the SNAP program distributes cash and consumers purchase from traditional stores, there is a community multiplier effect of about 1.84. For every $5.00 spent in SNAP money, about $9.20 in community spending is generated through additional employment and business (Hanson 2010). About 66% of those eligible to participate in SNAP do so (Leftin and Wolkwitz 2009).

Food programs also increase revenue to producers and reduce expenditures on other public services such as health care, special education, and psychological counseling. A study conducted for Second Harvest Heartland in Minnesota found that hunger costs Minnesota upwards of $1.62 billion a year or between $800 and $1,131 per taxpayer (Mykerezi et al. 2010). If hunger could be eliminated for a cost of $243.25 million, the return on this investment would be almost sevenfoldFootnote 1 (Second Harvest Heartland 2009). Thinking about expenditures on reducing hunger as an investment in human capital and economic productivity could help to change attitudes and priorities analogous to the drive to invest in early childhood education.

Charitable organizations like Feeding America collect both money and food that is distributed to food shelves where it is available—free—to hungry people. These programs help alleviate hunger and help to maintain some level of healthiness in their participants. Clearly demand for these programs increases with the poverty level. It is estimated that Feeding America, only one of several charitable feeding programs, provided about $678.8 million of food to poor people in 2010 (Feeding America 2010) The economic return to these programs is estimated to be between $1.56 and $2.73 for each $1.00 invested depending on how much of the donated food would have been otherwise wasted (Mykerezi et al. 2010).

In 2010 the WIC program served 9.2 million people, over half of all infants and one-quarter of children up to age four. This program is widely recognized as one of the most efficient food delivery programs in that it is linked to health care and advice with measurable results for mothers and children. Although it highly encourages breast-feeding, WIC funding purchases between 57 and 68% of the infant formula sold in the United States. Federal expenditures in 2010 were $6.7 billion up from $5.5 billion in 3 years (Oliveira and Frazao 2009; USDA ERS 2010c). Substantial changes in recent years to the foods that participants can purchase with WIC vouchers include providing more whole grains and cash for fresh fruits and vegetables. It is estimated that out of $4.6 billion food purchased by WIC participants, farm revenue increased by $1.3 billion in 2008 (Hanson and Oliveira 2009). WIC is the third largest Federal food and nutrition program; it comprises about 10% of the food and nutrition budget. It is a good investment in the future health and welfare of the nation’s children. It exhibits a dynamic efficiency, as the size and composition of the program changes with demographic and economic conditions.

Food and nutrition assistance is legislated under the Farm Bill. It is in farmers’ interest to have (poor) people able to purchase the food they need and, in turn, to maintain public (government) support for agriculture. Investment in good health and welfare makes good economic sense. This logic extended to the National School Lunch Act of 1946 and the Child Nutrition Act of 1966 that added school breakfasts (Gunderson 2009). Federal Expenditures for these two programs was $12.6 billion in 2010 and served an average of 42.7 million children per day. Children from families whose income is below 130% of the poverty level are eligible for free school lunches while those from families with incomes between 130 and 185% of the poverty level are eligible for reduced price lunches. More than half of school lunches are served free (55.7%) and 74.6% of breakfasts are served free. With only about 35% of children paying for their lunches, schools are dependent on federal allotments to prepare and serve food, an allotment that is criticized for being too little for healthy meals in school. This meal is sometimes the only food children from very poor families have on a school day, and thus, extremely helpful in reducing hunger.

