Abstract

This chapter examines the challenges in transforming a complex multi-organisational service enterprise. It builds on a review of relevant literature and an empirical analysis of the early experience and lessons learned by industry and MoD partners in the ATTAC (ATTAC (Availability Transformation: Tornado Aircraft Contract) is a long-term, whole-aircraft availability contract where BAE Systems take prime responsibility to provide Tornado aircraft with depth support and upgrades, incentivised to achieve defined levels of available aircraft, spares and technical support at a target cost.) enterprise which delivers a through life support programme in the defence sector. The transformation will be explored within three sections. The first illustrates and further develops current understanding of the drivers and challenges inherent in the move to service. In the second section, the need for a ‘holistic enterprise perspective’ for service delivery in complex engineering systems is discussed and illustrated through the ATTAC case study. Finally, the challenges in undertaking such a complex transformation process are discussed. The frameworks created may support future service enterprise leaders in identifying and communicating to all stakeholders the key drivers for the transition to through-life support services and assessing the key barriers which may be faced in managing their own transformation.

Access provided by Autonomous University of Puebla. Download chapter PDF

Similar content being viewed by others

Keywords

These keywords were added by machine and not by the authors. This process is experimental and the keywords may be updated as the learning algorithm improves.

1 Introduction

Many organisations are in the process of moving from a product- to a service-based business model. Such changes are driven by a variety of factors including the opportunity to create a more stable source of revenue; to establish a source of competitive advantage and differentiation; and the opportunity through services to build or maintain customer relationships. However, for companies who have a long history as a product-focused business, such changes present a considerable challenge in transforming processes, culture and relationships with customers. Within this monograph, the focus is on complex engineering services which often require multiple partners involved in co-creating complex customer solutions beyond the capabilities of any individual organisation. In other words, the delivery of complex engineering services requires a correspondingly complex multi-organisation ‘service enterprise’.

This chapter explores service enterprise transformation for the move to service. A defence sector case study of a complex service enterprise, involving multiple customer, prime and supplier partners, will be used to illustrate such efforts to transform for service co-creation. The successful transformation of complex service systems is a difficult and challenging undertaking for all stakeholders as the literature review within the first chapter highlights. BAE Systems and their partners have met those challenges and are breaking new ground in their ways of co-creating value. The case study represents a stage in this service journey and was offered by BAE Systems and their partners to enable learning from some of the challenges identified and addressed in their transformation.

Following this introductory section, the chapter will be structured as follows:

-

Section 2.2 will provide a brief overview of the ATTAC case study describing the methodology used and identifying an outline of key parties involved in delivering the programme;

-

Section 2.3 will examine the key drivers in the shift from product to services, and challenges to implementation at the individual, organisational and inter-organisational levels;

-

Section 2.4 will outline and discuss factors driving the adoption of a multi-organisational ‘service enterprise’ for complex delivery of customer value;

-

Finally in Sect. 2.5, the case study findings on the partners’ experience of the overall transformation and change cycle for ATTAC will be discussed. Partner behaviours, characteristics of each phase and changing relationships will be illustrated and lessons will be identified for future implementation of service contracts.

2 The ATTAC Case Study: Overview and Methodology

An in-depth case study of the ATTAC programme enabled researchers to examine the transition involved in implementing the ATTAC contract for through-life support. Through case study methodology phenomena can be examined in situ and the meanings actors bring to such phenomena can be better understood. Case study research is also useful when the aim of the research is to answer ‘how’ and ‘why’ questions (Yin 2003). This matches the wider aims of this research to gain an understanding of how and why such complex service provision contracts actually materialise in practice, as perceived by involved (and uninvolved) actors in the Provider and the Client. The ATTAC case study was chosen for two main reasons—it was the first of its scale and complexity between the Provider and the Client. Though both parties intended to continue to let and bid for such contracts, this first attempt was an opportunity for both parties to learn and this enabled the researchers to interview widely—six client and 22 provider interviews were conducted. These informants were classified into three groups—those involved in the design and implementation of the contract; those who supported implementation; and those who viewed the contract from a distance. The interviews were conducted in 2008 and were semi-structured, face-to-face taking an average of 1.5 h each. Interviews enable researchers to uncover how informants perceive and interpret situations and events (Bryman 2008). Themes covered were the scope of the contract; their role in implementation and the obstacles and enablers they met; their perceptions of issues in other areas of the implementation. The case study analysis presented in the chapter has been rigorously validated through a series of presentations to key customer and provider contract and support functions. Written reports have also been made available for validation and feedback (Yin 2003). A brief overview of the ATTAC programme and contributing partners is provided below.

The UK Ministry of Defence (MoD) is increasingly opening the support of military systems to private companies, and working in partnership with multiple organisations to deliver support. One example is ATTAC (Availability Transformation: Tornado Aircraft Contracts), a long-term, whole-aircraft availability contract where BAE Systems take prime responsibility to provide Tornado aircraft with depth support and upgrades, incentivised to achieve defined levels of available aircraft, spares and technical support at a target cost.

The support contract is delivered through a complex ‘multi-organisational service enterprise’ comprising a variety of on-base organisations at RAF Marham, supported by off-base organisations acting in partnership (Mills et al. 2009). The drivers for the adoption of this partnered approach was the need for reductions in the cost of providing this service and the belief that the service could be more effectively delivered through closer working between public and private sector partners.

From the time an aircraft is recalled for servicing, to the time it becomes available again for further duties, a wide variety of organisations and sub-organisations have collaborated in providing this ‘availability service’.

BAE Systems are the prime service provider and perform many key roles either directly or through managing RAF personnel to deliver their services. Managed by BAE Systems, a ‘fleet management’ organisation provides the planning activities that translate the RAF Squadron requirements for Tornados into the schedule of aircraft through maintenance hangers. BAE Systems then manage the hanger activity, staffed by both BAE Systems and the customer RAF Air Command personnel, where the operational services are delivered.

