Abstract

The management of invasive alien species (IAS) is complex and requires consideration of intertwined ecological and economic dimensions. Given the wide variety of costing purposes and practices, and the associated risk of misunderstandings and/or miscommunication which may jeopardize perceptions and management, there is an urgent need to disentangle the nature of IAS costs. We provide a synthesis of the nature and diversity of the economic costs associated with IAS and the potential limits of their assessment. This work promotes a common understanding of costs of IAS across disciplines, which is essential for improving the estimation, interpretation, selection, and uptake of costs when designing IAS management policies or raising societal awareness of their threats. Our study contributes to a clearer understanding of the nature of costs, serving as a sound basis for managing biological invasions.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

Alien or non-native (exotic) species invade regions outside their native range, mostly as a consequence of human activities. A subset of these species establishes successfully in their novel ranges, i.e. become permanent additions to regional species pools. Those exerting negative impacts on the recipient environment are known as invasive alien species (IAS) (CBD 2002; Falk-Petersen et al. 2006; Blackburn et al. 2011). IAS affect the functioning of ecosystems and related ecosystem services (Linders et al. 2019), often leading to cascading impacts on socio-economic activities and human well-beingFootnote 1 (Bacher et al. 2018). Accordingly, negative impacts on the environment caused by IAS may result in significant economic losses (IPBES 2019; Shackleton et al. 2018). Biological invasions are therefore a complex phenomenon where ecological and economic issues are often intertwined.

Severe risks to human health or biodiversity due to the presence of IAS are sufficient reasons to initiate prevention or management actions to halt the ever-increasing spread of IAS worldwide (Dana et al. 2019; de Groot et al. 2020). However, understanding the economic costs caused by IAS is key, to foster a sound foundation for management decisions (Dana et al. 2014; IUCN 2018). These costs can also be used to inform the general public and communicate the societal significance of biological invasions (Davis et al. 2018). However, costs can vary in nature because, among other reasons, they are not assessed against the same criteria and objectives or over the same periods of time (Diagne et al. 2020a; 2021a). For instance, some costs are concrete out-of-the pocket expenses linked to management measures while others refer to potential loss of value that might be borne in the future under certain prospective scenarios (Bacher et al. 2018).Footnote 2 Systems to summarize or analyze the costs of biological invasions are often missing (Marsh et al. 2021). Any simple aggregation or extrapolation attempt of these economic costs is likely to lead to erroneous conclusions, which may be misleading for evidence-based policy and/or decision-making. With biological invasions on the rise and increasing interest in assessing their economic impact (see for example the articles in this Special Issue; Seebens et al. 2021), there is a palpable and increasing need to disentangle the nature of costs associated with biological invasions and provide a clear understanding of their numerous dimensions and how they relate to each other. This will help avoid confusion and contribute to more meaningful assessments of economic impacts for decision makers and other societal stakeholders affected by invasions.

The body of grey and scientific literature on the economics of IAS has grown substantially in recent years. This literature includes cost assessments of IAS across ecosystems (e.g. Cuthbert et al. 2021a), taxa (e.g. Bradshaw et al. 2016), regions (e.g. special issue published in NeoBiota dedicated to the cost of IAS around the world (Zenni et al. 2021) and sectors (e.g. Marsh et al. 2021). Such cost assessments of IAS were conducted by scientists but also national sector specific agencies such as agricultural, forestry or the environment (e.g. Great Lakes Commission, & St. Lawrence Cities Initiative 2012; The Research Group, LLC 2014). This literature also includes methodological reviews and syntheses (e.g. Lovell et al. 2006; Olson 2006; Frésard 2011; Marbuah et al. 2014; Jackson 2015; Epanchin-Niell 2017; Warziniack et al. 2021). Although there are multiple frameworks for categorizing IAS impacts on the state and dynamics of ecosystems (e.g. Blackburn et al. 2014; Hawkins et al. 2015), frameworks that classify impacts on humans and economic activities are largely missing, except for specific sectors (e.g. Paini et al. 2016 for crop production). Two recent general frameworks are the SEICAT framework (Bacher et al. 2018) that allows to classify IAS taxa in terms of the magnitude of their impacts on human well-being, based on the capability approach from welfare economics, and the Invacost database (Diagne et al. 2020a,b), that includes a descriptor of the market and/or activity sectors impacted by the IAS. Inter-governmental organizations, such as the IUCN and CABI, have proposed a toolkit for the economic analysis of IAS providing methodological elements to define their costs and benefits (Emerton and Howard 2008). The spatial planning tool InVEST is being adapted to specifically evaluate the costs and benefits of IAS management scenarios at regional scales (Gallardo et al. 2019). Despite these syntheses and frameworks, the economic terms and concepts related to the impacts of biological invasions lack clarity while they are regularly used by environmentalists.

In this paper, we present a systematic assessment on the nature and diversity of economic costs associated with IAS. Our objective is to provide a useful framework for both natural and social scientists as well as practitioners and other stakeholders, promoting a common understanding of this complex topic. We expect this to help clarify the concepts around the economic costs of IAS, and thereby to enhance both interdisciplinary collaborations and impact of resulting research, with greater output for resource managers, policy makers and the general public. We first analyze the economic foundations of the economic costs of IAS and, second, propose a synthetic view of the nature of costs. Third, we investigate the approaches and decision-making scenarios that mobilize these different cost concepts, highlighting the discrepancies associated with cost assessment and cost aggregation.

The nature of economic costs of IAS

There is a wide variety of terms and concepts used in economic cost assessment. Doney (1963) discusses one hundred twenty-two specialized or modified cost concepts including direct and indirect costs, marginal and total costs, disutility and opportunity costs. This diversity reflects the complexity of economic activity. It also reflects the diversity of problems related to costing as well as of disciplines that use these concepts. Thus, many concepts serve limited purposes or are used in a confusing way because the object whose cost is being measured is distinct from the production or consumption goods for which the cost concepts were originally defined. This applies to the costing of IAS, which is based on many concepts used for different purposes and perspectives (e.g. Perrings et al. 2002; Pimentel 2005; Born et al. 2005; Jackson 2015).

Ecological damage and economic costs of IAS

There are several definitions and uses of the concept of economic costs of IAS in the literature, with approaches that focus exclusively on the economic damage costs of IAS (e.g., Krcmar-Nozic et al. 2000), on the management costs of IAS (e.g., Scalera 2010), or on the total costs of IAS aggregating all costs, including damage and management costs (e.g. Pimentel et al. 2005; Diagne et al. 2021a, Crystal-Orneiras et al. 2021). While most approaches to economic costs are limited to an analysis of monetary costs (i.e. expressed in a monetary value) (e.g. Krcmar-Nozic et al. 2000), some studies propose hybrid approaches considering that economic costs consist not only of monetary values (e.g. Eschen et al. 2021). Before going into the details of the different categories of costs, we propose a broad definition of economic costs and ecological damage of IAS. We express the consequences of biological invasions in normative terms in relation to conservation ecology (ecological damage) and economics (economic costs) by considering that any loss of biodiversity or human well-being, respectively, are considered negative.

We define ecological damageFootnote 3 of IAS as the harm to ecosystems caused by IAS, such as a loss of biodiversity or ecological function (blue circle in Fig. 1a). Ecological damage can take multiple aspects that are expressed in biophysical units (e.g. number of lost native species, volume of degraded water). They can hardly be aggregated since they are measured in different units.

a Schematic representation of the economic costs (yellow) and ecological damage (blue) caused by IAS. In many cases, when ecological damage has a negative impact on human well-being, it is also perceived as an economic cost (green). b The economic costs can be expressed in monetary (red dots) and non-monetary terms

We define economic costs of IAS as the harm caused by IAS to human welfare (yellow circle in Fig. 1a), welfare referring to a measure of human satisfaction as originally defined by Smith (1759) and widely discussed since.Footnote 4 These costs arise from all negative consequences for which a value can be assigned by humans (e.g. monetary, existence or bequest values). This implies that the economic costs are made up of the costs of damage caused by IAS to humans, but also the costs of preventing and controlling this damage. They include disutilities on health, security, infrastructure and economic production as well as welfare losses associated with investments in IAS prevention and control. Economic costs can also be an indirect consequence of environmental damage through, for example, negative feedbacks impacting other economic sectors. In this sense, economic costs include all the additional costs resulting from economic disruptions due to the environmental damage. Although often expressed in monetary terms (red dots in Fig. 1b), economic costs can be measured through other quantitative or qualitative metrics. Non exhaustively, these metrics include time costs (e.g., time to bypass an area inaccessible due to IAS, time to treat IAS or repair damage), convenience costs (e.g., inconvenience caused by IAS, loss of eudaimonic well-being) or psychological costs (see Zeithaml (1988) for an overview of non-monetary costs and perceived value).

