Abstract

Procuring complex performance where both the performance required and the infrastructure to support the requirement are complex, is the current frontier on procurement knowledge. Trends to bundle contracts for products and services together exemplify the challenge. These product-service bundles take the form of contracts for the use of the product (e.g., including long term maintenance and support) rather than just the product as an artefact. Such contracts bind a Prime contractor and the customer into complex long term agreements. Contractual incentive mechanisms have long been used to align the interests of customer and supplier in such projects. This chapter explores the use and role of incentives in complex engineering support environment, drawing on a case study from recent research on availability contracting to support fighter jets. The chapter presents the challenge to the conventional incentive mechanisms inherent in the combination of flexibility and cost control required in contracting for jet fighters availability.

Access provided by Autonomous University of Puebla. Download chapter PDF

Similar content being viewed by others

Keywords

These keywords were added by machine and not by the authors. This process is experimental and the keywords may be updated as the learning algorithm improves.

1 Introduction

The aim of this chapter is to briefly outline the need for, and role of, incentives in complex support environments. It discusses the major types of contractual incentive, their advantages and disadvantages and how they relate to service support engineering, and links incentives to the S4T core integrative framework. The chapter provides a case study based on a composite of military fighter jet contracts to explore detailed issues in contracting for availability and incentive mechanisms. The chapter ends with conclusions and comment on current trends and areas of future interest.

Contractual incentives for performance have a long history. Their importance can be illustrated through their use in the transportation of prisoners to Australia in the eighteenth and nineteenth centuries. Those ships incentivised on an outcome (i.e., number of prisoners delivered alive) were extraordinarily successful at keeping their cargo well through a hazardous and arduous journey. Other ships incentivised on inputs (speed, price and a share in any consumables such as food and drink ‘left over’ at the end of the journey) had terrible convict passenger attrition rates. So in this instance, giving those responsible for transporting the prisoners the incentive of being able to sell off any unused provisions for their own profit did not align with the intention of the contract. Following a scandal about the poor mortality rates and a public enquiry, the Home Department, the equivalent of the Home Office today, insisted that in all future shipments, the contractors should be paid for the number of convicts landed, rather than for the number embarked (for a full description of the history of incentives in UK government procurement, see Sturgess 2010).

This example from the transportation of convicts shows an eighteenth century use of an outcome-based contract for procuring complex performance. Given the state of technology at that time performance of the task was complex, and it was deemed necessary to incentivise the contractor. The example also illustrates how badly incentives can affect performance when they are not thought through, (as here) when some contractors were not incentivised on convicts delivered alive and well, this is often termed the problem of ‘perverse incentives’. A perverse incentive creates an effect that was not intended by the customer.

Incentives include penalty incentives, the early days of individual train operating companies running the UK rail network provide an example of a penalty clause that became a perverse incentive. The penalty on running a train very late was so high as to incentivise the train operating companies to instead cancel the train entirely. Thus incurring a much smaller penalty (but at great disadvantage to rail users) an unintended consequence. Incentives are usually financial but can also include non financial incentives such as reputation by association and the carrot of future work.

Incentives have been formally defined by Her Majesty’s Treasury (1991:1) as:

A process by which a provider is motivated to achieve extra ‘value added’ services over those specified originally and which are of material benefit to the user. These should be assessable against pre-determined criteria. The process should benefit both parties.

The purpose of incentives has been defined by Broome (2002:111) as to:

Align more closely the motivations of the contractor, consultant or supplier to those of the client, so that any of the participants, by working for the success of their organization, is indirectly working for the success of the project.

The key, as Broome states, is that an incentive will put more emphasis on achieving a client objective rather than a contractual obligation alone (2002:111). Examples of financial incentives include profit sharing in cost-plus incentive contracts, bonus performance provisions attached to various lump sum and cost reimbursable contracts and multiple financial incentive mixes (Rose and Manley 2005). These detailed forms will be discussed below, the intention in this introduction is to show why incentives matter.