Engineering support is managed by BAE Systems based at both RAF Marham and their other sites. This activity resolves technical queries and safety issues and is similarly staffed by RAF and industry personnel.

The Defence Equipment & Support (DE&S)-managed Tornado IPT (Integrated Project Team) contains solely MOD staff covering administration, engineering, logistics, and commercial support of ATTAC on behalf of the Ministry of Defence. This organisation is responsible for airworthiness and procurement and monitoring of contract performance.

Following maintenance, the aircraft may need to be repainted. A third party company provides a painting service, one of the later in-line processes in the delivery of maintained aircraft and, therefore, a significant dependency.

None of the support services would be possible without the variety of sub-organisations within RAF Air Command who both provide and are responsible for the hangars themselves, and their electrical / hydraulic power and information technology infrastructure.

A number of the supply chain organisations are also a critical part of this multi-organisational service enterprise. Spare components and systems are provided by both the prime and sub-tier supply organisations, which may deliver to the prime, to the customer or directly to the RAF squadron for aircraft on duty. Finally, a further organisation, the Defence Storage and Distribution Agency, is the sole provider of transport and off-base storage of Tornado parts.

The ATTAC services are co-created by a complex and inter-dependent multi-organisational service enterprise, which must align and coordinate activities to support delivery of the service for the RAF. However, in order to fulfil this role, the contributing partners and in particular BAE Systems have to undergo a significant transformation in their ways of working and indeed in the business model or rationale underpinning their practices. In the sections to follow, this transformation is explored in terms of the focus for transformation—the drivers and challenges in the move to service; the need for a holistic multi-organisational enterprise response; and finally, an exploration of the nature of the transformation process experienced by the service enterprise partners.

3 The Move to Service

Within this section, key drivers and challenges in the move to service are identified within the literature and an analysis of how such factors are evident in the ATTAC programme has also been provided. Key messages from interviews with the ATTAC partners are presented in the text to illustrate participants’ perspectives on the drivers for transformation and the challenges faced. The analysis examines the drivers for the move to service more holistically and likewise, considers obstacles or challenges to achieving this transformation from the point of view of all parties.

3.1 Key Drivers in the Move to Service

What are the key drivers in the move from product to service orientation? Several studies have highlighted financial factors as drivers for a transition from products to services, such as the additional profits and revenues that can be achieved by manufacturers by focusing on aftermarket activities (Wise and Baumgartner 1999; Mathe and Shapiro 1993). Oliva and Kallenberg (2003) cite the following drivers: the generation of revenue from installed base of products with long-life cycles; services have higher margins than products; and services are a more stable source of revenue, resistant to economic cycles that drive investment and equipment purchases. Ward and Graves (2007) likewise identify financial factors as drivers for the move to Through-life Management. However in their study, the emphasis was less on increasing profits and revenues and more on cost reduction and revenue protection in the long term. Cost reduction included direct benefits for supplying companies and the reduction of cost of ownership for both military and civil customers. They emphasised that the aerospace industry has already supplemented product revenues with aftermarket revenues and are now more focused on agreeing through-life contracts, which seek to capture life-cycle business and revenues at the earliest possible stage and aim to reduce cost of ownership for customers. Such drivers are clearly in evidence within the ATTAC programme where interviewees were clear that the context for their business activities had changed. A change in the geopolitical climate ending the ‘cold wars’ have resulted in shifts within the defence sector from manufacture to service.

Several interviewees described the principal value proposition for the lead supplier as ‘an opportunity to access ongoing support budgets for the Tornado aircraft’. It was recognised that the traditional stream of business was diminishing in that there would be ‘no new manned air defence platforms in the foreseeable future’. The move to service was, therefore, being made to protect revenues. Such long-term support contracts were also perceived as representing a considerable opportunity for stable profit over time.

Returning to the research literature, customers are also demanding more services. Oliva and Kallenberg (2003) identify the role of changes within customer firms in prompting calls for service from their suppliers. They include factors, such as pressure to downsize, more outsourcing, focus on core competencies, increasing technological complexity and the consequent need for higher specialisation in influencing requirements for greater levels of through-life service. The nature of value for the customer would also seem to be changing. This is evidenced through the customer demand for capability, availability, operability and affordability (Ward and Graves 2007).

Clients want more value and this value is connected to the use and performance of systems; they want solutions more than just products or services; they want to take advantage of their supplier’s know-how and not just their product; they want an integrated and global offering and are reluctant to do business with several suppliers; finally, they want customised relationships Mathieu (2001, p. 458).

MoD is also changing its definition of customer value—emphasising availability and capability for future contracts. There is a willingness from MoD to transfer support of defence assets to the industry (Ministry of Defence 2005).

Cost reductions were a major driver for the ATTAC customer. The ATTAC contract offered savings of at least £510 million over the first 10 years. Savings arose from reductions in RAF and civilian personnel and the improvements a commercial organisation was expected to bring to task (Mills et al. 2009).

Competitive factors have also been suggested as key drivers in the move from a product to a service focus since services are more difficult to imitate, and are therefore a sustainable source of competitive advantage (Oliva and Kallenberg 2003). Mathieu (2001) also identified a number of competitive advantages in the transition from product to service delivery. Services, Mathieu suggested, offered strong competitive advantage through differentiation opportunities; can help in building industry barriers to entry; and services which directly enhance the value of the tangible product and support its application are more effective as competitive weapons than services of a more general nature. Superior service increases both first-time and repeat sales, enhancing the market share. Additionally, the level and quality of the services offered is an effective way to maintain on-going relationships. Hence, services also provide marketing opportunities and the opportunity to maintain strong customer relationships. There was evidence that relationship-building opportunities were recognised within the ATTAC programme where the delivery of support services was acknowledged as a factor in maintaining or strengthening the relationship with the customer and helping to secure the loyalty.