Many ecological damages have a negative impact on humans and can therefore also entail economic costs (green shaded area in Fig. 1a). For example, an alteration of the ecological structure of landscapes or a degradation of biodiversity, when perceived negatively by humans, constitute an ecological damage but also an economic cost. On the other hand, ecological damages which are not perceived or at least not perceived negatively by humans, do not constitute an economic cost (blue crescent in Fig. 1a). Examples include unnoticed loss of biodiversity (e.g. in the deep sea or in primary forests), long-term ecological damage that is not perceived due to uncertainties and unknowns (e.g., via very long-term ecological cascade effects), or ecological impacts that are perceived positively by humans but are ecologically harmful. Conversely, some economic costs are not ecological damages (yellow crescent in the Fig. 1a). The principal example being the costs of direct impacts on human activities or infrastructure, with no link with ecosystem degradation such as yield loss for off-ground cultivation or damages to infrastructure such as water intake pipes related to hydroelectric dams or telephone cables. Nevertheless, the gradient between natural and managed systems should lead to consider the boundaries between “pure” ecological damage (blue in the Fig. 1), or “pure” economic costs (yellow in the Fig. 1), and situations where ecological damage triggers economic costs (green in the Fig. 1) as blurred.

When ecological damages trigger economic costs, those costs are expressed as welfare losses and are therefore either monetary values (e.g. willingness to pay) or non-monetary values of satisfaction losses such as time costs or well-being losses. Although in Fig. 1b, monetary and non-monetary costs are represented in equal parts, cost assessments are based primarily on monetary valuation (see Diagne et al., 2020a, b for an exhaustive analysis). This is true for the cost of damage caused by IAS and even more so for management costs of IAS, which are essentially measured in monetary terms as these costs are mostly monetary expenses (Zavatela, 2000). This focus on the monetary unit is explained by the fact that it makes it possible to aggregate these costs (and thus to evaluate a total cost) but also to compare them (which is essential when it comes to comparing the cost of damage with the cost of management and thus to evaluate the management effort to be put in place).Footnote 5 The use of the monetary standard implies however measuring satisfaction according to a utilitarian vision, through the sole prism of money. Moreover, when market values are not available, as is the case for many goods and services related to health, education, or the environment, monetary measurement requires resorting to non-market valuation methods. It involves the assessment of costs based on observation of real-world choices (revealed preference methods) or explicit statements (stated preference methods) of the economic agents. These methods come along with several limitations, which have been widely discussed in the environmental economics literature (Cameron and Carson 1989; Spangenberg and Settele 2010; Carson 2012; Hausman 2012; Johnston et al. 2017), as well as methodological advances to bound them (Carson 2012; Freeman III et al. 2014; Rakotonarivo et al. 2016). While expressing in monetary terms all economic costs triggered by ecological damages might be desirable in that it simplifies the inclusion of impacts to the environment in decision-making and policy-design processes, economic costs with non-market values are not all commensurable (Bacher et al. 2018). This may be because they are not all well-understood, not systematically measured and reported, or because the monetary metric is not always acknowledged by the scientific and civil communities (Spangenberg and Settele 2010). Non-market values are inevitably contingent on humans' subjective perceptions and understanding (Shackleton et al. 2019).

The private and social costs of IAS

By their very nature, IAS belong to the class of mobile public bads in that they produce costs to society as they proliferate and propagate in space and time impacting negatively public goods (e.g. biodiversity conservation).Footnote 6 As soon as an IAS spreads from one property, region or country to another, it becomes a spatial externalityFootnote 7 and failure to prevent its spatial propagation is detrimental to the recipients of the bad. The distinction between private costs from social costs is usual in the economics literature. It allows to analyze the costs of IAS at different scales and to promote socially optimal management. Private costs are defined as the costs incurred by a private agent as a result of their private activity or, in the case of an IAS, as a result of the prevalence of the IAS on their property. Social costs are the total costs to society and include both private costs plus any external costs, these last being defined as the costs borne by third parties that are not compensated.Footnote 8 As an illustrative example of these cost concepts, the red swamp crayfish (Procambarus clarkii) was introduced in Europe through Spain by a crayfish farm in 1972. Over the next 40 years the crayfish spread through Spain, but also through 10 other European countries (Holdich 1999). The impacts of this IAS result in both economic costs (i.e., on fishing or agriculture) and ecological damages (i.e., on biodiversity). If the crayfish farm from which the invasive crayfish was introduced incurs a cost as a result of the spread of the crayfish in his property, that cost would be a private cost. The costs borne by fishers and farmers and more generally by individuals who value biodiversity in the neighboring areas are external costs. The social cost of the crayfish invasion is the cost collectively borne at the European scale or even beyond (e.g. as trade losses in other countries outside Europe).

These cost concepts are useful in several respects. First, private and external costs allow for distinguishing which costs are borne by whom. Social costs represent the total cost of an activity and are used to assess the costs of IAS. Private, social and external costs are used in the process of managing IAS and internalizing efficiently the externality. Second, and more importantly, these concepts allow to address market failures, as pricing mechanisms must take into account all costs associated with an activity in order to work effectively. To return to our example, if the external costs of introducing the crayfish into the farm had been paid by the owner, he would never have chosen to produce it because the costs incurred would have been much greater than the expected profit from farming the crayfish. The evaluation of external costs and the implementation of pricing mechanisms that make those responsible for negative externalities pay their costs are one of the cornerstones of public economics. Making the producers of externalities pay the price of external costs resolves market failures and thus achieves social efficiency (Pigou, 1920).Footnote 9

In the presence of an external cost, the notion of liability is key insofar as the market failure is solved as soon as this cost is borne by the party that is responsible for it. In case of pollution from a production activity impacting a third party, the problem is simple as it is possible to make the firm liable for the nuisance to pay for it. It is more complex when it comes to the proliferation of a species. As Perrings et al. (2000) note, liability is often irrelevant with respect to IAS as those responsible for their introduction are difficult to identify or may have disappeared. Hence, the boundary between private and external costs of IAS is sometimes ambiguous as invasions are often unintentional and not the result of a deliberate choice (Hulme et al. 2008). An IAS introduced involuntarily into private property is a negative externality often produced by an unknown entity that is not necessarily aware of it. When the IAS establishes on the property, it becomes a private cost for the owner. It is also an external cost however, in the sense that the property owner did not intentionally introduce this IAS that is coming from elsewhere. Nevertheless, as Coase (1960) shows, market imperfection can be solved in spite of liability. For example, it is conceivable that a landowner free of IAS makes a monetary transfer to an infected neighbor in order for the latter to control the IAS on her/his property so that it does not spread over. As we shall see in Sect. “Cost concepts in IAS management methods”, efficient management of IAS requires coordination and cooperation at the landscape level, and the mechanisms to drive this are based on an assessment of private, external and social costs. Assessment of landowner's private costs and external costs incurred in neighboring properties is used to define monetary arrangements or agreement terms to coordinate management efforts. The social cost is used to compel landowners to manage IAS on their properties and design public policies for this social cost to be as small as possible.

The economic costs and benefits of IAS

Economics studies how agents allocate resources to best serve their interests. As conveyed by Epanchin-Niell (2017), beyond the assessment of the economic cost of IAS, the economics of IAS management aims at understanding trade-offs associated with actions or policies. These trade-offs concern in particular the choices of where, when and how to manage IAS, which invasions to manage and how to ensure coordination for effective management. The cost of one alternative over another is an input to the analysis of these questions, as are the relative benefits of the different alternatives. It is common practice to compare the costs and benefits of a management action, or even to define a least-cost strategy, known as cost-effective (Sect. “Cost concepts in IAS management methods”). This leads to a comparison between the costs of management and the benefits of this management, the latter being the costs of damage avoided thanks to the management effort. Therefore, the dichotomy between management costs and damage costs is common in the literature, with the economic costs of IAS referring to the sum of the two.

Although these concepts, defined and discussed in the further subsections, are intrinsically linked to each other, their interrelatedness is the cause of much confusion in the literature. Figure 2 illustrates the distinction and tenuous link between the costs and benefits of invasions on the one hand [part (a)] and the costs and benefits of managing them on the other [part (b)]. It reads as a mirror image (the vertical central gray line is the mirror) and allows us to highlight the links and equivalences, or correspondences, between these two categories of concepts. Colors are used to identify loss (red) or gain (blue) situations. On the left (Fig. 2a.) are the costs and benefits of IAS and on the right (Fig. 2b) are the costs and benefits of IAS management. As can be seen, the damage/loss costs of IAS are equivalent to the benefits of management, because management prevents these damages and losses. Similarly, the benefits of IAS (i.e. the positive contribution of IAS), when they exist, are losses when it comes to IAS management. They are forgone benefits that should be subtracted when assessing the total benefits of IAS management. This mirror effect is explained by the fact that IAS management mitigates the ecological and economic damage they cause. Management is costly but produces benefits by reducing the cost of the damage caused by IAS.