The chapter is structured as follows. Firstly, we introduce the notion of procuring complex performance (Sect. 8.2). Section 8.3 discusses contract strategy, building on the basic forms of contract to introduce contracting and contractual incentives for performance-based contracts such as availability. This section introduces the importance of identifying and allocating risk. Section 8.4 is a case study of incentive use in contracting for availability in military fighter jets. The case material provides a lead into the conclusions.

2 Procuring Complex Performance

It is becoming increasingly common for organisations to leverage service opportunities to deliver more value, to both the customer and the organisation itself. Cohen et al. (2006) suggest that this need to leverage service opportunities has been occurring since the early 1990s in Western Europe, the USA and Japan. As competition for manufactured products has increased and margins have become reduced, offering service solutions has been seen as maximising revenues and profit (Cohen et al. 2006). Many economies are increasingly servitized (Vandermerwe and Rada 1988). Advocates of the move to services cite downstream (i.e., the customers end of the value chain) markets as offering large potential revenues with higher margins, and also as requiring fewer assets than product manufacturing; and that due to their steady service-revenue streams, they can often be countercyclical (Wise and Baumgartner 1999). In complex engineering support, services typically range from routine and planned maintenance, to unscheduled repairs to inserting upgrades such as new technology into existing systems or platforms, through to disposal.

Vargo and Lusch suggest that there is a

…need for refocusing substantial firm activity or transforming the entire firm orientation from producing output, primarily manufactured goods, to a concern with service(s)’ (Vargo and Lusch 2008:254).

In the academic literature a concern with understanding these bundled offerings of products and services has led to an interest in the product service system (Mont 2002; Baines et al. 2007).

Industrial and public sector customers as business to business procurement professionals reflect these trends through increasingly purchasing (or in health settings commissioning) a combination of products and services. One example of this phenomenon is the blurring of traditional boundaries of ownership, design and post-construction performance in major construction projects. In combining the purchase of service with a product the buyer is procuring complex performance (Caldwell and Howard (2010); Lewis and Roehrich (2009); Caldwell et al. 2009) or what is increasingly known as Procuring Complex Performance (PCP). PCP can be defined as a combination of performance complexity (a function of the level of knowledge embedded in the performance and/or the level of customer interaction and infrastructural complexity. The latter involving substantial bespoke or highly customised hardware and software elements (Lewis and Roehrich 2009). Caldwell and Howard (2010) take a more relational approach to defining procuring complex performance writing of the need for a co-ordinated, relationship-focused approach to buying made necessary by the task being so composed of sub-elements that it cannot be achieved by the sequential or additive achievement of individual tasks or transactions.

This chapter addresses the contractual forms that are emerging to support the procuring of the complex performance inherent in newly ‘servitized’ business models and specifically contractual incentives in product service contracts where availability is the key customer requirement. Typical product service contracts must incentivise industry to provide new levels of service, for example, innovative environmental practices, ease of maintenance, flexibility once in use and ease of ultimate disposal. The client must in effect, procure complex performance (as opposed to a complex product or building); clients increasingly value the “in use value” of the product infrastructure over the tangible product. This theme is returned to in the discussion of the core integrative framework. However, the move towards a product service business model is not without risk. “In industries where excellence in product manufacturing and design form the key to uniqueness and hence power in the value network, diverting focus to an issue such as PSS [product service system] development is a recipe to lose rather than win the innovation battle” (Tukker and Tischner 2006: 1553). Incentive design can play a key role as our case study will suggest, in maximising the opportunities and minimising the risks in adopting a product service approach.

3 Contract Strategy

Although there are many variations, two contract payment systems have dominated product logic-dominant manufacturing and construction that is either price- or cost-based. Price-based contracts have a fixed price or rate, the customer does not know what costs are incurred. This can be particularly problematic when in large complex undertakings there is a time lag between the costs being incurred and the contractor being able to consolidate and report the costs incurred, potentially resulting in the customer facing a much larger bill than expected with litigation a real possibility. Under cost-based payment systems the actual costs incurred by the supplier are reimbursed together with a fee to cover overheads and profit (including target cost-based contracts). To avoid the problem of cost lag described above some form of cost transparency or ‘open book’ costing is required. Table 8.1 lists some key features of both types but also introduces performance-based contracts, for example it might be a payment for the availability of beds in a hospital rather than a contract for the delivery of a facility.

