Abstract

This study aims to identify current topics in the corporate governance literature by conducting a bibliometric review of corporate governance bibliometric reviews published in the Scopus database. It applies different bibliometric analyses, including keyword cartography, authors’ citations, countries’ citations, organizations’ citations, documents’ citations, references’ citations, and journal citations. In addition, it applies evolution and content analyses. It reviewed 87 bibliometric reviews of corporate governance published in Scopus. VOSviewer was used as software for conducting bibliometric analysis, whereas author used CiteSpace and WordStat software for evolution and content analyses. The results identified four major clusters: (1) private equity, (2) corporate social responsibility, (3) gender diversity, and (4) sustainability. In addition, the results reveal that journals on Corporate Social Responsibility and Environmental Management, Management Review Quarterly, and Meditari Accountancy Research contribute to bibliometric reviews of corporate governance in terms of number of papers and citations. This study provides recommendations for future research in this area. This study has implications for bibliometric reviews of corporate governance topics such as corporate governance in specific legal and industrial contexts, ownership structure, attributes of the board of directors, and different financial decisions. This is the first study to review bibliometric analyses of corporate governance topics. These results will be useful in future bibliometric reviews of corporate governance. This study presents an overview of the bibliometric review development of corporate governance and a summary of the most productive authors, organizations, journal sources, and references. It also provides potential research opportunities for future bibliometric reviews of corporate governance topics.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

Introduction

Over the last few years, there has been an increase in research interest in bibliometric analysis. It is becoming increasingly popular owing to the development of new bibliographic software, quantitative and qualitative approaches, and the ability to deal with large amounts of data (Donthu et al. 2021). In addition, it allows for the application of different objective data analyses, identification of key trends and topics in a particular research field, assessment of journal performance, and determination of co-authorship and co-citation networks. This study examines previous bibliometric reviews on corporate governance topics and identifies research areas for future bibliometric reviews.

The corporate governance concept is important because of the separation between the managers and shareholders of a company, which creates conflicts of interest between them (Berle and Means 1932; Jensen and Meckling 1976). The shareholders’ goal is to maximize their wealth, whereas the managers’ goal is to gain financial and nonfinancial advantages. Consequently, managers may take advantage of company resources at the shareholders’ expense.

Several bibliometric reviews of corporate governance topics are available in the financial literature. A few reviews have focused on general corporate governance (Cucari 2019; Ellili 2023b; Khatib et al. 2022; Pandey et al. 2023). Other bibliometric studies have emphasized specific topics in corporate governance, such as the board of directors (Rebeiz 2022). In addition, some bibliometric studies consider other aspects of corporate governance, including sustainability (Barbanti et al. 2022; E-Vahdati et al. 2019), corporate social responsibility (CSR) practices (Lund-Thomsen and Pillay 2012), microinsurance performance (Apostolakis et al. 2015), the COVID-19 pandemic (Koutoupis et al. 2021), stakeholder management (Pedrini and Ferri 2019), internal audit (Behrend and Eulerich 2019), and integrated reporting (Thawani et al. 2024). By applying bibliometric and content analyses, this study identifies the most frequent topics in previous bibliometric reviews of corporate governance as well as various future research ideas.

This study had four research questions. (1) What were the most common topics in previous bibliometric reviews of corporate governance? This first question examines the main themes within previous bibliometric reviews, highlights thematic evolution over time, and indicates areas of academic interest. (2) What are the most productive authors, countries, and organizations that have contributed to bibliometric reviews of corporate governance? The second question targeted the key contributors—authors, countries, and organizations—to corporate governance bibliometrics. This offers insight into influential networks and collaborative patterns. (3) What are the most-cited bibliometric reviews? The third question sheds light on the impact of bibliometric reviews by identifying the most cited and influential papers. This offers a comprehensive list of essential papers for researchers. (4) What are the most cited reference papers and journals in the bibliometric reviews of corporate governance? This question focuses on foundational literature and journals, shedding light on the core academic resources contributing to ongoing research on corporate governance. The above questions were answered using different software such as VOSviewer, CiteSpace, and WordStat.

The research objectives of this study are as follows: (1) provide an overview of the major contributions of corporate governance bibliometric reviews; (2) determine the authors, organizations, countries, papers, and reference journals that have the greatest influence on this research topic; (3) create simple presentations by mapping and visualizing results; and (4) provide future research ideas.

This study employs a comprehensive bibliometric analysis methodology to examine the current state of corporate governance research. Utilizing VOSviewer, CiteSpace, and WordStat, our approach includes several key steps: (1) the extraction of bibliometric data from the Scopus database using targeted search queries related to corporate governance; (2) application of trend analysis to examine the evolution of research interest over time; (3) network analysis to explore co-authorship and co-citation patterns, revealing the most influential authors, organizations, and countries; (4) keyword analysis to identify common themes and emergent corporate governance topics; and (5) content analysis to further examine the thematic concentrations of the corporate governance literature.

Despite the availability of several reviews covering broad corporate governance themes and specific topics, there is a gap in the comprehensive compilation and analysis of bibliometric studies on corporate governance. By exploring the current state of bibliometric analyses in corporate governance, this study contributes to a novel synthesis of existing research and identifies emergent themes for future bibliometric reviews. To the best of our knowledge, there is no prior study on the bibliometric review of corporate governance bibliometric papers; therefore, this study provides insight into this topic. This study contributes to the corporate governance literature by evaluating the bibliometric reviews of this topic. The results identify four major clusters: (1) private equity, (2) CSR, (3) gender diversity, and (4) sustainability. Additionally, the results indicate that the number of bibliometric reviews of corporate governance publications has increased over the years, thereby reflecting the importance of this topic. Moreover, this study identifies the most productive authors, countries, and organizations; determines the most important references and journals; and proposes future research ideas in this field.

This study is a pioneering effort in corporate governance bibliometric reviews, marking an advancement beyond the existing literature by mapping the current state of research and shedding light on emerging trends and underexplored topics for future bibliometric reviews. Unlike prior reviews that focused on specific corporate governance topics, this comprehensive bibliometric analysis, utilizing different tools, such as VOSviewer, CiteSpace, and WordStat, enables a novel synthesis of the field’s development. By identifying four major clusters, private equity, CSR, gender diversity, and sustainability, this study highlights these areas as topics of interest and discusses their potential as future research areas. This study provides a consolidated foundation for researchers to examine corporate governance and offers theoretical and practical implications. Moreover, this study contributes a framework for future bibliometric reviews in corporate governance, guiding researchers toward areas for investigation and assisting practitioners and policymakers in aligning their strategies with the cutting edge of academic research.

The remainder of this paper is organized as follows. Section "Methodology and data" presents the methodology and data. Section "Results of trend, evolution, and bibliometric analyses" presents the results of the bibliometric and content analyses. Section "Future research directions" proposes future research ideas, and Section "Discussion, implication, limitations, and conclusion" concludes the paper.

