Abstract

Economic aspects of implementing coal gasification technology are considered. Many objective causes hindering the comparison of economic characteristics of the considered coal gasification technologies are outlined. The energy and economic efficiencies of producing synthesis gas (syngas) from coal are estimated. The factors having the most pronounced effect on the efficiency, such as gasifier type, specific oxygen consumption, and initial fuel cost, are found. According to the calculations, the cost of produced syngas is two to three times higher than the price of natural gas for consumers. Therefore, the use of syngas and hydrogen produced from it for the centralized generation of power and heat will not be economically feasible in the foreseeable future. Integrated gasification combined cycle (IGCC) units are still not competitive with conventional coal-fired power plants, basically due to high specific capital expenditures, which are responsible for more than 2/3 of the price of delivered electricity. The issues of economic competition for hydrogen production from coal using alternative production processes are discussed in detail. It is demonstrated that hydrogen produced from cheap local coals (in Russia, these are coals from large coal deposits in Siberia and the Far East) can win the competition with hydrogen from natural gas. Nevertheless, activities should be continued to improve coal gasification processes and associated technologies, first of all, oxygen production technologies, to cut down capital and operating expenditures. Further development of coal chemical technologies involves high risks associated with the new global climate policy aimed at a drastic decrease in CO2 emissions and the replacement of fossil fuels in the global fuel and energy balance by renewable energy sources. State support for the development of new coal technologies and for coal chemistry science is necessary to retain the domestic coal industry.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

The ever-growing process of the global economy’s decarbonization can have a detrimental effect on the coal industry [1]. Its survival requires finding new coal applications by manufacturing products with high added value. Coal gasification is among the key technologies for solving this problem. As demonstrated in [2], coal gasification technologies have already reached a fully matured engineering status. Various designs of gasifiers and associated equipment are available in the market. They are suitable for coal-based production of almost an entire range of products conventionally obtained from oil and natural gas. But these products must be competitive in the market. Therefore, an urgent task is to assess the economic efficiency of coal gasification technologies for the production of gas for various needs. The obtained results should determine the targets for further scientific-and-technological policy in this field.

Since there is no mass market for coal gasification plants, including IGCC plants, no statistical data on their economic performance are available. That is why information on such characteristics can be obtained by analyzing the implemented projects, feasibility studies of new projects, and results of numerical investigations on the basis of dedicated mathematical models. Unfortunately, the comparability of the data thus obtained is often unsatisfactory.

Many objective causes exist that hinder the comparison of the economic performance of the developed technologies of coal gasification and their implemented applications. First of all, this is process differences as to the list of equipment items and their performance and characteristics. “Design” factors, such as mix and length of the required utilities (interconnection wiring, water supply system, access roads, etc.) and climatic and geographical differences among the plant construction sites, can hardly be comparable. The structure of the declared total capital investments may also differ considerably. They may include only the costs for the plant proper (for the main and auxiliary equipment, its installation and commissioning, construction work), but they can be much wider (“total costs” for the project) to embrace the costs of land management, land lease, engineering surveys, licensing, construction of external utilities, etc. The expenditures sometimes include the cost of borrowed capital and, on the contrary, do not include government subsidies for the implementation of pilot projects. Finally, it should be borne in mind that pilot plants are usually much more expensive than commercially produced ones.

The formation of the unit cost of technology in different projects depends heavily on “country” factors, including differences among countries in the cost of capital; national currency rates; inflation rates; the level and forms of state support for demonstration projects; the availability and level of development of the scientific, process, and production base; etc. For example, the freezing of the FutureGen program in the United States in 2008 suspended more than 30 coal gasification projects. Recently, investors have referred to uncertainties in the climate policies of states as one of the main causes for the cancellation of coal projects. The difference in inflation rates hinders the comparison of projects implemented or estimated in different years.

COAL GASIFICATION ECONOMICS

The economics of syngas production from coal is well illustrated in [3]. This is a feasibility study for the construction of a plant for gasification of coal from the Karakan-Western coal strip mine prepared by specialist of the Technische Universitat Bergakademie Freiberg, Germany, in 2017. Raw Karakan Grade D coal (candle coal) with a moisture content of approximately 15%, ash content on dry basis of 9%, sulfur content on dry basis of 0.39%, and a lower heating value of 23 MJ/kg was to be gasified. The coal heating value on a dry ash-free basis (Qdaf) is 31 MJ/kg [4]. Grade D coal is characterized by a low production cost which is less than $0.6/GJ in 2017 prices [5]. The obtained syngas was to be used for manufacturing chemical products. The coal gasification plant capacity is 1800 t/day of coal. A process flow diagram of syngas production from coal is presented in Fig. 1.

The project [3] considers two technologies of oxygen coal gasification:

1. The GSP-process: high-temperature entrained flow gasification of pulverized coal (first option); industrial applications are available;

2. The COORVED innovative technology combining dense bed gasification and fluidized bed gasification; this technology is under development (second option).

An appropriate pilot plant is in operation in Freiberg [3]. The main advantages of a COORVED multizone gasifier over a GSP entrained flow gasifier are as follows:

1. No coal pulverization,

2. Simpler systems for coal injection into the gasifier and ash removal from it,

3. Less oxygen consumption, and

4. Simpler automation of main processes.

Both technologies call for gasification at a pressure of approximately 4 MPa; the expected carbon conversion efficiency is 99.8%.