Finally, Ward and Graves (2007) additionally identified the need for risk reduction or risk transfer as a driving factor in the development of TLM contracts. They found some evidence particularly from defence sector companies that the adoption of TLM involves the transfer of risk from the customer down through the supply chain that assumes much higher levels of operating risk, financial risk and technological risk. The issue of transferring risk would seem to represent both a key driver and challenge for the ATTAC programme. The transfer of risk from the customer to the supply chain is more complex in the defence sector where there is a need to retain national capability.

Although the drivers for suppliers and customers have here been presented separately, there was a strong tendency for both supply and customer interviewees to express mutually beneficial drivers for the programme. There was common agreement among interviewees that the programme was developed to deliver ‘more for less’ in such a way as to provide benefits for all parties and a belief that the service could be more effective through closer working between public and private sector partners.

However, there was also clear recognition that the programme was a testing ground for new forms of contracting and collaborative delivery and that many challenges would need to be overcome to achieve this move to a service model. An overview of the key drivers for the move to service is presented in Table 2.1.

3.2 Challenges Faced in the Transition to Service

The research literature examining the transition to through-life services draws attention to a broad range of challenges to achieving this aim. Such challenges exist at the individual level where managers struggle to adopt the necessary service mindsets and behaviours; at the organisational level where structures, systems, governance and culture may all conflict with service needs; and at the inter-organisational level where partnerships can be difficult to form, traditional adversarial relationships dominate and suppliers or customers may need to be educated in different values and practices. The individual, organisational and inter-organisational barriers to the move from a product to a service orientation are summarised in Table 2.2 and discussed in detail in the following paragraphs. Evidence of the existence of such barriers within the ATTAC case study is assessed and any further obstacles identified.

Beginning at the individual level, Gebauer et al. (2005) point out that strong managerial motivation is necessary to support the scale and complexity of change towards servitization and through-life support. However, managers from a traditional manufacturing background have considerable scepticism which must be overcome in order for the move from products to services to generate positive outcomes for their businesses. They argue that such managers have a number of cognitive biases which mean they favour tangible products over rather intangible services processes.

The overemphasis on obvious and tangible environmental characteristics explains, for example, why managers do not place a high valance (reward) on extending the service business, thus limiting the investment of resources in the service area. Scepticism of the economic potential explains why managers underestimate the probability that their efforts will result in successful performance. Risk aversion limits managerial expectations of estimating accurately that (successful) performance will result in the rewards Gebauer et al. (2005, p. 17).

Further, they suggest that behaviour aligning with such assumptions can become a self-fulfilling prophecy. In other words, managers place low investments of time and effort into service, leading to poor performance. This can then create further scepticism of the economic benefits of the move to a service model and exaggerated perceived risks, thus resulting in further low investment (Gebauer et al. 2005). Within the ATTAC programme, there was also evidence of a degree of scepticism among some individuals within both supplier and customer partners concerning the degree to which the contract would deliver benefits and whether partners would be able to move beyond traditional adversarial relationships. This scepticism seemed, however, to lessen as the process of transition progressed; this will be discussed in the later section on the process of transformation.

In addition to overcoming manager’s preferences for working with the tangible, leaders of the transition to through-life support also need to recognise that some of the necessary adaptations to create a service environment will be ‘politically sensitive’. For example, moving away from traditional incentive and performance systems can be challenging and disturbing for workers and managers. Mathieu (2001) also recognised such political sensitivities where changes would be seen as a threat to some organisational units and an opportunity for others. MoD efforts to reduce costs through the implementation of the ATTAC contract would no doubt have resulted in the major changes for individuals and units within the client organisations. In such circumstances there would naturally be strong resistance to change among some individuals. For BAE Systems managers, this move to service may likewise have threatened or enhanced ‘empires’.

Finally, the ATTAC programme faced a further challenge relating to the individual career plans of those involved in the programme. For BAE Systems the issue faced was recruitment and retention for services on base, within an organisation where the traditional career pathways were in production and linked to ‘visibility’ at the main headquarter sites.

At the wider organisational level there are also a number of potential obstacles to the transition to through-life services. An organisation’s culture may also be an obstacle to the move to through-life support. Mathieu (2001) argues that service culture is specific and different from the traditional manufacturing culture and that service firms would also tend to be organised differently from manufacturing firms. She argues that a manufacturing company will benefit from the implementation of a service strategy, only if it is successful in making the transition from a traditional industrial culture to a service culture where service quality is paramount. The organisation’s traditional internal efficiency metrics applied in manufacturing may also be inappropriate for many service activities (Gronroos and Ojasalo 2004). Many respondents within the ATTAC case study highlighted cultural factors as a major challenge in achieving the successful move to service.

In particular, on-base service contract staff noted very different timescales which were adopted by front and back office staff and the difficulties of changing such practices.

Services are often delivered through complex organisational structures which can be a potential barrier to the seamless delivery of services and support to the customer.

The part of the business providing services or support may be different to the part of the business acting as the interface to customers and suppliers. This results in complex interactions and often conflict and delays between different parts of the organisation, Ward and Graves (2007, p. 474).

Geographical dispersion and a broader sense of fragmentation presented a very real problem for the ATTAC programme. This issue is discussed in the later section on transformation.

Likewise, the development of information systems to support advanced services, and through-life contracts is a key issue facing aerospace companies (Ward and Graves 2007). The information needs are complex and require greater levels of information sharing between the customer and the service provider.

