Abstract

Decarbonization and digitalization are intrinsic requirements for business evolution within the global climate paradigm. This study delves into the impact of Carbon Information Disclosure (CID) quality on the digital transformation of corporations. Using text analysis techniques and OLS regression models, this research scrutinizes the annual and sustainable development reports, alongside financial data, of 4,045 companies listed on China's A-share market over the period 2013–2020. The results show that CID significantly promotes corporate digital transformation. Unabsorbed slack resources and negative coverage within a company have negative and positive, respectively, moderating effects on the relationship between CID and digital transformation. Additionally, the spillover effect of CID within the industry has a positive impact on corporate digital transformation, with this effect being more pronounced in private companies and highly competitive industries. These insights reveal a mutually reinforcing synergy between decarbonization and digitalization. The study offers profound insights into the equilibrium between digitalization and decarbonization for stakeholders in sustainable development.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

1 Introduction

Is it possible for decarbonization to inversely facilitate the digital transformation of companies? In the context of a global commitment to sustainable development, the convergence of digitalization with decarbonization is essential for attaining sustainable development objectives internationally (Yang et al., 2023). Faced with challenges posed by the demand for low-carbon and green development, we require innovative digital technologies to offer effective solutions for sustainable development and to unleash the potential synergies between digitalization and decarbonization (Chen, 2023). Previous research has already discussed the impact mechanisms of digitalization on the low-carbon development of enterprises from various perspectives, including the flow of innovative elements (Morrar et al., 2017; Wang et al., 2022), factor substitution (Zhong et al., 2022), industrial structural upgrading (Li & Wang, 2022; Zhang et al., 2022), and the enhancement of governance levels (Dutil & Williams, 2017; Hao et al., 2022).

In comparison, it remains unclear whether and how decarbonization can promote the digitalization process. Though Chen's (2023) study is among the limited number examining decarbonization's effect on corporate digitalization, it overlooks the varying low-carbon development needs of organizations. Recognizing these varied demands is crucial for delineating precise mechanisms through which decarbonization influences digitalization and for outlining bespoke digital transformation strategies. Consequently, the aim of our study is to examine how, at the micro-level, the advancement of decarbonization can inversely stimulate the digital transformation of enterprises, thereby facilitating a dual victory in achieving sustainable corporate development and enhanced operational efficiency.

Carbon Information Disclosure (CID) represents the proactive dissemination by companies of data regarding their greenhouse gas emissions, management of carbon-related issues, and carbon performance. These disclosures are indicative of a firm's commitment to climate change mitigation and adaptation (Zhang & Liu, 2020), reflecting its aspirations for low-carbon growth (Luo et al., 2013). However, the degree to which this voluntary initiative motivates technological innovation within companies requires further exploration. According to signaling theory and stakeholder theory, CID can mitigate information asymmetry and bolster trust between firms and their external stakeholders (Liesen et al., 2015), which may lead to more efficient capital market allocations (Lemma et al., 2020) and potentially increase firm value (Wang et al., 2023) or decrease financing costs. Contrastingly, legitimacy theory suggests that corporations may use CID as a strategic instrument for legitimization (Griffin et al., 2017; Park et al., 2023), thereby cultivating an eco-friendly corporate image (Luo, 2019; Pitrakkos & Maroun, 2020). Concerns have been raised regarding the efficacy of voluntary carbon disclosures, centered on the possibility that companies may embellish carbon reduction data for stakeholder appeasement without implementing actual reductions (Depoers et al., 2016; Hrasky, 2011; Luo, 2019). We hope to explore whether CID, a voluntary low-carbon development initiative, can become a driving force for technological progress in enterprises to alleviate external concerns about the quality of carbon information disclosure. Specifically, we examine the impact of CID on enterprises' digital transformation and the extent to which these impacts depend on internal resources and external media coverage of the enterprises. Furthermore, we also analyze the industry spillover effects of CID and the boundary conditions of these spillover effects.

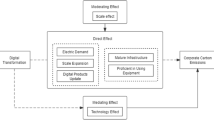

We contend that CID significantly influences firms' digital transformation, both directly and indirectly. Direct effects include the necessity for firms to employ digital technologies such as cloud computing, artificial intelligence, and blockchain to collect and analyze carbon data (Gong et al., 2022), as well as to optimize energy consumption and supply chain management (Yang et al., 2023), heightening the demand for advanced digitization. Indirectly, CID reduces information asymmetry between companies and external stakeholders (Lemma et al., 2020), bolsters investor confidence, and eases financing constraints, thus catalyzing digital transformation. Additionally, the impact of CID on digital transformation varies with the firm's internal Unappropriated Slack Resources (USRs) and external negative reporting. Abundant internal slack resources can reduce reliance on external financing, potentially moderating the positive effects of CID on digitization (Chen et al., 2013; Wu & Hu, 2020). Conversely, external negative coverage can compel firms to urgently address legitimacy deficits through CID, thereby yielding greater benefits for their digital transformation initiatives. Our research framework is delineated in Fig. 1.

To examine our proposed hypotheses, we use text analysis techniques to create a comprehensive dataset that captures the quality of CID and the extent of corporate digital transformation, consisting of 74 and 181 key terms, respectively. Our sample encompasses all firms listed on the Shanghai and Shenzhen stock exchanges over the period from 2013 to 2020. This setting is particularly relevant given that Chinese listed companies are not compulsorily required to disclose carbon information, and the country is experiencing rapid digitalization. This context presents an optimal backdrop for investigating the synergistic of decarbonization and digitalization efforts. Our results indicate that an increase of one standard deviation in CID quality (0.047) corresponds to an enhancement of 0.0132 standard deviations in a firm's digital transformation.

We strive to contribute in three aspects. Firstly, this paper innovatively proposes the reverse incentive effect of corporate decarbonization demand on digital transformation, going beyond previous literature that focused on the impact of digital technologies on corporate low-carbon development (Morrar et al., 2017; Wang et al., 2022) or the market reaction to CID (Borghei et al., 2018). Our study responds to the call for synergistic development between digitalization and decarbonization, providing empirical support in a new direction and alleviating external concerns about the quality of CID. Secondly, the research unveils the industry-level spillover effects of this synergy, exploring how intra-industry CID spillovers influence a company's digital transformation. This extends the decarbonization-digitalization synergy beyond the corporate level, demonstrating the interplay of digital practices among industry peers facing common decarbonization pressures. This, in turn, enriches theoretical perspectives on corporate digital transformation (Lee et al., 2015) and provides empirical support and decision-making guidance for industry associations and policymakers in designing targeted low-carbon and digital transformation strategies. Finally, we use text analysis and entropy weighting methods to innovatively remeasure CID quality, overcoming the limitations of existing manual identification techniques (Li et al., 2018; Shao & He, 2022) and minimizing subjective bias in structured text variables. This methodological advancement offers a new tool for assessing corporate sustainability disclosures.