The economic costs of IAS

In the economics literature on biological invasions, the economic costs of IAS are generally described as consisting of damage/loss costs and management/control/applied mitigation costs (e.g. Perrings et al. 2000, Pimentel et al. 2005, Born et al 2005, Kettunen et al. 2009, Marbuah et al. 2014, Epanchin-Niell 2017, Diagne et al. 2020b, 2021a, Warziniack et al. 2021). These terms are often used without being defined or even illustrated with examples. Emerton and Howard (2008) adopt the term “opportunity costs (benefits lost)” to refer to what others name damage/loss costs.Footnote 10 They describe this category of costs as composed of “On-site production losses”, “Losses to other sectors and activities”, and “Congestion and crowding costs” (Emerton and Howard 2008: 44–45). Management costs usually refer to the set of costs incurred at the different stages of managing an invasion (e.g. Robertson et al. 2020) including: understanding and predicting invasions and their impacts, prevention measures for introduction or spread (e.g. education and awareness campaigns, quarantine), early detection (e.g. phytosanitary control of introduction pathways, border checks), surveillance, monitoring and control (e.g. eradication campaigns, mitigation or containment strategies). Marbuah et al. (2014) specifies that control costs are sometimes used as a proxy measure of damage cost. This applies in particular to the costs of repairing damage on human-made infrastructures or of human health expenses, which may be considered in assessments both as management or damage/loss costs. As a matter of fact, repairing the damage of an IAS is a management action, but the expenses incurred correspond to the value of the damage/losses suffered. Emerton and Howard (2008) assume that repairing costs are management costs that they define as “direct physical expenditures on prevention, eradication, containment, management and restoration activities, such as spending made on equipment, wages, infrastructure, transport, maintenance, research, etc.”. On the contrary, Diagne et al. (2020b) consider these costs are damage/loss costs because they are dedicated to the consequences of the invasion and not to the management of the IAS itself.

We define management costs as the expenses dedicated to managing the IAS (Fig. 2a,b top). We define damage/loss costs as the damage caused by IAS and the expenses to repairFootnote 11 these damages (Fig. 2a). They include:

-

physical capital and infrastructure loss (including repair of damage to infrastructure or the endangerment of economic activities),

-

human capital loss (including human health expenses),

-

natural capital loss (biodiversity loss/degradation) accompanied by losses/degradation in ecosystem services (which encompass all four services, e.g. provisioning services such as harvest/yield/production, regulating services such as carbon sequestration and climate regulation, supporting services such as primary production and nutrient cycling, and cultural services such as recreation, tourism and aesthetic values).

A substantial number of studies have attempted to measure the economic damage/loss costs of IAS, at the stage when the IAS has already successfully established in the region under study. As not all damages can be assessed to the same standard (e.g., monetary) and because they are either unknown or uncertain, such assessments are often not comprehensive. While there is relatively less methodological bias in the assessment of management costs than in the assessment of damage costs, few studies have attempted to provide an overall picture of management costs (exceptions being Scalera (2010) and Tucker et al. (2013) for an assessment at a European scale, Hoffmann and Broadhurst (2016) for Australia, Ahmed et al. (2022) for the cost of inaction in IAS management). Instead, studies focusing on the costs of control or on the cost of eradication of a single species at a given location or region are more common (e.g. Howald et al. 2007; Brockerhoff et al. 2010; Holmes et al. 2015; Robertson et al. 2017; Jardine and Sanchirico 2018).

The economic benefits of IAS

Economic agents may benefit from the presence and/or use of IAS (benefits of IAS) (Fig. 2a), either through revenues from their exploitation, or because IAS contribute positively to ecosystem services (e.g. provisioning services such as exploitation and commercialization of introduced fish or shellfish, regulating services such as wetland plants controlling pollution through absorbing heavy metals, cultural services such as opportunistic recreational hunting of an established IAS). IAS may also have a positive ecological impact on native species, through food webs for instance (e.g. bird population feeding on an invasive crayfish). Kourantidou et al. (2022) have reviewed and discussed the different aspects behind these IAS that can simultaneously be assets and liabilities (or burdens). Many exotic species, later turning into IAS, have been introduced on purpose, for economic or ecological reasons, without first conducting a cost–benefit or a risk–benefit assessment of their introduction (McNeely 2001).

Economists typically consider the economic benefits of IAS management as avoided damages that would be otherwise caused by the IAS (Fig. 2b). As previously explained, the fundamental question resource managers often come across is: what are the costs of the IAS management action compared to the benefits associated with this action? The net economic benefits of a management program can be estimated as the benefits of IAS management (damages/loss avoided thanks to the management action, blue in Fig. 2b) minus the losses due to IAS management (the management costs and the potential forgone benefits of IAS related to the IAS management action, red in Fig. 2b, to which the possible negative or positive side effects of management can be added (not shown in Fig. 2b)). This approach is developed in Sect. “Cost concepts in IAS management methods”.

The direct and indirect economic costs of IAS

Economists typically make the distinction between direct costs related to production (cost of labor, cost of raw materials, etc.) and indirect costs generated (taxation, overheads, long-term investment in infrastructure, behaviors and market adjustments etc.).Footnote 12 This translates into a distinction between the costs immediately incurred and those that are more diffuse, shared, longer term and by nature complex to assess. For invasive species scholars, the dividing line between direct and indirect costs comes down to a suite of principles. For Emerton and Howard (2008), “direct economic impacts arise from the effects of the invading species on the host habitat or ecosystem and measures to manage the invasive species, while indirect economic impacts refer to effects on other sites, sectors and times in terms of markets, prices, health, nutrition, trade, the environment and public and private spending”. This definition is somehow confusing as costs incurred in other sites are typically referred to as external costs. But the costs incurred in other connected sectors clearly contribute to the indirect costs of IAS and call for an understanding of the macroeconomic interrelationships at work. In this perspective, assessing the costs of IAS related to human disease (e.g. Asian Tiger Mosquito), Chiadmi et al. (2020) assume direct costs are those related to health expenditures (patient care, treatment, etc.), whereas work absenteeism or decreases in productivity are considered as indirect costs. Born et al (2005) or Holmes et al. (2009) propose another definition and distinguish costs based on their ease of quantification. They define indirect costs as secondary costs such as long term costs (impacts with time lags) or more diffuse costs with cascading impacts (interspecific interactions, macroeconomic retroactions).

Between these two definitions and consistently with economics literature, we assume direct costs are the costs immediately incurred, whatever the site or sector impacted, that are straightforward to identify and quantify. Indirect costs are then assumed to be secondary, and more diffuse (for instance through species interdependencies or macroeconomics effects). Considering this definition, while indirect costs are not necessarily always hard to quantify, they are generally more difficult to identify than direct costs as they involve understanding ecological interdependencies on the one hand, economics interdependencies on the other.

A related distinction, as proposed by Diagne et al. (2020b), is between observed costs (i.e., those actually incurred by an IAS within its invasive distribution area at the time of the assessment) and potential costs (i.e., those not incurred but expected for an IAS beyond its actual distribution area and/or predicted over time within or beyond its actual distribution area). While the direct/indirect distinction emphasizes the link to the invasion, the observed/potential distinction informs on the likelihood of existence of the cost at the time of evaluation, regardless of its temporal or spatial location relative to the invasion. As potential costs are the subject of numerous sources of socio-economic and ecological uncertainty, they deserve careful consideration for any use in cost assessment (Diagne et al. 2021a; Leroy et al. 2022). To take this uncertainty into account, cost assessments can use expected utility approaches (von Neumann and Morgenstern 1944) and assign probabilities to different possible scenarios about the invasion and its impacts. Some ecological or interdisciplinary works seeks to build on the expected spread of the IAS, for instance using simple generalized linear models based on the known distribution for ragweed (Ambrosia artemisiifolia) in Europe (Richter et al. 2013), using general hierarchical model framework for spatiotemporal processes based on abundance variation for the eurasian collared-dove (Streptopelia decaocto) in the United-States (Hooten et al. 2007), projecting the rate of migration over time based on current local observations and past observations made abroad for the ruffe (Gymnocephalus cernuus) in the United-States (Leigh 1998) or assuming a colonisation of all suitable habitats identified in climate modelling for the Red Imported Fire Ant (Solenopsis invicta) in Australia (Wylie and Janssen-May 2017).

The nature of economic costs of IAS

To summarize, we distinguish 7 main cost concepts used in the literature on biological invasions. We have listed them in Table 1 following page, which is intended to cover each cost dimension. In order to illustrate these concepts, we voluntarily use a single case study published in Biological Invasions in 2022: the invasion of primrose willow (Ludwigia grandiflora) in the Brière marsh (France) (Bougherara et al. 2022).