The move towards through-life management and the development of advanced services, such as equipment health monitoring, requires significantly higher levels of data sharing between customers, manufacturers and service providers. Contracts based on availability targets need detailed reliability, failure and usage data. Support chain management and integrated logistics support also require access to customer inventory data… However, respondents across the participating companies admit that data and knowledge sharing, whether within their own organisations or with customers and suppliers, could be improved (Ward and Graves 2007, p. 474).

Within ATTAC there was recognition that there needed to be significantly greater information sharing and openness. There was also a recognition that reporting mechanisms, while changing, often still reflected more traditional, predominantly product orientation of some of the managers within the business.

As Mathieu (2001) also suggests, support function services like Purchasing, HR and Finance also need to be persuaded to adapt from the embedded mindset and systems of a traditional equipment supply business to understand and respond to service needs. This challenge was also in evidence within the ATTAC case study where changes were required in the culture and practices of support staff from functions based in the corporate main sites towards better supporting the needs of the service contracts. Improving the transparency and visibility of service requirements and back office support processes are thought to be key enablers for this mindset change.

The transition to through-life solution provision often cannot be made by an individual company operating alone (Ward and Graves 2007), which, therefore, brings further inter-organisational challenges to adopting a through-life service approach.

Where partnering is required with other companies within a group, other manufacturers or independent MRO and support providers, some of whom may be competitor organisations, the picture becomes even more complex (Ward and Graves 2007, p. 474).

The need to work in unison with other service partners adds a further layer of inter-organisational complexity to the journey that service companies must make. Some of the Aerospace case examples, presented in their study, were hindered in their move to through-life services by either their suppliers or customers who retained a traditional view of aftermarket activities. Within the ATTAC programme dependencies between partners are a critical issue, where a wide number of stakeholders are involved in service delivery.

Foote et al. (2001) even suggest that changing the basis of relationships with traditional clients may be so difficult that it is new clients without that baggage that should be preferred. For the ATTAC partners there is not an option of changing clients or indeed suppliers until contract review. Both parties have had to deal with historical relationships and stereotypes and forge new relationships over time. There is a recognition, however, that such relationships are largely between individuals. Respondents suggested that there is a need to move from positive individual relationships to broader organisational relationships.

In Table 2.3 the individual, organisational and inter-organisational barriers experienced within ATTAC are summarised and provide a framework that can be used to analyse and communicate relevant barriers to key stakeholders in the transformation.

4 Taking an ‘Enterprise’ Perspective

Complex engineering service systems inevitably involve complex organisational solutions, which go beyond the boundary of single organisations. The brief overview of the ATTAC programme makes clear the complex network of organisational entities involved in value delivery to the MoD customer. The complex multi-organisational nature of the ATTAC enterprise is illustrated and discussed in greater detail in the next chapter on ‘enterprise imaging’. Within this and subsequent chapters in this section of the monograph, we have adopted a holistic ‘service enterprise’ perspective when discussing the ATTAC programme. This perspective views the boundaries of the enterprise as incorporating all inter-dependant parties involved in value delivery rather than a single and separate ‘organisational entity’ perspective. It is our contention that to understand the delivery of value in complex engineering service systems, the service enterprise needs to be viewed and managed from this holistic enterprise perspective.

4.1 What is an ‘Enterprise’?

It is significant when a leader in aerospace or any industry asserts that a given set of activities - regardless of scale - must be viewed as an interconnected whole. That interconnected whole is an enterprise Murman et al. (2002, p. 8).

From Murman et al.’s perspective, it would seem that, in terms of distinct boundaries, an enterprise is whatever an enterprise leader says it is. This would seem to be a rather arbitrary boundary definition. However, while basing enterprise boundary definitions on leadership assertions may seem to devalue the concept, it may perhaps also be the concept’s greatest strength. Leaders establish a coherent enterprise perspective to encourage the achievement of common goals. As Murman et al. (2002) argue, ‘the meaning of enterprise is not always clear. Leaders and others have to assert the interdependence of various stakeholders, and make clear that they are part of a common enterprise’ (p. 13). Nightingale (2000) attempts to capture the complex web of inter-related processes and organisations involved in her definition of ‘enterprise’,

Enterprises are complex, highly integrated systems comprised of processes, organizations, information and supporting technologies, with multifaceted interdependencies and interrelationships across their boundaries Nightingale (2000).

This definition describes some of the elements of an enterprise and emphasises the necessary dependencies. It does not however, define the essential characteristics of an enterprise.

In the absence of clear definitions, the following defining characteristics are offered for a ‘service enterprise’. A ‘service enterprise’ is an ‘organising perspective’ which is: (a) proposed by a group of leaders (b) as a means of establishing a holistic approach (c) among a number of disparate enterprise stakeholders (functions, organisations), for the (d) achievement of common complex significant purpose/mission (value creation and delivery, performance improvement), and which (e) cannot be delivered by single entity thinking and practices (interdependence).

This definition also emphasises the role of leadership in promoting a holistic enterprise perspective as a means of establishing coherence among a number of interdependent parties engaged in service delivery. The definition also echoes that commonly given to ‘organisations’ by organisation theorists who claim that ‘organisations arise from activities that individuals cannot perform by themselves or that cannot be performed as efficiently and effectively alone as they can be with the organised efforts of a group’ (Hatch and Cunliffe 2006).

4.2 The Need for Multi-Organisational Inter-Dependent Enterprises

In the earlier section, the drivers for the move from a product- to a service-oriented approach were discussed. Such a move might be undertaken by an individual company operating largely independently and as indicated, the move would face many challenges. Within complex engineering services such as ATTAC however, value is delivered by many partners operating interdependently and consequently, the move to service is significantly more complex. So why would organisations choose to adopt a multi-organisational, inter-dependant approach to delivering value?

