Abstract

This study examined impulse control during an online shopping festival in China. The research model integrated the flow theory into a Stimulus-Organism-Response (S-O-R) framework to explore the direct and indirect impacts of positive eWOM on impulse buying; the mediating role of consumer inertia was assessed as a risk-reduction strategy in impulse-control intervention. The proposed model reasonably well fits the data; all hypotheses are supported. The structural equation modeling results (n = 497) show that positive eWOM contributes to impulse buying because of the online shopping frenzy. Simultaneously, the rise of these stimuli also leads to reflective impulse control, and the three types of consumer inertia can explain the transition from positive eWOM to impulse buying. Furthermore, the affective and cognitive inertia enhance the dependence on the behavioral type after continuous stimulation with positive reinforcement. The findings imply consumer inertia helps secure decision quality and alleviates impulse behavior. In addition, the behavioral inertia generated by sustained affective and cognitive stimulation is essential to subsequent impulse purchases associated with evolving brand loyalty. The study consequently offers some suggestions for marketers to promote repeat purchases as well as potential lines of inquiry for further research.

Similar content being viewed by others

Introduction

Research background

E-commerce is one of the most innovative retail strategies that erode physical retail in the twenty-first century. Electronic word-of-mouth (eWOM) communication effectively influences consumers’ purchase decisions in the industry; reviews and ratings have become the most popular way for customers to find out about a brand or product online (Roy et al. 2021). For example, the Double Eleven event on 11 November, known as “Singles’ Day,” is the most famous online shopping festival with the most significant transaction in China. Like Black Friday in the United States, this shopping frenzy has always attracted online shopping because of its promotion activities, and the trade continues to rise yearly. According to the 2020 report from the Chinese Ministry of Commerce, China has become the largest e-commerce market in the world, with its total revenue reaching 37,210 billion RMB in 2020 from 26,100 billion RMB in 2016, representing a 6.3% annual increase rate (MOFCOM 2021). The perceived utilitarian and hedonic motives from reading positive online reviews or ratings urge consumers to buy impulsively in an online shopping frenzy (Baumeister 2002; Horvath et al. 2015; Zhang et al. 2018). However, because of the cognitive load of stimuli, it is necessary to re-examine impulse buying as the sales of online marketing channels rise yearly (Shiu 2017, 2021).

Past research and current study contribution

In recent studies, consumers’ self-control was found to resist urges that involve attempts by individuals to restrain their desires, conform to rules, and change how they think, feel, or act (Iyer et al. 2020). However, these studies have mainly focused on why consumers engage in problematic buying and their self-regulation strategies to avoid and distract from compulsive behavior or to control unnecessary spending during shopping (Horvath et al. 2015). In contrast to the previous goal of reducing the irrational impact on consumers’ finances, the current study makes an incremental contribution to the theory of bounded rationality by examining the impulse-control strategies that prudent shoppers or rational consumers use more frequently in deliberate decisions. The rise of reviews or ratings may resume the interrogation that leads to decision postponement and reflective self-control, which aims to increase the certainty that the purchase decisions will not fail (Ahmad et al. 2022; Chevalier and Mayzlin 2006; Lamberton 2020; Shiu 2018, 2021). Particularly, consumer inertia is considered a reasonable strategy in such a confusing scenario to deal with the increasing stimuli from different sources, thereby avoiding poor decisions (Shiu 2021). Therefore, this study is the first to explore whether consumer inertia can be viewed as a risk-reduction strategy to predict impulse control in an online shopping frenzy. Specifically, an appraisal transformation framework was developed to assess whether and how three types of consumer inertia (i.e., affective, cognitive, and behavioral inertia) can mitigate and ease the transition from positive eWOM to impulse buying.

Study motivation and paper organization

For decades, the Stimulus-Organism-Response (S-O-R) framework has depicted past studies of purchase behavior in e-commerce, examining the relationships between external/internal stimuli (e.g., marketing information and consumer experience or knowledge), consumers’ reactions, and buying behavior (Chan et al. 2017). However, the fast expansion of online shopping has provided people with many choices; this can lead to too much information and make it difficult to process it all (Shiu 2021). Therefore, this study employs flow theory within the S-O-R framework to investigate the effects of stimuli on the flow experience of decision-makers. The integrated model assessed whether consumer inertia predicts complete engagement in an intrinsically rewarding activity that can elicit optimal experience by narrowing the focus of attention and filtering out extraneous stimuli (Csikszentmihalyi 2020).