2 Literature review and development of hypothesis

2.1 Literature review on voluntary carbon information disclosure

In exploring the various theoretical perspectives on CID, we find that opinions are not homogenous and occasionally contradictory (Bui et al., 2020). These differences stem from the discretionary power companies hold during the CID process. From a legitimacy perspective, firms might deploy CID strategically as a tool for legitimization. Driven by such motives, companies might issue symbolic content to obscure their poor environmental performance (Deegan & Gordon, 1996; Michelon et al., 2019). For instance, Hrasky (2011) and Luo (2019) found that companies in carbon-intensive industries tend to undertake substantial carbon reduction actions, whereas firms in less carbon-intensive sectors are more likely to engage in symbolic disclosures. However, such symbolic disclosures do not genuinely reflect a company's commitment to low-carbon development nor contribute to sustainable progress. In contrast, stakeholder theory and signaling theory offer alternative viewpoints, suggesting that CID can reduce information asymmetry between companies and stakeholders (Liesen et al., 2015; Zhang & Liu, 2020), and lead to a range of benefits, such as an increase in corporate value (Wang et al., 2023) and a reduction in financing costs (Clarkson et al., 2008; Luo & Tang, 2014).

Building on the previously discussed distinct theories, research has extensively explored the drivers of CID, including regulatory pressures (Luo, 2019; Reid & Toffel, 2009), firm-specific traits (Jaggi et al., 2018), governance (Liao et al., 2015), environmental performance, and stakeholder pressures (Guenther et al., 2016; Liesen et al., 2015). Research has also covered the financial implications of CID, notably its impact on corporate value and financing costs (Luo & Tang, 2014). Two streams of literature are most relevant to our research. The first indicates that digital technology plays a significant role as a driving factor in CID by improving energy efficiency or contributing to sustainable development (Albarrak et al., 2019; Amri et al., 2019; Shao & He, 2022). However, these studies fail to recognize that the promotion of low-carbon development and the advancement of digital technologies is a synergistic process, and it remains unclear whether CID can, in turn, act as a driving force for the progress of digital technologies. The second stream focuses on the impact of regional environmental information disclosure on corporate green innovation (Ding et al., 2022; Li et al., 2022; Tan et al., 2022) or the influence of regional environmental regulations on corporate digitalization (Chen, 2023). Still, both these factors center on regional objective environmental constraints and do not reflect the differentiated needs of enterprises for their own low-carbon development.

In summary, although research has examined the motivations and economic consequences of CID from multiple theoretical perspectives, there remains a need to delve deeper into the specific roles of technology and the internal low-carbon demands of company in order to address the deficiencies identified in the aforementioned two streams of literature. In light of this, the purpose of this paper is to investigate the impact of CID on the digital transformation of enterprises.

2.2 Hypothesis development

2.2.1 Carbon disclosure and corporate digital transformation

We content that corporate CID is instrumental in facilitating digital transformation within corporations, exerting both direct and indirect influences. Directly, CID mandates heightened requirements for digital technology within corporations, aimed at enhancing the accuracy and promptness of carbon emissions reporting. Indirectly, CID fosters digital transformation initiatives by ameliorating the financing climate and diminishing associated costs.

In terms of direct impact, companies need to establish a holistic digital framework to disclose carbon information accurately, promptly, and comprehensively. This digital framework includes the collection, analysis, and accounting of carbon data through digital technologies (Yang et al., 2023). Although reaching this objective is challenging, adopting a range of digital solutions is vital. For example, Tang and Tang (2021) suggested a climate management system that integrates the Internet of Things, blockchain technology, and life cycle assessment to authenticate data, offering a thorough evaluation of products' environmental impacts and carbon emissions. Moreover, companies might need bespoke energy or carbon accounting systems, applying artificial intelligence and machine learning to continuously refine emission factors, which requires advanced digital proficiency, especially for firms operating in multiple regions and sectors (Luers et al., 2022). Overall, a significant disparity persists between current carbon accounting practices and recent advancements in digital technology (He et al., 2022), presenting considerable opportunities for enhancing enterprises' use of digital technologies in disclosing carbon information.

In terms of indirect impact, effective carbon disclosure mitigates enterprises' financing constraints and bolsters financial backing for digital transformation. Such a transformation demands ongoing investment due to its large scale, lengthy return periods, and considerable technological risk (Guo & Xu, 2021; Li et al., 2023). Given these factors, including high costs and uncertainties (Matsunaga, 2021; Matt et al., 2015), investors may become hesitant. However, similar to environmental disclosure, carbon reporting builds up cumulative information effects (Clarkson et al., 2004) and bolsters corporate transparency (Bui et al., 2020). This non-financial information disclosure meets diverse stakeholder demands for sustainability, builds trust, and, ultimately, encourages long-term investment. Signaling theory also proposes that disclosing carbon activities highlights a firm's superior environmental performance, setting them apart from less eco-friendly competitors (Giannarakis et al., 2018), and boosts investor confidence. In contrast, firms neglecting carbon disclosure risk investor suspicion about potential environmental mismanagement, leading to reduced investment (Meng et al., 2023).

It is undeniable that carbon information disclosures made by companies may contain symbolic disclosures driven by strategic motives. However, we expect the proportion of symbolic disclosures to be low because the carbon disclosure activities of companies are strictly monitored by the public or investors. It is unrealistic for companies to seek long-term benefits through a large amount of symbolic disclosure. Thus, we propose the following hypothesis:

Hypothesis 1

There is a positive relationship between carbon information disclosure and corporate digital transformation.

2.2.2 The moderating effect of unabsorbed slack resources

Internal resource slack and the easing of external financing constraints both play substitutable roles in an enterprise's digital transformation process, providing support for buffering risks during the transition. In the course of digital transformation, firms are required to invest significantly in the development of immature digital technologies, and the outcomes of such technological development are often marked by a high degree of uncertainty (Greve, 2003). The Resource-Based View (RBV) suggests that unabsorbed slack resources (USRs) can flexibly adapt to volatile internal and external environments, or even unforeseen risks. George (2005), Chen et al. (2013), and Wu and Hu (2020) have also confirmed that companies with a large amount of idle resources are perceived to have better performance in implementing their strategies. Therefore, we argue that USRs can also act as an internal buffering mechanism for risk during digital transformation.

USRs refer to readily available and uncommitted resources, such as cash flow or liquidity, that can be easily recovered or integrated into a company's technological innovation activities (Bourgeois III & Singh, 1983). During the digital transformation of enterprises, when there is an abundance of USRs, the company's commitment to exploratory innovation increases, while the need for external financing decreases. In other words, a company can mitigate resource constraints faced by its researchers in the process of technological innovation entirely through the use of internal USRs, and even encourage them to pursue high-risk digital innovation technologies and untried digital transformation strategies (Wu & Hu, 2020). For instance, Tabesh et al. (2019) found that USRs are associated with exploratory innovation in their study on how CEO characteristics affect the deployment of slack resources in software companies. Similarly, Wu and Hu (2020) indicated that the synergistic effect of government subsidies and USRs have a positive impact on corporate green innovation.