Methodology and data

Methodology

Following Khan et al. (2022), Patel et al. (2022), and Ellili (2022, 2023a), this study combines qualitative and quantitative bibliometric analysis methods. It conducts the following analyses: (1) trend analysis, (2) evolution analysis, (3) keyword analysis, (4) authors’ citations, (5) countries’ citations, (6) organizations’ citations, (7) document citation analysis, (8) document co-citation analysis, (9) journal citations, and (10) content analysis.

Data

Data extraction

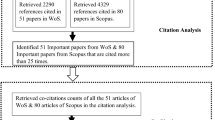

This study was conducted using Scopus documents because this database is considered the most comprehensive source of academic research documents and has the largest collection of high-quality papers of good quality (Elsevier 2020). In this study, we used the keywords “Bibliometric” and “Corporate Governance” in the article title, abstract, or keywords, and yielded 93 documents. This analysis did not consider bibliometric reviews of corporate governance published after December 25, 2022 (data extraction date). Data were filtered in multiple stages according to the Preferred Reporting Items for Systematic Reviews and Meta-Analyses (PRISMA) diagram (Moher et al. 2009) presented in Fig. 1. This diagram comprises of four major phases: identification, screening, eligibility, and inclusion.

The identification phase involves an initial search for studies, including the number of records identified through database searches and additional sources. In this phase, 93 records were identified using a specific search query that combined “Bibliometric” and “Corporate Governance” in titles, abstracts, and keywords. After this initial search, the records were screened for relevance in the screening phase, and duplicates were removed. In our analysis, no record was removed based on duplication or relevance, indicating the high relevance of the initial search results to the study’s focus. However, one document was excluded, resulting in 92 records based on document type and excluding an editorial piece. In the eligibility stage, the full texts of potentially relevant studies were assessed in more detail to determine their eligibility for inclusion in the review. This phase reports the number of full-text articles assessed for eligibility, the number excluded, and the reasons for exclusion. Five documents were excluded based on language criteria, with three in Spanish, one in Portuguese, and one in Ukrainian, leaving 87 records for inclusion in the bibliometric analysis. The inclusion stage reports the final number of studies included in the bibliometric analysis and provides a clear overview of the selection process. In our analysis, the final selection revealed 56 articles, 29 reviews, five conference papers, and two book chapters, totaling 87 documents.

Data processing

The data were filtered and exported to CSV Excel. They were then uploaded to VOSviewer and converted into Web of Sciences format for uploading to CiteSpace. The six steps of data processing and conversion are illustrated in Fig. 2. The first step included exporting filtered documents from the Scopus database to a CSV file in Excel format to organize and prepare the data for further analysis. The second step involved uploading the prepared CSV file to VOSviewer, a software tool, to construct and visualize bibliometric networks, including journals, authors, and papers. The third step includes a range of bibliometric analyses, including keyword cartography, author citations, country citations, organization citations, document citations, document co-citations, and journal citations, to explore various dimensions of academic contributions to the field of corporate governance. The fourth step involved converting the Excel file into a format compatible with CiteSpace, another bibliometric software tool, to identify trends and detect emerging topics within the literature. The fifth step involved applying content analysis using WordStat, a software tool for text analysis, to examine the themes and patterns within the titles and abstracts, providing qualitative insights into the bibliometric findings. The sixth and last step involves synthesizing insights from bibliometric and content analyses to highlight gaps in the literature and propose future research directions in corporate governance.

Software selection

In this study, we performed bibliometric analyses using VOSviewer software. We chose this software tool because of its robust capabilities in constructing and visualizing bibliometric networks, including co-authorship and co-citation networks, which are critical for understanding the structure and evolution of corporate governance literature. Additionally, it has a user-friendly interface and can handle large datasets (van Eck and Waltman 2010). In addition, we performed an evolution analysis using the CiteSpace software. We selected this software tool because of its strength in performing evolution analysis and detecting emerging trends in the literature. Its unique features, such as time splitting, enabled us to identify the main themes in the development of literature over time (Chen 2006). Finally, we performed content analysis using WordStat. This software tool was employed for content analysis because of its advanced text-mining capabilities, allowing for a detailed exploration of thematic content within the studied document cases (Peladeau 1998). Its flexibility in handling qualitative data facilitates a deeper understanding of the underlying themes in corporate governance research.

Together, these tools form a comprehensive set for bibliometric reviews. Each tool was selected for its specific contribution to our analytical framework, ensuring a robust and multifaceted literature examination.

Bibliometric analysis

Bibliometric analysis is a quantitative approach that applies statistical methods to academic publications to examine the patterns, trends, and dynamics within a specific research field (Donthu et al. 2021). We employed bibliometric analysis to review and synthesize existing bibliometric reviews on corporate governance. This analysis enables us to quantify the volume and growth of literature over time; analyze the network of research collaboration through co-authorship and citation patterns; identify the most influential authors, articles, and journals contributing to the field; identify clusters of research topics; and examine the evolution of the main themes in corporate governance research.

This study utilized several bibliometric analyses to achieve its research objectives. These analyses included co-citations, networks, trends, and keywords. Co-citation analysis examines the frequency with which two documents are cited together (Donthu et al. 2021) to identify the foundational documents and thematic relationships within the corporate governance literature. The network analysis technique maps and visualizes the relationships between authors, institutions, and countries, and reveals collaboration patterns (Donthu et al. 2021). Trend analysis involves examining publication counts over time (Donthu et al. 2021) to understand growth trends and research interest dynamics in corporate governance studies. Keyword analysis examines the co-occurrence of keywords within the literature (Donthu et al. 2021) to identify the main themes and emerging topics in corporate governance research.

Results of trend, evolution, and bibliometric analyses

This section analyzes the 87 corporate governance bibliometric reviews considered in this study and presents the results of the trends and different bibliometric analyses.

Trends in publications of corporate governance bibliometric reviews

Figure 3 illustrates the number of documents published in bibliometric reviews of corporate governance topics. The first bibliometric study of this topic was published in 2013 (Eulerich et al. 2013). The development of this type of study was very slow between 2010 and 2017, with a maximum of four papers published in 2018 and 2019. The number of publications increased in 2020 and 2021 to 17, and then continued to increase in 2022 to reach the highest number of 40. The increase in the number of publications indicates a higher interest of academic researchers in publishing bibliometric reviews of corporate governance topics in Scopus journals. In this analysis, the increase in the number of publications is explained not only by the growing recognition of the importance of corporate governance but also by the importance of integrating bibliometric reviews into research methods.

Current research topics

A keyword analysis was conducted to present the development and growth of corporate governance bibliometric reviews. Following Khan et al. (2022), meaningful analysis requires a minimum threshold of two occurrences for a particular keyword. This yielded 48 words with a total of 289. The results presented in Fig. 4 show that the most common terms are private equity, CSR, gender diversity, and sustainability.