The rest of this paper is organized as follows: Section “Theory and hypotheses” summarizes a literature review on eWOM, impulse buying, and the mediating effect of consumer inertia between positive eWOM and impulse buying. Accordingly, we developed a set of hypotheses and an integrated model combining flow theory and the S-O-R framework in this section. The study methods and results are then presented in Sections “Methods” and “Results”. Finally, Section “Discussion” discusses its implications, limitations, and future research.

Theory and hypotheses

eWOM and impulse buying

Research on impulse buying in social science began in the 1950s; the construct was associated with unplanned buying. The early study mainly investigated purchase decisions made by consumers after entering a retail store (Silvera et al. 2008). The impulse behavior research extended to exploring people’s reactions to the stimuli that markedly heighten emotional reactions (Iyer et al. 2020; Kim and Johnson 2016). Meanwhile, eWOM, engaged in spreading positive or negative service experiences (Zhang, Omran et al. 2021; Wakefield and Wakefield 2018), is a disseminating means in marketing and must be considered an essential topic in the online shopping era (Ahmad et al. 2022). Over the past decades, researchers have examined the pros and cons of eWOM in online shopping on short- and long-term judgments, as well as the influences of consumers’ product involvement and purchase experiences on the decisions (e.g., Abbasi et al. 2023; Ahmad et al. 2022; Hu and Kim 2018; Kim and Johnson 2016; Lee et al. 2022).

Tsao and Hsieh (2015) found that eWOM, transmitted by experts, celebrities, and other shoppers, can be more trusted than the stimuli from marketers. As a result, most consumers are accustomed to browsing reviews from other online users or internet celebrities before shopping online. Although opposing ratings are more potent in the marginal decrease of sales than positive ones are in the additional increase of sales (Chevalier and Mayzlin 2006; Verma and Dewani 2021), favorable consumers with self-enhancement and enjoyment are likelier to send recommendations that lead to impulse purchasing (Hu and Kim 2018; Kim and Johnson 2016). Furthermore, the argument quality of online reviews, characterized by perceived informativeness and persuasiveness, source credibility, and the number of reviews, significantly affects consumers’ purchase intention (Zhang et al. 2018).

In brief, the argument quality of online reviews, characterized by perceived informativeness, persuasiveness, and credibility, can affect consumers’ purchase intention. Those recommendations cause self-control failure (e.g., conflicting goals and standards, failure to keep track, or depletion of self-regulatory resources), which leads to impulsive purchases (Baumeister 2002; Lamberton 2020; Zhang et al. 2018). This occurrence is widespread in online shopping; therefore, the above discussion led us to form the following hypothesis:

H1: Positive eWOM contributes to impulse buying.

Consumer inertia in the impulse-control intervention

However, positive eWOM growth is also critical for consumers to resume reflective self-control, associated with re-examining the negative side of the established belief systems (Chevalier and Mayzlin 2006; Lamberton 2020; Vafeas and Hughes 2021). Consumer inertia as a risk-reduction strategy will likely retake charge in this appraisal transformation to cope with the rise of favorable reviews or ratings while embracing a new belief system (Chevalier and Mayzlin 2006; Kuo et al. 2013; Shiu 2021).

In management literature, inertia is defined as “rigid behavior and a reliance on past responses” (Vafeas and Hughes 2021). The construct can be conceptualized as having cognitive, affective, and behavioral aspects (Polites and Karahanna 2012). According to Kuppens et al. (2010), affective inertia is the degree to which a previous emotion can predict a person’s current emotional status, and it is defined as an emotional change brought on by pressure. In contrast, cognitive inertia consumes one’s mental resources in choosing options (Bruyneel et al. 2006). The third type, behavioral inertia, is what individuals always do without overthinking (Messner and Vosgerau 2010). The three types, taken together, demonstrate the propensity of consumers to stick to the habits or actions they adopt to respond rationally or irrationally (Anderson and Srinivasan 2003; Polites and Karahanna 2012; Shiu 2021; Shiu and Tzeng 2018).