Easing external financing constraints is a vital pathway through which carbon information disclosure can facilitate a firm's digital transformation. However, when a firm has ample USRs, the need to alleviate financing constraints diminishes, as the firm can rely on internal USRs rather than external funding to drive the digital transformation. In essence, the abundance of internal USRs and the easing of external financing constraints from carbon information disclosure serve as alternative mechanisms in the firm's digital transformation process. Dolmans et al. (2014), in exploring the interplay between resource slack and constraints, noted that firms can either leverage available resources or procure external ones to support long-term growth, acknowledging the substitutable function of both. Therefore, we propose the following hypothesis:

Hypothesis 2

The positive relationship between CID and corporate digital transformation is weaker when companies have large amount of USRs.

2.2.3 The moderating effect of negative coverage

When a firm's negative actions become known to the public, it faces a legitimacy deficit. During these periods, compared to other firms, CID can bring more benefits to those lacking legitimacy, including promoting the development of digital transformation. Legitimacy theory suggests that negative behavior violates the social contract, thereby diminishing the level of a firm's legitimacy (Hrasky, 2011). Investors may lose confidence and become skeptical of the company's future actions after becoming aware of its misconduct (Farooq & Wicaksono, 2021). Moreover, banks and other financial institutions, as creditors, often see information asymmetry as a major obstacle in risk assessment. Negative actions trigger doubts about corporate opportunistic behaviors (Adbi, 2022; Lu et al., 2022), leading creditors to impose stricter scrutiny systems and risk controls, thereby increasing the firm's debt financing costs. Reduced investments and rising debt costs mean greater financing constraints for a firm, which is detrimental to its digital transformation.

When challenged on the grounds of legitimacy, corporations must promptly display their commitment to responsibility to stakeholders. CID acts as a representative of the company's commitment to low-carbon development and can transmit positive signals to stakeholders to compensate for lost legitimacy to a certain extent (Hrasky, 2011; Luo, 2019). CID allows a company to show investors its commendable performance in carbon reduction and its proactive attitude towards emission reduction, therefore restoring investor confidence and catalyzing investment, alleviating financing pressure. Furthermore, CID enables creditors to understand the company's commitment to low-carbon development, providing relevant information about emissions and carbon efficiency to reduce risk estimation and the cost of debt financing (Orens et al., 2010).

We content that, compared to firms that have not exposed negative behavior, those facing a legitimacy crisis are more motivated to enhance their legitimacy, and the benefits realized through CID are more substantial, thus enabling them to advance their digital transformation to a greater degree. Because when these questioned companies participate in CID activities, they can alleviate doubts among investors and creditors to a greater extent, thereby reducing financing constraints more broadly. Thus, we propose the following hypothesis:

Hypothesis 3

The positive relationship between CID and corporate digital transformation is stronger when in the presence of negative coverage.

3 Methodology

3.1 Sample and data

To examine the impact of CID on firms' digital transformation, we included all listed companies on the Shanghai and Shenzhen Stock Exchanges in China between 2013 and 2020. Since Chinese listed companies are the primary subject of CID, we chose to focus on them. We selected 2013 as the starting year because the China Securities Regulatory Commission (CSRC) issued the "Measures for the Management of Environmental Information Disclosure by Listed Companies" in 2012, which mandated listed companies to disclose environmental information. Prior to 2013, there was very little CID. We obtained our CID and digital transformation data by analyzing the text of firms' sustainability reports (ESG reports or corporate social responsibility reports) and annual reports. Negative media reporting data were collected from the China National Research Data Service (CNRDS). Financial data, such as corporate financial structure, ownership nature, and corporate governance, were obtained from the China Securities Market and Accounting Research (CSMAR) databases, which are one of the largest data sources for Chinese listed companies (Liu et al., 2021a; Luo et al., 2022; Shao & He, 2022). We collected a preliminary dataset for all listed companies, comprising 26,632 observations.

After extracting data from the above data sources, we selected the initial sample by referring to Liu et al.'s (2021a) criteria: (1) excluding the ST and PT firm samples, with ST firms referring to two consecutive years of losses and PT firms referring to three consecutive years of losses; (2) excluding firms in the financial and insurance sectors; and (3) excluding observations with missing variables. Finally, we obtained an unbalanced panel dataset consisting of 24,722 firm-year observations from 4,045 unique firms during the 2013–2020 period for the analysis.

3.2 Variable selection

3.2.1 Measures of dependent variable

In this study, we have selected Digital Transformation of firms as the dependent variable. There are three measurement approaches that have been employed to measure the digital transformation of firms. Firstly, the frequency of digital-related vocabulary in texts such as annual reports has been widely used as the primary measurement method in previous studies (Chen, 2023; Llopis-Albert et al., 2021; Yuan et al., 2021). Secondly, the degree of digitalization of firms has been measured by some scholars through the proportion of digital intangible assets to total assets or intangible assets, where a higher proportion of digital intangible assets indicates a deeper level of digital transformation (Firk et al., 2021). Lastly, Ko et al. (2022) designed six questions related to digital technology innovation using survey method to measure digital transformation of firms.

Drawing on the research methods of Llopis-Albert et al. (2021) and Chen (2023), we constructed a set of textual indicators that characterize the degree of digital transformation of firms across five dimensions: artificial intelligence, blockchain, cloud computing, big data, and digital applications. These five dimensions consist of a total of 74 textual vocabulary words. We measured the degree of Digital Transformation of firms by calculating the logarithm of the sum of the frequencies of these words in annual reports after adding 1.

For our robustness tests, we measured the degree of digital transformation of firms using PIDA, the ratio of digital intangible assets to total assets. We classified an intangible asset item as a digital intangible asset if it contained keywords related to digital economy technologies such as “software,” “network,” “client,” “management system,” and “intelligent platform,” or patents related to these keywords. We then calculated PIDA as the ratio of digital intangible assets to total assets.

3.2.2 Measures of independent variable

Previous empirical research on CID has predominantly relied on CDP reports, rather than corporate ESG or sustainability reports (Depoers et al., 2016; Luo, 2019; Luo et al., 2013). Although CDP data has been recognized for its structured advantages, the samples and information that can be obtained from CDP reports are relatively scarce. For instance, the CDP 2021 China Corporate Disclosure Report had only 146 listed companies participating in the study. To more comprehensively exploit the carbon information from ESG reports issued by listed companies, we utilized innovative text analysis techniques to break down the ESG reports and establish firms' CID quality scores.

Initially, we created a corporate CID terminology dictionary by referring to significant CID literature and CDP survey questionnaires. By utilizing Python for word segmentation and manual recognition of the CDP survey questionnaires and CID literature, we identified 181 CID-related vocabulary terms across eight dimensions that form the basis of the CID terminology dictionary in this study. These eight dimensions comprise carbon emission reduction strategies and targets, management of carbon emission reduction, publicity of carbon emission reduction, evaluation of carbon performance, emergency response plans for carbon, measures for carbon emission reduction, third-party verification agencies, and methods for carbon accounting.

