Abstract—

The article examines the influence of ethno-linguistic diversity on the rate of economic growth in the regions of the Russian Federation. The empirical results obtained confirm that ethnic diversity supports economic growth and that elasticities of growth rates with respect to the initial level of diversity differ by region and time period and depend both on the indices of ethnolinguistic fractionalization themselves and on the initial level of per capita income in the region. From the standpoint of the theoretical model, it can be concluded that there is an optimal level of ethnic diversity, as well as that this level, determined by the parameters of the population’s tolerance towards representatives of other ethnic groups, as well as the share of rent in income, has not been achieved in any of the Russian regions.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction. The issues of interaction between ethnic diversity and economic development have been discussed for 25 years. Over the past decade, a number of articles have appeared on the Russian economy. Various spheres of economic life have been investigated, including economic growth and population heterogeneity in terms of ethnic, linguistic, religious diversity, with which, as a rule, cultural differences are associated. The authors acknowledge that such differences can entail costs for society associated with overcoming mistrust and misunderstanding, the emergence of various kinds of conflicts, which, ultimately, can affect labor productivity, a decrease in investment activity in slowing down economic growth and even permanent stagnation [1]. However, at the same time, the interpenetration of cultures, the addition of people’s competencies and mutual learning are a development resource that can contribute to economic growth.

This article discusses a diversity model built as an augmented Tullock model [2]. In the model, each agent has a unit of resource and decides whether to use it to produce a product or to carry out activities aimed at obtaining rent, which is created by these same agents in the course of production activities. Here the concept of rent obviously includes part of the natural rent, as well as administrative rent, all resources and incomes distributed in society as a result of nonmarket, often hidden trading, which we call “rent-oriented activity,” which is related to the sphere of redistribution. The resulting solution as a Nash equilibrium is then “used” by a hypothetical social regulatorFootnote 1 for setting the problem of maximizing the total income in the economic system depending on the parameter of diversity—the number of participating groups of the population. Whether there are real forces behind the actions of the social regulator, pushing the system to the optimum in terms of diversity, is not yet discussed. However, the very concept of optimal diversity as a solution to a problem in an explicit form can be used in economic analysis, which we tried to do.

We construct panel growth models using data on the level of ethnic heterogeneity (we calculate the index of ethnolinguistic fractionalization) based on the population censuses for 2002 and 2010 with the addition of indicators of the quality of institutions in the regions of the Russian Federation to the classical regressors. The findings confirm that ethnic diversity supports economic growth.

The article is structured as follows. In the first part, the main directions of research on the influence of ethnic diversity on economic growth are analyzed, in the second, a theoretical description of the model is presented, in the third, the empirical results obtained are discussed and interpreted. In conclusion, the results are summed up.

Literature review. Problems associated with the diversification of society (ethnic, religious or linguistic) and its impact on economic development at the level of countries and regions attract much attention of scientists, but the findings are ambiguous: some empirically confirm the lack of influence of heterogeneity on economic growth, others demonstrate a negative impact, finally, there is evidence of positive effects of heterogeneity. In our work, we assumed that the elasticity of economic growth from the level of national heterogeneity is not constant over time and can change according to the level of economic development of the region.

Various indicators are used to study ethnic heterogeneity: fractionalization index, entropy and polarization index. Their calculation and interpretation are presented in [3–5]. We use the fractionalization indicator as a factor in the ethnic heterogeneity of Russian regions.

The negative impact of national heterogeneity on economic growth is explained by high transaction costs, differences in cultural and historical values, low levels of trust, and dissatisfaction with the actual distribution of public goods. The negative influence is empirically confirmed in works [1, 5–9]. In [6], the negative impact of fractionalization on the growth rate of per capita GDP in countries with economies in transition is noted, in [1, 8] demonstrates a decrease in economic growth with an increase in heterogeneity, in [10] it is shown that heterogeneity has a greater negative impact in regions with low income.

The positive effect of ethnic heterogeneity on economic growth is explained by the advantages of the division of labor, the development of innovation by combining the experience, knowledge and skills that different ethnic groups possess. Often, the positive effect of the influence of ethnic diversity is observed in small geographic formations—municipalities, cities and regions—while the negative effect is more often diagnosed at the country level [11–14].