A primary question is whether consumers can satisfy their needs using heuristic shortcuts in impulse control. This phenomenon relies on a particular condition when trading risks for benefits possibly invites bad long-term outcomes or as an alternative when self-control against impulsive purchases is vital for more rewarding ones (Reyna and Farley 2006). In light of this, consumer inertia is believed to be crucial for impulse-control intervention. The following hypotheses about the mediating roles of three dimensions of consumer inertia as risk-reduction strategies were thus developed for the transition from positive eWOM to impulse buying:

H2: Three types of consumer inertia mediate the relationship between positive eWOM and impulse buying (i.e., H2a: affective inertia, H2b: cognitive inertia, H2c: behavioral inertia).

The reciprocal influences among three types of consumer inertia

Previous relevant studies have investigated e-commerce adoption, focusing on users’ psychological influences (e.g., motivation, personality, and perception) (Al-Adwan et al. 2022). With that focus, flow theory posits that complete engagement in an intrinsically rewarding activity can elicit optimal experience through the presence of consumers’ cognitive and affective states (Csikszentmihalyi 2020; Ming et al. 2021). Individuals tend first to recall items linked together in their memory of cognition and affection in decision-making. When positive reinforcement is most continuously activated, the habitual use of the belief system will emerge from the genuine subconscious. As a result, behavioral inertia represents a consistent repurchasing or re-patronizing behavior for select products/services due to perceived transition costs or psychological commitment (Anderson and Srinivasan 2003; Huang and Yu 1999; Polites and Karahanna 2012; Seth et al. 2020). According to the above discussion, ongoing affective and cognitive stimulation is what leads to behavioral inertia. Thus, we put forth the following hypotheses:

H3: Behavioral inertia mediates the relationship between affective inertia and impulse buying.

H4: Behavioral inertia mediates the relationship between cognitive inertia and impulse buying.

Research model

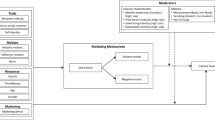

The hypothesized model we developed from the extant psychological research is illustrated in Fig. 1. The research model integrated the flow theory into a S-O-R framework (Ming et al. 2021; Shiu et al. 2023). Considering the cognitive load of rising reviews or ratings, this study aimed to examine whether a stimulus, such as positive eWOM, affects the flow experience that can trigger the intrinsic states of organisms, including three types of consumer inertia, leading to a response, such as impulse buying. The investigation focused on the direct impact of positive eWOM on impulse buying and the indirect effect of impulse control by including three mediators in this relationship (i.e., affective, cognitive, and behavioral inertia). Moreover, two additional mediating effects of behavioral inertia in the relationships between cognitive inertia and impulse buying and between affective inertia and impulse buying were tested since the behavioral habit likely stems from mental awareness and psychological emotion. Finally, the integrated model was built to evaluate consumers’ use of inertia as a risk-reduction/facilitating strategy that explains the transition from positive eWOM to impulse buying in an online shopping frenzy. Table 1 exhibits the most relevant studies supporting the integrated model and each hypothesis.

The research model integrated flow theory into a S-O-R framework. The study looked at how a stimulus—in this case, positive eWOM—affects the sensation of flow, which can cause three different types of consumer inertia and, ultimately, a response—in this case, impulse buying—by evoking the intrinsic states of an organism.

Methods

Sample and data collection

The online shopping festival has become a popular marketing strategy in China. The Double 11 Shopping Festival, which Alibaba initiated in 2009, has become the world’s largest online shopping festival that offers various discounts and promotions. In this online shopping carnival, personal involvement, informational incentives, and social influence effectively promote consumers’ impulse buying (Xu et al. 2017; Zhang, Shao et al. 2021). Therefore, the research context complies with the scope of the research model associated with eWOM and impulse buying to test the mediating role of consumer inertia (Lucas 2003). Some shoppers who participated in the Double Eleven shopping festival in 2020 were invited to our online survey at two sampling stages (i.e., pre-test and formal surveys). Recommended as a precursor to confirmatory factor analysis (CFA) and structural equation modeling (SEM), the scale items were examined using an exploratory factor analysis (EFA) for major revision and purification in pre-test surveys (Hair et al. 2018). Ultimately, 497 valid responses using convenience sampling were collected in the formal study; this number of responses exceeded a minimum sample size of 200 for the subsequent analytical steps, including CFA and SEM (see the research flowchart in Fig. 2).