Outcome or performance-based contracts are seen increasingly in the public and private sectors. Such outcome-based contracts are by nature long term: “In the case of resulted-oriented PSS [product-service systems], one actor becomes responsible for all costs of delivering a result, and hence has a great incentive to use materials and energy optimally” (Tukker and Tischner 2006, also Thierry et al. 1995). So for example for a traditional manufacturer in a complex engineering environment such as fighter jets, the scope of their business expands to include cost effective maintenance and support service (and after sales) in addition to the core product. Such manufacturers then face decisions about the shape of their business, and their business model.

The business model (Spring and Araujo 2009; Spring and Mason 2010) in defence, like many manufacturing models has historically have been able to make money out of initial product sales and the subsequent market for spares.

And because manufacturing promised the greater returns through the provision of spare parts as well as the purchase of original equipment, the judgment of manufacturing primes about design tradeoffs and systems assignments had to be taken with some scepticism Sapolsky (2004:24).

The design, manufacture and sell spares business model in fact did not incentivise the defence OEM to produce reliability. Parts/systems that went wrong meant further sales, an old fashioned ‘throw it over the wall’ to the customer approach. Engineers could focus on new build and provision of spares and associated activity became a backwater (although a profitable one). Defence companies and their engineering talent were simply not incentivised to produce reliable easy to maintain components or systems. One consequence of this business model was an ‘arms length’ relationship between engineering and support, with no feedback loop from supporting maintenance (Davies 2004), and little ‘design for supportability’ (Goffin and New 2001).

Thus in addition to a manufacturer having to adapt to a new business of support the fundamental business model of the manufacturer has to change. In complex engineering environments the complexity of such contracts mandates incentive mechanisms to co-ordinate and align customer and contractor interests. The following case study now explores incentives in the complex procurement environment of fighter jets. The case study is based on over 30 interviews with managers and engineers and the personal experiences of one of the authors over a career of aircraft-related commercial management.

4 A Case Study of Military ‘Fast Jet’ Aircraft

When considering contracts for long term availability for military ‘fast jet’ aircraft, there are some key requirements unique to the military arena which make these contracts perhaps more difficult and challenging to construct than the ones in normal commercial environment between industrial companies or civilian public bodies. Incentivisation is the key to making such contracts work effectively and this case study examines some of the differences and difficulties in constructing incentivisation mechanisms.

It is generally accepted that military commanders, when in a war situation, demand the best products and services available, delivered when they want them and subject to constant changes as the threat changes. Whilst this could also be argued to be true of any public body, civilian or industrial contracts, the military are in a unique ‘all or nothing’ situation where being second best or being late is unacceptable if they are to win the war.

For these reasons, during the Cold War, the UK Government (and other NATO allies) adopted an approach whereby their Armed Forces and the civilian Ministry of Defence between them, enabled and controlled this required flexibility by carrying out the work ‘in-house’ (i.e., Royal Air Force (RAF) personnel servicing the aircraft) and having MoD staff purchase the necessary equipment and technical services to support this on a piecemeal basis from many contractors; i.e., setting up “enabling contracts” with a multitude of supplier companies to procure spares and repairs on an “as required” basis. For instance, the Tornado aircraft had some 350 separate contracts for the MoD team to manage. To add to this supply complexity, the capabilities of the aircraft need to be improved constantly as new technology becomes available and the capabilities of potential enemies also improve. Therefore, a key feature of the newly emerging CFA (Contracting for Availability) contracts is both to keep costs down and to keep aircraft availability up, such capability improvements must be embodied at the same time as routine servicing work. The use of servicing ‘downtime’ to fit upgrades maximises availability (when done well) and was previously not the case under in-house servicing. Any incentivisation mechanism, therefore, has to recognise that the technical standard of the aircraft will be enhanced again and again within the existing contract.