Figure 3 shows the combination of three of the seven concepts listed in Table 1 in the form of a cube, with one fixed concept (economic costs). Each combination could in turn be broken down into several situations using the remaining cost concepts. Both from the perspective of providing decision support tools (Sect. “Cost concepts in IAS management methods”) and in the perspective of assessing the costs of IAS for public awareness purposes (Sect. “Highlighting the societal importance of the costs of IAS for raising awareness and underpinning public intervention”), the assessment consists of estimating for one or more IAS, at a more or less large spatial scale, each component of the cube described in Fig. 3. Support for management strategies will generally be aimed at comparing management costs and damage/loss costs (weighting two halves of the cube). Awareness approaches will seek to assess the full range of costs (adding up all the entities making the cube).

The different combinations of three concepts of the economic cost of IAS (damage/loss and management costs, monetary and non-monetary costs, directand indirect costs). Each component of the cube represents a unique combination of one of the two distinctions within each of the three concepts (dark gray), illustrated with an example (light gray)

The use of the different nature of costs in decision making

The literature on the economics of IAS has made significant advances in recent years, helping to inform decisions and policy making (see for example Epanchin-Niell (2017), Büyüktahtakin and Haight (2018) for recent reviews). The evaluation of the costs of IAS meets two needs. The first is to provide data to feed into economics and operations research methods (such as mathematical models) and provide insight on management strategies to guide public policies (Sect. “Cost concepts in IAS management methods”). The second need is to highlight the societal importance of the social cost of invasions and underpinning public intervention (Sect. “Highlighting the societal importance of the costs of IAS for raising awareness and underpinning public intervention”). In the following section, we review management methods and discuss their main weaknesses and limitations.

Cost concepts in IAS management methods

Considering approaches in support of IAS management policies, we distinguish those with a qualitative focus from those with a quantitative focus. Both have either been developed from a private (focus on private costs) or a benevolent social planner standpoint (focus on social and external costs). The perspective adopted on costs and benefits is that of IAS management (Fig. 2b) rather than that of the IAS itself (see Fig. 2a).

Approaches with a qualitative focus are mostly based on bioeconomic modelling and have in common the goal to model the interactions between economic and ecological systems (e.g. Epanchin-Niell and Wilen 2015; Springborn et al. 2016; Courtois et al. 2018; Skonhoft and Kourantidou 2021). By construction, the economic structure of these models is either inspired by a cost–benefit or cost-effectiveness logic. The first includes the costs and benefits (avoided damages/losses) of management. The second includes management costs, and occasionally the benefits derived from it. Rather than assessing the cost/benefit or cost/effectiveness ratio of a portfolio of management strategies however, these approaches aim to qualitatively characterize optimal conditions, identify determinants of suboptimality and solve them. Going beyond just the valuation and aggregation of costs and benefits (as in the case of cost–benefit analysis, see below), it is the marginal values and therefore the relative gradients of cost and benefit functions that are assessed and analyzed. The focus is then on qualitative assumptions of costs and benefits, and while the functional forms implicitly account for direct and indirect costs, and market and non-market values, they are primarily stylized and conceptual. These approaches are nonetheless informative and provide important qualitative results regarding the impact of cost uncertainty (e.g. Sims and Finnoff 2013), the inefficiencies associated with the external costs of private management (e.g. Fenichel et al. 2014; Aadland et al. 2015) and regulating these inefficiencies by internalizing these costs via taxation or subsidies (Costello et al. 2017).

Approaches with a quantitative focus based on cost estimates are mainly cost–benefit analysis (CBA), cost-effectiveness analysis (CEA) and multicriteria decision analysis (MCA). Like bioeconomic models, these approaches provide guidance on how, where, or when to manage IAS, but they promote insights based on cost estimates. CBA aims to assess the net benefits of management strategies (i.e. avoided damages/losses from management minus management cost) to determine whether these strategies are desirable from an economic point of view (e.g. Zavaleta 2000; Keller et al. 2007; Brown and Daigneault 2014a,b; Reyns et al. 2018). The approach is particularly useful for assessing the return on investment of a given management strategy or for ranking alternatives in order of net benefit. Using CBA, the challenge is to assess management costs and avoided damages/losses as comprehensively as possible and, to be comparable, to express these costs in monetary terms. Because of the many flaws of non-market economic valuation methods, an inevitable weakness of CBA applied to IAS is that it biases monetary estimates of the full value of biodiversity and of ecosystem services (Turner et al. 2003). This problem is particularly salient when the approach is used to specifically assess the monetary (cardinal) value, or return on investment, of a particular management strategy.Footnote 13 It is less salient when the approach is used ordinally to compare the relative profitability of several strategies. Monetization of all costs is not necessary when using CEA. The approach, also called cost-utility analysis, aims to select the strategy that achieves a management objective at the lowest cost. This objective need not be monetary nor even economic. Instead, it can be biophysical such as reducing the spread of an IAS, lowering its prevalence (e.g. Louette et al. 2013), or eradicating it (e.g. Martins et al. 2006; Howald et al. 2007; Robertson et al. 2017). In addition, CEA may include social considerations such as public acceptability constraints and management considerations such as budget constraints (e.g. Roberts et al. 2018; Courtois et al. 2021). When the management objective assigned in CEA is to reach the highest management benefit at the lowest cost, the costs considered are the costs of management (whether private or social), the benefits are the damage/losses avoided through management, or a subset of that damage/loss. However, contrary to CBA, benefits need not be expressed in monetary terms but can be expressed in a biophysical unit. Indeed, because CEA does not seek to inform us about how profitable a management strategy is, there is no need to raise monetary values. This does not however, mean that CEA can cope with composite costs expressed in distinct units. For example, if the management objective is to minimize monetary and non-monetary losses from IAS, one needs to define an aggregation rule that allows making these losses comparable and therefore aggregable. Problems similar to those encountered in CBA related to standardizing all costs may thus be encountered in CEA as well. Although MCA does not solve the problem of comparability, the objective of the approach is precisely to tackle decision problems that involve several criteria. MCA is based on the assumption that there is no one optimal management solution but compromise solutions. Like CBA or CEA, MCA can be applied to select eradication, control, surveillance, prevention and monitoring strategies, and can even be used to compare prevention versus control strategies or any other combination of IAS interventions. The ingredients of the approach, the so-called evaluation criteria, may vary according to the context, in particular the categories of costs incurred due to the IAS, as well as management requirements relevant to public policy. Criteria may include management costs, monetary damage/loss costs, non-monetary damage/loss costs and even ecological damages that do not trigger economic costs (e.g. Schmiedel et al. 2016). Management requirements such as acceptability, feasibility, distributive justice or risk and uncertainty can also be included in the criteria (e.g. Booy et al. 2017). Each criterion may be expressed in its own unit (e.g. monetary or biophysical terms, Likert scales), the advantage being the avoidance of the inevitable flaws that underlie economic valuation methods. The solution promoted by MCA does however rely on the preferences of users (e.g. modelers, decision makers) regarding the relative weights of criteria (aggregation rule) and these preferences are not always easy to elicit. A number of participatory approaches have therefore been devised in order to elicit weights from a set of stakeholders or experts. The aggregation rule obtained remains, however, contingent on the elicitation method, making MCA subject to aggregation biases as well (see Bouyssou 1990, Podinovski 2002, Munda 2004). This may explain why MCA has enjoyed limited practical application, with few studies examining their effectiveness.

Highlighting the societal importance of the costs of IAS for raising awareness and underpinning public intervention

The evaluation of the costs of IAS can also be used for (1) raising awareness of the general public for changing individual behaviours and of decision makers for defending the place of IAS in the political agenda and (2) registering a species in the lists of IAS with regard to their economic cost criterion by evaluating the importance and significance of these costs for society as a whole or in specific local contexts.

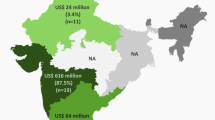

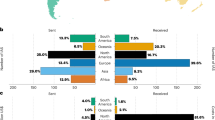

For these two objectives, a benevolent social planner perspective is often adopted with a focus on both social and external costs. The costs and benefits of IAS itself (Fig. 2a) are used, rather than those of the IAS management (see Fig. 2b) as was the case in Sect. “Cost concepts in IAS management methods”. In worldwide or region-wide studies, costs are aggregated to produce large numbers with societal impacts (Pimentel et al. 2001; Pimentel 2011; Diagne et al. 2021a). Assessments are conducted across different ecosystems (e.g. aquatic: Cuthbert et al. 2021a, b) and/or economic sectors (e.g. agriculture: Paini et al. 2016) over different scales, be it spatial (e.g. national: Hoffmann and Broadhurst 2016; regional: Heringer et al. 2021; global: Diagne et al. 2021a), temporal (e.g. weeks, years: Angulo et al. 2021b), or taxonomic (e.g. species: Schaffner et al. 2020; class: Bradshaw et al. 2016).Footnote 14 The Intergovernmental Science-Policy Platform on Biodiversity and Ecosystem Services (IPBES), recognizing that the threat of IAS lacks quantification and is not well understood by decision makers, is currently conducting a “thematic assessment of invasive alien species and their control” including an analysis of their costs and benefits to be presented at the tenth session of the Plenary (https://ipbes.net/invasive-alien-species-assessment). These combined costs can either be compared to each other or to other economic aggregates in order to highlight critical invasive problems and set priorities.