Next, we employed machine learning methods to analyze the texts of corporate ESG reports and calculate the frequency of the 181 CID-related vocabulary terms.

Finally, we used the entropy weighting method to weight the eight dimensions of carbon information disclosure and obtain the CID Quality score. We divided this index by 100 for ease of expression. A higher value for the CID Quality index indicates better quality of corporate CID. The entropy weighting method can effectively avoid biases caused by human factors and determine the weights of evaluation system indicators (Wang & Lee, 2009).

3.2.3 Measures of moderating variable

We use two moderators in this study: intra-firm USRs and firm Negative Coverage. We measure USRs by the ratio of net operating cash flows to total assets. Although many prior studies have used financial ratios to measure firm-level resource slack (Dolmans et al., 2014), Seifert et al. (2004) argued that financial performance does not necessarily reflect resource slack, while cash flow can better capture the concept of freely disposable resources. Cash flow represents disposable resources and forms the funds available for digital transformation activities within a firm.

We measure corporate Negative Coverage by the proportion of negative media coverage to total media coverage, following Jia et al. (2016). We use a relative measure in the form of a ratio, unlike prior studies that have measured external legitimacy pressure solely by the absolute value (logarithm) of negative media coverage (Carlini et al., 2020). This is because media coverage of a company may include not only negative but also neutral or positive coverage.

3.2.4 Measures of control variables

We control for various firm-level factors that may affect digital transformation in firms, following Chen (2023) and Luo et al. (2022). Specifically, we measure a firm's profitability using ROA (Return on Assets), which is calculated as the ratio of net income to total assets. Firm Size is measured using the natural logarithm of total revenue, as larger firms may have greater resources to support digital transformation. Lev is measured as the ratio of total liabilities to total assets, reflecting a firm's ability to repay debts. Firm Age is measured using the natural logarithm of the number of years since the firm was listed. Top1 is measured as the percentage of shares held by the largest shareholder. Equity Incentives are measured as a binary variable with a value of 1 if the firm implemented stock options or restricted stock awards in the current year, and 0 otherwise. Additionally, we control for the firm's ownership nature using SOE (State-Owned Enterprise), which is coded as 1 if the government is the ultimate owner of the firm, and 0 otherwise. We also control for industry effect and year effects.

3.3 Estimation model

In this study, we estimated the following regression to examine the relationship between CID Quality and Digital Transformation.

In Eq. (1), \(Digital Transformatio{n}_{it}\) and \(CID Qualit{y}_{it}\) represent the degree of digital transformation and the quality of carbon disclosure of firm i in year t, respectively. Larger values indicate a deeper degree of digital transformation and higher quality of carbon disclosure. \(Control{s}_{it}\) represents a set of control variables. We also control for industry fixed effects \({\mu }_{i}\) and year fixed effects \({\eta }_{t}\). \({\varepsilon }_{it}\) is a random error term. Based on Hypothesis 1, we predict that \({\beta }_{1}\), the regression coefficient of \(CID\, Qualit{y}_{it}\), is positive and significant, implying that CID can drive digital transformation in firms.

To test for moderation effects, we estimated the following regression model, which includes an interaction term between the moderating variable and CID:

In Eqs. (2) and (3), we predict a negative and significant regression coefficient for \(CID\, Qualit{y}_{it}\times US{R}_{it}\) and a positive and significant regression coefficient for \(CID\, Qualit{y}_{it}\times Negative\, {Coverage}_{it}\), supporting Hypotheses 2 and 3.

4 Results

4.1 Descriptive statistics of variables

Table 1 presents the results of the descriptive statistics and correlation analysis. In our sample, the average level of Digital Transformation is 1.476 (with a standard deviation of 1.411). The majority of companies (67.7%) have already commenced digital transformation projects, which is consistent with the digitalization trend among Chinese enterprises observed in the existing literature (Chen, 2023; Zhai et al., 2022). Additionally, the visualization in Fig. 2 shows that, from 2013 to 2020, the level of digitalization in the southern provinces of China (excluding Beijing) was generally higher than in the northern provinces, aligning with the regional economic development status of China.

The mean of CID Quality is 0.017, with a standard deviation of 0.047, reflecting the vast differences among Chinese listed companies regarding whether they disclose carbon information and the extent of disclosure. This is largely consistent with the findings of Li et al. (2018). About three-quarters (75.5%) of the companies failed to disclose carbon information. Among those that did disclose, the extent of disclosure ranged from negligible to including as many as 191 relevant terms. Figure 3 demonstrates that since 2017, there has been a slow yet steady increase in CID Quality, especially in the years of reinforced implementation of China's environmental protection laws (2017 and 2018), signifying a complex interrelation between unregulated pressure and the response strategies towards CID by private enterprises.

Furthermore, the correlation coefficients from Table 1 show that there is a significant positive correlation between Digital Transformation and CID Quality, with a coefficient of 0.029 at the 1% significance level, preliminarily validating Hypothesis H1. To further exclude the possibility of multicollinearity, we calculated the Variance Inflation Factors (VIFs) for each variable and found the maximum VIF to be 1.97, with an average of 1.38, which is well below the acceptable level of 10 (Wang & Qian, 2011). Therefore, multicollinearity is not a significant issue in our study.

4.2 Multiple regression analysis

Table 2 presents the regression results for the relationship between CID Quality and firm's digital transformation. Model 1 serves as the baseline model, while Model 2 includes CID Quality to test Hypothesis 1. In Models 3 and 4, we respectively added CID Quality × USRs and CID Quality × Negative Coverage to test Hypotheses 2 and 3.

Hypothesis 1 predicts that CID can significantly accelerate a firm's digitalization efforts. In Model 2, we observe a positive and significant relationship between CID Quality and Digital Transformation at the 5% level (\(\beta\)=0.397, \(\rho\)<0.05), thus supporting Hypothesis 1. Examining the marginal effects, an increase of one standard deviation in CID quality (0.047) corresponds to a 0.0132 standard deviation rise in the measure of digital transformation (0.047 × 0.397/1.411). This finding emphasizes the influential role of CID in facilitating technological advancement, and resonates with recent studies that have established a connection between decarbonization and digitalization (Li et al., 2022; Tan et al., 2022). In Model 3, the coefficient for CID Quality × USRs is negative and significant (\(\beta\)= − 5.473, \(\rho\)<0.1), indicating that the relationship between CID quality and corporate digital transformation weakens in companies with substantial resource slack. This supports Hypothesis 2 and aligns with the arguments presented in the RBV literature. Likewise, Model 4 demonstrates that the coefficient of CID Quality × Negative Coverage is positive and significant (\(\beta\)= 0.954, \(\rho\)<0.1), suggesting that the relationship between CID quality and digital transformation is strengthened in companies with negative reporting, which supports Hypothesis 3. This result also reminds us of the necessity to be wary of firms engaging in CID activities for legitimacy motives.