In this section we will examine some of the key factors in the adoption of a multi-organisational enterprise approach to service delivery. Several inter-related factors will be considered including: the trend for organisations to narrow the scope of their activities and outsource all non-core activities; the growing requirement of customers to have holistic solutions; the increasing involvement of customers in the co-creation of value; and finally, the need to work collectively with others in the value chain to both reduce costs and improve performance.

4.2.1 Focus on core competence and outsourcing of non-core activities

Individual organisations are increasingly adopting a strategy of identifying and focusing on their core competence. This leads to a narrowing of capability and increased specialisation. A core competence perspective states that companies should differentiate between their competencies as “core”, those that are essential to compete in the market and the firm is extremely good at, and “non-core” those that are not essential to compete in their chosen market (Lonsdale and Cox 2000). Only those competencies that are non-core should be performed externally by a third party company.

This trend is now well established in many sectors where prime contractors are increasingly relying on ‘full service’ suppliers for whole subsystems (Gadde and Jellbo 2002:43), as well as being in charge of managing and designing their own supply chain (Doran 2003).

The objective of this approach is that firms should strengthen and leverage their core competencies (Ellram and Billington 2001) and outsource non-core competencies. This is particularly the case when “the total costs of owning [them] are demonstrably higher than sourcing externally, and the associated risks of market failure or market power are not excessive” (Lonsdale and Cox 2000). The ATTAC programme provides evidence of the application of this principle in the defence sector where industry is being expected to take on roles which are considered ‘non-core’ for the MoD. However, there are risks within this approach, for instance where the MoD has a need to retain skill and capability for reasons of national security. There are consequently some reservations among ATTAC partners regarding the nature of activities appropriate for outsourcing and the need to maintain skills and capabilities within the armed forces.

4.2.2 ‘Holistic’ customer solutions which cannot be delivered by individual companies

While individual organisations have been engaged in narrowing their strategic focus onto certain technologies, services or processes, customers are moving in the opposite direction, increasingly seeking total solutions and services. As highlighted in an earlier section, the MoD is clearly moving towards seeking total solutions for maintenance and upgrade of their various platforms as evidenced in the rise of through-life support and availability contracts (Ministry of Defence 2005). To meet this customer need, organisations seek to offer total, systemic product or service solutions. However, since the trend has been to outsource non-core activities, fewer organisations are able to provide a one-stop solution utilising their own resources alone. This problem has driven organisations in all sectors toward greater inter-organisational collaboration. The strategy deployed is to offer the customer a complete solution and to achieve this integration of each of the elements via close collaboration with a network of specialist external providers (Möller and Halinen 1999). The proposition that collaborative multi-organisational enterprises, rather than single companies, now compete is well supported in the literature (Akkermans et al. 1999; Lawrence 1999; McAfee et al. 2002).

4.2.3 Increasing involvement of customers in the ‘co-creation of value’

The need to adopt a strategy of operating within integrated and inter-dependent ‘service enterprises’, is also prompted by the increasing involvement of customers in ‘value co-creation’. This shift in view, where customers are part of the value creating enterprise has been highlighted by many writers. Vargo and Lusch (2006, 2008) described the shift as moving from a traditional goods centred or ‘product-dominant logic’ to an emerging ‘service dominant logic’. In the former way of thinking, the customer was seen as the passive recipient of goods. Recent thinking has recognised that the customer is a co-producer or co-creator of value. Prahalad and Ramaswamy (2000, 2003) argued that companies should encourage the customer to be proactively involved in co-creation of value. They describe customers as being ‘co-opted’ into the design and delivery of services. Indeed, they suggest that the co-creation of value has shifted our ways of thinking about products and services and the boundaries between the provider and customer.

The ATTAC programme represents a complex engineering service which is truly co-created with the customer. For example, the hangar maintenance activities are managed by BAE Systems and resourced by a combination of BAE Systems, RAF and others. Maintenance activities are only made possible through a number of RAF provided services including electrical/hydraulic power and information technology infrastructure for the hangar buildings. The engineering support again provided by both BAE Systems and MoD personnel is necessary to resolve technical queries and safety issues. Finally, the service enterprise includes the Defence Equipment & Support managed Tornado IPT (Integrated Project Team) containing solely MoD staff covering administration, engineering, logistics, and commercial support of ATTAC on behalf of the Ministry of Defence. This organisation is responsible for airworthiness and procurement and monitoring of contract performance. Such complex co-creation of value requires a holistic enterprise perspective to function effectively.

4.2.4 Need for collaborative cost reduction and performance improvement

Finally, companies are finding it necessary to engage to adopt a multi-organisational service enterprise perspective in their drive to reduce overall service costs. Globalisation and customer demands for better products and services at lower costs have led companies to seek ways to reduce the overall cost of delivering customer value. This pressure for cost reduction is explicitly built into the ATTAC contract and the enterprise partners are actively seeking to eliminate waste and generate improvements.

While individual company costs might be reduced by a single company approach, the impact of such cost reductions may be detrimental to the whole service system. Therefore, a multi-organisational service enterprise perspective is needed to achieve significant and sustainable cost reduction. Inter-organisational cost management techniques, including the use of target costing, may deliver significant benefits if they are adopted in an integrated manner (Slagmulder 2002). In the same vein, performance improvement in the overall service to customers is similarly only possible from a service enterprise perspective, in order to avoid ‘islands of excellence’ in an otherwise dissatisfactory service.

The need for a more holistic enterprise perspective and the challenges involved in achieving such an approach were widely recognised by all parties within the ATTAC programme. An enterprise approach involving greater integration would, for example, facilitate faster and more informed decision making than could be achieved in ‘old functional or organisational silos’.

Progress has been made within the ATTAC programme towards achieving an enterprise perspective, but many felt that inter-organisational boundaries needed to be removed. Nevertheless, while the need for a holistic service enterprise perspective has been explored, achieving the goal of designing and managing such multi-organisational enterprises remain a significant challenge for all organisations including ATTAC.