Cost estimates inevitably involve methodological biases related to estimation methods (see Carson 2012; Johnston et al. 2017 or Hanley and Roberts 2019 for a review) but also, in the case of global assessments, to the aggregation of heterogeneously estimated costs originating from different case studies (Warziniack et al. 2021). This heterogeneity includes the temporal and geographical scales, the currency in which costs are measured, whether they are assessed at a species or at a spatial level, whether they are monetary or measured with another unit, or whether they are reported or estimated. Pioneering global IAS cost assessments summed and extrapolated cost data published in case studies using simple heuristics and rules of thumbs (e.g. Pimentel et al. 2001). Building on this work, Kettunen et al. (2009), based on a previous study synthesizing existing economic costs of IAS in Europe conducted within the DAISIEFootnote 15 project (Vila & Basnou 2008), proposed two aggregation protocols. The first combines actual cost data from the collected studies using real or estimated costs, while the second is based on spatial extrapolation considering value transfer. Cost extrapolation methods also involve several methodological biases related to invasion risk and the choice of heuristics. We refer the reader to Olson et al. (2006)’s discussion on the topic. Recent assessments proposed more sophisticated cost aggregation methods. To deal with temporal heterogeneity of cost data, Diagne et al. (2021a) use the invacost R package (see Leroy et al. 2022) to implement two cost aggregation protocols. The first is designed for use in data-poor scenarios. It allows both the cumulative costs and the average annual costs of IAS to be estimated over different time intervals, using the cost estimates as they appear in the collected studies. The second is designed for use in data-rich scenarios. Using an ensemble modeling approach, it calculates the average annual costs of IAS by estimating the long-term trend in annual cost. Model inputs are primarily based on observed cost estimates from collected studies (potential costs (introduced at the end of Sect. “The direct and indirect economic costs of IAS”) are often excluded from cost analysis to improve the realism of cost estimates), supplemented by educated guesses regarding the likely start and end years (Leroy et al. 2022). Aggregating the costs of studies conducted in different countries also raises the question of expressing these evaluations in a common currency. Global studies either express IAS costs in US dollars (Pimentel et al. 2001; Pimentel 2011; Diagne et al. 2021a) or in euros (Kettunen et al. 2009) and are based on exchange rate conversions. In addition, Diagne et al. (2020a,b), include a standardization of cost data based on the Purchasing Power Parity (PPP) to make the currencies from different countries comparable.

Not all studies assessing the costs of IAS, however, take a global or even intertemporal perspective. Many studies focus on the costs of one IAS or on IAS in a given area. Aggregation biases appear then to a lesser extent and in any case, it is no longer a question of aggregating estimates from heterogeneousFootnote 16 studies but rather of aggregating costs of different natures (e.g. cost on infrastructure, biodiversity loss). These studies are likely to raise awareness of the cost of an IAS or an area particularly vulnerable to IAS (e.g. Chakir et al. 2016). They may also aim to compare the costs of several IAS (e.g. García-Llorente 2008), or even the costs of one or several IAS in different areas (e.g. Japelj et al. 2019). Although forwarding estimates of IAS costs, these analyses are not all focused on the cardinal value of cost but on ordinal estimates. This is the case, for example, in Bougherara et al. (2022), where the cost of an IAS is evaluated in different zones of a regional park to order the zones where costs are deemed to be the highest. For these authors, the cardinal value of the cost does not really matter, the focus being on the areas where the costs are relatively the highest.

More generally, beyond awareness of the cost of IAS, the relative costs of IAS or of invaded sites are important information delivered by these studies. The distribution of costs between socioeconomic groups, sectors or sites is key to decision making, for instance when economic instruments or corrective measures are to be introduced (Emerton and Howard 2008). This distributive problem is particularly salient when poor and vulnerable people depend on the positive contribution of IAS for their livelihood (Emerton and Howard 2008; Perrings 2007; Shackleton et al. 2007). From a perspective similar to that of the UN system of environmental economic accounting (see seea.un.org), it is de facto appropriate to consider in a spatially explicit way the main stakeholders bearing the costs of IAS, be it management costs or the cost of damages/losses caused.

Conclusion

Clearly and unambiguously understanding economic costs of IAS is a powerful tool in the design of sound management policies for the prevention and control of IAS. This understanding can also contribute significantly to raising awareness of IAS threats and stimulate coordinated action. As the nature of economic costs of IAS is complex, careful attention should be paid to the way they have been calculated across space and time. Defining and distinguishing the different cost concepts helps inform cost–benefit, cost-effectiveness or multi-criteria analyses. At the same time, it is a prerequisite for deciding whether it makes sense to aggregate the different costs assessed and when the distribution of costs across affected stakeholders matters. In some cases, it may be useful or necessary to assess costs in non-monetary units and to make decisions based on monetary and non-monetary valuations combined. Accounting for the great variety of cost assessment objectives and practices, we have provided a synthesis on the fundamentals of IAS costs with the expectation that a shared understanding of the nature of costs can advance their estimation, interpretation, selection and uptake.

Data availability

Not applicable.

Code availability

Not applicable.

Notes

The approach developed in this article focuses on invasive species but, by analogy with their harmfulness and propagation dynamics, also applies to pests and pathogens in agriculture and aquaculture, and to infectious and vector-borne human diseases.

Out-of-the pocket costs are defined by the American Accounting Association (1952) as “those costs which with respect to a given decision of management give rise to cash expenditures”.

Ecological damage is part of environmental damage. The latter is defined by the United Nations (inforMEA.org) as the deterioration of the environment through depletion of resources such as air, water and soil; the destruction of ecosystems and the extinction of wildlife.

More precisely, welfare refers to the well-being of individuals, the economy of well-being being defined by the OECD (2020) as the capacity to create a virtuous circle in which citizens’ well-being drives economic prosperity, stability and resilience. Following the OECD well-being framework, the determinants of well-being are manifold and include wealth, health, happiness and comfort.

In economics, cost underlies the determination of supply and in conjunction with demand provides the elements of the pricing mechanism which is the main organizing force of the economic system.

Symmetric to a public good, a public bad shares with this category of good the properties of non-excludability and non-rivalry. For a more thorough discussion, see Kolstad (2000) or more recent editions. The concept of mobile public bad is introduced by Costello et al. (2017). It reflects the fact that the bad is spatially mobile in the image of transboundary pollution, epidemics, pests, or biological invasions.

An externality is a cost or benefit incurred by an agent as a result of a third party without agreement. The concept was initially defined by Pigou (1920) when studying pricing. The costs of public bads are negative externalities produced by the agent that causes them.

Note that Coase (1960) completes the analysis by showing that bargaining between parties makes it possible to resolve the market imperfection provided that transaction costs are nil or low. Transaction costs are defined as the costs associated with a market transaction including prospecting costs, negotiation costs and monitoring costs (Coase 1937, Dahlman 1979).

Usually in economics, the opportunity cost is defined as the sacrifice of not adopting an alternative choice (e.g. management) (Viner 1930).

We follow the perspective of Diagne et al. (2020b) which is more suited to approaches aimed at defining management strategies (see Sect. “Cost concepts in IAS management methods”).

The American Accounting Association, Committee on Cost Concepts and standard (1952) defines direct cost as costs obviously traceable to a unit of output or segment of business operations. Indirect costs are defined as costs not readily identifiable or incurred as a result of the production of specific goods or services.

The evaluation of damage/loss costs is often approached through the analysis of replacement and control costs or through willingness to pay approaches. Indirect and potential costs are particularly complex to estimate as they depend on ecological and economic interdependencies. Formal approaches to evaluate these costs using partial or general equilibrium models have been proposed, although they are not yet widely applied to IAS costing (see Warziniack et al. 2021 for a review).

see Table 2 in Appendix for a review of the different assessment studies.

Delivering Alien Invasive Species Inventories for Europe.

There is also surely less heterogeneity in the aggregations made within the framework of the ACBs for the management of the IAS described in Sect. Cost concepts in IAS management methods because the subject is more targeted (a species, a given scale, over a known period).