Table 1 presents the performance characteristics of the above-mentioned options of syngas production from the Karakan coal calculated on the basis of the data from [3, 4]. It is evident from Table 1 that the choice of gasification technology has a considerable effect on the project economics. According to [2], the energy efficiency of a technology can be characterized by the coal thermochemical conversion efficiency, which is the ratio of the energy of produced product to the energy of the gasifier feedstock (coal):

where \({{g}_{g}}\) is the specific syngas yield, kg(of gas)/kg (of coal); \({{\left( {{\text{LHV}}} \right)}_{g}}\) and \({{\left( {{\text{LHV}}} \right)}_{c}}\) are the (lower) heating value of the gas and the coal, respectively, MJ/kg.

The coal thermochemical conversion efficiency as to the yield of the CO + H2 mixture is 74.6% for the first option and 72.6% for the second option. For generator gas, it is higher and attains 75.6 and 81.1%, respectively. The differences are explained by the different composition of the produced gas. The H2/CO molar ratio is approximately 0.34 in the first option and 0.79 in the second option. In addition, the produced gas in the second option has a high methane content of approximately 1.6 vol %.

Syngas production involves high power consumption to produce oxygen and cover other need of the plant itself. These needs estimated for the two options require 0.72 and 0.57 kWh/kg of dry ash-free coal, respectively (with a specific energy consumption for oxygen production of 1.2 kWh/m3 of O2 and normal conditions). The oxygen unit accounts for more than 90% of the total power consumption. The energy efficiency of a coal gasification plant producing a mixture of CO and H2 and designed considering its needs for purchased power is 66.3% in the first option and 66.0% in the second option.

Since the considered options differ appreciably in the specific power consumption, it would be feasible to determine the total energy efficiency of gas production from coal (η). The characteristic takes into account the energy consumption for generation of the purchased power (provided that all steam needs are covered by the heat recovery within the plant) and is determined as

where e is the specific power consumption of the unit, referring to the energy of the gasified coal, MJ/MJ, and \({{{{\eta }}}_{p}}\) is the efficiency of purchased power generation.

If we assume that the purchased electricity is generated at a coal-fired power plant with an efficiency of 40%, then the total energy efficiency of producing a CO + H2 mixture from coal will be 53.9% in the first option and 56.2% in the second option, i.e., the second option turns out to be more advantageous from the energy standpoint.

It follows from Table 1 that the considered options differ noticeably in the economic performance. The cost of equipment as per unit weight of the daily gasified coal is $56/(t/day) in the first option and $35/(t/day) in the second option. As to the equipment cost structure, the oxygen unit accounts for the cost’s major share amounting to 50% in the first option and 69% in the second option. At the same time, the expenditures for the gasifier proper is relatively low comprising only 8% and 14%, respectively.

The cost of syngas production is $8.4/GJ in the first option and $6.3/GJ in the second option (in 2017 prices). In the structure of the syngas cost, the capital expenditures can be as high as 35–44% and the operating costs as high as 39–41% for both options. The coal cost in the syngas cost is 18–23% or approximately $1.5/GJ. This means that coal is supplied for conversion at a price approximately two times higher than the cost of its production.

The produced syngas cost turns out to be 2.4–3.2 times higher than the price of natural gas for Russian consumers, which was approximately $2.6/GJ in 2017. Hence, it follows that syngas production from coal is not yet economically attractive for the conditions of Russia if the syngas is used as a fuel for the generation of electricity and heat. Under these conditions, reducing the cost of coal supplied as a feedstock for conversion to the level of its production cost will be unhelpful because of the relatively low percentage of the coal costs in the syngas production cost. The economics of combining coal gasification with a combined-cycle unit will be discussed below.

A different situation is observed if the syngas is aimed at the production of chemicals. This is explained by the fact that the production of syngas from coal or a petroleum feedstock is also an expensive and energy-intensive process. However, in this case, we have to reduce their CAPEX and OPEX components to attain the competitiveness of coal chemical technologies. This requires continuing work to improve coal gasification technologies and associated processes. First of all, attention should be given to the development of new oxygen-production technologies.

The cost of equipment can be reduced, firstly, by its further improvement and, secondly, by replication. The practice demonstrates a huge potential for decreasing the cost of equipment by the commercialization of new developments. An example of this can be a PWR gasifier by Pratt & Whitney Rocketdyne, Inc. (United States) in the 2000s. This is one of few new developments of gasifier designs in this century. Application of rocket technologies and materials enabled the designers of the PWR generator to reduce the size of the entrained flow gasifier by 90% and its unit cost by almost 50% while maintaining the coefficient of thermochemical coal conversion at a level of 85% [6].

An oil giant, ExxonMobil, undertook to scale and commercialize the technology with the support of the US Department of Energy. However, after the development company was sold to the defense holding GenCorp, Inc. (now Aerojet Rocketdyne Holdings, Inc.) in 2013, this development decayed and was sold to GTI (Gas Technology Institute, United States) in 2015. In 2017, the PWR design under the brand R-Gas attained the stage of large-scale demonstration performed together by GTI and the Chinese partner, Yangquan Coal Industry Group, at the Shanxi Coal Chemical Plant, China. The R-Gas gasifier is expected to decrease the cost of produced syngas and chemical products on its basis by 15–30% [7].

PRODUCTION OF HYDROGEN FROM COAL

The gasification plants discussed in this paper may be intended for the production of hydrogen as the final product of coal conversion. This requires oxygen (or steam-oxygen) blow, and the process scheme should include the steam reforming of CO to hydrogen.