4.3 Endogeneity testing

This study may face endogeneity issues because the decision of firms to disclose carbon information might not be random. Carbon information disclosure is an environmental strategy that could be influenced by unobservable variables. To address sample selection bias, we use the Heckman two-step method. In the first stage, we estimate whether firms disclose carbon information (Dummy CID) using Probit regression. Consistent with prior literature, we use the industry-level proportion of firms disclosing carbon information (Industry-level CID) as an exclusion restriction variable to satisfy the exogeneity and relevance constraints of the Heckman model (Liu et al., 2021b; Wang & Qian, 2011). On the one hand, different industries may have varying propensities for firms to disclose carbon information, such as carbon-intensive industries having a higher probability of disclosing carbon information (Luo, 2019). Therefore, the selected exclusion restriction variable satisfies the relevance constraint. On the other hand, in the context of this study, unobservable firm-specific characteristics related to digital transformation are unlikely to affect the industry-level probability of carbon information disclosure. Therefore, Industry-level CID satisfies the exogeneity constraint.

Table 3 reports the results of the first and second stages of the Heckman selection model. We observe that the variables we are interested in, CID Quality and CID Quality × USRs, are significant in Models 2 and 3 (\(\beta\) = 0.577, \(\rho\)< 0.01; \(\beta\)= − 6.664, \(\rho\)< 0.01). In Model 4, the variable we are interested in, CID Quality × Negative Coverage, is positively and nearly significant (T = 1.58). These results are generally consistent with those presented in Table 2, indicating the robustness of our conclusions.

4.4 Robustness check

We conducted robustness checks on our study from three perspectives: replacing the dependent variable, replacing the independent variables, and changing the regression method. Firstly, we replaced the absolute measure of Digital Transformation with the relative measure of PIDA, which is calculated as the ratio of a firm's digital intangible assets to its total assets. Secondly, we substituted the CID Quality variable with LnCID, which is the logarithm of the total number of CID-related words in the ESG report after adding 1. Lastly, since 32.3% of Digital Transformation values are zero, we used the Tobit model for regression analysis due to the truncation at that point. The results of our robustness checks confirm the validity of our initial findings, and further details can be found in Appendix A.

4.5 Further analysis of industry spillover effects

Corporate carbon information disclosure can reduce information asymmetry between firms and external stakeholders, enhancing their confidence and investment willingness in the firm. However, does industry-level CID have spillover effects on a firm's digital transformation? Some studies have recognized the spillover effect of carbon information in the interaction between carbon trading markets and stock markets (Ji et al., 2019; Lin & Chen, 2019), suggesting the existence of spillover effects of carbon information. We calculate the level of carbon information disclosure spillover faced by firms, following Haddad et al. (2022), and use it as an independent variable in regression analysis. We construct Eq. (4) to examine whether corporate carbon information disclosure has spillover effects in the industry.

In Eq. (4), \(S\_CID\, Qualit{y}_{it}={\sum }_{j\ne i}^{n}{\omega }_{ij}CID\,Qualit{y}_{jt}\) represents the level of carbon information disclosure spillover faced by a firm, where \({\omega }_{ij}\) is the weight matrix and \({\omega }_{ij}\)=1 if firms i and j belong to the same industry, and 0 otherwise. We focus on the direction and significance level of \({\beta }_{1}\) in Eq. (4). If \({\beta }_{1}\) is positive and significant, it indicates that corporate carbon information disclosure has a positive spillover effect on other firms within the industry.

Table 4 reports the regression results of industry-level spillover effects of corporate carbon information disclosure (CID). Model 1 investigates the spillover effects of CID at the industry level, while Models 2 and 3 examine the boundary conditions of CID spillover effects, using the ownership nature of firms (SOE) and the Herfindahl–Hirschman Index (HHI) as the two selected boundary conditions to represent the degree of industry competition. A higher HHI value indicates a higher degree of industry monopoly. The regression coefficient of S_CID Quality is positive and significant (\(\beta\) = 0.017, \(\rho\) < 0.01) in Model 1, indicating that CID has a positive spillover effect on the digital transformation of firms within the industry, which is consistent with our expectations. In Models 2 and 3, the coefficients of S_CID Quality × SOE and S_CID Quality × HHI are negative and significant (\(\beta\)= − 0.004, \(\rho\)< 0.1; \(\beta\)= − 0.147, \(\rho\)< 0.05), indicating that the positive spillover effects of the CID are more pronounced in the private enterprise group and in fully competitive industries. Han et al., (2011) also found that the diffusion of information technology is more apparent in completely competitive industries. These results also provide guidance for the formulation of CID policies.

5 Discussion

This article examines the impact of voluntary Corporate Innovation Diffusion (CID) on enterprise digital transformation, aiming to fill the research gap in existing literature regarding the insufficient attention to heterogeneous corporate requirements for low-carbon development. The study finds a significant positive correlation between carbon information disclosure and enterprise digital transformation, which corresponds to some extent with the research by Fouquet and Hippe (2022). Fouquet and Hippe argue that the advancement of digital technologies can greatly promote the process of decarbonization. For instance, improved information management systems are enhancing the coordination of energy production. The increase in computing power has made the use of big data possible, analyzing vast and complex datasets on infrastructure used to generate, transform, store, trade, transport, or control energy (Bhattarai et al., 2019). Furthermore, Barteková and Börkey (2022) also believe that digital technologies are crucial for improving the efficiency of energy systems and driving low-carbon development. Digital technologies such as artificial intelligence, the Internet of Things, blockchain, and cloud computing have lowered the barriers to the large-scale deployment of green businesses, increasingly facilitating the transition towards a low-carbon economic model. However, it is evident that these literatures have not considered that decarbonization could also inversely promote the digitalization process of enterprises, and our research complements this fact well.

Regarding the positive impact of industry Corporate Innovation Diffusion (CID) spillover effects on corporate digital transformation: This study differs from previous discussions that focused on the spillover of carbon activities to the stock market and their subsequent impact (Tan et al., 2022; Xu et al., 2022), which proposed that carbon activities could affect investor expectations in the stock market through risk spillover channels and consequently affect stock prices. However, our research highlights that corporate low-carbon activities can influence other firms in the same industry through competitive or imitative effects. Our study shares certain parallels with the work of Jiang and Ma (2021), who considered the technological spillover effects of carbon emission networks under environmental regulation, and Han et al. (2011), who observed a more significant spillover of information technology in highly competitive industries. Our study considers the impact and boundary conditions of the industrial spillover effects of low-carbon activities on corporate digital transformation, which is of reference value for all parties needing to balance decarbonization with digitization.

In summary, our study is consistent with existing literature to a certain extent while also presenting new perspectives and findings. Particularly in terms of the spillover effect of industry CID, our research reveals its importance for private enterprises and highly competitive industries. These findings provide a new perspective on understanding how businesses balance environmental responsibilities and technological innovation under the current environmental policy framework and offer new research directions for future research in related fields.