There is perhaps a need for more effective communication of a common service vision within the overall ATTAC enterprise. Certainly, Ward and Graves (2007) emphasise the need for systematic and proactive communication of the service vision throughout the internal and external network of service providers. They highlight widely differing experiences of success in achieving such coherent communication. One company described within the study has ‘embraced the through-life concept with conviction’ and is actively implementing a service strategy externally and internally. This is being achieved through a combination of service dominated website and advertising; communication of their service strategy throughout their internal and external network; a training programme introducing service theory and knowledge; and recruitment policies emphasising service skills. For other companies within their study, the adoption of a service strategy to support through-life management does not appear to be a consistent strategic message. In a context such as the ATTAC programme where the customer plays such a strong role in the co-creation of value, it is difficult to determine whose role it is to develop and communicate the service vision and to lead the necessary transformation to achieve service goals.

In the next chapter of this book on ‘enterprise imaging’, a methodology is described for visualising and delineating the organisational entities involved in delivering service including the service providers, the customer and the supply chain. Regardless of where boundaries are drawn, it is clear that the move to service will require a significant transformation for all partner organisations. This transformation process is explored in the remaining part of this chapter.

5 The Transformation Process

Within the change management literature there have long been attempts to distinguish the levels of magnitude of change with many writers contrasting levels of significance or extent of the desired change and the impacts of such changes. These changes have been variously described as ‘realignment’ versus ‘transformation’ (Balogun and Hope-Hailey 2008); ‘incremental’ versus ‘radical’ (Baden-Fuller and Stopford 1995); or ‘incremental change’ versus ‘reinvention’ (Goss et al. 1998).

Transformation has been described as a ‘change which cannot be handled within the existing paradigm and organisational routines: it entails a change in the taken for granted assumptions and the “ways of doing things around here”. It is a fundamental change within the organization’ (Balogun and Hope-Hailey 2008, p. 20).

Incremental change is not always enough for some businesses that require a more fundamental shift in their capabilities. ‘These companies do not need to improve themselves; they need to reinvent themselves. Reinvention is not changing what is, but creating what is not (Goss et al. 1998, p. 85). They go on to suggest that reinvention involves ‘altering your context’ and that in doing so, this makes it possible for organisations to alter their culture and performance, and to do so sustainably.

In relation to the move from a product to a service business model, Mathieu (2001) suggests that

the most ambitious service strategies are the ones which provide the manufacturing companies with the greatest benefits … Nevertheless, the most ambitious service strategies are also the riskiest because they have to support multiple costs associated with their implementation and challenges deeply embedded assumptions within the business (Mathieu 2001, p. 471).

The ATTAC service enterprise incorporating each of the organisational entities involved in delivering and supporting the programme would appear to be undergoing a significant transformation which has yet to be fully completed. The interview analysis with both industry and MoD partners provided evidence from the participants’ perspective on the magnitude of change and the lack of recognition of the scale and complexity of the changes involved. There was also recognition that the service enterprise transformation process was significantly more complex than transforming a single organisation.

A lack of full recognition by leaders of the scale and impact of transformations on the participants seems to be common across all sectors.

Executives have frequently underestimated the wrenching shift— the internal conflict and soul-searching— that goes hand in hand with a break from the present way of thinking and operating (Goss et al. 1998, p. 86).

There is certainly considerable evidence within the ATTAC case study that participants have found the transformation to a co-created service extremely challenging and that they have been through a cycle of changing reactions to this transformation. The stages through which the ATTAC enterprise has proceeded are presented in an analysis which builds upon the classical emotional change cycle first identified by Kubler-Ross in relation to the grieving process (1973, 2005) and widely adapted for organisational change processes (Scott and Jaffe 1994).

As the now classic change cycle suggests, those involved in change typically go through four phases in their emotional reactions to change—denial, where the impact of changes are underestimated; resistance, as the consequences of change are recognised; exploration, as those involved begin to make sense of the changes and experiment with new ways of working; and finally commitment, where the changing patterns are accepted and become embedded in normal practice (Scott and Jaffe 1994).

The findings of the ATTAC case study analysis demonstrated that participants went through a period of ‘denial’ in the early bid development stages of ATTAC where the parties involved were unaware of the scale and scope of the transformation to new ways of working and relating.

At this early stage, BAE Systems and the MoD would seem to have been working closely from what might be described as an integrated ‘service enterprise’ perspective, where they attempted to understand and co-design what might be involved in a partnered process of service delivery. This was demonstrated through such measures as ‘co-location’ and ‘having a joint mantra and joint mission statement’.

However, this holistic perspective may have been at least partially abandoned once the programme was underway in what could be described as the resistance or ‘discovery’ phase when the contract was being implemented. Realities began to be faced, blame allocated and some resistance experienced. Respondents suggested that some individuals were allocated to the service contract whose background was in building aircraft and who did not understand how maintenance differed from their normal context. Such individuals were resistant to the change to service.

During this difficult initial implementation period, the various enterprise partners seem to have reverted to ‘single entity’ rather than ‘service enterprise’ thinking, as they began to face the very real challenges of delivering the programme. This sense of fragmentation was evident not only between but within organisations as well. Such divisions were felt between on-base staff who directly managed the delivery of service and supporting functions who seemed not to understand the changing needs and timescales under which the service providers operated.

The perception among ATTAC personnel that they were ‘out on a limb’ operating in a very isolated way, was further reinforced by a geographical split. On-base personnel were supported by functions based on one of the company’s main sites approximately 200 miles away and whom it was felt, did not understand the new service ways of working. It seemed to some respondents that senior corporate management which had a strong presence ‘on base’ during the initial bidding phase seemed also to have migrated away during this implementation phase. During this challenging period, the need for enterprise cohesion was expressed by many through a desire to be co-located in order to have a better communication and greater visibility of service needs.