This is a catalytic process usually run at a pressure of 2–3 MPa in two stages:

1. High-temperature stage (at 350–450°C) on iron-chromium catalysts;

2. Low-temperature stage (at approximately 200–250°C) on copper-containing catalysts.

The residual content of CO in the syngas can be 0.2–0.6 vol %. The CO conversion reaction is exothermic. The reaction heat is quite high amounting to 41.1 kJ/mol (under normal conditions) or 184 MJ/m3 of CO (under normal conditions). This is approximately 14.5% of the CO heating value. The conversion process requires quite a lot of steam comprising 0.8 kg/m3 of CO under the stoichiometric and normal conditions. Steam can be generated from thermal resources of the plant itself. Gas at the CO converter outlet is heavily ballasted with CO2 (40–45%), which must be removed to produce commercial-grade hydrogen.

The technologies of CO conversion to hydrogen and treatment of the produced hydrogen to remove CO2 have been well mastered in the industry. However, their application makes the plant’s process system much more intricate due to connection to it additional reactor- and heat-exchange equipment operating under high pressure with a corrosive medium. The operating expenses increase because of the use of additional consumables (catalysts, sorbents, etc.) and energy. All this increases the cost of the plant proper and the cost of the final product, i.e., commercial-grade hydrogen.

The cost estimate for hydrogen production from coal has been prepared on the basis of the data in Table 1. The CO to H2 conversion efficiency is assumed to be 99%, and that of the CO2 capture efficiency is 95%. The calculation results are presented in Table 2. The specific yield of commercial-grade hydrogen is approximately 2.1–2.2 m3/kg of dry ash-free coal (under normal conditions). The content of H2 in the commercial-grade hydrogen is approximately 94%. The efficiency of coal-to-commercial-grade hydrogen thermochemical conversion is estimated to be 67.1% for the first option and 74.4% for the second option. Considering the power consumption for the oxygen production and other needs of the plant, the plant’s energy efficiency drops to 58.3% for the first option and to 67.2% for the second option. The calculated total energy efficiency of the commercial-grade hydrogen production with account taken of the efficiency of power generation at an external coal-fired TPP (equal to 40%) will be, respectively, 45.2 and 56.4% (if all the demands of the plant for steam are covered due to recovery of the plant’s own heat).

High demand of hydrogen-from-coal production units for electricity and the presence of large amounts of waste heat and combustible gases in various elements of the process circuit allow us to raise the issue of integrating them with power installations. The efficiency of such integration can be quite high.

The cost of hydrogen production from coal can be estimated on the basis of experimental data obtained in China [8]. Approximately 130 coal gasification plants for hydrogen production are in operation globally, more than 80% of which are in China. Therefore, the Chinese data on the economics of commercial hydrogen production from coal can be considered the most reliable. Hydrogen produced from coal turns out to be the cheapest in China, where its price is approximately $9.2/GJ of H2 (Table 3). Hydrogen produced by steam methane reforming (SMR) is 1.6 times more expensive with a price of approximately $15/GJ of H2. This difference is largely due to the low cost of the coal mined in the country and a high price of imported natural gas. And this is in spite of the fact that the capital expenditures for plants for producing hydrogen from coal (approximately $1400/kW H2) are approximately two times greater than those for plants for producing hydrogen from natural gas ($500–900/kW H2) [8].

Under the conditions of Russia, there is good reason to believe that the cost of hydrogen production from cheap Siberian and Far Eastern coals, first of all brown coals, using low-priced Chinese gasifiers may be quite comparable to the cost of hydrogen production from coal in China. Chinese gasifiers have to be used since Russian enterprises have not yet made equipment required for this purpose.

In China, the hydrogen produced by water electrolysis using network power has the highest price ($44/GJ H2). And this is in spite of fact that most power in China is generated at coal-fired power plants. At the same time, hydrogen production using electricity from renewable power sources (RPS) turns out to be nearly two times cheaper ($24/GJ H2) [8]. This performance has been provided by cheap local equipment, its low-cost operation, and application of high-potential resources of solar and wind energy.

It should be noted that water electrolysis yields high-purity (>99.5%) hydrogen. The purity of commercial-grade hydrogen from coal is much lower, approximately 90–95%. For many large hydrogen consumers (direct reduction of iron, methanol synthesis, etc.), this is quire acceptable. High-temperature oxygen-blown coal gasifiers can produce hydrogen up to 97% pure [9]. However, many applications require higher purity hydrogen (ammonia synthesis, many catalytic process in oil refining and petrochemical industries, fuel cells on the basis of proton-exchange membranes, etc.). Hydrogen purification involves additional expenditures increasing the hydrogen price. The purification expenditures depend on the required hydrogen purity and the purification technology.

The cost of hydrogen production from coal in China is comparable with the hydrogen production cost using natural gas in many countries of the world, including Russia (Table 4). The exception is the low-price gas countries, in particular, the Middle Eastern countries and the United States. In China, hydrogen produced from coal is used basically for the synthesis of ammonia, a product which is in great demand on the domestic market. China is the world’s largest consumer of nitrogen fertilizers, the demand for which is estimated at 46 million t per year. In China, ammonia from coal is competitive with ammonia from natural gas and imported ammonia.