There are, however, several regulations affecting school lunches that are roundly criticized for poor nutrition. They require too many calories, they use preprepared, ready-to heat/eat foods high in fat and sugar, they facilitate obesity, etc. The dietary guidelines for school lunches and breakfasts are under scrutiny with room for improvement. In January 2011 USDA’s Food and Nutrition Service (FNS) proposed new rules to revise the meal patterns and nutrition requirements for the National School Lunch Program and the School Breakfast Program to align them with the 2005 Dietary Guidelines for Americans, as required by the Richard B. Russell National School Lunch Act (USDHHS 2011). The proposed changes are based on recommendations from the National Academies’ Institute of Medicine (IOM) set forth in the report School Meals: Building Blocks for Healthy Children (Institute of Medicine 2009). This proposed rule would increase the availability of fruits, vegetables, whole grains, and fat-free and low-fat fluid milk in school meals; reduce the levels of sodium and saturated fat in meals; and help to meet the nutritional needs of school children within their calorie requirements. Implementation of this proposed rule would result in more nutritious school meals that improve the dietary habits of school children and protect their health (Federal Register 2011). Three months later, USDA’s FNS published a final rule allowing institutions receiving funds under the Child Nutrition Programs to purchase unprocessed locally grown foods for use in schools. Additional federal funding to purchase and prepare high quality foods is not, however, forthcoming and parents are being charged more for their children’s meals. The additional charge to the one-third of parents who actually pay for school lunches must cover the additional cost of all the meals served. This is a reallocation of the resource base which can be considered an investment in the future health of individuals, neighborhoods, and the economy.

These changes signal new demands by parents and public health and nutritional professionals. Old mandates are changing to improve the nutritional quality and appeal of school meals. This is part of a surging recognition for increasing the consumption of fruits and vegetables and decreasing the consumption of fats, sugars, and high caloric foods largely devoid of other nutrients. It also moves food and agricultural policy closer to nutrition/health-based criteria and away from maximizing production yields on basic commodities. This may not seem like the best technical efficiency, but it is a move toward dynamic efficiency that produces a healthier population and saves long-term health care costs. By diversifying the land use and the market rewards, it may also help sustain the agricultural environment.

Information

Besides prolific food labeling, advertising, and public media stories, the Internet stands ever ready to give us both food facts and fictions. Consumers tend to trust their friends and neighbors and the “citizen expert” more than food professionals or government authorities in most cases. They seek credible assurance that food ingredients and additives are genuine, safe, and efficacious and that labeling and advertising claims are truthful. Food companies are quick to add health claims (even before proven) in order to boost sales. This often raises consumer expectations beyond what any food can deliver which, in turn, leads to mistrust in the food system and in public policy. Regulatory agencies that have the responsibility for truth-in-information about food need the authority and the funding to police the efficacy of the messages and the behavior of the “speakers.” These agencies include the U.S. Food and Drug Administration, Department of Trade and Commerce, and the Department of Agriculture. Lusk (Chap. 13) provides a thorough discussion on consumer information and labeling.

Traceability

Being able to trace food to its origins is part of new regulations in the Bioterrorism Preparedness and Response Act of 2002 (Public Law 2002) and the Food Safety Modernization Act of 2011 (Public Law 2011). Numerous food safety events have sharpened the need for rapid tracking capability. However, complex processed foods use multiple global suppliers that change with ingredient prices and seasons. Some realistic method of traceability and international standards and protocols to assure ingredient safety needs to be devised and implemented. Some argue that big branded food companies have every incentive to check on this safety themselves; their reputation is at risk. This is true, but much of the food we eat does not carry a national/international brand name and someone needs to have the authority to identify and curtail unsafe food from entering the system or to remove it quickly. Counterfeit food and substandard products have been under investigation by Interpol-Europol in Europe to determine the extent to which food is counterfeited or diluted for profit (Rothschild 2012). As prices rise, substituting inferior ingredients is not an uncommon practice. When there are truly bad actors in the industry, when decisions deliberately taken are harmful to people’s health and welfare, they need to be held accountable criminally and/or civilly as the case dictates. When they are not, confidence in the food system erodes and peoples’ health is at risk. Hooker and Souza-Monteiro (Chap. 10) discuss food safety and traceability in detail, while Nganje (Chap. 11) covers quality assurance for imports and trade using risk-based surveillance to help identify potential problem shipments for detailed inspection.

Conclusion