Abstract

This paper investigates stock returns presenting fat tails, peakedness (leptokurtosis), skewness, clustered conditional variance, and leverage effects. We apply the exponential generalized beta distribution of the second kind (EGB2) to model stock returns as measured by six AMEX industry indices. The evidence suggests that the error assumption based on the EGB2 distribution is capable of accounting for skewness and kurtosis and therefore of making good predictions about extreme values. The goodness-of-fit statistic provides supporting evidence in favor of an EGB2 distribution in modeling stock returns.

Access provided by Autonomous University of Puebla. Download chapter PDF

Similar content being viewed by others

Keywords

1 Introduction

In analyzing financial time series, the conventional approach usually assumes a Gaussian distribution. The advantage of using a Gaussian assumption is that the statistical analysis of asset returns can be simplified: the main focus is on the first two moments. This simplification is appealing to practitioners, since it can directly link statistical tools to the mean-variance framework in making daily portfolio decisions. This advantage, however, entails a cost. Recent financial disturbances suggest that significant daily loss occurs more frequently and the behavior of volatility cannot reasonably be predicted based on a normal distribution.

To address this issue, practitioners have developed the Value at Risk (VaR) and Expected Tail Loss methods to deal with extreme values of asset price movements. Yet, using VaR to measure a portfolio’s maximum loss over a target horizon within a given confidence interval is essentially based on a normal distribution. This scheme may work well at the 95% confidence interval. However, using the normal model, VaR estimates in general lead to under-forecasts of losses at the 99% level. The 1987 market crash with its − 17σ attests to the failure of the VaR method in estimating variance by employing the normal distribution.

Recognizing the frequent occurrences of market crashes, major defaults, financial turmoil, and the collapse of asset prices, financial institutions have begun to treat extreme values as a kind of common risk when managing their portfolios. From a practical perspective, if portfolio distributions depend on more than two parameters, optimal choice cannot be satisfied by the mean-variance approach. To account for the distributional anomalies of stock returns, we must incorporate skewness and kurtosis into portfolio decisions and risk management. From an academic point of view, although it is generally recognized that the GARCH type model is capable of dealing with the volatility cluster phenomenon, it nonetheless fails to account for the fat tails and skewness. In fact, as argued by Brooks et al. (2005), “If asset returns are fat-tailed, it will lead to a systematic underestimate of the true riskiness of a portfolio, where risk is measured as the likelihood of achieving a loss greater than some threshold” (p. 400). From an econometric point of view, the exclusion of fat-tailed and skewed information in the asset return model is bound to result in missing variables and misspecification problems.

Several non-Gaussian distributions have been proposed in the finance literature. For example, Bollerslev (1987) suggests a Student’s t-distribution; Nelson (1991) proposes a general error distribution (GED, also known as an exponential power distribution); and Fama (1963), Liu and Brorsen (1995), Rachev and Mittnik (2000), and Khindanova et al. (2001) use Paretian distributions (or stable distributions). Despite the large volume of research into the distribution of stock returns, attention has been directed to a particular feature of asset return behavior. The research lacks a more general treatment of stock return characteristics such as fat tails, peakedness (leptokurtosis), skewness, clustered conditional variance, and leverage effects. This paper addresses these non-normality issues and provides empirical evidence based on six industry indices from the American Stock Exchange (AMEX): biotechnology, computers, natural gas, telecommunications, oil, and pharmaceuticals.

In this study, we employ a distribution called the exponential generalized beta distribution of the second kind (EGB2).Footnote 1 The distribution proposed by McDonald and Xu (1995) and Wang et al. (2001) has several advantages compared with alternative distributions. First, as a four-parameter distribution, it allows diverse levels of skewness and kurtosis. Its parameters are estimated simultaneously with the model structure estimation process so that it is able to accommodate a wider range of data characteristics. The skewness and excess kurtosis of EGB2 are in the range of ( − 2, 2) and (0, 6), respectively. Second, a number of distributions used in statistical analysis, such as logistics distribution and log-normal distribution, are nested in the EGB2 distribution.Footnote 2 Third, unlike a Hansen-type (1994) skewed generalized t-distribution requiring the imposition of several restrictions on the parameter values to permit estimation (Brooks et al. 2005),Footnote 3 the EGB2 model is simple and has a closed-form density function for the distribution; its higher order moments are finite and explicitly expressed by its parameters.