Table 2 describes the participants’ profiles. Total valid respondents n = 497; 62.8% of the respondents were female, and 37.2% were male. 76.4% were under 34 years of age. 75.8% held junior college or undergraduate degrees, and 66.2% were office workers (e.g., government employees, state-owned enterprise staff, and private enterprise workers). All income levels range from 22.5% to 27.4%. The sample profile has some degree of representation of current online shoppers in China; moreover, a biased sample can still be a reasonable estimate because most demographics were not missing out on sampling (Hair et al. 2018).

Measures

The Double Eleven event scenario has been adapted to investigate the research theme associated with eWOM and impulse behavior. The questionnaire included five variables: positive eWOM, three types of inertia, and impulse buying. Each item was measured on a five-point Likert scale (1 = strongly disagree to 5 = strongly agree). The Cronbach’s alphas for all constructs ranged from 0.76 to 0.79, and the 20-item scale was 0.94, indicating acceptable internal consistency (Hair et al. 2018).

The items used in the study were adopted from the extant and relevant literature (see measures in the Supplementary Appendix). Four items were adapted from Chevalier and Mayzlin (2006) to measure positive eWOM (α = 0.79). To measure consumer inertia, three dimensions (i.e., affective, cognitive, and behavioral inertia) were measured each by four items adapted from Kuppens et al. (2010), Messner and Vosgerau (2010), and Anderson and Srinivasan (2003) (α = 0.78, 0.76, and 0.78, respectively). Lastly, we used four items adapted from Rook and Fisher (1995) to measure impulse buying tendency (α = 0.78). Several demographic characteristics were controlled in the SEM analysis, such as gender, age, level of education, occupation, and monthly income.

Results

CFA-reliability and validity

We used standardized factor loadings (SFLs) from the measurement model with the suitable model fit to assess the composite reliability (CR) and average variance extracted (AVE). Tables 3 and 4 present the reliability and validity analysis results, respectively.

Table 3 shows that positive eWOM has a CR value of 0.86; affective inertia, 0.86; cognitive inertia, 0.85; behavioral inertia, 0.86; and impulse buying, 0.86. All values of CR and each construct’s SFLs exceed the minimum requirement of 0.70, indicating good construct reliability (Hair et al. 2018).

Table 4 shows the key variables’ mean, standard deviations, and Pearson correlations. Positive eWOM, three types of consumer inertia, and impulse buying are closely correlated (r raged from 0.63 to 0.71); all correlations are significant at the 0.01 level. The results also show satisfactory convergent and discriminant validities because all AVE exceed 0.50, and each square root of AVE located along the diagonal (in boldface) is greater than the corresponding correlations in the off-diagonal (Hair et al. 2018).

Model fit

We conducted CFA and SEM for the measurement and structural models. Table 5 displays the assessment of model fit indices, suggesting both measurement and structural models were favorable because χ2/df was below 3, the goodness-of-fit index (GFI) was above 0.90, the comparative fit index (CFI) and incremental fit index (IFI) were above 0.95, and standardized root mean square residual (SRMR) and root mean square error of approximation (RMSEA) were below 0.05 (Hair et al. 2018).

Path analysis

Structural equation modeling was used to construct simultaneous regression paths and test the hypothesized model (see results in Table 6). Following a similar practice recommended, the SEM analyzed mediation when consumer inertia was introduced in the relationship between positive eWOM and impulse buying. The results show positive eWOM contributed to impulse buying (β = 0.14, p < 0.01). Thus, H1 is supported. Furthermore, as a result of having H1 supported, affective inertia partially mediated the relationship between positive eWOM and impulse buying because both relationships of positive eWOM−affective inertia (β = 0.70, p < 0.001) and affective inertia−impulse buying (β = 0.21, p < 0.001) were found significant. This result indicates that H2a is partially supported. Similarly, cognitive inertia also partially mediated the relationship because both positive eWOM−cognitive inertia (β = 0.65, p < 0.001) and cognitive inertia−impulse buying (β = 0.39, p < 0.001) were found significant. Thus, H2b is partially supported. Also, behavioral inertia partially mediated the relationship because both positive eWOM−behavioral inertia (β = 0.22, p < 0.001) and behavioral inertia−impulse buying (β = 0.17, p < 0.001) relationships were found significant. Thus, H2c is partially supported.