In recent years, budget pressures have meant that the traditional in-house driven flexibility (i.e., in house servicing and separate upgrading) is unaffordable and although there have been some successes, recent studies have shown that partnering with industry on long term, output-based incentivised contracts is the way ahead to achieve demanded cost savings. Indeed recent Defence Support Review (Ministry of Defence and Deloitte 2010:7) states:

incentivisation is key if the department [MoD] is to seek further savings in support costs once responsibilities are transferred to industry.

A particularly difficult issue remains though, in that the budget-holders demand for cost efficiencies should not be allowed to over-ride the military commanders’ rightful expectation of demand-flexibility. They need to sit side by side.

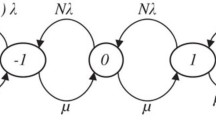

Figure 8.1 illustrates the tensions within a typical availability contract for fighter jets (or other complex military procurements) between the operational user, here the Royal Air Force, the Treasury represented by the Defence and Equipment Support Agency and the civilian Prime contractor. As this case draws out the key requirements for the user are flexibility and availability. However the Treasury are concerned with minimising cost whilst the Prime contractor needs the stability to be able to plan for a sustainable business. At first view these three differing requirements can be seen as irreconcilable. So, how is this dilemma between cost efficient supply and maximum military flexibility resolved? It must be stated here that the solution of simply reducing cost by reducing quantity of products is not part of this paper (for example, if politicians decide that squadrons of aircraft will be taken out of the inventory). What is in discussion is trying to make the maximum use from the inventory available—and at the cheapest cost.

Incentivisation with Industry is seen as a key enabler in this. Examples of incentivised contracts are now available for the RAF’s fast-jet fighter fleets, covering Tornado, Harrier and most recently, Typhoon. These contracts transfer the bulk of the servicing work [i.e., planned periodic servicing and capability embodiments] to Industry [and its’ attendant contractual relationships with the layers of suppliers], through a Prime Contractor promising guaranteed outputs (e.g., aircraft availability, flying hour levels, etc.). Put another way, 350 contracts can be merged into one contract, with the key feature that output is guaranteed, whereas, in the “enabling contract” regime before, there were no guarantees, only the best efforts of the RAF and civilian personnel managing the process.

A new pricing method has been developed by BAE Systems to introduce an incentivisation framework and attendant behavioural changes necessary to motivate all the parties to drive down costs. Referred to as Target Performance Price Incentive (TPPI), this method links technical/maintenance data and individual prices on specific equipments (repairs, spares) with an incentivised gainshare which rewards the parties fairly in accordance with the effort they have put into achieve savings through reliability improvements or servicing periodicity changes. So for example if the Prime Contractor can reduce the break downs on the aircraft which leads to ‘repair arisings’ at the supplier company on a particular component, then the TPPI gainshare mechanism allows for the reduction in through-life cost to be shared between customer, prime contractor and equipment supplier on an agreed pre-set basis. What is new is that TPPI can track savings on each equipment, rather than as previously where only total contract cost reductions would be known, with no audit trail as to why costs had come down.

However, data capture is essential to the process and this is an absolute must for the process to work. It is a difficult balancing act to manage this process, as within the industrial forum the prime contractor has to ensure engagement with his suppliers, who also have to be financially motivated to contribute their intellectual effort. A 3-way split of savings to include the supply base is much harder to achieve equitably than a 2-way split. A further issue is that the true end-to-end savings from any initiatives may be hard to determine, as the MoD budget process separates industrial spend controlled by MoD Defence Equipment and Support (D.E. & S) from other spend within the wider MoD. For example, the cost of providing an output from an RAF base will consist largely of the items listed in Table 8.2.