Although the EGB2 is capable of accounting for fat tails and the higher order moments of returns, previous studies using EGB2 distribution fail to incorporate a recent advancement in asset return behavior: the asymmetric response of asset return volatility to news (McDonald and Xu 1995). In addition, their analysis has been focused on aggregate stock market returns (Hueng and McDonald 2005). In this study, we introduce this asymmetric behavior into an EGB2 distribution and examine stock indices for six industries. Thus, our model is characterized as an asymmetric GARCH(1,1) cum EGB2 distribution model and provides evidence for industrial stock return analysis.Footnote 4

The remainder of the paper is organized as follows. Section 2 describes the methodology of the AGARCH-EGB2 model. Section 3 discusses the data used in this study. Section 4 presents the empirical results for U.S. industrial stock returns. Section 5 reports the goodness-of-fit tests to assess alternative distribution. Section 6 contains the probability evaluation via non-Gaussian distributions. Section 7 contains concluding remarks and a summary.

2 The AGARCH Model Based on the EGB2 Distribution

The AGARCH(1,1)-EGB2 stock return model can be represented by:

where R t is the portfolio’s return at time t; and μ t is the conditional mean that follows an ARMA(m, n) process.Footnote 5 The error term ε t is assumed to be independent. The conditional variance, h t , is assumed to follow GARCH(1,1); ν c , ν a , and ν b > 0 ensure a strictly positive conditional variance; I is an indicator variable that takes the value of unity only when the error term is negative; the negative error term component in the variance equation captures the asymmetric effect of an extraordinary shock to the variance: bad news usually has a more profound effect than good news (Glosten et al. 1993); z t is assumed to have a zero mean and unit variance and is independent and identically distributed (i. i. d) if the model is correctly specified. The conditional distribution is assumed to be the exponential generalized beta distribution of the second kind (EGB2).

The EGB2 distribution has the probability density function (pdf) given by:

where x is a random variable; δ is a location parameter that affects the mean of the distribution; σ reflects the scale of the density function; p and q (p > 0 and q > 0) are shape parameters that together determine the skewness and kurtosis of the distribution of the asset return series; and B(p, q) is the beta function.Footnote 6 As suggested by McDonald (1991), the EGB2 is suitable for coefficient of skewness values between − 2 and 2 and coefficient of excess kurtosis values of up to 6. Thus, it is capable of accommodating fat-tailed and skewed error distributions pertinent to stock return modeling.

Different from the Student’s t-distribution, which has a fat-tail feature, the EGB2 distribution allows both fat fail and peakedness features. In other words, the pdf curve of Student’s t-distribution is flat-topped; the pdf curve of the EGB2 distribution has a peak around the mean. This feature makes the EGB2 distribution superior to the Student’s t-distribution, since a histogram of actual equity returns shows fat tails and peakedness. The disadvantage is that the EGB2 distribution has four parameters to be estimated, while the Student’s t-distribution has only three parameters.

Compared with other four-parameter distributions, such as stable distributions and skewed t-distributions, the EGB2 distribution is plausible in that it has a closed-form pdf and contains higher-order moments. It follows that the parameters can be estimated by using a maximum likelihood function and the model can be evaluated based on skewness and kurtosis coefficients.

The first four central moments are:

where ψ(), ψ′(), ψ′′() and ψ′′′() denote digamma, trigamma, tetragamma, and pentagamma functions, respectively.Footnote 7 Since the error term ε t is standardized in the model, we can express δ and σ by using the above polygamma functions as:

where

With some algebraic manipulation, we can write the univariate GARCH-EGB2 log-likelihood function as followsFootnote 8:

where T is the number of periods, B(p, q) is the beta function, h t is the conditional variance, and ε t is the standardized error term. Various analysis packages can be used to conduct the maximum likelihood estimation. This paper uses the BFGS algorithm in a RATS®; program.

The skewness and excess kurtosis for the EGB2 distribution are given, respectively, by:

The standard deviation of skewness and kurtosis coefficients can be drawn by using a standard delta method.Footnote 9

This model is appealing, since it contains richer features pertinent to asset return behavior. First, the asset return in the mean equation embodies time series patterns, which can facilitate forecasting. Second, the variance equation allows for the evolution of volatility and treats the impacts of bad news and goods news on variance asymmetrically. Third, the distribution is flexible enough to nest alterative distributions. For instance, the EGB2 converges to normal distribution as p = q approaches infinity, to log-normal distribution when only p approaches infinity, to the Weibull distribution when p = 1 and q approaches infinity, and to the standard logistic distribution when p = q = 1. It is symmetric if p = q. The EGB2 is positively (negatively) skewed as p > q (p < q) for σ > 0.