Figure 4 illustrates four major clusters: (1) private equity (red), (2) corporate social responsibility (green), (3) gender diversity (blue), and (4) sustainability (yellow).

In the first cluster, bibliometric reviews mainly focused on the corporate governance of small and medium enterprises (SMEs) (Handley and Molloy 2022; Kumar et al. 2020). In particular, some studies have emphasized family firm internationalization (Alayo et al. 2021) and gender issues in family businesses (Nguyen et al. 2022). Other studies have examined the financial policies of indentureships (Coronel-Pangol et al. 2022; Sannajust and Groh 2023) and investments in private equity (Sharma et al. 2023).

In the CSR cluster, there are several bibliometric analyses of different topics, such as the evolution of research on CSR (Ferramosca and Verona 2020), CSR reporting (Turzo et al. 2022), CSR practices in the banking industry (Zainuldin and Lui 2022) and family firms (Mariani et al. 2023). Other studies have examined the relationship between CSR, accounting information quality, and earnings management practices (Kumar et al. 2023a, b).

In terms of gender diversity, bibliometric reviews have focused on the presence of females in corporate governance (Mumu et al. 2022). In particular, there are studies that examine the presence of women on boards of directors (Khatib et al. 2023) and female network directorships (Drago and Aliberti 2019).

In the sustainability cluster, there are several bibliometric reviews on different topics, such as the relationship between corporate governance and environmental performance (Enciso-Alfaro and García-Sánchez 2023; Zheng and Kouwenberg 2019) and the association between business strategy and sustainable development (Kumar et al. 2021a, b; Pizzi et al. 2020).

In addition to VOSviewer, CiteSpace was used after converting CVS files into the Web of Sciences format to determine the different stages, as well as the development patterns, of the most frequently occurring keywords in the corporate governance bibliometric reviews. The most common keywords were determined and presented in CiteSpace by time and frequency to create the time view shown in Fig. 5, which shows the most common keywords between 2013 and 2023. The first keywords were “corporate governance research” and “bibliometric method,” which were included in Eulerich (2013). The latter study was a bibliometric review of the corporate governance literature in Germany. “VOSviewer” and “Gephy” were the most common visualization software, and Scopus was the most used database in bibliometric reviews between 2016 and 2021. During this period, the most common topics of the bibliometric reviewers were “accounting,” “capital structure,” “board of directors,” “corporate social responsibility,” “board diversity,” and “sustainability.” In 2022, there was an extension in most of the topics already included in previous bibliometric analyses, such as “climate change,” “environmental, social, and governance” (ESG), “sustainable development goals,” “earnings management,” and “integrated reporting.” Other new topics emerged and were related to “venture capital,” “entrepreneurship,” and “blockchain.” In addition, the “Web of Science” database has been the most commonly used database in recent bibliometric reviews.

Authorship analysis

Table 1 presents the top cited authors of bibliometric reviews of corporate governance topics and their respective organizations and countries. This corresponds to a threshold of a minimum of three papers by the author, which yielded six of the 226 authors. Table 1 shows Kumar. S had the highest number of published documents and citations, followed by Pandey N., in terms of the number of papers. All remaining authors have published three papers. Caputo A. and Sureka R. have more than 100 citations, whereas Baker H. K. and Eulerich M. had fewer than 100 citations. All these authors have conducted bibliometric analyses of several journals that publish papers on corporate governance. Further details regarding these journals are presented in the co-authorship analysis.

In addition to citation performance analysis, co-authorship science mapping was applied to identify the major groups of authors that contributed to the publication of bibliometric reviews of corporate governance research topics. Because the corporate governance bibliometric review is new, the network of co-authorship includes all authors who have published at least two bibliometric reviews and one citation. This analysis indicates two main clusters, as shown in Fig. 6, which are led by Kumar, who made the highest contribution in terms of the number of papers and citations. Each cluster consists of seven authors. They were mainly located in India. The authors conducted bibliometric reviews of several journals. In particular, the first group of authors (green cluster) conducted bibliometric reviews of the European Financial Management (Baker et al. 2020a), Latin American Business Review (Kumar et al. 2020a, 2020b), Managerial Finance (Baker et al. 2020b), European Journal of Finance (Burton et al. 2020), Social Responsibility Journal (Kumar et al. 2023a, b), and Managerial Auditing Journal (Kumar et al. 2021a, b). The second group of authors (red cluster) applied bibliometric analysis to the Canadian Journal of Administrative Sciences (Donthu et al. 2022) and Business Strategy and the Environment (Kumar et al. 2021a, b).

Country analysis

The most cited countries are listed in Table 2. They correspond to a threshold of a minimum of five papers by country, yielding 11 countries, with 39. Table 2 presents the distribution of countries that have published bibliometric reviews of corporate governance. India had the highest contribution in terms of the number of publications, followed by Italy, while the United Kingdom had the highest number of citations. These three countries account for almost 44.34% of the total publications and 52.41% of the total citations. Malaysia, Spain, China, Australia, and Germany have more than 100 citations, while the USA, the United Arab Emirates, and Indonesia have citations lower than 100. In addition, Table 2 reveals that bibliometric reviews have mainly been conducted in Asia, Europe, the USA, and Australia.

In addition to the countries’ performance analysis, a co-authorship analysis was applied to determine the major groups of countries that contributed to corporate governance bibliometric reviews. Researchers on this topic could benefit from the information about potential international collaborations provided by this analysis. Since this research field is relatively new, the co-authorship network includes all countries with at least two publications, yielding 24 countries of 39. As shown in Fig. 7, there were four main clusters. The first cluster (red) consisted of seven countries, and was led by India, which had the highest number of publications. In addition, India has international collaborations not only with Asia but also with the United Kingdom, Australia, and the USA. The key topic of this cluster is a bibliometric review of different journals. The second cluster (green) consisted of six countries, led by Spain, with the most publications. Spain has conducted collaborative research with Germany, Portugal, Chile, and Ecuador, and the main topic is sustainability. The third cluster (blue) consisted of five countries, led by Italy. This cluster indicates that Italy collaborated most with China, Pakistan, Norway, and South Africa in research on sustainability. Finally, the fourth cluster (yellow) consisted of four countries led by the United Arab Emirates, which have research collaborations with Bahrain, Jordan, and Greece. Most studies in this author group are bibliometric reviews of different journals.

Organizations analysis

Table 3 illustrates the top organizations publishing papers in bibliometric reviews of corporate governance topics, which correspond to a threshold of a minimum of two papers and one citation per organization. Removing the duplications of several organizations resulted in 16 out of 184 organizations. Table 3 shows the distribution of organizations publishing bibliometric reviews on corporate governance. The Malaviya National Institute of Technology in India has the highest contribution in terms of the number of publications and citations, followed by Mansoura University in Egypt in the number of papers and Abu Dhabi University in the United Arab Emirates. These three organizations accounted for almost 45.62% of the total publications. The University of Trento in Italy and the University of Lincoln in the United Kingdom had the second highest number of citations, followed by the Global University in India, Swinburne University of Technology in Malaysia, and Swinburne University of Technology in Australia. The remaining organizations, except Azman Hashim International Business School in Malaysia, have two publications on bibliometric reviews of corporate governance topics.

