Abstract

After proposing the model’s algorithm and analyzing a number of results for the technology index (TI) in different sectors and countries and along a full economic cycle, it is now possible to propose a specific taxonomy for the technology dependence of firms and sectors. This chapter starts by showing the current difficulties and possible misinterpretations of the OECD technology intensity factor currently in global use. Based on statistically analyzed data, it is here proposed a metric to be the basis of a new taxonomy for technology dependence. That metric is to be applied to the TI of the KTC model. It will use the same levels of low, medium low, medium high, and high technology dependence, according to the four quartiles the TI values distribution suggests. This new taxonomy will be equally significant in different countries, what does not happen with the OECD current system. This chapter follows Fernandes [1]. Besides the technology content of any GVA process, the KTC model allows to compute the technology content of an output product (as well as its knowledge and capital contents). This is explained and illustrated in the second part of this chapter.

Access provided by Autonomous University of Puebla. Download chapter PDF

Similar content being viewed by others

Keywords

The technology index (TI) relates the value added by the use of technology T to total GVA. I advocate that it represents the firm’s or sector’s dependence on technology better than the parameter. TI that currently is used to classify economic activity sectors as of high or low technology dependence. TI is a factor used by OECD to designate how much an industrial sector depends on technology; though it exclusively specifies its dependence on R&D, because it is computed as the ratio between R&D costs and GVA. In this way, the TI parameter shows the technological innovation effort but it does not show the whole dependence on technology use. Also, it does not hold its significance when comparing the same sectors in different economies because they may have very different R&D efforts. Taking as an example the division 32—manufacture of radio, television, and communication equipment: To this division it was attributed a TI of 18.65 % in the USA [3] whereas in Portugal, the average of the TI from 1996 to 2003 was almost zero [2]. Accordingly, one would conclude that this division is a high technology division in the USA and a low-technology one in Portugal. To further illustrate this problematic approach, Table 5.1 shows the OECD’s technological intensity compared with the TI from the KTC model, for various industrial sectors, where the difference of the two criteria is pointed out.

Divisions 32, 31, 26, and 15 + 16 in the USA are classified on their technology dependence, according to OECD criterion, as of high technology, medium–high technology, medium–low technology, and low technology, respectively. In Portugal, the same divisions show zero technology dependence, while, if classified according to the TI, they show an effective technology dependence of 18, 16, 29, and 23 %, respectively.

Such a different classification of technology dependence of the same sectors in two countries indicates that the metric is not adjusted to the goal.

5.1 A New Metric for a New Taxonomy

Establishing a metric for sectors’ classification concerning technology dependence becomes easier to propose if considering the TI statistical distribution in an economy. We shall start by looking at how the three indexes relate to each other in a real economy in order to better understand their distributions.

The three indexes KI, TI, and CI must add to unity and so are not independent. The values of KI, TI, and CI were computed for 49 Portuguese divisions along 8 years, 1996–2003. In a three-dimensional space {KI, TI, CI} the points are over a plane surface, as it may be observed in Fig. 5.1 where the results for the year 2000 are plotted. In this space, one point representing division i has the coordinates {KI i , TI i , CI i }. The plane surface equation is KI = 1 − TI − CI.

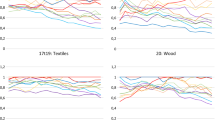

To examine how the indexes depend on each other, the same group of points may be seen in a two-dimensional space, projecting them in one face of the above 3D space, first on the {KI, CI} face, second on the {KI, TI} face and third on the {CI, TI} face. This is depicted in Fig. 5.2,Footnote 1 where correlations were analyzed between the pairs of indexes {KI, CI}, {KI, TI}, and {CI, TI}. The point distributions on the three planes show weak correlations as seen by the low correlation factors R 2. These correlations, even if weak, are explained as follows: The parameters L, T, and C were assumed to be independent, such that one of them may be changed without affecting the others. For example, a firm may decide to raise its labor costs (higher L) or build new headquarters (higher C) without affecting, respectively, T and C in the first case and L and T, in the second case. However, the respective indexes are not independent because they must sum to the unity. As such, when one index changes the others change in opposite direction; as for example, for a higher L, ceteris paribus, KI increases and, necessarily, TI + CI decreases. But does each index decreases at the same rate? The plane {KI, CI} shows values for KI with typically twice the values of CI, and a fair negative correlation represented by the factor R 2 = 0.55. On the plane {KI, TI}, the same effect can be observed but the correlation is weaker, R 2 = 0.33. On the plane {CI, TI}, both indexes have values under 0, 5 and the correlation is absent. The overall conclusion is that a higher KI implies necessarily a smaller TI + CI and it correlates better with a smaller C than with a smaller T, what is easy to understand as higher labor costs imply, in most cases and in the short term, lower profits, sinking the value of C and the value of CI.