Hydrogen production from coal has considerable accompanying CO2 emissions of approximately 170 kg CO2/GJ H2, which is two times greater than the emission in hydrogen production using natural gas (see Table 3). However, this is 1.6 times less than the CO2 emissions in the production of hydrogen by water electrolysis using electricity generated at coal-fired power plants.

According to [8], the provision of units for hydrogen production from natural gas with 90% CO2 capture systems increases CAPEX by 50%, fuel consumption by 10%, and doubles OPEX. This is due to the specifics of the very technology of steam reforming of natural gas to hydrogen. It calls for the use of approximately one-third of consumed natural gas for heating of the conversion reactor. To do this, natural gas is burned in air at atmospheric pressure. Because of this, the CO2 concentration in flue gases is relatively low (less than 15%), which sharply increases the cost of CO2 capture.

In unit for hydrogen production from coal, CO2 is captured from the high-pressure gas mixture after the CO conversion reactor. It has a quite high CO2 content of approximately 40–45%. Therefore, an increase in the capital costs for CO2 capture is small amounting to approximately 5%. The fuel cost rises by approximately the same value. OPEX will increase considerably. Nevertheless, even with CO2 capture, the hydrogen from coal is cheaper in China than hydrogen from natural gas having costs $12.5 and 19.2/GJ H2, respectively (see Table 3). Moreover, even under these conditions, the Chinese “coal” hydrogen is quite competitive with hydrogen from natural gas in most regions of the world (see Table 4). This means that Chinese high value-added chemical products made with high consumption of hydrogen will still be competitive in the world even after the introduction of global limits on CO2 emissions.

The current hydrogen costs given in Tables 3 and 4 agree quite well with the data from other sources. In particular, the monograph [10] contains the following costs of hydrogen production by various methods (for the conditions of 2018), $/GJ H2:

1. Coal gasification: 11.2 without CO2 capture and 13.6 with CO2 capture;

2. Steam reforming of natural gas: 17.3 without CO2 capture and 18.9 with CO2 capture;

3. Water electrolysis using electricity from nuclear power plants (34.6), solar power plants (SPP) (48.2), wind power plants (WPP) (49.1).

The current hydrogen production cost is estimated in report [11] as follows:

1. Coal gasification with CO2 capture: $15/GJ H2 at a coal cost of $1.5/GJ and $16.7/GJ H2 at a coal cost of $3.8/GJ;

2. Steam reforming of natural gas with CO2 capture: $10.8/GJ H2 at a natural gas cost of $3.2/GJ and $18.3/GJ H2 at a natural gas cost of $8.4/GJ.

The predicted costs of producing hydrogen from coal and natural gas will likely remain nearly the same for a long time. The effect of engineering progress on them will be compensated for by an increase in the cost of coal and natural gas.

The presented data confirm the conclusion already made that hydrogen can be produced with competitive economic indicators from cheap coal. Therefore, coal gasification technologies have certain prospects for large-scale application. This is promoted by the considerable and steadily growing demand for hydrogen. Between 1975 and 2018, the global hydrogen consumption increased by more than 4.6 times and now comprises 115 million t or 13.8 million TJ per year [8]. At same time, around 70 million t of hydrogen is used in “pure” form (mostly for oil refining and production of ammonia) and a further 45 million t is used in a mixture with various gases (for the production of methanol, direct reduction of metals, etc.).

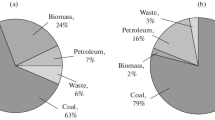

Hydrogen is currently produced basically from natural gas (76%) and coal (23%). Electrolysis technologies account for slightly more than 1% of total hydrogen production with less than 0.1% coming from water electrolysis, and the rest is created as a by-product of alkali electrolysis in the production of chlorine and caustic soda [8]. Hydrogen production consumes approximately 6% of natural gas and 2% of coal produced in the world. “Coal” hydrogen production is concentrated mainly in China.

Progress in the development of fuel cells can considerably extend the scope of hydrogen application and, finally, give rise to the “hydrogen” power industry [12]. First of all, this pertains to “portable” and “mobile” power sources where hydrogen can be used to supply power to various low-power portable devices, self-contained robots, vehicles, etc. [13], competing with electricity accumulators. However, sufficiently pure hydrogen is needed to do this. Hydrogen from coal does not comply with this condition. Hence, it should be additionally treated primarily to remove CO.

According to the forecast in [14], by the year 2050, the global hydrogen consumption can increase six times, up to 696 million t per year (83.5 million TJ/year), if a strict climate scenario is carried out where global warming is limited to 1.5°C (Table 5). In this case, hydrogen can meet up to 24% of the world’s final energy need. An increase in the demand for hydrogen is expected to occur mainly due to its consumption for transportation and in the power industry. In the latter case, hydrogen is to be used to cover a peak demand that is essential with a large share of RESs in the structure of generating capacities. In this case, hydrogen will be produced by water electrolysis using RES power with its service being an intermediate energy storage. This scenario would require massive investment up to $11 trillion in production, storage, and transport infrastructure. The theoretical global hydrogen demand by 2050 is estimated to be 1370 million t/year (164 million TJ/year) or 49% of global final energy demand. This estimation assumes the replacement of fossil fuels used for transportation, in industry, for power generation, and in housing and utility services where it is feasible from the process standpoint.