3 Data

The use of industrial indices by institutional and individual investors in making portfolio decisions has become a common strategy in pursuing higher returns, liquidity, investment style, and diversification. For this reason, in this paper we explore indices for six industries traded on the American Stock Exchange (AMEX): biotechnology, computers, natural gas, telecommunications, oil, and pharmaceuticals.

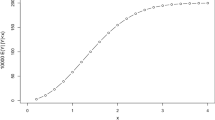

The sample is non-balanced weekly data covering the period from 8/26/1983 through 9/17/2006 The earliest data start on 8/26/1983 for the computer and oil indices; the latest begin on 12/9/1994 for biotechnology. The data source is Trade Tool, Inc. We use weekly data in order to be consistent with industry practices. For example, Value Line, Bloomberg, and Baseline all use weekly stock data to calculate a stock’s beta. In addition, weekly data are free of the Monday effect and other calendar effects. Figure 55.1 shows the time series plots for these six indices. We can easily see the boom period in 2001 for the computer, telecom, and biotech industries and the rise in oil and natural gas in recent years.

The weekly returns along with other statistics for these six indices are reported in Table 55.1. Looking at the skewness coefficient, we find that all six indices have negative values and four of them are significant at the 1% level. A negative skewness coefficient means that there are more negative extreme values than positive extreme values in the sample period. With respect to the excess kurtosis (the kurtosis coefficient minus 3), all of the estimated values are statistically significant at the 1% level, suggesting that the presence of fat tails is confirmed. The range of the excess kurtosis coefficient is between 1.06 and 4.85. If we check the range of peakedness, the values are between 1.08 and 1.20.Footnote 10 This range is much lower than the referenced figure, 1.35, indicating the presence of a high peak in the probability density function for all of the indices under investigation. Further, by inspecting the Jarque–Bera statistics, the normality assumption is uniformly rejected for all six indices. The Ljung–Box Q statistics show that we cannot reject the null hypothesis of the absence of serial correlation at the 5% level for all of the series, indicating no evidence of serial correlation for the stock return series under investigation. However, the Ljung–Box Q2 tests indicate that all six statistics of return squares are significant at the 1% level, suggesting volatility clustering and that this finding would be consistent with a GARCH-type specification.

In sum, the above statistics clearly indicate that the popular normality assumption does not match up well with the weekly returns under investigation. Stock index returns often show positive excess kurtosis (fat tails), accompanied by negative skewness. The peakedness does not conform to that of the normal distribution either. Besides the non-Gaussian features, some weekly returns show autocorrelation, and all of the return squared series display significant volatility clustering.

4 Empirical Evidence

4.1 GARCH(1,1) Model: The Normal Distribution

It is convenient to start with a GARCH(1,1) model based on the normal distribution, which sets a basis for comparison. With a general model in hand, which is given by the** set of equations in (52.1), we proceed with our estimation by setting the error distribution to be normal; that is, \({\epsilon}_{t}\vert {\Phi}_{t-1} \sim N(0,{h}_{t})\), where N stands for the normal distribution.

Before estimating the AGARCH-EGB2 model, we apply the Box–Jenkins method to filter out the time series pattern. Footnote 11 The residuals from the mean equation are normalized by dividing by the estimated standard deviation obtained from the conditional variance equation. Using standardized residuals to fit the model allows us to remove the heteroscedasticity due to stochastic variance. The statistics are reported in Table 55.2.

Checking the variance equation, we find that most of the coefficients in the GARCH(1,1) equations are statistically significant, indicating that stock-return volatilities are characterized by a clustering phenomenon. Further, the average variances for various stock returns are rather high, indicating that variances display a higher degree of persistence. The information from the asymmetric coefficient suggests that only half of the six cases show a significant asymmetric effect, which seems to be less apparent than those found in the daily data in the literature. This may be the result of using weekly data, which moderates the effect.

Looking at the statistics for skewness, the evidence shows that the null hypothesis of the absence of skewness is rejected at the 1% level in three out of six cases, while the null hypothesis of the absence of kurtosis is rejected in five cases. The significant excess kurtosis coefficients are in the range of 0.52–1.26. A joint test of the Jarque–Bera statistics shows that all of the return residuals are rejected by assuming a Gaussian distribution. The rejection occurs because the stock-index changes are either not independent, not normally distributed, or both. Further looking into the measure of peakedness, the estimate values are around 1.25, lower than the reference point of the standard normal distribution of peakedness, 1.35, indicating that all of the returns are leptokurtic. It is apparent that the normality assumption of the residuals is problematic.