In addition to the organization’s performance analysis, a co-authorship analysis was applied to determine the major groups of organizations that contributed to corporate governance bibliometric reviews. Researchers on this topic could benefit from the information about potential international collaborations provided by this analysis. The co-authorship network includes the top 100 organizations, with a total of 185. This corresponds to a minimum threshold of one paper and five citations by the organization. The analysis indicates two main clusters, as shown in Fig. 8. The first cluster (red) consists of four organizations and is led by the Universidad Catolica de la Santisima Concepcion in Chile, which has collaborative research with the Islamic University of Technology in Bangladesh, Saint Louis University in Spain, the International University of Business Agriculture and Technology in Bangladesh, and Universidad Pontificia Comillas in Spain. The main topic of this group of organizations is related to the association between corporate governance and governance. The second cluster (green) consists of three organizations and is led by Universidad Pontificia Comillas in Spain, which has research collaborations with the Islamic University of Technology and the International Islamic University Chittagong in Bangladesh. The main topic of this group of organizations is gender diversity in corporate governance.

Most cited papers

This section analyzes the ten most cited papers on corporate governance bibliometric reviews. The threshold was set to a minimum of 30 citations per paper. Table 4 indicates that the topics of the most cited papers vary from the review of specific journals, including Business Strategy and the Environment (Kumar et al. 2021a, b), Review of Managerial Science (Mas-Tur et al. 2020), and the European Journal of Finance (Burton et al. 2020), to the review of several topics related to corporate governance, such as mergers and acquisitions (Xie et al. 2017), sustainable development (Pizzi et al. 2020), shipping finance (Alexandridis et al. 2018), corporate governance in Germany (Tunger and Eulerich 2018), CSR (Ferramosca and Verona 2020), the capital structure of SMEs (Kumar et al. 2020), and internationalization of family firms (Alayo et al. 2021).

In addition to performance analysis, citation network analysis was applied to determine the major groups of papers that contributed to bibliometric reviews of corporate governance. Researchers on this topic can benefit from information on possible citations. The network included 87 papers. Figure 9 shows the two main clusters. The first cluster (red) consists of 22 papers, led by Xie et al. (2017), the main topic of which is related to the bibliometric review of several corporate governance topics. The second cluster (green) consisted of 13 papers led by Mas-Tur et al. (2020). The key topic of this group of papers is related to the bibliometric reviews of topics published in different journals.

Source analysis

This section presents the top sources of published papers on bibliometric reviews of corporate governance. The threshold was a minimum of three papers, yielding four of 68 sources. Table 5 shows these four journals, along with their respective numbers of publications and citations, and reveals that there is no concentration on a specific publisher. In addition, three of the four journals were ranked in the top Scopus quartile (Q1), with source-normalized impact per paper (SNIP) factors higher than 1.0. The SNIP measures the contextual citation impact by weighting citations based on the total number of citations in a subject field and comparing the citation impact of sources in different subject fields (Moed 2010).

In addition to the sources’ performance analysis, co-citation analysis was applied to determine the major groups of sources that published bibliometric reviews on corporate governance. Researchers on this topic could benefit from the information about potential publications provided by this analysis. The co-citation network included the top 100 co-cited sources of 2,497 sources. The analysis identified five main clusters, as shown in Fig. 10. The first cluster (red) consists of 27 sources and was led by the Journal of Business Ethics. The main topic of this cluster was a bibliometric review of topics related to CSR and sustainability. The second cluster (green) consists of 22 sources and was led by the Journal of Financial Economics. The key topics of the bibliometric review in this cluster were mainly related to private equity and CSR. The third cluster (blue) consists of 18 sources and is led by Scientometrics. The main research topics of this group are related to all the clusters identified in Sect. "Current research topics:". This includes private equity, CSR, board diversity, and sustainability. The fourth cluster (yellow) consists of 18 sources led by the Accounting Review. The main topics of the bibliometric reviews in this group of sources are related to CSR and sustainability. The first cluster (purple) comprised 18 sources, which the Journal of Cleaner Production leads. The main topics of this group were related to CSR and sustainability.

Most cited references

This section presents the top-cited references in the bibliometric reviews of corporate governance topics. The threshold was a minimum of five citations of a reference, yielding eight references for a total of 7,850. Table 6 illustrates that six of the most cited reference papers are in bibliometric review guidelines and software, whereas only two references are related to corporate governance theories (Jensen and Meckling 1976; Shleifer and Vishny 1997). This analysis is helpful for researchers interested in bibliometric analysis and corporate governance to identify the most common references.

In addition to reference citation analysis, a reference co-citation analysis was conducted to determine the reference groups cited in the bibliometric reviews of corporate governance. Researchers interested in this field will find useful information regarding the most common references. The co-citation network included references with at least three citations. This yielded 35 references with a total of 7,850. Figure 11 shows the four main clusters. The first cluster (red) includes 12 references led by Pritchard (1969). These references are mainly related to bibliometric guidelines and software. The second cluster (green) includes eight references, led by Van Eck and Waltman (2010). The main topic of this cluster is related to different bibliometric analyses (such as co-citation) and the different databases used in bibliometric reviews (such as Scopus and Web of Sciences). The third cluster (blue) consists of eight references led by Jensen and Meckling (1976). This cluster is primarily related to different corporate governance theories. The fourth cluster (yellow) included seven references, as led by Kessler (1963). Most studies in this cluster are bibliometric reviews (Huang and Ho 2011; Tunger and Eulerish 2018).

Content analysis

In addition to the above bibliometric analyses, content analysis of the titles and abstracts of corporate governance bibliometrics was conducted using WordStat. This software utilizes specific metrics, including coherence (normalized pointwise mutual information [NPMI]), frequency (FREQ), and cases (Peladeau 1998). The NPMI is a standardized measure that assesses the thematic similarity of words within a topic, where higher values indicate more coherent topics. FREQ refers to the frequency of the occurrence of the most significant terms within each topic, offering insights into the dominant terms characterizing each topic. Cases represent the number of documents in which the top terms of a topic appear, providing a quantitative measure of the prevalence of each topic within the studied documents. Table 7 illustrates the five topics: firm performance, environmental disclosure, social responsibility, risk management, and gender diversity. These results indicate a similarity between the topics identified by the content and the clusters determined by keyword analysis with regard to sustainability, CSR, and gender diversity.