References

Aadland D, Sims C, Finnoff D (2015) Spatial dynamics of optimal management in bioeconomic systems. Comput Econ 45(4):545–577

Adelino R, Heringer G, Diagne C, Courchamp F, Faria L, Zenni R (2021) The economic costs of biological invasions in Brazil: a first assessment. NeoBiota 67:349–374

Ahmed DA, Hudgins EJ, Cuthbert RN, Kourantidou M, Diagne C, Haubrock PJ, Leung B, Liu C, Leroy B, Petrovskii S, Beidas A, Courchamp F (2022) Managing biological invasions: the cost of inaction. Biol Invasions. https://doi.org/10.1007/s10530-022-02755-0

American Accounting Association, Committee on Cost Concepts and Standards, “Report or the Committee on Cost Concepts and Standards, The Accounting Review (1952), 174–188

Angulo E, Ballesteros-Mejia L, Novoa A, Duboscq-Carra V, Diagne C, Courchamp F (2021a) Economic costs of invasive alien species in Spain. NeoBiota 67:267–297. https://doi.org/10.3897/neobiota.67.59181

Angulo E, Diagne C, Ballesteros-Mejia L, Adamjy T, Ahmed DA, Akulov E, Courchamp F (2021b) Non-English languages enrich scientific knowledge: the example of economic costs of biological invasions. Sci Total Environ 775:144441

Bacher S, Blackburn TM, Essl F, Genovesi P, Heikkilä J, Jeschke JM, Jones G, Keller R, Kenis M, Kueffer C, Martinou AF, Nentwig W, Pergl J, Pyšek P, Rabitsch W, Richardson DM, Roy HE, Saul W-C, Scalera R, Vilà M, Wilson JRU, Kumschick S (2018) Socio-economic impact classification of alien taxa (SEICAT). Methods Ecol Evol 9(1):159–168. https://doi.org/10.1111/2041-210X.12844

Ballesteros-Mejia ML, Angulo E, Cooke B, Diagne C, Nuñez M, Courchamp C (2021) Economic costs of biological invasions in Ecuador: the importance of Galapagos Islands. NeoBiota 67:375–400. https://doi.org/10.3897/neobiota.67.59116

Bang A, Cuthbert RN, Haubrock PJ et al (2022) Massive economic costs of biological invasions despite widespread knowledge gaps: a dual setback for India. Biol Invasions. https://doi.org/10.1007/s10530-022-02780-z

Blackburn TM, Pyšek P, Bacher S, Carlton JT, Duncan RP, Jarošík V, Richardson DM (2011) A proposed unified framework for biological invasions. Trends Ecol Evol 26(7):333–339

Blackburn TM, Essl F, Evans T, Hulme PE, Jeschke JM, Kühn I, Kumschick S, Marková Z, Mrugała A, Nentwig W, Pergl J, Pyšek P, Rabitsch W, Ricciardi A, Richardson DM, Sendek A, Vilà M, Wilson JRU, Winter M, Genovesi P, Bacher S (2014) A unified classification of alien species based on the magnitude of their environmental impacts. PLoS Biol 12:e1001850. https://doi.org/10.1371/journal.pbio.1001850

Bodey TW, Angulo E, Bellard C, Fantle-Lepczyk J, Lenzner B, Turbelin A, Watari Y, Courchamp F (2021) The economic burden of protecting islands from invasive alien species. https://doi.org/10.1101/2021.12.10.471372

Booy O, Mill AC, Roy HE, Hiley A, Moore N, Robertson P et al (2017) Risk management to prioritise the eradication of new and emerging invasive non-native species. Biol Invasions 19(8):2401–2417

Born W, Rauschmayer F, Bräuer I (2005) Economic evaluation of biological invasions—a survey. Ecol Econ 55(3):321–336

Bougherara D, Courtois P, David M, Weill J (2022) Willingness to pay in space: a choice experiment on a biological invasion. Biol Invasions. https://doi.org/10.1007/s10530-021-02707-0

Bouyssou D (1990) Building criteria: A prerequisite for MCDA. In: Bana e Costa CA (ed) Readings in Multiple Criteria Decision Aid. Springer, Berlin, pp 58–80

Bradshaw CJ, Leroy B, Bellard C, Roiz D, Albert C, Fournier A, Barbet-Massin M, Salles J-M, Simard F, Courchamp F (2016) Massive yet grossly underestimated global costs of invasive insects. Nat Commun 7(1):1–8

Brockerhoff EG, Barratt BIP, Beggs JR, Fagan LL, Kay N, Phillips CB, Vink CJ (2010) Impacts of exotic invertebrates on New Zealand’s indigenous species and ecosystems. N Z J Ecol 34:158–174

Brown P, Daigneault A (2014a) Cost-benefit analysis of managing the invasive African tulip tree in the Pacific. Environ Sci Policy 39:65–76

Brown P, Daigneault A (2014b) Cost-benefit analysis of managing the Papuana uninodis (Coleoptera: Scarabaeidae) taro beetle in Fiji. J Econ Entomol 107(5):1866–1877

Büyüktahtakin IE, Haight RG (2018) A review of operations research models in invasive species management: state of the art, challenges, and future directions. Ann Oper Res 271:357–403. https://doi.org/10.1007/s10479-017-2670-5

Cameron TA, Carson RT (1989) Using surveys to value public goods: the contingent valuation method. RFF Press, Washington DC

Carson RT (2012) Contingent valuation: A practical alternative when prices aren’t available. J Econ Perspect 26(4):27–42

CBD (2002) Guiding principles for the prevention, introduction and mitigation of impacts of alien species that threaten ecosystems, habitats or species. Annex to COP 6 decision VI/23 of the Convention on Biological Diversity. www.cbd.int/decision/cop/default.shtml?id=7197. Accessed 14 June 2022

Chakir R, David M, Gozlan E, Sangare A (2016) Valuing the impacts of an invasive biological control agent: a choice experiment on the asian ladybird in France. J Agric Econ 37(3):619–638

Chiadmi I, Traoré SAA, Salles J-M (2020) Asian tiger mosquito far from home: assessing the impact of invasive mosquitoes on the French Mediterranean littoral. Ecol Econ 178:106813. https://doi.org/10.1016/j.ecolecon.2020.106813

Coase RH (1937) The nature of the firm. Economica 4(16):386–405

Coase RH (1960) The problem of social cost. J Law Econ 3:1–44

Costello C, Querou N, Tomini A (2017) Private eradication of mobile public bads. Eur Econ Rev 94:23–44

Courtois P, Figuieres C, Mulier C, Weill J (2018) A cost–benefit approach for prioritizing invasive species. Ecol Econ 146:607–620

Courtois P, Martinez C, Thomas A (2021) Spatially explicit criterion for invasive species control. Working paper

Crystal-Ornelas R, Hudgins E, Cuthbert RN, Haubrock PJ, Fantle-Lepczyk J, Angulo E, Kramer A, Ballesteros-Mejia L, Leroy B, Leung B, López-López E, Diagne C, Courchamp F (2021) Economic costs of biological invasions within North America. NeoBiota 67:485–510. https://doi.org/10.3897/neobiota.67.58038

Cuthbert RN, Bartlett A, Turbelin A, Haubrock PJ, Diagne C, Pattison Z, Courchamp F, Catford J (2021a) Economic costs of biological invasions in the United Kingdom. NeoBiota 67:299–328

Cuthbert RN, Pattison Z, Taylor NG, Verbrugge L, Diagne C, Ahmed DA, Leroy B, Angulo E, Briski E, Capinha C, Catford J, Dalu T, Essl F, Gozlan RE, Haubrock PJ, Kourantidou M, Kramer AM, Renault D, Wasserman RJ, Courchamp F (2021b) Global economic costs of aquatic invasive alien species. Sci Total Environ 775:145238. https://doi.org/10.1016/j.scitotenv.2021.145238

Dahlman CJ (1979) The problem of externality. J Law Econ 22(1):148

Dana ED, Jeschke JM, García-de-Lomas J (2014) Decision tools for managing biological invasions: existing biases and future needs. Oryx 48(1):56–63

Dana ED, García-de-Lomas J, Verloove F, Vilà M (2019) Common deficiencies of actions for managing invasive alien species: a decision-support checklist. NeoBiota 48:97–112. https://doi.org/10.3897/neobiota.48.35118

Davis E, Caffrey JM, Coughlan NE, Dick JTA, Lucy FE (2018) Communications, outreach and citizen science: spreading the word about invasive alien species. Manag Biol Invasions 9(4):515–525. https://doi.org/10.3391/mbi.2018.9.4.14

de Groot M, O’Hanlon R, Bullas-Appleton E, Csóka G, Csiszár Á, Faccoli M, Gervasini E, Kirichenko N, Korda M, Marinšek A, Robinson N, Shuttleworth C, Sweeney J, Tricarico E, Verbrugge L, Williams D, Zidar S, Kus Veenvliet J (2020) Challenges and solutions in early detection, rapid response and communication about potential invasive alien species in forests. Manag Biol Invasions 11(4):637–660. https://doi.org/10.3391/mbi.2020.11.4.02

Diagne C, Catford JA, Essl F, Nuñez MA, Courchamp F (2020a) What are the economic costs of biological invasions? A complex topic requiring international and interdisciplinary expertise. NeoBiota 63:25–37. https://doi.org/10.3897/neobiota.63.55260