In addition, two mediating effects of behavioral inertia between affective inertia and impulse buying and between cognitive inertia and impulse buying were also assessed. The results showed that behavioral inertia was the partial mediator between affective inertia and impulse buying because all relationships among affective inertia, behavioral inertia, and impulse buying were found significant (β = 0.39, p < 0.001; β = 0.17, p < 0.001; β = 0.21, p < 0.001, respectively). Thus, H3 is partially supported. Similarly, behavioral inertia was also the partial mediator between cognitive inertia and impulse buying because all relationships among cognitive inertia, behavioral inertia, and impulse buying were found significant (β = 0.25, p < 0.001; β = 0.17, p < 0.001; β = 0.39, p < 0.001, respectively). Thus, H4 is partially supported.

Model power

Hair et al. (2018) suggested that the R2 values of 0.01, 0.09, and 0.25 can be used as threshold values to demonstrate predictive power. As for the explained variances, the proposed model showed excellent squared multiple correlations (R2) for the dependent variables (above 0.25), such as affective inertia (AI: R2 = 0.49), cognitive inertia (CI: R2 = 0.42), behavioral inertia (BI: R2 = 0.53), and impulse buying (IB, R2 = 0.58). These results suggest that large impacts on the endogenous variables were captured in the hypothesized model (see Fig. 3). The R2 values indicated a good explanation of the model building, and more than 50% of the variance in impulse buying could be explained.

This figure shows the S-O-R transition results and the variances explained on the endogenous variables in the hypothesized model. eWOM positive electronic word-of-mouth, AI affective inertia, CI cognitive inertia, BI behavioral inertia, IB impulse buying. Note: ➔Significant (p < 0.05) ⇢ Nonsignificant (p > 0.05). *p < 0.05, **p < 0.01, ***p < 0.001 (two-tailed).

Discussion

The study used a survey-based approach to collect data from a sample of Chinese consumers participating in an online shopping festival. The survey included questions about positive eWOM, consumer inertia, and impulse buying behavior. The data were analyzed using structural equation modeling to examine the mediating role of consumer inertia in the relationship between positive eWOM and impulse buying. The empirical results show that positive eWOM can lead to impulse buying directly (H1), simultaneously through the mediating effects of affective-, cognitive-, and behavioral-based inertia (H2a, H2b, and H2c, respectively). In addition, the affective and cognitive styles enhance the dependence of behavioral inertia on impulse buying under continuous stimulation (H3 and H4, respectively).

Theoretical implications

This study contributes to the literature by providing a comprehensive understanding of the mediating role of consumer inertia in the relationship between positive eWOM and impulse buying. The above results demonstrated some academic implications for understanding consumers’ rational and irrational choices in an online shopping frenzy. Consistent with the existing literature, positive eWOM influences shoppers’ information adoption in decision-making, thereby contributing to the impulse behavior of consumers. However, we show for the first time that the rise of positive eWOM also leads to reflective impulse control. Consumer inertia is an effective risk-reduction strategy to reduce the cognitive load of stimuli from the increasing positive eWOM. The risk-reduction approach helps consumers make more rational online shopping decisions (Shiu 2021).

Managerial implications and recommendations

Furthermore, the findings of this study can help marketers better understand the role of consumer inertia in impulse buying and provide insights into how to manage impulse buying during online shopping festivals. Two main managerial implications emerge. First, positive eWOM is significant for making remarkable sales records during an online shopping festival since time constraints often restrict consumers’ options. As a result, online shoppers have no choice but to rely on favorable reviews or ratings from other users or internet celebrities (Verma and Dewani 2021). Accordingly, e-retailers may optimize their marketing strategies by improving the quality of their products and online customer services to elicit positive evaluations. Second, consumer inertia reforms the transition from positive eWOM to impulse buying into more confident decision-making. The behavioral inertia, which emerges from ongoing affective and cognitive stimulation, ultimately coheres to impulse buying of one brand later. Therefore, marketers need to develop customers’ brand trust and loyalty by highlighting the importance of online reviews.