As shown in Table 7, firm performance represents 31.48% of the total bibliometric review topics of corporate governance. This topic includes two main types of bibliometric review. The first type of bibliometric review is related to the analysis of different corporate governance aspects, including the audit committee (Ha 2022), institutional investors (Ding et al. 2022), information (Kushkowski et al. 2020), and board of directors (Mirone et al. 2021). The second type of bibliometric review is related to the analysis of different journal publications and performance.

Environmental disclosure accounted for 25.46% of the total topics and mainly included bibliometric reviews of ESG disclosure (Khan 2022; Siao et al. 2022), environmental sustainability (di Vaio et al. 2023; Enciso-Alfaro and García-Sánchez 2023), and sustainable development goals (Pizzi et al. 2020).

Social responsibility was another topic identified by WordStat, representing 19.44% of the total topics. Studies on this topic are primarily related to CSR disclosure (Kumar et al. 2023a, b), CSR practices (Mariani et al. 2023), stakeholder engagement (Rodríguez-Fernández et al. 2020), and Islamic corporate governance (Pahlevi 2023).

Risk management accounted for 15.74% of all the topics. Bibliometric reviews of this topic have been conducted on risk management (Singhania et al. 2022), financial risk (Syed and Bawazir 2021), and earnings management (Teixeira and Rodrigues 2022).

The fifth and last topic identified by the content analysis was board diversity, which represented 7.88% of the total topics, including bibliometric reviews of the presence of women on the board of directors (Khatib et al. 2023; Mumu et al. 2022) and the network of female directors (Drago and Aliberti 2019).

Future research directions

The above bibliometric and content analyses have identified several research gaps. Bibliometric reviews of corporate governance have focused on a few areas, including private equity, CSR, sustainability, board diversity, and risk management. In this section, we summarize the research directions for future bibliometric reviews of corporate governance topics. These directions include the following.

-

1.

Corporate governance in a specific region Previous bibliometric reviews have been limited to a few countries, such as Ghana (Antwi et al. 2022), Zimbabwe (Nyakurukwa and Seetharam, 2023), Malaysia (Khatib et al. 2022), and Germany (Eulerich et al. 2013; Tunger and Eulerich 2018). Conducting bibliometric reviews of corporate governance in other regions would be of great interest. These regions can be determined based on geographical location (such as the Gulf Cooperation Council, the Middle East, and North Africa), type of law (common law versus civil law), and level of development (emerging versus developed countries). This would help to identify specific corporate governance systems according to geographical, legal, and developmental contexts.

-

2.

Corporate governance of specific industries Results of this study. Previous bibliometric reviews have focused on private equity and family firms (Alayo et al. 2021; Mariani et al. 2023; Nguyen et al. 2022). It would be interesting to apply bibliometric reviews of corporate governance in specific industries such as banking, real estate, tourism, and education. This would help us to understand the characteristics of corporate governance by industry.

-

3.

External corporate governance mechanisms Previous bibliometric reviews have focused only on internal corporate governance mechanisms, such as boards of directors (Trinarningsih et al. 2021) and institutional investors (Ding et al. 2022). Considering external mechanisms, such as government regulations, will be of great interest. This would help further understand the literature and propose recommendations for future research on these external mechanisms.

-

4.

Role of ownership structure in corporate governance This study’s bibliometric and content analyses identified a research gap in applying bibliometric reviews of investors other than institutional investors. It would be interesting to consider the role of other types of investors, such as managers, blockholders, or foreign investors, in future bibliometric reviews. This would help researchers identify future topics in this field.

-

5.

Other board of directors’ attributes Board diversity has been commonly reviewed in previous bibliometric research (Khatib et al. 2023). Other attributes of the board of directors include the board size, duality, and independence. It would be interesting to further explore these attributes because of the importance of their impact on corporate governance. This recommendation would be useful for corporate governance researchers who want to conduct bibliometric reviews to identify the main topics in this field and research gaps.

-

6.

Relationship between corporate governance and dividend payout A few previous bibliometric reviews have focused on the capital structure and financial policy (Hegde et al. 2023; Kumar et al. 2020). While there are other important financial decisions such as dividend payouts, applying future bibliometric reviews to the relationship between corporate governance and dividend payouts would be of great interest.

-

7.

Corporate governance in the digitalization era Digitalization has changed business models over the last few years. Sama et al. (2022) discussed the opportunities and challenges of corporate governance in the digital economy. There is a need to review the main topics related to this research field and identify different possible digital transformations in corporate governance, such as digital boards of directors.

Discussion, implication, limitations, and conclusion

This study analyzes corporate governance bibliometric reviews published in Scopus, identifies the key concepts in this field, and provides future research ideas. Trend analysis identifies a growing interest in this subject, particularly evident from the increase in publications between 2020 and 2022, reflecting the evolving importance of corporate governance in academic research. The bibliometric and content analyses identified four major research topics in corporate governance: (1) private equity, (2) CSR, (3) gender diversity, and (4) sustainability. In addition, different bibliometric analyses identified the most productive authors, organizations, and countries. More particularly, Kumar S. and Pandey N. have made significant contributions and citations in corporate governance bibliometric reviews. Organizations such as the Malaviya National Institute of Technology in India and Mansoura University in Egypt are recognized as significant research centers, demonstrating high research productivity in this field. Furthermore, countries such as India, Italy, and the United Kingdom lead publications in this field and have strong international collaborations, advancing research on corporate governance bibliometric reviews. This study also emphasizes the importance of the pioneering studies of Jensen and Meckling (1976) and Shleifer and Vishny (1997), which continue to guide current research, reflecting their continuing impact on corporate governance theories.

This study has several implications. First, it summarizes the evolution of bibliometric reviews of corporate governance topics and identifies the key topics in this field. Second, it provides researchers with the idea of cited papers and relevant references. Third, the findings of this study will help bibliometric review researchers interested in corporate governance gain knowledge about possible future research ideas on which they would focus. They can focus on corporate governance in specific legal and industrial contexts. In addition, it has been noted that different research opportunities require further analysis. Moreover, most studies emphasize internal corporate governance mechanisms. Due to the dynamics of the external environment, it is interesting for researchers to continuously evolve their studies to improve their research outcomes. Additionally, the main drive of corporate governance has traditionally been adopted; it would be of great interest to explore corporate governance in the digitalization era.

This study also highlights the need to examine the potential associations between corporate governance and different strategic financial decisions, such as dividend payouts. Further research should be conducted in this direction, as most bibliometric studies focus on CSR and sustainability. Although companies are advised to promote social responsibility and sustainable development, increasing shareholders’ wealth and maximizing financial performance remain important objectives.

Although this study provides useful insights into bibliometric reviews of corporate governance, it has a few limitations. First, it was limited to including only documents published in Scopus; future research may include other databases, such as the Web of Sciences. Second, this study used three different software programs—VOSviewer, CiteSpace, and WordStat—and future studies may explore other bibliographic software such as bibliometrics. This will present a more comprehensive analysis of the bibliometric reviews of a specific topic.