Thus, when analyzing the impact of ethnic heterogeneity on economic growth at the country level, most works confirm the negative impact of national diversity on economic dynamics. At the level of cities and regions, one can often find the positive effect of fractionalization on economic growth, but the rule is not universal.

For regions of the Russian Federation [5], on the basis of panel data, it was found that the fractionalization indicator has a positive effect on the GRP level, the average per capita income level in the region and the level of budget expenditures, at the same time contributes to a decrease in crime in the region. However, in [15], the relationship between diversity and GRP growth rates is observed only for regions with a low population and has a negative character. Later work [16] did not reveal a stable unambiguous relationship between the growth rates of GRP for all regions of the Russian Federation, and for regions with a low number of economically active population, an inverse relationship was revealed between ethnic heterogeneity and economic growth.

The relationship between national heterogeneity and economic growth is mediated by the institutional environment: [17, 18] shows the greater negative impact of fractionalization on economic growth in countries with low quality institutions, including a low level of democratic freedoms [7, 19].

We assume that institutional factors play a key role in determining the impact of ethnic heterogeneity on economic dynamics, strong institutions help to partially “smooth out” the prerequisites for possible national conflicts, hinder the development of inequality in society, while their underdevelopment can lead to an increase in the negative impact of national diversity at the level of the country as a whole.

In our work, as a basic model, we following the works [1, 6–8, 10, 17], used the classical growth model (taking into account the growth rate of GRP in the regions of the Russian Federation), supplementing the list of regressors with indicators of the institutional environment and ethnic heterogeneity (fractionalization indicator).

Research methodology. An important goal of our research is to analyze the problems and possibilities of achieving the optimal level of diversity in the economic system, at which the greatest effect is achieved in the form of the release of the maximum useful product. The fact that such a condition exists is supported by empirical studies when two variables are included in the growth regression that measure heterogeneity with different signs. So, for example, in the classic work of Alesin and La Ferrara [10] in regressions for long-term growth in the countries of the world both the fractionalization index and its combination with the initial per capita income were used, which had different signs. Thus, depending on the specific situation, the effect of heterogeneity can be multidirectional.

The problem of analyzing the optimality of diversity is often posed in the literature in the form of fixing the existence of a “trade-off” (trade-off – bargaining) between different factors, a change in which in opposite directions is associated with a change in the degree of heterogeneity. The optimal level of heterogeneity is established as a result of a sort of bargaining between them. Lazier [20, 21] notes the existence of a trade-off between the productive benefits of diversity and the costs of communication. This means that more diversity brings more benefits, but also more communication costs. In [10], a model of ethnic heterogeneity is proposed, which presents the dual nature of fragmentation: diversity in it is a factor in the production function, the growth of which leads to an increase in the productivity of the economy, but the alienation of members of different groups affects the level of preferences and is represented in the utility function. In such a model, with more groups, fewer public goods are produced and there may be an optimum of diversity that does not necessarily mean maximum output, but maximizes the utility functions of the members of all groups. Here, the trade-off comes to the fore between productivity, on the one hand, and the desired level of consumption of public goods, and hence the tax rate at which all members of the system can vote. Other authors [22] also proposed a model in which diversity acts at the level of both production functions and the utility function of individuals. However, if in the previous model the increase in heterogeneity worsens welfare, since it reduces the consumption of public goods, in this case the diversity concerns the goods produced and consumed, which is positively assessed by consumers. The negative effects of diversity in this model are taken into account by increasing the cost of production factors.

In the models described, both positive and negative effects of heterogeneity on economic results are presented. At the same time, the costs of communication appear as a result of distrust of conflicts, and as a product of misunderstanding that increases the “cost of bargaining.” The activity of different groups for the appropriation of rent is also important, which, according to Tullock [2], requires the diversion of resources from productive activities and leads to a decrease in the product created.

Model. The proposed diversity optimization model is close to our earlier published version [23] and is a two-step game model with rational agents (ethnic groups). It describes a system consisting of separate groups consisting of homogeneous individuals, however, there are qualitative differences between members of different groups.