6 Conclusion

6.1 Findings of the study

The primary goal of this article is to explore the impact of voluntary carbon information disclosure (CID) on enterprise digital transformation within the context of the coordinated development of digitization and decarbonization. Building on existing literature, we've identified a research gap concerning the insufficient attention to heterogeneous corporate demands for low-carbon development. Consequently, we regard CID as an enterprise's own demand for low-carbon development and attempt to address this research gap. Our findings indicate that CID significantly facilitates enterprise digital transformation, which can occur through direct or indirect channels, thus supporting Hypothesis 1. In terms of marginal effects, an improvement of one standard deviation (0.047) in the quality of enterprise CID corresponds to an increase of 0.0132 standard deviations in the degree of digital transformation. Furthermore, the relationship between CID and enterprise digital transformation depends on unabsorbed slack resources within the company and external media coverage. The impact of CID on digital transformation is most pronounced when the company faces both internal resource shortages and negative media exposure, supporting Hypotheses 2 and 3. Finally, we also tested and found a positive impact of the industry spillover effect of CID on enterprise digital transformation, and this positive influence is conditioned on the nature of corporate ownership and industry competition status.

6.2 Theoretical contribution

We attempt to make the following theoretical contributions. First, against the backdrop of the coordinated development of decarbonization and digitization, our study enriches the literature on the synergy of decarbonization in promoting digital development within the coordinated development literature. Previous research has found digital development at the regional or enterprise level can actively promote low-carbon development through various channels (Dutil & Williams, 2017; Hao et al., 2022; Morrar et al., 2017; Wang et al., 2022). In contrast, the impetus of de-carbonization regulations on increasing the level of digitization has only been examined at the regional level (Ding et al., 2022; Li et al., 2022; Tan et al., 2022). Our research extends this relationship from a regional context to the enterprise level. Secondly, we have identified a spillover effect of corporate low-carbon behavior within the industry, further enriching the research context of corporate low-carbon behavior. Corporate low-carbon activities not only have a positive impact on the enterprise itself (Wang & Shao, 2023) but also affect other companies within the industry or region through spillover effects. Our study focuses on and identifies the industrial spillover effect of corporate low-carbon activities and its boundary conditions, suggesting that the synergistic system of decarbonization and digitization exists not only at the corporate level but also at the industry level. Lastly, our research utilizes text analysis methods to measure the quality of CID, enriching the measurement tools for CID.

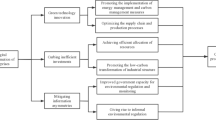

6.3 Policy insights

This paper attempts to provide the following practical implications for the synergy between low-carbon development and digitization:

-

(1)

Governments should strengthen the construction of the CID quality system, fully leveraging the positive effects of CID on corporate digital transformation. Enhancements in CID quality can promote not only digitalization at the firm level but can also drive the digital transformation of other enterprises within the same industry through spillover effects. Therefore, on the one hand, governments should take proactive measures to establish and implement clear and comprehensive CID standards and guidelines. These measures would ensure that disclosed carbon information is highly reliable, transparent, and comparable, providing a trustworthy informational foundation for enterprises and their investors. Additionally, governments should invest in infrastructure for CID to reduce disclosure costs for enterprises and increase their willingness to disclose.

-

(2)

Industry associations should provide training to ensure enterprises fully recognize the synergistic effects of decarbonization and digitization. Some enterprises regard low-carbon practices as having positive externalities and believe that the costs of low-carbon actions do not cover the benefits, leading to reluctance in carrying out CID or engaging in symbolic disclosures. Such an approach is detrimental to the long-term interests of enterprises. Conversely, training and awareness campaigns by industry associations can help businesses understand the various potential long-term benefits of low-carbon behavior, including its role in fostering digitization, thereby enhancing the motivation for CID. Additionally, industry associations should intensify training for private enterprises and firms in competitive industries due to their more significant spillover effects.

-

(3)

Governments should enhance the regulation of carbon information disclosure. Even if governments have established standards for improving CID quality and industry associations have widely promoted the potential benefits of CID, some enterprises may still engage in merely symbolic CID. Therefore, regulation is essential to maintain the fairness of the CID system. Specifically, there should be reinforced oversight of firms with strong internal resource constraints and a lack of external legitimacy, as these are most motivated to undertake symbolic CID.

6.4 Future outlooks

Our research also has certain limitations that need to be further explored in the future. We have only selected Chinese A-share listed companies as our research subjects. However, as CID represents a voluntary commitment by companies to low-carbon development, the current state of its disclosure may vary among different countries. Therefore, future research could consider the impact of CID on corporate digital transformation in different countries and under various carbon disclosure regulatory environments.

Data availability

Data will be made available on reasonable request.

References

Adbi, A. (2023). Financial sustainability of for-profit versus non-profit microfinance organizations following a scandal. Journal of Business Ethics, 188(1), 57–74.

Albarrak, M. S., Elnahass, M., & Salama, A. (2019). The effect of carbon dissemination on cost of equity. Business Strategy and the Environment, 28, 1179–1198.

Amri, F., Zaied, Y. B., & Lahouel, B. B. (2019). ICT, total factor productivity, and carbon dioxide emissions in Tunisia. Technological Forecasting and Social Change, 146, 212–217.

Barteková, E., & Börkey, P. (2022). Digitalisation for the transition to a resource efficient and circular economy. Working paper.

Bhattarai, B. P., Paudyal, S., Luo, Y., Mohanpurkar, M., Cheung, K., Tonkoski, R., Hovsapian, R., Myers, K. S., Zhang, R., & Zhao, P. (2019). Big data analytics in smart grids: State-of-the-art, challenges, opportunities, and future directions. IET Smart Grid, 2, 141–154.

Borghei, Z., Leung, P., & Guthrie, J. (2018). Voluntary greenhouse gas emission disclosure impacts on accounting-based performance: Australian evidence. Australasian Journal of Environmental Management, 25, 321–338.

Bourgeois III, L.J., & Singh, J.V. (1983). Organizational slack and political behavior among top management teams. In Academy of management proceedings. Academy of Management Briarcliff Manor, 10510, pp. 43–47

Bui, B., Moses, O., & Houqe, M. N. (2020). Carbon disclosure, emission intensity and cost of equity capital: Multi-country evidence. Accounting & Finance, 60, 47–71.

Carlini, F., Cucinelli, D., Previtali, D., & Soana, M. G. (2020). Don’t talk too bad! stock market reactions to bank corporate governance news. Journal of Banking & Finance, 121, 105962.

Chen, W. (2023). Can low-carbon development force enterprises to make digital transformation? Business Strategy and the Environment, 32, 1292–1307.

Chen, Y.-M., Yang, D.-H., & Lin, F.-J. (2013). Does technological diversification matter to firm performance? The moderating role of organizational slack. Journal of Business Research, 66, 1970–1975.

Clarkson, P. M., Li, Y., & Richardson, G. D. (2004). The market valuation of environmental capital expenditures by pulp and paper companies. The Accounting Review, 79, 329–353.

Clarkson, P. M., Li, Y., Richardson, G. D., & Vasvari, F. P. (2008). Revisiting the relation between environmental performance and environmental disclosure: An empirical analysis. Accounting, Organizations and Society, 33, 303–327.