References

Alayo, M., T. Iturralde, A. Maseda, and G. Aparicio. 2021. Mapping family firm internationalization research: Bibliometric and literature review. Review of Managerial Science 15 (6): 1517–1560. https://doi.org/10.1007/s11846-020-00404-1.

Alexandridis, G., M.G. Kavussanos, C.Y. Kim, D.A. Tsouknidis, and I.D. Visvikis. 2018. A survey of shipping finance research: Setting the future research agenda. Transportation Research Part E: Logistics and Transportation Review 115: 164–212. https://doi.org/10.1016/j.tre.2018.04.001.

Antwi, I.F., C. Carvalho, and C. Carmo. 2022. Corporate governance research in Ghana through bibliometric method: Review of existing literature. Cogent Business and Management 9 (1): 2088457. https://doi.org/10.1080/23311975.2022.2088457.

Apostolakis, G., G. van Dijk, and P. Drakos. 2015. Microinsurance performance—A systematic narrative literature review. Corporate Governance (Bingley) 15 (1): 146–170. https://doi.org/10.1108/CG-08-2014-0098.

Ayoko, O.B., A. Caputo, and J. Mendy. 2021. Management research contributions to the COVID-19: A bibliometric literature review and analysis of the contributions from the Journal of Management and Organization. Journal of Management and Organization 27 (6): 1183–1209. https://doi.org/10.1017/jmo.2021.70.

Baker, H.K., S. Kumar, and N. Pandey. 2020a. A bibliometric analysis of European Financial Managementʼs first 25 years. European Financial Management 26 (5): 1224–1260. https://doi.org/10.1111/eufm.12286.

Baker, H.K., S. Kumar, and N. Pandey. 2020b. A bibliometric analysis of Managerial Finance: A retrospective. Managerial Finance 46 (11): 1495–1517. https://doi.org/10.1108/MF-06-2019-0277.

Baker, H.K., S. Kumar, and D. Pattnaik. 2020c. Twenty-five years of Review of Financial Economics: A bibliometric overview. Review of Financial Economics 38 (1): 3–23. https://doi.org/10.1002/rfe.1095.

Barbanti, A.M., R. Anholon, I.S. Rampasso, V.W.B. Martins, O.L.G. Quelhas, and W. Leal Filho. 2022. Sustainable procurement practices in the supplier selection process: An exploratory study in the context of Brazilian manufacturing companies. Corporate Governance (Bingley) 22 (1): 114–127. https://doi.org/10.1108/CG-10-2020-0481.

Bartolacci, F., A. Caputo, A. Fradeani, and M. Soverchia. 2020. Twenty years of XBRL: What we know and where we are going. Meditari Accountancy Research 29 (5): 1113–1145. https://doi.org/10.1108/MEDAR-04-2020-0846.

Behrend, J., and M. Eulerich. 2019. The evolution of internal audit research: A bibliometric analysis of published documents (1926–2016). Accounting History Review 29 (1): 103–139. https://doi.org/10.1080/21552851.2019.1606721.

Berle, A., and G. Means. 1932. The modern corporation and private property. New York: Commerce Clearing House.

Burton, B., S. Kumar, and N. Pandey. 2020. Twenty-five years of The European Journal of Finance (EJF): A retrospective analysis. European Journal of Finance 26 (18): 1817–1841. https://doi.org/10.1080/1351847X.2020.1754873.

Chen, C. 2006. CiteSpace II: Detecting and visualizing emerging trends and transient patterns in scientific literature. Journal of the American Society for Information Science and Technology 57: 359–377. https://doi.org/10.1002/asi.20317.

Coronel-Pangol, K., C. Orden-Cruz, and J. Paule-Vianez. 2022. Bibliometric analysis of alternative financing for entrepreneurship|Análisis bibliométrico de la financiación alternativa para el emprendimiento. Cuadernos De Gestion 22 (2): 167–182. https://doi.org/10.5295/cdg.211559kc.

Cucari, N. 2019. Qualitative comparative analysis in corporate governance research: A systematic literature review of applications. Corporate Governance (Bingley) 19 (4): 717–734. https://doi.org/10.1108/CG-04-2018-0161.

di Vaio, A., R. Hassan, and R. Palladino. 2023. Blockchain technology and gender equality: A systematic literature review. International Journal of Information Management 68: 102517. https://doi.org/10.1016/j.ijinfomgt.2022.102517.

Ding, L., Z. Zhao, and L. Wang. 2022. A bibliometric review on institutional investor: Current status, development and future directions. Management Decision 60 (3): 673–706. https://doi.org/10.1108/MD-09-2020-1302.

Donthu, N., S. Kumar, D. Mukherjee, N. Pandey, and W.M. Lim. 2021. How to conduct a bibliometric analysis: An overview and guidelines. Journal of Business Research 133: 285–296. https://doi.org/10.1016/j.jbusres.2021.04.070.

Donthu, N., S. Kumar, N. Pandey, W.M. Lim, and B. Pilling. 2022. Canadian Journal of Administrative Sciences: A retrospective review using bibliometric analysis. Canadian Journal of Administrative Sciences 39 (4): 359–380. https://doi.org/10.1002/cjas.1687.

Drago, C., and L.A. Aliberti. 2019. Interlocking Directorship Networks and Gender: A Bibliometric Analysis. In Springer Proceedings in Business and Economics 115–136. https://doi.org/10.1007/978-3-030-00335-7_8

Ellili, N.O.D. 2022. Bibliometric analysis and systematic review of environmental, social, and governance disclosure papers: Current topics and recommendations for future research. Environmental Research Communication 4: 092001. https://doi.org/10.1088/2515-7620/ac8b67.

Ellili, N.O.D. 2023a. Bibliometric analysis of sustainability papers: Evidence from environment, development and sustainability. Environment, Development and Sustainability (In Press). https://doi.org/10.1007/s10668-023-03067-6

Ellili, N.O.D. 2023b. Bibliometric analysis on corporate governance topics published in the Journal of Corporate Governance: The International Journal of Business in Society. Corporate Governance (Bingley) 23 (1): 262–286. https://doi.org/10.1108/CG-03-2022-0135.

Elsevier: Content Coverage Guide. 2020. Accessed: December 28, 2022. [Online]. Available: https://www.elsevier.com/__data/assets/pdf_file/0007/69451/Scopus_ContentCoverage_Guide_WEB.pdf

Enciso-Alfaro, S.-Y., and I.-M. García-Sánchez. (2023). Corporate governance and environmental sustainability: Addressing the dual theme from a bibliometric approach. Corporate Social Responsibility and Environmental Management 30 (3): 1025–1041. https://doi.org/10.1002/csr.2403.

Eulerich, M., S. Haustein, S. Zipfel, and C. van Uum. 2013. The publication landscape of German corporate governance research: A bibliometric analysis. Corporate Ownership and Control 10 (2): 661–673. https://doi.org/10.22495/cocv10i2c4art1.