At the first step, static Nash equilibrium is implemented for n agents—groups that maximize their income for given individual resources. It is assumed that groups are aware of their economic interests as common to the group members and make decisions aimed at maximizing their welfare. They also have a certain amount of production resource, for example, labor, and can use it in two ways. On the one hand, they can direct them to useful productive activities and receive an appropriate labor income, on the other, they can participate in redistributive activities, appropriating the rent created in the course of productive activities and thereby, receiving additional income. Thus, each group decides in what proportion to use its resource, based on a given goal.

The solution at this step in aggregated form is as follows [23]:

where \(X\) is the total volume of rent-oriented activities of all operating groups aimed at appropriating the created rent; \(Y\) is the total volume of useful activities aimed at the production of products and generating the corresponding income. The quantities \(X\;\)and \(Y\) are normalized to unity, and thus the condition \(X + Y = 1\). This means that an increase in the number of groups n does not increase the scale of the economic system under consideration, but decreases their average size. At the same time, the growth n leads to growth of X and, accordingly, to a decrease in Y. Thus, at the first step of solving the model, the growth of transaction costs is simulated as the number of rent-seeking agents grows.

Parameter r is the rate of taxation of each agent by rent. This parameter is not equivalent to the tax rate, and the volume \(r \cdot Y\) is not the budget for the system in question, although it may overlap with it. The indicated value reflects all the product created in society, which is distributed according to informal rules, depending on the strength of influence of the corresponding group in society. These can really be funds of the budget system, for which administrative bargaining is being conducted by departments, companies, other agents of influence, as well as “misuse of budgets,” funds from the shadow economy, unreturned export earnings, unpaid taxes and other funds, for example, noncommercial organizations and criminal proceeds.Footnote 2 Under the power of influenceFootnote 3 we understand both administrative and informal bargaining opportunities (including shadow and criminal opportunities).

At the second step of the model, a hypothetical social regulator comes into play,Footnote 4 which solves the problem of maximizing the total income in the economic system depending on the parameter of diversity, the number of participating groups of the population. Whether there are real forces behind the actions of the social regulator, pushing the system to the optimum in terms of diversity, is not yet discussed. However, the very concept of optimal diversity as a solution to a problem in an explicit form can be used in economic analysis. Here we assume that with an increase in the number of groups, the productivity parameter (specific income from productive activities) can grow with an increase in the number of groups in the system. Such an effect may be based on an increase in the complementarity of the use of resources and the presence of positive externalities associated with mutual learning. These regularities are taken into account by the production function introduced by us, which in the considered version of the model is somewhat simpler than that we published by us earlier [23]. We ask it how \(Q = a\left( {\frac{{n - 1}}{n}} \right)Y = a\left( m \right)Y\), where Q is the a designation for the release of the system; variable \(m = \frac{{n - 1}}{n}\) reflects the dynamics of the number of identified groups and is introduced for the convenience of analysis, the parameter \(a\) is the productivity of the factor, considered as a function of the specified variable, reflecting the number of groups. We set the requirement for the function \(a(m)\):

Condition (2) assumes a monotonic effect of the growth of diversity on efficiency; at the same time, each additional group that stands out within the system increases efficiency, but to a lesser extent than the previous one; this seems to us a completely natural assumption. Condition (3) means that efficiency cannot be increased too much only due to the growth of diversity, and its limiting value is set by the technology used.

Accordingly, the following function of factor productivity is assumed:

clearly possessing properties (2)–(3) if c, γ < 0.

Here parameter c, changing, is responsible for the overall growth of labor productivity, due to technological changes, the parameter γ is the index of tolerance of members of one group in relation to members of other groups: the higher it is, the greater the effect of an increase in the number of groups on labor productivity.

Now it is possible to define for the social regulator the problem of optimization of diversity, aimed at determining such a level m*, which ensures the release of the maximum product in the system:

Having solved it, we obtain

The fact that the variable m* varies in the range \(\frac{1}{2} \leqslant m^* \leqslant 1\) requires additional analysis, which can be found in [23].Footnote 5 Analysis of the second derivative per sign indicates that solution (6) is a maximum, at least for γ < 1.