The exploration phase, also evidenced within the ATTAC interviews, represents a recognition that things need to be done differently and also a greater clarity on the differences between old and new ways of working. It was for example, recognised that organisational pace and the processes needed to support it in design, development, and manufacture ‘where lead times are measured in years’, was significantly different to maintenance and upgrade, ‘where lead times are measured in weeks or hours’. There was also acknowledgment that while the old business models were outdated, there remained significant vestiges of such models in the industry ‘hierarchies’ and ‘power bases’.

At the time of data collection, efforts were being made to make the necessary changes towards new ways of working. There was evidence of a number of improvement activities and efforts to reconfigure the organisational arrangements in order to provide better service. While such efforts to make improvements seem to have been largely single organisation-led, there was, however, evidence of a return to a joint and holistic service enterprise perspective. When the findings of the ATTAC case study were fed back to all the parties involved, there was common agreement among the interviewee respondents and others present that the programme had not yet fully reached the commitment stage in the change cycle but that there were significant signs that they were getting there. The commitment stage would involve all service enterprise partners working to deliver and improve the service offered from a holistic enterprise perspective rather than optimising for individual organisational benefit. The ATTAC enterprise partners recognised that joint thinking was required to work as an enterprise both across and within organisations, through the involvement of multi-disciplinary and multi-organisational teams rather than viewing issues as an ‘industry—’ or ‘customer-problem’.

There was also clear evidence within the ATTAC enterprise of strong relationships and a common sense of purpose developing. Greater contact between service personnel, who had recent operational experience, and industry partners led to stronger ‘connection’ between the contract services and their customers’ needs. This clear line of sight between service providers and users has helped to incentivise people to perform their best to deliver value to their customers. There was also a developing understanding that cohesion as a holistic service enterprise required time and increased openness to better understand partners motivations and ways of working.

As the ATTAC enterprise began to work more closely together, new questions were raised concerning how service enterprises should be managed, and who should lead such enterprises. Much has yet to be learnt in managing multi-organisational service enterprises.

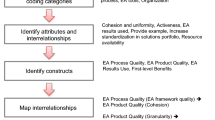

Stages in the experience of transformation through contract development and implementation are summarised in Fig. 2.1, and characteristics and behaviours encountered at each stage are briefly outlined. As the enterprise partners have gone through the change cycle, they have moved from initial efforts to jointly manage from a holistic ‘service enterprise perspective’ to ‘single entity thinking’ while they struggled with the realities of implementation before seeing a return in later stages to the enterprise level management.

Stages experienced in the ATTAC transformation (adapted from Scott and Jaffe 1994)

This model may be supportive to other complex service enterprises in understanding the cycle experienced in developing co-created services. Further research will clearly be necessary to determine if all enterprise stakeholders face a journey from initial enterprise cohesion in designing services; through a discovery phase where enterprise partnerships may be strained; to an eventual return to cohesion as partners come to understand their inter-dependence in co-creating value.

6 Conclusions and Future Work

Complex engineering service systems inevitably involve complex organisational solutions, which go beyond the boundary of single organisations. In this chapter, the need for complex multi-organisational service enterprises has been explored and questions have been raised regarding the challenges of managing such enterprises particularly where customers are heavily involved in value co-creation. Finally, the study has shed some light on stages in the transformation process and the experience of those involved. This study, and the related work presented in the chapters within this section, begins to uncover the significant challenges faced in ‘organising’ to deliver complex services. There is evidence of the need to clarify the service vision, including the key drivers for the move to service. Organisational leaders likewise must recognise and address the challenges faced in moving from a product-dominant focus to a service ethos. For complex services there are additional challenges in the need for leadership across a multi-organisational enterprise. Traditional relationships between the customer and suppliers must change as all parties recognise their inter-dependence in co-creating value. The transition model discussed highlights the evolving nature of organising to deliver service. Enterprise partners must experience a learning curve in discovering how to work together and deliver service in this new environment.

The challenges inherent in the delivery of complex, co-created services are considerable and require a significant shift in perspective and practices among the partners. This case study represents an early stage in this service journey for BAE Systems and their partners and has provided insights into some of the necessary transformations in ways of working and thinking. The research partnership underpinning the contents of the chapter is ongoing and continues to generate learning for the service science community. Many questions remain, concerning how best to manage the transformation of complex service enterprises. However, the frameworks created may support future service enterprise leaders in identifying and communicating to all stakeholders, the key drivers for the transition to through-life support services and assessing key barriers which may be faced during their own transformation.

7 Chapter Summary Questions

The chapter has highlighted the challenges faced by multi-organisational service enterprises in managing the transition from a product- to service-based business model for traditional manufacturing partners, their suppliers and customers.

-

To what extent are the service enterprise partners clear about the driving forces and motivations for the move to service?

-

What are the key individual, organisational and inter-organisational challenges faced in the transition to service?

-

How can service enterprise partners be supported through the transition curve?