In seeking to carry out a cost benefit analysis of cost reduction initiatives and to construct an incentivisation method to reward all the parties according to savings effected, it is extremely difficult to assess the effect on all three military budgets in Table 8.2 without a long and cumbersome exercise, but without this any cost-benefit case is flawed. The current challenge is now to construct such end-to-end cost models and hence to establish the true cost of individual military platform outputs relative to their perceived military benefit.

Finally, it must not be forgotten that the possibility of cost overruns is always a threat (either for the customer, the contractor or both depending on the contract pricing method chosen) and commercial staff must always consider this in any risk assessment within the contract price. The issue here is determining firstly who is best placed to hold the risk, as risk always equates to price in a contract, and secondly how do we motivate the parties to work together to mitigate that risk? The methods to share the risk of cost overruns or the rewards of cost under run are now commonly referred to as Painshare or Gainshare mechanisms. The latest thinking is that the customer will accept a share of the pain if that means the datum contract price is lower, and thus more affordable. Although such sharing arrangements have been used in the past for example, large one-off development contracts, the new CFA Contracts are unique in that they can track the reasons for cost variances down to component level.

The challenge in constructing incentivisation methods in the military environment can, therefore, be summarised as:

-

How to adequately motivate all parties to reduce costs but maintain the required flexibility?

-

How to make the incentive mechanism simple to operate, yet take into account true end-to-end costs?

-

How to make the mechanisms dynamic to change, as the products are operated in different ways, and updated, over time?

We now examine each of these in the context of fast jets.

The least developed of these challenge questions is that of flexibility for the military and it is that question which will cause the most difficulties for commercial staff who are trained to look for stability in contracts. The issue is how to construct a cost model and attendant contract conditions which accurately portray the increased price of risk (if any) of providing a far greater degree of output flexibility and with a rapid reaction time. If this is possible a reasoned judgment can be made by the customer’s military staff and budget holders as to the price they are willing to pay for that flexibility.

Finally, questions are now being asked as to how to create the next generation of contracts and incentive mechanisms which move beyond single-aircraft contracts into multi-aircraft contracts, in order to give output flexibility across a range of aircraft in the RAF inventory but within one budget. Military Commanders now require a ‘force-mix’ approach to the deployment and use of their assets. For example, they may require a period of “surge” in flying for many months on one aircraft, as it has the capability to use a particular type of smart weapon. Yet, there is no increased budget available to pay for this higher usage.

The higher levels of MoD may, therefore, decide to “suppress” the flying levels on another aircraft in order to pay for this specific surge. Current individual aircraft contracts allow for a limited flexibility, and the force-mix approach would enhance this, but much improved budgeting and incentivisation models may be needed to allow the “budget balancing” as the cost of operation of each aircraft is different. What then is the way forward? What improved features should a second generation of CFA Contracts contain?

The challenge now is to be able to construct contracts and their incentive mechanisms which recognise force-mix, involving varying outputs as demanded, and at probably a short notice. However, they must be able to track savings and equitably reward the parties, when some stakeholders may be disadvantaged by reducing output on one aircraft to generate an increased output on another. This must be done whilst continuing to service the military need at the time, all within the original fixed budget! Taking this one [rather large] step further, it is possible to construct a scenario whereby force-mix applies to the full military inventory. Such an approach would allow budget trade-offs between aircraft, tanks, ships, etc. in terms of what assets are needed for particular missions, and the total potential cost.

Such a scenario would demand an ever-closer partnering relationship not just with the contracting customer (MoD D.E. & S) but with the Military as operators. Industrial companies, and particularly their commercial staff, have to understand how these products are used and deployed in-theatre to understand the flexibility required and be able to construct an incentive mechanism which will stand the test of time over perhaps 10–15 years in operation. Building upon the first generation contracts with output flexibility and an agreed risk-sharing mechanism, far more complex cost models are required to simulate the risk and cost involved in providing more flexibility and in shorter timescales. These must also recognise that any Prime Contractor must persuade his entire supply chain of the need to actively engage with this approach.