Measuring the ethnic heterogeneity of the population. As an indicator of heterogeneity, we used the fractionalization index equal to one minus the Herfindahl–Hirschman index, calculated on the basis of the shares of the population of a particular ethnic group represented in the territory under considerationFootnote 6. The fractionalization index is a calculation of the probability that two individuals, randomly selected from the general population, belong to different ethnic groups:

where si is the proportion of the population belonging to the group i in the region. The value of the indicator varies from 0 to 1, while a value equal to 1 indicates a high level of heterogeneity in the region, and a value of 0 is typical for a country with an absolutely homogeneous ethnic composition. To calculate the indicator, we used the data on the ethnic structure of the population of the regions of Russia on the basis of the population census for 2002 and 2010.

Statistical data. Table 1 shows the characteristics of the considered sample for 2002 and 2010, as well as the periods 2003–2010 and 2011–2018.

According to Table 1, the level of ethnic heterogeneity in the regions of the Russian Federation in the period from 2002 to 2010 was relatively stable and generally not too high: the average value of the fractionalization index in 2010 compared to 2002 increased from 0.31 to 0.33. At the same time, the lowest value of the ethno-linguistic diversity index was observed in the Vologda and Bryansk oblasts in 2002 and 2010, its highest value in the Republic of Dagestan in 2002 and 2010. The values of the fractionalization indices significantly exceed the average value for the sample for such regions of the Russian Federation as: the Republic of Kabardino-Balkaria (the index value is 0.62), the Republic of Karachay-Cherkessia (0.72), the Republic of Bashkortostan (0.73) and for the Chukotka Autonomous Okrug (0.67). Slight differences in the mean, median, standard deviation, maximum and minimum values of the index indicate that, despite the use of data from the 2002 and 2010 census, due to the lack of more relevant statistics, the conclusions obtained on the relationship between heterogeneity and economic growth in the regions of the Russian Federation will be relevant in today’s realities.

Model specifications. In general terms, the considered specifications can be represented as follows:

where \(\ln \left( {{{y}_{{it}}}} \right)~\) is the logarithm of the growth of the gross regional product in 2002–2010 and 2010–2018; \(popu{{l}_{{it}}}~\) is the change in the population in 2002–2010 and 2010–2018 for the region i; \(invetsmen{{t}_{{it}}}~\) is the the average value of the share of investments in GRP for the periods 2002–2010 and 2010–2018 for the region i; \(GR{{P}_{{it}}}~\) is the logarithm of GRP per capita in 2002 and 2010 for the region i; \(ins{{t}_{{it}}}\) is a factor in the development of the institutional environment in the region i, we used the infant mortality rate (the number of children who died under 1 year of age per 1000 live births per year) in 2002 and 2010; \(inde{{x}_{{it}}}~\) is the index of ethno-linguistic fractionalization in 2002 and 2010 in the region i; \(index\_GR{{P}_{{it}}}\) is the the product of the index of ethno-linguistic fractionalization and the logarithm of GRP per capita in 2002 and 2010 in the region i; \(inde{{x}_{{it}}}\_10\) is the structural variable equal to the product of the dummy variable for 2010 and the index of ethno-linguistic fractionalization.

Table 2 shows the results of econometric estimates for four specifications of the model.

The specifications are built for two time periods: 2003–2010 and 2011–2018 using as regressors the initial indicators (for 2002 and 2010) indices of ethnolinguistic fractionalization and per capita income. Also applied are regressors related to the periods as a whole, the average share of investments in GRP and the rate of population growth. Their use is associated with the risk of the problem of “endogeneity of regressors” [24]. To test it, one should use the dynamic panel scoring method, or the Arellano-Bond 2 method [25]. This would require at least three periods, while we have two of them. However, the stability of the coefficients for variables in all regressions (see Table 2) allows us to believe that this problem does not have a negative impact on the assessment results. The parameters of the impact of the indices of ethnic fractionalization are individual for each region and change in the second period compared to the first.