References

H. Akkermans, P. Bogerd, B. Vos, Virtuous and vicious cycles on the road towards international supply chain management. Int. J. Oper. Prod. Manag. 19(5/6), 565–581 (1999)

C. Baden-Fuller, J. Stopford, Rejuvenating the mature business (Routledge, London, 1995)

J. Balogun, V. Hope-Hailey, Exploring strategic change, 3rd edn. (Prentice Hall, London, 2008)

A. Bryman, Social research methods, 3rd edn. (Oxford University Press, Oxford, 2008)

D. Doran, Supply chain implications of modularization. Int. J. Oper. Prod. Manag. 23(3), 316–326 (2003)

L. Ellram, C. Billington, Purchasing leverage considerations in the outsourcing decision. Eur. J. Purch. Supply. Manag. 7, 15–27 (2001)

N.W. Foote, J. Galbraith, Q. Hope, D. Miller, Making solutions the answer. McKinsey Q. 3, 84–93 (2001)

L. Gadde, O. Jellbo, System sourcing—Opportunities and problems. Eur. J. Purch. Supply. Manag. 8, 43–51 (2002)

H. Gebauer, E. Fleisch, T. Friedli, Overcoming the service paradox in manufacturing companies. Eur. Manag. J. 23(1), 14–26 (2005)

T. Goss, R. Pascale, A. Athos, The reinvention roller coaster: Risking the present for a powerful future. Harv. Bus. Rev. Change (Harvard Business School Press, Boston, 1998)

C. Gronroos, K. Ojasalo, Service productivity: Towards a conceptualization of the transformation of inputs into economic results in services. J. Bus. Res. 57, 414–423 (2004)

M. Hatch, J. Cunliffe, Organization theory: Modern, symbolic, and post-modern perspectives (Oxford University Press, Oxford, 2006)

E. Kubler-Ross, On death and dying (Routledge, New York, 1973)

E. Kubler-Ross, On grief and grieving: Finding the meaning of grief through the five stages of loss (Simon & Schuster, New York, 2005)

F.B. Lawrence, Closing the logistics loop: A tutorial. Prod. Invent. Manag. J. 40(1), 43–51 (1999)

C. Lonsdale, A. Cox, The historical development of outsourcing: The latest fad? Ind. Manag. Data Syst. 100(9), 444–450 (2000)

H. Mathe, R.D. Shapiro, Integrating service strategy in the manufacturing company (Chapman & Hall, London, 1993)

R.B. McAfee, M. Glassman, E.D. Honeycutt Jr, The effects of culture and human resource management policies on supply chain management strategy. J. Bus. Logist. 23(1), 1–18 (2002)

J. Mills, V. Crute, G. Parry, Enterprise imaging: Visualising the scope and complexity of large scale services. QUIS 11 – The Service Conference, Wolfsburg, Germany 11-14 June 2009

Ministry of Defence (MoD), Defence industrial strategy: Defence white paper, command 6697. Presented to Parliament by the Secretary of State for Defence. UK, December 2005

V. Mathieu, Service strategies within the manufacturing sector: Benefits, costs and partnership. Int J of Serv Ind Manag 12(5), 451–475 (2001)

K. Moller, A. Halinen, Business relationships and networks: Managerial challenge of the network era. Ind. Mark. Manag. 28(5), 413–427 (1999)

E. Murman, T. Allen, K. Bozdogan, J. Cutcher-Gershenfeld, H. McManus, D. Nightingale, E. Rebentisch, T. Shields, F. Stahl, M. Walton, J. Warmkessel, S. Weiss, S. Widnall, Lean enterprise value: Insights from MIT’s lean aerospace initiative (Palgrave, London, 2002)

D.J. Nightingale, Lean enterprises—A systems perspective. MIT engineering systems division internal symposium, pp. 341–358 (Cambridge, MA, USA, 2000)

R. Oliva, R. Kallenberg, Managing the transition from products to services. Int. J. Serv. Ind. Manag. 14(2), 160–172 (2003)

C.K. Prahalad, V. Ramaswamy, Co-opting customer competence. Harv. Bus. Rev. Jan–Feb (2000), pp. 79–87

C.K. Prahalad, V. Ramaswamy, The new frontier of experience innovation. MIT Sloan Manag. Rev. 44(4), 12–18 (2003)

C. Scott, D.T. Jaffe, Managing organisational change (Kogan, London, 1994)

R. Slagmulder, Managing costs across the supply chain, in Cost management in supply chains, ed. by S. Seuring, M. Goldbach (Physica-Verlag, New York, 2002)

S.L. Vargo, R.F. Lusch, Service-dominant logic: What it is, what it is not, what it might be, in The service-dominant logic of marketing: Dialog, debate and directions, ed. by R.F. Lusch, S.L. Vargo (ME Sharpe, Armonk, 2006), pp. 43–56

S.L. Vargo, R.F.L. Lusch, Service-dominant logic: Continuing the evolution. J. Acad. Mark. Sci. 36(1), 1–10 (2008)

Y. Ward, A. Graves, Through-life management: The provision of total customer solutions in the aerospace industry. Int. J. Serv. Technol. Manag. 8(6), 455–477 (2007)

R. Wise, P. Baumgartner, Go downstream: The new profit imperative in manufacturing. Harv. Bus. Rev. Sept–Oct: (1999), pp. 133–141

R.K. Yin, Case study research: Design and methods, 3rd edn. (Thousand Oaks, Sage, 2003)

Acknowledgments

The authors would like to acknowledge and thank their sponsors within BAE Systems, Louise Wallwork and Jenny Cridland, and John Barrie for their support and direction. We would also like to thank the ATTAC enterprise industry and MoD partners for their engagement with our work. This research was supported by BAE Systems and the UK Engineering and Physical Sciences Research Council via the S4T project.

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2011 Springer-Verlag London Limited

About this chapter

Cite this chapter

Purchase, V., Parry, G., Mills, J. (2011). Service Enterprise Transformation. In: Ng, I., Parry, G., Wild, P., McFarlane, D., Tasker, P. (eds) Complex Engineering Service Systems. Decision Engineering. Springer, London. https://doi.org/10.1007/978-0-85729-189-9_2

Download citation

DOI: https://doi.org/10.1007/978-0-85729-189-9_2

Published:

Publisher Name: Springer, London

Print ISBN: 978-0-85729-188-2

Online ISBN: 978-0-85729-189-9

eBook Packages: EngineeringEngineering (R0)