According to [15], the global demand for pure hydrogen is estimated to be approximately 280 million t by 2050 and 520 million t by 2070 vs. 75 million t in 2019. The following hydrogen consumption structure is assumed, %:

Road transport | 30 |

Production of aviation kerosene together with СО2 | 20 |

Synthesis of ammonia followed by its use as a fuel in sea transport | 10 |

Chemical industry and metallurgy industries | 15 |

Peak power generation | 15 |

Building heating and hot water supply | 5 |

Others | 5 |

Total | 100 |

It is assumed that approximately 40% of hydrogen will be produced from fossil fuels with CO2 capture and 60% will be by water electrolysis; 95% percent of hydrogen will be delivered to consumers in a pure form via dedicated hydrogen piping (comprising new pipelines and revamped gas networks). The remaining 5% of hydrogen will be supplied to consumers in a mixture with natural gas and biomethane.

When assessing the prospects for producing hydrogen from coal, account should be taken of the anticipated considerable progress in hydrogen production technologies using power from renewable energy sources. This pertains to both electrolysers and solar- and wind-power plants. RESs-based hydrogen production has an important advantage: it can be performed with acceptable performance indicators right at consumers. This is explained, firstly, by the availability everywhere of solar and wind energy and, secondly, by the economic efficiency of low-power electrolysers. As a result, the costs for creating a hydrogen transport infrastructure are reduced. On the other hand, hydrogen from electrolysis is initially pure and, therefore, ready for use everywhere, including in type PEM (proton-exchange membrane) low-temperature fuel cells.

According to the forecast in [16], the cost of RES-based water electrolysis hydrogen could drop from the current $50/GJ to $17–25/GJ by 2030. Achieving this goal requires a reduction in the electrolyser capex by more than half, down to $400/kW. This would require a breakthrough in engineering improvement of electrolysers and the deployment of 70 GW of electrolyser capacity. Continued technological advancement in the production of electrolysers and the creation of SPPs and WPPs by the middle of the century may decrease the cost of hydrogen from renewables to $8.3/GJ ($1.0/kg H2). This is comparable with the current cost of hydrogen from coal or natural gas. At the same time, it is noted in [16] that the technologies for hydrogen production from coal or natural gas do not offer so many opportunities for technical improvement. The economic advantages of producing hydrogen from natural fuels in comparison with water electrolysis are also revealed when considering the full life cycle of the applicable technologies [17].

The forecast in [11] demonstrates that the cost of renewable electrolysis hydrogen will decrease by approximately three times by 2050 with reference to 2018: down to $10–22/ GJ H2 when using SPP power or $8–10/GJ H2 when using WPP power (Table 6). But this forecast is based on conditions that can hardly be met, including

1. Fourfold decrease in the specific cost of electrolysers (from $840/kW in 2018 to $200/kW by 2050);

2. Fourfold decrease in the SPP power cost;

3. Twofold decrease in the WPP power cost.

Lower hydrogen costs are for the best SPPs and WPPs generating electricity using high-potential resources of solar and wind energy. This will yield the following by 2050:

1. High load factor (LF) of 27% for SPPs and 63% for WPPs;

2. Low cost of generated electricity amounting to $4.5/(MW h) for SPPs and $11/(MW h) for WPPs.

It should be noted that the average load factor in Russia in 2019, according to Rosstat, was 13.5% for SPPs and 17.8% for WPP, i.e., it was several times less.

Thus, a certain consensus on the predicted cost estimates of hydrogen production has been achieved. It is advisable to compare these estimates with the predicted cost of natural gas and coal [1]. The predicted cost estimates of hydrogen production and conventional fuels by 2040, $/GJ, are presented below:

Local hydrogen production using the following: | |

|---|---|

coal | 12.5–20.0 |

natural gas | 12.0–19.0 |

power from SPPs | 12.0–25.0 |

power from WPPs | 10.0–22.0 |

Hydrogen import (data for destination port and 2030 [16]) from | |

Chile to the United States | 23.0 |

Saudi Arabia to Germany | 28.0 |

Saudi Arabia to Japan | 31.0 |

Australia to Japan | 28.0 |

Natural gas price in | |

the United States | 3.2–4.2 |

the European Union | 7.1–8.4 |

Japan | 8.2–9.7 |

China | 8.2–9.3 |

Coal price in | |

the United States | 2.1–2.3 |

the European Union | 2.5–3.3 |

Japan | 2.8–3.7 |

The lower costs of local hydrogen production are for the production of hydrogen from cheap coal and natural gas as well as for the use of high-quality resources of solar and wind energy. For coal, lower values are for the scenario of sustainable development of the world’s energy sector, while higher values are for the scenario of stated policy [1].

The presented data suggest that, in the foreseeable future, hydrogen will not be economically competitive with organic fuels, such as natural gas and coal with the latter being used for the generation of power and heat in centralized energy supply systems. The same conclusion was made in [18].

High expected cost of natural gas in the European Union, Japan, South Korea, and China should not be misleading when assessing the prospective hydrogen market. The high gas cost in these regions is caused by high gas transportation costs. Transportation of hydrogen will be even more expensive. Transportation of liquid hydrogen by sea is approximately five times more expensive than liquefied natural gas transportation [16]. In particular, the cost of hydrogen transportation from Saudi Arabia to Japan is estimated to be $14.2/GJ H2 or $1.7/kg H2 (forecast for 2030) [16]. These include the cost of hydrogen liquefaction and loading ($7.5/GJ H2), sea transportation ($5/GJ H2), and liquid hydrogen unloading ($1.7/GJ H2). Establishing the global hydrogen market will require construction of applicable infrastructure almost from greenfield that will result in huge investments. High transportation costs make the imported hydrogen delivered from regions with good solar and wind energy characteristics (Saudi Arabia, Australia, Chile, etc.) and, therefore, having low production cost, very expensive at attractive markets in Asia, Europe, and the United States.