5 Discussion

Contracting for the availability of fighter jets is an example of procuring complex performance. Core to the contract is to enable instant flexibility to change outputs, e.g., primarily to increase or decrease the flying hours. However, additional complexity is added by the air force’s need as a customer to have instant and unpredictable access to aircraft, and to be able when required to use the aircraft in unspecified ways. Given the unique ‘bill of materials’ of each fighter jet which will have already been through many major and minor maintenance and upgrade procedures the Prime contractor takes on huge risk which mandates the collection of robust data on usage and costs. Yet, there may at times be direct conflict between the Prime’s need for reliable data for planning and cost management and military requirements for speed and flexibility. Current incentive mechanisms for gain and pain share rely on this detailed data collection.

The picture that emerges from the case is of the need for a strategic partnering relationship based on intense working together for collaborative advantage (Huxham and Vangen 2004). This relational approach is far removed from a transaction-based business model. Previous academic work in this area (Lamming 1993; Dyer and Singh 1998) has noted the need for new levels of information exchange in such relationships. Whilst such relational approaches do stress the need for mechanisms to enable inter-organisational dialogue the scale and complexity of the fighter jet Prime and user interface place huge stresses on traditional mechanisms such as early customer-contractor dialogue on risks and the requirement for a joint, not contractor only assessment log. These additional relational costs and the costs of the incentive mechanism itself have to be costed into the contract. From the interviews it was clear that the costs of collecting the information required to support certain incentive schemes were not insignificant both in financial terms and in the time involved.

In complex environment like fast jet support, companies do not just add value, they reinvent it according to Normann and Ramirez (1993:66). These authors suggest working with other economic actors like suppliers and customers to co-create value is more important than relying on a location within the value system or supply chain. What is significant about the customer role in value creation (and value destruction) is the ability the customer will have to ensure that the incentives are achieved/not achieved. There is a two part challenge, firstly to ensure that the customer (and all levels of the customer) has an understanding of how the contract is incentivised. Secondly that the customer value element to the work-mix is added in a way that is relevant, appropriate and sustainable. As the customer and end-user may not evaluate value delivered in a fixed or stable way it is critical that the incentive structure adapts to changes in the customer/end user, e.g., in military contexts these might be ‘surges’ when additional resources are required or slow periods when resource demand is reduced. This is a key problem in PFI hospital contracts where incentives support the expansion of hospital capacity by the contractor, for example rewarding the contractor by the number of beds the hospital supports. But such incentive structures do not support any moves by the end user to reduce capacity (for example through reallocating services around an area or by reducing demand). In effect one-way incentives are created that discourage the contractor from supporting strategic change by the user.

Earlier traditional manufacturing business models based on the volume supplied were discussed. With the pressure on the Prime to achieve reliability in availability contracting the supply chain faces lower volume requirements. A key challenge raised by the case study is how to effectively incentivise the supply chain of suppliers to the Prime to transition to a business model not based on volume. It is still relatively early in the development of availability contracting, and these first generation contracts have not addressed the issue to the depth that prolonged use of availability would require. The recommendation from the incentive literature would be the need to pay a premium over existing prices to compensate for lower volumes. But such ‘largesse’ may be restricted by the cost ceiling within which the Treasury require such contracts to be operated; this topic is significant and requires further exploration.

The Benefits Triangle (Fig. 8.1) was used to identify the tensions arising from the multiple parties within a fighter jet availability contract. So far this chapter has discussed the user and Prime perspectives. Turning to the MoD, DE & S or Treasury perspectives identifies a paradox at the centre of these contractual forms as often used in the UK. It is ironic that an outcome-based contract such as those discussed should be created through a focus on an input—a fixed or maximum contract value. For example, according to the National Audit Office:

The Harrier Integrated Project Team’s Joint Upgrade and Maintenance Programme cost model contained all the appropriate efficiency levers, but its starting point was the budget available and the estimate from the Prime Contractor on how much a contract may cost (2007:24).