Correlations between pairs of indexes, {KI, CI}, {KI, TI}, and {CI, TI}. (Fernandes [1], reproduced with permission from Elsevier

I propose a metric for technology dependence of firms, sectors, and economies according to a criterion and a reference. The criterion is the TI, at four levels: Low, medium–low, medium–high, and high technology dependence; and the reference values are the four quartiles of the TI distribution in a reference economy to be chosen. In the case of the above data, distributions of the three indexes are shown in Table 5.2.

Accordingly, the sectors classification in what relates to technology dependence would be as shown in Table 5.3. It is important to note that the TI distribution is somehow dependent on the economy under study. The main reason is that every economy distributes its value gains by salaries or in savings (investment) in different ways, depending on the respective economic development situation. Still, those differences are relatively small as it was verified in Table 4.2.

According to this criterion and taking the values shown on Figs. 4.5 and 4.6 as examples, the sectors would be classified as shown in Table 5.4.

5.2 Technological Content of a Product

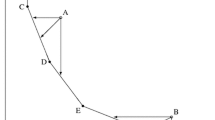

The last section was devoted to analyze the technology contribution to the GVA of a firm or a sector. The same method may be used to evaluate the technological content of a product. Let us consider a hypothetical firm, which output comprises one only product, as depicted in Fig. 3.2. Its final product value (FPV) equals the sum of the GVA with the intermediate product value (IPV). The value chain of this product could be represented as shown in Fig. 5.3. The IPV of that firm IPV1 is the sum of the FPVs of a number of firms belonging to a second level in the value chain, which, in turn, are the sum of the respective GVA and IPV. This repeats along the levels of the chain up to infinity, both in what concerns levels’ firms and time.

Another way of describing the value chain is depicted in Fig. 5.4, where, in the last firm, the FPV = 100, the GVA = 40, and IPV = 60. The IPV = 60 of the last firm is the sum of the GVA with the IPV of all firms of the second level, which values are 20 and 40, respectively, and so forth.

These representations of the value chain show clearly that the FPV of a firm is the sum, up to infinity, of all the GVA of the firms behind, along its value chain. As such the value of a product is the sum of the GVA of all products belonging to its value chain.

As the KTC method allows assessing the technological part of the GVA, which is T, the technological content of a product (TCP) is the sum of all the T contributions along the value chain. Making explicit the values of T along the value chain, as shown in Fig. 5.5, the TCP is given by the infinite series Eq. 5.1

The output of a real firm was examined along these lines [4] scrutinizing its value chain. The firm’s FPV was 100 % and its GVA (level 1) was 29 %, such that its IPV = 71 %. The GVA has given the following indexes: KI = 0.61, TI = 0.28, and CI = 0.11. At level 2, the two firms with the largest contributions (28 + 2 = 30 %) were scrutinized and their indexes evaluated. The rest of level 2 firms (41 %) was classified according to the average indexes of the economic sectors they belonged to (divisions 22, 31, 32, 33, 40, 64, 72, and 74) (8 %), and to imports (33 %). At level 3, behind the two firms identified of level 2, one firm was identified and scrutinized, the other level 3 firms being given the indexes of the economic sectors they belonged to. By the end of this value chain analysis, 60 % were classified rigorously and 8 % was classified according to the average indexes of the economic sectors they belong to. The remaining 32 % could not be classified. This is a theoretical framework impossible to fulfill in practical terms. However, it has the merit of pointing out the difference between the TCP and the technological contribution of one firm to its output. The same reasoning may be developed for knowledge and for capital.

Notes

- 1.

Reprinted from Publication Technological Forecasting and Social Change 79, António S C Fernandes, Assessing the Technology Contribution to Value Added, Copyright (2012), 281-297, with permission from Elsevier.

References

Fernandes ASC (2012) Assessing the technology contribution to value added. Technol Forecast Soc Chang 79:281–297

Fernandes ASC (2003) Technology-driven organizations? What is that? In: Proceedings of IEEE international engineering management conference—IEMC-2003, Albany, pp 14–18

Hatzichronoglou T (1990) Revision of the high-technology sector and product classification. STI working papers OCDE/GD(97)216

Loureiro FC, Marques RV, Fernandes ASC (2002) Análise duma Cadeia de Valor Acrescentado—Fornecedores de Conhecimento, Tecnologia e Capital. Actas do 4º Encontro sobre o Valor Acrescentado pela Engenharia, Escola de Engenharia da Universidade do Minho, Guimarães Portugal (27–46) ISBN 972-8692-07-02

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

Copyright information

© 2013 Springer-Verlag London

About this chapter

Cite this chapter

S. C. Fernandes, A. (2013). Technology Dependence Taxonomy. In: The Contribution of Technology to Added Value. Springer, London. https://doi.org/10.1007/978-1-4471-5001-5_5

Download citation

DOI: https://doi.org/10.1007/978-1-4471-5001-5_5

Published:

Publisher Name: Springer, London

Print ISBN: 978-1-4471-5000-8

Online ISBN: 978-1-4471-5001-5

eBook Packages: EngineeringEngineering (R0)