Diagne C, Leroy B, Gozlan RE, Vaissière AC, Assailly C, Nuninger L, Roiz D, Jourdain F, Jarić I, Courchamp F (2020b) INVACOST: a public database of the economic costs of biological invasions worldwide. Scientific Data 7:277

Diagne C, Leroy B, Vaissière AC, Gozlan RE, Roiz D, Jarić I, Salles JM, Bradshaw CJA, Courchamp F (2021a) High and rising economic costs of biological invasions worldwide. Nature 592:571–576. https://doi.org/10.1038/s41586-021-03405-6

Diagne C, Turbelin A, Moodley D, Novoa A, Leroy B, Angulo E, Adamjy T, Dia CAKM, Taheri A, Tambo J, Dobigny G, Courchamp F (2021b) The economic costs of biological invasions in Africa: a growing but neglected threat? NeoBiota 67:11–51

Doney, L.D. (1963). A Study of Selected Cost Concepts of Economics and Accounting. LSU Historical Dissertations and Theses. 838

Duboscq-Carra V, Fernandez R, Haubrock PJ, Dimarco R, Angulo E, Ballesteros-Mejia L, Diagne C, Courchamp F, Nuñez M (2021) Economic impact of invasive alien species in Argentina: a first national synthesis. NeoBiota 67:329–348. https://doi.org/10.3897/neobiota.67.632

Duncan CA, Jachetta JJ, Brown ML, Carrithers VF, Clark JK, Ditomaso JM et al (2004) Assessing the Economic, Environmental, and Societal Losses from Invasive Plants on Rangeland and Wildlands1. Weed Technol 18(sp1):1411–1416

The Research Group LLC (2014) Economic impact from selected noxious weeds in Oregon. Prepared for Oregon Department of Agricultural Noxious Weed Control Program

Emerton L, Howard G (2008) A toolkit for the economic analysis of invasive species. Global Invasive Species Programme, Nairobi

Epanchin-Niell RS (2017) Economics of invasive species policy and management. Biol Invasions 19:3333–3354

Epanchin-Niell RS, Wilen JE (2015) Individual and cooperative management of invasive species in human-mediated landscapes. Am J Agr Econ 97(1):180–198

Eschen R, Beale T, Bonnin JM et al (2021) Towards estimating the economic cost of invasive alien species to African crop and livestock production. CABI Agric Biosci 2(18)

Falk-Petersen J, Bøhn T, Sandlund OT (2006) On the numerous concepts in invasion biology. Biol Invasions 8(6):1409–1424

Fantle-Lepczyk JE, Haubrock PJ, Kramer AM, Cuthbert RN, Turbelin AJ, Crystal-Ornelas R, Diagne C, Courchamp F (2022) Economic costs of biological invasions in the United States. Sci Total Environ 806:151318. https://doi.org/10.1016/j.scitotenv.2021.151318

Fenichel EP, Richards TJ, Shanafelt DW (2014) The control of invasive species on private property with neighbor-to-neighbor spillovers. Environ Resource Econ 59(2):231–255

Freeman AM III, Herriges JA, Kling CL (2014) The measurement of environmental and resource values: theory and methods, 3rd edn. Routledge, England, p 459

Frésard M (2011) L’analyse économique du contrôle des invasions biologiques : Une Revue de Littérature. Revue D’économie Politique 121(4):489–525

Gallardo B, Bacher S, Bradley B, Comín FA, Gallien L, Jeschke JM et al (2019) InvasiBES: understanding and managing the impacts of invasive alien species on biodiversity and ecosystem services. NeoBiota 50:109

García-Llorente M, Martín-López B, González JA, Alcorlo P, Montes C (2008) Social perceptions of the impacts and benefits of invasive alien species: Implications for management. Biol Cons 141:12

Great Lakes Commission, St. Lawrence Cities Initiative (2012) Restoring the natural divide: separating the Great Lakes and Mississippi River basins in the Chicago Area waterway system. https://www.issuelab.org/resources/13297/13297.pdf. Accessed 14 June 2022

Gruber MA, Janssen-May S, Santoro D, Cooling M, Wylie R (2021) Predicting socio-economic and biodiversity impacts of invasive species: Red Imported Fire Ant in the developing western Pacific. Ecol Manag Restor 22(1):89–99

Hanley N, Roberts M (2019) The economic benefits of invasive species management. People Nat 1(2):124–137

Haubrock PJ, Cuthbert RN, Ricciardi A, Diagne C, Courchamp F (2022) Economic costs of invasive bivalves in freshwater ecosystems. Divers Distribut 28(5):1010–1021

Haubrock PJ, Cuthbert RN, Sundermann A, Diagne C, Golivets M, Courchamp F (2021a) Economic costs of invasive species in Germany. NeoBiota 67:225–246

Haubrock PJ, Cuthbert RN, Yeo D, Banerjee AK, Liu C, Diagne C, Courchamp F (2021b) Biological invasions in Singapore and Southeast Asia: data gaps fail to mask potentially massive economic costs. NeoBiota 67:131–152. https://doi.org/10.3897/neobiota.67.64560

Haubrock PJ, Turbelin A, Cuthbert RN, Novoa A, Taylor N, Angulo E, Ballesteros-Mejia L, Bodey T, Capinha C, Diagne C, Essl F, Golivets M, Kirichenko N, Kourantidou M, Leroy B, Renault D, Verbrugge L, Courchamp F (2021c) Economic costs of invasive alien species across Europe. NeoBiota 67:153–190. https://doi.org/10.3897/neobiota.67.58196

Haubrock PJ, Bernery C, Cuthbert RN, Liu C, Kourantidou M, Leroy B, Turbelin AJ, Kramer AM, Verbrugge LNH, Diagne C, Courchamp F, Gozlan RE (2022) Knowledge gaps in economic costs of invasive alien fish worldwide. Sci Total Environ 803:149875. https://doi.org/10.1016/j.scitotenv.2021.149875

Hausman JA (ed) (2012) Contingent valuation: a critical assessment. Elsevier, Amsterdam

Hawkins CL, Bacher S, Essl F, Hulme PE, Jeschke JM, Kühn I, Kumschick S, Nentwig W, Pergl J, Pyšek P (2015) Framework and guidelines for implementing the proposed IUCN ENVIRONMENTAL IMPACT CLASSIFICATION For Alien Taxa (EICAT). Divers Distrib 21:1360–1363. https://doi.org/10.1111/ddi.12379

Heringer G, Angulo E, Ballesteros-Mejia L, Capinha C, Courchamp F, Diagne C, Duboscq-Carra V, Nuñez M, Zenni R (2021) The economic costs of biological invasions in Central and South America: a first regional assessment. NeoBiota 67:401–426. https://doi.org/10.3897/neobiota.67.59193

Hoffmann BD, Broadhurst LM (2016) The economic cost of managing invasive species in Australia. NeoBiota 31:1

Holdich DM (1999) Negative aspects of crayfish introductions. In: Gherardi F, Holdich DM (eds) Crayfish in Europe as alien species -how to make the best of a bad situation? AA Balkema, Rotterdam, pp 31–47

Holmes TP, Aukema JE, Von Holle B, Liebhold A, Sills E (2009) Economic impacts of invasive species in forests: past, present, and future. Ann N Y Acad Sci 1162(1):18–38

Holmes ND, Campbell KJ, Keitt BS, Griffiths R, Beek J, Donlan CJ, Broome KG (2015) Reporting costs for invasive vertebrate eradications. Biol Invasions 17(10):2913–2925

Hooten MB, Wikle CK, Dorazio RM, Royle JA (2007) Hierarchical spatiotemporal matrix models for characterizing invasions. Biometrics 63:558–567

Howald G, Donlan C, Galván JP, Russell JC, Parkes J, Samaniego A, Wang Y, Veitch D, Genovesi P, Pascal M, Saunders A (2007) Invasive rodent eradication on islands. Conserv Biol 21(5):1258–1268

Hulme PE, Bacher S, Kenis M, Klotz S, Kühn I, Minchin D et al (2008) Grasping at the routes of biological invasions: a framework for integrating pathways into policy. J Appl Ecol 45(2):403–414

IPBES (2019) Global assessment report on biodiversity and ecosystem services of the Intergovernmental Science-Policy Platform on Biodiversity and Ecosystem Services. In: Brondizio ES, Settele J, Díaz S, Ngo HT (eds) IPBES secretariat, Bonn, Germany, p 1148

IUCN (2018) Compilation of costs of prevention and management of invasive alien species in the EU. Technical note prepared by IUCN for the European Commission. 73 p.