It should be noted that the change-over to large-scale application of hydrogen in the power industry can only be driven by politically motivated decisions. An analysis of the issue whether the hydrogen can compete with alternative energy sources, primarily electricity, in the field of mobile and portable power sources, as well as in distributed generation, is beyond the scope of this study.

ECONOMICS OF IGCC UNITS

Economic assessments of IGCC plants can be obtained by analyzing the known projects. Thus, the turnkey specific cost of the successful 300 MWel. Taean project in Korea was $4670/kW in 2016, and the cost of the 618 MWel. Edwardsport power plant (United States) was $5670/kW as of the date of its commissioning in 2013. The turnkey specific cost for the failed 630 MWel. Taylorville Energy Center (Illinois, United States) project escalated from its original values of $3170/kW in 2006 to $5800/kW in 2013 when the project was canceled because of its high cost. In 2016, a feasibility study was prepared for the construction of a 332 MW IGCC plant in Egypt, according to which the estimated specific cost was $4210/kW [19]. The data presented in this paper on the specific cost, corrected for differences among the countries, agree well with each other, which is also confirmed by other independent estimates [20, 21].

The structure of capital expenditures for an IGCC plant depends heavily on the employed gasification technology. Thus, for the Puertollano plant it is as follows, % [22]:

Air separation unit | 12 |

|---|---|

Gasifier with auxiliary equipment | 26 |

Syngas cleaning and conditioning | 8 |

Combined-cycle unit | 54 |

For an IGCC plant on the basis of the Shell gasifier, it is somewhat different, % [21]:

Fuel facilities and fuel treatment station | 7 |

Air separation unit | 14 |

Gasifier with auxiliary equipment | 22 |

Syngas cleaning and conditioning | 18 |

Water treatment and waste treatment | 3 |

Combined-cycle unit | 16 |

Electrical equipment | 6 |

Automatic control system | 2 |

Construction | 12 |

According to the above-presented figures, the coal gasification package accounts for approximately one fourth of the total capital cost for an IGCC plant.

The above-presented data on IGCC plant can be compared with average capital investments in competing units estimated by the US EIA in 2019 [23].

A coal-fired ultra-supercritical STU, $/kW: | |

|---|---|

without СО2 capture | 3661 |

with 90% СО2 capture | 5851 |

gas-fired combined-cycle unit with 90% СО2 capture | 2470 |

Based on the data from [24, 25], Table 7 was prepared where performance indicators of the IGCC plant and competing technologies are presented. The IGCC plant is based on a ConocoPhillips (E-Gas®) gasifier, which is a two-stage gasifier with liquid slag removal where coal-water slurry is gasified at high temperatures (1370°С; 3.7 MPa) in an oxygen flow (95% purity). The IGCC plant produces 690 MW of gross power and 600 MW of rated (net) power. The auxiliary power consumption is 90 MW (15%). The IGCC plant includes an F-class gas turbine modified for operation on syngas. A coal-fired steam-turbine unit (STU) for 600/600°С/26.2 MPa steam conditions is equipped with low-emission burners and a flue gas treatment system to remove sulfur and nitrogen oxides. Table 7 presents two gas-fired CCU with F-class and H-class gas turbines, respectively. The first CCU with a net output of 702 MWel consists of two F-class gas turbines with an output of 242 MW each and one 246 MW steam turbine. Hence, the installed capacity of this CCU is 730 MW with an auxiliary power consumption of 28 MW (3.84%). The second CCU has an output of 429 MW and is a monoblock installation consisting of one steam turbine and one gas turbine. Both CCUs are provided with low-emission combustors. Table 7 also includes two simple-cycle GTUs used to cover peak loads. One medium power (100 MW) GTU is based on an E-class gas turbine, and one large (237 MW) GTU uses an F-class gas turbine.

The levelized cost of electricity has been calculated under the following conditions: the discount rate is 5%, the cost of borrowed capital at the construction stage is 5%, the cost of coal is $1.8/GJ, and the cost of natural gas is $3/GJ. In the structure of capital expenditures, a percentage of other expenditures, including those for connecting the project to external utilities, amounts to approximately 16.7% for all considered units. Economic estimates are given in 2016 prices.

It follows from Table 7 that, with the accepted conditions, the IGCC plant will not be competitive with alternative engineering solutions in terms of the levelized cost of electricity. The cost of electricity delivered by the IGCC plant turns out to be higher than the power from a coal-fired steam turbine unit by a factor of 1.3, from a natural-gas fired CCU by a factor of 2.9, and from a simple cycle GTU by a factor of 1.6–3.0. The main cause of such a high price is great capital expenditures for the IGCC plant. The percentage of investment component in the levelized cost of electricity from an IGCC plant is 66%, while that for gas-fired CCUs is approximately 38–43%.

The presented conclusions are confirmed by other studies, for example [26, 27] as well as by the results of operation of existing IGCC plants. Thus, the operation of the IGCC plant at the Edwardsport power plant turned out to be unprofitable by 2018. It had an extremely poor 40% capacity factor during its first 55 months of operations, far below the 79% capacity factor projected, and the all-in cost of power from the plant averaged $145/(MW h) [28]. Our estimations demonstrate that, even with the projected capacity factor, this plant would generate electricity at a cost of approximately $102/(MWh) that is greater than the cost of power from a coal-fired STU or a gas-fired CCU by a factor of 1.3 or 2.7, respectively. The cost of electricity generation by these installations is estimated in [15] as $76.4 and $38.1/(MW h), respectively.