E-Vahdati, S., N. Zulkifli, and Z. Zakaria. 2019. Corporate governance integration with sustainability: A systematic literature review. Corporate Governance (Bingley) 19 (2): 255–269. https://doi.org/10.1108/CG-03-2018-0111.

Ferramosca, S., and R. Verona. 2020. Framing the evolution of corporate social responsibility as a discipline (1973–2018): A large-scale scientometric analysis. Corporate Social Responsibility and Environmental Management 27 (1): 178–203. https://doi.org/10.1002/csr.1792.

Ha, H.H. 2022. Audit committee characteristics and corporate governance disclosure: Evidence from Vietnam listed companies. Cogent Business and Management 9 (1): 2119827. https://doi.org/10.1080/23311975.2022.2119827.

Handley, K., and C. Molloy. 2022. SME corporate governance: A literature review of informal mechanisms for governance. Meditari Accountancy Research 30 (7): 310–333. https://doi.org/10.1108/MEDAR-06-2021-1321.

Hegde, A.A., V. Masuna, A.K. Panda, and S. Kumar. 2023. What we know and what we should know about speed of capital structure adjustment: A retrospective using bibliometric and system thinking approach. Qualitative Research in Financial Markets 15 (2): 224–253. https://doi.org/10.1108/QRFM-11-2021-0188.

Huang, C.Y., and Y.S. Ho. 2011. Historical research on corporate governance: A bibliometric analysis. African Journal of Business Management 5 (2): 276–284.

Jensen, M.C., and W.H. Meckling. 1976. Theory of the firm: Managerial behavior, agency costs and ownership structure. Journal of Financial Economics 3: 305–360.

Kessler, M.M. 1963. Bibliographic coupling between scientific papers. American Documentation 14: 10–25. https://doi.org/10.1002/asi.5090140103.

Khan, M.A. 2022. ESG disclosure and firm performance: A bibliometric and meta-analysis. Research in International Business and Finance 61: 101668. https://doi.org/10.1016/j.ribaf.2022.101668.

Khan, A., J.W. Goodell, M.K. Hassan, and A. Paltrinieri. 2022. A bibliometric review of finance bibliometric papers. Finance Research Letters 47: 102520. https://doi.org/10.1016/j.frl.2021.102520.

Khatib, S.F.A., D.F. Abdullah, A. Elamer, and S.A. Hazaea. 2022. The development of corporate governance literature in Malaysia: A systematic literature review and research agenda. Corporate Governance (Bingley) 22 (5): 1026–1053. https://doi.org/10.1108/CG-12-2020-0565.

Khatib, S.F.A., D.F. Abdullah, A. Elamer, I.S. Yahaya, and A. Owusu. 2023. Global trends in board diversity research: A bibliometric view. Meditari Accountancy Research 31 (2): 441–469. https://doi.org/10.1108/MEDAR-02-2021-1194.

Koutoupis, A., P. Kyriakogkonas, M. Pazarskis, and L. Davidopoulos. 2021. Corporate governance and COVID-19: A literature review. Corporate Governance (Bingley) 21 (6): 969–982. https://doi.org/10.1108/CG-10-2020-0447.

Kumar, S., N. Pandey, and S. Tomar. 2020a. Twenty years of latin American business review: A bibliometric overview. Latin American Business Review 21 (2): 197–222. https://doi.org/10.1080/10978526.2020.1722683.

Kumar, S., R. Sureka, and S. Colombage. 2020b. Capital structure of SMEs: A systematic literature review and bibliometric analysis. Management Review Quarterly 70 (4): 535–565. https://doi.org/10.1007/s11301-019-00175-4.

Kumar, S., N. Pandey, B. Burton, and R. Sureka. 2021a. Research patterns and intellectual structure of Managerial Auditing Journal: A retrospective using bibliometric analysis during 1986–2019. Managerial Auditing Journal 36 (2): 280–313. https://doi.org/10.1108/MAJ-12-2019-2517.

Kumar, S., R. Sureka, W.M. Lim, S. Kumar Mangla, and N. Goyal. 2021b. What do we know about business strategy and environmental research? Insights from Business Strategy and the Environment. Business Strategy and the Environment 30 (8): 3454–3469. https://doi.org/10.1002/bse.2813.

Kumar, S., N. Pandey, and J. Kaur. 2023a. Fifteen years of the Social Responsibility Journal: A retrospective using bibliometric analysis. Social Responsibility Journal 19 (2): 377–397. https://doi.org/10.1108/SRJ-02-2020-0047.

Kumar, S., A. Sharma, P. Mishra, and N. Kaushik. 2023b. Corporate social responsibility disclosures and earnings management: A bibliometric analysis. International Journal of Disclosure and Governance 20: 27–51. https://doi.org/10.1057/s41310-022-00156-2.

Kushkowski, J.D., C.B. Shrader, M.H. Anderson, and R.E. White. 2020. Information flows and topic modeling in corporate governance. Journal of Documentation 76 (6): 1313–1339. https://doi.org/10.1108/JD-10-2019-0207.

Lund-Thomsen, P., and R.G. Pillay. 2012. CSR in industrial clusters: An overview of the literature. Corporate Governance (Bingley) 12 (4): 568–578. https://doi.org/10.1108/14720701211267874.

Mariani, M.M., K. Al-Sultan, and A. de Massis. 2023. Corporate social responsibility in family firms: A systematic literature review. Journal of Small Business Management 61 (3): 1192–1246. https://doi.org/10.1080/00472778.2021.1955122.

Mas-Tur, A., S. Kraus, M. Brandtner, and R.W. EwertKürsten. 2020. Advances in management research: A bibliometric overview of the review of managerial science. Review of Managerial Science 14 (5): 933–958. https://doi.org/10.1007/s11846-020-00406-z.

Mirone, F., G. Sancetta, D. Sardanelli, and S. Mele. 2021. How independent directors affect firms’ performance and sustainability: An analysis of Italian firms. Corporate Governance and Organizational Behavior Review 5 (2): 72–81. https://doi.org/10.22495/cgobrv5i2p7.

Moed, H.F. 2010. Measuring contextual citation impact of scientific journals. Journal of Informetrics 4 (3): 265–277. https://doi.org/10.1016/j.joi.2010.01.002.

Moher, D., A. Liberati, J. Tetzlaff, D.G. Altman, the PRISMA Group. 2009. Preferred reporting items for systematic reviews and meta-analyses: The PRISMA statement. PLoS Medicine 6 (7): e1000097. https://doi.org/10.1371/journal.pmed.1000097.

Mumu, J.R., P. Saona, M.S. Haque, and M.A.K. Azad. 2022. Gender diversity in corporate governance: A bibliometric analysis and research agenda. Gender in Management 37 (3): 328–343. https://doi.org/10.1108/GM-02-2021-0029.