Empirical results. We have empirically confirmed a positive relationship between the growth of prosperity in the region and the size of the population in it, as well as the level of investment. We also confirmed the negative dependence of the growth rate of GRP per capita on the initial value of per capita income in the region. This fact is explained by the fact that the regions of the Russian Federation with low per capita GRP demonstrated high rates of economic growth in the period under consideration, perhaps the trend is due to the low value of the base level of the indicator in 2002.

The coefficients over indicators population size, investment level and initial level of GRP per capita for all specifications they differ insignificantly; in our opinion, the stability of the estimates testifies in favor of the reliability of the results obtained.

We use the infant mortality rate as a marker of the quality of institutions in the region. It is believed that high infant mortality is an indicator of general ill-being and weakness of state institutions, which determine not only the low level of medicine, but also the provision of public goods in general, including the protection of property rights, and the provision of financing for business. Our calculations confirm this hypothesis: the initial levels of child mortality negatively affect the rate of economic growth; the insufficient development of the institutional environment in the region does not allow creating attractive and favorable conditions for sustainable long-term development, thereby restraining the growth of GRP.

The index of ethnic fractionalization has demonstrated its significance: under the assumption of the invariability of elasticity (its value was 1.18 for the regions of the Russian Federation), the positive effect of fractionalization on the rate of economic development in the region was shown. In other words, a change in fractionalization from absolutely homogeneous to a situation where all people in the region belong to different nations will lead to an increase in the GRP logarithm by 1.18%. We assume that this result may be partly due to the fact that in the Russian Federation more attention of the federal authorities is paid to regions with a high level of ethnic heterogeneity, such regions are more inclined to receive subsidized support, including for smoothing out possible conflicts.

We assume that the elasticity is not the same for different regions. To test this assumption, we estimated the parameters of the specification model 4 by including an interactive variable in the equation, which is the product of the index and the initial GRP level in the region [9]. The significance of the indicator indicates the need to take into account the initial level of well-being in the region when calculating the elasticity of GRP growth rates on the level of ethnic heterogeneity. Another explanatory variable we use in this regression is \(inde{{x}_{{it}}}\_10\), a structural variable equal to the product of the dummy variable for 2010 and the index of ethno-linguistic fractionalization. Behind this is our assumption that the economy of the Russian regions after 2010 acquired qualitative characteristics that distinguish it from the economy before the 2009 crisis, which resulted in a decrease in the availability of financing, incentives to invest, and a decrease in the economy’s sensitivity to market signals. In such conditions, the mechanism that determines the sensitivity of the output of useful products to the impact of ethnic diversity could change. Indeed, the significance of the regressor, calculated as the product of the initial per capita GDP and the fractionalization index, and the positiveness of the coefficient in it, indicate that there has been an increase in the positive impact of diversity on income, which was reflected in the increase in the elasticity of growth rates from the fractionalization index. We explain this by the fact that against the background of a general decrease in income in the economy, especially after 2014, the importance of the policy of redistributing funds for equalizing the income levels of the population has increased. This policy, implemented in various forms, consistently ensured a higher level of consumption in national and multiethnic regions, in comparison with the levels of GRP created there, and, thus, had a rather pronounced national character.Footnote 7

From the standpoint of the theoretical model and the optimal solution (6), the following interpretation is possible. Ethnic diversity has a positive effect on economic growth, meaning that the optimal level of diversity m* in the Russian economy has not been achieved and, thus, \(m < m{\text{*}}\), where \(m\) there is an actual level of diversity. After 2010, the optimal level of diversity m* increased relative to the actual, which led to an increase in the gap between the specified parameters and the elasticity of the GRP growth rates from the fractionalization indices. The growth could be due, first, to an increase in the parameter γ, which determines the degree of tolerance of ethnic groups towards each other against the background of the increasing importance of the income equalization policy. Secondly, by reducing the parameter r, the share of the distributed rent in the generated income (according to (1)). It can also be assumed that the actual level of rent-seeking activity X decreased due to (5) and, thus, the value of the benefits of diversity also increased, which also had a positive effect on the levels of elasticity coefficients.