Coal gasification at the Great Plains Gasification Plant in the United States turned out to be unprofitable [29]. Failing economics caused the Australian authorities to stall the ambitious Arckaringa coal gasification project, which included a liquid product unit and an IGCC plant [30]. In addition, projects for the construction of new coal-fired steam-turbine units were also rejected. This resulted from the absence of their demand in windy periods (when electricity is generated mainly at wind power plants) and the high cost of generated electricity in still-air periods (due to the low average annual load of the plant and a great investment component in the cost of electricity).

The fate of the 582 MWel IGCC plant at the Kemper power facility, Mississippi, United States, was unfortunate. In 2017, the gasification unit with a Kellog Brown & Root (KBR) TRIG gasifier was tested and decommissioned prior to being put into operation when it was clarified that it would have to be upgraded. The Kemper power facility was converted to natural gas. The IGCC plants were converted to natural gas before their commissioning in the Caledonia Clean Energy and Don Valley projects, Cash Creek IGCC project in the United States, and Good Spring Plant project in Canada. The financial insolvency caused the closure of the Sulcis project in Italy and another six projects in other countries. Sixteen projects with IGCC plants were terminated at the design stage. How many more projects were rejected at the feasibility study is still unknown. Information about them is rarely divulged. The main causes for the termination of IGCC plant projects were their low economic efficiency of coal gasification, uncertainty in the climate policy, and insufficient government support.

A SWOT-analysis of IGCC plants (Table 8) demonstrate that these plants have considerable advantages and great potential for their large-scale application. However, their introduction will be hindered by high risks associated with the new global climate policy aimed at a drastic decrease in CO2 emissions and the replacement of fossil fuels in the global fuel and energy balance by renewable energy sources. Poorer state support for the development of new coal technologies and for coal chemistry science plays a negative role.

Adaptation of IGCC plants to the new conditions of power industry development requires their further improvement, including developing new thermodynamic cycles and process schemes. In particular, compressorless CCUs offering effective CO2 capture directly in the unit cycle [31, 32] can be noted. Works on new cycles and schemes do not usually attract commercial interest and, therefore, require government support.

CONCLUSIONS

(1) The conversion of coal to syngas and hydrogen to be used for generation of electric and thermal energy will not be economically attractive for the conditions of Russia in the foreseeable future. The cost of the produced syngas turns out to be 2–3 times higher than the price of natural gas for consumers.

(2) IGCC plants also cannot compete with coal-fired power plants. The power generated by the IGCC plant is 1.3 or 2.9 times more expensive than the power delivered by a coal-fired STU or a natural gas-fired CCU, respectively. The main cause of such a high cost is great capital expenditures for the IGCC plant. The percentage of the investment component in the cost of power delivered by an IGCC plant exceeds 66% vs. 38–43% for a natural gas-fired CCU.

(3) The production of syngas from cheap Siberian and Far Eastern coals for further production of hydrogen and some other chemical products on its basis may be economically attractive. In this case, it is important to reduce the demand of gasification technology for oxygen and the consumption of electricity for its production.

(4) The target of the development of coal chemical technologies is to reduce the unit CAPEX and OPEX. This requires continuing the improvement of coal gasification technologies and associated processes. In doing so, special attention should be given to the development of new oxygen-production technologies.

(5) For the largest coal producer, which is Russia, it will be expedient to enhance state support for the development of new coal technologies and coal chemistry science. It is not improbable that a demand for new coal technologies will arise in the future, and Russian science should be ready to propose them, and the industry should be able to apply them.

REFERENCES

World Energy Outlook 2019 (International Energy Agency, Vienna, 2019).

S. P. Filippov and A. V. Keiko, “Coal gasification: At the Crossroads. Technological factors,” Therm. Eng. 68 (3), 209–220 (2021).

Assessment of Technical and Economic Potential of Deep Processing of Coal of “Karakanskii-Zapadnyi” Open Cast Mining Site (Technische Univ. Bergakademie Freiberg, Inst. für Energieverfahrenstechnik und Chemieingenieurwesen, Freiberg, Germany, 2017) [in Russian]. http://www.karakan-invest.ru/investor/perspective/Otchet-FGA.pdf. Accessed March 21, 2020.

Characteristics of Coal Mined at Karakanskii-Zapadnyi Open-Pit. http://www.karakan-invest.ru/en/buyer/ features/. Accessed March 30, 2020.

“Karakan’s unique coal,” Nedra TEK Sib., No. 2, 10–12 (2017).

S. Fusselman, “Compact gasification development and test status,” in Proc. Gasification Technologies Council Annual Conf., San Francisco, Cal., Oct. 9–18, 2011 (Gasification Technologies Council, 2011).

A. Duckett, “GTI will demo R-GAS gasification in China,” Chem. Eng., June 27 (2017). https://www. thechemicalengineer.com/news/gti-will-demo-r-gas-gasification-in-china-1/. Accessed February 20, 2020.

The Future of Hydrogen. Seizing Today’s Opportunities (International Energy Agency, Vienna, 2019).