Nguyen, M.-H., H.T.T. Nguyen, T.-T. Le, A.-P. Luong, and Q.-H. Vuong. 2022. Gender issues in family business research: A bibliometric scoping review. Journal of Asian Business and Economic Studies 29 (3): 166–188. https://doi.org/10.1108/JABES-01-2021-0014.

Nyakurukwa, K., and Y. Seetharam. 2023. Corporate governance in a weak legal environment: A systematic review focusing on Zimbabwe. Qualitative Research in Financial Markets 15 (2): 319–335.

Pahlevi, R.W. 2023. Mapping of Islamic corporate governance research: A bibliometric analysis. Journal of Islamic Accounting and Business Research 14 (4): 538–553. https://doi.org/10.1108/JIABR-12-2021-0314.

Pandey, N., C. Andres, and S. Kumar. 2023. Mapping the corporate governance scholarship: Current state and future directions. Corporate Governance: An International Review 31 (1): 127–160. https://doi.org/10.1111/corg.12444.

Patel, R., J.W. Goodell, M.E. Oriani, A. Paltrinieri, and L. Yarovaya. 2022. A bibliometric review of financial market integration literature. International Review of Financial Analysis 80: 102035. https://doi.org/10.1016/j.irfa.2022.102035.

Pedrini, M., and L.M. Ferri. 2019. Stakeholder management: A systematic literature review. Corporate Governance (Bingley) 19 (1): 44–59. https://doi.org/10.1108/CG-08-2017-0172.

Peladeau, N. 1998. WordStat: Content analysis module for SimStat. Montreal, Quebec, Canada: Provalis Research.

Pizzi, S., A. Caputo, A. Corvino, and A. Venturelli. 2020. Management research and the UN sustainable development goals (SDGs): A bibliometric investigation and systematic review. Journal of Cleaner Production 276: 124033. https://doi.org/10.1016/j.jclepro.2020.124033.

Pritchard, A. 1969. Statistical bibliography or bibliometrics. Journal of Documentation 25: 348–349.

Rebeiz, K.S. 2022. The phenomenological complexity of boardroom’s research. Corporate Governance (Bingley) 22 (6): 1243–1258. https://doi.org/10.1108/CG-11-2021-0416.

Rodríguez-Fernández, M., A.I. Gaspar-González, and E.M. Sánchez-Teba. 2020. Sustainable social responsibility through stakeholders engagement. Corporate Social Responsibility and Environmental Management 27 (6): 2425–2436. https://doi.org/10.1002/csr.2023.

Sama, M.L., A. Stefanidis, and R.M. Casselman. 2022. Rethinking corporate governance in the digital economy: The role of stewardship. Business Horizons 65 (5): 535–546. https://doi.org/10.1016/j.bushor.2021.08.001.

Sannajust, A., and A. Groh. 2023. Pioneering management buy-out and entrepreneurial finance research: Mike Wright’s research legacy. Small Business Economics 60: 1–35. https://doi.org/10.1007/s11187-022-00635-4.

Sharma, S., K. Malik, and M.N. KaurSaini. 2023. Mapping research in the field of private equity: A bibliometric analysis. Management Review Quarterly 73: 61–89. https://doi.org/10.1007/s11301-021-00231-y.

Shleifer, A., and R.W. Vishny. 1997. A survey of corporate governance. Journal of Finance 52 (2): 737–783. https://doi.org/10.1111/j.1540-6261.1997.tb04820.x.

Siao, H.-J., S.-H. Gau, J.-H. Kuo, M.-G. Li, and C.-J. Sun. 2022. Bibliometric analysis of environmental, social, and governance management research from 2002 to 2021. Sustainability (Switzerland) 14 (23): 16121. https://doi.org/10.3390/su142316121.

Singhania, S., R.K. Singh, A.K. Singh, and V. Sardana. 2022. Corporate governance and risk management: A bibliometric mapping for future research agenda. Indian Journal of Corporate Governance 15 (2): 223–255. https://doi.org/10.1177/09746862221126351.

Syed, A.M., and H.S. Bawazir. 2021. Recent trends in business financial risk–A bibliometric analysis. Cogent Economics and Finance 9 (1): 1913877. https://doi.org/10.1080/23322039.2021.1913877.

Teixeira, J.F., and L.L. Rodrigues. 2022. Earnings management: A bibliometric analysis. International Journal of Accounting and Information Management 30 (5): 664–683. https://doi.org/10.1108/IJAIM-12-2021-0259.

Thawani, B., T. Panigrahi, and M. Bhatia. 2024. Eleven years of integrated reporting: A bibliometric analysis. International Journal of Disclosure and Governance (In Press). https://doi.org/10.1057/s41310-024-00229-4

Trinarningsih, W., A.R. Anugerah, and P.S. Muttaqin. 2021. Visualizing and mapping two decades of literature on board of directors research: A bibliometric analysis from 2000 to 2021. Cogent Business and Management 8 (1): 1994104. https://doi.org/10.1080/23311975.2021.1994104.

Tunger, D., and M. Eulerich. 2018. Bibliometric analysis of corporate governance research in German-speaking countries: Applying bibliometrics to business research using a custom-made database. Scientometrics 117 (3): 2041–2059. https://doi.org/10.1007/s11192-018-2919-z.

Turzo, T., G. Marzi, C. Favino, and S. Terzani. 2022. Non-financial reporting research and practice: Lessons from the last decade. Journal of Cleaner Production 345: 131154. https://doi.org/10.1016/j.jclepro.2022.131154.

van Eck, N.J., and L. Waltman. 2010. Software survey: VOSviewer, a computer program for bibliometric mapping. Scientometrics 84: 523–538. https://doi.org/10.1007/s11192-009-0146-3.

Xie, E., K.S. Reddy, and J. Liang. 2017. Country-specific determinants of cross-border mergers and acquisitions: A comprehensive review and future research directions. Journal of World Business 52 (2): 127–183. https://doi.org/10.1016/j.jwb.2016.12.005.

Zainuldin, M.H., and T.K. Lui. 2022. A bibliometric analysis of CSR in the banking industry: A decade study based on Scopus scientific mapping. International Journal of Bank Marketing 40 (1): 1–26. https://doi.org/10.1108/IJBM-04-2020-0178.

Zheng, C., and R. Kouwenberg. 2019. A bibliometric review of global research on corporate governance and board attributes. Sustainability (Switzerland) 11 (12): 3428. https://doi.org/10.3390/su10023428.

Funding

This study was not supported by any funding source.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The author declares no conflicts of interest.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Ellili, N.O.D. A bibliometric review of bibliometric reviews of corporate governance: current topics and recommendations for future research. Int J Discl Gov (2024). https://doi.org/10.1057/s41310-024-00256-1

Received:

Accepted:

Published:

DOI: https://doi.org/10.1057/s41310-024-00256-1