Deegan, C., & Gordon, B. (1996). A study of the environmental disclosure practices of Australian corporations. Accounting and Business Research, 26, 187–199.

Depoers, F., Jeanjean, T., & Jérôme, T. (2016). Voluntary disclosure of greenhouse gas emissions: Contrasting the carbon disclosure project and corporate reports. Journal of Business Ethics, 134, 445–461.

Ding, J., Lu, Z., & Yu, C.-H. (2022). Environmental information disclosure and firms’ green innovation: Evidence from China. International Review of Economics & Finance, 81, 147–159.

Dolmans, S. A., van Burg, E., Reymen, I. M., & Romme, A. G. L. (2014). Dynamics of resource slack and constraints: Resource positions in action. Organization Studies, 35, 511–549.

Dutil, P., & Williams, J. (2017). Regulation governance in the digital era: A new research agenda. Canadian Public Administration, 60, 562–580.

Farooq, Y., & Wicaksono, H. (2021). Advancing on the analysis of causes and consequences of green skepticism. Journal of Cleaner Production, 320, 128927.

Firk, S., Hanelt, A., Oehmichen, J., & Wolff, M. (2021). Chief digital officers: An analysis of the presence of a centralized digital transformation role. Journal of Management Studies, 58, 1800–1831.

Fouquet, R., & Hippe, R. (2022). Twin transitions of decarbonisation and digitalisation: A historical perspective on energy and information in European economies. Energy Research & Social Science, 91, 102736.

George, G. (2005). Slack resources and the performance of privately held firms. Academy of Management Journal, 48, 661–676.

Giannarakis, G., Zafeiriou, E., Arabatzis, G., & Partalidou, X. (2018). Determinants of corporate climate change disclosure for European firms. Corporate Social Responsibility and Environmental Management, 25, 281–294.

Gong, Q., Ban, M., & Zhang, Y. (2022). Blockchain, enterprise digitalization, and supply chain finance innovation. China Economic Transition= Dangdai Zhongguo Jingji Zhuanxing Yanjiu, 5, 131–158.

Greve, H. R. (2003). A behavioral theory of R&D expenditures and innovations: Evidence from shipbuilding. Academy of Management Journal, 46, 685–702.

Griffin, P. A., Lont, D. H., & Sun, E. Y. (2017). The relevance to investors of greenhouse gas emission disclosures. Contemporary Accounting Research, 34, 1265–1297.

Guenther, E., Guenther, T., Schiemann, F., & Weber, G. (2016). Stakeholder relevance for reporting: Explanatory factors of carbon disclosure. Business & Society, 55, 361–397.

Guo, L., & Xu, L. (2021). The effects of digital transformation on firm performance: Evidence from China’s manufacturing sector. Sustainability, 13, 12844.

Haddad, V., Ho, P., & Loualiche, E. (2022). Bubbles and the value of innovation. Journal of Financial Economics, 145, 69–84.

Han, K., Chang, Y. B., & Hahn, J. (2011). Information technology spillover and productivity: The role of information technology intensity and competition. Journal of Management Information Systems, 28(1), 115–145.

Hao, Y., Xu, L., Guo, Y., & Wu, H. (2022). The inducing factors of environmental emergencies: Do environmental decentralization and regional corruption matter? Journal of Environmental Management, 302, 114098.

He, R., Luo, L., Shamsuddin, A., & Tang, Q. (2022). Corporate carbon accounting: A literature review of carbon accounting research from the Kyoto Protocol to the Paris Agreement. Accounting & Finance, 62, 261–298.

Hrasky, S. (2011). Carbon footprints and legitimation strategies: Symbolism or action? Accounting, Auditing & Accountability Journal, 25, 174–198.

Jaggi, B., Allini, A., Macchioni, R., & Zagaria, C. (2018). The factors motivating voluntary disclosure of carbon information: Evidence based on Italian listed companies. Organization & Environment, 31, 178–202.

Ji, Q., Xia, T., Liu, F., & Xu, J.-H. (2019). The information spillover between carbon price and power sector returns: Evidence from the major European electricity companies. Journal of Cleaner Production, 208, 1178–1187.

Jia, M., Tong, L., Viswanath, P., & Zhang, Z. (2016). Word power: The impact of negative media coverage on disciplining corporate pollution. Journal of Business Ethics, 138, 437–458.

Jiang, Q., & Ma, X. (2021). Spillovers of environmental regulation on carbon emissions network. Technological Forecasting and Social Change, 169, 120825.

Ko, A., Fehér, P., Kovacs, T., Mitev, A., & Szabó, Z. (2022). Influencing factors of digital transformation: Management or IT is the driving force? International Journal of Innovation Science, 14, 1–20.

Lee, S. Y., Park, Y. S., & Klassen, R. D. (2015). Market responses to firms’ voluntary climate change information disclosure and carbon communication. Corporate Social Responsibility and Environmental Management, 22, 1–12.

Lemma, T. T., Shabestari, M. A., Freedman, M., & Mlilo, M. (2020). Corporate carbon risk exposure, voluntary disclosure, and financial reporting quality. Business Strategy and the Environment, 29, 2130–2143.

Li, D., Huang, M., Ren, S., Chen, X., & Ning, L. (2018). Environmental legitimacy, green innovation, and corporate carbon disclosure: Evidence from CDP China 100. Journal of Business Ethics, 150, 1089–1104.

Li, G., Xue, Q., & Qin, J. (2022). Environmental information disclosure and green technology innovation: Empirical evidence from China. Technological Forecasting and Social Change, 176, 121453.

Li, M., Liu, N., Kou, A., & Chen, W. (2023). Customer concentration and digital transformation. International Review of Financial Analysis, 89, 102788.

Li, Z., & Wang, J. (2022). The dynamic impact of digital economy on carbon emission reduction: Evidence city-level empirical data in China. Journal of Cleaner Production, 351, 131570.

Liao, L., Luo, L., & Tang, Q. (2015). Gender diversity, board independence, environmental committee and greenhouse gas disclosure. The British Accounting Review, 47, 409–424.

Liesen, A., Hoepner, A. G., Patten, D. M., & Figge, F. (2015). Does stakeholder pressure influence corporate GHG emissions reporting? Empirical evidence from Europe. Accounting, Auditing & Accountability Journal, 28(7), 1047–1074.

Lin, B., & Chen, Y. (2019). Dynamic linkages and spillover effects between CET market, coal market and stock market of new energy companies: A case of Beijing CET market in China. Energy, 172, 1198–1210.

Liu, W., De Sisto, M., & Li, W. H. (2021a). How does the turnover of local officials make firms more charitable? A comprehensive analysis of corporate philanthropy in China. Emerging Markets Review, 46, 100748.

Liu, W., Xu, Y., Fan, D., Li, Y., Shao, X.-F., & Zheng, J. (2021b). Alleviating corporate environmental pollution threats toward public health and safety: The role of smart city and artificial intelligence. Safety Science, 143, 105433.