M. El-Shafie, S. Kambara, and Y. Hayakawa, “Hydrogen production technologies overview,” J. Power Energy Eng. 7 (1), 107–154 (2019). https://doi.org/10.4236/jpee.2019.71007

M. Kayfeci, A. Kecebas, and M. Bayat, “Hydrogen production,” in Solar Hydrogen Production: Processes, Systems, and Technologies, Ed. by F. Calise, M. D. D’Accadia, M. Santarelli, A. Lanzini, and D. Ferrero (Elsevier, London, 2019), pp. 45–83.

Hydrogen: A Renewable Energy Perspective (International Renewable Energy Agency, Abu Dhabi, 2019).

O. S. Popel’, A. B. Tarasenko, and S. P. Filippov, “Fuel cell based power-generating installations: State of the art and future prospects,” Therm. Eng. 65, 859–874 (2018). https://doi.org/10.1134/S0040601518120078

S. Filippov, “New technological revolution and energy requirements,” Foresight STI Governance 12 (4), 20–33 (2018). https://doi.org/10.17323/2500-2597.2018.4.20.33

Hydrogen Economy Outlook: Key messages (Bloomberg NEF, 2020). https://data.bloomberglp.com/professional/ sites/24/BNEF-Hydrogen-Economy-Outlook-Key-Messages-30-Mar-2020.pdf. Accessed July 14, 2020.

Energy Technology Perspectives (International Energy Agency, 2020).

Path to Hydrogen Competitiveness: A Cost Perspective (Hydrogen Council, 2020). https://hydrogencouncil.com/ wp-content/uploads/2020/01/Path-to-Hydrogen-Competitiveness_Full-Study-1.pdf. Accessed August 15, 2020.

M. Khzouz, E. I. Gkanas, J. Shao, F. Sher, D. Beherskyi, A. El-Kharouf, and M. Al Qubeissi, “Life cycle costing analysis: Tools and applications for determining hydrogen production cost for fuel cell vehicle technology,” Energies 15, 3783 (2020). https://doi.org/10.3390/en13153783

J. Eichman, A. Townsend, and M. Melaina, Economic Assessment of Hydrogen Technologies Participating in California Electricity Markets, Technical Report NREL/TP5400-65856 (National Renewable Energy Laboratory, 2016).

D. A. Ali, M. A. Gadalla, O. Y. Abdelaziz, and F. H. Ashour, “Modelling of coal-biomass blends gasification and power plant revamp alternatives in Egypt’s natural gas sector,” Chem. Eng. Trans. 52, 49–54 (2016). https://doi.org/10.3303/CET1652009

Engineering-Economic Evaluations of Advanced Fossil Fuel Power Plants, EPRI Report No. 3002016284 (Electric Power Research Inst., 2019).

Cost and Performance Baseline for Fossil Energy Plants Volume 1B: Bituminous Coal (IGCC) to Electricity, NETL Report No. DOE/NETL-2015/1727 (National Energy Technology Laboratory, 2015).

G. Aranda, A. Van der Drift, and R. Smit, The Economy of Large Scale Biomass to Substitute Natural Gas (bioSNG) Plants, ECN Report No. ECN-E-14-008 (ECN, 2014).

Capital Cost Study. Capital Cost and Performance Characteristic Estimates for Utility Scale Electric Power Generating Technologies, Report of Sargent & Lundy to US EIA, Rev. 1 (U.S. Department of Energy, Washington, DC, 2020).

Updated Capital Cost Estimates for Utility Scale Electricity Generating Plants (U.S. Energy Information Administration, 2013).

Updated Capital Cost Estimates for Utility Scale Electricity Generating Plants (U.S. Energy Information Administration, 2016).

Levelized Cost and Levelized Avoided Cost of New Generation Resources in the Annual Energy Outlook 2020 (U.S. Energy Information Administration, 2020).

H.-T. Oh, W.-S. Lee, Y. Ju, and Ch.-H. Lee, “Performance evaluation and carbon assessment of IGCC power plant with coal quality,” Energy 188, 116063 (2019). https://doi.org/10.1016/j.energy.2019.116063

“Duke hit hard by exorbitant O&M costs at Edwardsport IGCC facility,” Power, Sept. 27 (2018).

S. J. McKenzie, “Electric, basin electric at odds over rates, synfuels plant,” Minot Daily News, Feb. 4 (2020).

“Coal on the way out of South Australia,” New Daily, June 11 (2015).

A. S. Kosoi, Yu. A. Zeigarnik, O. S. Popel, M. V. Sinkevich, S. P. Filippov, and V. Ya. Shterenberg, “The conceptual process arrangement of a steam–gas power plant with fully capturing carbon dioxide from combustion products,” Therm. Eng. 65, 597–605 (2018). https://doi.org/10.1134/S0040601518090045

O. N. Favorskii, V. M. Batenin, and S. P. Filippov, “Energy development: Choice and implementation of strategic decisions,” Herald Russ. Acad. Sci. 90, 283–290 (2020). https://doi.org/10.1134/S1019331620030016

Author information

Authors and Affiliations

Corresponding author

Additional information

Translated by T. Krasnoshchekova

Rights and permissions

About this article

Cite this article

Filippov, S.P., Keiko, A.V. Coal Gasification: At the Crossroads. Economic Outlook. Therm. Eng. 68, 347–360 (2021). https://doi.org/10.1134/S0040601521050049

Received:

Revised:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1134/S0040601521050049