We then examine the independence of stock returns up to the 13th order, which is one-quarter for weekly data. On the basis of the Ljung–Box statistics, none of Q(13) is significant, indicating the absence of autocorrelation in the weekly data. Further checking the Q(13)2 statistics for examining the null hypothesis of dependency on the squared returns also finds no case that is significant, suggesting that the volatility clustering phenomenon has been reduced significantly as evidence of implementing an AGARCH(1,1) specification. From the test results then, it can be argued that stock returns departing from normality may be mainly attributed to leptokurtosis.

4.2 AGARCH(1,1): The EGB2 Distribution Model

In this section, we estimate the parameters represented by (55.1) that assumes an EGB2 distribution. Table 55.3 reports the comparable statistics based on the standardized return residuals from an AGARCH(1,1) cum EGB2 distribution. The statistics, including the estimated coefficients and Q(13) and Q(13)2, turn out to have results similar to those reported in Table 55.2, which is based on a normal distribution. However, by using the EGB2 distribution, the skewness problem has been removed for all six indices, and no coefficient is rejected at the conventional significance levels.

Turning to the statistics of kurtosis, we find that none of the cases are significant at the 1% level. This suggests that the EGB2 distribution works well on the kurtosis. By inspecting the estimates of p and q, we find that p ranges from 1.25 to 2.28 and q ranges from 1.60 to 4.53. These pair-wise figures are nowhere near being equal and are far from the normal distribution that requires that both p and q approach infinity. Finally, we check the peakedness, which ranges from 1.22 to 1.28, conforming to the existence of a high peak. In sum, the testing results suggest that the EGB2 distribution produces a much more satisfactory result for modeling skewness and tailed information than can be achieved by assuming a normal distribution.

5 Distributional Fit Test

While highlighting the model’s ability to account for the skewness and kurtosis of the residuals may not be adequate to justify the performance of the distribution, in this section we shall conduct the log-likelihood ratio test and goodness-of-fit test for different distributions. The log-likelihood function values in Tables 55.2 and 55.3 already clearly show that the EGB2 distribution has outperformed the normal distribution. We conduct a log-likelihood ratio test, which is expressed as:

where ln L 1 is the maximum log-likelihood of the unrestricted distribution and ln L 0 is the maximum log-likelihood of the restricted distribution. The likelihood ratio statistic, LR, follows an asymptotic χ2(k) distribution with k degrees of freedom under the null hypothesis that the restrictions are valid, where k is the number of restrictions imposed. We find that in Table 55.4 all of the LR statistics are highly significant at the 1% level. The evidence is firmly in favor of the EGB2 distribution.

We further use the χ2 goodness-of-fit (GoF) statistic to compare differences between observed distributions of standardized residuals and theoretical distributions based on estimated shape parameters (Snedecor and Cochran 1989).Footnote 12 The null hypothesis tested by the GoF statistic is that the observed and predicted distribution functions are identical. The test statistic is given by:

where f i is the observed count of actual standardized residuals in the ith data class (interval), F i is the predicted count derived from the estimated values for the distribution parameters, and k is the number of data intervals used in distributional comparisons. GoF has an asymptotic χ2 distribution with degrees of freedom equal to the number of intervals minus the number of estimated distribution parameters minus one. For the EGB2 distribution, two parameters are estimated; for the normal distribution, no parameter is required, since the error term has been standardized.

Table 55.4 reports the results of the χ2 test for the standardized residuals generated by the AGARCH(1,1) – the EGB2 distribution model. The test power is maximized by choosing a data class equiprobably (equal probability). The rule of thumb of a Chi-squared test is to choose the number of groups starting at 2 ×T 0. 4. Our sample contains either 660 or 1,200 observations with 40 intervals being used. The degree of freedom is 37 for the EGB2 distribution and 39 for the normal distribution. The critical values for the chi-squared distribution are provided in the notes to the table.

The testing results show that the null is rejected for the computer index on the normal distribution at the 5% level; however, none is rejected on the EGB2 distribution. Although both distributions in general are acceptable for the sample, the EGB2 distribution yields lower values of the χ2 statistics. Putting the goodness-of-fit test, LR test, and previous skewness and kurtosis coefficient tests together, plus the peakedness analysis, it is clear that the EGB2 distribution is superior to the normal distribution in our empirical analysis.