Based on the estimates obtained, we calculated the elasticities of economic growth rates from the initial values of the fractionalization index for each region in the periods 2003–2010 and 2011–2018. Table 3 presents descriptive statistics of the obtained elasticities for 2002 and 2010.

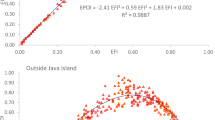

The graphs show the relationship between the elasticity coefficients of the GRP growth rates in the regions and the level of the initial indices of ethnic heterogeneity for 2002 and 2010 (Figs. 1, 2)

Average values of the elasticity of GRP per capita versus the level of ethnic heterogeneity for the regions of the Russian Federation in 2002 and 2010 amounted to 1.27 and 1.34, respectively. The scatter of elasticity values in 2002 and 2010 is quite significant, the minimum values in 2002 and 2010 were 0.43 and 0.44, respectively (both values refer to the Vologda oblast), while the maximum values reached levels 2.02 and 2.14 in 2002 and 2010, respectively (Republic of Adygea). The graphs show that the benefits of diversity dominate the costs of interaction: in general, higher values of the diversity index correspond to higher values of elasticities, which indicates a stronger positive impact of diversity on economic growth.

Conclusions. We have shown theoretically and empirically the ambiguity of the effect of heterogeneity on economic growth allows us to conclude that there is an optimal level of ethnic diversity. In addition, we have shown that this level, determined by the parameters of the population’s tolerance towards representatives of other ethnic groups, as well as by the share of rent in income, has not been achieved in any of the Russian regions.

Consideration of empirical results through the prism of a theoretical model allows us to formulate certain conclusions that are useful for the formation of economic policy for taking practical measures in the field of allocating funds and shaping the behavior of economic agents. First, we can conclude that the policy of equalizing the incomes of regional budgets and households, including support for national and multiethnic jurisdictions, showed itself positively, which turned out to be especially important against the background of a general deterioration in financial support after the economic crisis of 2009. Accordingly, in our opinion, this policy should be maintained in the future. Second, the scale of shadow redistributive activity is of great importance: the higher it is, the greater the deduction from the volume of total efforts is required to ensure such activity, and the useful product produced by society decreases accordingly. Consequently, all measures aimed at reducing the share of the shadow economy, which reaches a large size in Russia [26], will be effective: reducing the burden on business, stimulating private investment, improving the quality of public goods provided by the state and increasing confidence in it from economic agents and the population.

Notes

From English “social planner.”

It is clear that this consideration of bargaining for resources is broader than interethnic competition, but certain parallels can be drawn, especially in the light of subsidies received by many national jurisdictions around the world in various forms.

In the English-speaking tradition of “bargaining power.”

From English “social planner.”

Calibration of the parameters of this model is not very useful, since it is built under the simplifying assumption that all groups are equal in size. However, based on empirical analysis, it can be assumed that the parameter on average for the regions is 0.20–0.24.

This index is also known as the Elf-index, i.e., index of ethno-linguistic fractionalization. We also use the term “diversification index.”

This is quite clearly seen from the statistics published by Rosstat on GRP and actual consumption of the population and subjects of the Federation.

REFERENCES

W. Easterly and R. Levine, “Africa’s growth tragedy: policies and ethnic divisions,” Quart. J. Econ. 112 (4), 1203–1250 (1997). https://doi.org/10.1162/003355300555466

G. Tullock, “The welfare cost of tariffs, monopolies, and theft,” West. Econ. J. 5, 224–232 (1967).

K. Desmet, M. Breton, I. Ortuno-Ortin, and S. Weber, Nation Formation and Genetic Diversity, Center for Operations Research and Econometrics Discussion Paper, no. 2006/95, 2006.