It is often the case that incentive schemes are created within this maximum price, with the only option of cost reduction through gainshare. From the generic case study it would appear that the military are currently pushing at the frontier of how flexible a Prime can be under such a fixed-price (target price) contract. It is perhaps still not proven that where such contracts create a focus on cost reduction that innovative solutions (in innovation terms really new ideas or methods as opposed to incremental improvements) will be encouraged in the long term.

6 Conclusions and Trends in Incentive Design in Complex Support Environments

Contracting for a bundle of goods and services creates complexity, when these bundles are significant engineering capabilities such as availability in jet fighter contracts the procurement is for complex performance. Conventional incentive schemes including those with elements of shared pain/gain work to align customer and supplier/contractor interests. However, in the military environment of fighter jets support, the interests or requirements of the customer demand almost total flexibility from the Prime contractor, who is in turn reliant on robust data for their own planning purposes.

The Prime in such contracts needs to have the ability for example to accurately monitor contracts critically in major temporary cost overruns in periods of exceptional usage (e.g., flying hours). Yet it is at just such times that the military will have least time and sympathy for supporting data collection. In the case study it is clear that flexibility is the customers’ key concern (within a tight budget envelope) which can then only be contracted for when translated into a business model that can model that risk, hence the repeated need for joint consideration and management of the risk registers. Any incentive scheme will only work well where it is cost effective and the contractor genuinely has control over performance.

Whilst it is easy to appreciate military needs for flexibility, advanced contracting for availability must also provide Primes with sustainable business models, which includes the capacity to plan internally, externally and financially. The increasing emergence of targets, Key Performance Indicators (KPIs) and performance criteria on the customer in such contracts are likely. Outcome-based contracts like availability in complex engineering support areas may require incentive schemes to include the performance of the customer.

Whilst such contracting does provide a reliable and consistent source of income for a Prime, there is an unanswered question over whether the Prime moving to increased flexibility of support provision is consistent with such Primes also coming up with truly innovative solutions. If, as the case study suggests, the next frontier for availability is contracts that support more than one platform, and even ultimately different platform bases (e.g., combining elements of land, sea and air platform availability) the supposed link between contracting for long term availability and innovation must be proven.

Finally it remains a challenge to incentivise the supply chains to achieve through put (volume) reductions as down times are reduced in better maintained availability contracts. Suppliers will need to migrate to new business models, some suppliers can become consolidators providing a bigger volume of parts, others may need higher prices to accept the change. There is little work in this area which will grow in importance as availability contracting matures.

7 Chapter Summary Questions

The chapter considers that the user/operator requires far more flexibility than the current Prime provision, and this drives the following questions:

-

What processes can be taken to ensure the customers have articulated their real requirement?

-

Is that requirement an assessable requirement (i.e., can it be measured cost effectively in some way to reflect performance against it?)

-

Does the current incentive mechanism encourage behaviours on all sides that encourage collaboration?

-

Is the distribution of benefit from the incentive scheme equitable over time?

References

T.S. Baines, H.W. Lightfoot, S. Evans, A. Neely, R. Greenough, J. Peppard, R. Roy, E. Shehab, A. Braganza, A. Tiwari, J.R. Alcock, J.P. Angus, M. Bastl, A. Cousens, P. Irving, M. Johnson, J. Kingston, H. Lockett, V. Martinez, P. Michele, D. Tranfield, I.M. Walton, H. Wilson, State-of-the-art in product service-systems. Proc. I MECH. E Part B J. Eng. Manuf. 221(10), 1543–1552 (2007)

J. Broome, Procurement routes for partnering (Thomas Telford Publishing, London, 2002)

N.D. Caldwell, M. Howard (eds.), Procuring complex performance: Studies of innovation in product-service management (Routledge Taylor Francis, New York, 2010) (forthcoming)

N.D. Caldwell, J.K. Roehrich, A.C. Davies, Procuring complex performance: T5 and PFI compared. J. Purch. Supply. Manag. 15(3), 178–186 (2009)

M.A. Cohen, N. Agrawal, V. Agrawal, Winning in the aftermarket. Harv. Bus. Rev. 84(5), 129–138 (2006)