6 The Implication of the EGB2 Distribution

In addition to the superior performance justified by statistical criteria, the EGB2 distribution offers a useful tool for evaluating the probability of those extreme values. According to the normal distribution, the 1987 market crash, which is beyond − 17σ (daily data), would have never happened. However, recent market crashes indicate that big market swings or significant declines in asset prices happen more frequently than we expect. Although VaR is one of the most prevalent risk measures under normal conditions, it cannot deal with the involvement of those extreme values, since extreme values are not in the state of normal. From this perspective, the EGB2 distribution provides a management tool for calculating risk.

Table 55.5 reports the probability of the semivolatility of shocks. We find that the predicted probabilities for extreme values for the EGB2 distribution become greater than that of the normal distribution, especially in the horizon beyond − 2σ. For instance, the probability of a − 5σ and − 7σ shock in the biotechnology index for the EGB2 distribution is 1.03E-4 and 2.36E-6. These values are much greater than the 2.87E-7 and 1.28E-12 values, respectively, based on the normal distribution.

Yet, the probabilities for the EGB2 distribution under a moderate regime (within ± 2σ) are less than that of the normal distribution. This is another way to tell the peakedness and fat tails of portfolio returns. Notice that the dividing point between the EGB2 distribution and the normal distribution is in the neighborhood of ± 2σ, where the probabilities of both distributions are equivalent. This feature implies that VaR at the 95% confidence level based on the normal distribution is by chance consistent with reality. However, beyond this critical level, the VaR method based on the normal distribution leads to overly optimistic forecasts of losses.

7 Conclusion

This study provides a time series model that incorporates the asymmetric GARCH feature into a non-Gaussian distribution: an exponential generalized beta distribution of the second kind (EGB2). When we apply data for six stock indices to the EGB2 distribution, the evidence consistently shows that the model is capable of dealing with skewness and kurtosis of stock returns. Testing the model by using goodness-of-fit and likelihood ratio statistics, the EBG2 distribution outperforms the model by assuming normal distribution. Because of its capacity for modeling skewness and fat tails, the EGB2 model provides a useful tool for forecasting variances involving extreme values. As a result, this model can be practically used for risk management.

Notes

- 1.

There are other names for the EGB2 distribution used in non-financial fields or in non-American journals; for example, generalized logistic distribution is used in Wu et al. (2000), z-distribution in Barndorff-Nielsen et al. (1982), the Burr type distribution in actuarial science (Hogg and Klugman 1983), and four-parameter Kappa distribution in geology (Hosking 1994).

- 2.

Wang et al. (2001) show that the EGB2 distribution is very powerful in modeling exchange rates that have fat tails and leptokurtic features.

- 3.

- 4.

It is not our intention to exhaust all the non-Gaussian models in modeling stock returns, which is infeasible. Rather, our strategy is to adopt a distribution that is rich enough to accommodate the features of financial data. To our knowledge, there are different types of flexible parametric distributions parallel to the EGB2 distribution, such as a skewed generalized t-distribution (SGT) (Hueng and Brooks 2002) and an inverse hyperbolic sine distribution (IHS) (Johnson et al. 1994), among others.

- 5.

The GARCH-M specification was explored. The conditional variance variable is insignificant for all six indices. Other macro variables and industry factors may be added to the mean equation or variance equation. Here, we focus on the time series property.

- 6.

It should be noted that beta function here has nothing to do with the stock’s beta.

- 7.

The digamma function is the logarithmic derivative of the gamma function; the trigamma function is the derivative of the digamma function.

- 8.

See the appendix in Wang et al. (2001).

- 9.

The derivation is available upon request.

- 10.

See the notes to Table 55.1.

- 11.

According to the correlogram of each stock index, the following ARMA processes are revealed. For biotechnology, AR(12) is detected; AR(11) for computers; AR(10) for natural gas; AR(11,15) for telecommunications; AR(1) for oil; and AR(25) for pharmaceuticals.

- 12.

The chi-square test is an alternative to the Anderson-Darling and Kolmogorov-Smirnov goodness-of-fit tests. The chi-square test and Anderson-Darling test make use of the specific distribution in calculating critical values. This has the advantage of allowing a more sensitive test and the disadvantage that critical values must be calculated for each distribution.