Jackson T (2015) Addressing the economic costs of invasive alien species: some methodological and empirical issues. Int J Sustainable Society 7(3):221–240

Japelj A, Kus Veenvliet J, Malovrh J et al (2019) Public preferences for the management of different invasive alien forest taxa. Biol Invasions 21(11):3349–3382. https://doi.org/10.1007/s10530-019-02052-3

Jardine SL, Sanchirico JN (2018) Estimating the cost of invasive species control. J Environ Econ Manag 87:242–257

Johnston RJ, Boyle KJ, Adamowicz W, Bennett J, Brouwer R, Cameron TA et al (2017) Contemporary guidance for stated preference studies. J Assoc Environ Resour Econ 4(2):319–405

Keller RP, Lodge DM, Finnoff DC (2007) Risk assessment for invasive species produces net bioeconomic benefits. Proc Natl Acad Sci 104(1):203–207

Kettunen M, Genovesi P, Gollasch S, Pagad S, Starfinger U, ten Brink P, Shine C (2009) Technical support to EU strategy on invasive alien species (IAS). Institute for European Environmental Policy (IEEP), Brussels

Kirichenko N, Haubrock P, Cuthbert RN, Akulov E, Karimova E, Shneider Y, Liu C, Angulo E, Diagne C, Courchamp F (2021) Economic costs of biological invasions in terrestrial ecosystems in Russia. NeoBiota 67:103–130. https://doi.org/10.3897/neobiota.67.58529

Kolstad C (2000) Environmental economics. Oxford University Press, Oxford, p 400

Kouba A, Oficialdegui FJ, Cuthbert RN, Kourantidou M, South J, Tricarico E, Gozlan RE, Courchamp F, Haubrock PJ (2021) Identifying economic costs and knowledge gaps of invasive aquatic crustaceans. Sci Total Environ 813:152325. https://doi.org/10.1016/j.scitotenv.2021.152325

Kourantidou M, Cuthbert RN, Haubrock PJ, Novoa A, Taylor N, Leroy B, Capinha C, Renault D, Angulo E, Diagne C, Courchamp F (2021) Economic costs of invasive alien species in the Mediterranean basin. NeoBiota 67:427–458. https://doi.org/10.3897/neobiota.67.58926

Kourantidou M, Haubrock PJ, Cuthbert RN, Bodey TW, Lenzner B, Gozlan R, Nuñez MA, Salles J-M, Diagne C, Courchamp F (2022) Invasive alien species as simultaneous benefits and burdens: trends, stakeholder perceptions and management. Biol Invasions. https://doi.org/10.1007/s10530-021-02727-w

Kovacs KF, Haight RG, McCullough DG, Mercader RJ, Siegert NW, Liebhold AM (2010) Cost of potential emerald ash borer damage in U.S. communities, 2009–2019. Ecol Econ 69:569–578

Krcmar-Nozic E, Wilson B, Arthur (2000) The potential impacts of exotic forest pests in North America: a synthesis of research. Report BC-X-387. Canadian Forest Service Information, Pacific Forestry Centre, Victoria, British Columbia

Leigh P (1998) Benefits and costs of the ruffe control program for the Great Lakes fishery. J Great Lakes Res 24(2):351–360

Leroy B, Kramer AM, Vaissière AC, Kourantidou M, Courchamp F, Diagne C (2022) Analysing economic costs of invasive alien species with the invacost R package. Methods Ecol Evol. https://doi.org/10.1111/2041-210X.13929

Linders T, Schaffner U, Eschen R, Abebe A, Choge S, Gebreyes L, Mbaabu P, Desta H, Allan E (2019) Direct and indirect effects of invasive species: Biodiversity loss is a major mechanism by which an invasive tree affects ecosystem functioning. J Ecol 107(6):2660–2672. https://doi.org/10.1111/1365-2745.13268

Liu C, Diagne C, Angulo E, Banerjee AK, Chen Y, Cuthbert RN, Haubrock P, Kirichenko N, Pattison Z, Watari Y, Xiong W, Courchamp F (2021) Economic costs of biological invasions in Asia. NeoBiota 67:53–78. https://doi.org/10.3897/neobiota.67.58147

Louette G, Devisscher S, Adriaens T (2013) Control of invasive American bullfrog Lithobates catesbeianus in small shallow water bodies. Eur J Wildl Res 59:105–114. https://doi.org/10.1007/s10344-012-0655-x

Lovell SJ, Stone SF, Fernandez L (2006) The economic impacts of aquatic invasive species: a review of the literature. Agric Resour Econ Rev 35(1):195–208

Marbuah G, Gren IM, McKie B (2014) Economics of harmful invasive species: a review. Diversity 6(3):500–523

Marsh AS, Hayes DC, Klein PN, Zimmerman N, Dalsimer A, Burkett DA et al (2021) Sectoral impacts of invasive species in the United States and approaches to management. In: Poland TM, Patel-Weynand T, Finch DM, Miniat CF, Hayes DC, Lopez VM (eds) Invasive species in forests and rangelands of the United States. Springer, Cham, pp 203–230

Martins TLF, Brooke MDL, Hilton GM, Farnsworth S, Gould J, Pain DJ (2006) Costing eradications of alien mammals from islands. Anim Conserv 9(4):439–444

McNeely J (2001) Invasive species: a costly catastrophe for native biodiversity. Land Use Water Resour Res 1:1–10

Moodley D, Angulo E, Cuthbert RN, Leung B, Turbelin A, Novoa A, Kourantidou M, Heringer G, Haubrock PJ, Renault D, Robuchon M, Fantle-Lepczyk J, Courchamp F, Diagne C (2022) Surprisingly high economic costs of biological invasions in protected areas. Biol Invasions. https://doi.org/10.1007/s10530-022-02732-7

Munda G (2004) Social multi-criteria evaluation: methodological foundations and operational consequences. Eur J Oper Res 158(3):662–677

OECD (2020) How’s life? 2020: measuring well-being. OECD Publishing, Paris

Olson LJ (2006) The economics of terrestrial invasive species: a review of the literature. Agric Resour Econ Rev 35(1):178–194

Paini DR, Sheppard AW, Cook DC, De Barro PJ, Worner SP, Thomas MB (2016) Global threat to agriculture from invasive species. Proc Natl Acad Sci 113(27):7575–7579

Perrings C, Dalmazzone S, Williamson MH (2000) The economics of biological invasions. Edward Elgar Publishing, Cheltenham

Perrings C, Williamson M, Barbier EB, Delfino D, Dalmazzone S, Shogren J, Watkinson A (2002) Biological invasion risks and the public good: an economic perspective. Conserv Ecol 6(1):1. https://doi.org/10.5751/ES-00396-060101

Perrings C (2007) Pests, pathogens and poverty: biological invasions and agricultural dependence. In: Kontoleon A, Pascual U, Swanson TM (eds) Biodiversity economics: Principles, Methods and Applications. Cambridge University Press, Cambridge, pp 133–165

Pigou AC (1920) The economics of welfare. Macmillan & Co, London

Pimentel D (2011) Biological invasions: economic and environmental costs of alien plant, animal, and microbe species. CRC Press

Pimentel D, McNair S, Janecka J, Wightman J, Simmonds C, O’connell C et al (2001) Economic and environmental threats of alien plant, animal, and microbe invasions. Agr Ecosyst Environ 84(1):1–20

Pimentel D, Zuniga R, Morrison D (2005) Update on the environmental and economic costs associated with alien-invasive species in the United States. Ecol Econ 52(3):273–288

Pimentel D (2005) Environmental consequences and economic costs of alien species. In: Inderjit S (ed) Invasive plants: ecological and agricultural aspects. Birkhäuser, Basel, pp 269–276

Podinovski VV (2002) The quantitative importance of criteria for MCDA. J Multi-Crit Decis Anal 11(1):1–15

Rakotonarivo OS, Schaafsma M, Hockley N (2016) A systematic review of the reliability and validity of discrete choice experiments in valuing non-market environmental goods. J Environ Manage 183:98–109

Reaser JK, Meyerson LA, Cronk Q, De Poorter MAJ, Eldrege LG, Green E, Vaiutu L (2007) Ecological and socioeconomic impacts of invasive alien species in island ecosystems. Environ Conserv 34(2):98–111

Renault D, Leroy B, Manfrini E, Diagne C, Ballesteros-Mejia L, Angulo E, Courchamp F (2021) Biological invasions in France: alarming costs and even more alarming knowledge gaps. NeoBiota 67:191–224. https://doi.org/10.3897/neobiota.67.59134

Renault D, Angulo E, Cuthbert RN et al (2022) The magnitude, diversity, and distribution of the economic costs of invasive terrestrial invertebrates worldwide. Sci Total Environ 835(155391)

Reyns N, Casaer J, De Smet L, Devos K, Huysentruyt F, Robertson PA, Verbeke T, Adriaens T (2018) Cost-benefit analysis for invasive species control: the case of greater Canada goose Branta canadensis in Flanders (northern Belgium). PeerJ 6:e4283. https://doi.org/10.7717/peerj.4283

Richter R, Berger UE, Dullinger S, Essl F, Leitner M, Smith M, Vogl G (2013) Spread of invasive ragweed: climate change, management and how to reduce allergy costs. J Appl Ecol 50:1422–1430