A. Davies, Moving base into high-value integrated solutions: A value stream approach. Ind. Corp. Change 13(5), 727–756 (2004)

J. Dyer, H. Singh, The relational view: Cooperative strategy and sources of interorganizational competitive advantage. Acad. Manag. Rev. 23(4), 660–679 (1998)

K Goffin, New C, Customer support and new product development & An exploratory Study. Int J of Oper & Prod Manag. 21(3), 275–301 (2001)

C. Huxham, S. Vangen, Doing things collaboratively: Realizing the advantage or succumbing to inertia? Org. Dynam. 33(2), 190–201 (2004)

R. Lamming, Beyond partnership: Strategies for innovation and lean supply (Prentice Hall, Basingstoke, 1993)

M.A. Lewis, J. Roehrich, Contracts, relationships and integration: Towards a model of the procurement of complex performance. Int. J. Proc. Manag 2(2), 125–142 (2009)

Ministry of Defence, Deloitte, Defence support review: Phase 1 report (Refresh), 2010 (forthcoming)

O.K. Mont, Clarifying the concept of product-service system. J. Clean. Prod. 10(3), 237–245 (2002)

R. Normann, R. Ramirez, From value chain to value constellation: Designing interactive strategy. Harv. Bus. Rev. 71(4), 65–77 (1993)

T. Rose, K. Manley, A conceptual framework to investigate the optimisation of financial incentive mechanisms in construction projects. International symposium on procurement systems. The impact of cultural differences and systems on construction performance. Feb 7–10 (Las Vegas, USA, 2005)

H.M. Sapolsky, Inventing systems integration, in The business of systems integration, ed. by A. Prencipe, A. Davies, M. Hobday (Oxford University Press, Oxford, 2004), pp. 15–34

M. Spring, L. Araujo, Service, services and products: Rethinking operations strategy. Int. J. Oper. Prod. Manag. 29(5), 444–467 (2009)

M. Spring, K. Mason, Business models for complex performance: Procuring aerospace engineering design services, in Procuring complex performance, ed. by N.D. Caldwell, M. Howard (Routledge Press, New York, 2010)

G. Sturgess, Commissions and concessions: A brief history of contracting for complexity in the public sector, in Procuring complex performance, ed. by N.D. Caldwell, M. Howard (Routledge Press, New York, 2010)

M. Thierry, M. Salomon, J.V. Nunen, L.V. Wassenhove, Strategic issues in product recovery management. Calif. Manag. Rev. 37(2), 114–135 (1995)

H.M. Treasury, Guidance no. 58: Incentivisation (Her Majesty’s Stationary Office, London, 1991)

A. Tukker, U. Tischner, Product-services as a research field: Past, present and future. Reflections from a decade of research. J. Clean. Prod. 14, 1552–1556 (2006)

S. Vandermerwe, J. Rada, Servitization of business: Adding value by adding services. Eur. Manag. J. 6(4), 315–324 (1988)

S.L Vargo, R.F Lusch, From goods to servive(s): Divergences and convergences of logics. Ind. Mark. Manag. 37(3), 254–259 (2008)

R. Wise, P. Baumgartner, Go downstream—The new profit imperative in manufacturing. Harv. Bus. Rev. 77 (Sept–Oct), 133–141 (1999)

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2011 Springer-Verlag London Limited

About this chapter

Cite this chapter

Caldwell, N.D., Settle, V. (2011). Incentives and Contracting for Availability: Procuring Complex Performance. In: Ng, I., Parry, G., Wild, P., McFarlane, D., Tasker, P. (eds) Complex Engineering Service Systems. Decision Engineering. Springer, London. https://doi.org/10.1007/978-0-85729-189-9_8

Download citation

DOI: https://doi.org/10.1007/978-0-85729-189-9_8

Published:

Publisher Name: Springer, London

Print ISBN: 978-0-85729-188-2

Online ISBN: 978-0-85729-189-9

eBook Packages: EngineeringEngineering (R0)