Social implications and solutions

However, the findings also reveal at least two social implications. Given that consumer inertia partially mediates the positive eWOM–impulse buying relationship for prudent buyers, impulse buying may still be problematic in an online shopping frenzy if consumers have no prior experience (Lee et al. 2022; Shiu 2017). That is because the affective facet of impulsive behavior is susceptible to interpersonal and social influences, and the cognitive aspect is incapable of identifying fraudulent reviews. Public policy and social marketing are two possible solutions for reducing inappropriate impulse purchases (Silvera et al. 2008).

Limitations and future research

Our research has contributed to understanding inertia as a risk-reduction strategy and consumers’ self-control that mediates and explains the affective, cognitive, and behavioral processes associated with impulse buying triggered by positive eWOM. However, some restrictions may provide future research direction and further improvement potential. One limitation is that this study investigated the conceptual model within the e-commerce context in China. This integrated model also needs empirical validation across various e-commerce platforms and countries. In addition, many triggers might affect impulse buying; however, only the effect of positive eWOM was considered and investigated in this study. Notably, the other internal and external factors contributing to impulsive buying behavior, such as traits, motives, and marketing stimuli, should be included in future research to understand consumers’ self-control behavior (Iyer et al. 2020). Moreover, since rational decision-making cannot select wisely among similar options in a confusing setting (Shiu 2021), future research should therefore examine the moderating effect of consumer confusion on the relationships between consumer inertia and impulse buying, as well as between positive eWOM and impulse buying, as online marketing channel sales increase yearly. Last but not least, it will also be worthwhile for marketers and researchers to explore viable strategies (e.g., service failure/recovery) for dealing with the expectancy violation of consumers at the post-decision stage (Yang and Mundel 2022; Wakefield and Wakefield 2018).

Data availability

The data supporting this study’s findings are available from the corresponding author upon reasonable request.

References

Abbasi AZ, Tsiotsou RH, Hussain K, Rather RA, Ting DH (2023) Investigating the impact of social media images’ value, consumer engagement, and involvement on eWOM of a tourism destination: a transmittal mediation approach. J Retail Consum Serv 71:103231. https://doi.org/10.1016/j.jretconser.2022.103231

Ahmad A, AlMallah MM, AbedRabbo M(2022) Does eWOM influence entrepreneurial firms’ rate of diffusion of innovation? J Res Mark Entrep 24(1):92–111. https://doi.org/10.1108/JRME-01-2021-0012

Al-Adwan AS, Al-Debei MM, Dvivedi YK (2022) E-commerce in high uncertainty avoidance cultures: the driving forces of repurchase and word-of-mouth intentions. Technol Soc 71:102083. https://doi.org/10.1016/j.techsoc.2022.102083

Anderson RE, Srinivasan SS (2003) E-satisfaction and e-loyalty: a contingency framework. Psychol Mark 20(2):123–138. https://doi.org/10.1002/mar.10063

Baumeister RF (2002) Yielding to temptation: self-control failure, impulsive purchasing, and consumer behavior. J Consum Res 28(4):670–676. https://doi.org/10.1086/338209

Bruyneel S, Dewitte S, Vohs KD, Warlop L (2006) Repeated choosing increases susceptibility to affective product features. Int J Res Mark 23(2):215–225. https://doi.org/10.1016/j.ijresmar.2005.12.002

Chan TKH, Cheung CMK, Lee ZWY (2017) The state of online impulse-buying research: a literature analysis. Inf Manage 54(2):204–217. https://doi.org/10.1016/j.im.2016.06.001

Chevalier JA, Mayzlin D (2006) The effect of word of mouth on sales: online book reviews. J Mark Res 43(3):345–354. https://doi.org/10.1509/jmkr.43.3.345

Csikszentmihalyi M (2020) Finding flow: the psychology of engagement with everyday life. Hachette, UK

Hair JF, Sarstedt M, Ringle CM, Gudergan SP (2018) Advanced issues in partial least squares structural equation modeling (PLS-SEM). Thousand Oaks, CA, Sage

Horvath C, Buettner OB, Belei N, Adiguzel F (2015) Balancing the balance: self-control mechanisms and compulsive buying. J Econ Psychol 49:120–132. https://doi.org/10.1016/j.joep.2015.05.004

Hu Y, Kim HJ (2018) Positive and negative eWOM motivations and hotel customers’ eWOM behavior: does personality matter? Int J Hosp Manag 75:27–37. https://doi.org/10.1016/j.ijhm.2018.03.004