References

Barndorff-Nielsen, O., J. Kent, and M. Sorensen. 1982. “Normal variance-mean mixtures and z distributions.” International Statistical Review 50, 145–159.

Brooks, C., S. P. Burke, S. Heravi, G. Persand. 2005. “Autoregressive conditional kurtosis.” Journal of Financial Economics 3, 399–421.

Bollerslev, T. 1987. “A conditionally heteroskedastic time series model for speculative prices and rates of return.” Review of Economics and Statistics 69, 542–547.

Fama, E. 1963. “Mandelbrot and the stable paretian hypothesis.” Journal of Business 36, 420–419.

Glosten, L. R., R. Jagannathan, and D. E. Runkle. 1993. “On the relation between the expected value and the volatility of the normal excess return on stocks.” Journal of Finance 48, 1779–1801.

Hansen, B. E. 1994. “Autoregressive conditional density estimation.” International Economic Review 35, 705–730.

Hogg, R. V. and S. A. Klugman. 1983. “On the estimation of long tailed skewed distributions with actuarial applications.” Journal of Econometrics 23, 91–102.

Hosking, J. R. M. 1994. “The four-parameter kappa distribution.” IBM Journal of Research and Development 38, 251–258.

Hueng, C. J. and R. Brooks. 2002. Forecasting asymmetries in aggregate stock market returns: evidence from higher moments and** conditional densities, working paper, WP02–08–01, The University of Alabama.

Hueng, C. J. and J. B. McDonald. 2005. “Forecasting asymmetries in aggregate stock market returns: evidence from conditional skewness.” Journal of Empirical Finance 12, 666–685.

Johnson, N. L., S. Kotz and N. Balakrishnan. 1994. Continuous univariate distributions, vol. 1, 2nd ed., Wiley, New York.

Khindanova, I., S. T. Rachev, and E. Schwartz. 2001. “Stable modeling of value at risk.” Mathematical and Computer Modeling 34, 1223–1259.

Liu, S. M. and B. Brorsen. 1995. “Maximum likelihood estimation of a GARCH – stable model.” Journal of Applied Econometrics 2, 273–285.

McDonald, J. B. and Y. J. Xu. 1995. “A generalization of the beta distribution with applications.” Journal of Econometrics 66, 133–152.

McDonald, J. B. 1991. “Parametric models for partially adaptive estimation with skewed and leptokurtic residuals.” Economics Letters 37, 273–278.

Nelson, D. B. 1991. “Conditional heteroskedasticity in asset return: a new approach.” Econometrica 59, 347–370.

Rachev, S. T. and S. Mittnik. 2000. Stable paretian models in finance, Wiley, Chichester.

Snedecor, G. W. and W. G. Cochran. 1989. Statistical methods, 8th ed., Iowa State Press, Ames, Iowa.

Theodossiou, P. 1998. “Financial data and the skewed generalized t distribution.” Management Science 44, 1650–1661.

Wang, K.-L., C. Fawson, C. B. Barrett and J. B. McDonald. 2001. “A flexible parametric GARCH model with an application to exchange rates.” Journal of Applied Econometrics 16, 521–536.

Wu, J.-W., W.-L. Hung, and H.-M. Lee. 2000. “Some moments and limit behaviors of the generalized logistic distribution with applications.” Proceedings of the National Science Council, ROC 24, 7–14.

Acknowledgements

We are grateful to Michael J. Gombola, Daniel Dorn, Hazem Maragah, and C.F. Lee for their helpful comments in an earlier draft of this paper. We alone are responsible for any errors. Thomas C. Chiang would like to acknowledge the research support received from the Marshall M. Austin Endowed Chair, LeBow Business College, Drexel University.

Author information

Authors and Affiliations

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2010 Springer Science+Business Media, LLC

About this chapter

Cite this chapter

Chiang, T.C., Li, J. (2010). Stock Returns, Extreme Values, and Conditional Skewed Distribution. In: Lee, CF., Lee, A.C., Lee, J. (eds) Handbook of Quantitative Finance and Risk Management. Springer, Boston, MA. https://doi.org/10.1007/978-0-387-77117-5_55

Download citation

DOI: https://doi.org/10.1007/978-0-387-77117-5_55

Publisher Name: Springer, Boston, MA

Print ISBN: 978-0-387-77116-8

Online ISBN: 978-0-387-77117-5

eBook Packages: Business and EconomicsEconomics and Finance (R0)