A. N. Bufetova, E. A. Kolomak, and M. M. Mikhaleva, “National diversity and economic development of Russian regions,” Mir Ekon. Upr. 17 (3), 143–157 (2017). https://doi.org/10.25205/2542-0429-2017-17-3-143-157

A. N. Bufetova and E. A. Kolomak, “National heterogeneity in the regions of Russia: assessment, change, impact on economic development,” Vopr. Ekon., No. 1, 120–142 (2021). https://doi.org/10.32609/0042-8736-2021-1-120-142

N. Campos and V. Kuzeyev, “On the dynamics of ethnic fractionalization,” Am. J. Polit. Sci. 51 (3), 620–639 (2007).

A. Alesina, A. Devleeschauwer, W. Easterly, S. Kurlat, R. Wacziard, “Fractionalization,” J. Econ. Growth 8 (2), 155–94 (2003).

A. Alesina, J. Harnoss, and H. Rapoport, Birthplace Diversity and Economic Prosperity, National Bureau of Economic Research Working Paper, no. 18699, 2013. https://doi.org/10.3386/w18699

T. Vanhanen, “Domestic ethnic conflict and ethnic nepotism: a comparative analysis,” J. Peace Res. 36 (1), 55–73 (1999).

A. Alesina and E. La Ferrara, “Ethnic diversity and economic performance,” J. Econ. Liter. 43, 762–800 (2005).

S. Michalopoulos and E. Papaioannou, “National institutions and subnational development in Africa,” Quart. J. Econ. 129 (1), 151–213 (2014).

J. Montalvo and M. Reynal-Querol, Ethnic Diversity and Growth: Revisiting the Evidence, Economics Working Paper Series, Working Paper no. 1585, 2017.

N. Lee, “Migrants and ethnic diversity, cities and innovations: firm effect of city effects?,” J. Econ. Geogr. 15 (4), 1–28 (2014).

A. Alesina, J. Harnoss, and H. Rapoport, “Birthplace diversity and economic prosperity,” J. Econ. Growth 21 (2), 101–138 (2016).

L. E. Limonov and M. V. Nesena, “Features of the ethnocultural diversity of Russian regions,” Reg.: Ekon. Sotsiol., No. 3 (87), 146–170 (2015). https://doi.org/10.15372/REG20150906

L. E. Limonov and M. V. Nesena, “Cultural diversity of russian regions and economic growth,” Obshchestv.Nauki Sovrem., No. 1, 63–79 (2016).

W. Easterly, “Can institutions resolve ethnic conflict?,” Econ. Dev. Cult. Change 49 (4), 687–706 (2001).

A. Alesina, S. Michalopoulos, and E. Papaioannou, “Ethnic inequality,” J. Polit. Econ. 124 (2), 428–488 (2016).

J. Bluedorn, “Can democracy help? Growth and ethnic divisions,” Econ. Lett. 70 (1), 121-26 (2001).

E. Lazear, “Globalisation and the market for team-mates,” Econ. J. 109 (454), 15–40 (1999a).

E. Lazear, “Culture and language,” J. Polit. Econ. 107 (6), 95–126 (1999b).

G. Ottaviano and G. Peri, “Cities and cultures,” Nota di Lavoro, No. 92 (2004).

N. I. Suslov, “Optimal diversity in the socio-economic system: formal aspects” in IX Moscow International Operations Research Conference (MAKS Press, Moscow, 2018), pp. 229–233.

B. Baltagi, Econometric Analysis of Panel Data (Wiley, Ltd, Chichester, 2005).

M. Arellano and S. Bond, “Some tests of specification for panel data: Monte Carlo evidence and an application to employment equations,” Rev. Econ. Stud. 58, 277–297 (1991).

N. I. Suslov and E. N. Mel’tenisova, “Analysis of the impact of rising energy prices on the size of the shadow economy in the countries of the world,” Zh. Nov. Ekon. Assots, No. 3, 12–43 (2015).

Funding

The study was supported by grant 19-010-00731A “Comprehensive analysis of the heterogeneity of Russian regions and assessment of its impact on socio-economic development”.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Suslov, N.I., Isupova, E.N. & Ivanova, A.I. Ethnic Diversity in Russian Regions and Economic Growth: Theoretical Model and Its Approbation on Panel Data. Stud. Russ. Econ. Dev. 33, 149–156 (2022). https://doi.org/10.1134/S1075700722020149

Received:

Revised:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1134/S1075700722020149