Huang MH, Yu ST(1999) Are consumers inherently or situationally brand loyal? A set intercorrelation account for conscious brand loyalty and nonconscious inertia Psychol Mark 16(6):523–544. https://doi.org/10.1002/(SICI)1520-6793(199909)16:6<523::AID-MAR5>3.0.CO;2-B

Iyer GR, Blut M, Xiao SH, Grewal D (2020) Impulse buying: a meta-analytic review. J Acad Mark Sci 48(3):384–404. https://doi.org/10.1007/s11747-019-00670-w

Kim AJ, Johnson KKP (2016) Power of consumers using social media: examining the influences of brand-related user-generated content on Facebook. Comput Hum Behav 58:98–108. https://doi.org/10.1016/j.chb.2015.12.047

Kuo Y, Hu T, Yang S (2013) Effects of inertia and satisfaction in female online shoppers on repeat-purchase intention: the moderating roles of word-of-mouth and alternative attraction. Manag Serv Qual 23(3):168–187. https://doi.org/10.1108/09604521311312219

Kuppens P, Allen NB, Sheeber LB (2010) Emotional inertia and psychological maladjustment. Psychol Sci 21(7):984–991. https://doi.org/10.1177/0956797610372634

Lamberton C (2020) Reflective self-control in self-control scholarship: a Peircean analysis. J Consum Psychol 30(1):201–207. https://doi.org/10.1002/jcpy.1144

Lee YY, Gan CL, Liew TW (2022) The impacts of mobile wallet app characteristics on online impulse buying: a moderated mediation model. Hum Behav Emerg Tech 2022:2767735. https://doi.org/10.1155/2022/2767735

Lucas JW (2003) Theory-testing, generalization, and the problem of external validity. Sociol Theor 21(3):236–253. https://doi.org/10.1111/1467-9558.00187

Messner C, Vosgerau J (2010) Cognitive inertia and the implicit association test. Journal of J Mark Res 47(2):374–386. https://doi.org/10.1509/jmkr.47.2.374

Ming J, Zeng J, Bilal M, Akram U, Fan M (2021) How social presence influences impulse buying behavior in live streaming commerce? The role of S-O-R theory. Int J Web Inf Syst 17(4):300–320. https://doi.org/10.1108/IJWIS-02-2021-0012

MOFCOM (2021) E-commerce in China 2020. https://dzsws.mofcom.gov.cn/article/ztxx/ndbg/202109/20210903199156.shtml. Accessed 25 Oct 2022

Polites GL, Karahanna E (2012) Shackled to the status quo: the inhibiting effects of incumbent system habit, switching costs, and inertia on new system acceptance. MIS Q 36(1):21–42. https://doi.org/10.2307/41410404

Reyna VF, Farley F (2006) Risk and rationality in adolescent decision making: implications for theory, practice, and public policy. Psychol Sci Public Interest 7(1):1–44. https://doi.org/10.1111/j.1529-1006.2006.00026.x

Rook DW, Fisher RJ (1995) Normative influences on impulsive buying behavior. J Consum Res 22(3):305–313. https://doi.org/10.1086/209452

Roy G, Datta B, Mukherjee S, Basu R (2021) Effect of eWOM stimuli and eWOM response on perceived service quality and online recommendation. Tour Recreat Res 46(4):457–472. https://doi.org/10.1080/02508281.2020.1809822

Seth H, Talwar S, Bhatia A, Saxena A, Dhir A (2020) Consumer resistance and inertia of retail investors: development of the resistance adoption inertia continuance (RAIC) framework. J Retail Consum Serv 55:102071. https://doi.org/10.1016/j.jretconser.2020.102071

Shiu JY (2017) Investigating consumer confusion in the retailing context: the causes and outcomes. Total Qual Manag Bus Excell 28(7-8):746–764. https://doi.org/10.1080/14783363.2015.1121094

Shiu JY (2018) Individual rationality and differences in Taiwanese spa hotel choice. Tour Econ 24(1):27–40. https://doi.org/10.1177/1354816617718972

Shiu JY (2021) Risk-reduction strategies in competitive convenience retail: how brand confusion can impact choice among existing similar alternatives. J Retail Consum Serv 61:102547. https://doi.org/10.1016/j.jretconser.2021.102547