Llopis-Albert, C., Rubio, F., & Valero, F. (2021). Impact of digital transformation on the automotive industry. Technological Forecasting and Social Change, 162, 120343.

Lu, J., Wang, C., Jamali, D., Gao, Y., Zhang, C., & Liang, M. (2022). A novel framework to unearth corporate hypocrisy: Connotation, formation mechanism, manifestation, and contagion effect. Business Ethics, the Environment & Responsibility, 31, 1136–1156.

Luers, A., Yona, L., Field, C. B., Jackson, R. B., Mach, K. J., Cashore, B. W., Elliott, C., Gifford, L., Honigsberg, C., & Klaassen, L. (2022). Make greenhouse-gas accounting reliable—build interoperable systems. Nature, 607, 653–656.

Luo, L., Tang, Q., & Lan, Y. C. (2013). Comparison of propensity for carbon disclosure between developing and developed countries: A resource constraint perspective. Accounting Research Journal, 26, 6–34.

Luo, L., & Tang, Q. (2014). Does voluntary carbon disclosure reflect underlying carbon performance? Journal of Contemporary Accounting & Economics, 10, 191–205.

Luo, L. (2019). The influence of institutional contexts on the relationship between voluntary carbon disclosure and carbon emission performance. Accounting & Finance, 59, 1235–1264.

Luo, Y., Xiong, G., & Mardani, A. (2022). Environmental information disclosure and corporate innovation: The “Inverted U-shaped” regulating effect of media attention. Journal of Business Research, 146, 453–463.

Matsunaga, M. (2021). Testing the theory of communication and uncertainty management in the context of digital transformation with transformational leadership as a moderator. International Journal of Business Communication. https://doi.org/10.1177/23294884211023966

Matt, C., Hess, T., & Benlian, A. (2015). Digital transformation strategies. Business & Information Systems Engineering, 57, 339–343.

Meng, X., Chen, L., & Gou, D. (2023). The impact of corporate environmental disclosure quality on financing constraints: The moderating role of internal control. Environmental Science and Pollution Research, 30, 33455–33474.

Michelon, G., Patten, D. M., & Romi, A. M. (2019). Creating legitimacy for sustainability assurance practices: Evidence from sustainability restatements. European Accounting Review, 28, 395–422.

Morrar, R., Arman, H., & Mousa, S. (2017). The fourth industrial revolution (Industry 4.0): A social innovation perspective. Technology Innovation Management Review, 7, 12–20.

Orens, R., Aerts, W., & Cormier, D. (2010). Web-based non-financial disclosure and cost of finance. Journal of Business Finance & Accounting, 37, 1057–1093.

Park, J., Lee, J., & Shin, J. (2023). Corporate governance, compensation mechanisms, and voluntary disclosure of carbon emissions: Evidence from Korea. Journal of Contemporary Accounting & Economics, 19(3), 100361.

Pitrakkos, P., & Maroun, W. (2020). Evaluating the quality of carbon disclosures. Sustainability Accounting, Management and Policy Journal, 11, 553–589.

Reid, E. M., & Toffel, M. W. (2009). Responding to public and private politics: Corporate disclosure of climate change strategies. Strategic Management Journal, 30, 1157–1178.

Seifert, B., Morris, S. A., & Bartkus, B. R. (2004). Having, giving, and getting: Slack resources, corporate philanthropy, and firm financial performance. Business & Society, 43, 135–161.

Shao, J., & He, Z. (2022). How does social media drive corporate carbon disclosure? Evidence from China. Frontiers in Ecology and Evolution, 10, 971077.

Tabesh, P., Vera, D., & Keller, R. T. (2019). Unabsorbed slack resource deployment and exploratory and exploitative innovation: How much does CEO expertise matter? Journal of Business Research, 94, 65–80.

Tan, X., Peng, M., Yin, J., & Xiu, Z. (2022). Does local governments’ environmental information disclosure promote corporate green innovations? Emerging Markets Finance and Trade, 58, 3164–3176.

Tang, Q., & Tang, L. M. (2021). Developing blockchain-based carbon accounting and decentralized climate change management system. In: Information for efficient decision making: big data, blockchain and relevance. World Scientific, pp. 431–450

Wang, D., Huang, Y., Guo, M., Lu, Z., Xue, S., & Xu, Y. (2023). Time dynamics in the effect of carbon information disclosure on corporate value. Journal of Cleaner Production, 425, 138858.

Wang, H., & Qian, C. (2011). Corporate philanthropy and financial performance: the roles of social expectations and political access. Academy of Management Journal, 54, 1159–1181.

Wang, L., Chen, L., & Li, Y. (2022). Digital economy and urban low-carbon sustainable development: The role of innovation factor mobility in China. Environmental Science and Pollution Research, 29, 48539–48557.

Wang, L., & Shao, J. (2023). Environmental information disclosure and energy efficiency: Empirical evidence from China. Environment, Development and Sustainability. https://doi.org/10.1007/s10668-023-02910-0

Wang, T.-C., & Lee, H.-D. (2009). Developing a fuzzy TOPSIS approach based on subjective weights and objective weights. Expert Systems with Applications, 36, 8980–8985.

Wu, H., & Hu, S. (2020). The impact of synergy effect between government subsidies and slack resources on green technology innovation. Journal of Cleaner Production, 274, 122682.

Xu, L., Wu, C., Qin, Q., & Lin, X. (2022). Spillover effects and nonlinear correlations between carbon emissions and stock markets: An empirical analysis of China’s carbon-intensive industries. Energy Economics, 111, 106071.

Yang, G., Nie, Y., Li, H., & Wang, H. (2023). Digital transformation and low-carbon technology innovation in manufacturing firms: The mediating role of dynamic capabilities. International Journal of Production Economics, 263, 108969.

Yuan, C., Xiao, T., Geng, C., & Sheng, Y. (2021). Digital transformation and division of labor between enterprises: Vertical specialization or vertical integration. China Industrial Economics, 9, 137–155.

Zhai, H., Yang, M., & Chan, K. C. (2022). Does digital transformation enhance a firm’s performance? Evidence from China. Technology in Society, 68, 101841.

Zhang, J., Lyu, Y., Li, Y., & Geng, Y. (2022). Digital economy: An innovation driving factor for low-carbon development. Environmental Impact Assessment Review, 96, 106821.

Zhang, Y.-J., & Liu, J.-Y. (2020). Overview of research on carbon information disclosure. Frontiers of Engineering Management, 7, 47–62.

Zhong, M.-R., Cao, M.-Y., & Zou, H. (2022). The carbon reduction effect of ICT: A perspective of factor substitution. Technological Forecasting and Social Change, 181, 121754.

Funding

No funding was received for conducting this study.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Competing interests

The authors have no relevant financial or non-financial interests to disclose.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Qu, Z., He, Z. Carbon information disclosure as a driving force for corporate digital transformation: a textual analysis from China. Environ Dev Sustain (2024). https://doi.org/10.1007/s10668-024-04669-4

Received:

Accepted:

Published:

DOI: https://doi.org/10.1007/s10668-024-04669-4