Shiu JY, Liao ST, Tzeng SY (2023) How does online streaming reform e-commerce? An empirical assessment of immersive experience and social interaction in China. Hum Soc Sci Commun 10:224. https://doi.org/10.1057/s41599-023-01731-w

Shiu JY, Tzeng SY (2018) Consumer confusion moderates the inertia-purchase intention relationship. Soc Behav Pers 46(3):387–394. https://doi.org/10.2224/sbp.6792

Silvera DH, Lavack AM, Kropp F (2008) Impulse buying: the role of affect, social influence, and subjective wellbeing. J Consum Mark 25(1):23–33. https://doi.org/10.1108/07363760810845381

Tsao WC, Hsieh MT (2015) eWOM persuasiveness: do eWOM platforms and product type matter? Electron Commer Res 15(4):509–541. https://doi.org/10.1007/s10660-015-9198-z

Vafeas M, Hughes T (2021) Inertia, boredom, and complacency in business-to-business relationships: identifying and interpreting antecedents and manifestations. J Bus Res 130:210–220. https://doi.org/10.1016/j.jbusres.2021.03.038

Verma D, Dewani PP (2021) eWOM credibility: a comprehensive framework and literature review. Online Inf Rev 45(3):481–500. https://doi.org/10.1108/OIR-06-2020-0263

Wakefield LT, Wakefield RL(2018) Anxiety and ephemeral social media use in negative eWOM creation J Interact Mark 41(1):44–59. https://doi.org/10.1016/j.intmar.2017.09.005

Xu X, Li Q, Peng L, Hsia T, Huang C, Wu J (2017) The impact of informational incentives and social influence on consumer behavior during Alibaba’s online shopping carnival. Comput Hum Behav 76:245–254. https://doi.org/10.1016/j.chb.2017.07.018

Yang J, Mundel J(2022) Effects of brand feedback to negative eWOM on brand love/hate: an expectancy violation approach J Prod Brand Manag 31(2):279–292. https://doi.org/10.1108/JPBM-05-2020-2900

Zhang TT, Omran BA, Cobanoglu C (2021) Generation Y’s positive and negative eWOM: use of social media and mobile technology. Int J Contemp Hosp Manag 29(2):732–761. https://doi.org/10.1108/IJCHM-10-2015-0611

Zhang L, Shao Z, Li X, Feng Y (2021) Gamification and online impulse buying: the moderating effect of gender and age. Int J Inf Manage 61:102267. https://doi.org/10.1016/j.ijinfomgt.2020.102267

Zhang KZK, Xu H, Zhao S, Yu Y (2018) Online reviews and impulse buying behavior: the role of browsing and impulsiveness. Internet Res 28(3):522–543. https://doi.org/10.1108/IntR-12-2016-0377

Acknowledgements

This research is partly funded by the Higher Education Fund of the Macao SAR Government (Grant No.: HSS-MUST-2021-10) to the first author from 2021 to 2023.

Author information

Authors and Affiliations

Contributions

J.Y.S. contributed substantially to conceptualization, design, draft review/editing, and funding acquisition; G.W. contributed to the investigation, formal analysis, and original draft writing; H.-H.C. participated in English writing and draft revising; all three authors gave final approval of the version to be submitted.

Corresponding author

Ethics declarations

Competing interests

The authors declare no competing interests.

Ethical approval

This study was granted complete ethical standards of Macau University of Science and Technology regulations. The pre-test and formal survey followed relevant guidelines and rules as per the Declaration of Helsinki.

Informed consent

This article obtained prior consent from all human participants in the pre-test and formal survey.

Additional information

Publisher’s note Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Supplementary information

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons license, and indicate if changes were made. The images or other third party material in this article are included in the article’s Creative Commons license, unless indicated otherwise in a credit line to the material. If material is not included in the article’s Creative Commons license and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this license, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Shiu, J.Y., Wei, G. & Chang, HH. Impulse control during the online shopping frenzy in China: the role of consumer inertia. Humanit Soc Sci Commun 10, 667 (2023). https://doi.org/10.1057/s41599-023-02204-w

Received:

Accepted:

Published:

DOI: https://doi.org/10.1057/s41599-023-02204-w

- Springer Nature Limited